Markets Update - 11/25/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

US equity indices rallied Monday following President-elect Donald Trump signaling his intention to nominate Key Square Group founder Scott Bessent as Treasury secretary. Investors viewed the pick favorably seeing the hedge fund manager as someone who will be supportive of the equity market and Treasury market functioning and who may help mitigate some of Trump’s most extreme protectionist policies, such as his stance on tariffs. As BBG noted:

Bessent has deep familiarity with global financial systems — a trait that made him palatable to investors. And while he’s indicated he’ll back the president-elect’s tariff plans and fight to extend Trump’s tax cuts, Bessent isn’t known as an ideologue, spurring Wall Street expectations that he will prioritize economic and market stability over scoring political points.

The relief rally extended to bonds with yields falling sharply across the curve. The dollar also pulled back the most since August. That didn’t help gold though, which saw its worst day since June, or crude, which sank on an apparent peace deal between Israel and Lebanon as well as promises from the Trump team to expand oil drilling in the US. Nat gas bounced back while copper edged higher. Bitcoin though fell, its worst day since Aug.

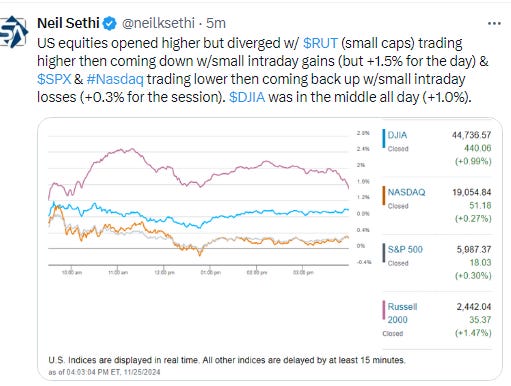

The market-cap weighted S&P 500 was +0.3%, the equal weighted S&P 500 index (SPXEW) +0.9%, Nasdaq Composite +0.3% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index +0.7%, and the Russell 2000 +1.5%.

Morningstar style box consistent with the “other 493” sectors leading again as they have since Nvidia’s earnings report Wednesday.

Market commentary:

Markets can now map a road ahead for policies,” said Colin Graham, head of multi-asset strategies at Robeco, who’s positions are overweight on both US stocks and Treasuries. Bessent is “seen as more moderate on tariffs so could be perceived as bond positive.

“Investors are viewing this nomination as one that will provide a Goldilocks scenario for Mr. Trump’s pro-business proposals,” said Matt Maley at Miller Tabak + Co.

“Supporters will argue that Mr. Bessent’s career as a macro investor will provide him with an ability to understand the knock-on effects of President Trump’s trade, tariff, tax, and deregulatory agenda,” said Ed Mills, Raymond James Washington policy analyst, in a note to clients. “If Mr. Bessent can delay or limit an across-the-board tariff policy, while extending tax cuts, pushing deregulation (that increases energy production), all support U.S.-based industries — all supporting U.S. GDP growth — that would be cheered on by the market.”

“Markets can now map a road ahead for policies,” said Colin Graham, head of multi-asset strategies at Robeco, whose positions are overweight on both US stocks and Treasuries. Bessent is “seen as more moderate on tariffs so could be perceived as bond positive.”

Lucy Baldwin, global head of research at Citi, is telling investors to be more selective “under the hood” in US markets. Baldwin says, “think about the broadening thesis in the US, but add if you can, a barbell approach to have some Europe.”

“With valuations elevated and the S&P 500 already near 6,000, the market will creep higher from here,” said Eric Beiley, executive managing director of wealth management at Steward Partners. “But I don’t see a big year-end rally because rising yields will keep investors at bay.”

“Sentiment and positioning based on at least five indicators have grown dangerously bullish, leaving less room for positive surprises,” Savita Subramanian, head of US equity and quantitative strategy at Bank of America wrote in a note to clients on Nov. 15.

The rally isn’t necessarily in jeopardy simply because there’s growing speculation that the market has run too far. Valuations and investor sentiment can stay frothy for weeks — even months — before stocks suffer a significant drop, said Max Kettner, chief multi-asset strategist at HSBC Bank Plc, adding that there are “very few reasons to suggest a year-end rally has already been front-loaded.”

RBC Capital Markets strategist Lori Calvasina tipped the S&P 500 to reach the 6,600 level by the end of 2025, an advance of about 11%, propelled by solid economic and earnings growth.

A year-end rally will push the S&P 500 to 6,200 points, according to Goldman Sachs Group Inc.’s Scott Rubner. Retail euphoria is accelerating just as stocks enter their best seasonal trading pattern. Corporate demand for buybacks is also increasing, adding to the reasons why the rally could start in the coming days, Rubner said in a note to clients on Friday.

