Markets Update - 11/12/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

Equities gave back Monday’s gains as many (but not all) of the “Trump trades” saw some consolidation as some profits were booked, leading to outsized weakness in small caps (which had led the post-election rally) exacerbated by bond yields once again pushing higher as did the dollar ahead of an important CPI print tomorrow morning.

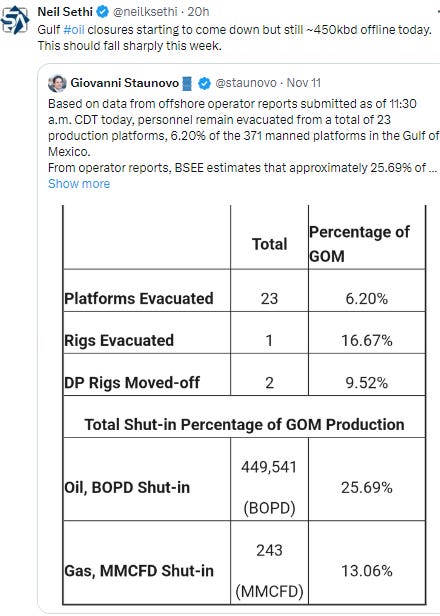

Gold and copper both fell back again on the stronger dollar, both breaking important support levels. Nat gas, crude, and bitcoin were all little changed though.

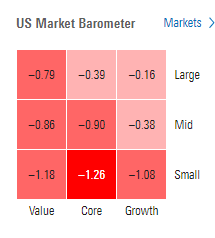

The market-cap weighted S&P 500 was -0.3%, the equal weighted S&P 500 index (SPXEW) -0.8%, Nasdaq Composite -0.1% (and the top 100 Nasdaq stocks (NDX) -0.2%), the SOX semiconductor index -1.0%, and the Russell 2000 -1.8%.

Morningstar style box showed every style in the red. Growth outperformed.

Market commentary:

Stocks may have already gotten ahead of themselves even before Trump earned a second term in the White House last week, according to Siebert chief investment officer Mark Malek. Now that the market has removed the overhang of the election, some of the core economic headwinds that have lingered are coming back to the forefront, he added. “What’s driving today’s trade is maybe a little bit of exhaustion,” Malek told CNBC. “We’re all concerned about [debt and deficits]. The deficit is always a problem when it’s a problem, but right now the market views it as a problem. It may be a reason to take your foot off of the gas when the market already has a bit of indigestion.”

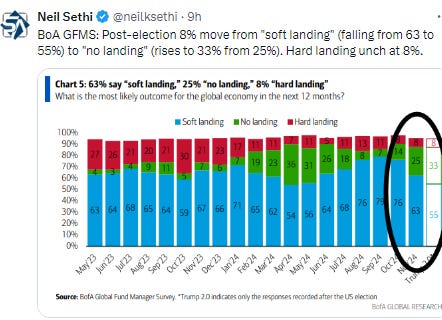

The post-election advance in US stocks could stall as investors start to take profits, according to strategists at Citigroup Inc. led by Chris Montagu. Investor exposure to American shares jumped to the highest since 2013 after the presidential vote amid optimism around stronger economic growth, according to a survey from Bank of America Corp.

“We are on watch for potential profit taking, consolidation, or even correction for US equities heading into the first quarter of the new year,” said Dan Wantrobski at Janney Montgomery Scott. “Upward momentum remains strong and investor sentiment favorable, but stocks are once again overbought/extended across multiple timeframes.”

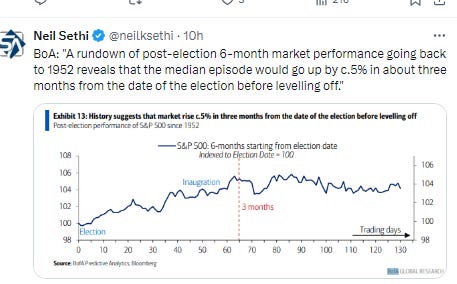

“The market is looking at the presidential election and whatever policies they think are going to be put in place,” said Larry Tentarelli, founder of the Blue Chip Daily Trend Report. “It’s a lot of what we saw back in 2016 when Trump won the election the first time.”

Scott Kleinman at Apollo Global Management Inc. has warned markets not to get too comfortable with the current trajectory of inflation and interest rates.

“Inflation is not tamed,” Kleinman said in a Bloomberg Television interview on Tuesday. “The Fed can say what it wants. You just have to open your eyes and look around.”

To Will Compernolle at FHN Financial, a hot consumer price index and/or strong retail spending could push yields higher if a December rate cut “starts looking imprudent.”

BG: A survey conducted by 22V Research shows 55% of investors expect the market reaction to CPI to be “mixed/negligible”, 31% said “risk-off” and only 14%, “risk-on.” 48% of investors surveyed believe that core CPI is on a Fed-friendly glide path without a significant tightening of financial conditions or a recession. However, 44% believe that financial conditions need to tighten. This is the highest value since April.

“At this point, the market is pricing in that we’ll most likely see an extension of the corporate business tax, and that it won’t expire next year,” said Dave Sekera, chief U.S. market strategist at Morningstar. “But I think there’s also some expectations now that we may see further tax cuts as well, which could boost earnings growth going forward.”

