Markets Update - 1/15/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

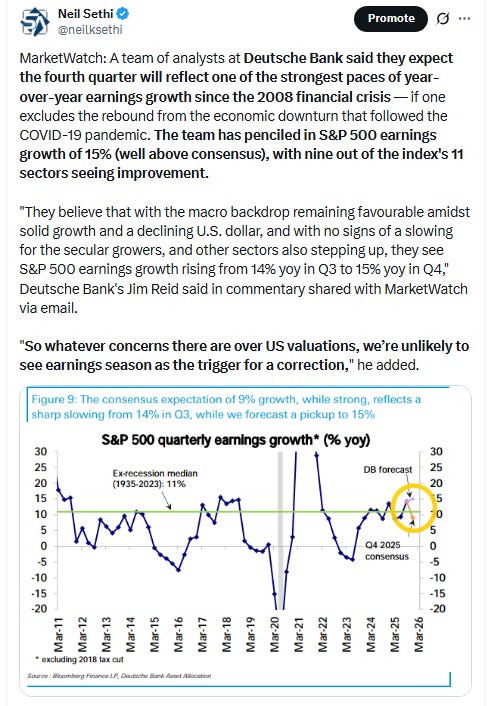

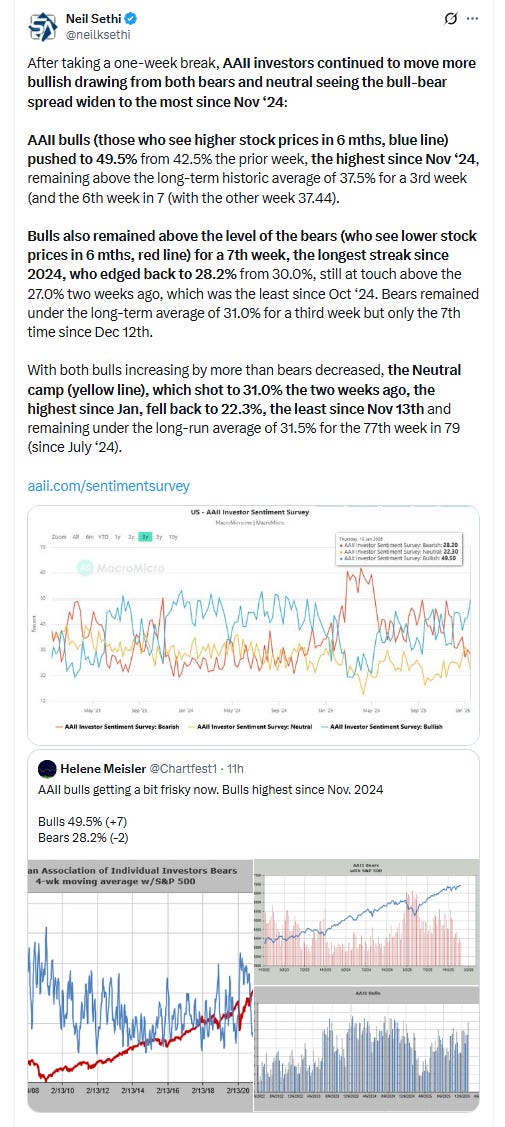

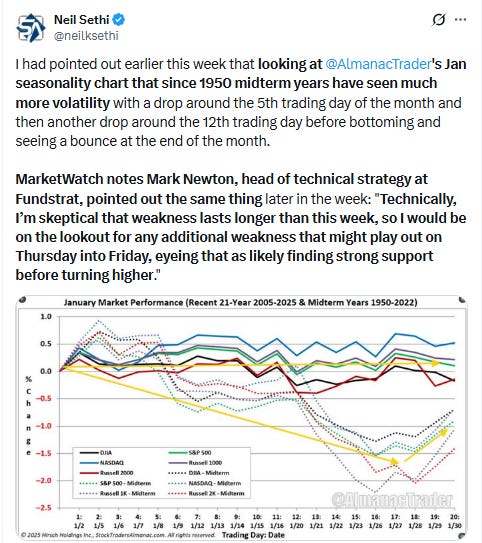

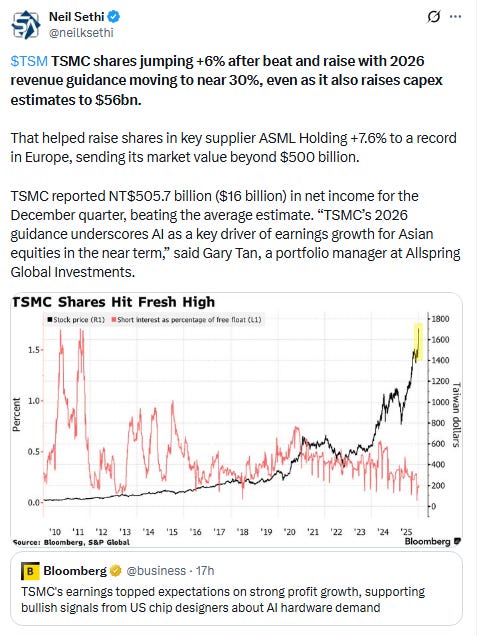

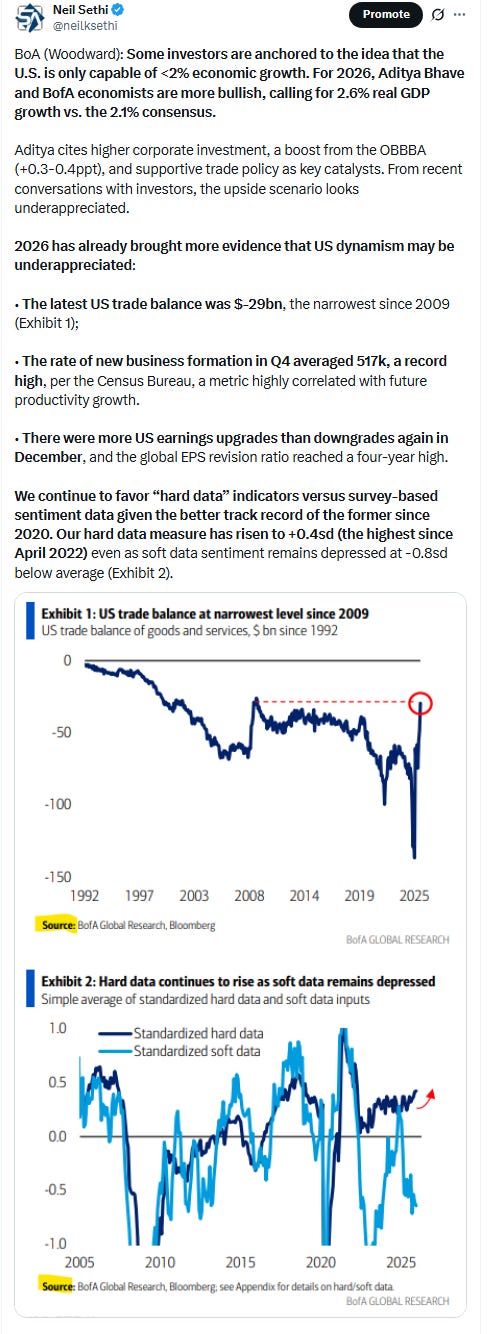

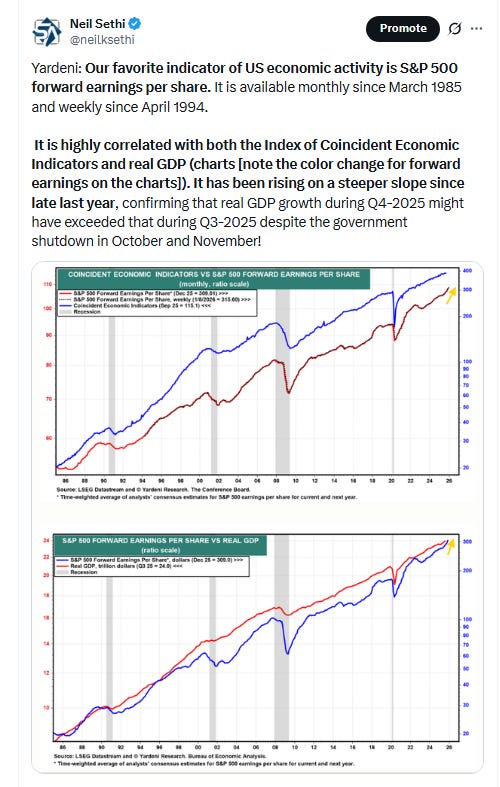

US equity indices opened higher after the first back-to-back losses for the SPX this year as the tech trade is back on track (at least as far as suppliers go) following Taiwan Semiconductor delivering another record quarter, reporting a 35% jump in profit, boosting its capital spending plans, and raising 2026 expected revenue growth to close to 30%. It would finish up over 6%. TSMC suppliers Applied Materials and Lam Research rose more than 7% in the premarket while ASML hit a record in Europe. Financials were also stabilizing after Blackrock reported a record quarter of asset inflows, while Goldman Sachs and Morgan Stanley both reported very strong results as well. They would build on early modest gains to finish up 4% and 6% respectively and new 52-week highs. We also got before the bell jobless claims which fell back, with initial claims falling to near 50-year lows.

