Markets Update - 1/15/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

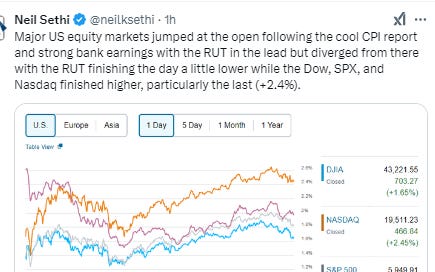

US equities jumped higher following a cooler than expected (at the core level) CPI report (which followed a similar report from the UK) which saw bond yields and the dollar drop and bets on Fed rate cuts increase. Also boosting sentiment today was a batch of better than expected results from the big banks leading financials to finish along with growth stocks at the top of the leaderboard. The Bloomberg gauge of the “Magnificent Seven” megacaps rallied 3.7%, although gains were broad with 10 of 11 sectors up.

Elsewhere, the risk on vibe spilled over into the commodities market with crude, gold, copper, bitcoin and nat gas all higher.

The market-cap weighted S&P 500 was +1.8%, the equal weighted S&P 500 index (SPXEW) +1.0%, Nasdaq Composite +2.5% (and the top 100 Nasdaq stocks (NDX) +2.3%), the SOX semiconductor index +2.1%, and the Russell 2000 +2.0%.

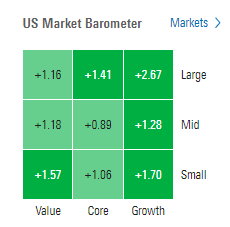

Morningstar style box showed the broad strength led by growth.

Market commentary:

“Wednesday’s softer-than-expected CPI print offers some relief, especially after last Friday’s hot employment numbers, that the Fed may be able to still cut interest rates in 2025,” said Skyler Weinand, chief investment officer at Regan Capital.

“The market [is] breathing a sigh of relief as back-to-back inflation gauges, PPI yesterday and CPI this morning, came in slightly below expectations,” said John Kerschner, head of U.S. securitized products and portfolio manager at Janus Henderson Investors. “Perhaps most importantly, today’s CPI number takes additional rate hikes off the table, which some market participants were beginning to prematurely price in.”

“This [inflation] report supports the view that the pricing out of rate cuts this year has gone a bit too far, and that when the data turns lower again, as it did after Q1 last year, some extra easing will be put back on the table,” Kyle Chapman, FX markets analyst at Ballinger Group, said in emailed comments.

“Extreme sentiment led to a powerful post-CPI move,” said Steve Sosnick at Interactive Brokers. “The proximate cause of today’s rallies in stocks and bonds was a better-than-expected month-over-month core CPI reading, but the magnitude of the rallies reflected the jittery sentiment that had pervaded markets.”

To Tina Adatia at Goldman Sachs Asset Management, while the latest CPI release is likely insufficient to put a January rate cut back on the table, it strengthens the case that the Fed’s cutting cycle has not yet run its course.

“The market will be encouraged by the decrease in core inflation, which should alleviate some of the pressure on stock and bond markets, both of which have had a poor start to the year on inflation fears and concerns the Fed would not only stop cutting interest rates, but could even reverse course and begin raising them,” said Chris Zaccarelli at Northlight Asset Management.

At the very least, the latest inflation figures are causing some short covering, according to Steve Wyett at BOK Financial.

“The market is relieved that potential ‘nose-bleed’ interest rates are — for now — taken off the table and the bond market will not curtail the massive run we’ve seen over the last two years in the equity markets,” said John Kerschner at Janus Henderson Investors.

At Evercore, Krishna Guha says the CPI print reinforces the view that the market has “overtraded” the inflation story since the start of the year on limited new information — and should be risk-on. “It reinforces the base case for two Fed cuts, and keeps open the possibility of a March cut,” he noted.

To Ellen Zentner at Morgan Stanley Wealth Management, Wednesday’s CPI won’t change expectations for a pause later this month, but it should curb some of the talk about the Fed potentially raising rates. “And judging by the market’s initial response, investors appeared to feel a sense of relief after a few months of stickier inflation readings.”

