Markets Update - 1/10/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

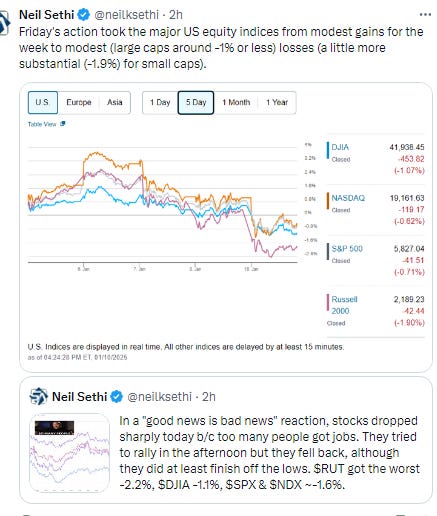

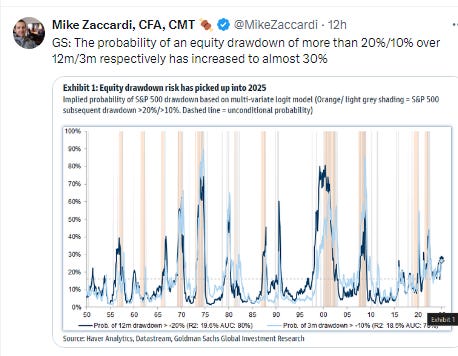

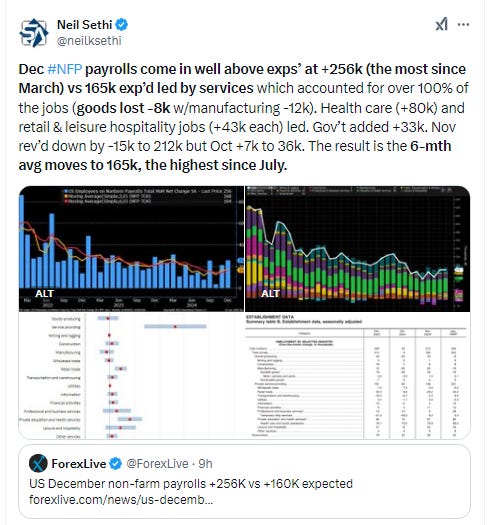

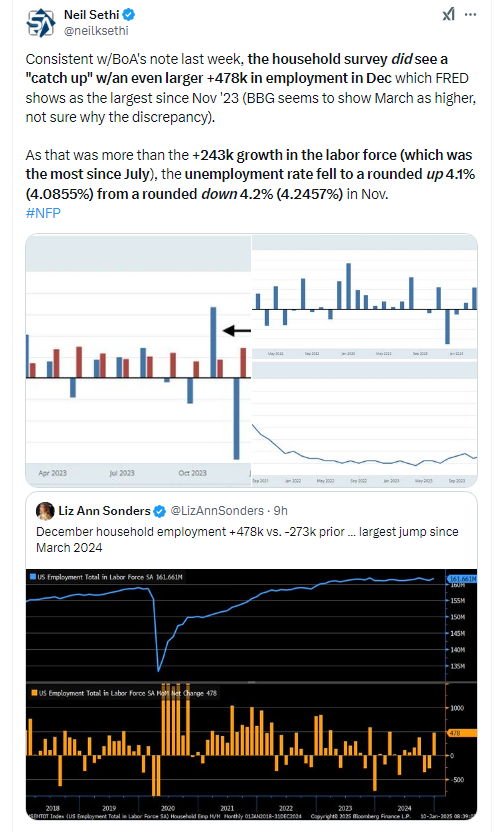

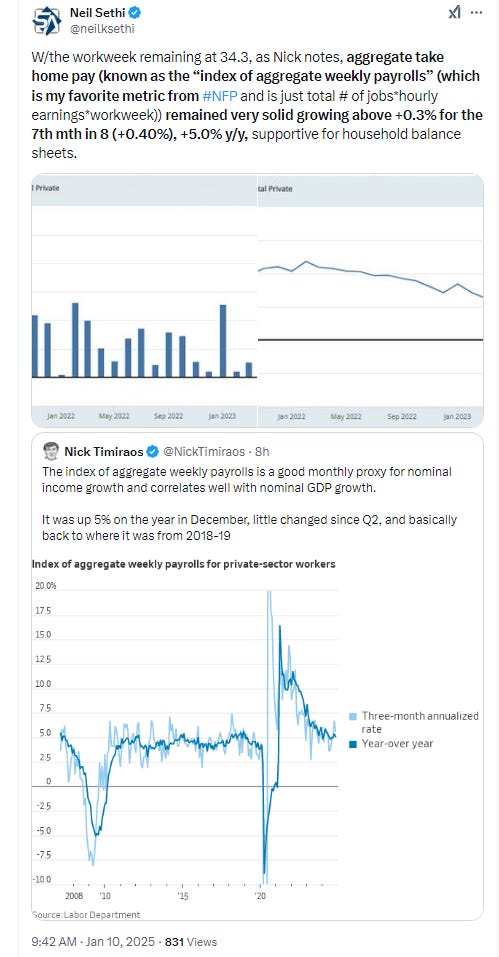

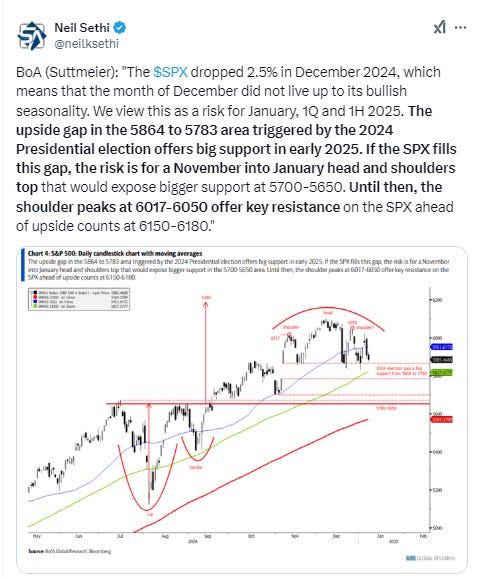

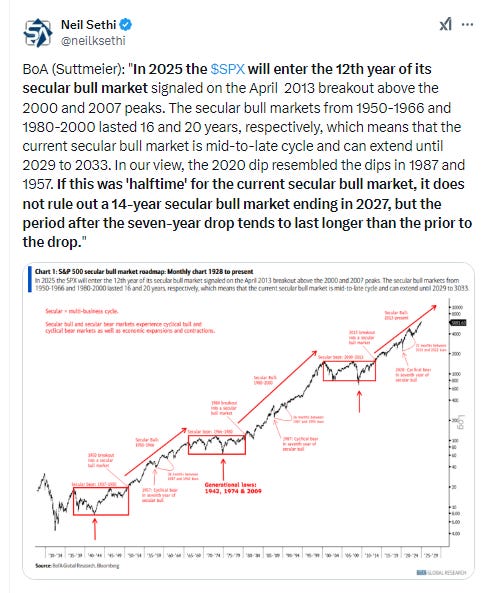

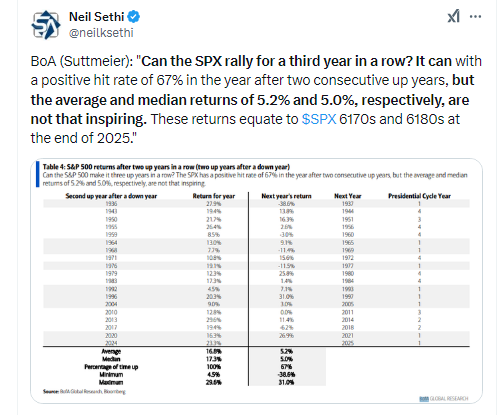

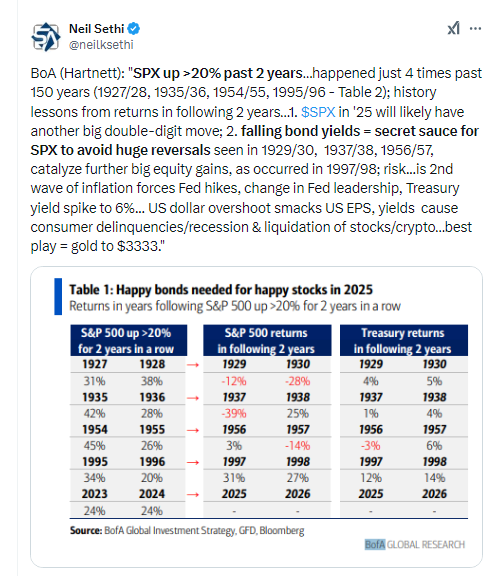

US equities saw broad losses to end the week on a “good news is bad news” reaction to a much stronger than expected (by most outside of BBG’s Anna Wong) Nonfarm payrolls report as well as a jump in inflation expectations in the U of Mich consumer survey along with more hawkish Fedspeak which all led to another day of rising bond