Markets Update - 1/13/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

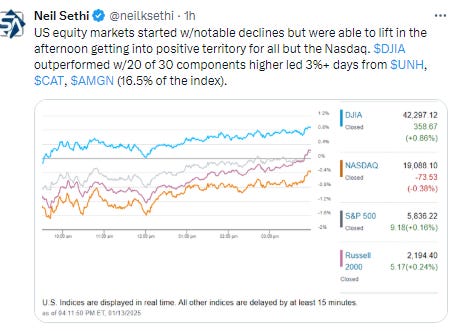

US equities started the day in the red on follow through selling from last week but were able to find their footing in the afternoon to push higher with the major indices outside the Nasdaq finishing in the green (and the Nasdaq cutting most of its losses). Under the surface the action was even better as most stocks outside of the very largest saw solid gains (380 of the 500 stocks in the SPX were up today). That was despite another day of rising bond yields (with the 10yr & 30yr yields the highest since Oct ‘23) as bets on Fed rate cuts in 2025 continued to be pared back.

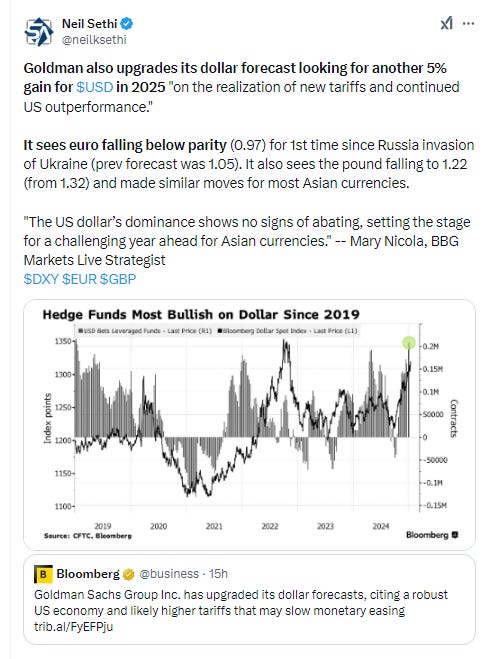

The dollar moved to 26-mth highs before falling back to finish little changed. Oil jumped on new Russia sanctions, copper edged higher, while nat gas fell after initially shooting higher on a frigid forecast, gold fell back from resistance and bitcoin recovered from early losses to finish little changed.

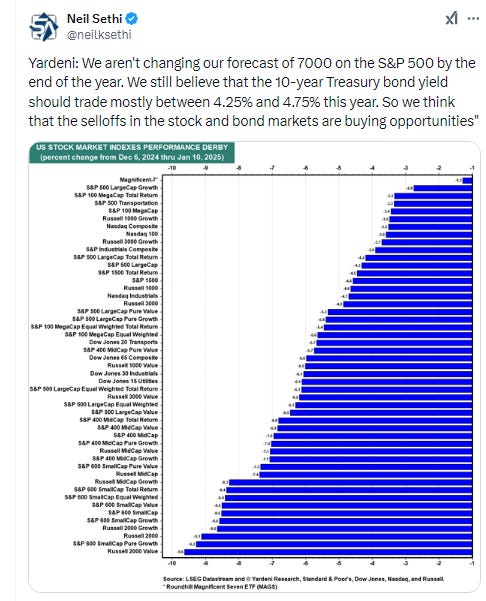

The market-cap weighted S&P 500 was +0.2%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite -0.4% (and the top 100 Nasdaq stocks (NDX) -0.3%), the SOX semiconductor index -0.4%, and the Russell 2000 +0.2%.

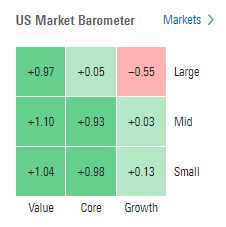

Morningstar style box showed the bifurcation between growth and everything else.

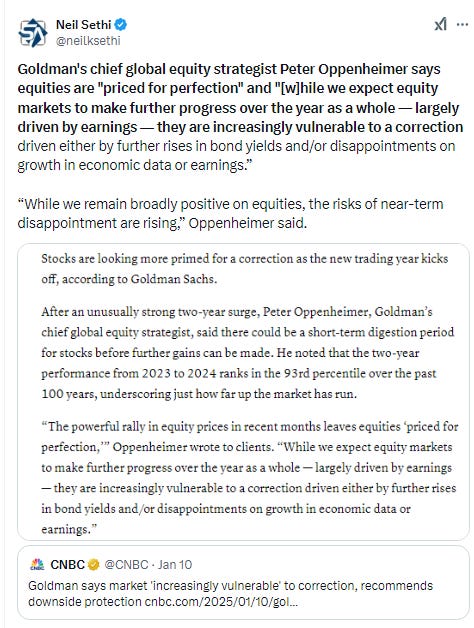

Market commentary:

“As long as the US fixed-income market hasn’t stabilized, it will be difficult for the equity market to regain strength,” said Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management. “We need some stabilization.”

“While even cooler-than-expected inflation data this week won’t nudge the Fed into another rate cut this month, it may help ease some of the bearish momentum — as could a solid start to earnings season,” according to Chris Larkin at E*Trade from Morgan Stanley.

To Callie Cox at Ritholtz Wealth Management, while analysts have been slashing earnings expectations “like mad,” the degree of cuts has been unusual, and the reports over the next few weeks could help stabilize the market.

“If anything, earnings are a reminder of how we got here,” she said. “It’s so important to remember how encouraging the story is for the economy right now. High expectations have caused us to stumble, but this dip could entice a lot of buyers simply because the foundation is strong.”

