Markets Update - 10/31/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

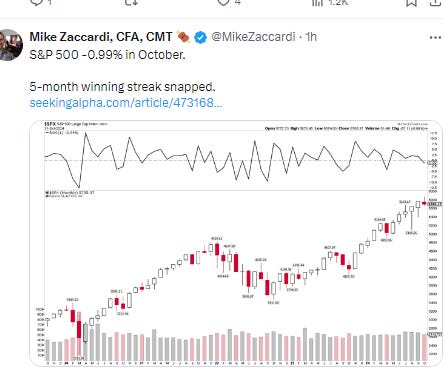

US equities started the Thursday session lower once again following weaker than expected guidance from Microsoft on its earnings call and a report from Meta that while checking most boxes didn't meet expectations for user growth and confirmed a "heavy" cap-ex spend (even though less than expected). The weakness was despite a batch of positive economic reports spanning from jobless claims to personal incomes & spending to core PCE prices (although that was a tenth hotter than expected y/y) to the employment cost index. They stabilized late morning but a late day selloff that may have been due to month end rebalancing or perhaps systematic selling due to the rise in volatility (or probably both) saw them close at the lows of the day, the worst day since Aug 5th, not a great set up for tomorrow.

Treasury yields were little changed, but the dollar edged back due to strength in the euro and yen. Gold had its worst day since July, and bitcoin and natgas also fell. Crude though was higher while copper was once again little changed.

The market-cap weighted S&P 500 was -1.9%, the equal weighted S&P 500 index (SPXEW) -1.1%, Nasdaq Composite -2.8% (and the top 100 Nasdaq stocks (NDX) -2.4%), the SOX semiconductor index -4.0%, and the Russell 2000 -1.6%.

Morningstar style box saw every style lower but again growth the weakest.

Market commentary:

The “disappointing” set of results from Microsoft and Meta was hurting sentiment, said Marija Veitmane, a senior multi-asset strategist at State Street Global Markets. Investors are questioning whether the companies can sustain profit growth while ramping up spending on artificial intelligence and cloud services. “The market is concerned with the continued increase in investments, and that is likely to weigh on stocks in the short term,” she said. “In the medium term, however, we still see weakness in tech stocks as a buying opportunity. It’s a very crowded position, so it is getting sold on any sign of disappointment, but we always see investors coming back as there’s no other alternative if you want quality.”

“I think we’re getting to the point where AI enthusiasm and potential is not enough. These companies, while they’re still levered to those themes and hold favorable long term growth profiles, are not quite delivering the growth that is priced into them,” said Ross Mayfield, investment strategist at Baird Private Wealth Management.

The guidance out of Microsoft and Meta raise some of the same questions that we heard during the last earnings season, according to Matt Maley at Miller Tabak + Co. “Thankfully, Alphabet did show some signs that their ROI on the AI phenomenon is bearing some fruit,” Maley said. “However, last night’s results do seem to indicate that it could still be a much longer time for these returns to build up in a significant way for many companies — at least when you compare it to the timeframe investors have been assuming for much of this year.”

Investors need to make sure they have diversification within tech and that they are not solely invested in the parts of the AI trade that have worked such as semiconductors, according to Michael Landsberg, chief investment officer, Landsberg Bennett Private Wealth Management. “It makes some sense to trim some from those names that have worked so well over the past 12-18 months and look for AI laggards as well as other tech themes like cybersecurity, robotics and automation, and smart homes and cities,” he said.

“Yesterday’s US GDP data once more evidenced the continued ‘US exceptionalism’ theme which still underpins much of the USD’s recent strength,” said Michael Brown, a senior research strategist at Pepperstone Group Ltd. “I still find it tough to bet against the greenback in such an environment, and would be buying any pre-election USD dips.”

“Who becomes president changes the perspective of the investment cycle,” Daniel Yoo, head of asset allocation, Yuanta Securities, said on Bloomberg Television, highlighting the potential effects of higher tariffs and lower corporate taxes under a potential Donald Trump presidency. “That will probably accelerate the process of inflation pressure and therefore the lowering of interest rates may be taken at a slower pace or not even happen.”