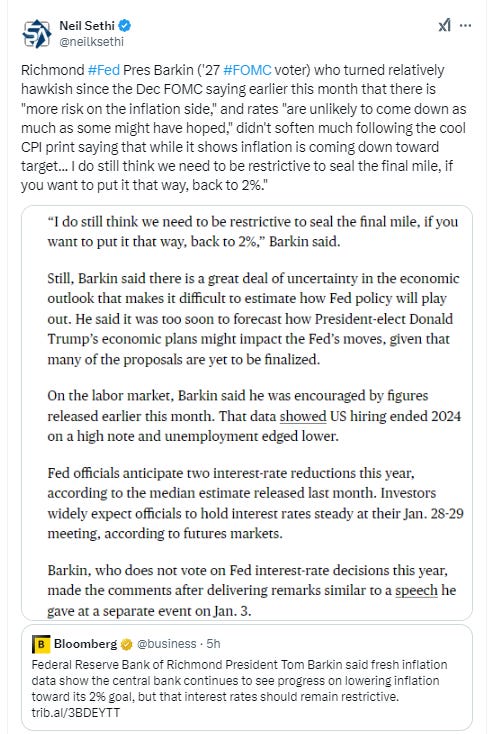

“We still think that it will be easy for the Federal Reserve to remain on hold for now and wait for more data and fiscal policy clarity,” said Allison Boxer at Pacific Investment Management Co. “We expect this to be the message Chair Jerome Powell aims to communicate at the January meeting.”

“For the Fed, this is certainly not enough to prompt a January cut,” said Seema Shah, chief global strategist at Principal Asset Management. “But, if today’s print were accompanied by another soft CPI print next month plus a weakening in payrolls, then a March rate cut may even be back on the table.” Shah also noted that perhaps the key takeaway is that markets are likely to be “whipsawed” over the next few data releases as investors seek a narrative that they can be comfortable with for more than just a few days at a time.

To Solita Marcelli at UBS Global Wealth Management, Fed cuts are still on the table as inflation should moderate over the coming months. “The strength of the economy remains a supporting factor for corporate earnings growth at the current level of yields,” she noted. “While volatility could make it an uncomfortable journey before the S&P 500 hits our year-end target of 6,600, we expect the equity bull market to continue and maintain our ‘attractive’ rating on US equities.”

At Nationwide, Mark Hackett says the encouraging inflation data is “bringing bulls off the sidelines.”

“Equity investors have become increasingly sensitive to moves in the bond market, with an intense focus on rates, inflation, and Fed policy,” said Hackett. “Focus will now shift to earnings, which has been a headwind in recent quarters, as we have entered earnings season with elevated expectations. Given the weakness over the past month, the odds for a positive surprise this earnings season have improved.”

“We got a good start today to earnings season. The bank earnings are key because the financial sector is so tied to the general economy. So for these big banks to put up bullish numbers today, I think it does bode well,” said Larry Tentarelli, chief technical strategist at Blue Chip Daily Trend Report.

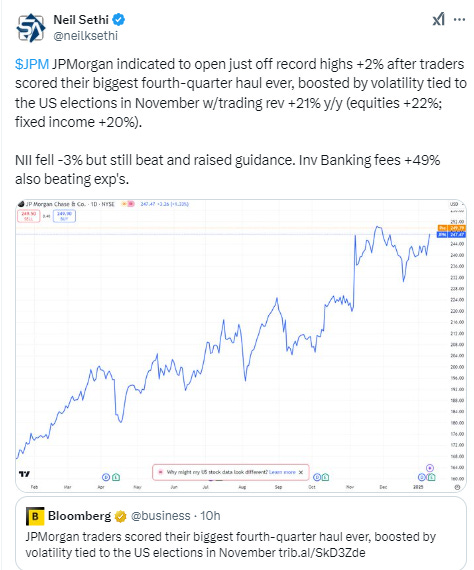

In individual stock action, growth stocks such as Tesla and Nvidia popped around 8% and 3%. A Bloomberg gauge of the “Magnificent Seven” megacaps rallied 3.7%. A Goldman Sachs basket of money-losing tech companies jumped 3.2%, while a group of most-shorted shares added 3.8%. The KBW Bank Index surged 4.1% as Citigroup Inc., Goldman Sachs Group Inc., Wells Fargo & Co. and JPMorgan Chase & Co. kicked off the earnings season. JPMorgan Chase shares rose nearly 2% after the bank reported an EPS and revenue beat, which was driven by strong fixed-income trading and investment banking results. Shares of Goldman Sachs popped 6% after the bank posted a top- and bottom-line beat in the previous quarter, and Wells Fargo shares jumped more than 6% after the bank said net interest income would be 1% to 3% higher in 2025. Citigroup shares gained 6% after the company beat fourth-quarter estimates.

