Markets Update - 11/24/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

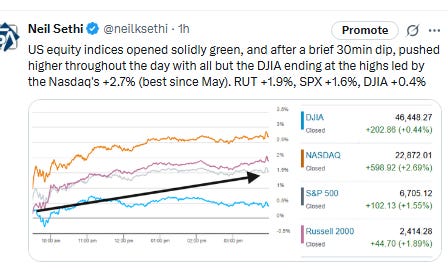

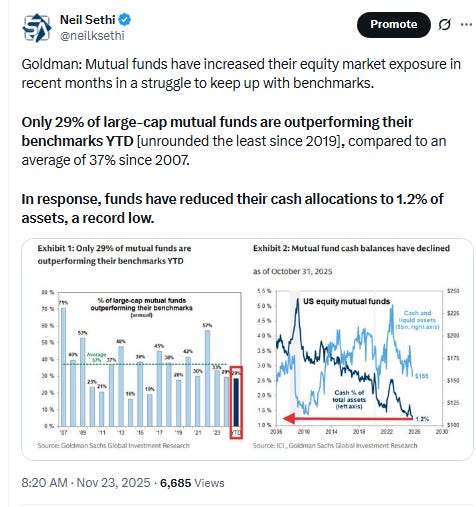

US equity indices opened higher as they continued their rebound from 2-month lows hit ahead of Friday’s session, led by technology stocks including a more than 4% gain premarket gain for Alphabet (which finished with a 6% gain and associated Broadcom finished up over 11%). In Asia, Alibaba Group Holding Ltd. jumped 4.7% after a strong debut for its AI app. After a brief dip in the first half hour, the indices pushed higher throughout the day led by growth names and small caps with all but the DJIA (pulled down by its non-growth holdings) ending near the highs of the session led by the Nasdaq’s +2.7% (its best day since May). Russell 2000 small cap index was +1.9%, SPX +1.6%, and DJIA +0.4%. The SPX equal-weighted index, though, like the DJIA was up just +0.4%.

Elsewhere, Treasury yields fell back again, while the dollar was little changed again. Gold though got moving to the upside, and copper, crude, and bitcoin (finally) saw positive sessions as well. Natgas though was lower.

The market-cap weighted S&P 500 (SPX) was +1.6%, the equal weighted S&P 500 index (SPXEW) +0.4%, Nasdaq Composite +2.7% (and the top 100 Nasdaq stocks (NDX) +2.6%), the SOXX semiconductor index +4.6%, and the Russell 2000 (RUT) +1.9%.

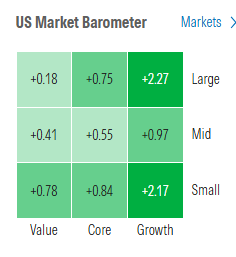

Morningstar style box shows the widespread gains with growth stocks and small caps outperforming.

Market commentary:

“Investors hate noise. They crave certainty, and the market simply cannot deliver that right now,” Mark Malek, CIO at Siebert Financial, said in a note.

“There’s still a positive backdrop for the tech sector,” said Kevin Thozet, member of Carmignac Gestion’s investment committee. “Typically, seasonality is pretty good walking into Thanksgiving and the end of the year. So I’m rather risk-on from now on and into the first-quarter of 2026.”

“Our view is that the derisking is behind us for now,” Michael Romano, UBS’ head of equity derivative hedge fund sales, wrote in a note distributed Sunday.

“I believe the combination of a reset of the equity market and the increased odds of a rate cut in December has propelled stocks higher and put the year end melt-up back on the table,” said Chris Murphy, Susquehanna International Group’s co-head of derivatives strategy.

“US stocks enter the shortened Thanksgiving week in an oversold state, with recent volatility likely to fade and support a melt-up on broader participation.”

— Michael Ball, BBG Macro Strategist

“Clearly, the big theme that’s driving the market on Monday is Gemini 3. That’s driving Google. That’s driving Broadcom. And that’s clearly having a very significant effect on tech,” said Joseph Shaposhnik, founder and portfolio manager of the Rainwater Equity ETF, which owns shares in Broadcom.

