Markets Update - 1/13/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

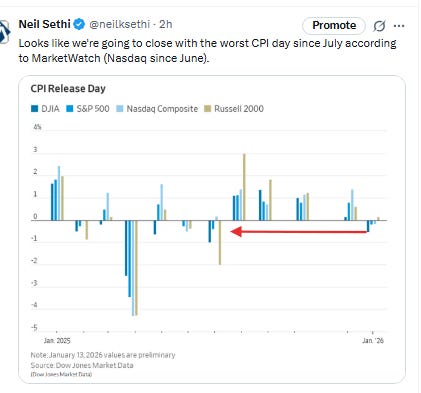

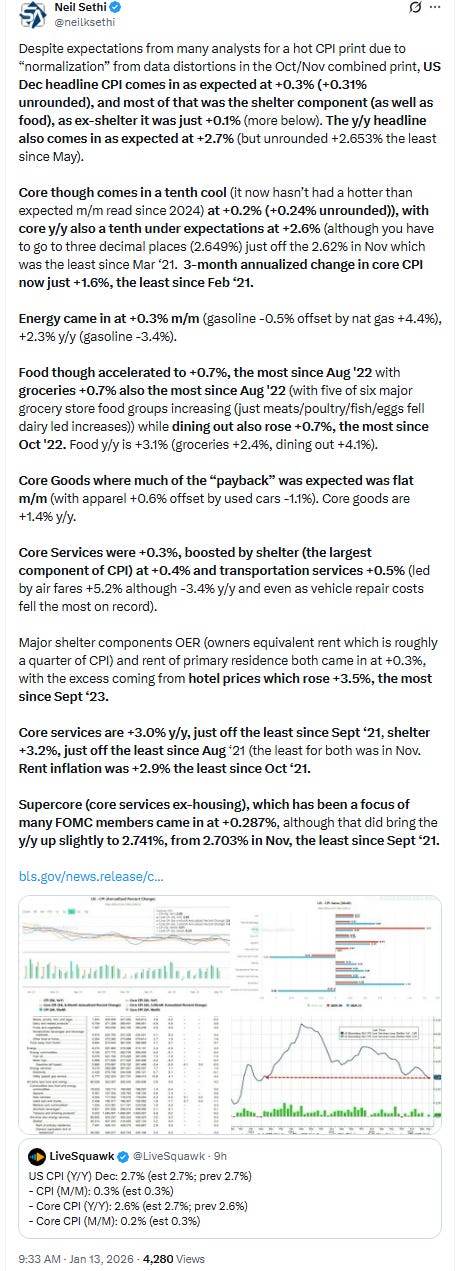

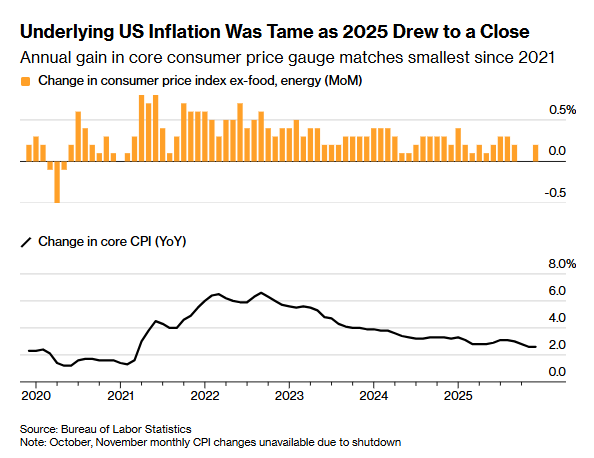

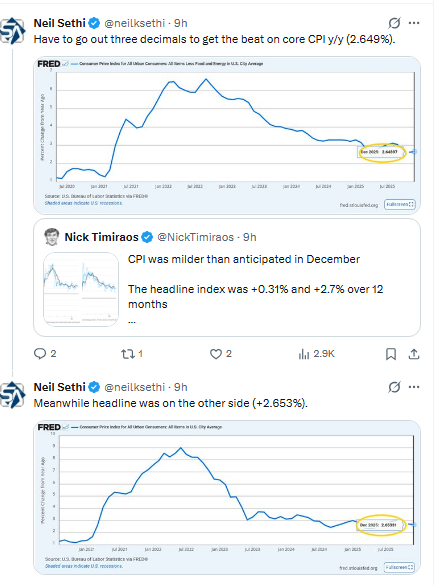

US equity indices opened with marginal gains (other than the DJIA which was lower as its financials and software names were under pressure) after a cooler than expected CPI report which though only modestly boosted expectations for Fed rate cuts (and saw no change to a very low probability for a Jan cut). Investors were also digesting the first of the big bank earnings from JPMorgan, which vacillated between gains and losses (and would later fall -4%) even after the largest bank in the nation posted better-than-expected results. Delta Air Lines, however, shed more than 1% premarket on mixed results (and would also end much lower).

Indices though all lost ground from the open, then traded in a seesaw pattern throughout the day. Positively, all but the Russell 2000 did see a little push the last half hour, but all finished in the red, although just the DJIA (-0.8%) was down more than -0.2%.

Elsewhere, bond yields edged lower, but the dollar got back Monday’s losses. Commodities were mixed with crude, natgas, and bitcoin higher, gold and copper little changed.

The market-cap weighted S&P 500 (SPX) was -0.2%, the equal weighted S&P 500 index (SPXEW) UNCH, Nasdaq Composite -0.1% (and the top 100 Nasdaq stocks (NDX) -0.2%), the SOXX semiconductor index +1.0%, and the Russell 2000 (RUT) -0.1%.

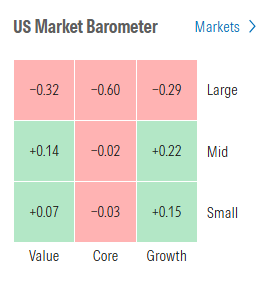

Morningstar style box an interesting “T” shape with large caps and core styles lower, everything else higher, but all small changes.

Market commentary:

“Today’s data probably won’t have much influence on Fed policy given the coming change in leadership. But it keeps expectations on track for lower rates and likely supports risk appetite,” said David Russell, global head of market strategy at TradeStation.

“Today’s softer-than-expected core CPI print is unlikely to alter the Fed’s calculus for the January meeting,” said Seema Shah at Principal Asset Management. “With unemployment still low, growth running above trend, fiscal stimulus providing an offset, and inflation remaining above target, the Fed can comfortably keep rates on hold this month and likely over the next few meetings.”

“We expect the Fed to pause this month and possibly in March,” said Jeff Roach at LPL Financial. “However, by the time the Committee convenes in April and June, conditions will likely warrant another cut in rates. For now, the balance of risks tilt toward the weakening labor market. Hence, investors should brace for weaker payrolls and rising unemployment.”

“The market understands that now a January cut is off the table and is waiting for other economic data before drawing any major conclusions,” said John Kerschner at Janus Henderson Investors. “Let’s hold our horses, be patient and wait to see what other non-polluted data say before we change our overall forecasts.”

“If price pressures remain subdued in the coming months as data noise clears, it could open the door for another rate cut in the Spring,” said Angelo Kourkafas at Edward Jones. “With CPI out of the way, investors will now turn their attention to corporate earnings for signals on where markets may head next.”

December’s in-line CPI report may not be enough to move the Fed’s view toward more aggressive rate-cutting, but as a cooling jobs environment persists, inflation may not be as much of a constraint when it comes to interest rate policy, according to Bret Kenwell at eToro. “However, the report should do little to rock the boat for equity investors, who are likely to turn their attention to the start of earnings season,” he said.

The Fed still has some room to move, especially given weaker job creation and downward revisions in the latest report, but they may choose to wait and see if the impact of tariffs is really transitory, noted Scott Helfstein at Global X. Rates are still likely to come down, but the timing is getting a little more cloudy, he noted.

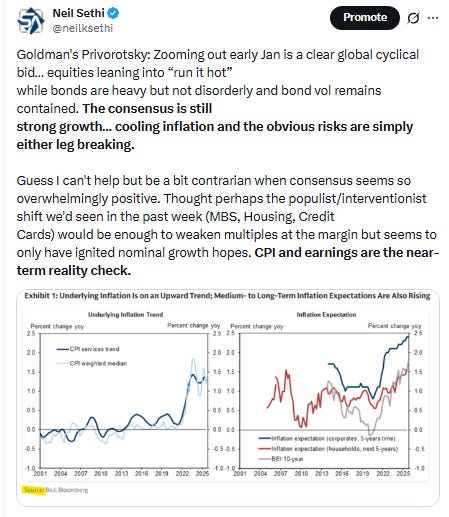

"December inflation likely was understated by the lingering effects of measurement problems tied to the government shutdown, suppressing increases in rents and other key categories for a second straight month," said Jennifer Timmerman, a senior investment strategy analyst at Wells Fargo Investment Institute. "We expect these distortions to persist through April."

“Tuesday’s CPI was in-line with expectations and that will likely keep the Federal Reserve on pause when it comes to interest rates for the foreseeable future. After cutting rates three times in the fall of 2025, the Fed is likely to take its time and absorb more data, especially given the noise we’ve seen in the recent data as a result of the government shutdown. Recent positive employment data, elevated inflation, sticky price levels and political noise will keep the Fed at bay through at least the Spring,” Skyler Weinand, the chief investment officer at Regan Capital said.

“We’ve seen this movie before — inflation isn’t reheating, but it remains above target,” said Ellen Zentner at Morgan Stanley Wealth Management. “There’s still only modest pass-through from tariffs, but housing affordability isn’t thawing. Today’s inflation report doesn’t give the Fed what it needs to cut interest rates later this month.”

