Markets Update - 1/16/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

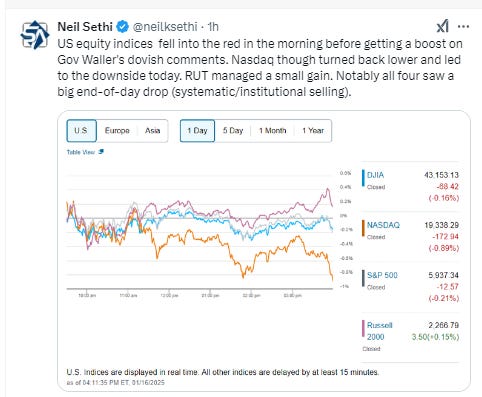

US equities started the day little changed as they digested Wed’s gains but fell at the open following a flurry of economic reports (noted in the economy section), led by a decent retail sales report which showed strong core spending, before recovering on some very dovish comments from Fed Gov Waller (noted in the FOMC section) which saw equities recover into positive territory. From there they diverged though with the Nasdaq falling in a choppy fashion throughout the day as the Mag 7 stocks sold off, ending the session at the lows, while the other indices were less volatile with the Russell 2000 finishing with a small gain, the S&P 500 and Dow with mild losses.

Elsewhere, yields fell back on the Waller comments as did the dollar (although it was supported by Treasury Secretary nominee’s comments). Gold, copper and nat gas saw strong gains, crude fell back while bitcoin was little changed.

The market-cap weighted S&P 500 was -0.2%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite -0.9% (and the top 100 Nasdaq stocks (NDX) -0.7%), the SOX semiconductor index +0.2%, and the Russell 2000 +0.2%.

Morningstar style box showed every style green but relative weakness in the large caps.

Market commentary:

“Investors are hitting the pause button following yesterday’s momentous rally,” said Jose Torres at Interactive Brokers.

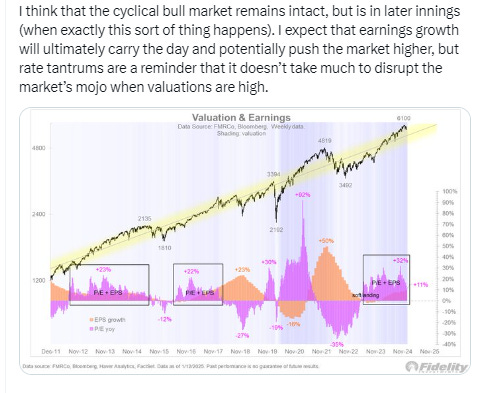

“So there’s some heaviness and almost even exhaustion to this market, as we all try to give this bull market another leg to go and see what fuels the next upside moment,” said Keith Buchanan, senior portfolio manager at Globalt Investments. “Earnings have started out with the banks being definitely a positive, but it seems there’s going to have to be more than that, and that’s what today’s action seems like,” Buchanan added.

“In the coming weeks, the fourth-quarter earnings season will provide investors with an opportunity to shift some attention from macro to micro data,” said David Lefkowitz at UBS Global Wealth Management. “We continue to have an attractive view on US equities.”

“We’re in a goldilocks scenarios where growth is holding up,” Suresh Tantia, a strategist for UBS Wealth Management, said on Bloomberg Television. “We do expect the earnings of tech companies in Asia to rise substantially this year, especially in the AI space.”

Even a solid corporate earnings season is unlikely to fuel a sustained rally in equity markets. That’s the view of Helen Jewell at BlackRock Inc., who warned the outlook for stocks remained fragile over the coming weeks amid concerns around economic growth and inflation. “It’s going to be a rocky reporting season, although not necessarily as much on the earnings number itself,” Jewell said in an interview. “My nervousness is more on how much beats get rewarded versus how much misses get hit, particularly in the US where the valuation multiple is very high.”