Traders are pondering the potential for Trump’s economic policies, including trade tariffs and immigration crackdowns, to spur inflation and affect the path for Federal Reserve monetary policy. “If we have those tariffs kicking in, if we have those so-called deportations, those would have an outright inflationary impact, and so would result in higher bond yields,” said Kevin Thozet, a member of the investment committee at Carmignac. “Higher bond yields across the curve may start to bite at some point,” especially at a time of lofty stock-market valuations, he said. “Up until Trump’s inauguration in January, we will be in a period where there will be some form of uncertainty regarding the implementation of his policy measures,” Thozet said.

The postelection excitement for investors may be setting up the market for a short-term pullback, according to Citi. The investment firm’s quantitative research team said in a note to clients that the current positioning in the stock market is “extended” and that “unwind risks are building for both the S&P 500 and Russell 2000.” “S&P positioning is currently at the highest level witnessed in the past 3 years, with positioning levels also extended across Nasdaq and Russell 2000. Profits are elevated for both S&P and Russell and this could lead to near-term profit-taking which may limit further upside,” the note said.

In individual stock action, key components of the so-called Trump trade were among the most notable losers Tuesday. Small-cap stocks, which are viewed as a potential beneficiary of a second Trump presidency, were broadly under pressure, with the Russell 2000 dipping -1.5%. Shares of Tesla, which have advanced 31% since Election Day, sank roughly -5%, while Trump Media & Technology Group fell -7%. The stock is down -9% since Trump’s victory. Shares of Dow-component Amgen tumbled more than -6% after Cantor Fitzgerald analyst Olivia Brayer published a research note that said data from the company’s phase 1 trial of MariTide suggests the experimental obesity drug may result in bone mineral density loss. Home Depot (HD 403.08, -5.21, -1.3%) shares fell despite upgrading sales expectations.

In after hours movers:

In corporate news from BBG:

Qualcomm Inc. Chief Executive Officer Cristiano Amon said the artificial intelligence boom won’t lead to a global chip shortage similar to what happened during the pandemic, even with demand for AI-enabled smartphones rising.

Apple Inc. was notified by the European Union that its geo-blocking practices are potentially in breach of consumer protection rules, adding to the iPhone maker’s regulatory issues in the bloc.

Meta Platforms Inc. rebuffed the Federal Trade Commission’s plans to modify a 2020 privacy settlement with the company, arguing that such a move would need approval from a federal court.

Dish Network Corp. creditors rejected the US satellite-television provider’s bond-exchange offer, as the deadline arrives for a debt deal that is key to the company’s proposed acquisition by rival DirecTV.

The US Justice Department sued Tuesday to block UnitedHealth Group Inc.’s $3.3 billion purchase of Amedisys Inc. over concerns the deal would harm competition in the market for home-health and hospice services.

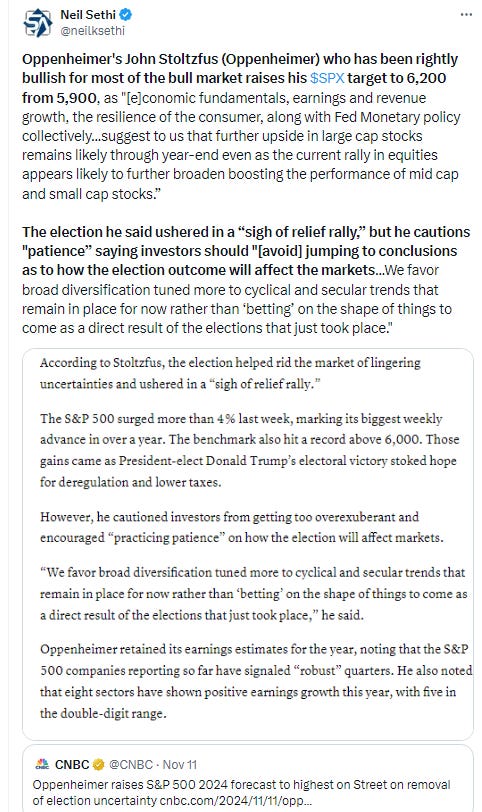

Home Depot Inc. lifted its forecast for a key sales metric after adverse weather propped up demand for home-improvement materials in the latest quarter.

Elliott Investment Management has built a $5 billion-plus position in Honeywell International Inc. and is pushing the industrials giant to pursue a break up.

Tyson Foods Inc. beat fiscal fourth-quarter earnings estimates and projecting stronger results next year, with a turnaround in its chicken business offsetting losses in beef.

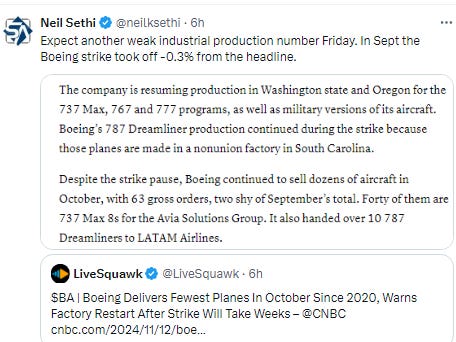

Boeing Co. delivered 14 jetliners in October, its lowest monthly total since November 2020, as a strike by the company’s largest union hamstrung its operations.

