Markets Update - 1/12/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

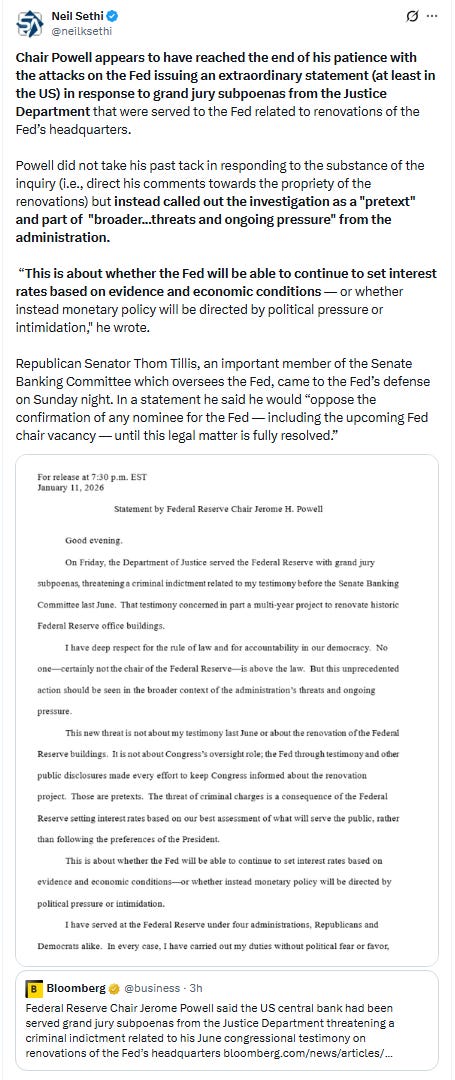

US equity indices started Friday’s session lower as they digested the latest back and forth between the Trump administration and Fed in the form of subpoenas from the DoJ and a very unusual video response from Fed Chair Powell. That also pushed the dollar down and gold up. Adding to the pressure on stocks was a call from Pres Trump to cap credit card interest rates at 10% which pulled down shares of credit card issuers including all of the large banks. Citigroup was down 4% in the premarket, JPMorgan (which reports earnings tomorrow) and Bank of America more than 2%. Capital One shares plunged 11%.

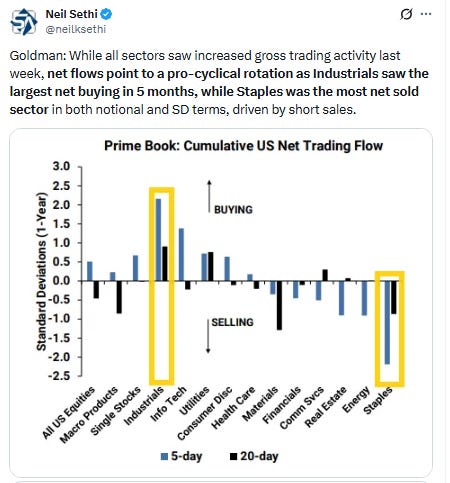

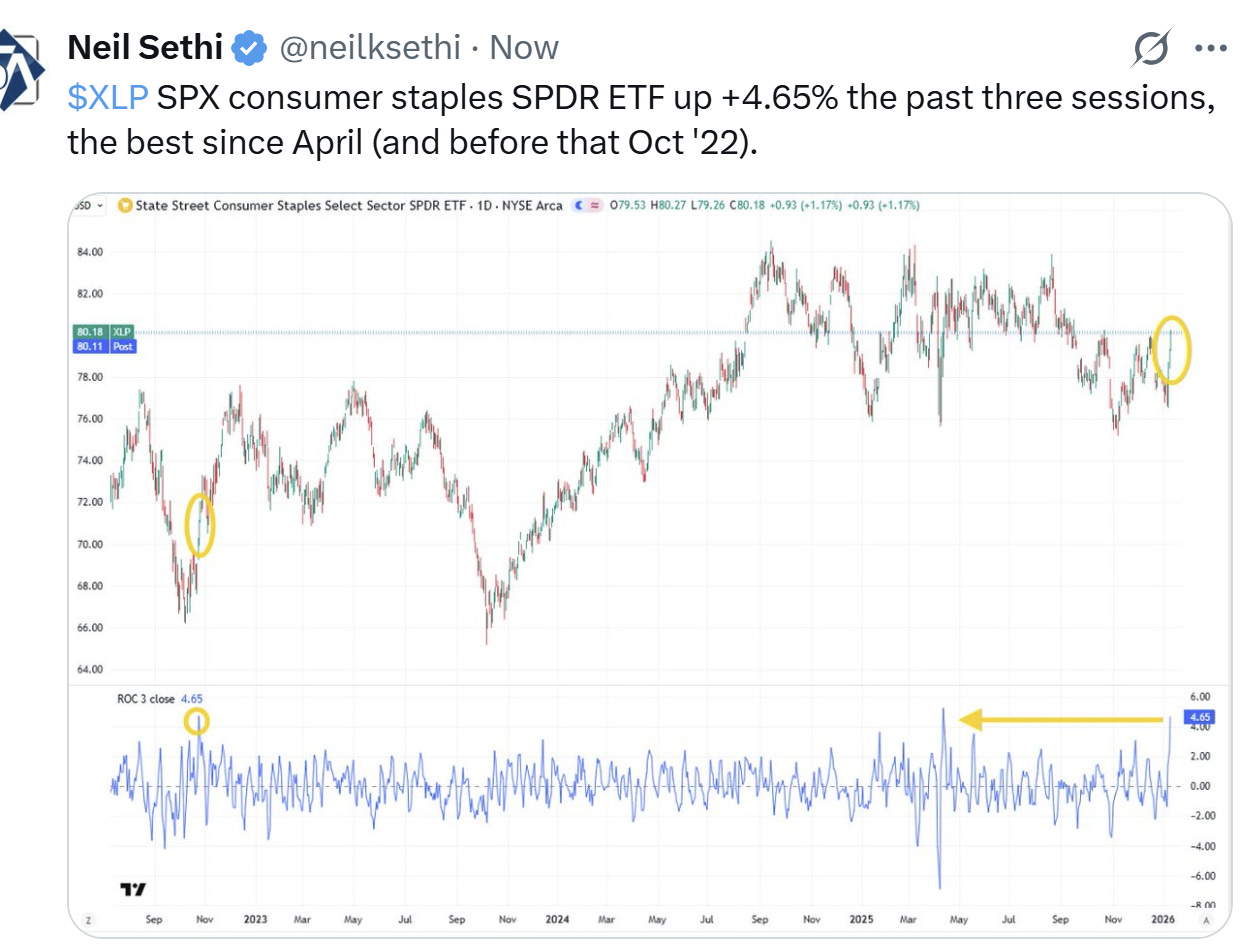

But markets took comfort in a number of Republicans who rushed to the defense of the Fed/Powell, along with Treas Secretary Bessent saying he wasn’t in favor of the investigation, and most financials pared losses while investors continued their buying of other sectors with Staples capping its best 3-day run since April led by shares of Walmart. Alphabet led gains in megacaps as Google confirmed a multiyear deal with Apple Inc. to power the iPhone maker’s artificial-intelligence technology.

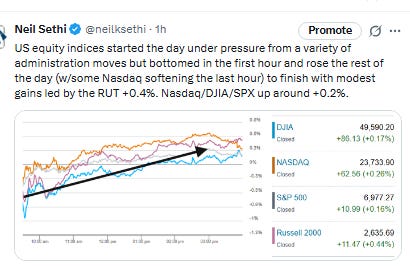

So after a rocky first hour, markets began to march higher and finished the day with with modest gains led by the Russell 2000 +0.4%. Nasdaq/DJIA/SPX ended up around +0.2%.

