Markets Update - 10/30/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

US equities started the Wednesday session once again lower following a big beat in ADP's monthly payroll report, a mostly in-line GDP report (which saw strong growth driven by consumption and core prices falling to the 2nd least since 2020), but perhaps most importantly a mixed batch of earnings releases with a gain in Google parent Alphabet being offset by weakness in other large names such as Eli Lilly, AMD & Caterpillar. They moved into positive territory though soon after the open, but couldn’t hold the gains falling throughout the session after the first hour led lower by semiconductor shares to finish around the lows of the day, not a great setup for tomorrow, especially with Microsoft trading flat and Meta trading lower after earnings (more below).

Treasury yields and the dollar were little changed again today as again was copper. Gold, bitcoin and crude were up (the former to another ATH and the second just below) while natgas fell back.

The market-cap weighted S&P 500 was -0.3%, the equal weighted S&P 500 index (SPXEW) -0.2%, Nasdaq Composite -0.6% (and the top 100 Nasdaq stocks (NDX) -0.8%), the SOX semiconductor index -3.4%, and the Russell 2000 -0.2%.

Morningstar style box again saw a big bifurcation between growth and value this time in the latter’s favor.

Market commentary:

“Growth-oriented stocks, like the NASDAQ 100, returned to leadership,” on Tuesday, Rob Haworth, senior investment strategist at U.S. Bank Asset Management, said. “We are closely monitoring tech earnings releases to ensure businesses investment in artificial intelligence and other productivity enhancing tools remains robust to support strong future earnings growth.”

“Solid but not blistering growth fits nicely within the current economic backdrop,” said Bret Kenwell at eToro. “Too hot of a print and investors would likely question the Fed’s decision to cut rates by 50 basis points in September, while a weak print could reignite worries about a deteriorating economy.” Kenwell says investors should cheer for strong economic data — even if that means slower-than-expected rate cuts from the Fed. “It’s far better to have a strong economy and earnings driving stocks higher rather than hopes of easing monetary policy from the Fed,” he said.

The major averages have risen to new record highs in recent weeks, but heightened uncertainty ahead of the U.S. presidential election on Nov. 5. could stall the market’s gains. Matt Stucky, chief portfolio manager at Northwestern Mutual, thinks the market’s reaction will be more muted compared to 2016.

“Things are uncertain, but I don’t think that this is a repeat of the volatility that we saw in 2016,” Stucky said. “In contrast, today we’re seeing results lean in a certain way but there’s still a very high likelihood that either candidate could win. With that being the case, you don’t have positioning completely offsides heading into election night.”

“There’s still a good deal of information for the market to digest in the coming days and weeks,” said Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities. “Sentiment feels fragile.”

“Fiscal support will boost growth and inflation and, all else equal, result in tighter monetary policy and higher rates,” he said. That combination adds to “concerns about the potential lack of US fiscal discipline in Congress and rising indebtedness.”

“The strongest earnings growth visibility is still coming from tech and communication services and parts of consumer discretionary sectors,” said Scott Chronert, head of US equity strategy research at Citigroup. “We need both — an ongoing conviction in earnings growth for the ‘growth’ cohort, and an ongoing improvement in trends for other sectors.”

“The guidance from the mega-cap tech companies is expected to be positive,” said Adam Parker, founder of Trivariate Research. “If earnings estimates come up for this group following third-quarter results, it’s hard for the S&P 500 to go lower.”

“Animal spirits” could return to markets in the wake of the US election, Barclays Plc strategists led by Emmanuel Cau wrote in a note, saying as investors appear to be in “wait-and-see” mode into the vote.

“The Magnificent Seven names should have better profit growth regardless — they are high quality companies, near monopolies in many cases,” Jonestrading’s O’Rourke said. “The investor question is how much of premium multiple do they deserve relative to the rest of the market and does that premium place them at risk of disappointment. On the other side, the S&P 500 excluding the Magnificent Seven should be positioned for profit growth to resume as the Fed proceeds on its easing cycle.”

While betting has largely skewed toward former President Donald Trump winning the election next week, polling is likely more accurate, according to Freedom Capital Markets chief global strategist Jay Woods.

