Markets Update - 11/06/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

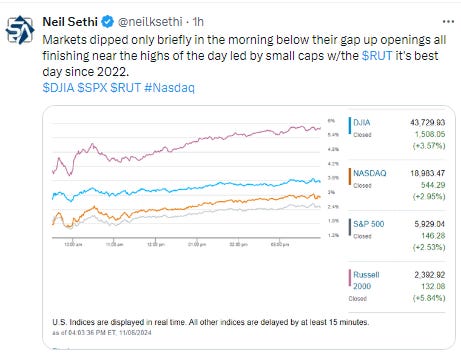

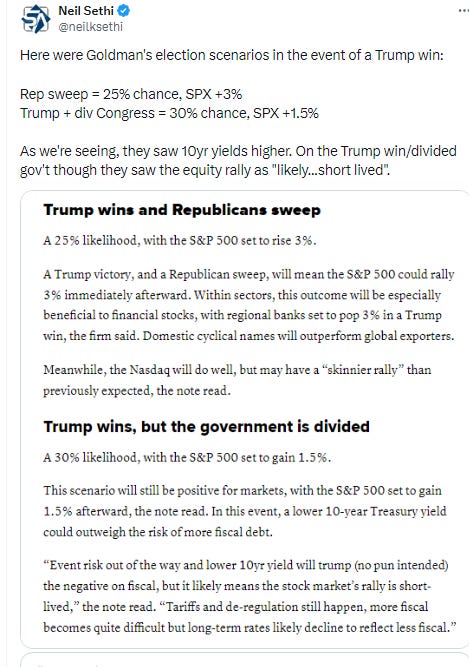

US equities screamed higher today following Donald Trump’s winning of the Presidential election with the SPX, Nasdaq, and Dow all jumping to all-time highs and the Russell 2000 small cap index now just 2% away:

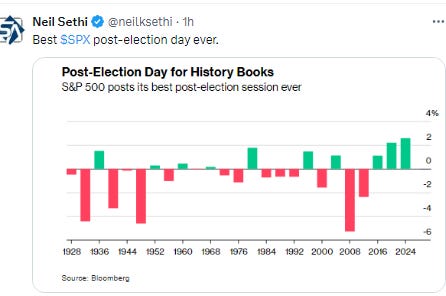

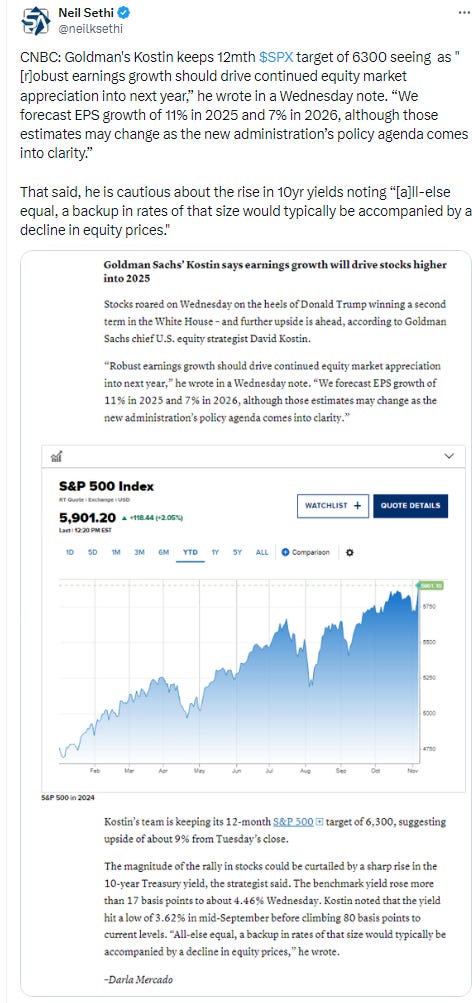

The S&P 500 climbed 2.5% on bets the newly elected president will enact pro-growth policies that will boost Corporate America and cut corporate taxes. The benchmark had its best post-Election Day in history, according to data compiled by Birinyi Associates Inc. and Bloomberg. The Russell 2000 gauge of small caps rallied 5.8% amid speculation they will benefit from Trump’s protectionist stance and tax cuts. The Dow Jones Transportation Average jumped to a fresh high after a three-year drought of records, finally confirming the strength of its industrial counterpart.

