Markets Update - 1/14/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

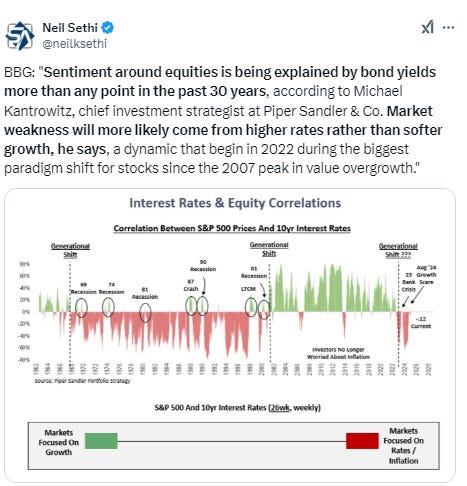

US equities started the day on better footing Tuesday following a BBG report that the Trump administration is considering a “phased” approach to tariffs and the December producer price report coming in cooler than expected, which saw a very mild softening in bond yields, although longer duration remain near the highest since Oct ‘23 (which were the highest since 2007). With few additional catalysts today, markets meandered lower and higher but during the session the gap between the megacaps and most of the rest of the market widened, with the Nasdaq finishing in the red (SPX little changed) for a second day but equal weighted SPX and Russell 2000 small cap index finishing with solid gains.

The dollar fell for a 2nd day but remained near 26-mth highs. Oil also edged lower while nat gas, gold, copper, and bitcoin all advanced.

The market-cap weighted S&P 500 was +0.1%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite -0.2% (and the top 100 Nasdaq stocks (NDX) -0.1%), the SOX semiconductor index +0.5%, and the Russell 2000 +1.1%.

Morningstar style box showed the strength in small caps but every style was up outside of large growth.

Market commentary:

“All eyes are now on Wednesday’s CPI report, as it will fuel the market’s Fed-obsessed sentiment,” Brigati said. “A strong inflation number adds to this idea of no cuts in 2025, and potentially even a rate hike, while a weak inflation data point may help to calm the market’s Fed fears.”

“The Fed and markets will not benefit from particularly benign PPI inputs into PCE as was the case in November,” said Krishna Guha at Evercore. “In the very near term, this leaves markets exposed (in both directions) to Wednesday’s CPI report.”

“All eyes are now on Wednesday’s CPI report, which may be the most important inflation reading in recent memory, as it will fuel the market’s Fed-obsessed sentiment,” said Chris Brigati at SWBC. “A strong inflation number adds to this idea of no cuts in 2025, and potentially even a rate hike, while a weak inflation data point may help to calm the market’s Fed fears.”

“If CPI comes in hotter than expected, it would certainly be bad news for equity markets because it would imply that the Fed will indeed remain slower to lower interest rates,” said Sam Stovall, chief investment strategist at CFRA Research.

Wall Street is also gearing up for the unofficial start of the earnings season, with results from big banks hitting the tape on Wednesday. Lenders including JPMorgan Chase & Co. and Wells Fargo & Co. are expected to show continued gains from trading and investment banking, which helped offset net interest income declines caused by higher deposits and sluggish loan demand. “When it comes to big-bank earnings, net interest income is the key data point to watch,” Brigati at SWBC said. “If banks have been able to take advantage of borrowing at cheaper rates versus their loan portfolio, this is a constructive sign for the coming year.”

In individual stock action, big tech stocks wavered Tuesday, putting pressure on the S&P 500 and Nasdaq.NVIDIA (NVDA 131.76, -1.47, -1.1%), Tesla (TSLA 396.36, -6.95, -1.7%), and Alphabet (GOOG 191.05, -1.24, -0.6%) traded lower with no specific news driving the movement while other names like Microsoft (MSFT 415.67, -1.52, -0.4%), Eli Lilly (LLY 744.91, -52.57, -6.6%), and Meta Platforms (META 594.25, -14.08, -2.3%) reacted negatively to headlines. MSFT reportedly paused hiring in its US consulting unit as part of a cost-cutting plan, according to CNBC; LLY lowered Q4 revenue guidance; and META reacted to reports that TikTok US is not going to be sold after initial reporting suggested that may be the case. Eli Lilly & Co. sank 7% amid disappointing sales.

