Markets Update - 11/01/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

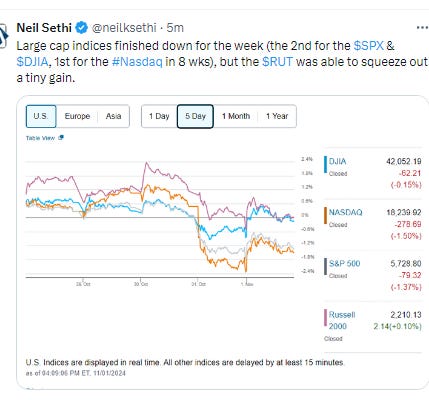

US equities started the Thursday session higher for the first time since Monday despite a much weaker than expected hurricane and strike impacted payrolls report which markets looked through with help from a decline in bond yields and a big jump in Amazon shares offsetting a decline in Apple following their earnings reports last night. After hitting their peak in the morning, equities fell most of the afternoon as bond yields reversed higher with value shares seeing the worst of the declines. Indices still finished with solid gains, but well off the highs of the morning.

Treasury yields as noted initially fell but then reversed higher to finish at the highest since July, and the dollar followed them first down then back up. Gold fell for a 2nd day as did bitcoin and natgas. Crude though was mildly higher while copper was once again little changed.

The market-cap weighted S&P 500 was +0.4%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite +0.8% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +1.1%, and the Russell 2000 +0.6%.

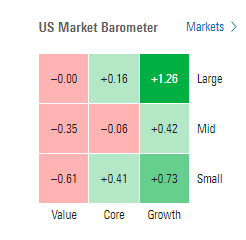

Morningstar style box saw growth get back in the lead after lagging the last few days while value turned weak.

Market commentary:

“We’re in the midst of a hectic stretch with economic data, earnings, the Fed, and the US election,” said Bret Kenwell at eToro. “There’s been some additional volatility around these events, but so far nothing has changed the big-picture view. Until that changes, the long-term drivers of the bull market remain intact.

Megacap tech stocks are still “the tail wagging the dog,” said Rob Williams, chief investment strategist at Sage Advisory. “You’re seeing some broadening, but it’s still such a massive component right now.”

“Friday’s jobs report showed that the labor market decelerated quite significantly in October compared to September,” said Clark Bellin, president and chief investment officer at Bellwether Wealth. “But this was a noisy number largely due to hurricanes and labor strikes, so it’s unlikely that this weakness is going to cause the Federal Reserve to pivot away from its expected 25 basis point rate cut at the November meeting.”

Julia Pollak, ZipRecruiter’s chief economist, said that while the jobs report “largely” reflects the effects of the strike and storms such as Hurricanes Helene and Milton, it is not necessarily a “blip,” but “is quite consistent with the big picture and the ongoing labor market slowdown that we’ve seen over the past two years,” she told CNBC. “The main issue in the labor market is still restricted monetary policy, not strikes and storms, and that actually is sort of a consistent narrative that we’ve seen.”

To Ian Lyngen at BMO Capital Markets, it was a disappointing employment update that was noisy enough to prevent a rethink of the state of the labor market. “While the Fed will likely attribute some of the weakness in today’s data to one-off factors, the softness in today’s data argues for the Fed to continue its easing cycle at next week’s meeting,” said Lindsay Rosner at Goldman Sachs Asset Management. “Stormy numbers, but sky clearing for November 25 basis-point cut.”

“Ultimately, we’ll take notice of today’s labor market data, but we won’t obsess about it given the unclear weather-impacts,” said Rick Rieder at BlackRock. “In the end, we think the Fed will cut rates 25 basis ppoints next week, and probably also in December, but we are also ready to engage with the slew of further data and information over the coming days and weeks.”

Seema Shah at Principal Asset Management says markets can “likely park” the data to the side due to the hurricane impact that clouded the picture of labor market strength. “It reaffirms that the Fed must persist with its easing cycle, even in the face of surprisingly strong economic activity data in recent weeks,” Shah said. “A 25 basis-point cut in November and December are on the cards.”

