Markets Update - 11/27/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

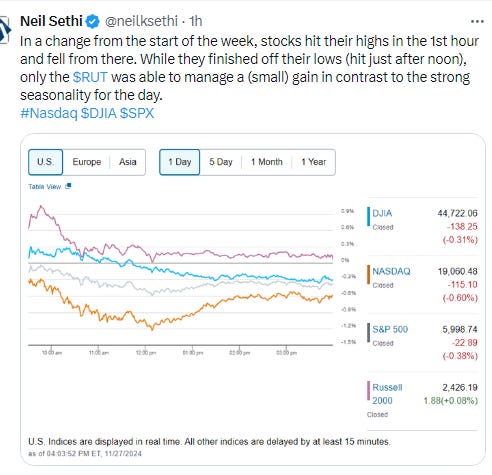

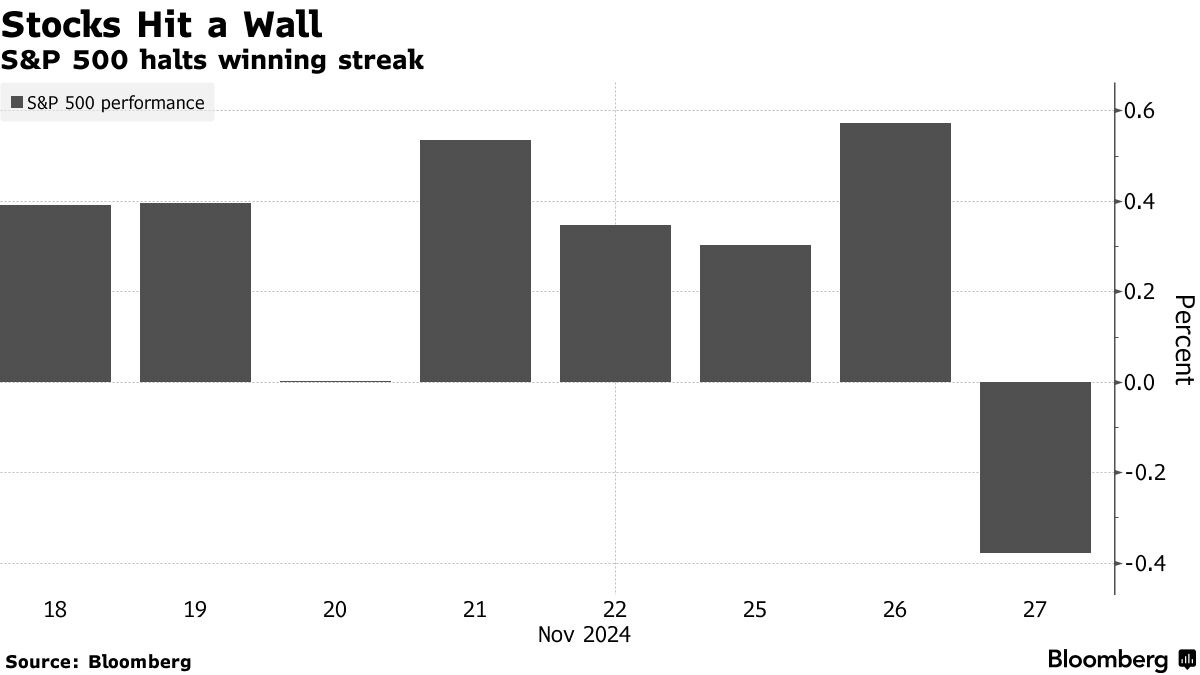

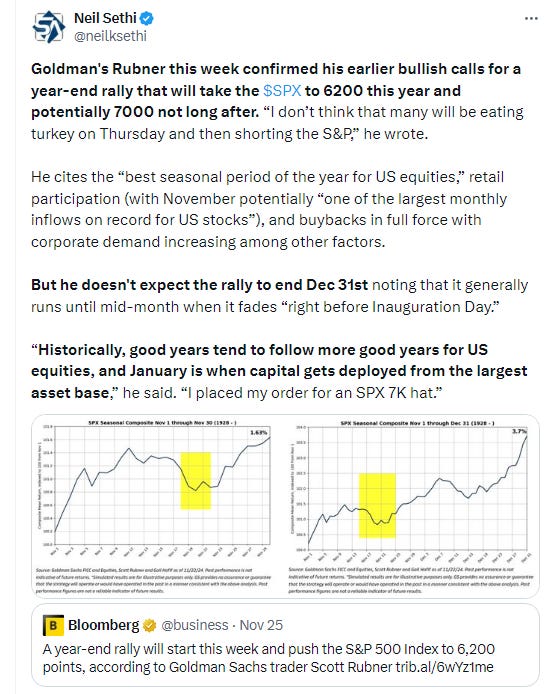

US equity indices were mixed again Wednesday as they digested more key appointments from incoming President Trump and a slew of US economic reports headlined by Oct’s personal income and spending report which showed a strong rise in incomes, slightly weaker than expected spending, and an as expected read on core PCE prices, the Fed’s favorite inflation measure. However, that as expected print meant an acceleration from a year ago to 2.8% evidencing the difficult path the Fed will have bringing the metric all the way down to 2%. In contrast to Tuesday, it was small caps which outperformed with a small gain while large caps were lower snapping the S&P 500’s 7-day win streak. Bloomberg’s Mag 7 index was down nearly -1%.

