Markets Update - 11/07/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

Note: Friday’s update will likely be delayed to Saturday.

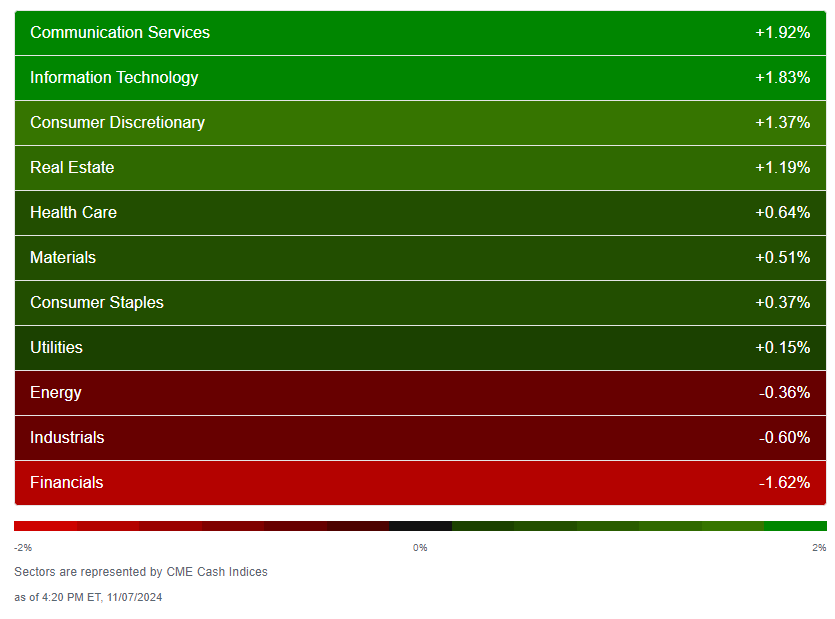

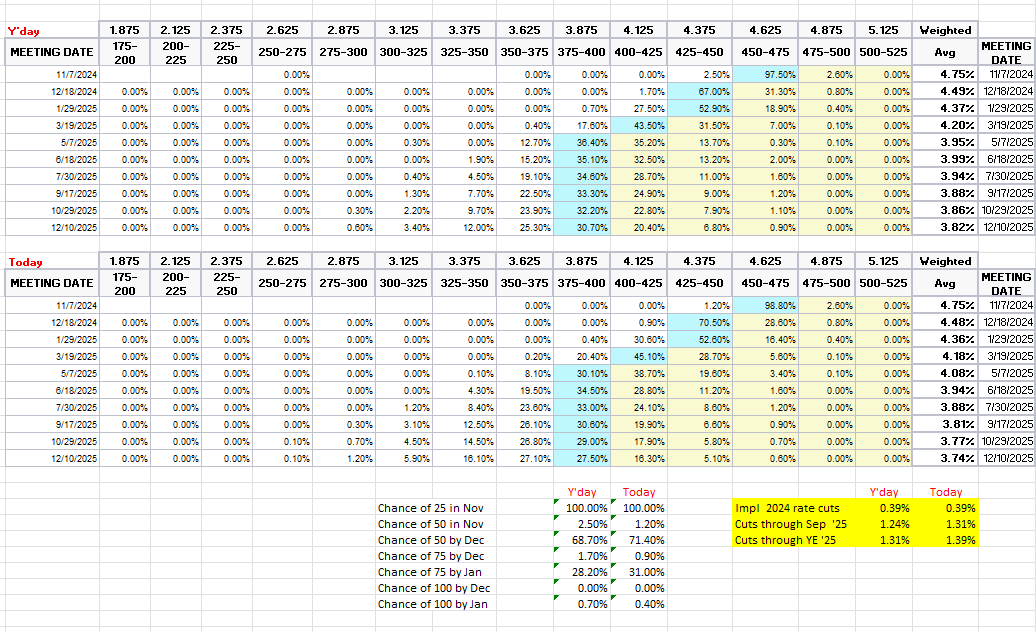

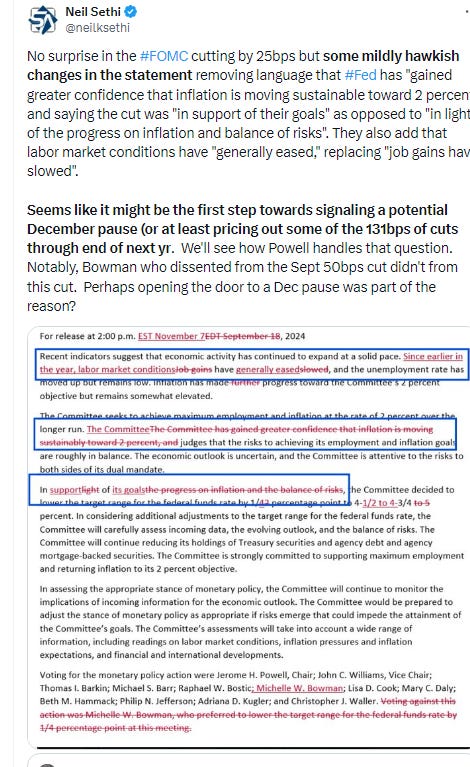

Large cap equities extended their post-election rally, with the S&P 500 approaching 6,000 and notching its 49th record this year while the Nasdaq Composite also hit an all-time high boosted by pullbacks in bond yields and the dollar as large cap growth shares led the way today. That didn’t help smaller caps though which lagged for the first time this week finishing slightly lower. The highlight of the day was the FOMC decision, which as expected cut rates by 25bps, but contained some signals that a continued succession of cuts was far from a sure thing given the economic resilience although markets currently see a December cut as more likely than not.