“The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected,” said John Kerschner, global head of securitized products and portfolio manager at Janus Henderson Investors. “What this tells the market is that inflation continues to move lower, albeit at a somewhat glacial pace.”

“Given the quirks of November’s dual-month report, it’s surprising not to see more numerous large month-over-month readjustments,” said Stephen Kates at Bankrate. “Consumers can breathe a sigh of relief that we didn’t snap back to the 3% annual inflation rate. Although today’s reading doesn’t demonstrate additional progress for inflation, it doesn’t take a step backwards either.”

“While the broader path remains in favor of two quarter-point reductions this year, the marginal increase in rate bets signals markets are willing to shift their view when the data calls for it. It’s just a question of whether future economic releases can be consistent enough to support a more dovish shift in expectations for borrowing costs.” —Kristine Aquino, Managing Editor, Markets Live

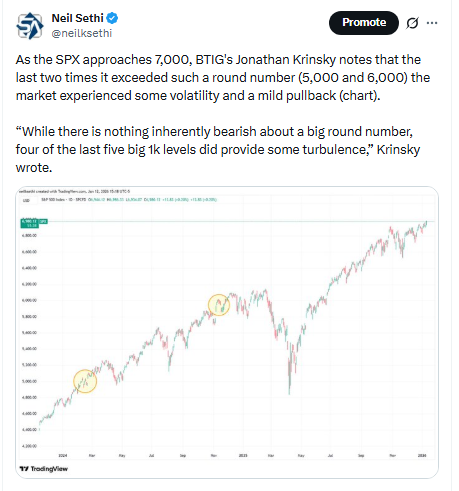

“This loss of momentum suggests investors may be signaling a pause or consolidation in the market,” José Torres, senior economist at Interactive Brokers noted. It could also signal that market participants would like to see more earnings reports featuring “beats and raises” before sending the two major equity benchmarks north of those psychologically important round numbers, Torres told MarketWatch in emailed commentary on Tuesday.

“There’s a lot of noise that’s hovering around the market right now,” said Robert Pavlik, a senior portfolio manager at Dakota Wealth Management, pointing to selling in financial stocks. Several affordability proposals have been brought forth by the Trump administration ahead of this year’s midterm elections, and Pavlik noted it’s unclear what will come of them. Yet on Tuesday, “it’s a lot of high-dollar-priced stocks in the Dow driving the weakness,” he said. “I’m not overly concerned with it.”

“Strong earnings growth makes it unlikely the labor market experiences significant deterioration,” said Lauren Goodwin at New York Life Investments. “And though recent policy announcements are disruptive to market expectations, they are designed to improve economic activity ahead of an election year.” Goodwin says she’s “staying fully invested – if more focused on quality and diversification as the cycle extends.”

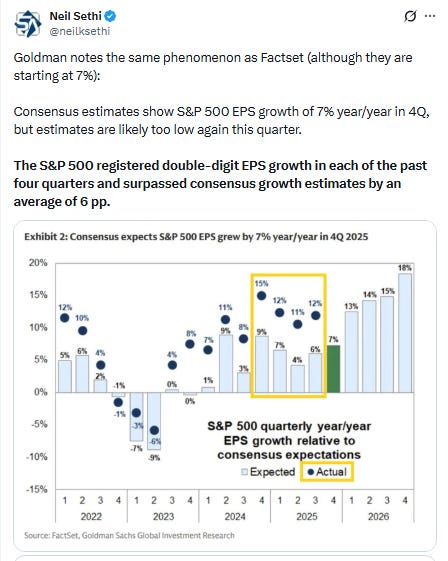

While it’s way too early to draw conclusions from the first few companies reporting results, Steve Sosnick at Interactive Brokers says he’s somewhat worried by the lack of concern coming into this earnings season. “If companies can leap over the high bars that are set for them, then all should be fine,” he said. “If not, then that leaves a bit more room for disappointment than we might otherwise face.”

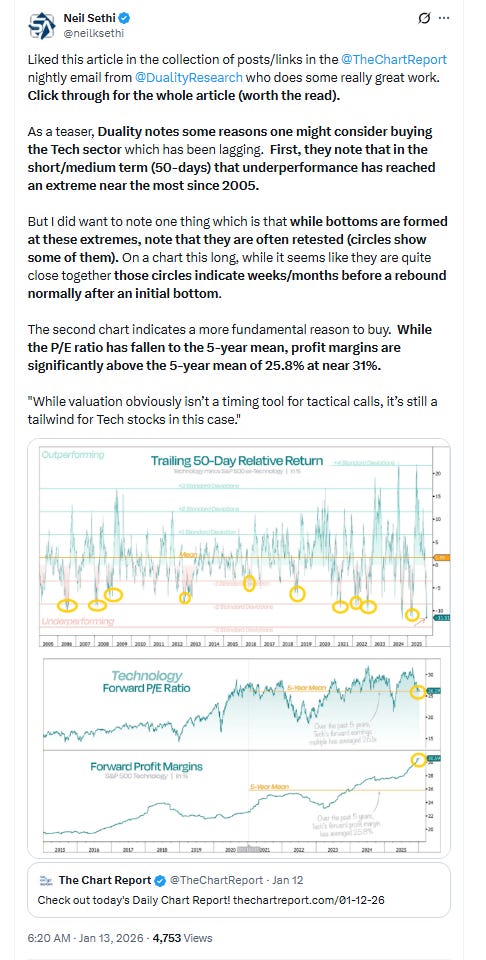

Elevated price multiples likely mean S&P 500 firms will need to match or beat profit estimates over the coming weeks, and in aggregate, they’ll probably need to confirm or raise earnings guidance for the current quarter to sustain price appreciation, said Anthony Saglimbene at Ameriprise. “With broad index valuations above long-term norms, we believe the earnings bar continues to rise with each successive reporting season, creating a greater risk of disappointment if companies can’t live up to investor expectations,” he noted. That said, Saglimbene bets the market will likely continue to reward companies that can beat profit expectations and raise guidance, while also pairing healthy top-line growth with expense discipline and providing a credible or favorable outlook for the road ahead. “Technology companies that can deliver revenue beats, sustained margin performance, and cash flow generation should continue to be rewarded with higher stock prices,” Saglimbene said. “This is one of the most important factors of the earnings season if broader stock averages are to maintain their upward momentum at the start of the new year.”

“The market probably won’t react to Trump’s blatant politicization of the Fed until the economy rebounds and/or inflation returns to the top of investors’ minds. There are various scenarios where this stuff just wont matter. But longer term, we shouldn’t take the independence of central banks for granted,” said Dario Perkins, a strategist at TS Lombard.

“There are so many moving parts that instead of being the first person to react, no one is truly comfortable making a move here,” said Portfolio manager Vincent Ahn at Wisdom Fixed Income Management in Plano, Texas, What bond-market participants care about most in the near term are inflation expectations, confidence in economic growth, and the Fed’s likely response to both of those things, Ahn added. The portfolio manager also said he counts himself as one of the people who remains “nervous” about upside risks to inflation in 2026, saying: “I am definitely not in the camp that thinks we are in the all-clear” or “taking a victory lap.”

An economic environment where wealthier and lower-income Americans diverge in their spending habits won’t be able to last, according to Stifel.

“Amid economic optimism we take an opposing view, believing that the ‘K-shaped’ economy (stocks up, only the wealthy spend more) is economically unsustainable,” wrote Barry Bannister, the firm’s chief equity strategist, in a Tuesday note. “As aggregate labor income (payrolls x hours x real wages) falls in 2026 (our forecast), we expect real personal consumption (~70% of GDP) to slow.” That slowing core GDP outlook combined with valuation risk does not support a fourth consecutive year of double-digit gains for the S&P 500 this year, he added.

“This period feels a lot like the late-’90s tech bubble: We believe large-cap growth is extremely overvalued,” said Josh Schachter, CIO and senior portfolio manager at Easterly Snow. “We think small-cap value is the place to be, not only because large-cap growth stocks are overvalued, but also because small caps can have great potential, great valuations, great stories, great upsides and great risk-reward profiles on their own.”

“We’ve definitely started to see some reversion and money coming out of the AI stocks and coming into small-cap value stocks,” Schachter told MarketWatch in emailed commentary Tuesday. “We believe this is just the beginning of the process.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

