Markets Update - 11/18/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

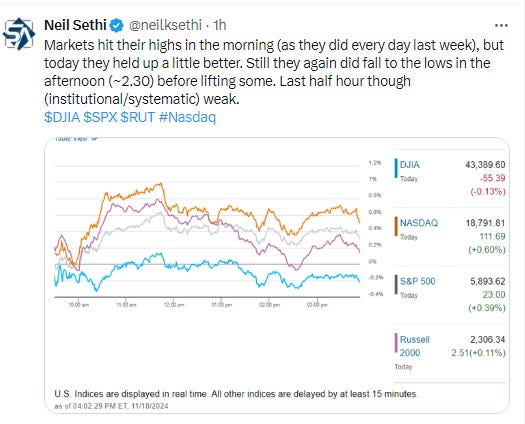

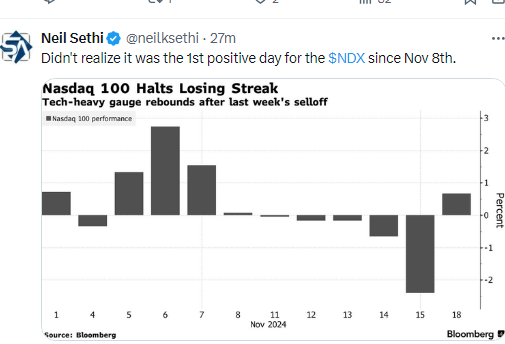

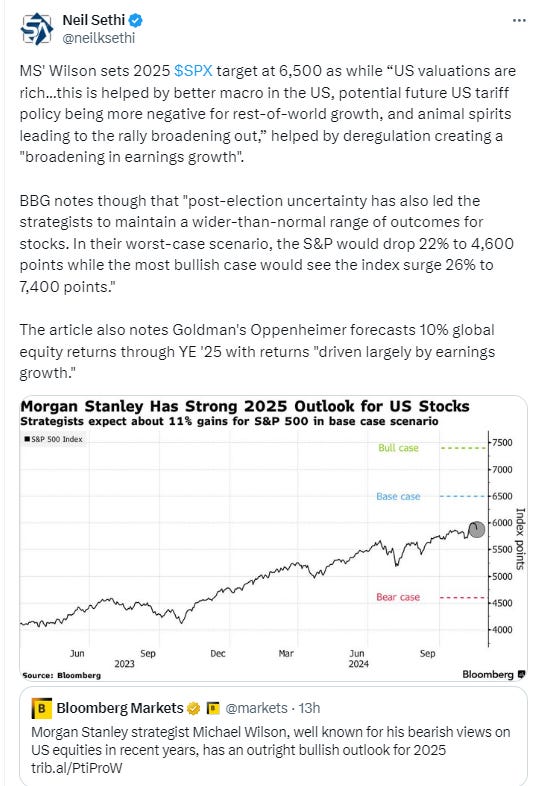

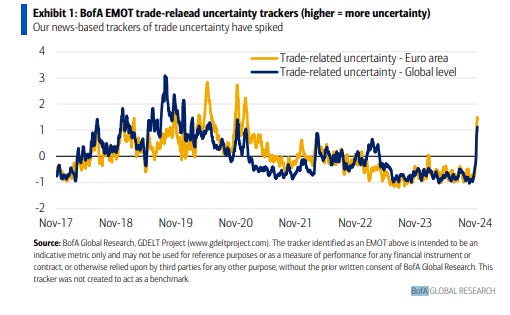

US equity indices rebounded Monday from the worst week in 2 months with modest gains including from larger growth stocks which saw the Nasdaq 100 in the green for the 1st time since Nov 8th (longest losing streak since Jan). The S&P 500 and Russell 2000 also managed to stay in the green as markets welcomed pullbacks in yields and the dollar and as they await the highlight of the week in Nvidia’s earnings Wednesday (which fell on a negative news headline).

With the dollar and yields falling, commodities took advantage with gold, copper, crude, and nat gas all gaining. Bitcoin was little changed remaining above the $90k level.

The market-cap weighted S&P 500 was +0.4%, the equal weighted S&P 500 index (SPXEW) +0.4%, Nasdaq Composite +0.6% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +1.1%, and the Russell 2000 +0.1%.

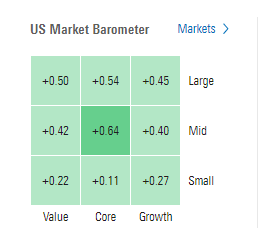

Morningstar style box all green and very balanced.

