Markets Update - 1/20/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

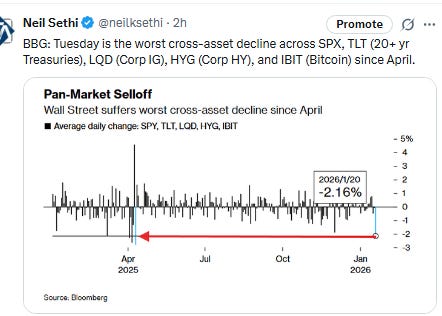

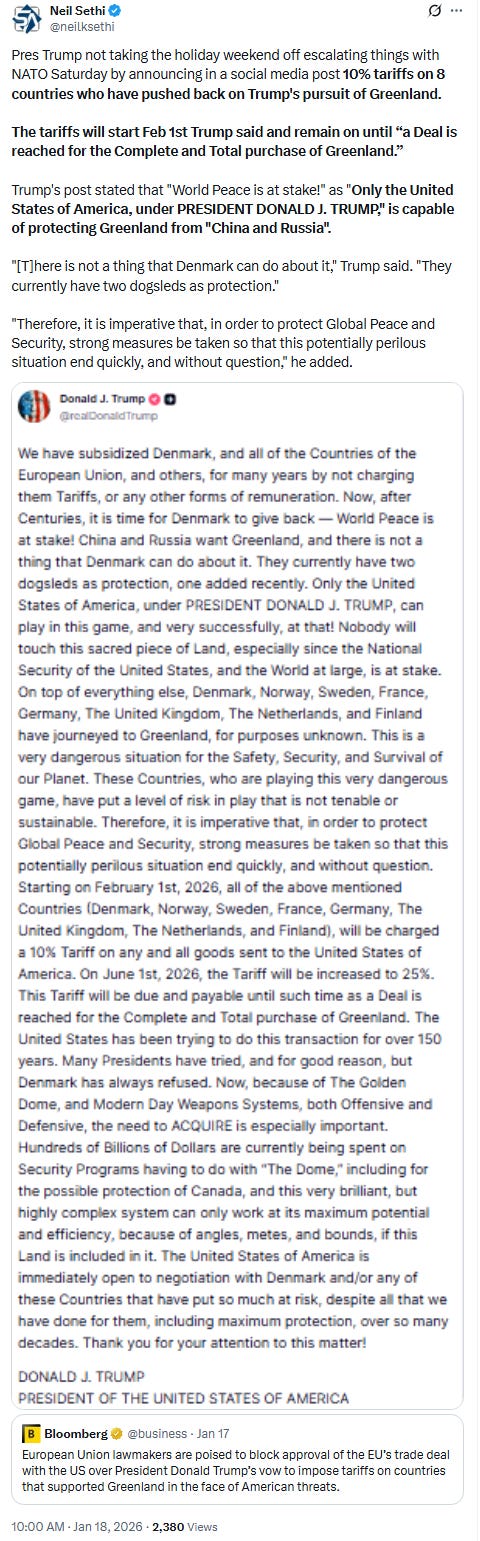

US equity indices started Tuesday solidly lower, after losses built in the overnight session, as US markets opened for the first time following Pres Trump’s tariff escalations over the weekend (which were continuing into Tuesday). Markets were also under pressure from a jump in US Treasury yields following a nearly unprecedented overnight surge in Japanese yields. Few stocks were escaping the combined fallout with technology shares underperforming as Nvidia, AMD and Alphabet all were lower by more than 2%.

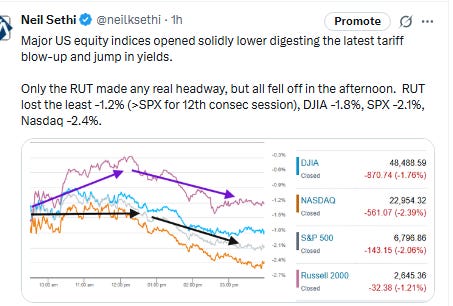

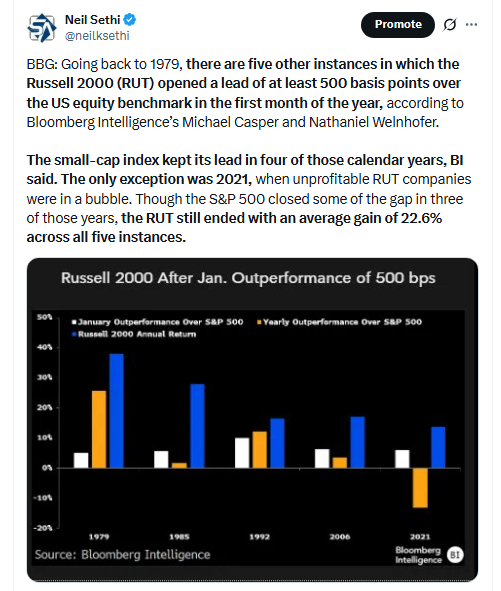

Post-open only the small cap Russell 2000 (RUT) was able to make any real headway, but it never got to positive territory, and all the indices fell off in the afternoon with no letup in any of the catalysts for the move lower. The RUT lost the least -1.2% (and outperformed the SPX for a 12th straight session), DJIA -1.8%, SPX -2.1%, and Nasdaq -2.4%.

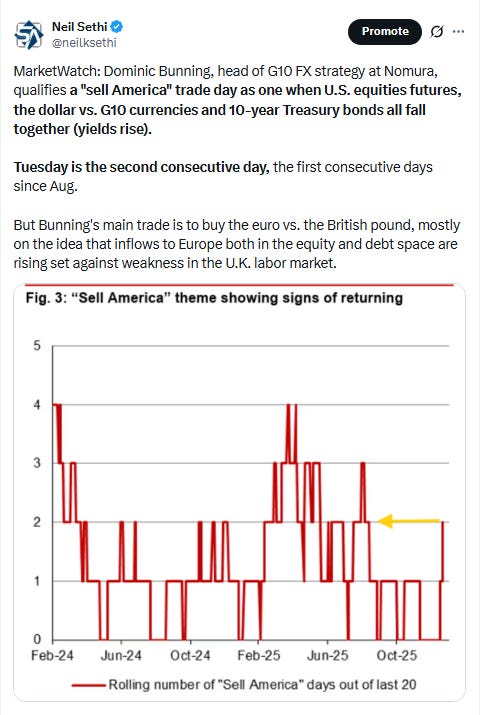

Elsewhere, long duration bond yields as noted jumped higher (shorter were little changed), but the dollar dropped on a “sell America” trade. Crude ended little changed as did copper, while gold and natgas surged (the former the most since 2020, the latter the most since 2006), while bitcoin fell sharply.

The market-cap weighted S&P 500 (SPX) was -2.1%, the equal weighted S&P 500 index (SPXEW) -1.5%, Nasdaq Composite -2.4% (and the top 100 Nasdaq stocks (NDX) -2.1%), the SOXX semiconductor index -1.7%, and the Russell 2000 (RUT) -1.2%.

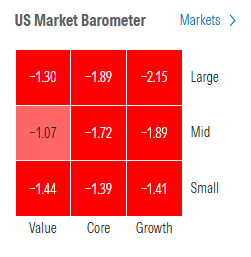

Morningstar style box clearly showed every style down at least -1%.

Market commentary:

“The nervousness is palpable,” said Alexandre Baradez, chief market analyst at IG in Paris. “All in all, you have so many issues piling up — from credit cards to the independence of the Fed and tariffs — that I really don’t see the case for stock markets to keep on breaching new records.”

“With the US off yesterday the implications of the tariff threats over Greenland had yet to fully percolate through financial markets,” Deutsche Bank’s Jim Reid said in a Tuesday morning note. “Markets have reacted but there’s clearly room for bigger moves if the rhetoric increases further.”

There’s “growing fears about some kind of retaliatory trade escalation from Europe, with increasingly strong comments from several officials,” Reid added.

“The key element to watch in the coming days is whether the message translates into formal measures or remains purely rhetorical, which would make a clear difference in the market reaction,” said Francisco Simón, European head of strategy at Santander Asset Management.

“The key thing to watch will be whether the EU decides to activate its anti-coercion instrument,” Saravelos said. “It is a weaponization of capital, rather than trade flows, that would by far be the most disruptive to markets.”

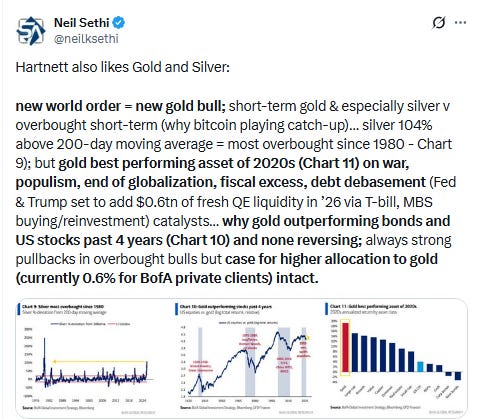

“Unsurprisingly, while that headline noise does pan out, some participants may seek to take profits on their long risk positions, or seek downside protection through options, though all this should further bolster what was already an incredibly solid bull case for precious metals, like gold and silver, where the ‘path of least resistance’ continues to lead clearly higher,” said Michael Brown, senior research strategist at Pepperstone.