“It’s great for Alphabet and investors in Alphabet, but it always concerns me when we have one stock that is leading the market higher. We’re not looking necessarily at a broad-based improvement,” said Melissa Brown, managing director of investment decision research at SimCorp. “That just doesn’t seem to me to be a sustainable force behind driving the market higher over the next however many days.” Brown noted that any upcoming economic data releases – including September U.S. retail sales and September producer price index data on Tuesday – that signal a “stagflationary environment” could be a driver.

“The market could continue to be okay, but when sentiment is so negative, bad news tends to get exaggerated,” she told CNBC. “When you add on top of that the lower trading volume environment, I think any bad news, maybe the impact is going to be multiplied.”

“There are increasing signs that the economy remains sluggish, which will put additional emphasis on the retail sales release this week, although once more the data will be slightly historic,” said Richard Hunter, head of markets at Interactive Investor. “There will be some hopes that the recently guarded sentiment will at least temporarily be erased.”

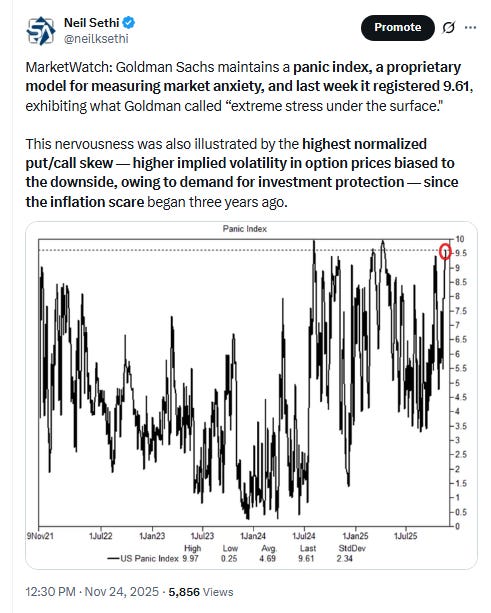

“A larger-than-usual number of US data releases have been bunched together due to the government shutdown. Furthermore, the December Fed meeting remains pivotal, with markets split between a cut and a hold. That pricing is likely to shift decisively, potentially even on the day of the meeting. All told, that makes for elevated market anxiety deep into the festive season.” —Skylar Montgomery Koning, BBG macro strategist.

“It’s a more disorderly process than what we’re accustomed to,” he said. “At the same time, we think that Powell wants to keep cutting. He has the votes to do that. We think the data is giving a little cover to him to deliver one last rate cut to protect the labor market from gradual deterioration.”

The $30 trillion U.S. Treasury markets should prepare for President Donald Trump’s “reciprocal tariffs” to potentially be rolled back by the Supreme Court, according to Mizuho.

“To date, the Treasury has collected an extra $140-150 billion which would need to be refunded, and the full-year deficit would increase by about $240-$250 billion, according to a Mizuho Securities led by Steven Ricchiuto, U.S. chief economist.

The added financing need “would build on top of a $2.3 trillion deficit,” the team wrote. However, corporations also would benefit from not having to pay those tariffs, the Trump tax cuts, an easier path for the Federal Reserve to cut rates and a brighter outlook for the U.S. economy.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