Elsewhere, bond yields edged higher, but the dollar fell back from a 1-month high on Fed independence concerns. Commodities were broadly higher with crude, gold, copper, bitcoin and natgas all in the green.

The market-cap weighted S&P 500 (SPX) was +0.2%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite +0.3% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOXX semiconductor index +0.5%, and the Russell 2000 (RUT) +0.4%.

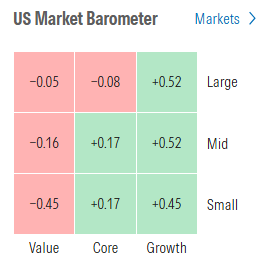

Morningstar style box back to mixed with a preference for growth.

Market commentary:

“The market has seen this before and doesn’t like it. It’s not about Powell at this point, it’s about the independence of the Fed,” said Jay Woods, chief market strategist for Freedom Capital Markets. “So when news like this hits, the knee jerk reaction is to sell off.”

“This is unambiguously risk off. We expect the dollar, bonds and stocks to all fall in Monday trading in a sell-America trade similar to that in April last year at the peak of the tariff shock and earlier threat to Powell’s position as Fed chair, with global investors applying a higher risk premium to U.S. assets,” said Krishna Guha, head of global policy and central bank strategy at Evercore ISI.

“Gold and other safe havens should rally,” added Guha.

Later Guha said while independence risks will likely be a key theme in 2026, Krishna Guha at Evercore says there are two ways to interpret US markets stabilizing. “The first is this does not matter to markets,” he said. “The second is it matters a lot, but partly for this reason investors think this move is going nowhere and the administration will look for a de-escalation off ramp. We are firmly in the second camp.”“Concerns about the Fed’s independence have really been reinforced with the latest criminal investigation,” Jan Hatzius, chief economist at Goldman Sachs Group Inc., said at a strategy conference in London. “Our expectation, though, is that this is a committee decision. I have no doubt that in his remaining term as chair, Powell is going to make decisions based on the economic data.”

“The risk premium embedded into the dollar has room to increase in the coming weeks should investors revive the Sell America theme of last year. This risk premium may widen should this week’s data out of the US show that inflation is sticky and the White House announces a new Fed chair who is overtly dovish.” — Ven Ram, BBG macro strategist.

“Whether the White House’s latest attempt to influence Fed policy succeeds or not is key to the medium- and long-term market implications,” said Thierry Wizman at Macquarie Group. “But if it does succeed, we foresee a weaker dollar, a steeper yield curve, higher long-term yields, and higher inflation breakevens as modal outcomes, all else equal.”

“Are the subpoenas and threat of criminal prosecution simply a ploy to manipulate the Fed? I can’t say, but I can say that I hope not,” said Mark Malek at Siebert Financial. “The Fed must remain independent in order for the central bank to remain effective and – and this is important – or the integrity of the US dollar and the all-important Treasury markets to remain the world’s benchmarks.”

The strength of the evidence in favor of greater central bank autonomy lowering inflation has often been overstated, and even complete independence offers no guarantee of low inflation in future, according to Jennifer McKeown at Capital Economics. “But sustained political intrusion into monetary policy would come at a cost, even if markets are willing to overlook it in the short term.”

“With a successful criminal prosecution looking highly unlikely based on what we know so far, it’s not obvious to us how much incremental pressure this really puts on the Fed. So unless someone actually resigns, it’s not clear this really changes the picture,” said Tobin Marcus, head of U.S. policy and politics at Wolfe Research. While Marcus noted that the developments were still alarming, they’re not “necessarily sufficient” to spur a “big” sell-off. “We suspect the constraint on Trump will be the lack of tools to fully control Fed policy, rather than discipline from a huge market backlash,” he continued.

“It doesn’t matter that much, in some sense,” Rob Williams, chief investment strategist at Sage, told CNBC. “I think it’s some noise, and it’s not even pushing rates around that much ... the focus is going to be on data,” he continued, pointing to the upcoming release of the consumer price index for December on Tuesday.

“After shrugging off last week’s geopolitical surprises, US markets face domestic political headlines as trading kicks off this week,” said Chris Larkin at E*Trade from Morgan Stanley. “Barring additional surprises, the markets will likely turn their attention to earnings and inflation data.”

“The impact of Chairman Powell being under investigation is likely a long-term impact, meaning it’s not going to change interest rates in the near term; it’s not going to change inflation in the near term,” Jim Lebenthal, chief markets strategist at Cerity Partners, said to CNBC. With the anticipation of “pretty good” earnings this week and CPI possibly coming in “well below 3%,” not to mention an economy that’s “growing rapidly,” the strategist said that there’s just “too many good things” in the short term. That’s what’s keeping the broader market higher, even if the investigation spells bad news in the long term, he said.

“The bull market still has legs, and it’s entirely possible that we see further gains irrespective of what happens with internal and external policy, said Giuseppe Sette at Reflexivity.

“US banks have performed pretty well during the past quarter, so I’ll be looking into whether this earnings season provides confirmation,” said Andrea Tueni, head of sales trading at Saxo Banque France. “If that’s the case, the sector may actually become one of the drivers of this year.”

The first week of the fourth quarter earnings season could help set the tone for how stocks trade through the rest of the month, noted Anthony Saglimbene at Ameriprise. Strong updates on credit, margins, and capital deployment from key banks could help anchor investor confidence as the reporting season quickly broadens to the rest of corporate America over the coming weeks, he said. However, if expenses run hot or guidance turns cautious, market reactions could be more volatile, and the narrative may shift toward a more selective or defensive stance given some of the more bearish developments.

“Earnings will need to do more of the heavy lifting this year to keep major averages rising,” Saglimbene concluded. “Starting this week, investors will see if corporate America is up for the challenge.”

Strong earnings per share doesn’t mean strong price returns, according to Savita Subramanian at Bank of America Corp. “Earnings optimism is justified and even weaker guides are not reason to worry - it’s seasonally appropriate,” she said. “But ‘alpha’ on beats is less of a slam dunk: early reporters that have beat lagged the following day. Boom earnings years have seen lower price returns than normal- equities anticipate rather than react.”

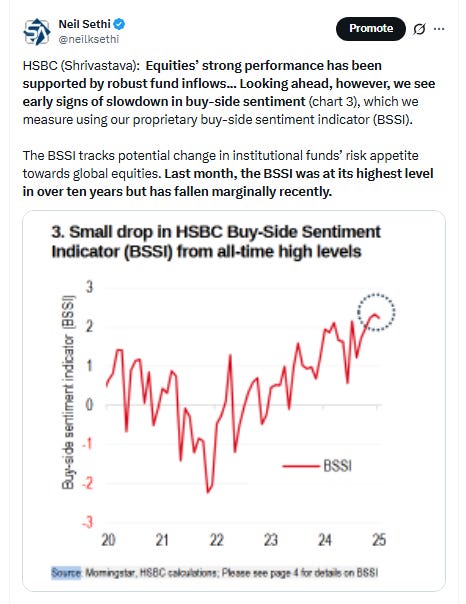

This week’s US inflation data is unlikely to “ruffle any feathers”, according to Max Kettner at HSBC. If anything, the fourth quarter reporting season with a similarly easy-to-beat setup like in the last two quarters should be the next bullish catalyst, he said.

“People are getting more bullish on economic growth prospects for 2026, regardless of what the trailing employment situation looks like,” said David Donabedian, a senior investment strategist at CIBC Private Wealth Management. “Thinking about the impact of the rate cuts we’ve already seen, the expected upcoming stimulus from the One Big Beautiful Bill, and a bounce in some of the data.”