“The market reaction is appropriate given the rapidly rising uncertainty,” said Michael O’Rourke, chief market strategist at JonesTrading. “The thought of forcibly coercing an ally to yield sovereign territory will incur geopolitical damage that will take years to repair.” If the tariffs go into effect or the US illegally annexes Greenland, the selloff in stocks should be much more severe, O’Rourke added, noting the 11% drop over three days when Trump introduced his tariffs in April. “Once again we risk heading into unchartered territory,” he said.

“The blow-back from the Administration’s policies towards Greenland is significant,” said Matt Maley at Miller Tabak. “It is raising questions about the future of our relationships in Europe - and even the future of NATO - although that’s not a major concern yet by any means. However, the political and geopolitical landscapes are still becoming more volatile very quickly.”

“The only hope really is that Republican senators and congressmen put a stop to this,” said Laurent Lamagnere, deputy chief executive officer at AlphaValue in Paris. “Investors have taken advantage of these volatility moments to buy the dip but for myself, I am not comfortable. There is no guarantee it will work this time.”

“My working assumption is that an ‘off-ramp’ from these threats will soon be found,” said Michael Brown, senior research strategist at Pepperstone. “With the fundamental bull case for risk still a resilient one, and providing that any European retaliation remains largely rhetorical, I would view equity dips as buying opportunities.”

“Hopefully sanity prevails and then you find some compromise, and folks will have to adjust, and this will land well,” Vis Raghavan said in a Bloomberg Television interview in Davos.

“This should be seen as the beginning of a now-familiar ‘escalate to de-escalate’ cycle that ultimately culminates in some sort of ‘deal’ – with Trump himself deciding how much policy uncertainty and collateral damage there is along the way,” said a team of strategists at Evercore ISI led by Sarah Bianchi.

“Since April 2025, we have seen repeated tariff threats and counter-threats that ultimately have proven to be the opening bids in negotiations that have brought compromise,” Paul Christopher at Wells Fargo Investment Institute noted.

“Markets have reacted in a relatively sanguine fashion, and for now, we think that’s probably the right and expected reaction,” said Brian Levitt and Benjamin Jones at Invesco. “We knew the US administration wanted to acquire Greenland, and President Trump has a clear history of threatening high tariffs and then walking them back.”

Citigroup Inc.’s global banking head Vis Raghavan believes investors will pull through the initial “shock and awe” from Trump’s latest tariff threats.

“Hopefully sanity prevails and then you find some compromise, and folks will have to adjust, and this will land well,” Raghavan told Bloomberg Television in Davos.

“Tariff fears are back in focus and are now intertwined in geopolitical matters,” said Paul Stanley at Granite Bay Wealth Management. “While this adds a new wrinkle to the tariff issue, we believe cooler heads will prevail and that these tariff threats are being used as a negotiating tactic for control of Greenland.”

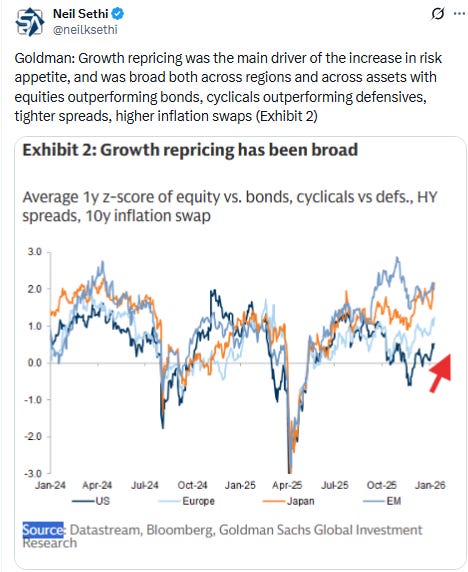

“This is ‘sell America’ again within a much broader global risk off,” said Krishna Guha at Evercore. “Global investors at the margin are looking to reduce or hedge their exposure to a volatile and unreliable US. What remains to be determined is the magnitude and duration of these dynamics.”

“Our bet is that in the base case the severity will ultimately still be contained as investors bet on some version of a compromise,” said Guha. “But the impacts would be very severe if this goes off the rails, and there will be long-lasting implications, including for the dollar.”“There’ll be an eagle eye on Davos and what the US does and US President Donald Trump says about its bid to acquire Greenland,” said Kyle Rodda at Capital.com. “There’s a chorus calling that this will be a “TACO” moment: Trump will chicken out when the blow back from his actions hits. But there’s a chance that this won’t occur.”

“Greenland and tariffs have become the primary conversation at Davos and headlines from the event are serving as a reminder of the uncertainties associated with Trump 2.0 and the White House’s agenda,” Ian Lyngen at BMO Capital Markets said.

“Tariff War 2.0, or Territory War 1.0 if you prefer, is in full swing and has potential to cause significant near-term market disruptions,” said Victoria Greene at G Squared Private Wealth. “A lot depends on how the next few weeks play out. So, we are not ‘panic selling,’ but watching carefully and ready for volatility.”

“On the other side of trade deficits and trade wars, there are capital and capital wars,” Ray Dalio, founder of Bridgewater Associates, told CNBC’s “Squawk Box” at the World Economic Forum in Davos, Switzerland. “If you take the conflicts, you can’t ignore the possibility of the capital wars. In other words, maybe there’s not the same inclination to buy at U.S. debt and so on.”

“If I were an advisor to some European governments, I would say you almost need to create a little bit of market volatility because Donald Trump cares about that a lot, probably more than other politicians,” said Michael Krautzberger, chief investment officer for public markets at Germany’s largest asset manager.

Brad Long, chief investment officer at Wealthspire, told CNBC that he isn’t surprised these latest developments are weighing on stocks, given that the market is “already priced for perfection” with “high” valuations and earnings expectations. “While tariffs is not new and Greenland, frankly — or the administration’s interest in Greenland — isn’t new, the weaponization of tariffs in the short term to achieve kind of a non-economic or maybe economic adjacent goal is new,” he said. “Europe walked out of 2025 largely unscathed, or at least unscathed on a relative basis for tariffs. Now, this is a direct line to some of the U.S.′ closest allies — eight nations across Europe, 10% to 25% tariffs. We’re kind of picking back up the 2025 April volatility of Trump uncertainty and shifts in policy.”

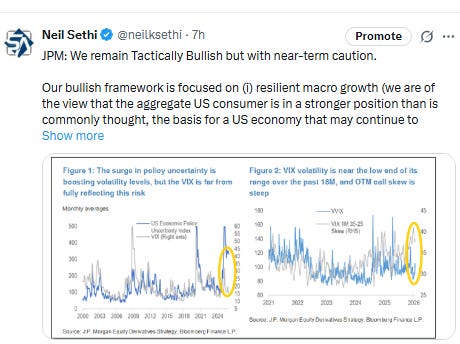

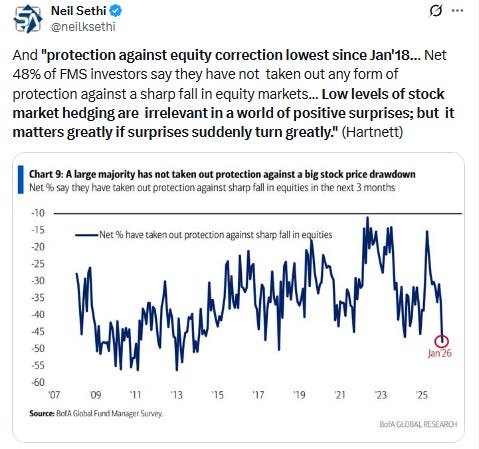

“Speculator positioning over the last few weeks has become net risk-on, leaving the market subject to upset if the latest geo-economic flare-up over Greenland escalates. The market is even less prepared for a risk-off move from this perspective than it was when Trump launched his tariff salvo last year, with the net measure back then significantly more in favor of risk-off instruments.” — Simon White, macro strategist

“We have anticipated a reversal out of high momentum stocks in January given current valuations, geopolitical and macroeconomic unknows, tariff rate uncertainty, and a midterm election cycle, none of which bode particularly well for robust market gains,” said Eric Teal at Comerica Wealth Management. “The emphasis should be on geographic and sector diversification and playing defense at this juncture.”

“The degree of bullishness, of maximum exposition to risk and underexposure to protection and cash is actually weighing on investor sentiment,” said David Kruk, head of trading at La Financiere de l’Echiquier. “That accounts for a large amount of the current profit taking. Most investors are not that overly concerned with the rise of Japanese yields or the geopolitical situation.”

“Tariff risks reared their head at an unfortunate time for a market that was broadly bullish, pointing to more short-term pain. With exposure likely only hedged via crowded commodity markets, investors are probably taking profits, particularly in European equity markets where valuations no longer screen as cheap.” — Skylar Montgomery Koning, macro strategist

“Investors and the US administration are likely to keep focus on the US Treasury bond market, which weakened modestly in the wake of US President Trump’s latest tariff threats,” said Paul Donovan at UBS Global Wealth Management. “The implications of additional tariffs are more US inflation pressures and a further erosion of the USD’s status as a reserve currency.”

“While investors could remain worried about Liberation Day 2.0 selling from Europe over the US threat to take Greenland, European investors likely have limited options if they wish to rotate out of Treasuries,” said Gennadiy Goldberg at TD Securities. “However, in the near-term, attempts at diversifying can pressure Treasuries.”

“I highly doubt it will get to [the magnitude of post-Liberation Day],” said Hank Smith, director and head of investment strategy at Haverford Trust. “The expectations were that the tariff uncertainty throughout particularly the second half of 2025 was becoming settled and more certain in 2026,” he said.

The U.S. “cannot afford significantly higher interest rates,” he told MarketWatch Tuesday. “Our current budget deficit can’t afford it, and the annual budget can’t afford paying any more in interest than we already do.”