Ginsberg (Wolfe Research): "After bucking the seasonal headwinds in the first half of the month, the tape looks to finally be feeling the effects of the overbought signals and signs of complacency that we had discussed a few weeks ago."

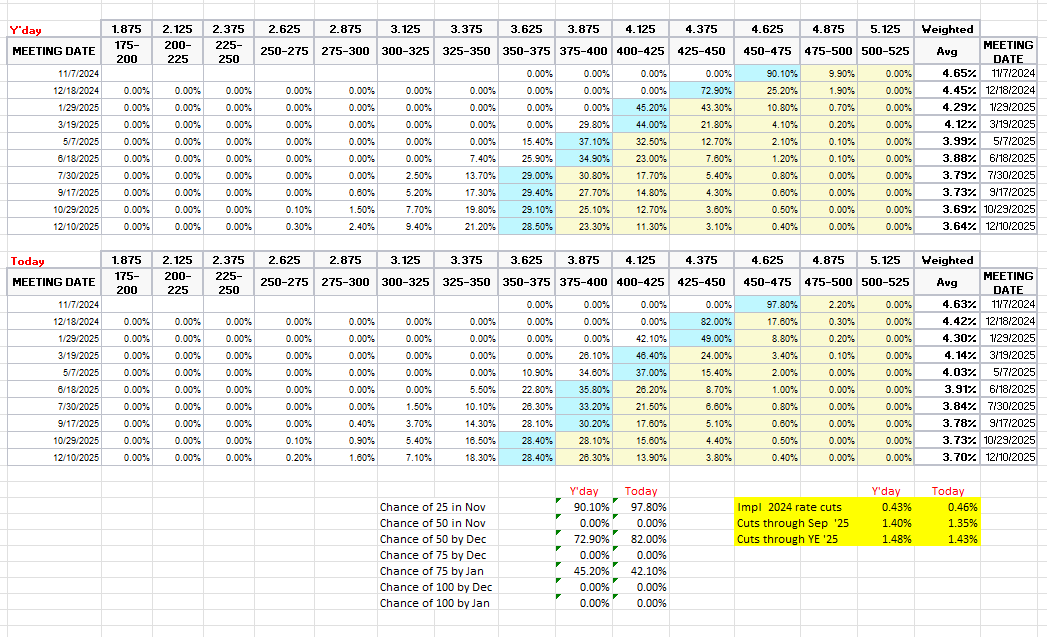

“Equity and bond fund inflows have been remarkably strong over the last year, with over $500 billion going into equities and $700 billion into bonds,” said Deutsche Bank strategists including Parag Thatte and Binky Chadha. “Amidst widespread concerns about the cycle, low confidence, and perceptions of stretched household budgets, a frequent question has been ‘where is all this money coming from’?” They say part of the puzzle is explained by large upward revisions to household income and savings. Another part is explained by massive cash holdings built up around the pandemic. However, while the capacity to invest is clearly helpful, it is not by itself sufficient to drive inflows, they noted. “For equities, booming inflows are tied to strong growth but also to rising risk appetite, which is now very elevated,” they said. “Given our view that the business cycle has plenty of legs, we see strong equity inflows continuing.”