yields (with the 10yr & 30yr yields the highest since Oct ‘23) as bets on for Fed rate cuts in 2025 withered. The S&P 500 has now given back almost all of its gains since Election Day.

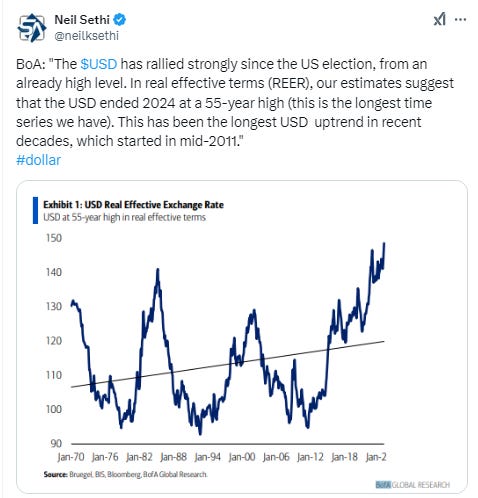

On the back of the above catalysts, the dollar moved to 26-mth highs, but it didn’t prevent notable gains in gold, copper, nat gas, or bitcoin (see below).

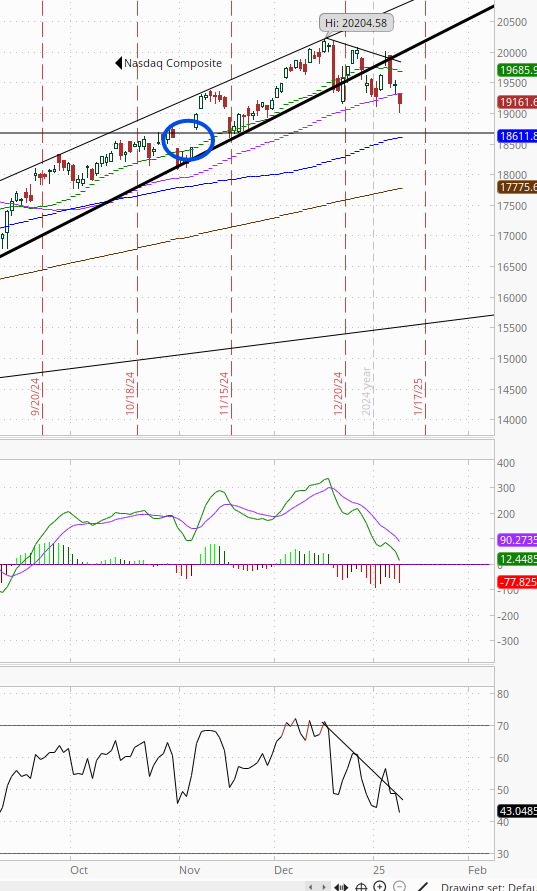

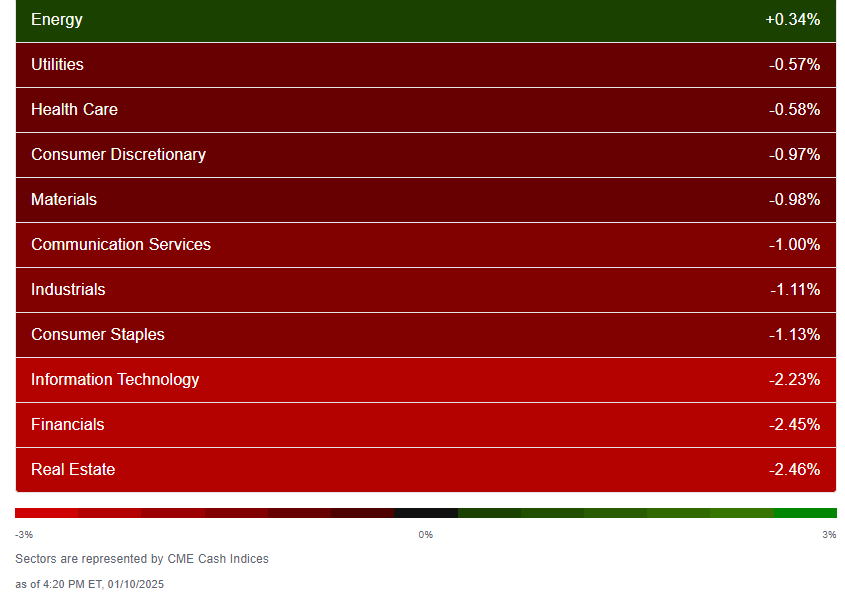

The market-cap weighted S&P 500 was -1.5%, the equal weighted S&P 500 index (SPXEW) -1.5%, Nasdaq Composite -1.6% (and the top 100 Nasdaq stocks (NDX) -1.6%), the SOX semiconductor index -2.4%, and the Russell 2000 -2.2%.

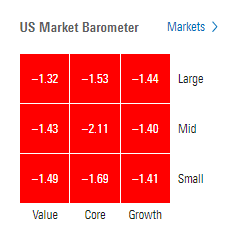

Morningstar style box showed the broad losses.