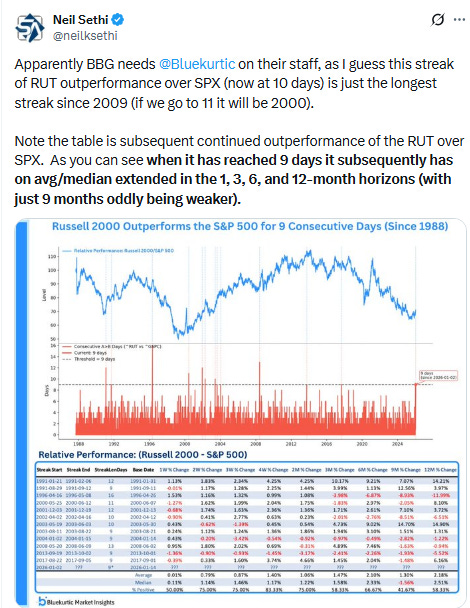

The Nasdaq led at the open, but the small cap Russell 2000 (RUT) would overtake it and the SPX by late morning as the latter two along with the DJIA traded sideways most of the session. All would fall back though the last 90 minutes but all also at least end in the green. The RUT led +0.9% (outperforming the SPX for an 11th session, the longest streak since 2000), DJIA +0.6%, Nas/SPX +0.3%.

Elsewhere, bond yields were higher, while the dollar was as well. Crude pulled back sharply after Pres Trump appeared to take further near-term Iranian action off the table, and gold, copper, and bitcoin were lower as well. Natgas ended little changed.

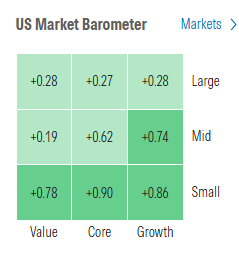

The market-cap weighted S&P 500 (SPX) was +0.3%, the equal weighted S&P 500 index (SPXEW) +0.5%, Nasdaq Composite +0.3% (and the top 100 Nasdaq stocks (NDX) +0.3%), the SOXX semiconductor index +1.8%, and the Russell 2000 (RUT) +0.9%.

Morningstar style box clearly showed the weakness in the larger growth stocks.

Market commentary:

“When you come out of a year like 2025, a year of very strong equity returns, the market is trying to persist with what it thinks will be the winners of 2026,” said Martin Frandsen, portfolio manager at Principal Asset Management. “The jury is very much out there; it’s common that there’s high volatility in the first couple of weeks.”

“A solid earnings showing from Goldman Sachs and Morgan Stanley won’t erase sector angst overnight, but paired with Thursday’s improving risk tone, it strengthens the case that recent bank weakness reflects policy jitters rather than a deterioration in core earnings power, leaving room for financials to end the week on firmer footing if the broader backdrop cooperates.” — Brendan Fagan, FX Strategist, Markets Live

“Bank stocks rallied sharply in 2025 on expectations of a stellar fourth-quarter, and now may be suffering from buy-the-rumor-sell-the-news syndrome,” wrote Ed Yardeni of eponymous firm Yardeni Research. “We expect bank stocks will be off to the races after consolidating last year’s gains, boosted by continued strong earnings growth.”

“Technology stocks had looked vulnerable in recent weeks as investors rotated away from megacap names and into more cyclical areas of the market,” said Fawad Razaqzada Forex.com. “TSMC’s update, though, appears to have stabilized that ‘rotation’ rather than reversed it outright.”

“Taiwan Semi’s results today, and more importantly, their capex spending plans, point to reassuring investors that the AI trade is not necessarily a bubble at this point,” said Kim Forrest, investment chief at Bokeh Capital Partners. “They’re going to spend money, lots of money, to build out capacity.”

Thursday’s action suggests a bit of “bargain hunting” – especially in the tech space after the TSMC news as well as the pullback seen over the past couple of weeks, according to Kenny Polcari at SlateStone Wealth. “If earnings continue to beat expectations and economic data remains supportive, the likely path remains advance, backfill, then advance again,” he noted.

While stocks are bouncing as the entire technology sector is getting a boost, there is growing evidence that the not only are we seeing some “rotation” between different sectors in the marketplace, but we’re also seeing some of that rotation within the tech sector, said Matt Maley at Miller Tabak. “In other words, investors seem to be a lot more confident that chip stocks can continue to grow their profits while they’re not so sure that the buyers of all of these chips — the hyperscalers — will see the same kind of profit growth,” Maley said.

2026 quarterly estimates for mid- and small-cap indices are expected to outpace comparative growth for the large-cap benchmark, noted Sam Stovall at CFRA. Valuations are contributing to the rotation. “As a result, this projected acceleration in earnings-per-share growth rates should allow for continued relative price outperformances for these smaller asset classes, Stovall concluded.

A strong macro environment in 2026, supported by easier monetary conditions and robust fiscal stimulus across major economies, is likely to favor cross-regional performance, according to Magdalena Ocampo at Principal Asset Management. “AI, which has fueled US large-cap tech gains, faces greater scrutiny as investors shift focus from aggressive AI-related spending to profitability,” she said. “While US tech allocation remains important, it may be prudent for investors to diversify into regions offering direct or indirect AI exposure at more attractive valuations and benefiting from supportive policy tailwinds.” Ocampo also notes that AI reinforces the importance of maintaining US exposure given its tech leadership. Still, concerns over aggressive AI-driven spending and high valuations heighten pressure for companies to deliver on earnings. “Given US equity market concentration, investors should seek diversification,” she said.

“This earnings season will give investors confidence in the durability of earnings growth, which is a key driver for market returns over the next 12 months,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

“We maintain our S&P 500 year-end target at 7,700 and recommend under-allocated investors add exposure to our preferred areas,” she said.

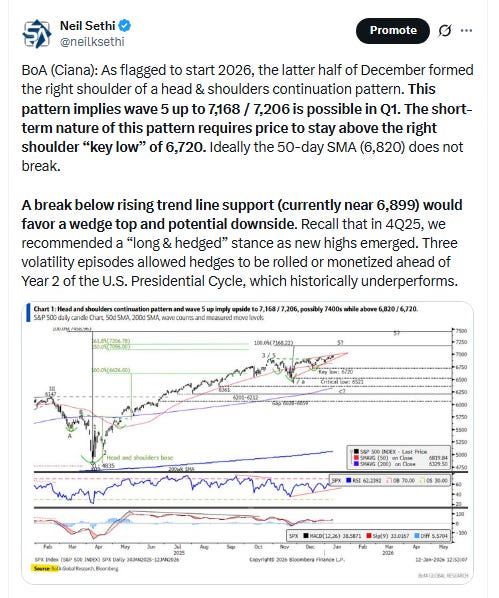

“Overall, a broad-based bounce arguably should begin again in US equity indices, but gains likely could depend on the ‘Magnificent Seven’ showing a bit more stabilization after recent weakness,” said Mark Newton at Fundstrat Global Advisors.