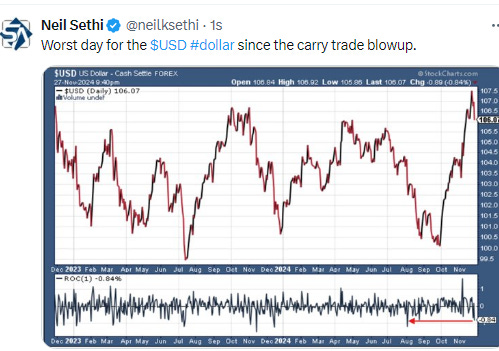

Despite the sticky PCE prices figure bond yields fell and the dollar had its worst day since August. Gold and copper edged higher, oil edged lower. Nat gas fell sharply on warmer forecasts while bitcoin saw a big bounce after falling nearly -10% the prior two sessions.

The market-cap weighted S&P 500 was -0.4%, the equal weighted S&P 500 index (SPXEW) -0.1%, Nasdaq Composite -0.6% (and the top 100 Nasdaq stocks (NDX) -0.9%), the SOX semiconductor index -1.5%, and the Russell 2000 +0.1%.

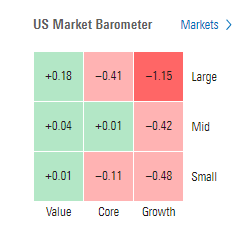

Morningstar style box consistent with the “other 493” styles lagging large growth.

Market commentary:

“Today’s data shouldn’t change views of the likely path for disinflation, however bumpy,” said David Alcaly, lead macroeconomic strategist at Lazard Asset Management. “But a lot of observers, probably including some at the Fed, are looking for reasons to get more hawkish on the outlook given the potential for inflationary policy change like new tariffs.”

To Bret Kenwell at eToro, overall inflation has been moving in the desired direction, but a lack of further follow-through could force investors to reassess bets on future rate cuts.

“The last mile towards price stability has been stymied by still ‘sticky’ inflation and bumps along road,” said Quincy Krosby at LPL Financial.

Wednesday’s inflation data that came in line with expectations is a welcome preholiday update for the Federal Reserve, according to Scott Helfstein, Global X’s head of investment strategy. “This is a nice Black Friday gift for the Fed,” he said. “They can eat turkey and watch football for a day knowing that they are close to full employment with price stability.” Helfstein said the numbers are “very close” to the Fed’s target goal. Additionally, he said the reading is unlikely to change the path of interest rates, or the probability of a 25 basis point cut at the central bank’s December policy meeting.

“I think [the Fed will] cut again [in December],” Stephen Stanley, Santander U.S. Capital Markets chief U.S. economist, told CNBC’s “Power Lunch.” “I think they feel like they’re still pretty far away from neutral, so they feel like they still have some distance to go and they’d like to get another notch in their belt on that.”

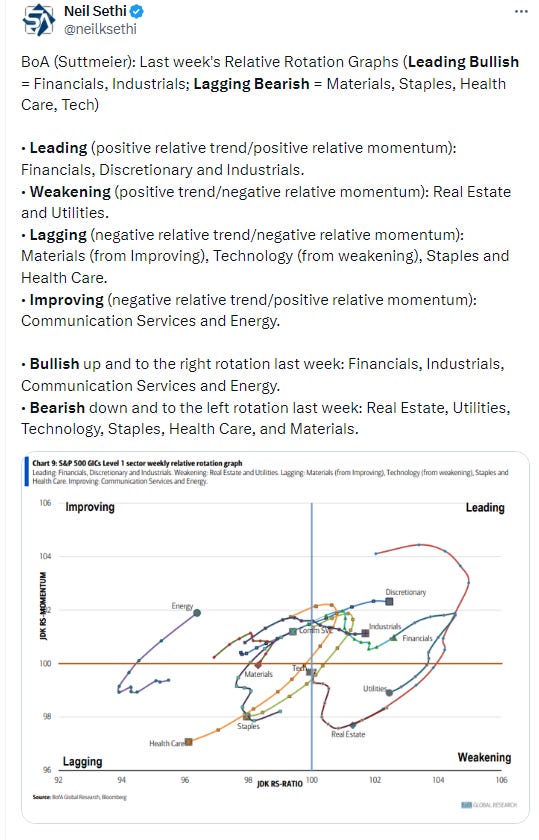

“It’s beginning to look a lot like ‘tech mess’,” said Jonathan Krinsky at BTIG. “The relative breakdown in tech is a concern heading into 2025, although the good news so far is rotation into other parts of the market keeps the broadening trade alive.”

“If we get close to a place where we are talking about across-the-board tariffs, I think that would be a wake-up call for risk assets, equities and credit alike,” Wei Li, global chief investment strategist at BlackRock Inc., said in an interview with Bloomberg TV. “We’re risk-on for now, but things could change.”

In a note to clients on Tuesday, Solita Marcelli, chief Americas investment officer at UBS Global Wealth Management, said that while threats of tariffs may trigger short-term volatility in the markets, the backdrop remains supportive for global stocks, especially in the US. “Within the US, the technology, utilities, and financial sectors are among those we see as attractive,” she wrote.

JPMorgan Chase & Co.’s equity strategy team, led for years by Marko Kolanovic until his departure earlier in 2024, has turned positive on US stocks.

Dubravko Lakos-Bujas, who took over market research for the firm this summer, released a year-end 2025 target of 6,500, which eclipses the average projection of about 6,300 among strategists tracked by Bloomberg.

“Heightened geopolitical uncertainty and the evolving policy agenda are introducing unusual complexity to the outlook, but opportunities are likely to outweigh risks,” he wrote.

Inflows into US equities surged after the election and a retail frenzy is back, while selling of Europe continues unabated, according to Barclays Plc’s Emmanuel Cau. The strategist still sees some dry powder as despite big US inflows from long-only funds and retail, there was limited re-grossing by hedge funds and systematic strategies. He says sentiment indicators haven’t rebounded with the overall market, suggesting bullishness is not as widespread as it seems.

In individual stock action:

Information technology was the worst-performing sector in the S&P 500 on Wednesday, slumping close to -2%. HP and Dell were the biggest laggards in the sector, shedding more than -12% each. Autodesk tanked more than -8%, while CrowdStrike and Workday fell more than -6%. Nvidia, Salesforce, Oracle and Intel declined more than -3% each.

