Markets Update - 10/18/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

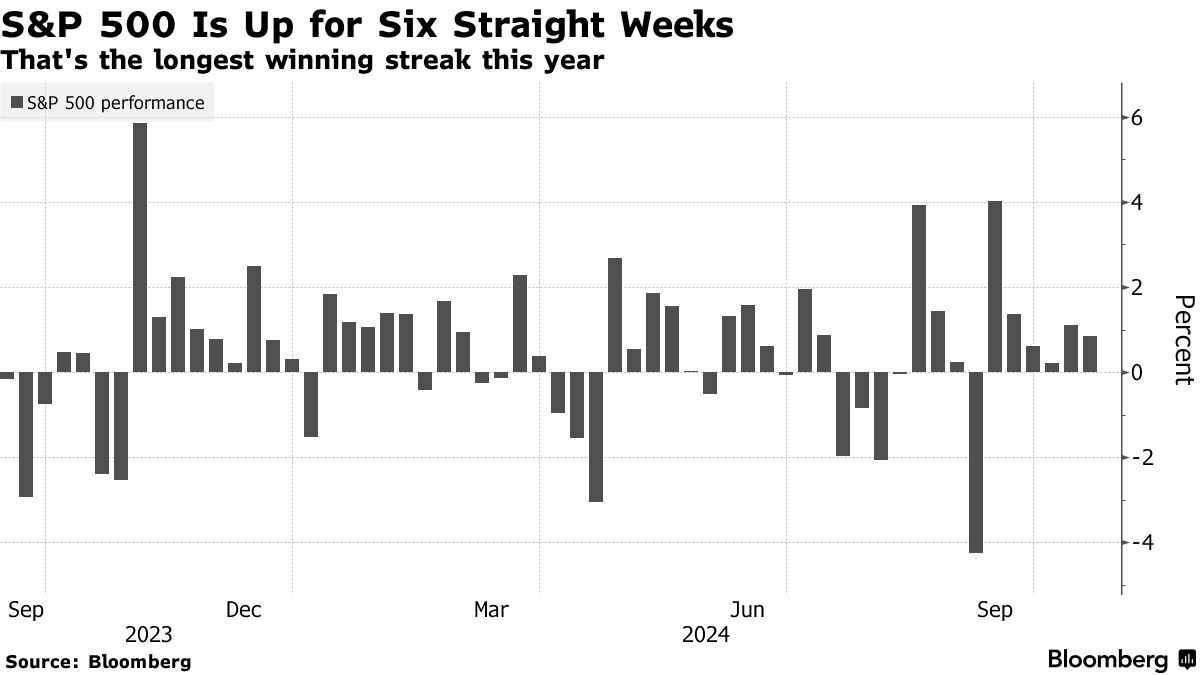

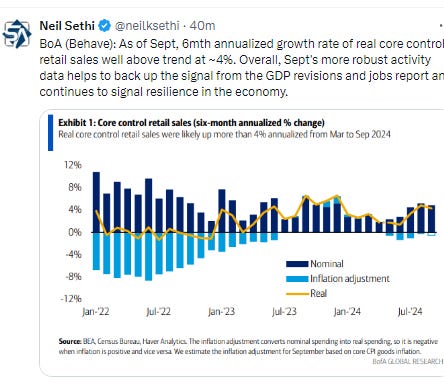

US large cap equities started Friday with mild gains following Netflix’s strong earnings Thursday after the close and finished little changed from where they started on a lighter news day, while small caps gave up early gains to finish lower (although leading for the week with a +1.9% gain). Still the SPX and Nasdaq were able to complete a 6th consecutive weekly gain, the longest for the former this year.

Treasury yields edged back, and the dollar saw its first real decline of the month. Crude and nat gas also fell while gold pushed to a record high. Bitcoin and copper were also up.

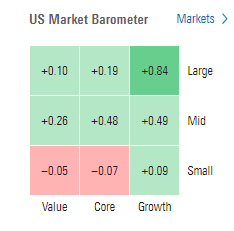

The market-cap weighted S&P 500 was +0.4%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite +0.6% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +0.1%, and the Russell 2000 -0.2%.