In a Thursday client note, a team led by Macquarie strategist Thierry Wizman said traders will be on a knife's edge in 2026, balancing hope for disinflation from an AI-productivity boom with potential harm from reinflation as the world's economies seek control over crucial minerals and commodities.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

Chip plays led the market after Taiwan Semiconductor delivered another record quarter, saying it expects to boost capital spending in 2026 to between $52 billion and $56 billion — an outlook signaling confidence in the artificial intelligence buildout from the world’s largest contract chipmaker. The stock jumped more than 6%. The VanEck Semiconductor ETF (SMH) climbed 3%, with Nvidia and Micron Technology adding more than 2% each.

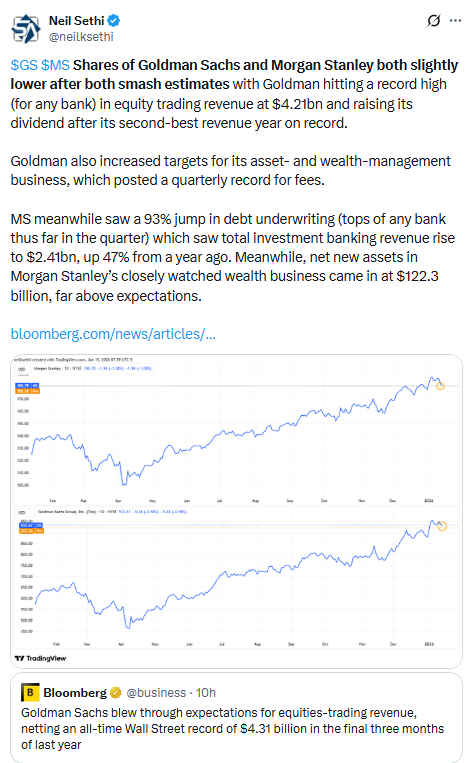

Bank stocks rose following the latest raft of quarterly earnings. Goldman Sachs advanced 4% after its fourth-quarter profit topped Wall Street estimates. Morgan Stanley jumped nearly 6% after its wealth management unit contributed to top and bottom line beats in the fourth quarter. Both stocks touched fresh 52-week highs.

Corporate Highlights from BBG:

OpenAI is looking to bolster its US hardware supply chain and find partners for a push into consumer devices, robotics and cloud data centers, part of a major product expansion planned for the coming years.

Tight memory chip supplies will constrain the number of US export licenses for Nvidia Corp. to sell its H200 artificial intelligence processors to Chinese customers, according to the top Republican on the House China committee, citing terms of a Commerce Department rule issued this week.

Goldman Sachs Group Inc. blew through expectations for equities-trading revenue, posting an all-time Wall Street record of $4.31 billion in the final three months of last year.

Morgan Stanley’s debt bankers increased revenue 93% in the fourth quarter, by far the biggest jump on Wall Street and capping a record year for that business.

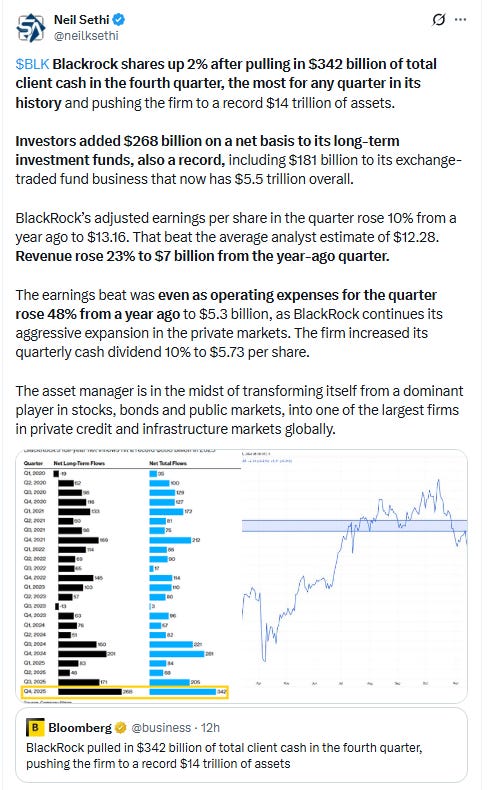

BlackRock Inc. pulled in $342 billion of total client cash in the fourth quarter, pushing the firm to a record $14 trillion of assets as it integrates a string of recent acquisitions to become a force in private markets.

BlackRock has raised $12.5 billion as part of a partnership with Microsoft Corp. to bankroll data centers and energy infrastructure, advancing its efforts to cash in on the artificial intelligence boom.

Carlyle Group Inc.’s wealth business has nearly doubled since Harvey Schwartz became chief executive officer in 2023 and is on track to account for some 20% of the firm’s capital flows.

A judge turned back Amazon.com Inc.’s initial challenge to Saks Global Enterprises’ foray into Chapter 11, by approving short-term financing for the bankruptcy.

A judge refused to fast track Paramount Skydance Corp.’s lawsuit accusing directors of Warner Bros. Discovery Inc. of misleading investors about a more than $82.7 billion buyout bid from Netflix Inc.

Paramount Skydance’s leadership has held talks in recent days with French President Emmanuel Macron amid a European charm offensive to garner support for its $108.4 billion hostile bid for Warner Bros. Discovery Inc.

Netflix Inc. obtained global streaming rights to Sony Group Corp.’s films after they complete their run in theaters and pay-per-view, adding releases from one of Hollywood’s biggest studios.

Boston Scientific Corp. agreed to buy medical device maker Penumbra Inc. in a deal valued at more than $14 billion to expand in the treatment of blood clots and stroke.

Talen Energy Corp. agreed to buy three natural gas power plants from Energy Capital Partners for $3.5 billion as power producers race to snap up generators with the AI boom driving up electric demand.

Coterra Energy Inc. is exploring a combination with Devon Energy Corp., according to people familiar with the matter, a potential tie-up between two shale explorers that would be among the biggest oil and gas deals in years.

Verizon Communications Inc. said it would issue $20 credits to customers affected by a widespread service outage on Wednesday, which it attributed to a “software issue.”

A US judge ruled Equinor ASA can resume building its multibillion-dollar wind project near New York, marking the second time this week a federal court has blocked the Trump administration from enforcing a halt on offshore developments.

Mastercard Inc., Visa Inc. and UK fintech Revolut Ltd. lost a lawsuit with the UK regulator over its plans to usher in a cap on cross-border card fees.

Spotify Technology SA is raising the price of its premium subscription service by 8% in an effort to achieve sustained profitability.

Ashmore Group Plc’s first quarterly net inflows since 2021 signaled a potential reversal of fortune for the emerging-markets-focused asset manager that’s seen persistent client redemptions in recent years.

UniCredit SpA said that recent media reports about its interest in potentially buying a stake in rival Banca Monte dei Paschi di Siena SpA were “unjustified.”

Richemont’s customers splurged on its watches and Cartier jewelry over the holidays particularly in the US, even as wider concerns about the luxury market remain.

Mid-day movers from CNBC:

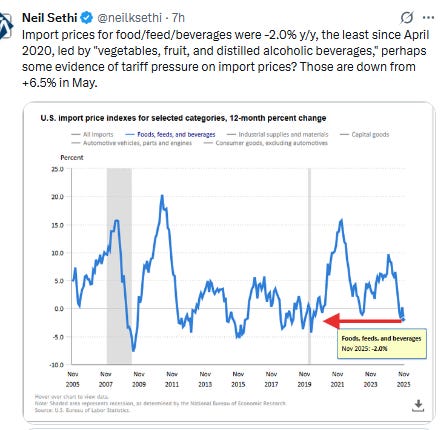

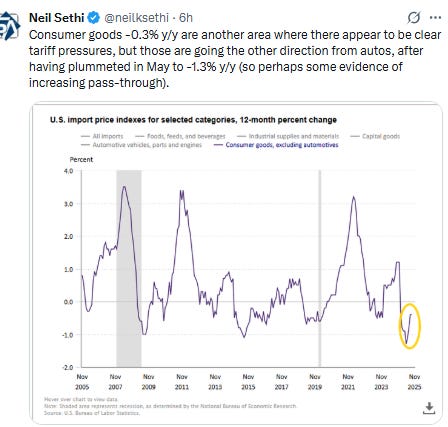

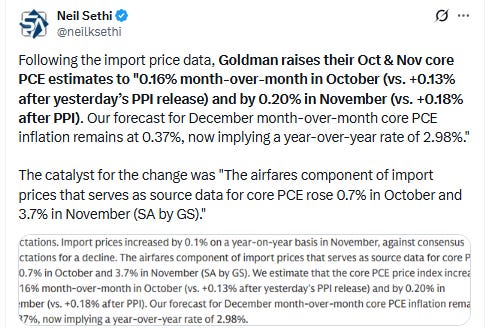

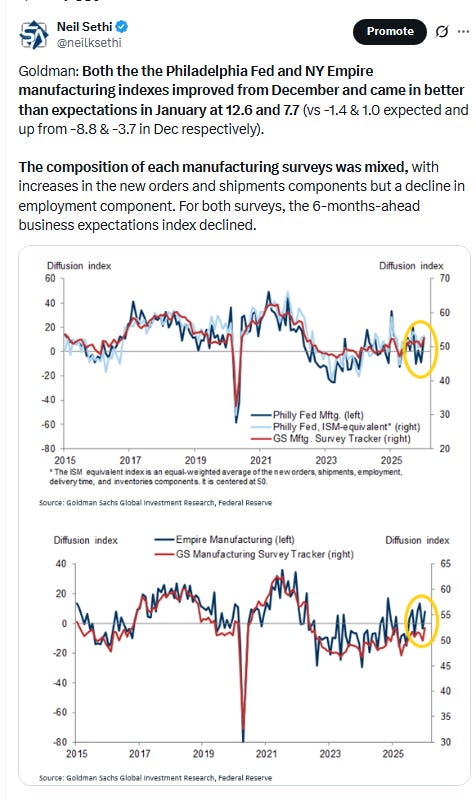

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

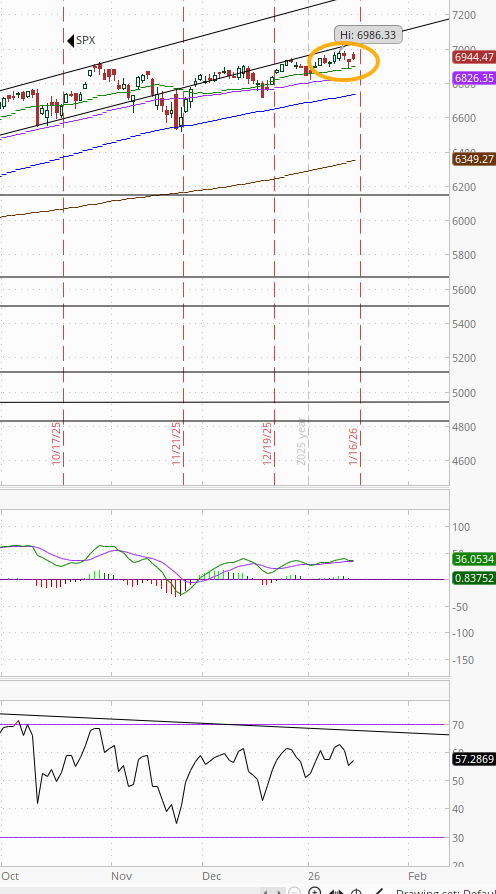

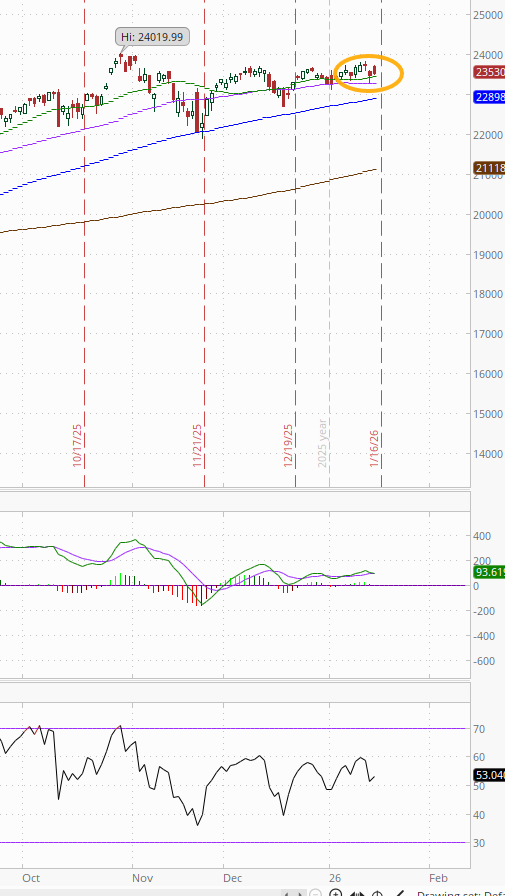

The SPX edged up but not quite to an ATH. The daily MACD and RSI are both neutral with a negative divergence but at least had made new local highs.

The Nasdaq Composite a similar story although hasn’t made an ATH since Oct.

RUT (Russell 2000) remains the best chart of the bunch continuing on its rebound from its 50-DMA hit two weeks ago with another ATH. Its MACD as noted last week did cross to a “go long signal” and the RSI is now dipping a toe in overbought territory.

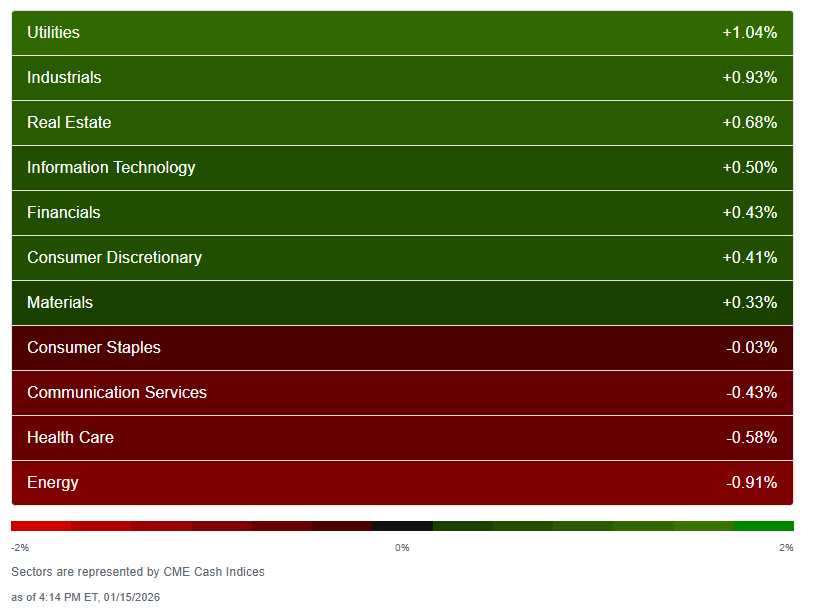

Sector breadth according to CME Cash Indices (uses futures prices) remained relatively healthy (as it’s been all year ex-Jan 7th).

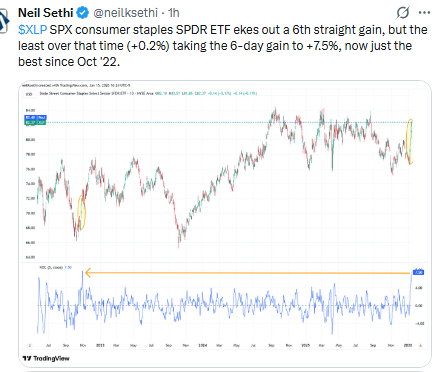

7 of 11 sectors were higher (there have been 7 sectors or more in the green every day this year other than the 7th & 14th when there were 3 and 6)), and if you use sector ETF’s Staples was also higher at +0.2% (which was a 6th-straight gain), but just one up over +0.7% (vs five Wed, three Mon/Tues, seven Fri, six a week ago) and one at least +1% (vs three Wed, two Tues, one Mon, five Fri, four a week ago).

The top four changed for the first time since Mon although it still contained Utilities (which led today) and RE. Joining them were Industrials and Tech (Tech after finishing next to last Wed). Financials in the green for the first time since Thurs.

Two sectors down more than -0.5% (down from three Wed, matching Mon/Tues after none Fri) but none down more than -1% (after two Wed, one Tues). Leading to the downside was Energy -0.9% after leading Tues/Wed.