"Betting on Trump — Too many people are falling into this trap," Woods said. "They're quoting betting sites and what the betting odds are on Trump winning but the polls are spot on. It is a dead heat right now."

"The Jets were favored to win too, and they lost. It's just where the money is going," Woods added.

While US stocks may be rising ahead of a potential victory for Donald Trump in next week’s US election, strategists at Citigroup Inc. say a clean sweep for the Republican party will be a signal to sell. A Trump win is generally seen as good news for stocks because his proposals to lower corporate taxes would likely benefit company earnings. The Citi strategists argue, however, that the “near-euphoric sentiment” that’s driving the S&P 500 toward a sixth straight month of gains is leaving it ripe for a pullback.

The S&P 500 could be due for a notable retreat in the not-so-distant future, according to financial advisory firm Janney Montgomery Scott.

Dan Wantrobski, associate director of research, said the broad index is “vulnerable to a bigger correction.” It could happen into year-end, he said, but is more likely to occur in the first quarter of 2025. “We remain concerned regarding stubborn overbought/extended conditions on the longer-term charts,” Wantrobski wrote to clients on Wednesday. “In terms of US equities ahead of elections next week, we are still watching the 5,750-5,800 zone for the S&P 500,” said Dan Wantrobski at Janney Montgomery Scott. “Measuring implications from recent bullish patterns still imply a target range of 6,200. However, we remain concerned regarding stubborn overbought/extended conditions on the longer-term charts.”

An earnings sentiment downturn is also evident, showing that the percentage of US stocks with positive earnings revisions has been receding from its April high, according to Tim Hayes at Ned Davis Research. “Earnings beat rate momentum peaked and is now negative,” said Hayes. “The breadth of positive earnings revisions has weakened. US revisions have declined, with negative implications for future earnings.” If the earnings sentiment trends continue, they will warn not to ignore indications of significant tape deterioration, especially with other sentiment indicators confirming that peak optimism is behind us, he added.

In individual stock action, Alphabet kicked off a major week for megacap tech earnings. The Google parent exceeded analysts’ expectations as the company saw strong quarterly revenue growth from its cloud business. Shares jumped almost 3%. semiconductor stocks extended opening losses in the afternoon trade, adding pressure to the major indices after soft Q4 revenue guidance from Advanced Micro Devices (AMD 148.60, -17.65, -10.6%). The broader semiconductor sector fell as shares of Super Micro Computer plunged nearly 33% after the departure of the company’s auditor raised concerns about its financial statements.

Homebuilders rallied as pending home sales in the US saw their biggest gain since 2020. Visa Inc. climbed on solid results. Eli Lilly & Co. got hit after lowering its guidance amid lackluster sales of its weight-loss drug. Garmin gained nearly 24% in afternoon trading after the company’s third-quarter results topped Wall Street’s expectations. That puts the stock, which hit a fresh intraday all-time high of $207.11, on track for a record close

After hours a 300 billion exchange-traded fund tracking the Nasdaq 100 (QQQ) extended losses after the close of regular trading as Meta’s spending guidance failed to enthuse investors despite a sales beat, raise to guidance, and greater than expected spending cuts. Microsoft rose slightly as its cloud-computing business and Office software fueled stronger-than-projected quarterly revenue growth. EBay Inc. dropped after projecting holiday season sales that fell short of analysts’ estimates.

Corporate Highlights from BBG:

Carvana Co. reported higher-than-expected results for the most recent quarter, buoyed by resilient used-car demand and pricing, and sounded a bullish note for its full-year earnings outlook.

Clorox Co. raised its annual profit guidance after increased advertising helped the bleach maker fully regain the market share that it lost when a cyberattack disrupted production last year.

MGM Resorts International reported lower-than-expected sales and profit for the third quarter amid a slowdown in Las Vegas betting.

DoorDash Inc. beat Wall Street’s expectations on virtually every key earnings metric, allowing the delivery service to post its first operating profit since the start of the pandemic.

Caterpillar Inc., the maker of iconic yellow bulldozers, reduced its sales outlook from a slowdown in construction activity around the world.

AbbVie Inc. raised its full-year profit forecast as demand for its top-selling anti-inflammatory drugs, Rinvoq and Skyrizi, exceeded expectations.