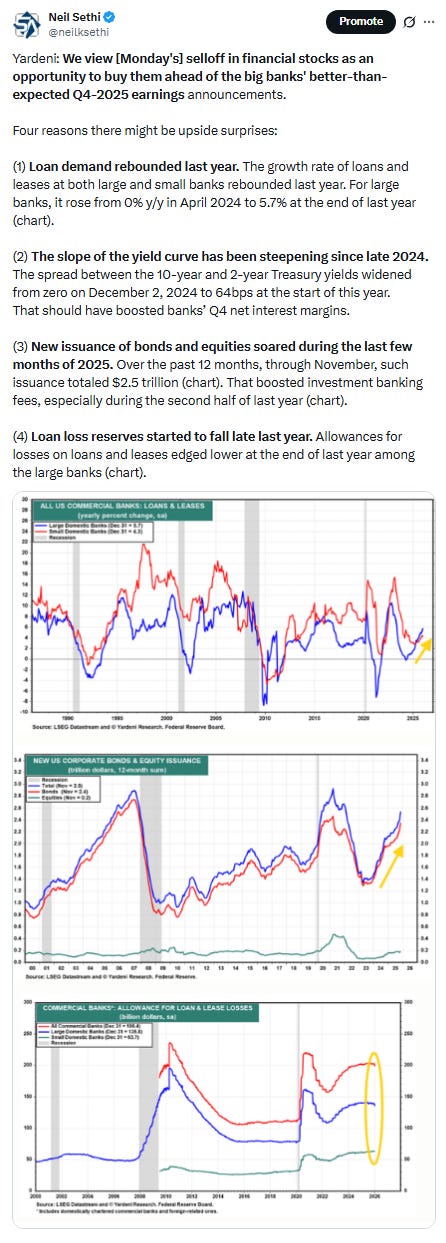

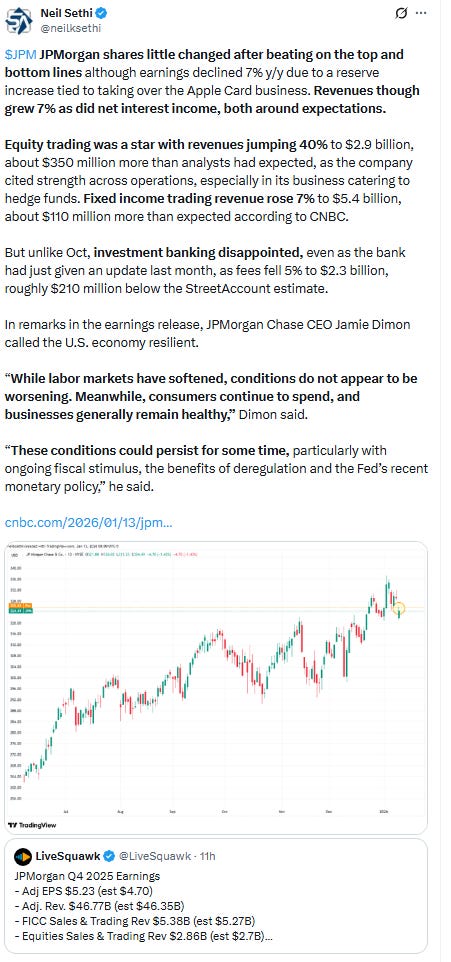

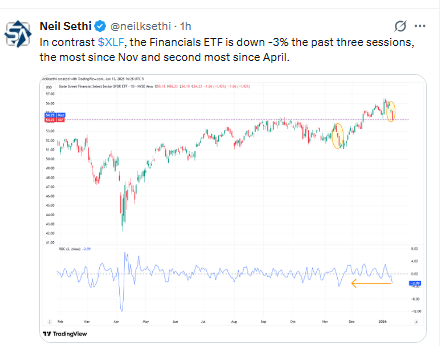

JPMorgan dipped 4.2%, even after the company’s fourth-quarter results beat on the top and bottom lines. While both companywide and equities trading revenue increased in the quarter, investment banking fees fell and missed expectations.

The company’s CFO, Jeremy Barnum, also signaled that the banking industry could push back against Trump’s call for a one-year 10% cap on credit card interest rates, which he declared late Friday. Goldman Sachs followed JPMorgan lower, declining more than 1%. Other financial stocks such as Mastercard and Visa lost 3.8% and 4.5%, respectively, putting them among the day’s worst performers. The State Street Financial Select Sector SPDR ETF (XLF) and Invesco KBW Bank ETF (KBWB) were under pressure as well.

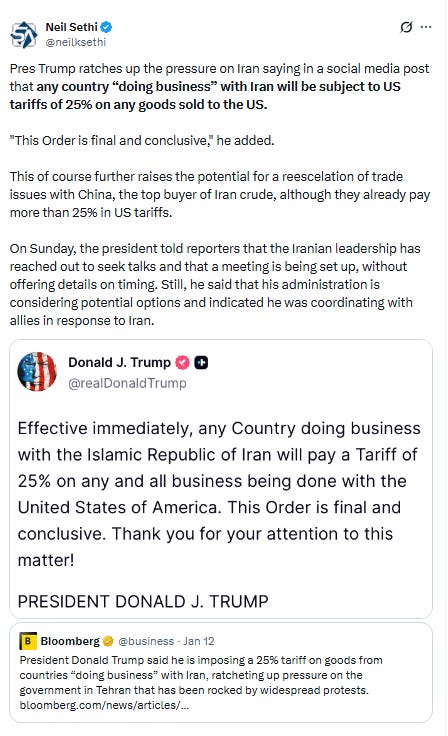

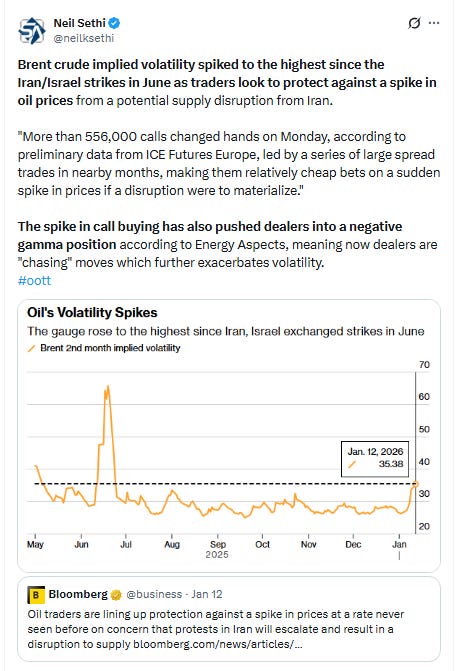

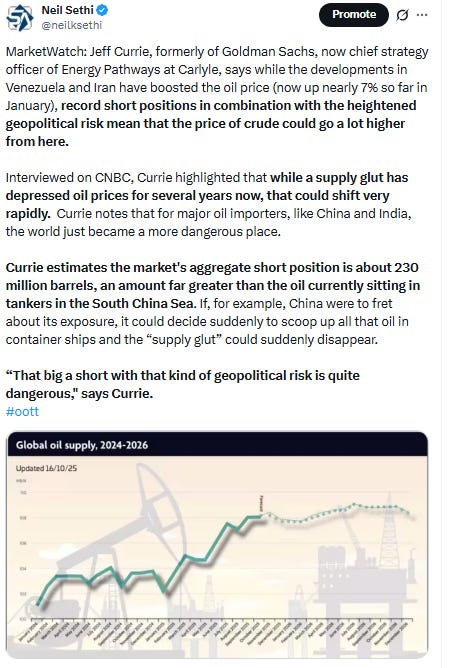

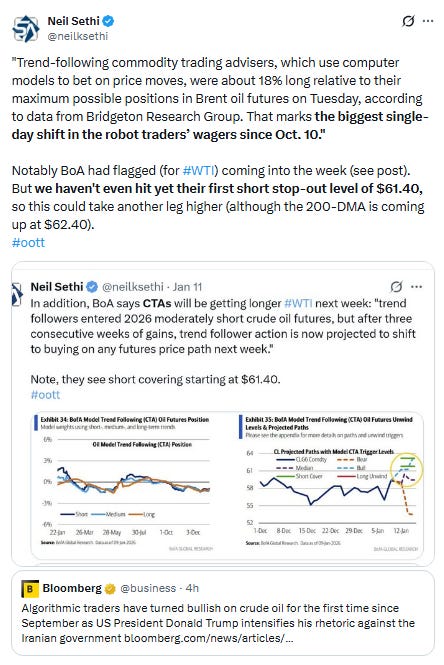

Meanwhile, oil prices jumped after Trump canceled all meetings with Iran — a top OPEC producer — and told protesters that “help is on its way.” This comes just a day after he said that any country doing business with Iran will be subjected to a 25% tariff “on any and all business being done” with the U.S

Corporate Highlights from BBG:

Meta Platforms Inc. is beginning to cut more than 1,000 jobs from the company’s Reality Labs division, part of a plan to redirect resources from virtual reality and metaverse products toward AI wearables and phone features.

Meta Platforms and EssilorLuxottica SA are discussing potentially doubling production capacity for AI-powered smart glasses by the end of this year, in a bid to capture growing demand and head off rivals, according to people familiar with the matter.

Apple Inc. announced a new subscription bundle of creative apps called Creator Studio, an attempt to give its photo- and video-editing software fresh momentum in the face of intensifying competition.

Microsoft Corp. pledged to pay for the costs of building and using the electric-grid infrastructure required by its data centers, an attempt to head off customer anger that the energy-hungry facilities are driving up their power bills.

Apollo Global Management Inc. is trying to open up trading on a private debt deal supporting Elon Musk’s artificial intelligence startup xAI Corp., according to people with knowledge of the matter.

Intel Corp. and Advanced Micro Devices Inc. rallied after KeyBanc Capital Markets upgraded the shares to overweight from sector weight, noting that the chipmakers have largely sold out their server CPU in 2026.

Concern that Adobe Inc. will struggle in the artificial-intelligence era has driven Wall Street analysts’ view on the maker of software for creative professionals to its most pessimistic in more than a dozen years.

Netflix Inc. is working on revised terms for its Warner Bros. Discovery Inc. acquisition and has discussed making an all-cash offer for the company’s studios and streaming businesses, people familiar with the discussions said.

U.S. Bancorp, the country’s largest regional bank, will acquire brokerage BTIG for as much as $1 billion as it looks to push deeper into investment banking and trading.

Bank of New York Mellon Corp.’s profit beat analysts’ estimates, driven by gains in fee revenue and interest income.

Boeing Co. sold more jets than Airbus SE in 2025, ending a seven-year losing streak as the US planemaker rallies from a period of tragedies and corporate crises.

Delta Air Lines Inc. provided a profit forecast that fell short of Wall Street estimates, with the major US airline taking a more cautious view for 2026 after the aviation industry emerged from a volatile year.

The US Department of Defense is set to invest in L3Harris Technologies Inc.’s missile unit with a $1 billion convertible preferred security, tightening the direct links between the government and a major defense contractor.