“While we are mindful of potential short-term volatility, we expect global equities to rise further and recommend under-allocated investors to add exposure,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “Those who are concerned of market swings should ensure they hold a well-diversified portfolio, and consider gold or capital preservation strategies to manage potential drawdowns.”

The best US stock market returns have come when policy uncertainty has been the highest, according to investment strategist Jim Paulsen. “Peace and stability may be emotionally attractive but could prove boringly unsatisfying when it comes to investment returns,” Paulsen writes, citing Baker, Bloom and Davis economic policy uncertainty data. Yet, historically, he says that “‘uncertainty’ has frequently been an investor’s best friend.”

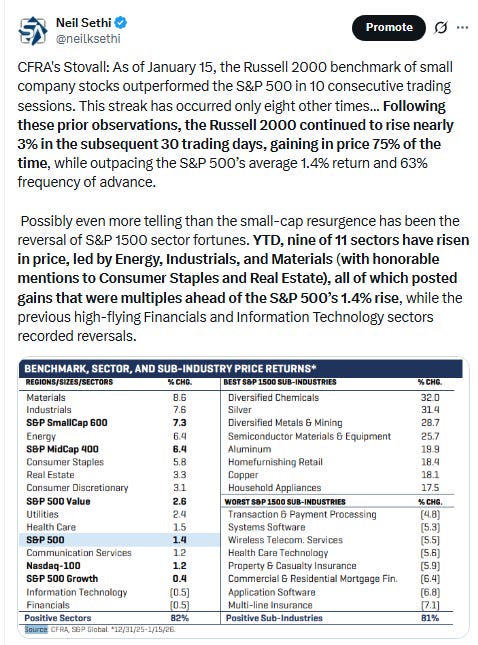

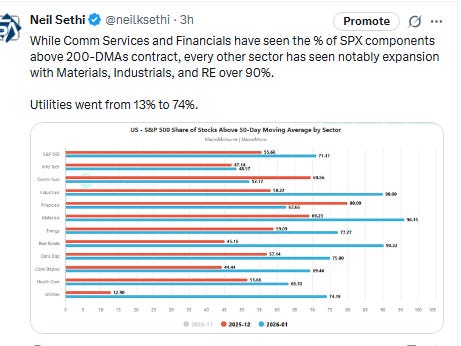

“The year is still young, but one of its most notable trends has been strength in small- and mid-cap stocks vs. tech softness and rotation away from the market’s longstanding megacap leaders,” Chris Larkin at E*Trade from Morgan Stanley said. “But with stocks starting the week in a defensive posture, it could be a challenge for recent winners to maintain their momentum without some clarity on the political front.”

“Beneficiaries of the rise in geopolitical tensions would be defense stocks, financials and gold, and we are long these in our portfolio,” said Mohit Kumar at Jefferies.

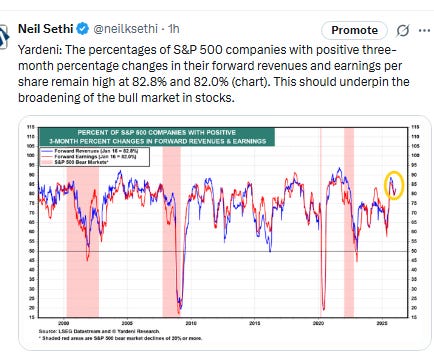

The small-cap rally is a broader call on the U.S. economy, writes Hardika Singh, economic strategist at Fundstrat: Investors typically like to see small-caps rally because most of their money is made domestically, so gains there tend to reflect bets on a booming economy. That’s a good sign because over the past year, investors watched every single economic report with a clenched jaw for signs of a downturn that are yet to turn up.

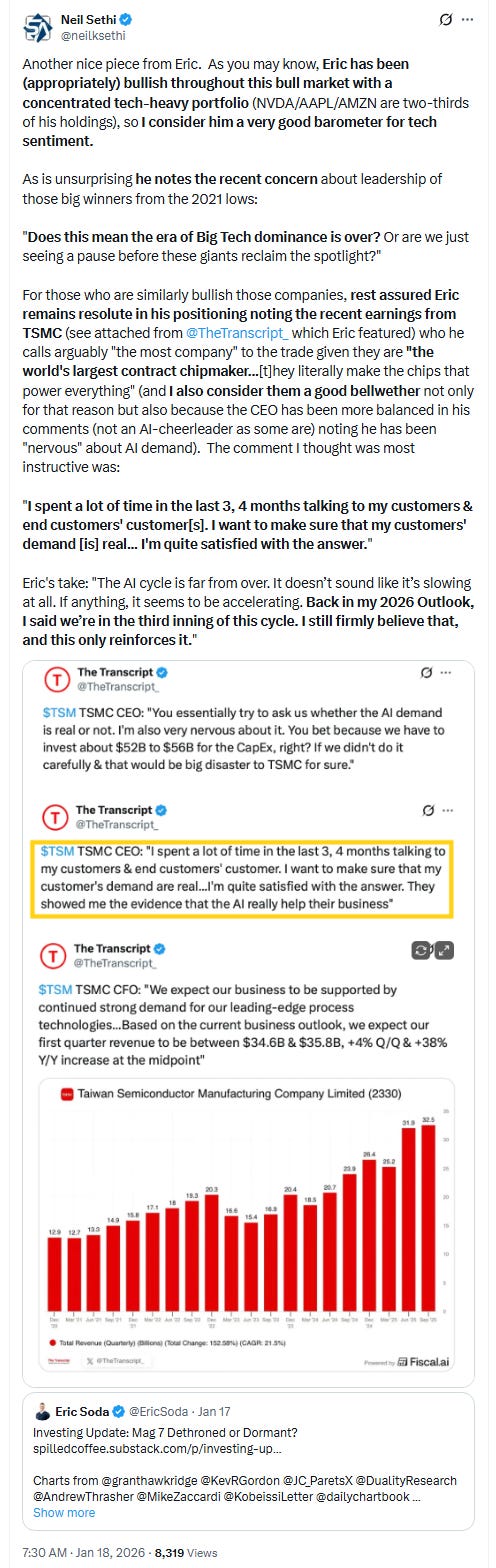

Louis Navellier, chair and founder of Navellier & Associates, said megacap technology stocks, especially names related to data centers and semiconductors, are “all good buys right now.”

“I don’t want investors to worry about all the gyrations and distractions because the U.S. is just asserting its leadership,” he said in emailed commentary on Tuesday.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

In corporate news, Lululemon Athletica Inc. shares dropped 5.70% after the firm removed its new Get Low line of workout apparel from its website just days after its debut.

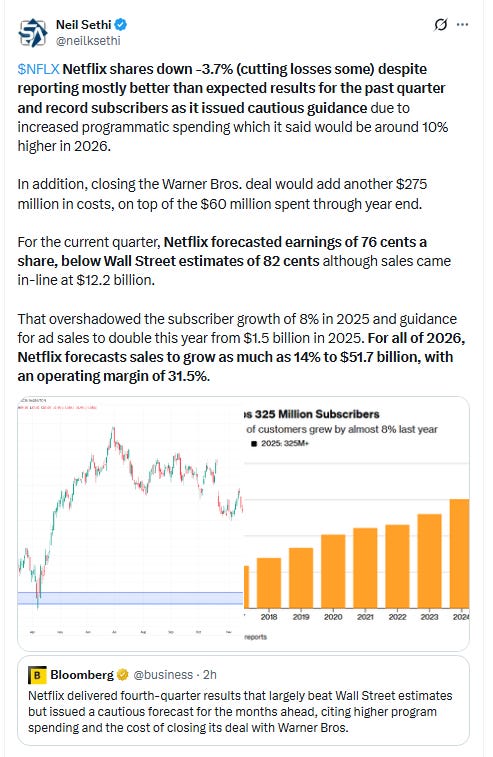

Netflix Inc. agreed to an amended all-cash deal to acquire Warner Bros. Discovery Inc.’s studio and streaming assets as it competes with Paramount Skydance Corp. for one of Hollywood’s most storied entertainment franchises. Netflix is scheduled to report earnings after the close Tuesday with investors being concerned about Netflix’s slowing flow of subscribers and the sustainability of its growth.

3M Co. shares fell after the industrial company gave an outlook for this year’s adjusted earnings per share with a midpoint below what analysts expected. U.S. Bancorp reported profit and a forecast for revenue that beat analysts’ estimates. And ServiceNow Inc. shares edged higher as the software company and OpenAI signed a multi-year agreement that will allow customers to use OpenAI models and custom AI capabilities.

