Markets Update - 11/22/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

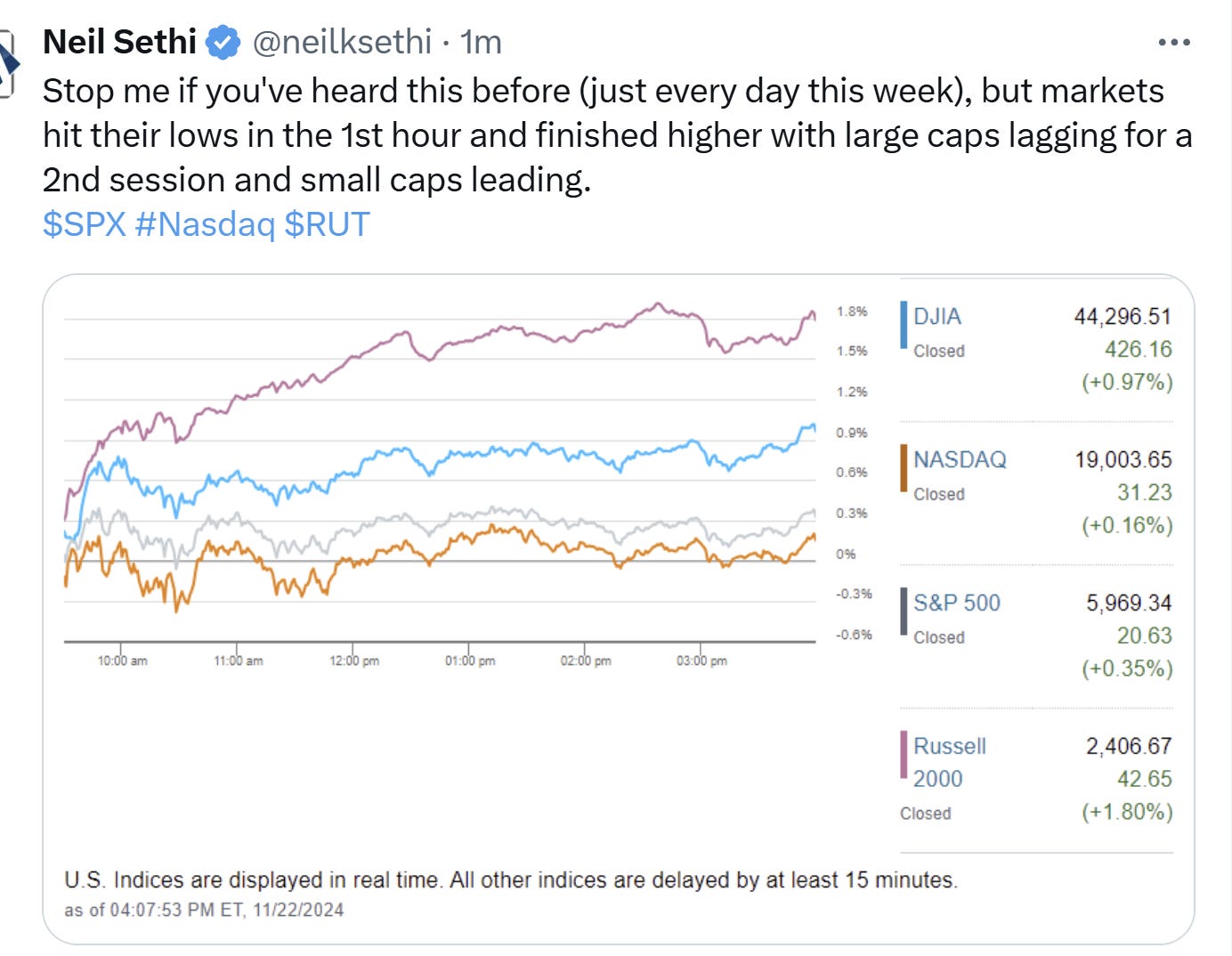

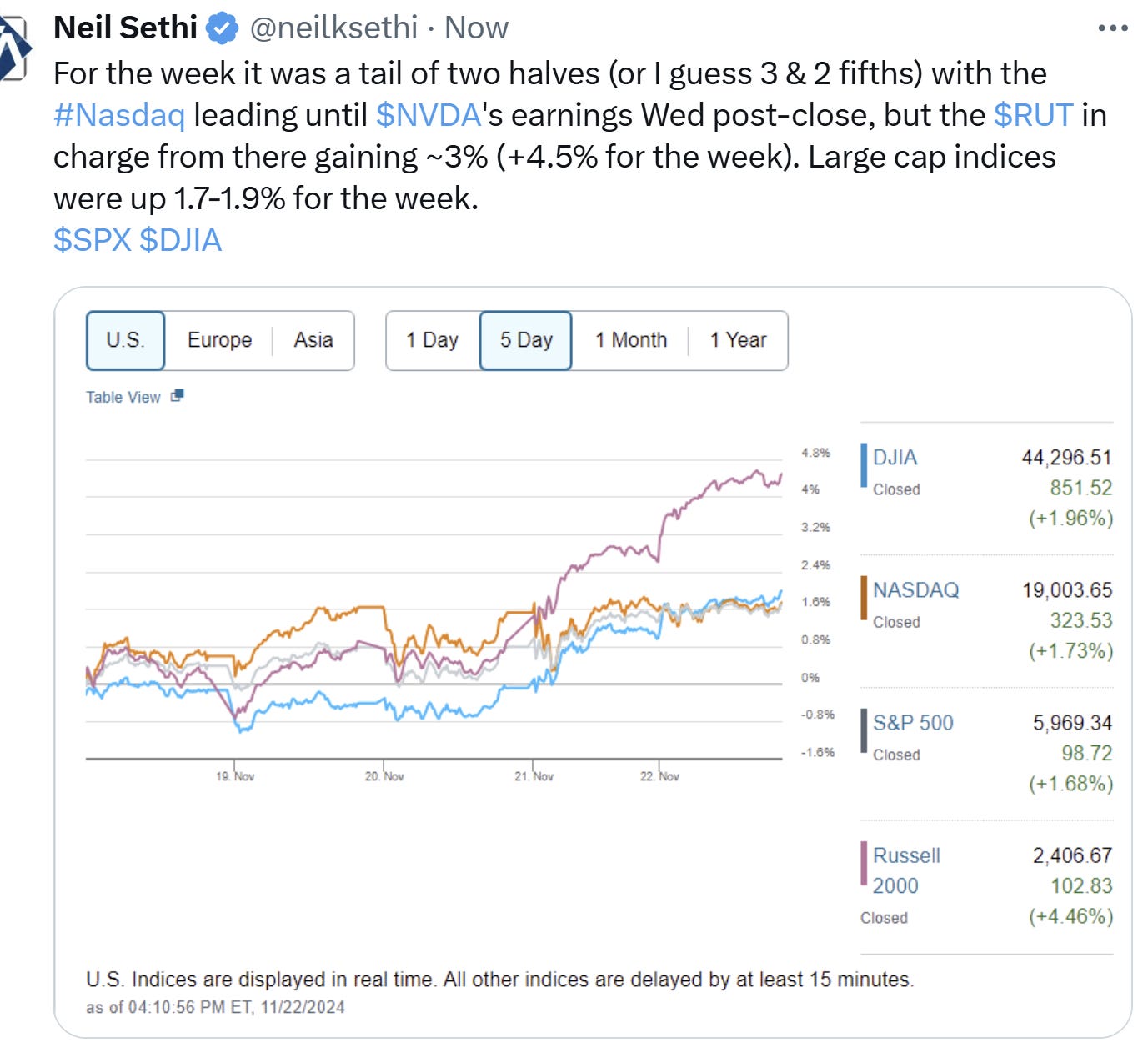

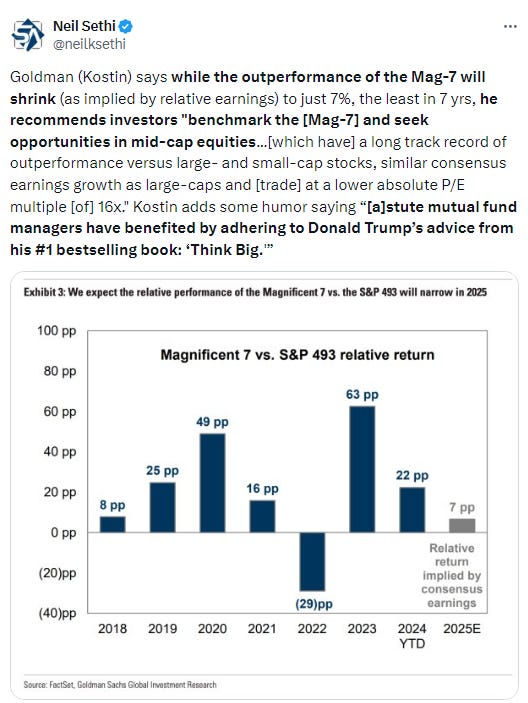

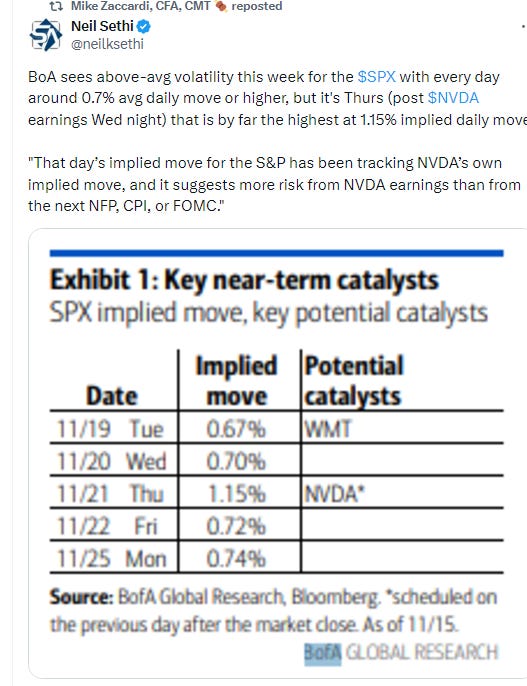

US equity indices again recovered from a weak first hour, as they have every day this week, but as we saw Thursday, it was the “other 493” leading the action led by small caps who led for the week as well.

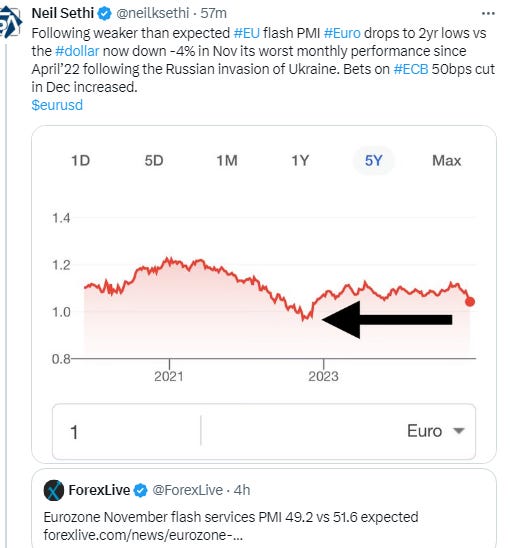

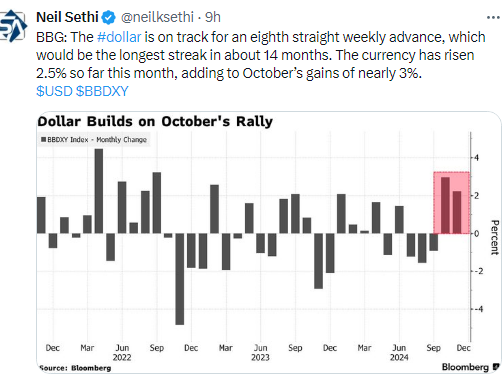

The gains in equities came along with a slight decline in bond yields, but that didn’t stop the dollar from jumping again (up for an 8th straight week, longest streak since