Bristol Myers Squibb Co. said about 5% of Opdivo patients are taking a new, easier-to-use version of the blockbuster cancer drug and said it’s on course to meet the company’s goal of adoption by at least 30% of patients in two years.

Tricolor Holdings founder Daniel Chu and former Chief Operating Officer David Goodgame pleaded not guilty to charges that they conspired to defraud lenders and investors in the bankrupt subprime auto lender.

Volkswagen AG’s namesake brand is projecting rising electric-vehicle sales this year as the German automaker prepares a range of affordable plug-in models.

Bayer AG’s pharmaceuticals unit is on track for a return to growth as new drugs for cancer and kidney disease offset sales lost to patent expirations.

China Vanke Co. presented revised proposals to extend two local bonds that included collateral pledges as well as longer grace periods, according to people familiar with the matter, as the distressed developer struggles to stave off default.

Mid-day movers from CNBC:

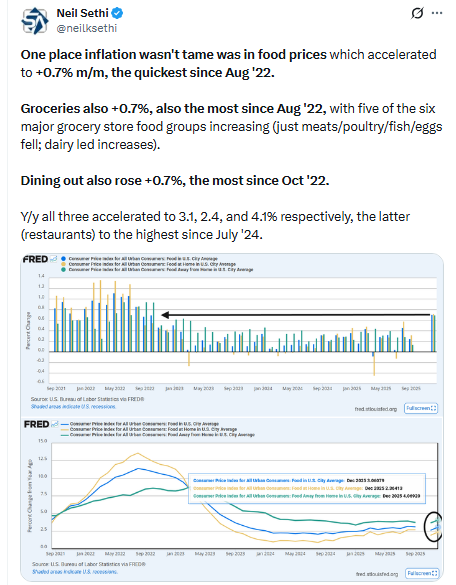

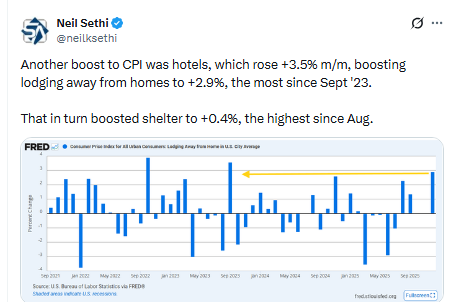

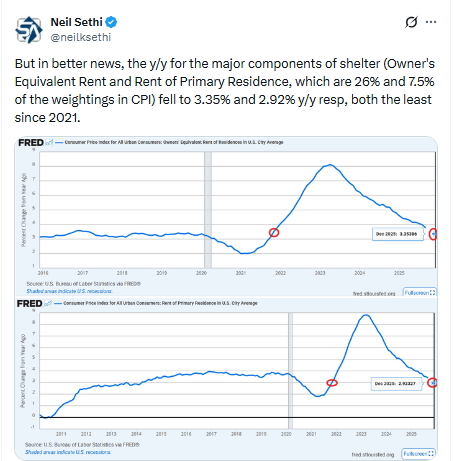

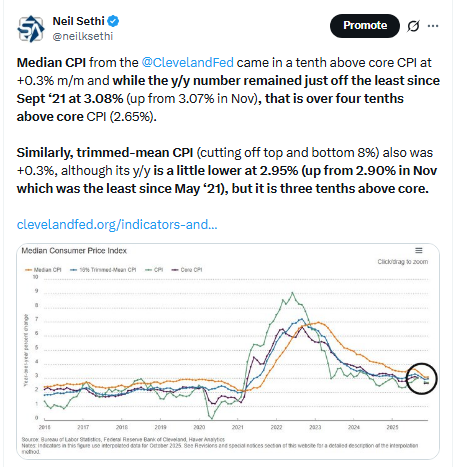

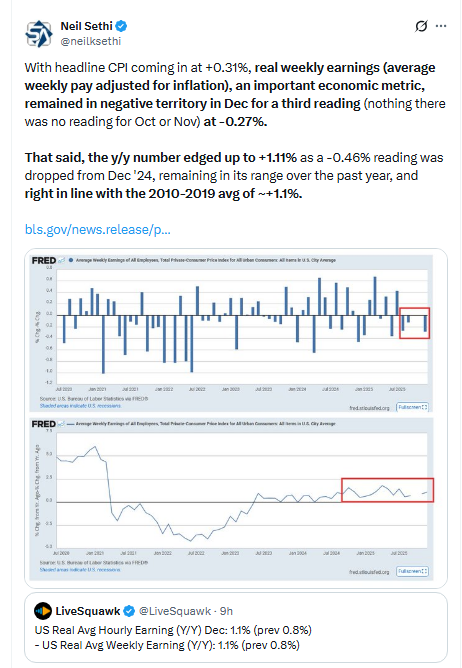

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

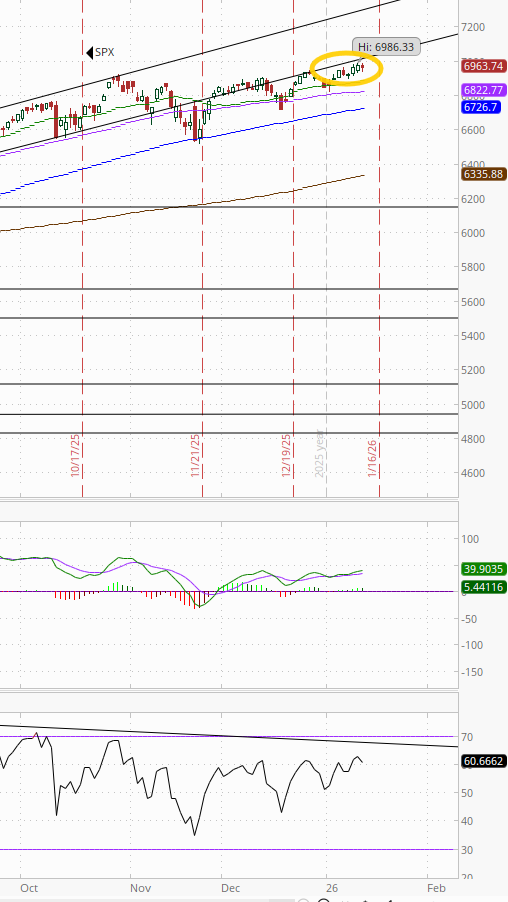

The SPX edged back from its ATH. The daily MACD and RSI are both neutral with a negative divergence but at least are making new local highs.

The Nasdaq Composite remains below its ATH.

RUT (Russell 2000) remains the best chart of the bunch although taking a pause from its rebound from its 50-DMA hit Thursday. Its MACD as noted Wed did cross to a “go long signal” and the RSI is now over 60.

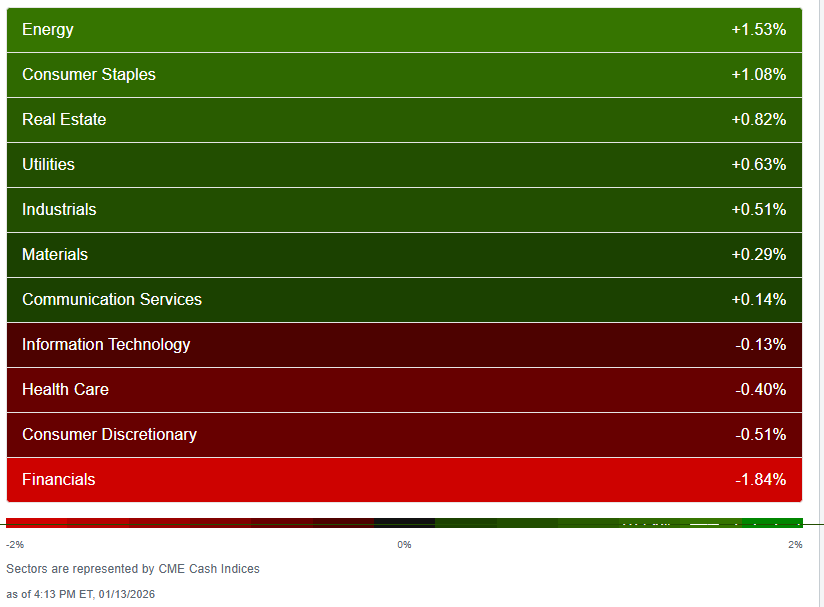

Despite the down day, sector breadth according to CME Cash Indices (uses futures prices) remained relatively healthy (as it’s been all year ex-Wed) although a little less so than most of those days.

7 of 11 sectors higher (after 9 the prior three sessions, ex-Wed, there have been at least 7 sectors up every day this year), with again three up over +0.7% (vs seven Fri, six Thurs) and two at least +1% (vs one Mon, but five Fri, four Thurs) led by Energy and Staples (Staples are now up +5.86% the past four sessions, outside of April the best since April 2020.

We did again have two sectors down more than -0.5% (matching Mon after none Fri) but only one was much more than that (Financials -1.8% (down for a third session and in last place a second session, now down -3% the past three sessions, the second most (after Nov) since Apr).

SPX stock-by-stock flag from @finviz_com for Tuesday looks a lot like Monday with the big difference less bright green overall and the bright red spread across much of the Financials and Software sectors. Meanwhile green spread across Energy.