SPX stock-by-stock flag from @finviz_com for Thursday a somewhat different look with the bright green migrating to Tech hardware while the red moved to Energy and drugmakers. Software continued to be weak though while Industrials, RE, and Utilities again saw solid gains.

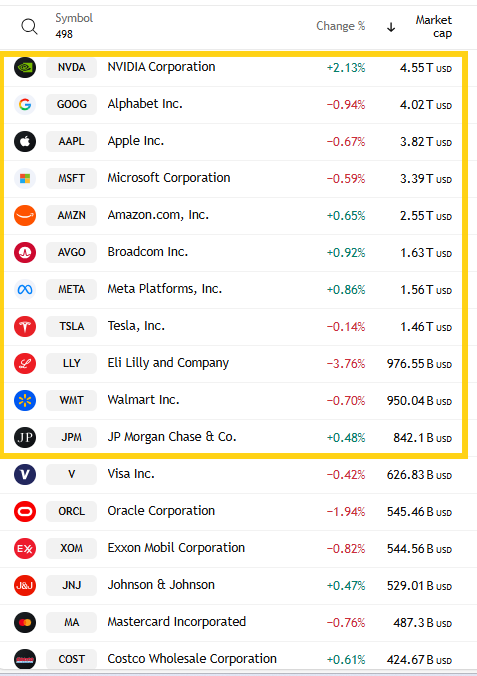

6 of the largest 11 SPX components were lower (from all 11 Wed, matching Tues). LLY easily led to the downside -3.8%. No others down more than -1%. Leading to the upside was NVDA +2.1%, the only up over +1%.

Mag-7 +0.2%, still down around -1.9% week-to-date (after gaining +0.7% last week rebounding from its worst week since April).

~40 SPX components were up 3% or more (after 25 Wed, 17 Tues, 15 Mon, 45 Fri, 70 a week ago). But it was back to a 2025 leader in KLAC leading +7.7%. 11 of those 40 up 3% or more were >$100bn in market cap (after 4 of 25 Wed, 3 Tues, 2 Mon, but 15 Fri) in KLAC, BLK, MS, AMAT, APH, GS, C, ANET, LRCX, CEG, IBKR (in descending order of percentage gains).

~12 SPX components down -3% or more (down from 20 Wed, 25 Tues, matching Fri/Mon) led by RobinHood HOOD -7.8%. Three of the 12 down -3% or more were >$100bn in market cap (from 8 Wed/Tues, matching Mon) in HOOD (although now not $100bn after the decline), BSX, LLY (in order of percentage losses).

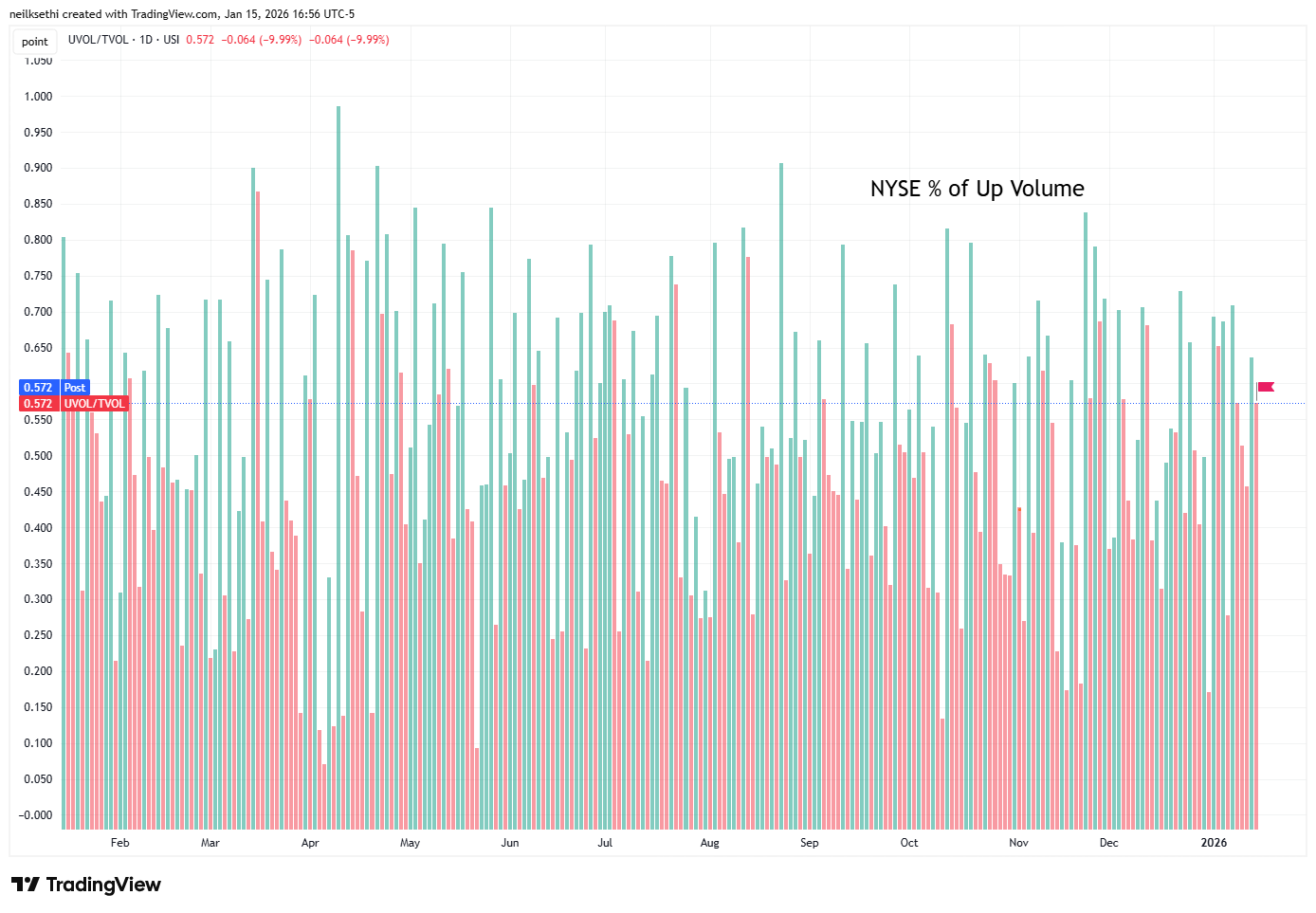

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) a little disappointing falling back to 57.2% from 63.6% Wed even as the index gain improved to +0.39% from +0.29%. Still that Wed reading was quite strong and the reading Thurs was still almost exactly the same as a week ago when the index gained +0.47%.

