Markets Update - 11/21/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

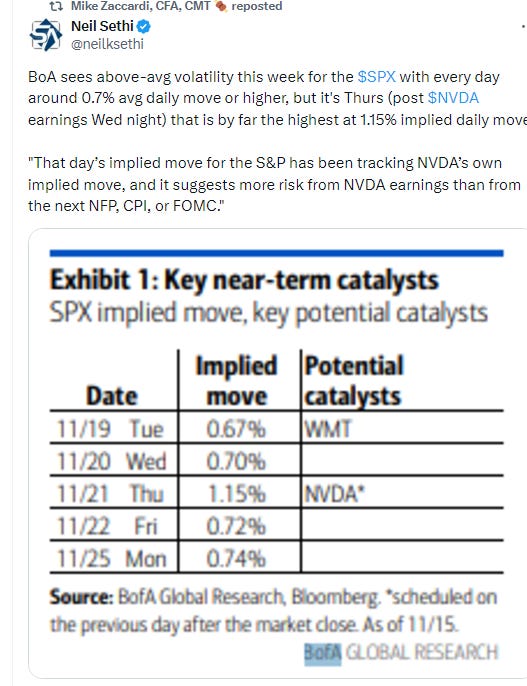

US equity indices again recovered from a weak first hour as semiconductor behemoth Nvidia went from a solidly down to a mildly up day following last night’s earnings report and some initial concern regarding continued escalation of the Russia/Ukraine conflict (the former reportedly firing an ICBM rocket and the latter using UK missiles for the first time to strike inside of Russia) eased. While many growth stocks advanced, it was non-growth sectors which outperformed today led by small caps.

The gains in equities were despite bond yields edging higher and the dollar jumping to a 1-yr high. That also didn’t stop gold, nat gas or crude from logging healthy gains, but copper did fall back. Bitcoin meanwhile continued its remarkable run coming within $500 of $100k.

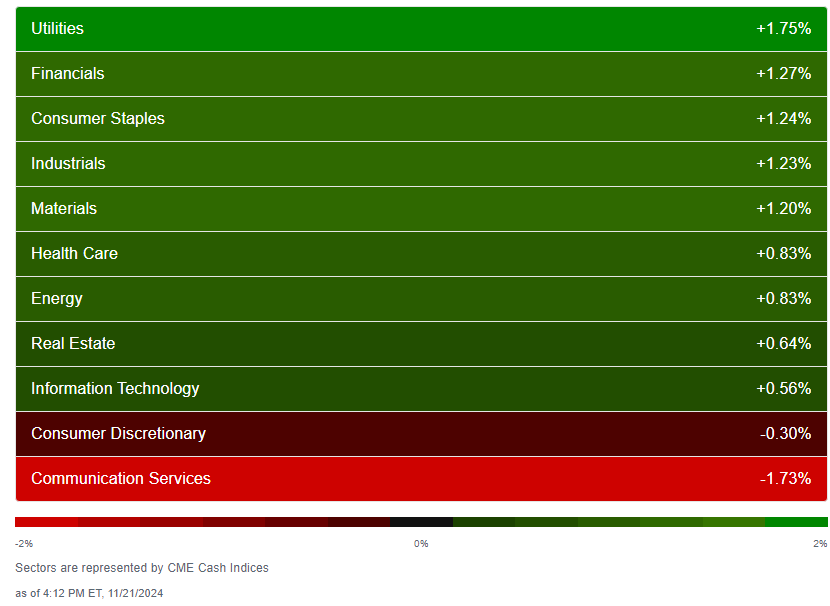

The market-cap weighted S&P 500 was +0.5%, the equal weighted S&P 500 index (SPXEW) +1.3%, Nasdaq Composite unch (and the top 100 Nasdaq stocks (NDX) +0.4%), the SOX semiconductor index +1.6%, and the Russell 2000 +1.7%.

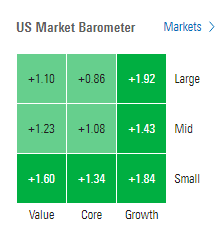

Morningstar style box saw every style advancing and again curiously saw a strong day from growth even as the Nasdaq was flat. Don’t have a good explanation for that.

Market commentary:

The move in Nvidia shares “tells you how much the expectations game on Nvidia has been ramped up,” Aswath Damodaran, finance professor at New York University’s Stern School of Business, said on CNBC’s “Closing Bell: Overtime.” “They don’t just have to beat analyst estimates; they got to beat them by 10%.”

“Any weakness will likely be bought for investors but traders who require beats and raises every quarter could lighten their exposure if no big beats happen for a few quarters,” Eric Clark, portfolio manager of the Rational Dynamic Brands Fund, said about Nvidia.

“Trump’s win has brought with it an increase in geopolitical uncertainty and that too is weighing on sentiment,” said Daniel Murray, Zurich-based chief executive officer of EFG Asset Management in Switzerland. “Ukraine now has an incentive to gain as much strategic advantage as possible ahead of Trump’s inauguration.”