Morningstar style box shows the mixed action with most styles around flat levels.

Market commentary:

“Earnings season is off to the races, and despite some mixed signals, appears to be in good shape,” said Liz Young Thomas, head of investment strategy at SoFi. “We’re in the early innings though, and coming up on the final days before the election and the next Fed meeting.”

“We believe the environment remains constructive for US equities,” said David Lefkowitz at UBS Global Wealth Management. “Earnings growth is broadening out. While the election outcome adds a layer of uncertainty, we don’t think any potential policy changes stemming from the election will significantly alter the environment. Valuations are high in absolute terms, but we think they are reasonable in light of the macro environment.”

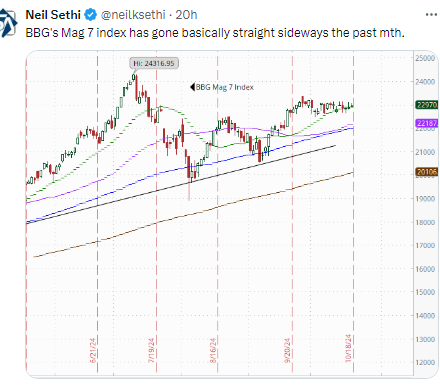

In a note titled “Rotation Nation,” Mike O’Rourke at JonesTrading said most of this week has been about the rally broadening out. While tech advanced, the group is lagging behind several other S&P 500 industries. He says the deceleration of inflation since mid-2024 has opened the door for rate cuts. And now economic strength has added accelerant to the mix. “Investors no longer need to crowd into the size and safety of the Magnificent Seven,” O’Rourke said. “Ironically, that crowding has the ‘Magnificent Seven’ collectively trading at more than twice the P/E multiple of the other 493 S&P 500 names. While the ‘Magnificent Seven’ leaders generally remain strong, the rotation has been real.”

A broadening out of the stock rally beyond tech megacaps would be a development that Gene Salerno, chief investment officer at SG Kleinwort Hambros Ltd., said he’d welcome. “It’s something frankly we’ve wanted to see for some time,” he said.

Chris Senyek at Wolfe Research says strong earnings revisions for the “Magnificent Seven” year-to date raise the bar to beat higher expectations relative to the other S&P 500 firms.“We believe that this group will likely need to beat by a larger margin than last quarter to return to the market’s leadership,” he said. “Along a similar vein, we believe reasonable expectations for the “Other 493” provides a lowered bar for upside surprises and supports our call for market performance to continue to ‘broaden out’ into year-end.”

“Will S&P 493 beat the ‘Magnificent Seven’? That’s a tough call considering how well the ‘Magnificent Seven’ companies historically have expanded their revenues, earnings and profitability,” said Ed Yardeni, founder of his namesake research firm. “While the Magnificent Seven has led the way since mid-2023, the S&P 493 is now beginning to catch up,” he concluded.

To Quincy Krosby at LPL Financial, it is highly unlikely that investors and traders alike will feel the anxiety of missing out if the technology sector delivers weaker than expected numbers and softer guidance. “A pullback as we inch closer to overbought technical conditions could offer a modicum of support as we enter a crucial week for earnings and move closer to what big tech reports and even more important, what big tech sees ahead,” she said.

Small caps are getting a boost from the so-called Trump Trade, according to Bank of America Corp. strategist Michael Hartnett. In a note, he said there are signs investors are positioning for presidential victory by Donald Trump, moving into banks, small-cap stocks and the dollar, assets that rallied in November 2016 in the wake of his last successful run.

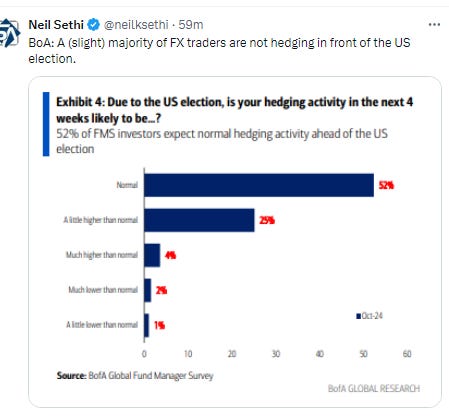

Despite volatility in the market increasing leading up to the election, stocks may actually continue to rally through November, according to Rob Williams, chief investment strategist at Sage Advisory. This would be atypical for an election year. “Usually it’s the other way around — the market’s hesitant, and then it does well after the election. Now we’re getting the reverse of it and ... Maybe you get the opposite of what we had — stocks will be strong into the election and then have some volatility fall on the election,” he said.

