Markets Update - 10/29/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

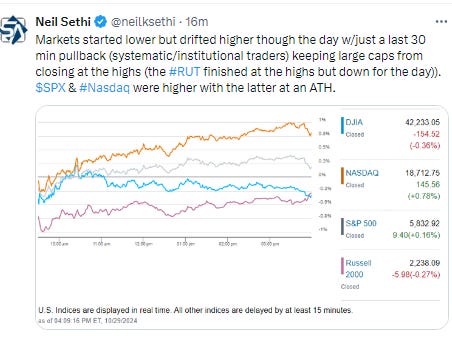

US equities started the Tuesday session lower but were able to improve throughout the day, although it was mostly a story of large cap growth stocks doing all the lifting as most stocks fell.

Treasury yields and the dollar were little changed as was copper. Gold, bitcoin and nat gas gained (the former to an ATH and the second just under) while crude edged lower.

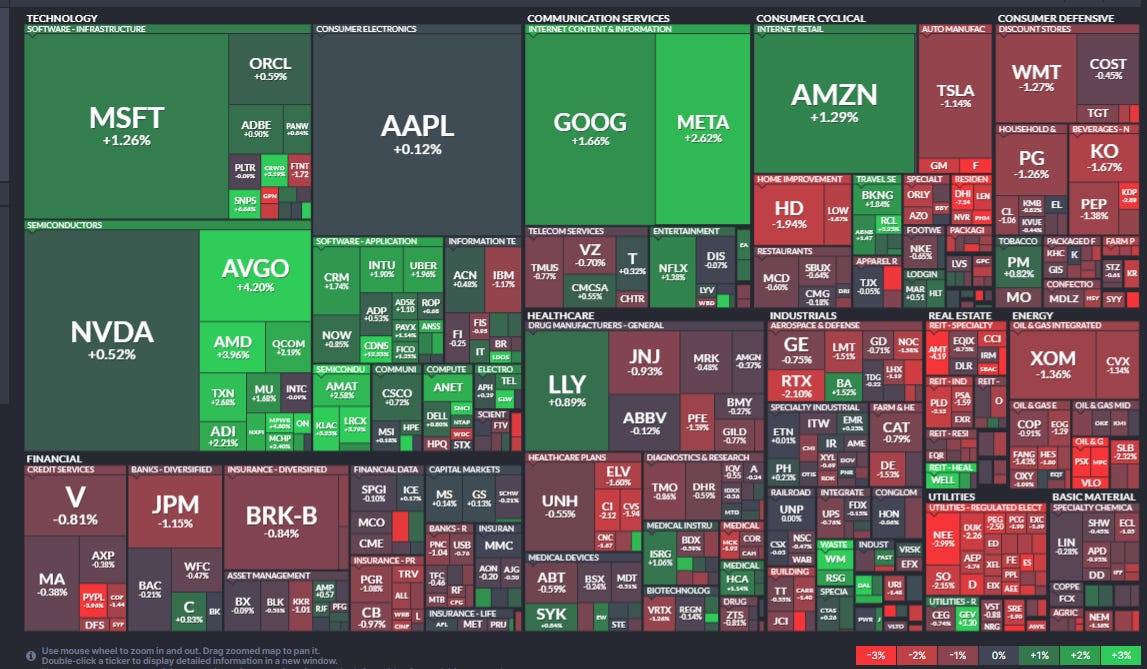

The market-cap weighted S&P 500 was +0.2%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite +0.8% (and the top 100 Nasdaq stocks (NDX) +1.0%), the SOX semiconductor index +2.3%, and the Russell 2000 -0.3%.

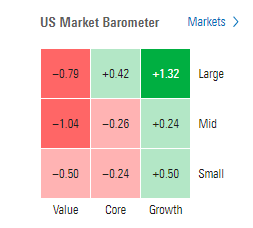

Morningstar style box also saw a big bifurcation between growth and value.

Market commentary:

"In equities, the market remains 'over-hedged' on account of the clustering of event risks and is forcing a risk management exercise after already experiencing two 'vol shock' events over the past three-month period. IF said risks clear without bunches of 'worst-case' scenarios all hitting heads multiple times, there is gonna be an unwind of said 'over-hedging' which creates a mechanical bid into year-end, because many are already 'under-capturing' the equities move." -- Charlie McElligott, Nomura

“So far, earnings season has met our expectations,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “It’s a big couple of weeks ahead for markets. We think the outlook for profit growth remains healthy, and expect 11% and 8% S&P 500 EPS growth in 2024 and 2025.”

“It’s currently an expensive market, and so I think that investors need for earnings growth to accelerate in order to justify these higher PE ratios,” CFRA Research chief investment strategist Sam Stovall said.

“Investors will need to see bigger revenue and earnings surprises for the group to outperform,” said Chris Senyek at Wolfe Research. “Our sense is a solid earnings season could once again put the group on a path to outperform into year-end.”