Shares of Urban Outfitters jumped more than 19% in afternoon trading following the retailer’s better-than-expected earnings and revenue for the third quarter. Those gains put the stock on pace for its best day since Aug. 26, 2020, when it rose about 21.4%.

Solar power stocks were broadly positive Wednesday after SolarEdge announced it is shutting down its energy storage business in effort to cut costs. SolarEdge jumped more than 16%, leading the sector higher in the wake of the announcement. The benchmark Invesco Solar ETF (TAN) rose 1.6% and is up more than 5% for the week.

Corporate Highlights from BBG:

Autodesk Inc. Chief Executive Officer Andrew Anagnost said the company is focused on cutting costs in its sales and marketing teams, a move that comes following pressure from activist investor Starboard Value LP.

The US Federal Trade Commission has opened an antitrust investigation of Microsoft Corp., drilling into everything from the company’s cloud computing and software licensing businesses to cybersecurity offerings and artificial intelligence products.

The US Federal Trade Commission is looking into whether Uber Technologies Inc. violated consumer protection laws with its flagship subscription service.

Urban Outfitters Inc. reported stronger-than-expected sales growth in the third quarter, led by its Anthropologie brand.

Nordstrom Inc. raised the lower end of its annual sales guidance after its off-price and flagship chains reported quarterly growth that was better than expected — results that could encourage the company’s board to push the founding family for a better offer to take Nordstrom private.

BlackRock Inc., Vanguard Group Inc. and State Street Corp. were sued by a group of states led by Texas for allegedly breaking antitrust law by boosting electricity prices through their investments, in the highest-profile lawsuit yet against the beleaguered ESG industry.

Symbotic Inc. cut its first-quarter revenue forecast and said it was unable to file its annual filing due to accounting errors.

Brookfield Asset Management Ltd. walked away from a plan to acquire Grifols SA, ending months of negotiations to take over the Spanish blood-plasma company.

Some tickers making moves at mid-day from CNBC.

In US economic data today (I wasn’t able to keep up so this is a summary from Briefing.com, but I posted what I did get out today, will have more on Friday):