Sep ‘23) this time to a 2yr high on the back of weakness in the euro and pound. That also again didn’t stop gold from powering to its best week since Mar ‘23 or crude from continuing its recent run to 2-wk closing high. Nat gas was up early to a 1yr high but fell back, while copper fell for a 2nd day. Bitcoin meanwhile continued its remarkable run touching $100k before ending just below.

The market-cap weighted S&P 500 was +0.4%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite +0.2% (and the top 100 Nasdaq stocks (NDX) +0.2%), the SOX semiconductor index -0.2%, and the Russell 2000 +1.8%.

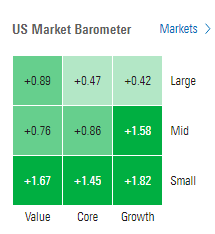

Morningstar style box consistent with small caps leading, large growth lagging.

Market commentary:

“I think markets are finally finding their footing for two reasons: One is recovery from that postelection hangover after the first week, and [two is] reaction to Nvidia’s earnings,” Nuveen CIO Saira Malik said on “Closing Bell.”

“Investors are rotating out of the previous high flyers of large-cap communication services and technology and into other cyclical sectors of consumer discretionary, industrials, and financials, as well as mid- and small-cap stocks,” said Sam Stovall, chief investment strategist at CFRA Research. “Drivers continue to be the traditional end-of-election-year rally, in which all sizes, styles, and sectors within the S&P 1500 rose in price.”