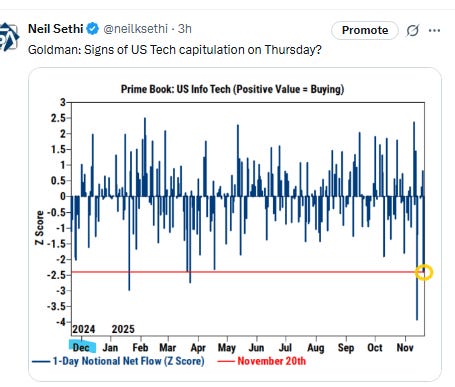

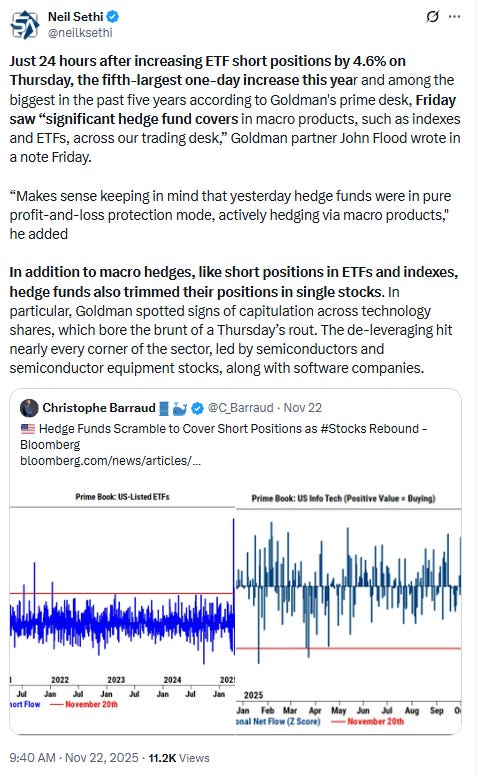

The enthusiasm surrounding Alphabet extended to other names in the AI trade. Broadcom surged 11.1%, while Micron Technology grew about 8%. Palantir Technologies and AMD popped 4.8% and 5.5%, respectively. Meta, Nvidia and Amazon also advanced.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

None today.

Mid-day movers from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX got a nice bounce but just to the underside of its 50-DMA. It has more resistance above that. The daily MACD remains in “sell longs” positioning, but the RSI bounced from the weakest since April.

The Nasdaq Composite a similar story.

RUT (Russell 2000) hasn’t quite made it to the 50-DMA.

Despite the better SPX gain, sector breadth from CME Cash Indices edged back from all 11 sectors higher Friday to 9 Monday with Staples in particular (-1.3%) sitting out the party. Energy (-0.3%) was also lower.

Looking to the upside, only four sectors were up over 1% (vs seven Fri) led by the three megacap growth sectors (explaining the better index performance) with Comm Services up almost 4% (after leading Fri +2.2%), Tech +2.5%, and Cons Discr +1.9%. Utilities the other +1.1%.

SPX stock-by-stock flag from finviz.com consistent with the largest stocks seeing much more green Monday vs Friday while there was more weakness elsewhere.

In that regard all of the top 9 (trillion-dollar club) were higher (after four Friday) led to the upside by AVGO’s huge +11.1% day (after leading to the downside -1.9% Friday). GOOG was up another +6.3% after leading to the upside Friday at +3.3%. Mag-7 was +3.5%, wiping away last week’s -2.2% on track to break its three-week losing streak.

~40 SPX components were up 3% or more, down from 130 Fri but up from just 3 Thurs, led by Broadcom AVGO +11.1% on the back of the GOOG wave (they help create Alphabet’s in-house processors). And despite the much lower total over 3%, more >$100bn in market cap were up that much in AVGO, MU, APP, HOOD, TSLA, GOOG (again), AMD, LRCX, PLTR, APH, CEG, GEV, ANET, INTC, KLAC, CRWD, AMAT, ADI (again) vs 12 Fri (in descending order of percentage gains).

10 SPX components down -3% or more up from one Fri, but down from 68 Thurs led by Carnival CCL -6.8%. ACN was the only >$100bn in market cap down at least 3%.

NYSE positive volume (percent of total volume that was in advancing stocks) fell back to 58.0% from the 2nd highest since May, in line though with the lower 0.45% gain in the index.

Nasdaq positive volume (% of total volume that was in advancing stocks) pushed up to 77.0%, the best since Aug 22nd, but it should be noted that was a little weak for the +2.69% gain in the index as both Aug 22nd and Aug 4th (circles) saw higher reads with gains under 2%.

