Markets Update - 11/13/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

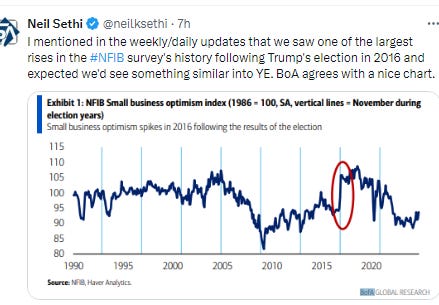

US equity indices finished weak again today despite an in-line CPI report which came as a relief to markets on edge following the runup in bond yields the past month and recent Fed comments. Following the report expectations for Fed rate cuts firmed and shorter term bond yields fell. But the dollar and longer term yields continued to rise as fears about a “too hot” economy rippled through markets particularly small caps.

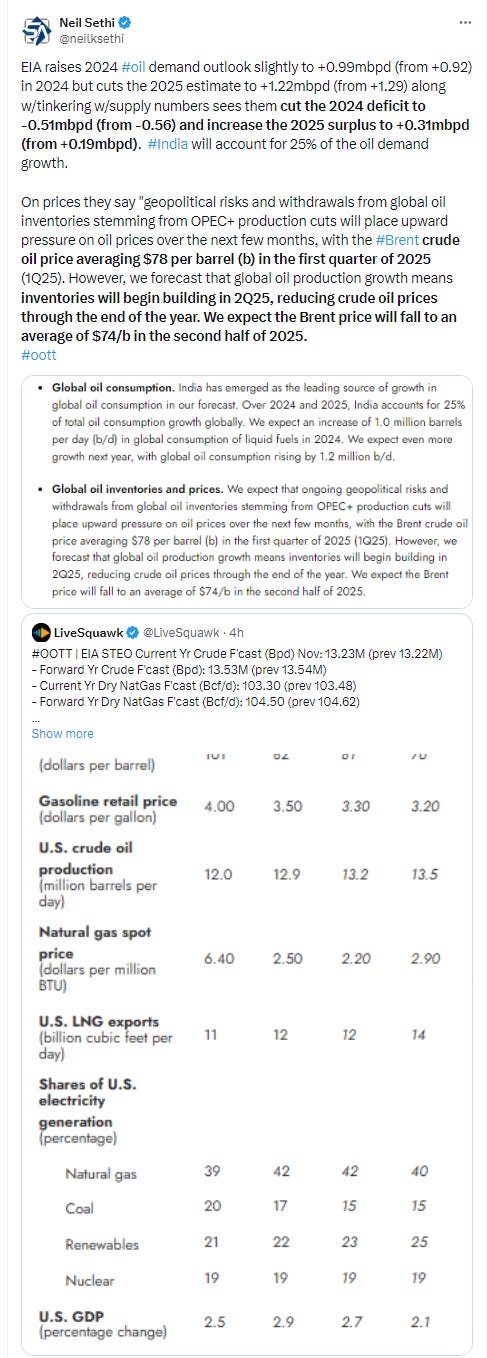

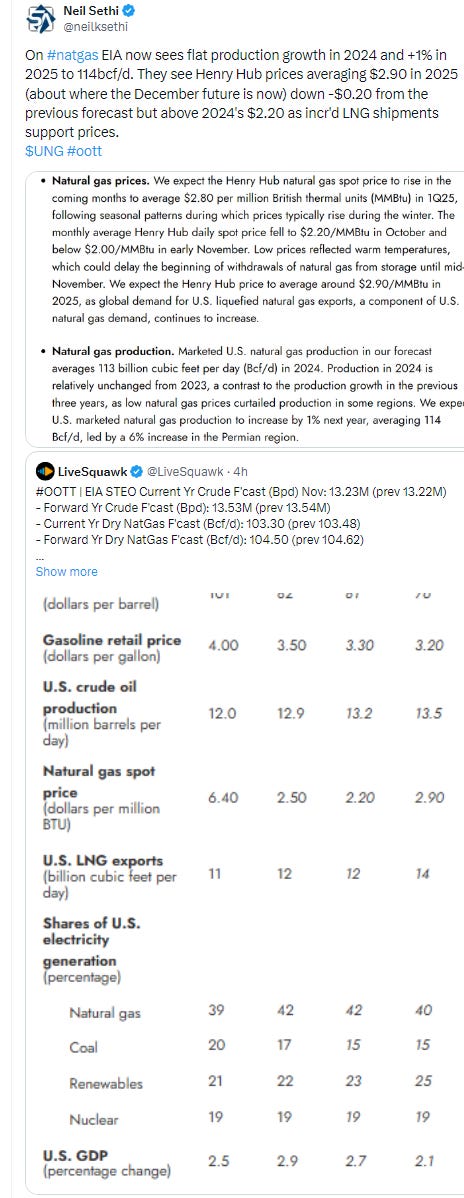

Gold and copper both fell back again on the stronger dollar for the 5th day in 6. Nat gas, crude, and bitcoin were all little changed though.