“Analysts may have gone too far in their rapid markdowns for earnings, with fourth-quarter estimates now at levels that our guidance model suggests can be easily beaten — though it may not matter to stocks if 2025 estimates keep dropping,” said Gina Martin Adams and Wendy Soong at Bloomberg Intelligence. The Magnificent Seven may be “the spoiler again” even as their growth eases, yet the key to 2025 will be the degree to which the other S&P 493 can generate some fundamental momentum, they noted.

“While economic growth has remained resilient in the face of ongoing inflation pressures, we expect growth to slow in 2025,” said Megan Horneman at Verdence Capital Advisors. “As a result, the current earnings estimate for 2025 may be too optimistic.” Horneman says she will monitor closely the comments from company leaders regarding inflation, their view on the labor market, what they are seeing regarding consumer spending and what a new administration may mean for their bottom line.

“We believe this earnings season will once again be stock pickers’ paradise,” Savita Subramanian, head of US equity and quantitative strategy, wrote Monday.

“The big banks often give us a good insight into what we can expect to see from the more consumer oriented companies, which report earnings later on in earnings season,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “If credit card usage is up, that typically bodes well for companies that sell directly to consumers.”

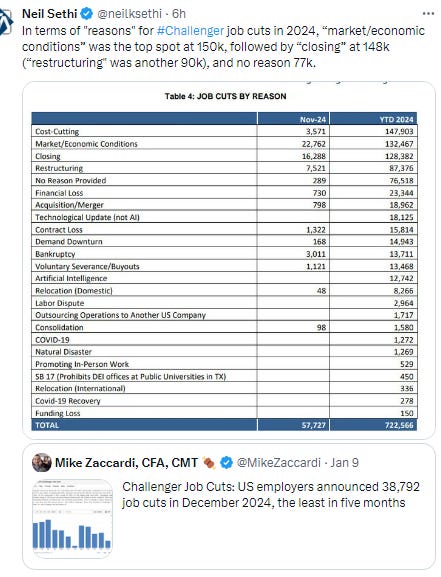

“The fact that employment is going so strong despite rates where they are will continue to fuel talk of higher neutral rates,” said Neil Dutta, head of economic research at Renaissance Macro Research, in a note Friday. “Markets are responding in kind with a broad tightening of financial-market conditions — rates up, dollar up, stocks down — and now seeing just one rate cut in 2025.”

Despite Friday’s stock-market slump, “as long as the Fed is on hold because the economy stays together and the labor market is resilient, I think that’s a good thing for risk assets,” said Kevin Gordon, senior investment strategist at Charles Schwab. Negative market reaction driven by inflation concerns may have been “a little bit overdone” on Friday, as the employment report showed wage growth slowed slightly in December, according to Gordon. But he cautioned that if inflation readings [this] week turn out to be hotter than expected, there’s more risk of a “protracted drawdown” in the U.S. stock market.

“With the 10-year yield potentially getting to 5%, I think it’s going to be very hard for the equity market to really gain any meaningful traction here until there’s — at minimum — stability in interest rates,” said Adam Turnquist, chief technical strategist at LPL Financial. “We don’t think there’s risk of the market going over to bear market territory, but certainly a correction could be in the cards on a short-term basis,” added Turnquist.

“The post-data reaction has left Treasuries oversold,” said Will Compernolle at FHN Financial. “Bond market pricing reflects too much investor confidence in labor market strength and an overly pessimistic inflation outlook. There may be nothing today or tomorrow on the calendar that will snap bond yields out of their upward drift, but a 0.2% increase in the core CPI on Wednesday, as the consensus expects, would give a bond-bullish jolt to the prevailing market sentiment.”

“We believe investors need to be more discerning as volatility may stay elevated,” said analysts at Citigroup in a research note Friday.

“The economy galloping into the new year with considerable momentum,” said Bernard Baumohl, chief global economist at the Economic Outlook Group. “Is the Fed’s strategy to contain inflation starting to unravel?” Baumohl asked. Most economists, including Baumohl, are not willing to go that far. Yet the situation looks dramatically different now compared to last fall, when the Fed cut rates aggressively and signaled more cuts to come.

”The slow progress over the past year continues to underscore that the last leg of inflation’s journey back to target remains quite arduous,” said senior economist Sam Bullard of Wells Fargo. “The path ahead looks even more challenging now with economic policies under the incoming administration likely to be inflationary.”

Investors could be overlooking the negative ramifications of President-elect Donald Trump’s proposals for both immigration and tariffs on growth, according to Barclays head of U.S. equity linked strategies Venu Krishna. “With the new administration, there are two opposing forces. On one hand you have the pro-growth policies, which the market has increasingly focused on thus far,” Krishna told CNBC’s “Squawk on the Street” on Monday. “On the other hand, the risk that has been underpriced is the impact of tighter immigration … and tariffs.”

A hawkish surprise from US data this week including on inflation and retail sales could present a buying opportunity for risk assets, according to HSBC strategists. The team led by Max Kettner says their sentiment and positioning indicators are already flashing a mild buy signal. “Some bad news would be good news right now,” the strategists wrote.

“Wall Street seems to have ‘gone fishing’ ahead of earnings season, as stocks pull back from December highs,” said Craig W. Johnson at Piper Sandler. “Despite the deterioration of breadth and sentiment, the primary uptrends for the major market indices remain intact. Wait for a deeper pullback to add to positions.”