Gold and copper bounced back, crude saw a mild gain, while bitcoin and nat gas edged lower.

The market-cap weighted S&P 500 was +0.7%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite +1.5% (and the top 100 Nasdaq stocks (NDX) +1.5%), the SOX semiconductor index +2.3%, and the Russell 2000 -0.4%.

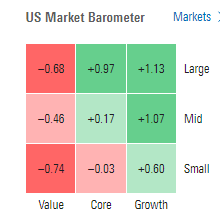

Morningstar style box a much more mixed showing today with all value styles down as was small cap core. Larger cap growth led.

Market commentary:

“What we saw yesterday was the playbook of the Trump trade in action but it’s soon going to evolve,” said Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux in Paris. “US yields can’t continue to go up with US equities on the rise, my conviction is that yields will calm down.”

“The results are in and the financial markets can breathe a little easier without concern over a prolonged election process,” said Scott Helfstein, head of investment strategy at Global X ETFs. “Investors should still be cautious about over- and underreaction to geopolitical news. These events can typically cause large swings in asset prices, but fundamentals will win out over time.”

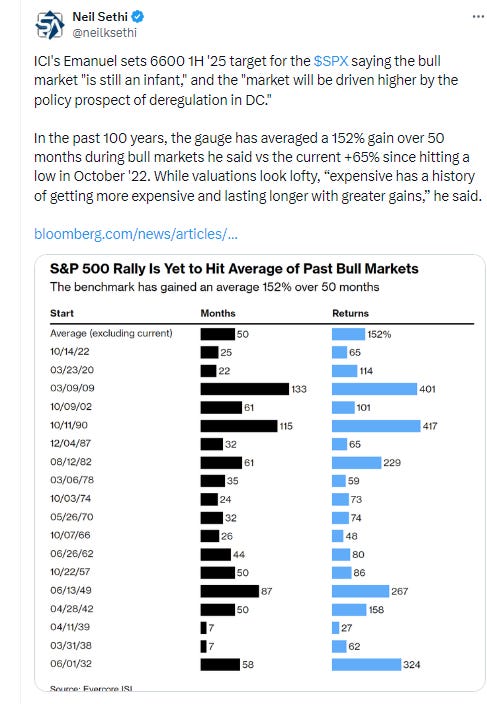

Evercore ISI strategists said the rally was nowhere near done. Trump’s plans to slice through red tape could propel the S&P 500 another 11% through the middle of next year, they said. History shows the bull market is “still an infant,” ISI strategist Julian Emanuel wrote in a note. “This market will be driven higher by the policy prospect of deregulation in DC,” he said, setting a price target for the index of 6,600 points by end-June 2025.

Until the extent and impact of Trump’s plans become clear, investors can expect volatile trading and a stock market that is moving generally higher, said Tony Roth, CIO at Wilmington Trust. “At some point, given the stretched multiples on equities and the higher income levels of bonds, we could very much have a very compressed equity risk premium and little opportunity left in the equity market. We’re not there yet. I think that we’ve got six months before we have to have a serious conversation about being there,” Roth said.

“Powell & Co. reminded investors about the solid economic footing the US continues to stand on,” said Bret Kenwell, US investment analyst at eToro. “Powell would not tip his hand on whether the Fed would likely cut rates in December, which shouldn’t surprise investors. However, the Fed appears more comfortable with the labor market and the current US economic backdrop than they did a few months ago.”