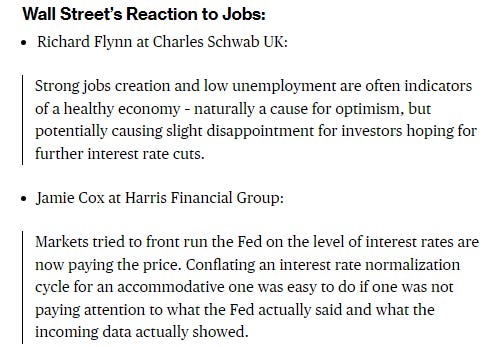

Market commentary:

“Good news for the economy but not for the markets, at least for now,” senior global market strategist Scott Wren said. “However, this unexpected gain relative to the consensus projection does not change our view that the labor market is likely to decelerate further in coming quarters.”

“Rates are moving a little bit too much, too fast and equity markets are selling off,” LPL Financial chief technical strategist Adam Turnquist said, adding that the recent move in yields foreshadows a potential pullback or correction for the S&P 500. “But the important thing that gets lost on days like today is the message of why rates are moving higher — it’s because the economy is doing better than expected,” he said. “Ultimately, that means the potential for better earnings, less risk of a recession, and that’s really going to dictate longer term returns versus a sell-off in today’s market.

At Interactive Brokers, Steve Sosnick says equity traders once again revealed their “liquidity addiction…Stock traders are once again more concerned about the potential for monetary accommodation rather than the type of robust economy that can improve corporate fundamentals,” he added.

Neil Birrell at Premier Miton Investors says that any hope of a quiet start to the year has well and truly disappeared now. “Good news for the strength of the economy and bad news for those hoping for interest-rate cuts, as inflation will stay bang at the top of the Fed’s agenda now,” he noted. “The jump in bond yields looks set to continue, which is bad news for equities. Could a 5% yield on the 10-year Treasury really be hit?”

“People are now going to get concerned that the Fed will not be able to cut at all, pressure is building on the Fed,” said Guy Stear at the Amundi Investment Institute. “Yields will continue to rise towards 5% in the next couple of months, putting pressure on equity markets unless you get a very strong first-quarter earnings season.”

Indeed, it looks like we are back in a world where good news is bad news, said Scott Helfstein at Global X. But that seems shortsighted, he noted. “We believe that companies can deliver on lofty earnings expectations this year powered by automation technologies like AI and deregulation, and that will drive equities rather than the Fed,” he said.

Although the stock market doesn’t need lower rates in order to go higher, a Fed that is easing policy is always a better environment for equity investors than one where they are tightening policy — or leaving policy unchanged, said Chris Zaccarelli at Northlight Asset Management. “At this point in the cycle, earnings will need to improve – and not just within the large tech companies – in order to have markets ‘grow into’ their already high valuations, so we would be cautious in the short term,” he noted.

For investors hoping equity markets would broaden from the megacap tech names, the latest data didn’t do them any favors, according to Lara Castleton at Janus Henderson Investors.

“People are now going to get concerned that the Fed will not be able to cut at all, pressure is building on the Fed,” said Guy Stear at the Amundi Investment Institute. “Yields will continue to rise towards 5% in the next couple of months, putting pressure on equity markets unless you get a very strong first-quarter earnings season.”

“Investors may want to brace themselves for more volatility as the market recalibrates expectations for fewer cuts,” said Gina Bolvin at Bolvin Wealth Management Group.

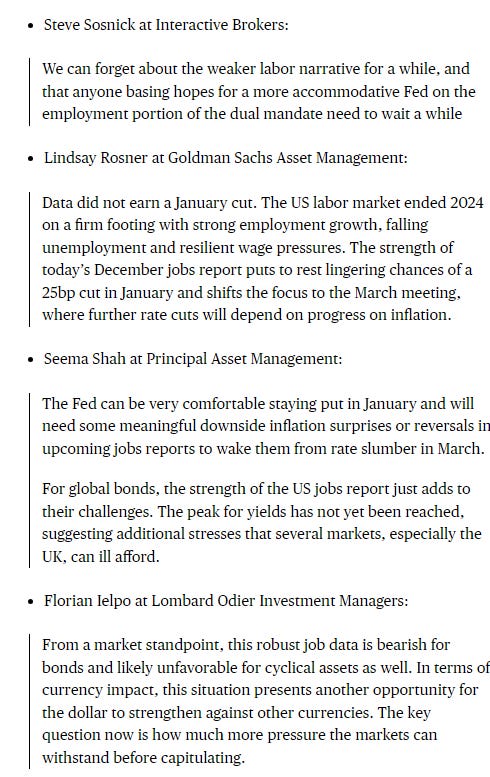

“The Fed can be very comfortable staying put in January and will need some meaningful downside inflation surprises or reversals in upcoming jobs reports to wake them from rate slumber in March,” said Seema Shah at Principal Asset Management. “For global bonds, the strength of the US jobs report just adds to their challenges. The peak for yields has not yet been reached.”

“The surprisingly strong jobs report certainly isn’t going to make the Fed less hawkish,” said Ellen Zentner at Morgan Stanley Wealth Management. “All eyes will now turn to next week’s inflation data, but even a downside surprise in those numbers probably won’t be enough to get the Fed to cut rates any time soon.”

To Bret Kenwell at eToro, while the market may not love the latest jobs data, there are a lot of worse things than a strong labor market. “Without a strong foundation in the labor market, the whole thing falls apart. Investors need to keep that in mind — even if that means rate-cut expectations take a step back,” Kenwell said.

“We see these rebounds in yields as a great opportunity to lock in income, particularly for investors who are still sitting on too much cash,” Manpreet Gill, chief investment officer for Africa, Middle East and Europe at Standard Chartered, told Bloomberg TV. “We think yields can still fall further.”

The move higher in Treasury yields over the past month has largely been driven by real rates — suggesting that higher growth expectations have been the dominant driver behind the selloff, according to Gennadiy Goldberg at TD Securities.

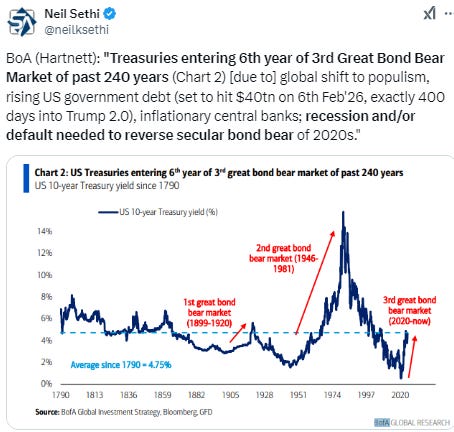

“The Fed is worried about the incoming administration,” Skyler Weinand, chief investment officer for Regan Capital, said on Bloomberg Television. The combination of the growing US fiscal deficit and a strong consumer could result in “higher interest rates for the next five to ten years,” he said.