“Geopolitics always has a potential of introducing volatility in the market and we have seen that with what is happening in Ukraine,” Themis Themistocleous, chief investment officer, EMEA at UBS Wealth Management told Bloomberg TV.

“This is the week where everyone is rethinking the Trump trade,” said Mark Malek, chief investment officer at Siebert. “People are taking it a little more seriously. It’s not enough to just say ‘we think the sector is going to do well’ — you have to have some answers.”

Strategists at market research firm Fundstrat expect US stocks to climb into the US holiday week, followed by some weakening in December. “The Nvidia earnings report leaves the likelihood of a Thanksgiving rally intact,” they wrote. “The AI trajectory has not changed all that much, but the market’s immediate reaction is less important than the fact that the uncertainty over Nvidia’s results is behind us.”

To Tom Essaye, founder of The Sevens Report, this week’s conflicting reports from Walmart Inc. and Target Corp. suggest some restraint from American consumers, who should be watched closely. “The state of the labor market and consumer spending are indicative of a soft landing and that’s a good thing,” the former Merrill Lynch trader said. “But they are also vulnerable to deterioration from here and if that occurs, then a hard landing becomes substantially more likely and that would be a decided negative for stocks.”

“The contest for the Treasury Secretary appears to have come down to Bessent, Rowan, and Warsh – all of whom fall into the category of qualified adults in the room,” according to BMO’s Ian Lyngen. Though, “clarity is always preferable from the market’s perspective.”