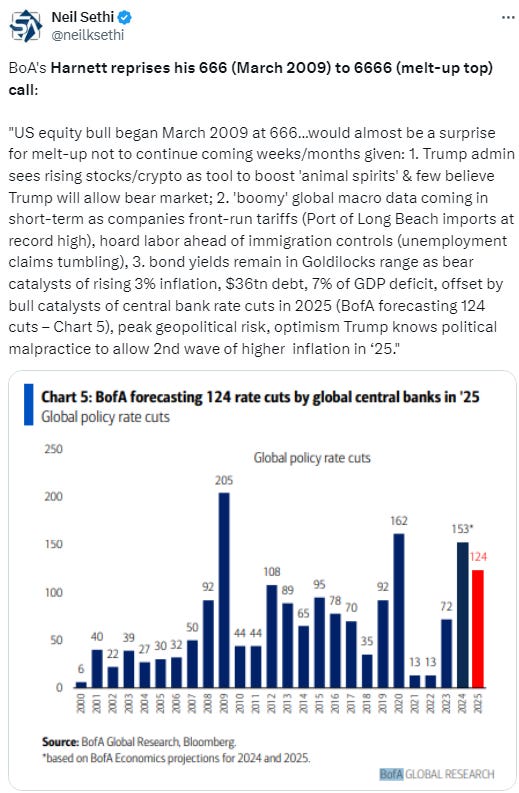

“The US flash PMIs for November were bullish in aggregate thanks to strength in services,” according to Vital Knowledge’s Adam Crisafulli, who said the details suggested a goldilocks scenario, “with favorable growth developments and cooling price pressures.”

Fundstrat’s Thomas Lee sees room for more gains in small-caps and cyclicals given President-elect’s plans for deregulation and general “animal spirits.” He also sees a “Trump put” keeping the broader market buoyant. Faith that the government and Donald Trump won’t let the economy knuckle under is helping bolster stocks, at least for the moment. “When sentiment reaches a ‘bullish extreme’ is when we see equities priced to ‘perfection,’” according to Lee. “By several measures, we are not there at that point yet.”

Recent choppiness shouldn’t make investors question whether the market has strength into the end of 2024, according to Robert Schein, chief investment officer of Blanke Schein Wealth Management. “The stock market is living up to its historical dynamic of seasonal strength in November,” Schein said. “We expect this strength to continue into year-end. Even though the market has been volatile over the past week as investors start to question the post-election rally, we believe the market’s overall fundamentals remain strong and are supportive of stock prices,” he added