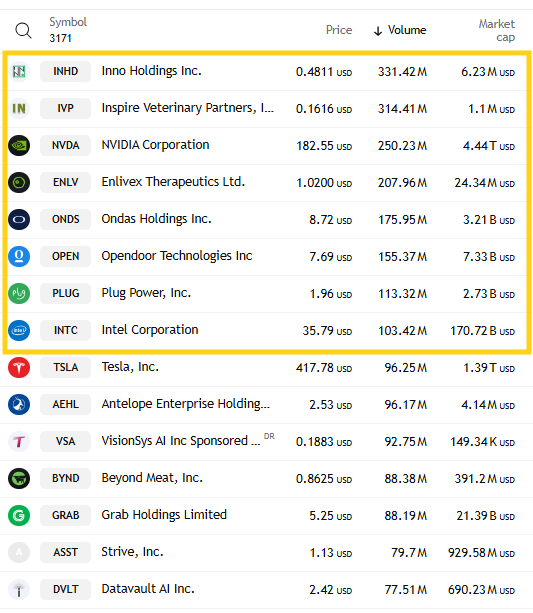

And speculation remained more subdued than what we saw two weeks ago when the top stock by volume in the Nasdaq was over 1.4bn (and even much less than the 875mn a week ago). Today it was 331mn (penny stock INHD) in line with what we’ve seen for the top stock the last few days.

8 stocks in total traded over 100mn shares down from 10 Fri and 12 a week ago.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks were lower than volume on the Nasdaq at 67% while the NYSE was higher at 61%.

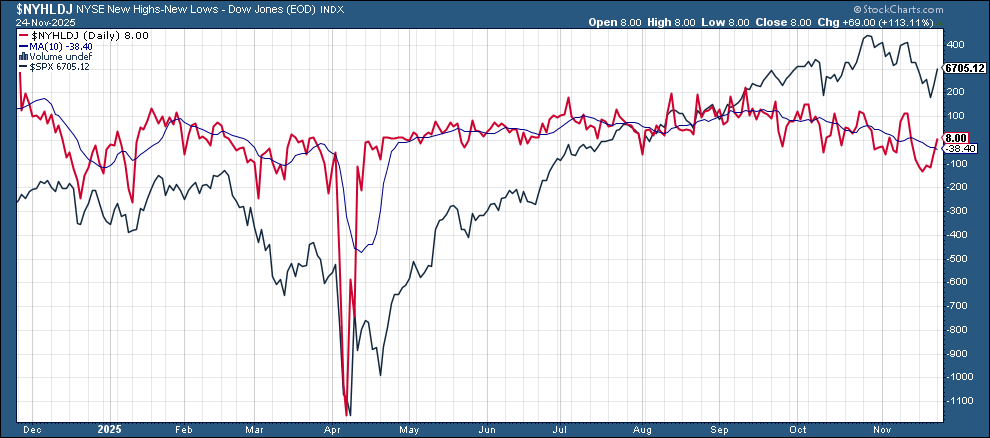

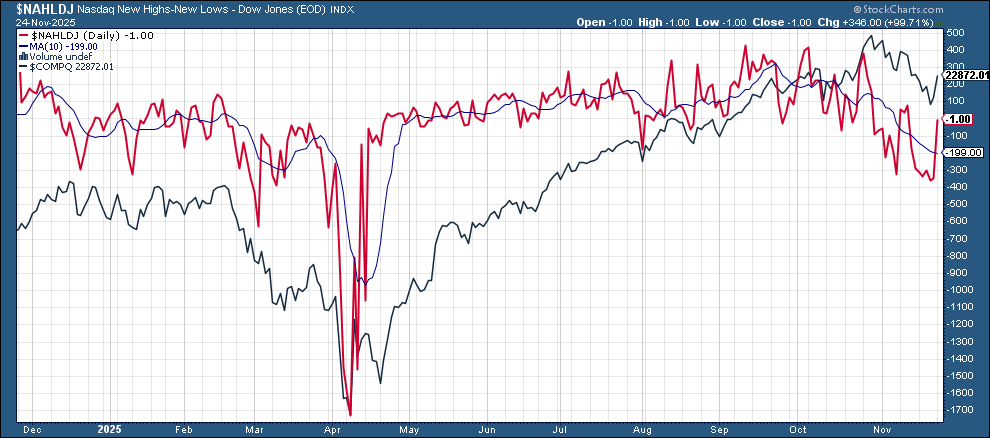

New 52-wk highs minus new 52-wk lows (red lines) improved to 8 from -115 Thursday on the NYSE and -1 from -357 on the Nasdaq, which was the least since April.