“One the one hand, macro conditions right now are very favorable: resilient growth, disinflation, stimulus and then relatively healthy earnings,” Vital Knowledge founder Adam Crisafulli said on CNBC’s “Closing Bell: Overtime.” “But you have expensive stocks, and then you have this yield dynamic that’s acting as a headwind.”

“With a week to go to the election and polls indicating a dead heat, investors are unlikely to take on much new risk, and may even prefer to de-risk until the outcome is known,” said Jason Draho at UBS Global Wealth Management. “Once the dust settles and the outcome is clear, the macro fundamentals should reclaim their spot in the driver’s seat, determining the market direction.”

BTIG’s Jonathan Krinsky believes there is more near-term choppiness ahead for the market with just five trading days left before the U.S. presidential election. “While we aren’t looking for a bear market, our conviction remains high that we are poised for some downside volatility over the coming weeks,” Krinsky wrote in a note.

“Have you heard the one about the markets preferring divided government?” said Brian Levitt at Invesco. “Of course you have. Is it true? Admittedly, the numbers do bear it out although I would argue the analysis isn’t statistically significant. Rather, the returns in most instances tend to be driven by a handful of notable years.” Levitt looks at two potential 2024 divided-government outcomes: 1) Republican President, Republican Senate, Democratic House (which has resulted in the second-best outcome for stocks) and 2) Democratic President, Republican Senate, Democratic House (this combination hasn’t happened since 1886-1889, leaving it out of the period of the analysis.) “For what it’s worth, the US stock market posted positive strong returns in recent examples of single-party rule, including under Democrat Bill Clinton (1993-1994), Republican George W. Bush (2005-2006), and Democrat Barack Obama (2009-2010),” he said. “Everyone may ‘know’ that the market does best under a divided government, or everyone might just be confusing correlation with causation.”

With market volatility at elevated levels ahead of the U.S. Presidential election next week, Piper Sandler advises investors to add to their positions when pullbacks occur. “Near-term pullbacks/profit-taking should be expected given the uncertainties around the upcoming U.S. Presidential election, geopolitical uncertainty, and Q3 earnings parade. At this juncture, the weight of the technical evidence remains constructive, and the primary trend of the major averages continues to be higher,,” chief market technician Craig Johnson wrote in a Tuesday note. Johnson reiterated his year-end S&P 500 price target of 6,100.