“If you get an aggressively negative Supreme Court ruling, you could see a kind of a revolt in the bond market, which makes me question the consensus that that ruling would be good for the equity market,” he says.Fundamentals in the economy seem strong at the start of 2026, and that may be enough for markets to continue pushing higher, said Jason Draho, head of asset allocation Americas at UBS Global Wealth Management. “The new year is off to a roaring start, for the markets and for economic and policy news. The strong start for risk assets suggests that there’s much more noise than signal in the news flow, with investors increasingly confident about cyclical growth acceleration in a run-it-hot economy,” Draho wrote in a note. Draho noted that policies intended to lower interest rates could benefit investors, even if they are intended to promote affordability for everyday consumers. Because of that, he said that markets are “unlikely to go down with a whimper this year after starting with a bang.”

Robert Edwards, chief investment officer at Edwards Asset Management, predicts the S&P 500 will end the year near 7,700, but doesn’t anticipate it’ll be a straight path. “2026 is likely to be a sawtooth year for the markets, where stocks experience a 7-15% pullback in the first half of the year for the simple reason that too much of Wall Street is bullish. The market is due for a sentiment reset and we expect that reset to take place in the next 6-months,” Edwards said in an email. Despite this expectation, Edwards said he remains very bullish on stocks as well. He said that he expects the market will be driven by strong earnings, an active IPO market and more excitement around AI. To take advantage of this, Edwards said that his strategy involves rotating away from overweight tech names and diversifying into broader stock-market exposure.

“Having international equities in a globally diversified portfolio makes a lot more sense now than it has in the past 15 years,” said Will McGough, the Overland Park, Kan.-based deputy chief investment officer at Prime Capital Financial. “You don’t want to liquidate U.S. equities. But I would be putting more money to work overseas, alongside America,’‘ he said via phone on Monday.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

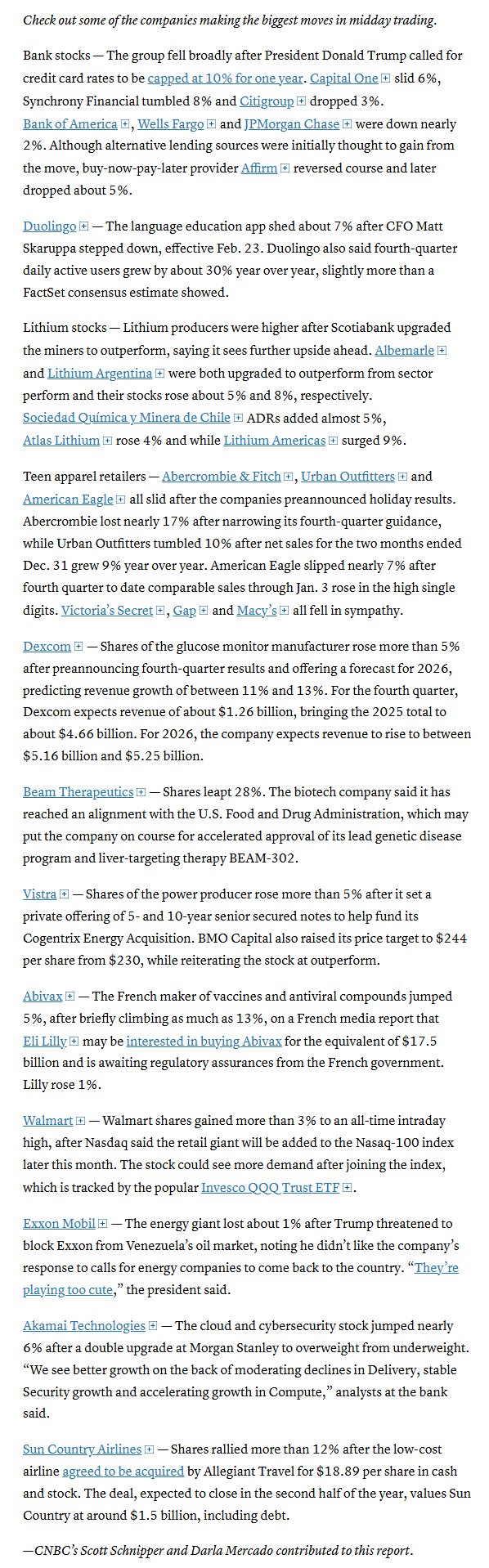

In individual stock action:

Bank stocks were the hardest hit Monday, with Citigroup down about 3%. JPMorgan and Bank of America were off by more than 1%. Capital One shares slid 6%.

Walmart gained 3% on enthusiasm ahead of its upcoming inclusion into the Nasdaq-100 index, which is tracked by the popular Invesco QQQ Trust ETF. The retailer led a gain in the consumer group, which could be getting an overall lift from Trump’s push to lower credit card rates, as well as oil prices, ahead of the U.S. midterm elections later this year.

Corporate Highlights from BBG:

Nvidia Corp. plans to invest $1 billion over five years in a new laboratory with Eli Lilly & Co., aiming to speed up the use of artificial intelligence in the pharmaceutical industry.

Societe Generale SA is scrapping a self-developed artificial intelligence tool in favor of Microsoft Corp.’s Copilot solution, highlighting the challenges even large lenders face in building out their own offering in the cost-intensive technology.

Paramount Skydance Corp. ratcheted up the stakes in the monthslong battle for Warner Bros. Discovery Inc., saying it plans to nominate directors to the board to thwart a merger with Netflix Inc.

UnitedHealth Group Inc. used “aggressive strategies” to maximize diagnoses and boost payments for patients on private Medicare health plans, a new Senate report found, adding to pressure on the largest US health insurer.

Eli Lilly & Co. said it expects its highly anticipated weight-loss pill to receive US regulatory approval as early as the second quarter of 2026, slightly later than it signaled earlier.

Novo Nordisk A/S’s obesity pill will allow it to tap into a massive population of patients that have not yet taken GLP-1s, the drugmaker’s chief executive officer said.

Sarepta Therapeutics Inc. reported its embattled gene therapy is expected to miss fourth-quarter sales estimates.

Moderna Inc. said its US Covid business did better than expected last year, a rare bright spot for the vaccine maker, which has struggled with the decline of people getting its shot.

A US judge ruled Orsted A/S can resume development of a wind farm project off the coast of Rhode Island while it challenges the government’s latest stop-work order, a major win for the Danish energy giant in an ongoing fight with the Trump administration over renewable energy.

Shake Shack Inc. reported preliminary fourth-quarter sales below Wall Street estimates, another sign of struggles in the fast-casual restaurant sector.

Five Below Inc. boosted its sales forecast beyond Wall Street estimates after reporting a banner holiday shopping season.

Allegiant Travel Co. agreed to buy Sun Country Airlines Holdings Inc. in a $1.5 billion cash-and-stock transaction, further driving consolidation in the US airline industry amid intensifying competition.

Alaska Air Group Inc. is upgrading its technology systems in the wake of painful outages that upended operations and hit earnings, a crucial step in the company’s strategy to establish itself as a global carrier.

QXO Inc. is raising another $1.8 billion from investors including Apollo Global Management Inc. and Temasek Holdings Pte, comfortably more than doubling the $1.2 billion financing deal it announced last week.

The US Supreme Court turned away a bid by Hertz Global Holdings Inc. to avoid more than $320 million in payments to bondholders tied to its Covid-era bankruptcy, leaving in place a ruling that favored creditors.

Michael Saylor’s Strategy Inc. acquired almost $1.25 billion in Bitcoin, marking the company’s largest purchase of the digital asset since July.

UBS Group AG said planned Swiss banking reforms are a threat to the national economy as pressure builds on the government to water down the proposals.

Airbus SE expects aircraft engines to remain in tight supply this year, suggesting that the bottlenecks that have complicated output in recent years show no signs of abating any time soon.

Heineken NV Chief Executive Officer Dolf van den Brink is stepping down abruptly as the brewer faces a drop in beer sales and underperforms rivals.

Simon Carter, chief executive officer of British Land Plc, is set to step down from the role after five years and will head to P3 Logistics Parks to lead the GIC Pte-owned investor and developer.