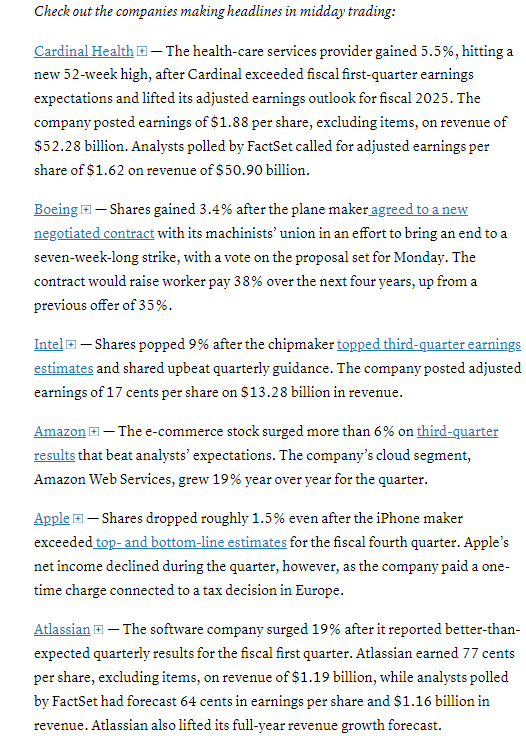

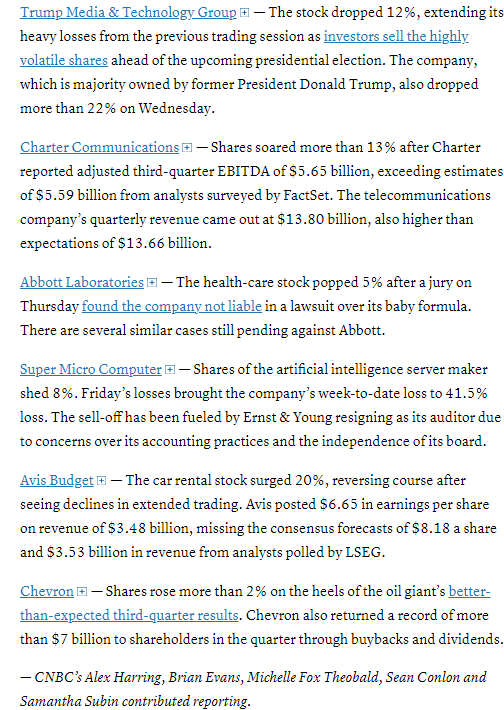

In individual stock action, Tech megacaps, which bore the brunt of the recent selling, led gains on Friday. Amazon.com Inc. surged 6.2% after strong results (as reported here last night). Intel Corp. rallied 7.8% on a bullish outlook. Exxon Mobil Corp. and Chevron Corp. beat profit, output and sales estimates. Boeing Co. rose 3.5% on optimism that a lengthy strike is nearing an end. Apple Inc. fell -1.2% after a tepid sales forecast.

Corporate Highlights from BBG:

Dish Network Corp. creditors plan to reject the US satellite-television provider’s revised bond-exchange offer, approval of which is needed for the company’s proposed acquisition by rival DirecTV to occur.

B. Riley Financial Inc. agreed to sell a portion of its wealth-management business to Stifel Financial Corp. for as much as $35 million, the latest in a series of asset deals aimed at stabilizing the money-losing investment firm.

BYD Co. kicked off the final quarter of the year with record monthly sales, continuing its strong performance in what is typically a peak season for auto purchases in China.

Charter Communications Inc. shares surged after the cable and internet giant reported losing fewer broadband subscribers than analysts expected in the third quarter despite the end of a federal internet subsidy program.

Reckitt Benckiser Group Plc jumped following a US jury verdict that cleared it and Abbott Laboratories over claims they hid potential risks of their premature-infant formulas.

Some tickers making moves at mid-day from CNBC.

In US economic data today:

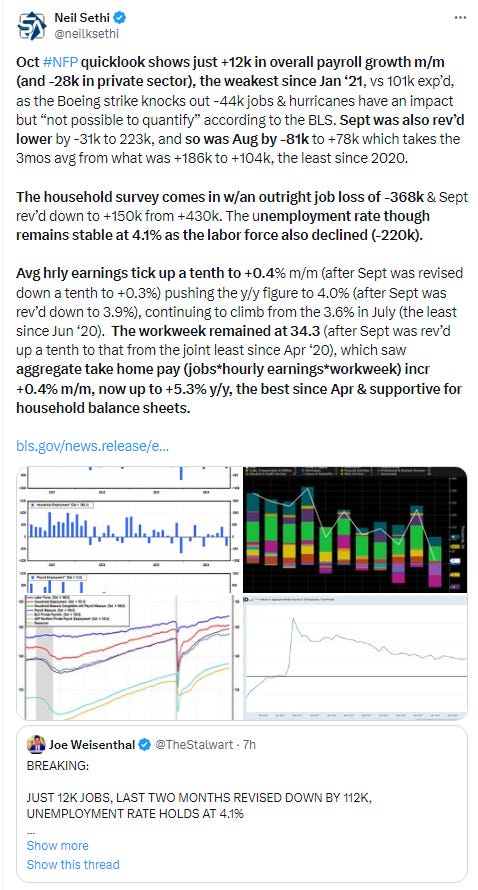

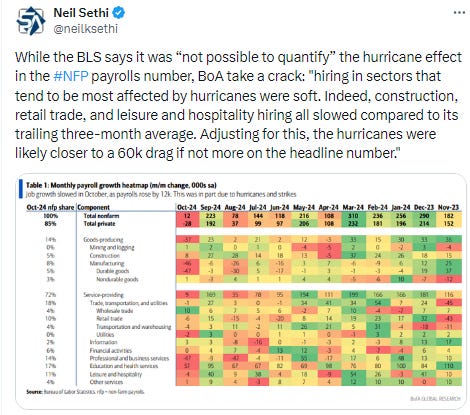

The marquee release was the Nonfarm Payrolls report which was heavily influenced by hurricanes and strikes that accounted for an estimated 80-100k in payroll job losses leaving the headline number at a gain of just +12k the least since Jan ‘21. But the household survey (which is a survey where they ask you if you had a job that week) was also weak seeing job losses of -368k. The labor force also fell though leaving the unemployment rate at 4.1%. In a positive, though, total incomes rose due to a rise in the average hourly wage.

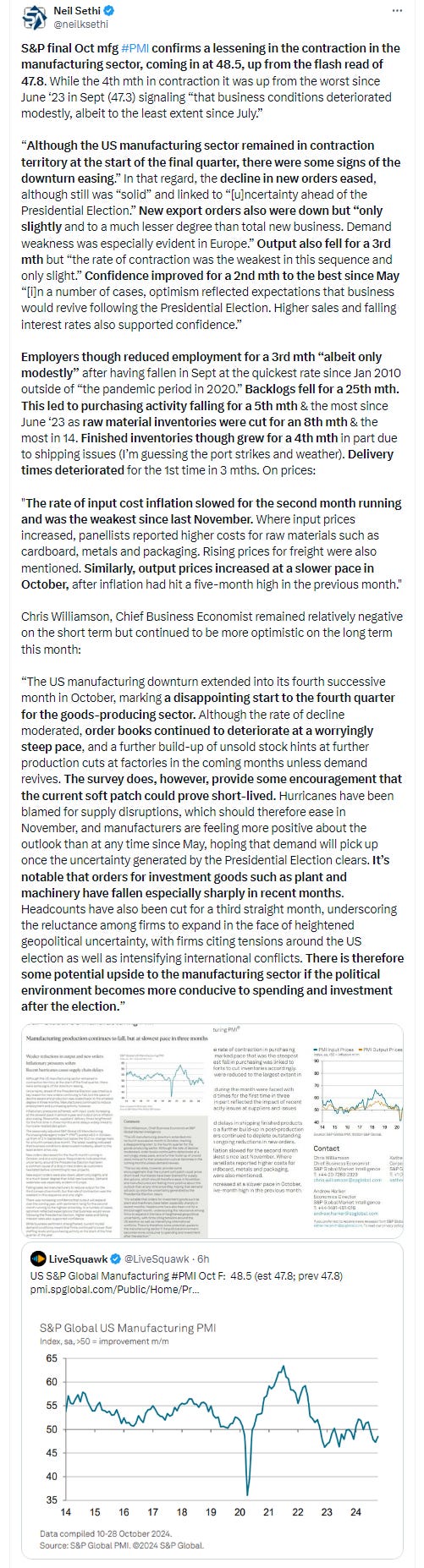

S&P’s final Oct manufacturing PMI confirmed a lessening in the contraction in the manufacturing sector, coming in at 48.5, up from the flash read of 47.8. While the 4th mth in contraction it was up from the worst since June ‘23 in Sept (47.3) signaling “that business conditions deteriorated modestly, albeit to the least extent since July.”