Humana Inc. issued a more optimistic 2024 forecast after third-quarter profit exceeded expectations, breaking with larger peers that have struggled to contain medical costs.

Walt Disney Co. won the rights to broadcast the annual Grammy music awards in a 10-year deal that wrests the show from its longtime home on Paramount Global’s CBS.

Bitcoin hedge-fund proxy MicroStrategy Inc. posted a third consecutive quarterly loss after taking an impairment charge against the value of its roughly $18 billion stockpile of the cryptocurrency.

Airbus SE will replace the head of its commercial aircraft business and stick with a goal to deliver about 770 aircraft this year, underscoring the planemaker’s focus on ironing out supply-chain glitches that have hampered production plans.

Some tickers making moves at mid-day from CNBC.

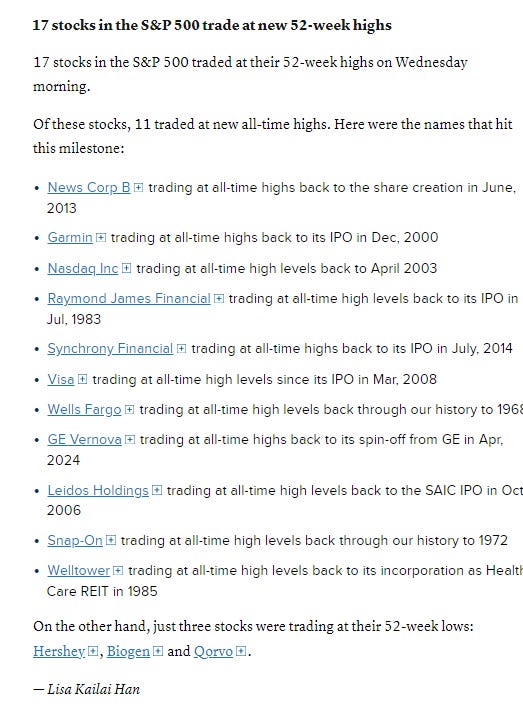

CNBC: 17 new SPX 52wk highs vs just 3 lows, but that's down from in the 30's last week and 112 Oct 14th.

In US economic data today:

Oct ADP employment report saw a huge beat at 233k more than double expectations for 111k, accelerating for a 2nd mth with the biggest gain since July ‘23 despite hurricanes and strikes. In terms of wages, job stayers fell a tenth to +4.6% y/y, the least since July ‘21, while pay for job changers continued to fall sharply to +6.2% the least since March ‘21. The spread is now the least this yr.

GDP showed the US economy expanded at a robust pace in the third quarter as household purchases accelerated ahead of the election and the federal government ramped up defense spending. At the same time, a closely watched measure of underlying inflation (core PCE prices) rose 2.2% y/y, just a bit above the Federal Reserve’s target. (didn’t finish up yet).

Boosted by mortgage rates falling to a 2yr low in the month, Sept pending home sales (contract signings so more forward looking) jump +7.4%, the most since June ‘20, well above exp’s for +1.9%, a 2nd mth of increases to the highest level since March after having fallen in July to the lowest on record (to 2001).