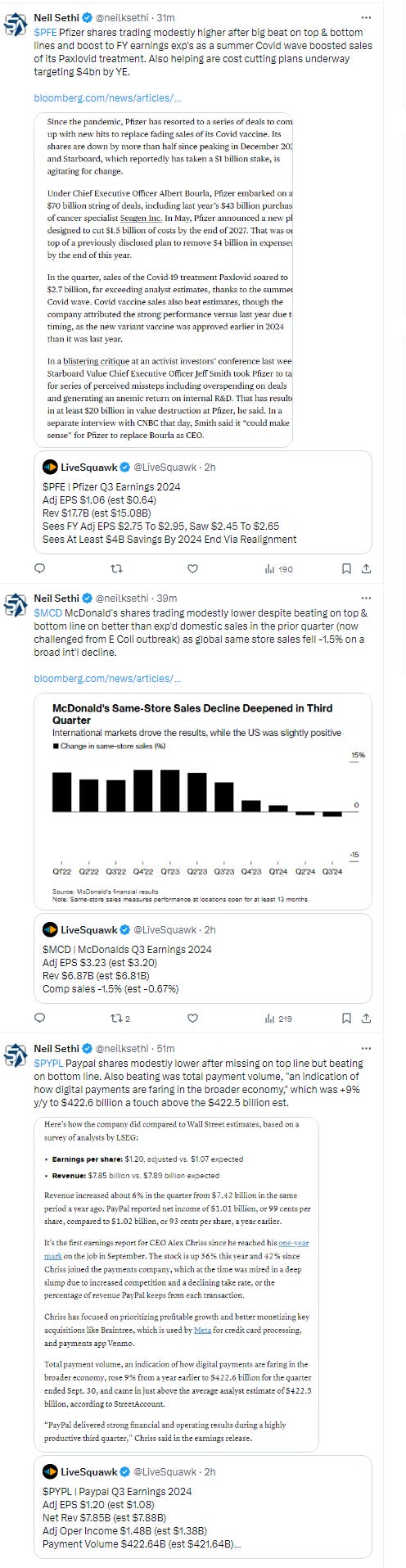

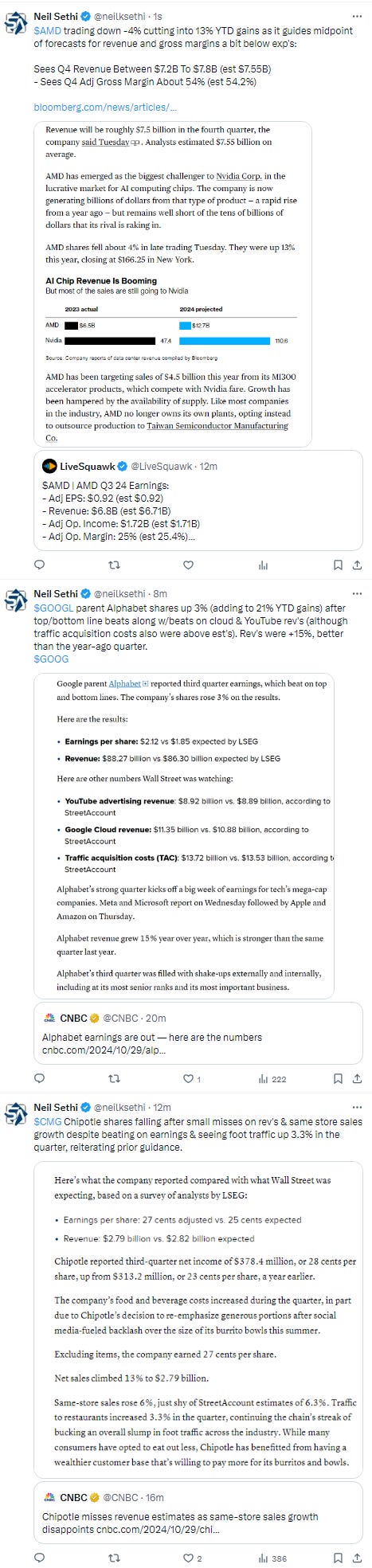

In individual stock action, ahead of their earnings releases this week, shares of Meta jumped 2.6%, and Alphabet advanced 1.8% on Tuesday. D.R. Horton (DHI 167.32, -13.06, -7.2%), Ford (F 10.41, -0.96, -8.4%), and Pfizer (PFE 28.46, -0.40, -1.4%) were some of the names that closed lower after reporting results, along with Dow component McDonald's (MCD 295.00, -1.79, -0.6%), while Royal Caribbean (RCL 210.10, +6.58, +3.2%) was an earnings-related winner today, as was VF Corporation whose shares had their best day on record after the retailer exceeded Wall Street’s expectations for the second fiscal quarter and offered insight into improvements within the Vans brand. On the other side, Shares of Crocs plunged more than -19% despite the company posting better-than-expected quarterly results, its largest percentage decrease since March 18, 2020, when it fell more than -24%.

After the bell, Shares of Google’s parent climbed 3.5%. Visa was also higher while shares of Advanced Micro Devices sank 6% amid a lackluster revenue forecast. Shares of Chipotle were also lower.

Corporate Highlights from BBG:

Reddit Inc. beat sales expectations for the third quarter and projected a strong holiday season as the newly public company continues to see its investments in advertising technology pay off.

Chipotle Mexican Grill Inc. reported third-quarter sales that fell just short of Wall Street’s expectations, highlighting the high bar investors are holding the chain to after strong performance earlier this year.

Visa Inc. reported adjusted earnings per share for the fourth quarter that beat the average analyst estimate.

Homebuilder stocks are tumbled after industry bellwether D.R. Horton Inc. delivered a 2025 revenue forecast that failed to meet Wall Street’s expectations.

Broadcom Inc. rallied after Reuters reported that OpenAI is working with the company on a new artificial-intelligence chip.

Pfizer Inc. Chief Executive Officer Albert Bourla said he’ll do “whatever it takes” to keep profits growing, including further cost cuts, as he seeks to fend off allegations of mismanagement from activist investor Starboard Value LP.

McDonald’s Corp. sales fell short of Wall Street’s expectations in the third quarter following weakness in international markets such as France, China, the UK and the Middle East.

Royal Caribbean Cruises Ltd. raised its earnings outlook for a fourth time this year and said it expects strong demand to continue.

JetBlue Airways Corp.’s worse-than-expected sales forecast suggested a recovery will take some time.

Some tickers making moves at mid-day from CNBC.

In US economic data today:

Home prices reaccelerated in August on a m/m basis but fell y/y to the least since rates peaked in 2023 (didn’t get to today).

US consumer confidence increased in October by the most since March 2021 on optimism about the broader economy and the labor market (also didn’t get to yet).

