Markets Update - 11/19/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

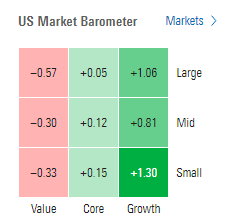

US equity indices continued their rebound Tuesday recovering from a down open following the escalations in the Ukraine/Russia conflict and ahead of Nvidia’s key earnings report tomorrow after the close. But unlike Monday’s relatively broad rally, Tuesday was concentrated in growth stocks led by tomorrow’s star Nvidia gaining nearly 5%. Bloomberg’s gauge of the “Magnificent Seven” was up +1.7%. The S&P 500 equal weighted index though fell -0.3%.

Bond yields and the dollar fell back for a 3rd day again seeing gold, copper, and crude take advantage. Nat gas was little changed while bitcoin pushed to another ATH.

The market-cap weighted S&P 500 was +0.%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite +1.0% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +0.6%, and the Russell 2000 +0.8%.

Morningstar style box showed the tilt to growth.

Market commentary:

“Rising geopolitical tensions has been and continues to be a risk for markets,” said Gaurav Mallik, chief investment officer at Pallas Capital Advisors. “The combination of Russia ratcheting up its war rhetoric and uncertainty about how the incoming U.S. presidential administration will respond, is a recipe for stock market volatility.”

“The market has been in an uptrend because of a strong economy, the Fed continually cutting rates, and strong Q3 earnings,” said Andrew Slimmon, Morgan Stanley Investment Management’s head of the applied equity advisors team. “The market is set up well for equities, and investors are not going to see the pullback they want.”

“The underlying trend for the market is positive,” said Keith Lerner, Truist’s co-chief investment officer. “The geopolitical stuff — that’s certainly a risk — but you’re seeing some modest selling. I’m not seeing panic. It’s more of a digestion of the recent gains.”

To Gaurav Mallik at Pallas Capital Advisors, geopolitical uncertainties are indeed a recipe for volatility. As for Nvidia’s results, he’s expecting strong numbers, citing capital expenditure by big tech and his view that there’s still “no clear substitute” for the company’s chips.

“This market is fickle,” said Nancy Tengler at Laffer Tengler Investments. “Stocks ultimately trade on earnings and they have been great. I don’t recommend stocks ahead of earnings, but if NVDA sells off, jump in.”

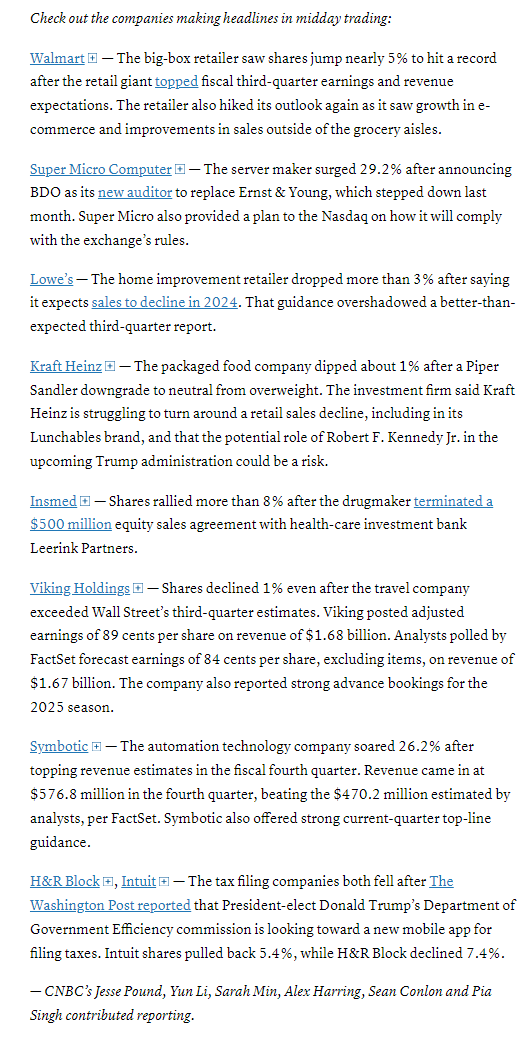

In individual stock action, Nvidia, which gained nearly 5% ahead of its closely watched earnings report Wednesday. Walmart added 3% after posting better-than-expected earnings and hiking its outlook on strong discretionary spending. Tesla rose 2%, bringing its month-to-date rally to 38%. Shares are headed for their best month since January 2023. Alphabet and Amazon also added more than 1% each. Some defense-related names benefitted from the rising tensions overseas. Dow component Boeing (BA 145.60, +1.73, +1.2%) was a standout in that respect.