BBG Corporate Highlights:

Goldman Sachs Group Inc. cruised past estimates as its equity traders delivered their best year on record.

JPMorgan Chase & Co.’s traders scored their biggest fourth-quarter haul ever, boosted by volatility tied to the US elections in November.

Citigroup Inc. said it will repurchase $20 billion worth of its stock in the coming years — unleashing billions of excess capital the bank had been keeping on hand in order to meet a key ask from shareholders.

Wells Fargo & Co.’s expenses dropped 12% in the fourth quarter as Chief Executive Officer Charlie Scharf continues to whittle headcount as part of broader efforts to slash costs and remake the bank. The company’s shares rose.

BlackRock Inc. attracted an annual record of $641 billion in client cash, underlining the firm’s global reach across public and, increasingly, private assets as it integrates multibillion-dollar acquisitions and reshapes its leadership.

Bank of New York Mellon Corp.’s fourth-quarter profit topped analyst expectations after higher-for-longer interest rates boosted margins.

Southwest Airlines Co. was sued by the US Transportation Department for allegedly violating rules that require airlines to set and meet realistic flight schedules.

CBS owner Paramount Global’s merger with film and TV producer Skydance Media should be reviewed by federal authorities because of the participation of China’s Tencent Holdings Ltd., which was recently added to a US military blacklist, a key member of Congress said.

NetApp Inc. has agreed to sell a portfolio of cloud software assets it acquired in recent years to Thoma Bravo-backed Flexera.

Airbus SE Chief Executive Officer Guillaume Faury said the engine issues afflicting many of its narrowbody aircraft will continue into the first half of the year and possibly beyond, complicating the European planemaker’s outlook as it grapples with persisted supply-chain constraints.

Pfizer Inc. sold about 700 million shares in Haleon Plc, further paring its stake in the maker of Sensodyne toothpaste.

Some tickers making moves at mid-day from CNBC.

In US economic data:

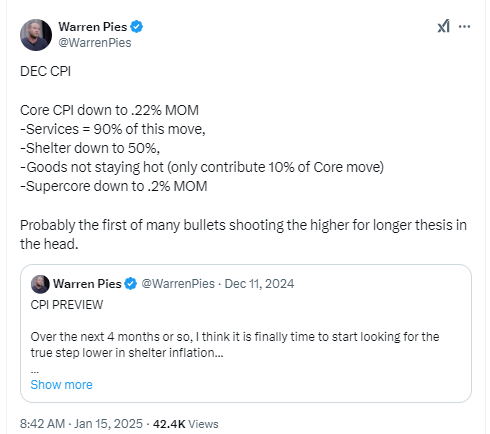

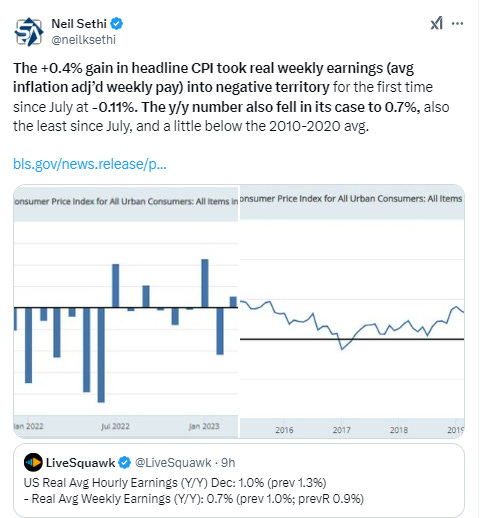

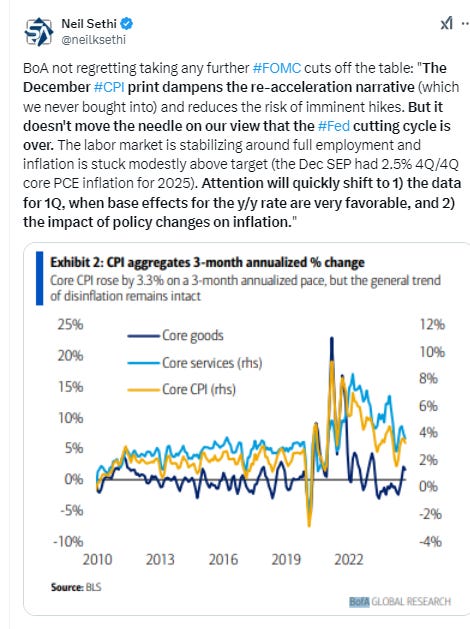

December’s consumer price index showed that core inflation, which excludes food and energy, rose 3.2%, the Bureau of Labor Statistics reported Wednesday. This was a notch down from the previous month and lower than the 3.3% estimated by economists surveyed by Dow Jones. Headline inflation increased 2.9% on a 12-month basis, in line with forecasts.

The Fed's Jan Beige Book (late Nov through Jan 6th) was more constructive than Nov’s w/the economy seeing increases across all 12 Districts w/commercial real estate, services, lending, and employment all growing. Wages and prices saw “moderate” and “modest” increases.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

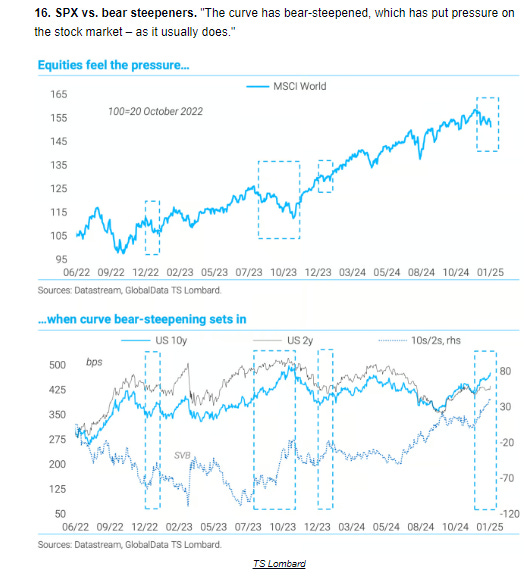

The SPX up to its 50-DMA also beneath its downtrend line from its ATH. Daily MACD & RSI remain weak, but as I noted Tuesday “maybe it’s setting up to put in a bottom.”

The Nasdaq Composite made it to the 20-DMA which hasn’t been much resistance previously, but it has had some trouble with that downtrend line from its ATH. Its daily MACD and RSI remain weak for now.

RUT (Russell 2000) able to continue its bounce from the 200-DMA now up into the teeth of resistance. As I noted last week until it gets over the 2290 level “we can’t really look higher, but it’s got a whole lot more resistance before that point, starting with the downtrend line” that it’s now right on top of. Still, some good things going on with the chart with daily MACD crossing over to "cover shorts" (circle) and RSI strongest in a month.

Equity sector breadth from CME Indices improved to 10 of 11 sectors in the green, with seven up around +0.9% or more (although we had six on Tuesday), and six up over 1% (from four), four up over 2% (none). The megacap growth sectors which had taken 3 of bottom 5 spots the last two days took 3 of the top 4 today along with financials all up over 2%. Staples the only red sector (but just -0.2%) as defensives took the bottom 3 spots.

Stock-by-stock SPX chart from Finviz consistent, with the Mag-7 a sea of green all up 2% or more led by Tesla’s +8% day. In fact the largest stock that was down today was Salesforce (#23 in the SPX).

Positive volume (the percent of volume traded in stocks that were up for the day) was very good (although not great) once again at 82% Wednesday for the NYSE, I say not great because it should be very strong given the gains for the NYSE Composite Index. Nasdaq was also good but not great at 75%. Positive issues (percent of stocks trading higher for the day) were similar at 84 & 75%.

New highs-new lows (charts) also saw notable improvement for a second day with the NYSE at 55 (from -264 on Monday) the best in a month & the Nasdaq to -12 from -332 (the Monday levels were the least since Nov ‘23 & Aug ‘24 respectively). They are now both back above its their 10-DMAs which are starting to turn back up (more bullish).