The S&P 500 has historically posted a 1.56% return in November, CFRA’s data going back to 1945 show, in what’s been the second-best month of the year for the index. This century, the gauge was down in November just on six occasions.

“The S&P 500 is slightly lower in October, but luckily, November seasonality is a big tailwind,” said Bespoke Investment Group strategists. Over the past 100 years, November has ranked as the fourth-best month with an average gain of 1.3% and positive performance 63% of the time, they said. More recently in the past 50 years, it is one of two months (the other being April) in which the index has averaged a gain of more than 2%. In that timeframe, it also traded higher more consistently than any month. Looking only at the past twenty years, November’s 2.43% average gain is only edged out by July’s 2.45% gain for the best month of the year, Bespoke concluded.

In individual stock action, losses in Microsoft (MSFT 406.46, -26.06, -6.0%) and Meta Platforms (META 567.58, -24.22, -4.1%) weighed down the equity market after their earnings reports. The disappointing outlooks fueled concern that a nearly 45% surge in the megacaps that have powered the bull market might have gone too far leading the the Vanguard Mega Cap Growth ETF (MGK) to close -3.0% lower. Weakness in chipmakers was another issue for equities. The PHLX Semiconductor Index (SOX) declined -4.0%. Monolithic Power (MPWR 759.30, -160.51, -17.5%) was the worst performer in the SOX Index even though the company beat Q3 expectations due to softer guidance than the market hoped for. The S&P 500 information technology sector was the worst performing sector by a wide margin, logging a -3.6% decline.

The consumer discretionary sector was the next worst performer, dropping -1.8%. In addition to Meta, sharp earnings-related declines in Aptiv (APTV 56.83, -12.24, -17.7%), MGM Resorts (MGM 36.87, -4.54, -11.0%), and eBay (EBAY 57.51, -5.12, -8.2%) pressured the sector.

Peloton shares though surged 28%, its best day since Aug. 22 after the company posted better-than-expected fiscal first quarter earnings. Peloton also announced Ford executive Peter Stern would be its next CEO.

After hours, Apple, the world’s most valuable company, fell -1.2% after posting revenue that met Wall Street estimates, though sales remained sluggish in the key market of China. Amazon climbed 4% after projecting profit and revenue in the current quarter that exceeded analysts’ estimates on optimism for a strong holiday shopping season. Intel surged 10% as its forecast sparked optimism that it’s capable of reclaiming some lost market share.

Corporate Highlights from BBG:

OpenAI is adding a new set of search features to its flagship product ChatGPT, escalating the artificial intelligence startup’s challenge to Alphabet Inc.’s Google.

Waymo, Alphabet Inc.’s autonomous driving unit, was valued at more than $45 billion, including its latest round of financing, according to people familiar with the matter.

Root Inc. shares are having their best day ever on Thursday after the auto insurance platform announced that it had turned profitable for the first time in its history.

Mastercard Inc. reported profit that beat analysts’ estimates, helped by a boost in cross-border transactions.

Merck & Co. lowered the top end of its full-year sales guidance after demand for its HPV vaccine fell for a second straight quarter in China.

Uber Technologies Inc. reported weaker-than-expected ride bookings and issued a middling forecast for the holiday quarter, even as it delivered record operating profit.

ConocoPhillips raised its production forecast for the year after surpassing output expectations in the third quarter.

Estée Lauder Cos. pulled its guidance for the year, citing uncertainty over a new chief executive and weak demand in China.

Roblox Corp., a video-game company, reported third-quarter bookings that beat analysts’ expectations and boosted its guidance for the full year, as the platform’s user base surged.

Norwegian Cruise Line Holdings Ltd. boosted its profit outlook for a fourth time this year as demand for sailings remains high, defying fears a slowdown in the wider leisure travel industry.

MetLife Inc. tumbled after the insurer reported third-quarter private equity returns that weighed on variable investment income.

Peloton Interactive Inc. shares soared after the fitness company named Ford Motor Co. executive Peter Stern as its next chief executive officer and delivered improving profitability.

