Asia Update - 2/16/26

The MSCI Asia Pacific Index was down for a second session although a milder -0.1% Monday after Friday’s -1.4% drop which nevertheless left the index solidly higher for the week just off of record highs (the 7th weekly gain in 8 weeks and 10th in 12, also on track for its 9th monthly gain in the last 10).

Major equity indices in the Asia-Pacific region were mixed with several regional markets closed for the lunar new year holiday including China (which remains closed until next Tuesday), Taiwan, Hong Kong (half-day), South Korea, and Singapore among others.

Japan's Nikkei: -0.2%, Hong Kong's Hang Seng +0.5%, China's Shanghai Composite: CLOSED, India's Sensex: +0.8%, South Korea's Kospi: CLOSED, Australia's ASX All Ordinaries: +0.2%.

In news:

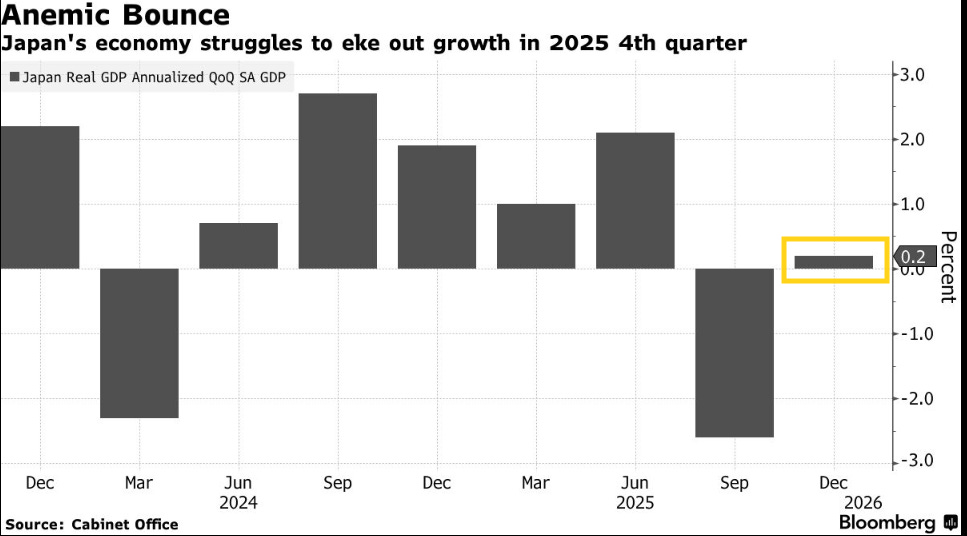

BBG - Japan’s real gross domestic product grew 0.2% on an annualized basis in the three months through December, according to a Cabinet Office report Monday. That was weaker than economists’ median estimate of 1.6% growth, underscoring the case for Prime Minister Sanae Takaichi’s proactive spending policies following her election triumph.

Consumer spending, the biggest component of GDP, grew just 0.1%, while capital spending rose 0.2%. Private housing investment was up 4.8% from the previous quarter, an expected outcome after a rout in the third quarter that resulted from regulatory changes.

Inbound tourism, counted as service exports in the data, provided support for much of 2025, but took a hit more recently. The number of visitors from China slumped after Beijing issued a travel warning against traveling to Japan following Takaichi’s controversial comments on Taiwan in November. Net exports didn’t contribute to growth in the latest quarter, even though exports alone rose every month in the fourth quarter.

“Personal consumption showed resilience, but whether this resilience can be sustained will depend on whether price relief measures will make an impact and whether real wages will turn positive,” according to Shinichiro Kobayashi, chief economist at Mitsubishi UFJ Research and Consulting. “Rising interest rates and wage increases could pose a risk to small and medium-sized enterprises, potentially limiting their ability to do capital investment.”