The market-cap weighted S&P 500 was unch, the equal weighted S&P 500 index (SPXEW) unch, Nasdaq Composite -0.3% (and the top 100 Nasdaq stocks (NDX) -0.2%), the SOX semiconductor index -2.0%, and the Russell 2000 -0.9%.

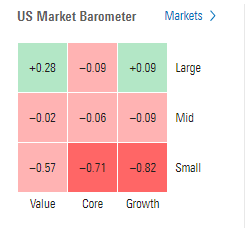

Morningstar style box showed the weakness in small caps.

Market commentary:

“After a run of unseasonably hot autumn data, today’s number cools fears of an imminent slowdown in the pace of rate cuts,” said Lindsay Rosner, head of multi sector fixed income investing at Goldman Sachs Asset Management.

“Markets should take some comfort from this, as it represents just the last mile of inflation that exhibits sticky service inflation,” Florian Ielpo, head of macro research at Lombard Odier Investment Managers, wrote in a note following the report.

“Today’s headline data won’t change the market’s view that inflation is well on its way to 2%” Jochen Stanzl, chief Market Analyst at CMC Markets, wrote in a note.

“It’s time to stop worrying about the Fed and inflation,” said David Russell, global head of market strategy at TradeStation. “Stocks have been on autopilot since the election and today’s numbers do nothing to hurt the trend. December is still in play for a cut.”

“After the massive rally we’ve seen in stocks, investors are looking for any sort of excuse that can usher in a pullback,” said Bret Kenwell at eToro. “Markets resolved higher following the election, instilling a ‘buy the dip’ mentality. If the market were to sell off in the short term, the pullbacks are likely to be shallow as fund managers buy the dip and look to chase performance into year-end.”

“A hotter-than-expected inflation number could have convinced the Fed to stand pat at its next meeting,” said Seema Shah at Principal Asset Management. “A December cut is still in the cards.”

“The in-line CPI print shows that while substantial progress has been made in the fight against elevated inflation, the ‘last mile’ is proving more challenging,” said Josh Jamner at ClearBridge Investments. “With inflation holding steady, the market narrative should not see a significant shift as a result of today’s data.”

It’s a “business-as-usual print” for the Fed, according to Bank of America Corp.’s Stephen Juneau, Meghan Swiber and Alex Cohen. “There is nothing in today’s report that would alarm the Fed,” they said. “Therefore, a 25 basis-point cut in December firmly remains our base case.”

At Citigroup Inc., economists maintained their view that the Fed will cut rates by 50 basis points in December after the CPI data. “While details remain volatile and not quite ‘normal,’ easing wage pressures, falling short-term inflation expectations, and high rates continuing to weigh on housing demand and prices should leave Fed officials comfortable that the path of inflation is slowing,” wrote Citi’s Veronica Clark and Andrew Hollenhorst.

Preston Caldwell at Morningstar says that while an outside possibility of a “skip” still exists, he continues to believe the Fed will most likely cut rates next month.

“We agree with current market expectations around Fed pricing,” said Lauren Goodwin at New York Life Investments. “Last week, Chair Jerome Powell reinforced that the Fed believes its policy stance is still restrictive, and that they remain on a rate-cutting trajectory.”

With inflation still stubbornly above the Fed’s 2% goal, the Fed may have only one rate cut left in December before taking a pause, according to Skyler Weinand at Regan Capital. “The incredible move in the stock market post-election has effectively eased financial conditions,” he said. “This easing, combined with incoming fiscal stimulus, may warrant a pause on rate cuts by the Fed in the near future to allow the dust to settle and to process more incoming data.” The Fed cutting short-term rates along with future fiscal stimulus may both ignite inflation again and provide cause for longer term interest rates to rise, he said — adding that he sees 10-year Treasury yields climbing to 5% in 2025.

Ellen Zentner at Morgan Stanley Wealth Management noted markets are already weighing the possibility that the Fed will cut fewer times in 2025 than previously thought, and that they may hit the pause button as early as January.

“The sticky components of inflation continue to ease, giving the Fed some leeway to cut rates next month but they will most likely pause in January,” said Jeffrey Roach at LPL Financial. “The strength of some cohorts of the consumer is keeping upward pressure on prices as consumer spending hasn’t slowed yet. Stronger-than-expected economic growth is likely keeping bond yields elevated.”

While investors shrugged off the latest news on US inflation, they seem increasingly concerned about its longer-term outlook, according to Diana Iovanel at Capital Economics. “We share their view and expect Treasury yields to rise a bit further still,” she said.

At Goldman Sachs Asset Management, Lindsay Rosner says that after a run of unseasonably hot data, the latest CPI cools fears of an imminent slowdown in the pace of rate cuts. “Still, with uncertainty over fiscal and trade policies high there is a risk that the Fed may opt to slow the pace of easing as the New Year chill sets in,” she noted.

In individual stock action, semiconductor stocks continued to be a pocket of weakness, leading the PHLX Semiconductor Index (SOX) to close -2.0% lower. This price action also weighed down the S&P 500 information technology sector, which fell 0.3% despite gains in Microsoft (MSFT 425.20, +2.17, +0.5%) and Apple (AAPL 225.12, +0.89, +0.4%).