Market commentary:

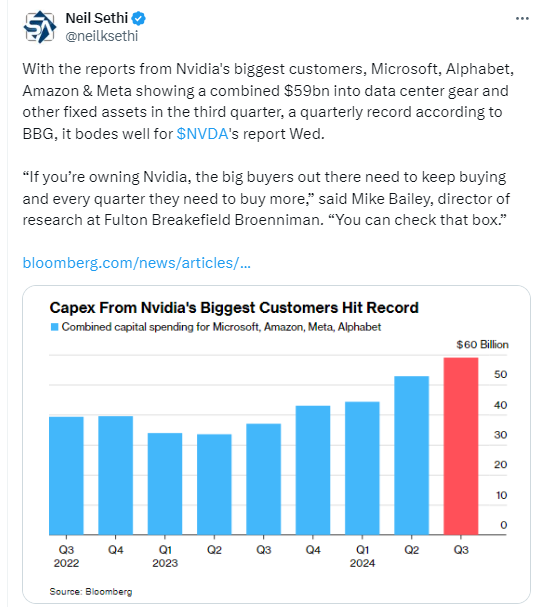

“The star this week is our friend Nvidia,” said Kim Forrest, chief investment officer at Bokeh Capital Partners, she said highlighting its important to all the key indexes with its recent inclusion in the Dow. “Unless some information comes out before then, the market is going to wait and see what’s going on with Nvidia.”

“Just when you thought it was a good point to have a lie down after a busy few weeks, the biggest global earnings event happens after the bell on Wednesday with $3.48 trillion of market cap at stake,” said Jim Reid, head of global economics and thematic research at the bank. Following that release, he will be watching the global flash purchasing managers’ index readings slated for Friday. Economists polled by Dow Jones expect the manufacturing index to come in at 48.8, while the services reading should be at 55. “They may capture some of the initial sentiment impact from around the world regarding Trump’s victory,” he said. “Europe will be especially interesting on this front as the continent awaits their trade fate.”

“Traders appear to be gauging the potential impact of a new Trump administration’s policies on the economy, and the possibility that the Fed may slow down its rate-cutting campaign,” said Chris Larkin at E*Trade from Morgan Stanley. “With a relatively light economic calendar this week, the focus will shift to earnings — especially Nvidia’s, which have the potential to dictate the market’s short-term momentum.”

The S&P had its biggest loss last week since early Sept and has now erased 60% of its post-election bump. RBC's Lori Calvasina: "Over the past week we’ve become increasingly convinced the S&P 500 may have already begun to experience another 5-10% drawdown."

“The reality is if it is 10-year yields moving up, are people starting to worry about the Fed?” Lori Calvasina, head of US equity strategy at RBC Capital Markets, said in an interview with Bloomberg TV. “There is all this stuff going in politics with the picks, the tariff discussion again.”

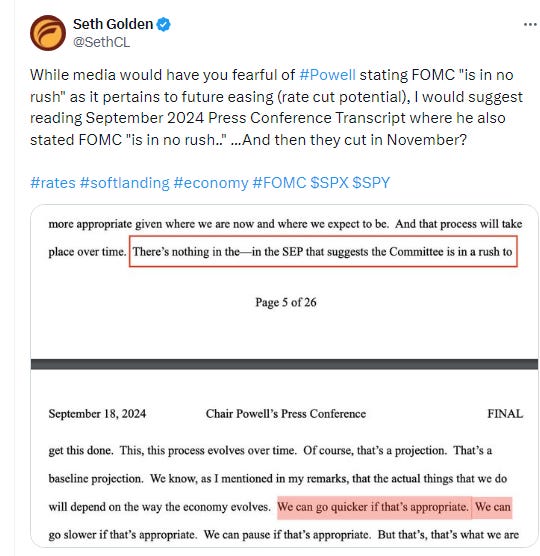

Jim Baird, chief investment officer at Plante Moran Financial Advisors, said recent signs of continued strength for the economy could lead to the Fed slowing its pace of cuts. “It is going to call into question how much more they need to cut, and how quickly. I think that’s what they’ve really been hinting at — that they’re going to be patient, they’re going to be data dependent, and that could mean a slower pace of rate cuts than either their forecasts have suggested or the market was expecting,” Baird said. Baird added that the effect of the election, such as the potential for higher tariffs under President-elect Donald Trump, “exacerbate” those questions about how much the Fed will cut.

In individual stock action, strength in mega-cap stocks and semiconductor-related names contributed to overall index gains. However, NVIDIA (NVDA 140.15, -1.83, -1.3%) was among the outliers, trading lower after reports from The Information suggested customers are concerned about overheating issues with its AI chips. The company is set to report earnings after Wednesday's close. Tesla (TSLA 338.74, +18.02, +5.6%) though was up sharply, extending its post-election rally on news from Bloomberg that the Trump administration may ease regulations on self-driving cars. The stock has surged 37.8% since November 5. Apple and Netflix gained 1.3% and 2.8%, respectively, while Advanced Micro Devices surged 3%.