Utilities stocks outperformed Tuesday, boosting the S&P 500 sector 1.4%. Vistra was the best performer in the sector, gaining more than 5%, while Constellation Energy surged 4%. NRG Energy and AES Corp added 3% and 2%, respectively.

Homebuilders jumped after KB Home’s earnings beat.

BBG Corporate Highlights:

Southwest Airlines Co. is pausing hiring for management, headquarters jobs and outside workers in a new round of cost cuts following a fight with activist shareholder Elliott Investment Management.

Units of CVS Health Corp., Cigna Group and UnitedHealth Group Inc. charged significantly more than the national average acquisition cost for dozens of specialty generic drugs, bringing in more than $7.3 billion in excess revenue over six years, the Federal Trade Commission said in a report on the drug middlemen.

B. Riley Financial Inc. received more demands for information from federal regulators about its dealings with now-bankrupt Franchise Group as well as a personal loan for Chairman and co-founder Bryant Riley.

Capital One Financial Corp. misled customers when it rolled out a new savings account with a higher interest rate it didn’t also give to existing savings accounts, the Consumer Financial Protection Bureau said Tuesday in a lawsuit against the bank.

United Rentals Inc. agreed to buy H&E Equipment Services Inc. for $3.4 billion in cash, gaining a fleet of equipment to serve construction and industrial markets.

Country Garden Holdings Co. suffered another record loss in 2023 as one of China’s largest developers continues its lengthy restructuring process after defaulting on its debt.

Some tickers making moves at mid-day from CNBC.

In US economic data:

The NFIB small biz sentiment index continued its “Trump bump,” up another +3.4 pts after +8pts in Nov, the largest 2-mth move on record (to 1985) to the highest since Oct 2018.

Markets got a much needed cooler than expected final demand PPI (wholesale prices) print, two tenths below exp's m/m at +0.2% despite a +3.5% jump in energy prices (gasoline was +9.7%) as food prices fell -0.1% (led by -14.7% decline in vegetables) and core-core (less food demand and trade services) was +0.1% (also under exp’s) despite a +7.2% in passenger transport costs (the most since Mar ‘22 and which feed into PCE prices) as “traveler accommodation services” fell -6.9%.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

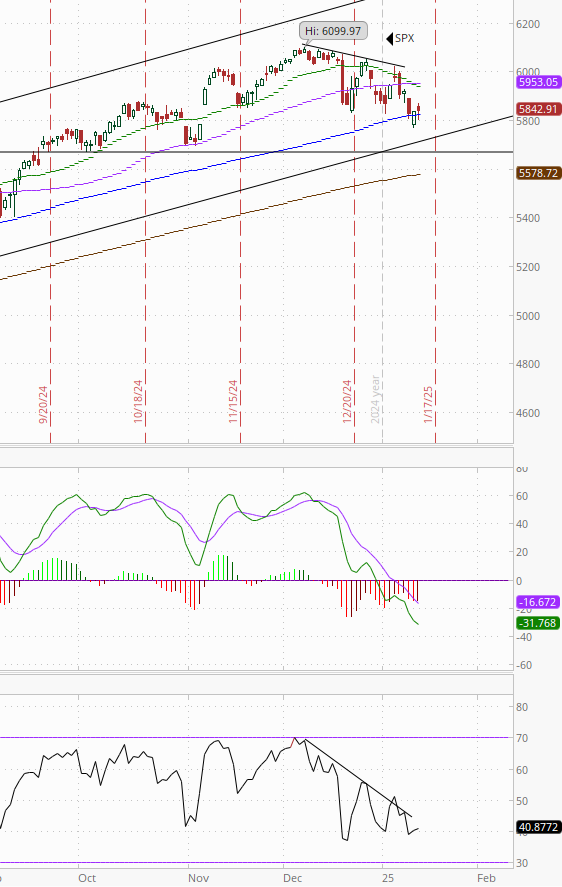

The SPX able to remain above its 100-DMA and break the sequence of lower highs and lows. Daily MACD & RSI remain quite weak, but maybe it’s setting up to put in a bottom.

The Nasdaq Composite bounced to its 50-DMA, but failed there falling back to near 2-mth lows, also though able to break the streak of lower highs and lows. Its daily MACD and RSI are very weak as well.