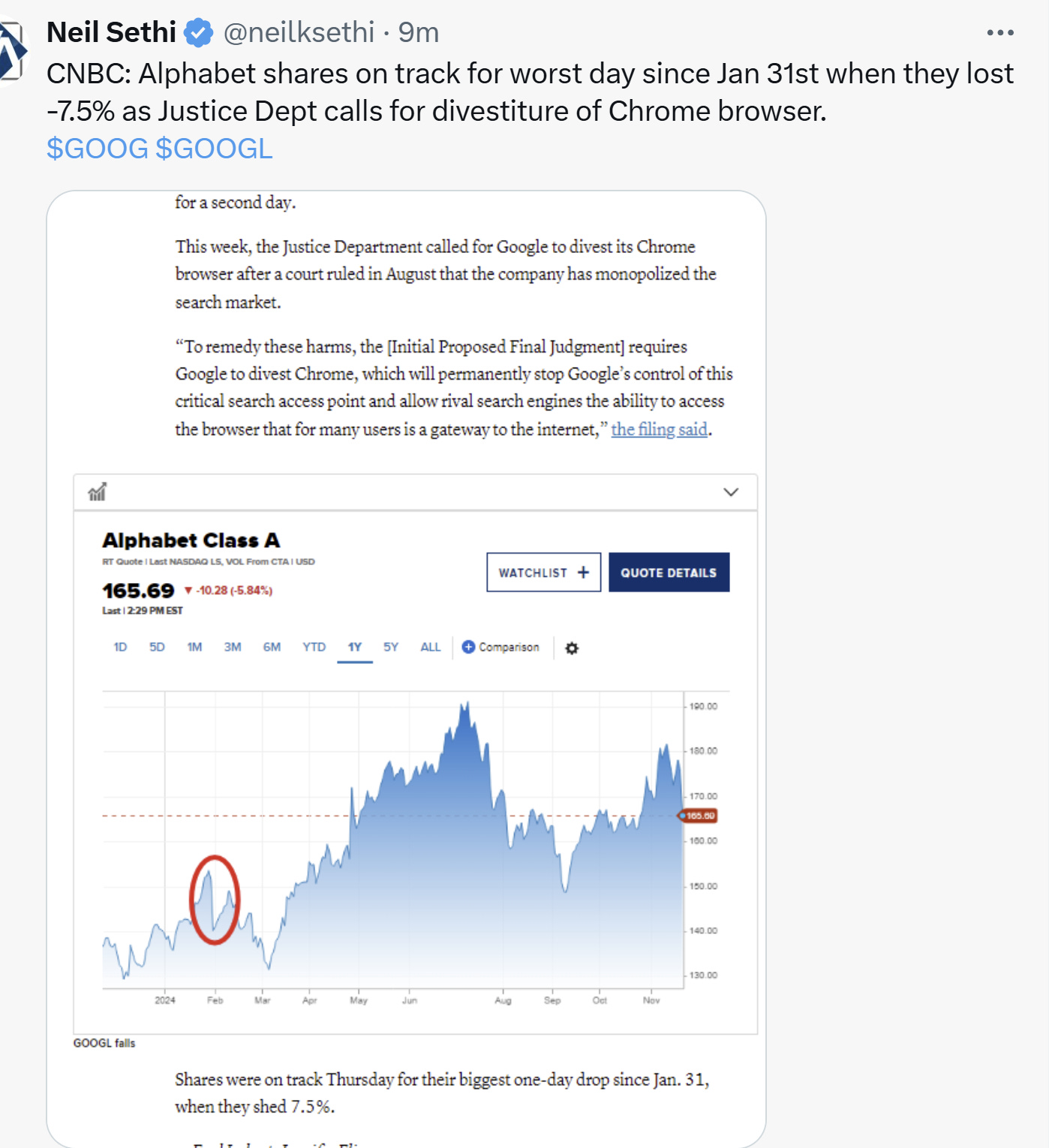

In individual stock action, shares of Nvidia (NVDA 146.67, +0.78, +0.5%) initially traded lower following its solid earnings report which saw a slight deceleration in its revenue growth rate and missed the Street’s most elevated expectations, but it was still a beat on all metrics and CEO Huang said demand for its Blackwell chip is "staggering." The industrial sector was boosted by an earnings-related gain in Deere & Co. (DE 437.54, +32.58, +8.1%). Meanwhile, the communication services sector was the worst performer by a wide margin, dropping 1.7%, due to a sizable decline in Alphabet (GOOG 169.24, -8.09, -4.6%) after reports that the DOJ is pushing for a forced sale of Chrome and potentially Android.

Amazon slumped -2.2%, but Snowflake was one bright spot in tech, popping nearly 33% after the company topped Wall Street’s estimates and lifted its product revenue guidance for the fiscal year. The software behemoth was the largest contributor to the Dow Jones Industrial Average’s 600-point gain. Goldman Sachs was another big winner, adding about 3%. Sherwin-Williams and Caterpillar also added nearly 3%, while Home Depot gained 2%.

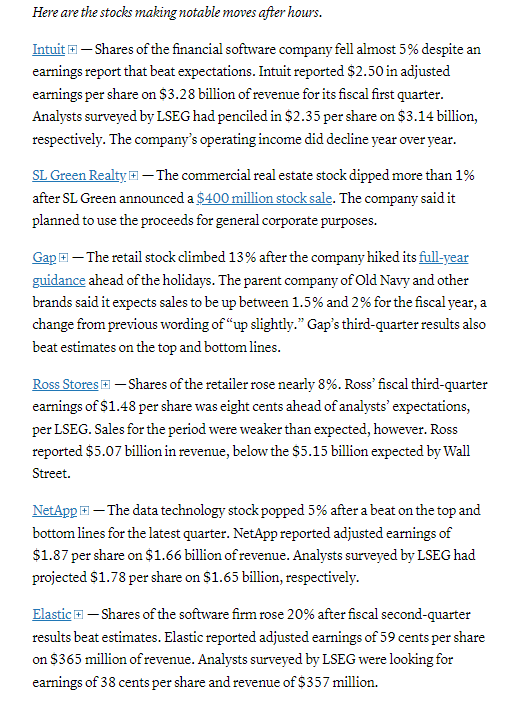

After hours movers from CNBC:

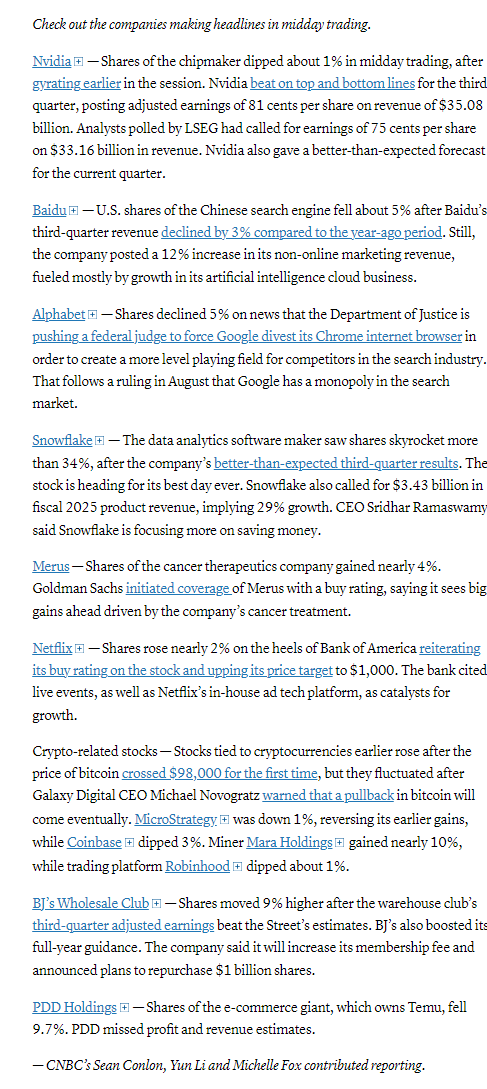

Some tickers making moves at mid-day from CNBC.