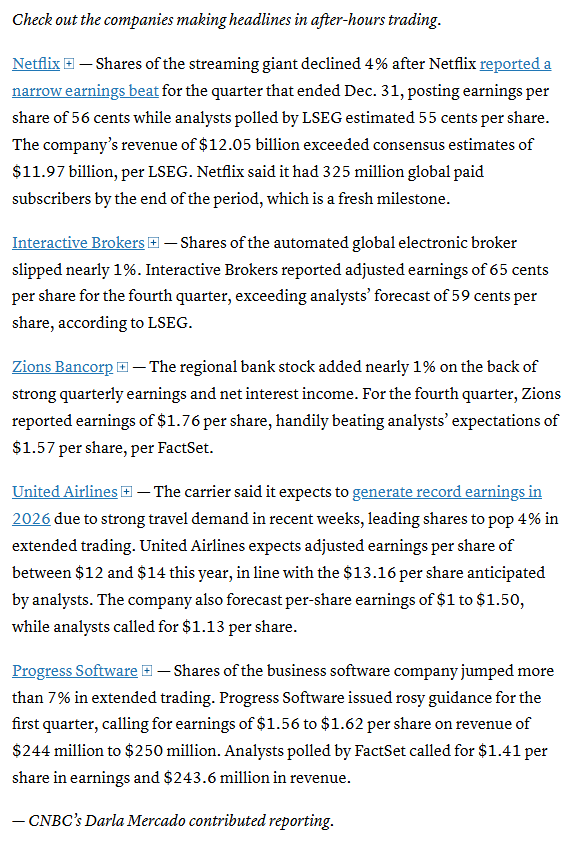

In late hours, Netflix Inc. delivered solid results, but issued a cautious forecast that saw shares fall. United Airlines Holdings Inc. beat earnings estimates.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Netflix Inc. reached an amended, all-cash agreement to buy Warner Bros. Discovery Inc.’s studio and streaming business as it battles Paramount Skydance Corp. to acquire one of Hollywood’s most iconic entertainment companies.

The US Federal Trade Commission will appeal a federal judge’s decision that Meta Platforms Inc. doesn’t have a monopoly in social networking, an agency spokesman said Tuesday.

3M Co.’s profit outlook fell narrowly short of Wall Street’s expectations for this year, a sign of the challenges the company faces as it tries to revamp operations and grow in an uneven economy.

Lululemon Athletica Inc. removed a new line of training apparel from its website just days after its debut, with some customers complaining that the leggings are too thin.

Boeing Co. shares have recouped their losses following the midair near-disaster involving one of the company’s jets in January 2024, a sign that investors continue to gain confidence in a turnaround under Chief Executive Officer Kelly Ortberg.

Homebuilder D.R. Horton Inc. missed analysts’ estimates for quarterly home orders even as mortgage rates slid.

U.S. Bancorp reported profit and a forecast for revenue that beat analysts’ estimates as lower interest rates make deposits cheaper and boost yields on securities the bank holds.

Wells Fargo & Co. is moving the headquarters for its wealth-management business to West Palm Beach, becoming the first big bank to run that operation from the heart of the wealth boom in South Florida.

Goldman Sachs Group Inc. and Qatar Investment Authority have agreed to expand their strategic partnership in a move that could see the sovereign wealth fund commit a total of $25 billion with the Wall Street bank’s asset management arm.

Artificial intelligence will displace so many jobs that it will eliminate the need for mass immigration, according to Palantir Technologies Inc. Chief Executive Officer Alex Karp.

Google DeepMind Chief Executive Officer Demis Hassabis said Chinese artificial intelligence companies haven’t been able to innovate beyond the cutting edge of technology and remain about six months behind the frontier AI of the leading western labs.

Anthropic Chief Executive Officer Dario Amodei said selling advanced artificial intelligence chips to China is a blunder with “incredible national security implications” as the US moves to allow Nvidia Corp. to sell its H200 processors to Beijing.

Michael Saylor’s Strategy Inc. acquired almost $2.13 billion in Bitcoin over the previous eight days, marking the digital asset treasury company’s largest purchase of the original cryptocurrency since July.

A personalized cancer treatment developed by Moderna Inc. and Merck & Co. helped prevent the recurrence of high-risk skin cancer after five years, new data confirming its prolonged benefit show.

Southern Co. Chief Executive Officer Chris Womack said that after years of flat growth in US electricity use, demand for the company is now expected to jump by 8% to 10% annually thanks to the boom for artificial intelligence.

The online brawl between Elon Musk and Ryanair Holdings Plc dragged into a second week, with the world’s richest man again floating the idea of buying the airline after clashing with its chief executive officer.

Commodities trader Vitol Group loaded its first oil cargo from Venezuela’s shore-based storage tanks, a move set to help clear bottlenecks and pave the way for the South American crude giant to ramp up production.

The lead prosecutors of former Glencore Plc executives are set to depart the UK’s Serious Fraud Office for private sector roles, leaving the crime fighting agency’s bid to tackle high-profile corruption cases in disarray.

GSK Plc agreed to buy Rapt Therapeutics, a US-based biotech developing treatments for patients with inflammatory and immunologic diseases, in a deal valued at $2.2 billion.

Qiagen NV, the European molecular testing firm, is weighing strategic options including a potential sale amid fresh takeover interest, people with knowledge of the matter said.

China has broadened a probe into PDD Holdings Inc. after its employees exchanged blows with regulators, dispatching over 100 investigators from various agencies to the company’s Shanghai headquarters in recent weeks, according to people familiar with the matter.

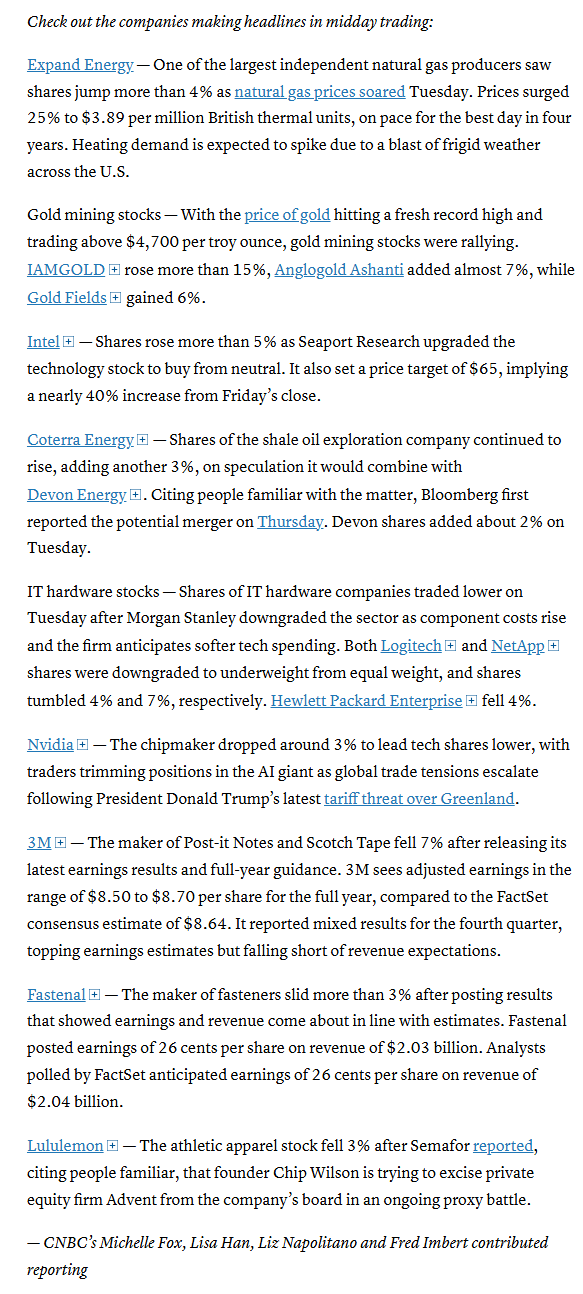

Mid-day movers from CNBC:

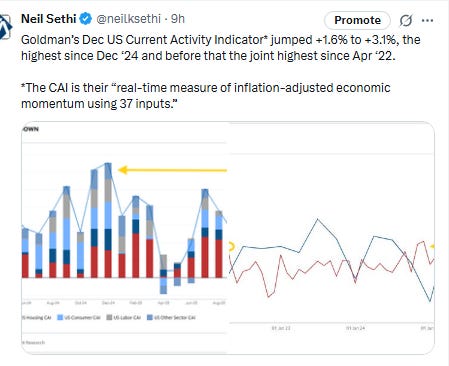

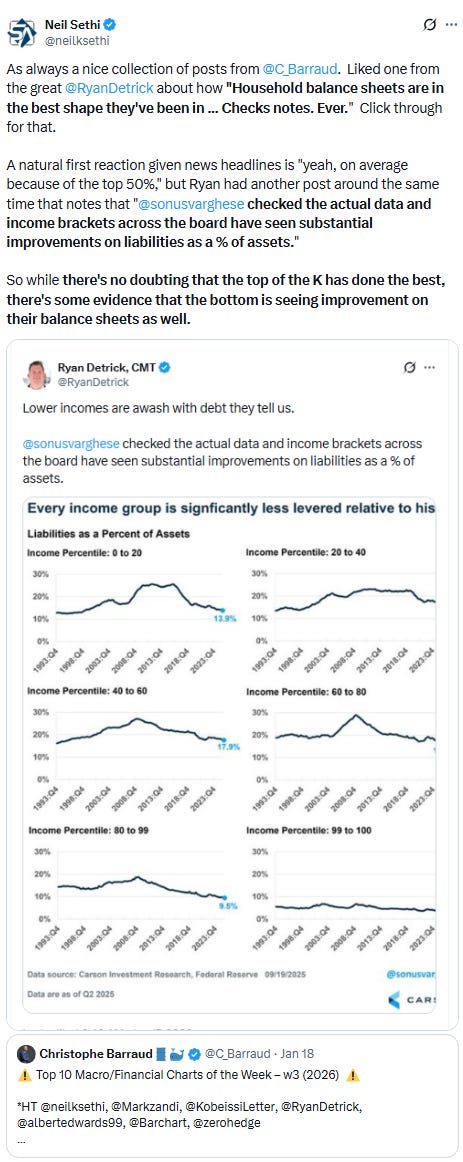

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

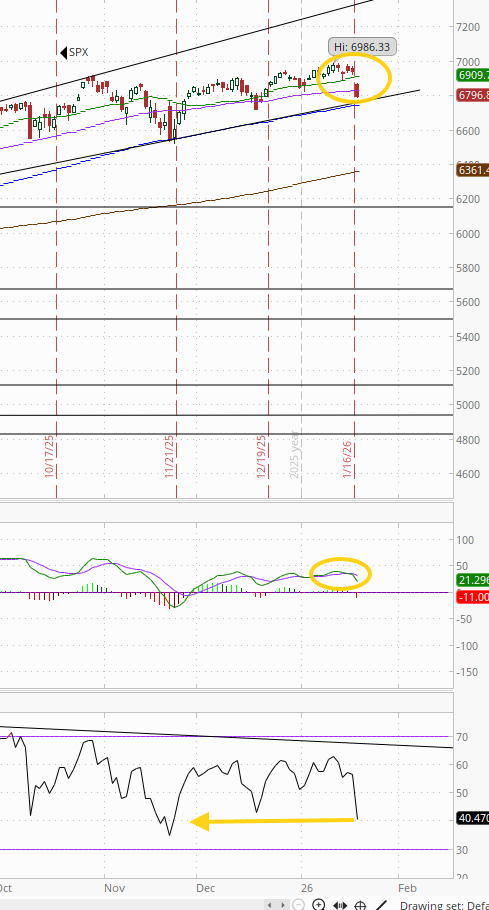

The SPX fell back over -2% the worst day in nearly three months. The daily MACD has now flipped to “sell longs” while the RSI has fallen to the weakest since Nov. It broke an uptrend line from the April lows, coming up on one from June.

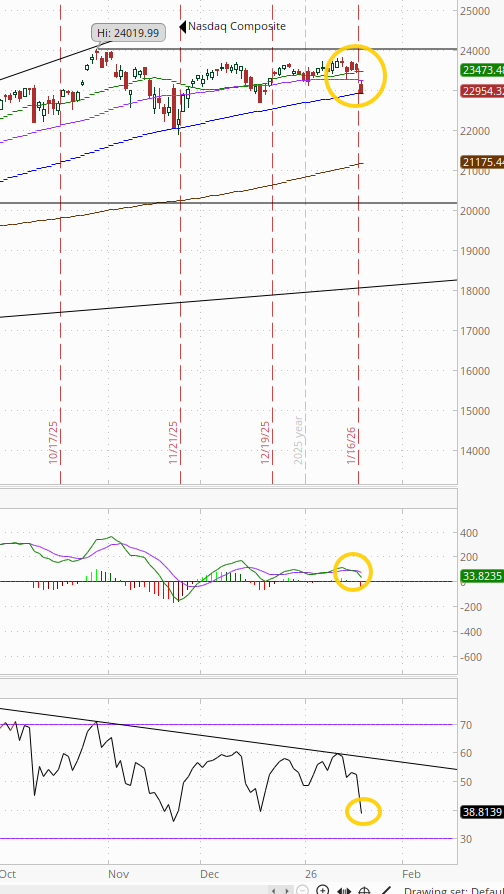

The Nasdaq Composite a similar story.

RUT (Russell 2000) remains the best chart of the bunch softening just a bit from its ATH. Its MACD remains with a “go long signal,” but the RSI did fall from over 70 to under.

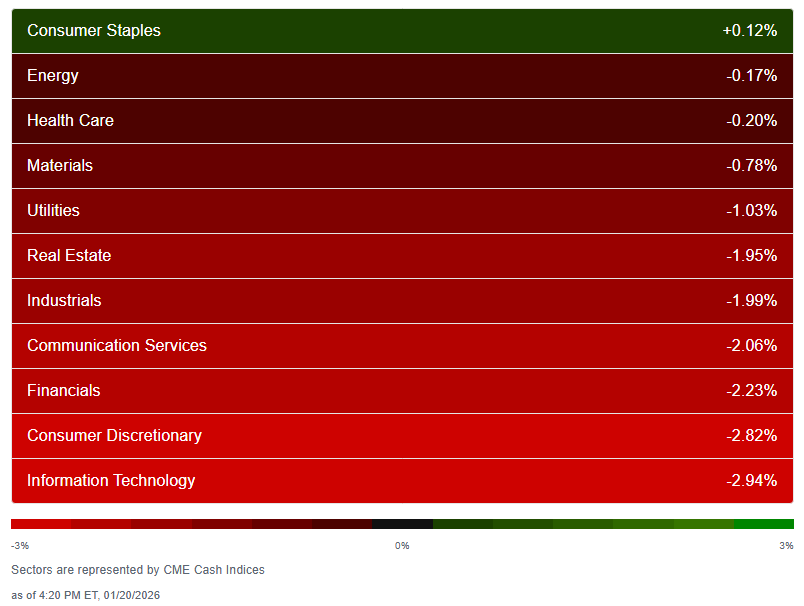

Sector breadth according to CME Cash Indices (uses futures prices) fell to the worst since Dec 31st with just one of 11 sectors higher (only the second time this year there has been less than 6 in the green (the other Jan 7th (3)), and the one that was higher (Staples) was barely so at +0.1%.

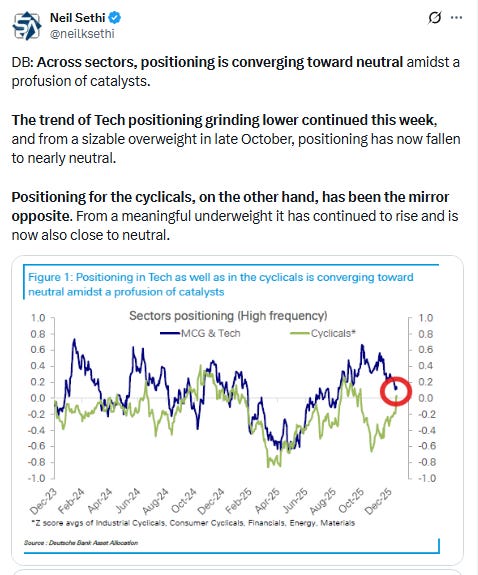

The top four though continued to be dominated by “the other 493” with a megacap growth sector (Tech, Comm Services, Cons Discr) only appearing twice total over the past 6 sessions.

Tuesday the three megacap growth sectors all came in at the bottom of the flag along with Financials, all down at least -2%. In addition two other sectors (RE and Industrials) were down over -1.9% and Utilities was also down over -1%, so heavy selling in most sectors Tuesday.

As you might imagine, a very different stock-by-stock flag from @finviz_com for Tues with red all over the place and just a few pockets in Staples, gold miners, Health Care, etc., escaping.

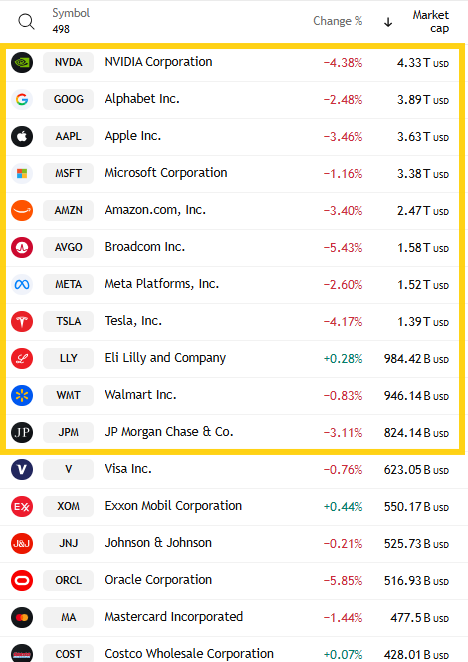

In that regard just one of the largest 11 SPX components was higher (from 6 Fri, 5 Thurs, but none Wed) in LLY +0.3%. Eight were down at least -2%, six at least -3%, and three (AVGO, NVDA, TSLA) were down over -4% (in order of losses).

Mag-7 -3.1% after -2.1% the prior week.

8 SPX components still were up 3% or more (after 13 Fri, 40 Thurs, 25 Wed). And the selloff in Tech still couldn’t dent 2025 winner SanDisk (which has already led the SPX twice previously this year) +9.6%.

Three of those 8 up 3% or more were >$100bn in market cap (after 4 Fri, 11 Thurs, 4 Wed) in NEM, BSX, INTC (in descending order of percentage gains).

~125 SPX components down -3% or more (the most this year up from 3 Fri, 12 Thurs, 20 Wed) led by NetApp NTAP -9.4%.

24 of the 125 down -3% or more were >$100bn in market cap (after 3 Fri/Thurs) and four >$1tn in market cap in KKR, BX, ORCL, AVGO, KLAC, SPGI, IBM, BLK, ADSK, C, YUM, NVDA, COF, TSLA, GE, PM, AAPL, AXP, AMZN, QCOM, LOW, JPM, CRM, INTU (in order of percentage losses).