Some tickers making moves at mid-day from CNBC.

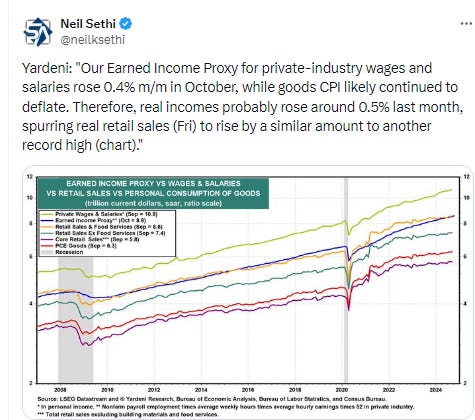

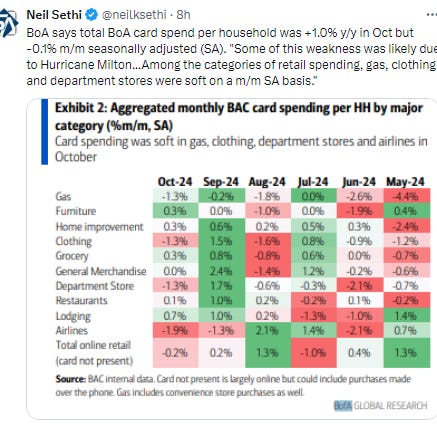

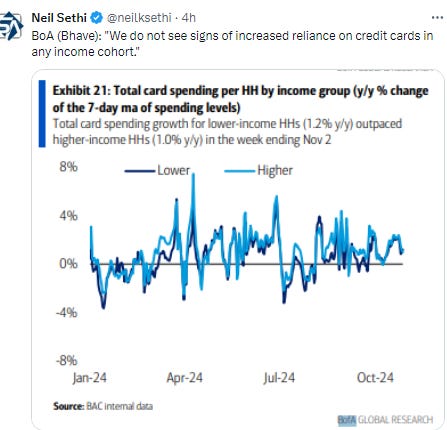

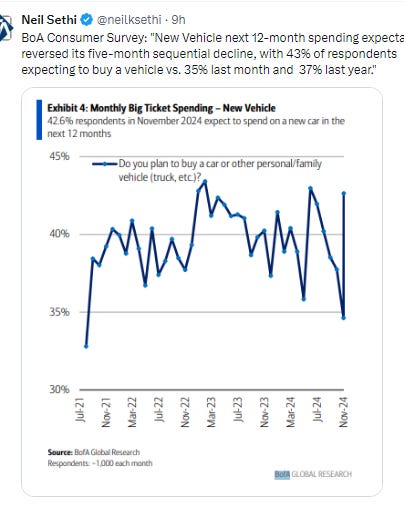

In US economic data:

The sentiment index from the National Federation of Independent Business (with a heavily Republican membership) gained 2.2 points to 93.7, matching the highest reading since early 2022 even as the group’s uncertainty index climbed to a fresh record, which will likely subside now that the election is over. Nine of the 10 components that make up the sentiment gauge increased in October, led by a 7-point improvement in the outlook for business conditions. That metric is now close to turning positive for the first time since Donald Trump was last in office.