After hours movers from CNBC:

Corporate Highlights from BBG:

Walmart Inc. boosted its outlook for the year on a solid start to the holiday season and strong demand from US consumers searching for value.

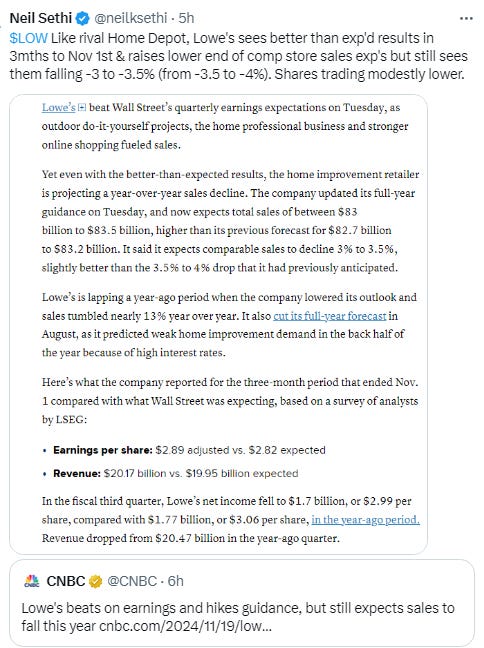

Lowe’s Cos. extended its streak of declining sales during the third quarter as it continued to feel the ripple effects of a weak housing market.

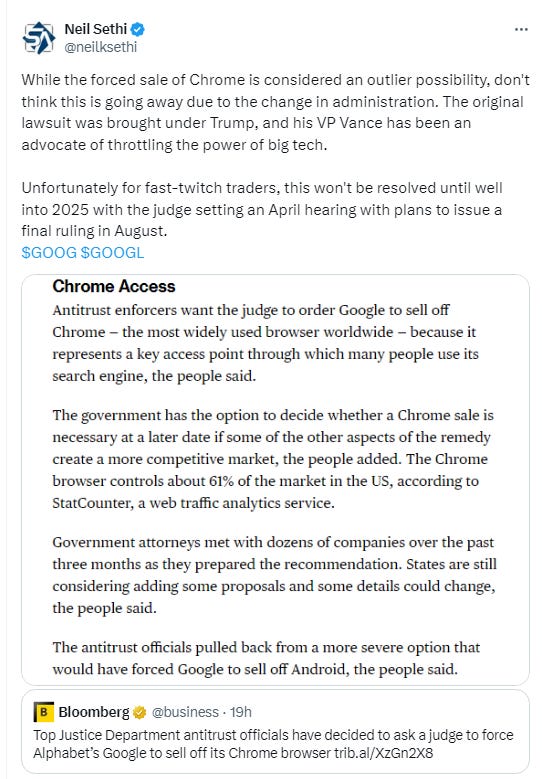

Alphabet Inc.’s Chrome browser could go for as much as $20 billion if a judge agrees to a Justice Department proposal to sell the business, in what would be a historic crackdown on one of the world’s biggest tech companies.

Super Micro Computer Inc. hired a new auditor and filed a plan to come into compliance with Nasdaq listing requirements.

Hewlett Packard Enterprise Co. and Juniper Networks Inc. representatives met with Justice Department antitrust enforcers last week in a final effort to persuade the agency not to challenge their proposed $14 billion deal, according to people familiar with the matter.

Some tickers making moves at mid-day from CNBC.

The lighter week in US economic data continued:

Housing starts and permits, which both fell more than expected although there was a clear hurricane influence with starts as they fell sharply in the South.

The state-level payrolls data from Oct gave us some indication of the job losses from hurricanes (which the BLS said were too difficult to estimate at the time of the original NFP report). Those appear to have been around 60-65k (ING estimate) meaning without hurricanes and Boeing strike (-44k) Oct payrolls would have been around 120k.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX continued its bounce from its 20-DMA, edging into the gap from last Friday’s drop. Its daily MACD & RSI are mixed.

The Nasdaq Composite also continued its bounce from its 20-DMA edging into the gap from the drop last Friday. It daily MACD & RSI are mixed.