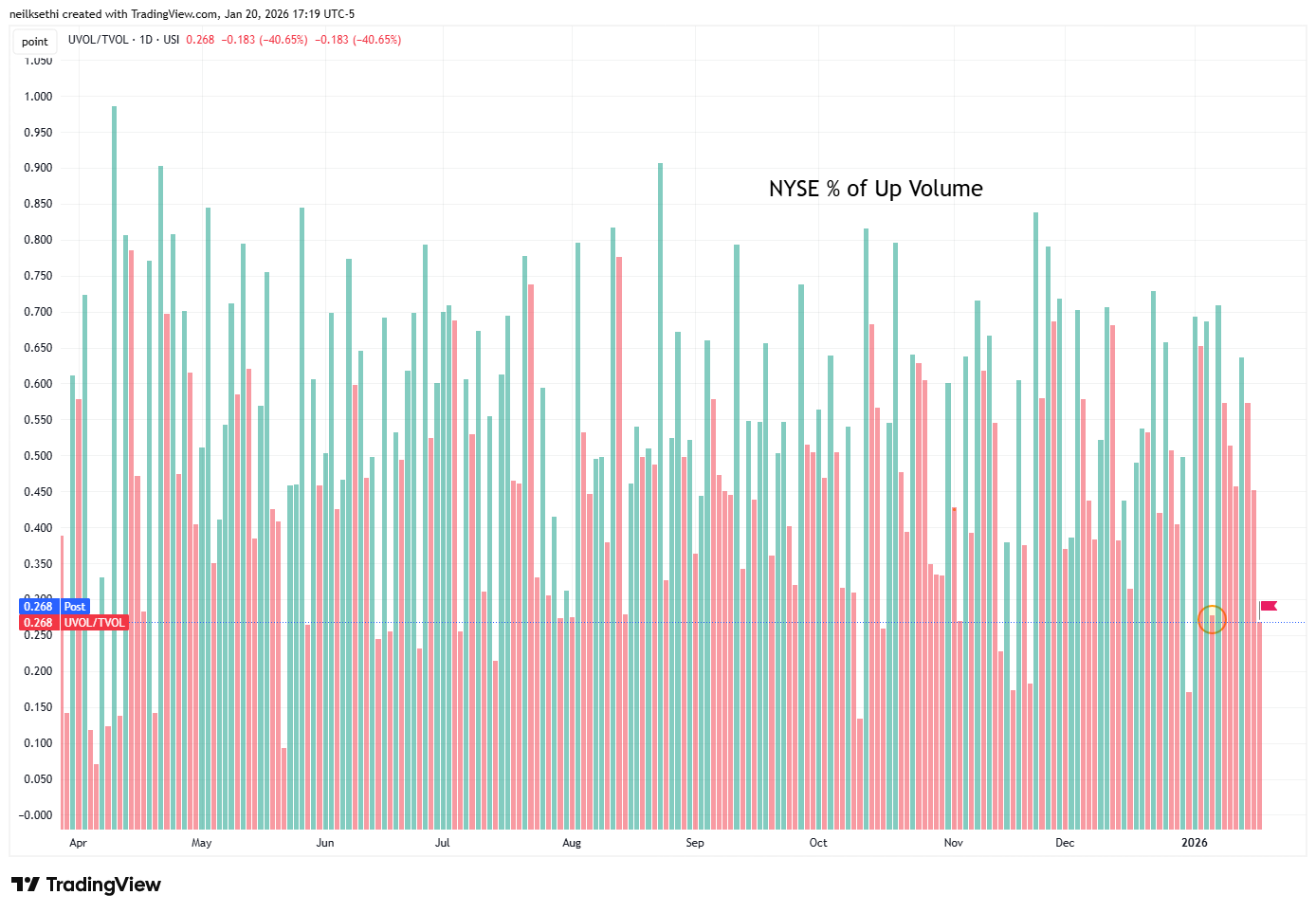

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) dropped as would be expected to 27.4%, but outperforming the -1.46% loss in the index. On Jan 7th (circle) it was 27.7% with a -1.02% loss.

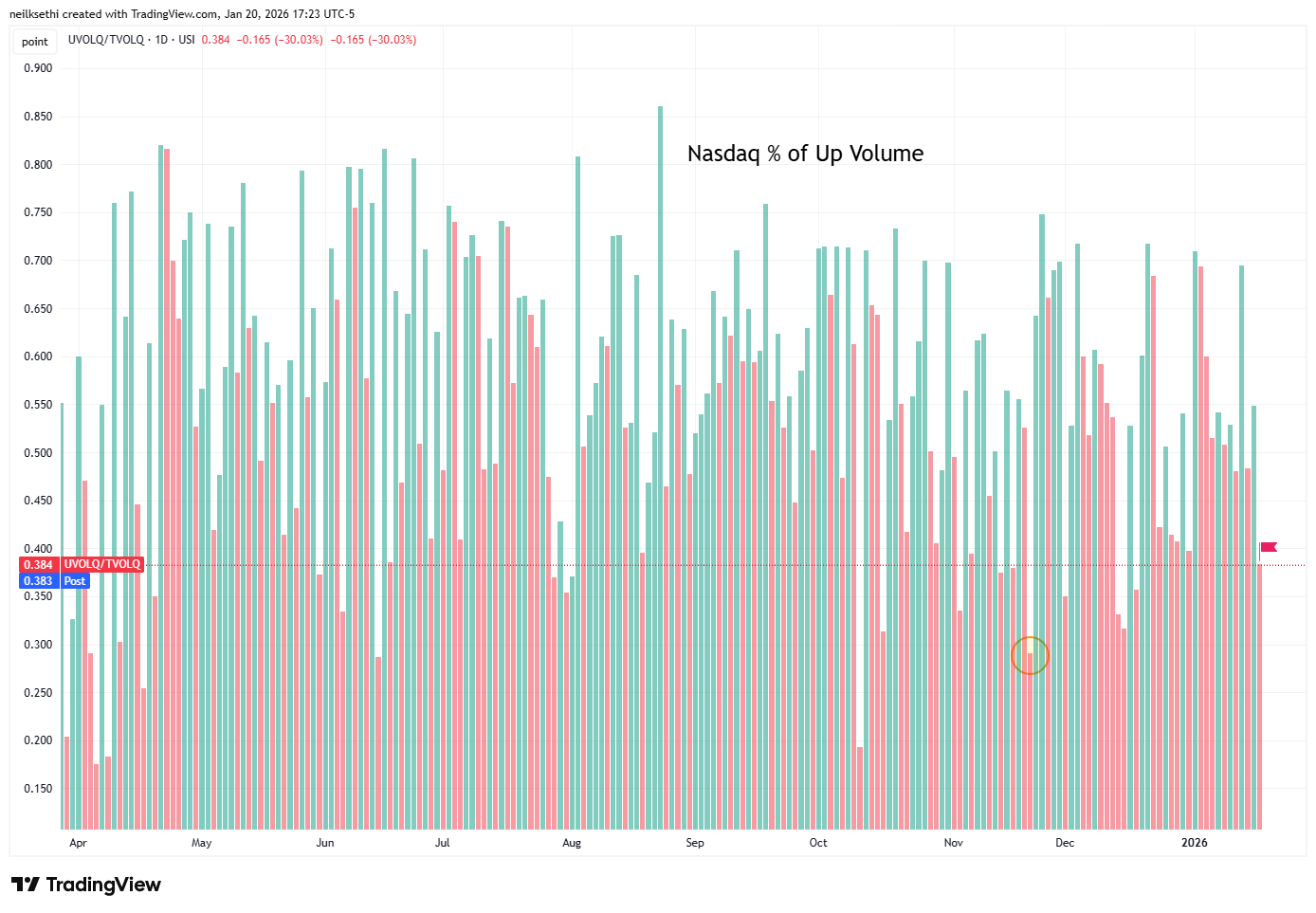

Nasdaq positive volume (% of total volume that was in advancing stocks) similarly fell to 38.4% outperforming the -2.39% loss in the index. Compare to Nov 20th when it was 29.8% with a -2.15% loss (circle).

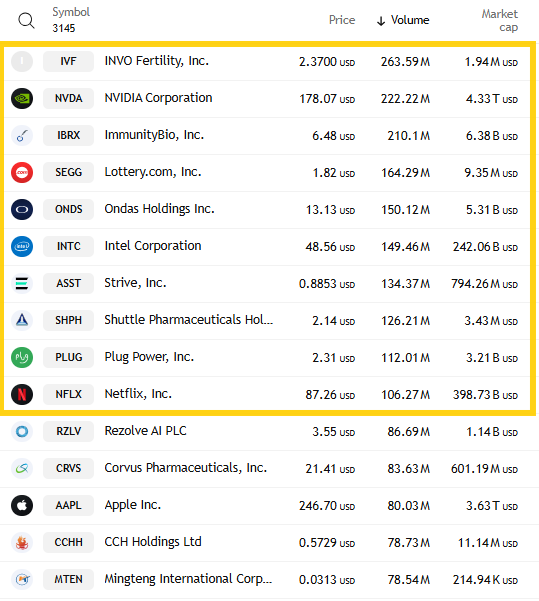

And that better relative positive volume on the Nasdaq was even as speculative volume fell back a third day (from one of the highest days since the summer last Wed). The top three stocks by volume fell back to a little under 700mn shares from 1bn Fri, 1.4bn Thurs and the huge 4bn Wed.

There were another seven that traded over 100mn shares (down from 10 Fri, nine Thur, seven Wed) so speculative activity remained just back towards more average levels.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, still did reflect it today with the Nasdaq notably lower than positive volume at 26%, while the NYSE was 21%.