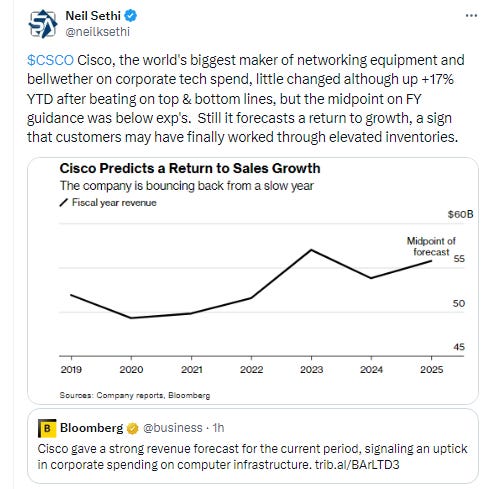

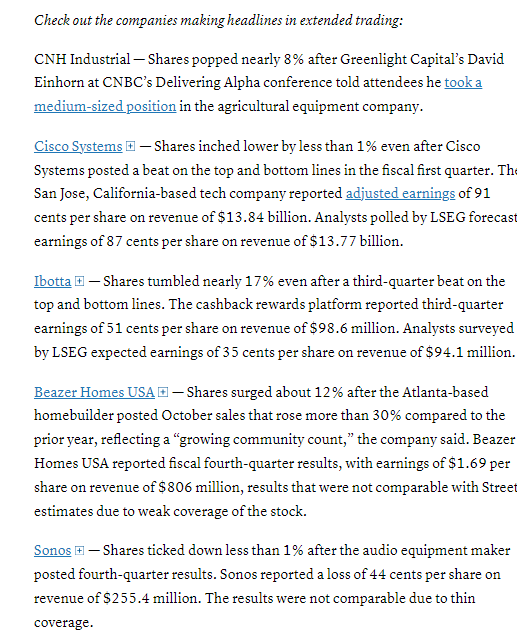

In late hours, Cisco Systems Inc. delivered an upbeat outlook for the current period, but a conservative annual forecast brought a muted reaction from investors.

In after hours movers:

In corporate news from BBG:

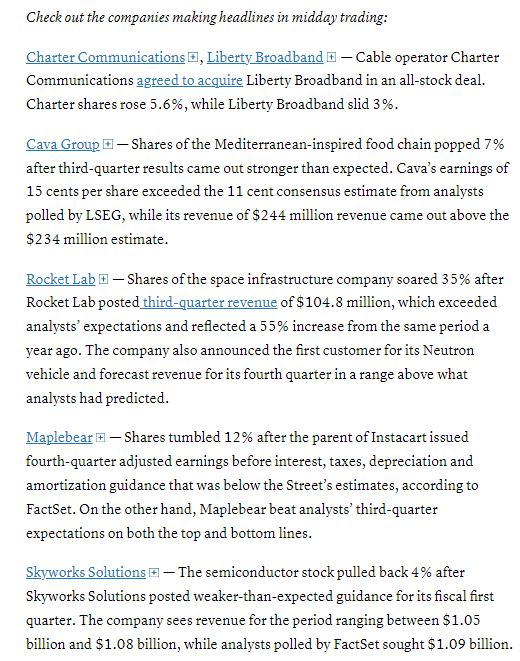

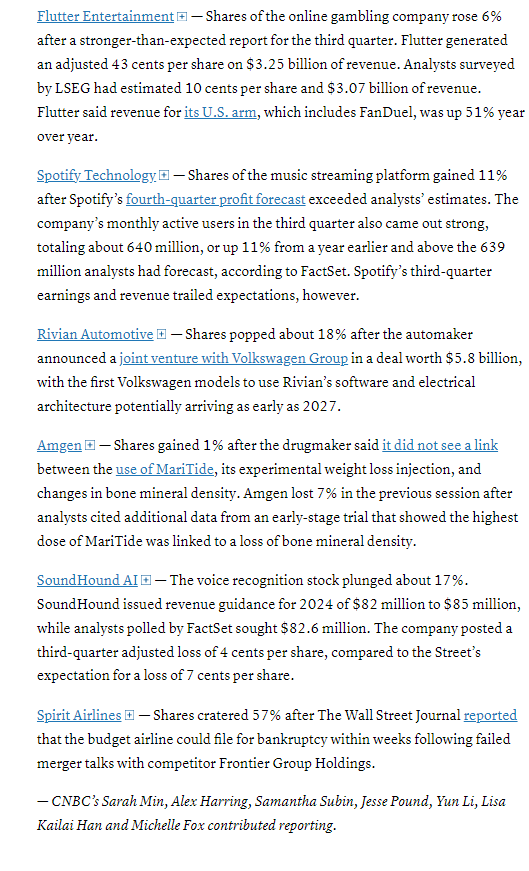

Some tickers making moves at mid-day from CNBC.