RUT (Russell 2000) able to like the SPX & Nasdaq get a bounce from its 20-DMA. Its daily MACD & RSI are in the weakest positioning of the three though.

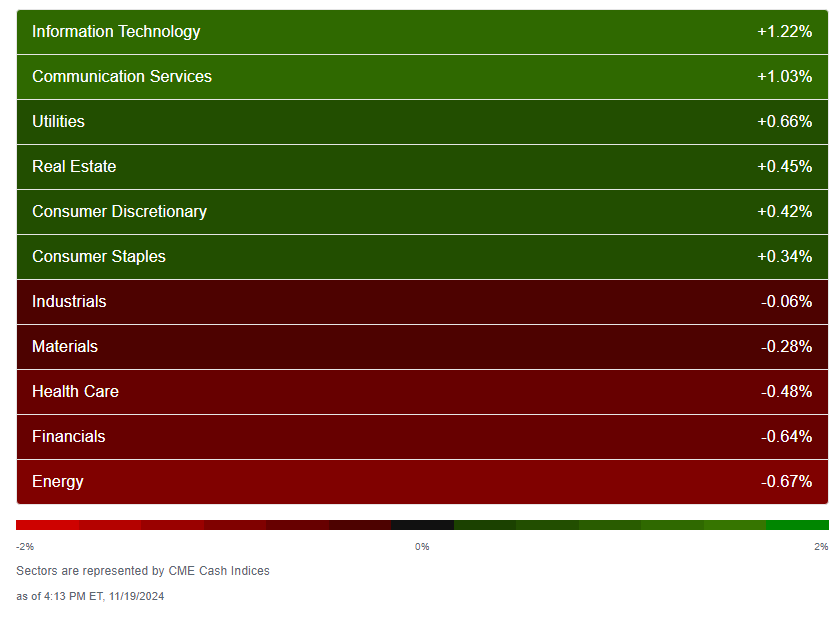

Equity sector breadth from CME Indices actually weaker Tuesday than Monday despite the stronger index action with 6 of 11 sectors up (down from 9), and just 3 were up +0.6% or more vs 7 Mon (2 up >1% same as Mon). While Monday saw a broad mix of sectors with no particular style dominating, today was dominated by growth shares. Of the 5 red sectors, four were down more than the worst sector Monday. So under the hood a weaker day.

Stock-by-stock SPX chart from Finviz consistent w/quite a bit of red.

Positive volume was mixed Tuesday with the NYSE continuing to lag at 50%, an understandable result with the NYSE composite flat on the day but still disappointing with the SPX & RUT firmly in the green. Nasdaq on the other hand was pretty good at 72%, the best in nearly 2 weeks. Issues continued to be (much) weaker though at 46 & 54%.

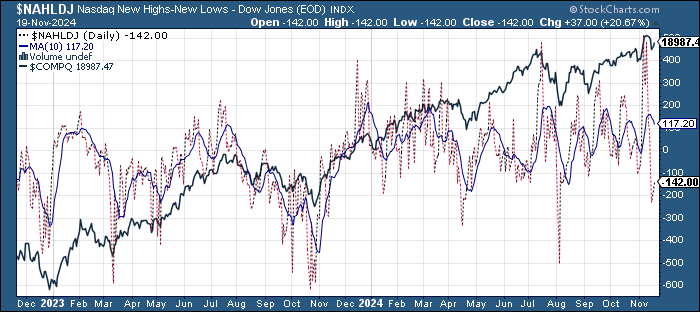

New highs-new lows were also mixed w/the NYSE falling back to 30 from 45 while the Nasdaq improved to -146 from -179. Still given they were 404 & 483 respectively a little over a week ago, they remain weak and well below the 10-DMAs (less bullish), with the DMA’s continuing to roll over.