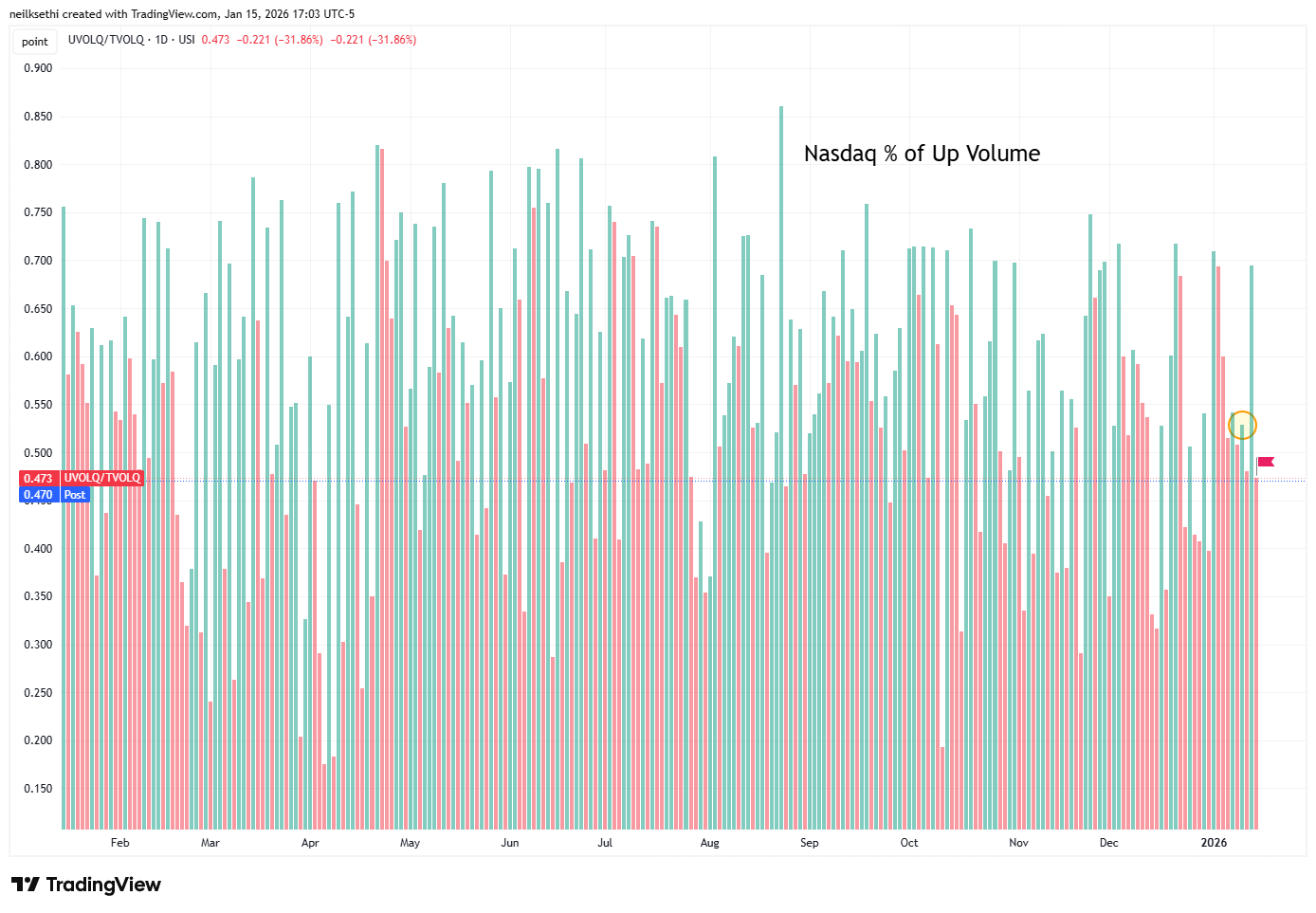

The Nasdaq positive volume (% of total volume that was in advancing stocks) deteriorated from the speculative fueled 69.2% Wed (which was even with the index losing -1%) to 47.3% Thurs even as the index improved to +0.25%. That reading though remains weak even with a fall-off in speculative activity. Compare to Monday when it was 52.9% on a +0.26% gain.

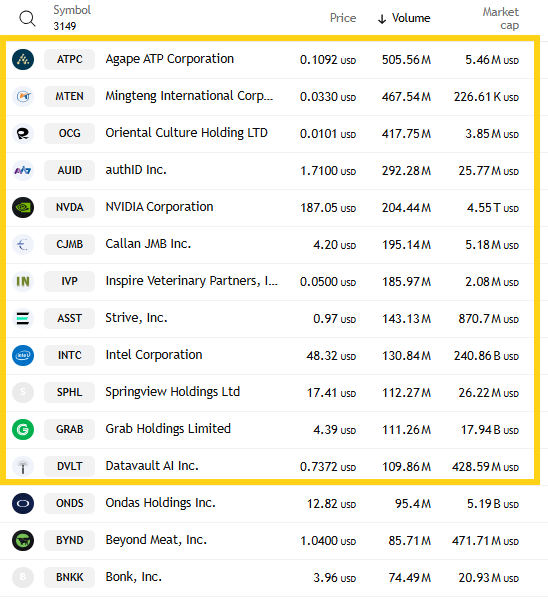

But as you probably already guessed the foregoing means speculative volume fell back from one of the highest days since the summer. The three stocks by volume though still accounted for 1.4bn, one of the highest figures we’ve seen in months outside of Wed (when they were 4bn). Again all penny stocks.

And there were still another nine that traded over 100mn shares (up from seven Wed) so speculative activity remains elevated if a little off the extreme levels of Wed.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, though didn’t reflect it today with the Nasdaq actually higher than positive volume at 54%, down a touch from the 55% Wed, while the NYSE was 66%.

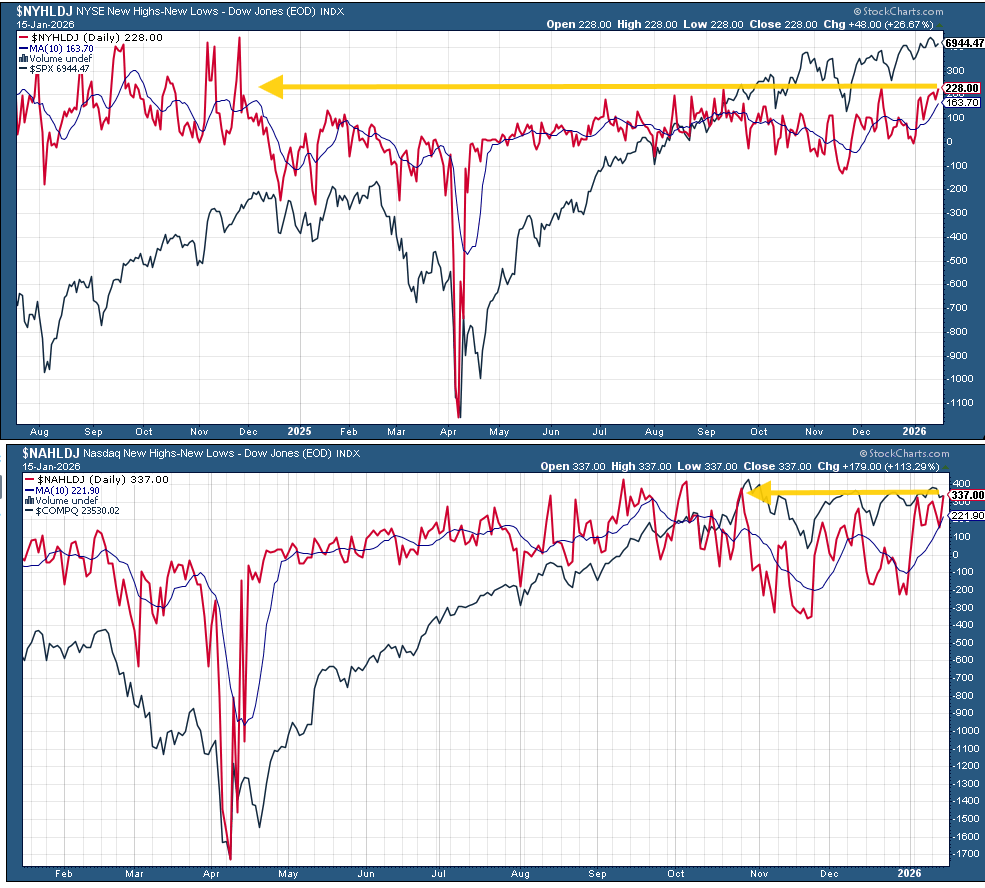

New 52-wk highs minus new 52-wk lows (red lines) though improved to 227 on the NYSE, the best since Nov ‘24, while the Nasdaq moved to 335, the best since Oct.