In individual stock action, the Dow was weighed down by component American Express (AXP 276.79, -8.99, -3.2%) which sank after trimming its revenue forecast despite despite better-than-expected Q3 EPS results and above-consensus earnings guidance. Netflix (NFLX 763.89, +76.24, +11.1%) though jumped following better-than-expected earnings results and guidance while Apple Inc. climbed 1.2% as sales of its newest iPhones in China soared.

Corporate Highlights from BBG:

Shares of Lamb Weston Holdings Inc. surged after activist investor Jana Partners said it had built up a 5% stake in the company in a bid to push the french-fry supplier to explore strategic alternatives.

Procter & Gamble Co. posted a second straight quarter of sluggish sales growth, dragged down by minimal price increases and weakness in key areas such as skin and baby care.

SLB warned oil explorers’ spending growth has waned in recent months as they take a cautious approach amid lower crude prices.

Ally Financial Inc. shares fell after the auto lender gave a more pessimistic outlook for loan charge-offs and lowered its net interest margin forecast as consumers struggle with expensive debts.

Verizon Communications Inc., the biggest wireless carrier in the US, will buy some of US Cellular Corp.’s spectrum licenses for $1 billion as the tower operator sheds parts of its portfolio.

Warren Buffett sold another slug of Bank of America Corp. stock after the lender repurchased enough of its own shares to nudge his stake back above 10% — a regulatory threshold that requires rapid disclosure.

CVS Health Corp. named David Joyner as its new chief executive officer, ending a tumultuous tenure for Karen Lynch at the pharmacy giant.

BMW AG is recalling nearly 700,000 vehicles in China due to coolant pump defects, a fresh setback for the German carmaker that’s reeling from other vehicle faults.

Some tickers making moves at mid-day from CNBC.

While the SPX flirted with record highs Friday, new 52 wk highs fell back to 38 from 66 the same time yesterday (and the least this week). Still just 2 new 52wk lows though.