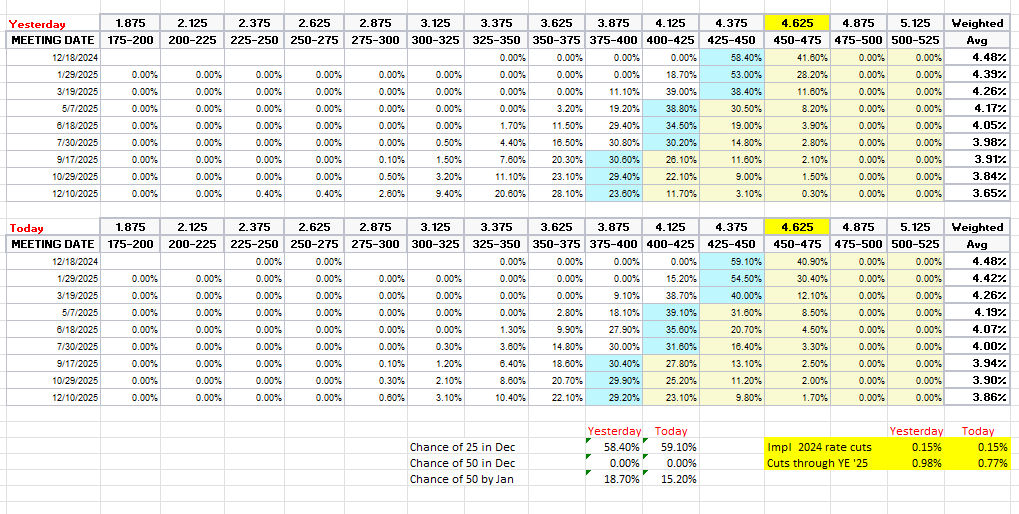

FOMC rate cut probabilities from CME’s Fedwatch tool were little changed (after CME fixed their data error as to the Dec 2025 contract). The chance of a December cut is at 59%, and around 77bps of cuts priced through end of 2025.

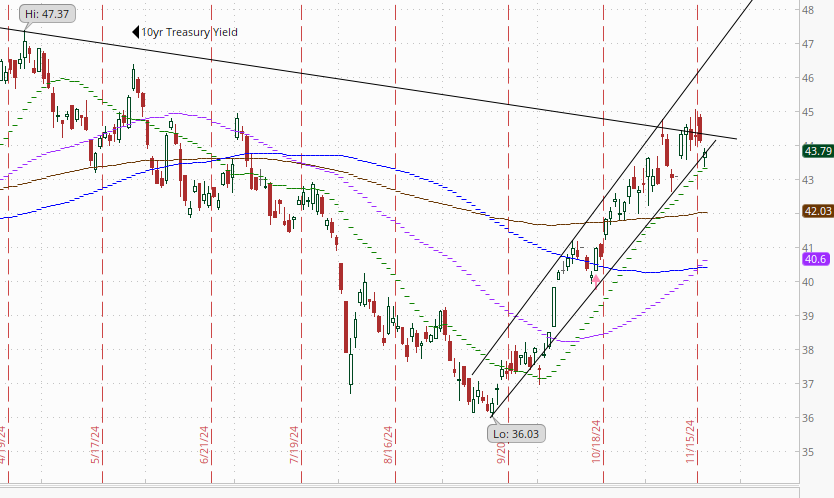

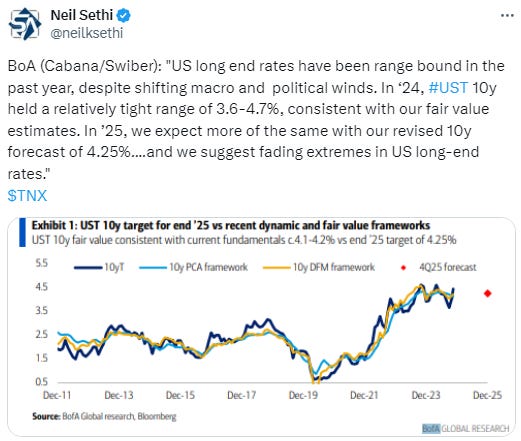

Treasury yields fell in the early going on the geopolitical jitters but pared those losses (esp on the front end) during the session with the 10yr yield, more sensitive to economic growth and long-term inflation, -4 basis points to 4.38%, falling further away from the 4.5% level (identified by many as a “line in the sand”). The 2yr yield, more sensitive to Fed policy, was -1bp to 4.27%. Both still remain near the highest since July (but the 10yr is just holding onto support at this point).