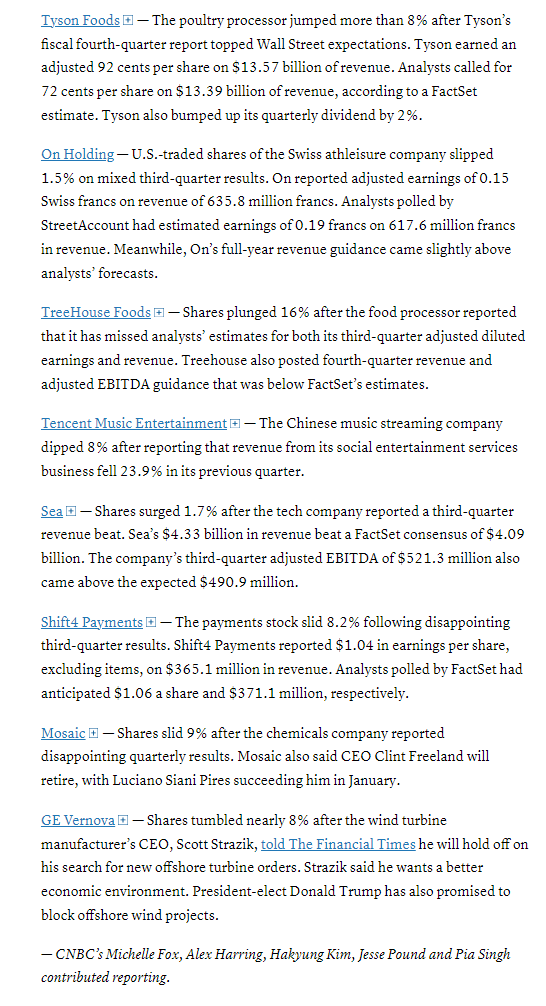

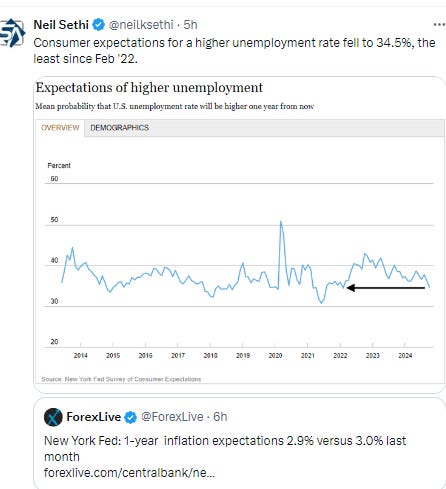

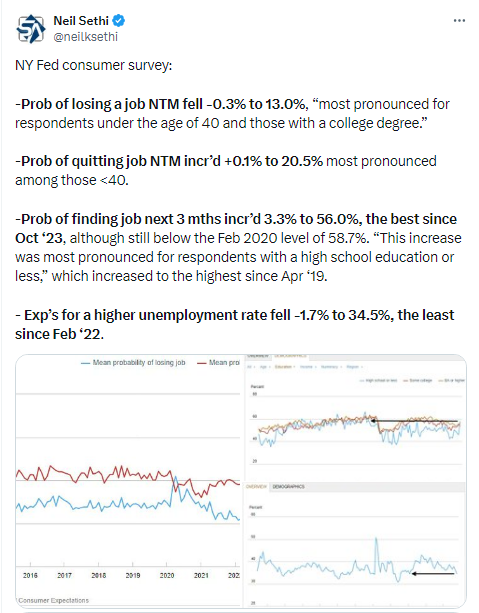

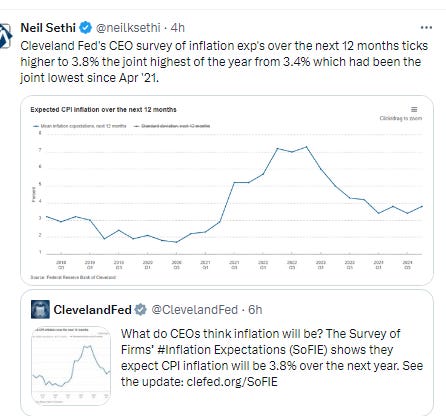

The NY Fed released their consumer survey (one I like because it has a consistent membership) which showed inflation expectations falling, labor market metrics improving, and most other indicators remaining stable.

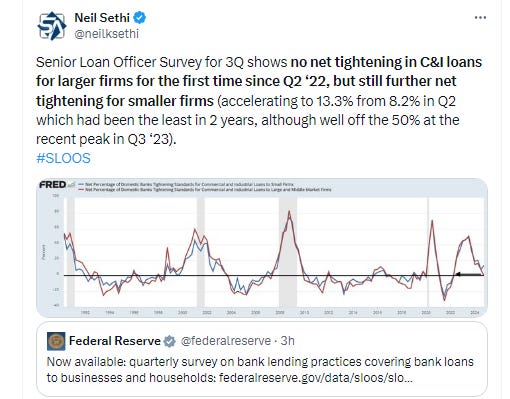

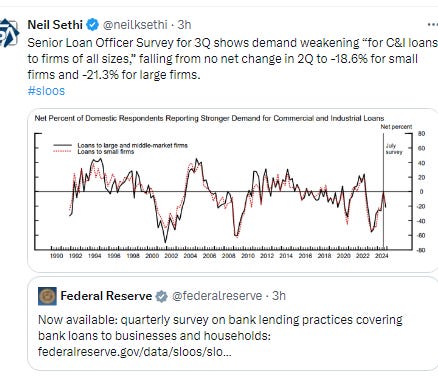

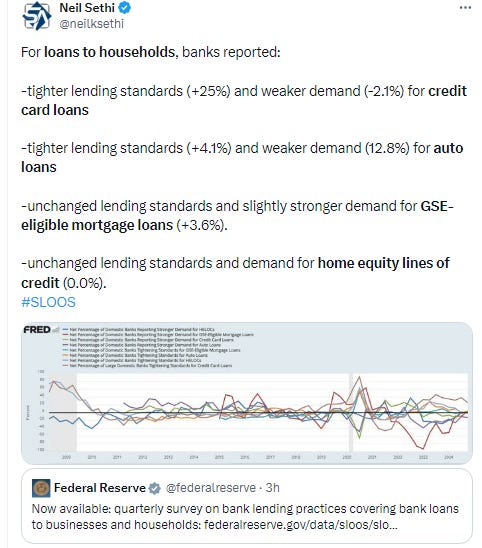

The Fed’s Senior Loan Officer Survey for 3Q which showed no to moderate increases in tightening for most business and consumer loans outside of credit cards, but also falling demand for most loans, particularly auto loans.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX a very moderate loss, but enough to take us back below the 6,000 level. Not a lot of close support. Daily MACD and RSI remain supportive.

The Nasdaq Composite an even smaller loss. Its daily MACD & RSI also supportive.

RUT (Russell 2000) apparently couldn’t make it the last tenth of a percent to an ATH before consolidating, it’s worst day in 2 mths. Its daily MACD remains supportive but the RSI crossed from over to under 70 indicating flagging momentum.