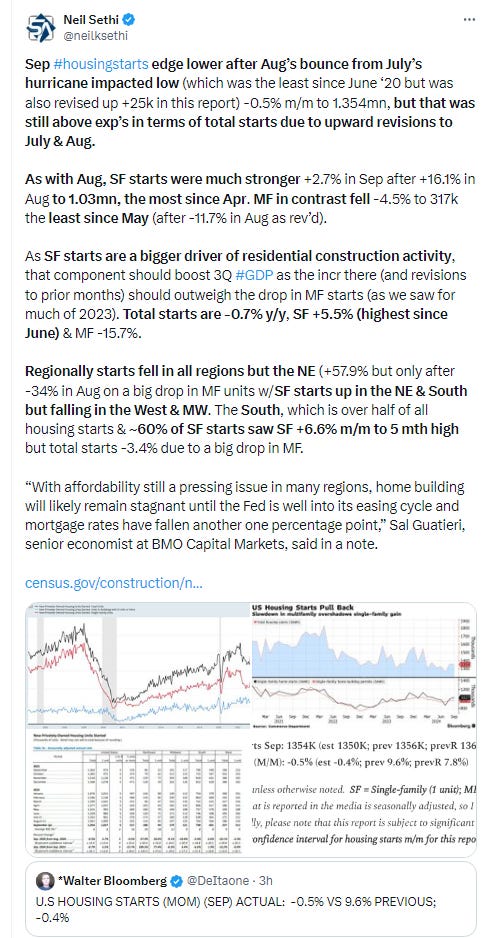

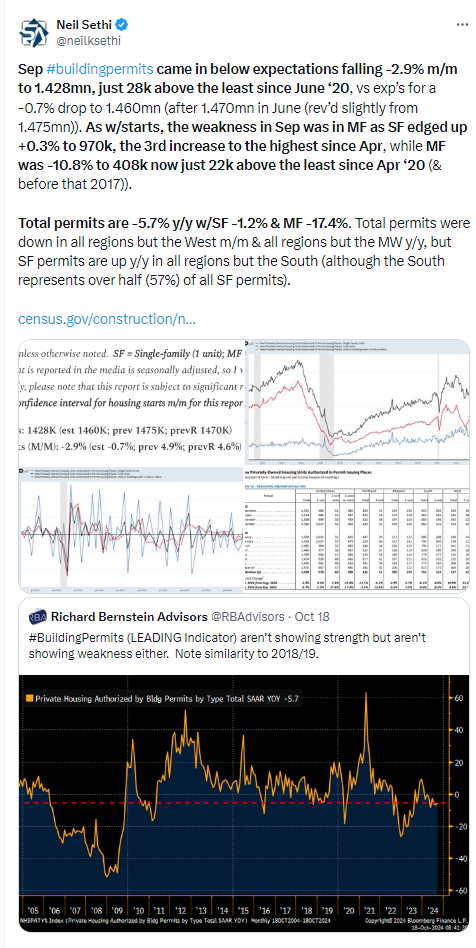

US economic data was limited to housing starts and permits. The former came in better than expected (when prior month upward revisions were taken into account) on the back of strong single-family starts, but the latter was not declining to just 28k above the least since June ‘20 again due to weakness in multifamily.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX edged higher but remained just below ATH’s. Daily MACD and RSI remain supportive.

The Nasdaq Composite similarly remain around the highest since July. As with the SPX the daily MACD & RSI remain supportive for now.

RUT (Russell 2000) not able to clear the 2300 level again after the highest close since Jan ‘22 Wednesday. Its daily MACD & RSI remain positive so we’ll see if it can get over next week.

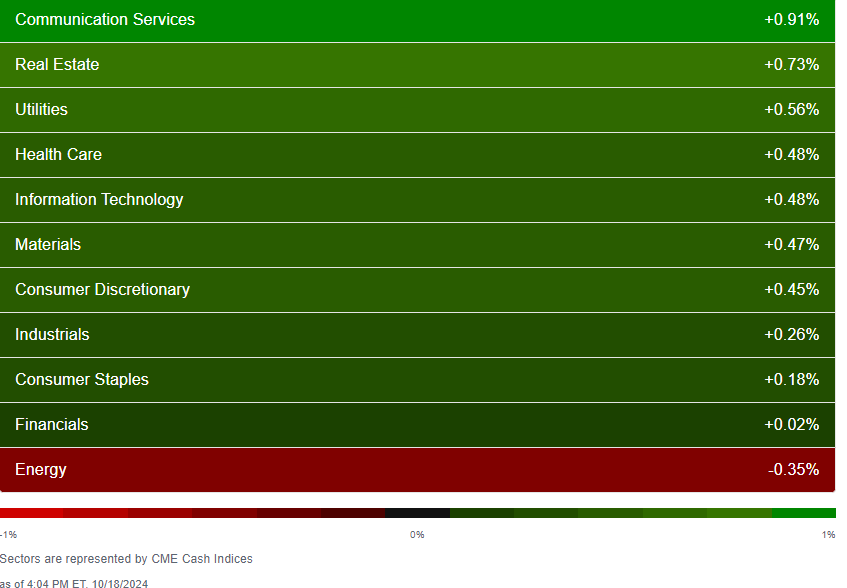

Equity sector breadth from CME Indices improved to 10 of 11 sectors green, matching Monday for best of the week, and no sector down by more than -0.35%. Seven sectors up that much or more, although none up 1% or more (best was communications +0.9%). Energy the lone decliner.

Stock-by-stock SPX chart from Finviz relatively consistent with green & red spread across the chart.

Positive volume improved as would be expected but at 57 & 72% on the NYSE & Nasdaq respectively the improvement was pretty solid (they NYSE despite the RUT finishing lower). Issues were 53 & 57%.

