Markets Update - 11/14/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

Note: High school playoffs grind on, so the Friday Markets Update will be delayed to Saturday again.

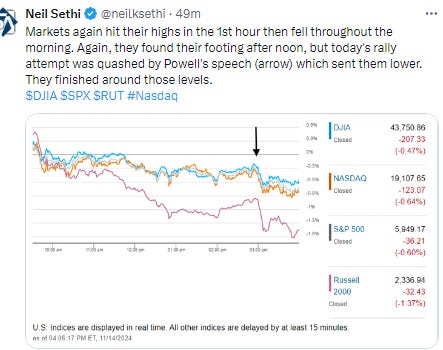

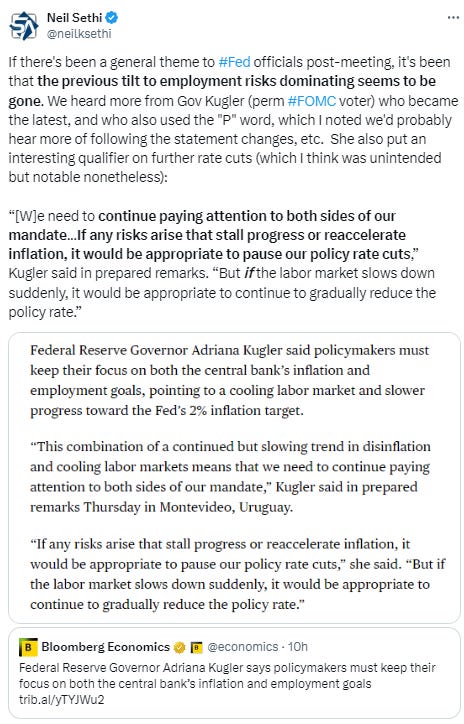

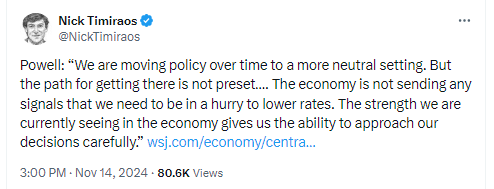

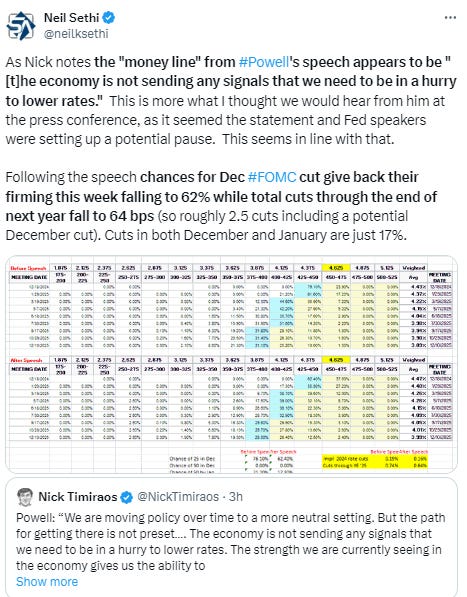

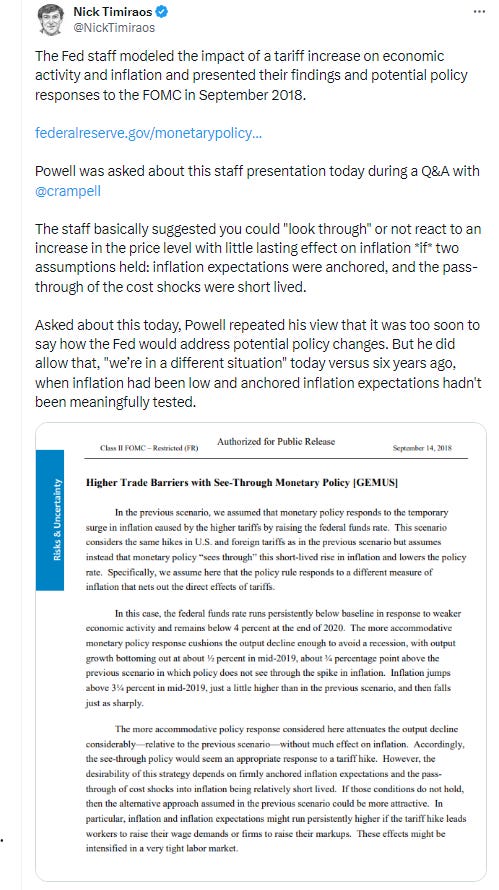

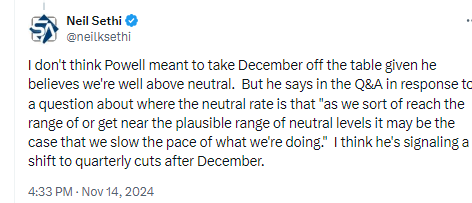

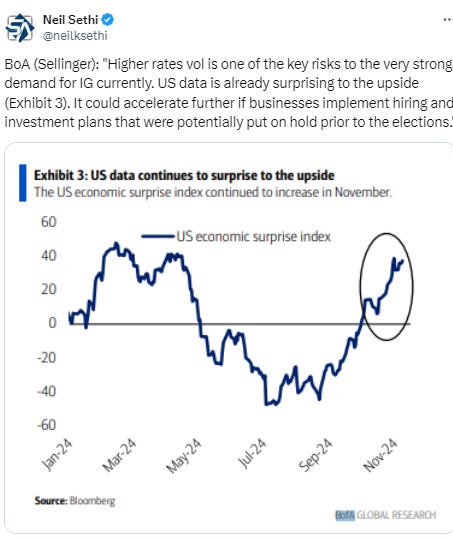

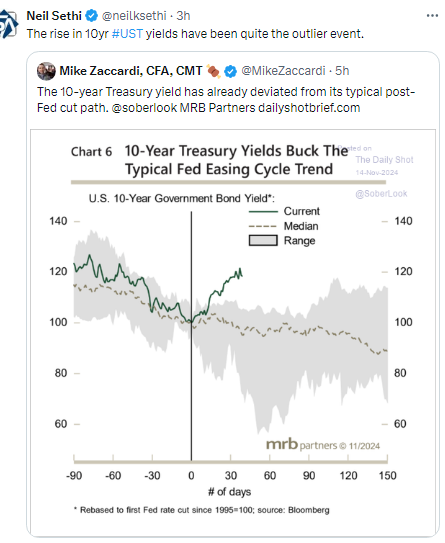

US equity indices again peaked in the first hour falling throughout the morning despite a mostly in-line PPI report, drop in jobless claims, and jump in shares of Disney after its earnings but after more hawkish comments from Fed Gov Kugler and ahead of an appearance by FOMC Chair Powell. Like Wednesday they seemed to find their footing a little after noon, but today the fledgling rally was quashed by that appearance from the Fed Chair. Really, it was one line that caught the markets’ attention: “The economy is not sending any signals that we need to be in a hurry to lower rates.” Stocks and bonds fell (yields jumped) as the firming in rate cut expectations we had seen during the week were priced back out leaving the market expecting less than 3 total rate cuts through the end of next year. In line with that small caps again saw the worst of the losses.

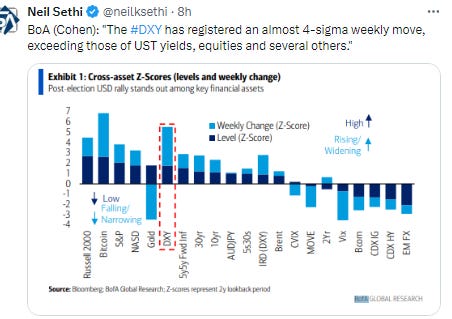

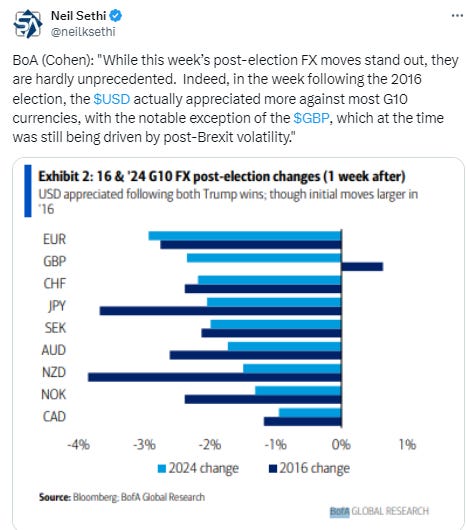

The dollar was already on the move and finished not far from 2 yr highs. That kept pressure on gold and copper which both fell although were able to bounce today finishing with much more mild losses. Bitcoin also fell as did nat gas while crude managed a slim gain.

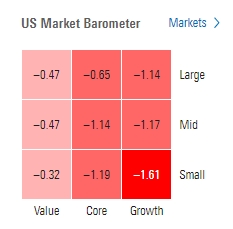

The market-cap weighted S&P 500 was -0.6%, the equal weighted S&P 500 index (SPXEW) -0.8%, Nasdaq Composite -0.6% (and the top 100 Nasdaq stocks (NDX) -0.7%), the SOX semiconductor index -0.1%, and the Russell 2000 -1.4%.

Morningstar style box showed the broad weakness with value outperforming.

Market commentary:

“Powell’s speech was hawkish,” said Neil Dutta at Renaissance Macro Research. “I think they will still cut in December since policy remains restrictive and they want to get to a neutral setting. That said, on the economy, I think Powell (and the broader consensus) is complacent. There is more downside risk in the near-term than is being appreciated.”