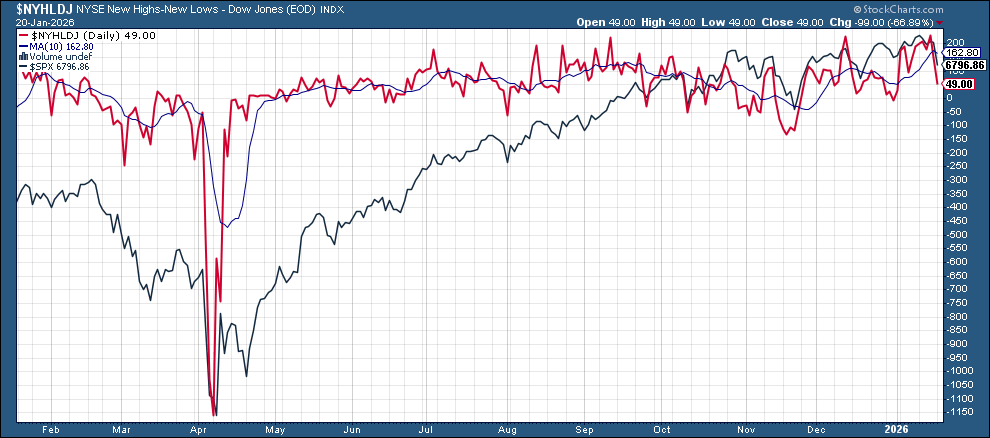

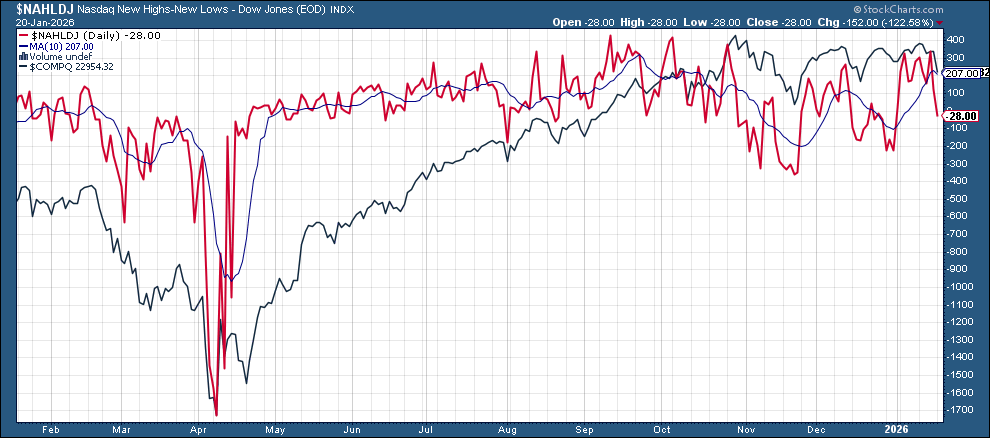

New 52-wk highs minus new 52-wk lows (red lines) fell back again now down to 49 on the NYSE from 227 Thurs, which was the best since Nov ‘24, while the Nasdaq fell to -32 from 335, the best since Oct.

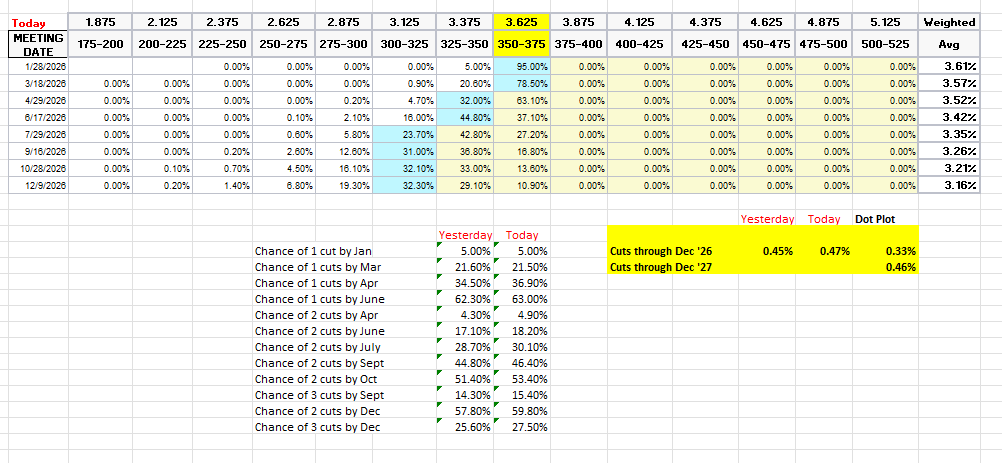

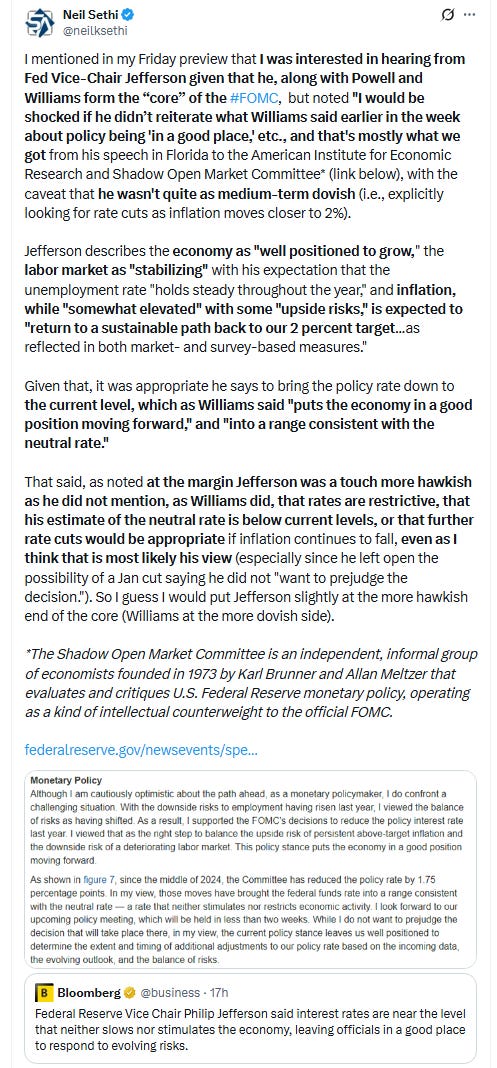

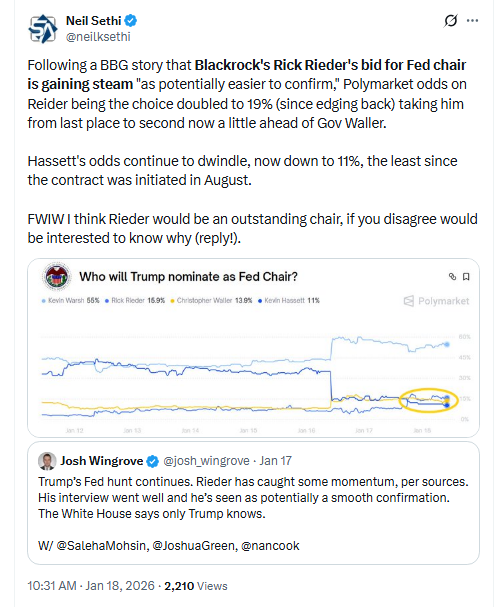

Despite all the drama in the markets, #FOMC rate cut pricing was little changed Tues remaining around the least since pricing for the Dec ‘26 contract was initiated (or at least as far back as the CME Fedwatch tool has been tracking it).

January didn’t move, but off the table unless the Fed chooses to revive it (very unlikely) at 5%. March is 22% (from 51% Jan 6th), April 38% (from 63%), with the first cut in June (63%). A second cut remains in Oct (53%, there was a 55% chance of a July cut on Jan 6th).

Pricing for 2026 edged up +2bps to 47bps (as noted Thurs under two cuts for the first time), with pricing for two cuts 60% and three cuts 28% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

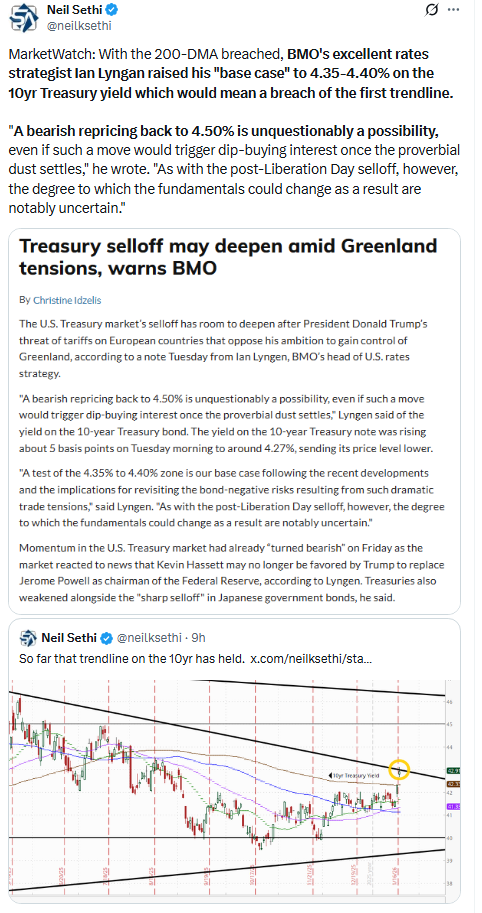

The 10yr #UST yield broke over the 200-DMA on the back of the global jump in yields catalyzed by the surge in Japanese yields (see post below) and ran right to the target I noted Friday - the downtrend line from the Jan ‘25 peak +7bps to 4.30% (up +14bps the past two sessions after having traded in a 10bps range the entire year to that point). We’ll see if it can hold. If not, 4.5% is the next big level to watch.

The 2yr yield, more sensitive to FOMC rate cut pricing, didn’t move nearly as much (although the fact it was higher when Fed rate cut bets increased slightly is unusual) +1bps to 3.60%, the highs of the year and remaining over the top of the channel it’s been in since the start of 2024, which it had not previously closed over since then.

