Markets Update - 11/20/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

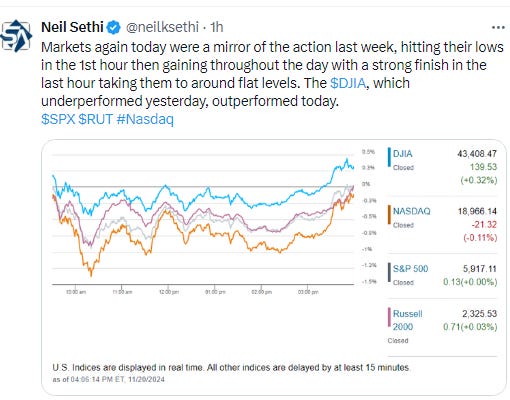

US equity indices again recovered from a weak first hour ahead of Nvidia’s key earnings report (more on that below) but were just able to get back to around flat levels.

Bond yields and the dollar broke a 3-day losing streak, but gold and copper were still able to manage gains, as did bitcoin to another ATH. Crude was little changed, while nat gas shot to the highest levels since January.

The market-cap weighted S&P 500 was unch, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite -0.1% (and the top 100 Nasdaq stocks (NDX) -0.1%), the SOX semiconductor index -0.7%, and the Russell 2000 unch.

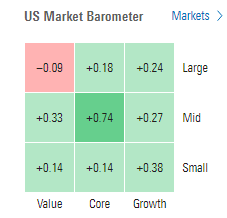

Morningstar style box showed every style managing an up day other than large value (a little curious given the index performance noted and sector performance noted below).

Market commentary:

“The health of the market being driven by results of individual companies in itself points to a certain element of fragility,” said Subitha Subramaniam, chief economist at Sarasin & Partners. “Is it sufficient that they beat, is it sufficient that they beat by a big margin? We are hanging on every statement of the CEO.”

“As I look at the Treasury secretary race, I want to see exactly who is in that role because the tax policies, the debt limit all come back,” Ed Mills, Washington policy analyst at Raymond James, told Bloomberg TV. “We need to see exactly how that person has a relationship with the Federal Reserve, because monetary policy will quickly figure into all of this.”

“Jitters over Nvidia’s earnings and climbing political tensions are worrying investors,” said Ryan Detrick, chief market strategist at Carson Group. “But, let’s not forget that stocks are still having a historic year and the economy isn’t showing any major signs of a slowdown.”

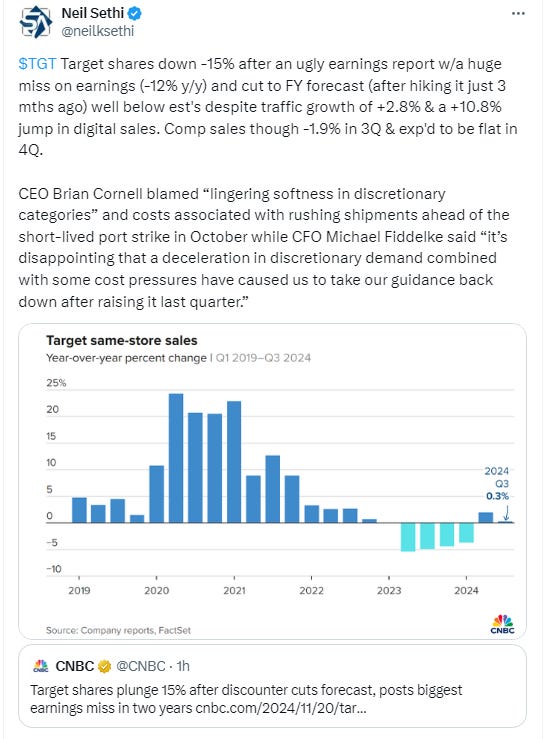

In individual stock action, many retailers were noticeably weak after Target's (TGT 121.72, -33.16, -21.4%) disappointing earnings and guidance, but not Williams-Sonoma which had its day in more than a decade and a half after exceeding Wall Street’s expectations for third-quarter earnings. The Pottery Barn and West Elm parent’s shares jumped almost 28%, the stock’s best day since 2008, when it climbed more than 39%

