Markets Update - 11/26/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

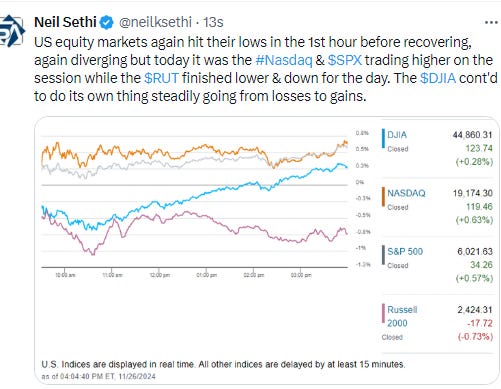

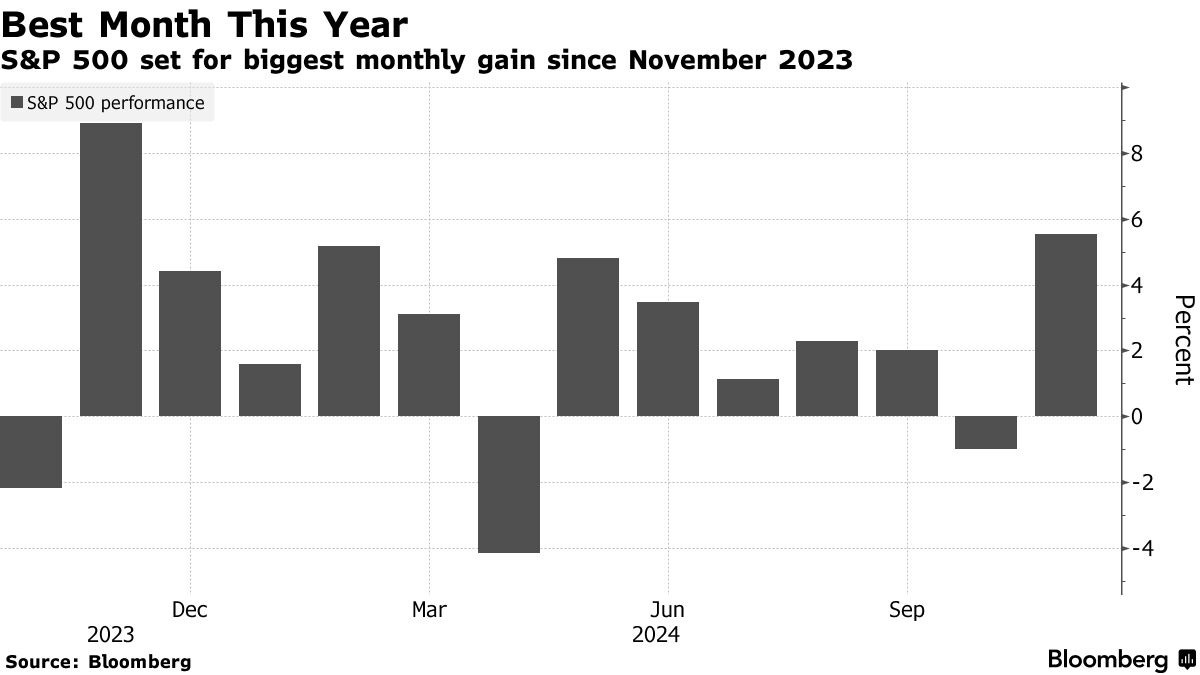

US equity indices were mixed Tuesday as they digested an opening tariff salvo from incoming President Trump calling for a 25% levy on products from Mexico and Canada, as well as an additional 10% tariff on Chinese goods. The initial reaction was to see futures on stocks and bonds fall and the dollar jump, but those moves were mostly reversed by the time cash markets opened, and large cap equities were able to make gains on the day on the back of a strong performance from large caps with Bloomberg’s Mag 7 index up over 1%. The SPX hit its 52nd ATH for the year. Small caps though fell. Also giving some lift to markets was strengthening confidence in an Israel/Lebanon peace deal which was approved around the time markets closed.

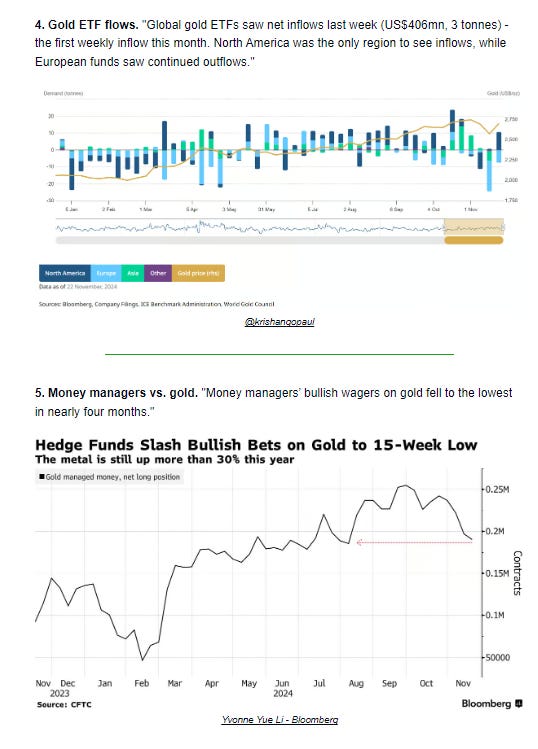

Gold was able to bounce back from its worst day since June, while nat gas moved to a 1-yr high. Copper also gained while crude and bitcoin fell.

The market-cap weighted S&P 500 was +0.6%, the equal weighted S&P 500 index (SPXEW) unch, Nasdaq Composite +0.3% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index +0.7%, and the Russell 2000 +1.5%.

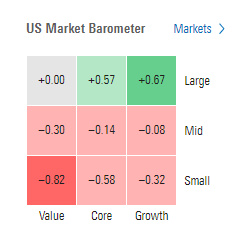

Morningstar style box consistent with the “other 493” styles lagging large growth.

Market commentary:

“We’re just seeing the start of the volatility and the volatility is going to continue as the rhetoric continues,” said Justin Onuekwusi, CIO at St. James’s Place. “It is very difficult to assess if it is a threat, promise or negotiation tool.”

“However, these tariffs do differ quite a bit from what Trump had mentioned during his campaign of 60% for China and a 10% broad tariff for the rest of the world. Whilst the market maybe cautious of the risk that Trump maybe incrementally introducing the tariffs, we do note the possibility that the final imposition may not be quite the same as what was proposed by him.”

“We still see tariffs as more strategizing and think the bark will be worse than the bite,” said Andrew Brenner at NatAlliance Securities.

To Dennis DeBusschere at 22V Research, Trump linking tariffs to drugs and immigration, rather than trade policy and economics signaled to investors that this announcement is a negotiating tactic, not a policy tool.

“It was Trump ‘following through’ on his campaign promises – nothing more, nothing less – and my sense is that investors welcomed the move,” said Kenny Polcari at SlateStone Wealth.

“Markets have become a lot more comfortable with the prospects of these tariffs being more bluster and more negotiating tactics than actual implementation,” Jamie Cox, managing partner at Harris Financial said. “Basically, what a lot of people think is that the rhetoric is a lot stronger than what the eventual tariffs will be.”

At BMO Capital Markets, Ian Lyngen says that perhaps the muted response in Treasuries is because not only had the market already priced in a renewed emphasis on “tariffs as trade policy,” but it’s also an acknowledgment that increases in levies have a one-time impact on realized inflation.