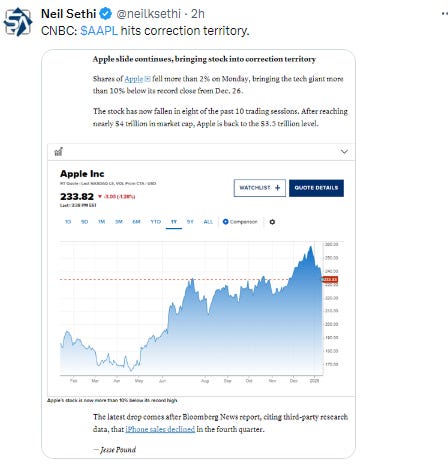

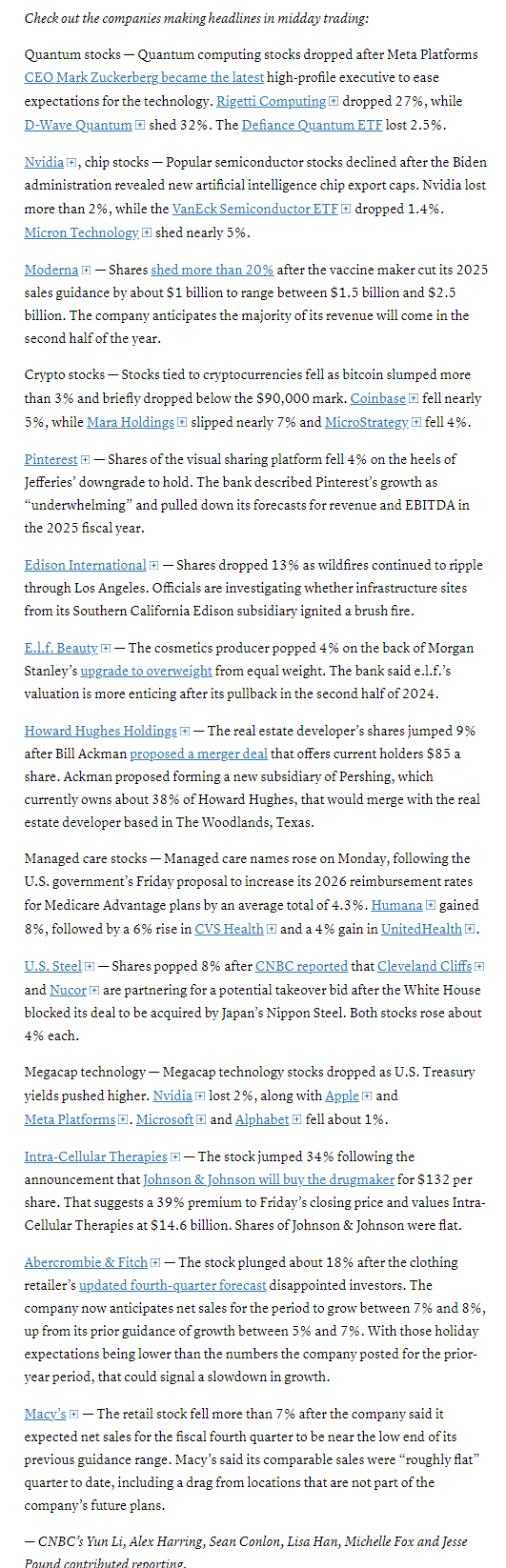

In individual stock action, Palantir and Nvidia, two of the bull market leaders popular with retail investors, shed more than 3% and nearly 2%, respectively, building upon their losses from last week. Nvidia fell almost 6% during the period, while Palantir lost more than 15%. Other popular tech shares including Apple and Micron were also down in the session.'

Outsized moves in the equity market were mostly reserved for individual names with specific news items. UnitedHealth (UNH 541.14, +20.45, +3.9%) jumped in response to news that the U.S. proposed a 4.3% increase to Medicare Advantage plan payments, a $21 billion boost to insurers for Medicare payments, according to Bloomberg. Moderna (MRNA 35.15, -7.10, -16.8%) was one of the biggest individual losers after slashing its FY25 revenue outlook.

BBG Corporate Highlights:

Apple Inc.’s iPhone sales declined about 5% globally in the final quarter of last year, hurt by underwhelming upgrades and competitors making inroads in China.

The White House unveiled sweeping new limits on the sale of advanced AI chips by Nvidia Corp. and its peers, leaving the Trump administration to decide how and whether to implement curbs that have encountered fierce industry opposition.

Macy’s Inc. issued a downbeat outlook for sales in the current quarter, a sign that executives might have been too optimistic about their expectations for a solid holiday shopping season.

Honeywell International Inc. is poised to proceed with a breakup following pressure from activist Elliott Investment Management to split, people familiar with the matter said.

Cleveland-Cliffs Inc. is partnering with Nucor Corp. to weigh a potential joint bid for United States Steel Corp., according to a person familiar with the matter. Cliffs’ top boss later confirmed his interest in the American steelmaker at a press event.

Lululemon Athletica Inc. expects fourth-quarter sales to surpass the market’s expectations, showing the upscale activewear brand is fending off upstart competitors and slower growth in consumer spending.

Abercrombie & Fitch Co. raised its fourth-quarter sales outlook on better-than-expected holiday sales, but the increase wasn’t enough to reassure investors the retailer could keep up the fast pace of growth.

Shake Shack Inc. reported fourth-quarter sales that surpassed expectations, signaling that efforts to raise its profile and serve customers faster are paying off.

Health insurance companies selling private Medicare Advantage plans in the US would see a greater increase in payments in 2026 than in the current year if a proposal released Friday is adopted by the incoming Trump administration.

Moderna Inc. slashed its sales forecast for this year as it struggles with slow demand for its Covid and RSV vaccines.

Johnson & Johnson agreed to acquire Intra-Cellular Therapies Inc., a company focused on treatments for central nervous system disorders, for about $14.6 billion.

Some tickers making moves at mid-day from CNBC.