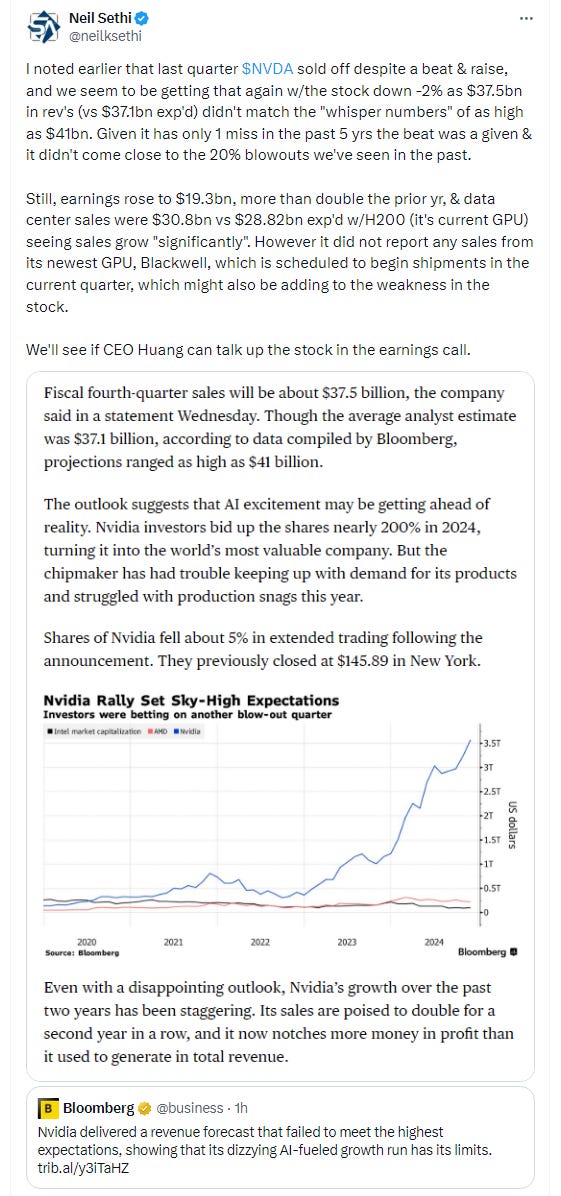

After the close an exchange-traded fund tracking the Nasdaq 100 (QQQ) slipped -0.2% while shares of Nvidia fell -1.7% in late trading after its outlook failed to meet expectations. The forecast was offset by signs of demand for the company’s newest product line, Blackwell.

After hours movers from CNBC:

Some tickers making moves at mid-day from CNBC.

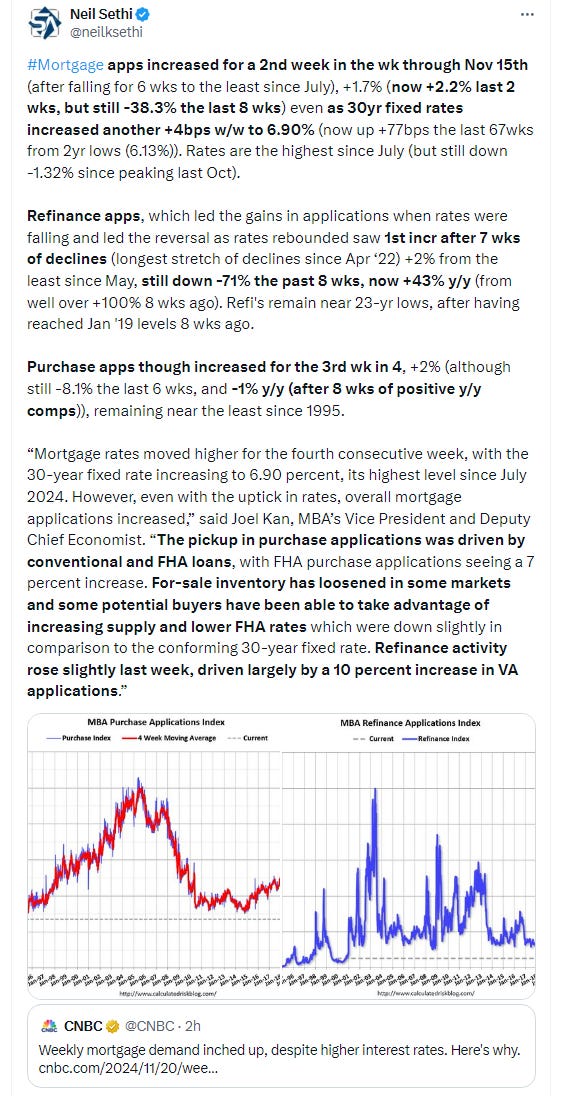

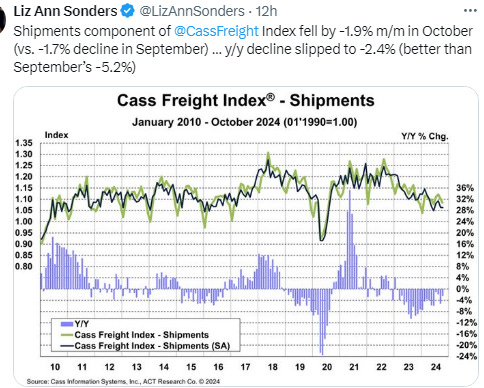

The lighter week in US economic data continued with just weekly mortgage applications today which increased for a 2nd week despite another rise in mortgage rates.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX again found support at its 20-DMA. Its daily MACD & RSI remain mixed.