CVS Health shares popped 5% after agreeing to add four new board members. Super Micro Computer skyrocketed about 16% following a Barron’s report that the AI server maker intends to file a plan for its annual report to avert a Nasdaq delisting. The health care sector settled little changed from Friday, weighed down by Eli Lilly (LLY 727.20, -19.00, -2.6%) after reports that some Republican Senators are reportedly open to Robert F. Kennedy Jr.'s nomination for Secretary of Health and Human Services.

Corporate Highlights from BBG:

Nvidia Corp. dropped after the Information reported that the chip giant has asked its suppliers to change the design of the server racks for its new Blackwell graphics processing unit due to an overheating problem.

Super Micro Computer Inc. climbed as the server maker approaches a Monday deadline to either file a delayed 10-K annual report or submit a plan to file the form to Nasdaq in order to remain listed on the exchange.

MicroStrategy Inc. bought about 51,780 Bitcoin for around $4.6 billion, the largest purchase by the crypto hedge-fund proxy since it began acquiring the digital-asset more than four years ago.

Spirit Airlines Inc. has filed for bankruptcy in the wake of greater competition from rival carriers and financial troubles following its scuttled merger with JetBlue Airways Corp.

CVS Health Corp. named Glenview Capital Management founder Larry Robbins to its board as part of an agreement with the activist firm that’s been pressuring the company for change.

President-elect Donald Trump nominated Chris Wright, the chief executive officer of Liberty Energy Inc., to lead the Energy Department.

Newmont Corp. agreed to sell its Musselwhite gold mine in Ontario to Orla Mining Ltd. for up to $850 million as part of a divestment campaign designed to boost shareholder returns.

Hewlett Packard Enterprise Co. was upgraded at Raymond James to strong buy from outperform.

Moderna Inc. was upgraded to buy from hold at HSBC, with analysts saying the market isn’t giving enough credit to the firm’s pipeline.

Biogen Inc. was downgraded to hold from buy at Needham, which said it does not see a “meaningful source of upside” for the stock in the next 12 months.

Some tickers making moves at mid-day from CNBC.