“The bond market was starting to price in the risk of further hikes, and so you get this slightly softer-than-expected inflation data, which allows you to have this big relief rally, mostly in the interest rate sensitive parts of the market,” Cameron Dawson, NewEdge Wealth’s chief investment officer, said Wednesday on CNBC’s “Closing Bell.” “Doesn’t mean that we’re necessarily out of the woods for things like small caps, in the volatility that they’ve been experiencing,” she added. “But the sigh of relief is welcome.”

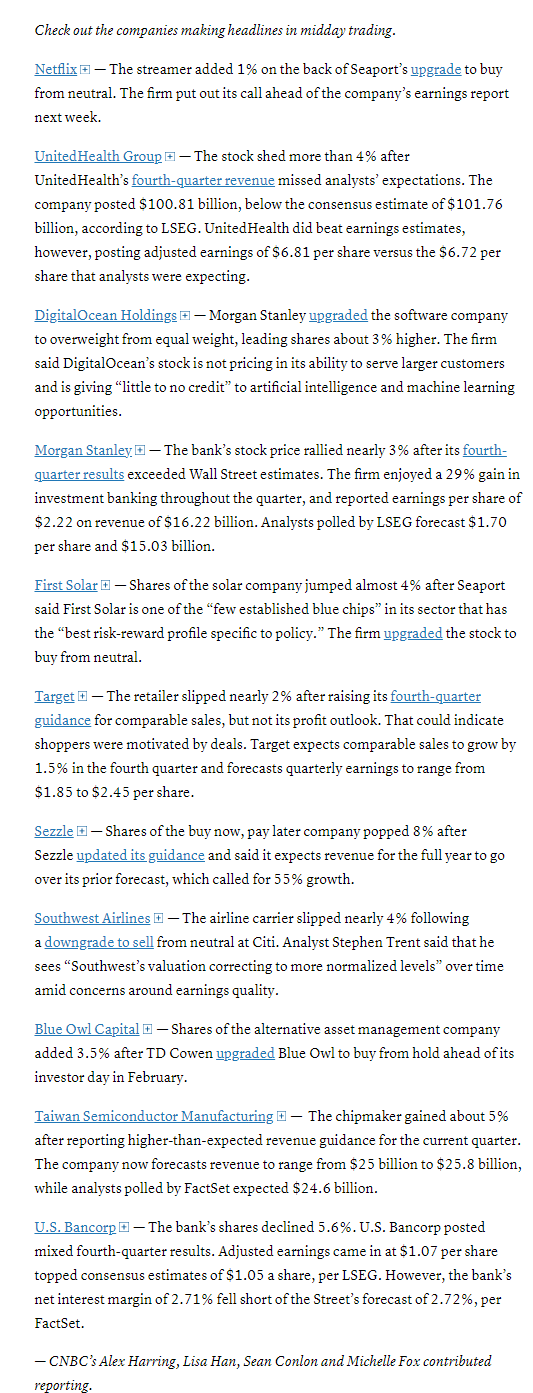

In individual stock action, Apple shares dropped 4% Thursday, its biggest daily loss since Aug. 5, when it fell 4.8%. So far in 2025, Apple is the worst-performing stock in the Magnificent Seven. Tesla dropped more than 3%. Nvidia slid about 2%, and Alphabet lost around 1%. A gauge of the “Magnificent Seven” megacaps slipped 1.9%.

Some companies that reported earnings traded lower despite better-than-expected results. Bank of America (BAC 46.64, -0.46, -1.0%) and US Bancorp (USB 48.03, -2.87, -5.6%) were among them while Morgan Stanley (MS 135.81, +5.26, +4.0%) hit a fresh 52-week high in response to earnings. Dow component UnitedHealth (UNH 510.59, -32.83, -6.0%) was another name that reported results, stumbling after reporting Q4 and year-end results that featured a higher medical care ratio.

Materials stocks in the S&P 500 are poised to notch their biggest weekly gains in more than a year. Every stock in the sector is on pace to finish the week in the green. CF Industries led the sector higher this week with a gain of more than 10%. Albemarle followed, rising around 9%.