Carvana Co. surged after the online used-car retailer reported higher-than-expected results for the most recent quarter, as growing sales and cost cutting brought about stronger profits and a better outlook for the rest of the year.

Comcast Corp. said it’s considering spinning off its cable networks into a new company as it grapples with the continuing industry-wide decline in subscribers.

DoorDash Inc. beat Wall Street’s expectations on virtually every key earnings metric, allowing the delivery service to post its first operating profit since the start of the pandemic.

Robinhood Markets Inc. fell after the brokerage reported revenue that missed analyst estimates because of a customer promotion program that required the firm to offset a portion of the haul.

Roku Inc., a manufacturer of set-top boxes used to stream TV, said it will no longer report the number of households that use its products each quarter, starting next year.

Cigna Group jumped after Chief Executive Officer David Cordani signaled the company is focused on returning cash to shareholders through buybacks rather than a possible deal with Humana Inc.

Clorox Co. raised its annual profit guidance after increased advertising helped the bleach maker fully regain the market share that it lost when a cyberattack disrupted production last year.

Bristol Myers Squibb Co. raised its 2024 earnings guidance after reporting better-than-expected revenue and profit, fueled by demand for the blood-thinner Eliquis and several newer treatments.

Altria Group Inc. kicked off a plan to cut at least $600 million of costs over the next five years as the tobacco group maintained its outlook for the year.

MicroStrategy Inc. has hired banks to help it raise $42 billion through the sale of new shares and fixed income to buy more Bitcoin after a flurry of deals over the past year.

Coinbase Global Inc., the largest US crypto exchange, posted results below Wall Street expectations even though revenue almost doubled.

Samsung Electronics Co. declared progress in supplying its most advanced AI memory chips to Nvidia Corp., seeking to reassure to investors who fear the company is falling further behind SK Hynix Inc. in a red-hot market.

Some tickers making moves at mid-day from CNBC.

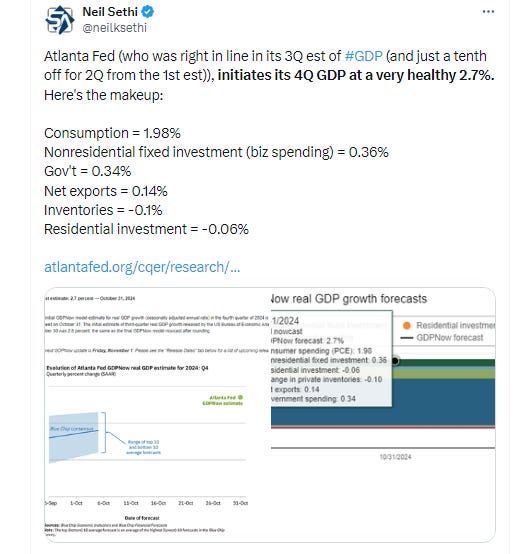

In US economic data today:

Initial jobless claims fell to a 5 month low and continuing claims also fell back but remained near the highest since Nov ‘21.

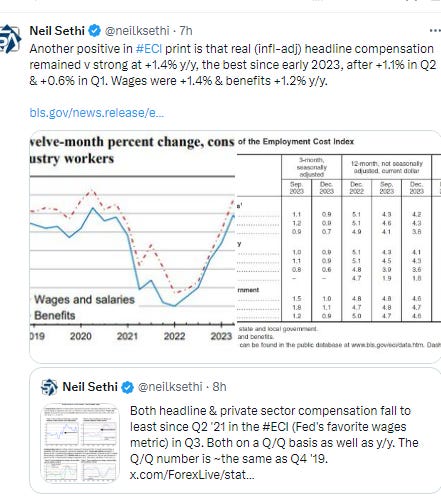

Q3 Employment Cost Index, the Fed’s favorite wage index, came in Q/Q the least since Q2 ‘21 and at the same level as Q4 ‘19. Y/y compensation also the least since Q2 ‘21.