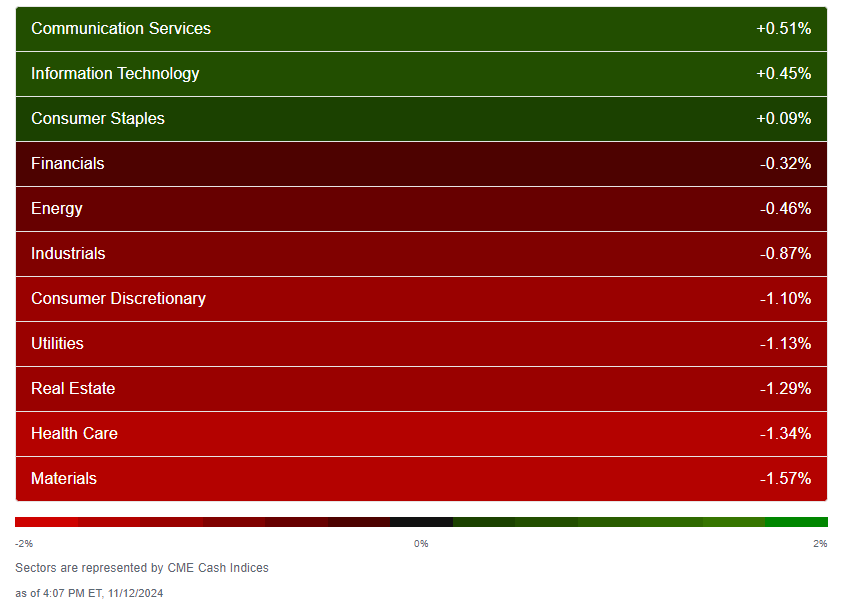

Equity sector breadth from CME Indices deteriorated again, down to 3 green sectors from 6 on Monday and 8 the prior three sessions. Megacap growth outperformed while defensives generally lagged for a second day along with materials. No sector up over 1% today (actually no sector up over a half percent) from 2 Mon & 5 Fri. Five though were down more than -1% (from none the prior 2 sessions).

Stock-by-stock SPX chart from Finviz consistent w/a lot of red outside of the top 6.

Positive volume was on the weak side for the fourth day in five at 24 & 48% on the NYSE & Nasdaq respectively. The 24% is due to the weakness in the small caps but that’s still pretty low. The 48% is not out of line with a mildly down day, but it’s definitely not great (which it was Monday). Issues were 20 & 30%.

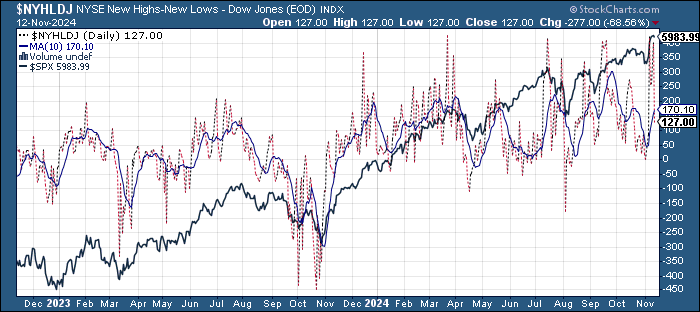

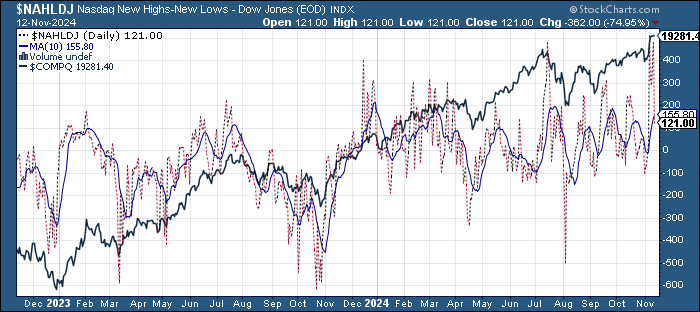

New highs-new lows dropped sharply to 123 & 119 from 404 & 483 respectively on Monday, which were not far from the best since early 2021. That’s the weakest since Election Day. They are also now below the 10-DMAs (less bullish), although the DMA’s continue moving higher for now.