We got a little more US economic data today:

Weekly initial jobless claims fell back to the lowest since April, just 26k above 50-yr lows from Oct ‘23, but continuing claims jumped to the highest since Nov ‘21. While still low historically it shows those who are losing their jobs are having a harder time finding new ones than a year ago.

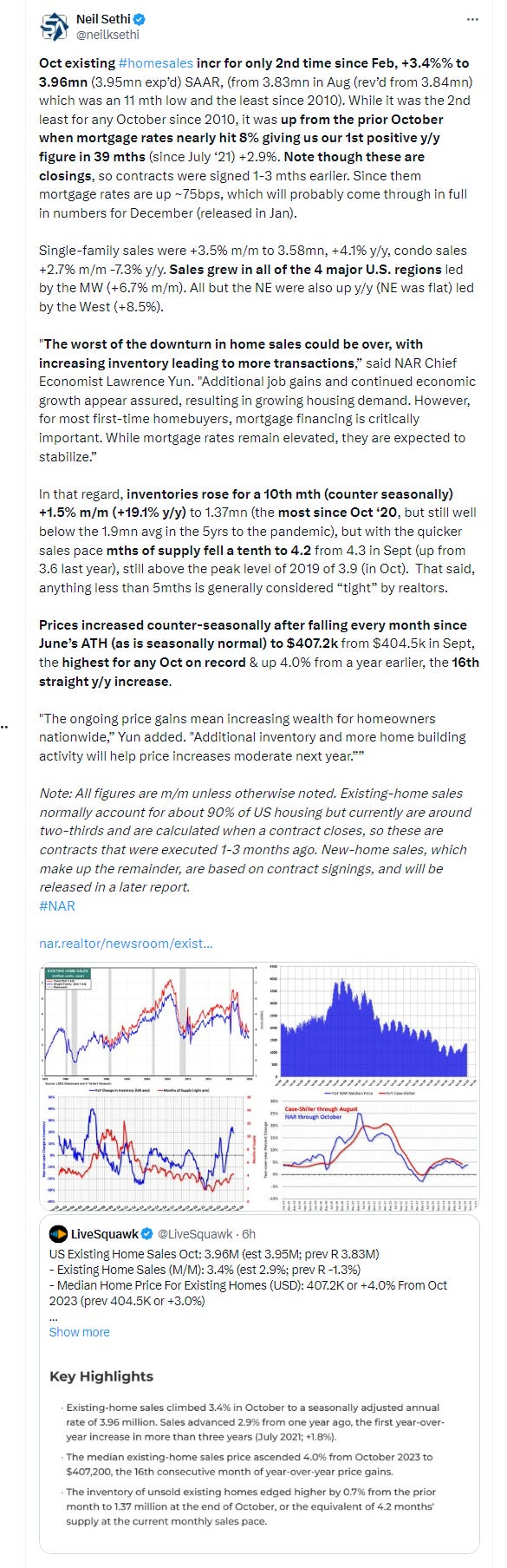

Oct existing home sales (closings) saw their 2nd increase since Feb as contract signings from July-Sept, when mortgage rates fell by over a percent, made it across the finish line. The y/y rate was positive for the first time since July ‘21 as we lapped last October when mortgage rates were coming off of near 8% levels. I’d expect we’ll get another month of ok sales in November, but December could see a big decline as current contract signings flow through.

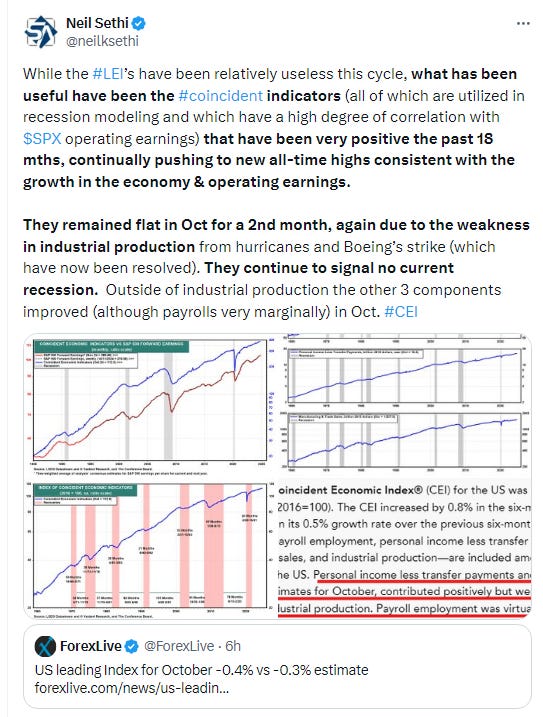

The Conference Board’s index of leading indicators, a broken recession indicator at this point, continued to show weakness for a 32nd month. The coincident indicators, a much more relevant metric, remained flat for a 2nd month (due to the impacts of hurricanes and the Boeing strike on industrial production).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX filled the gap from the Friday drop. Its daily MACD & RSI remain mixed.