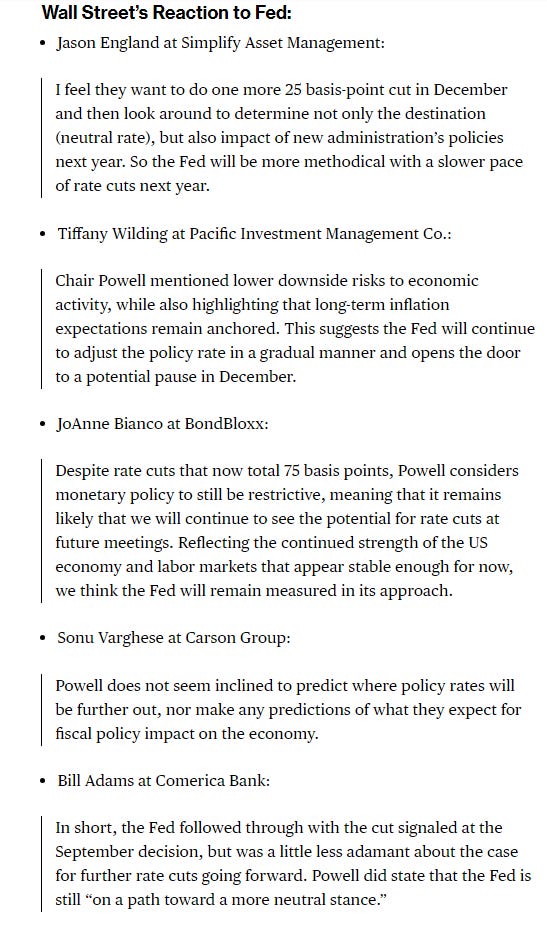

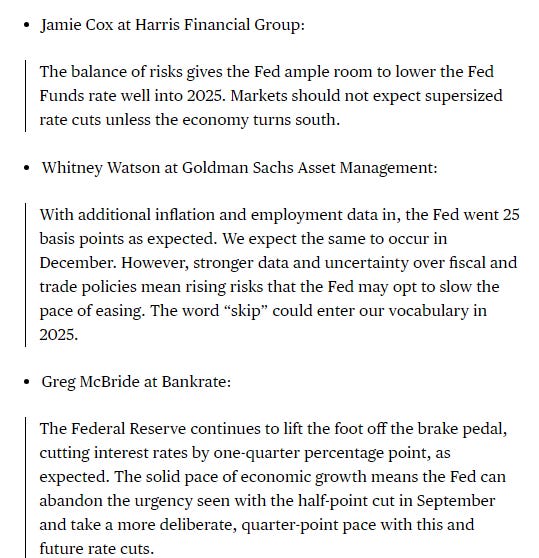

To Neil Dutta at Renaissance Macro Research, the latest Fed statement does not put a December skip in play. “We thought Powell’s comments were generally dovish, and he gave several indications that a December cut remains his base case,” said Aditya Bhave at Bank of America Corp. “Given that the policy mix will not change for a while, we remain comfortable with our call for another 25bp cut in December.”

Wednesday’s big rally for stocks could cause some investors and advisors to shuffle their portfolios in the coming weeks. The jump for stocks, along with the decline in bond prices, likely pushed portfolios away from their target allocations in certain types of client accounts, said Greg Halter, director of research at Carnegie Investment Counsel, a registered investment advisory firm. “When you have accounts, clients, that have a mandate to be 60% equities, or 70% or 80%, whatever the number is, and you had a big move like yesterday … that can take things out of whack. And so you do have to bring that back in line. Of course, you have to try to manage that around taxes, too,” Halter told CNBC.

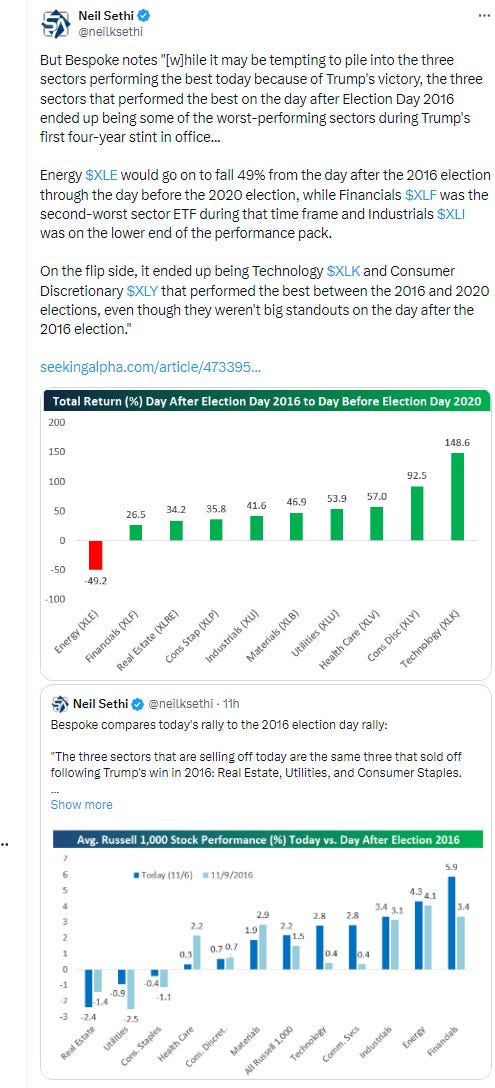

In individual stock action, big Tech stocks moved higher on Thursday to bolster the market, with Apple and Nvidia gaining 2.14% and 2.25%, respectively. Meta Platforms rose 3.42%. A Bloomberg gauge of the “Magnificent Seven” megacaps added 2.3%. Lyft Inc. jumped 23% after the ride-hailing company gave a bullish outlook. A closely watched gauge of banks dropped 2.7% after gaining over 10% in the previous session. JPMorgan Chase & Co. slid 4.3% after an analyst downgrade.

In action after the close:

In corporate news from BBG:

Lyft Inc. shares surged after the company issued strong earnings guidance for both this quarter and the full year, signaling that the ride-hailing service’s plan to attract more commuters is working.

Qualcomm Inc. gave a bullish sales forecast for the current period, pointing to bright spots in the mobile device industry.

Carlyle Group Inc. Chief Executive Harvey Schwartz made progress lifting margins and earnings on fees in the third quarter, a period when shareholder profits from deal exits remained muted for the firm.

Ralph Lauren Corp. raised its outlook for the year, citing strong sales in Europe and Asia and expectations for a solid holiday shopping season.

Moderna Inc. delivered better-than-expected profit and sales in the third quarter after an early start to sales of this season’s Covid boosters.

Expedia Group Inc. posted better-than-expected grossing bookings in the third quarter and said it was raising its full-year guidance, suggesting that demand has proven stronger than the company had previously thought heading into the holiday season.

Airbnb Inc. issued an upbeat forecast for the holiday period driven by “strong demand trends,” a relief to investors who feared that growth was tapering off.

Pinterest Inc. forecast weak sales for the holiday quarter, a sign the search and discovery network is struggling to keep pace with larger peers such as Meta Platforms Inc. and Snap Inc.