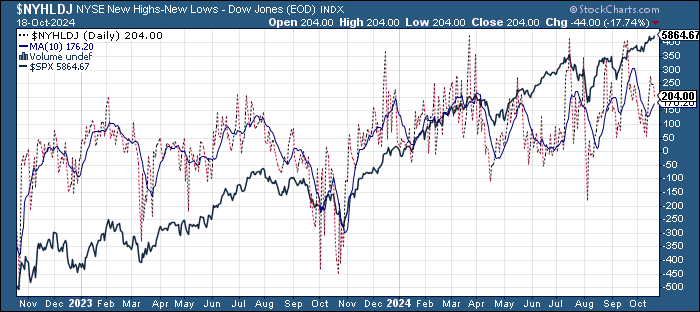

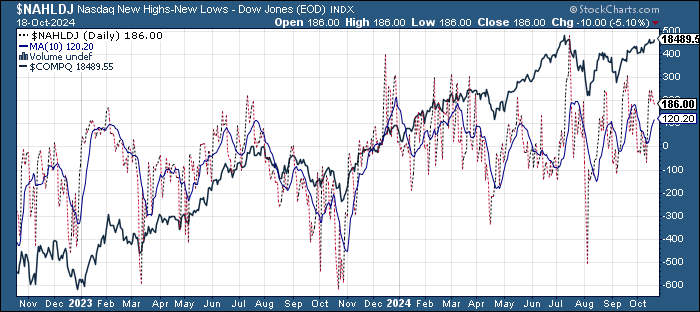

New highs-new lows (charts) though fell back to 204 and 186 respectively from around the best since September. Still above the 10-DMAs (more bullish).

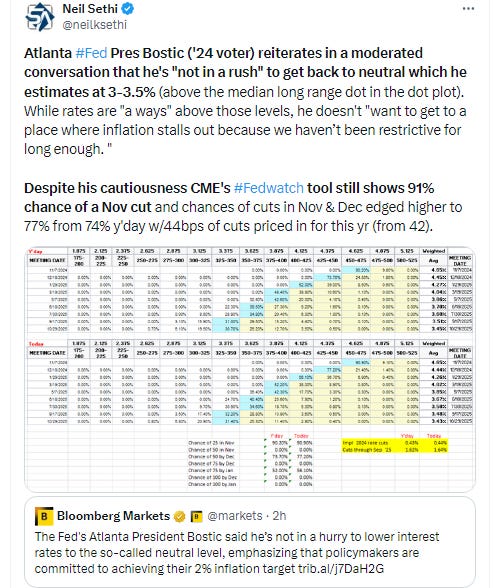

FOMC rate cut probabilities from CME’s Fedwatch tool edged to more cuts despite Atlanta Fed Pres’ Bostic’s comments that he was “in no rush” to cut rates with chances for a Nov 25bps cut edging to 91% (9% chance of no cut). Chance of 50bps through the end of year though up to 77% (down though from 86% before the retail sales report Thurs with now a 1.4% chance of no cuts this yr, and chance of 75bps through Jan meeting to 56% (down from 66% before the retail sales report). Now 44bps of cuts priced this yr, 164bps through Sep ‘25.

Treasury yields fell back with the 10-yr yield down 1 basis point to 4.08% from the joint highest close since July, while the 2-yr yield was down three basis points at 3.95%. Both were basically flat on the week.

Dollar had its first pullback of the month after a scorching nearly 4% run falling back from the 104 level and the uptrend line running back to the Sep ‘22 highs that outside of one week in June has capped all rallies. Daily MACD & RSI remain supportive but the RSI has crossed from over to under 70 an indication of loss of momentum.

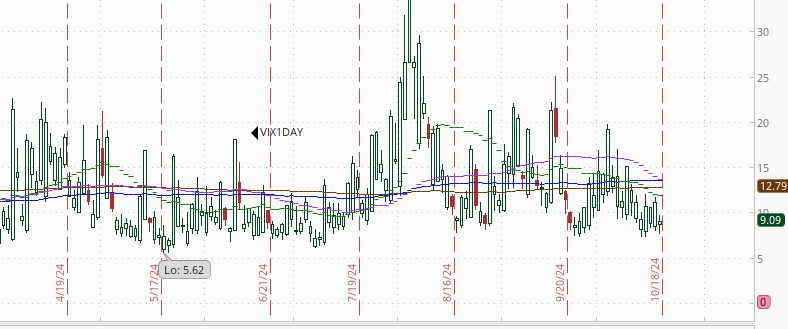

The VIX & VVIX (VIX of the VIX) both fell to the least since the start of the month with the former to 18 (consistent w/1.1% daily moves over the next 30 days) & the latter to 101 (consistent w/7.5% daily moves in the VIX over the next 30 days). As noted 2 weeks ago, though, these are 30-day volatility measures and now incorporate the election so will likely remain more elevated until that passes.