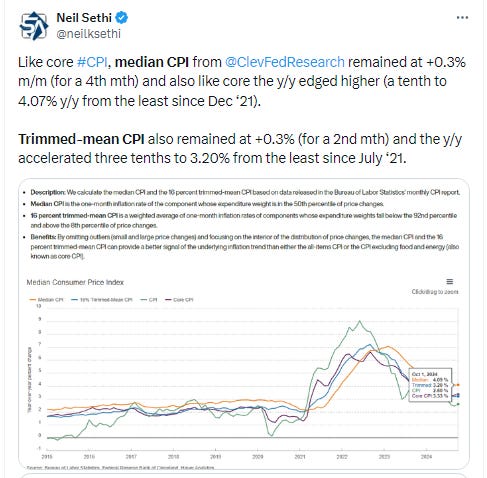

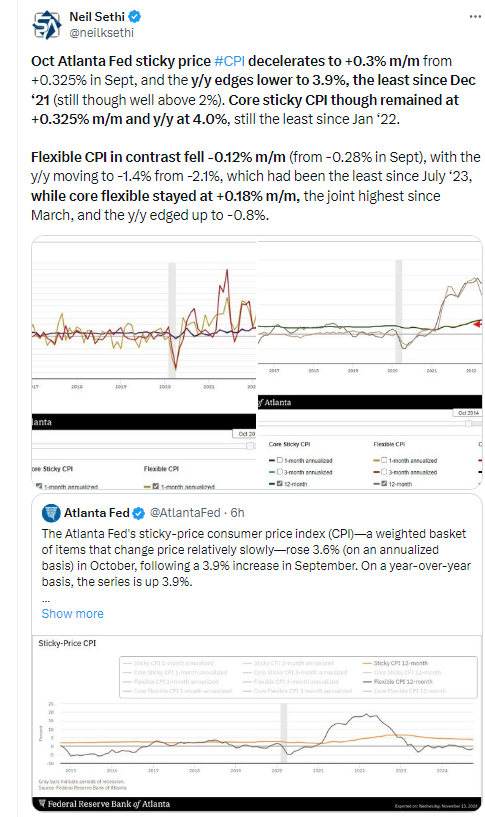

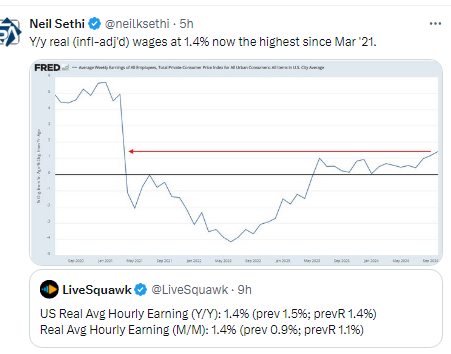

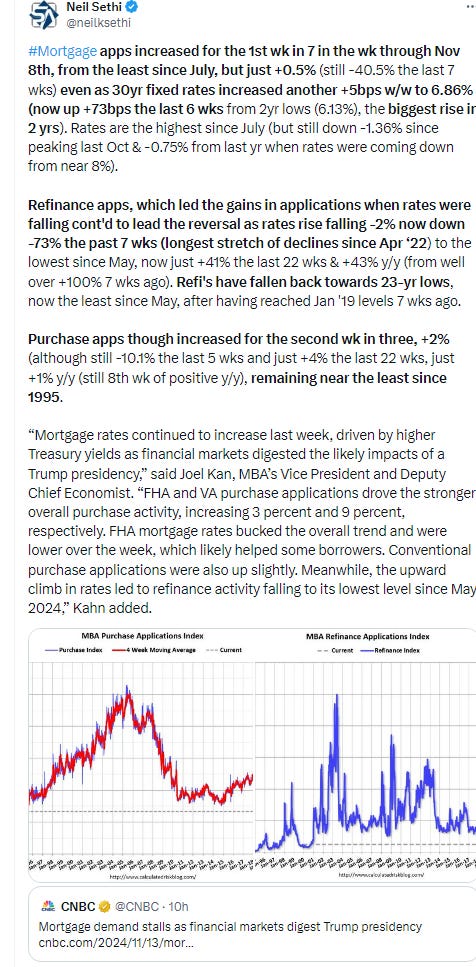

US economic data was dominated by the CPI report which came in exactly as expected for the most part. The only problem with that is what was expected was a continuation of above trend inflation with an acceleration on the year over year rate which explains 10yr yields drifting higher and the dollar continuing its run. We also got weekly mortgage applications which were basically flat w/w.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

