Asia Update - 2/13/26

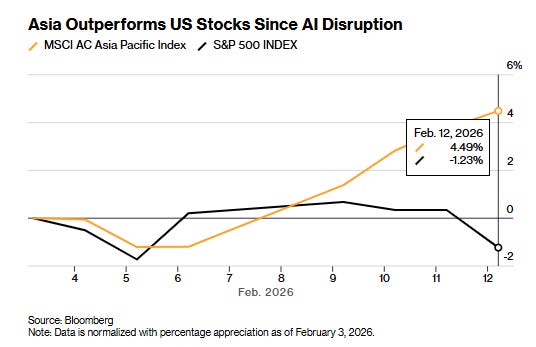

The MSCI Asia Pacific Index was down -1.4% Friday, its first losing day of the week, still leaving it solidly higher for the week just off of record highs (the 7th weekly gain in 8 weeks and 10th in 12, also on track for its 9th monthly gain in the last 10).

Major equity indices in the Asia-Pacific region also ended the week on a lower note.

Japan's Nikkei: -1.2%, Hong Kong's Hang Seng: -1.7%, China's Shanghai Composite: -1.3%, India's Sensex: -1.3%, South Korea's Kospi: -0.3%, Australia's ASX All Ordinaries: -1.5%.

Coming into Friday though the MSCI Asia Pacific Index had risen more than 12% in 2026, in contrast the S&P 500 is down 0.2% for the year, while the technology-heavy Nasdaq 100 gauge has lost around 2% with one of the largest divergences on Thursday when Asian stocks gained +0.75% while the SPX lost around -1.6%.

[more on the lowest correlation since 2022 as well as a number of other market and economic updates including from Goldman, SocGen and Flow Show in the Subscriber section].

In news:

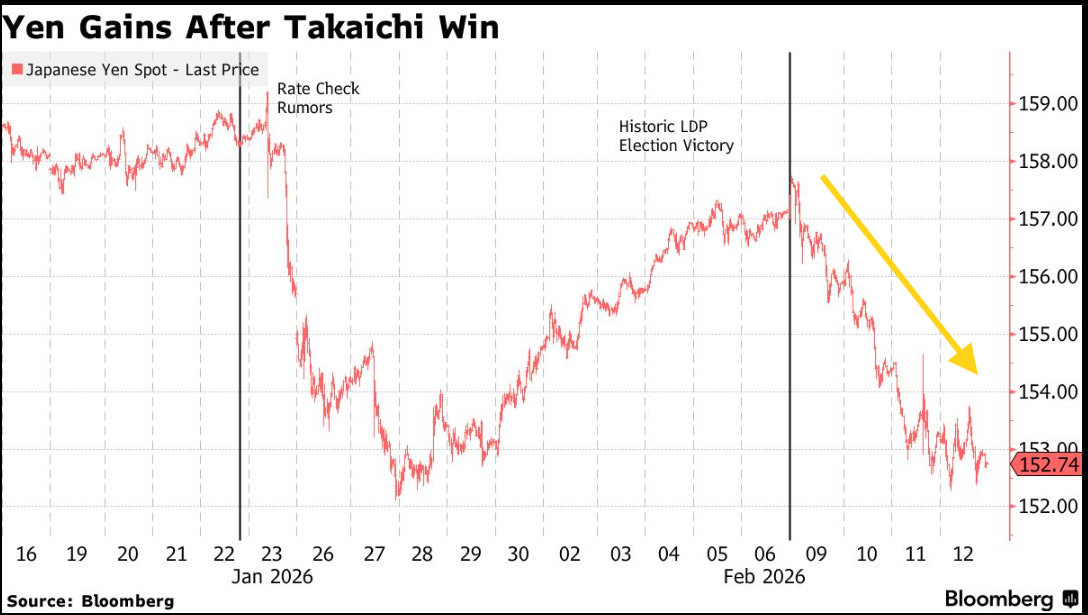

BBG - The yen is on track for its biggest weekly gain since November 2024 on confidence Prime Minister Sanae Takaichi’s election victory will allow her to expand fiscal stimulus while maintaining the trust of financial markets.

Japan’s currency has appreciated for four consecutive days against the dollar, and has strengthened about 2.8% so far this week. It was also supported by haven demand amid a deepening rout in risk assets.

Investors have interpreted Takaichi’s decisive win as reducing political uncertainty and lowering the risk of worst-case fiscal outcomes, helping lift the yen and pull Japanese government bond yields down from multi-year highs reached last month. Speaking Monday at a press briefing, Takaichi acknowledged market concerns over the sales tax cut on food for two years and reiterated plans to avoid issuing bonds to fund the measure.

Overnight index swaps show about a 78% chance of a rate hike by the BOJ in April.