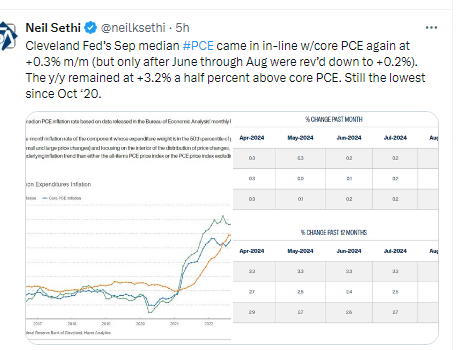

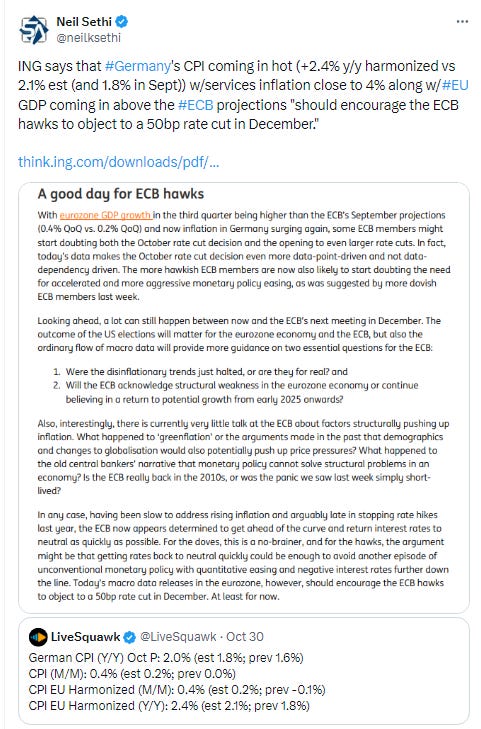

BBG on the Sept personal income and spending report (which I didn’t get to (add it to the long list this week)): The core personal consumption expenditures price index, which strips out volatile food and energy items, increased 0.3% in September, and 2.7% from a year earlier, according to Bureau of Economic Analysis data out Thursday. Overall inflation was 2.1%, the lowest since early 2021 and just above the central bank’s 2% goal. Inflation-adjusted consumer spending advanced 0.4%, supported by an 0.1% rise in real incomes. The savings rate fell to 4.6%. Thursday’s figures cap a month of upside surprises in key economic reports that will likely augur a cautious approach to rate cuts in the months ahead.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX fell through its 20-DMA (and a trendline from Aug) to a 4-wk low just above the 50-DMA. Daily MACD and RSI though have deteriorated to the worst since September.

The Nasdaq Composite fell to a 3-wk low a little more above the 50-DMA. The daily MACD & RSI have also deteriorated although not as badly.

RUT (Russell 2000) pushed a little under its 50-DMA also with weak daily MACD & RSI.