The Nasdaq Composite also filled its gap. It daily MACD & RSI are also mixed.

RUT (Russell 2000) continued its 3-day bounce from its 20-DMA. Its daily MACD & RSI are also mixed.

Equity sector breadth from CME Indices strong today w/9 of 11 sectors up (up from 6 the prior two days matching Mon despite the modest gain in the SPX) with 8 sectors up +0.6% or more vs 3 Tues/Wed & 7 Mon (five up >1% from two Mon-Wed). Growth sectors lagged taking the bottom 3 spots. Overall, breadth expanded for a 3rd session.

Stock-by-stock SPX chart from Finviz consistent w/a lot more green today and just some heavyweights (most notably Alphabet & Amazon) holding things back.

Positive volume was again better Thurs, it’s 3rd day of improvement, with the NYSE at a very good 78%, in line with the NYSE composite’s +1.1% day, while Nasdaq was relatively even better at 67%, despite the index finishing up less than a tenth of a percent. In addition, issues, which have been lagging all week, caught up at 77 & 65%.

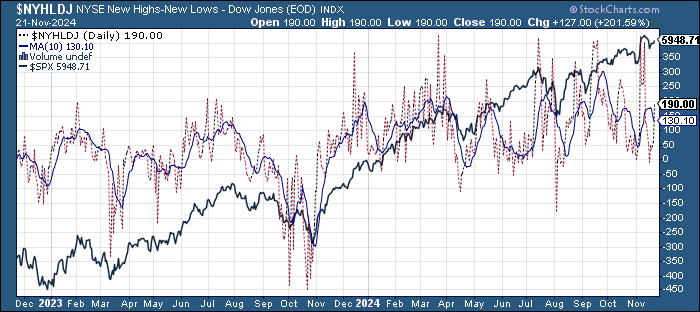

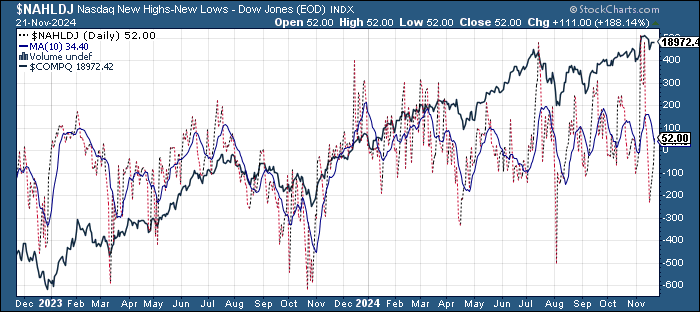

New highs-new lows improved as well w/the NYSE increasing to 190, the best since Nov 11th, from 64 while the Nasdaq improved to 38, the best since Nov 13th, from -59. While they are far off the 404 & 483 respectively a little over a week ago (which was around the best in 3 years), and they moved back above the 10-DMAs (more bullish), although the 10-DMA’s continue down for now.