“The yen is strengthening after Japanese Prime Minster Sanae Takaichi’s historic LDP win as traders price a policy mix that’s rare in Japan — tax cuts that don’t worsen the deficit, potentially funded by internal pools. The risk is that this involves FX-reserve selling, which is yen-supportive due to short-term buying, but volatility-positive because the market has no playbook for how far officials are willing to go.” — Michael Ball, Macro Strategist, Markets Live

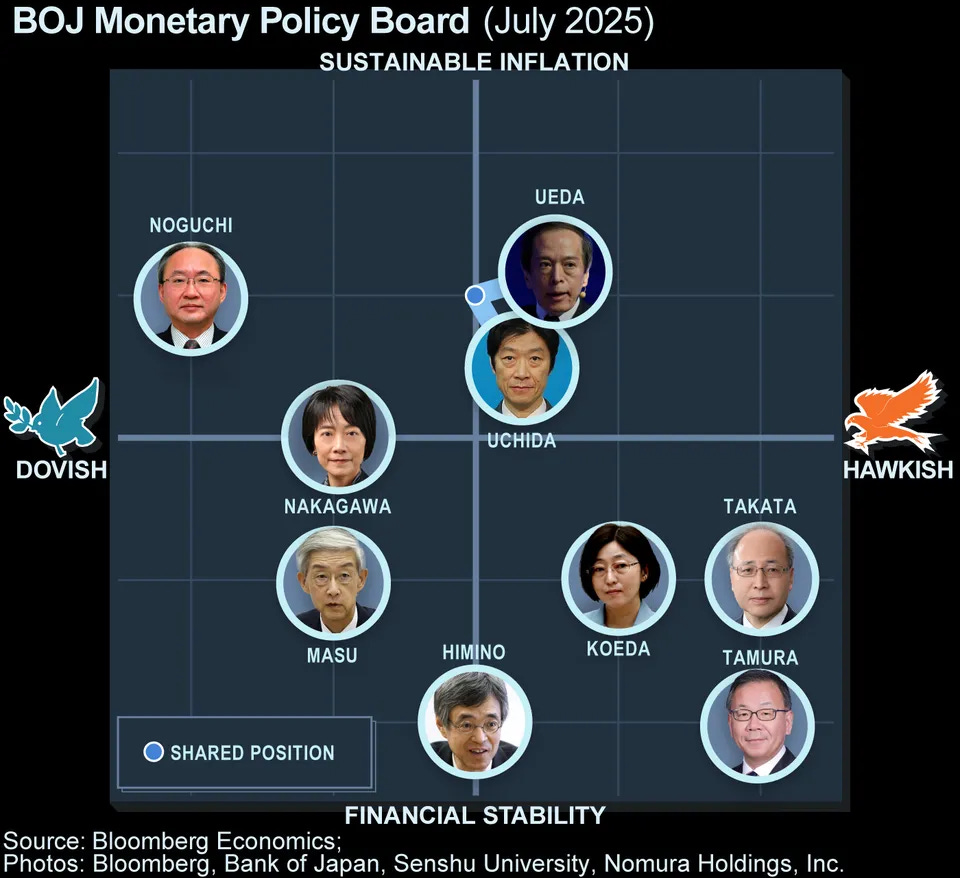

BBG - One of the Bank of Japan’s most hawkish members indicated that conditions for the central bank’s next interest rate hike could be in place by spring, a comment that is likely to fuel further speculation of an early move.

“It is quite possible that, as early as this spring, the price stability target of 2% can be judged to have been achieved if it’s confirmed with a high certainty that wage growth this year will be in line with the target for the third consecutive year,” Naoki Tamura said Friday in a speech at a business conference in Yokohama.

While it’s unclear if the rest of the BOJ board shares Tamura’s view, his remarks suggest that Governor Kazuo Ueda will probably face increased opposition if he decides to stand pat at the next policy meetings through April.

FT - The US and Taiwan have agreed to reduce tariffs on a range of food imports and other products as they officially signed a trade agreement on Thursday.

Donald Trump last week announced that the US would slash tariffs on Taiwan to 15 per cent in exchange for a $250bn investment in the US chip industry, as Washington moves to secure semiconductor supply chains and boost investment in American manufacturing.

The move brings duties on Taiwanese products in line with those levied on Japan and South Korea, and comes with a US promise to waive tariffs on generic drugs, aerospace parts and natural resources unavailable in the US.

BBG - China set final import tariffs on some dairy products from the European Union well below preliminary rates outlined late last year, in the latest sign of stabilizing trade ties between Beijing and Brussels.

The duties — set at as much as 11.7% following an anti-subsidy investigation — apply to goods including fresh and processed cheese and will take effect from Friday, China’s Ministry of Commerce said on Thursday. That compares with initial duties, collected in the form of deposits, of as much as 43% that were announced in December.