To Quincy Krosby at LPL Financial, while it’s expected that the last mile towards price stability will be bumpy, Powell reminded markets that once again the Fed will not deliver the series of rate cuts they want, unless of course the labor market deteriorates.

The potential for renewed inflation is being considered, though even hotter US data is unlikely to derail the risk-on mood since there’s another inflation print in December ahead of the next Fed meeting, according to JPMorgan Chase & Co.’s Andrew Tyler.

Higher odds of a December Fed cut increase the chances that an already firm economy will strengthen further, according to Dennis DeBusschere at 22V Research. Economic data needs to stay consistent with growth of around 2.5% (or lower) for 10-year yields to stay where they are, he added. “Our call is 10-year yields remain around current levels, but growth above 2.5% will lead to higher yields and a potential break above 4.55%,” DeBusschere noted. “That level of yield would be a headwind for small caps, debt risk names, and other riskier factors as it happens.”

“The fact that we had such an explosive week last week, now [we’re] having a little bit of a hangover and a malaise,” said Jay Woods, chief global strategist at Freedom Capital Markets. “But we’re holding onto most of those gains, so I think this week if anything is constructive.”

The S&P 500 may reach 6,100 before year-end amid enthusiasm over the Republican sweep of the White House and Congress, but pushing beyond that level may be challenging in the near term, according to Mike Wilson at Morgan Stanley. The gauge closed at 5,949.17 Thursday. The market may be pressured by any backup in benchmark borrowing rates, or expectations of less aggressive monetary easing by the Fed, Wilson said in an interview to Bloomberg Television, adding that pullbacks will probably be seen as buying opportunities.

The US equity benchmark is likely to grind higher into year-end — with a market melt-up possible, but not a base case, according to UBS Group AG strategists including Maxwell Grinacoff. With Commodity Trading Advisor funds already positioned max long, marginal upside from option dealer short gamma positioning and the Trump re-election well priced, a market grind higher is a more likely scenario, they noted.