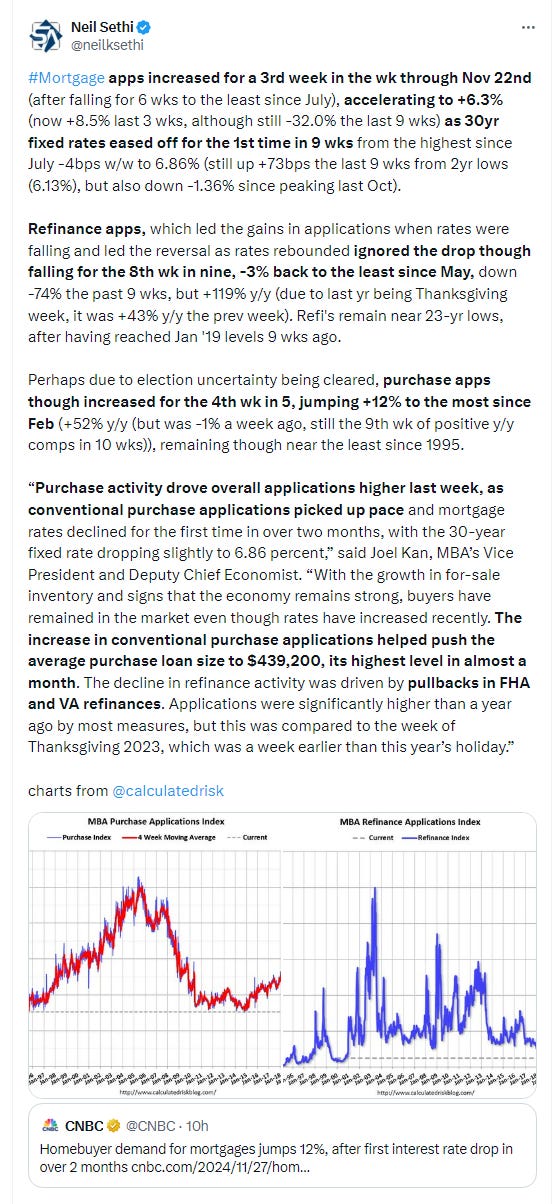

Weekly MBA Mortgage Applications Index 6.3%; Prior 1.7%

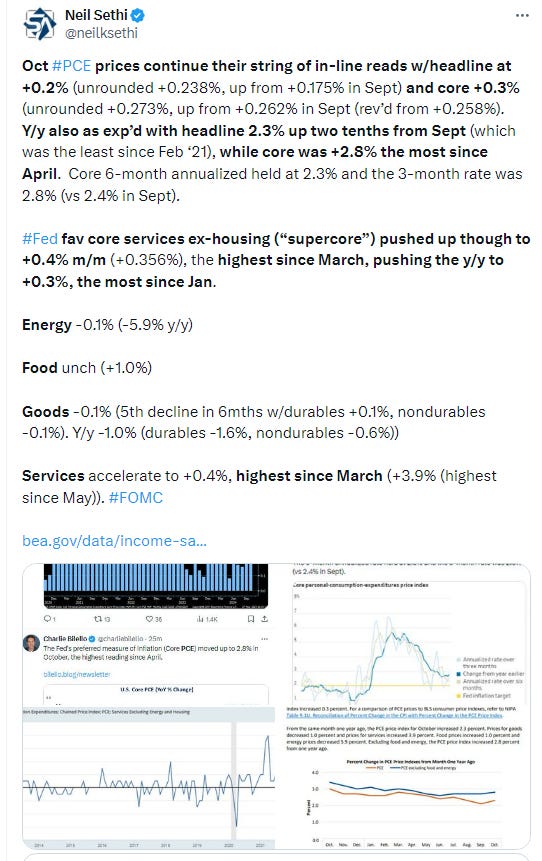

October Personal Income 0.6% (Briefing.com consensus 0.3%); Prior 0.3%, October Personal Spending 0.4% (Briefing.com consensus 0.2%); Prior was revised to 0.6% from 0.5%, October PCE Prices 0.2% (Briefing.com consensus 0.2%); Prior 0.2%, October PCE Price - Core 0.3% (Briefing.com consensus 0.3%); Prior 0.3%: The key takeaway from the report is the absence of disinflation in the PCE price indexes on a year-over-year basis. That wasn't necessarily a surprise given that the monthly readings were in-line with estimates, yet it may keep the Fed inclined to take a more gradual approach to cutting the target range for the fed funds rate. Core services prices — a closely watched category that excludes housing and energy — climbed 0.4% from a month earlier, the most since March.

Income figures from the October PCE report offer the possibility for healthy spending growth in the months ahead. Inflation-adjusted disposable personal income increased 0.4% last month, the most since January. Moreover, nominal wages and salaries rose a solid 0.5%, while the saving rate increased for the first time since the start of the year.

Services spending, which makes up the bulk of household consumption, rose 0.2% from a month earlier, largely reflecting health care outlays. Goods outlays ticked up.

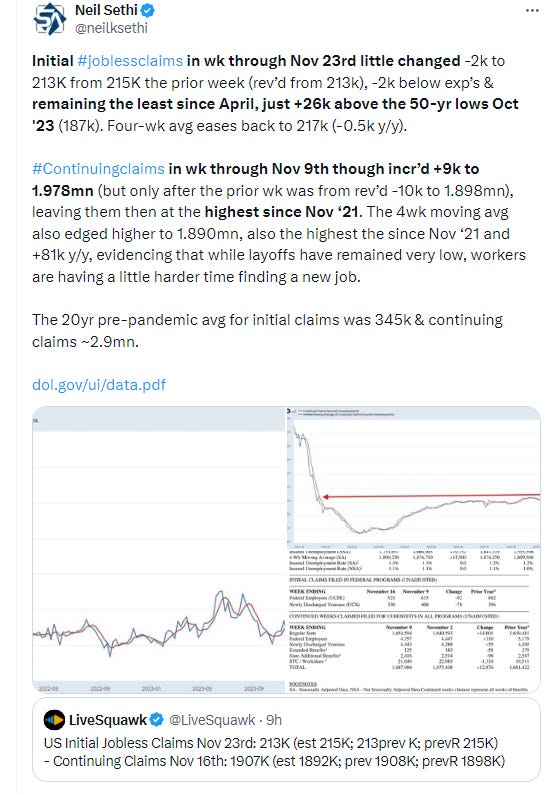

Weekly Initial Claims 213K (Briefing.com consensus 217K); Prior was revised to 215K from 213K, Weekly Continuing Claims 1.907 mln; Prior was revised to 1.898 mln from 1.908 mln: The key takeaway from the report is the much the same: employers are reluctant to let employees go, but for employees let go it is becoming more challenging to find a new job.

October Durable Orders 0.2% (Briefing.com consensus 0.4%); Prior was revised to -0.4% from -0.8%, October Durable Goods - ex transportation 0.1% (Briefing.com consensus 0.3%); Prior 0.4%: The key takeaway from the report is that it showed some softness in business spending in October, evidenced by a 0.2% decline in new orders for nondefense capital goods excluding aircraft -- a proxy for business spending.

October Adv. Intl. Trade in Goods -$99.1 bln; Prior was revised to -$108.7 bln from -$108.2 bln

October Adv. Retail Inventories 0.1%; Prior was revised to 0.6% from 0.8%

October Adv. Wholesale Inventories 0.2%; Prior was revised to -0.2% from -0.1%

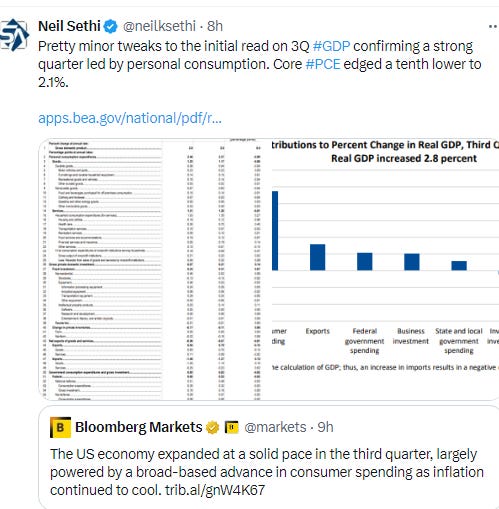

Q3 GDP - Second Estimate 2.8% (Briefing.com consensus 2.8%); Prior 2.8%, Q3 GDP Deflator - Second Estimate 1.9% (Briefing.com consensus 1.8%); Prior 1.8%: The key takeaway from the report is that there was a modest downward revision to personal consumption expenditures, yet that did not alter the fact that personal spending was quite healthy in the third quarter.

October Pending Home Sales 2.0% (Briefing.com consensus -1.5%); Prior was revised to 7.5% from 7.4%

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX fell back a touch from Tues’s ATH, its first decline in 8 sessions. Its daily MACD & RSI remain tilted positive.

The Nasdaq Composite fell back but bounced from near its 20-DMA remaining further below its ATH than the SPX. It daily MACD & RSI are also more mixed.