The Nasdaq Composite also bounced from its 20-DMA. It daily MACD & RSI are also mixed.

RUT (Russell 2000) able to like the SPX & Nasdaq get a bounce from its 20-DMA. Its daily MACD & RSI are also mixed.

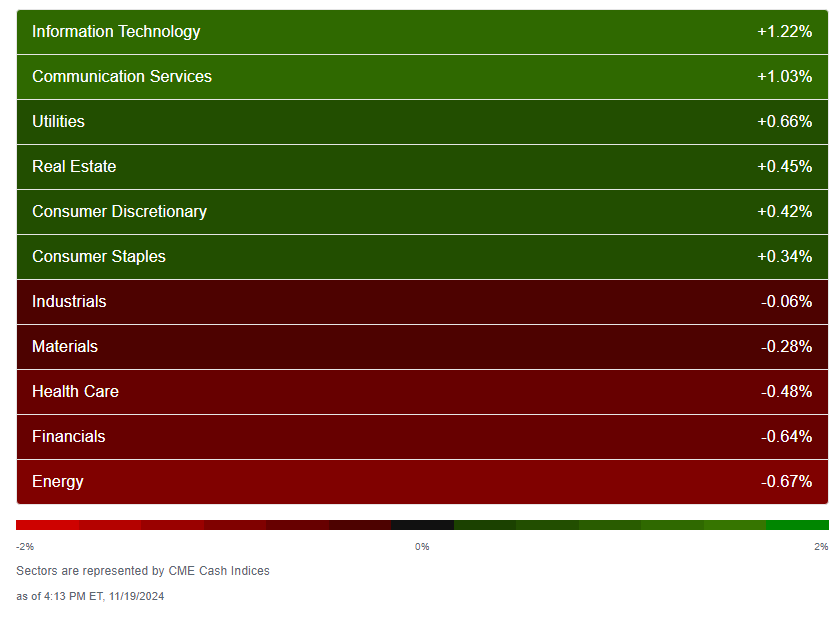

Equity sector breadth from CME Indices again saw 6 of 11 sectors up (same as Tues despite the weaker index performances), with again 3 up +0.6% or more vs 7 Mon (2 up >1% same as Mon & Tues). While Monday saw a broad mix of sectors & Tues growth shares leading, Wed it was cyclicals + health care. Of the 5 red sectors, just one was down more than -0.3% (vs 3 Tues), discretionary (-0.6%). So, again, despite a weaker performance from the indices the underlying statistics were arguably just as good.

Stock-by-stock SPX chart from Finviz consistent w/more green today but still plenty of weakness.

Positive volume was better Wed with the NYSE improving to 52%, an “ok” result with the NYSE composite up +0.16% on the day, while Nasdaq remained better at 59%, despite the index finishing down -0.11%. Issues continued to be weaker on both though at 45 & 47%.

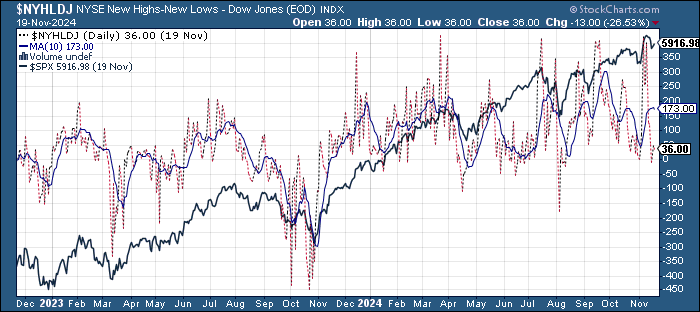

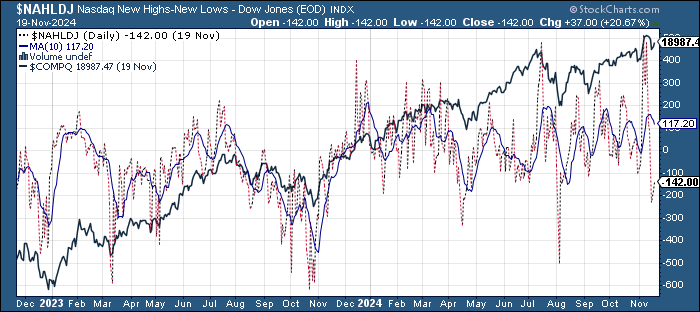

New highs-new lows improved w/the NYSE increasing to 64 from 30 while the Nasdaq improved to -59 from -146 . Still given they were 404 & 483 respectively a little over a week ago, and they remain well below the 10-DMAs (less bullish), with the DMA’s continuing to roll over.