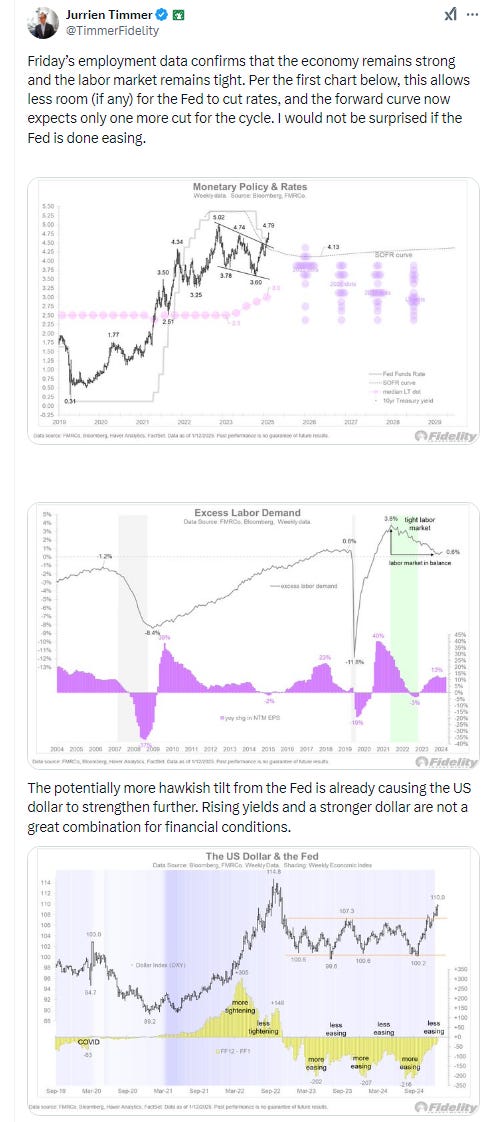

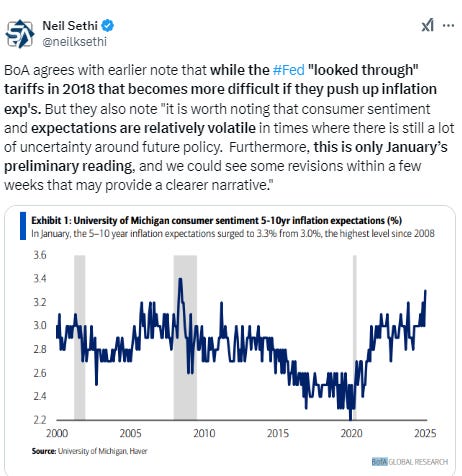

FOMC rate cut probabilities from CME’s #Fedwatch tool saw a notable increase in rate cut bets following the CPI report. January remains off the table, but the chance of a March cut moved to 28% from 20%, May to 52% from 36% (so better than 50/50), and June 67% from to 55%. Overall pricing for a 2nd cut in 2025 up to 50% with overall 2025 cut expectations at 39bps (from 27 on Monday) with the chance of no cuts at 19% (from 30% Monday).

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that until we get CPI this week. While the NFP report was strong, it’s important to remember with the data dependant Fed, it is only as strong as the last couple of months’ reports, so things can change quickly.