Birkenstock Holding Plc reported strong sales figures for the final months of 2025 as demand stays robust for its high-end sandals and clogs, despite the impact of a weaker US dollar and tariffs.

Mercedes-Benz Group AG fell further behind BMW AG in selling electric vehicles, leaving the automaker increasingly reliant on a slate of upcoming models to revive interest in its plug-in lineup.

Mid-day movers from CNBC:

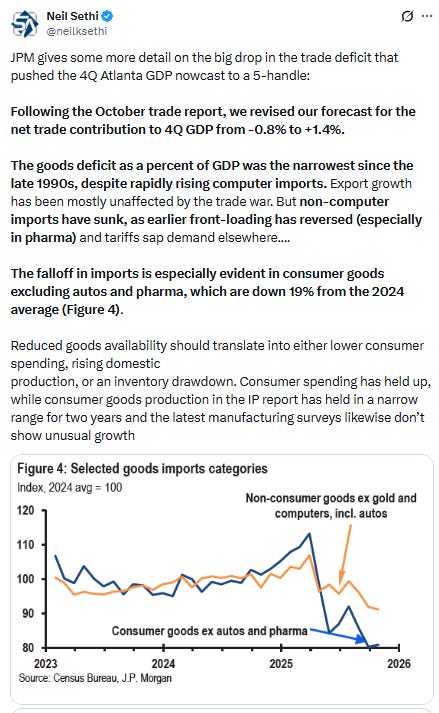

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

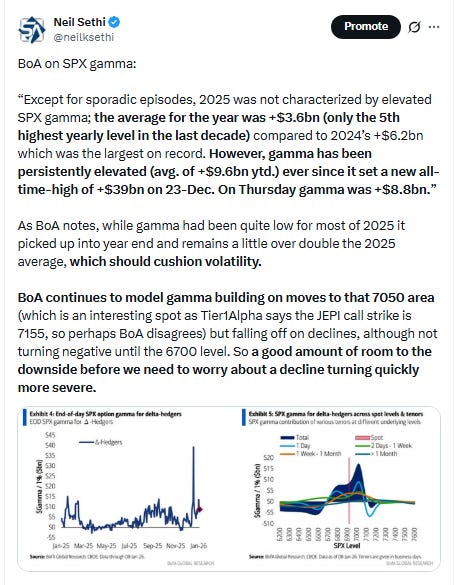

The SPX edged to another ATH. The daily MACD and RSI are both neutral with a negative divergence but at least are making new local highs.

The Nasdaq Composite remains below its ATH.

RUT (Russell 2000) remains the best chart of the bunch continuing its rebound from its 50-DMA hit Thursday and making another ATH. Its MACD as noted Wed did cross to a “go long signal” and the RSI is now over 60.

Sector breadth according to CME Cash Indices (uses futures prices) remained healthy (as it’s been all year ex-Wed) although the gains were much less robust Monday.

9 of 11 sectors higher for a third session (ex-Wed, there have been at least 7 sectors up every day this year), although just three were seven up over +0.7% (vs seven Fri, six Thurs) and one at least +1% (vs five and four) led by Staples which is now up +4.65% the past three sessions, the best since April (and before that Oct ‘22).

We did also have two sectors down more than -0.6% (after none Fri) but neither was more than -0.8% (Energy and Financials (down for a second session)).

SPX stock-by-stock flag from @finviz_com for Monday looks quite a bit like Friday with just a little more bright red and less bright green.

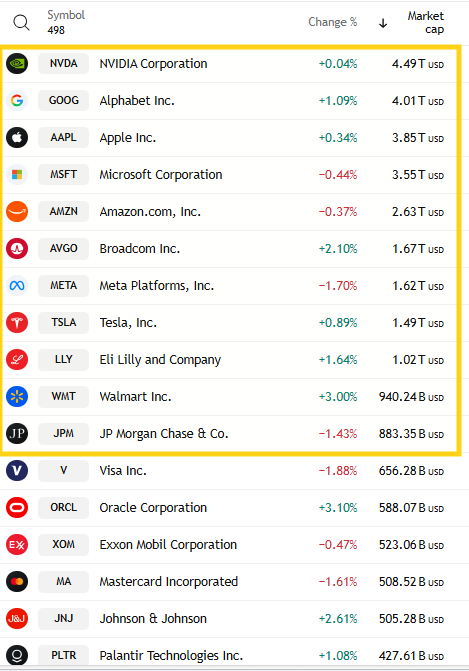

5 of the top 11 were lower (up from 3 Friday which was the least this year). META led to the downside -1.7%. Leading to the upside was WMT +3.0%, edging out AVGO +2.1% which led Fri. Mag-7 -0.04%, after gaining +0.7% last week (rebounding from its worst week since April).

~20 SPX components were up 3% or more (after 45 Fri, 70 Thurs, 12 Wed, 75 Tues, 50 last week). We continue to see 2025 leaders lead the SPX today being Western Digital WDC +5.8% followed by Seagate STX +5.7% (after SanDisk SNDK led twice last week. Two of those 20 were >$100bn in market cap (after 15 of 45 Fri, 7 of 70 Thurs, eight of twelve Wed) in NEM, APH (in descending order of percentage gains).

13 SPX components down -3% or more (approx same as Fri, down from 25 Thurs, 65 Wed) led by credit card issuer Synchrony Financial SYF -8.4%. Three of the 13 were >$100bn in market cap down -3% or more (up from one Fri, down from seven Thurs, twelve Wed) in COF, QCOM, INTC (in order of percentage losses).