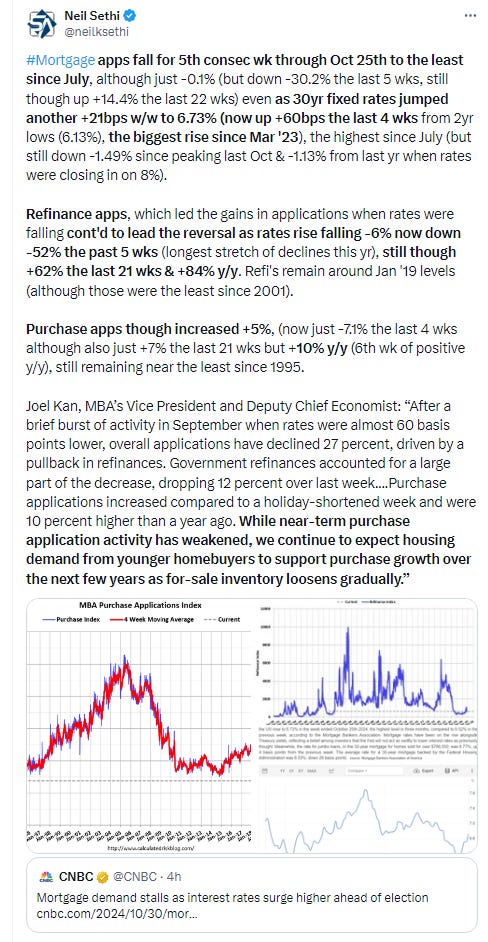

Mortgage applications fell slightly but purchase applications were up despite mortgage rates rising to the highest since July.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX continued to trade for a 6th day just above its 20-DMA which seems to be providing some support. Daily MACD and RSI though remain weak.

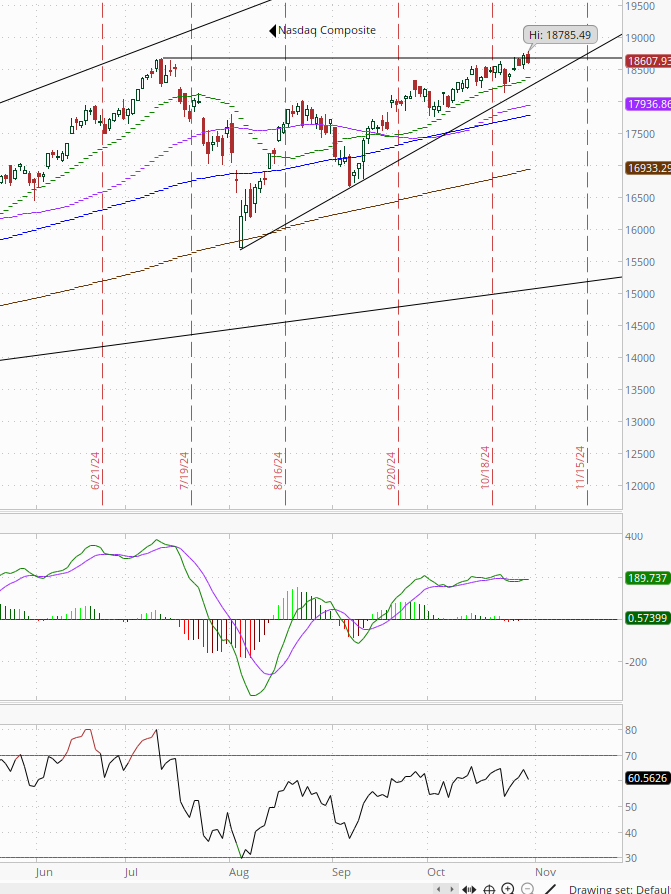

The Nasdaq Composite pushed to new ATH’s before falling back. The daily MACD & RSI are in better shape here than the SPX.

RUT (Russell 2000) tried to push higher but the effort was sold finishing a little down and just above its 20-DMA. Its daily MACD & RSI are not supportive.

Equity sector breadth from CME Indices did improve today w/6 green sectors (up from 2 Tues), although none were up over 1% (vs both Tues). Just one sector though down around -1% or more vs four Tues (tech the clear laggard led by semi’s). Another megacap growth sector led to the upside in communications (on the back of GOOG’s solid gain).

Stock-by-stock SPX chart from Finviz consistent with lots of red in semiconductors and very mixed action elsewhere.

Positive volume “improved” on both the NYSE & Nasdaq Wed, coming in at 49 & 47%. I used the quotes because while NYSE was in fact up from 32% Tues, Nasdaq was actually down from 58%, but as that was with a 145 point gain Tues while Wed Nasdaq lost -105 points, in my opinion that’s actually a better result. Still they both remain down from 72 & 73% Monday. Issues were not as good for Nasdaq at 38% but better for NYSE at 50%.