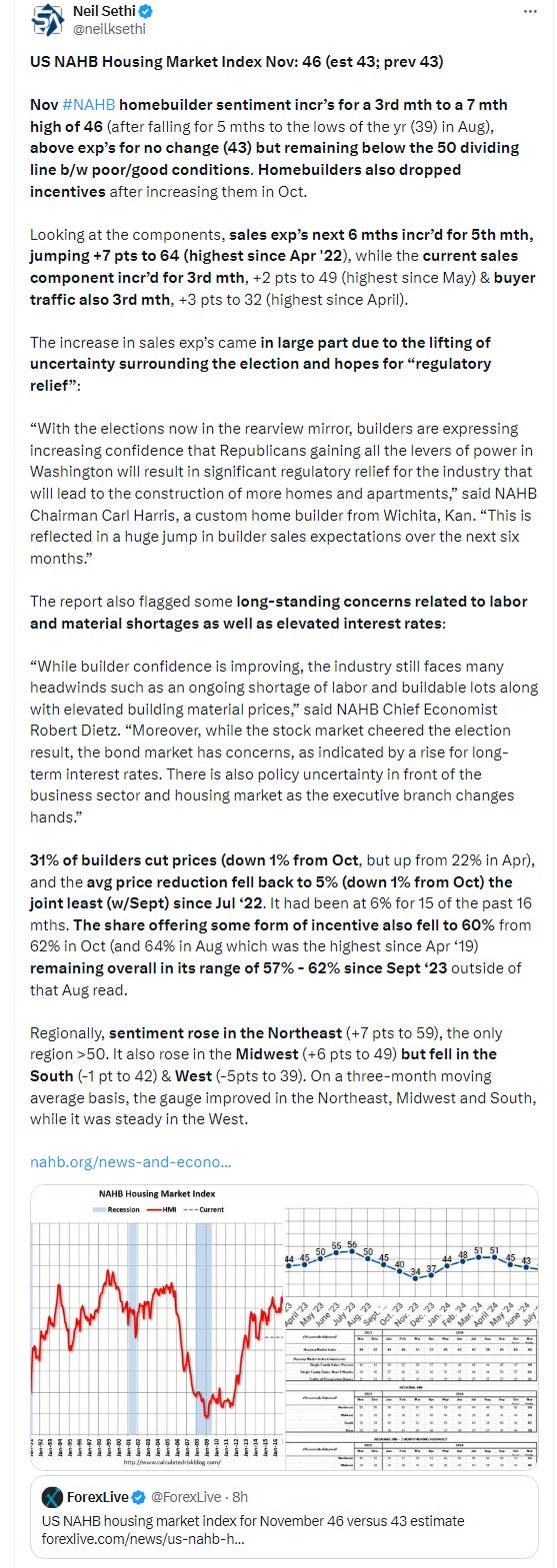

The lighter week in US economic data kicked off with the NAHB homebuilder sentiment index which moved to a 7-mth high (although remained below the 50 mark dividing “poor” from “good”. Still sales expectations moved to the highest since Apr ‘22 and builders pared incentives.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX was able to find some support at its 20-DMA, hanging just above the gap from the post-Election Day open, but its MACD still did cross over to “sell longs”. 14-day RSI also very close to turning negative.

The Nasdaq Composite, similar to the SPX, able to hold its 20-DMA and sits right around its breakout level having given up all of its gains since the post-election open. It also saw its daily MACD cross to “sell longs” & its 14-day RSI also close to turning negative.

RUT (Russell 2000) able to stop the “waterfall” decline at the breakout level from the post-election open also at its 20-DMA, the target from last week. It also has seen its daily MACD cross over to “sell longs”.

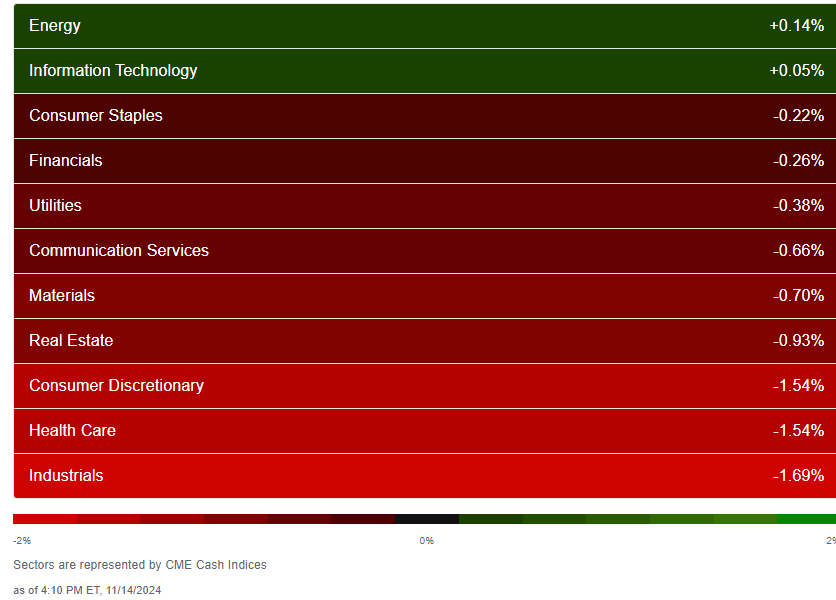

Equity sector breadth from CME Indices much improved Monday with 9 of 11 sectors up (more than we had Thurs & Fri combined), and 7 were up +0.6% or more (2 up >1%). Good mix of sectors with no particular style dominating. Also, the 2 red sectors were barely so.

Stock-by-stock SPX chart from Finviz consistent w/quite a bit of red.

Positive volume improved Monday as would be expected with the more positive index action again not bad (but not great) on the NYSE but better on the Nasdaq at 62 & 69% respectively. Those are about where it was last Monday when the indices were up a little less though. Issues continued to be weaker though at 57 & 49%.

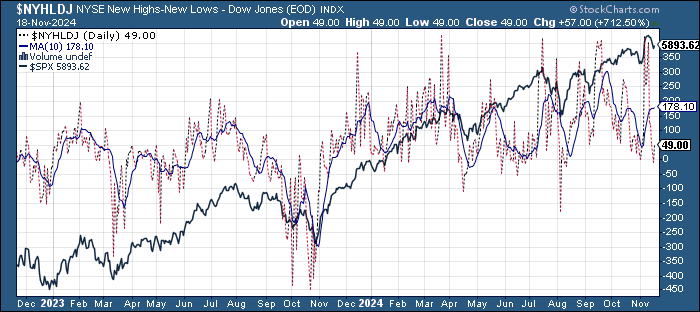

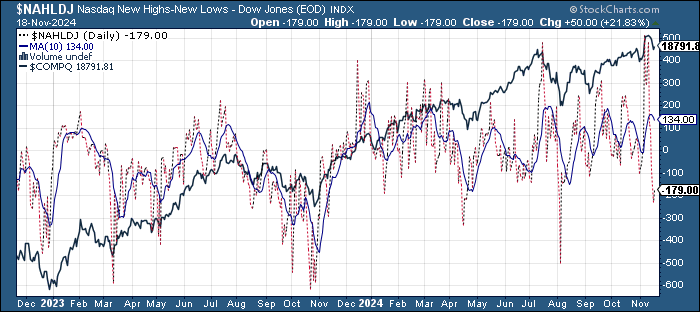

New highs-new lows also improved but remained pretty weak at 45 & -179 respectively. That’s up from -8 and -229 Friday, the worst since Aug, but remember they were 404 & 483 respectively a week ago (not far from the best since early 2021). They remain well below the 10-DMAs (less bullish), and the DMA’s continue to roll over.