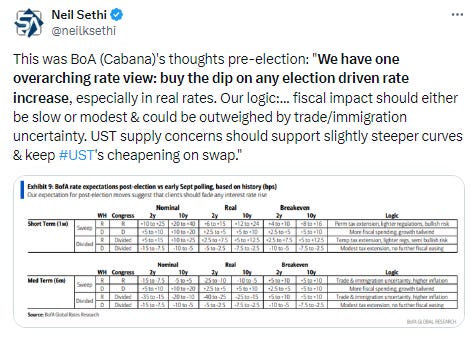

Treasury yields climbed across the curve, with the move led by longer-term bonds as traders slashed wagers on the scope of rate cuts by the Federal Reserve. Investors have doubled down on bets for policies such as tax cuts and tariffs that could trigger price pressures. The moves also signal worries that Trump’s proposals will fuel the budget deficit and spur higher bond supply. US 10-year yields advanced 17 basis points to 4.44%. A dollar gauge added 1.3%, with the yen leading losses in major currencies and the euro down 1.8%. The Mexican peso was almost flat after sinking as much as 3.5%. Bitcoin, viewed by many as a so-called Trump trade after he embraced digital assets during his campaign, hit a record high. Commodities came under pressure, with gold and copper tumbling, although oil was able to finish flat while natural gas saw a gain.

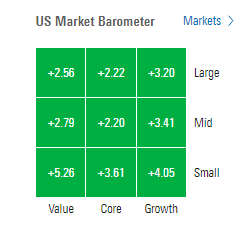

The market-cap weighted S&P 500 was +2.5%, the equal weighted S&P 500 index (SPXEW) +2.4%, Nasdaq Composite +3.0% (and the top 100 Nasdaq stocks (NDX) +2.7%), the SOX semiconductor index +3.1%, and the Russell 2000 +5.8%.

Morningstar style box shows every style up at least 2.2% with every small cap style up at least 3.6%.

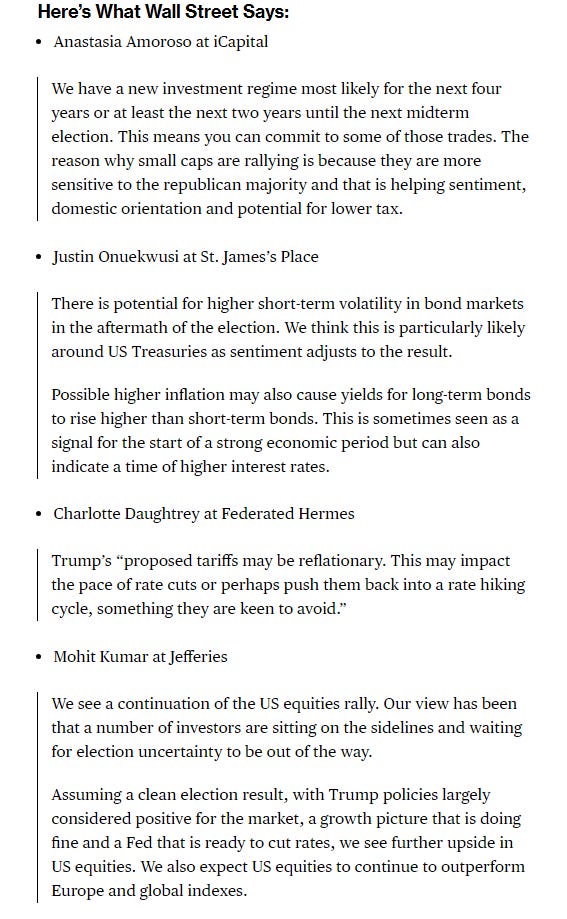

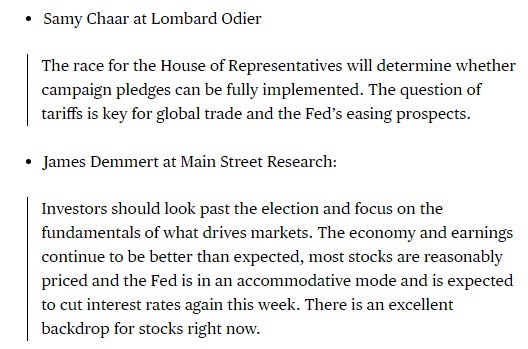

Market commentary:

“We’ve been talking about this Trump trade for a while. The fairly aggressive market reaction shows that investors didn’t know what to put on, and now they know,” Marvin Loh, senior macro strategist at State Street Global Markets, told Bloomberg TV. “We’re going to unpack the winners and losers.”

“For now, investor sentiment is pro-growth, pro-deregulation, and pro-markets,” said David Bahnsen, chief investment officer at The Bahnsen Group. “There is also an assumption that M&A activity will pickup and that more tax cuts are coming or the existing ones will be extended. This creates a strong backdrop for stocks.”

“The biggest takeaway from last night is that we received certainty that the market craves,” said Ryan Grabinski at Strategas. “This will allow both business and consumer confidence to improve. Attention now should shift to the Fed meeting tomorrow. The 10-year is approaching the 4.5% level, that’s the level risk assets ran into some trouble in the last 24 months.”

At Macquarie, Thierry Wizman says traders have to be mindful about pushing the “yield story much further.” “If there’s a surprise coming from Trump in the next few months (at least relative to hyped-up expectations), it will be about fiscal restraint — rather than fiscal irresponsibility. When the market realizes this, long-term UST yields could stabilize or decline.”