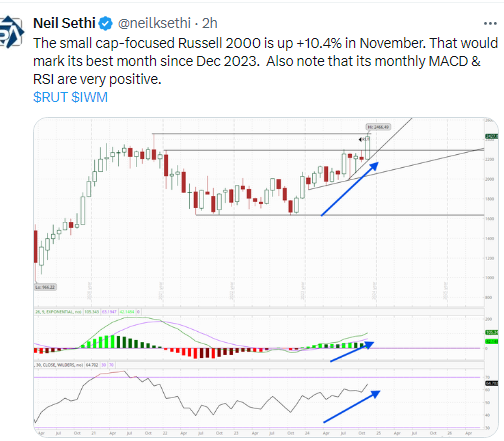

RUT (Russell 2000) edged out an up session, its 6th in 7, but didn’t make much progress back towards its ATH which it touched Monday for the first time since Nov ‘21. Its daily MACD & RSI remain the most bullish of the three.

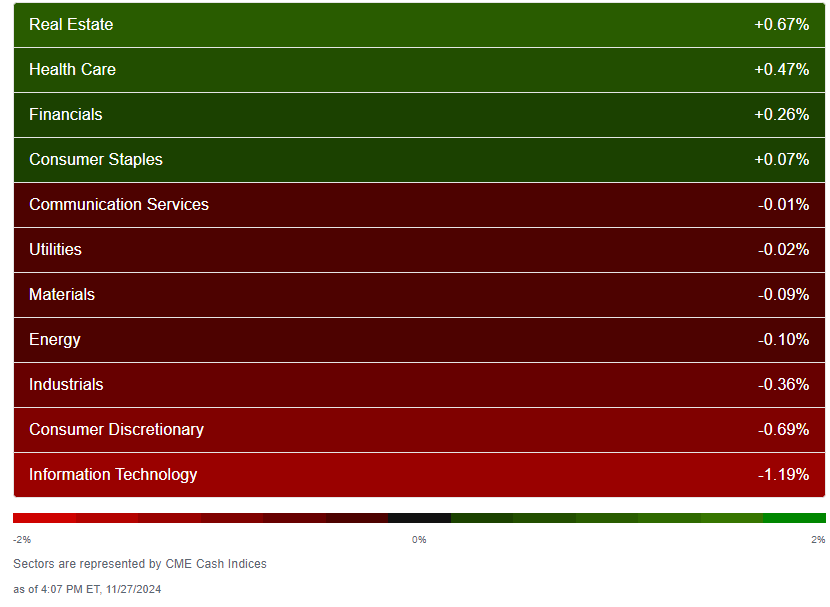

Equity sector breadth from CME Indices was weak for the 1st time in 5 sessions w/just 4 of 11 sectors green (down from 8 or 9 the prior 4 sessions), just one sector up +0.6% or more (vs 6 to 8 the prior 4 sessions) & none up >1%. While Tues we saw weakness in cyclicals, Wed it was megacap growth which took 2 of the bottom 3 spots with tech the only sector down more than -1%.

Stock-by-stock SPX chart from Finviz consistent showing the outsized weakness in tech. BBG Mag 7 index -0.9% today.

Positive volume was better Wed after its first weak day in 6 Tues with the NYSE at 57%, much better than the 35% Tues despite the index finishing slightly worse, while Nasdaq was 66% from 43% despite finishing solidly lower Wed (and solidly higher Tues). Issues were 59 & 54%. So we got back on track with the clear improvement in breadth post-Nvidia earnings.

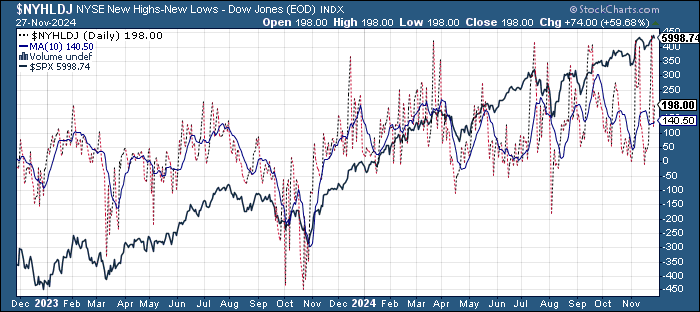

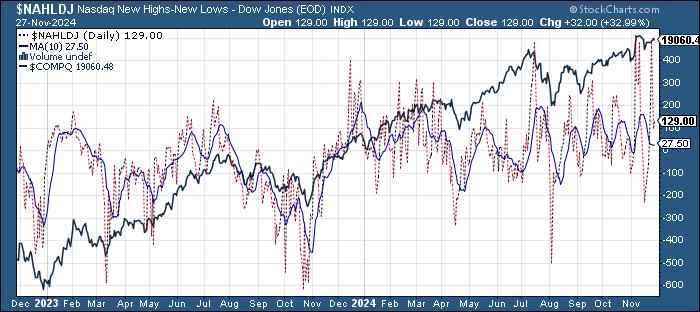

New highs-new lows bounced back as well w/the NYSE up to 196 from 122 (still well off Mon’s 437 which was the best since mid-2021), while the Nasdaq edged to 121 from 94 (down from 480 Mon, which was the 2nd best since mid-’21). They remain just above the 10-DMAs which have flattened out.