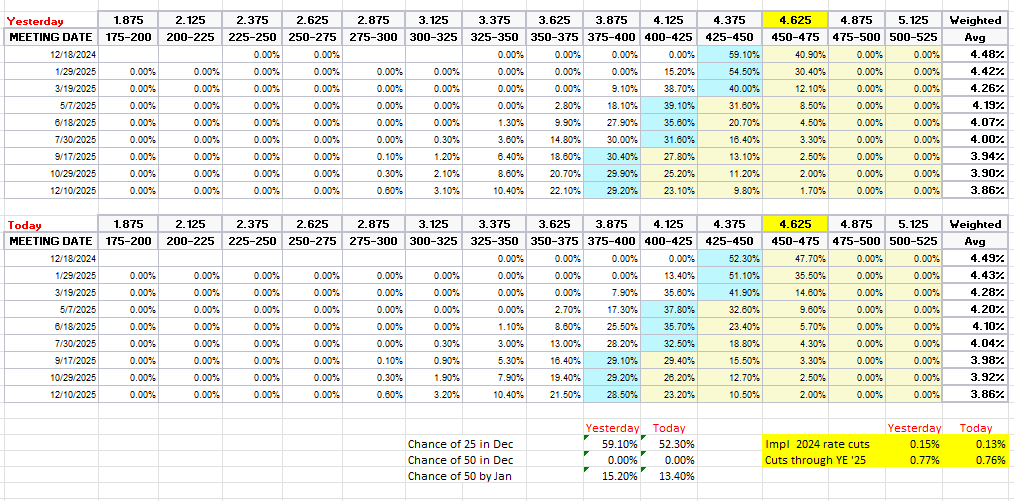

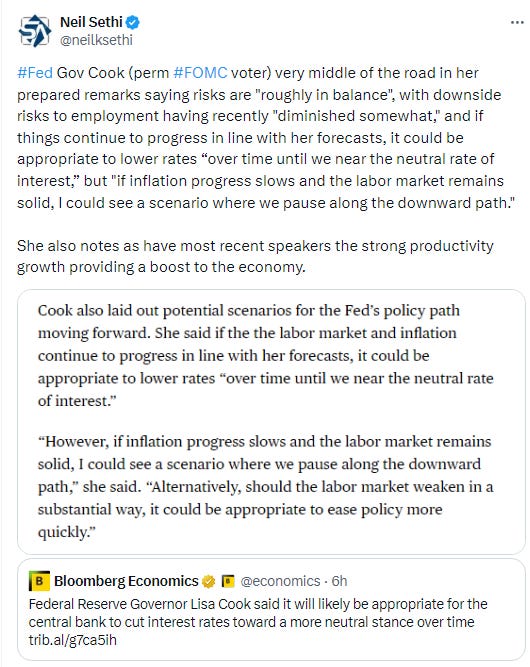

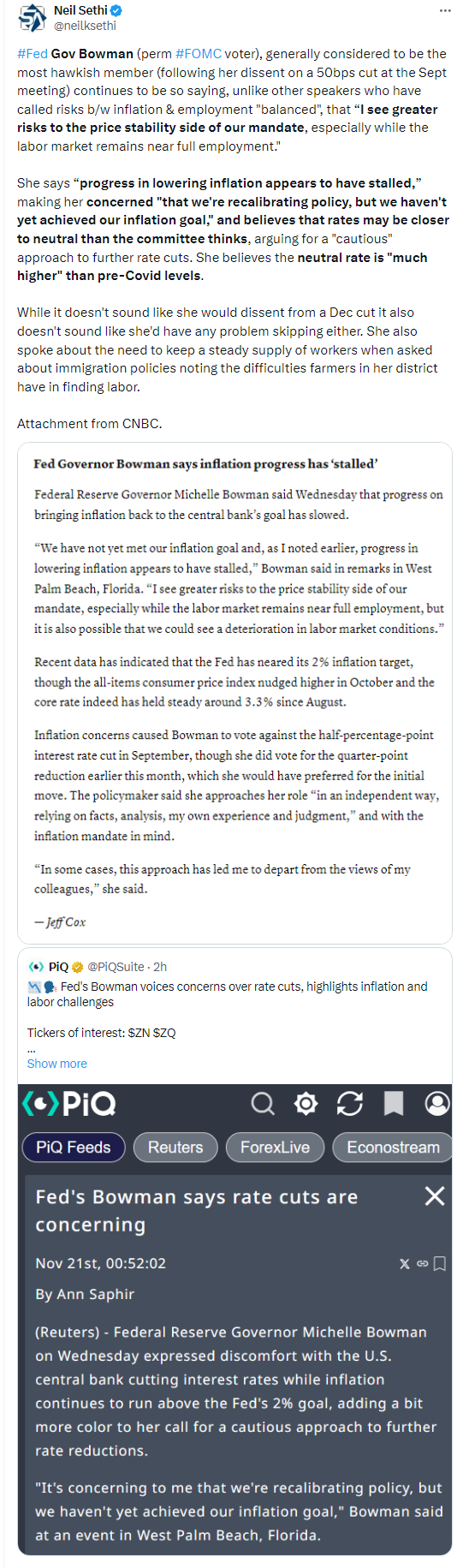

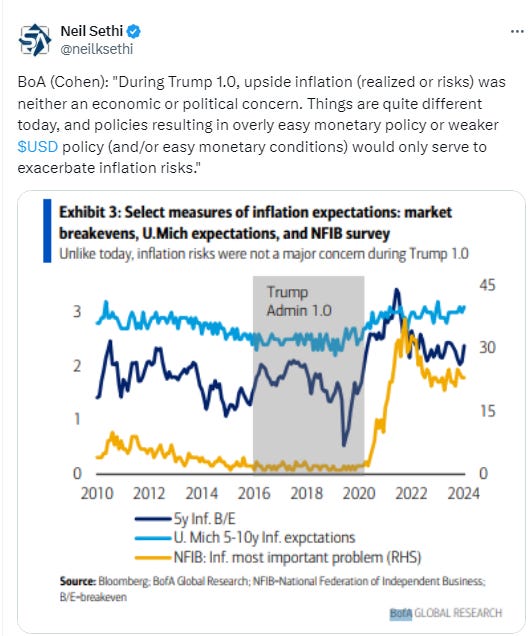

FOMC rate cut probabilities from CME’s Fedwatch tool edged lower following today’s Fed speakers (particularly Bowman). The chance of a December cut is now at 52% (from 59%), but still 76bps of cuts priced through end of 2025.