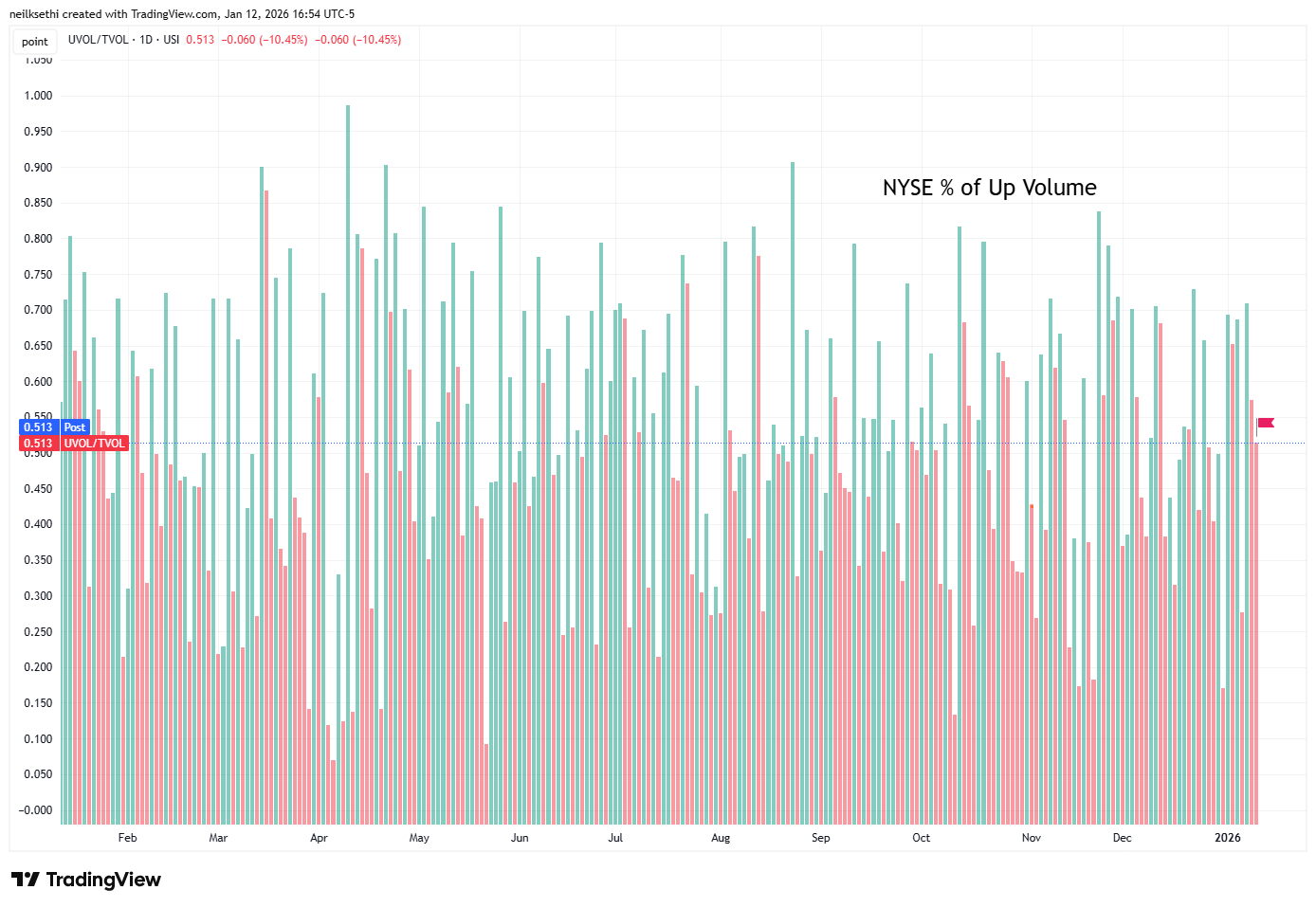

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) continued to deteriorate from Thurs’ very impressive 70.8% now down to 51.3% from 57.3% Fri despite the index gain coming in almost exactly the same at +0.46% from +0.47%.

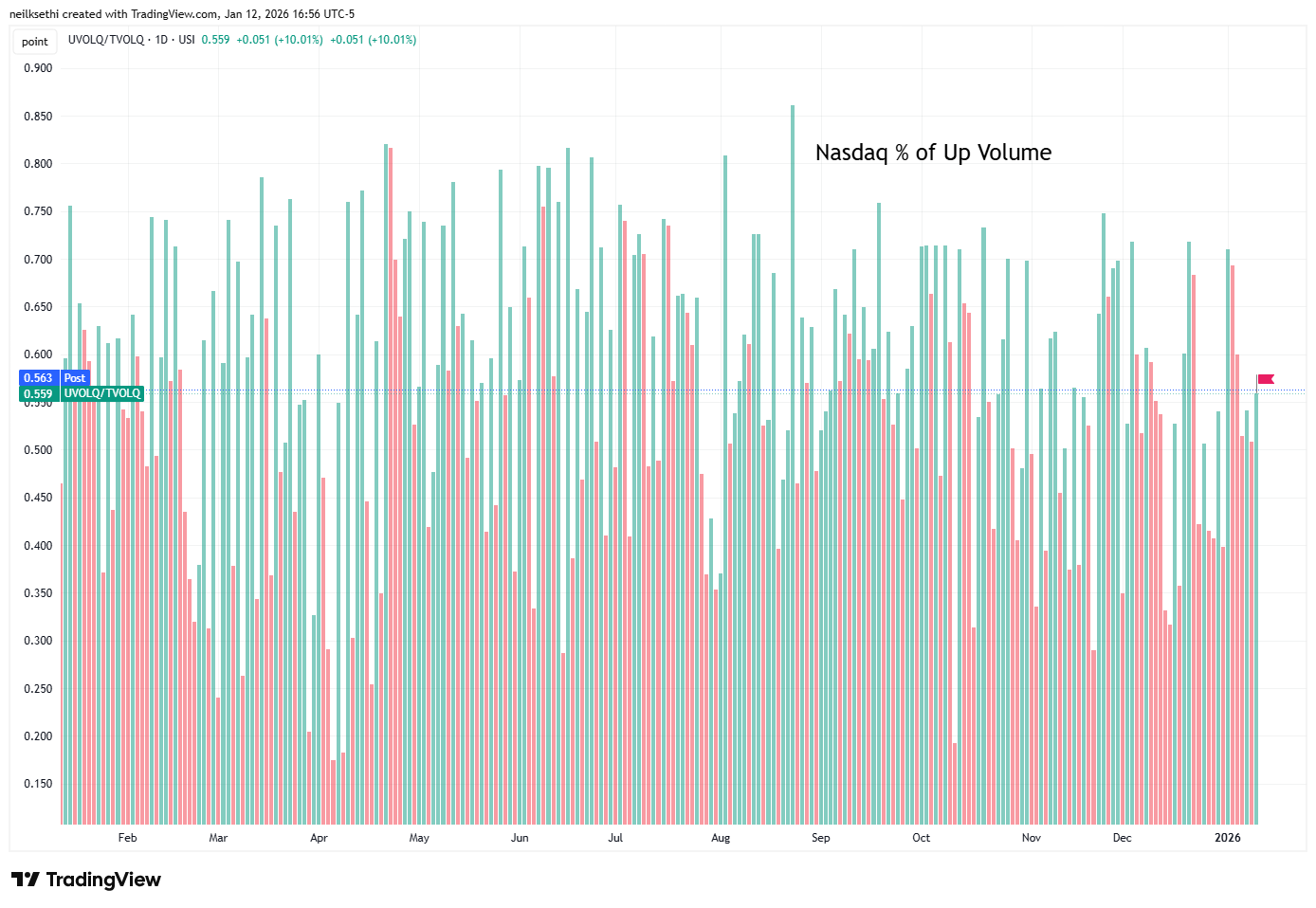

Nasdaq positive volume (% of total volume that was in advancing stocks) Monday though improved to 55.9% from 49.3% Friday despite the index gain falling to +0.26% from +0.81% Friday.

But the stronger positive volume came along with a pickup in speculative volumes on the Nasdaq making it less useful as an indicator. The top three stocks by volume collectively over 1.4bn shares double Friday’s ~700mn shares and around the most we’ve seen since the summer. But it’s nothing like it was in the summer/early fall with only 8 companies with volumes over 100mn shares vs 10 Friday (although three more were over 90mn).

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, continued though to remain not far off of positive volume, as has been the case for the most part the past few weeks, with Nasdaq at 52.8% and the NYSE at 55.8%.

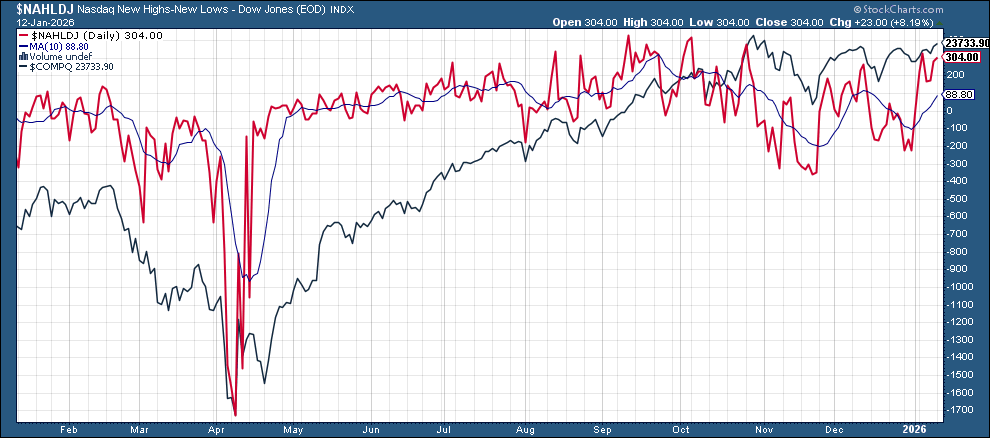

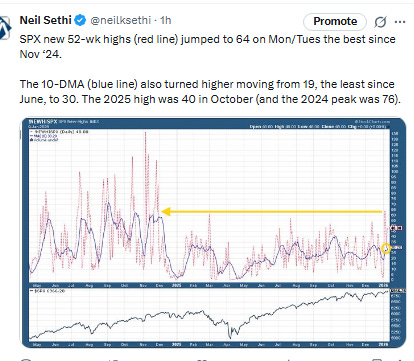

New 52-wk highs minus new 52-wk lows (red lines) improved on the NYSE to 202, the second highest since Aug, while the Nasdaq moved to 301, a little below the 326 on Tues (which was the best since Oct).