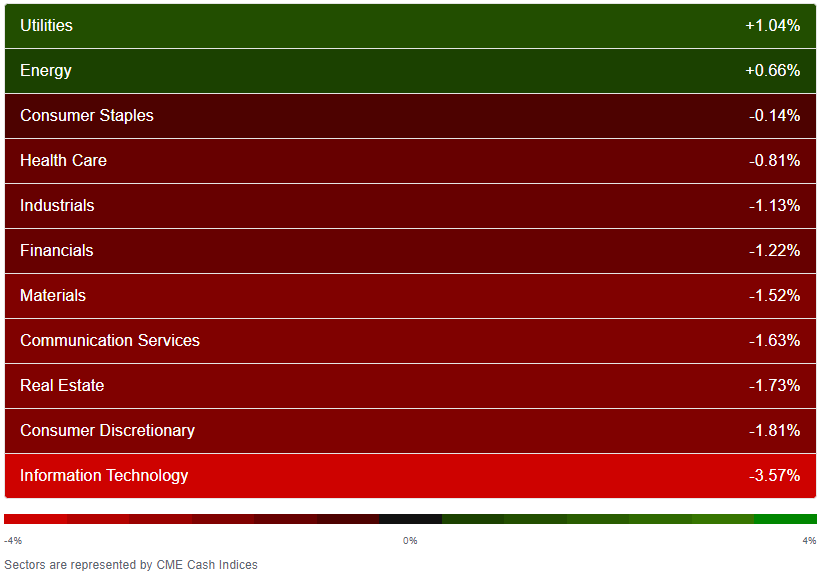

Equity sector breadth from CME Indices deteriorated w/just 2 green sectors (down from 6 Wed, same as Tues), although one (utilities) was up 1% (vs 1 Wed, 2 Tues). Seven sectors though down >-1% (vs 1 Wed, 4 Tues) w/tech in last place again today -3.6%. The other 2 megacap growth sectors (comms & discr) were also in the bottom 4 sectors today.

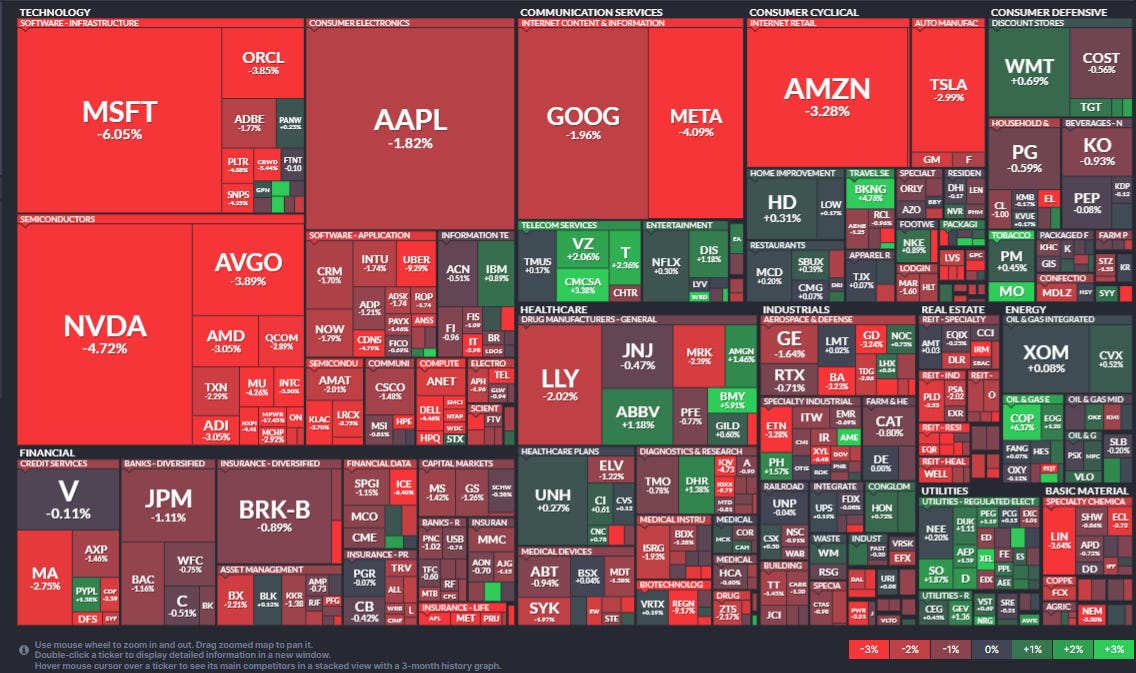

Stock-by-stock SPX chart from Finviz consistent with lots of red outside of some pockets of green in telecoms, utilities, energy, home improvement, restaurants, travel services, and tobacco.

Positive volume which had been better Wed deteriorated to the worst in over a week Thursday coming in at 27 & 32% resp on the NYSE & Nasdaq. Issues were 29 & 24%.