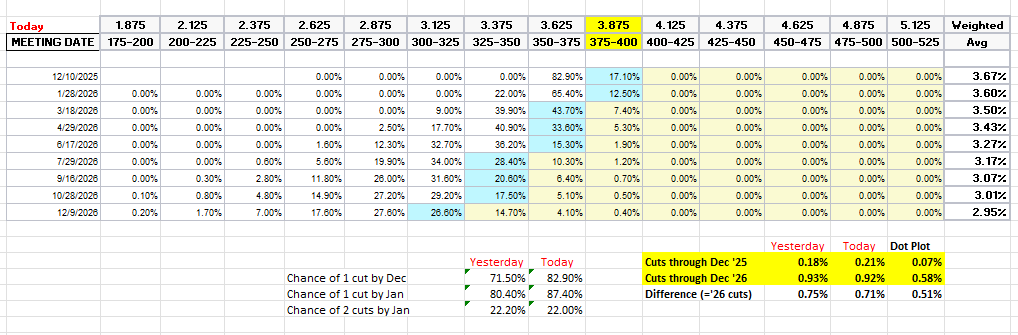

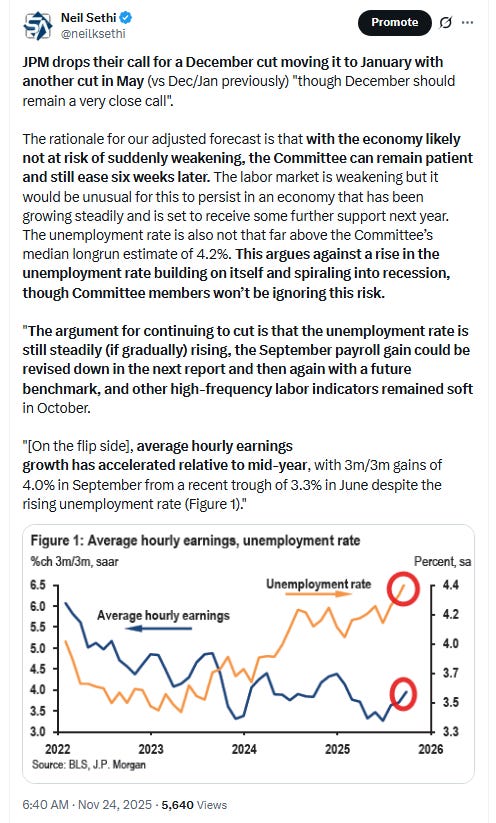

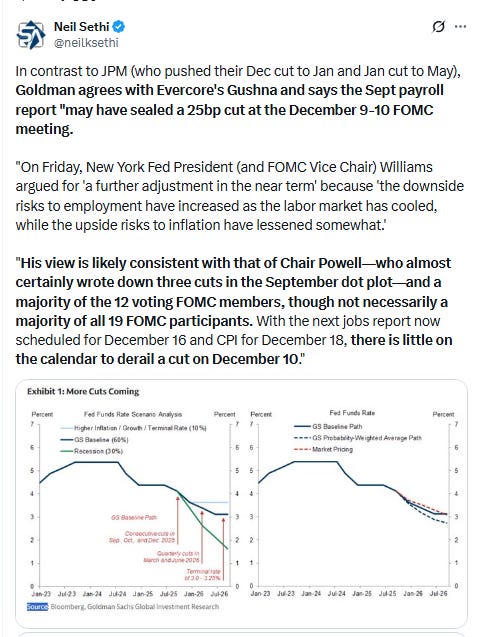

Odds on a Dec #FOMC rate cut continued to firm with pricing for December now at 84% up from 72% Friday and 33% Wed, the highest since the Oct FOMC, although still down from 100% Oct 16th.