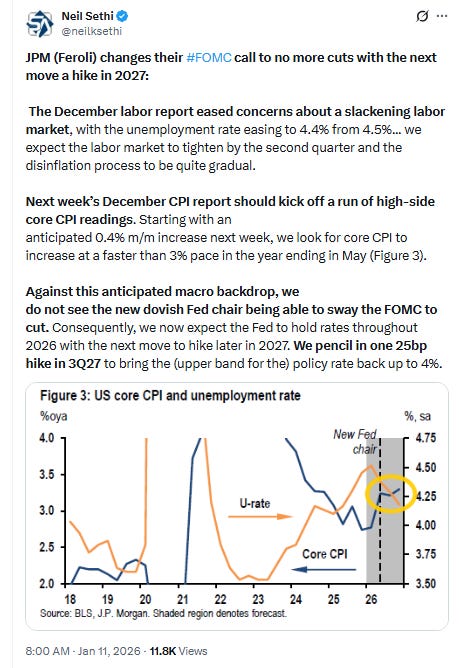

Ahead of CPI tomorrow #FOMC rate cut pricing for 2026 continued to push to the least (fewest) cuts since the Dec FOMC according to the CME’s Fedwatch tool. January remains off the table unless the Fed chooses to revive it (which would require a very cool CPI print tomorrow) at just 5%. March is now just 27% (from 51% a week ago), April 41% (from 63%), with the first cut in June (68%). A second cut is not until Sept (53%) with chances of two cuts by July now 36% (from 55% a week ago).

Pricing for 2026 remains at 51bps (the excel sheet shows 52bps but there’s an issue somewhere in how it’s doing the calculations because it should be marginally lower than Friday based on the inputs), with pricing for two cuts 66% and three cuts 33%, down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

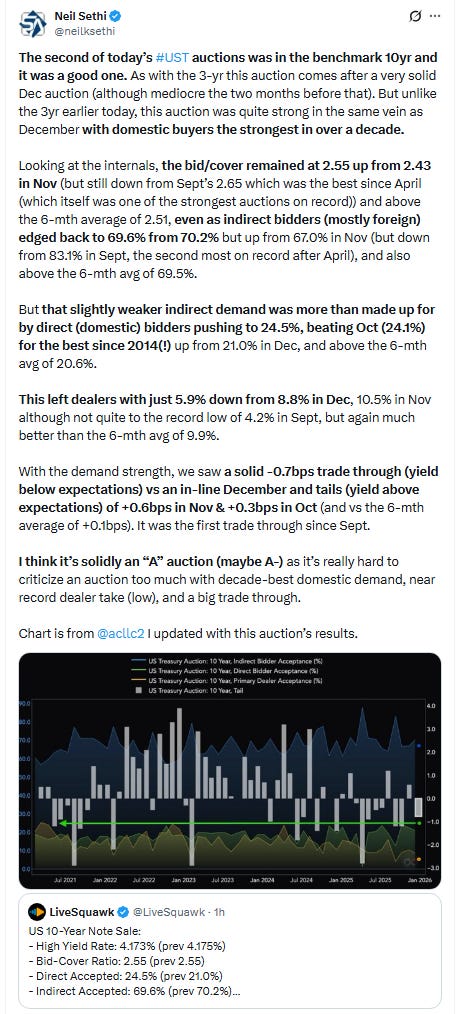

The 10yr #UST yield remained little changed as has been the case all year at 4.19%, remaining at the top of its range since the start of December. As noted Friday, it has traded in a 10bps range since then despite all of the headlines between now and then (including today’s).

The 2yr yield, more sensitive to FOMC rate cut pricing, remained at the highs of the year at 3.54%, still though just 12bps above the least since 2022, but again moving closer to the top of the channel it’s been in since the start of 2024, -9bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

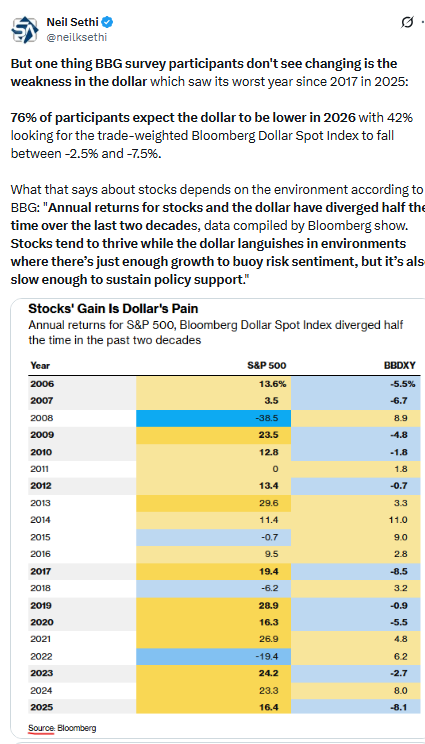

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) saw its rally set back by the attack on the Fed, down for just the second session in nine Mon from the highest close since Dec 9th. As noted Fri, it had been starting to push through the 50 and 200-DMAs as well as a trendline running back to the start of last year but fell back under.

It has not sustained a breakout above the 200-DMA since it fell under last February. As noted Fri, the daily MACD has now crossed to “cover shorts” positioning and the RSI is the best since Nov (but back under 60) giving some technical support to a breakout.

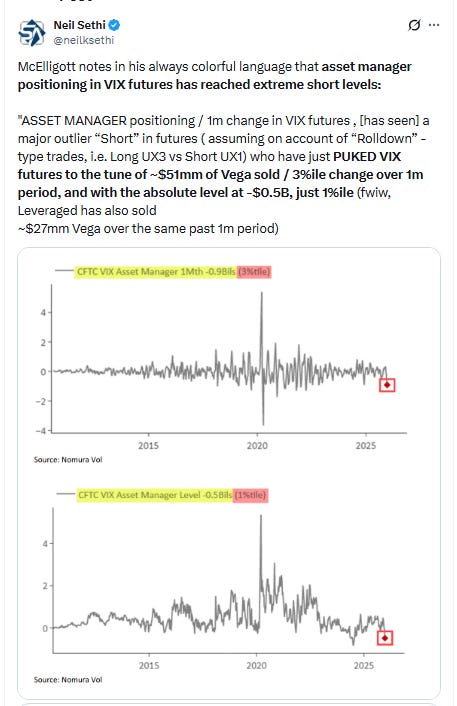

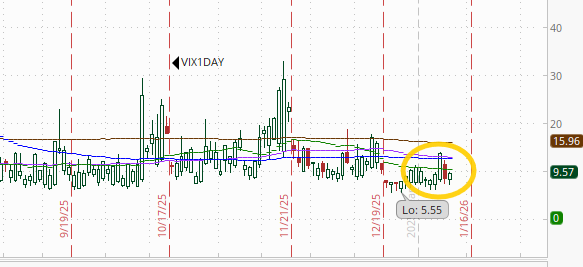

VIX edged higher but ended well off the highs of the day (which couldn’t even get through 17) at 15.1, still around the lows of 2025 (although up from 13.4 Dec 24th).

The current level is consistent w/~0.95% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) similarly was up modestly at 93.1 up from 81.7 Dec 24th. The current level remains consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

With CPI tomorrow the 1-Day VIX did move higher but at 9.6 this must be the lowest pre-CPI print we’ve seen in the past year at least. The current reading implies just a ~0.60% move in the SPX next session.

