Europe Update - 2/9/26

Includes some Mid-East

Europe’s benchmark STOXX 600 as of 8.00 am ET was +0.2%, taking it back to the cusp of all-time highs after its sixth weekly gain in seven (it’s also working on its 9th straight month of gains).

Major European indices also trade mostly on a higher note while the U.K.'s FTSE (-0.2%) underperforms on a weaker pound and higher rates as speculation is growing that British Prime Minister Starmer could be ousted after his unimpressive visit to China and growing focus on his knowledge of Lord Mandelson's ties to Jeffrey Epstein.

Germany's DAX: +0.4%, U.K.'s FTSE 100: -0.2%, France's CAC 40: UNCH, Italy's FTSE MIB: +1.2%, Spain's IBEX 35: +0.5%.

In news:

BBG - Keir Starmer’s future is in the balance after a crisis over the appointment of Peter Mandelson as ambassador to Washington claimed the job of the UK prime minister’s closest aide.

Morgan McSweeney quit as chief of staff on Sunday, saying he took “full responsibility” for his advice to hire the Labour veteran as US envoy, despite Mandelson’s known ties to the convicted pedophile financier Jeffrey Epstein. He was followed out of Downing Street by Tim Allan, who quit as Starmer’s director of communications. But it isn’t lost on Starmer’s allies and opponents alike that the man who actually appointed Mandelson remains in post.

There was astonishment among Starmer’s longest-standing supporters that the weakened prime minister had let McSweeney go. On Saturday, Starmer’s close allies had been saying his chief of staff wouldn’t resign because that would make the leader’s downfall inevitable. As late as Sunday morning, cabinet minister Pat McFadden told Sky News that he didn’t think McSweeney should take the hit over what was ultimately a “prime ministerial appointment.”

With McSweeney for so long a lightning rod for controversies engulfing the prime minister, Starmer will also be unshielded at a time when the Mandelson furor may be far from over. Members of Parliament recently secured the publication of vetting documents around the diplomatic appointment. That material has yet to land.

After losing his second chief of staff in just 19 months, Starmer moved swiftly to promote McSweeney’s former deputies, Jill Cuthbertson and Vidhya Alakeson to jointly fill the vacated role. His office indicated the prime minister is likely to speak on Monday to update the country on his next steps to deliver the change promised by his party in 2024.

No. 10 officials were bracing for cabinet ministers to privately tell the premier to stand aside or threaten their resignations if he doesn’t, according to people familiar with the matter who spoke anonymously in order to be candid about the turmoil at the top of the Labour Party. One aide to a cabinet minister said it was 50-50 whether Starmer would last the week.

The renewed speculation over Starmer’s position knocked gilts again, Monday morning — yields on the government bonds rose as much as four basis points across the curve, with 10-year yields up to 4.55%.