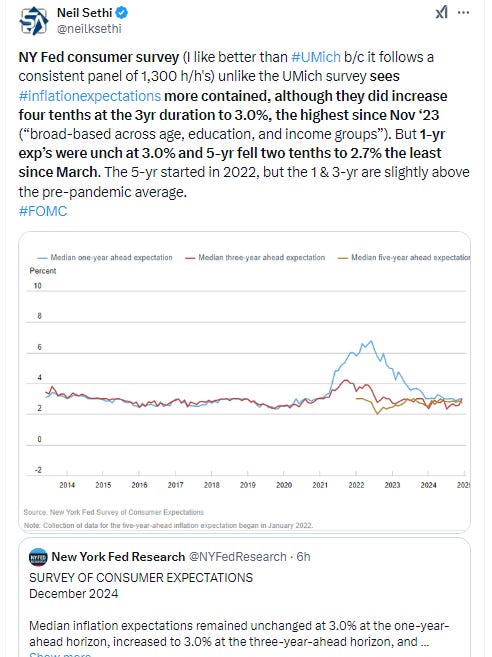

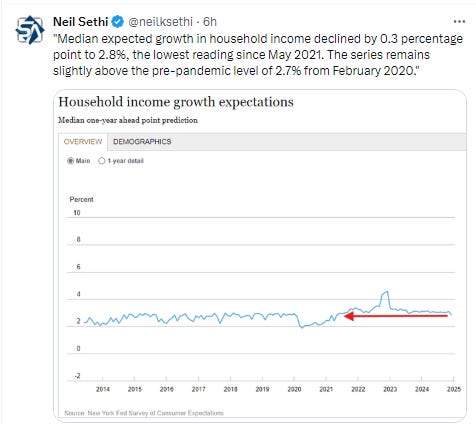

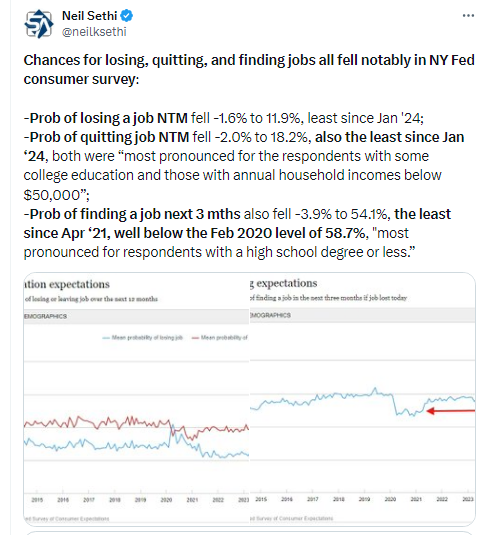

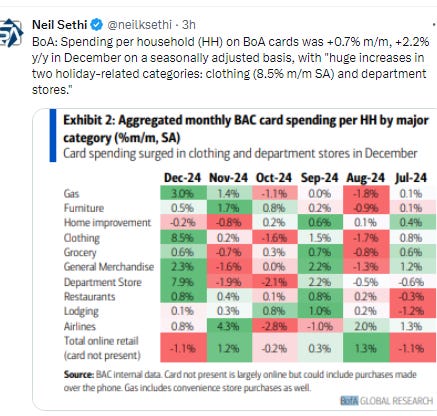

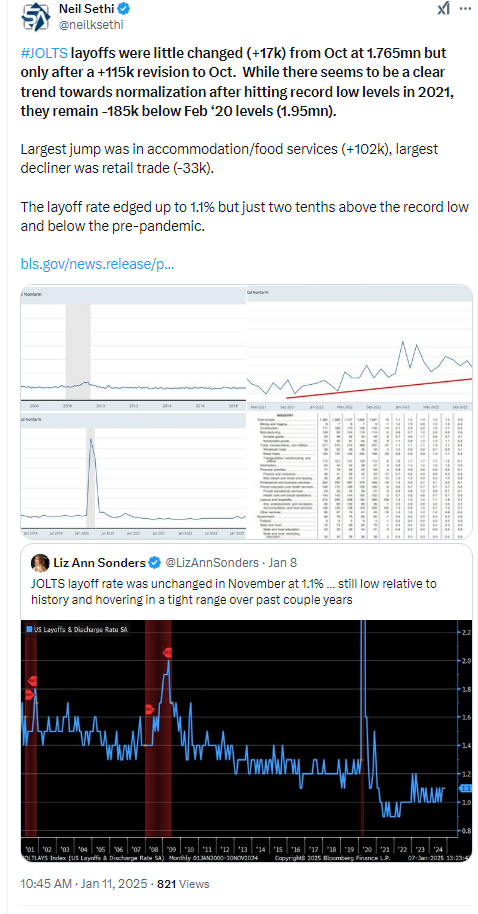

In US economic data we got the NY Fed consumer survey which saw 3-yr inflation expectations rise to the highest since Nov ‘23 but 1-yr were unchanged and 5-yr fell back among other items.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

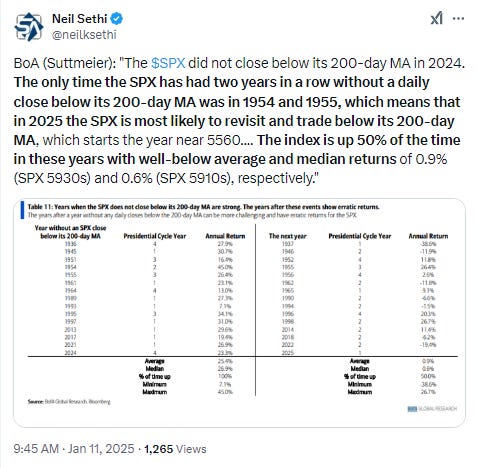

The SPX fell under its 100-DMA which it recovered, but the 4th day of lower highs and lows. It’s now though filled the gap from Election Day. Daily MACD & RSI remain quite weak.

The Nasdaq Composite fell to near a 2-mth low, also its 4th day of lower highs and lows, but it has further to go to get back to where it was Election Day. Its daily MACD and RSI are very weak as well.

RUT (Russell 2000) fell to a 3-mth low making it to the 200-DMA target I put on it just Thursday (which it fell below briefly before recovering). As I noted last week until it gets over the 2290 level “we can’t really look higher,” but now it’s got a whole lot more resistance before that point. Daily MACD & RSI remain weak after coming close to turning more positive last week.