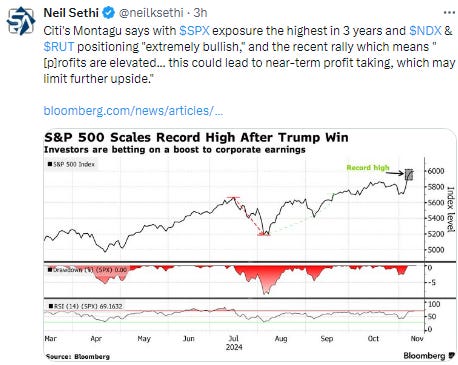

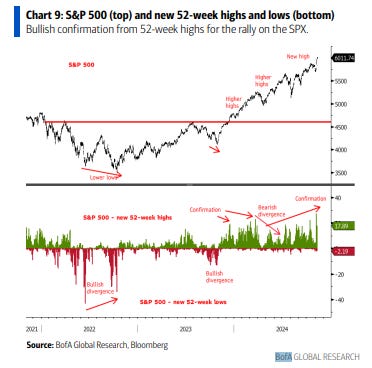

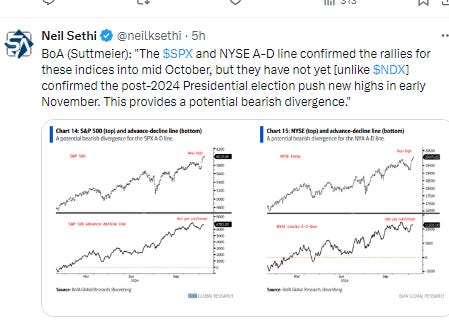

The SPX was flat again on the day just sort of hanging there below 6,000. Not a lot of close support. Daily MACD and RSI remain supportive.

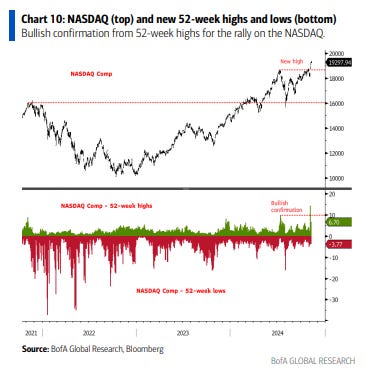

The Nasdaq Composite finished lower but remained above the lows of the week. Its daily MACD & RSI are also supportive.

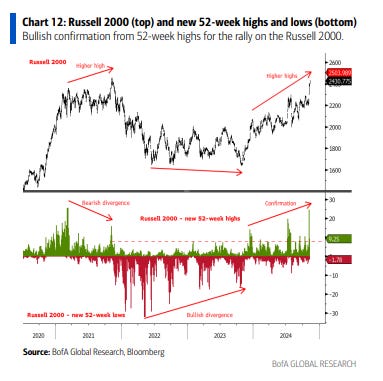

RUT (Russell 2000) I noted Tuesday “apparently couldn’t make it the last tenth of a percent to an ATH before consolidating”, and that continued down nearly another -1%. Its daily MACD remains supportive but the RSI crossed from over to under 70 indicating loss of momentum.

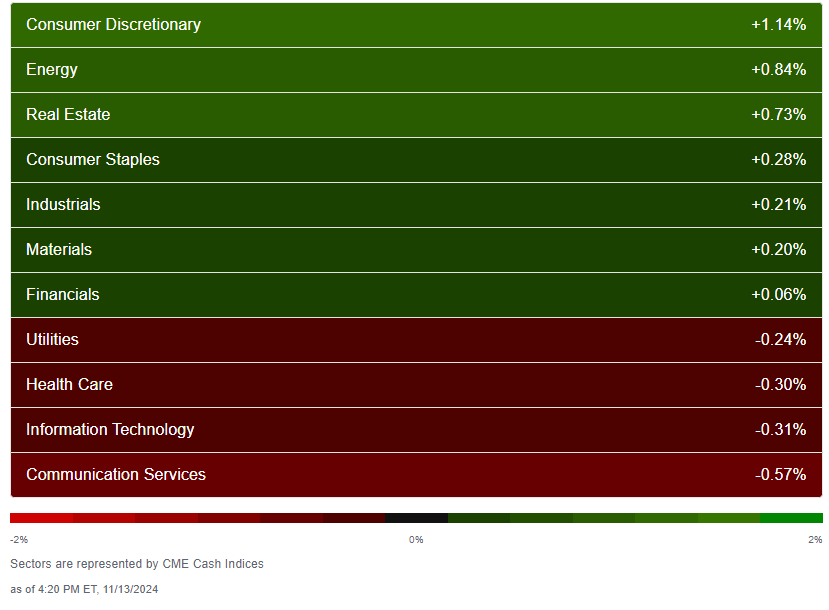

Equity sector breadth from CME Indices actually improved with 7 green sectors, up from 3 Tuesday & 6 Monday (but below the 8 the prior three sessions), and one sector up >1% today (none Tuesday, but two Mon & five Fri). Also none down >-1% (five Tues, none the prior 2 sessions). Cons discr led but the other 2 megacap growth sectors finished in last place (although the losses were mild).

Stock-by-stock SPX chart from Finviz consistent w/a good amount of green outside of semiconductors which were down for a 4th session.

Positive volume was not bad (but not great) on the NYSE but good on the Nasdaq after both having been weak for 4 of the prior 5 days at 45 & 61% on the NYSE & Nasdaq respectively. The 45% is not bad with the RUT down nearly a percent while the 61% is quite good considering the Nasdaq was down fifty points on the day. Issues were weaker though at 40 & 33%.