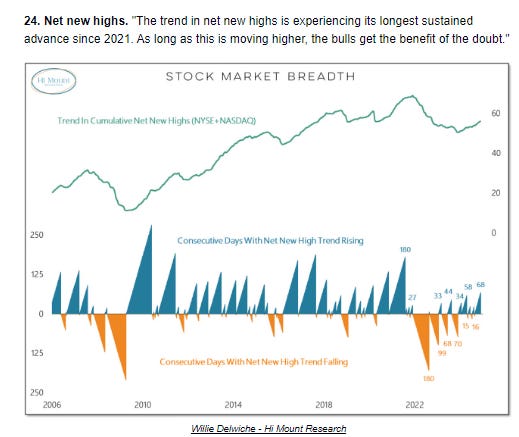

There are some signs that the stock market is trending toward being overbought, but investors should stay bullish for now, according to Canaccord Genuity. Analyst Michael Welch said in a note to clients that tactical indicators are not showing “a cause for concern” even with the stock market trading near record highs. “We continue to believe that with a Fed rate cut cycle in place, a favorable seasonal period, and a two-year-old bull market that remains below the median in both percent gain and duration, now is not the time to fight the Fed or the tape, but it is an opportunity for investors to position for further upside, especially on any near-term weakness,” Welch said.

Meantime, Bank of America Corp.’s Savita Subramanian is counting on another year of double-digit gains for the S&P 500 in 2025 — but says even better opportunities are present in individual stocks outside the benchmark.

Her 2025 year-end target for the gauge is 6,666, and she recommends companies with healthy cash return prospects and tied to US economy. The strategist is overweight financials, consumer discretionary, materials, real estate and utilities.

At Goldman Sachs Group Inc., strategists are advising investors to keep their money in US equities, but to adjust their holdings to mitigate the fact that close to half of the S&P 500’s rise in 2024 was due to the so-called “Magnificent Seven” big-tech stocks. The high concentration and valuation of the US stock market is a reason to implement diversification across strategies and regions, says Goldman’s Peter Oppenheimer. He adds that a overweight on US stocks still makes sense, however, given solid economic and earnings expectations for 2025.

The U.S. economy is robust and is expected to remain so in 2025 according to Gregory Daco, chief economist at EY-Parthenon. Daco expects the economy could grow at 2% in 2025, from 2.6% real GDP growth in the fourth quarter .

But the extent to which tariffs proposed by President-elect Donald Trump will be implemented in the coming year remains an overhang on the economic forecast, and has greater weight than any changes to tax policy. “The truth is that the drag from tariffs on growth is likely to outweigh tax cuts on the forecast horizon,” said Daco. “If I tell you that your taxes are not changing in 2026, your reaction to that is going to be very different than if I tell you that your taxes are going lower in 2026. And I think that’s a big misconception in terms of the potential boost to economic activity from the Tax Cuts and Jobs Act,” Daco continued. “If it expires, it weighs on the economy by about 1%. If it doesn’t expire, it has essentially no effect. You don’t get that drag, but it has no positive effect.”

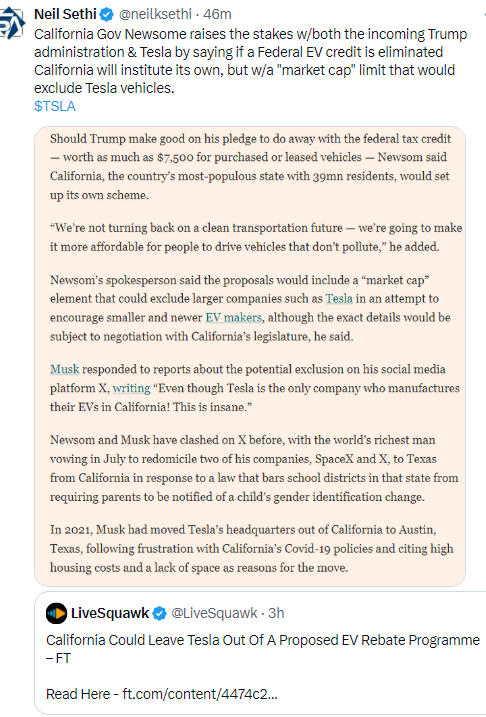

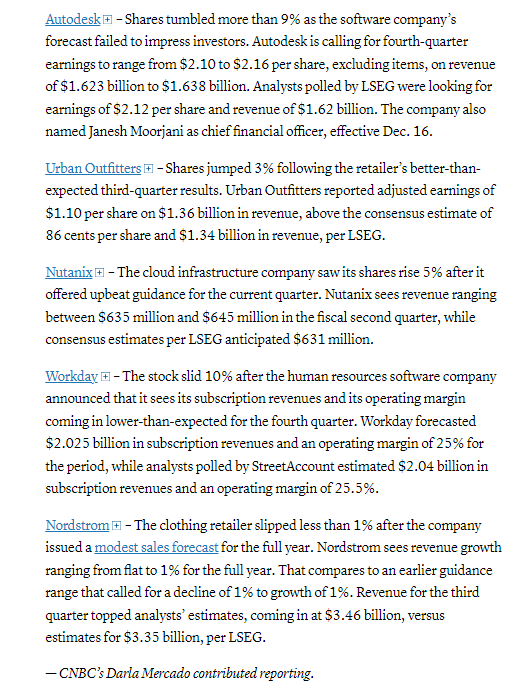

In individual stock action, Dow component Amgen (AMGN 280.01, -13.99, -4.8%) garnered some negative attention after underwhelming news from its Phase 2 trial update for the weight-loss drug MariTide. Other story stocks included retailers that reported earnings like Best Buy (BBY 88.48, -4.55, -4.9%), Kohl's (KSS 15.22, -3.12, -17.0%), Abercrombie & Fitch (ANF 146.62, -7.88, -5.1%), and Dick's Sporting Goods (DKS 212.22, -3.01, -1.4%). Microsoft Corp. drove software companies higher. While automakers like General Motors Corp. and Ford Motor Co. were hit due to their exposure to Mexico and China