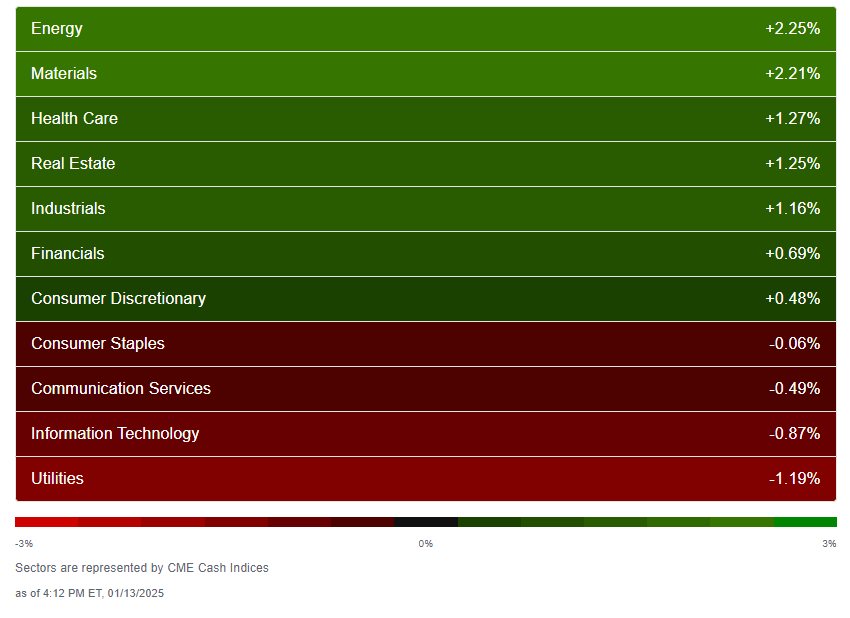

Equity sector breadth from CME Indices surprisingly strong despite the small gains/losses in the indices w/7 of 11 sectors in the green (up from one Fri), all up around a half percent or more, and five up over 1%. Just one sector down over -1% that much (utilities). The weakness at the index level explained by megacap growth sectors taking 3 of bottom 5 spots.

Stock-by-stock SPX chart from Finviz consistent showing a lot of green outside of many of the largest stocks. Every materials SPX component and all but one energy were up today. Financials a nice bounceback after every component was down Friday.

Positive volume (the percent of volume traded in stocks that were up for the day) bounced back to 52% Monday for the NYSE (from 24% Friday), an ok result given the gain in the NYSE Composite, while it edged down to 42% from 46% for the Nasdaq, a little weak given the losses on Friday were much larger perhaps meaning we’re not seeing as much of the penny stock speculation that Helene Meisler has noted that has pushed up positive volume on the Nasdaq the past month+. Positive issues (percent of stocks trading higher for the day) improved on both though to 54 & 41% from 19 & 22% respectively Friday.

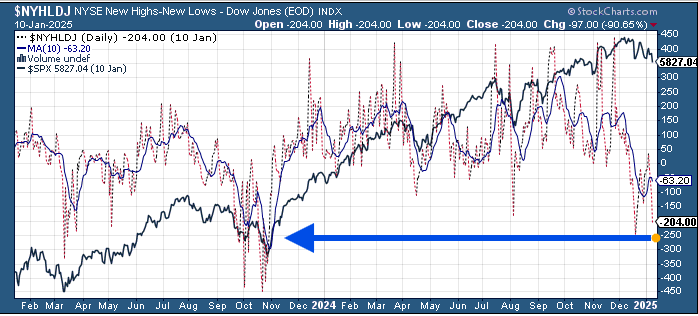

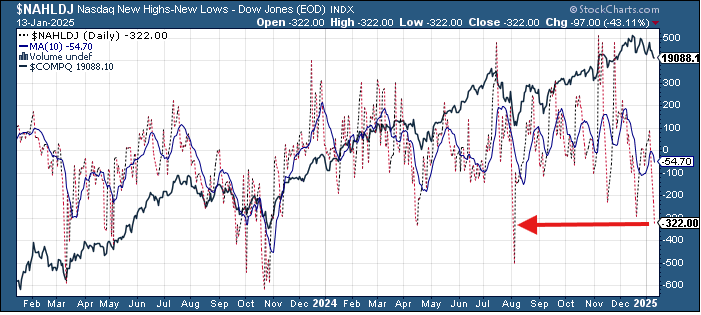

New highs-new lows (charts) though deteriorated with the NYSE at -264 & the Nasdaq at -332 (the least since Nov ‘23 & Aug ‘24 respectively). Both are also now under their 10-DMAs which have turned back down (less bullish).