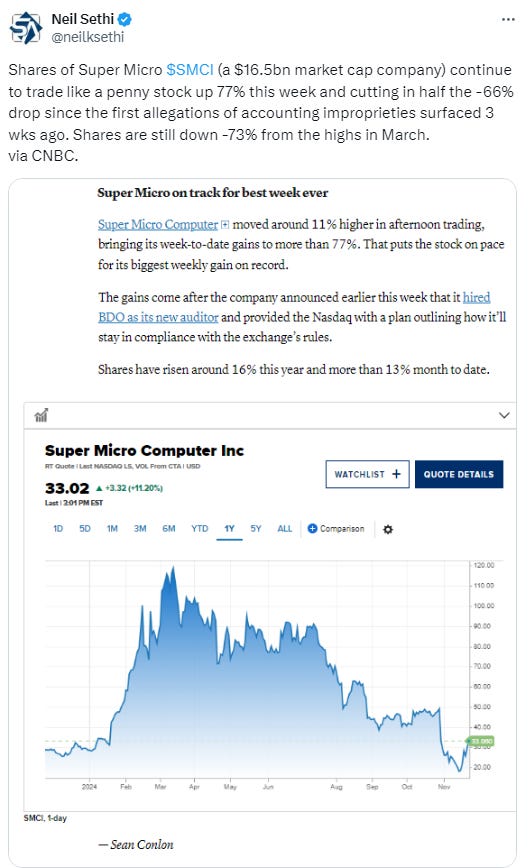

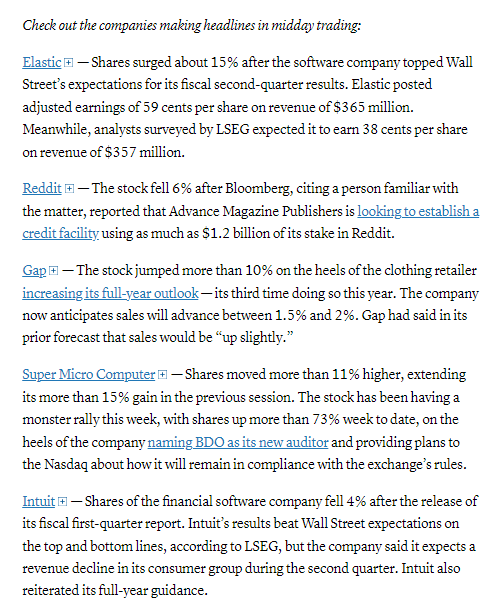

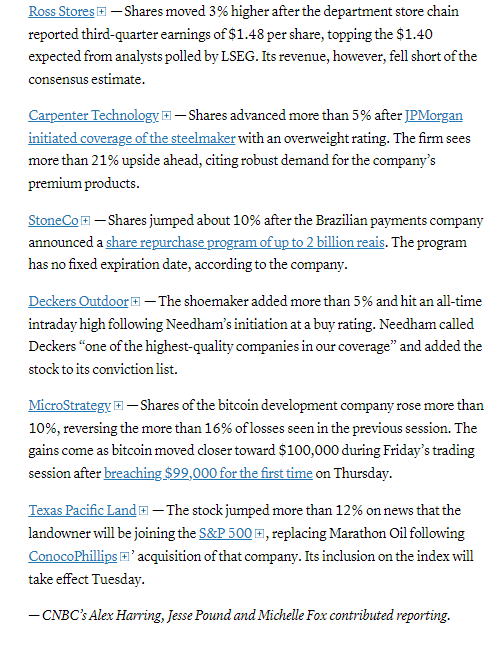

In individual stock action, the S&P 500 consumer discretionary sector (+1.2%) exhibited strength amid earnings news from the retail space. Ross Stores (ROST 146.09, +3.13, +2.2% and Gap (GAP 24.87, +2.83, +12.8%), which is not a sector component, closed higher after reporting quarterly results. Shares of companies related to Bitcoin also outperformed the broader equity market, seeing gains as crypto market participants await Bitcoin's potential move to the $100,000 milestone, with the cryptocurrency reaching $99768 at its high. Coinbase (COIN 304.64, +9.41, +3.2%) and MicroStrategy (MSTR 421.88, +24.60, +6.2%) are notable standouts in the space.

On the flip side, the communication services sector (-0.7%) was among the worst performers today, clipped by Meta Platforms (META 559.14, -3.95, -0.7%) and Alphabet (GOOG 166.57, -2.67, -1.6%). The latter traded down on a report that Microsoft-backed and ChatGPT owner OpenAI is considering developing its own browser, which would represent a viable competitive threat.

Corporate Highlights from BBG:

Ally Financial Inc. is exploring a sale of its credit card arm, according to people familiar with the matter, after getting back into that business through an acquisition three years ago.

Gap Inc. stock soared after it raised its full-year outlook as the apparel retailer attracts wealthier shoppers seeking value.

Nvidia Corp.’s surging share price has created a challenge for Jensen Huang’s charitable foundation: As the stock climbs, so does the amount of money it has to give away.

Walmart Inc.’s corporate employee bonuses are set to surpass targets again this year as the company’s stock soars and sales outperform its retail rivals.

Some tickers making moves at mid-day from CNBC.

In US economic data today:

Nov US flash PMIs hit 10-mth highs on the back of a continued improvement in the services sector which grew at the quickest pace in 31 months.

Final Nov UMich consumer sentiment (which did include in part the results of the election) confirmed a 4th mth of improvement to a 6-mth high but falls -1.2pts from the preliminary read to 71.8 (still up from 70.5 in Oct but also lower than the 73.9 expected). The report noted “[p]ost-election interviews were 1.3 points below the pre-election reading, moderating the improvement seen earlier in the month.” The decline was mostly due to a fall in expectations which were still the best since March. Current conditions fell less post-election but was still lower than Oct. 1-yr inflation expectations remained the least since Dec ‘20, but 5-10 yr expectations rose to the joint highest since Mar ‘11.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX edged a little closer to its ATH. Its daily MACD & RSI have turned a little more positive.

The Nasdaq Composite remains a little further from its ATH. It daily MACD & RSI are also more mixed.

RUT (Russell 2000) continued its now 4-day bounce from its 20-DMA back to less than 3% from its ATH. Its daily MACD (circle) & RSI (arrow) have also moved to a bullish positioning.