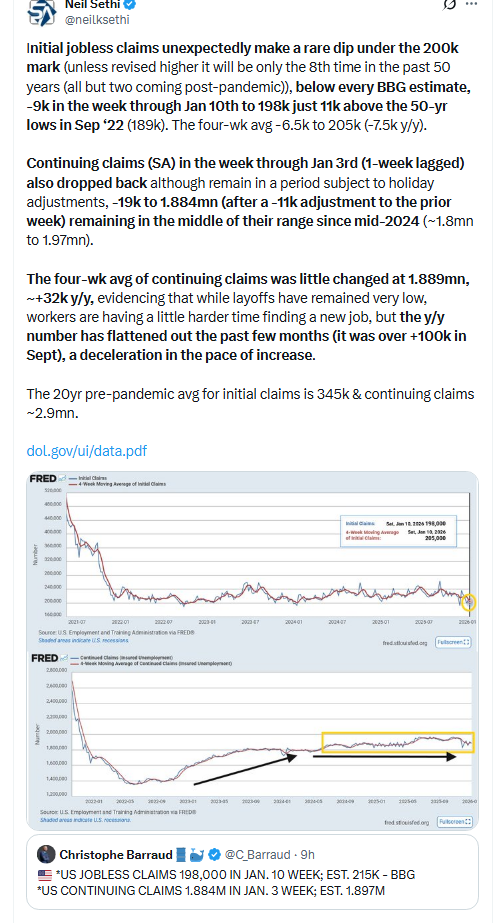

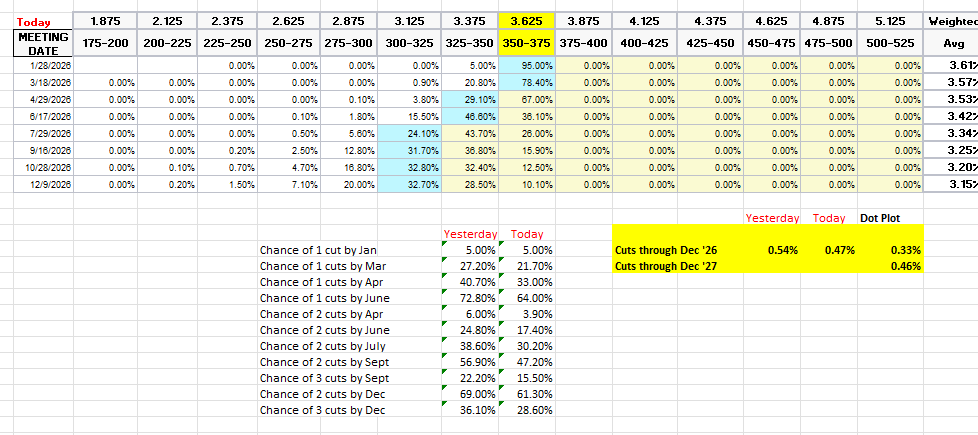

After NFP, CPI, etc., it was jobless claims (with a rare sub-200k initial claims number) and a few Fed speakers (most notably Philadelphia Fed Pres Paulson, one of the more dovish, who said rate cuts should be delayed until inflation moves closer to 2% absent a major softening in the labor market) which moved #FOMC rate cut pricing the most so far this month with 7bps of cuts priced out of 2026 and expectations falling to under two cuts and the least since pricing for the contract was initiated.

January didn’t move, but off the table unless the Fed chooses to revive it (unlikely) at 5%. March is just 22% (from 51% Jan 6th), April 33% (from 63%), with the first cut in June (64%). A second cut is now not until Oct (55%, it was 55% in July Jan 6th).

Pricing for 2026 dropped to 47bps (as noted below two cuts for the first time, with pricing for two cuts 61% and three cuts 29%, down though from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

The 10yr #UST yield edged up to 4.16%, in the middle of its range since the start of December. As noted Friday, it has traded in a 10bps range since then despite all of the headlines, movement in Fed rate cut expectations, etc.

The 2yr yield, more sensitive to FOMC rate cut pricing, moved more sharply higher +5bps to 3.57%, the highs of the year and now right up against the top of the channel it’s been in since the start of 2024, -8bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) after pausing for a few days, continued its move higher, pushing above the 50 and 200-DMAs to the highest close since Nov.

It has not sustained a breakout above the 200-DMA since it fell under last February. The daily MACD is just about into “go long” positioning and the RSI is the best since Nov (and over 60) giving some technical support to a breakout.

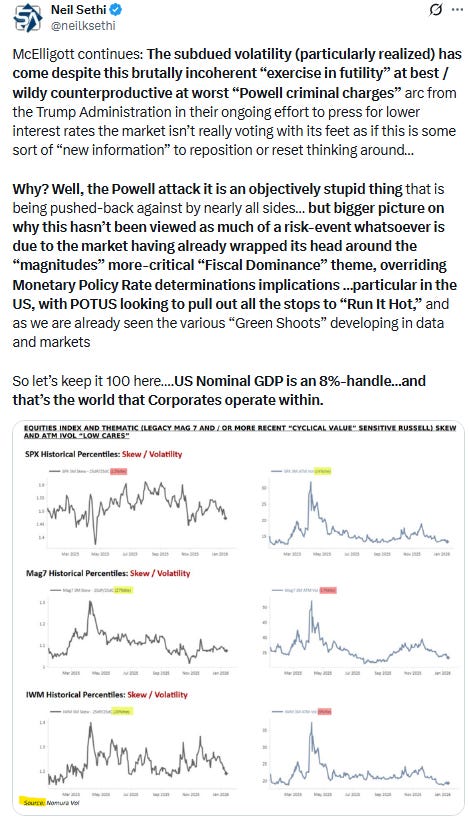

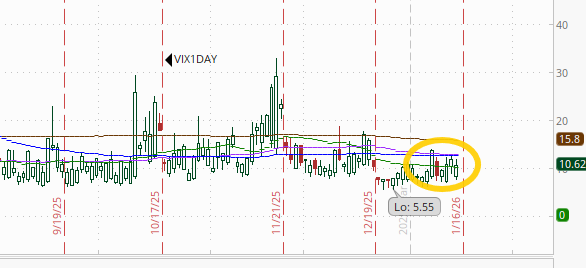

VIX edged back from the highest close in nearly a month to 15.8. The current level is consistent w/~0.98% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also fell back from its highest close since Nov after a big two-day move higher to 100.9.

The current level is now consistent with “moderately elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is also a level flagged by Charlie McElligott as one to watch.

And like the VIX and VVIX, the 1-Day VIX fell back a little now at 10.6. The current reading implies a ~0.66% move in the SPX next session.

I noted Friday “we finally have a tentative breakthrough, as #WTI futures closed Friday for the first time above both the 50-DMA and downtrend line from the July highs since that time,” and then added yesterday “they built on that again Wednesday taking them all the way to the 200-DMA target (brown line) where they failed (as I expected on the first try). The daily MACD remains supportive (cover shorts) and RSI is strongest since June, so I expect it will test that level again subject to news headlines (de-escalation with Iran, etc.).”

Unfortunately for crude bulls that’s exactly what we got “de-escalation with Iran” and WTI predictably fell back, although it finished a little off the lows after finding support at the 50-DMA. We’ll see if that can continue to hold.

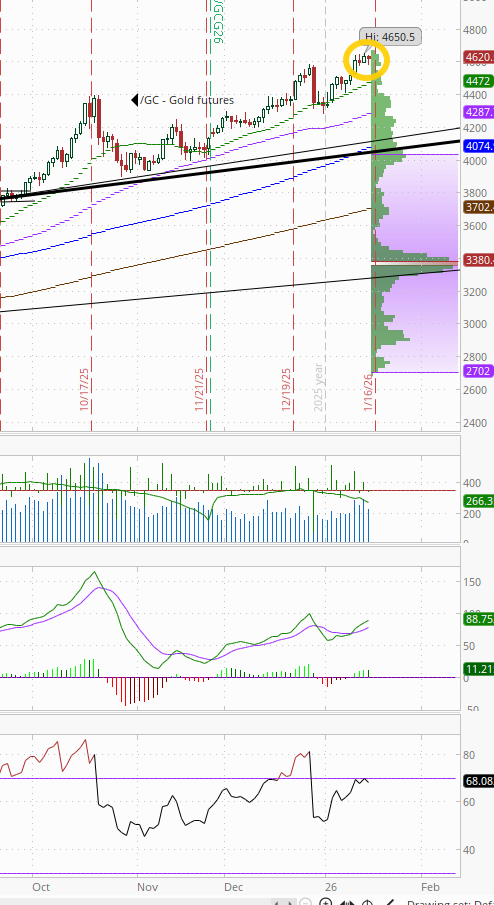

Gold futures (/GC) edged just off their all-time high. Daily MACD remains in “go long” positioning, while the RSI is over 60.