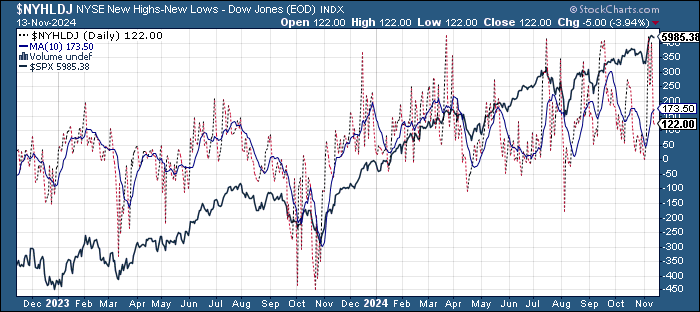

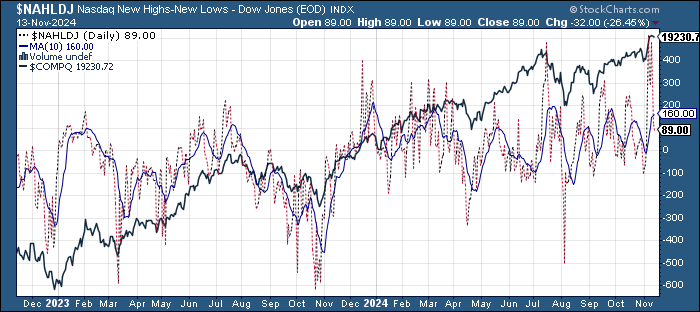

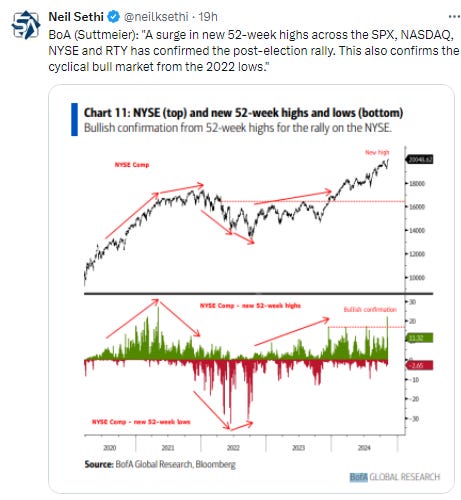

New highs-new lows though continued to drop to 120 & 89 (remember they were 404 & 483 respectively on Monday, which were not far from the best since early 2021). That’s the weakest since Election Day. They are also now below the 10-DMAs (less bullish), although the DMA’s continue moving higher for now.