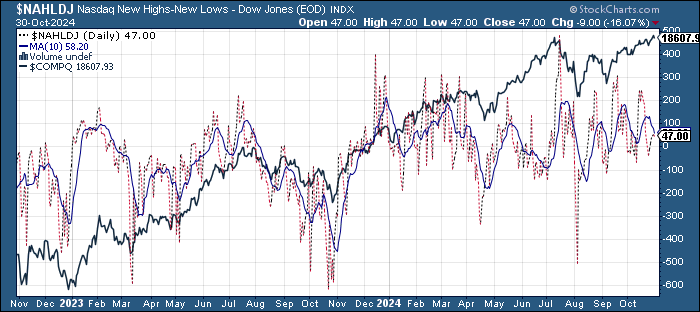

New highs-new lows (charts) were mixed again with the NYSE improving to 88 from 22, the least since Aug, while Nasdaq fell back to 45 still though the 2nd best in over a week. They’re both still below the 10-DMAs (less bullish), and so the DMA’s continue to head lower with the NYSE’s the least since Aug.

FOMC rate cut probabilities from CME’s Fedwatch edged a bit lower following the strong ADP number and solid GDP (and slightly hot PCE prices read) with the chance of 25bps in Nov at 95% (still basically a lock), the chance of 50bps through the end of year at 72% (just 1.3% chance of no cuts this yr), but the chance of 75bps after Jan’s meeting down to 43%.

Now 43bps of cuts priced this yr, 139bps through Sep ‘25 & 147bps through YE ‘25 (the latter 2 down -9bps from Tues).

Treasury yields were mixed today with the 10yr yield at one point on track for its biggest daily decline in a month before coming back to basically unchanged at 4.27%, just off the highest since July, still up 20bps since last week’s open, and just maintaining its steep ascent, while the 2yr yield was +6bps to 4.18% the highest close since July, now up 24 bps since the start of last week and +53bps in October.

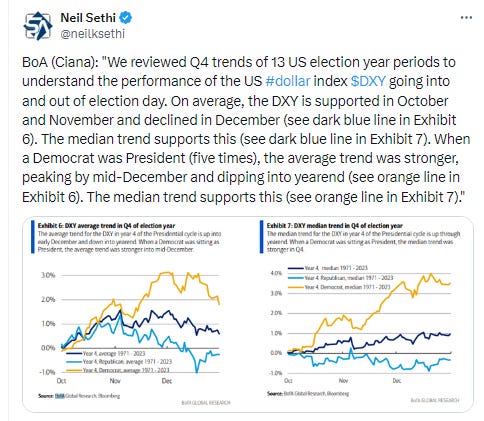

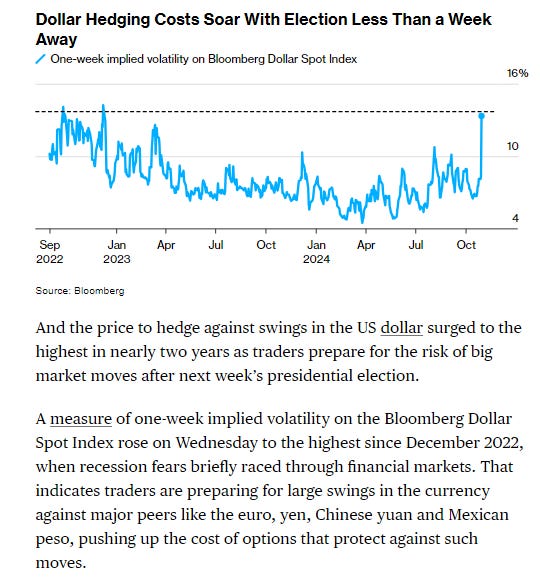

Dollar ($DXY) like the 10yr yield recovered from lower levels to finish basically flat on the day, remaining near the highest close since July, but also threatening to break lower. It for now remains above the uptrend line running back to the Sep ‘22 highs that outside of 8 or so days in June has capped all rallies (it’s been over for 7 days so far).

As noted last Monday, it broke a lot of resistance last week, and if it can stay over it opens up a run all the way to 106. Daily MACD & RSI though are turning less supportive, and a close below 104 could mean we’re in for a deeper pullback.

The VIX & VVIX (VIX of the VIX) edged higher but overall remained in their range of the past week with the former at 20.3 (consistent w/1.25% daily moves over the next 30 days) & the latter 113 (consistent w/”elevated” daily moves in the VIX over the next 30 days). As noted 3 weeks ago, though, these are 30-day volatility measures and now incorporate the election, so will likely remain more elevated until that passes (just another week (or so)!).