Societe Generale SA strategists including Andrew Lapthorne see US equities as “undeniably expensive” but say valuation conversations “are increasingly rare.” The US represents about 74% of the MSCI World market cap, also a record high. “This is almost entirely down to the valuation premium, without which the US would be closer to 50% of MSCI World.” While the stock market has mostly ignored the recent move higher in bond yields as economic growth holds up, it’s still something worth keeping an eye on.

While many investors seem reluctant to sell just yet, caution is warranted, according to Fawad Razaqzada at City Index and Forex.com. The S&P 500 is clearly overbought by several metrics, signaling that a correction or consolidation may be due, he noted. “Although a full-fledged selloff appears unlikely without the index first breaking multiple support levels, current conditions suggest a modest pullback may be in order for the S&P 500,” Razaqzada added. “For seasoned traders, a short-term pullback could offer buying opportunities, though a clear trend reversal signal has yet to emerge.”

“We are seeing that there is a bit more discrimination between Trump trades,” said Amelie Derambure, senior multi-asset portfolio manager at Amundi.

“There is expectation that Trump’s policies will be market friendly, growth friendly, will be impacting higher inflation but not massively, deregulation is going to be good for some sectors,” she said. “The assumption is we have good, soft Trump with no big negative impact priced by markets.”

Analysts at Brown Brothers Harriman said that with Trump likely to have the wherewithal to carry out his agenda, the scope for rate cuts could be limited going forward. “Market pricing for the Fed has already adjusted, which is giving the dollar a huge lift,” they wrote, advising that “investors should continue to lean into dollar strength.”

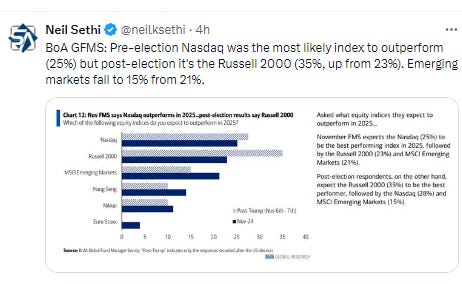

Morgan Stanley’s Wilson this week said a key risk for small caps present now that was not in 2016 is the market’s negative correlation to rates, while it was positive eight years ago when Trump first captured the White House. The Russell 2000 rose 60% during Trump’s first term, though still trailing the S&P 500 and the Nasdaq 100 indexes. “In other words, in today’s later-cycle environment, these cohorts’ adverse sensitivity to rising rates is greater than it was in that period,” he warned clients in a note. “Should rates see more upside post the election, these cohorts could be held back from a relative performance standpoint.”

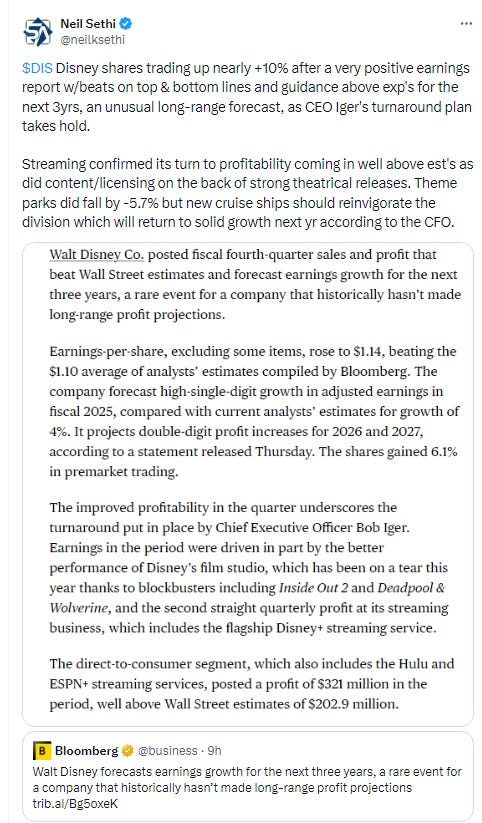

In individual stock action, Dow component Walt Disney (DIS 109.12, +6.40, +6.2%) went against the downside grain, jumping in response to earnings news. Automakers like Tesla Inc. and Rivian Automotive Inc. slumped as Reuters reported President-elect Donald Trump plans to eliminate the $7,500 consumer tax credit for electric-vehicle purchases. So-called “Trump Trades” also lost steam.

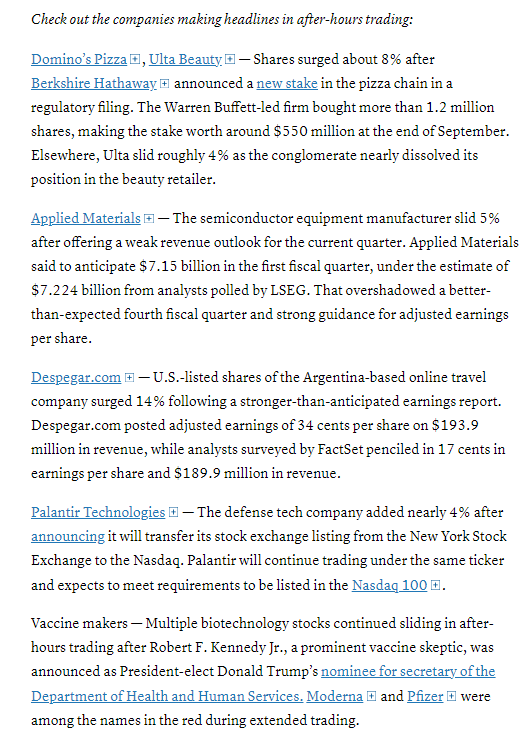

In after hours movers:

In corporate news from BBG:

Hims & Hers Health Inc. sank after Amazon.com Inc. said it would start marketing drugs to fight hair loss, an important component of the telehealth company’s business.