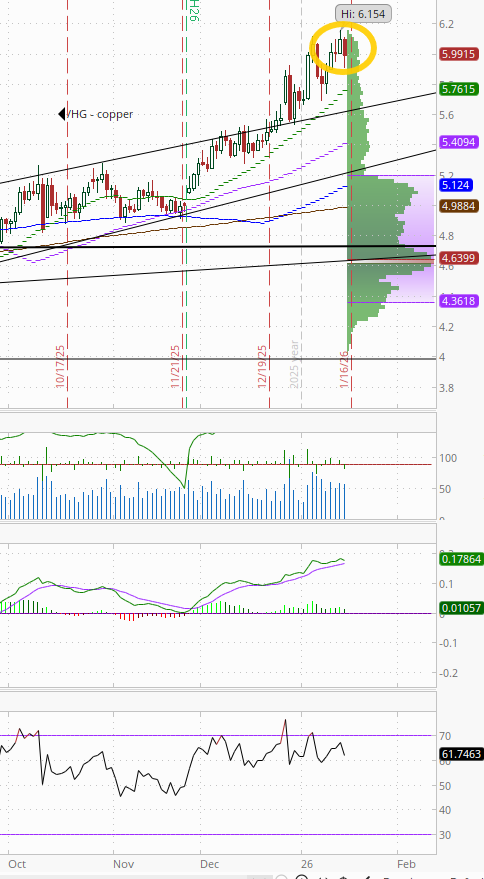

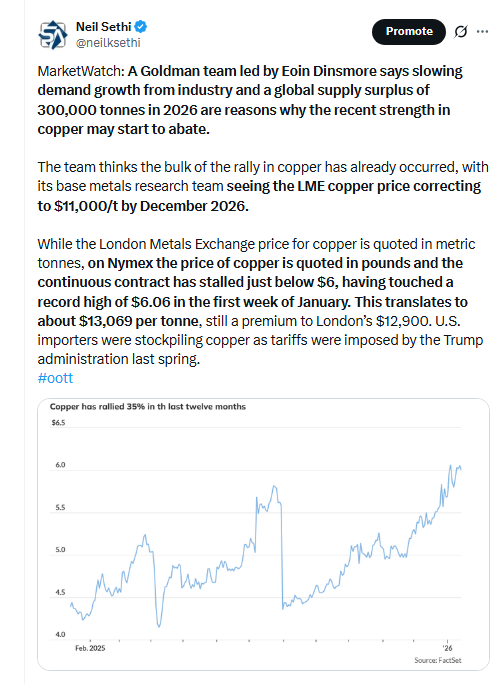

US copper futures (/HG) also fell back from all-time highs. Daily MACD remains in “go long” positioning while the RSI still has a negative divergence (lower high, minor).

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

On natgas futures (/NG) I noted Mon, “we’ve seen bounces several times during this decline, so need to see more before I take the $3 target off,” and today they made it down to $3 where they found support as I had expected. That completed a nearly -50% drop from the peak Dec 5th. Just below is a major support line running back to the low in Feb ‘24 (second chart).

The daily MACD remains firmly in ‘go short’ positioning, and RSI is still around the weakest since April, but I do expect this area will offer better support.

I asked Tues if Bitcoin futures were “perhaps ready for a run to $100k?” after they made it through the 50-DMA (the first close over the 50-DMA since October), and they got halfway there Wed up +3.6% and clearing the $95k level, but Thurs couldn’t get the rest of the way there.

The daily MACD still remains in “cover shorts” positioning (positive), while the RSI is over 50 so I continue to expect them to at least test that $100k level.

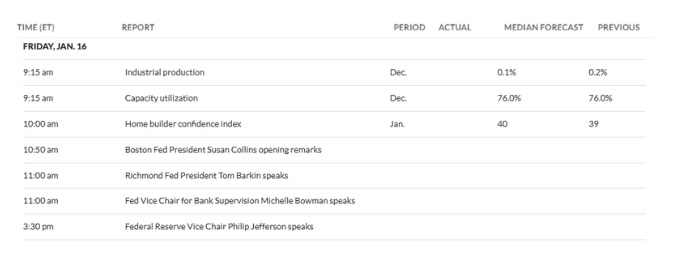

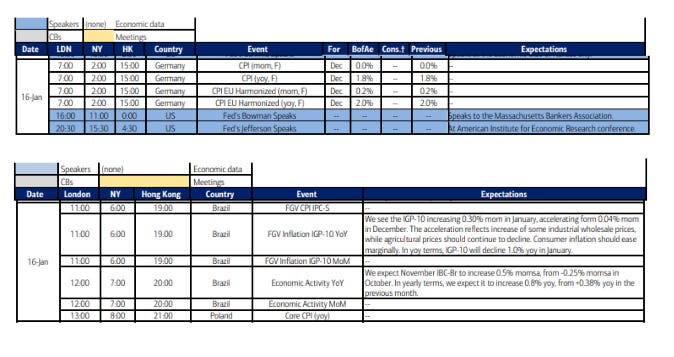

The Day Ahead

US economic data gives us our most complete look at manufacturing with Dec industrial production along with the Jan NAHB home builder confidence index (which I would imagine will get a lift).

We’ll wrap up our last Fed speakers before the blackout starts Friday night with Gov’s Bowman and Jefferson. Both are interesting. Vice-Chair Jefferson (who along with Powell and Williams form the “core” of the committee) doesn’t speak much, but I would be shocked if he didn’t reiterate what Williams said this week about policy being “in a good place,” etc. Gov Bowman I was interested in hearing last week to see if she has reigned in her dovishness after being removed from consideration as Fed Chair, but she didn’t touch on monetary policy, maybe tomorrow.

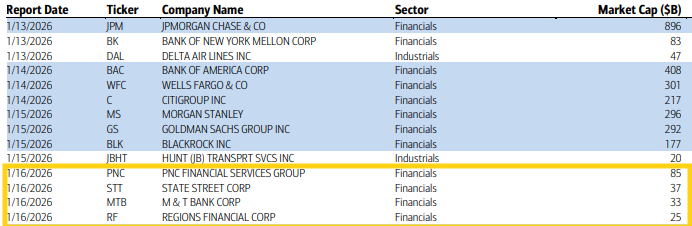

Q4 SPX earnings season continues Fri with another 4 SPX reporters, all of which are regional banks and none of which are over $100bn in market cap in PNC, STT, MTB, RF (in order of market cap).

Ex-US DM as noted Sunday is a light week, and there’s really not much Friday.

In EM, highlights are S Korea trade and unemployment, Brazil inflation and economic activity.

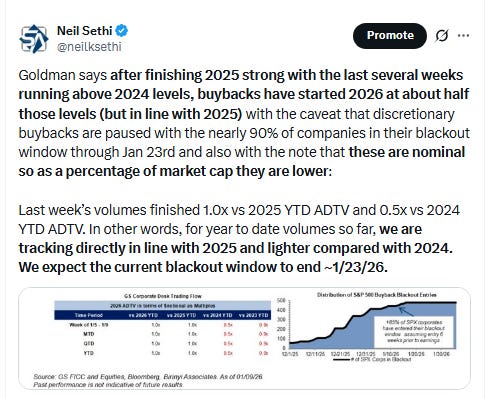

From Goldman:

Friday, January 16

09:15 AM Industrial production, December (GS flat, consensus +0.1%, last +0.2%)

Manufacturing production, December (GS -0.2%, consensus -0.1%, last flat)

Capacity utilization, December (GS 75.8%, consensus 76.0%, last 76.0%)

We estimate industrial production was unchanged in December, reflecting strong natural gas production offset by weak oil and auto production. We estimate capacity utilization edged down to 75.8%.

10:00 AM NAHB housing market index, January (consensus 40, last 39)

11:00 AM Fed Vice Chair for Supervision Bowman speaks

Fed Vice Chair for Supervision Michelle Bowman will speak on the economic outlook and monetary policy to the Massachusetts Bankers Association. Speech text and moderated Q&A are expected.

03:30 PM Fed Vice Chair Jefferson speaks

Fed Vice Chair Philip Jefferson will give a keynote address at the American Institute for Economic Research Conference in Boca Raton, Florida. Speech text and audience Q&A are expected. On November 17th, Vice Chair Jefferson noted that “while still solid, I continue to view the risk to my employment forecast as skewed to the downside,” adding that “the current policy stance is still somewhat restrictive, but we have moved it closer to its neutral level that neither restricts nor stimulates the economy.”

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,