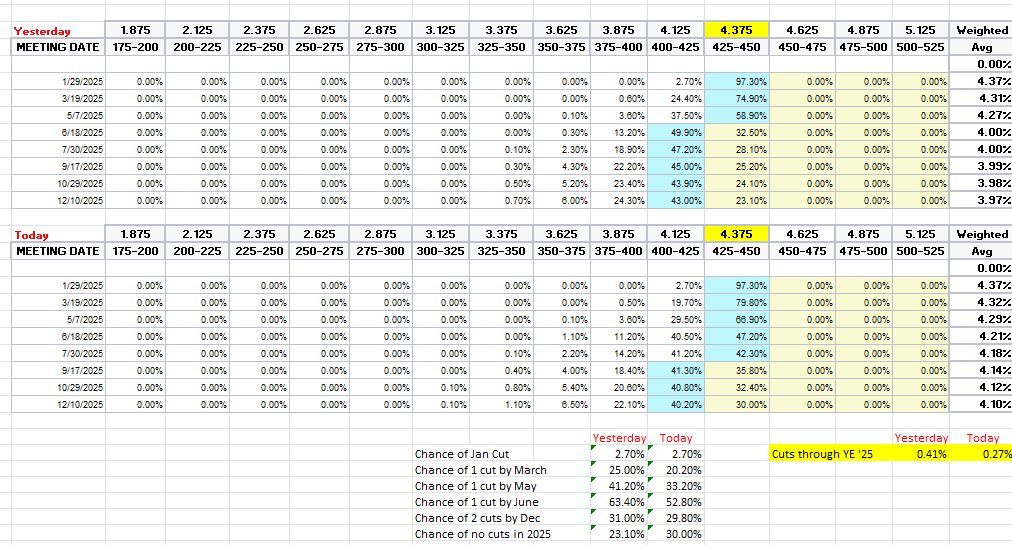

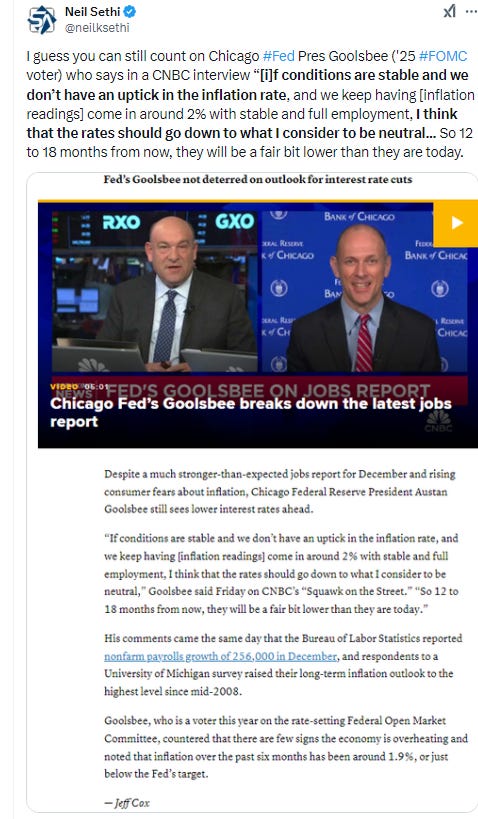

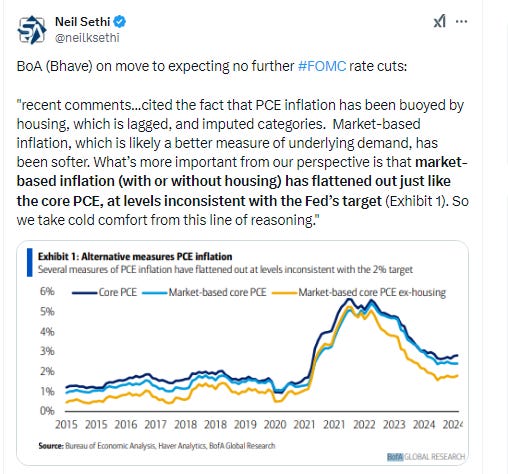

FOMC rate cut probabilities from CME’s #Fedwatch tool saw rate cut bets fall further. The chance of a March cut fell to 20%, May to 33%, June to 53%. Overall pricing for a 2nd cut in 2025 fell to 30% with overall 2025 cut expectations down to 27bps with the chance of no cuts at 30%.

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that until we get CPI this week. While the NFP report was strong, it’s important to remember with the data dependant Fed, it is only as strong as the last couple of months’ reports, so things can change quickly.