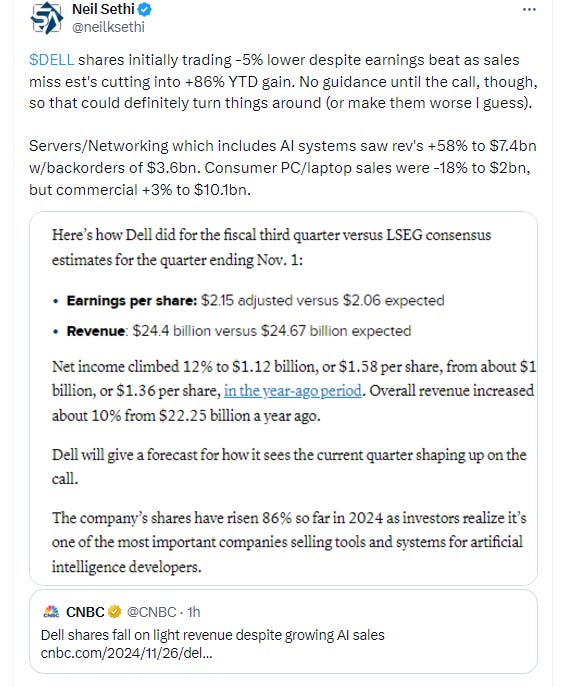

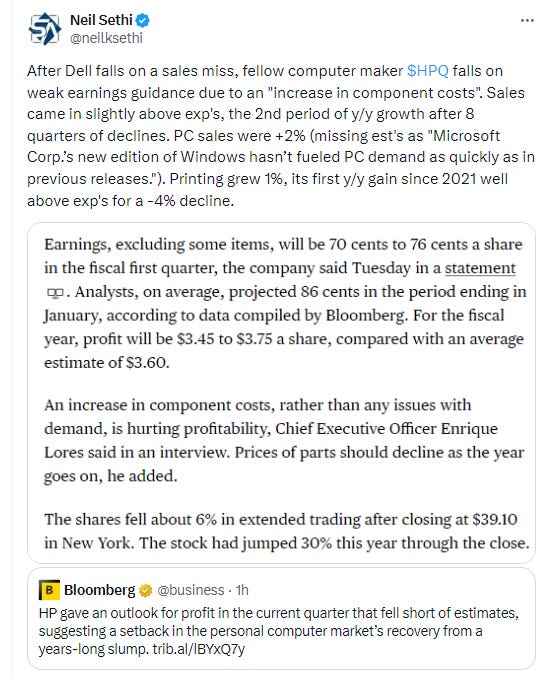

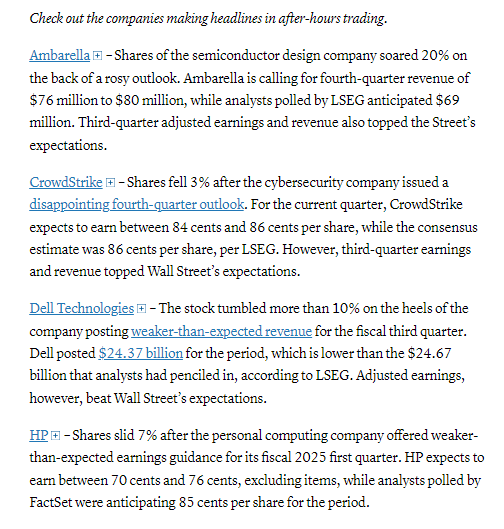

In late hours, Dell Technologies Inc. reported worse-than-expected sales, while HP Inc. and CrowdStrike Holdings Inc. gave lackluster outlooks.

After hours movers from CNBC:

Corporate Highlights from BBG:

Urban Outfitters Inc. reported stronger-than-expected sales growth in the third quarter, led by its Anthropologie brand.

Nordstrom Inc. raised the lower end of its annual sales guidance after its off-price and flagship chains reported quarterly growth that was better than expected — results that could encourage the company’s board to push the founding family for a better offer to take Nordstrom private.

Amgen Inc.’s experimental obesity shot failed to significantly outperform rivals and showed a high rate of gastrointestinal side effects.

Kohl’s Corp. cut its full-year sales outlook, signaling that its turnaround efforts are fizzling in an increasingly difficult retail environment.

Dick’s Sporting Goods Inc. raised its full-year sales outlook after posting strong results in the back-to-school season ahead of the holidays, spurred by high demand for sports gear.

Best Buy Co. cut its full-year guidance on sluggish demand for electronics and appliances, a sign of trouble for the retailer looking to pull off a turnaround.

JM Smucker Co. raised its earnings guidance as its popular Uncrustables frozen sandwiches outperformed expectations, offsetting softness at the recently acquired Hostess brand

Some tickers making moves at mid-day from CNBC.

In US economic data today:

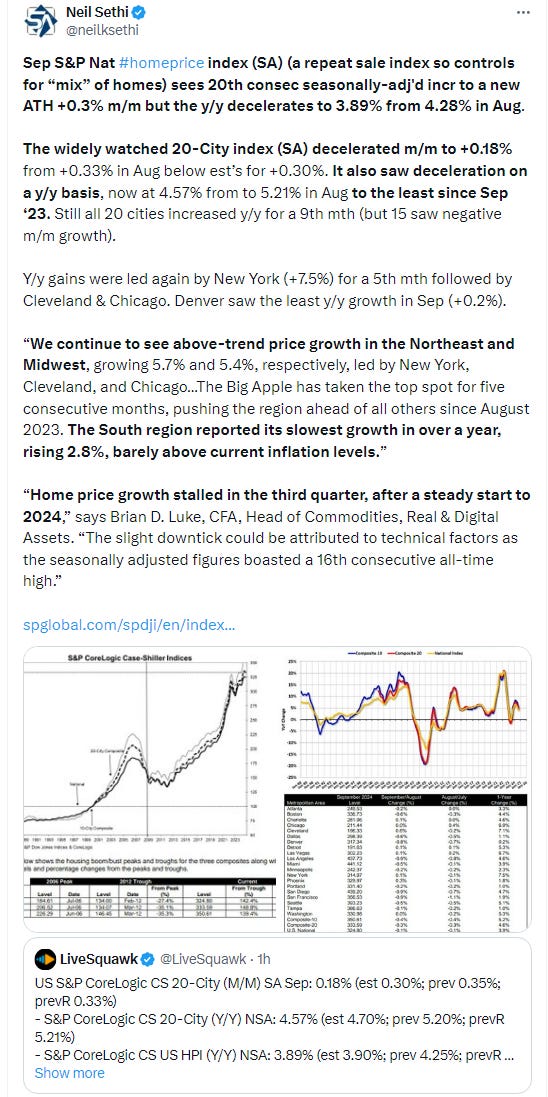

Home-price gains in the US slowed in September led by slowing in the South.

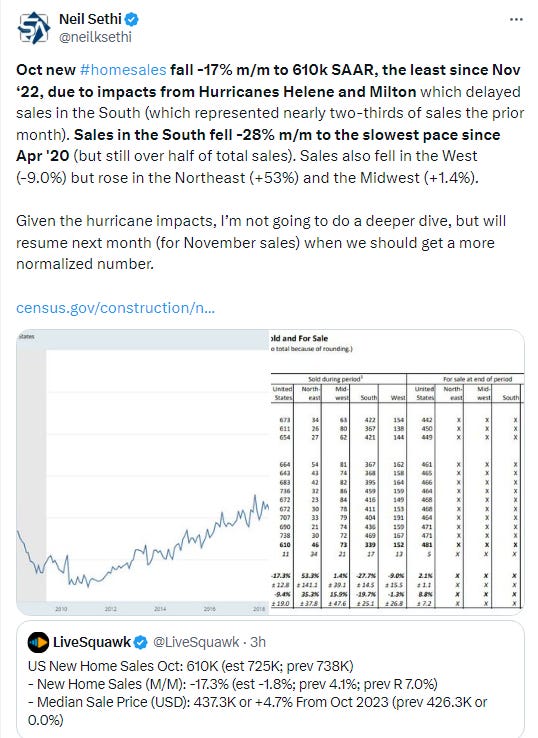

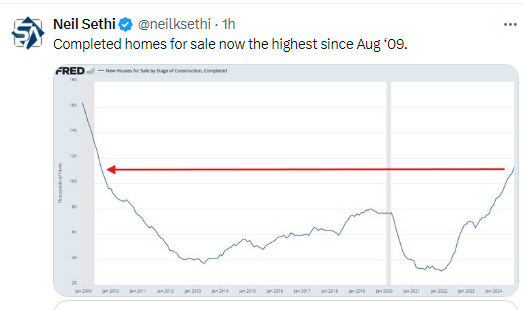

New home sales fell -17% m/m in Oct to the least since Nov ‘22 due to impacts from Hurricanes Helene and Milton which delayed sales in the South (which represented nearly two-thirds of sales the prior month).

