Asia Update - 2/9/26

The MSCI Asia Pacific Index jumped +2.5% Monday taking it to new record highs after falling last week for the first time in 7 weeks (and 2nd in the last 11 (but on track for its 9th monthly gain in the last 10)).

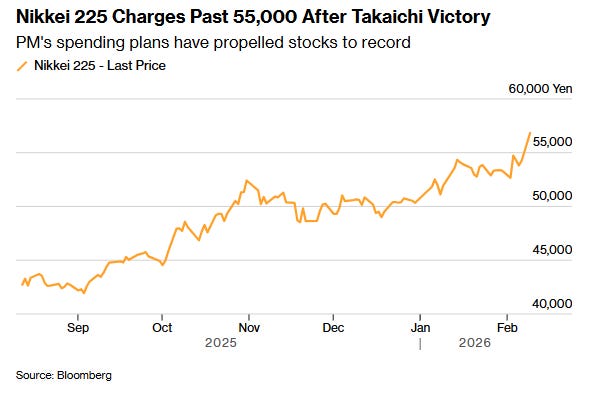

Major equity indices in the Asia-Pacific region also began the week on a higher note led by Japan's Nikkei (+3.9%) soaring to a fresh record after a snap election resulted in supermajority for Prime Minister Takaichi's LDP even before factoring the seats that were won by LDP's coalition partner Ishin (more below).

Japan's Nikkei: +3.9%, Hong Kong's Hang Seng: +1.8%, China's Shanghai Composite: +0.1%, India's Sensex: +0.6%, South Korea's Kospi: +4.1%, Australia's ASX All Ordinaries: +2.0%.

In news:

Japanese Prime Minister Sanae Takaichi's gamble to expand her majority paid off in a big way Sunday in a historic election triumph after her Liberal Democratic Party achieved the biggest post-war victory for a single party in a general election in Japan, positioning her as the nation’s strongest leader in the postwar era in an outcome that sent stock prices and bond yields soaring.

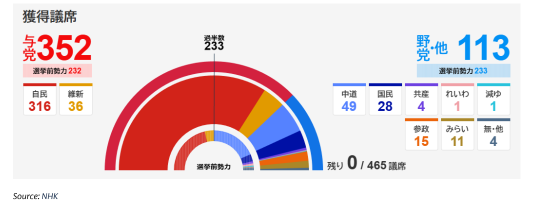

Public broadcaster NHK reported that her Liberal Democratic Party together with its coalition partner won 352 seats in the lower house, expanding its previous razor-thin majority of 233 by a considerable margin. The LDP’s haul of 316 seats gives it a higher proportion of representatives in the lower house than any other party in post-war Japan, and provides it with a super-majority (two-thirds of the lower house).

Such a super-majority smooths the process for the LDP to push through more contentious legislation surrounding spending, cuts to food taxes (and their length which the LDP wants to make temporary), and the issue of a constitutional amendment that recognizes Japan's Self Defense Force, expands the government's emergency powers, and makes other changes to election districts and enshrines free education.

Goldman: If the ruling coalition (LDP + JIP) secures two-thirds of the Lower House, this is a critical game-changer. Japan’s political system includes the ‘superiority of the House of Representatives’. If the Upper House rejects, amends, or fails to act on a bill passed by the House of Representatives within 60 days, the Lower House can pass the bill into law with a two-thirds majority of the members present. Technically speaking, this means they no longer have to be concerned about the minority in the Upper House. A constitutional amendment requires two-thirds support in both the Upper House and Lower House, plus more than 50% support in a national referendum.

Takaichi had staked her job on the outcome of the snap election just months after taking office, saying she would step down if her ruling coalition failed to win a majority. Instead, the margin of victory transforms her party’s fortunes just seven months after it lost control of both houses of parliament while putting her in league with former popular Japanese leaders Shinzo Abe and Junichiro Koizumi.

Takaichi’s mandate to push ahead with bold spending plans gave fresh life to the so-called Takaichi trade, underpinning stocks while weighing on bonds. The Nikkei 225 index rallied as much as 5.7%, the most since April, while yields on the benchmark 10-year bond jumped to 2.275% (chart).

But while yields were higher, despite the mandate for more aggressive spending, the yen is strengthening, now up 0.7% against the US dollar (chart).

Finance Minister Katayama attempted to assuage investors by saying that there will be no additional bond issuance to fund the prime minister's agenda.