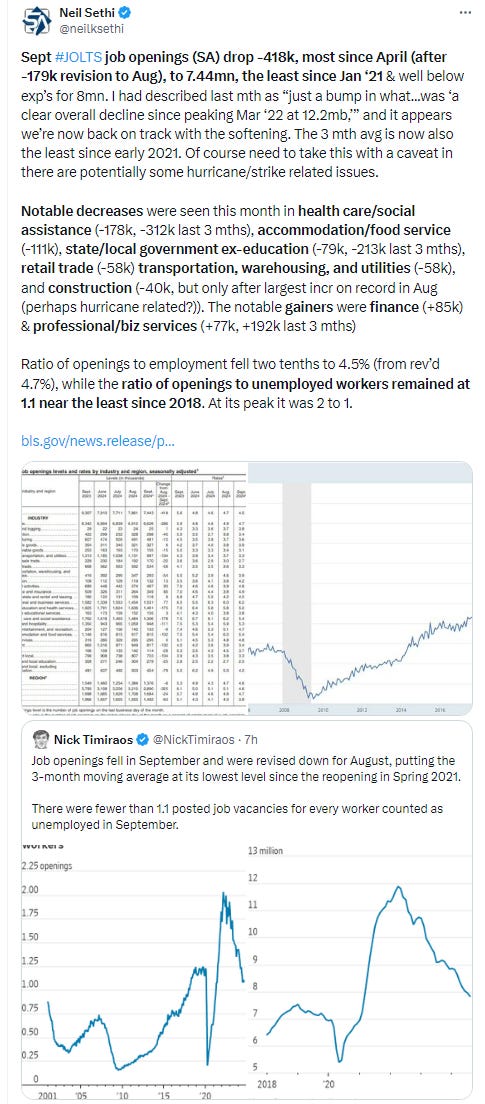

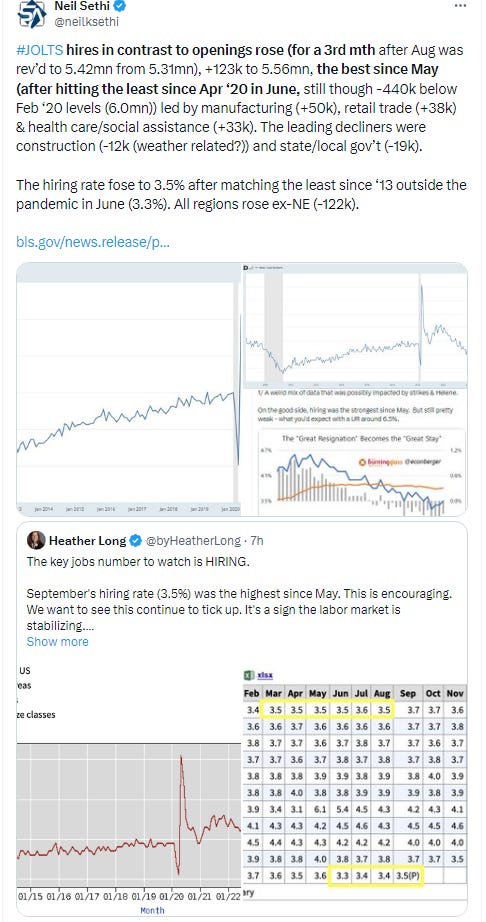

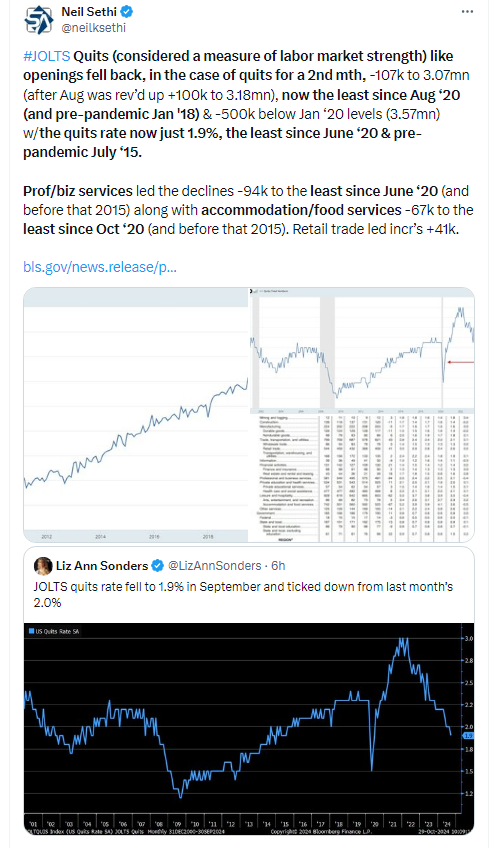

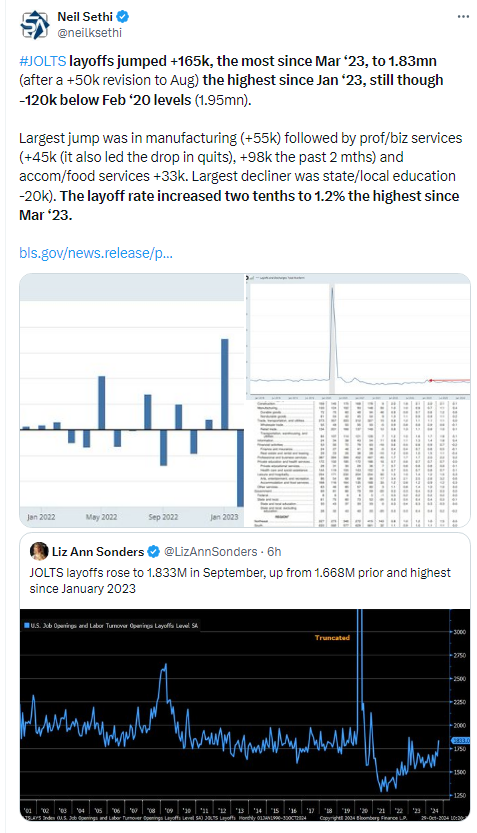

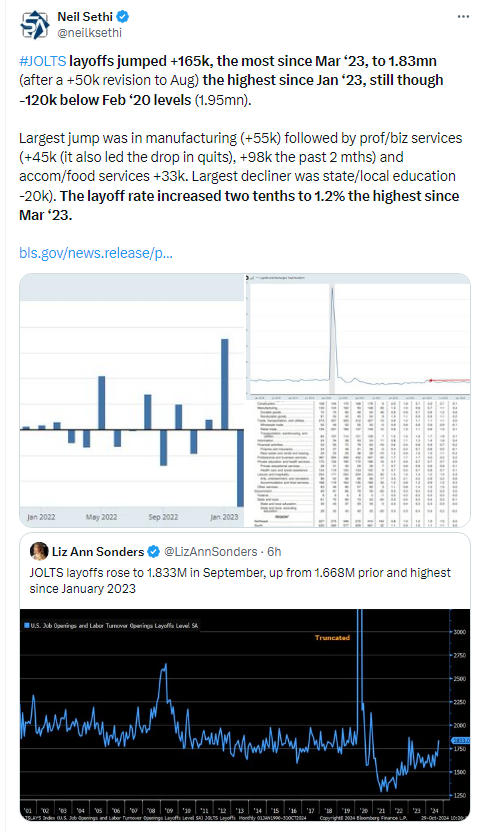

The JOLTS report for Sept showed a drop in job openings to the least since Jan ‘21, quits to the least since Aug ‘20 & layoffs to the highest since Jan ‘23. Hires though rebounded to the best since May, although still overall remaining on their downtrend since peaking late in 2021.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX continued to trade for a 5th day just above its 20-DMA which seems to be providing some support. Daily MACD and RSI though remain a bit weak.

The Nasdaq Composite was able to finally hold the new high setting up a potential run higher. The daily MACD & RSI have also improved.

RUT (Russell 2000) remained above its 20-DMA. Its daily MACD & RSI remain less supportive.