More Wall St reaction to NFP:

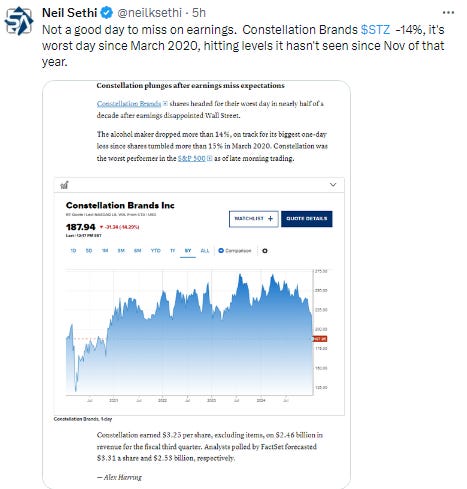

In individual stock action, chipmaker Nvidia shed 3%, while AMD and Broadcom lost 4.8% and 2.2%, respectively. Palantir was off by more than 1%. Insurance companies were among the market’s biggest losers on Friday as the devastation caused by the uncontained Los Angeles wildfires spread. Allstate lost 6.1%, while American International Group and Chubb each slid 1.3% and 3.6%, respectively. Travelers Companies traded 4.1% lower. Constellation Brands shares headed for their worst day in nearly half a decade after earnings disappointed Wall Street.

It wasn’t all bad today though. Delta Air Lines (DAL 66.95, +5.53, +9.0%) gained 9.7% following stronger-than-expected earnings results, while Walgreens Boots Alliance (WBA 11.76, +2.54, +27.6%) surged 27.6% after surpassing earnings estimates. Taiwan Semiconductor Manufacturing Company (TSM 208.37, +1.25, +0.6%) reported record revenues for the fourth quarter, leading to a 0.6% rise in its stock price.

BBG Corporate Highlights:

Tesla Inc. refreshed its best-selling Model Y, applying a design element of the polarizing Cybertruck to its high-volume sport utility vehicle.

Nvidia Corp. criticized new chip export restrictions that are expected to be announced soon, saying the White House was trying to undercut the incoming Trump administration by imposing last-minute rules.

Delta Air Lines Inc.’s profit beat Wall Street’s estimates for the final months of 2024, buoyed by gains in both the US market and overseas. The company doesn’t expect the momentum to slow in the new year.

Walgreens Boots Alliance Inc. reported quarterly sales that surpassed Wall Street’s expectations, spurring the shares and easing pressure on the drugstore chain as it mulls strategic options including a sale.

Constellation Energy Corp. agreed to acquire closely held Calpine Corp. for $16.4 billion in a deal that will create the largest fleet of US power stations.

The Walt Disney Co., Fox Corp. and Warner Bros. Discovery Inc. scrapped plans to create a joint sports streaming service just days after settling a lawsuit brought against the three companies alleging the platform would squelch competition.

Chip-design company Synopsys Inc. won conditional approval from the European Union’s merger watchdog for its planned $34 billion buyout of software developer Ansys Inc, after addressing the regulator’s fears over the deal.

Some tickers making moves at mid-day from CNBC.

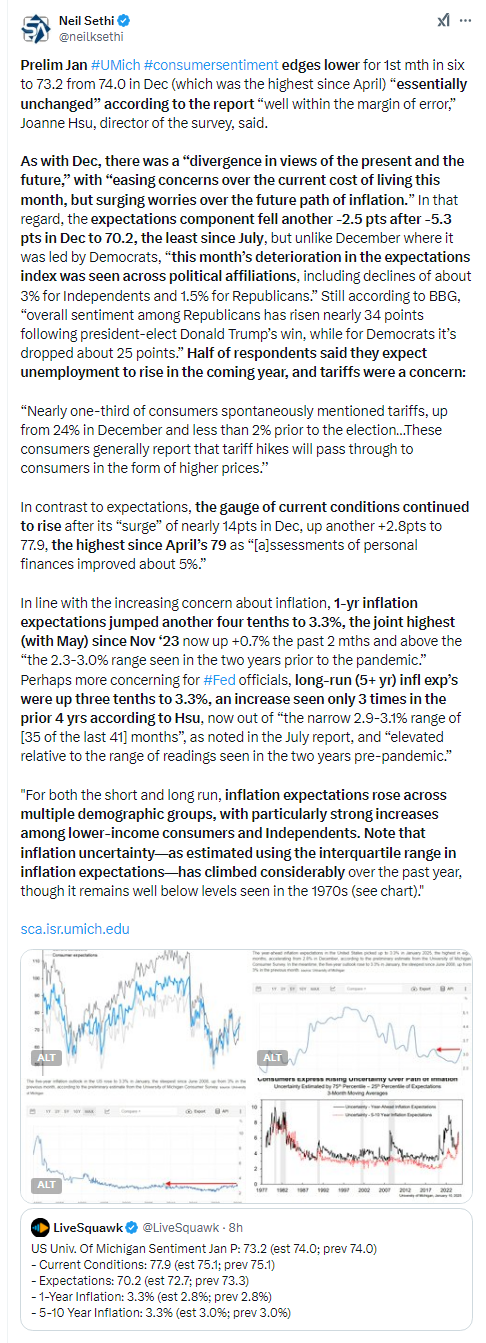

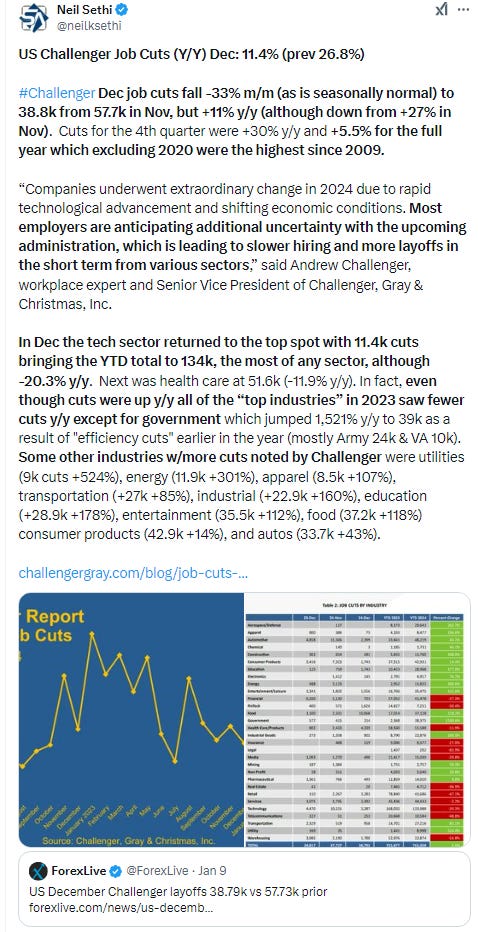

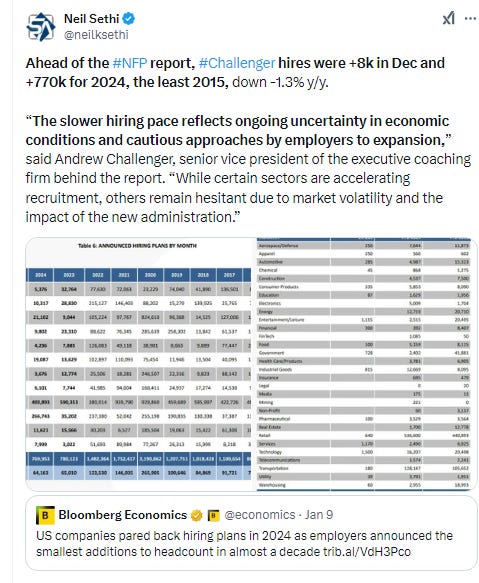

In US economic data we got the “blowout” Nonfarm payrolls report, but also a U of Mich consumer sentiment survey which showed a big jump in inflation expectations, just adding fuel to the fire of fewer FOMC rate cuts and higher bond yields.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