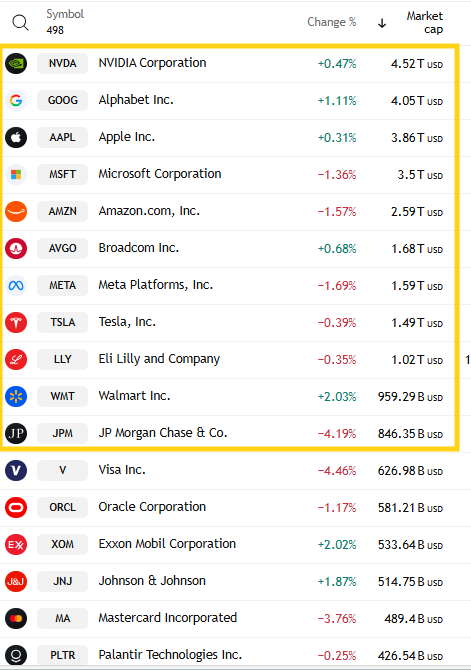

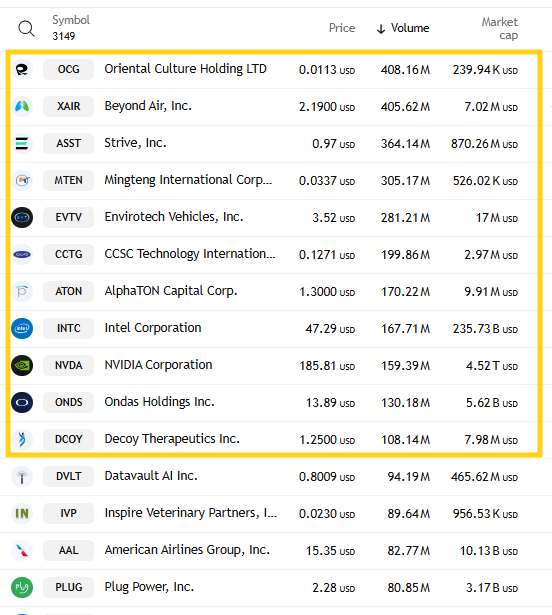

6 of the top 11 were lower (up from 5 Mon, 3 Fri (which was the least this year)). JPM easily led to the downside -4.2% (and the 12th largest SPX stock, Visa, was -4.5%). Leading to the upside for a second day was WMT +2.0% (up +6.5% the past three sessions (after its inclusion into the Nasdaq-100 was announced)).

Mag-7 -0.4%, putting it down around -0.5% week-to-date after gaining +0.7% last week (rebounding from its worst week since April).

~17 SPX components were up 3% or more (after 20 Mon, 45 Fri, 70 Thurs, 12 Wed, 75 last week). In a pivot away from 2025 leaders Moderna MRNA (one of 2025’s big losers) led +17.0%. Three of those 17 were >$100bn in market cap (after 2 Mon, 15 Fri) in INTC, AMD, ANET (in descending order of percentage gains).

~25 SPX components down -3% or more (up from 12/13 Fri/Mon, matching Thurs) led by Salesforce CRM -7.1% (which weighed on the DJIA). Eight of the 25 were >$100bn in market cap down -3% or more (up from three Mon, one Fri, seven Thurs) in CRM, ADBE, PGR, INTU, V, JPM, TMUS, MA (in order of percentage losses).

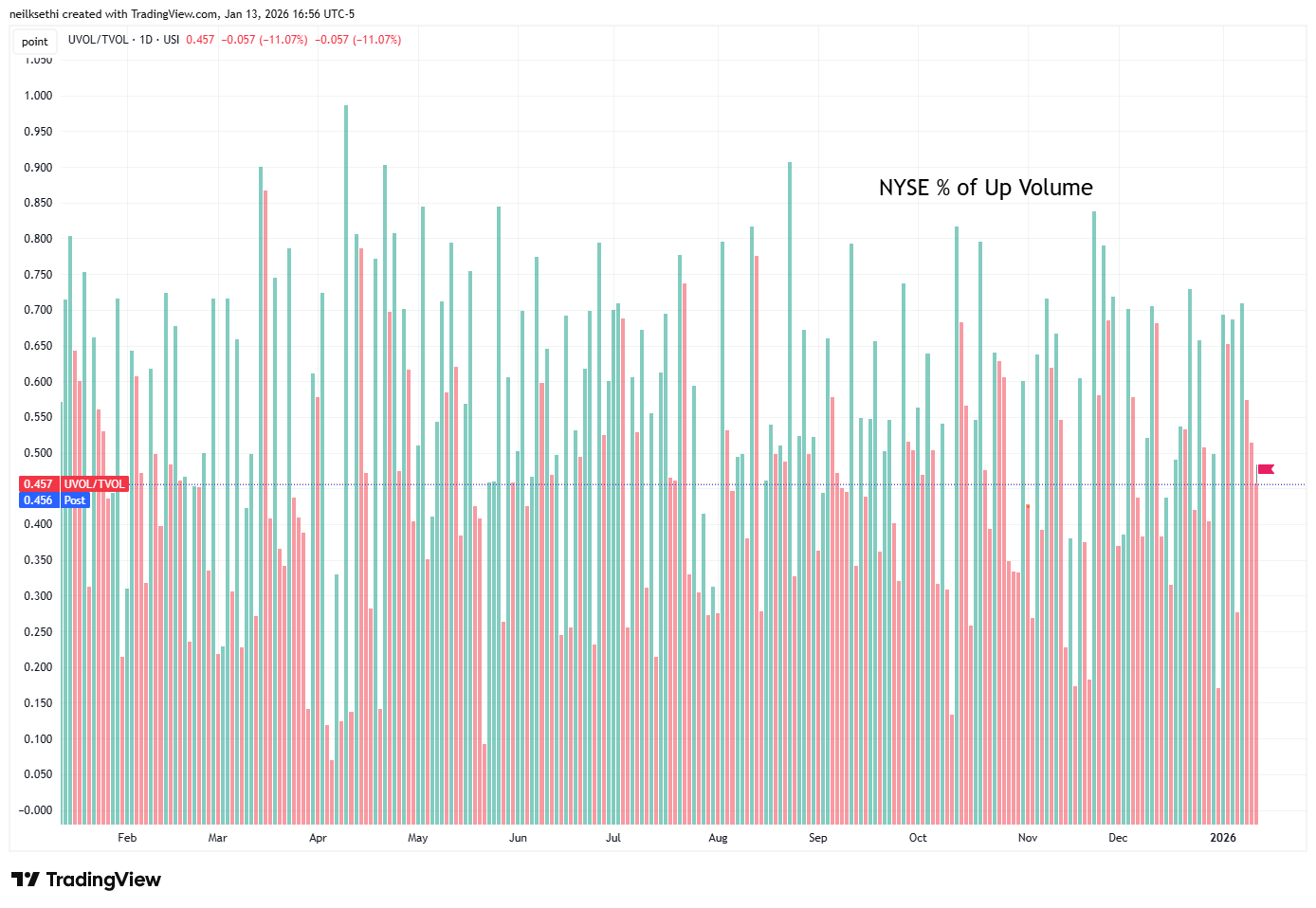

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) continued to deteriorate from Thurs’ very impressive 70.8% now down to 45.7% from 51.3% Mon not bad considering the index return was -0.18% vs +0.46% Mon.

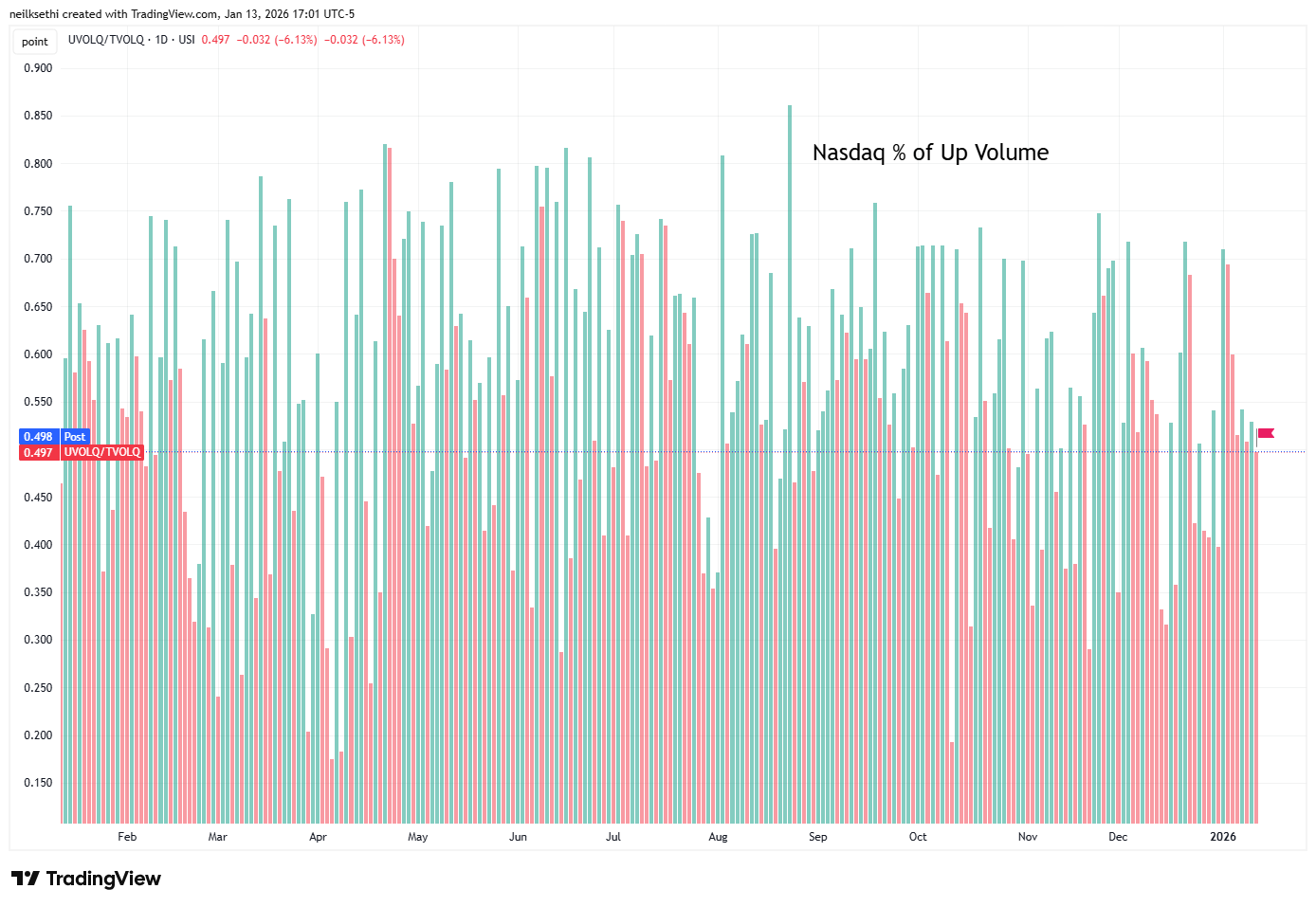

Similarly while Nasdaq positive volume (% of total volume that was in advancing stocks) fell back to 49.8% from 52.9% Friday that was with the index gain of +0.26% Monday turning to a -0.10% loss Tues, so not a bad result.