1-Day VIX, which will be a better near term indicator of expected volatility until the election, fell back under 10 to 9.1, lowest close since Sep 24th, just looking for a move of ~0.6% Monday, very normal.

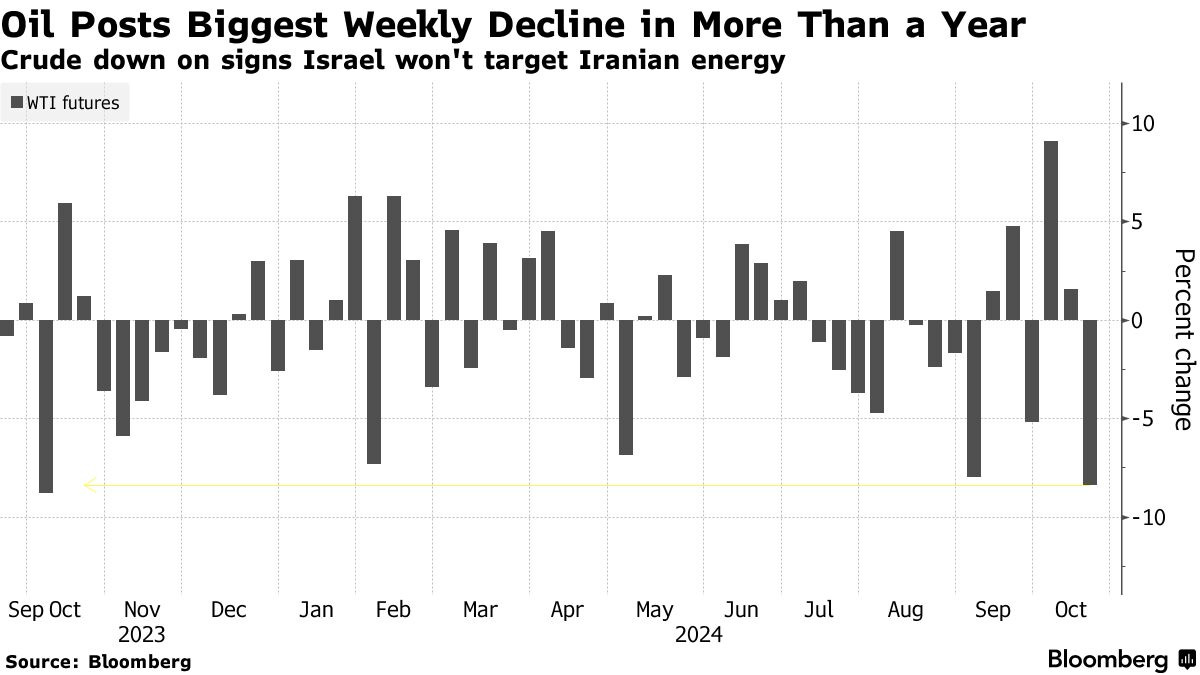

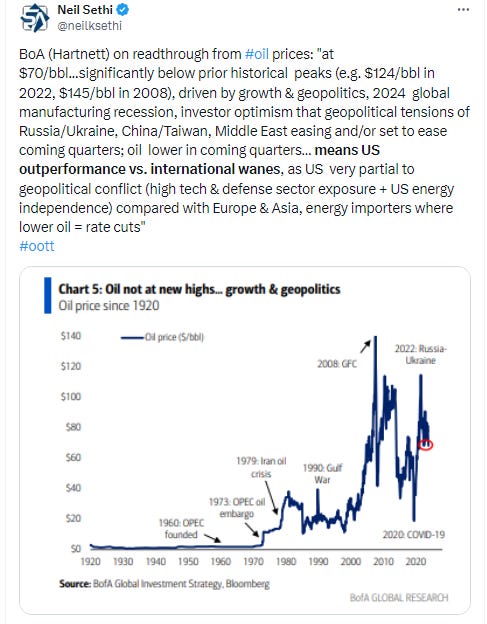

WTI not able to hold $70 Friday falling to the trendline target of $69 put on it once Israel announced it would not attack Iran's energy facilities, finishing -8.4% for the week, its worst in over a year. My confidence in this level holding is not high, though, and the daily MACD & RSI also point in the direction of lower prices. Next support is the $65-$67 zone where it bounced late Sept/early Oct.

As I said three weeks ago, overall “feels like a very binary situation. Either we get the strike against the facilities (or something similar (like against the nuclear sites)) which keeps the risk of major supply disruptions elevated (or actually sees major supply disruptions) or things dial back in which case seems like WTI will fall back towards the mid-60’s.”

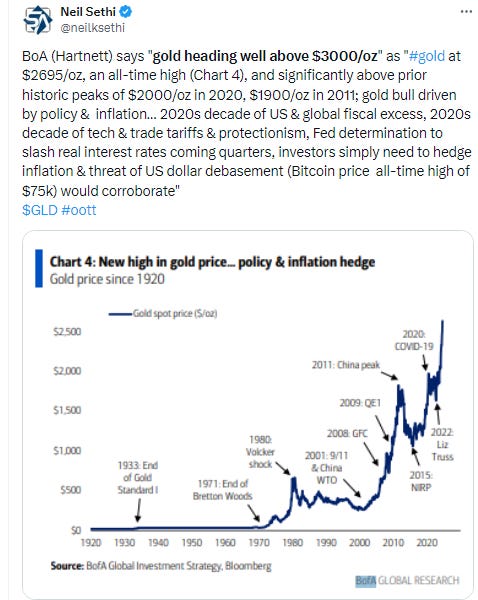