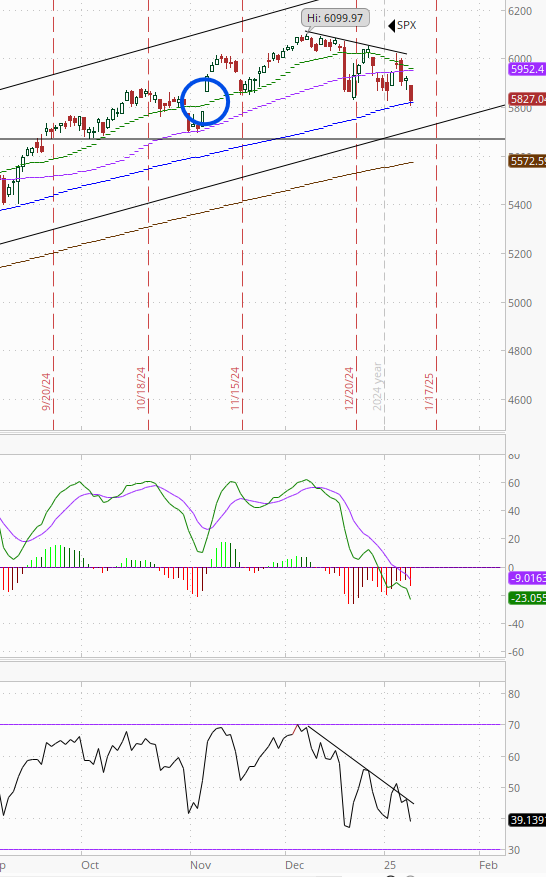

The SPX fell back to its 100-DMA which held, the least since Election Day. It’s now mostly filled the gap from that day. Daily MACD & RSI remain quite weak.

The Nasdaq Composite under its 50-DMA to the least since late November, but it has further to go to get back to where it was Election Day. Its daily MACD and RSI are weak as well although not as bad as the SPX.

RUT (Russell 2000) fell to a 3-mth low almost making it to the 200-DMA target I put on it just Thursday. As I noted last week until it gets over the 2290 level “we can’t really look higher,” but now it’s got a whole lot more resistance before that point. Daily MACD & RSI remain weak after coming close to turning more positive.

Equity sector breadth from CME Indices back to very weak with just 1 of 11 sectors in the green, the worst of the week, with just energy (+0.3%) managing to hold on for a gain. Every other sector down more than that w/8 down around -1% or more. Selling was fairly broad based with no style dominating.

Stock-by-stock SPX chart from Finviz consistent showing a lot of pain. A whole host of industries w/all or mostly all the shares lower. Every SPX financial sector stock was down, most -2 or -3%, except AJG, an insurance broker (+0.5%), every RE stock except HST (Host Hotels). Every semiconductor stock down as well.

Positive volume (the percent of volume traded in stocks that were up for the day) fell to 24% for the NYSE and 46% for the Nasdaq. While the NYSE was the weakest since Dec 27th, the Nasdaq was again unusually strong as it’s been most of the past month. Positive issues (percent of stocks trading higher for the day) though were even weaker at 19 & 22% respectively.

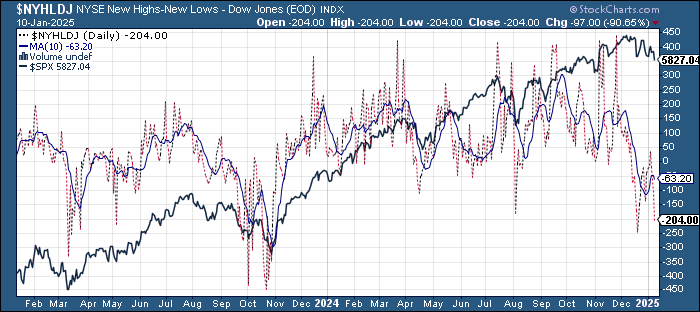

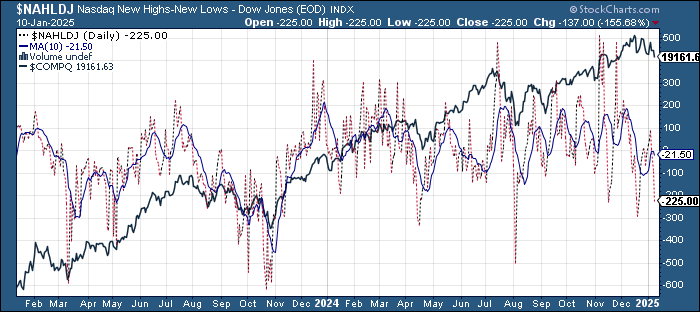

New highs-new lows (charts) also deteriorated with the NYSE at -203 & the Nasdaq at -229 (both the least since Dec 19th). Both are also now under their 10-DMAs which have turned back down (less bullish).