Meta Platforms Inc. was hit with a €798 million ($841 million) fine by European Union regulators by tying its Facebook Marketplace service to its sprawling social network, the US tech giant’s first ever penalty for EU antitrust violations.

ASML Holding NV, the Dutch maker of advanced chip-making machines that are critical to global supply chains, reaffirmed its long-term revenue outlook as it bets on an artificial intelligence-driven boom in semiconductor demand.

Ford Motor Co. agreed to a $165 million civil penalty to settle allegations the company failed to recall cars with defective rearview cameras in a timely manner, the second largest fine ever levied by the National Highway Traffic Safety Administration.

Merck & Co. licensed an experimental cancer antibody from a closely held Chinese company in a deal worth $588 million upfront, plus as much as $2.7 billion in milestone payments.

General Mills Inc., known for cereal brands such as Cheerios, made its fifth acquisition in the pet food sector since 2018 by buying the North American unit of Whitebridge Pet Brands in a deal valued at $1.45 billion.

Capri Holdings Ltd and Tapestry Inc. scrapped their $8.5 billion plan to merge after a court order froze the proposed combination of the US fashion companies due to antitrust regulators’ objections.

JD.com Inc.’s quarterly revenue rose 5.1%, a moderate expansion that suggests Chinese consumers are only cautiously spending again as Beijing tries to revitalize the economy.

Some tickers making moves at mid-day from CNBC.

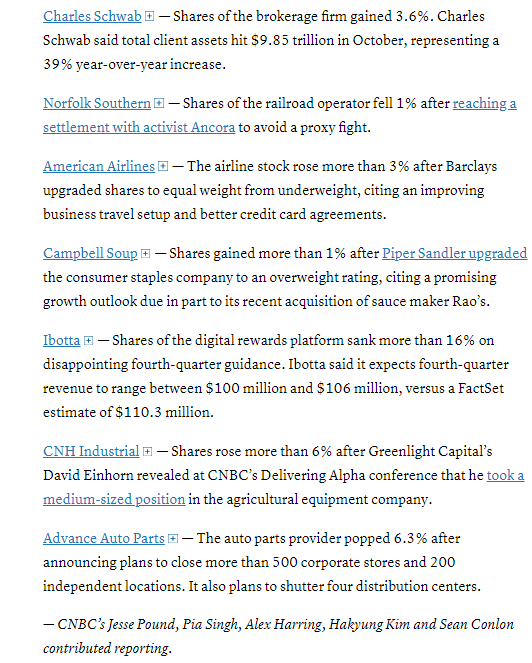

In US economic data:

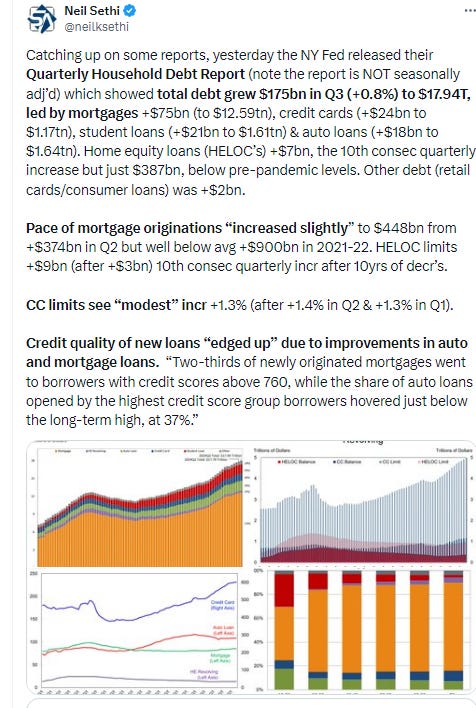

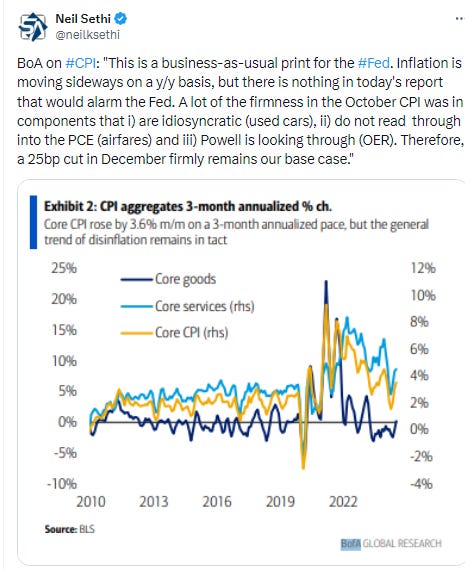

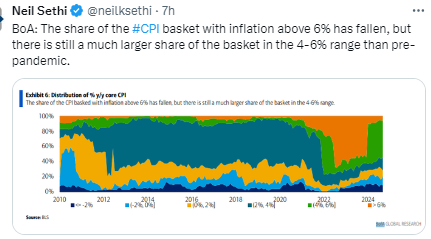

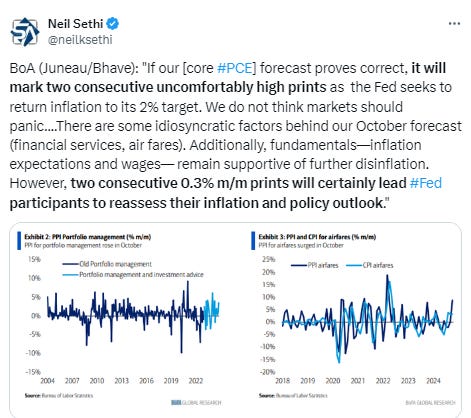

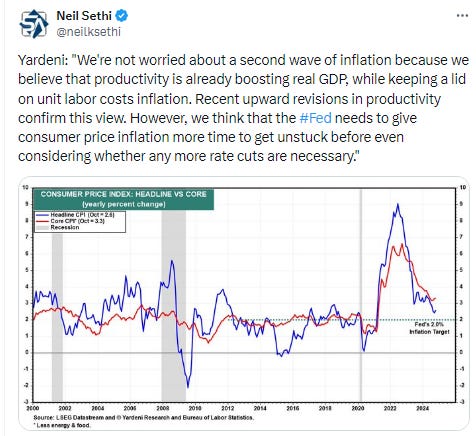

Producer prices for October were in line, but like CPI in line meant a continued firming in prices with the year-over-year figures trending higher across all key components.

Weekly jobless claims fell back.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX started to sag towards support after not being able to make further headway since Friday. Daily MACD and RSI remain mildly supportive.

The Nasdaq Composite similarly has started to sag towards support. Its daily MACD & RSI are similar.

RUT (Russell 2000) after getting to a tenth of a percent of an ATH has more of a waterfall type decline than a “sag”. Seems headed for a test of the 2300 breakout level. MACD remains supportive, but the RSI crossed from over to under 70 indicating loss of momentum.

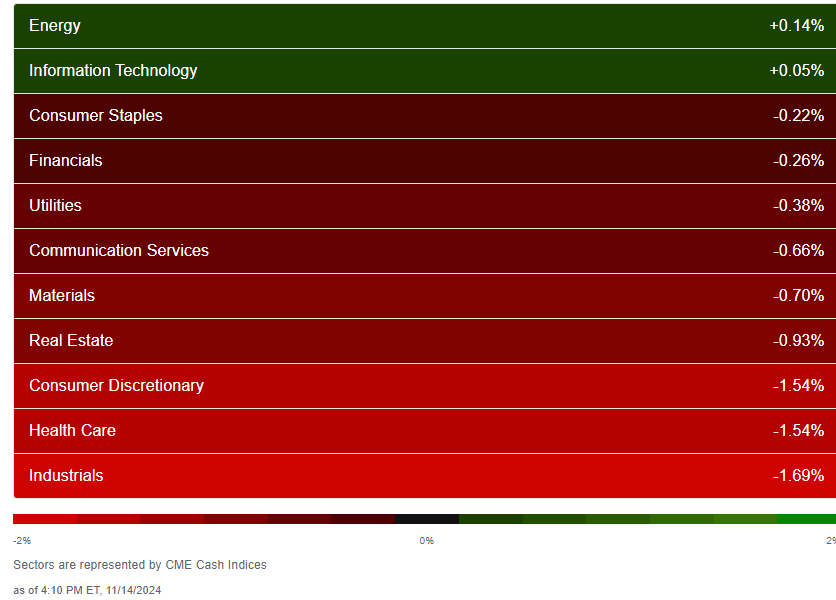

Equity sector breadth from CME Indices was one of the weakest this month with just 2 green sectors and neither up more than +0.14% (energy). Every red sector down more than that, with three down over -1.5%.

Stock-by-stock SPX chart from Finviz consistent w/quite a bit of red.

Positive volume was again not bad (but not great) on the NYSE but good on the Nasdaq at 39 & 51% respectively after both having been weak for 4 of the prior 5 days. The 39% is “ok” with both the SPX & RUT seeing solid losses while the 51% is quite good considering the Nasdaq was down over 100 points on the day. Issues were weaker again though at 36 & 30%. So while the positive volume (volume in gainers) has been good on the Nasdaq it’s been concentrated in just 30% of the names.

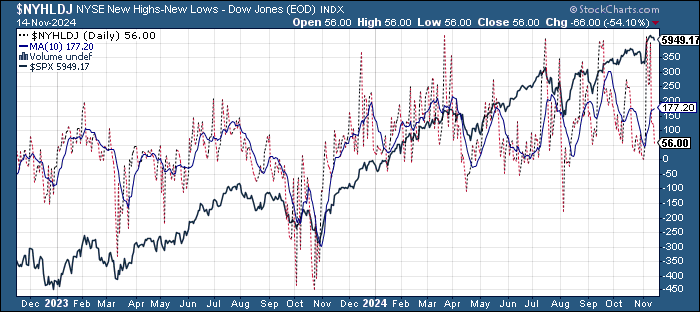

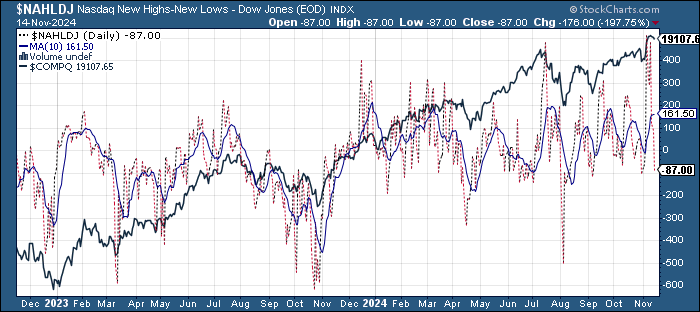

New highs-new lows though continued to drop to 55 and -88 (remember they were 404 & 483 respectively on Monday, which were not far from the best since early 2021). That’s the weakest since before Election Day. They remain below the 10-DMAs (less bullish), and now the DMA’s are flattening out.