DraftKings Inc., one of the largest-sports betting companies, cuts its full-year estimate for 2024 revenue and profit, citing a tough start to the fourth quarter.

Rivian Automotive Inc. expects to achieve a positive gross profit in the final three months of the year, sticking with the forecast despite a supply-chain bottleneck that disrupted electric-vehicle output.

Under Armour Inc. reported results that surpassed analysts’ expectations as the sportswear company’s turnaround gains momentum under founder Kevin Plank.

Ralph Lauren Corp. raised its outlook for the year, citing strong sales in Europe and Asia and expectations for a solid holiday shopping season.

Hershey Co. cut its outlook for growth in net sales growth and earnings as consumer pullback drives down volume sales, while “historically high” cocoa costs have driven price hikes.

Warner Bros. Discovery Inc., the parent of the Max streaming service, gained more subscribers than expected in the third quarter, suggesting its online business is picking up.

Some tickers making moves at mid-day from CNBC.

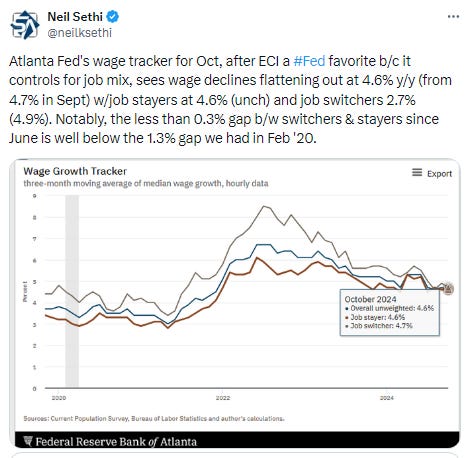

In US economic data today:

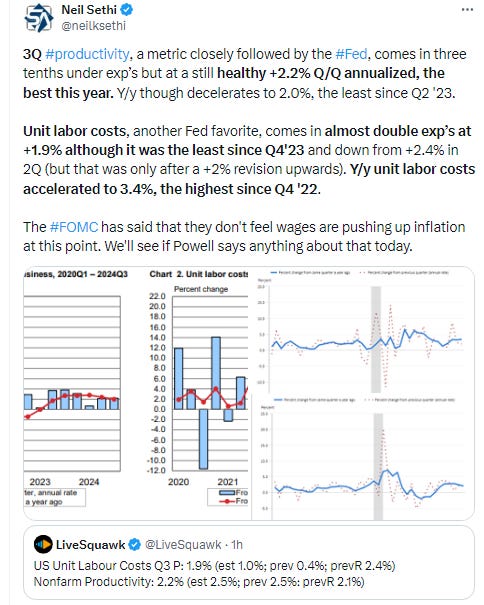

Q3 productivity remained solid at the best this year, although slightly below expectations and the y/y rate fell to the least since Q2 ‘23, while unit labor costs fell to the least this year but only after a big upward revision to Q2 which saw the y/y rate rise to the highest since Q4 ‘22.

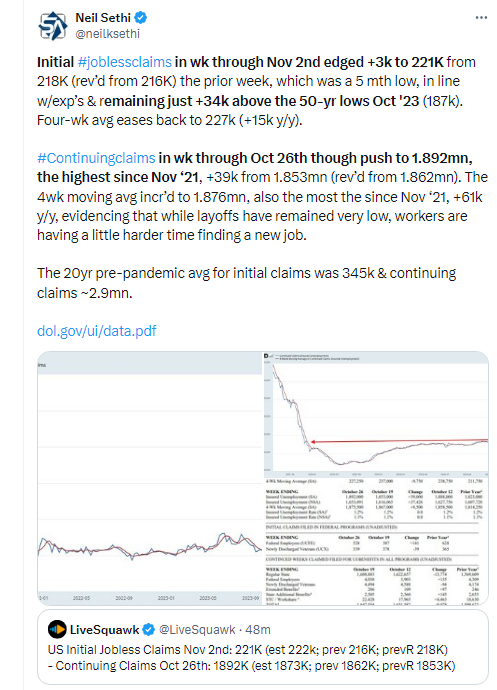

Initial jobless claims remained very low while continuing claims also remained low historically but edged to the highest since Nov ‘21.

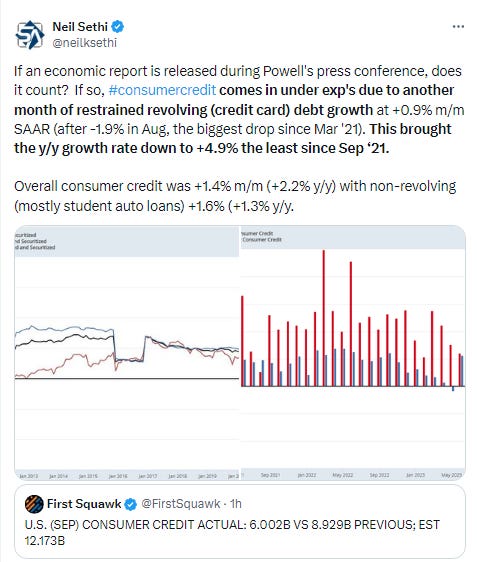

Consumer credit came in under expectations with another month of restrained revolving (credit card) debt growth (after the biggest drop since Mar '21 in Aug). This brought the y/y growth rate down to +4.9% the least since Sep ‘21. Overall consumer credit was +1.4% m/m (+2.2% y/y) with non-revolving (mostly student auto loans) +1.6% (+1.3% y/y).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX with another gap open moving to another ATH. Daily MACD and RSI (arrows) have turned more supportive.