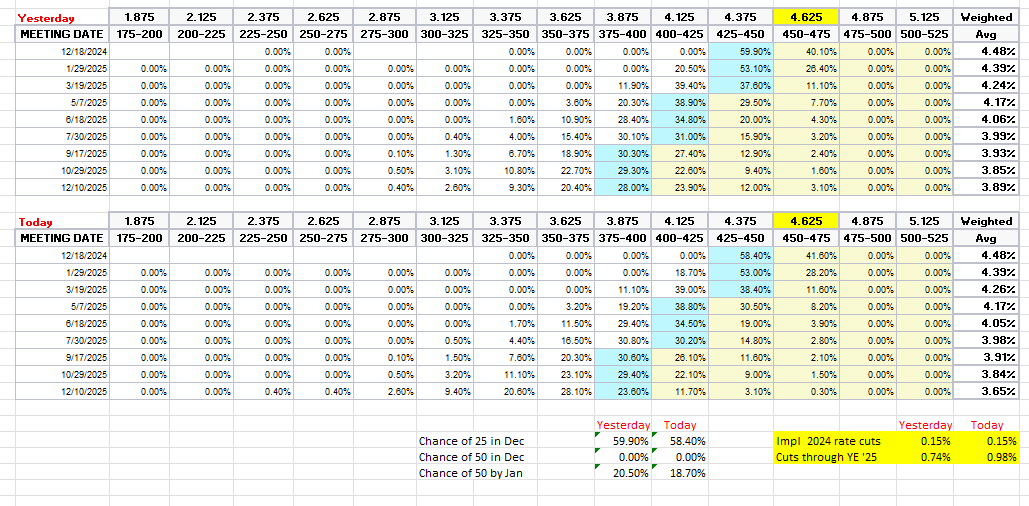

FOMC rate cut probabilities from CME’s Fedwatch tool were little changed except for what looks like a data error as to the Dec 2025 contract. The chance of a December cut is at 59%, and around 75bps priced through Oct ‘25, but Dec ‘25 jumps to 98bps. That has to be a data error, so I’m ignoring it for now.