As I have been noting prior to Friday the market had been mostly shifting the December cut to 2026, and it has continued to move cuts back to December, as while a cut by January improved to 87% (also the best since Oct 16th (96%)), cuts at both the Dec & Jan meetings remained at 22% barely up from 20% Wed.

And pricing for 2026 overall fell back another -4bps after -5bps Friday to 71bps (from the highest we’ve been for 2026 cuts), but in some evidence that not all of the cuts have been pulled back total cuts through Dec ‘26 are up slightly since Wed at 92bps (but still down though from 103bps pre-Oct FOMC which was the highs of the year (for cuts from December on)).

As a reminder the average dot on the dot plot has ~60bps of total rate cuts through Dec ‘26 from this point, so over a cut off.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is definitely where we were Apr 20th (a little too far) at 102bps). I said the day before July NFP “now it seems like we’re perhaps getting back to too few cuts”. I think at 76bps heading into the Sept FOMC we were perhaps a bit overdoing it, but if so not by much (really it will depend on what the trio of Miran, Bowman, and Waller want to do). Now that we see that Waller and Bowman aren’t going to follow Miran to push for large rate cuts, I think my previous stance that there will be at least 50bps this year (we’ve now gotten) but probably not a lot more than that looks pretty solid (which has been my call since last December). I said I thought we got back to overdoing it when over 50bps of rate cuts were priced for the rest of the year Oct 16th. I had said “while 50bps is my base case it’s less than 100% I think,” and that now is certainly the case. While I can’t disagree knowing what I know now with a less than 50% chance for Dec, there’s a lot of data we’re going to get before then, so as I mentioned Friday, I think we were pushing a bit to far as we get into the low 40% and under range.

Also remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point)