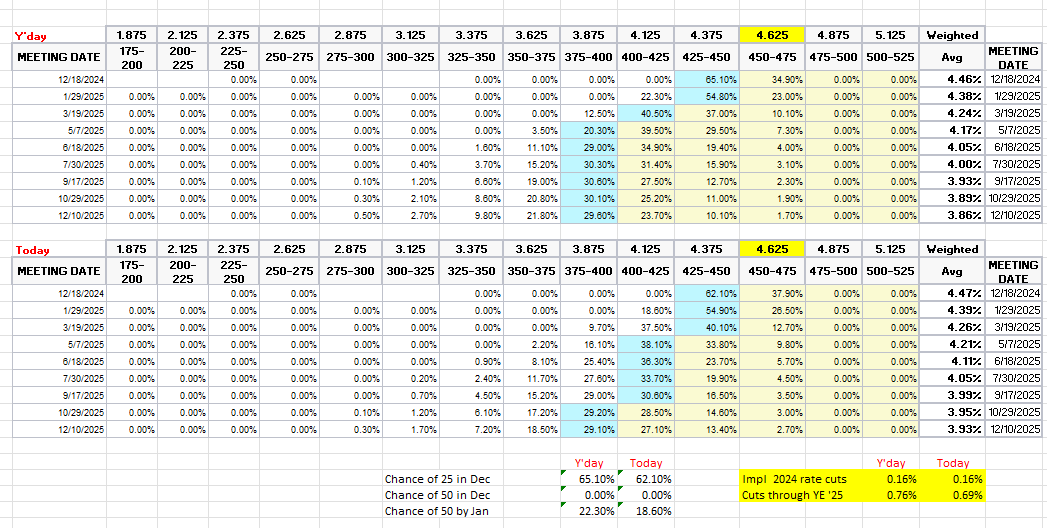

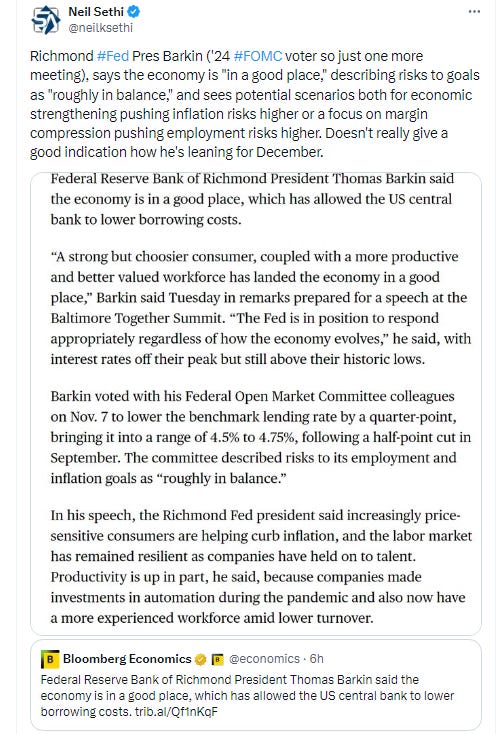

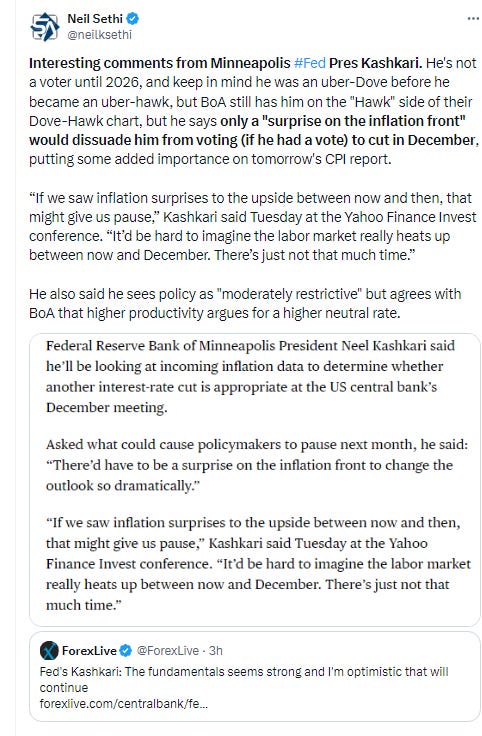

FOMC rate cut probabilities from CME’s Fedwatch tool edged lower. The chance of 25bps in Dec down to 62% (still 16bps priced in for 2024). And chances for 50bps through the Jan meeting are now down to 19%, with just 69 bps of cuts priced through YE ‘25 (down from 81 Friday and around 100 pre-election).

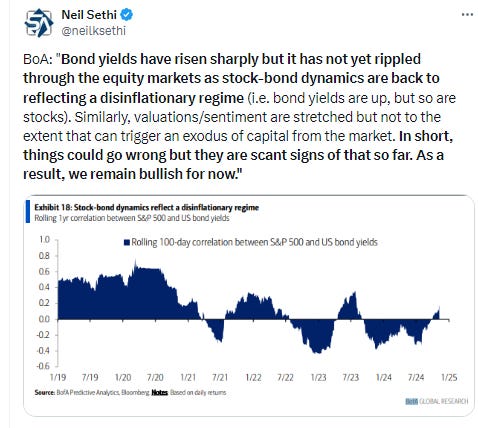

Treasury yields as noted pushed higher after being closed Monday. The 10yr yield was +12 basis points to 4.43% the highest close since July 2nd, +71bps since the start of October and pushing back up towards the downtrend line from the Oct highs as well as the 4.5% level identified by many as a “line in the sand”, while the 2yr yield was +9bps to 4.34%, also the highest close since July. It’s up +68bps since the start of October.

Dollar ($DXY) continued its sharp run since the election, making it to the 106 target I put on it 3 wks ago that looked in serious jeopardy pre-election, as well as the top of the 2-yr channel it has been in. It pushed over the top but fell back just under. The daily MACD & RSI have improved to more supportive although there is a negative divergence with the RSI (lower high while price is at a higher high). Where it goes from here a big question.