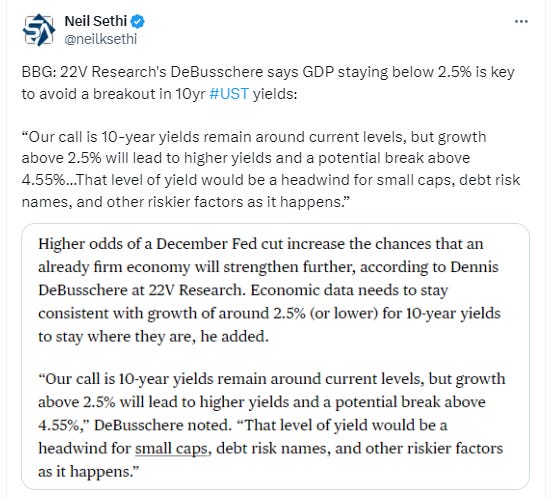

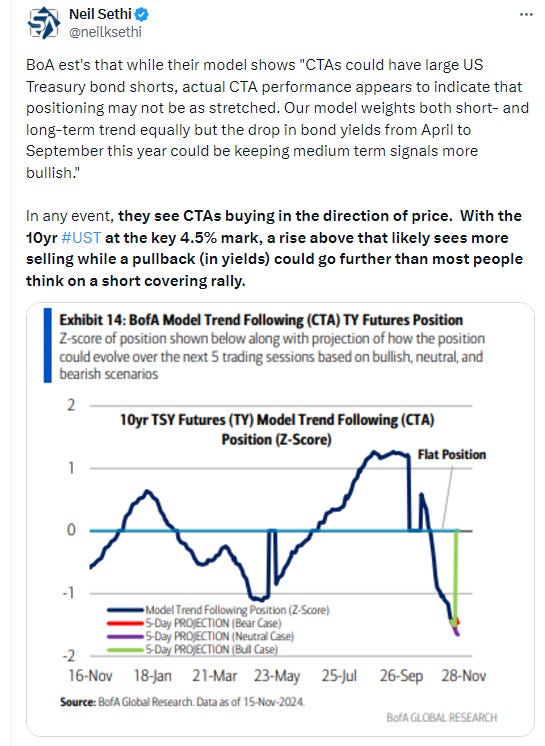

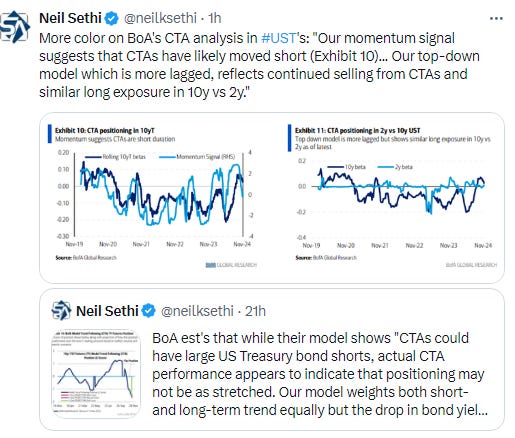

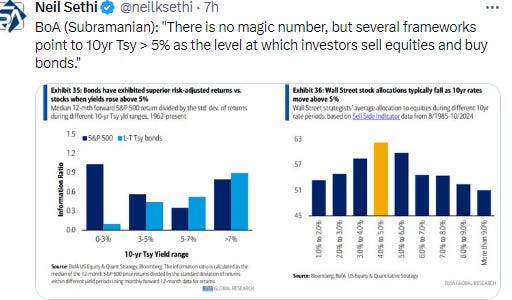

Treasury yields again Monday, like Thursday & Friday, moved higher in the morning, with the 10yr yield, more sensitive to economic growth and long-term inflation, again challenging the 4.5% level (identified by many as a “line in the sand”), before falling back to finish down 1 basis point at 4.41%. The 2yr yield, more sensitive to Fed policy, was -2bps to 4.28%. Both remain near the highest since July.

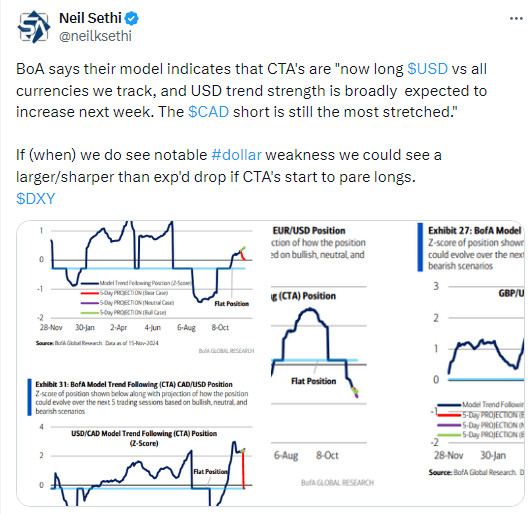

Dollar ($DXY) fell back for a 2nd day after again being rejected at the 107 level, now in the middle of the uptrend channel running back to September it’s only closed outside of for one session. The bottom of the channel is way down at 105. Daily MACD & RSI remain supportive but the RSI has crossed from over to under 70 indicative of a loss of momentum.

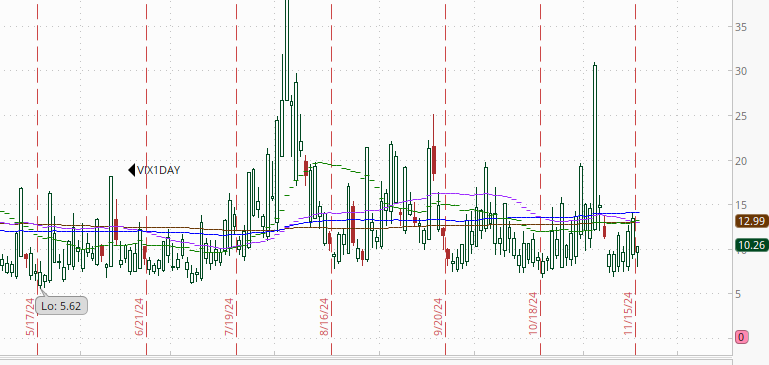

The VIX & VVIX (VIX of the VIX) both fell back although remained above last week’s levels. The former is at 15.6 (consistent w/around 1% daily moves over the next 30 days) and the latter to 93 (consistent with “moderately high” daily moves in the VIX over the next 30 days).