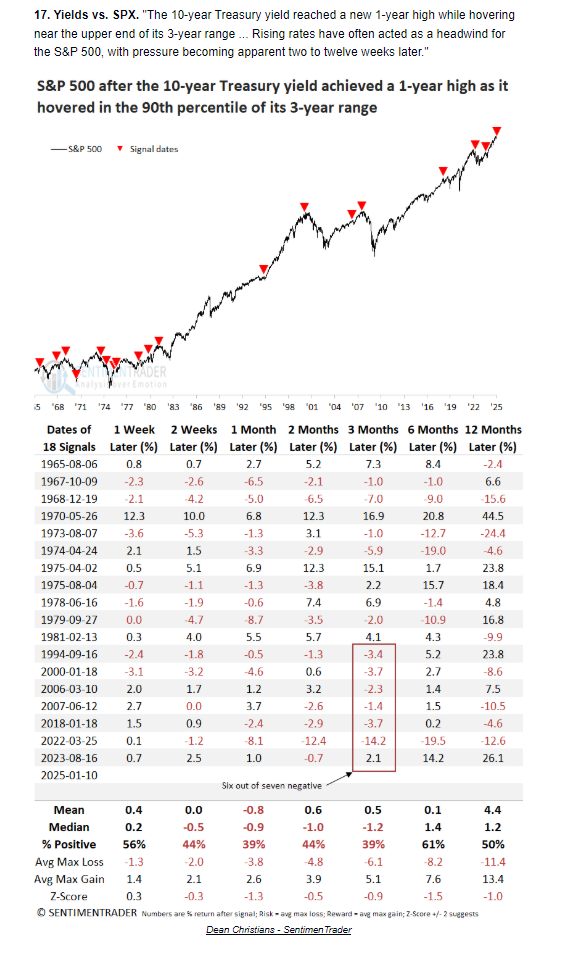

Longer duration UST yields fell sharply (largest drop since November) following the cool CPI report with the 10yr -14bps to 4.65%, still though +27bps since the Dec FOMC meeting (& +89bps from the Sept FOMC meeting), and until it breaks 4.6% in my book still "eyeing" 5%.

The 2yr yield, more sensitive to Fed policy, was -11bps to 4.26% now (just) back below the current Fed Funds rate.

I still find this level very rich, as I think a cut is more likely than no cuts and certainly more likely than hikes (as do Fed Funds futures markets).

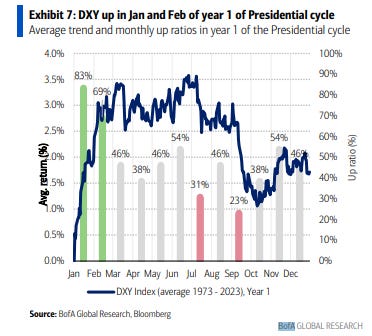

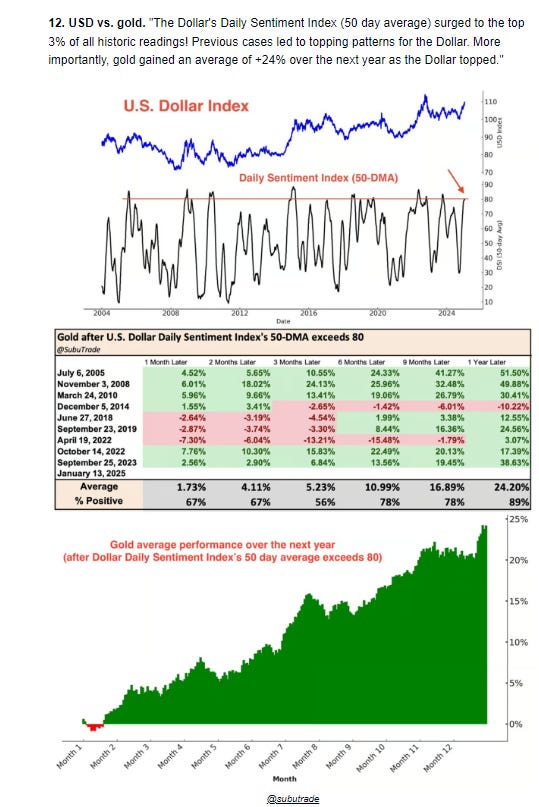

Dollar ($DXY) fell for a 3rd session but was able to bounce from its uptrend line and end with a very modest drop despite the decline in yields. It remains not far from 26-mth highs. Daily MACD and RSI remain positive, but they’re coming closer to breaking their momentum trendlines.

The VIX drops back to lowest close in over a week (although hasn’t broken the uptrend line to the December low) 16.2 (consistent w/1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly fell back to 98, now back under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100))

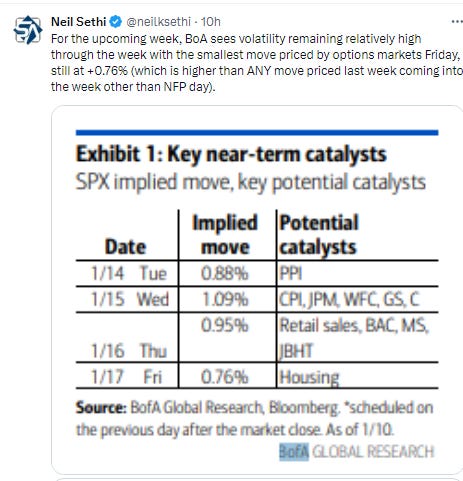

1-Day VIX also drops sharply from the highest ever for a CPI day (which turned out to be right looking for a move of 1.42% today (we got +1.8%). Still, at 13.6, it’s looking for a move of 0.86% Thursday, although for the first time this week it’s below the 0.96% BoA saw implied coming into the week.