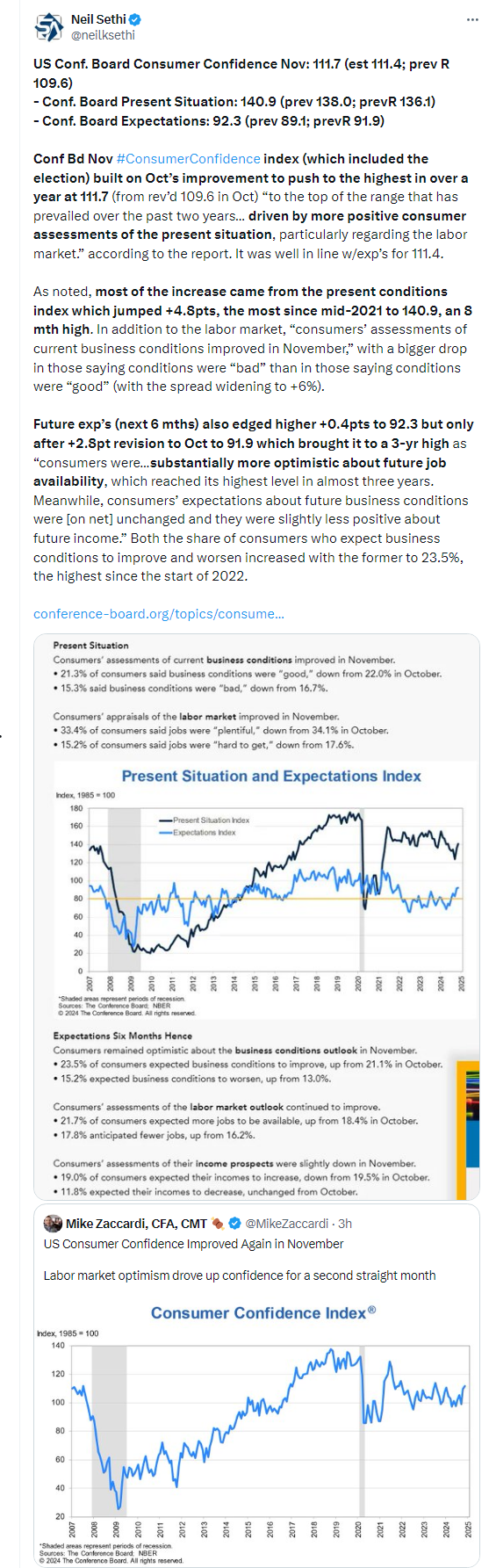

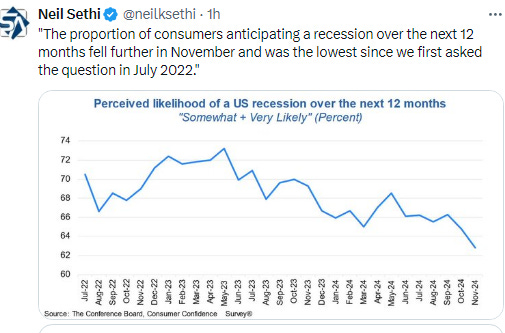

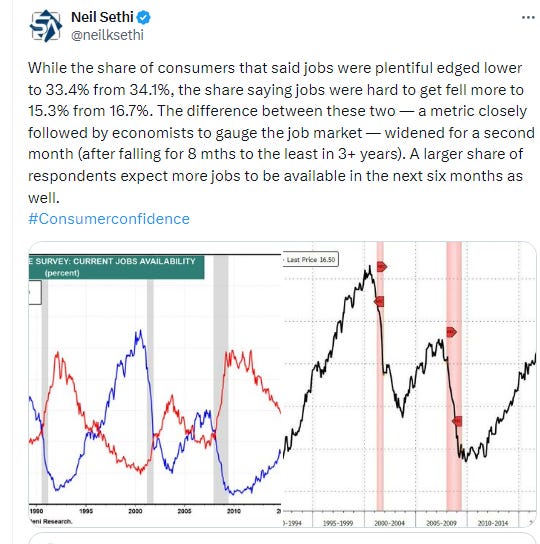

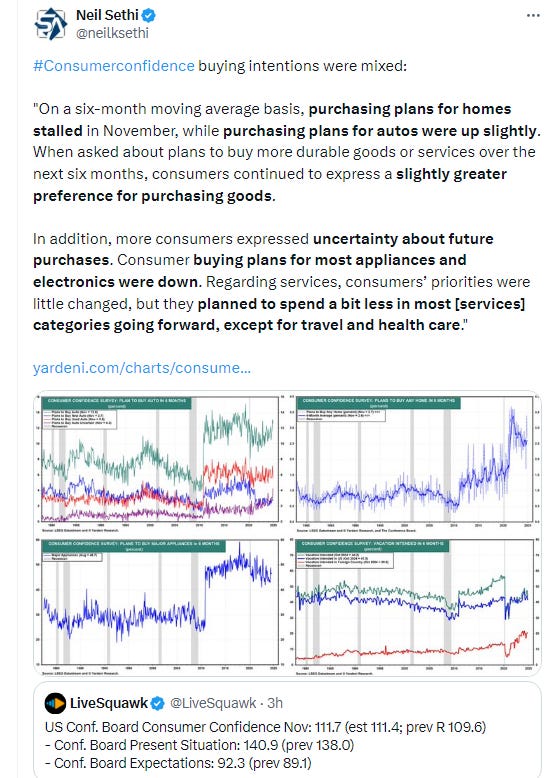

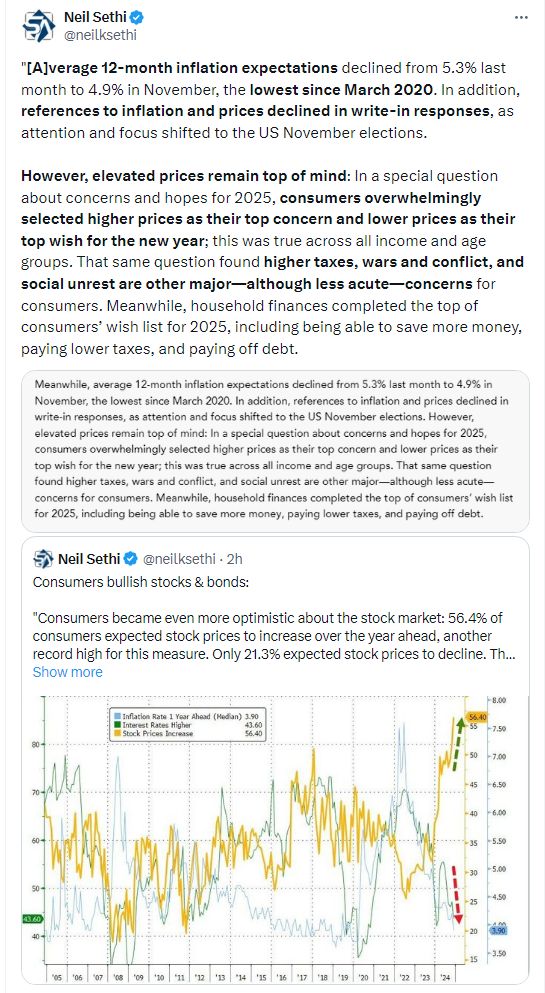

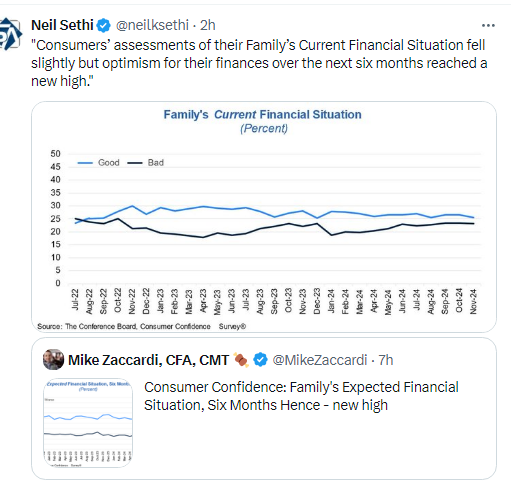

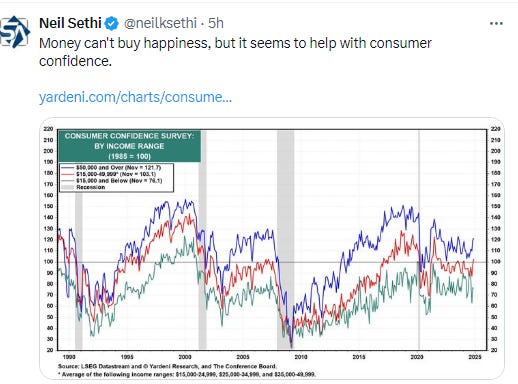

US consumer confidence increased in November to the highest level in more than a year on optimism about the economy and labor market.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