To Mark Haefele at UBS Global Wealth Management, the bond selloff has gone too far. He expects the Fed to stay on a path toward lower rates.

“The Fed is still likely to cut by 25 basis points at Thursday’s meeting and likely to cut again in December,” said Yung-Yu Ma at BMO Wealth Management. “As we move into 2025, we believe it’s possible that we only see two or three cuts for the year depending on the mix of policy and growth that plays out.”

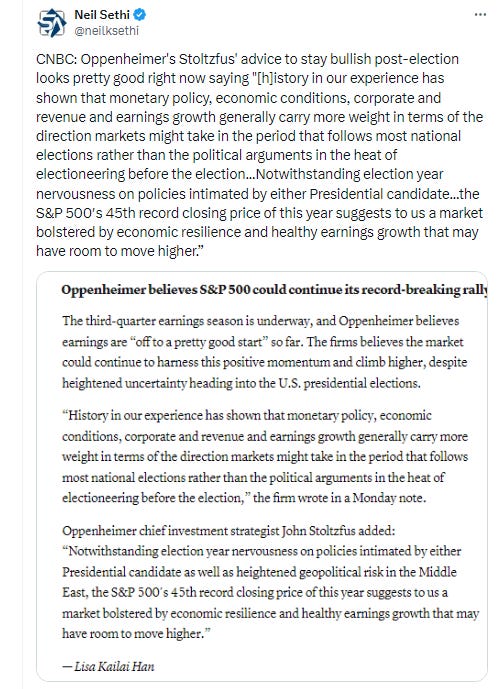

With many investors braced for a prolonged period of uncertainty, simply gaining some clarity on the outcome is providing a sigh of relief, according to Keith Lerner at Truist. He says the market currently appears more focused on the positive aspects of Trump’s agenda with less emphasis on the potential of tariffs and wider policy outcomes. “Markets are pricing in most of the positives today, though the backdrop is complex, and rates, deficit concerns, the potential for fewer Fed rate cuts, and tariffs could eventually provide a counterbalance to today’s upside price shock, he noted. “Still, the weight of the evidence in our work indicates the bull market still has some longevity left, and we are sticking with the primary market uptrend.”

“Markets hate uncertainty and now that the election is officially over, stocks are soaring today,” said Ryan Detrick at Carson Group. “Optimism over tax cuts, a still dovish Fed, and a potentially better economy are part of it, but the reality is the economy has been quite solid all year, so this really isn’t anything new. Back to your regularly scheduled bull market is how we see it.”

“Small and mid-cap companies are the economic backbone of the US economy,” said Charlotte Daughtrey, equity investment specialist at Federated Hermes. “There are strong tailwinds that are supportive for the next five to ten years.”

The surge in small caps suggests the performance of the US stock market will broaden from the big-tech cohort following Trump’s re-election, according to Vincent Juvyns at JPMorgan Asset Management.

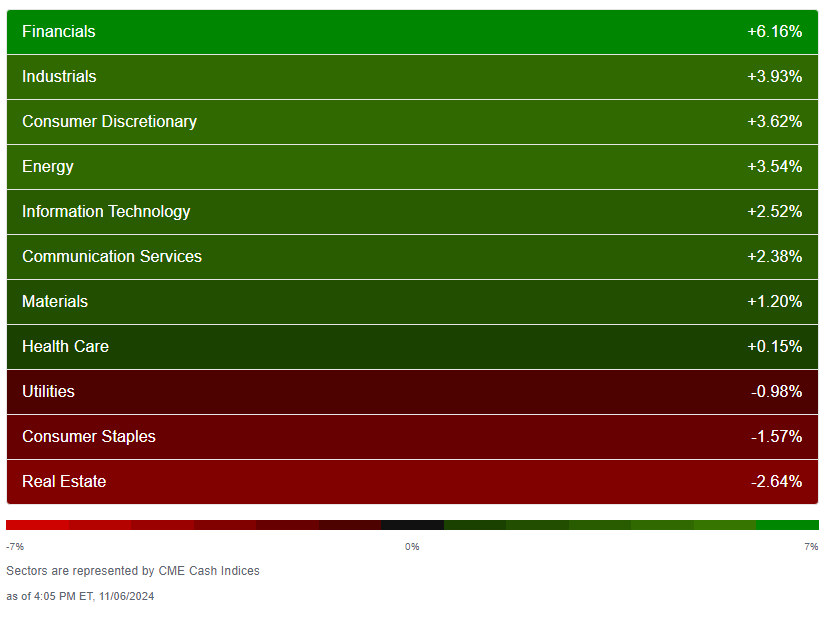

Chris Senyek at Wolfe Research says he remains bullish on stocks into year-end. “With Donald Trump winning the 47th Presidency of the United States, we believe that markets will heavily favor financials, US-based industrials (transports), energy, and crypto today and into year-end, he said. “We think more offensive tech outperforms as well with semis outperforming. By style, we’d own value, equal weight, small-cap and year-to-date laggards.”