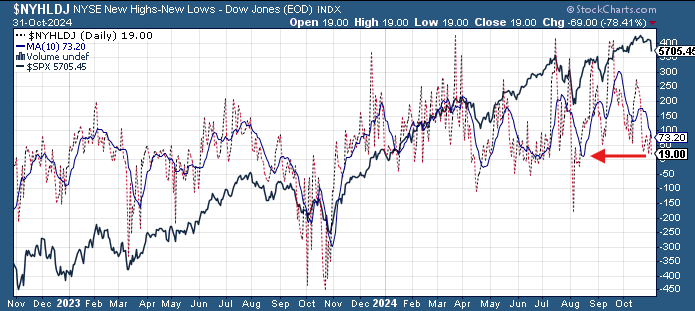

New highs-new lows (charts) also deteriorated to 18 & -105, the least since Aug & Sept respectively. They’re also still below the 10-DMAs (less bullish), and so the DMA’s continue to head lower with the NYSE’s the least since Aug.

FOMC rate cut probabilities from CME’s Fedwatch ahead of the jobs report tomorrow were not much changed although at a 10% chance of no Nov cut, it’s the highest we’ve seen recently and could soften a lot more on a hot payrolls number. 90% chance still though of a cut and the chance of 50bps through the end of year at 73% (just 1.9% chance of no cuts this yr). The chance of 75bps after Jan’s meeting at 45%.

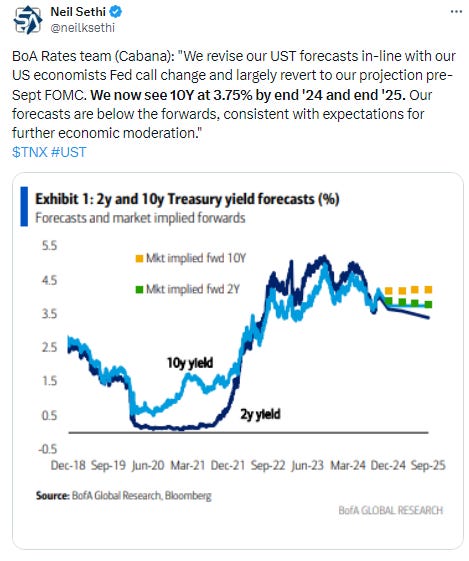

Still 43bps of cuts priced this yr, 140bps through Sep ‘25 & 148bps through YE ‘25.

Treasury yields were little changed pulling back after pushing higher following the solid morning economic data with the 10yr yield up 1 basis point at 4.28%, just off the highest since July, still up 21bps since last week’s open, and just maintaining its steep ascent, while the 2yr yield was -1bps to 4.17% from the highest close since July, now up 23bps since the start of last week and +52bps in October.

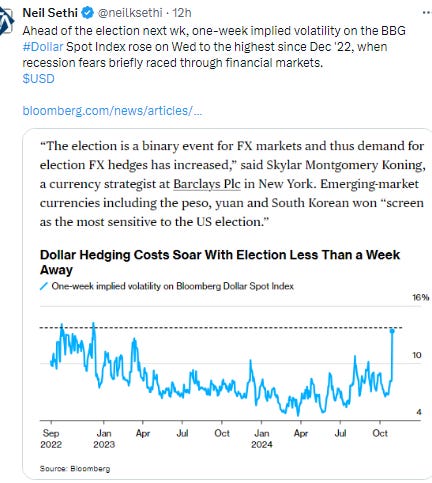

Dollar ($DXY) fell early on a stronger euro & yen pushing under the 104 level, but it was able to bounce at the 200-DMA (brown line). That now becomes a key level as the daily MACD crossing over to "sell longs" (circle) & RSI falling to a 3wk low (arrow) which raises the chances for a consolidation. It for now remains above the uptrend line running back to the Sep ‘22 highs that outside of 8 or so days in June has capped all rallies (it’s been over for 8 days so far).

Still, as noted last Monday, it broke a lot of resistance last week, and if it can stay over it opens up a run all the way to 106.