It is -4bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts, but that call is getting weaker by the day.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) dropped sharply (the most in a month) on the “sell America” trade falling back under the 50 and 200-DMAs (and the 20 and 100’s as well in addition to the downtrend line from Feb) after having closed Fri at the highest since Nov.

The daily MACD remains for now in “go long” positioning but the RSI fell back under 50 from over 60.

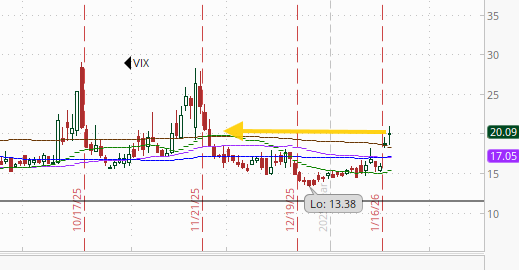

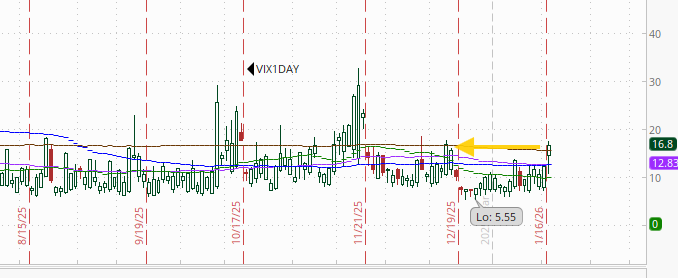

VIX pushed over 20 for the first time since Nov at 20.1. The current level is consistent w/~1.25% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also jumped to the highest since Nov at 117.1.

The current level is now consistent with “elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is also a level flagged by Charlie McElligott as one to watch.

The 1-Day VIX jumped to the level prior to the Dec FOMC at 16.8. The current reading implies a ~1.08% move in the SPX next session.

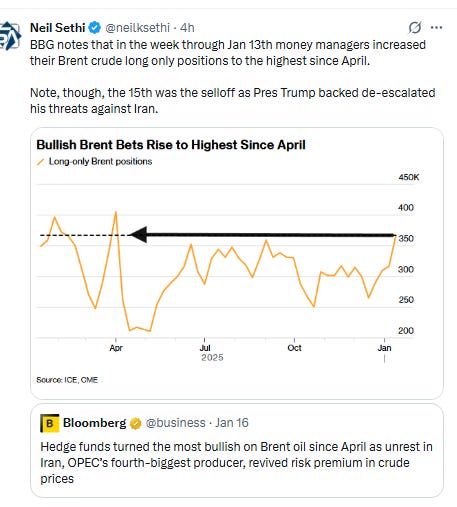

WTI futures weren’t sure what to make of things at first dropping then moving to gains then falling back to end little changed, remaining just above support at the 50-DMA. We’ll see if that can continue to hold.

Gold futures (/GC) jumped higher, their best day since Apr 2020, and pushing above the top of the expanding wedge they’ve been in since late 2024. Daily MACD remains in “go long” positioning, while the RSI is over 70.

US copper futures (/HG) though lost a little ground for a third session still not far from all-time highs. But as noted Friday, “the daily MACD has crossed to ‘sell longs’ positioning while the RSI has fallen to the least since Nov, so we’ll see if a deeper pullback is in the cards.”

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) surged 25%, and that was without the benefit of a contract roll, the largest gain I believe since Sept 2006 after a polar vortex was forecast which will drop temperatures sharply through the end of the month. I had said that “I do expect this area will offer better support” when it got to $3, but this obviously wasn’t what I had in mind.

The daily MACD flipped to ‘cover shorts’ positioning (too late), and RSI jumped over 50.

Bitcoin futures joined the risk-off selloff dropping -6.4%, back under the 50-DMAand $90k level.

The daily MACD also flipped to “sell longs” positioning, while the RSI fell back under 50.

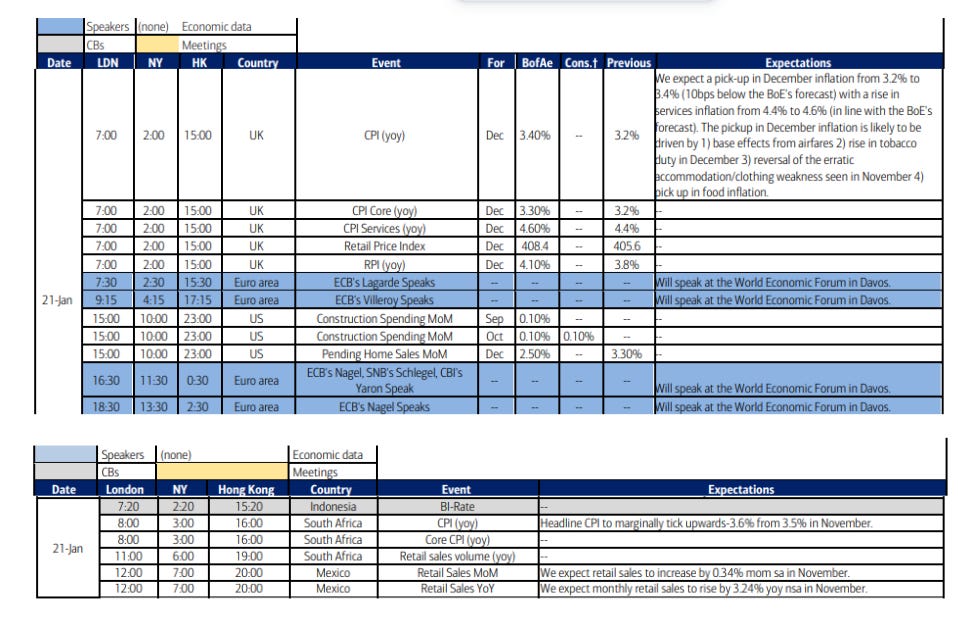

The Day Ahead

After no data (except for the ADP weekly report) Tuesday, we’ll get some Wednesday in a delayed Oct construction spending report, Dec pending home sales, and weekly mortgage applications and EIA petroleum inventories.

No Fed speakers with the blackout, but we will get a Treasury auction in the thinly traded 20yr Treasury Bond. As mentioned Sunday, this auction has only been newsworthy once as far as I know.

And it appears I had the wrong day (from more than one reputable source) on the Lisa Cook oral arguments which will actually be Wednesday. As I said yesterday: This is an extremely consequential case, as a decision against Cook (she is suing to block her “for cause” (i.e., for misconduct) removal as a Governor by Pres Trump on the basis of a not uncommon error in a mortgage in her name that predates her time at the Fed) would open the door wide to pretextual removal claims by a President giving wide powers to remake the Board.

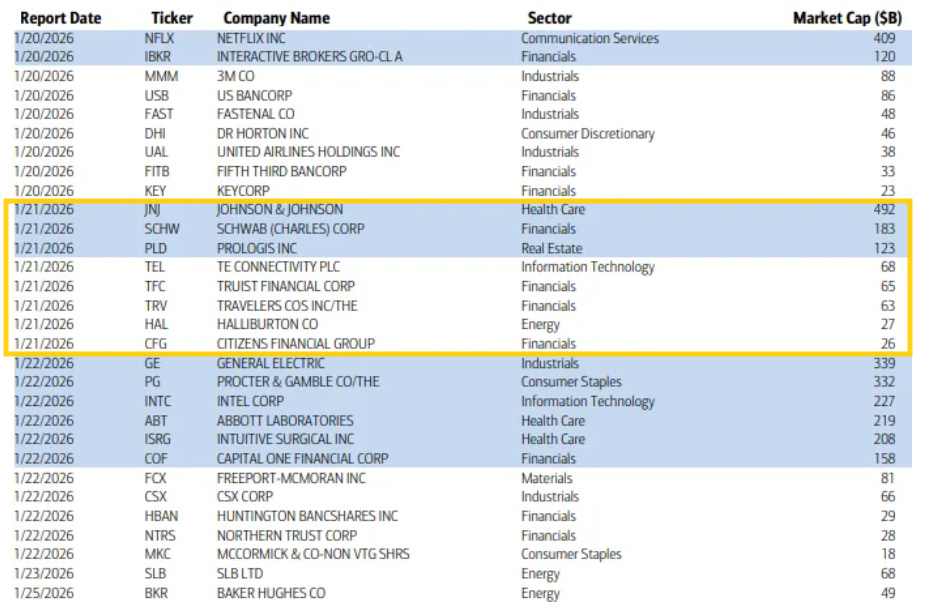

Q4 SPX earnings season continues to 8 SPX reporters, three of which are over $100bn in market cap in JNJ, SCHW, PLD (in descending order of market cap).

Ex-US highlights include UK and S Africa CPI, a policy decision in Indonesia

Finally, Pres Trump is making a keynote address in Davos overnight (scheduled for 2am ET) to be followed by a CNBC interview where he is expected to focus on his “America First” agenda and unveil proposals including around home affordability and credit card fees. He will likely also make additional comments, after having already created a stir over the weekend, regarding his desire for some sort of American ownership or control of Greenland (or perhaps walk it back a bit?).

Wednesday, January 21

10:00 AM Construction spending, October (GS +0.3%, consensus +0.1%, last +0.1% [August])

Construction spending, September (GS +0.1%)

10:00 AM Pending home sales, December (GS -1.0%, consensus -0.3%, last +3.3%)

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,