Equity sector breadth from CME Indices deteriorated notably with just 2 green sectors (from 9 Mon), although both were up over 1% (megacap growth sectors). Four sectors down around -1% or more though despite the SPX & Nasdaq finishing in the green led to the downside by yield sensitive sectors & energy.

Stock-by-stock SPX chart from Finviz consistent with lots of red outside of the “Super 6” and tech.

Positive volume was weak on both the NYSE & Nasdaq coming in at 32 & 58% from 72 & 73% Monday respectively. Issues fell to 31 & 45% from 65% for both Monday.

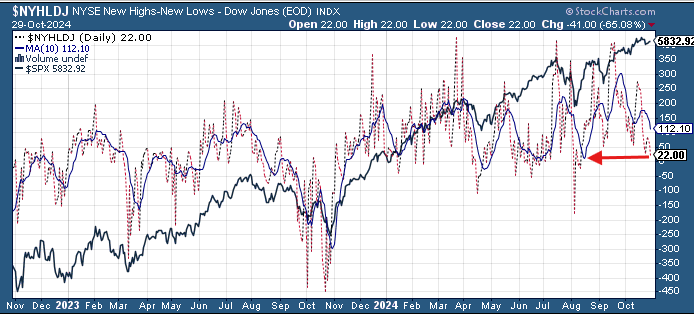

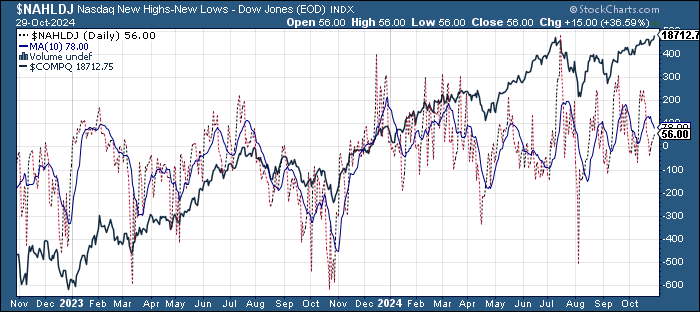

New highs-new lows (charts) were mixed again with the NYSE falling back to 22, the least since August, while Nasdaq improved to 39 the best in a week. They’re both still below the 10-DMAs (less bullish) and so the DMA’s continue to head lower with the NYSE’s the least since Aug.