The Nasdaq Composite also with another gap also moving to another ATH, and also seeing its daily MACD & RSI turn supportive.

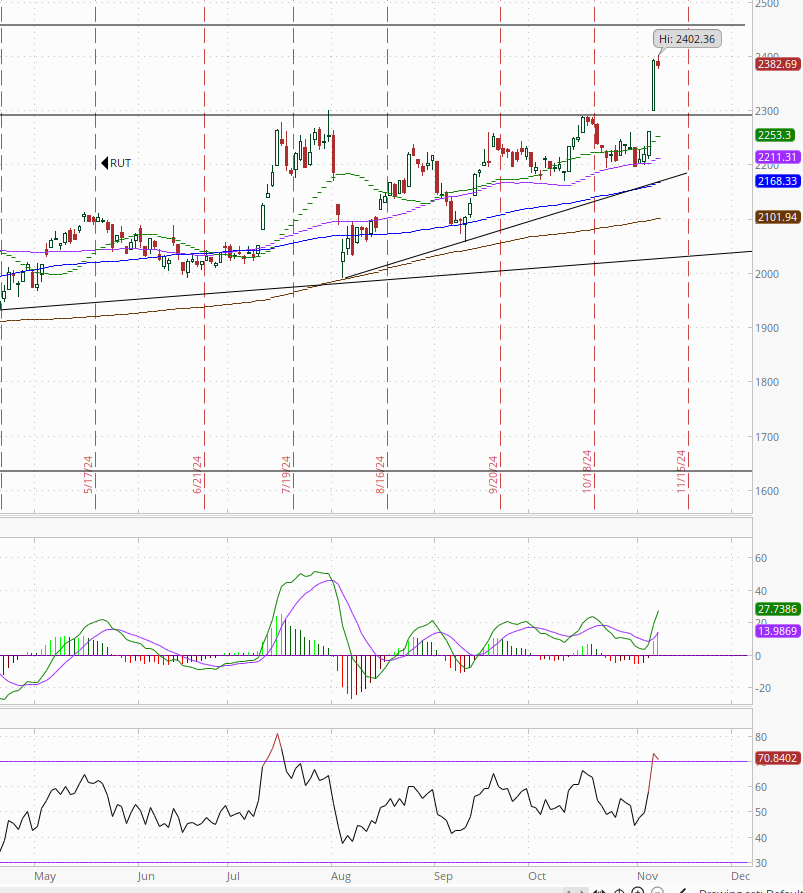

RUT (Russell 2000) tested but not able to clear the 2400 level, remaining near the highest since Nov ‘21 and just a couple percent from its ATH. Its daily MACD & RSI were already supportive after Wed’s rally.

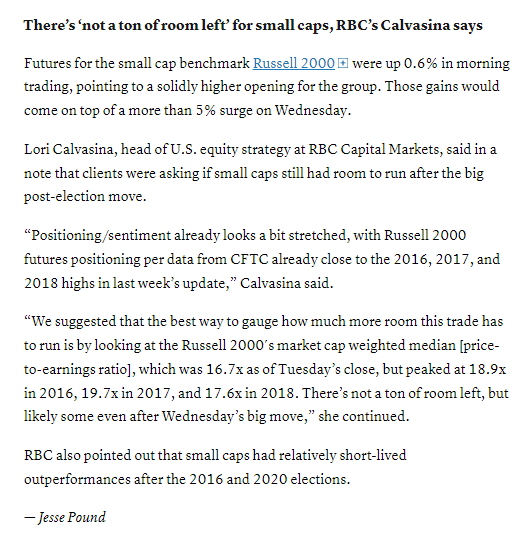

Equity sector breadth from CME Indices similar in the number of green sectors at 8 of 11 but whereas Wed it was yield sensitive sectors down, Thurs it was some giveback by financials, industrials, & energy following Wed’s rally. Only financials though were down more than -1% (vs 3 Wed). But while Wed there were 6 sectors up at least 1% (& four up >3%) today just four were up over 1% and none up over 2%.

Stock-by-stock SPX chart from Finviz shows a strong Mag 7 and tech overall but very mixed elsewhere.

Positive volume, which was fairly weak Wed all things considered, was again Thurs on the NYSE coming in at just 59% (due in part to the weaker day on the Russell 2000). The Nasdaq though improved to 73% up from 64% despite having half the point gain. Still those are down from 80 & 78% on Tues (which was the best combined since late August). Issues were 59 & 53%.

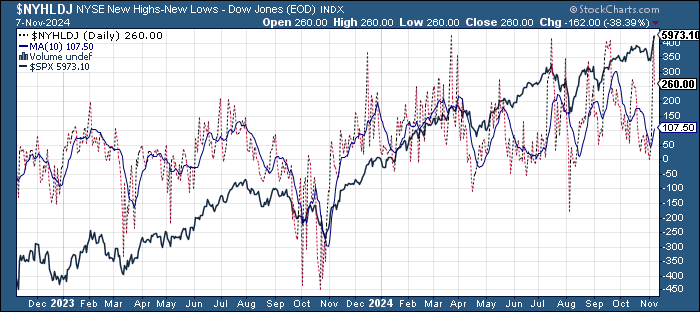

New highs-new lows though fell back on both from around the best since early 2021 at 259 & 309 respectively from 419 & 507. Still they remain well above the the 10-DMAs (more bullish), and so we continue to see the DMA’s turn up from the least since Aug & Sept respectively.