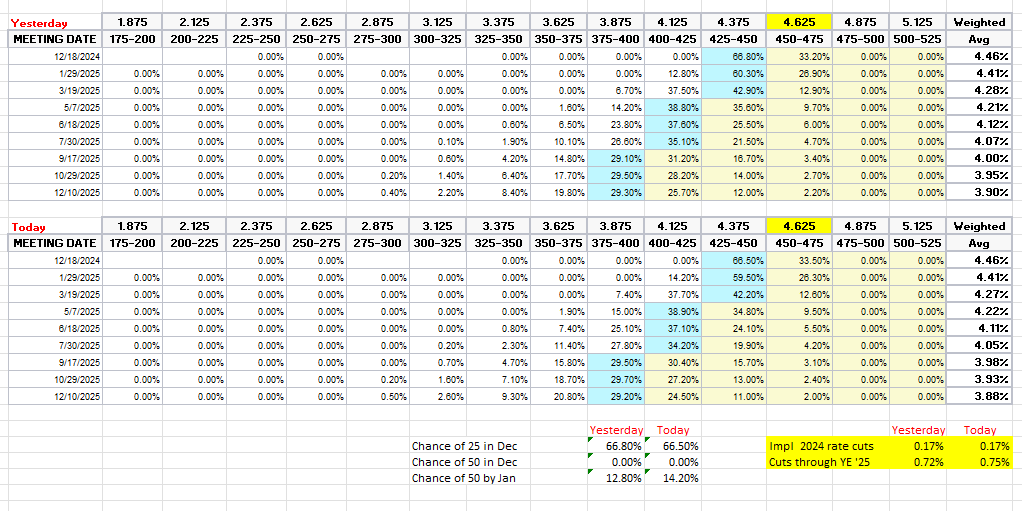

FOMC rate cut probabilities from CME’s Fedwatch tool were little changed despite the crush of data today which included a sticky core PCE prices print with chances for December cut remaining at 67%, the highest since before the July FOMC meeting (when they held rates steady). Total cuts through YE 2025 edged up to 75bps, keeping us around 3 cuts in total priced from here.