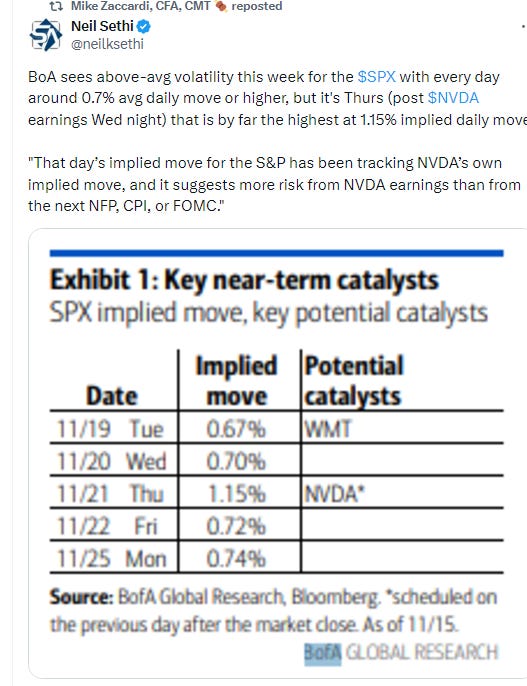

1-Day VIX dropped back after having hit the highest since the day after the election Friday a good sign signaling that the high gamma into monthly options expiration was reset. Now at 10.3, it’s looking for a move of ~0.65% Tuesday, in-line with what BoA said was implied from options markets coming into the week.

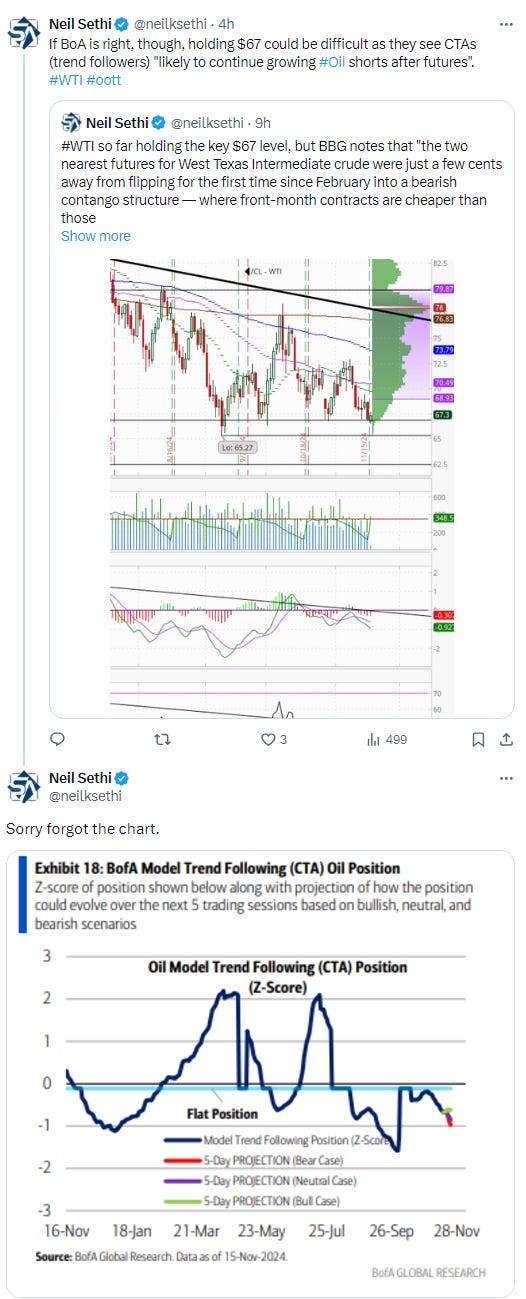

WTI like gold got a much needed bounce from important support, in WTI’s case $67, a level it had previously closed under only once (Sept 10th) in nearly 3 yrs (since Dec ‘21). As I said Friday, “there’s mild support down to the Sept 10th intraday low of $65.27 but this area really needs to hold or we’re looking back 3 years for support levels, not a great situation. Daily MACD & RSI are no help, remaining tilted negative.” So far just a bounce in a clear downtrend. It really needs to at the very least get back over the $70 level to at all change the picture.