But the relatively good positive volume was again supported by more elevated speculative volumes on the Nasdaq than what we had seen the last couple of months. The top three stocks by volume were a little under 1.2bn shares. While down from around 1.4bn shares Mon (which was around the most we’ve seen since the summer) it was up from Friday’s ~700mn shares, and the top seven traded over 2bn shares, all sub-$4 stocks (five true penny stocks). In all, 11 companies had volumes over 100mn shares, the most since mid-Dec.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, saw some divergence from positive volume on the Nasdaq as a result at 42.0% while the NYSE was 52.0%.

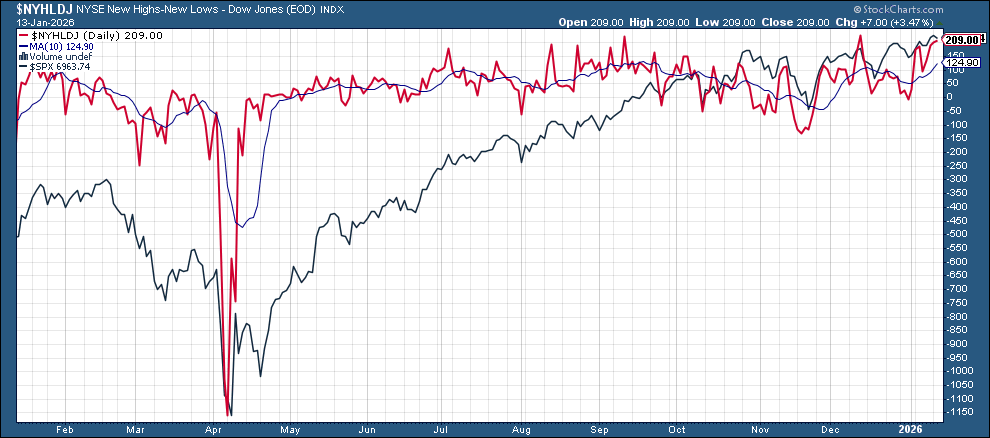

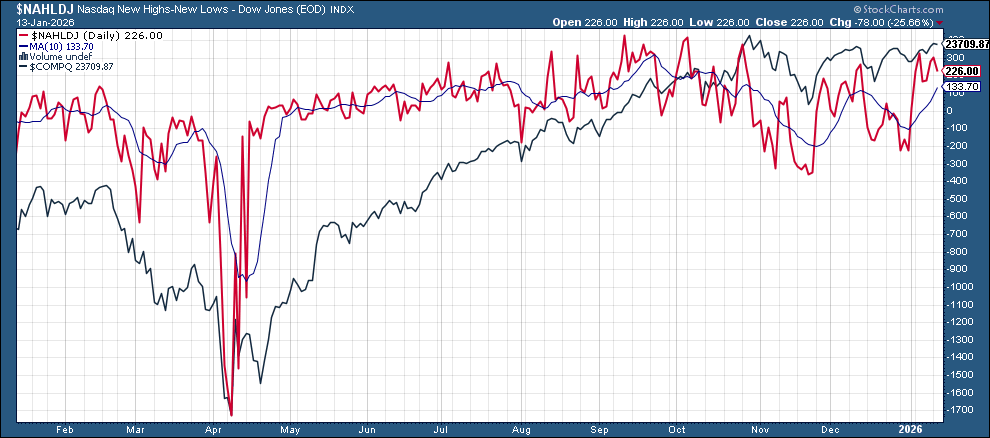

New 52-wk highs minus new 52-wk lows (red lines) were mixed improving slightly on the NYSE to 209, the second highest since Aug, but pulling back on the Nasdaq to 226 from 304.

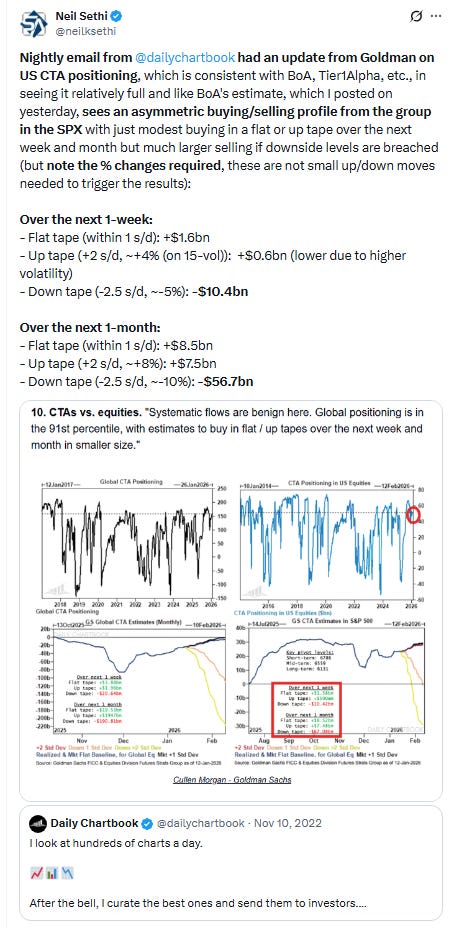

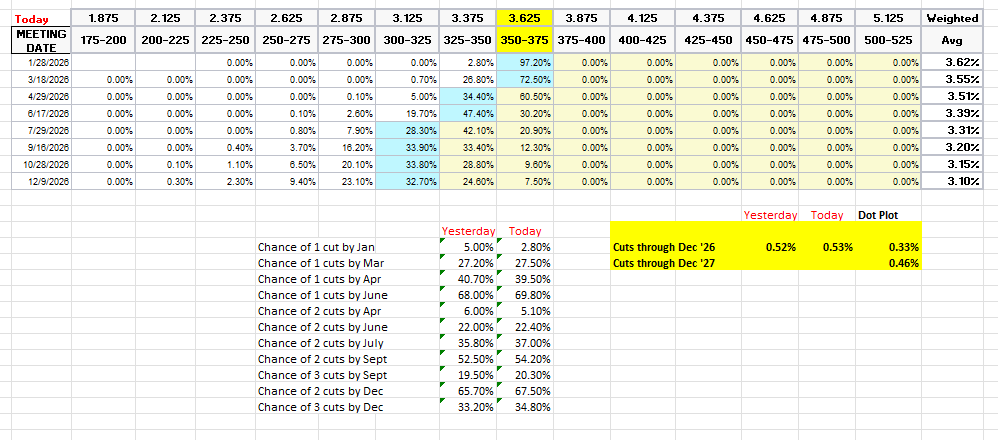

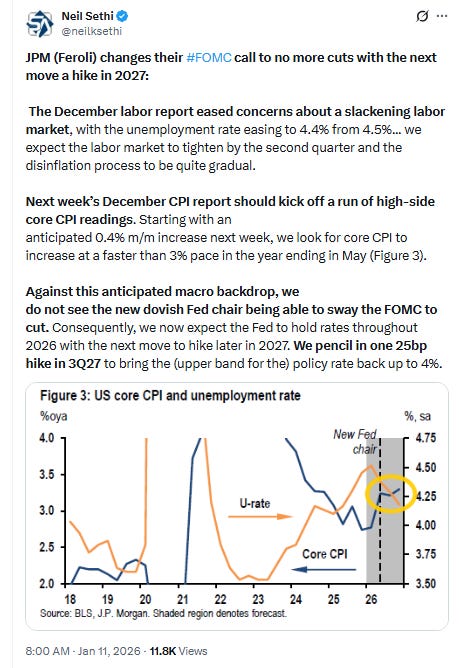

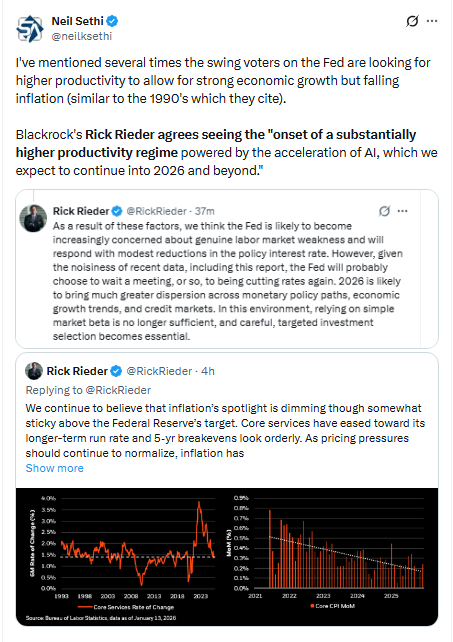

Despite the cool CPI print, #FOMC rate cut pricing for 2026 ended little changed overall near the least (fewest) cuts since the Dec FOMC according to the CME’s Fedwatch tool. January remains off the table unless the Fed chooses to revive it (unlikely) at just 2.8%. March is just 28% (from 51% a week ago), April 40% (from 63%), with the first cut in June (70%). A second cut is not until Sept (54%) with chances of two cuts by July now 37% (from 55% a week ago).