RUT (Russell 2000) able to continue its bounce from the 200-DMA. As I noted last week until it gets over the 2290 level “we can’t really look higher,” but it’s got “a whole lot more resistance before that point,” starting with the downtrend line that it’s approaching. Daily MACD & RSI remain weak for now.

Equity sector breadth from CME Indices another pretty good day w/6 of 11 sectors in the green (down from 7 Mon), again all up around a half percent or more (in fact all up around +0.9% or more, and four up over 1% (from five). The weakness at the SPX index level again explained by megacap growth sectors taking 3 of bottom 5 spots for a 2nd day (all of them red today). Utilities went from worst to first but next four spots were all cyclical value.

Stock-by-stock SPX chart from Finviz consistent looking a lot like Monday with a lot of green outside of the largest stocks (although software did better today).

Positive volume (the percent of volume traded in stocks that were up for the day) was very good at 70% Monday for the NYSE (from 52% Mon), although that corresponds to the strong day for the NYSE Composite Index. Nasdaq was also very good at 54% despite the down day in the index, up from 42%. Positive issues (percent of stocks trading higher for the day) were even better at 74 & 57%.

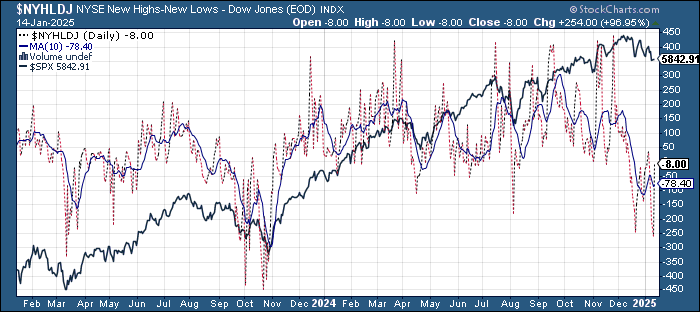

New highs-new lows (charts) also saw notable improvement with the NYSE jumping to -8 from -264 & the Nasdaq to -116 from -332 (which were the least since Nov ‘23 & Aug ‘24 respectively). NYSE is now back above its 10-DMA while the Nasdaq is not far, but for now they remain pointed lower (less bullish).

FOMC rate cut probabilities from CME’s #Fedwatch tool saw a mild increase in rate cut bets following the PPI report. The chance of a March remained at 20%, but May edged to 36%, and June to 55%. Overall pricing for a 2nd cut in 2025 up to 35% with overall 2025 cut expectations at 30bps (from 27) with the chance of no cuts at 26% (from 30%).

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that until we get CPI this week. While the NFP report was strong, it’s important to remember with the data dependant Fed, it is only as strong as the last couple of months’ reports, so things can change quickly.

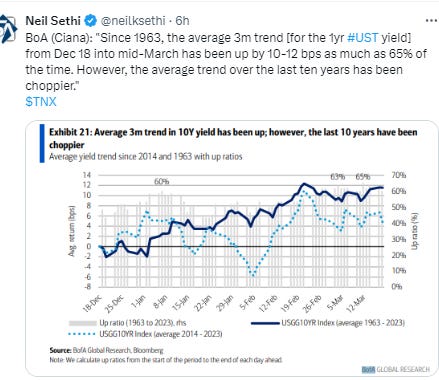

Longer duration UST yields edged lower for the 1st session in 9 with the 10yr -2bps to 4.79% from the highest since Oct ‘23 (which was the highest since 2007), +41bps since the Dec FOMC meeting (& +103bps from the Sept FOMC meeting), still "eyeing" 5%.

The 2yr yield, more sensitive to Fed policy, was also -2bps to 4.37% from the highest since July but remaining above the current Fed Funds rate.

I have mentioned before I find this level very rich, as I think a cut is more likely than no cuts and certainly more likely than hikes (as do Fed Funds futures markets), but I guess we’ll see.

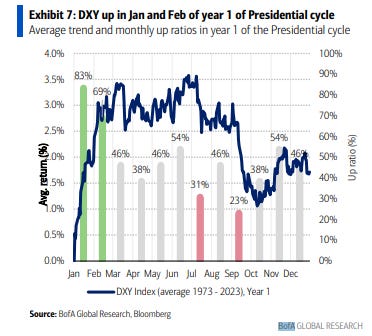

Dollar ($DXY) fell for a 2nd session although remains just off 26-mth highs. Daily MACD and RSI remain positive but the latter less so than the start of the month a small negative divergence, and they are close to breaking their momentum trendlines.