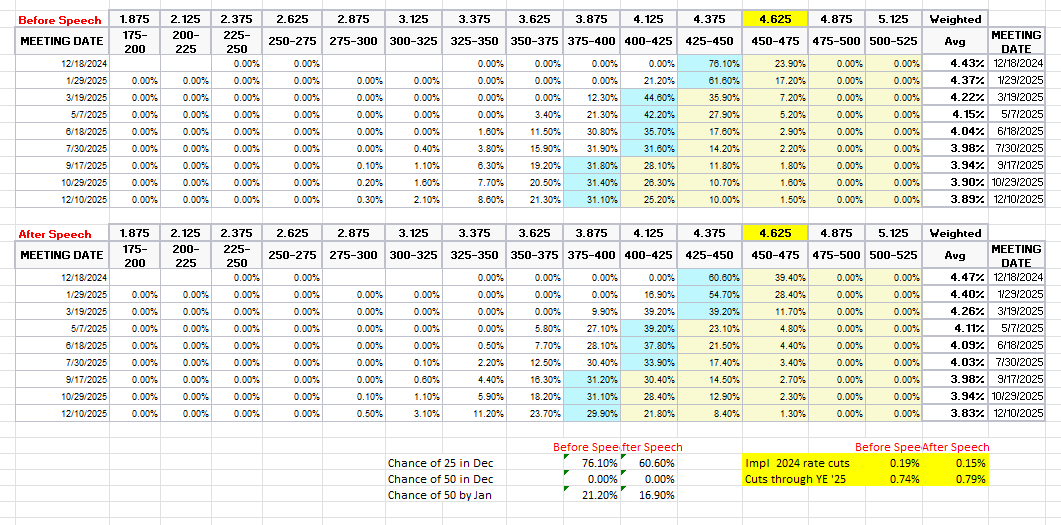

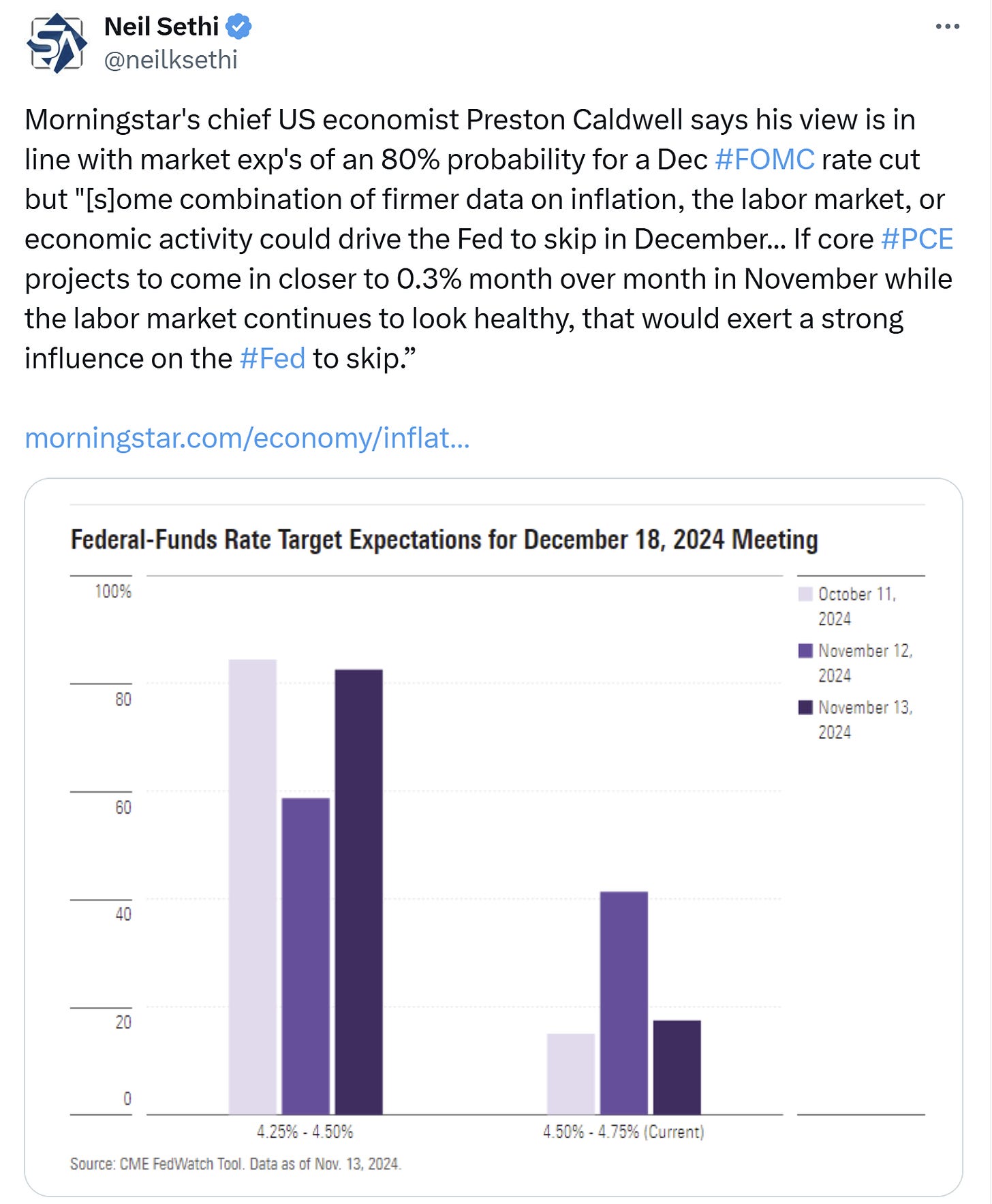

FOMC rate cut probabilities from CME’s Fedwatch tool as noted saw giveback of all of the firming of rate cuts this week (and then some) after the morning data, Fed commentary, and Powell’s speech although they did end up pricing back in some of the 2025 cuts. The chance of 25bps fell to 61% (from 82% Wed). Chances for 50bps through the Jan meeting fell to 17% (from 27%), but cuts priced through YE ‘25 was 79bps from 77 yesterday (but still down from around 100 pre-election).