“Japan’s surprisingly weak fourth-quarter GDP rebound appears temporary, leaving the Bank of Japan’s stimulus path intact. The softness largely reflected declines in volatile inventories and public investment. Prime Minister Sanae Takaichi is likely to ramp up public spending.” — Taro Kimura, economist

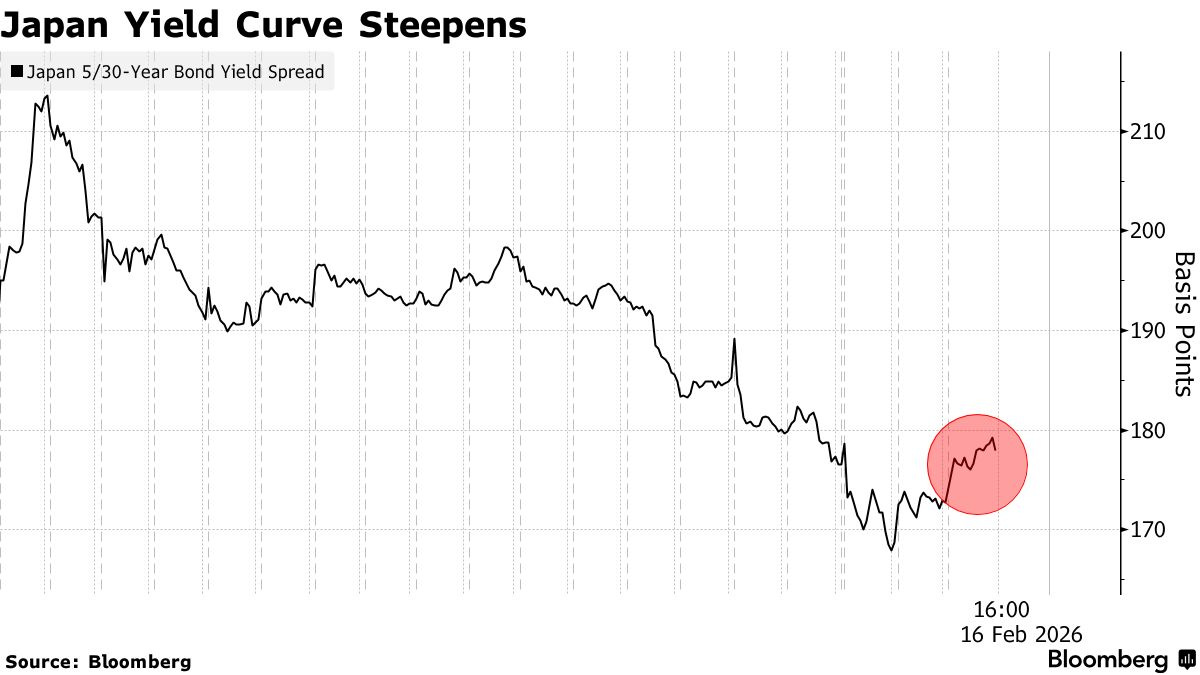

BBG - Japan’s super-long bond yields climbed as shorter-term rates fell, in what is known as a twist-steepening of the yield curve, as investors mull the outlook for fiscal policy and the Bank of Japan’s rate-hike path.

The 30-year bond yield rose about five basis points, and the 40-year rate jumped seven basis points. Shorter maturities were bought as data Monday showed Japan’s economic output in the fourth quarter of 2025 was much weaker than expected, prompting investors to slightly pare back bets on BOJ rate hikes.