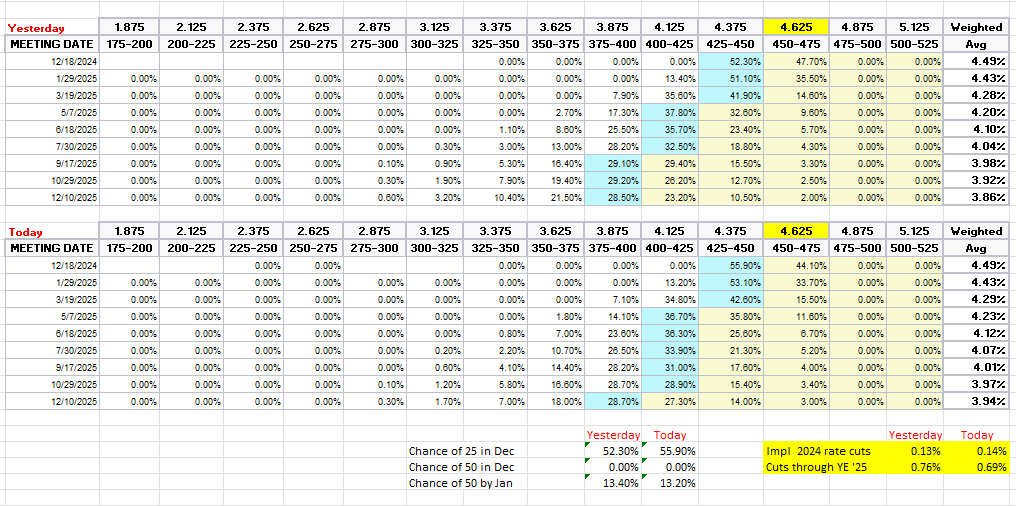

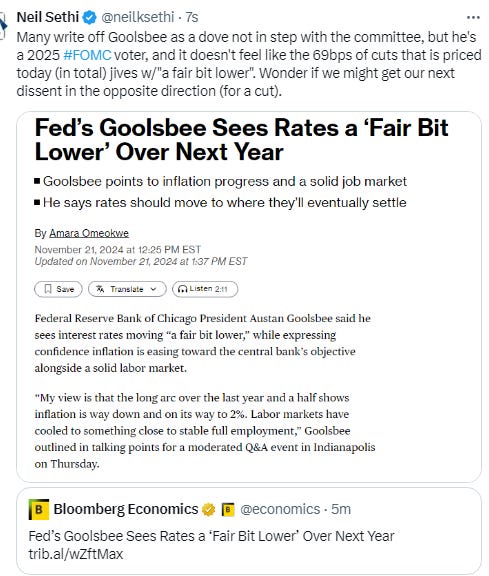

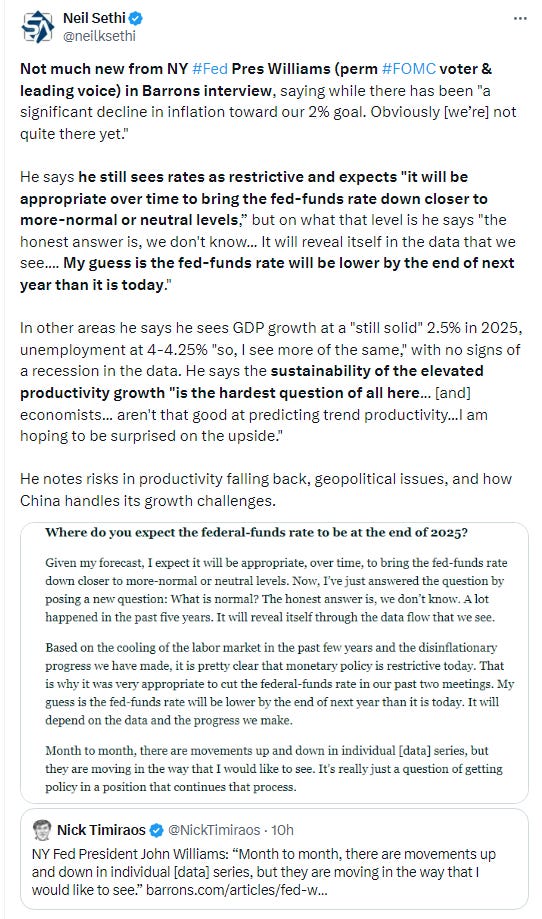

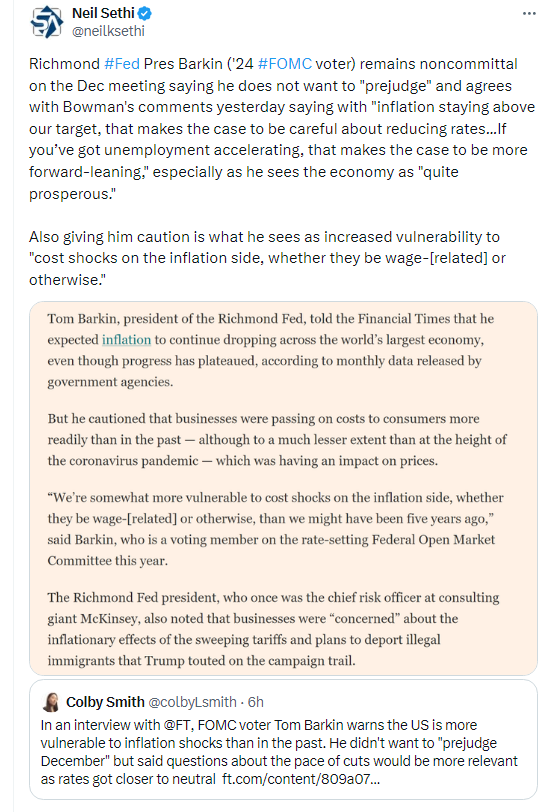

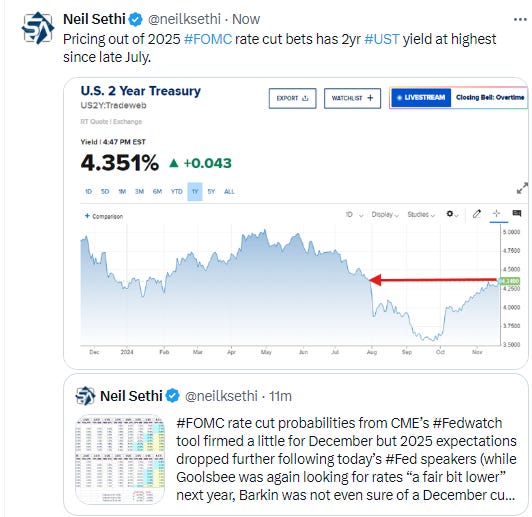

FOMC rate cut probabilities from CME’s Fedwatch tool firmed a little for December but 2025 expectations dropped further lower following today’s Fed speakers (while Goolsbee was again out looking for rates “a fair bit lower” next year, Barkin was not even sure of a December cut & Williams was much less dovish than prior appearances just saying he thought it likely that the rate “will be lower than today” next year). While the chance of a December cut increased to 55% (from 52%), 2025 expectations fell to 69bps of cuts (from 76), meaning less than 3 cuts in total are priced from here.