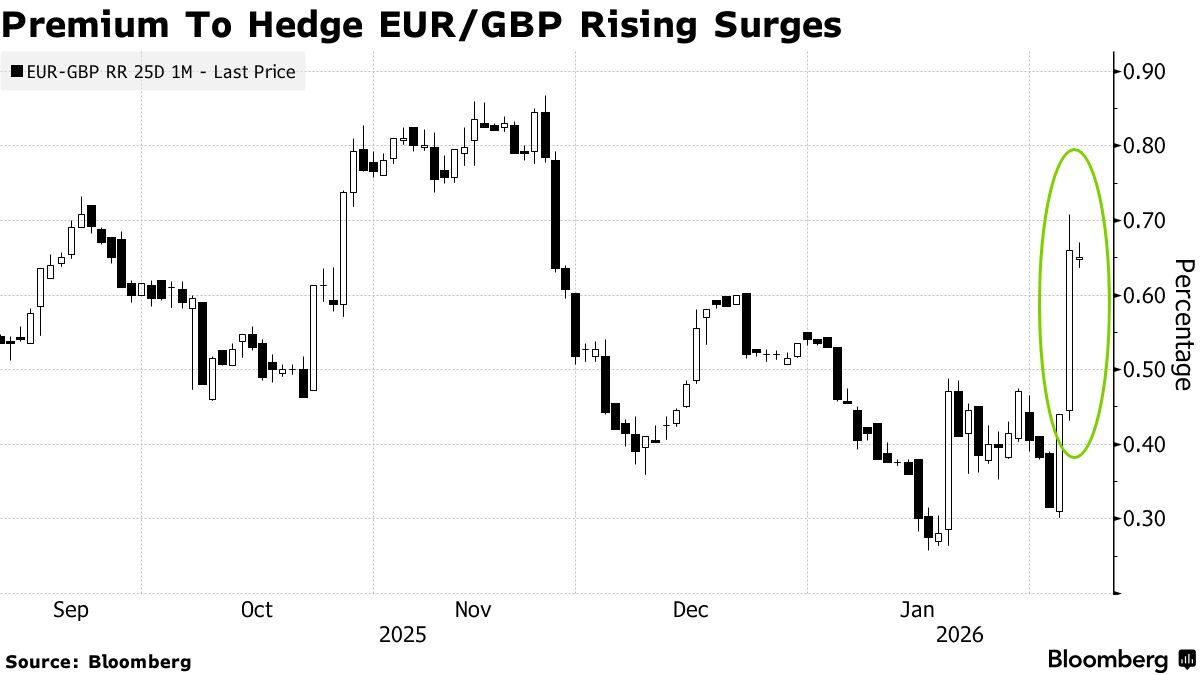

Sterling fell 0.5% to 0.8725 per euro on Monday, the lowest since Jan. 22. Hedge fund flows into “euro-pound remained one‑way, with heavy topside buying,” said Thomas Bureau, global head of FX option trading at Societe Generale, referring to demand for call options following the market moves on Feb. 5. “The pound has traded with EM‑style volatility, driven by global dollar strength and hypersensitivity to geopolitical headlines.”

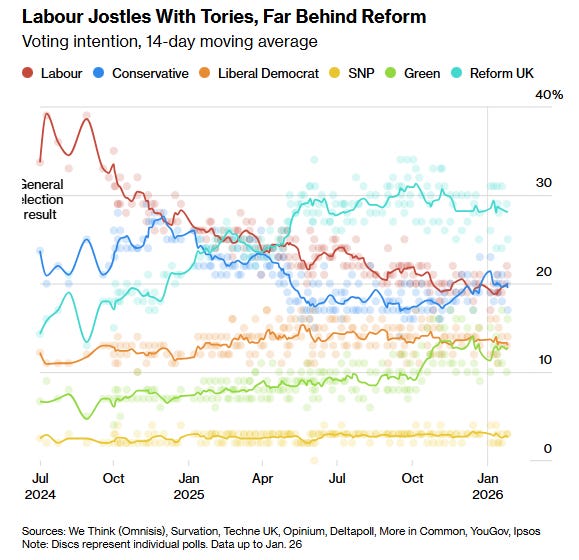

Even if Starmer survives the clamor for accountability around Mandelson, he faces jeopardy in the coming weeks. The most imminent flashpoint is a Feb. 26 special election in Gorton and Denton, a constituency which ought to be a Labour stronghold but where the Greens and Reform UK are now vying for first place.

BBG - Israeli Prime Minister Benjamin Netanyahu will visit Washington on Wednesday to discuss US-Iran diplomacy with President Donald Trump, whose focus on Tehran’s nuclear program falls short of his ally’s call for more sweeping measures.

The indirect US-Iran negotiations, launched in Oman, followed Trump’s buildup of US forces in the Persian Gulf in response to Tehran’s deadly crackdown against domestic protests. The White House’s initial talk of potentially regime-destabilizing punitive action in solidarity with the Iranian dissidents has been pared back to the long-running nuclear topic.

CNBC - The European Commission has told Meta it intends to impose “interim measures” to stop the tech giant from excluding third-party AI assistants from WhatsApp.