BBG Corporate Highlights:

Morgan Stanley’s fourth-quarter profit more than doubled, boosted by trading revenue that came in well ahead of estimates on volatility tied to the US elections.

Bank of America Corp. posted fourth-quarter profit that topped analysts’ estimates as investment-banking fees hit the highest in three years and net interest income outperformed forecasts.

PNC Financial Services Group Inc. and U.S. Bancorp gave muted predictions for net interest income in the first quarter, amid uncertainty over how lower interest rates will revive lending demand.

Microsoft Corp. is raising the price of its package of Office apps for consumers, a bet that subscribers will be willing to cough up more for access to new artificial intelligence tools.

UnitedHealth Group Inc.’s elevated medical costs persisted in the fourth quarter and revenue missed estimates.

Target Corp. raised its sales guidance following a better-than-expected holiday season, but the boost wasn’t big enough to ease investors’ concerns about profitability.

American Express Co. will pay about $230 million to resolve a long-running investigation into some of the firm’s prior sales practices which regulators said misled small-business owners.

Rio Tinto Group and Glencore Plc have been discussing combining their businesses, according to people familiar with the matter, in what could result in the mining industry’s largest-ever deal.

Reliance Industries Ltd., controlled by billionaire Mukesh Ambani, posted a slightly better-than-expected quarterly profit, as gains from its telecom and retail units offset the volatility in its petrochemical business.

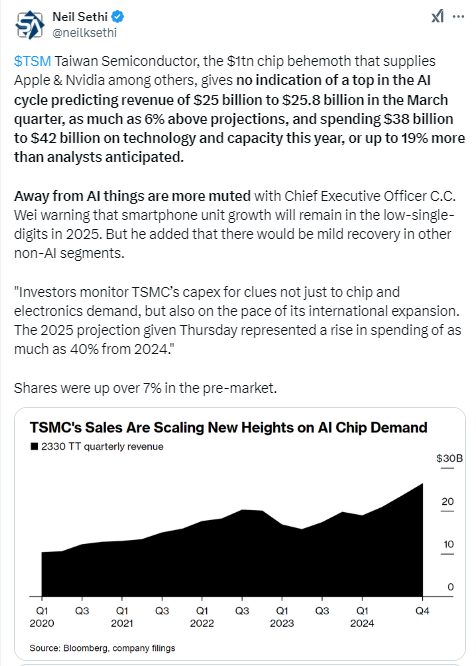

Taiwan Semiconductor Manufacturing Co. projected quarterly sales and capital expenditure ahead of analysts’ estimates, fueling hopes that spending on AI hardware should remain resilient in 2025.

Some tickers making moves at mid-day from CNBC.

In US economic data:

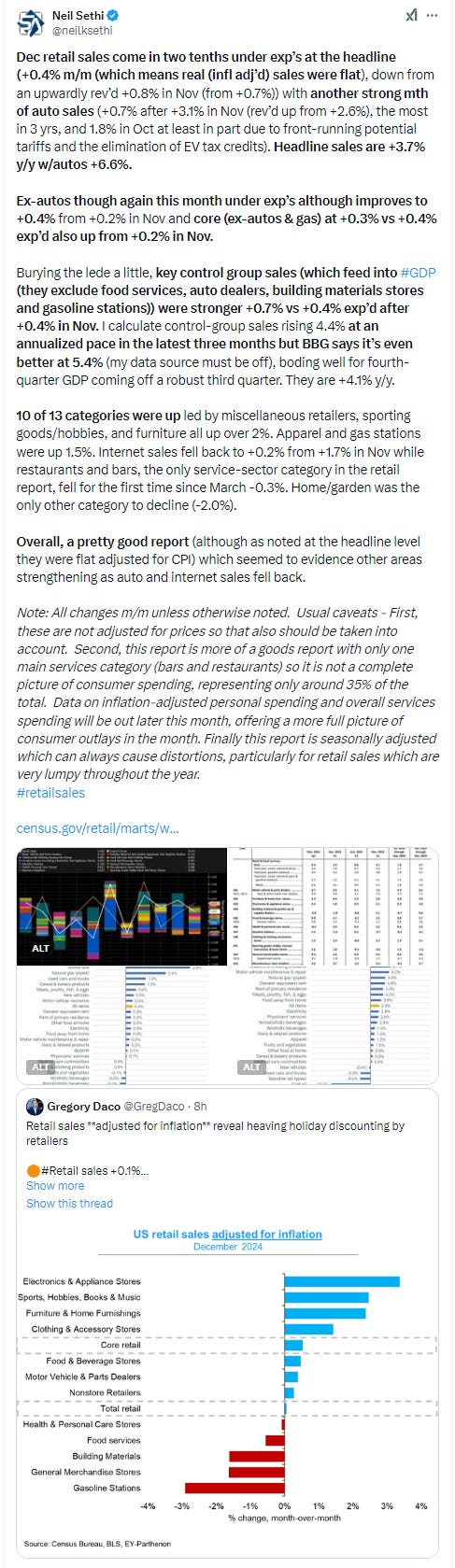

Dec retail sales come in two tenths under exp’s at the headline (+0.4% m/m (which means real (infl adj’d) sales were flat), but the key control group sales (which feed into GDP (they exclude food services, auto dealers, building materials stores and gasoline stations)) were stronger +0.7% vs +0.4% exp’d.

Dec import prices robbed us of an inflation trifecta coming in a tenth above exp’s headline (+0.1%), two-tenths above ex-petroleum (+0.2%) on the back of a +2.8% rise in food and beverage (the most since Jan ‘22) led by “vegetables, fruit, and coffee,” which more than offset decreases in industrial supplies/materials and finished goods.

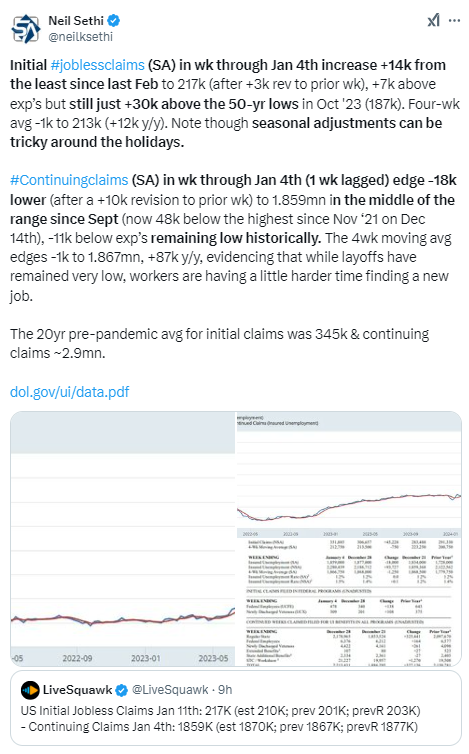

Initial jobless claims saw a small increase but remained near 50-yr lows while continuing claims fell back to the middle of the range since Sept.

Jan NAHB homebuilder sentiment edged up a point to 47, the highest since April and two tenths above exp’s but remaining below the 50 dividing line b/w poor/good conditions as buyer traffic continues to offset stronger results elsewhere.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX couldn’t get over the 50-DMA (has the downtrend line from its ATH just above). Daily MACD & RSI remain weak but are turning. As I noted Tuesday “maybe it’s setting up to put in a bottom.”

The Nasdaq Composite made it to the 20-DMA but fell back (I don’t think that was the issue as it hasn’t been much resistance previously, but it has had some trouble with that downtrend line from its ATH). Its daily MACD and RSI remain weak for now but are trying to turn more positive.

RUT (Russell 2000) able to continue its bounce from the 200-DMA getting over the downtrend line from November. As I noted last week though until it gets over the 2290 level “we can’t really look higher.” Still, as noted Wed, some good things going on with the chart with daily MACD crossing over to "cover shorts" and RSI strongest in a month.