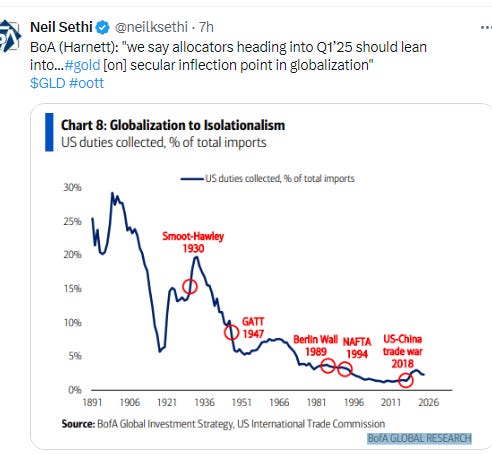

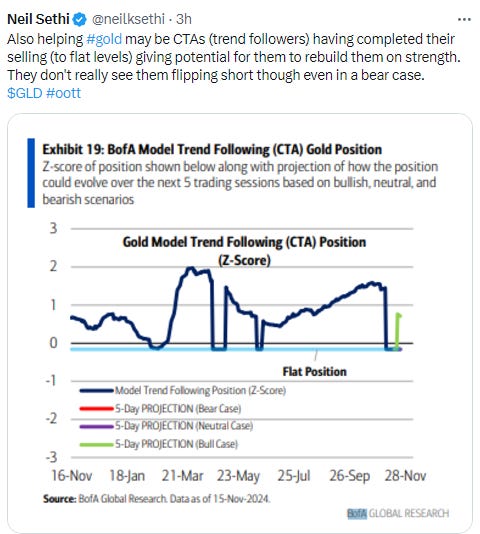

Gold was up for only the 2nd session in 9, but it was good timing as it was, as I said Friday, “hang[ing] on to its 100-DMA by its fingernails.” In this case the weak dollar and some positive headlines (notably a bullish call from Goldman) overcame the negative signals from the daily MACD and RSI (that latter of which bounced from the weakest since Oct ‘23). A clean break of the 100-DMA would have targeted the $2400 area.

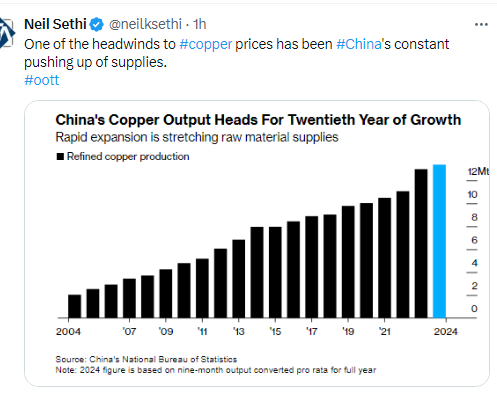

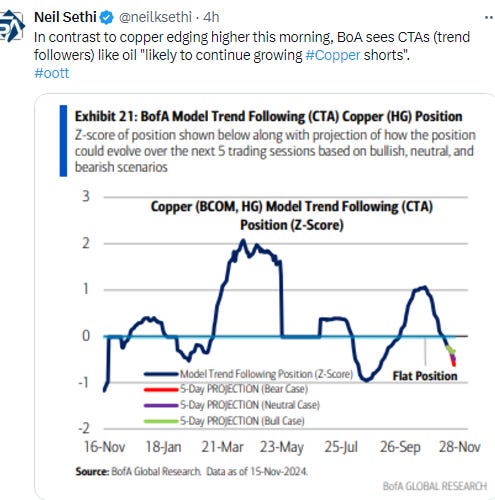

Copper (/HG) like gold was up for only the 2nd time in 9 sessions, taking advantage of the decline in the dollar. Daily MACD & RSI as noted last Monday though are in a negative positioning.

Nat gas (/NG) continued to bounce from its 20-DMA but couldn’t get to last week’s highs and remains below $3. The daily MACD & RSI remain positive for now.

Bitcoin futures technically a down session but they at one point were higher and put in a higher low, so I’d say all-in-all the bullish momentum is intact. I said last week it had gotten very extended, but that it had gotten more extended in February, so I continue to think Katie Stockton’s target of $97.5k is certainly doable.

The Day Ahead

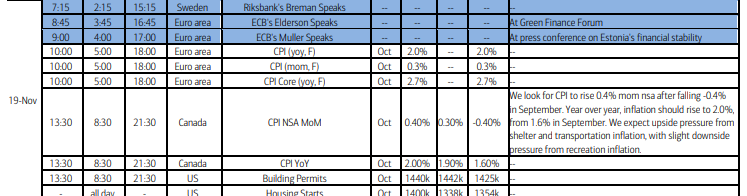

The lighter US economic data week continues with just housing starts and permits on Tuesday.

Don’t think there are any Fed speakers, and no Treasury note or bond auctions.

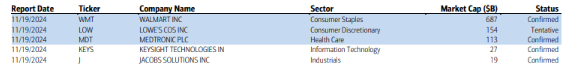

Earnings will be heavier though with five SPX reporters, three of which are >$100bn in market cap in Walmart (WMT), Lowe’s (LOW), and Medtronic (MDT) (see the full earnings calendar from Seeking Alpha).

Ex-US the highlights are Oct CPI reports from the EU & Canada. In EM we’ll get a policy decision from Hungary (no change is expected).

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,