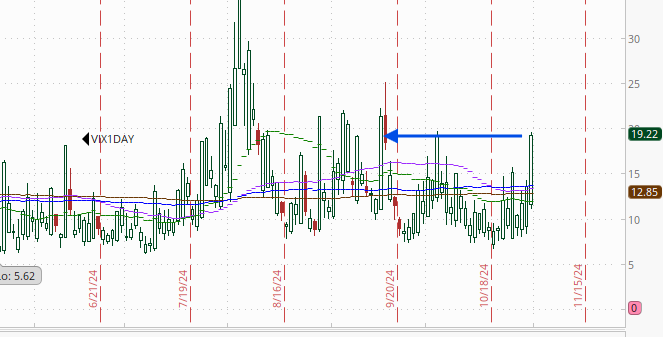

The VIX & VVIX (VIX of the VIX) jumped higher with the former at 23.2, the highest since Aug 8th (consistent w/1.46% daily moves over the next 30 days) & the latter 122 the highest since Oct 7th (consistent w/“elevated” daily moves in the VIX over the next 30 days). As noted 3 weeks ago, though, these are 30-day volatility measures and now incorporate the election, so will likely remain more elevated until that passes (just another week (hopefully)!).

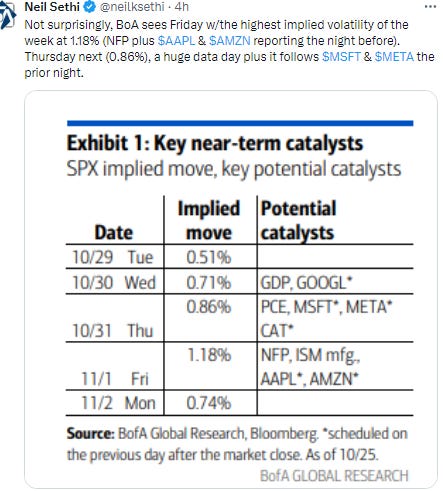

1-Day VIX, which will be a better near term indicator of expected volatility until the election, moved up to 19.2 with NFP tomorrow and after Apple & Amazon earnings tonight, looking for a move of ~1.2% Wednesday (which is again almost exactly what BoA predicted). That’s the highest since Sept 17th (before the Sept FOMC decision).

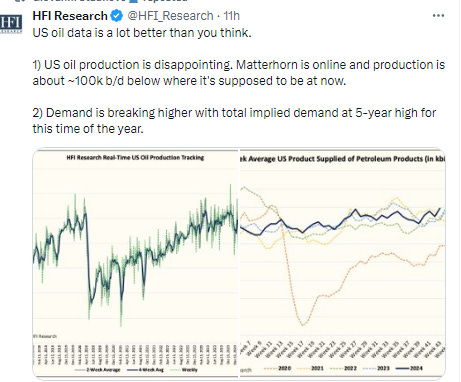

WTI continued its bounce today up another 2% after headlines on Iran planning an attack on Israel. Also, I missed yesterday that there was also a headline that the OPEC members with voluntary production offline could delay the planned December increase in their production. Still, though, as noted Monday, “the daily RSI & MACD remain negative, so I’m not entirely sure where we go from here, but I wouldn’t be making any big bets that we’ve seen the lows this year.” A break though above $71.60 changes the picture and could take us up to the $78 level quickly.

Gold fell back, its worst day in 2 mths falling back towards 20-DMA. The daily MACD and RSI remain overall supportive for now.

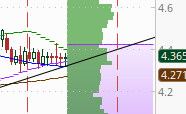

Copper again little changed (it has closed w/in a 10-cent range for over 2 weeks now) as it continued to trade sideways for an 12th session in the same range since Oct 15th just above the 50-DMA and the uptrend line from the Aug lows. As noted last week the daily MACD & RSI are not yet supportive. A break of the uptrend line targets $4, but also not much resistance higher until the Oct closing highs near $4.70.

Nat gas (/NG) fell again after its big jump Tuesday in the roll to the December contract. As noted then, “this is the biggest ‘roll jump’ we’ve seen in the past year, so we’ll see if it can stay above that huge gap.” Now we know the answer is “no” so the question is does it fill it? If yes, still has a ways to go. The jump in price did see the MACD & RSI flip more positive.

Bitcoin futures fell back after not quite getting an ATH close. Daily MACD & RSI remain supportive for now.