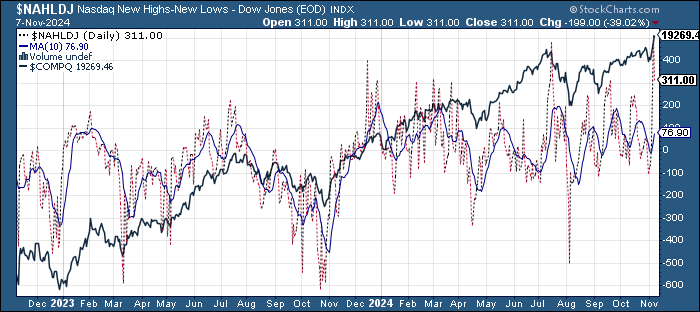

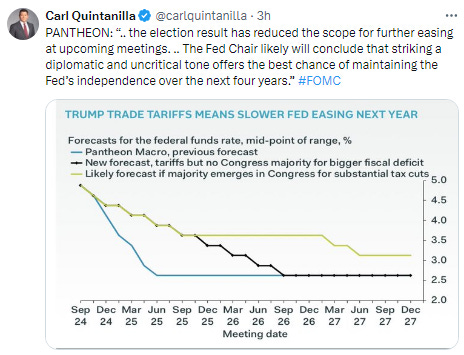

FOMC rate cut probabilities from CME’s Fedwatch tool see the chance of 25bps in Nov move to a certainty at 100% (with now a small 2.5% chance of a 50bps cut), but chances fell further out the curve w/ the chance of 50bps through the end of year to 69% from 78%, and the chance of 75bps after Jan’s meeting to just 28% from 43%.

Now just 39bps of cuts priced this yr (from 44), 124bps through Sep ‘25 (from 135) & 131bps through YE ‘25 (from 141).

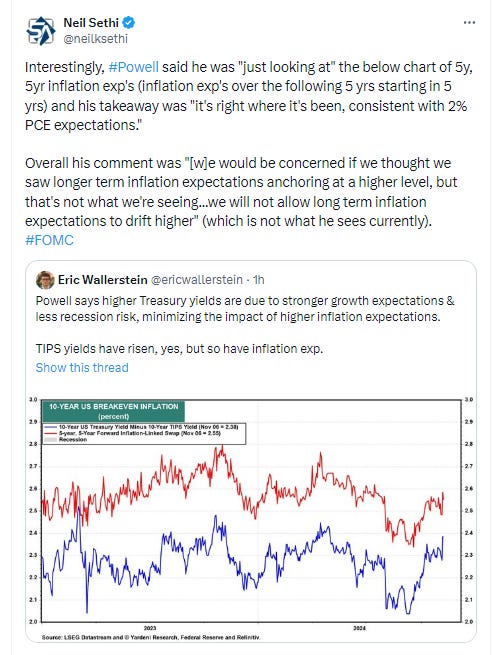

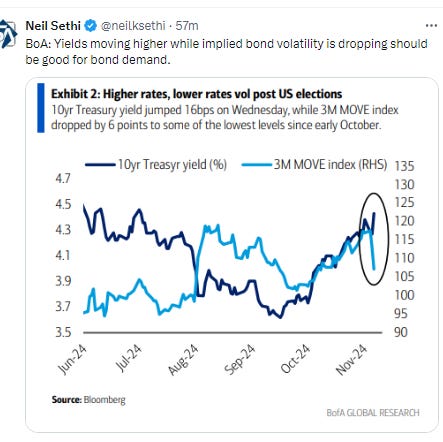

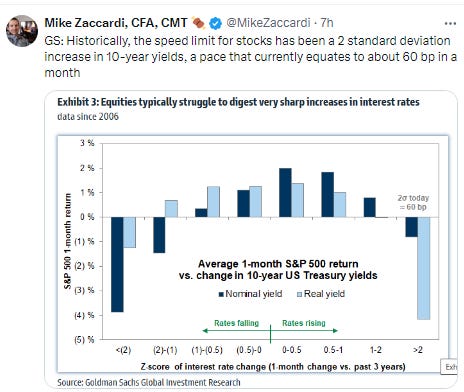

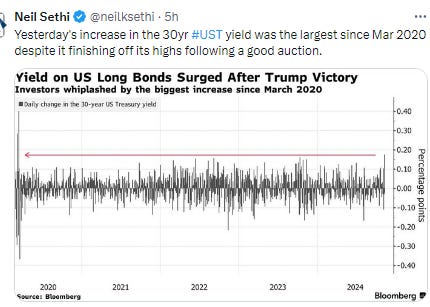

Treasury yields fell back today hitting the lows during Powell’s press conference before edging a little off by the close. The 10yr yield was -9 basis points to 4.34% from the highest close since July 2nd Wed, still +59bps since the start of October but falling back from the 4.5% level identified by many as a “line in the sand”, while the 2yr yield finished -3bps at 4.22% also from the highest close since July. It’s up +59bps since the start of October. For its part the 30yr bond yield was -6bps to 4.55% also from the highest since July 2nd.