Pricing for 2026 edged a touch higher to 53bps, with pricing for two cuts 68% and three cuts 35%, down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

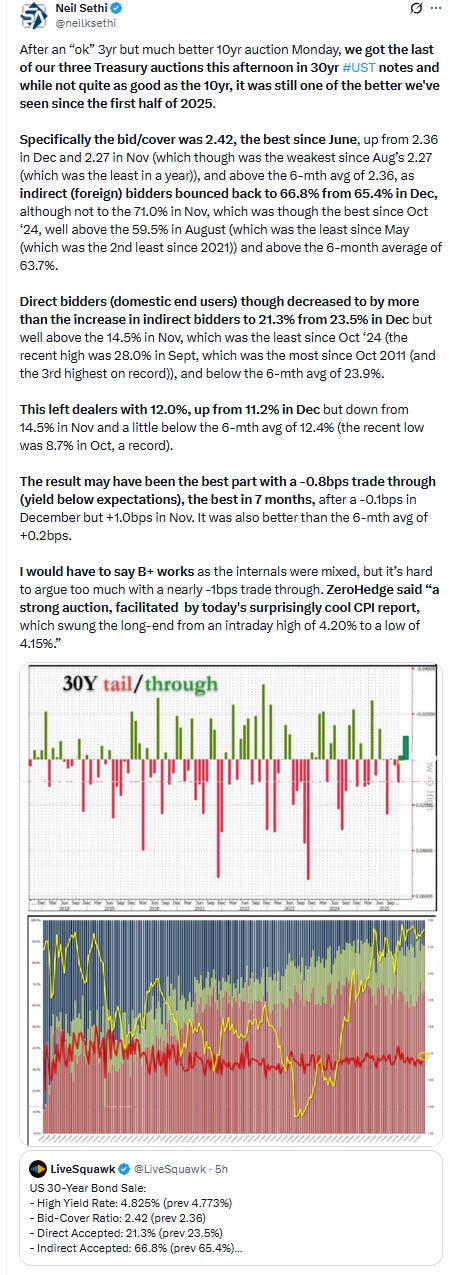

The 10yr #UST yield remained little changed as has been the case all year at 4.17%, remaining at the top of its range since the start of December. As noted Friday, it has traded in a 10bps range since then despite all of the headlines (including today’s).

The 2yr yield, more sensitive to FOMC rate cut pricing, also little changed remaining near the highs of the year at 3.53%, still though just 11bps above the least since 2022, but again moving closer to the top of the channel it’s been in since the start of 2024, -10bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) got back Mon’s losses but not able to extend above after it had been starting to push through the 50 and 200-DMAs as well as a trendline running back to the start of last year Fri before falling back Mon.

It has not sustained a breakout above the 200-DMA since it fell under last February. As noted Fri, the daily MACD has now crossed to “cover shorts” positioning and the RSI is the best since Nov (but back under 60) giving some technical support to a breakout.

VIX moved to the highs of the year at 16.0. The current level is consistent w/~1.0% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) saw its largest move higher since Nov 20th (NVDA earnings) to its highest close since around that time at 101.1 (up from 93.1 Mon and 81.7 Dec 24th).

The current level is now consistent with “moderately elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

And despite putting CPI behind us, 1-Day VIX moved higher although at 10.8 it remains relatively subdued. The current reading implies a ~0.68% move in the SPX next session.

I noted Friday “we finally have a tentative breakthrough, as #WTI futures closed Friday for the first time above both the 50-DMA and downtrend line from the July highs since that time,” and they built on that again Tuesday adding another +2.1%, now up +5.9% the past three sessions (the most since Oct) and taking them to the highest levels since late Oct, coming up on the 200-DMA target (brown line).

As I said Friday, “a green day on Monday would have me looking at the $62.50 level (200-DMA). Daily MACD remains supportive (cover shorts) and RSI is strongest since October.” RSI now the best since June.

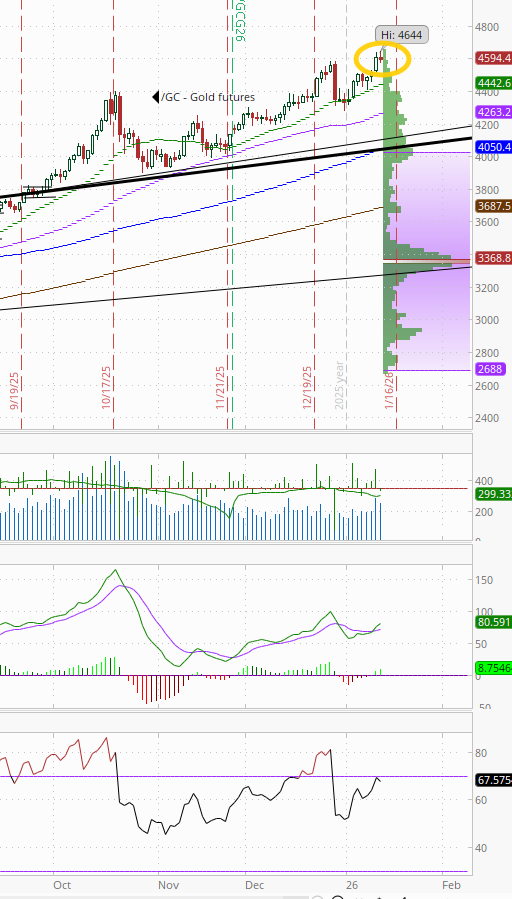

Gold futures (/GC) little changed after hitting an all-time high Monday. Daily MACD remains in “go long” positioning, while the RSI is over 60.

US copper futures (/HG) also little changed just under its all-time high. Daily MACD remains in “go long” positioning while the RSI still has a negative divergence (lower high).

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) continued to stabilize just below the $3.50 level after falling Friday to the lowest close since mid-October (and down around -45% from the peak Dec 5th).

As I noted Mon, “we’ve seen bounces several times during that decline, so need to see more before I take the $3 target off.” That said, we haven’t seen three green days during the decline, so that would be a change. The daily MACD remains firmly in ‘go short’ positioning, and RSI is still around the weakest since April.

Bitcoin futures up +3.6%, back to just under the $95k level, and, perhaps more importantly, over the 50-DMA that had pressured them the past few days.

It’s the first close over the 50-DMA since October. The daily MACD still remains in “cover shorts” positioning (positive), while the RSI is over 50, so perhaps ready for a run to $100k?

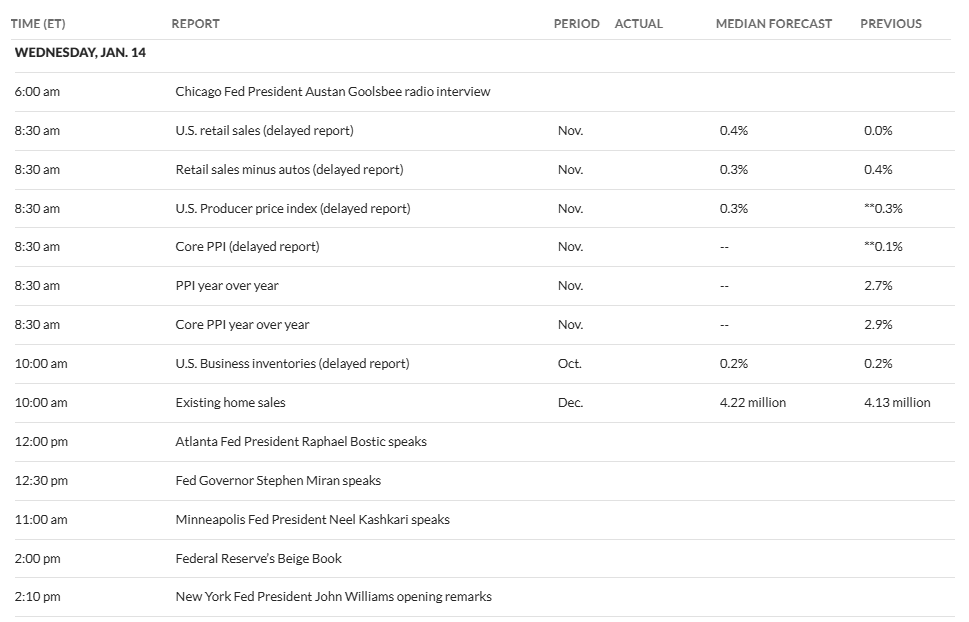

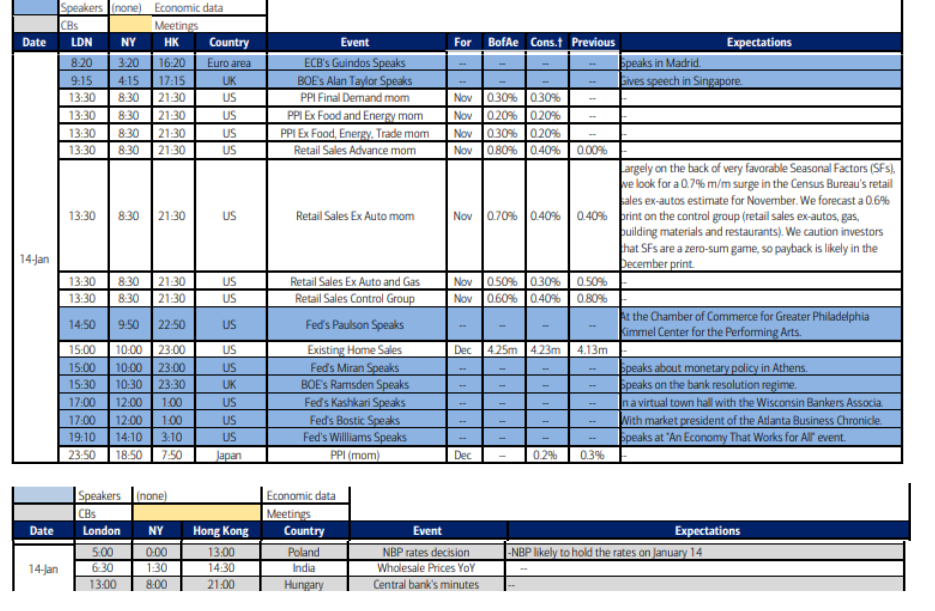

The Day Ahead

US economic data remains heavy Wed with delayed (Nov) retail sales and PPI reports along with Oct business inventories and an on-time Dec existing home sales report in addition to weekly mortgage applications and EIA petroleum inventories.

