Jan US ISM Manufacturing

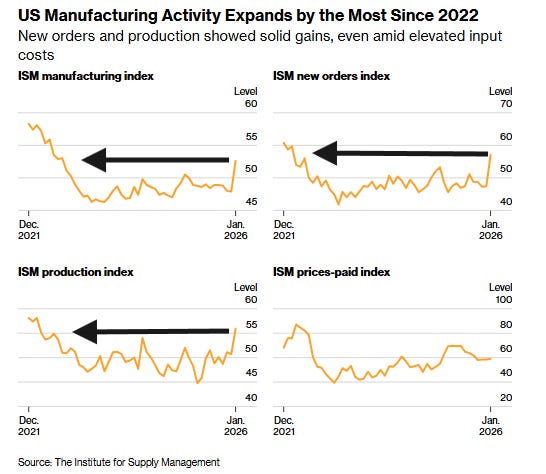

Headline index rises to the best since 2022 as do indices for new orders and production. But some questions on sustainability.

US ISM Manufacturing Jan: 52.6 (est 48.5; prev 47.9)

- Price Paid: 59.0 (est 59.3; prev 58.5)

- Employment: 48.1 (est 46.0; prev 44.9)

- New Orders: 47.1 (prev 47.7)

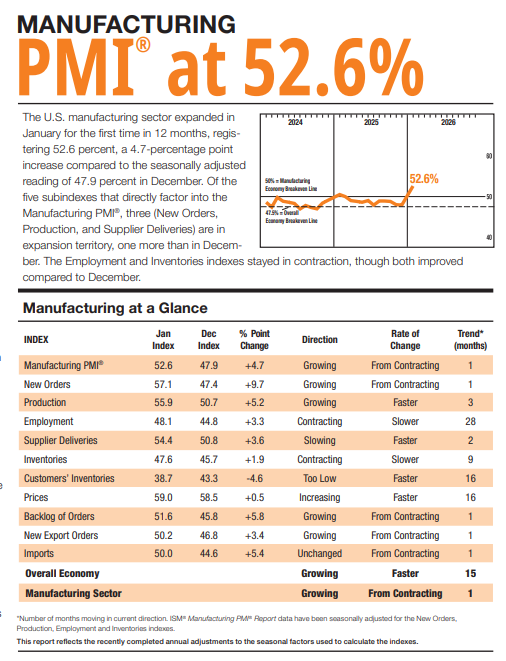

Like its S&P counterpart (which is generally smaller companies than the ISM survey and more domestic focused) which remained in expansion for the 12th month in 13 and accelerating to a 4-month high of 52.4, ISM’s Jan manufacturing #PMI, moved into expansion (over 50) for the first time in a year (since Jan ‘25, which was the first time since Sep ‘22) +4.7pts to 52.6, the best since Aug ‘22 after contracting in Dec the most since Oct ‘24. The reading was well above expectations for 48.5 and the 12-mth average of 49.1.

The PMI reading is indicative of expanding economic growth according to the report: “A Manufacturing PMI above 42.3, over a period of time, generally indicates an expansion of the overall economy,” and the current reading corresponds to a +1.7% growth in annualized real GDP. Note though the report indicated some caution on extrapolating the results:

“Although these are positive signs for the start of the year, they are tempered by commentary citing that January is a reorder month after the holidays, and some buying appears to be to get ahead of expected price increases due to ongoing tariff issues,” Susan Spence, chair of the ISM Manufacturing Business Survey Committee, said.

All five components which make up the headline improved in Dec, with three of the five were in expansion (up from two in Dec):

-New Orders jumped +9.7pts to expand for the first time in five months at 52.6, near a 4-year high,

-Production increased +55.9pts to 55.9, to a four year high,

-Employment rose +3.3pts, remaining though under 50 at 48.1, although well up from the 43.4 in July which was the least since 2020 (contacting for the 18th mth in 19 (and 12th straight)),

-Supplier Deliveries (meaning longer delivery times) +3.6pts to 54.4, and

-Inventories (raw materials) +1.9pts from the least since Oct ‘24 to 47.6. An Inventories Index greater than 44.5 percent, over time, is generally consistent with expansion in the Bureau of Economic Analysis (BEA) figures on overall manufacturing inventories (in chained 2000 dollars).