At Ameriprise, Anthony Saglimbene says animal spirits through year-end could push major averages higher as the overhang of the election is removed and investors look to put excess cash to work in equities “Finally, US stocks may see tailwinds from not only the election results but a retreat in volatility hedging, corporations moving out of their buyback blackout periods as the earnings season winds down, and strong fourth-quarter seasonality factors (particularly in election years).”

The small-cap “gains might not necessarily be sustainable,” said Julien Lafargue, chief market strategist at Barclays Private Bank. “Higher yields could also prove challenging to this group that relies on market access to fund themselves.”

“It looks like a Trump presidential win but also a win for Republicans in House and Senate. If that happens, you’re going to see the U.S. economy really taking off,” Mark Mobius, Mobius Emerging Opportunities Fund chairman, told CNBC early Wednesday.

“Trump is viewed as supporting lower corporate tax rates, deregulation, and industrial policies that favor domestic growth, all of which could provide more stimulus to the U.S. economy and benefit risk assets. ... During the 2016 election, the S&P 500 Index gained nearly 5% from the day before the presidential election through the end of the year in what became known as the Trump rally. We expect a similar trend could play out this time around, too,” Marc Pinto, head of Americas equities at Janus Henderson Investors, said in a note.

The macroeconomic environment remains favorable for risk-taking, BMO Wealth Management chief investment officer Yung-Yu Ma said Wednesday. But overall market enthusiasm could get tempered by more details about new tariff policies or a rise in Treasury yields, he added. “Stocks are surging, reminiscent of the post-election boost in 2016, but there are distinct differences that are likely to limit the extent of the rally, since control of the House is still up in the air and is likely to be controlled by Republicans by a very slim margin,” Ma wrote in a note to clients. “There is also uncertainty over tariffs, which is driving up long-term interest rates, and while current bond yields are not concerning, a run to 5% on the 10-year Treasury has been a level that gave markets pause in the recent past.”

“Favorable macro drivers still dominate, and the prospect of a Republican sweep and lower taxes is adding to the market enthusiasm,” said Ma at BMO. “That may get tempered in the coming weeks by more details regarding tariff policy or a continued rise in long-term Treasury yields, but for the past two years we’ve said that the environment is favorable for risk-taking and that remains the case.” In addition, the potential for extension of personal tax cuts under a Republican sweep are only marginally positive for the equity markets, he noted. Corporate tax cuts are much more significant, and while there have been promises to do more on this front, they come with unclear stipulations, including requirements that companies keep manufacturing operations in the US,” Ma concluded.

“Assuming the House goes Republican, we expect that a Red Sweep outcome will play out in a similar fashion to the 2016 playbook but to a lesser degree given a more mature economic backdrop and higher equity valuations,” said Jeff Schulze at ClearBridge Investments. “Business animal spirits could be rekindled once again from Trump’s pro-business approach.” Schulze says that which could lead to a more robust capital expenditures and investment environment. A more favorable corporate tax regime, full extension of the Tax Cuts and Jobs Act, and a lighter regulatory touch should outweigh the potential headwinds from increased tariffs and reduced immigration on corporate profits. “We expect cyclical leadership to continue in the coming months as the market anticipates stronger economic growth and better earnings delivery from this cohort than is currently priced,” Schulze noted

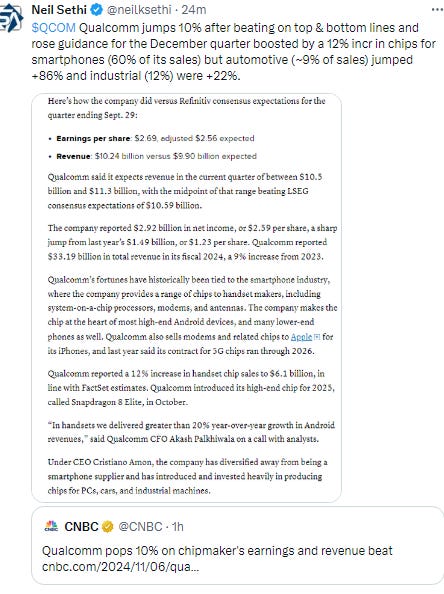

In individual stock action, investments seen as beneficiaries under a Trump presidency erupted. Tesla, whose CEO Elon Musk is a prominent backer of Trump, saw shares surge more than 14%. Bank shares got a boost with JPMorgan Chase climbing 11.5% and Wells Fargo jumping 13%, but the entire S&P 500 financial sector (+6.2%) was in good spirits, relishing the thought that regulatory oversight will be reduced and that growth optimism will spur increased capital markets activity. Goldman Sachs (GS 596.29, +69.33, +13.2%), KeyCorp (KEY 19.97, +2.70, +15.7%), and Discover Financial Services (DFS 182.63, +30.78, +20.3%) were other notables. Nucor (NUE 167.74, +23.13, +16.0%) and other steel stocks, which are expected to benefit from tariff protections under a Trump administration, put up some big gains as well.

