Europe Update - 1/30/26

Europe’s benchmark STOXX 600 as of 8.20 am ET was up +0.7% as it continues to trade just below all-time highs on track for a fifth weekly gain in six closing out its 8th straight month of gains. Major Major European indices also trade in the green with banks contributing to the strength.

Germany's DAX: +0.9%, U.K.'s FTSE 100: +0.5%, France's CAC 40: +0.7%, Italy's FTSE MIB: +0.9%, Spain's IBEX 35: +1.7%.

The Kremlin said on Friday that Russian President Vladimir Putin had agreed to a personal request from U.S. President Donald Trump to halt strikes on Kyiv until February 1 to create “favourable conditions” for peace talks. Trump said on Thursday that Putin had agreed to refrain from firing on Kyiv and other Ukrainian cities for a week because of cold weather, but did not say when that period would expire. Ukraine and Russia are due to continue peace talks on Sunday brokered by the US in the United Arab Emirates after meeting in Abu Dhabi for two days last week.

But U.S. and European officials are growing increasingly worried as hundreds of millions of dollars in U.S. energy assistance promised to Ukraine remain unreleased, even as a bone-cold winter pushes the nation’s war‑damaged power grid to the brink, said several sources familiar with the matter. The funds in question were originally slated to help Ukraine import liquefied natural gas and rebuild energy infrastructure damaged by Russian strikes, said the sources, who include a U.S. official and a Ukrainian official. The U.S. Agency for International Development had notified Congress during former President Joe Biden’s administration of its intention to disburse at least some of the funds, said two of the sources, who requested anonymity to discuss internal deliberations.

President Donald Trump warned the UK and Canada against striking business deals with China, after British Prime Minister Keir Starmer became the latest US ally to announce plans to deepen trade ties during a visit to Beijing. Asked what he thought of the UK doing business with China, Trump said late on Thursday that the move would be “very dangerous.” He then directed his criticism toward Canada, whose prime minister, Mark Carney, unveiled a new strategic partnership with Beijing earlier this month before delivering a speech at Davos that was widely seen as a critique of the US president.

European nations are starting to discuss ideas around a shared nuclear umbrella to complement existing security arrangements with the U.S., German Chancellor Friedrich Merz said, amid growing talk in Germany of developing its own nuclear defences. Merz said the talks were only at an initial stage and no decision was imminent.

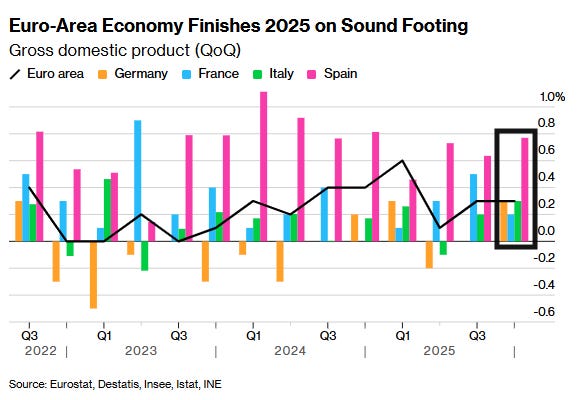

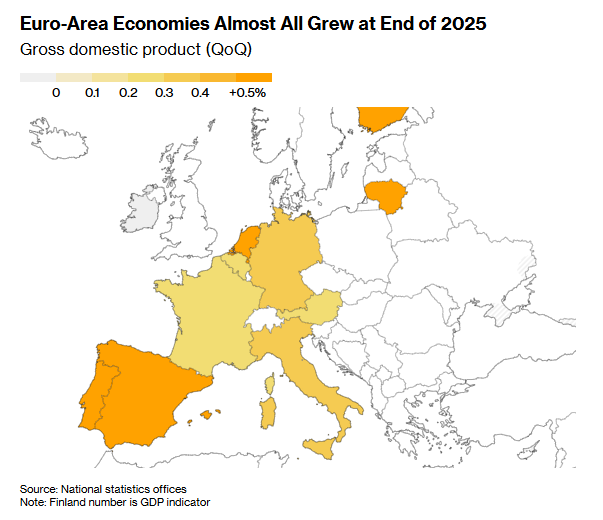

Fourth-quarter gross domestic product in the euro-area rose a better than expected 0.3% from the previous three months — maintaining the pace it set in the previous period — Eurostat said Friday. Analysts in a Bloomberg survey had foreseen an increase of 0.2%. Germany, Italy and Spain all surpassed estimates, with the latter proving the standout performer once again through expansion of 0.8%. At 0.2%, meanwhile, France matched forecasts.

In Germany, household and government consumption drove growth of 0.3% between October and December. Chancellor Friedrich Merz’s outlays on infrastructure and defense should add to momentum as the year progresses — particularly if he can also deliver on promises to slash bureaucracy and boost competitiveness. The government predicts GDP will rise 1% this year — progress for a country that only narrowly avoided a triple-dip recession in 2025.