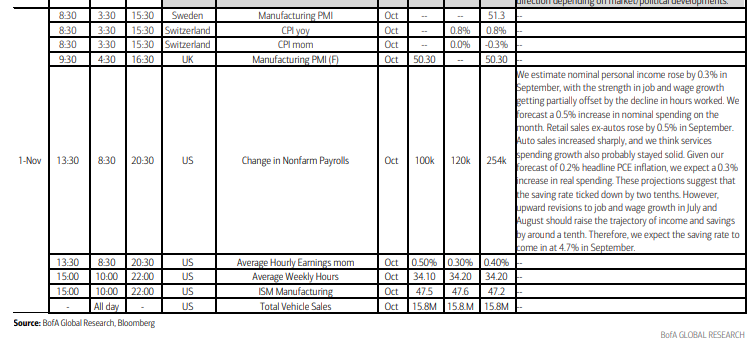

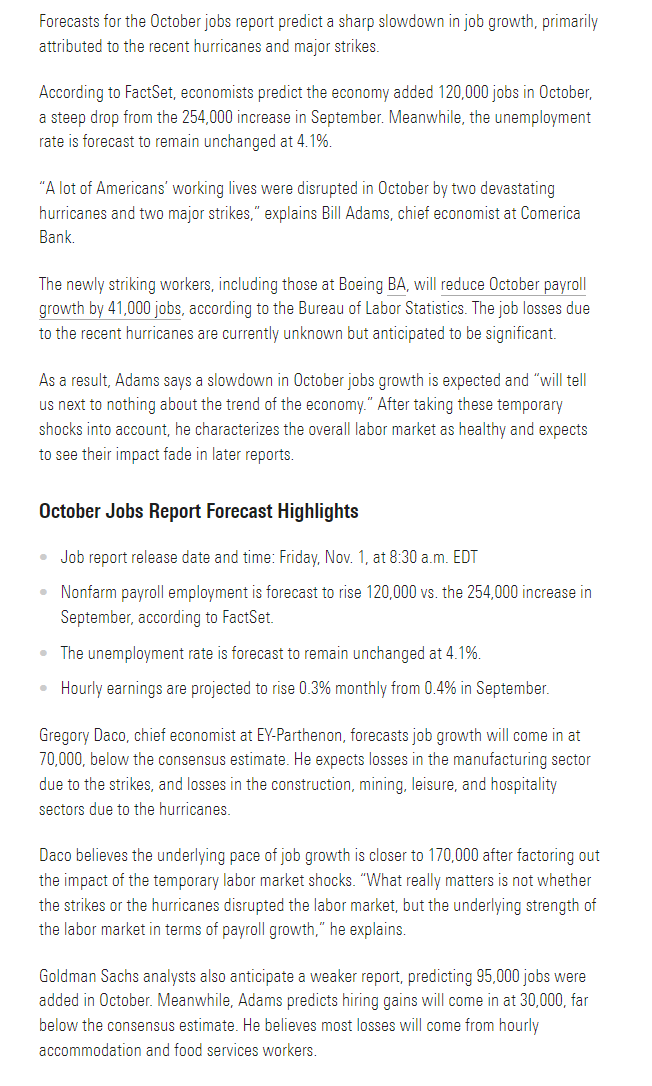

The Day Ahead

We wrap up a ridiculously heavy week for US economic data with another newsy day led by what is now the most important piece of monthly data we get in Oct’s Nonfarm Payroll report. If that wasn’t enough, we also get final Oct manufacturing PMIs and new vehicle sales, and Sept construction spending. No rest for the weary I guess.

At least nobody on the Fed calendar with the blackout period, and no Treasury auctions.

Earnings also finally lighten up with “just” 12 SPX components (which normally would be a lot but we had 47 today & 51 Wed) of which two are >$100bn in market cap in Exxon Mobil (XOM), Chevron (CVX). (see the full earnings calendar from Seeking Alpha).

Ex-US the highlight is final Oct manufacturing PMIs. In EM we’ll get Brazil’s industrial production & Mexico’s central bank economic survey.

f

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,