Shares of Coinbase surged more than 26%, putting the crypto exchange on pace for its best day on record back to its direct listing in April 2021, when it gained 31% from its reference price on its first day of trading as a public company following the “Bitcoin President” (as enthusiast Michael Saylor dubbed Trump) claimed victory. Shares of Trump Media & Technology Group , a social media company closely tied to Trump, finished up 5.8% after a volatile trading session.

Some tickers making moves at mid-day from CNBC.

No US economic data today other than mortgage applications which fell (and likely will keep falling given rates will likely continue to ratchet higher given the big jump in 10yr rates today).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX jumped to an ATH. Daily MACD and RSI remain weakish but turning quickly.

The Nasdaq Composite also jumped to an ATH. The daily MACD & RSI are a little stronger here.

RUT (Russell 2000) shot up to highest since Nov ‘21 just a couple percent from its ATH. Its daily MACD & RSI are the most positive.

Equity sector breadth from CME Indices despite the big equity gains deteriorated from Tues as yield sensitive RE, staples & utilities were sold, all down around -1% or more. Health care was basically flat but every other sector up at least 1% w/4 up >3% & financials +6.2%.

Stock-by-stock SPX chart from Finviz consistent, a real tail of haves and have nots (unlike Tues where you had to look hard from the red in a sea of green).

Positive volume which finally had back-to-back solid sessions was pretty weak Wed at 65 & 64% on the NYSE & Nasdaq respectively. While solidly above 50 compare that to the 80 & 78% on Tues (which was the best combined since late August. Issues were 80 & 71%.

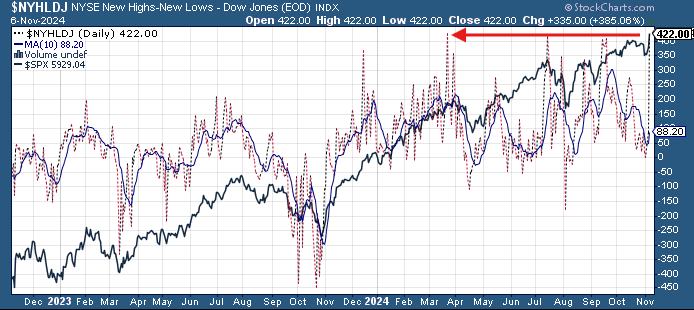

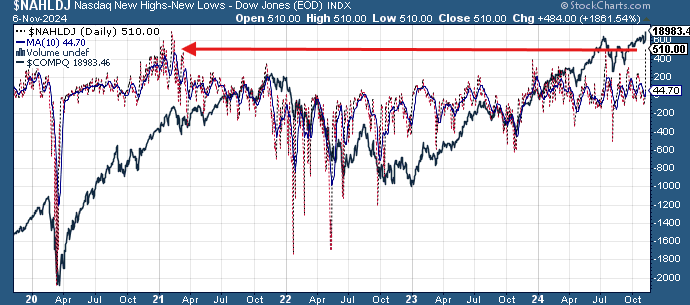

New highs-new lows though shot up to 419 & 507. That is the best since March (424) & early 2021 respectively putting them way above the the 10-DMAs (more bullish), and seeing the DMA’s turn up from the least since Aug & Sept respectively.