Equity sector breadth from CME Indices deteriorated but still had 8 of 11 sectors in the green, with seven up over +0.5%, and three up over 1% (down from six Wed). The megacap growth sectors which took 3 of the top 4 spots yesterday took the bottom 3 today all finishing down at least -0.9%. Every other sector was up at least +0.4%.

Stock-by-stock SPX chart from Finviz consistent, with the Mag-7 all red after a sea of green yesterday. Apple down -4%, its biggest daily loss since Aug. 5. So far in 2025, it’s the worst-performing stock in the Mag-7. In contrast, utilities and real estate each had just one stock in the red.

Positive volume (the percent of volume traded in stocks that were up for the day) was ok at 63% Thurs for the NYSE, pretty middling given the decent gain in the NYSE Composite Index. Nasdaq was pretty good though at 57% despite the solidly down day. Positive issues (percent of stocks trading higher for the day) were 61 and 50% respectively.

New highs-new lows (charts) fell back though with the NYSE at 48 (still up from -264 on Monday) & the Nasdaq to -31 still up from -332 Monday (the Monday levels were the least since Nov ‘23 & Aug ‘24 respectively). They are still though both back above its their 10-DMAs which are starting to turn back up (more bullish).

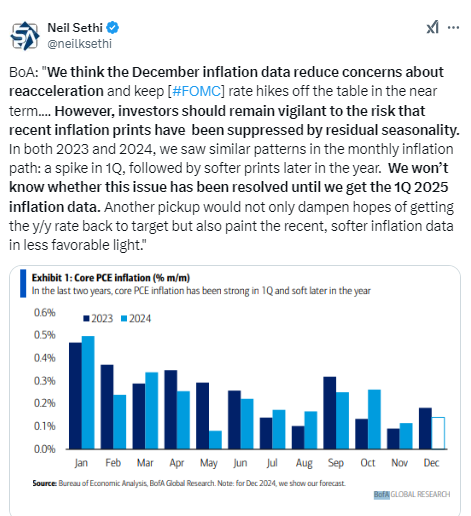

FOMC rate cut probabilities from CME’s #Fedwatch tool continued to add in cuts after the dovish comments from Gov Waller. January remains off the table, but the chance of a cut by March moved to 30% from 20% Tuesday, by May oddly edged back to 48% still up from 36% Tuesday, and by June to 69% from to 55%. Overall pricing for a 2nd cut in 2025 up to 54% with overall 2025 cut expectations at 43bps (from 27 on Monday) with the chance of no cuts at 14% (from 30% Monday).

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that until we get CPI this week. While the NFP report was strong, it’s important to remember with the data dependant Fed, it is only as strong as the last couple of months’ reports, so things can change quickly.

Longer duration UST yields fell for a second day following the Waller comments noted above with the 10yr -4bps to 4.61%, now down -18bps in two days, although still +23bps since the Dec FOMC meeting (& +85bps from the Sept FOMC meeting). I said yesterday “until it breaks 4.6% in my book it is still ‘eyeing’ 5%,” so I think this is a key level.

The 2yr yield, more sensitive to Fed policy, was -2bps to 4.24% now further below the current Fed Funds rate, down -15bps since Monday.

I still find this level a little rich, and I’m looking for it continue to soften in the near term.

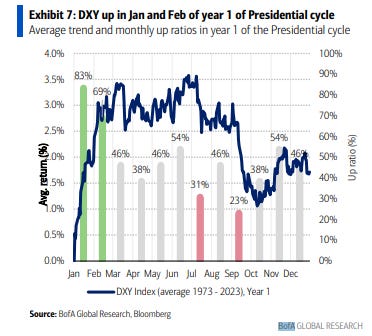

Dollar ($DXY) fell for a 4th session but so far has been able to hold its uptrend line. It remains not far from 26-mth highs. Daily MACD and RSI remain positive, but they’re starting to break their momentum trendlines.

The VIX edged a touch higher as it holds its uptrend line to the December low at 16.6 (consistent w/1.04% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly edged up to 99, right under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)). It did break its trendline today.