There have been efforts to deepen economic cooperation between the two sides following a leaders summit in July, including a recent visit by French President Emmanuel Macron to China. Earlier this week, the EU moved to exempt one of Volkswagen AG’s China-built electric vehicles from hefty import duties, the first car to get approval under a new mechanism aimed at thawing tensions.

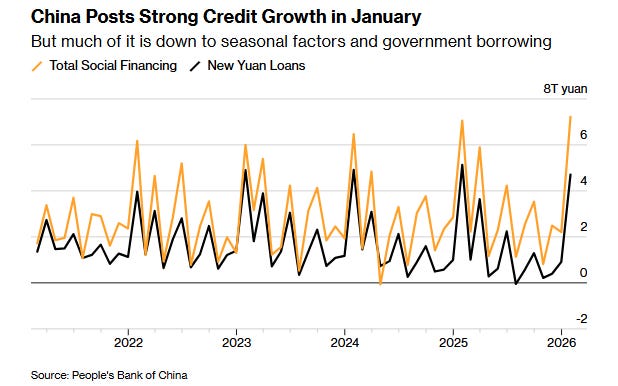

BBG - China’s credit expansion picked up more than expected from a year ago in January, boosted by strong government bond sales as well as seasonal factors driving financing activities but loan growth was disappointing pointing to still sluggish demand.

Aggregate financing, a broad measure of credit, increased 7.2 trillion yuan ($1 trillion), according to data released by the People’s Bank of China on Friday. That surpassed a median forecast of 7.1 trillion yuan by economists in a Bloomberg survey.

Loan growth disappointed, however, pointing to still sluggish borrowing demand. Financial institutions offered 4.7 trillion yuan of new loans in the month, falling short of the median forecast of 5 trillion yuan.

In a sign that the property market is still weakening, a proxy of mortgages — or household mid- and long-term loans — expanded the least in three years for the month of January.

New mid- and long-term loans for companies, a measure of their willingness to invest or expand, was also at the lowest level for January since 2022.

BBG - China’s existing home prices fell at a slower pace in January, a rare positive sign during the prolonged property crisis, while new home values declined the same amount as December but that was the joint-least since August.

[Note Goldman’s implications on negative home prices in the subscriber section]

Resale home prices in 70 cities dropped 0.54% from December, the smallest decline in eight months, figures from the National Bureau of Statistics showed on Friday. Values of new homes, excluding state-subsidized housing, slid 0.37%, the same pace as a month earlier.

BBG - Japan said it seized a Chinese fishing vessel and arrested its captain after the ship entered the nation’s exclusive economic zone and sought to avoid inspection, adding a fresh complication to strained ties between the two Asian giants.

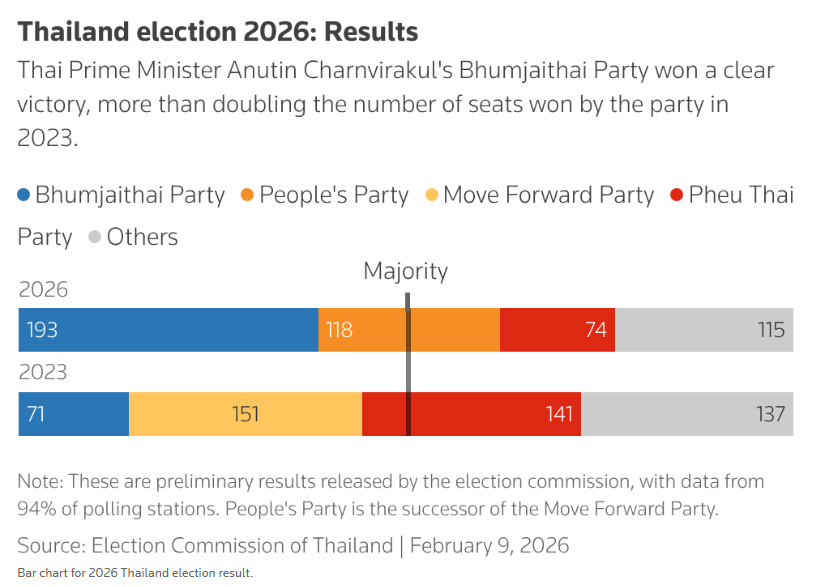

RTRS - Thailand’s Bhumjaithai Party, which won Sunday’s general election by a wide margin, will be joined by the third-place Pheu Thai party to form a coalition government, Thai Prime Minister Anutin Charnvirakul said on Friday.

Anutin-led Bhumjaithai romped to a surprise victory on Sunday securing 193 seats in the 500-member House of Representatives, followed by the reformist People’s Party with 118 seats and the populist Pheu Thai at 74, according to Reuters’ calculations based on election commission data.

The rest of the rundown of major Asian political, economic, and corporate news and analysis from Bloomberg, Reuters, FT, Briefing.com, WSJ, BoA, Goldman, etc., follows for paid subscribers.