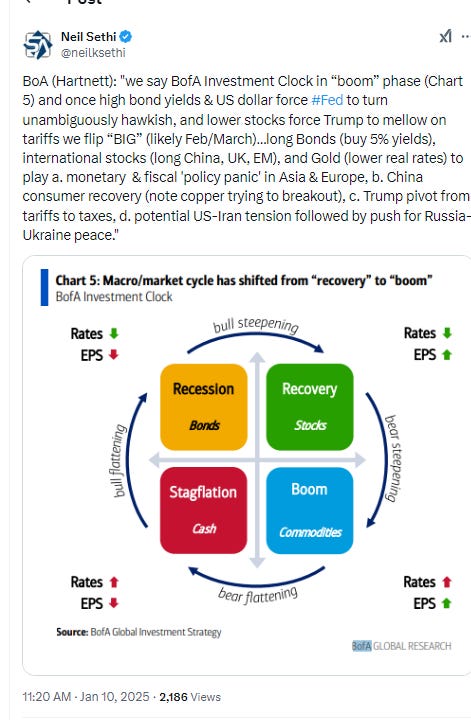

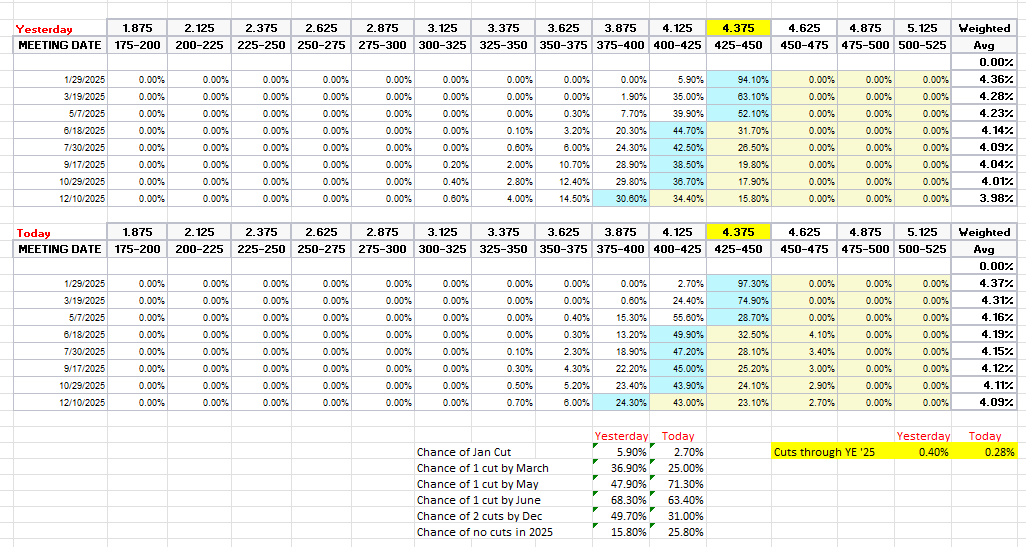

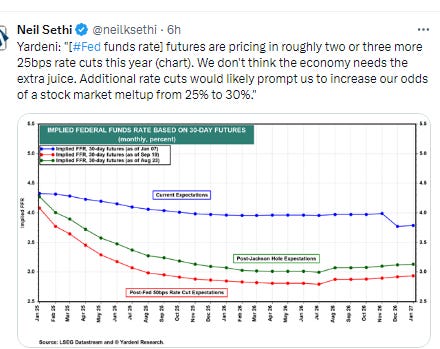

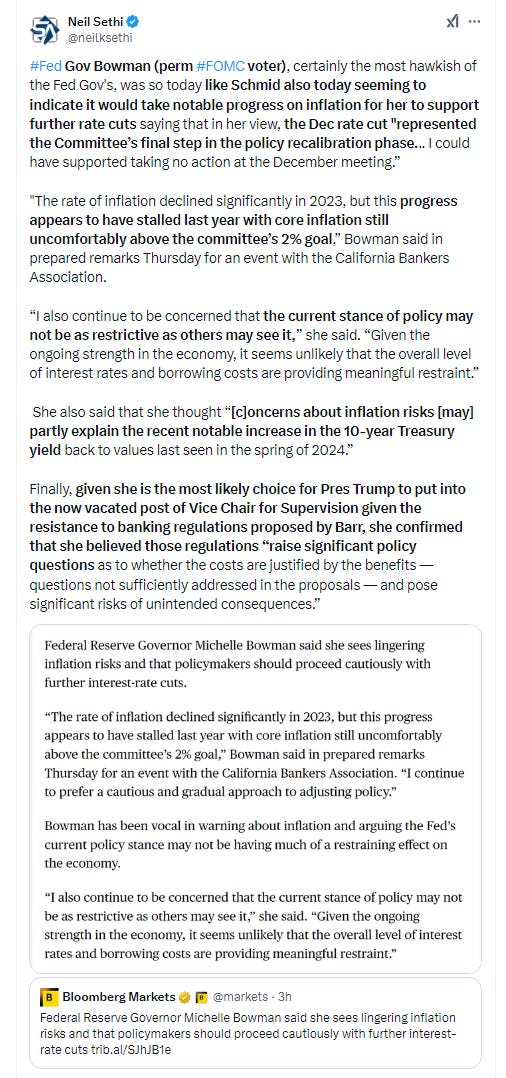

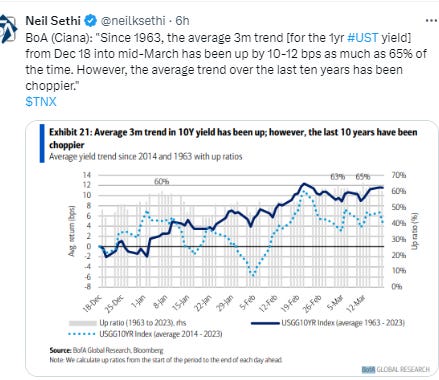

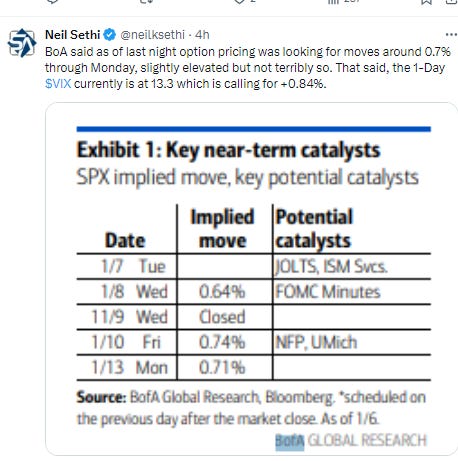

FOMC rate cut probabilities from CME’s #Fedwatch saw some big moves, bigger than one might have thought given the Fed has made clear they don’t think labor markets are a source of inflation and “welcome” jobs growth (but it was on the back of a stream of hawkish Fed speakers this week and we also saw after a jump in inflation expectations which definitely got the Fed’s attention). The chance of a Jan cut down to 3%, March to 25% (from 37%), something is wrong w/May so I’m ignoring that, June fell to 63% (from 68%). Overall pricing for a 2nd cut in 2025 fell to 31% (from 50%) with overall 2025 cut expectations down -12bps (so a half a 25bps cut) to 28bps with the chance of no cuts at 25% (from 16%).

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that until we get CPI next week. While this report was strong, it’s important to remember data is only as strong as the last couple of months’ reports, so things can change quickly.