Gold a solid day Friday up over 1%, its 6th gain in 7 days hitting an ATH. Also, the daily MACD (circle) now joins the RSI (arrow) in signaling more upside may be ahead.

Copper continued its bounce from the 50-DMA target. We’ll see if it can keep it going, but as noted last week daily MACD & RSI are not yet supportive. A break of the uptrend line targets $4, but also not much resistance until the Oct closing highs near $4.70.

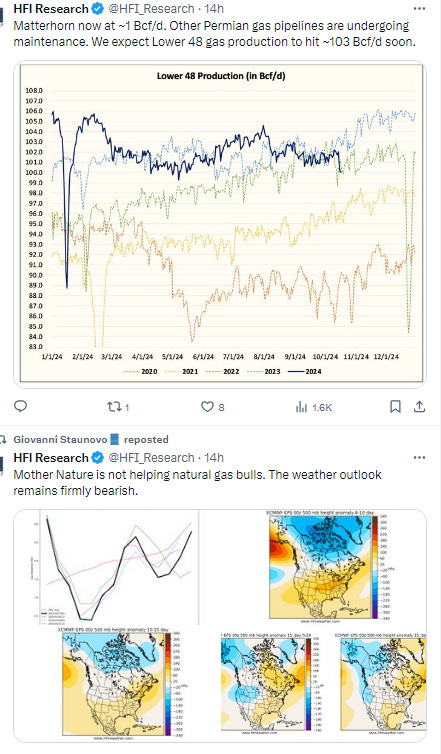

Nat gas as expected wasn’t able to hold falling another -4% (down -15% last week (and over -25% the last 2 wks)) making it to the target of the 200-DMA/$2.25 which I noted 2 wks ago “should offer some solid support.” However the MACD & RSI argue for even lower prices.

Bitcoin futures up for 5th day in 6 Friday, again clearing the top of the channel they’ve been in since March, but this time they closed over for the first time since then consistent with the more positive daily MACD & RSI noted Thursday. As noted then if it can stay over (through Monday’s close) this is definitely a bullish development.

More Sunday.

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,