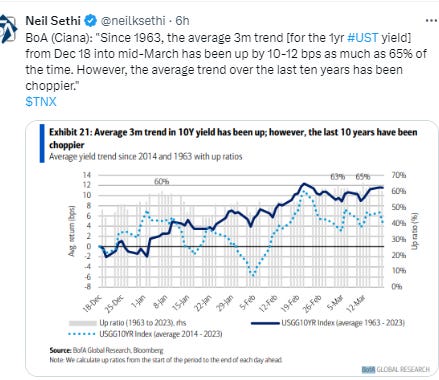

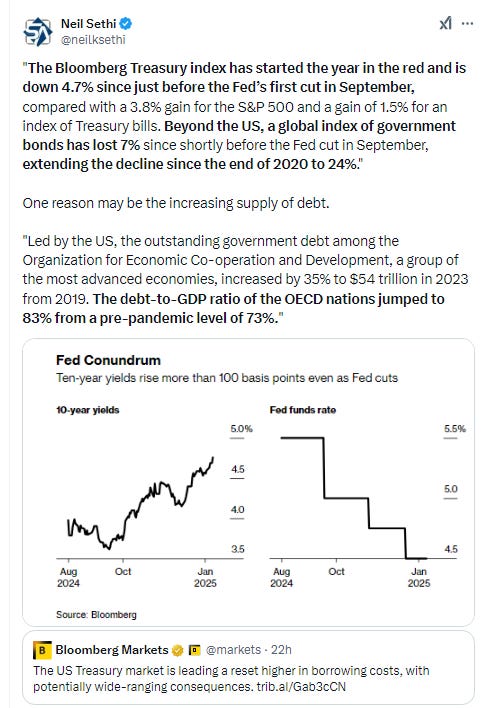

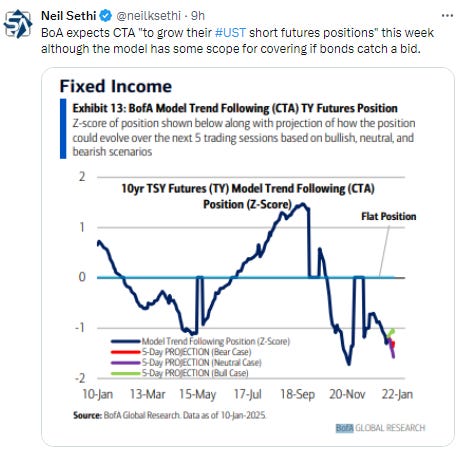

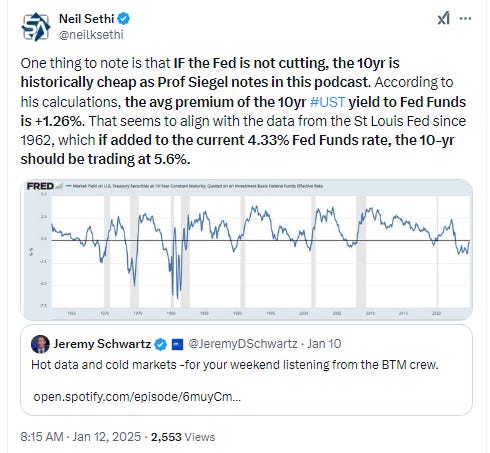

Longer duration UST yields were up Monday for an 8th consec session with the 10yr +5bps to 4.81%, the highest since Oct ‘23 (which was the highest since 2007), +43bps since the Dec FOMC meeting (& +105bps from the Sept FOMC meeting), now "eyeing" 5%.

The 2yr yield, more sensitive to Fed policy, was up +1bps to 4.39%, now the highest since July and remaining above the current Fed Funds rate, meaning the 2yr is pricing net rate hikes over the next 2 years. I have mentioned before I find this level very rich, as I think a cut is more likely than no cuts and certainly more likely than hikes (as do Fed Funds futures markets), but I guess we’ll see.

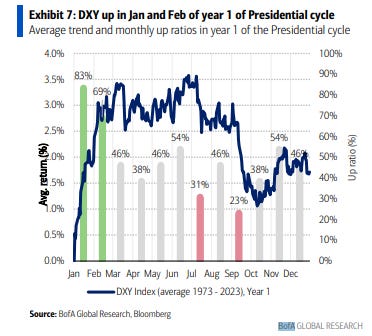

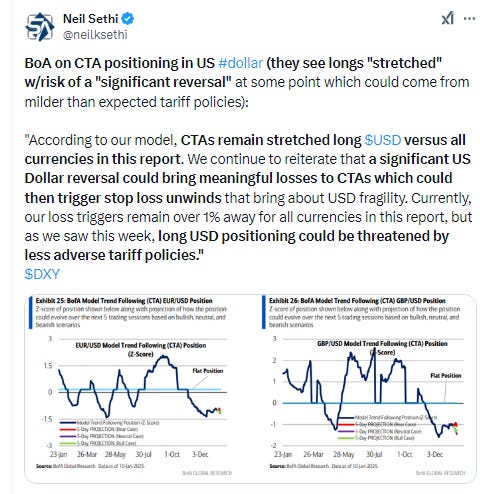

Dollar ($DXY) was up for a fourth session to a new 26-mth high before falling back to finish slightly lower. It breached the 110 level before falling back. Daily MACD and RSI remain positive but the latter less so than the start of the month a small negative divergence.

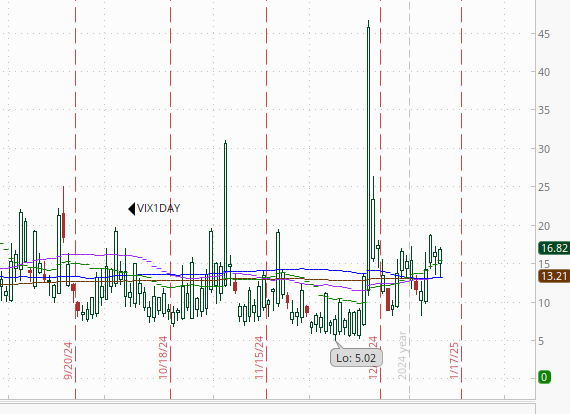

The VIX again pushed through 20 before falling back ending still elevated at 19.2 (consistent w/1.2% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly moved to the highest since the Dec FOMC meeting before falling back to 110, still over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)). Also another higher high and higher low for both.

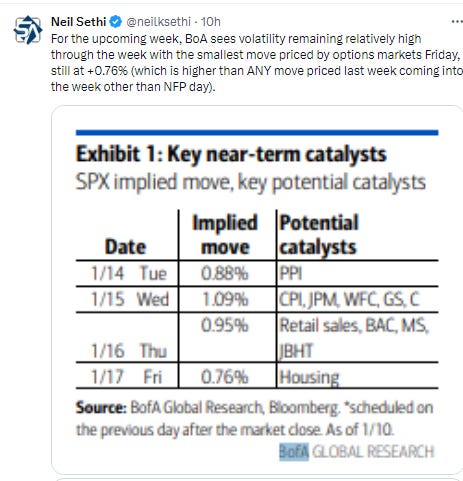

1-Day VIX edged up to 16.82, looking for a move of 1.06% Tuesday, above the 0.88% BoA saw implied coming into the week.