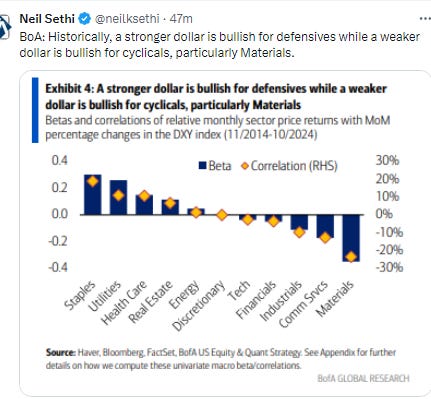

Dollar ($DXY) fell back giving up a big chunk of Wed’s gains although remaining above the 104 level. The daily MACD & RSI remain weakish but are quickly improving.

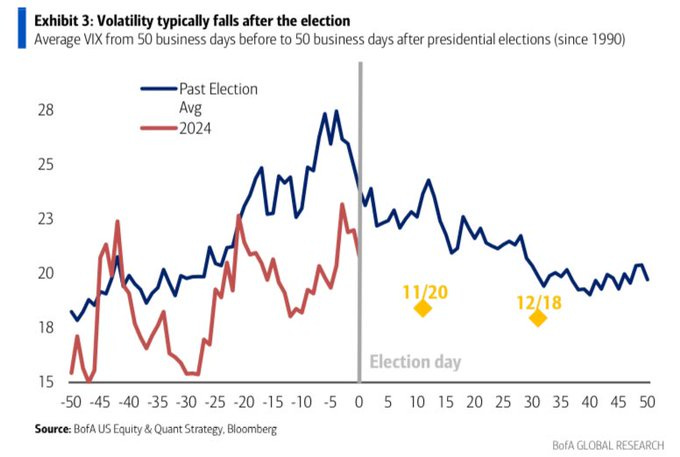

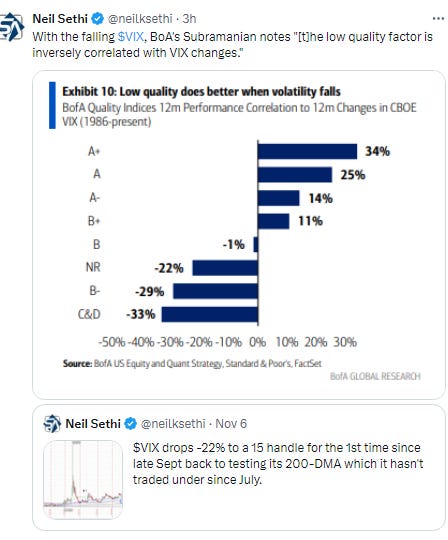

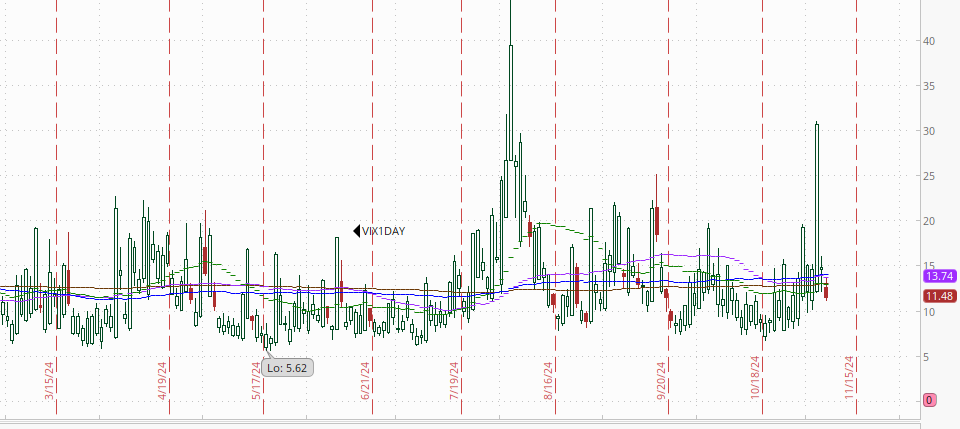

The VIX & VVIX (VIX of the VIX) both fell and closed under their respective 200-DMAs for the first time since mid-July. The former is now 15.2, also under 16 for the first time since then (and therefore consistent w/sub-1% daily moves over the next 30 days for the first time since then) & the latter to 89 (consistent w/“moderate” daily moves in the VIX over the next 30 days but off the “high to extreme” levels seen earlier).

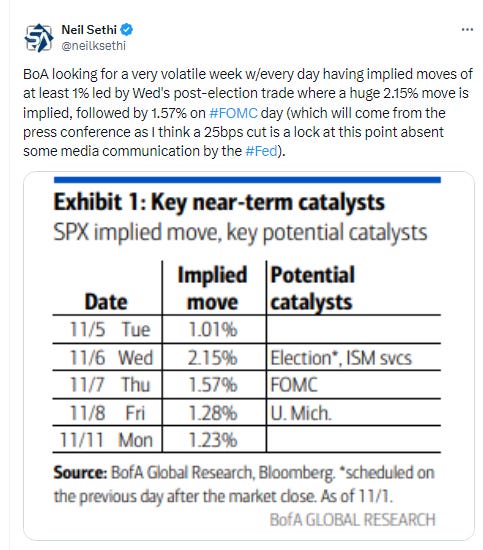

1-Day VIX fell back as well to 11.5, the least since Oct 28th, still though not to the sub-10 levels characteristic of placid markets, looking for a move of ~0.7% Friday. This is again less than the 1.28% BoA had seen implied for Friday from options markets coming into the week.