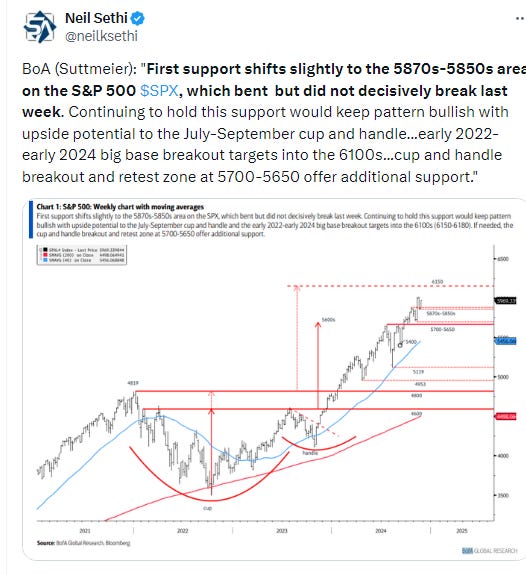

The SPX as noted edged to an ATH. Its daily MACD & RSI remain tilted positive.

The Nasdaq Composite remains a little below its ATH. It daily MACD & RSI are also more mixed.

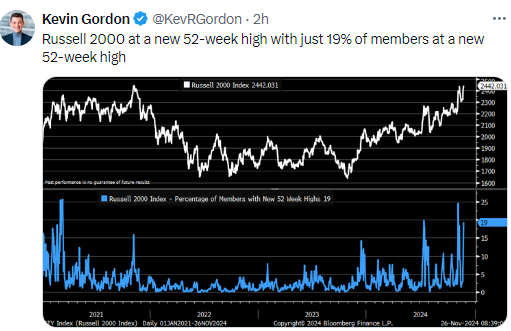

RUT (Russell 2000) fell for the first time in 6 sessions after Monday touching ATH territory for the first time since Nov ‘21. Its daily MACD & RSI remain the most bullish of the three.

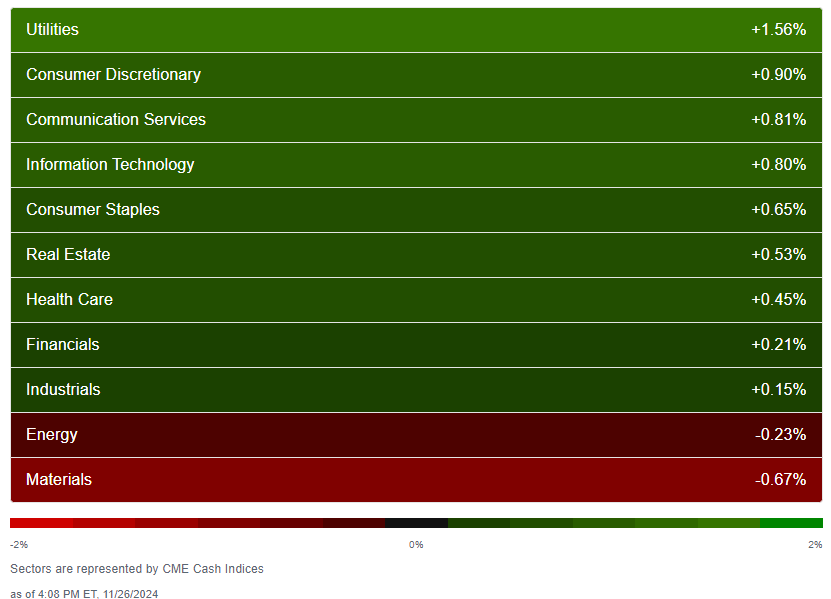

Equity sector breadth from CME Indices remained very solid for a 4th session w/again 9 of 11 sectors green (same as Mon & Thurs, up from 8 Fri) but just 5 sectors up +0.6% or more vs 7 Mon, 6 Fri, 8 Thurs, and like Mon 1 up >1% from 4 Fri, 5 Thurs. Unlike Mon & Fri, though, we saw outsized weakness in one sector (cyclicals) who took the bottom 4 spots, although no sector was down more than -0.7%.

Stock-by-stock SPX chart from Finviz consistent with more red sprinkled in but still lots of green. Interesting how weak most of semi’s were on a day NVDA was green. Mag 7 +1.22% today according to Bloomberg.

Positive volume was weak for the 1st day in 6 with the NYSE at just 35%, well worse than would be expected from a flat day on the NYSE Composite, while Nasdaq was just 43% despite the index seeing solid gains. Issues were 34 & 39%. So the clear change in breadth post-Nvidia earnings hit a wall today.

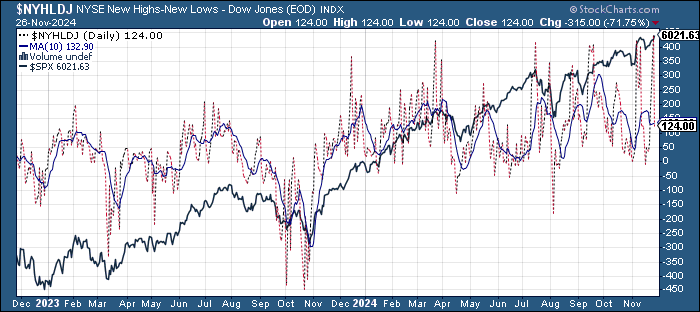

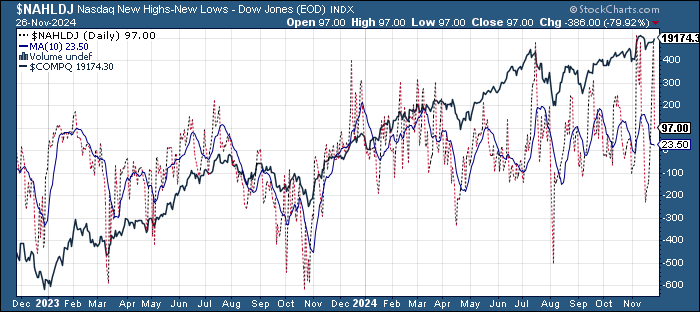

New highs-new lows fell sharply as well w/the NYSE falling to 122 from 437, which was the best since mid-2021, while the Nasdaq fell to just 94 from 480, which was the 2nd best since mid-’21. They fell back near the 10-DMAs, and the 10-DMAs haven’t really turned higher.