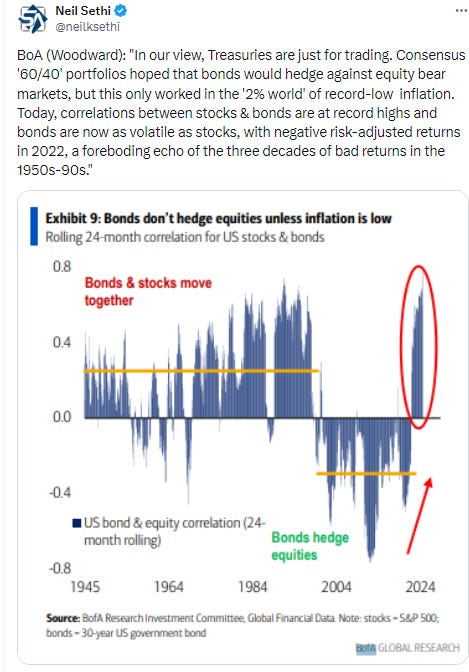

Treasury yields were volatile with the 10yr yield, more sensitive to longer term growth/inflation expectations, ending -3 basis points at 4.42% after at one point nearing 4.5% (identified by many as a “line in the sand”), still +70bps since the start of October. The 2yr yield, more sensitive to Fed policy, was +1bps to 4.29%, also off the highs but still the highest close since July. It’s up +63bps since the start of October.

Dollar ($DXY) continued its sharp run since the election, making it over the 107 level, near 2yr highs, and over the top of the channel I redrew. The 2023 high was $107.40. Daily MACD & RSI are supportive.

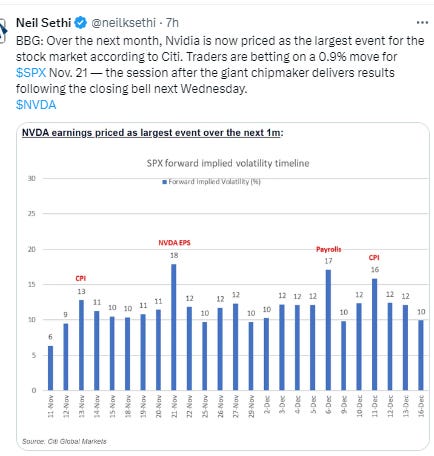

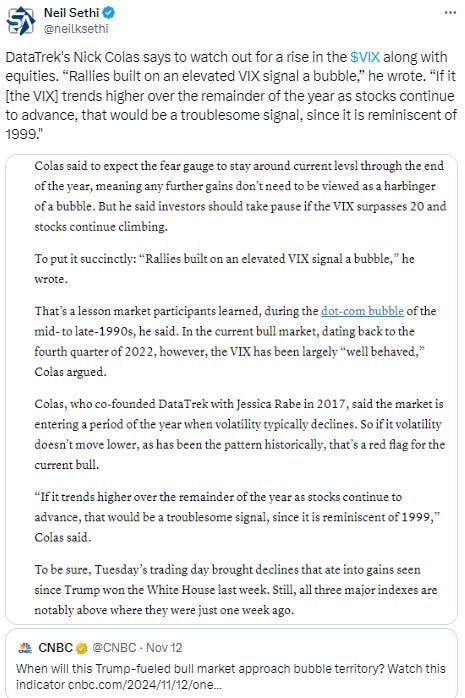

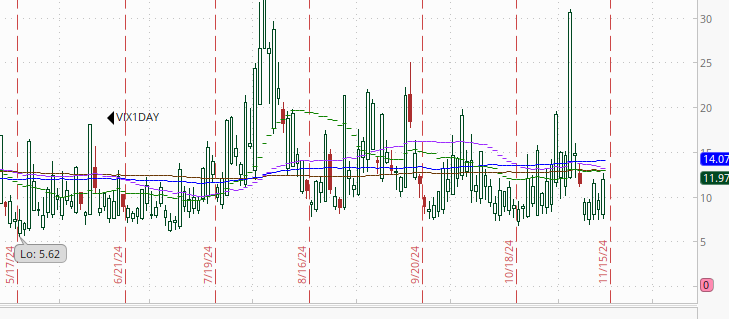

The VIX & VVIX (VIX of the VIX) were little changed with the former just off the lowest close since mid-July at 14.3 (consistent w/sub-1% daily moves over the next 30 days) and the latter at 94 (still consistent w/“moderate” daily moves in the VIX over the next 30 days).

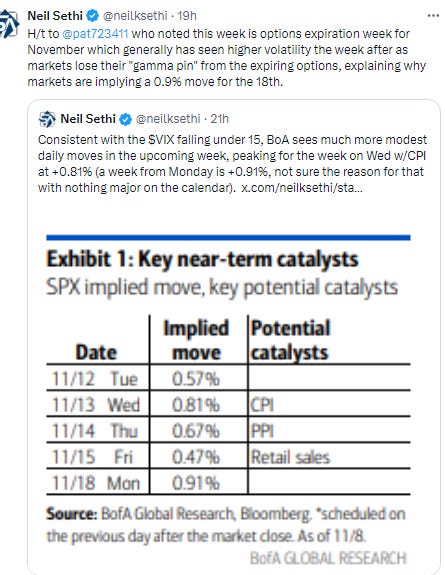

1-Day VIX jumped to highest since the day after the election following Powell although still just 12, so looking for a move of ~0.76% Thursday, above what BoA said was implied from options markets coming into the week.