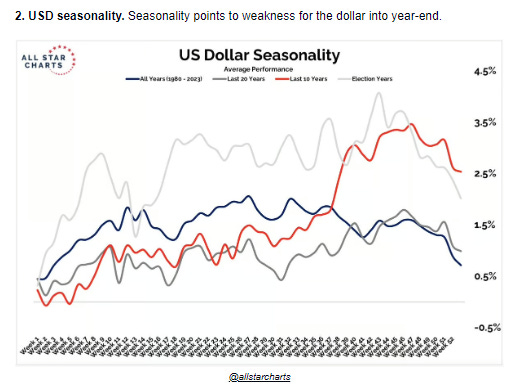

Dollar ($DXY) fell back for a 3rd day from the 107 level, remaining in the middle of the uptrend channel running back to September that it’s only closed outside of for one session. The bottom of the channel is way down at 105. Daily MACD & RSI remain supportive but the RSI has crossed from over to under 70 indicative of a loss of momentum.

The VIX & VVIX (VIX of the VIX) both moved higher at the open but gave up most of the gains although remained above last week’s levels. The former is at 16.4 (consistent w/around 1% daily moves over the next 30 days) and the latter to 97 (consistent with “moderately high” daily moves in the VIX over the next 30 days).

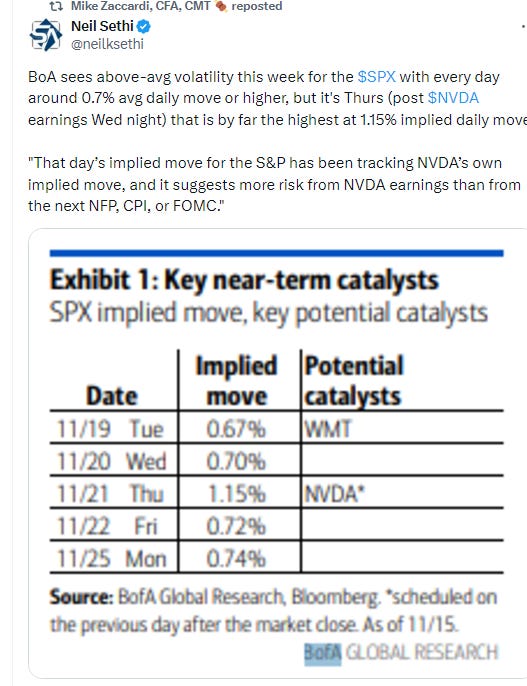

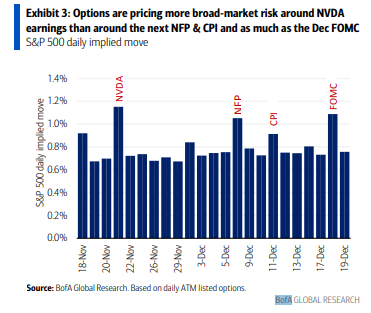

1-Day VIX edged up to 11.6, looking for a move of ~0.72% Wednesday, in-line with what BoA said was implied from options markets coming into the week. It though should jump to around the 20 level tomorrow as Nvidia’s earnings come into the 1-day window (after Wed’s close).

WTI able to edge higher after its “much needed bounce” Mon from the $67 level (which it had previously closed under only once (Sept 10th) in nearly 3 yrs (since Dec ‘21)). As I said Friday, “there’s mild support down to the Sept 10th intraday low of $65.27, but this area really needs to hold or we’re looking back 3 years for support levels, not a great situation. Daily MACD & RSI are no help, remaining tilted negative.” So far it remains as I said Monday “just a bounce in a clear downtrend… needing to at the very least get back over the $70 level to at all change the picture.” The good news is the MACD & RSI are moving to a more neutral posture.

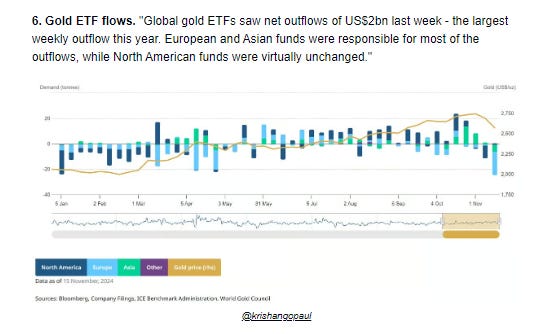

Gold continued its bounce from its 100-DMA, now though at a resistance zone which stretches to the $2400 level. If it can clear that, though, it has pretty clear sailing back to $2800. Daily MACD & RSI remain weak but are turning quickly. Not yet supportive though.

Copper (/HG) like crude & gold continued its 2 day rally with the weaker dollar, with room for it to continue before hitting resistance (unlike the other two). Daily MACD & RSI as noted last Monday remain in a negative positioning though.