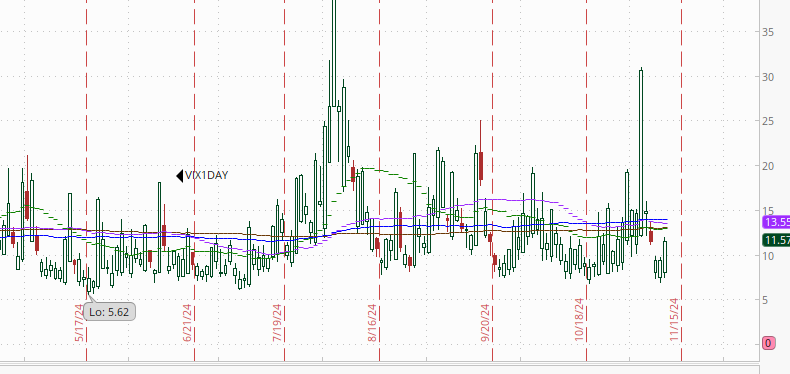

The VIX & VVIX (VIX of the VIX) edged lower with the former to the lowest close since mid-July at 14.7 (consistent w/sub-1% daily moves over the next 30 days) & the latter to 89 (consistent w/“moderate” daily moves in the VIX over the next 30 days).

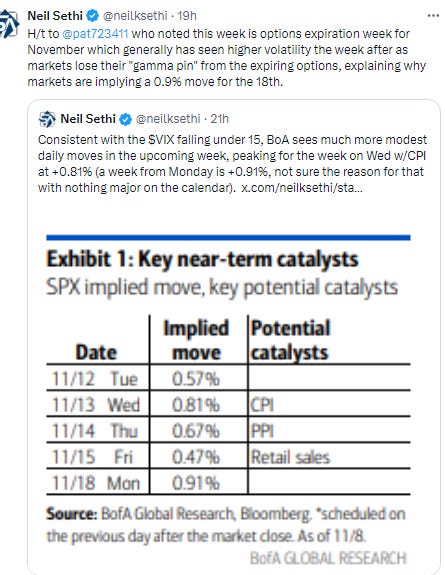

1-Day VIX saw a small pop with CPI coming up tomorrow morning, but remained very tame at 11.6, looking for a move of just ~0.7% Wednesday, a little below what BoA said was implied from options markets coming into the week.

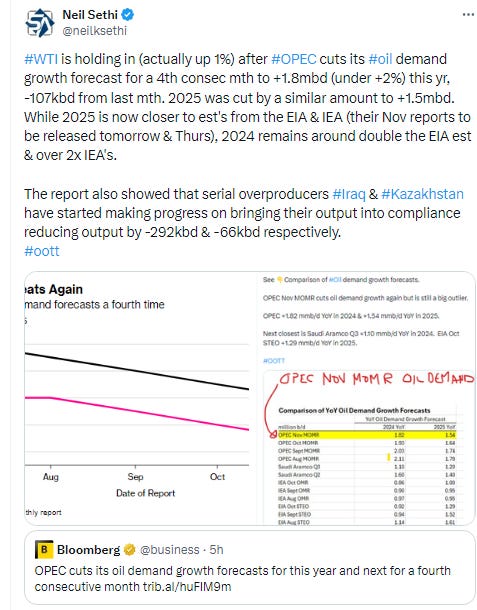

WTI gave up early gains to finish little changed, getting closer to the $67 area I noted Monday. Daily MACD & RSI continue to turn more bearish.

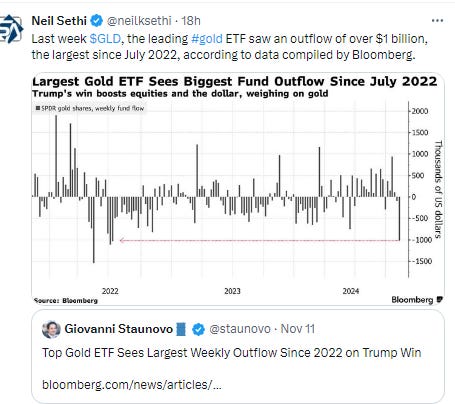

Gold fell for the 4th day in 5, and breaking under the uptrend line from February it’s only closed under one other time (for one day in July) consistent with the daily technicals noted Monday (daily MACD in “sell longs” positioning and the RSI the weakest since Feb but not yet oversold). The RSI is now the weakest since Oct ‘23.

Copper (/HG) also fell for 4th day in 5, breaking under the low from Wednesday with losses accelerating thereafter, seemingly on track to get to the $4.07 target of the uptrend line (with secondary target at $4). The daily MACD & RSI as noted Monday flipped back to a more negative positioning.

Nat gas (/NG) made it up to $3 before falling back to finish mildly lower but retaining most of Monday’s +10% jump. It remains over the downtrend line from the Nov ‘23 highs it had only closed over one day previous to Monday. The MACD & RSI remain positive as well.

Bitcoin futures recovered from some weakness after hitting $90k early in the session to tack on another 1.4%, although couldn’t get back to the $90k level. I noted Friday that while it’s “a little [now a lot] extended above its moving averages, so some consolidation would make sense, unlike February its RSI isn’t even above 70 yet, so definitely could (does?) have further to go.” Well, the RSI is now 78, but back in February it got to 88.