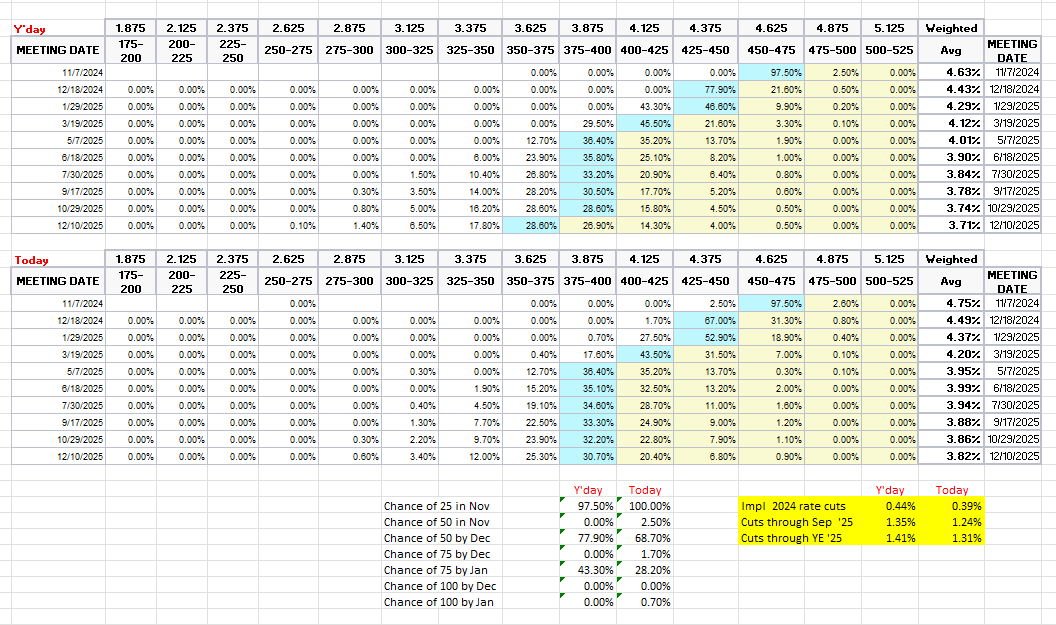

FOMC rate cut probabilities from CME’s Fedwatch tool see the chance of 25bps in Nov move to a certainty at 100% (with now a small 2.5% chance of a 50bps cut), but chances fell further out the curve w/ the chance of 50bps through the end of year to 69% from 78%, and the chance of 75bps after Jan’s meeting to just 28% from 43%.

Now just 39bps of cuts priced this yr (from 44), 124bps through Sep ‘25 (from 135) & 131bps through YE ‘25 (from 141).

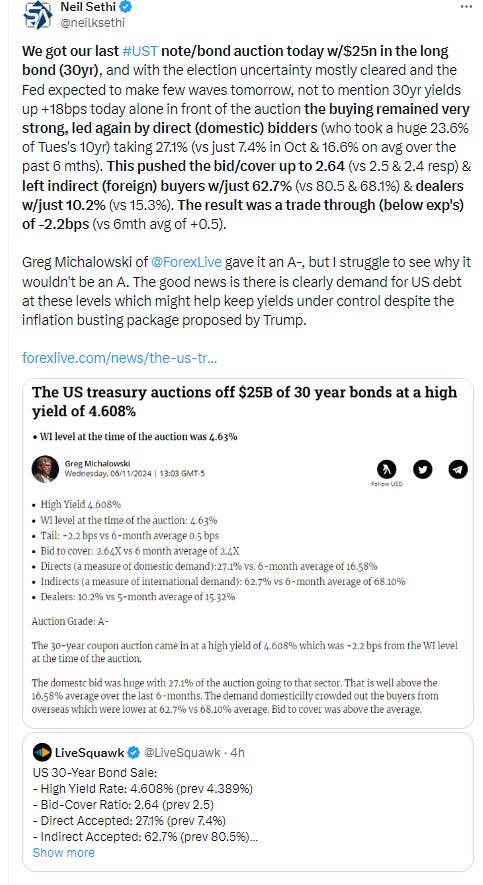

Treasury yields as noted shot higher particularly at the long end although finished off the highs after a solid 30yr Treasury auction, with the 10yr +14 basis points to 4.43%, the highest close since July 2nd, now up +68bps since the start of October and pushing towards the 4.5% level identified by many as a “line in the sand”, while the 2yr yield finished +6bps at 4.25%, the highest close since July, but it had been up +6 bps earlier in the day. It’s up +62bps since the start of October. For its part the 30yr bond yield was +16bps to 4.61% also the highest since July 2nd.

Dollar ($DXY) saw quite the reversal Wed after falling under support Tues with one of the best days (if not the best) since March 2020 jumping to a 4 mth high and putting squarely back on the table the 106 target I had noted 2 wks ago. The daily MACD & RSI remain weakish but are quickly improving.

It is also back above the downtrend line running to the Sep ‘22 highs which I think we can probably now retire.

The VIX & VVIX (VIX of the VIX) both dropped sharply with the election uncertainty mostly out of the way falling to their respective 200-DMAs before getting a bounce. The former is now 16.3, the lowest close since Sept (and consistent w/1% daily moves over the next 30 days) & the latter to 97 (consistent w/“moderate to high” daily moves in the VIX over the next 30 days but off the “extreme” levels seen earlier).

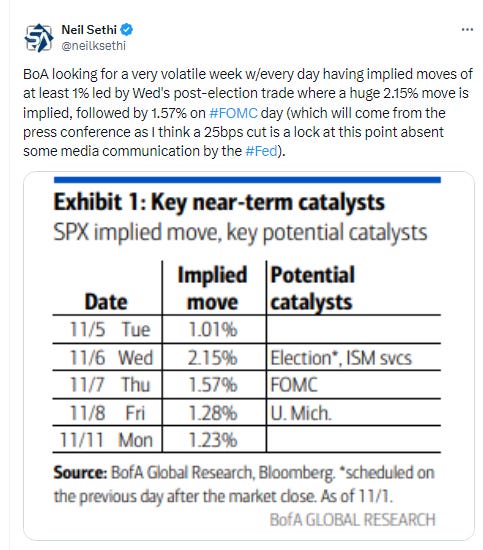

1-Day VIX, fell sharply as well to 14.9, still relatively elevated with the FOMC tomorrow, looking though for just a move of ~0.9% Thursday versus Wed’s 2%. This is less than the 1.57% BoA had seen coming into the week.