I noted Friday “we finally have a tentative breakthrough, as #WTI futures closed Friday for the first time above both the 50-DMA and downtrend line from the July highs since that time,” and they built on that Monday adding another +1.8% taking them to the highest levels in a month just under the 100-DMA.

As I said Friday, “a green day on Monday would have me looking at the $62.50 level (200-DMA). Daily MACD remains supportive (cover shorts) and RSI is strongest since October.”

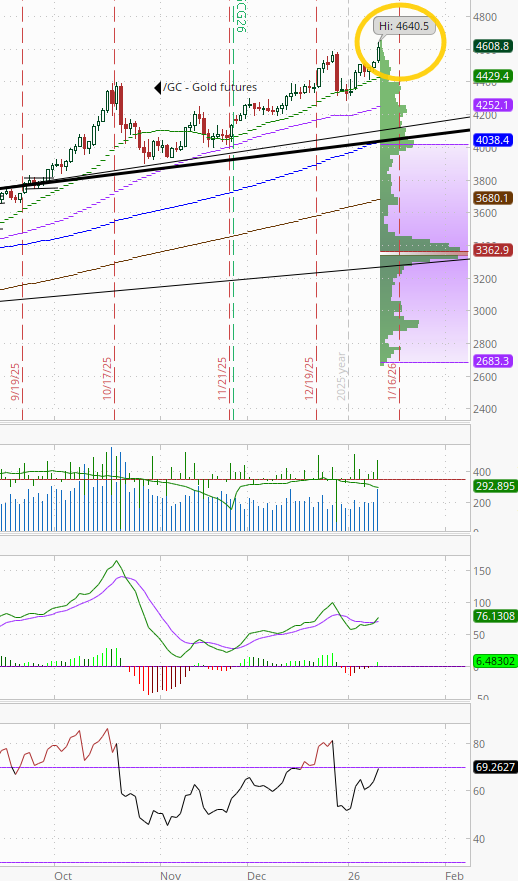

While many other trades reversed from their initial moves, gold futures (/GC) not so much taking advantage to jump +2% to another all-time high. Daily MACD also flipped to “go long” while the RSI is over 60.

US copper futures (/HG) also maintained their gains for the most part, adding another +2% as well, but not quite making it to all-time high territory. Daily MACD remains in “go long” positioning while the RSI still has a negative divergence (lower high).

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) didn’t quite make it to the $3 support level bouncing today +6.8% after falling Friday to the lowest close since mid-October (down around -45% from the peak Dec 5th).

But we’ve seen big bounces several times during that decline, so need to see a lot more before I take the $3 target off. The daily MACD remains firmly in ‘go short’ positioning, and RSI is still around the weakest since April.

Bitcoin futures up mildly but continued their sideways trade over the last few sessions after again testing and failing at the 50-DMA (purple line). The daily MACD still remains in “cover shorts” positioning, while the RSI is around 50.

The Day Ahead

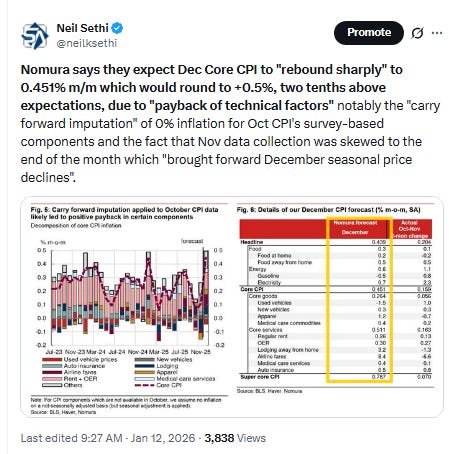

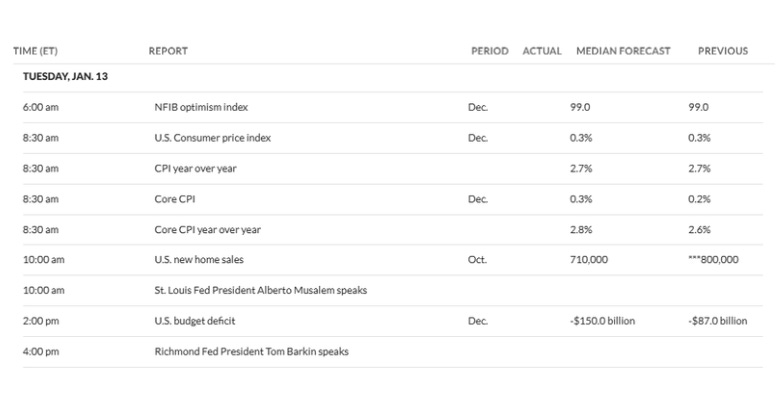

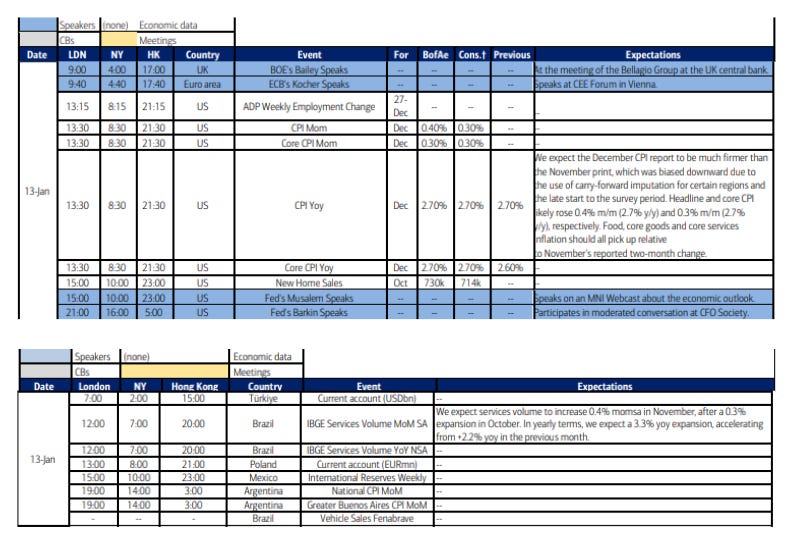

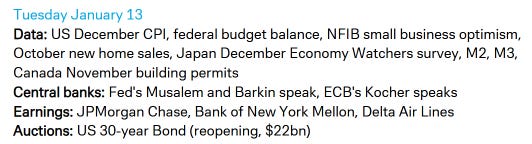

US economic data picks up Tuesday with probably our highlight of the week in Dec CPI, along with a delayed Oct new home sales report and Dec NFIB small biz sentiment.

We’ll get more Fed speakers but both of them non-voting regional Fed Presidents in Musalem and Barkin. That said, NY Fed Pres Williams, an influential voice, speaks tonight at 6pm ET.

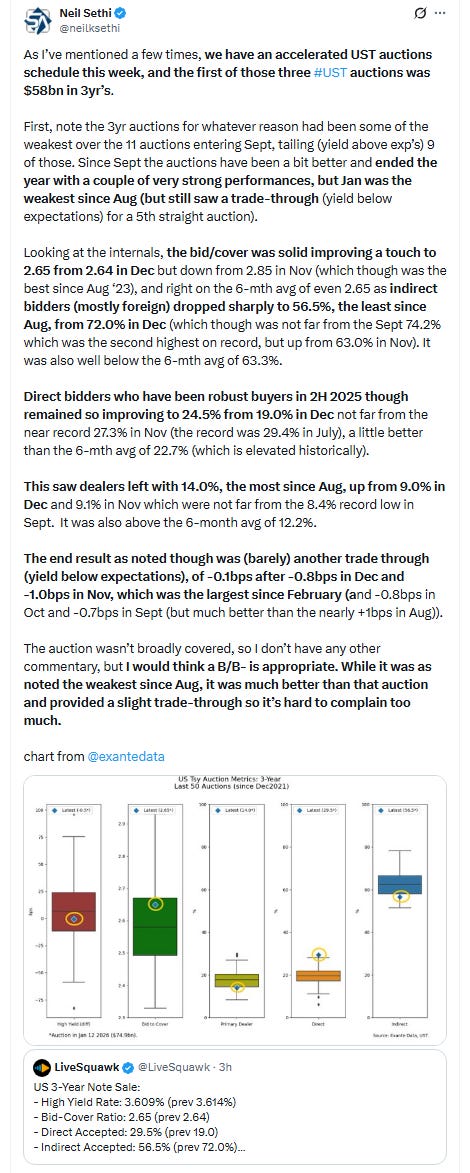

We’ll also get our last of the Treasury auctions this week with 30yrs(reopening).