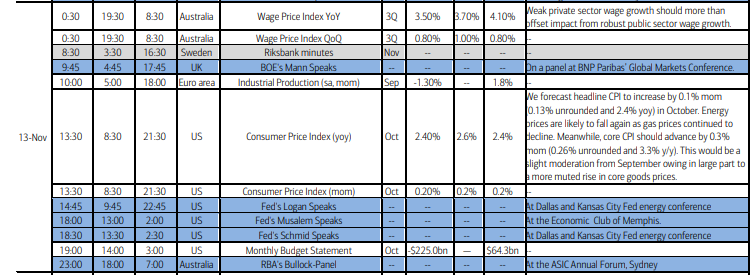

The Day Ahead

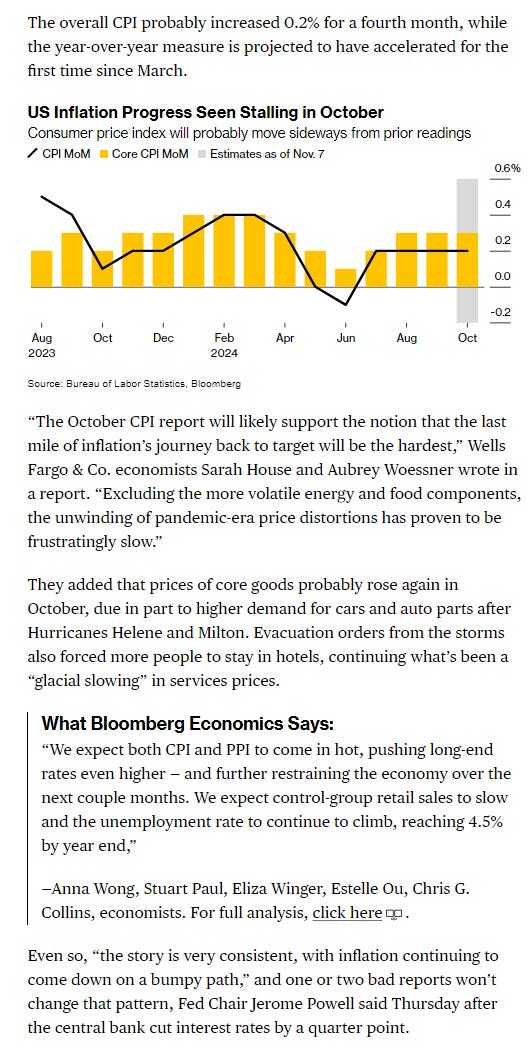

In US economic data tomorrow we’ll get the highlight of the week in CPI. Some blurbs on that below. We’ll also get weekly mortgage applications and EIA petroleum inventories.

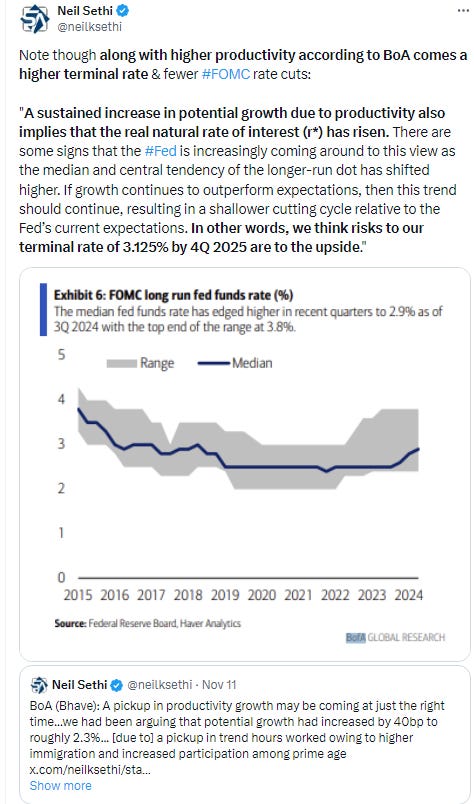

In terms of Fed speakers, we’ll get Williams (not listed, that’s from BBG), Logan, Musalem, and Schmid. They’re all actually interesting, particularly as they speak after the CPI report is released. Williams, as head of the NY Fed, is one of the “Big 3” (along with the Chair & Vice-Chair). Logan is an expert on funding markets. She’s been nonchalant about RRP falling to zero, so I assume that will remain her position, but she’ll be a leading signal on when that changes. The latter two are (along with Bowman) the hawks on the FOMC, so it will be interesting to hear their thoughts on the timing and pace of future cuts and level of the terminal rate.

Earnings will be light with just one SPX component, although it’s a heavyweight >$100bn in market cap in Cisco Systems (CSCO). (see the full earnings calendar from Seeking Alpha).

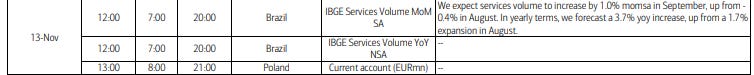

Ex-US the calendar is light. Some notables are Japan Oct PPI and EU industrial production. Nothing really notable in EM.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,