Lots more Fed speakers although most of them we have heard from in the past week. Still will be interesting to get their takes after CPI. We know what Gov Miran is going to say, and I doubt NY Fed Pres Williams will change his position (rates are “in a good position”) from less than 48 hours earlier, but if he does it would be market moving. I would imagine Philadelphia Fed Pres Paulson (2026 voter, not listed below speaks at 9.50am ET) will continue to be relatively dovish. We haven’t heard from Chicago Fed Pres Goolsbee in a while (not a 2026 voter though). We’ll also get appearances from Minneapolis Fed Pres Kashkari (2026 voter) and outgoing Atlanta Fed Pres Bostic.

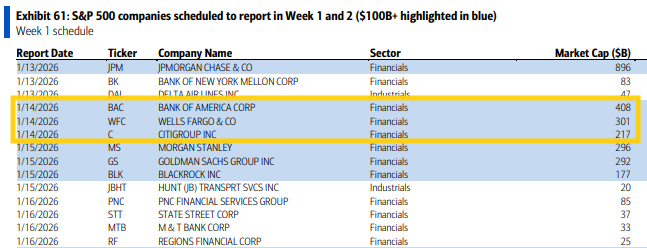

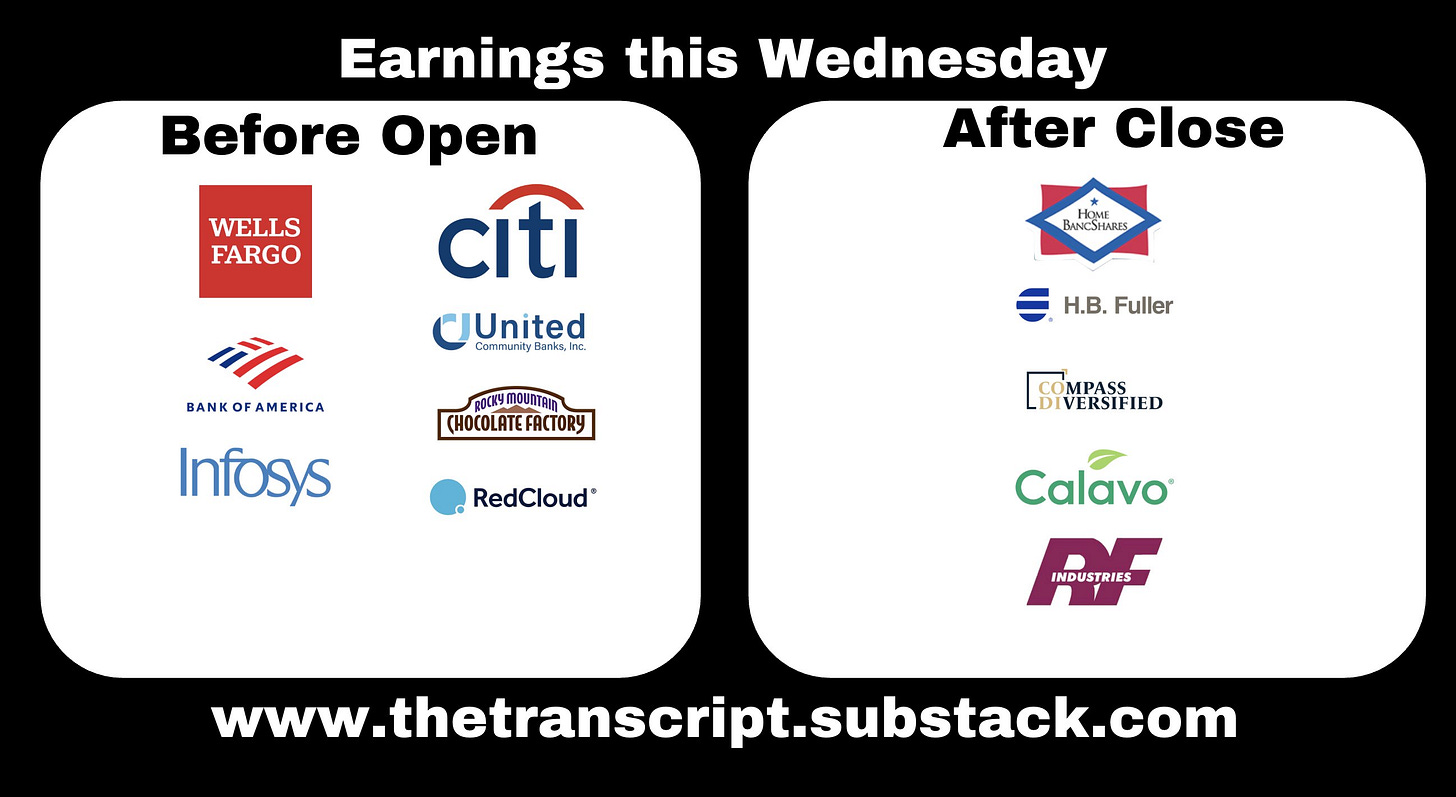

Q4 SPX earnings season continues with another 3 SPX reporters, but all over $100bn in market cap in the other three “Big Four” banks (BAC, WFC, C (in order of market cap)).

Ex-US DM as noted Sunday is a light week. Wednesday has some central bank speakers and Japan Reuters Tankan estimate and current account balance.

In EM, highlights are a policy decision in Poland, Hungary minutes, China loan growth, and India wholesale prices.

And, we get another release of opinions from the Supreme Court at 10am. Anticipation of course remains high that the Trump tariff case will be among them.

From Goldman:

Wednesday, January 14

08:30 AM Retail sales, November (GS +0.6%, consensus +0.4%, last flat)

Retail sales ex-auto, November (GS +0.4%, consensus +0.4%, last +0.4%)

Retail sales ex-auto & gas, November (GS +0.3%, consensus +0.3%, last +0.5%)

Core retail sales, November (GS +0.4%, consensus +0.4%, last +0.8%)

We estimate core retail sales increased 0.4% in November (ex-autos, gasoline, and building materials; month-over-month SA), reflecting mixed signals on holiday sales from alternative data but a tailwind from potential residual seasonality. We estimate headline retail sales increased 0.6%, reflecting a rebound in auto sales and higher gasoline prices.

08:30 AM PPI final demand, November (GS +0.1%, consensus +0.3%, last +0.3% [September])

PPI final demand, October (GS +0.3%)

PPI ex-food and energy, November (GS +0.1%, consensus +0.2%, last +0.1% [September])

PPI ex-food and energy, October (GS +0.2%)

PPI ex-food, energy, and trade, November (GS +0.2%, consensus +0.3%, last +0.1% [September])

PPI ex-food, energy, and trade, October (GS +0.2%)

09:50 AM Philadelphia Fed President Paulson (FOMC voter) speaks

Philadelphia Fed President Anna Paulson will speak on the economic outlook at the Chamber of Commerce for Greater Philadelphia. Speech text is expected. On January 3rd, President Paulson said that she sees “inflation moderating, the labor market stabilizing and growth coming in around 2% this year,” adding that “if all of that happens, then some modest further adjustments to the funds rate would likely be appropriate later in the year.”

10:00 AM Existing home sales, December (GS +2.0%, consensus +2.3%, last +0.5%)

10:00 AM Business inventories, October (consensus +0.1%, last +0.2%)

10:00 AM Fed Governor Miran speaks

Fed Governor Stephen Miran will speak on regulation, the supply side and monetary policy at the Delphi Economic Forum in Athens. Q&A is expected. On January 8th, Governor Miran said that he is “looking for about a point and half of cuts” in 2026, noting that “underlying inflation is running within noise of our target, and that’s a good indication of where overall inflation is going to be going in the medium term.”

12:00 PM Minneapolis Fed President Kashkari (FOMC voter) speaks

Minneapolis Fed President Neel Kashkari will speak in a virtual town hall with the Wisconsin Bankers Association. On January 5th, President Kashkari said that “my guess is that we’re pretty close to neutral right now,” adding that “we just need to get more data to see which is the bigger force—is it inflation, or is it the labor market—and then we can move from a neutral stance whatever direction is necessary.”

12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks

Atlanta Fed President Raphael Bostic will participate in a moderated discussion with David Rubinger, president and publisher of the Atlanta Business Chronicle. Moderated Q&A is expected.

02:10 PM New York Fed President Williams (FOMC voter) speaks

New York Fed President John Williams will deliver opening remarks at the New York Fed’s annual “An Economy That Works for All” event.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,