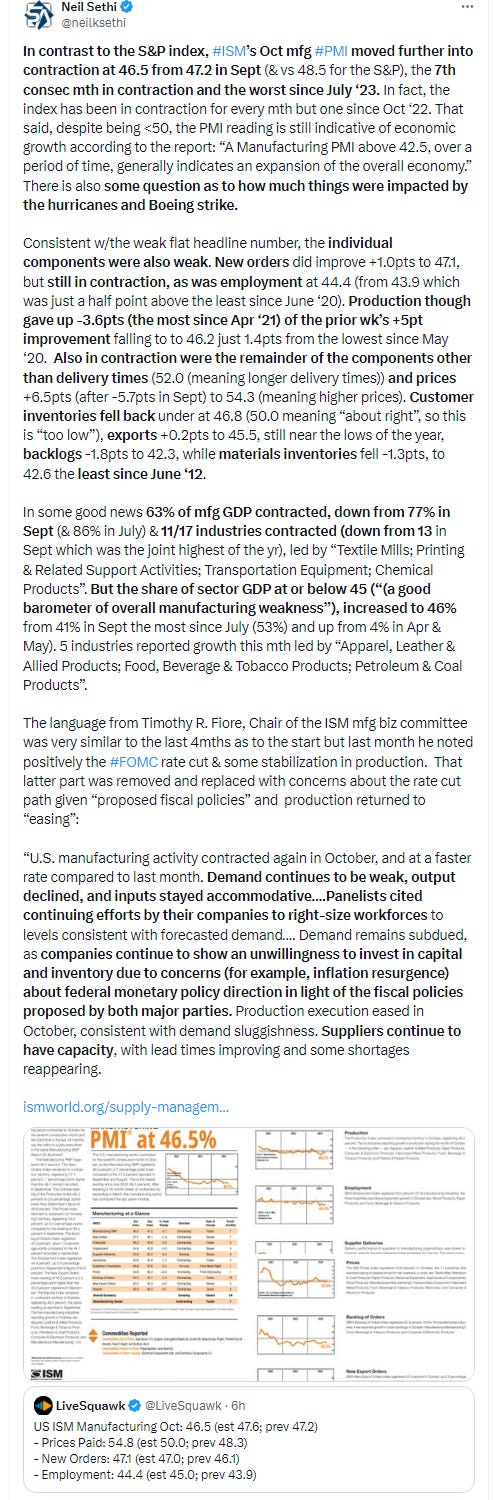

In contrast to the S&P index, ISM’s Oct manufacturing PMI moved further into contraction at 46.5 from 47.2 in Sept, the 7th consec month in contraction and the worst since July ‘23. In fact, the index has been in contraction for every mth but one since Oct ‘22.

Construction spending came in subdued at a +0.1% m/m pace in Sept but that was better than the flat read estimated. Private sector spending was unchanged while public sector spending jumped 0.5%.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX held above its 50-DMA. Daily MACD and RSI though as noted Thursday have deteriorated to the worst since September.

The Nasdaq Composite bounced a little from its 3-wk low but couldn’t get over the 20-DMA (green line). The daily MACD & RSI have also deteriorated here but not as badly as the SPX.

RUT (Russell 2000) was able to get back over its 50-DMA, but that’s about it. Its daily MACD & RSI remain weak.

Equity sector breadth from CME Indices improved as would be expected but still just 5 green sectors (up from 2 Thurs but down from 6 Wed), and just 1 was up >1% (discretionary +2.4% on the back of Amazon’s +6.2% gain). Two sectors down >-1% (much better than 7 Thurs but up from 1 Wed) w/utilities in last place -2.3%.

Stock-by-stock SPX chart from Finviz consistent with a lot less red outside of utilities, RE, energy & drug stocks.

Positive volume which was good Mon & Wed and weak Tues & Thurs was weak again Fri at 41 & 54% on the NYSE & Nasdaq respectively, both quite weak given the index gains (particularly though the NYSE). Issues were 44 & 53%.

New highs-new lows (charts weren’t updated yet) were mixed w/the NYSE falling to just 1, the least since Aug 12th while the Nasdaq improved slightly to -74 from the least since Sept. They’re also still below the 10-DMAs (less bullish), and so the DMA’s continue to head lower with the NYSE’s the least since Aug.