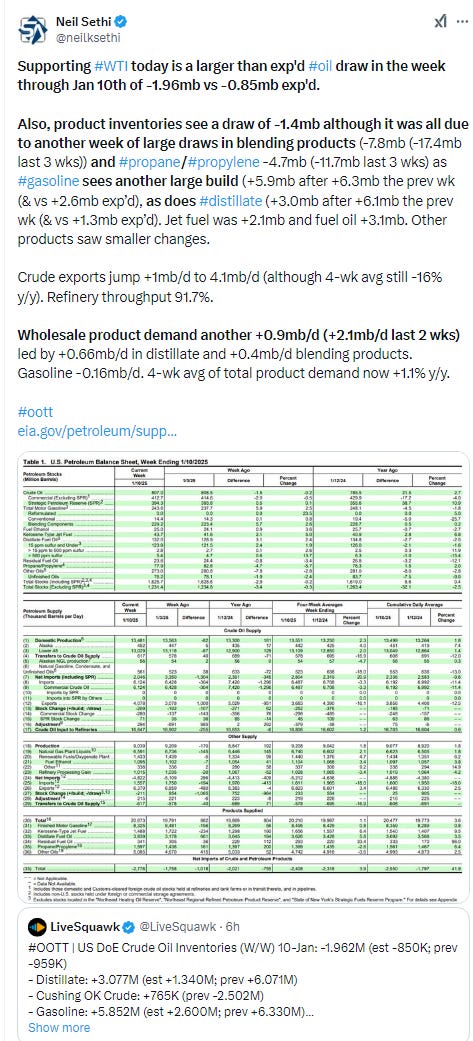

WTI up another 3% today taking its 4-day run to 11% and closing above $80 for the first time since July. Daily MACD & RSI remain very supportive with the latter (as well as the 12-day EMA signal line of the former) the strongest since Sep ‘23 (second chart).

Gold up over 1% now testing the underside of the downtrend line from its ATH. I said Tuesday it needed “to break one way or the other before long. Daily MACD & RSI point to higher” so we’ll see if we get that.

Copper (/HG) up for a 9th session, closing at a 2-mth high and now pushing over its 200-DMA as I said last week “opening up a run higher”. Its RSI and MACD remain positive, with the former now the strongest since Sept.

Nat gas (/NG) a little less volatile Tuesday but up another 4% (and still the 12th session in 13 w/a 5% or more intraday move) to the highest close in 2 yrs. Daily MACD remains in “go long” position and RSI remains over 50 although continues to have a negative divergence (lower high).

Bitcoin futures jump back over $100k, back up to the downtrend line from its ATH. The daily MACD and RSI remain weak for now but another green day would flip them positive.

The Day Ahead

US economic data Thursday remains heavy with another top tier (though not as top tier as CPI on NFP) report in Dec retail sales. We’ll also get import prices, the NAHB homebuilder sentiment index, final Nov business inventories and weekly jobless claims.

No Fed speakers on the schedule.

In earnings, the big financials continue to dominate with another six SPX components, five from that industry. Three reporters are >$100bn in market cap - UnitedHealth (UNH), Bank of America (BAC), and Morgan Stanley (MS). We also get Taiwan Semiconductor (TSM) a $1tn company. (Link to Seeking Alpha’s earnings calendar).

Ex-US we’ll get Nov UK GDP and final Germany and Italy Dec CPI as well as the minutes from the ECB Dec meeting. In EM, we’ll get a policy decision from South Korea overnight and some data from Brazil tomorrow. Tomorrow night we’ll get the big “data dump” from China (retail sales, industrial production, property investment, etc.).

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,