On Monday, the EU informed the company that its preliminary view was that it had “breached” EU antitrust rules. The investigation is still ongoing, and measures are subject to Meta’s reply and rights of defense, the Commission said.

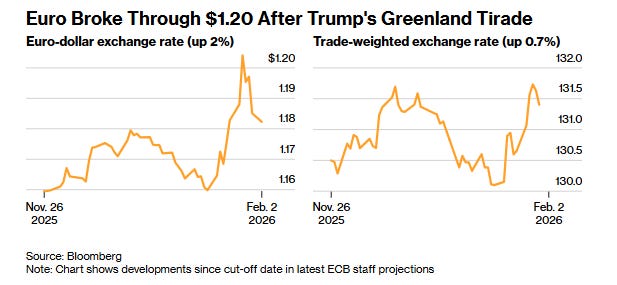

BBG - The European Central Bank will assess the effects of the euro’s recent rally on consumer-price growth in its quarterly forecasts due in March, but recent moves have been rather limited, Executive Board member Piero Cipollone told Cyprus News Agency.

Officials consider the exchange rate as one element “to project inflation dynamics,” the Italian policymaker said, according to a transcript posted on the ECB’s website on Sunday. “We will see how the new projections match and the impact this will have.”

At the same time, Cipollone highlighted that the ECB doesn’t have a specific target for the common currency, and that it’s been bunching around $1.17-$1.18 for almost a year now. “After the episode we saw a couple of weeks ago it is now back to levels seen in previous months,” Cipollone said.

BBG - European Central Bank President Christine Lagarde vowed to ensure EU heads of government consider a whole list of measures to strengthen the bloc’s long-term resilience before their upcoming summit.

“I will send it to each of the leaders of the European Union, to the president of the European Commission and to the president of the European Council,” Lagarde said Thursday in Frankfurt. “This is our checklist of what we regard as very much likely to enhance growth, to improve productivity and to really unleash the talent of Europe.”

Leaders are scheduled to meet on Feb 12. The checklist is meant to help them assess priorities to help boost their economies at a time when the region is facing challenges to growth and competitiveness.

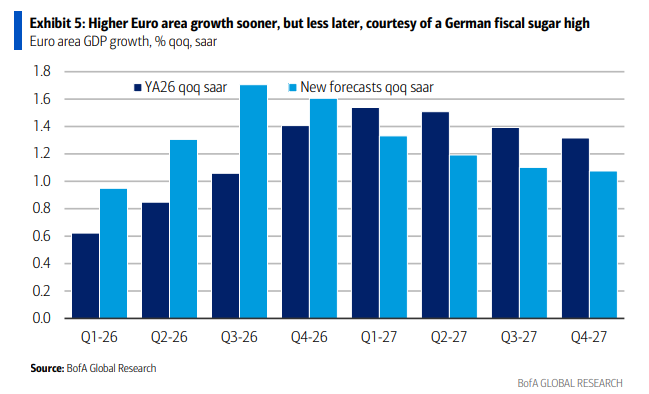

BoA raises their growth forecasts for the EU to 1.2% (+20bp) for 2026 but cut to 1.3% (-10bp) for 2027, reflecting a strong, but short-lived German fiscal growth peak (inflation and ECB forecasts below for subscribers):

Indeed, our forecasts for Germany move from 0.7% and 1.6% in 2026 and 2027, to 1.0% and 1.7% respectively, but sequential growth looks very different. It goes from 0 over the past six years to 2.5% qoq saar in 2H26E before slowing to just below 1% by 2H27E….

This German “sugar rush” will take Euro area growth above trend in the later part of this year (Exhibit 5). German growth acceleration will be so big that it will be tempting to extrapolate – to other Euro area members, to medium-term growth dynamics, to inflation and ultimately ECB policy rates. But careful, growth can quickly normalize afterwards, and we think it will.

The rest of the rundown of major European political, economic, and corporate news and analysis from Bloomberg, Reuters, FT, Briefing.com, WSJ, BoA, Goldman, etc., follows for paid subscribers.