US President Donald Trump congratulated Takaichi in a post on Truth Social, describing her as a “highly respected and very popular Leader” and saying the “wonderful people of Japan, who voted with such enthusiasm, will always have” his strong support.

“The Liberal Democratic Party’s landslide victory in Japan’s lower-house election gives Prime Minister Sanae Takaichi a much stronger hand to reshape economic and foreign policy. She has leaned heavily on personal popularity and a distinctly conservative brand of politics. She can now move ahead swiftly to put her policies into action.” — Taro Kimura, BBG economist

“That kind of ambiguity is not particularly helpful for the yen and it could well be that we’ll be testing the 159, 160 mark in the coming days,” said Chris Scicluna, head of economic research at Daiwa Capital Markets Europe. “I think that some talk of possible interventions could well be reemerging as the week goes on.”

10yr JGB yield

USD/JPY

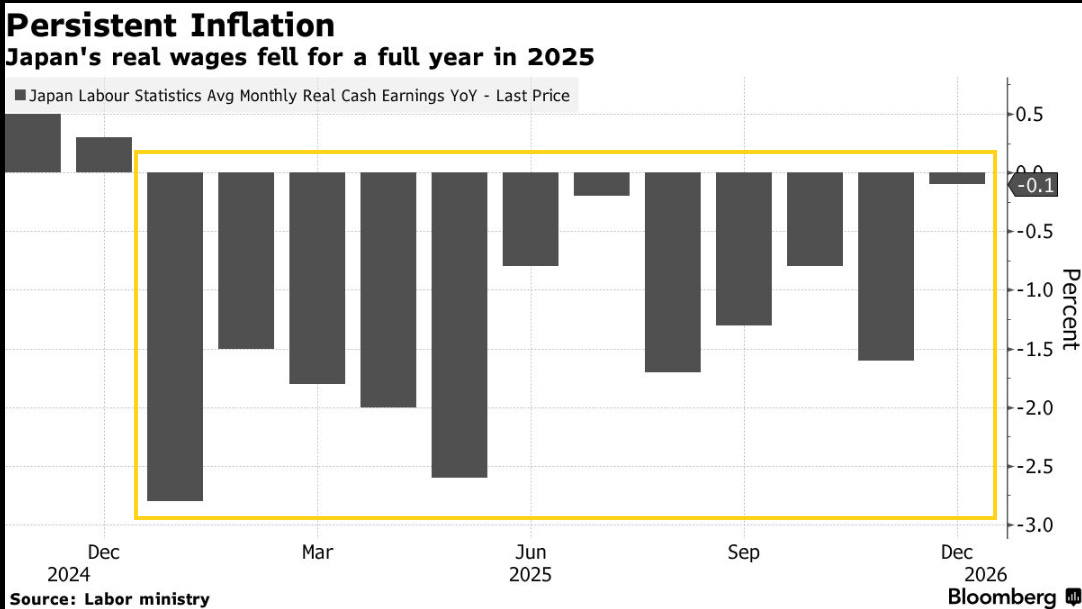

BBG - Meanwhile data showed that Japanese workers’ real wages fell in every month of 2025, underscoring the persistence of inflation and bolstering the case for Prime Minister Sanae Takaichi to continue down a more expansionary fiscal path

Real wages slipped 0.1% from a year earlier in December, the labor ministry reported Monday. Economists had expected the reading to turn positive for the first time in a year after inflation moderated as a result of policy measures intended to reduce living costs. Real wages for 2025 overall declined for the fourth year running.

Still, nominal wages rose 2.4% from the previous year, while base pay climbed 2.2%, pointing to underlying momentum as pay negotiations that culminate in March continue. A more stable gauge that avoids sampling problems and excludes bonuses and overtime showed full-time workers’ wages increased 2.1%. Looking ahead, economists expect real wages to pick up as inflationary pressures begin to ease, particularly for food.

“It’s not that regular wages have fallen significantly, but rather that bonuses have not increased as much as most people expected at this stage,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities. “I don’t think that the basic trend in wages is that weak.”

Wage trends are a key consideration for the central bank as it weighs the timing of its next rate hike.