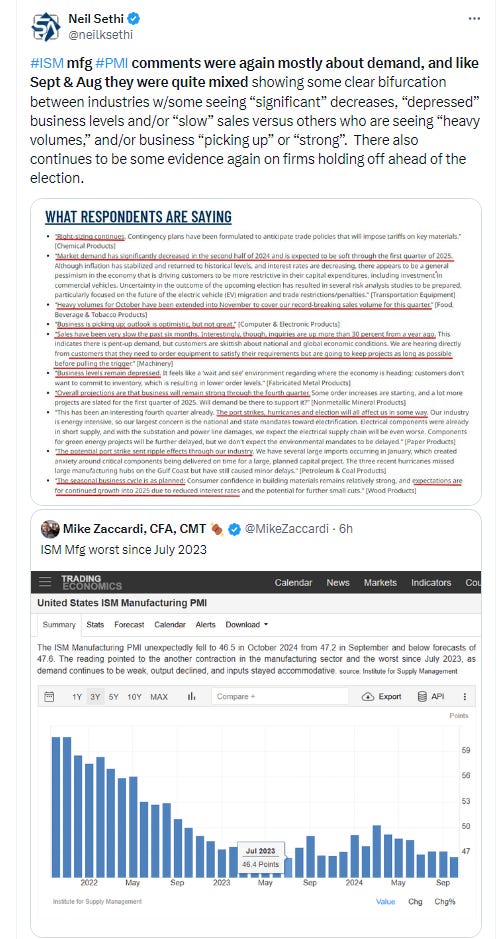

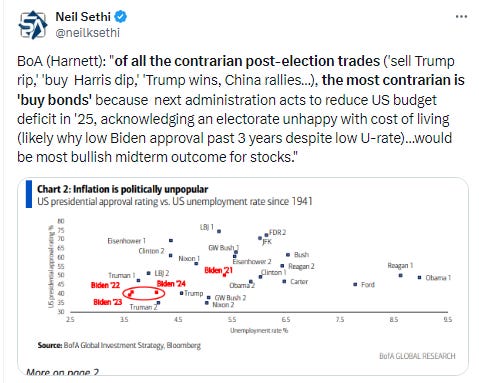

FOMC rate cut probabilities from CME’s Fedwatch following the #NFP report see the chance of 25bps in Nov move back to a virtual certainty at 98% (at one point it was 100% w/a 0.5% chance for a 50bps cut) from 90% before the print. The chance of 50bps through the end of year moved to 82% from 73% (w/ 0.3% chance of no cuts this yr). The chance of 75bps after Jan’s meeting though fell to 42% from 45%.

Now 46bps of cuts priced this yr (from 43), but just 135bps through Sep ‘25 (from 140) & 143bps through YE ‘25 (from 148).

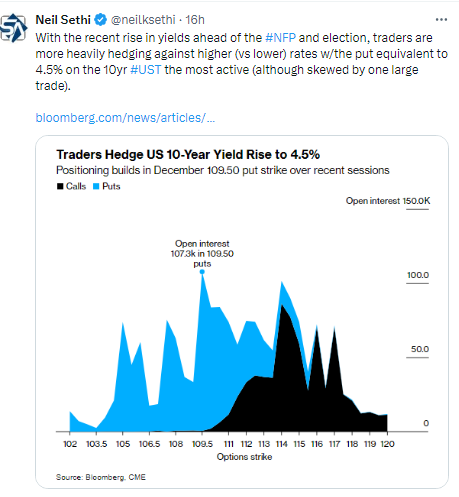

Treasury yields fell following the NFP report but reversed course around 9 am and started climbing, finishing at the highs of the day with the 10yr yield up +8 basis points on the day (and up 13bps from the lows) to 4.36%, the highest since July, and now up 62bps since the start of October, and maintaining its steep ascent. The 2yr yield was +5bps to 4.21% from the highest close since July, now up +57bps since the start of October.

