Markets Update - 11/08/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

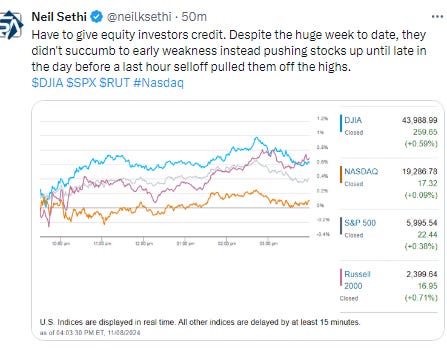

Equities capped a huge week with modest gains as they digested a whirlwind two weeks of economic data and market moving events, led for the day and week by small caps, with the Russell 2000 seeing its best week since April 2020. Large caps though did just fine this week with the S&P 500 finishing the week up +4.7%, the best in a year. Nasdaq for its part was up +5.7% for the week.

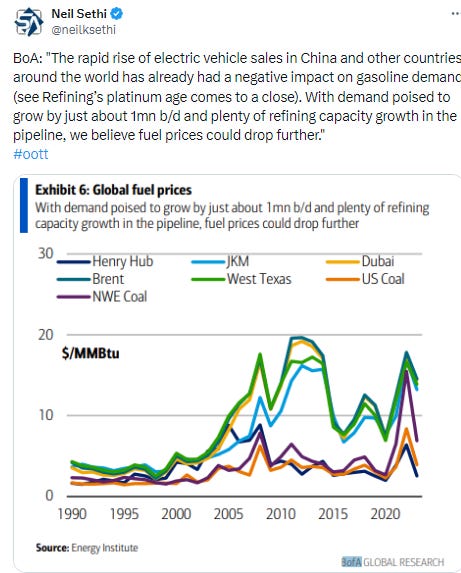

Bond yields fell back (to finish down for the week for the 1st time in 8 wks) but the dollar still was able to gain to finish higher Friday and for the week for a 6th straight week. Gold and copper both fell back Friday with the former capping its worst week since May and the latter a 6th straight down week. Crude and nat gas also fell back Friday but both managed a slightly up week, while bitcoin was higher capping its best week since February.

The market-cap weighted S&P 500 was +0.4%, the equal weighted S&P 500 index (SPXEW) +0.5%, Nasdaq Composite +0.1% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index -0.8%, and the Russell 2000 +0.7%.

Note the stock market is open but the bond market is closed for Veteran’s Day.

For the week, Wednesday was definitely the big story but the indices saw decent gains most other days as well (which days varied from index to index).

Morningstar style box showed a strong tilt to small cap growth but every style advanced.

Market commentary:

“[T]he path of Fed cuts is cloudier today than it was a week ago before the election,” said Scott Helfstein, head of investment strategy at Global X ETFs.

Investors generally view a Republican-controlled government as more favorable on expectations for deregulation, the potential for more mergers and acquisitions and proposed tax cuts. However, concerns over the large federal deficit and increased tariffs have also sparked concerns of an uptick in inflation. “The market is signaling that a Trump administration would be good for growth and risk assets, but the combination of faster growth with new tariffs would be inflationary,” he added. “While the Fed feels the risks are balanced between stable prices and maximum employment, this could shift quickly increasing the risk to reaccelerating inflation.”

“To me, there is little alternative to the US,” said Marija Veitmane, a senior multi-asset strategist at State Street Global Markets. “The US is already the best performing equity market globally and we expect that outperformance to continue. US companies are the most profitable and likely to remain so, helped by the potential for lower taxes and less stringent regulation.”

“Equities are eager to price in Trump’s domestic growth policies (via small-caps) and hopes for easier regulation relative to the Biden administration,” Barclays strategist Venu Krishna said in a note to clients. “Whether these moves are sustainable remains to be seen; momentum is extending lofty gains as ‘winners keep winning’, and the sharp post-Election Day moves have pushed major gauges near (or into, in the case of [Russell 2000]) technically overbought territory,” Krishna added.

“When everything seems like it’s all working well, it’s like, ‘what’s going to hit us?’” Keith Lerner, co-CIO at Truist Wealth, said on CNBC’s “Closing Bell” Friday. “There’s probably something from left field. Sentiment’s getting a little bit stretched, maybe some choppiness after this round number. But all in all, we still think you want to stick with that primary uptrend,” he continued.

The S&P 500 briefly topped the 6,000 mark, which “is a psychologically significant milestone, and could invite even more investor interest in stocks, since there is still plenty of money sitting on the sidelines in money market funds and in bonds,” said Clark Geranen, CalBay Investments. While the post-election rally likely has more upside ahead, Geranen said he would not be surprised to see stocks take a breather before rallying again into year-end.