On new orders: “This reading is above the 12-month average (48.5 percent)…the highest since it registered 59.7 percent in February 2022.” “Of the six largest manufacturing industries, four reported increased new orders [up from one in Dec]. For every negative panelist comment about new orders, two comments indicated optimism about near-term demand. A number of comments, however, mentioned post-holiday replenishment and customers’ desire to get ahead of additional tariff-driven price increases as possible reasons for the increase,” said Susan Spence, Chair of the ISM Manufacturing Business Survey Committee. Eight industries reported growing new orders (up from two in Dec, six in Nov) while 7 reported declines (down from 13). An index above 52.1 percent, over time, is generally consistent with an increase in the Federal Reserve Board’s Industrial Production figures.

On production: “The Production Index expanded in January for the third month in a row, registering 55.9 percent, a 5.2 percentage point increase since December’s seasonally adjusted reading of 50.7 percent and the highest since February 2022 (58.1 percent). “Of the six largest manufacturing industries, four (Machinery; Food, Beverage & Tobacco Products; Transportation Equipment; and Chemical Products) reported increased production. Panelists had a 1-to-1.4 ratio of positive to negative comments regarding output” says Spence. 11 industries reported growth in production (up from four in Dec, seven in Nov), 6 reported declines (down from 9). An index above 52.1 percent, over time, is generally consistent with an increase in the Federal Reserve Board’s Industrial Production figures according to the report.

On employment: “Since January 2023, the Employment Index has contracted in 36 of 37 months. Of the six big manufacturing industries, two (Transportation Equipment; and Computer & Electronic Products) reported higher levels of employment in January. For every comment on hiring, there were two on reducing head counts. Companies continued to focus on accelerating staff reductions due to uncertain near- to mid-term demand. The main head-count management strategies remain layoffs and not filling open positions…66 percent of panelists still indicate that managing head counts is the norm at their companies as opposed to hiring,” said Spence. Of the 18 manufacturing industries, just five reported employment growth (up through from four in Dec, two in Nov. 11 though reported a decrease (up from 9). An Employment Index above 50.3 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

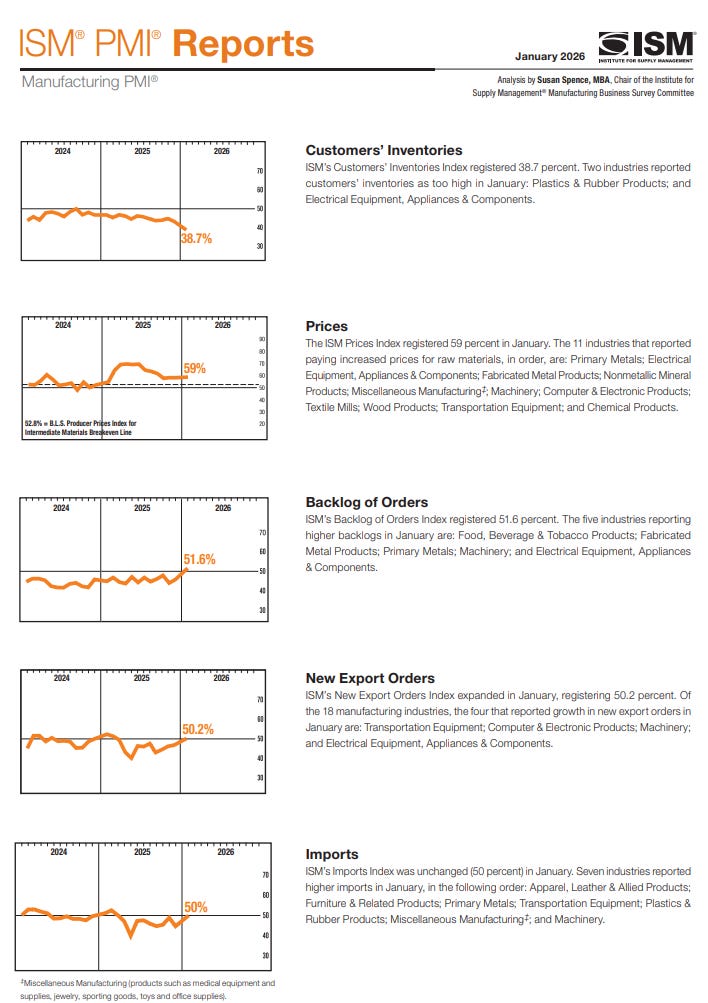

Looking outside of the headline components to the index, every component increased other than Customer Inventories but only one expanded - Input Prices (ISM doesn’t measure output prices) - which rose slightly +0.5pts, the first increase in six months to 59.0, the 16th straight month of expansion, but well below the near 3-year high in June of 69.7 (but also still +6% y/y).