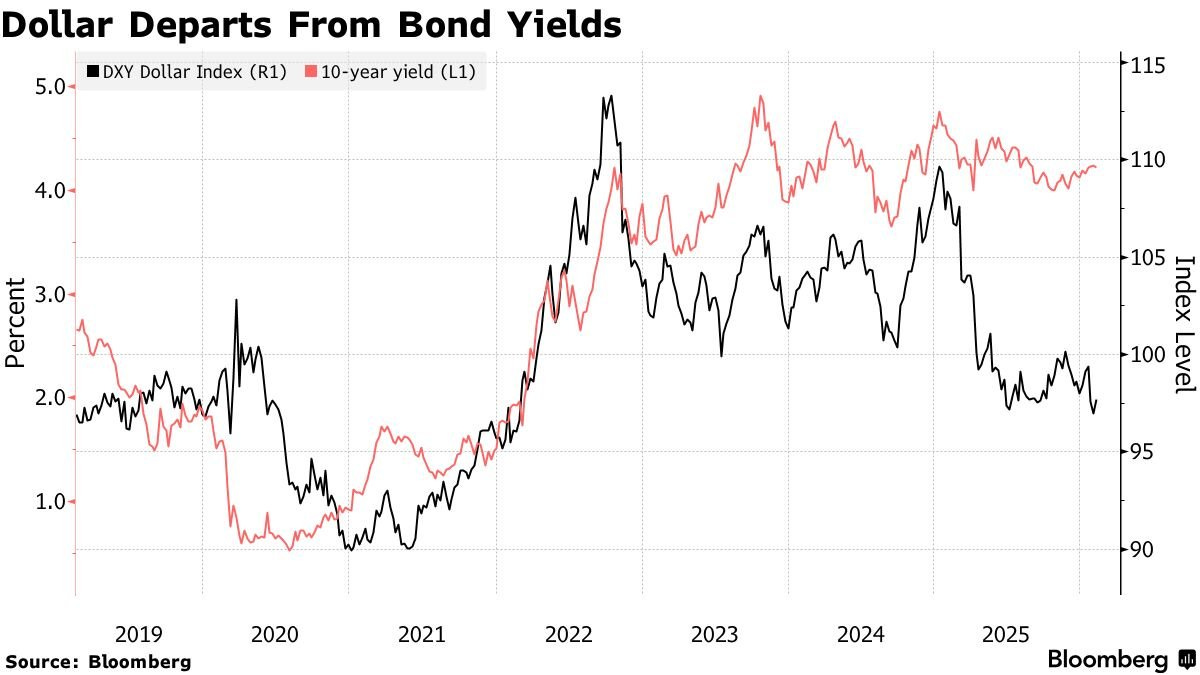

BBG - Chinese officials urged banks to limit purchases of US government bonds and instructed those with high exposure to pare down their positions BBG reports according to people familiar with the matter.

Communicated verbally to some of the nation’s biggest banks in recent weeks, the guidance reflects growing wariness among officials that large holdings of US government debt may expose banks to sharp swings, the people said.

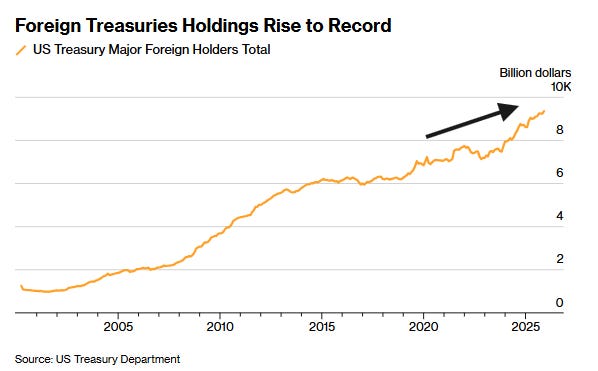

To put this into context though, Chinese banks hold around $300 billion worth of dollar-denominated bonds as of September, most of which are assumed to be Treasuries.

While a sizeable number, it is a small fraction of the $9.4 trillion of foreign holdings of US Treasuries which are up ~$500 billion y/y according to the latest official data.