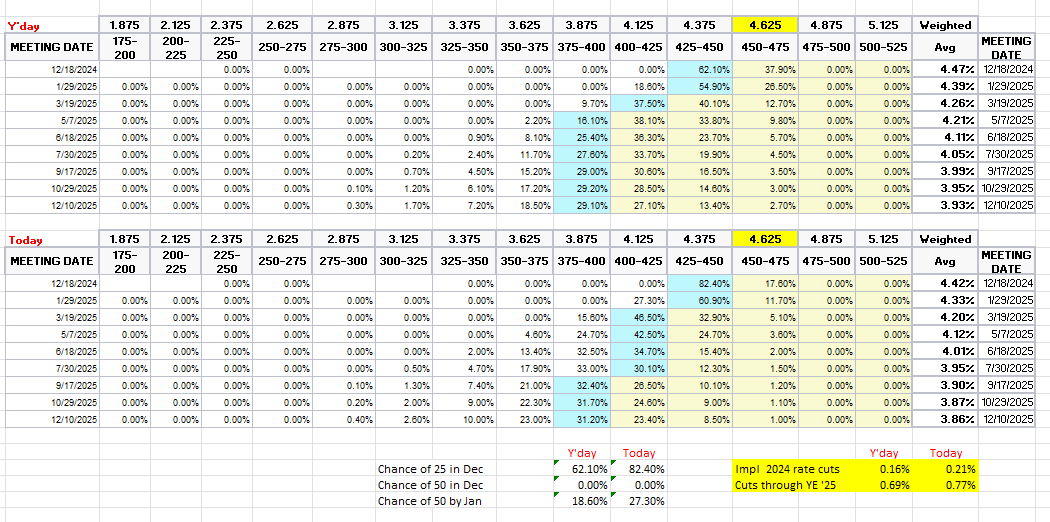

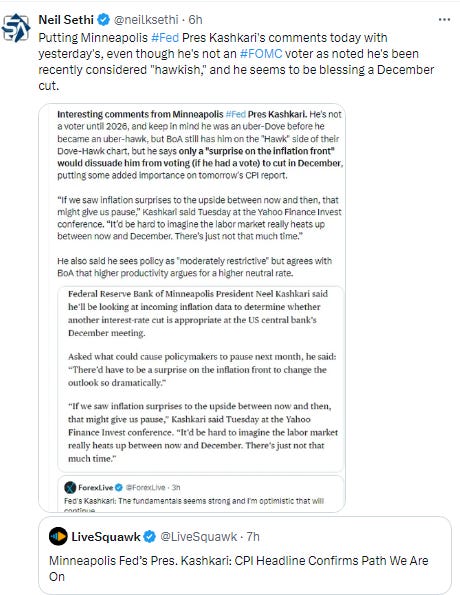

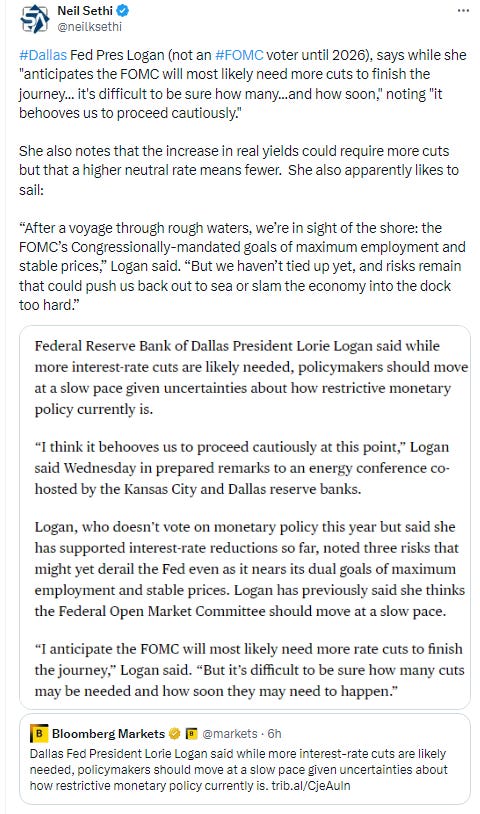

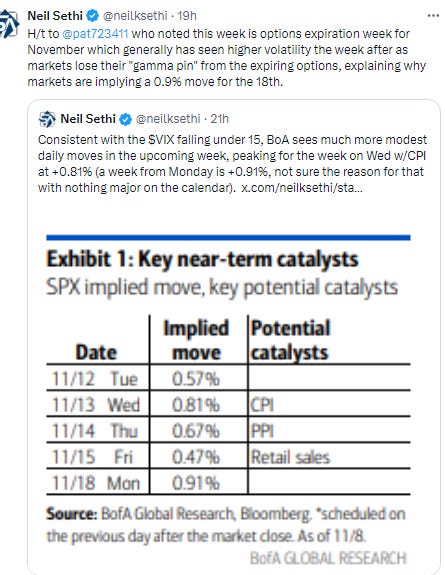

FOMC rate cut probabilities from CME’s Fedwatch tool saw some cuts priced back in. The chance of 25bps in Dec improved to 82% from 68% Tues (now 21bps priced in for 2024 from 16). Chances for 50bps through the Jan meeting are up to 27% from 19%, with 77bps of cuts priced through YE ‘25 (up from 69 Tues but still down from around 100 pre-election).

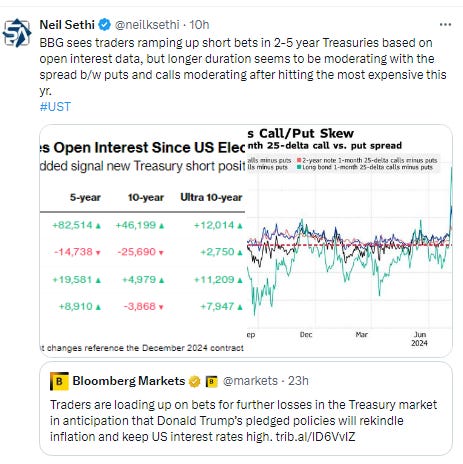

Treasury yields were mixed with the 10yr yield, more sensitive to longer term growth/inflation expectations, reversing from early losses to finish +2 basis points at 4.45% the highest close since July 2nd, +73bps since the start of October and pushing over the downtrend line from the Oct highs towards the 4.5% level identified by many as a “line in the sand”. The 2yr yield though, more sensitive to Fed policy, was -6bps to 4.28% from the highest close since July. It’s still up +62bps since the start of October, but you can see it’s lagging the 10yr.

Dollar ($DXY) continued its sharp run since the election, blowing through the 106 target I put on it 3 wks ago, as well as the top of the 2-yr channel it has been in to the highest close since Nov 1, 2023. I redrew the top of the channel to incorporate that high (instead of having more touches with the previous downtrend line). While it's above the previous one I had it's still below the new one as you can see. The 2023 high was $107.40.

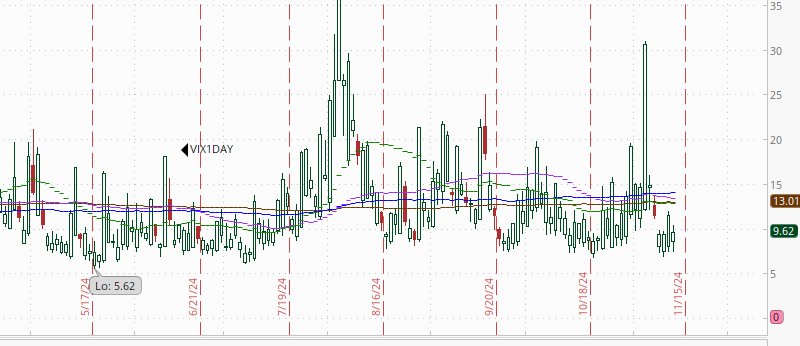

The VIX & VVIX (VIX of the VIX) were mixed with the former falling to the lowest close since mid-July at 14.0 (consistent w/sub-1% daily moves over the next 30 days) but the edging to 92 (still consistent w/“moderate” daily moves in the VIX over the next 30 days).