For France, while the full year was a very solid +0.9%, the second half of 2025 was clouded by another government collapse and rows over tax hikes and spending cuts that are needed to rein in a gaping budget deficit. Fourth-quarter investments still increased by 0.2% while consumer-spending growth accelerated to 0.3%. “We’re off to a good start in 2026,” Finance Minister Roland Lescure said on TF1 television. “I hope we’ll get at least the 1% (growth) we’re expecting.” Prospects for a strong rebound remain limited, economists say. The budget "remains unfavourable to businesses" and higher taxes could curb investment and job creation, ING economist Charlotte de Montpellier said in a note. She described the overall outlook as “modestly positive,” citing early signs of improving business confidence, though a strong euro could hinder exports.

While Italy saw trade act as a drag on its economy, that was more than offset by domestic demand, resulting in expansion of 0.3%. Over the whole of 2025, the euro zone's third largest economy grew by 0.7% from the year earlier, when adjusted for the number of working days, national statistics bureau ISTAT reported.

Spain’s economy has outperformed its peers for several years, helped by a booming tourism industry and immigration. Its latest growth success was fueled by household consumption, its statistics office said.

Other parts of the bloc also recorded growth: GDP was up by 0.5% in the Netherlands, 0.2% in Austria, 0.8% in Portugal and 1.7% in Lithuania. Ireland, however, created a statistical drag for the bloc as its vast multinational sector, based there for tax reasons, contracted sharply. This is more a statistical effect, however, and does not indicate actual contraction in the economy.

“The upturn should reinforce the ECB’s view that no further rate cuts are needed in the near term. However, when policymakers gather in Frankfurt next week, the recent strengthening of the euro — and its disinflationary impact — are likely to loom large in the discussions.” —BBG’s Simona Delle Chiaie.

“The fourth quarter performance (for Germany) is admittedly modest yet still the best quarterly performance in the last three years,” ING economist Carsten Brzeski said. “Increasing new orders and falling inventories bode well for at least a soft turnaround in industry.”

Germany’s Economy Minister Katherina Reiche said on Friday the country must pivot toward new “growth engines”, arguing that traditional export strengths “no longer carry our growth” as they once did. “The sources of global growth today lie in areas like digitalization and artificial intelligence; in new energy technologies, biotechnology, advanced materials, and the defence industry,” Reiche told Germany’s lower house of parliament.

Spain said Friday that consumer prices rose 2.5% from a year ago in January — down from 3% the previous month.

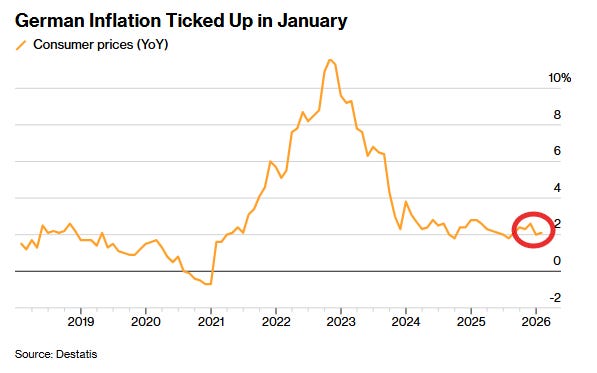

But Germany’s CPI accelerated y/y to 2.1% up from 2% in December. Analysts had predicted an unchanged reading.

An ECB poll of euro-area consumers showed inflation expectations over the next 12 months held steady at the end of 2025. That survey indicated a slightly more positive mood around the economy.

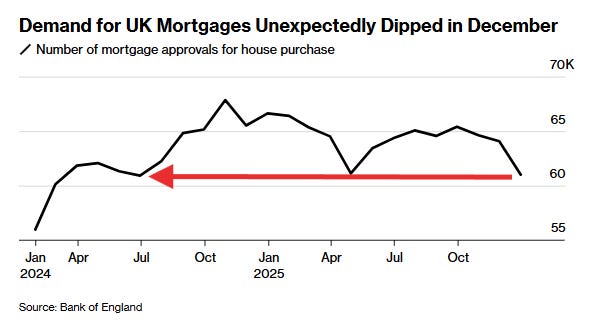

UK households scaled back their borrowing in December for the first time in three years, suggesting sentiment remained cautious going in 2026 in a potential warning sign for the tepid British economy. Banks and building societies authorized 61,013 home loans, down from 64,072 in November and the lowest for 18 months, the Bank of England said Friday. It was the first December fall since 2022, surprising economists who on average had expected a modest increase to 64,900. The central bank also said consumers borrowed an extra £1.5 billion ($2.8 billion) of unsecured debt, less than economists forecast. The figure was down from an unusually high £2.1 billion in November and weaker than the months leading up to Chancellor of the Exchequer Rachel Reeves’ Nov. 26 budget when fears of tax rises weighed heavily on household spending decisions. Credit card borrowing and “other” loans such as car finance both posted declines last month. “December’s money and lending data suggest that households’ caution with their borrowing and saving hasn’t gone away, reinforcing our view that consumer spending will underperform consensus expectations in 2026 and 2027,” said Ruth Gregory, deputy chief UK economist at Capital Economics.