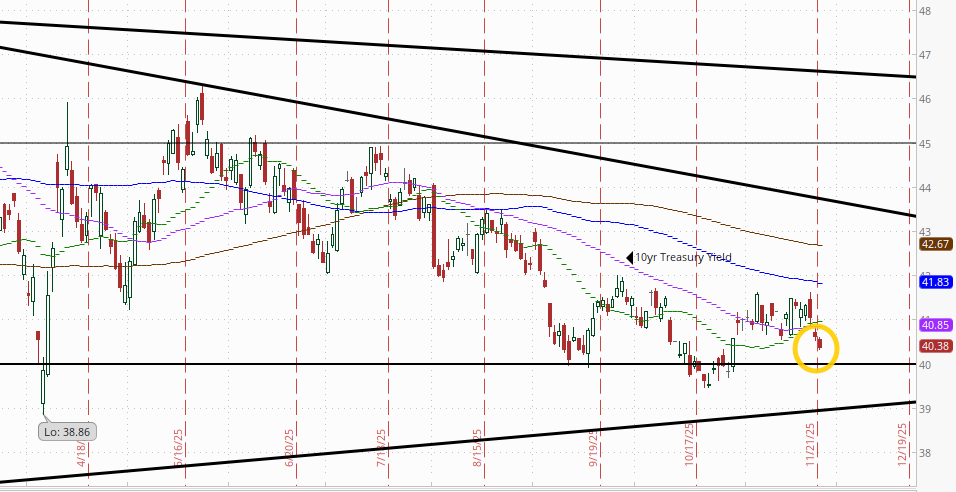

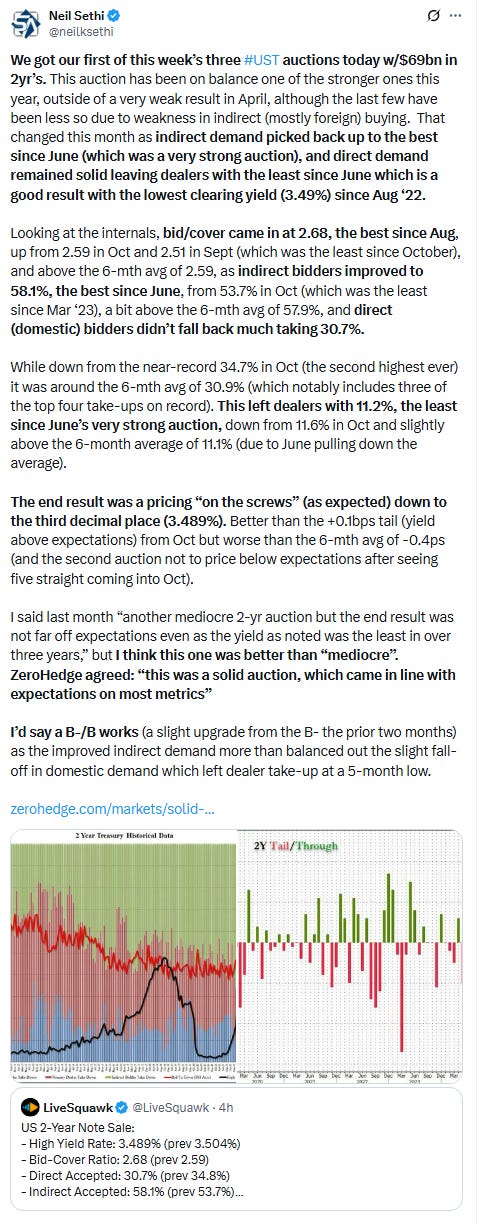

The 10yr #UST yield little edged to the lowest close since Oct 29th, -2bps to 4.04%. It was -8bps last week.

The 2yr yield, more sensitive to FOMC rate cut pricing, edged down -1bps to 3.50% the lowest this month and starting to get towards the bottom of the range since late August. It is 38bps below the Fed Funds midpoint. It was -10bps last week.

The Effective Fed Funds Rate (red line) remained at 3.88% a tenth above the Fed Funds midpoint and up 5bps since Sept, evidence of continued growing stresses in funding markets that will likely see the Fed adding assets to its balance sheet soon.

I had said when the 2yr yield it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO said on his weekly podcast he now sees it at 3.3% by year’s end (but sees risk to the downside), but I still took some off Sept 5th at 3.5%. I’ll add back at ~3.90% if we get there (seems though that ship might have also sailed).

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) remains near the highest since May and over the 200-DMA but strangely can’t seem to find any upward momentum after “breaking out”. It has hardly moved the past three sessions.

The daily MACD remains in a mild “go long” reading, and the RSI is over 60, so as I said earlier last week “it would seem to have the setup to make a run.”

VIX fell back for a second session to 20.5 after hitting the highest since April on Thurs. The current level is consistent w/~1.27% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) has seen an even larger pullback now down to 104 now just a touch above Nomura’s Charlie McElligott’s breakeven “stress level” of 100 (and consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX like the VIX and VVIX fell back in its case to the lowest close since Nov 12th at 14.3. That level implies a ~0.90 move in the SPX next session down from the ~1.45% implied for Monday (which was just about dead on).

#WTI futures got a +1.6% bounce from the lowest close since Oct 21st after having fallen -4.3% the previous three sessions. The MACD and RSI though have softened to more negative reads as noted Friday.

Gold futures (/GC) moved higher +1.7% after ending little changed for four sessions as they continue their consolidation since peaking a month ago. Daily MACD and RSI remain with relatively neutral readings.

US copper futures (/HG) continue to bounce along just above their 50-DMA (purple line) and uptrend line since August. They remain in the middle of their range since the end of September. Longer term, they remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020). Daily MACD and RSI remain mildly negative.

Natgas futures (/NG) edged lower but continue to remain in the range over the past week near the highest since Dec ‘22. As noted Wed, “daily MACD has softened to ‘sell longs’ positioning, and the RSI has fallen from above to under 70, often a sign of a consolidation/pullback, so we’ll see where it goes from here.” Importantly, though, those metrics haven’t deteriorated much further.

Bitcoin futures bounced +4.2% from the lowest since April as the $85k level has held so far. They are still down around -33% from the highs. The daily MACD remains in “go short” positioning, but the RSI has bounced back over 30 from the weakest since June ‘22, which can be the sign of a bottom. As I noted Friday “seems the selloff is getting long in the tooth.”