After an initial stampede into “Trump Trades,” investors in some asset classes are tapering their enthusiasm as they question whether he will push through his ambitious tariff proposals as US president. “Even with red majorities across Congress, it’s likely that these policy actions will take time,” said James Athey, fund manager at Marlborough Investment Management. “That might make significant further gains in the short term a little harder to come by.”

In individual stock action, megacap growth was generally weak. Nvidia (NVDA 147.63, -1.25, -0.8%) which started trading as a Dow Jones Industrial Average component today, was one as were the other $3 trillion companies in terms of market cap -- Apple (AAPL 226.96, -0.27, -0.1%) and Microsoft (MSFT 422.54, -2.89, -0.7%). In contrast Tesla (TSLA 231.22, +24.31, +8.2%) did not struggle under selling pressure with shares finishing the week nearly 30% higher, their best week since January 2023, when shares popped more than 33%.

Law enforcement tech stock Axon Enterprises jumped more than 28% after the company raised its full-year revenue guidance. Trump Media advanced 15% after the president-elect said he had no plans to sell his shares in the social media company. Coinbase extended its rally on Friday as most of the crypto sector took a pause following its postelection rocket rally. Shares of the crypto exchange operator were higher by 5% in afternoon trading and on pace for a weekly gain of about 47%, which would make it its best week since January 2023.

In corporate news from BBG:

Tesla Inc. is now offering the option to lease its polarizing Cybertruck, with prices starting at $999 a month.

Paramount Global, the parent of CBS, MTV and its namesake Hollywood movie studio, reported third-quarter sales that missed analysts’ estimates, overshadowing big gains in streaming subscribers.

Expedia Group Inc. posted better-than-expected gross bookings in the third quarter and said it was raising its full-year guidance, suggesting that demand has proven stronger than the company had previously thought heading into the holiday season.

Airbnb Inc. issued an upbeat forecast for the holiday period driven by “strong demand trends,” a relief to investors who feared that growth was tapering off.

Pinterest Inc. forecast weak sales for the holiday quarter, a sign the search and discovery network is struggling to keep pace with larger peers such as Meta Platforms Inc. and Snap Inc.

Block Inc., a digital payments company, posted third-quarter revenue that was below analysts’ forecasts.

DraftKings Inc., one of the largest-sports betting companies, cuts its full-year estimate for 2024 revenue and profit, citing a tough start to the fourth quarter.

Rivian Automotive Inc. said it’s on track to achieve a positive gross profit in the final three months of the year, counting on a surge of regulatory credit sales after production disruptions added to losses.

Sweetgreen Inc. shares tumbled after higher labor and protein costs resulted in a wider-than-expected loss for the third quarter.

Some tickers making moves at mid-day from CNBC.

In US economic data today consumer sentiment as measured by the U of Michigan moved to a 6 mth high above expectations fueled by a big jump in future expectations (to the highest since 2021). Note, though, that the results did not include the period after the election.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX capped off its best week in a year with a more modest gain, finishing just under the 6,000 level. Daily MACD and RSI remain supportive.

The Nasdaq Composite finished slightly lower but after a huge week which also turned its daily MACD & RSI supportive.

RUT (Russell 2000) again tested but not able to clear the 2400 level, closing pennies under, but the highest close Nov ‘21 and remaining just a couple percent from its ATH. Its daily MACD & RSI also supportive.