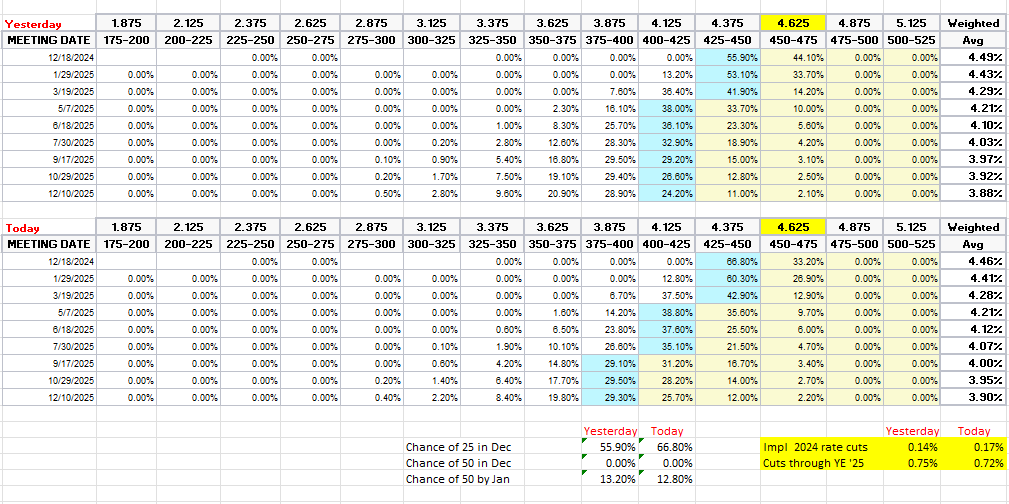

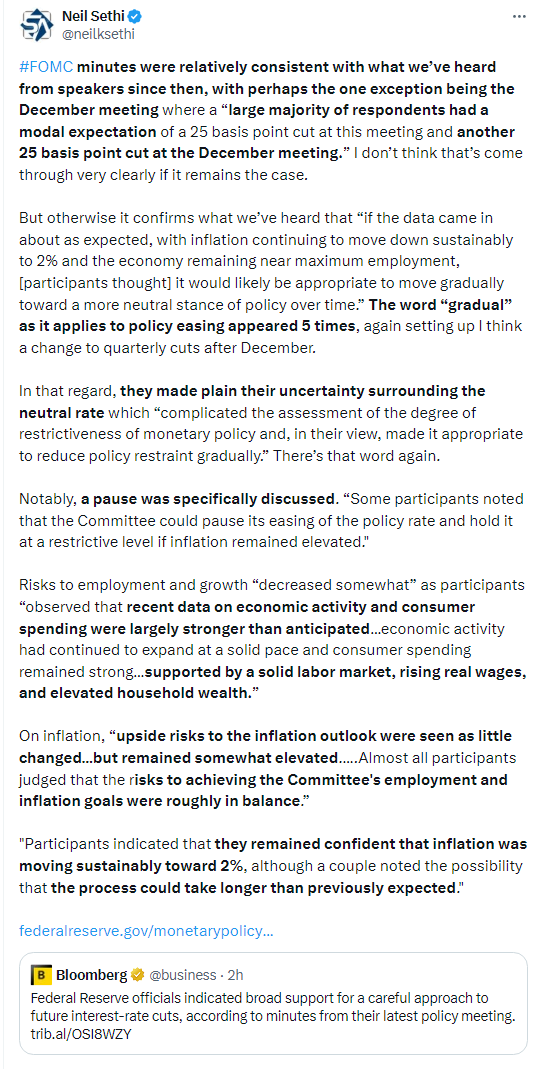

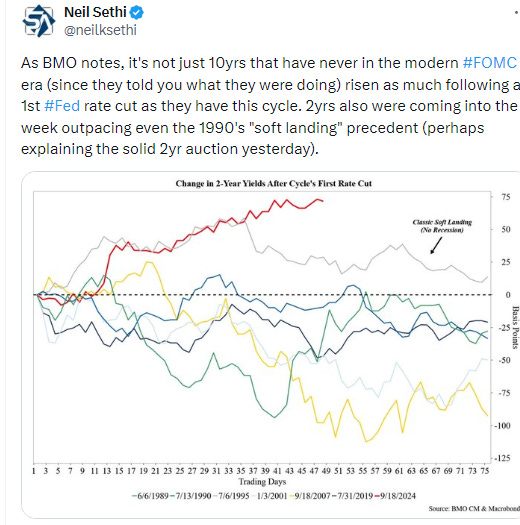

FOMC rate cut probabilities from CME’s Fedwatch tool were little changed for 2025 following the FOMC minutes, but expectations for December shot up to 67%, the most since the July FOMC meeting (where they held rates steady). Total cuts through YE 2025 edged lower to 72bps, keeping us around 3 cuts in total priced from here.

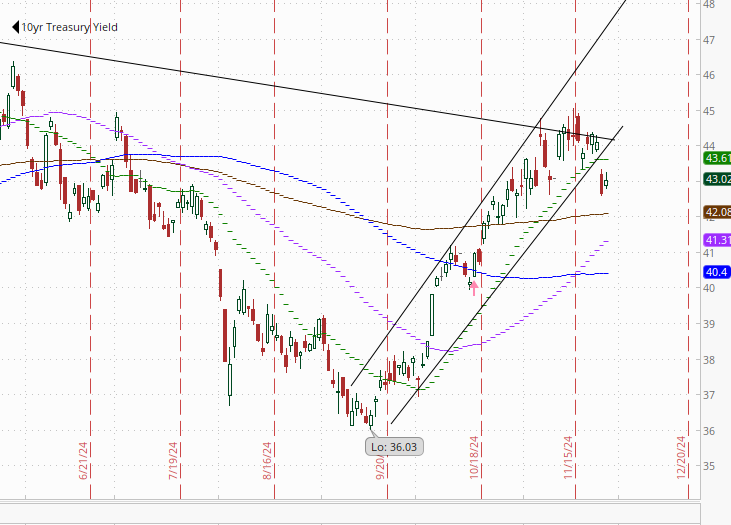

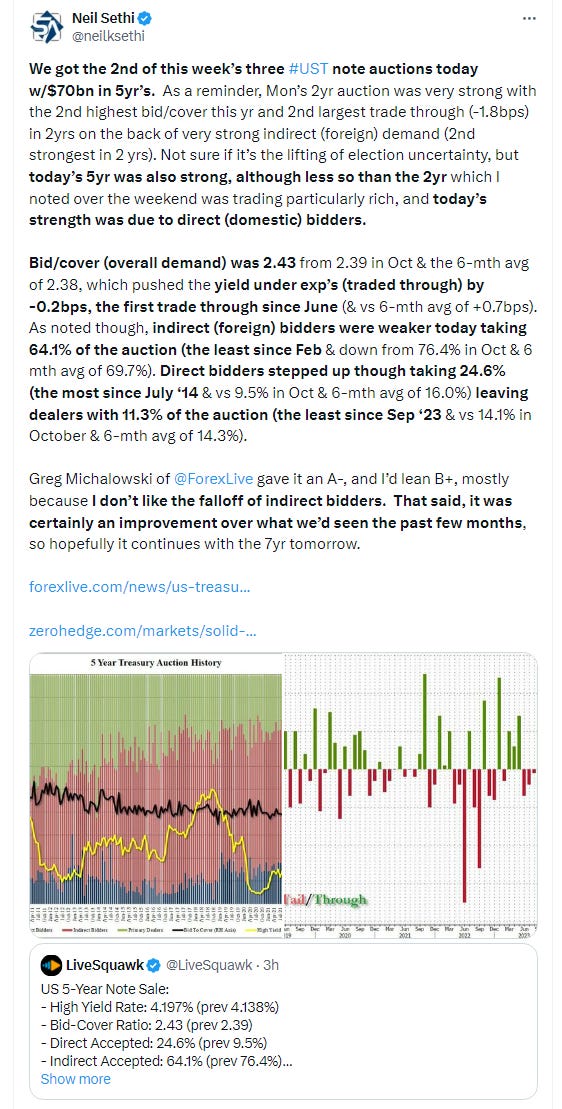

Treasury yields jumped in the overnight session on the Trump tariff concerns but drifted lower to end with the 10yr yield, more sensitive to economic growth and long-term inflation, +4 basis points (after falling -15 Mon) to 4.30%, off the lowest close in a month, and the 2yr yield, more sensitive to Fed policy, falling another -2bp (after -10 Mon) to 4.25% on the constructive FOMC minutes. There was also a pretty good 5yr auction as well.