The VIX broke its string of higher highs and lows although remained elevated at 18.7 (consistent w/1.16% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly fell back to 107, still over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)). How CPI comes out will have a big say in where these go next.

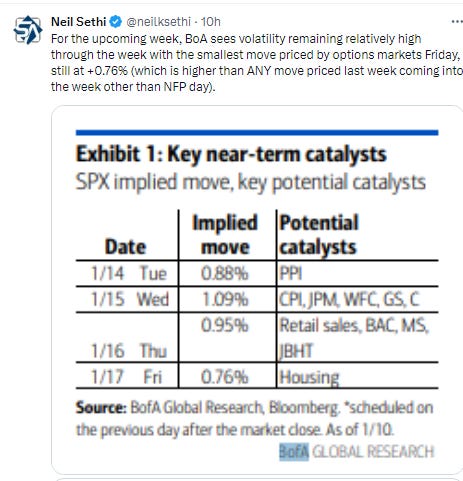

1-Day VIX jumped to 22.5, the highest for a CPI day since inception (Apr ‘23), looking for a move of 1.42% Tuesday, above the 1.09% BoA saw implied coming into the week.

WTI fell back but kept most of its 8% two-day run above $78 which it held above. Daily MACD & RSI remain very supportive for now.

Gold fell to its uptrend line/50-DMA which it bounced from to end mildly higher but below the resistance of the downtrend line from its ATH. It will have to break one way or the other before long. Daily MACD & RSI point to higher. We'll see.

Copper (/HG) up for an 8th session, closing at a 2-mth high and remaining above the downtrend line it hadn’t closed over previously since May. Still hasn’t been able to close over its 200-DMA though. Its RSI and MACD remain positive, with the former the best since Oct. Needs to get through the 200-DMA to open up a run higher.

Nat gas (/NG) remained volatile Tuesday falling back -5% before regaining that ground and finishing slightly higher (another move of over 6% during the session for the 11th in 12) just off the highest close in 2 yrs. Daily MACD remains in “go long” position and RSI remains over 50 although continues to have a negative divergence (lower high).

Bitcoin futures edged higher remaining in its range over the past month between the 50-DMA and 20-DMA/downtrend line from ATH. The daily MACD and RSI remain weak for now.

The Day Ahead

US economic data Wednesday highlighted by the main event of the week in the CPI report. While we got some better news on PPI at the headline level, the components that flow through to PCE prices (the Fed’s favorite inflation gauge) were mixed, so markets will be reacting to CPI whichever way it comes down, which is hopefully on the cool side after the strong employment report and rises in some consumer inflation expectations. We’ll also get the Fed’s Beige Book as well as weekly mortgage applications and EIA petroleum inventories.

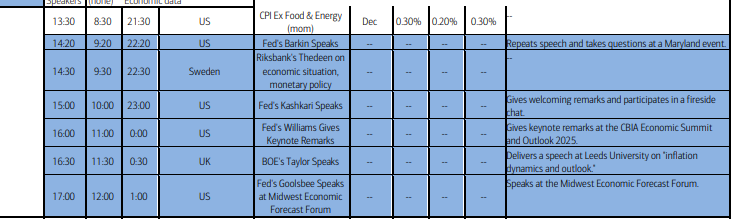

In Fed speakers, we’ll get Williams again. Today he made opening remarks at a housing conference and didn’t touch on monetary policy, but tomorrow he gives the keynote at the CBIA economic summit, so hopefully we get something on that. We also get Kashkari, Barkin and Goolsbee, which could be interesting depending on how CPI comes out.

In earnings, we “unofficially” kick off 4Q earnings with the big banks. We’ll get JPMorgan, Wells Fargo, Goldman Sachs, Citigroup, and Blackrock along with Bank of NY Mellon (all SPX components, all but the last >$100bn in market cap. (Link to Seeking Alpha’s earnings calendar).

Ex-US the highlight is UK Dec inflation data along with revised data for France, Sweden, and Spain. We’ll also get a 10yr Gilt auction (which could be interesting), EU Nov industrial production, and the Jan Reuters Japan Tankan estimate among other reports. In EM we’ll get trade data from South Korea and India among other reports and a policy decision in Indonesia.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,