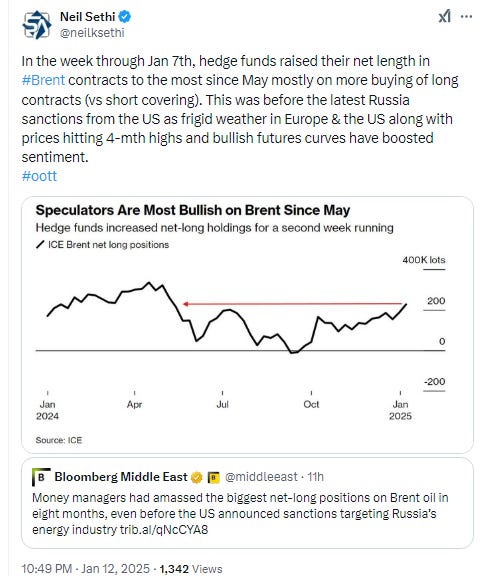

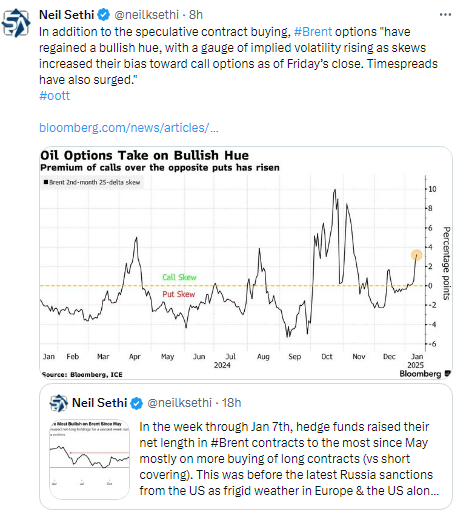

WTI shot higher after new Russia sanctions were announced over the weekend, described by BBG as the most significant to date, hitting a 5-mth high at one point near $80 which it hasn’t closed over since July. Daily MACD & RSI remain very supportive although the latter is the most overbought since April. I said Friday “next week will be interesting,” and so far it hasn’t disappointed.

Gold after ignoring the jump in rates Friday fell back today the downtrend line from its ATH. Daily MACD remains in "cover shorts" signal & daily RSI remains above 50, so it still has the setup to get through.

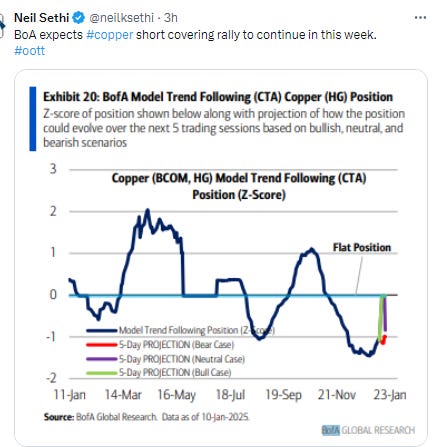

Copper (/HG) up for a 7th session Friday, closing at a 2-mth high, and remaining above the downtrend line it hasn’t closed over previously since May. Still wasn’t able to clear its 200-DMA though. Its RSI and MACD remain positive, with the former the best since Oct. Needs to get through the 200-DMA to open up a run higher.

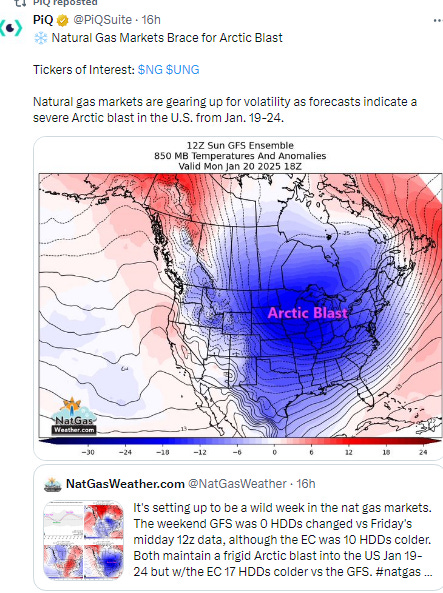

Nat gas (/NG) remained very volatile Monday jumping around +10% before giving that up to finish mildly lower (another move of over 6% during the session for the 10th in 11) on forecasts for January cold fluctuating back and forth as well as some issues with LNG exports at Freeport. Daily MACD has moved back to “go long” position though and RSI remains over 50 although continues to have a negative divergence (lower high).

Bitcoin futures fell through the 50-DMA to a 2-mth low before rebounding to get back over. As I said Wed “feels like the 50-day needs to hold.” The daily MACD and RSI remain weak though.

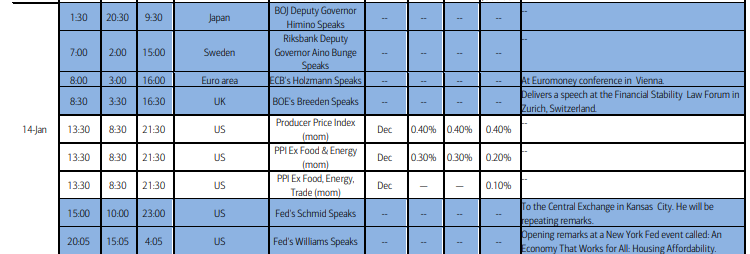

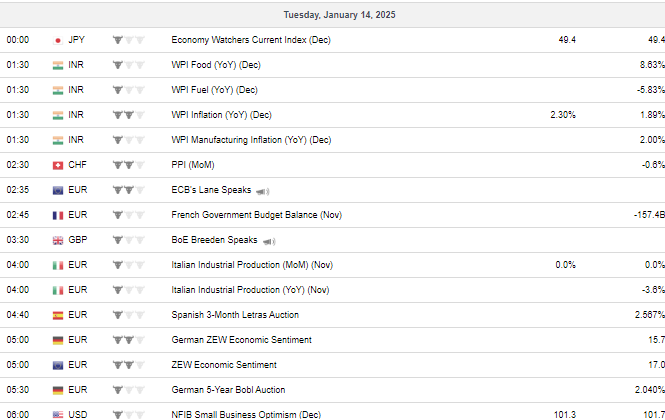

The Day Ahead

US economic data picks up Tuesday with Dec NFIB small biz sentiment survey and PPI.

Couple of Fed speakers highlighted by NY Fed Pres Williams who we haven’t heard from since the Dec FOMC meeting, although in 2024 he didn’t provide much into his thinking so I’m not expecting much. Normally the NY Fed is a leading voice though. We also get KC Pres Schmid who we heard from last week (see note in Fed section).

No SPX earnings tomorrow.

Ex-US a lighter day highlighted by a number of central bank speakers. We’ll also get Germany’s ZEW economic sentiment and Italy industrial production. In EM BBG has China new loan data scheduled but BoA doesn’t.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,