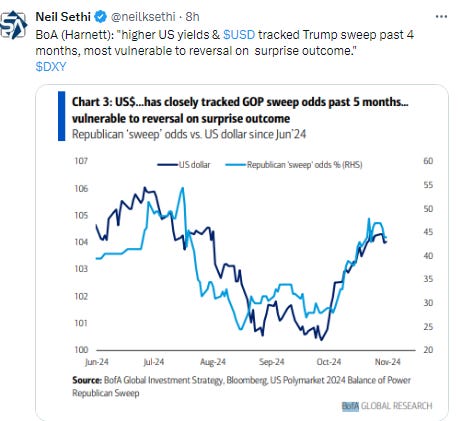

Dollar ($DXY) early on Friday followed yields down and fell under its 200-DMA (brown line), what I called “a key level with the daily MACD crossing over to ‘sell longs’ & RSI falling to a 3wk low which raises the chances for a consolidation.’” But like yields it rallied throughout the day, also finishing at the highs, back above the 104 level, and remaining above the uptrend line running back to the Sep ‘22 highs that outside of 8 or so days in June has capped all rallies (it’s been over for 9 days so far).

As noted Monday, it broke a lot of resistance last week, and if it can stay over it opens up a run all the way to 106.

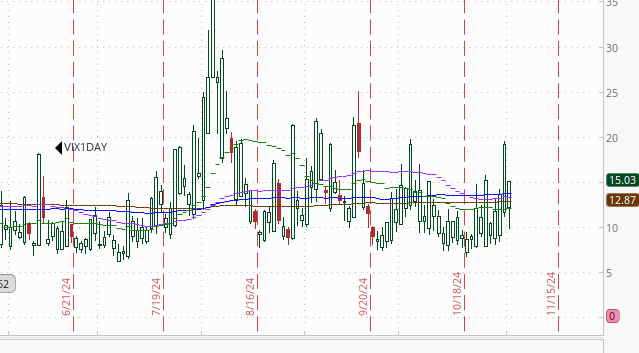

The VIX & VVIX (VIX of the VIX) fell back with the jobs report out of the way although mildly with the former to 21.9, (consistent w/1.4% daily moves over the next 30 days) & the latter to 119 (consistent w/“elevated” daily moves in the VIX over the next 30 days). As noted 3 weeks ago, though, these are 30-day volatility measures and now incorporate the election, so will likely remain more elevated until that passes (just another week (hopefully)!).

1-Day VIX, which will be a better near term indicator of expected volatility until the election, fell back to 15 with NFP behind us and no big earnings after the close, looking for a move of ~0.9% Monday. Wonder what level it will hit next week.

WTI continued its bounce today at one point up another 1% but fell back to post a very modest gain, ending the week with a -3.2% loss. As noted Monday, “the daily RSI & MACD remain negative, so I’m not entirely sure where we go from here, but I wouldn’t be making any big bets that we’ve seen the lows this year.” A break though above $71.60 though changes the picture and could take us up to the $78 level quickly, but seems that needs a big catalyst.

Gold fell for a 2nd day, falling back towards its 20-DMA as I mentioned last week. The daily MACD has also now crossed over to “sell longs” something that has seen mild weakness previously (circles).

Copper remained unbelievably calm (it has closed w/in a 10-cent range for almost 3 weeks now) as it continued to trade sideways for a 13th session in the same range since Oct 15th just above the 50-DMA and the uptrend line from the Aug lows. As noted last week the daily MACD & RSI are not yet supportive. A break of the uptrend line targets $4, but also not much resistance higher until the Oct closing highs near $4.70.

Nat gas (/NG) fell for a 3rd session after its big jump Tuesday as it rolled to the December contract. As noted then, “this is the biggest ‘roll jump’ we’ve seen in the past year, so we’ll see if it can stay above that huge gap.” And as I said yesterday “now we know the answer is ‘no’ so the question is does it fill it? If yes, still has a ways to go.” That remains the case. The MACD & RSI remain more positive but only because of the jump in price on the roll.

Bitcoin futures fell back again after coming oh so close to an ATH close Wednesday. Daily MACD & RSI remain supportive for now.

More on Sunday.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,