Dollar ($DXY) was a bit more volatile on the Trump tweets, but less so than Monday when it fell the most since Aug on the Bessent pick. Tues it ended slightly higher, but with the range between open and close within Monday’s range (an “inside day”). It remains firmly in the middle of the uptrend channel running back to September that it’s only closed outside of for one session. Daily MACD remains supportive (although is close to tipping less so) but the RSI as noted Mon has fallen from above to under 70 (although that didn’t make much difference a week ago). Now has the resistance of the old highs.

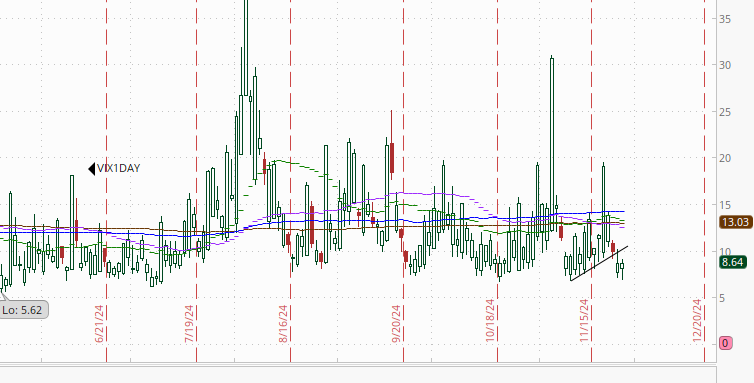

The VIX & VVIX (VIX of the VIX) fell again, the former to 14.1 (consistent w/less than 1% daily moves over the next 30 days) and the latter to 87 (the least since July & consistent with “moderate” daily moves in the VIX over the next 30 days).

1-Day VIX unch at 8.6, matching the lowest close since July 9th & looking for a move of around 0.54% Wed.

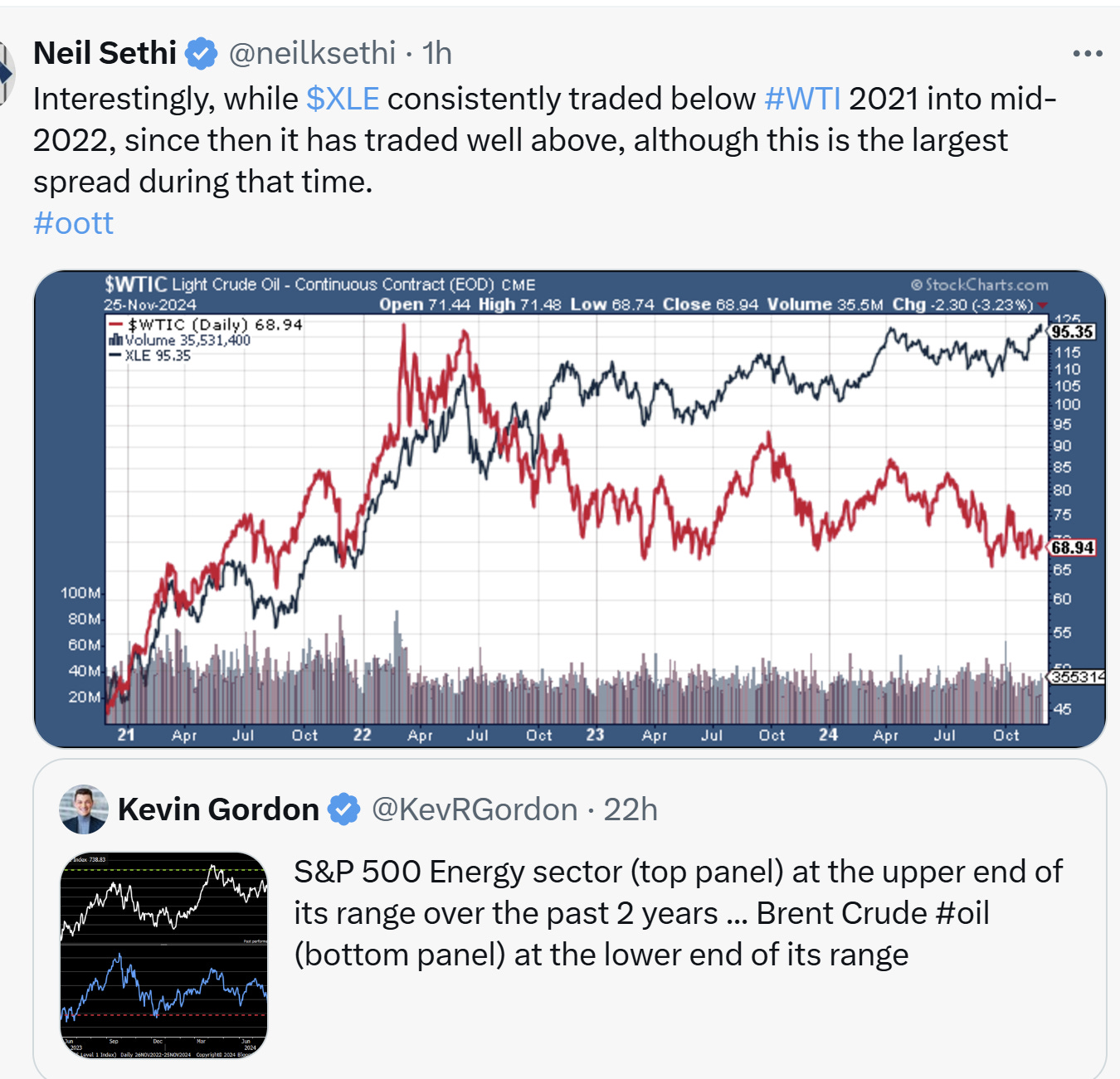

WTI fell to the $68 level before bouncing, finishing slightly down on the day as it appears debate has begun around OPEC+ extending voluntary production cuts and with the Israel Security Cabinet approving an Israel/Lebanon peace deal. As noted Monday it has “little support to protect from a retest of the key $67 level.”

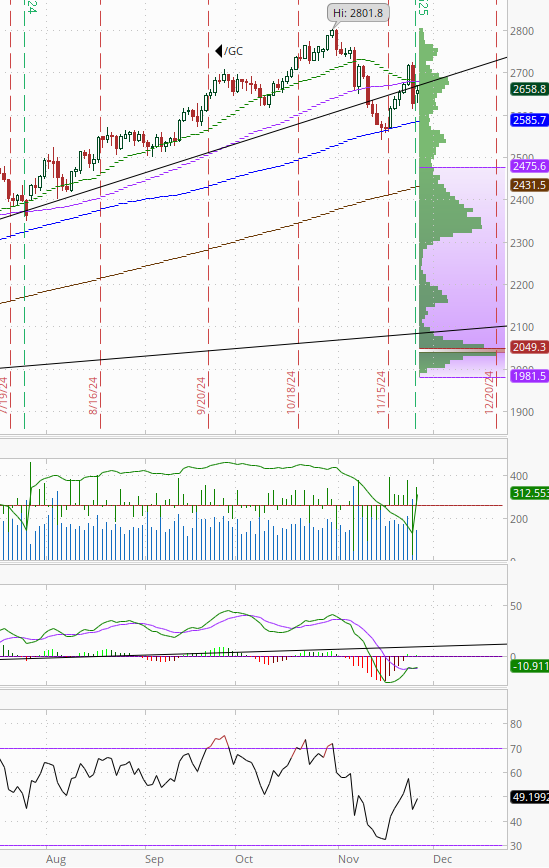

Gold got a bounce Tues after its worst session since June 6th Mon but just back to the underside of resistance. Until it gets over that, we have to look lower not higher. The daily MACD & RSI as noted Mon “turned from positive to neutral at best. Another test of the 100-DMA coming?”