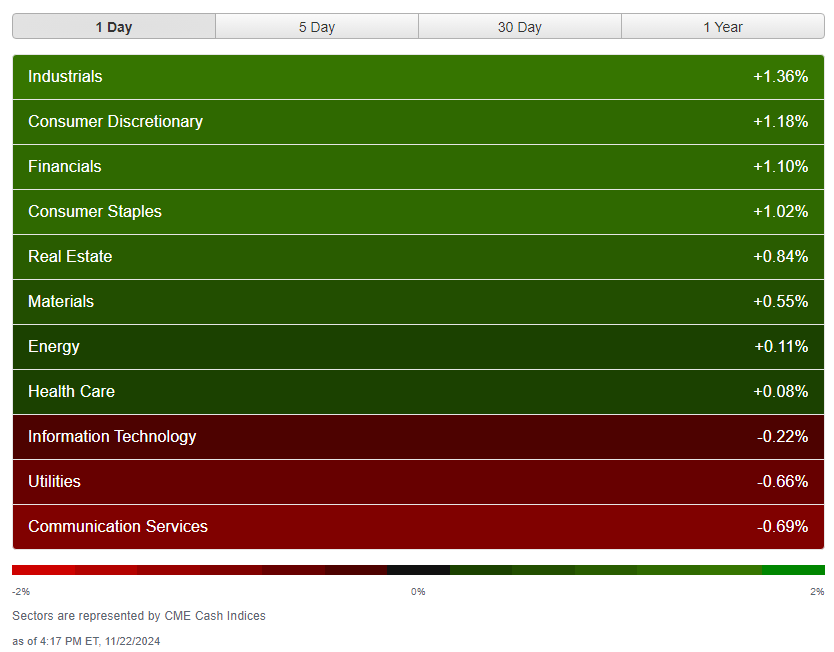

Equity sector breadth from CME Indices another solid day w/8 of 11 sectors up (down from 9 Thurs & Mon but up from 6 Tues & Wed) with 6 sectors up +0.6% or more vs 8 Thurs, 7 Mon, 3 Tues/Wed (four up >1% from five Thurs but just two Mon-Wed). Growth sectors were more mixed today with tech and communications 2 of the bottom 3, but discretionary in 2nd place behind industrials (and tech weakness was mostly just NVDA, PANW & INTU). Overall, my takeaway is we clearly saw a rotation out of megacap growth into the "other 493" post-Nvidia’s earnings.

Stock-by-stock SPX chart from Finviz consistent showing lots of green outside of some of the largest stocks and pockets of health care & utilities.

Positive volume was again good Fri, it’s 4th day of improvement, with the NYSE at 77%, down slightly from Thurs, but the NYSE Composite gained nearly half a percent less, while Nasdaq was 67%, despite the index finishing up less than two tenths of a percent. In addition, issues, which had been lagging all week until Thurs, remained supportive at 74 & 69%. So a clear change in breadth post-Nvidia earnings Wed night.

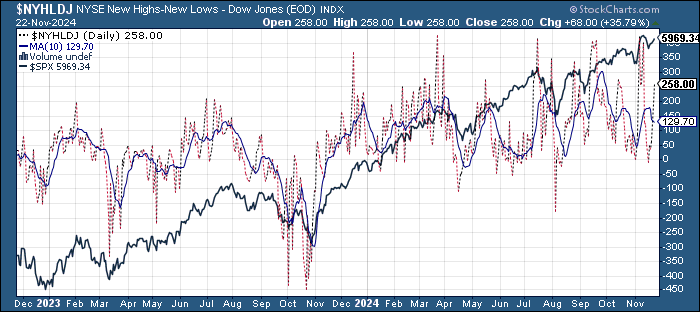

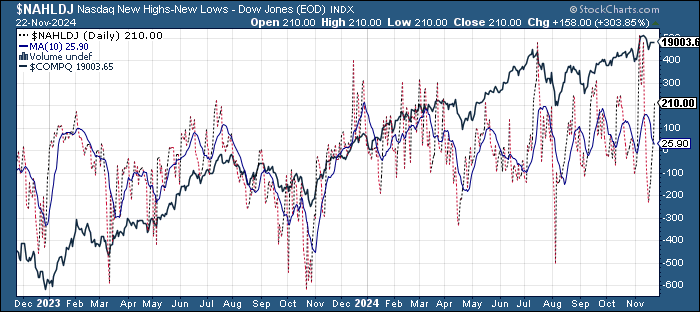

New highs-new lows improved as well w/the NYSE increasing to 256, while the Nasdaq improved to 208, a big jump from 38. Those are the best since Nov 11th when they were 404 & 483 respectively (which was around the best in 3 years), and they continue to move further above the 10-DMAs (more bullish), although the 10-DMA’s continue down for now.