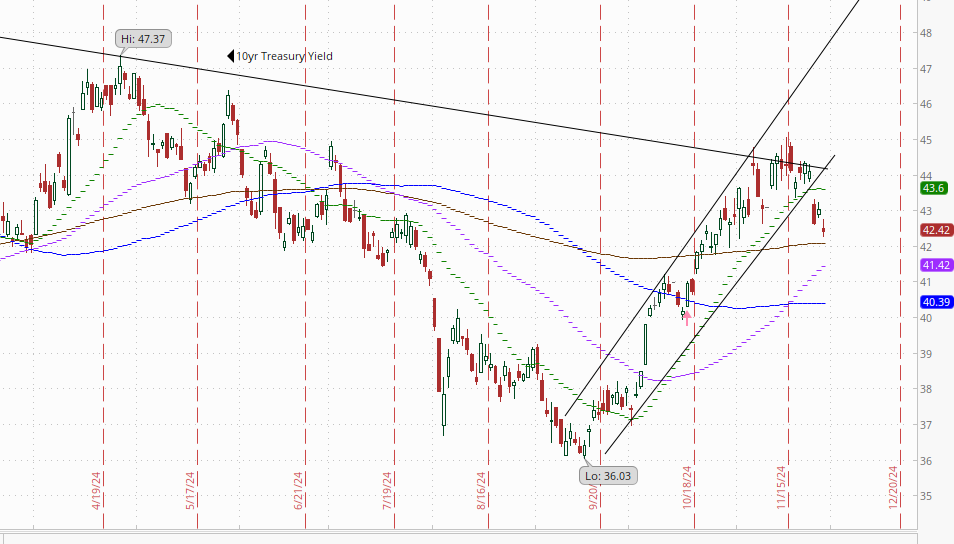

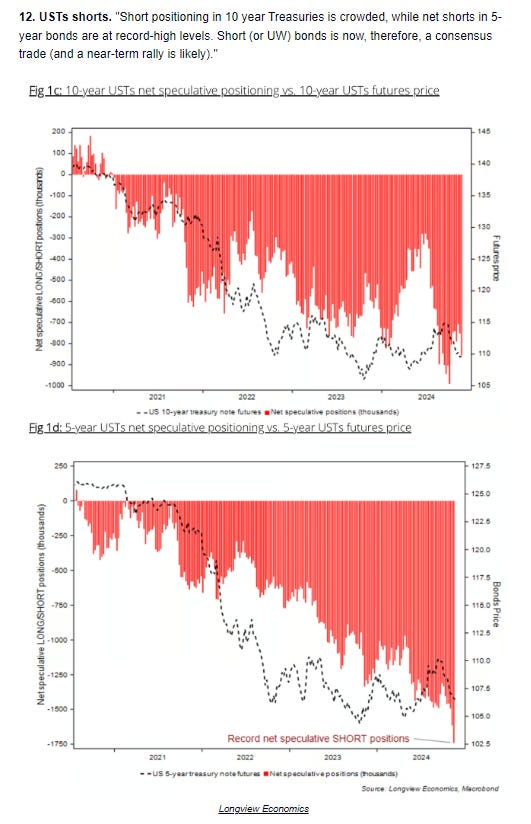

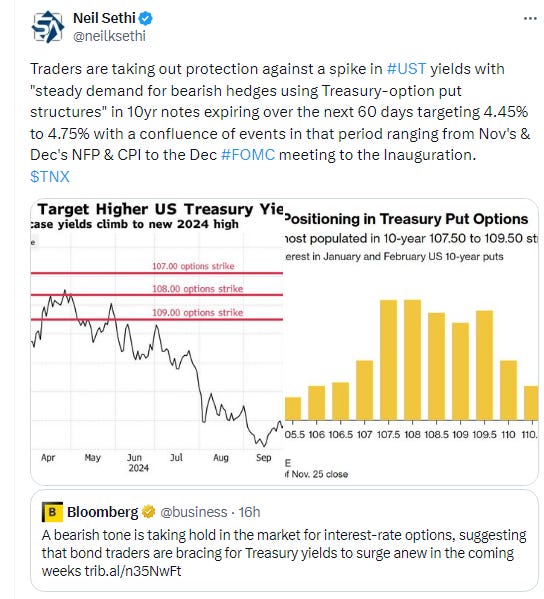

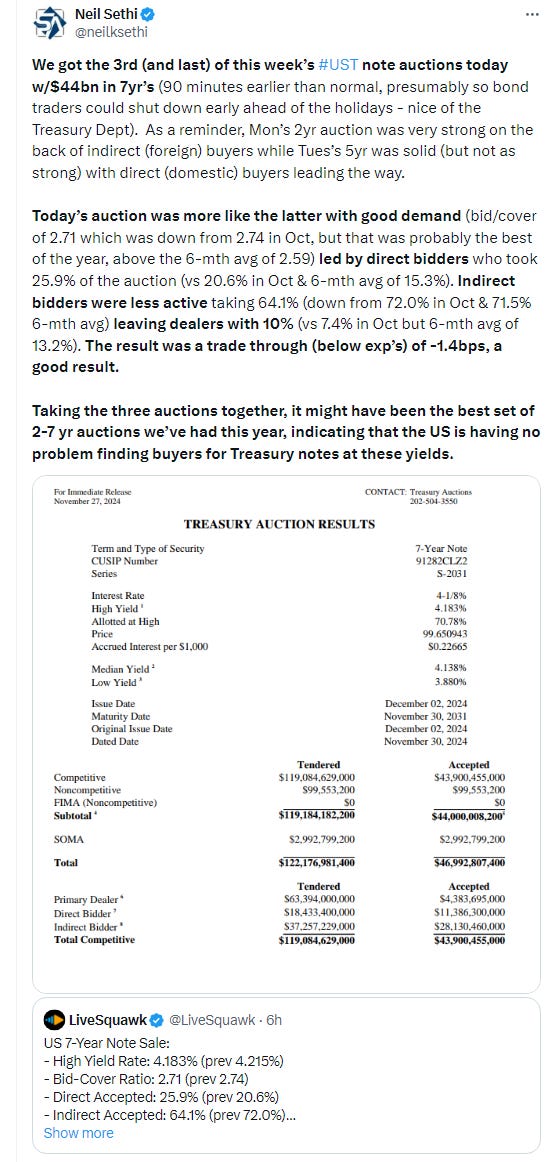

Treasury yields fell again despite that core PCE prices print helped by a strong 7-yr auction with the 10yr yield, more sensitive to economic growth and long-term inflation, -6 basis points to 4.24%, now down -18bps since the election and almost to its 200-DMA (brown line), and the 2yr yield, more sensitive to Fed policy, falling -3bp to 4.22% about where it was the day after the election.

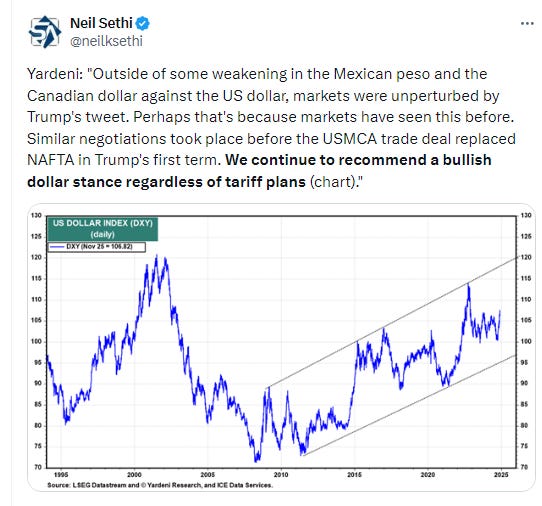

Dollar ($DXY) fell sharply Wed, its worst day since the carry-trade blowup in Aug, threatening to fall out of the uptrend channel running back to September that it’s only closed outside of previously for one session. Also its daily MACD (circle) & RSI (arrow) have moved to a more bearish positioning. We’ll see if the 20-DMA (green line) can hold.

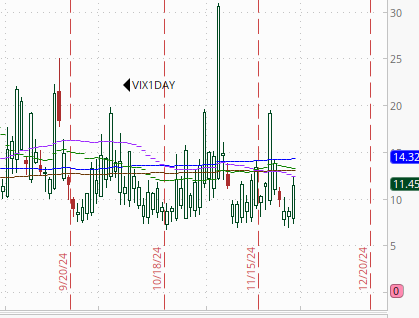

The VIX & VVIX (VIX of the VIX) were little changed, both sitting on top of uptrend lines running back to early July, the former at 14.1 (consistent w/less than 1% daily moves over the next 30 days) and the latter 88 (consistent with “moderate” daily moves in the VIX over the next 30 days).

1-Day VIX interestingly jumped to 11.45 from the lowest close since July 9th, still just looking for a move of around 0.72% Fri.

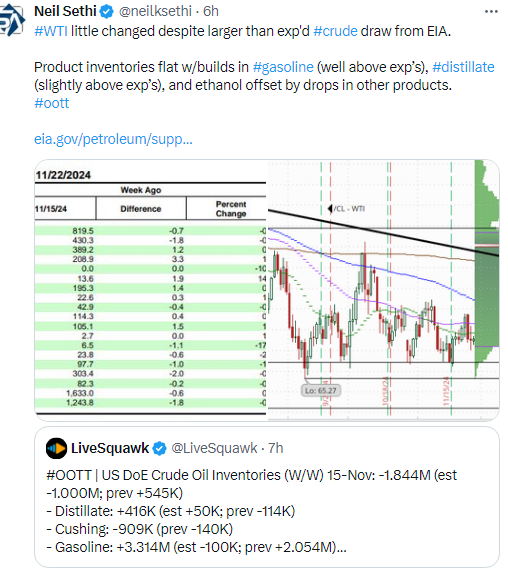

WTI again tested the $68 level but again finished little changed as the increasingly likelihood of OPEC+ extending voluntary production cuts for now offsets the Israel/Lebanon peace deal and oversupply concerns. As noted Monday it has “little support to protect from a retest of the key $67 level.”