1-Day VIX fell back with CPI in the rearview window to 9.6, looking for a move of just ~0.6% Wednesday, pretty close to what BoA said was implied from options markets coming into the week.

WTI did make it down to the $67 area I noted Monday where it was able to bounce finishing little changed for a second day. That’s an important support level. Daily MACD & RSI remain tilted negative but not strongly.

Gold fell for the 5th day in 6 to a 2-mth low, making its way now to a support/resistance line noted by Helene Meisler at Real Money just above the 100-DMA. We’ll see if that holds given as noted Monday the daily MACD is firmly in “sell longs” positioning, and the RSI is now the weakest since Oct ‘23.

Copper (/HG) also fell for 5th day in 6 to the lowest close in 3 mths, making it to the the $4.07 initial target of the uptrend line running back to last October (with secondary target at $4). With the daily MACD & RSI as noted Monday flipping back to a more negative positioning feels like a test of $4 is more likely than not.

Nat gas (/NG) again fought with $3 before falling back but still finished at the highest close in 5 mths. It remains over the downtrend line from the Nov ‘23 highs it had only closed over one day previous to Monday. The MACD & RSI remain positive as well.

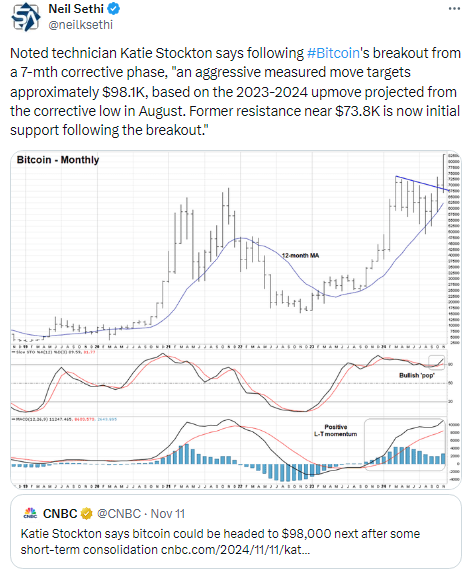

Bitcoin futures had a volatile day (no surprise I guess) jumping over $94k before falling back to finish down -1% again closing below the $90k level. I noted Friday that while it’s “a little [now a lot] extended above its moving averages, so some consolidation would make sense, unlike February its RSI isn’t even above 70 yet, so definitely could (does?) have further to go.” Well, the RSI is now 79, but back in February it got to 88.

The Day Ahead

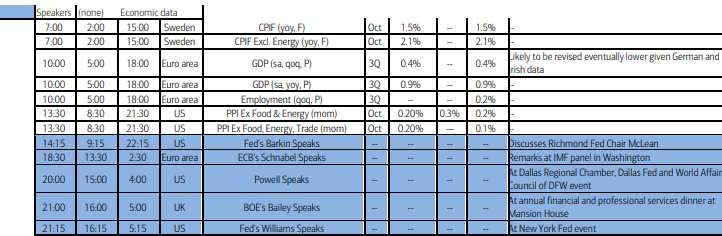

In US economic data tomorrow we’ll get PPI and weekly jobless claims as well as the EIA petroleum inventories (I forgot delayed by a day due to Veteran’s Day). The IEA will also issue its monthly report.

In terms of Fed speakers, we’ll get the man himself in Chair Powell at 3pm ET. We’ll also get Barkin (who we heard from earlier this week, we’ll see if the CPI report changes anything), and Williams (again, we heard from him today).

Earnings will like today be light in terms of SPX reporters by number, but they’re both heavyweights >$100bn in market cap in Walt Disney (DIS) and Applied Materials (AMAT). Of course we’ll get plenty of other earnings along with those (see the full earnings calendar from Seeking Alpha).

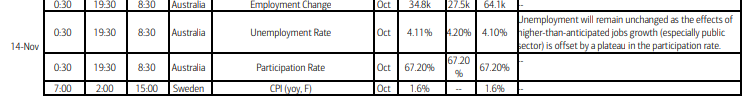

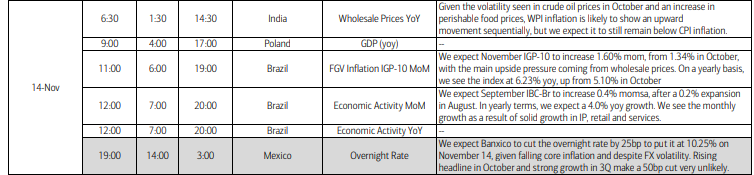

Ex-US the highlights are Australia Oct employment, and 3Q EU GDP. In EM the highlight is the policy decision from the Bank of Mexico (Banxico) which is expected to be a 25bps cut. We’ll also get some inflation reads from India & Brazil.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,