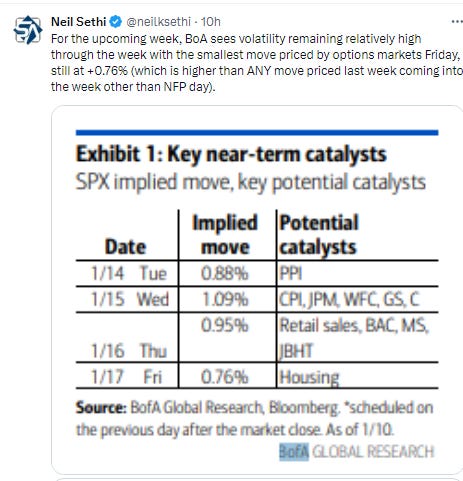

1-Day VIX also edged higher to 14.35, it’s looking for a move of 0.90% Thursday, above the 0.76% BoA saw implied coming into the week.

WTI fell below but recovered the $78 level, still though finishing -3% lower breaking its 4-day win streak. Daily MACD remains supportive but the RSI has moved from over to under 70, often consistent with a consolidation.

Gold followed its MACD & RSI that I noted Tuesday and pushed through the downtrend line from its ATH to a 1-mth high. Has relatively clear sailing to test that level. So far it’s ignoring the normal seasonal pattern of a weak January.

Copper (/HG) up for a 10th session to a 2-mth high after its close over the 200-DMA “opened up a run higher” as I noted last week. Its RSI and MACD remain positive, with the former the strongest since Sept.

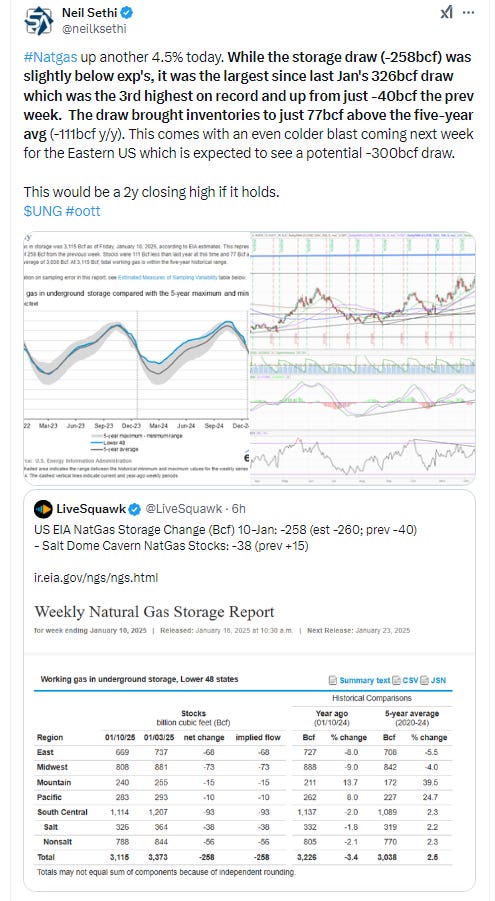

Nat gas (/NG) up another 4.5% (and the 13th session in 14 w/a 5% or more intraday range) to the highest close in 2 yrs. Daily MACD remains in “go long” position and RSI remains over 50 although continues to have a negative divergence (lower high).

Bitcoin futures held $100k, but still under that downtrend line from its ATH. The daily MACD and RSI remain weak for now but another green day would flip them positive.

The Day Ahead

US economic data ends a heavy week with Dec housing starts and permits and industrial production, the latter our most comprehensive look at the manufacturing sector.

No Fed speakers on the schedule.

In earnings, we’ll get another seven SPX components, but none >$100bn in market cap. Largest are Truist Financial (TFC) and Schlumberger (SLB) at around $55bn (Link to Seeking Alpha’s earnings calendar).

Ex-US we’ll get Dec UK retail sales and final EU Dec CPI as well as the minutes from the ECB Dec meeting. In EM, overnight we’ll get the big “data dump” from China (retail sales, industrial production, property investment, etc.) and tomorrow Brazil inflation data.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,