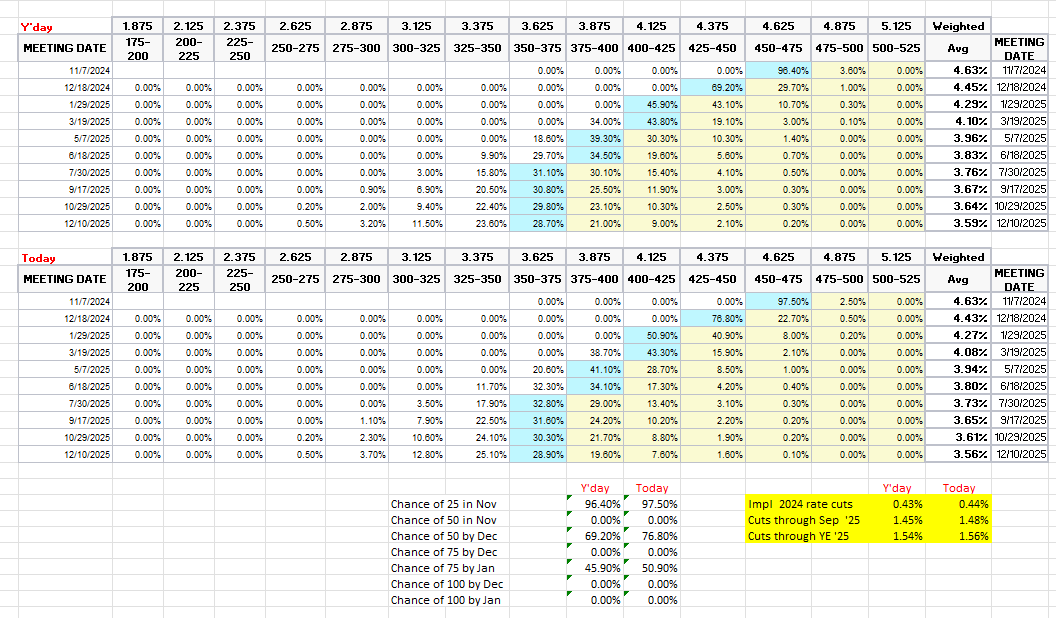

FOMC rate cut probabilities from CME’s Fedwatch tool jostled around following the data today at one point seeing 100% chance of a Nov cut. By the end of the day though that was back to 97.5% (still basically a lock), but the chance of 50bps through the end of year moved up to 77% from 69% Monday (just 0.5% chance of no cuts this yr), and the chance of 75bps after Jan’s meeting to 51% from 46%.

Now 44bps of cuts priced this yr, 148bps through Sep ‘25 & 156bps through YE ‘25.

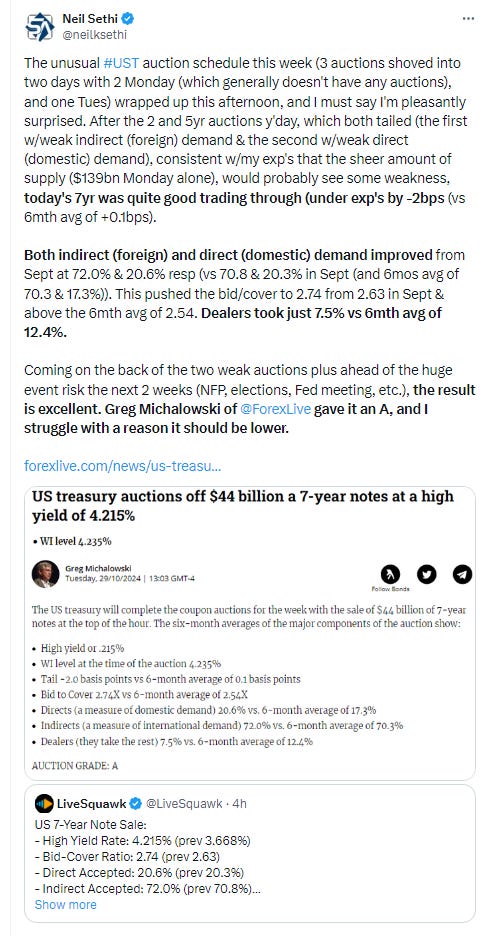

Treasury yields took a pause after initially moving higher to start the session, with the 10yr yield ending -1 basis point at 4.27%, just off the highest since July after exceeding 4.3% during the session, still up 20bps since last week’s open, and maintaining its steep ascent, while the 2yr yield was -2bps to 4.12% from the highest close since Aug 1st, up 18 bps since last week.

Dollar ($DXY) like yields was flat on the day, remaining near the highest close since July. It also remains above the uptrend line running back to the Sep ‘22 highs that outside of 8 or so days in June has capped all rallies (it’s been over for 6 days so far).

As noted last Monday, it broke a lot of resistance last week, and if it can stay over it opens up a run all the way to 106. Daily MACD & RSI remain supportive, although the RSI is showing flagging momentum. A close below 104 will be something to watch out for.