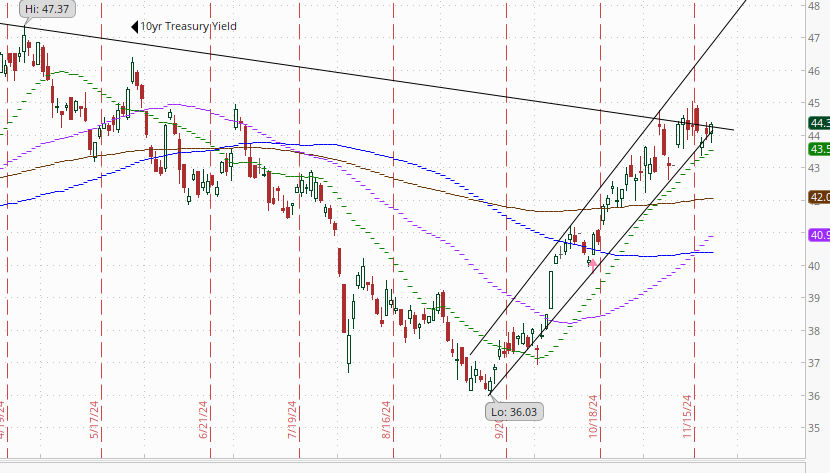

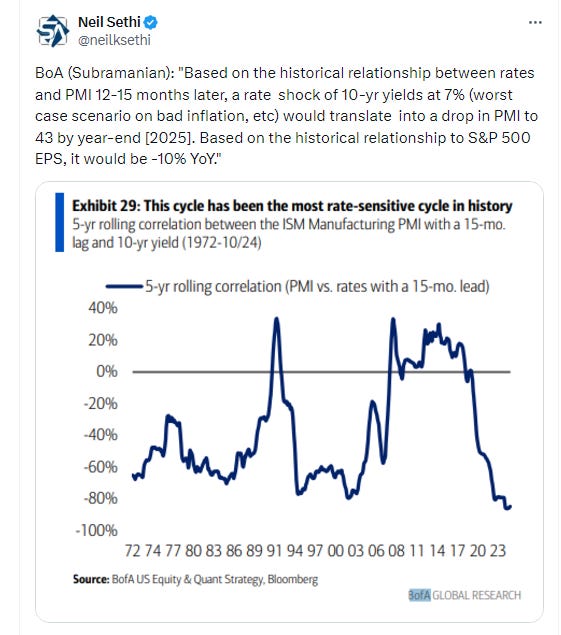

Treasury yields edged higher again with the 10yr yield, more sensitive to economic growth and long-term inflation, +3 basis points to 4.44%, little changed since Nov 6th remaining below the 4.5% level (identified by many as a “line in the sand”). The 2yr yield, more sensitive to Fed policy, was +4bp to 4.35% the highest since late July.

Dollar ($DXY) up again Thurs driving to a new 13-mth high in line with Wed’s “outside day” candle, its first close over $107 since Oct ‘23. It remains in the middle of the uptrend channel running back to September that it’s only closed outside of for one session. Daily MACD & RSI remain overall supportive, so as I said Wed “we’ll see if it can keep the rally going.” Oct ‘23 high is $107.40.

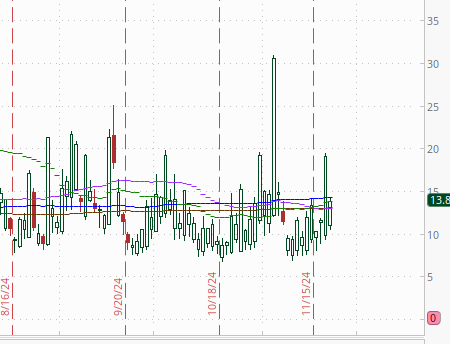

The VIX & VVIX (VIX of the VIX) fell back from the highest levels since the election with Nvidia earnings behind us, but just a little remaining well above week ago levels, the former to 16.9 (consistent w/a little more than 1% daily moves over the next 30 days) and the latter to 101 (consistent with “elevated” daily moves in the VIX over the next 30 days).

1-Day VIX also remained elevated at 13.8 (down from 19 Wed) looking for a move of around 0.87%, above what BoA said was implied from options markets coming into the week despite the relatively tame move in Nvidia.

WTI continued its rebound after testing the key $67 level last week making it over $70, what I said was “the very least to at all change the picture.” Not only that but its daily MACD (circle) & RSI (arrow) have moved to a more positive condition. All that said, we saw all of this at the start of the month, and the rally went a little further then fizzled. We’ll see if this time is different.