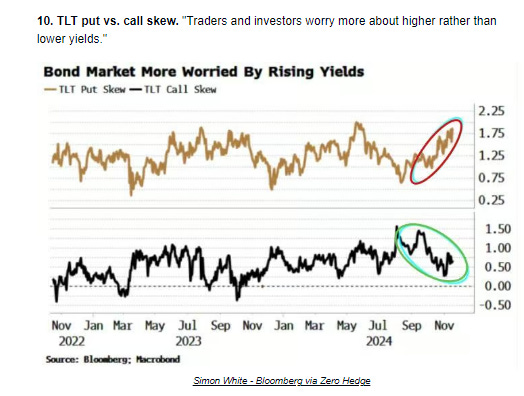

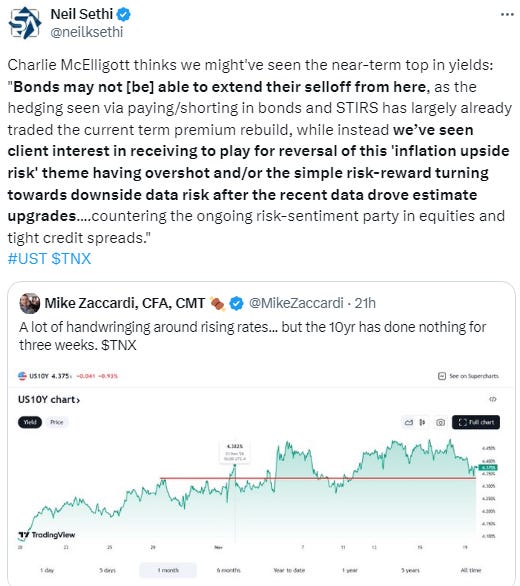

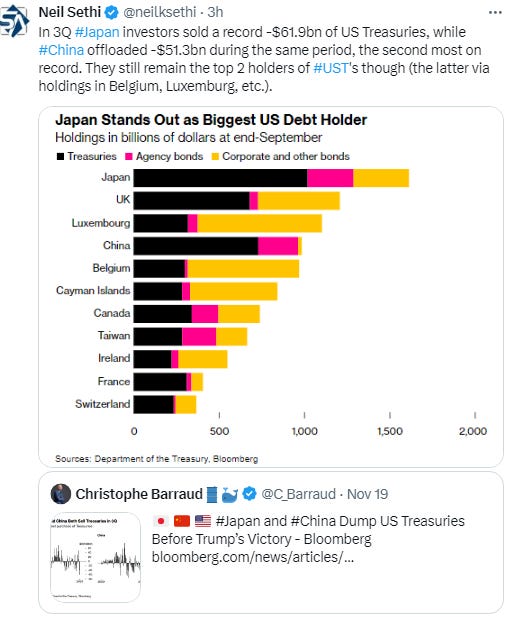

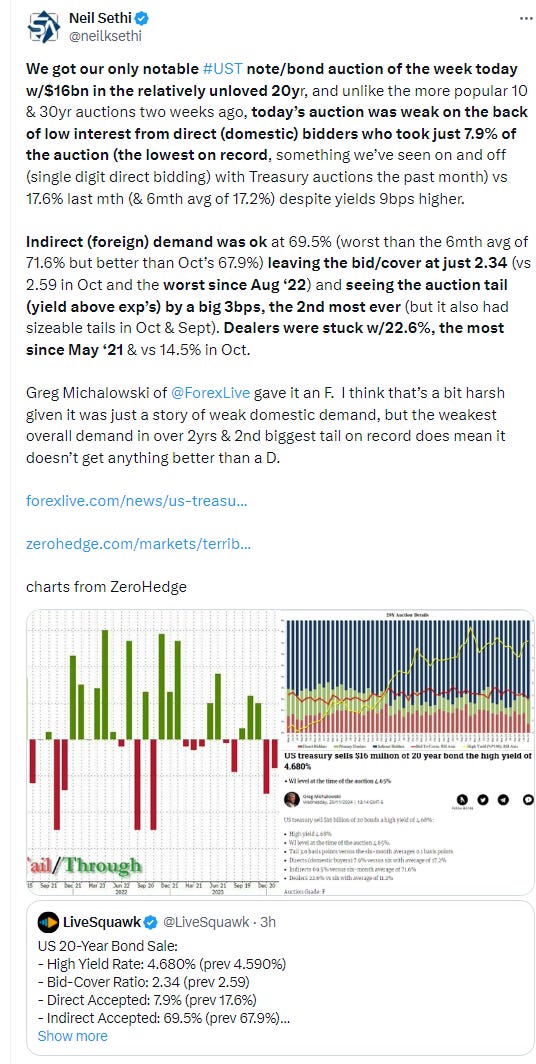

Treasury yields pushed higher, gaining some steam after a weak 20yr Treasury auction although the increases were modest overall with the 10yr yield, more sensitive to economic growth and long-term inflation, +3 basis points to 4.41%, remaining not far from the 4.5% level (identified by many as a “line in the sand”). The 2yr yield, more sensitive to Fed policy, was +3bp to 4.30%. Both still remain near the highest since July.

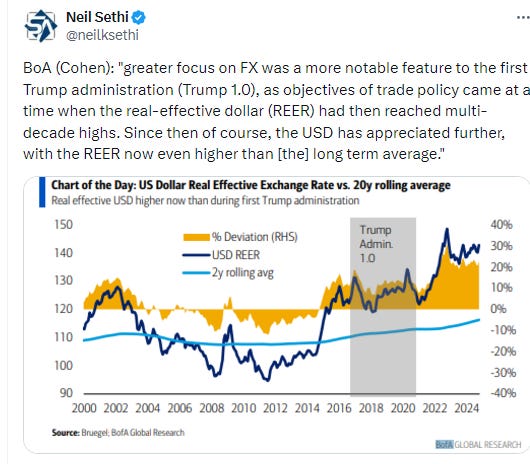

Dollar ($DXY)broke it’s 3 day losing streak with an “outside day” (candle completely contains the previous day’s candle (almost 2 days)). It remains in the middle of the uptrend channel running back to September that it’s only closed outside of for one session. Daily MACD & RSI remain overall supportive, so we’ll see if it can keep the rally going.