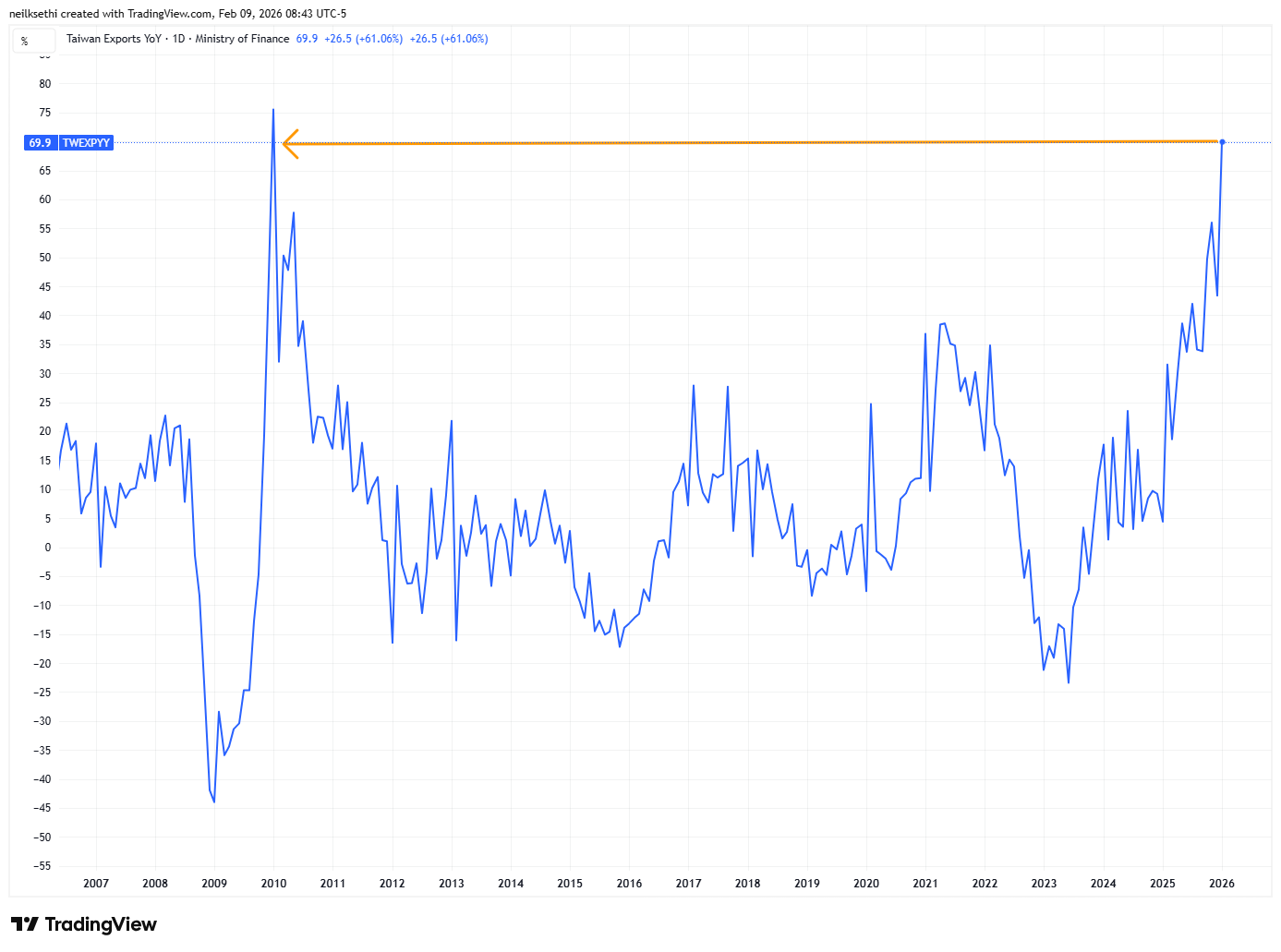

RTRS - Taiwan’s exports rose much more than expected in January, hitting the fastest monthly clip in 16 years amid continued demand for the island’s chips and technology that are powering AI applications.

Exports showed a 69.9% increase year-on-year, the largest since 2009 to $65.77 billion, versus 51.9% in a Reuters poll and 43.4% in December, reaching a monthly record high by value, the finance ministry said on Monday. The export performance continued a streak of 27 consecutive monthly year-on-year gains.

The ministry said in a statement that AI and cloud business demand was strong.

In January, Taiwan’s exports to the United States surged 151.8% from a year earlier to $21.28 billion, while exports to China climbed 49.6%.

Exports of electronic components rose 59.8% to $22.36 billion, also a record high.

The rest of the rundown of major Asian political, economic, and corporate news and analysis from Bloomberg, Reuters, FT, Briefing.com, WSJ, BoA, Goldman, etc., follows for paid subscribers.