Gold continued its bounce from its 100-DMA for a 4th day, pushing further into the resistance zone which stretches to the $2400 level. As I said Monday “if it can clear that, though, it has pretty clear sailing back to $2800. Daily MACD & RSI remain weak but are turning quickly. Not [quite] yet supportive though.”

Copper (/HG) unlike gold wasn’t able to continue its 3 day rally, falling back even though it, unlike gold, doesn’t have any real resistance. Daily MACD & RSI as noted last Monday remain in a negative positioning.

Nat gas (/NG) continued its rally from its 20-DMA for a 5th day with another strong session fueled by a colder turn in weather forecasts and a bullish storage report, at one point pushing to a 1yr high before falling back to finish right at the Jan highs. It’s now up over 25% since the low last Friday. The daily MACD & RSI remain very positive as well.

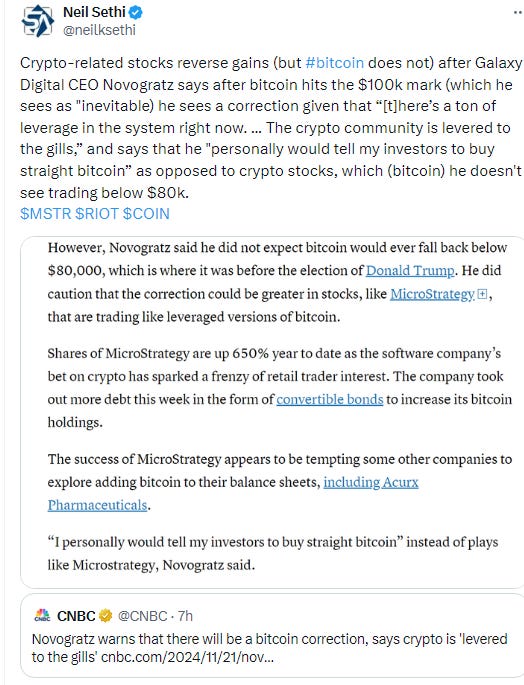

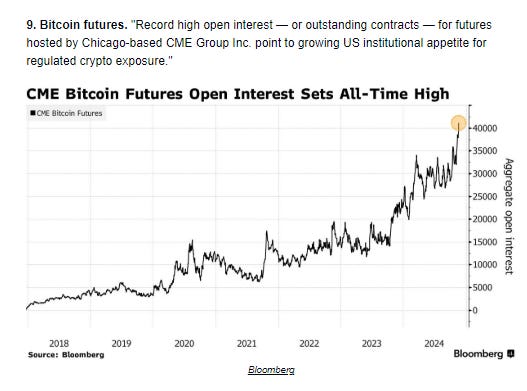

Bitcoin futures continued their series of ATH’s consistent with Monday’s note that “all-in-all the bullish momentum is intact.” I said last week it had gotten very extended, “but that it had gotten more extended in February, so I continue to think Katie Stockton’s target of $97.5k is certainly doable (as is $100k in the short term).” Well we passed Stockton’s target and came w/in $500 of $100k. As Mike Novogratz said today feels like $100k is “inevitable”.

The Day Ahead

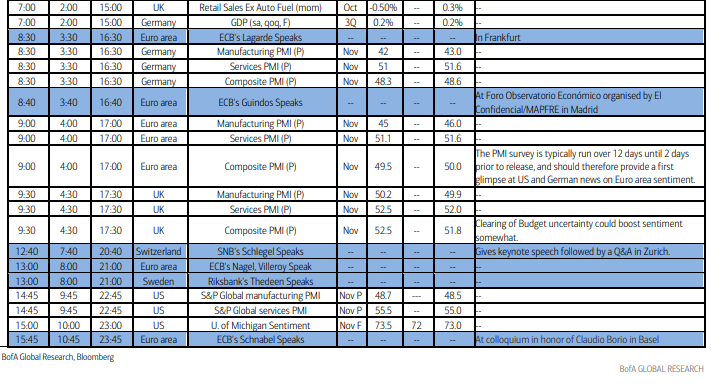

The US economic data remains a bit heavier Friday highlighted by flash PMI’s along with final U of Mich Nov sentiment (which will incorporate the election results).

I don’t see any Fed speakers on the schedule, and no Treasury auctions.

Earnings will be much lighter with the largest US reporter tomorrow the Buckle ($2.4bn market cap) (see the full earnings calendar from Seeking Alpha).

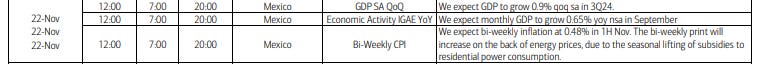

Ex-US the highlights will be flash PMI’s, Oct Japan CPI & UK retail sales, and even more central bank speakers including ECB Pres Lagarde. In EM we’ll get a number of economic reports from Mexico including GDP & CPI.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,