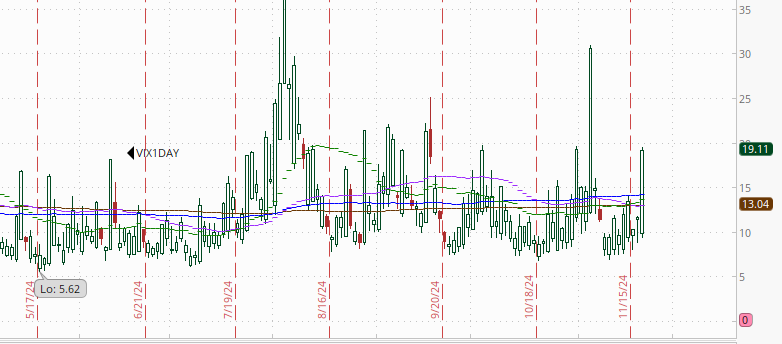

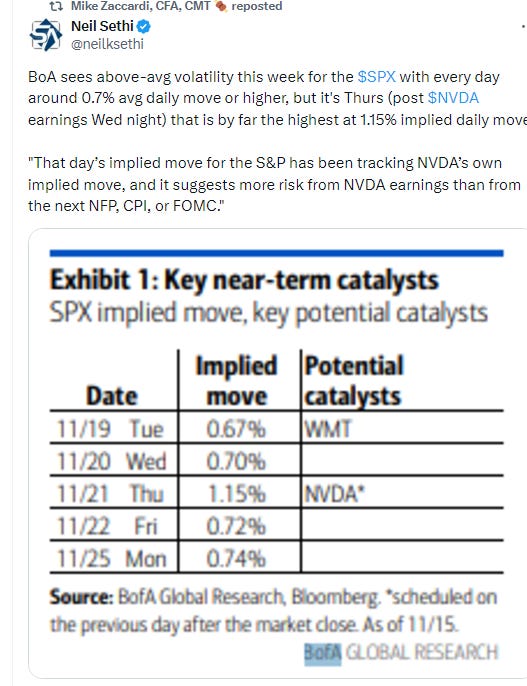

The VIX & VVIX (VIX of the VIX) both moved to the highest levels since the election, the former to 17.2 (consistent w/a little more than 1% daily moves over the next 30 days) and the latter to 102 (consistent with “elevated” daily moves in the VIX over the next 30 days). With Nvidia earnings behind us, we’ll see if these fall back tomorrow.

1-Day VIX shot up to 19, as estimated yesterday, the highest since the election & looking for a move of ~1.2% Thursday, around what BoA said was implied from options markets coming into the week. It should fall back now that Nvidia earnings are behind us though and based on where Nvidia is trading now (down -1%), it’s looking like we won’t be seeing that type of move tomorrow (at least due to Nvidia).