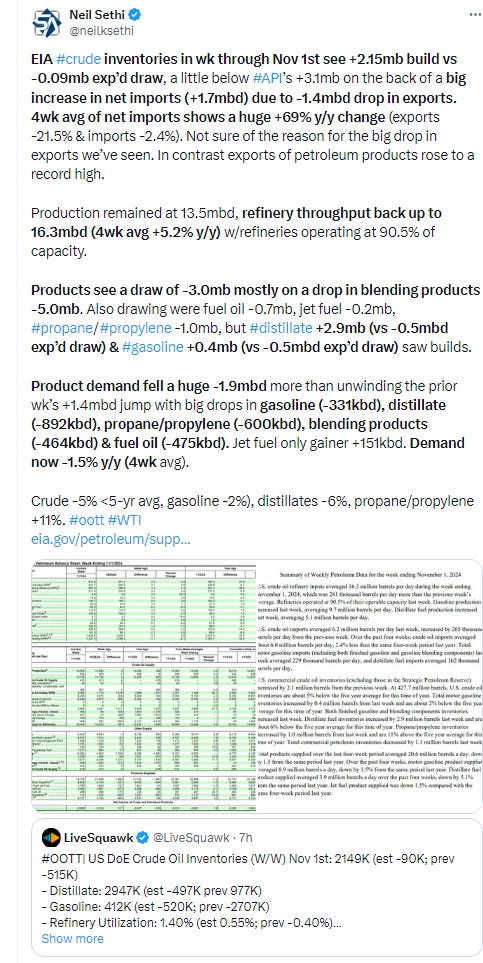

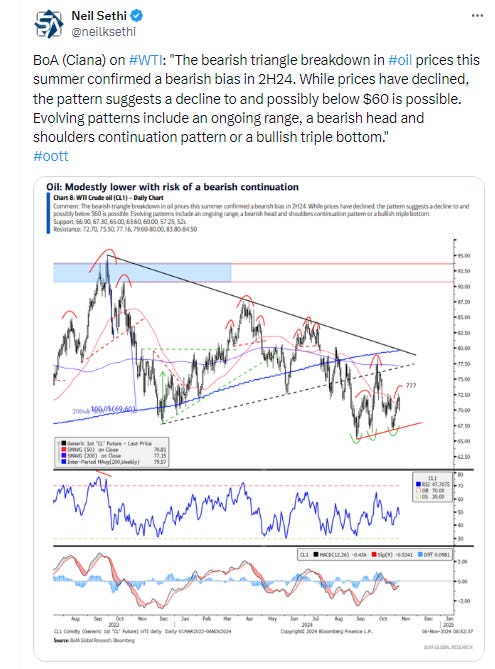

WTI dropped sharply early in the session before rallying back to finish flat despite a weak EIA inventories report, keeping it just over the $71.60 level. Daily MACD & RSI remain in supportive positioning.

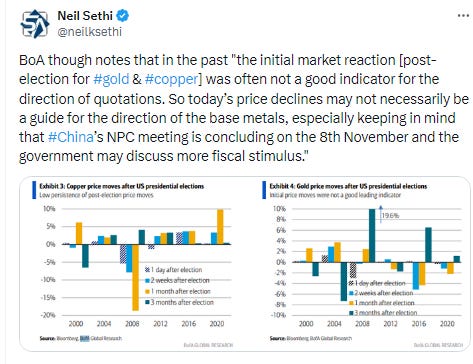

Gold fell sharply not able to withstand the strong dollar and rotation into Bitcoin falling -3%, its worst day since March 2022, stopping only when it reached the 50-DMA which provided some support. We’ll see if it can hold but the daily MACD remains in “sell longs” positioning and the RSI is the weakest since Feb.

Copper also fell sharply down -5.3%, which might be the biggest down move ever in the contract I follow (/HG) although I know spot copper has had days that were worse than today (but not many). This took it below the 200-DMA, opening up the potential for a test of $4. The daily MACD & RSI also turned negative.