Copper (/HG) edged higher for a 2nd day but finished off the highs remaining above its trendline back to the Oct ‘23 lows it has mostly respected since then. Daily MACD & RSI as noted last Monday remain in a negative positioning but are turning.

Nat gas (/NG) rolled to the Jan contract on my system which gave it a boost over the $3.40 resistance as noted Monday, a 1-yr high. The daily MACD & RSI remain positive. Next resistance $3.65.

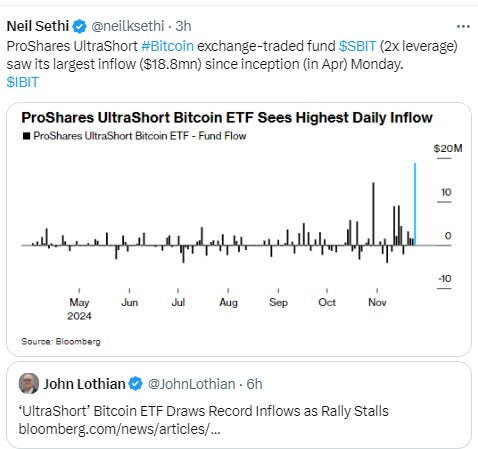

Bitcoin futures fell another -3.5%, now down nearly -10% from the highs. As I said Monday, “Not fatal to the run, but definitely raises the possibility of a consolidation. RSI is flashing a warning signal going from over 80 to under 70. If it does consolidate, it could fall quite a bit before finding support.” $90k feels like an important level.

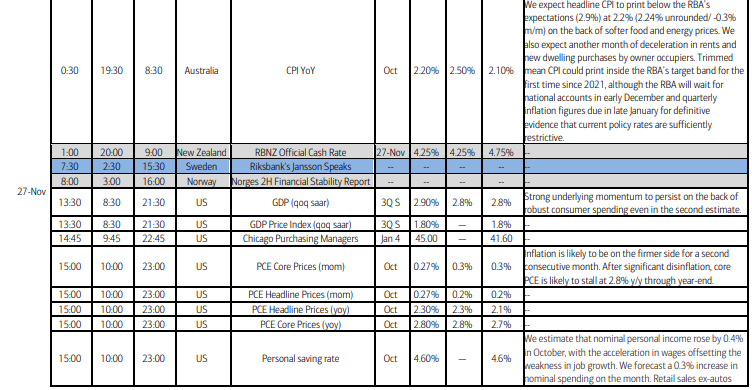

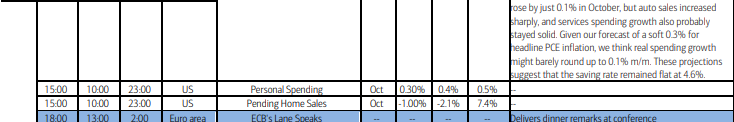

The Day Ahead

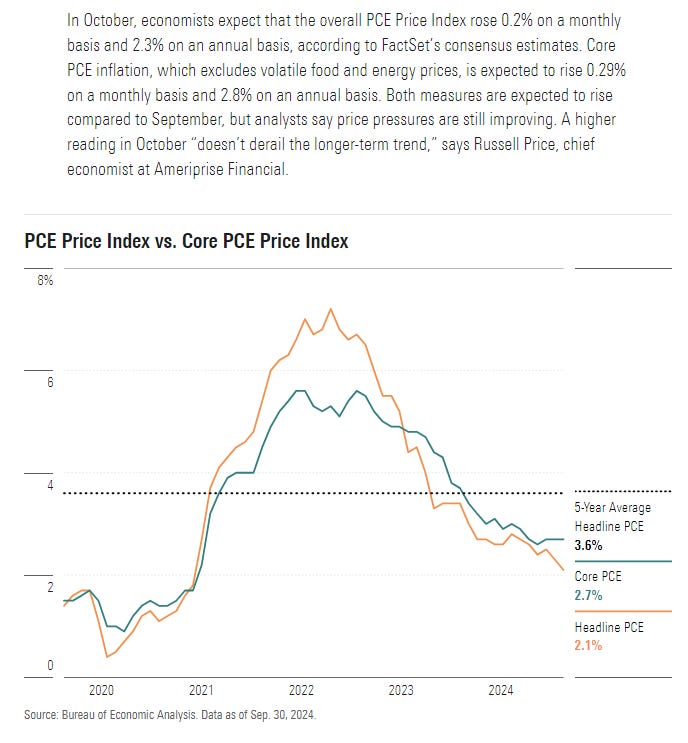

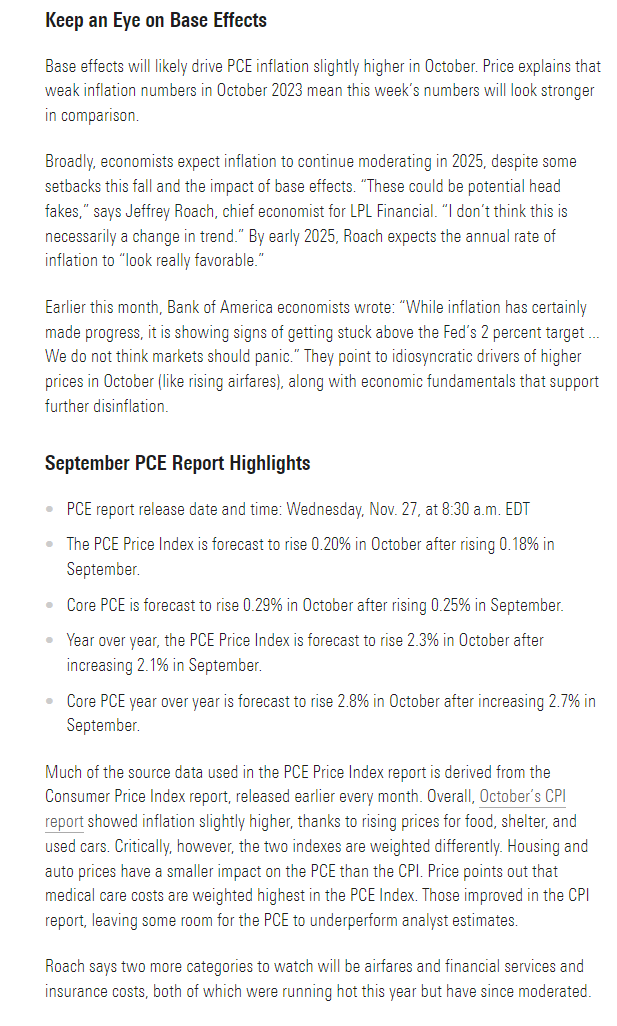

US economic data will be impossible to keep up with tomorrow (if you’re an individual human) with the key report of the week - personal income and spending for Oct along with core PCE prices, the Fed’s favorite measure of inflation (more on that below) - along with an update on Q2 GDP, pending home sales, durable goods orders, goods trade deficit and preliminary inventories, and weekly jobless claims, mortgage applications, and petroleum inventories. I’ll be working on those probably into Friday.

There are again no Fed speakers scheduled, but we’ll also get the last of our three Treasury auctions in $44bn in 7yr notes. Fingers crossed the solid demand keeps up.

We’ll get some earnings, but we’re done with our SPX reporters for the week (see the full earnings calendar from Seeking Alpha).

Ex-US a lighter day highlighted by a policy decision from New Zealand who is weighing a 50bps rate cut. We also get #China industrial profits, #Germany’s GfK consumer confidence, Australia CPI, In EM we get #Mexico trade data which now takes on more importance.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,