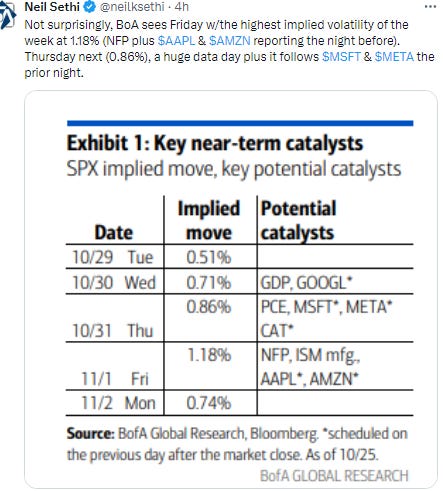

1-Day VIX, which will be a better near term indicator of expected volatility until the election, moved up to 13.6 with the big slate of earnings we just had plus more in the morning in addition to heavy roster of reports tomorrow incl the ECI (Fed's favorite wage metric) and Sept PCE prices (Fed's favorite inflation indicator), looking for a move of ~0.86% Wednesday, looking for a move of ~0.86% Wednesday (which is again exactly what BoA predicted).

WTI got a nice bounce today up almost 3% after a constructive EIA inventories report which showed larger crude and products draws than expected along with strong demand taking it to the highest levels of the week (after the gap down). Still, though, as noted Monday, “the daily RSI & MACD remain negative, so I’m not entirely sure where we go from here, but I wouldn’t be making any big bets that we’ve seen the lows this year.”

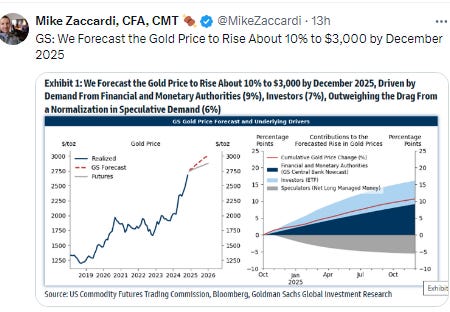

Gold continued its climb higher pushing to a new ATH at $2800 and extending further above its 20-DMA. The daily MACD and RSI remain overall supportive.

Copper again little changed (it has closed w/in a 10-cent range for over 2 weeks now) as it continued to trade sideways for an 11th session in the same range since Oct 15th just above the 50-DMA and the uptrend line from the Aug lows. As noted last week the daily MACD & RSI are not yet supportive. A break of the uptrend line targets $4, but also not much resistance higher until the Oct closing highs near $4.70.

Nat gas (/NG) fell back after its big jump yesterday in the roll to the December contract, starting to fall in the gap it created. As noted Tues, this is the biggest “roll jump” we’ve seen in the past year, so we’ll see if it can stay above that huge gap. The jump in price did see the MACD & RSI flip more positive.

Bitcoin futures closed a little higher but still just below the all time high in March. Daily MACD & RSI remain supportive for a close above.

US economic data remains heavy tomorrow with Oct Challenger job cuts, Sept personal income and spending with PCE prices (incorporated into today’s 3Q GDP report), 3Q Employment Cost Index (the Fed’s favorite wages index), and weekly jobless claims.

Nobody on the Fed calendar with the blackout period, and no Treasury auctions.

Earnings remain heavy with 47 SPX components (from 51 today) of which again two are >$1tn in market cap in Apple (AAPL), Amazon (AMZN), and 10 more are >$100bn in market cap in Mastercard (MA), Merck (MRK), Uber Technologies (UBER), Comcast (CMCSA), Linde (LIN), Eaton (ETN), ConocoPhillips (COP), Bristol Myers (BMY), Regeneron (REGN), and the Southern Company (SO). (see the full earnings calendar from Seeking Alpha).

Ex-US the highlight is the BoJ policy decision. No change is basically a lock, so attention will be focused on any hints as to whether December (or January) is put on the table, but with the backdrop of confusion on the new government I’d be surprised if there was any strong indications. We’ll also get Japan industrial production and retail sales, Germany retail sales, French and EU CPI’s and EU employment. In EM we’ll get China’s manufacturing PMI’s, South Korea industrial production, Brazil employment, and policy decisions in Columbia & Ukraine.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,