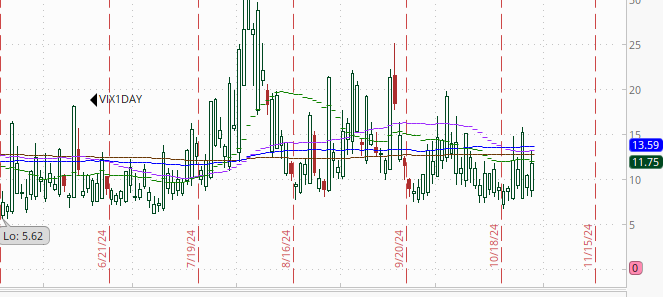

The VIX & VVIX (VIX of the VIX) edged lower but remained in their range of the past week with the former at 19.3 (consistent w/1.2% daily moves over the next 30 days) & the latter 109 (consistent w/”elevated” daily moves in the VIX over the next 30 days). As noted 3 weeks ago, though, these are 30-day volatility measures and now incorporate the election, so will likely remain more elevated until that passes.

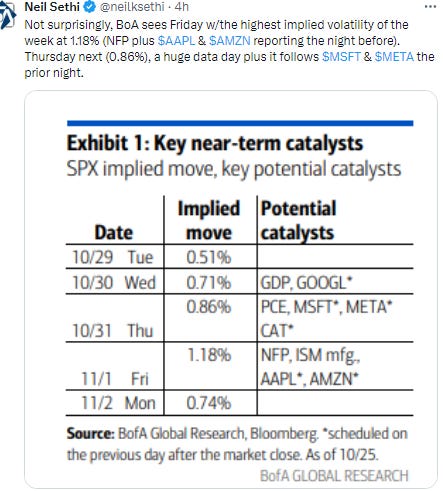

1-Day VIX, which will be a better near term indicator of expected volatility until the election, moved up to 11.75 with the big slate of earnings we just had plus more in the morning in addition to GDP, looking for a move of ~0.7% Wednesday (which is what BoA predicted).

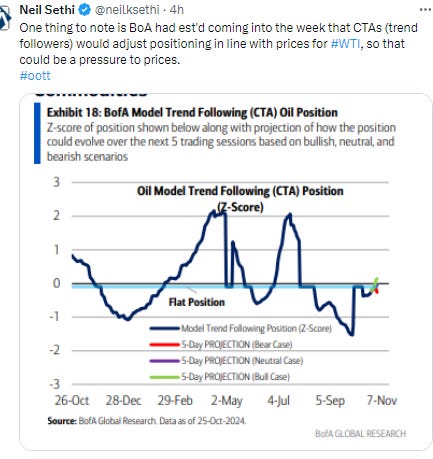

WTI again tested the $67 level which again held (for now). As noted Monday, “the daily RSI & MACD remain negative, so I’m not entirely sure where we go from here, but I wouldn’t be making any big bets that we’ve seen the lows this year.”

Gold though continued its climb higher pushing to a new ATH and extending further above its 20-DMA. The daily MACD and RSI remain overall supportive.

Copper again little changed (it has closed w/in a 10-cent range for 2 weeks now) as it continued to trade sideways for a 10th session in the same range since Oct 15th just above the 50-DMA and the uptrend line from the Aug lows. As noted last week the daily MACD & RSI are not yet supportive. A break of the uptrend line targets $4, but also not much resistance higher until the Oct closing highs near $4.70.

Nat gas (/NG) got a big jump in the roll to the December contract (which might explain the plummet Monday (thin volumes on the outgoing contract?)) jumping over $2.90, and now back over the downtrend line running to the high of last October. This is the biggest “roll jump” we’ve seen in the past year, so we’ll see if it can stay above that huge gap. The jump in price does have the MACD & RSI flipping more positive.

Bitcoin futures continued higher today, at one point touching a new ATH completing the move I had anticipated 4 weeks ago (although I thought it would come much quicker). Daily MACD & RSI remain supportive for a close above.