On prices: “Of the six largest manufacturing industries, four (Machinery; Computer & Electronic Products; Transportation Equipment; and Chemical Products) reported price increases in January. The Prices Index reading continues to be driven by increases in steel and aluminum prices that impact the entire value chain, as well as tariffs applied to many imported goods. Higher prices were reported by 29 percent of respondents in January, up 2.6 percentage points from 26.4 percent in December but lower compared to 49.2 percent in April 2025, which was the highest share since June 2022 (65.2 percent),” said Spence. 11 industries reported paying higher prices (the same as Dec but down from from 12 in Nov, 14 in Oct) while just three saw declining prices (down from four in Dec). A Prices Index above 52.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

-New export orders (unlike the S&P report) expanded for the first time in 11 months improving for a fourth month +3.4pts (+7.2pts last four months) to 50.2, while

-imports were +5.4pts to 50.0.

-Backlogs improved for a second month +5.8pts to 51.6 from a 7-month low in Nov expanding for the first time in 40 months (since Sept ‘22).

-Customer inventories as noted were the only component to fall, -4.6pts to 38.7, to the least since mid-2022 (50.0 meaning “about right”, so this is “too low” (”usually considered positive for future production”).

On exports: “Trade frictions still are a major concern: For every positive comment, there were 1.2 negative comments,” says Spence. Just four of 18 industries reported growing export orders (down one from Dec), with 9 reporting declines (up one).

On backlogs: Despite expanding, of the six largest manufacturing industries, only two reported expansion in order backlogs in January. Only 5 of 18 industries reported growing backlogs (up though from one in Dec), while 8 reported declines.

A big improvement was also seen in the % of manufacturing GDP that contracted which fell to just 20% compared to 85% in Dec, the highest since July ‘24, and 9 of 17 industries expanded after just two in Dec (the least in over a year).

8 industries contracted (down from 15 in December, the most since 2022, and 11 in Nov).

And the share of sector GDP at or below 45 (“strongly contracting…a good barometer of overall manufacturing weakness”), fell to 12% from 43% in Dec and 39% in Nov, the least since 4% in Aug (the least of 2025).

Of the six largest manufacturing industries, five (Transportation Equipment; Machinery; Chemical Products; Food, Beverage & Tobacco Products; and Computer & Electronic Products) expanded in January,” says Spence.

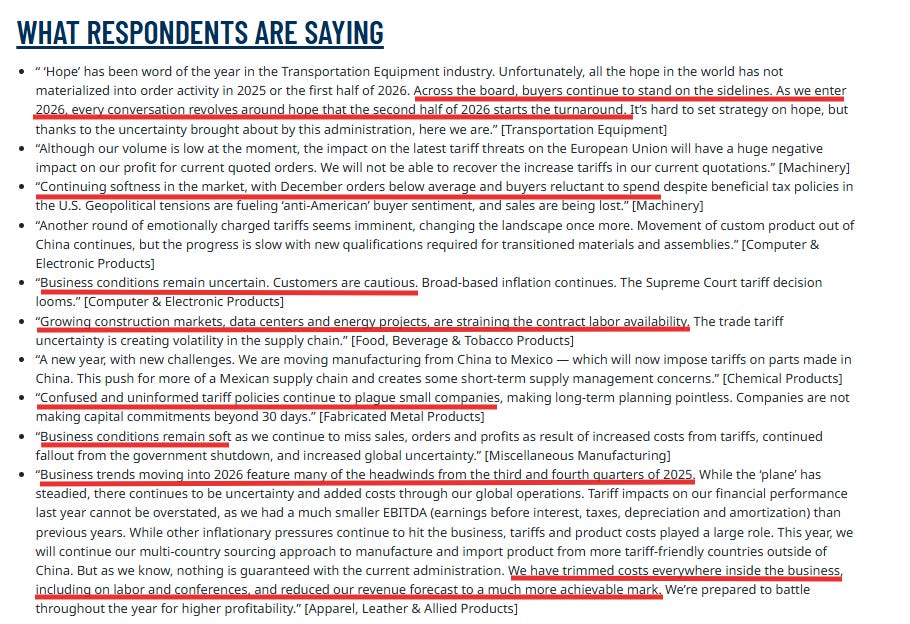

[comments after the charts]

The comments didn’t match the improvement in the index, but it appears many of the responses came during the tariff escalation with NATO and South Korea. As such they were much more tariff heavy with many mentions. Higher costs continued to be a frequent mention.

Most also commented on weak sales/business activity, although a little less than December. Still only one mentioned strong sales and it was related to data centers which are “straining contract labor availability.”

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-pmi-reports/pmi/january/

To subscribe to these summaries, click below.

To invite others to check it out,