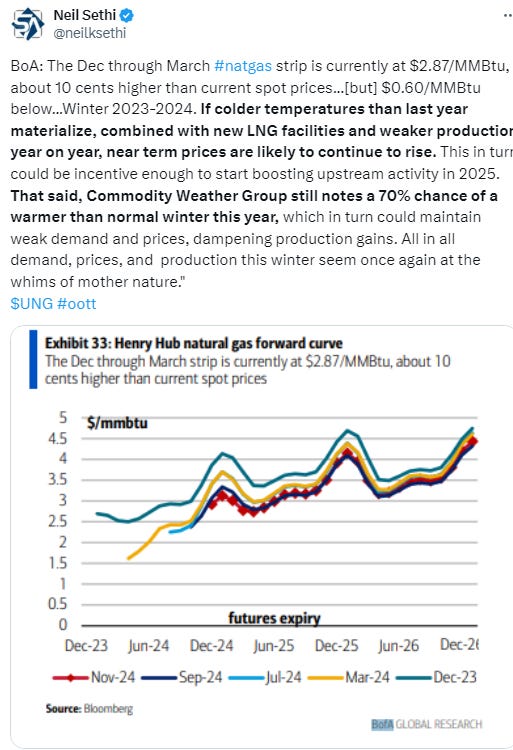

Nat gas (/NG) continued to bounce from its 20-DMA at one point above $3 at a 5-mth high, but couldn’t hold the level. The daily MACD & RSI remain positive for now.

Bitcoin futures resumed their series of ATH’s consistent with yesterday’s note that “all-in-all the bullish momentum is intact.” I said last week it had gotten very extended, but that it had gotten more extended in February, so I continue to think Katie Stockton’s target of $97.5k is certainly doable (as is $100k in the short term).

The Day Ahead

The lighter US economic data week continues with just weekly mortgage applications and EIA petroleum inventories Wed.

We’ll get a couple more Fed speakers in Lisa Cook & Michelle Bowman as well as our main Treasury auction of the week in $16bn in 20-yr bonds.

Earnings will be the star tomorrow with four SPX reporters, but only one of them really matters in Nvidia (NVDA). We do though get two other >$100bn market cap co’s in TJX (TJX) & Palo Alto Networks (PANW). Target (TGT) surprisingly is “just” $70bn (see the full earnings calendar from Seeking Alpha).

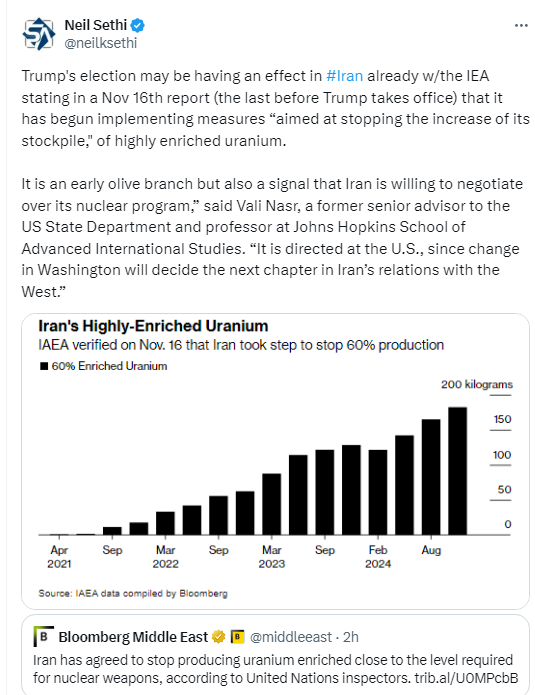

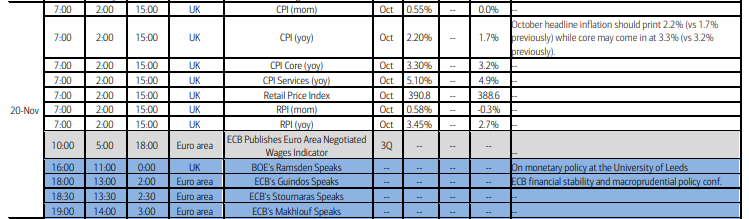

Ex-US the highlights are the UK’s Oct CPI report & key EU wage data for 3Q. We’ll also get another round of BoE & ECB speakers. In EM we’ll get a policy decisions from Turkey, South Africa & Egypt. Holds are expected but there’s scope for different outcomes.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,