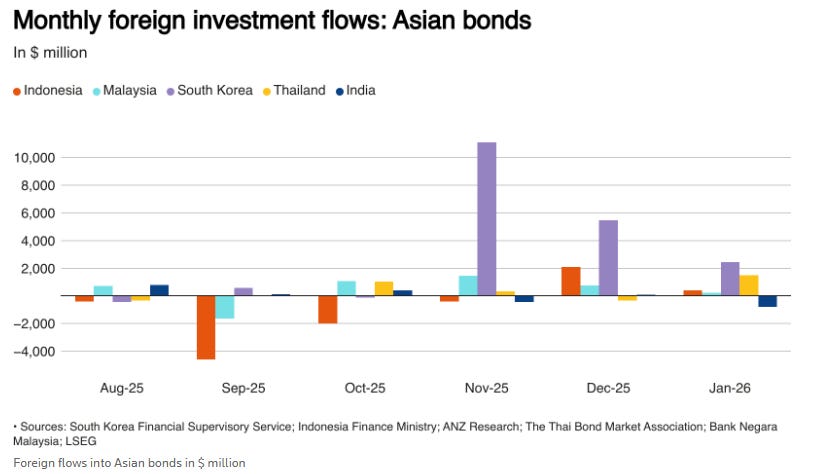

RTRS - Asian bonds attracted foreign inflows for a fourth straight month in January as an improving growth outlook and robust demand for regional exports boosted investor appetite.

Foreign investors bought a net $3.78 billion worth of local bonds in South Korea, Thailand, Malaysia, India and Indonesia last month, compared with net purchases of about $8.07 billion in December, according to data from local regulators and bond market associations.

BBG - Bank of Japan Governor Kazuo Ueda said Prime Minister Sanae Takaichi made no specific requests during a regular meeting to discuss the economy and swap general ideas.

“We discussed economic and financial conditions in general,” Ueda said Monday, following his talks with Takaichi at the Prime Minister’s Office in Tokyo.

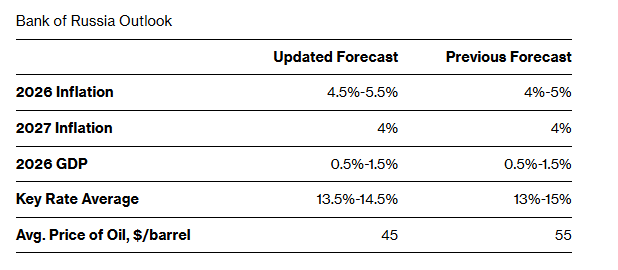

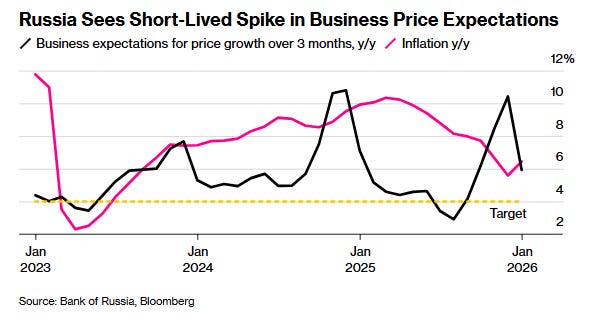

On Friday, Russia’s central bank lowered borrowing costs for the sixth straight time, delivering modest relief to businesses struggling under high interest rates and brushing off an uptick in inflation as temporary.

The Bank of Russia cut the benchmark rate by 50 basis points to 15.5% on Friday, a move predicted by just two of eight economists surveyed by Bloomberg. The rest expected officials to hold.

“In January, price growth accelerated significantly due to one-off factors,” policymakers said in a statement announcing the decision. Still, they estimate underlying dynamics haven’t shifted considerably, and “after the effect of one-off factors fades, disinflation will continue.”

Nevertheless, policymakers signaled greater faith in their ability to rein in price growth. “We are now more confident that we can continue to lower the key rate at upcoming meetings,” Nabiullina said during a briefing Friday in Moscow, adding inflation had passed its peak. She said policymakers considered both a 50-basis-point cut and a hold at their rate meeting.

Policymakers began aggressively cutting the key rate from a record 21% in June last year, after early signs of easing price pressure. By the end of 2025, the pace of rate reductions had slowed. The prolonged period of elevated borrowing costs is straining companies’ ability to service debt, while banks are increasingly restructuring loans to mitigate difficulties.

That was despite inflation expectations among businesses rising in January to the highest level since 2022, while household inflation expectations remained at a one-year high of 13.7%.

Subscriber section contains more news plus Goldman’s renewed overweight on Japan and BoA on CTAs in the yen.

The rest of the rundown of major Asian political, economic, and corporate news and analysis from Bloomberg, Reuters, FT, Briefing.com, WSJ, BoA, Goldman, etc., follows for paid subscribers.