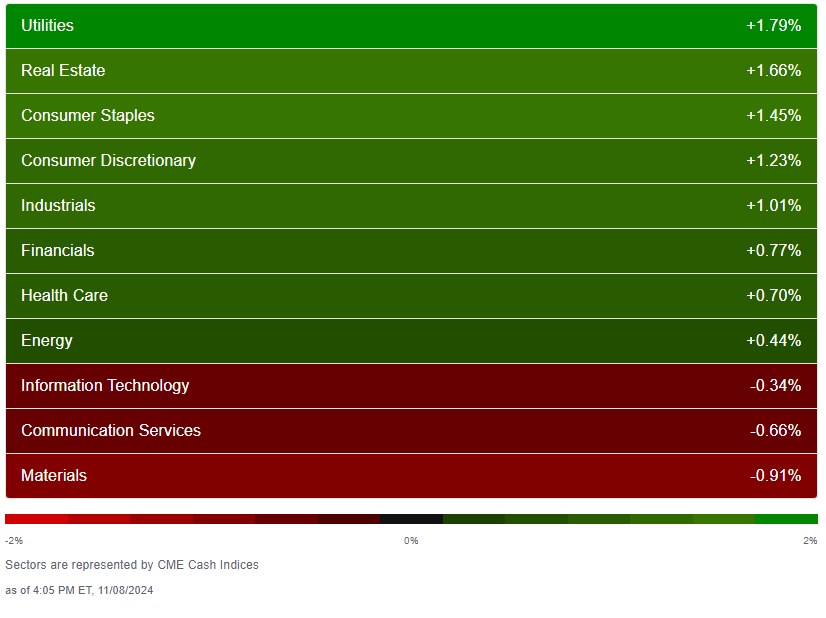

Equity sector breadth from CME Indices remained at 8 green sectors for a 3rd day, but while Wed it was yield sensitive sectors down and Thurs it was some giveback by financials, industrials, & energy, Friday it was tech, communications, and materials that were down (so no sector finished down more than once the past 3 days). Also no sector down more than -1% Friday (vs 1 Thurs & 3 Wed), but 5 were up at least 1% (vs 4 Thurs & 6 Wed) led by the high yielders that got hammered on Wed.

Stock-by-stock SPX chart from Finviz shows a strong Mag 7 and tech overall but very mixed elsewhere.

Positive volume remained an issue Friday, weak for a third day, again particularly on the NYSE at just 48% (so under 50 despite gains in both the Russell 2000 and SPX). The Nasdaq was just a smidge better at 54%, but both show a lack of broad buying interest as compared with 80 & 78% on Tues (which was the best combined since late August). Issues were 61 and 53%.

New highs-new lows were little changed at 260 & 291 respectively which would be considered pretty good if not for hitting 419 & 507 on Wed around the best since early 2021. Still they remain well above the 10-DMAs (more bullish), and so we continue to see the DMA’s turn up from the least since Aug & Sept respectively.

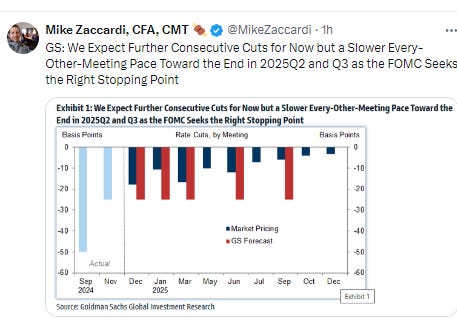

FOMC rate cut probabilities from CME’s Fedwatch tool dropped further on Friday with the chance of 25bps in Dec down to 65% (so just 16bps priced in). Its was pushing 80% a couple of days ago. Chances for 50bps through the Jan meeting just 24% from 43%. Now just 39bps of cuts priced this yr (from 23), just 89 bps through YE ‘25 (from near 100).

Treasury yields fell back today hitting the lows during Powell’s press conference before edging a little off by the close. The 10yr yield was -9 basis points to 4.34% from the highest close since July 2nd Wed, still +59bps since the start of October but falling back from the 4.5% level identified by many as a “line in the sand”, while the 2yr yield finished -3bps at 4.22% also from the highest close since July. It’s up +59bps since the start of October. For its part the 30yr bond yield was -6bps to 4.55% also from the highest since July 2nd.

Dollar ($DXY) remained volatile having a second “inside day” trading within the previous day’s range, this time moving to the upside. The daily MACD & RSI have improved to neutral.

The VIX & VVIX (VIX of the VIX) both continued lower after closing under their respective 200-DMAs for the first time since mid-July. The former is now 14.9 (consistent w/sub-1% daily moves over the next 30 days) & the latter to 87 (consistent w/“moderate” daily moves in the VIX over the next 30 days).

1-Day VIX continued to drop, back below 10 at 9.4, the least since Oct 22nd, and back to levels more characteristic of placid markets, looking for a move of ~0.6% Monday, less than half the 1.23% BoA said was implied from options markets coming into last week.

WTI not able to bounce from early losses Friday to give up the hard-fought gains for the week. The good news is it seems to have established itself in the middle of the range of the past 2 months (from testing the bottom). Daily MACD & RSI are mildly supportive.

Gold fell back from the resistance of its 20-DMA to end its worst week since May. The daily MACD remains in “sell longs” positioning though and the RSI is just off the weakest since Feb.

Copper (/HG) also fell back after it’s best day since Nov ‘22 to finish lower for a 6th straight week, although it did at least remain above the 200-DMA (brown line). The daily MACD & RSI also flipped back to a more neutral positioning.

Nat gas (/NG) had a fourth day trading inside the candle from Monday following its big reversal, down a little for a second day but finishing the week with a slim gain. As noted Tues it seems again to be having trouble with the area of the downtrend line from the Nov ‘23 highs but also hasn’t broken down. The MACD & RSI remain positive for now because of the jump in price on the roll last week.

Bitcoin futures edged to another ATH Friday closing out their best week since February. A little extended above moving averages so some consolidation would make sense, but unlike February its RSI isn’t even above 70 yet, so definitely could (does?) have further to go. Daily MACD & RSI remain positive.

The Day Ahead

Enjoy the weekend. It’s been a tumultuous two weeks. More on Sunday.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,