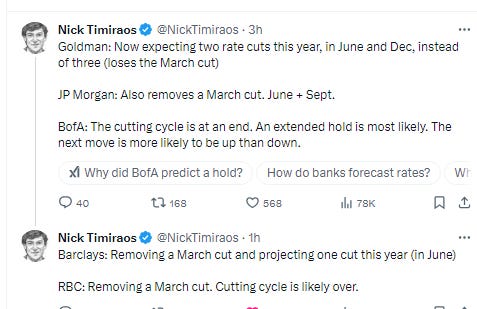

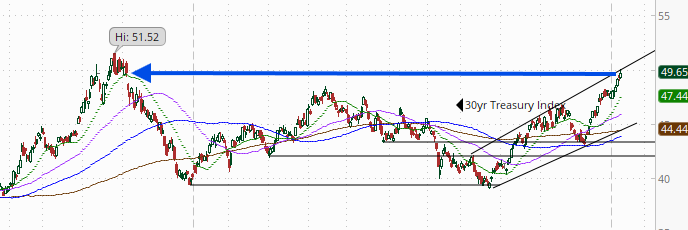

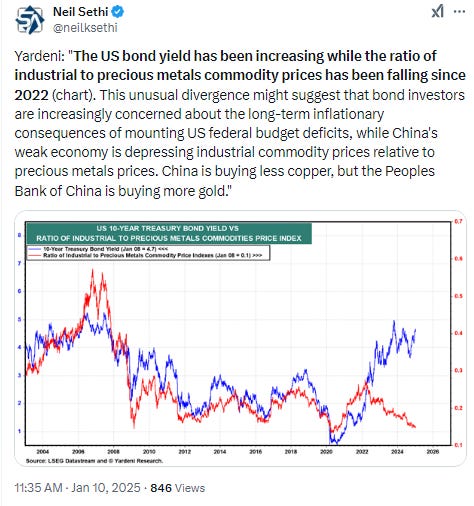

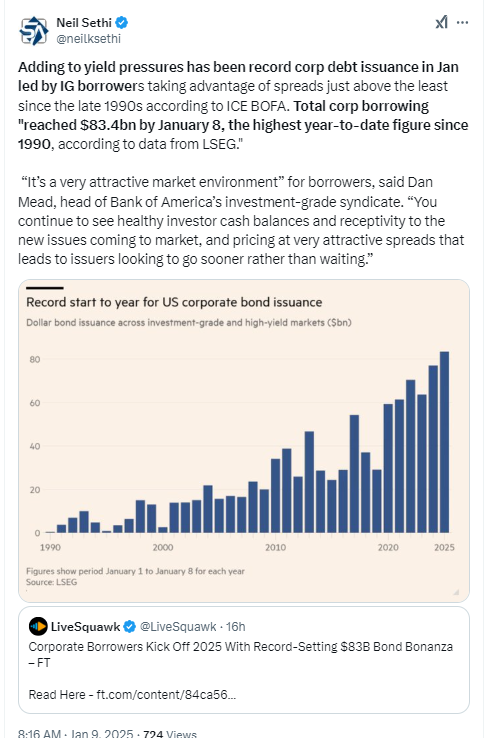

I said Monday, “the NFP report Friday probably decides if the 10yr yield breaks through 4.7%,” and it sure did. Longer duration Treasury yields were up Friday for a 7th session with the 10yr +7bps to 4.76%, now the highest since Oct ‘23 (which was the highest since 2007), +37bps since the Dec FOMC meeting (& +100bps from the Sept FOMC meeting), and through the 4.7% level I’ve said it’s been “eyeing” the past 3 weeks. I guess now it’s eyeing 5%. The 2yr yield, more sensitive to Fed policy, notably also was up +9bps (so more than 10yrs) to 4.38%, now the highest since July. I say “notably” because it is now right on top of the current Fed Funds rate, meaning the 2yr is pricing zero net cuts over the next 2 years. I have mentioned before I find this level very rich, as I think a cut is more likely than no cuts (as do Fed Funds futures markets), but I guess we’ll see.

As a side note, the 30-yr yield touched 5% today before pulling back to finish just under. It is also the highest since Oct ‘23.

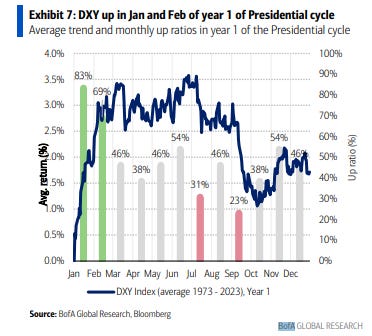

Dollar ($DXY) given the action in yields unsurprisingly jumped to a 26-mth high and capping the 14th up week in 15. It touched the 110 level before falling back Daily MACD and RSI remain positive but the latter less so than the start of the month a small negative divergence.

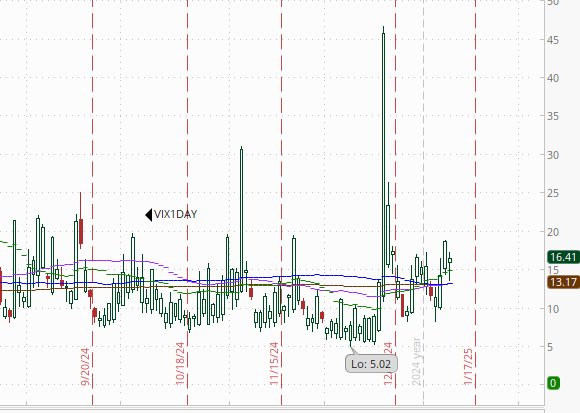

The VIX at one point pushed through 20 before falling back ending still elevated at 19.5 (consistent w/1.2% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly moved to the highest since the Dec FOMC meeting at 115, over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX fell back to 16.41 with the event risk of NFP cleared, but that’s still a fairly high number, looking for a move of 1% Monday, well above the 0.71% BoA saw coming into the week.

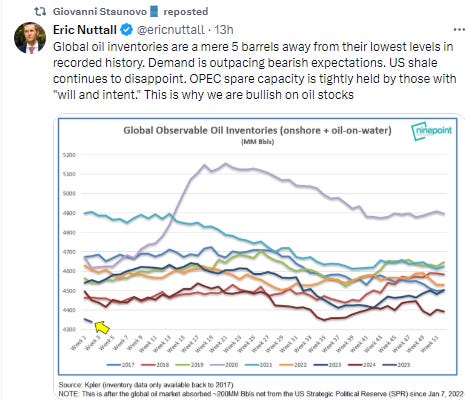

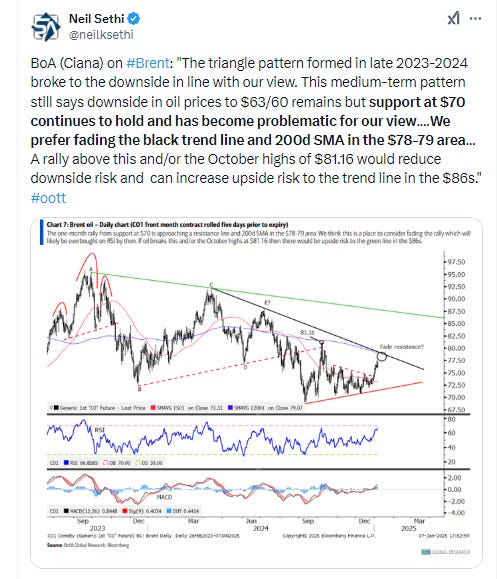

WTI surprised me Friday, pushing right through not only its 200-DMA but also the downtrend line from Oct ‘23 that it hasn’t closed appreciably over since then. It fell back after getting to the key $78 level (late Aug & Oct highs) but still closed “appreciably over”. Daily MACD & RSI remain very supportive with the latter the strongest since April, so it has the technical setup to get through. Next week will be interesting either way.