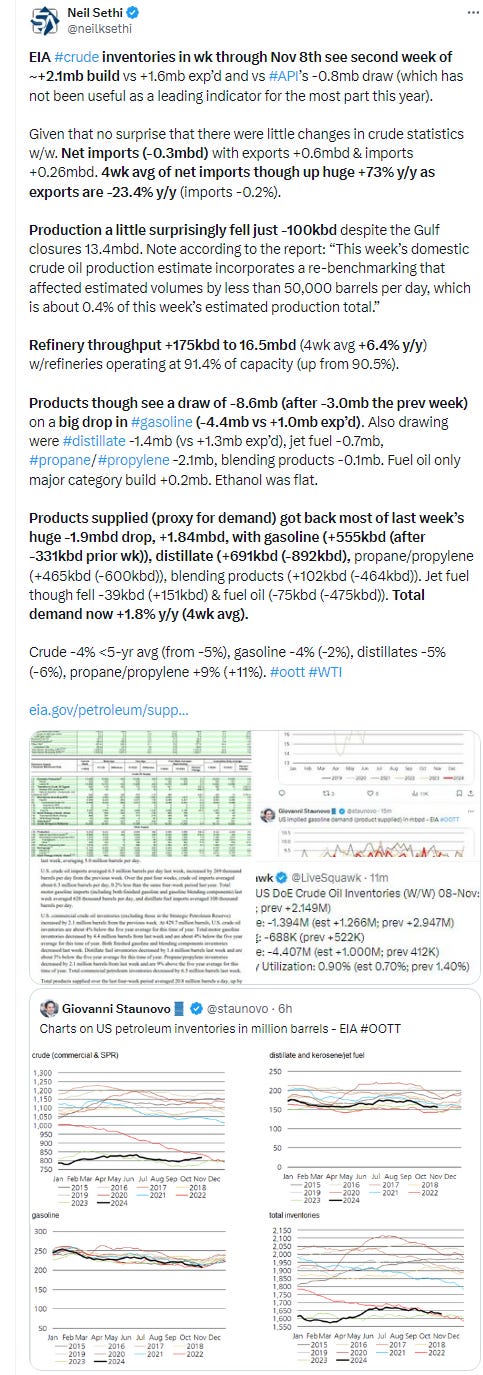

WTI continued its bounce after making it down to the $67 area target yesterday but most of it was sold during the day leaving it with a modest gain. As I said Wed on $67 “that’s an important support level.” Daily MACD & RSI remain tilted negative but not strongly.

Gold fell for the 6th day in 7 to a 2-mth low, falling under the support/resistance line noted by Helene Meisler at Real Money as well as the 100-DMA before recovering. As I said Wednesday, “we’ll see if that holds given as noted Monday the daily MACD is firmly in ‘sell longs’ positioning, and the RSI is now the weakest since Oct ‘23.”

Copper (/HG) also fell for 6th day in 7 to the lowest close in 3 mths, making it to the the $4 secondary target where, like crude with $67, it bounced sharply to cut most of its losses. Unfortunately the daily MACD & RSI as noted Monday are in a negative positioning so not super confident we don’t test that important level again.

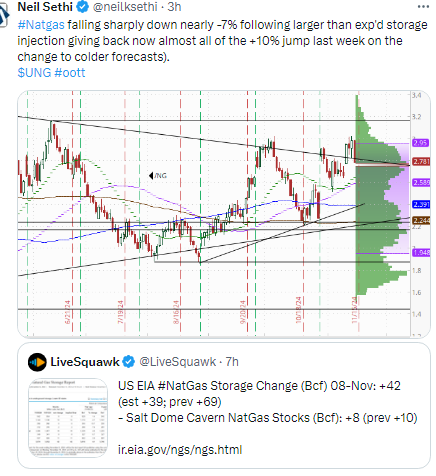

Nat gas (/NG) fell sharply after a bearish storage report from its highest close in 5 mths. It’s now given back most of the gains from its 10% rally last week, back under the downtrend line from the Nov ‘23 highs it had only closed over one day previous to Monday (now though it’s still just 4 total days so I’m leaving it on the chart). The MACD & RSI remain positive for now.

Bitcoin futures again traded over but couldn’t close over the $90k level. I noted Friday it had gotten very extended but that it had gotten more extended in February, so we’ll see if it has one more push in it that can keep it over that level.

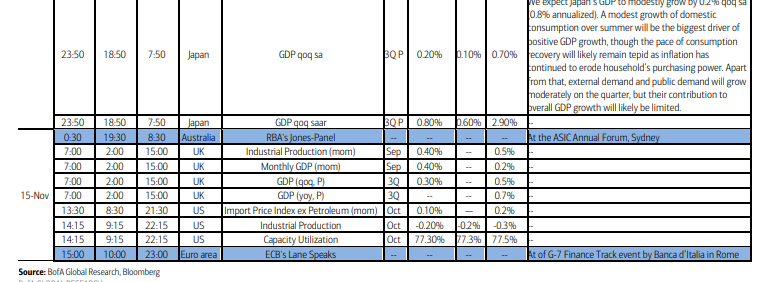

The Day Ahead

A full slate of US economic data tomorrow in Oct retail sales, industrial production, and import prices, and final Sept biz inventories.

In terms of Fed speakers, we just get Williams again in the afternoon.

Earnings will be light with no SPX reporters, although we’ll get some other earnings of note including Alibaba Group Holding (BABA)(see the full earnings calendar from Seeking Alpha).

Ex-US the highlights are the monthly China “data dump” which includes industrial production, retail sales, fixed investment, unemployment, etc., and 3Q GDP figures from Japan & the UK. Outside of the China data in EM we’ll get some trade data from India.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,