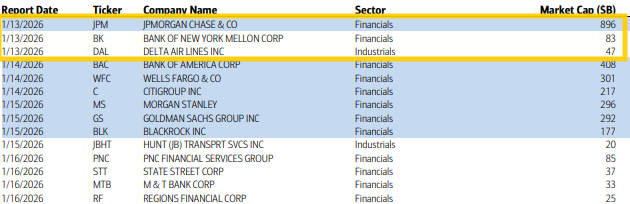

Q4 SPX earnings season unofficially kicks off with JPM’s report, one of 3 SPX reporters. The other two are BK and DAL.

Ex-US DM as noted Sunday is a light week. Tuesday highlight I guess is Japan’s December Economy Watchers survey.

In EM, highlights are Brazil services volumes, Mexico reserves, and Argentina CPI.

From Goldman:

Tuesday, January 13

06:00 AM NFIB small business optimism, December (consensus 99.5, last 99.0)

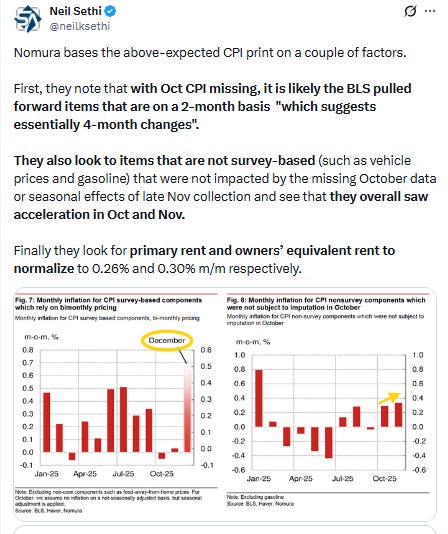

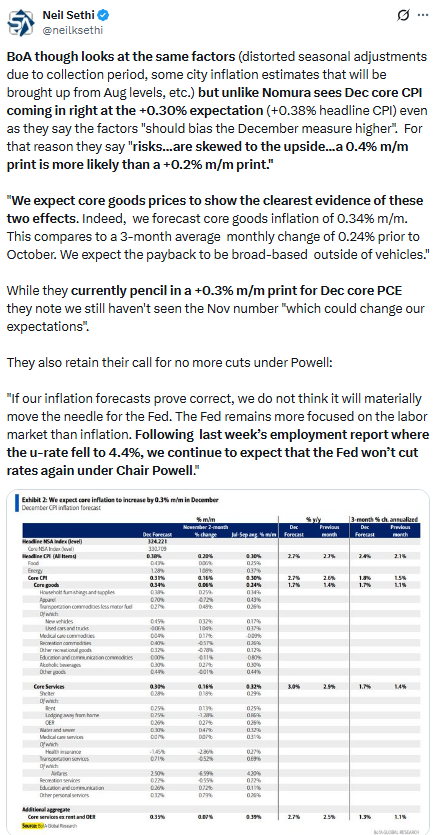

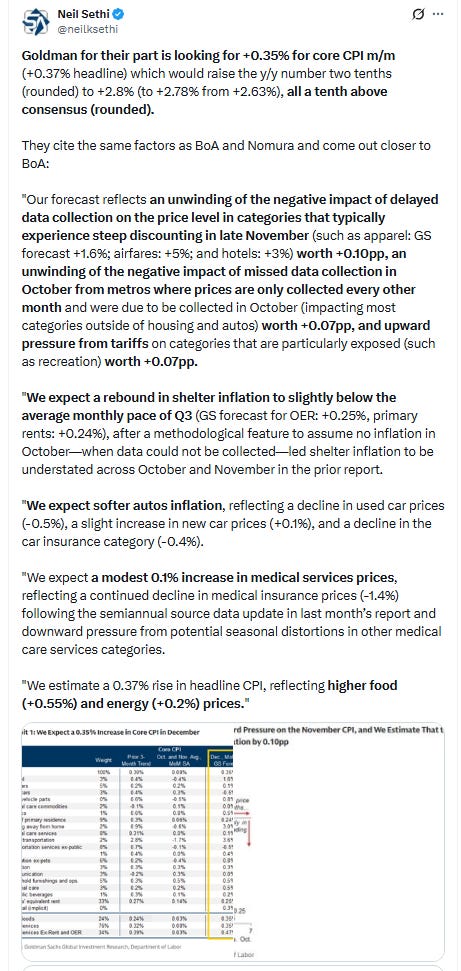

08:30 AM CPI (MoM), December (GS +0.37%, consensus +0.3%, last +0.10% [Oct/Nov avg.])

Core CPI (MoM), December (GS +0.35%, consensus +0.3%, last +0.08% [Oct/Nov avg.])

CPI (YoY), December (GS +2.74%, consensus +2.7%, last +2.74%)

Core CPI (YoY), December (GS +2.78%, consensus +2.7%, last +2.63%)

We estimate a 0.35% increase in December core CPI (month-over-month SA), which would raise the year-over-year rate by 0.2pp to 2.8% on a rounded basis. Our forecast reflects an unwinding of the negative impact of delayed data collection on the price level in categories that typically experience steep discounting in late November (such as apparel: GS forecast +1.6%; airfares: +5%; and hotels: +3%) worth +0.10pp, an unwinding of the negative impact of missed data collection in October from metros where prices are only collected every other month and were due to be collected in October (impacting most categories outside of housing and autos) worth +0.07pp, and upward pressure from tariffs on categories that are particularly exposed (such as recreation) worth +0.07pp. We expect a rebound in shelter inflation to slightly below the average monthly pace of Q3 (GS forecast for OER: +0.25%, primary rents: +0.24%), after a methodological feature to assume no inflation in October—when data could not be collected—led shelter inflation to be understated across October and November in the prior report. We expect softer autos inflation, reflecting a decline in used car prices (-0.5%), a slight increase in new car prices (+0.1%), and a decline in the car insurance category (-0.4%). We expect a modest 0.1% increase in medical services prices, reflecting a continued decline in medical insurance prices (-1.4%) following the semiannual source data update in last month’s report and downward pressure from potential seasonal distortions in other medical care services categories. We estimate a 0.37% rise in headline CPI, reflecting higher food (+0.55%) and energy (+0.2%) prices.

08:30 AM New home sales, October (GS -3.7%, consensus -10.6%, last +20.5% [August]); New home sales, October (GS 709k, consensus 715k, last 800k [August])

New home sales, September (GS -8.0%)

10:00 AM St. Louis Fed President Musalem (FOMC non-voter) speaks

St. Louis Fed President Alberto Musalem will speak on an MNI webcast about the economic outlook and policy. Moderated Q&A is expected. On November 13th, President Musalem said that “we need to proceed and tread with caution, because there’s limited room for further easing without monetary policy becoming overly accommodative.”

04:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks

Richmond Fed President Tom Barkin will participate in a moderated conversation at the CFO Society in Washington DC. Moderated Q&A is expected.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,