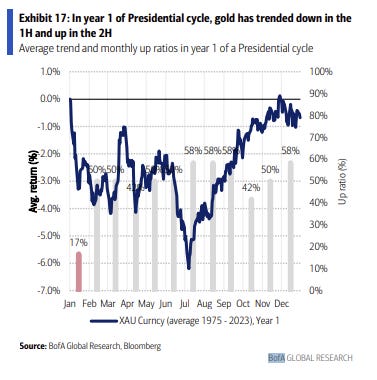

Gold was surprisingly strong in the face of the jump in rates, up over 1% and through the 50-DMA, which I have described as “key resistance”. It seemed to have trouble at the downtrend line from its ATH though. Daily MACD remains in "cover shorts" signal & daily RSI continues to push 50, so it has the setup to get through.

Copper (/HG) continued its bounce from just above the $4 mark for a 6th session Friday, closing at a 2-mth high, and above the downtrend line it hasn’t closed over previously since May. Wasn’t able to clear its 200-DMA though. Its RSI and MACD remain positive, with the former the best since Oct. We’ll see if it can get through the 200-DMA which opens up a run higher.

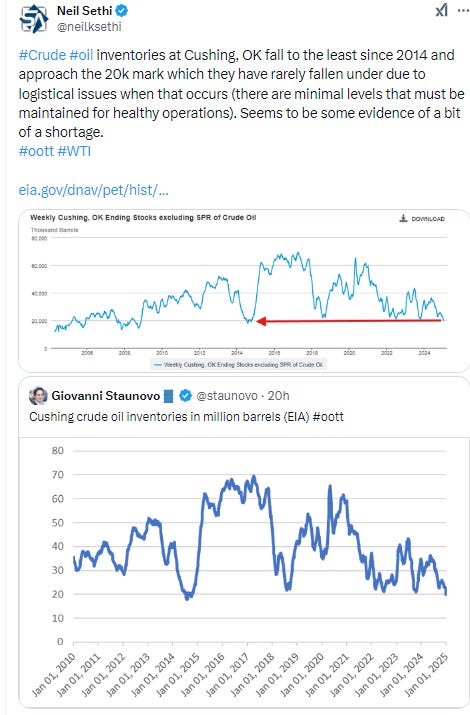

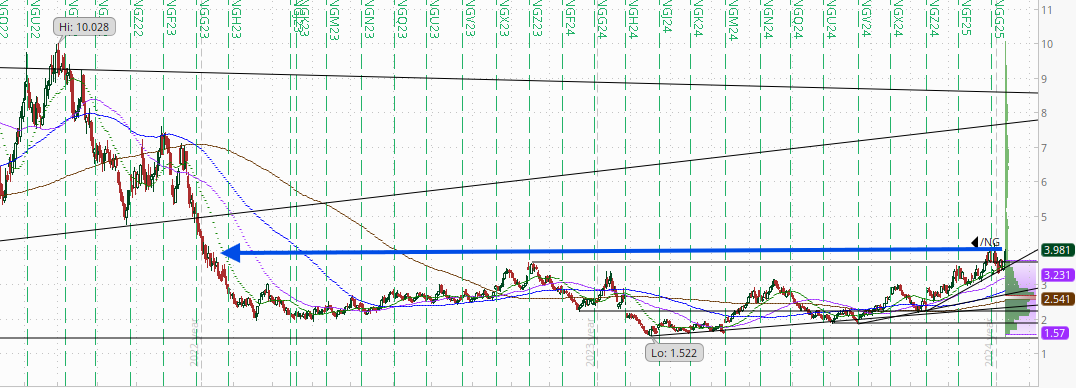

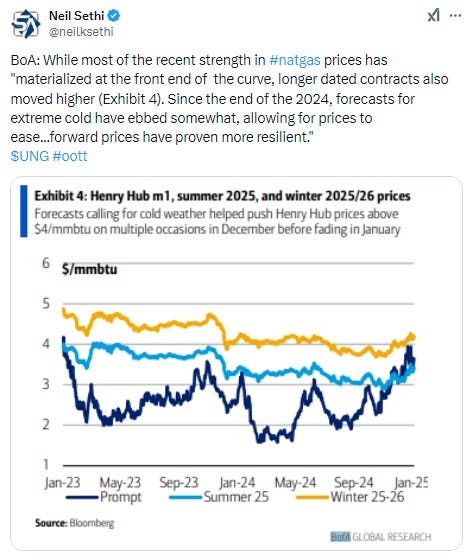

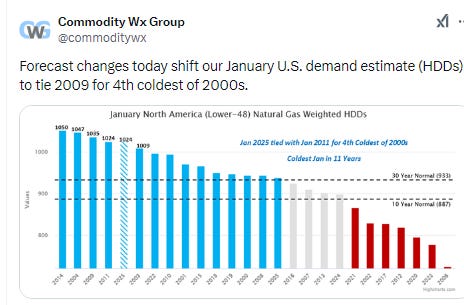

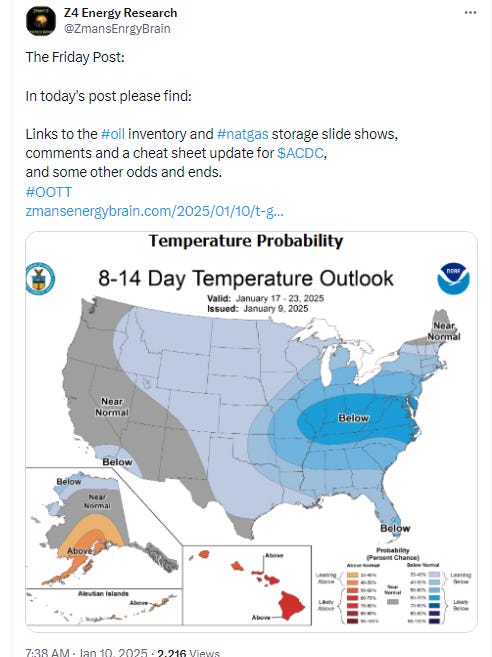

Nat gas (/NG) remained volatile Friday jumping another +8.5% (it’s moved over 6% in 9 of the past 10 sessions) on forecasts for January cold to extend through the end of the month, finishing at the highest close since Jan ‘23. Daily MACD remains in “sell longs” position but is close to crossing and RSI is pushing further over 50 but continues to have a negative divergence (lower high).

Bitcoin able to bounce from its 50-day although remains near the lowest since Nov. As I said Wed “feels like the 50-day needs to hold.” The daily MACD and RSI remain weak though.

The Day Ahead

Enjoy the weekend (stay warm if you’re on the eastern half of the US (and hopefully safe if you’re in the LA area)). More on Sunday

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,