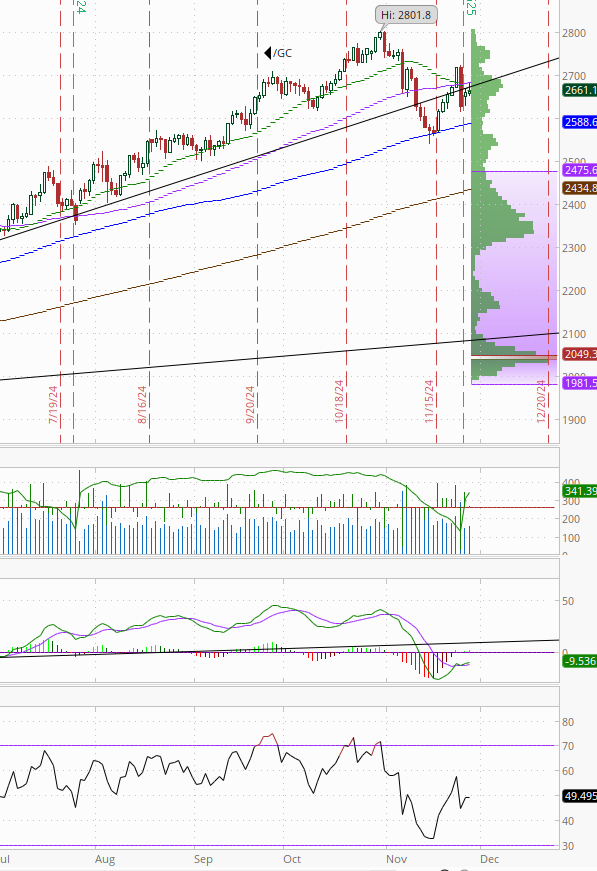

Gold tried but wasn’t able to get through resistance of the 50-DMA/$2700 level. As noted Tues, “until it gets over that, we have to look lower not higher…the daily MACD & RSI as noted Mon turned from positive to neutral at best. Another test of the 100-DMA coming?”

Copper (/HG) edged higher for a 3rd day but again finished off the highs remaining just above its trendline back to the Oct ‘23 lows that it has mostly respected since then. Daily MACD & RSI though are very close to turning more positive.

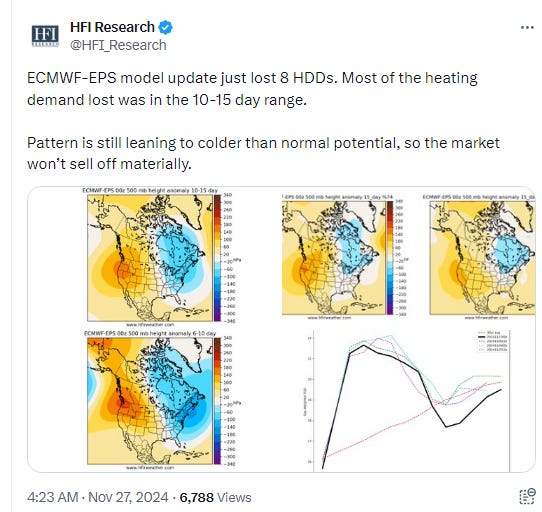

Nat gas (/NG) fell sharply after having closed at a 1-yr high Tues following a warmer turn in forecasts. The daily MACD & RSI remain positive but the RSI broke its uptrend line. The $3.15 level (June highs) might provide some support.

Bitcoin futures bounced sharply Wed up over +6%. That saved the daily MACD & RSI from turning more negative. Could see it breaking either way in terms of the $90-100k range.

The Day Ahead

US markets are closed tomorrow for Thanksgiving. They’ll reopen Friday morning but not for a full day closing at 1 pm ET for equities, 2 pm ET for bonds. No US economic data is scheduled (I’ll catch up on some of today’s crush of reports).

There are again no Fed speakers scheduled Friday and no Treasury auctions.

Also as noted yesterday, we’re done with our SPX reporters for the week (see the full earnings calendar from Seeking Alpha).

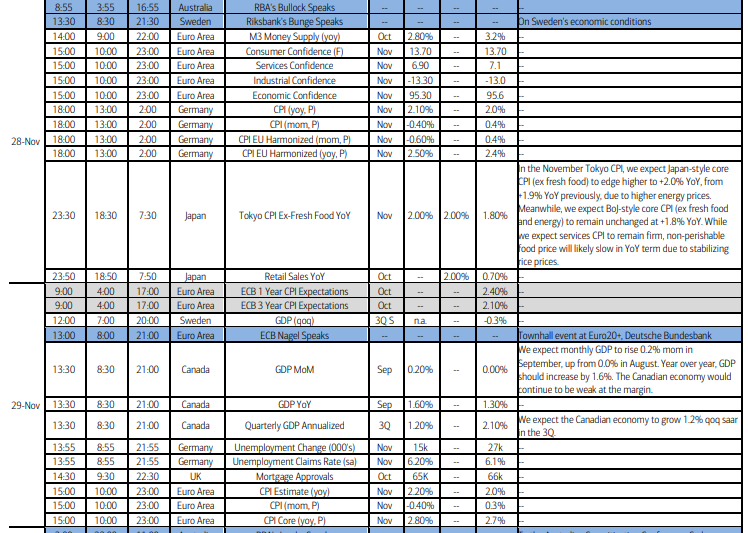

Ex-US Thursday we’ll get preliminary Nov CPI from Germany and Spain and EU lending and biz & consumer confidence. Friday we’ll get Japan’s Nov Tokyo CPI (leading indicator for Japan full country), retail sales, and industrial production, as well as preliminary Nov CPI from France, Italy, and EU, UK lending, Germany’s employment, and Q3 GDP from Canada.

EM highlight Thurs is a policy decision from South Korea (no change is expected), Fri it’s GDP from India.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,