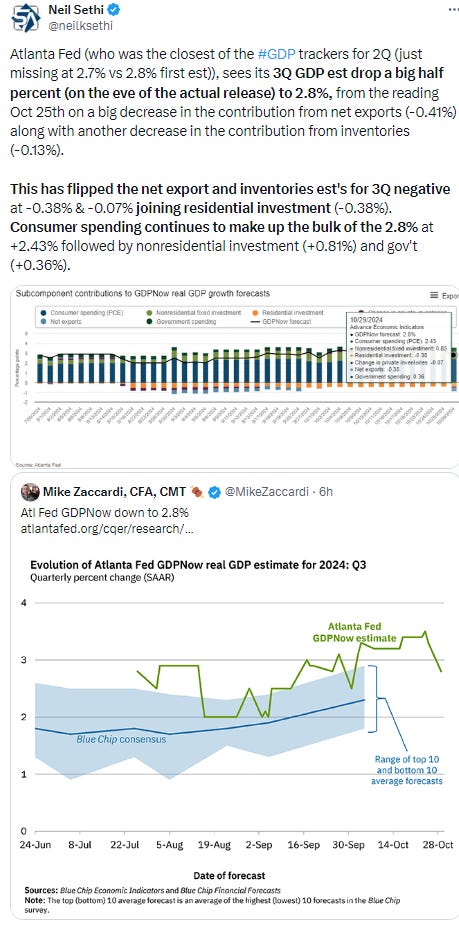

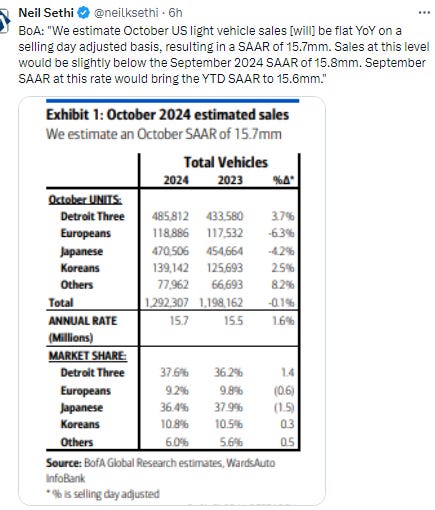

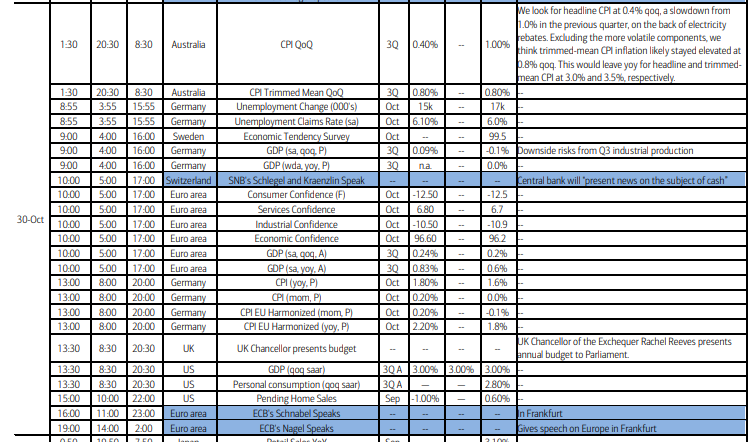

US economic data remains heavy tomorrow with Oct ADP, 3Q GDP, and Sep pending home sales in addition to weekly mortgage applications and EIA petroleum inventories.

Nobody on the Fed calendar with the blackout period, and no Treasury auctions, but we do get the Treasury Refunding announcement with details on the Treasury auctions for the next 3 months. No fireworks are expected though as the Treasury already told us Monday the borrowing amount would be lower this quarter.

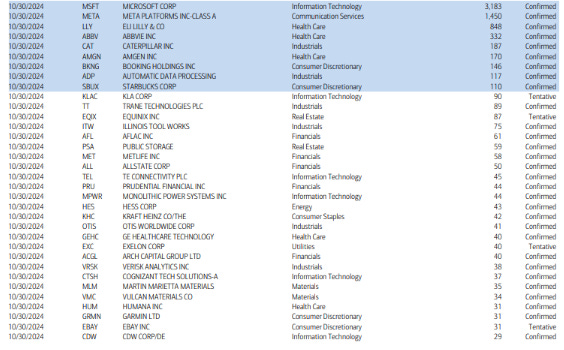

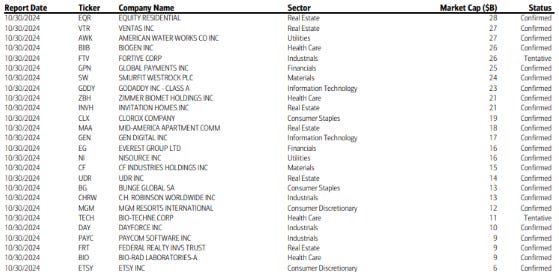

Earnings remain heavy with our (new) heaviest reporting day of the year (by market cap) with 51(!) SPX components of which two are >$1tn in market cap in Microsoft (MSFT) & Meta Platforms (META). 7 more are >$100bn in market cap in Eli Lilly (LLY), Caterpillar (CAT), Amgen (AMGN), Starbucks (SBUX), Abbvie (ABBV), Booking (BKNG) & ADP. (see the full earnings calendar from Seeking Alpha).

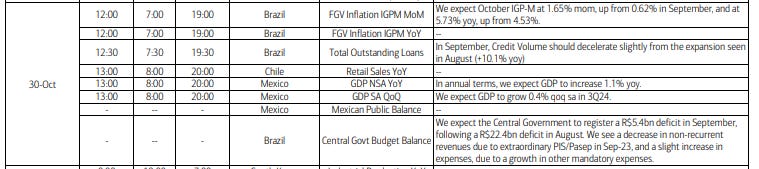

Ex-US the highlight is the UK unveiling its new budget, a highly anticipated event. There’s also though EU consumer & biz confidence, Germany’s Oct employment and CPI plus 3Q GDP, and Australia CPI. In EM we’ll get Brazil inflation & Mexico GDP.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,