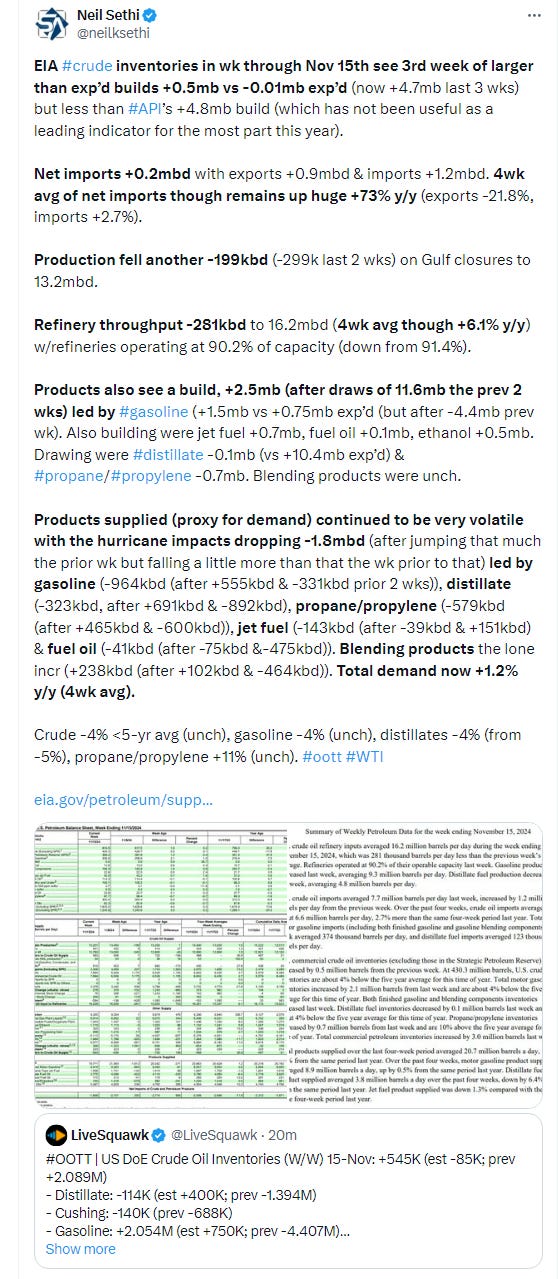

WTI little changed, which is a positive after a larger than expected crude build in the EIA inventories report today. As I said Monday, so far what we’ve seen is “just a bounce in a clear downtrend… needing to at the very least get back over the $70 level to at all change the picture. The good news is the MACD & RSI are moving to a more neutral posture.”

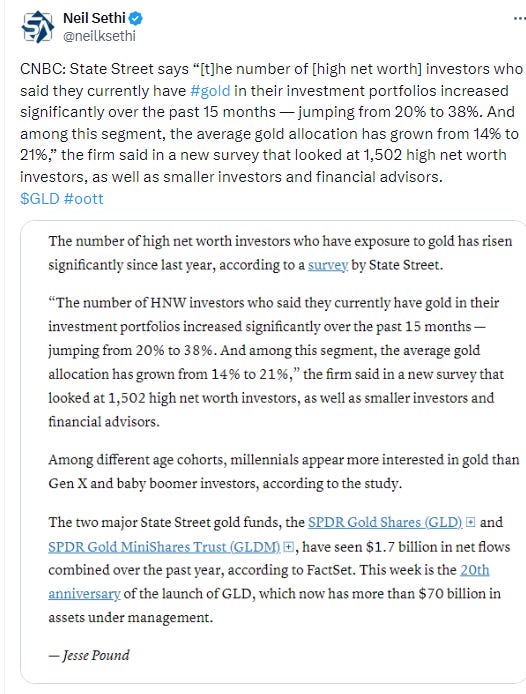

Gold continued its bounce from its 100-DMA, edging into the resistance zone which stretches to the $2400 level. If it can clear that, though, it has pretty clear sailing back to $2800. Daily MACD & RSI remain weak but are turning quickly. Not yet supportive though.