WTI again fought back from lower levels Thurs finishing a little higher above the $72 level. Daily MACD & RSI remain in supportive positioning.

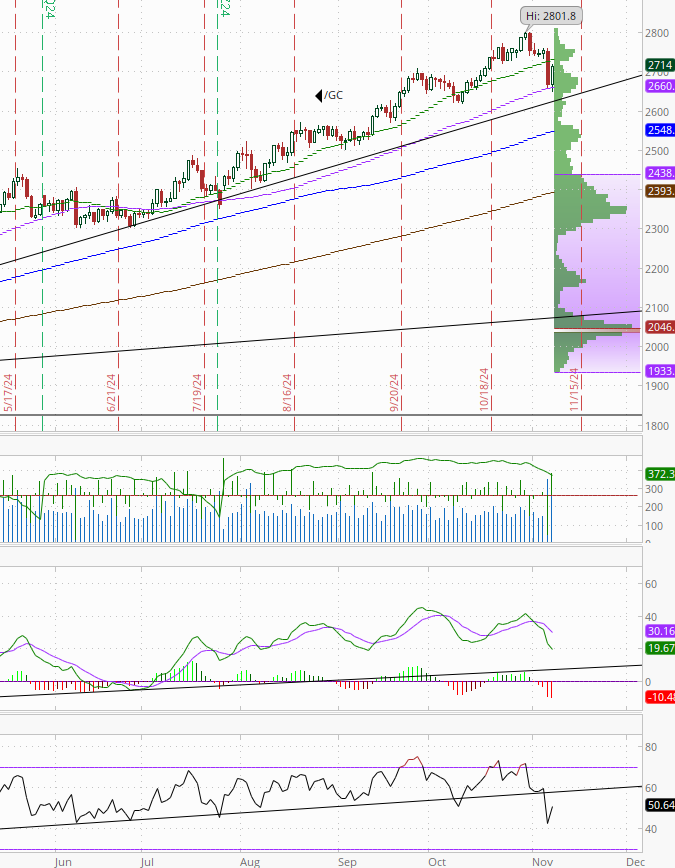

Gold got a nice bounce (best day since mid-Sept) from its 50-DMA after its worst day since March 2022. The daily MACD remains in “sell longs” positioning though and the RSI is just off the weakest since Feb.

Copper (/HG) had an even bigger day than gold jumping +4.5%, it’s best day since Nov ‘22, and getting back most of Wed’s -5.3% drop, one of the biggest drops on record. The bounce took it from below a cluster of moving averages and the uptrend from the Aug lows to back above all of them. The daily MACD & RSI also flipped back to a more neutral positioning.

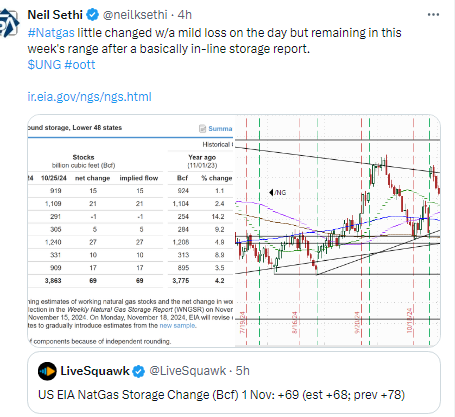

Nat gas (/NG) had a third “inside day” following its big reversal day Monday, down a little but remaining in the range of this week. As noted Tues it seems again to be having trouble with the area of the downtrend line from the Nov ‘23 highs but also hasn’t broken down. The MACD & RSI remain positive because of the jump in price on the roll last week.

Bitcoin futures ended slightly lower after setting a new ATH intraday remaining above the $75k level. Daily MACD & RSI remain positive.

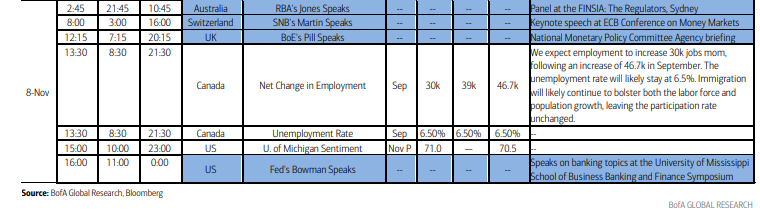

The Day Ahead

Economic data tomorrow limited to the U of Michigan’s preliminary Nov consumer sentiment survey. Unfortunately I don’t think it will contain the results of the election.

We do get one Fed speaker in Gov Bowman who will be speaking on banking topics at 11 am ET. Would be interesting to get her take after she dissented in Sept but not in Nov.

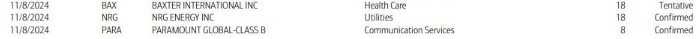

Earnings will be light with just 3 SPX components and none>$100bn in market cap (see the full earnings calendar from Seeking Alpha).

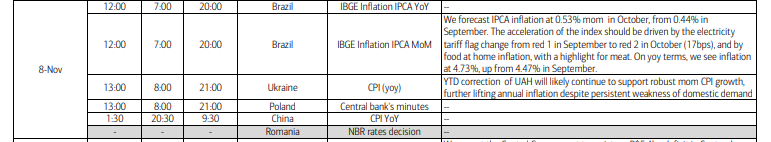

Ex-US the highlight will be Canada’s employment report. We’ll also hear from the BoE’s chief economist Pill who will likely have some comments on the new UK budget. In EM we’ll get Brazil inflation & a policy decision from Romania.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,