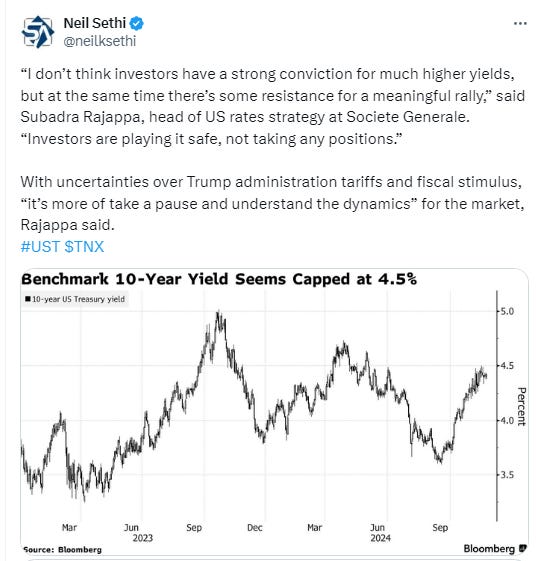

A surge in bond yields would sink stock-market buoyancy and high valuations, according to Plurimi Wealth Management Group Chief Investment Officer Patrick Armstrong. “There will come a point where multiples just aren’t sustainable if you’ve got 5% Treasuries,” Armstrong said in an interview with Bloomberg TV. “Unexpected inflation is what kills Treasuries and big cap tech at the same time.”

“A broadening rally is crucial but the one thing standing in the way of a strong advance for stocks the rest of the year is the bond market,” said Jamie Cox, managing partner at Harris Financial Group. “That may ultimately put a lid on a hefty year-end rally.”

While the S&P 500 might be a long way away from fumbling a strong year, don’t get too optimistic about a strong, smooth finish to the year, according to Callie Cox at Ritholtz Wealth Management. “Yields show that expectations have moved a lot over the past two months, yet we haven’t seen any sustained, clear momentum in economic data,” Cox said. “December could be a reality check for people convinced that the economy is firing on all cylinders again.”

“Investors are especially upbeat right now, too. We all love a good collective mood before the holidays, but I’m worried we could get caught off guard by bad news,” she concluded.

“Equity bulls will want to see a healthy bounce in the consumer data, married with a below consensus read on PCE inflation,” said Chris Weston, head of research at Pepperstone Group in Melbourne. “With US swaps now implying a 36% chance of a 25 basis point cut from the Fed on 18 Dec, weaker US data would see pricing for a 25 basis point cut rise back above 50%, which should support equity risk and be a headwind for the US dollar.”

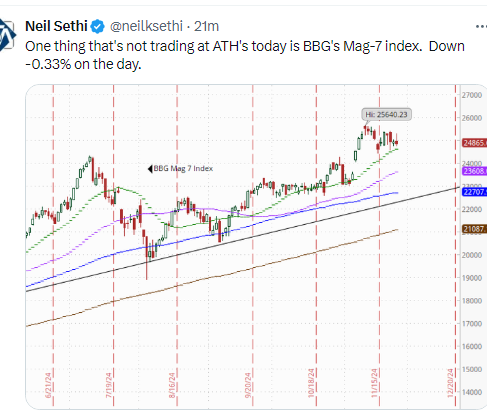

In individual stock action, Big techs were mixed, with Amazon.com Inc. rallying while Nvidia Corp. and Tesla Inc. pushed lower. Macy’s Inc. sank after delaying its earnings as an investigation revealed a worker his millions in expenses.

The SPDR S&P Homebuilders ETF (XHB) rallied nearly 5% and touched an all-time high, bringing its November gain to 10% and its year-to-date advance at more than 31%

After hours movers from CNBC:

Some tickers making moves at mid-day from CNBC.

No major US economic data today. That changes tomorrow and especially Wednesday when we’ll fit a week’s worth into 2 days.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX at one point touched an ATH before falling back to finish below. Its daily MACD & RSI remain tilted positive.

The Nasdaq Composite remains a little further from its ATH. It daily MACD & RSI are also more mixed.

RUT (Russell 2000) continued its now 5-day bounce from its 20-DMA at one point touching ATH territory for the first time since Nov ‘21. Its daily MACD & RSI are the most bullish of the three.

Equity sector breadth from CME Indices remained very solid w/9 of 11 sectors green (up from 8 Fri & same as Thurs) with 7 sectors up +0.6% or more vs 6 Fri, 8 Thurs, (but 3 Tues/Wed) but just one up >1% from 4 Fri, 5 Thurs. Like Fri, sector dispersion was high with growth, cyclicals, and defensives sprinkled throughout (a bullish sign). Energy the big laggard today (only sector down more than -0.3% (-2.0%)).

Stock-by-stock SPX chart from Finviz consistent showing lots of green again outside of some of the largest stocks, energy, and defense names.