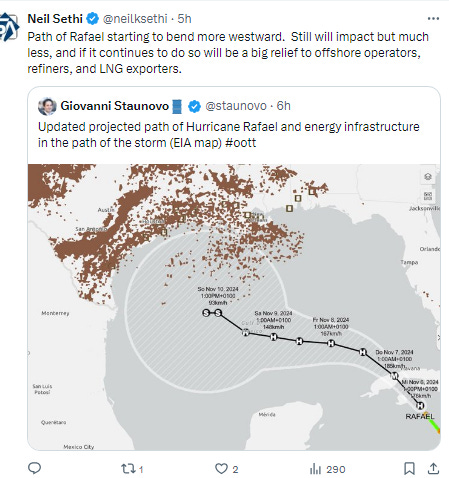

Nat gas (/NG) had one of the better days in the commodity sphere getting a bounce although not able to clear the highs of the week. As noted Tues it seems again to be having trouble with the area of the downtrend line from the Nov ‘23 highs. The MACD & RSI remain positive because of the jump in price on the roll.

Bitcoin futures a huge day up nearly 10% easily cruising to an ATH blowing through the $75k level. Daily MACD & RSI remain positive.

The Day Ahead

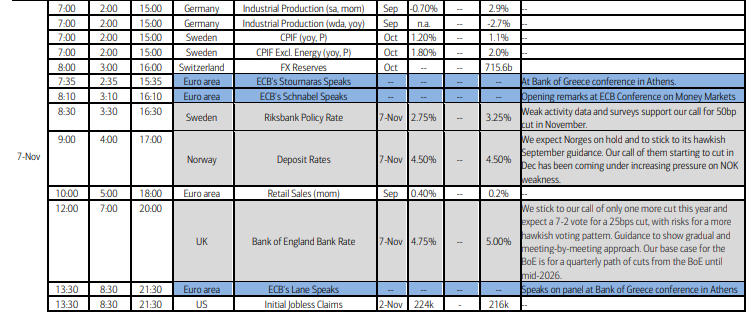

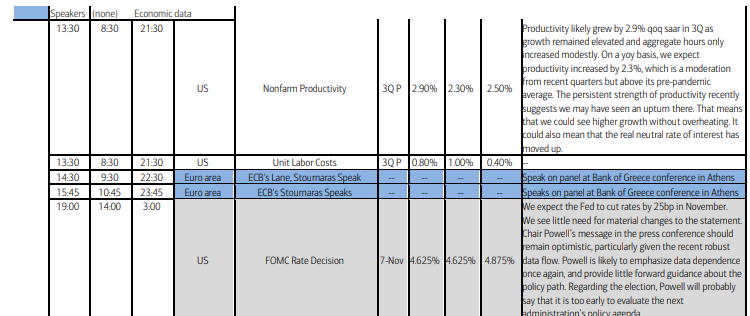

Economic data tomorrow will pick up with the important quarterly productivity report. Productivity is a “free lunch” in that it allows for greater economic output without greater expense (whether in labor or equipment). The Fed loves higher productivity, and it is not unlikely it will be brought up one way or another by Powell. We’ll also get Sept consumer credit and final wholesale inventories along with weekly jobless claims.

With the FOMC decision and press conference we’ll of course get an important Fed speaker in Powell. Most expect he’ll look to be very noncommittal given the uncertain state of the markets, post-election policies, etc.

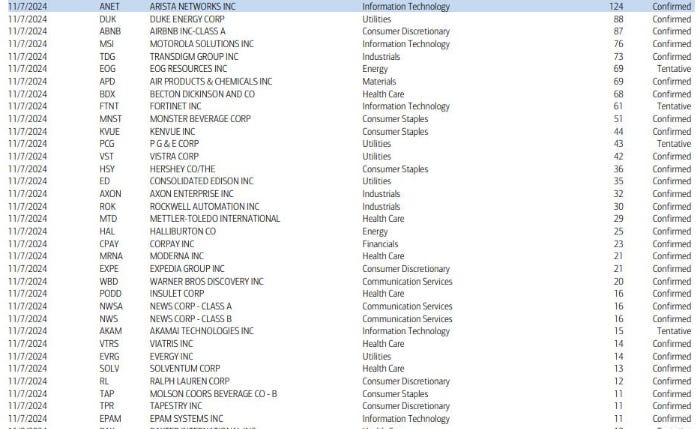

Earnings will remain heavy with 34 SPX components and one >$100bn in market cap: Arista Networks (ANET) (see the full earnings calendar from Seeking Alpha).

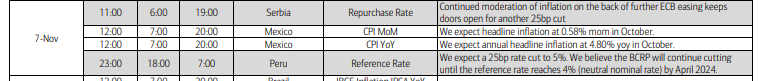

Ex-US the highlight will be a policy decision from the Bank of England. A cut is widely expected but given the huge spending package unveiled by Chancellor Reeves they’re likely to be cautious about the path forward. We’ll also get a policy decision from the Bank of Norway (a hold is expected). In data we’ll get Germany’s Sept industrial production and EU retail sales. In EM we’ll get policy decisions from Peru (25 bps cut exp’d) and Serbia along with Mexico CPI.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,