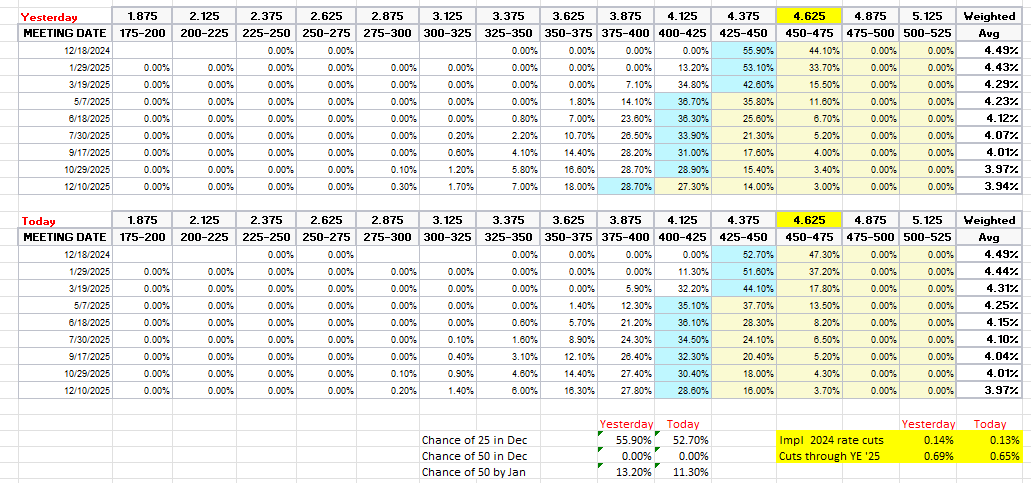

FOMC rate cut probabilities from CME’s Fedwatch tool gave back Friday the firming we’d seen Thurs for a December cut, while 2025 expectations dropped further, on the strong flash PMIs. Chance of a December cut fell to 53% (in the range though of this week), while 2025 expectations fell to 65bps of cuts (from 76 on Wed), meaning just around 2.5 cuts in total are priced from here. Seems we might be getting a little too far on the “fewer cuts” side of the boat.

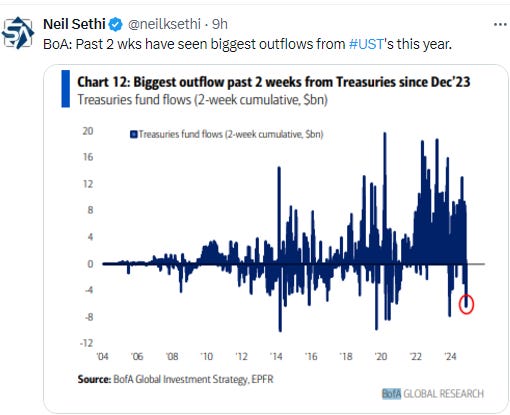

Treasury yields edged lower despite the better than expected flash PMIs with the 10yr yield, more sensitive to economic growth and long-term inflation, -2 basis points to 4.44%, still little changed since Nov 6th and remaining below the 4.5% level (identified by many as a “line in the sand”). The 2yr yield, more sensitive to Fed policy, was though +2bp to 4.37% the highest since late July, as rate cuts were priced out as noted above.

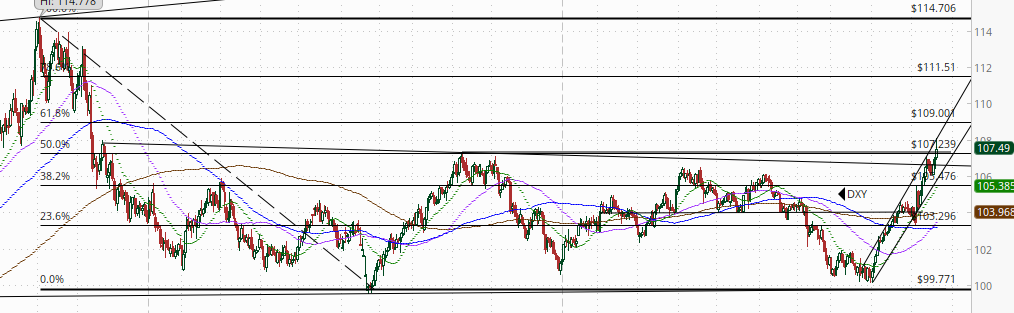

Dollar ($DXY) up again Fri capping an 8th consecutive up week, the longest streak since Sep ‘23 & driving to a 2-yr high as it continues the bullish “outside day” candle from Wed. It touched at one point the top of the uptrend channel running back to September that it’s only closed outside of for one session before falling back towards the middle. Daily MACD & RSI remain supportive, so as I said Wed “we’ll see if it can keep the rally going.” Doesn’t really have any resistance until we get up into the 112 area. There’s Fibonacci resistance in terms of the 61.8% retracement of the drop from the Sept ‘22 highs to July ‘23 lows at $109.