Positive volume was again good Mon, it’s 5th solid day, with the NYSE at 67%, down from 77% Fri but the NYSE Composite was up less Monday, while Nasdaq was 66%, in-line with Friday (although here the index finishing up more so a bit of a weaker day). In addition, issues, which had been lagging until Thurs, remained supportive at 73 & 66%. So the clear change in breadth post-Nvidia earnings continues.

New highs-new lows improved as well in a big way w/the NYSE jumping to 437, the best since mid-2021, while the Nasdaq shot to 480, the 2nd best since then, and they are well above the 10-DMAs (more bullish), although the 10-DMAs continue down for now (which won't be for long).

FOMC rate cut probabilities from CME’s Fedwatch tool were little changed for December but 2025 expectations saw a notable increase, perhaps on thinking that Bessent (who has said he wants a measured use of tariffs) will avoid the worst of potential inflation fears resulting from the use of those? Chance of a December cut is at 56%, but 2025 expectations jumped to 75bps of cuts (from 65 on Friday, back to Wed’s levels), meaning we’re back to 3 cuts in total priced from here. I said last week it “seems we might be getting a little too far on the ‘fewer cuts’ side of the boat,” so I expect this might continue.

Treasury yields fell sharply as noted on a relief rally following the Bessent pick with the 10yr yield, more sensitive to economic growth and long-term inflation, -15 basis points to 4.27%, the lowest close in a month. The 2yr yield, more sensitive to Fed policy, dropped -10bp to 4.27%, as rate cuts were priced in as noted above.

Dollar ($DXY) another mover on the Bessent pick, falling sharply although finishing well off the lows. Still it was its worst day since Aug (and 3rd worst of the year), after finishing last week up for an 8th consecutive up week, the longest streak since Sep ‘23, at a 2-yr high. Still it remains firmly in the middle of the uptrend channel running back to September that it’s only closed outside of for one session. Daily MACD remains supportive but the RSI again has fallen from above to under 70 (although that didn’t make much difference a week ago. Now has the resistance of the old highs.

The VIX & VVIX (VIX of the VIX) fell back towards the lowest since July, the former to 14.6 (consistent w/a little less than 1% daily moves over the next 30 days) and the latter to 88 (consistent with “moderately elevated” daily moves in the VIX over the next 30 days).

1-Day VIX also fell back to 8.6, the lowest close since July 9th & looking for a move of around 0.54% Tuesday.

WTI fell -3% despite rumors that OPEC+ would further extend voluntary production cuts and Trump plans to refill the US SPR as fears over overproduction from plans to encourage more oil production as well as a potential Israel/Lebanon peace deal dominated. This put WTI back under $70 and provides little support to protect from a retest of the key $67 level, consistent with my statement last week that the bullish action we had seen we also “saw at the start of the month, and the rally went a little further then fizzled. We’ll see if this time is different. A break over $72.50 would be different.” Unfortunately no such luck for oil bulls.

Gold had its worst session since June 6th falling over -3% and slicing back under the $2400 level after its best week since Mar ‘23. In addition the daily MACD & RSI turned from positive to neutral at best. Another test of the 100-DMA coming?

Copper (/HG) diverged from gold for a 3rd session holding in while gold fell sharply continuing to just hold its trendline back to the Oct ‘23 lows it has mostly respected since then. Daily MACD & RSI as noted last Monday remain in a negative positioning but are turning.

Nat gas (/NG) continued to be volatile jumping +10% at the start of the session on a confluence of bullish news from colder weather to Trump plans to restart LNG exports, finishing though off the highs and remaining below $3.40 resistance. As noted last week, it is getting ready to roll to the Jan contract which is trading a little higher ($3.43). The daily MACD & RSI remain positive.

Bitcoin futures fell -6%, its worst session since the Aug 5th yen carry trade issues. Not fatal to the run, but definitely raises the possibility of a consolidation. RSI is flashing a warning signal going from over 80 to under 70. If it does consolidate, it could fall quite a bit before finding support.

The Day Ahead

US economic data picks up considerably the next two days. Tuesday we’ll get reports on home prices and new home sales as well as consumer confidence and more regional Fed PMIs.

While there are no Fed speakers scheduled, we’ll also get the minutes from the Nov FOMC meeting which will be parsed for clues on a December cut, pace for cuts after December, the neutral rate, etc. We’ll also get our second (of three) Treasury auctions in $70bn in 5yr notes. Hopefully it comes through as strong as today’s 2yr.

We’ll also get by far our heaviest earnings day of the week with 7 SPX components including our only reporter >$100bn in market cap, Analog Devices (ADI), although Dell Technologies (DELL) is close ($97.6bn). (links are Seeking Alpha, see the full earnings calendar).

Ex-US no data of note, but we’ll continue to get a lot of central bank speakers. Not listed is the BoE’s chief economist Pill as well (according to BBG). In EM, the highlight is Brazil inflation.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,