Copper (/HG) like gold continued its 3 day rally but the progress slowed. Still has some room for it to continue before hitting resistance (unlike gold). Daily MACD & RSI as noted last Monday remain in a negative positioning but are turning.

Nat gas (/NG) continued to bounce from its 20-DMA and again moved over $3 but this time it kept going pushing past the June highs to the highest since Jan, closing at the highs of the day. The daily MACD & RSI remain positive for now as well.

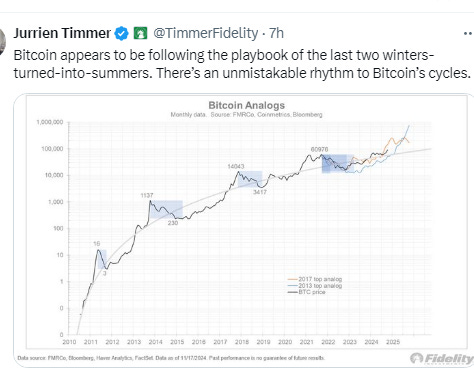

Bitcoin futures continued their series of ATH’s consistent with Mon’s note that “all-in-all the bullish momentum is intact.” I said last week it had gotten very extended, “but that it had gotten more extended in February, so I continue to think Katie Stockton’s target of $97.5k is certainly doable (as is $100k in the short term).” We’re almost there.

The Day Ahead

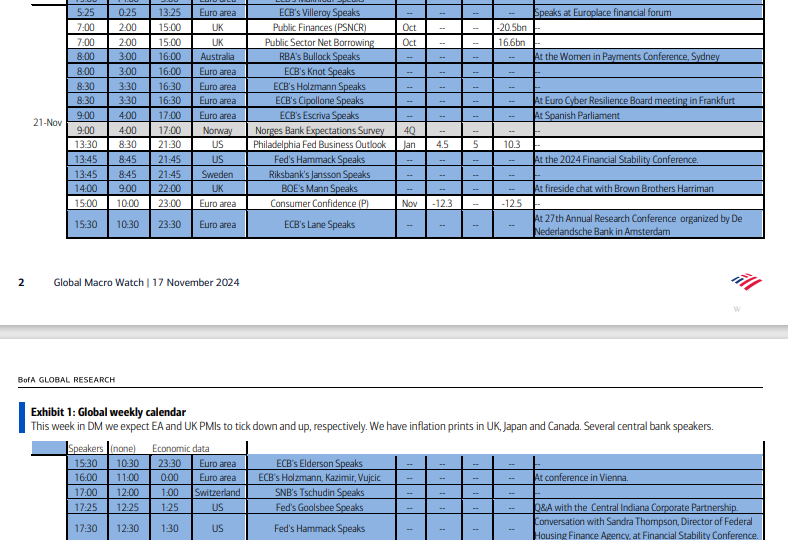

The lighter US economic data week picks up the next two days. On Thursday we’ll be getting weekly jobless claims along with Oct leading indicators and existing home sales.

We’ll get a few more Fed speakers in Michelle Bowman (again), Austan Goolsbee (again), Beth Hammack, and Michael Barr (again). Barr doesn’t normally comment on monetary policy, and we heard from Goolsbee & Bowman a couple of times recently, so I’ll be focused on Hammack, a voter this year.

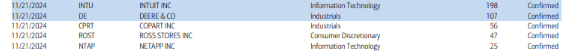

Earnings will continue, a bit of a letdown after getting Nvidia (NVDA) today, but we still get 5 SPX reporters, two of which are >$100bn market cap in Intuit (INTU) and Deere & Company (DE) (see the full earnings calendar from Seeking Alpha).

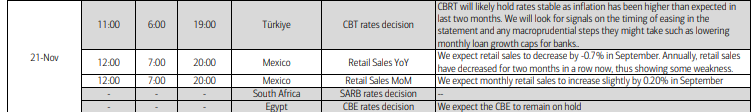

Ex-US we’ll get a policy decision from Norway, EU Nov consumer confidence, and an absolute crush of central bank speakers (a lot ECB members, but also RBA, BoE, Riksbank, etc.). In EM we’ll get policy decisions from Turkey, South Africa & Egypt (I apologize, I had them listed for today, but they’re tomorrow, today was Indonesia & Hungary, both holds). Holds are expected but there’s scope for different outcomes as well.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,