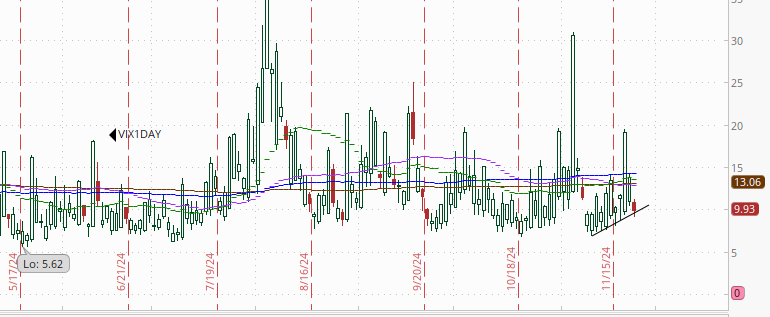

The VIX & VVIX (VIX of the VIX) fell back to and near (respectively) the lows of the week, the former to 15.2 (consistent w/a little less than 1% daily moves over the next 30 days) and the latter to 95 (consistent with “moderately elevated” daily moves in the VIX over the next 30 days).

1-Day VIX also fell back to 9.9 looking for a move of around 0.62% Monday, a little below what BoA said was implied from options markets coming into the week.

WTI continued its rebound Friday after testing the key $67 level last week making it over the 50-DMA consistent with the daily MACD & RSI flipping to a more positive condition as noted Thursday. Still as I said then, “we saw all of this at the start of the month, and the rally went a little further then fizzled. We’ll see if this time is different.” A break over $72.50 would be different.

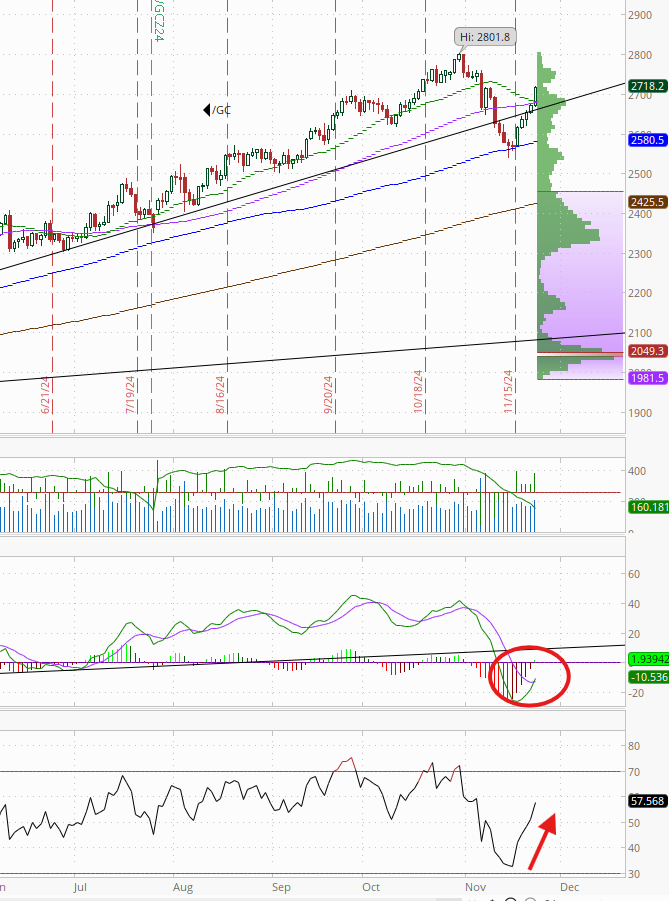

Gold continued its bounce from its 100-DMA for a 5th day, it’s best week since Mar ‘23, making it over the $2400 level. As I said Monday “if it can clear that, though, it has pretty clear sailing back to $2800,” and consistent with that it shot up +1.5% once it was over. In addition the daily MACD & RSI turned positive, so it’s got a lot going for it.

Copper (/HG) unlike gold fell for a 2nd day just holding that trendline back to the Oct ‘23 lows its mostly respected since then. Daily MACD & RSI as noted last Monday remain in a negative positioning.

Nat gas (/NG) very volatile Friday continuing its rally from its 20-DMA for a 6th day right at the start of the session to another 1yr high before falling sharply soon after, ending down over -6% back under the June highs. Not sure of the reason as the forecasts remain on the cold side, perhaps some profit taking. It is also getting ready to roll to the Jan contract. The daily MACD & RSI remain positive.

Bitcoin futures continued their series of ATH’s consistent with Monday’s note that “all-in-all the bullish momentum is intact.” I said last week it had gotten very extended, “but that it had gotten more extended in February, so I continue to think Katie Stockton’s target of $97.5k is certainly doable (as is $100k in the short term).” As noted Thurs we passed Stockton’s target, and today it touched $100k (for one minute). As Mike Novogratz said yesterday $100k was “inevitable”, but the question now is where does it go from here? I don’t have a good answer for that.

The Day Ahead

Enjoy the weekend.

More on Sunday.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,