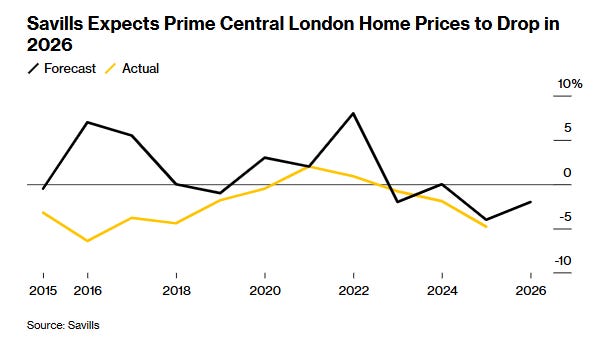

London’s top property brokers, who have overestimated house price growth in the city’s priciest neighborhoods for years, have finally thrown in the towel. Savills Plc — which cumulatively overestimated prime central London house price growth by a margin of 42.7% percentage points in the 11 years through 2025 — now sees back-to-back annual declines. It’s the first time it has made such a gloomy prediction since the aftermath of the global financial crisis. The broker predicted that prices would drop 4% in 2025 — its most bearish call in years — though that was still a slight underestimate. It sees prices falling another 2% this year and failing to rise again until 2028. It’s a striking reversal. Since the downturn began in 2015 the broker saw prices rising a cumulative 18 percentage points when in fact they’ve fallen by 24.7 points. To be sure, a series of shocks in years when Savills had expected robust growth, including the Brexit vote, the coronavirus pandemic and Russia’s invasion of Ukraine that triggered new transparency rules for UK property, account for much of the aggregate overestimate.

China has lifted restrictions on British parliamentarians it had banned from visiting the country, Prime Minister Keir Starmer said on Friday, as he sought to highlight the gains he’s made by traveling to the Asian nation. China in 2021 slapped sanctions on nine Britons for “maliciously spreading lies and disinformation” about human rights abuses in Xinjiang.

Deutsche Bank AG Chief Executive Officer Christian Sewing said Europe is stepping up efforts to streamline financial regulations and boost competitiveness amid recent geopolitical tensions. “I witness over the last 12 weeks, but in particular over the last four weeks - and this can also be an impact of all the geopolitical discussions - a real reconsideration on the European side,” Sewing said on an a call with analysts. “The word reduction of regulation in certain items is gaining speed.”

In corporate news:

Appliance manufacturer Electrolux reported strong results for Q4 with help from cost reductions and strong cash flow.

Shares of German sportswear giant Adidas added 6% Friday after the company published an earnings update after the bell on Thursday. The preliminary figures showed currency-neutral revenues jumped 13% in 2025 to hit a record 24.8 billion euros ($29.6 billion).

Elsewhere, Spain’s CaixaBank reported early Friday morning that its net profit rose 1.8% to 5.89 billion euros ($7 billion), above the 5.78 billion euros expected by analysts. Dividends jumped 15% to 0.50 euros per share. Touting a “great year,” the bank raised its growth and profitability targets.

In economic data:

U.K.’s December Mortgage Approvals 61,010 (expected 65,000; last 64,070) and Mortgage Lending GBP4.60 bln (expected GBP4.50 bln; last GBP4.59 bln). December Net Lending to Individuals GBP6.10 bln, as expected (last GBP6.60 bln)

Eurozone’s Q4 GDP 0.3% qtr/qtr (expected 0.2%; last 0.3%); 1.3% yr/yr (expected 1.2%; last 1.4%). December Unemployment Rate 6.2% (expected 6.3%; last 6.3%)

Germany’s December Import Price Index -0.1% m/m (expected -0.4%; last 0.5%); -2.3% yr/yr (expected -2.6%; last -1.9%). January Unemployment Change 0 (expected 4,000; last 3,000) and January Unemployment Rate 6.3%, as expected (last 6.3%). Q4 GDP 0.3% qtr/qtr (expected 0.2%; last 0.0%); 0.4% yr/yr (expected 0.3%; last 0.3%)

France’s Q4 GDP 0.2% qtr/qtr, as expected (last 0.5%); 1.1% yr/yr (expected 1.2%; last 0.9%). December PPI 0.2% m/m (last 2.8%); -2.0% yr/yr (last -1.5%). Q4 nonfarm payrolls -0.1% qtr/qtr (last 0.0%)

Italy’s Q4 GDP 0.3% qtr/qtr (expected 0.2%; last 0.1%); 0.8% yr/yr (expected 0.5%; last 0.6%). December Unemployment Rate 5.6% (expected 5.8%; last 5.6%). December PPI -0.7% m/m (last 1.0%); -1.4% yr/yr (last -0.2%)

Spain’s January CPI -0.4% m/m (expected -0.3%; last 0.3%); 2.4% yr/yr, as expected (last 2.9%). January Core CPI 2.6% yr/yr (last 2.6%). Q4 GDP 0.8% qtr/qtr (expected 0.6%; last 0.6%); 2.6% yr/yr (expected 2.7%; last 2.8%). November Current Account surplus EUR210 mln (last surplus of EUR7.18 bln)

Swiss January KOF Leading Indicators 102.5 (expected 103.1; last 103.6)

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below.

To invite others to check it out,