July 2022 NY Fed Survey of Consumer Expectations - "Inflation Expectations Decline Across All Horizons"

Inflation expectations fall sharply as do spending intentions, but income and labor market metrics improve

July 2022 NY Fed Survey of Consumer Expectations - "Inflation Expectations Decline Across All Horizons"

Survey of Consumer Expectations - FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

After the June 2022 NY Fed's Survey of Consumer Expectations provided a mixed read on what has now become the market’s latest obsession, inflation expectations, with 1-year inflation expectations continuing to push higher but longer term inflation expectations falling back, the July survey was unambiguously positive, at least as to that metric, with significant declines in 1, 3 and 5-year ahead inflation expectations.

Expectations for home price growth and a range of other items also fell sharply. While we did see further softening for spending intentions and credit access perceptions, we saw improvements in many other metrics. Importantly, most of these metrics remain better than pre-pandemic levels (credit access a notable outlier despite the big increase this year in consumer credit levels).

Looking more specifically, one- and three-year-ahead inflation expectations both declined sharply in July, to 6.2% and 3.2% from 6.8% and 3.6% in June respectively. Both decreases were broad based across income groups. The measures of disagreement across respondents (the difference between the 75th and 25th percentiles of inflation expectations) increased at the one-year-ahead horizon and decreased noticeably at the three-year-ahead horizon. Median five-year ahead inflation expectations also declined sharply to 2.3% from 2.8% in June. After being stable at 3.0% during the first three months of the year, the series has trended down slightly.

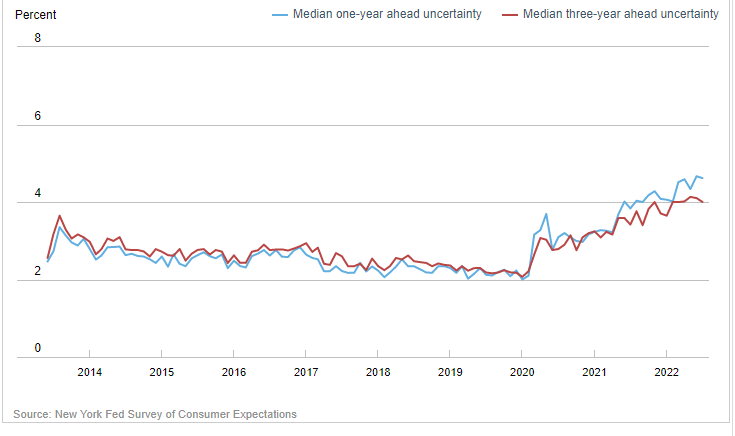

Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined slightly at both the one- and three-year-ahead horizons. Uncertainty at the five-year-ahead horizon decreased more substantially.

The median expected change in home prices one year from now dropped sharply to 3.5% from 4.4%, its third consecutive decrease and its lowest reading of the series since November 2020. The decline was broad based across education and income groups and across census regions, but was largest in the Northeast census region.

Expectations for inflation in other areas also decreased - “Expectations about year-ahead price changes decreased sharply by 4.2 percentage points for gas (to 1.5%) and by 2.5 percentage points for food (to 6.7%). The decrease in expected gas price growth was the second largest in the series, just below the 4.5 percentage point decline in April of this year. The decline in food price growth expectations was the largest observed since the beginning of the series in June 2013. There were smaller declines in expectations about year-ahead changes in rent (from 10.3% to 9.9%), medical care (from 9.5% to 9.2%), and college education (from 8.7% to 8.4%).”

Turning to the labor market, median one-year-ahead expected earnings growth remained unchanged at 3.0% in July for the seventh consecutive month, while the mean perceived probability of losing one's job in the next 12 months declined slightly to 11.8% from 11.9%, remaining well below its pre-pandemic reading of 13.8% in February 2020. The mean probability of leaving one's job voluntarily in the next 12 months rose to 19.5% from 18.6% in June. The series has moved within a narrow 18.6% to 20.4% range over the past year. Finally, the mean perceived probability of finding a job in the next three months (if one's current job was lost) declined to 55.9% from 56.8%, moving slightly below its trailing 12-month average of 56.5%.

Looking at household finance indicators, there was more mixed news. Positively, the median expected growth in household income increased by 0.2 percentage point in July to 3.4%, a new series high. The increase was most pronounced for respondents without a college education and with lower (below $50k) annual household incomes.

Less positively, median year-ahead nominal household spending growth expectations fell by 1.5 percentage points to 6.9% in July, well below its series high of 9.0% in May, but remains above its trailing 12-month average of 6.4%. The decline, the largest in this series and only the second this year, was broad-based across age, education, and income groups.

And perceptions of credit access compared to a year ago continued to deteriorate in July, falling for a seventh month, with the share of respondents finding it harder to obtain credit now than a year ago reaching a series high. Expectations about future credit availability improved slightly.

Positively, the average perceived probability of missing a minimum debt payment over the next three months did decrease by 0.5 percentage point to 10.8%, remaining below its pre-pandemic level of 11.4% in February 2020.

Also positively, perceptions about households' current financial situations compared to a year ago improved slightly in July, with slightly fewer respondents reporting being financially worse off than they were a year ago. Respondents were also more optimistic about their household's financial situation in the year ahead, with fewer respondents expecting their financial situation to deteriorate a year from now.

Looking at more economy-wide indicators, the mean probability that the U.S. unemployment rate will be higher one year from now decreased by 0.2 percentage point to 40.2% from the highest level since April 2020. The mean perceived probability that U.S. stock prices will be higher 12 months from now increased to 34.3% from 33.8% while the mean perceived probability that the average interest rate on saving accounts will be higher 12 months from now decreased to 34.1% from 35.7%. The median expectation regarding a year-ahead change in taxes (at current income level) increased by 0.4 percentage point to 4.9%. Median year-ahead expected growth in government debt decreased by 0.4 percentage point to 10.7%.

Overall, this report has consistently been more encouraging than most of the other sentiment surveys, and it likely was the case again this month (pending huge improvements in the other surveys) given the improvements in this report on many metrics, namely household incomes, financial situations, most labor market metrics, and inflation expectations. The softening in spending intentions will be something to watch, but overall an encouraging report, particularly as far as the Fed is concerned. The broad based fall in inflation expectations has to be a relief to see.

To subscribe to these summaries, click below.

To invite others to check it out:

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter Substack for newer posts or https://sethiassociates.blogspot.com for the full history.