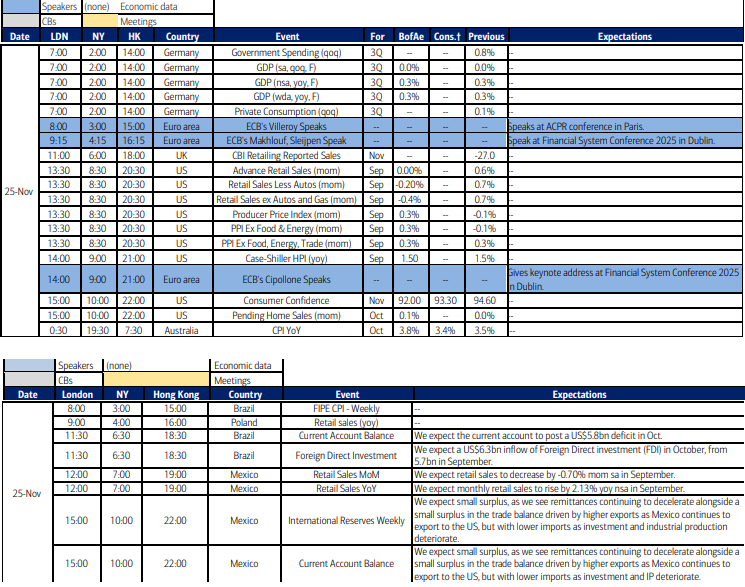

The Day Ahead

US economic data Tuesday picks back up with Sept retail sales and repeat home price indices, Nov Conf Bd consumer confidence, and Oct pending home sales. We’ll also get some regional Fed PMIs.

Still no Fed speakers on the calendar, but we’ve gotten a couple of media interviews, and I’d imagine we’ll have more.

We’ll get the second of this week’s Treasury auctions with 5-yr notes.

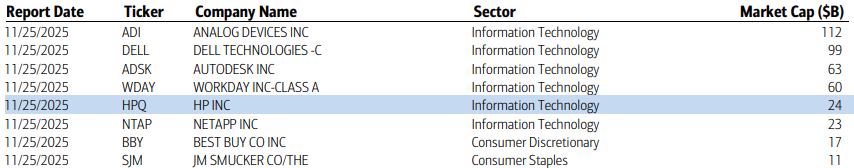

We’ll also get our biggest (and last) day of the week in SPX earnings with 8 components, one of which is >$100bn in market cap in HPQ. We’ll also hear from a number of retailers including Best Buy, Burlington, Kohl’s, Abercrombie, and Urban Outfitters

Ex-US DM highlights include Japan PPI, Germany GDP, EU car registrations, plus several central bank speakers.

In EM highlights are Brazil trade and FDI figures, Metico and Poland retail sales and Mexico reserve balances.

08:30 AM Retail sales, September (GS +0.3%, consensus +0.4%, last +0.6%)

Retail sales ex-auto, September (GS +0.2%, consensus +0.3%, last +0.7%)

Retail sales ex-auto & gas, September (GS +0.2%, consensus +0.3%, last +0.7%)

Core retail sales, September (GS +0.1%, consensus +0.3%, last +0.7%)

We estimate core retail sales increased 0.1% in September (ex-autos, gasoline, and building materials; month-over-month SA), reflecting mean reversion after an outsized increase in the prior month and a slight headwind from potential residual seasonality. We estimate headline retail sales increased 0.3%, reflecting a boost from an increase in gasoline prices.

08:30 AM PPI final demand, September (GS +0.2%, consensus +0.3%, last -0.1%)

PPI ex-food and energy, September (GS +0.1%, consensus +0.2%, last -0.1%)

PPI ex-food, energy, and trade, September (GS +0.1%, consensus +0.3%, last +0.3%)

09:00 AM S&P Case-Shiller home price index, August (GS flat, consensus +0.1%, last +0.2%)

10:00 AM Conference Board consumer confidence, November (GS 93.0, consensus 93.3, last 94.6)

10:00 AM Pending home sales, October (GS +3.0%, consensus +0.1%, last flat)

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,