Markets Update - 12/1/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

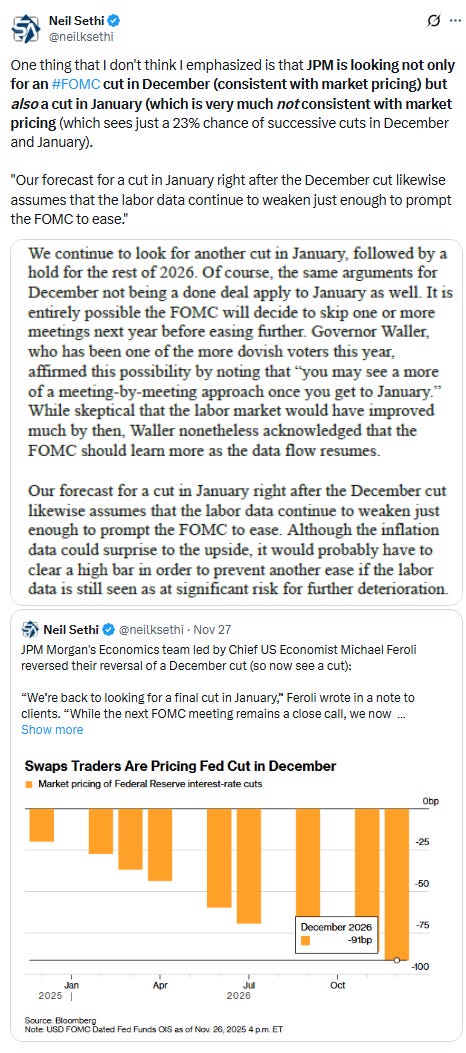

US equity indices opened trading Monday solidly lower, upended to some extent by hawkish comments from Bank of Japan Gov Ueda that sent global bond yields higher. That added to a risk-off tone that also saw Bitcoin falling over -5%. Alphabet, AMD and Broadcom shares dipped more than 1%, although it was small caps that were leading the selling. That continued throughout the session, with Broadcom ending down over -4%, more than offsetting strong performances from retailers and energy producers. Crypto-related stocks including Coinbase and Strategy also tumbled in Monday’s session as nearly $1 billion of leveraged crypto positions were liquidated.

While the Nasdaq did make some upward progress from its opening levels it still finished -0.4%. In contrast, the small cap Russell 2000 lagged on the back of those rising yields -1.3%. SPX was -0.5%, DJIA -0.9%. Interestingly, the last hour unusually saw net selling despite first-session 401(k) flows (presumably overwhelmed by larger vol control, leveraged ETF, etc., selling).

Elsewhere, Treasury yields as noted were higher, the dollar lower. Gold though was again higher, again joined by natgas and crude, while bitcoin fell and copper edged back.

The market-cap weighted S&P 500 (SPX) was-0.5%, the equal weighted S&P 500 index (SPXEW) -0.7%, Nasdaq Composite -0.4% (and the top 100 Nasdaq stocks (NDX) -0.4%), the SOXX semiconductor index -0.1%, and the Russell 2000 (RUT) -1.3%.

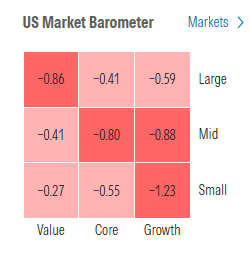

Morningstar style box shows widespread losses after seeing only gains for the previous five sessions.

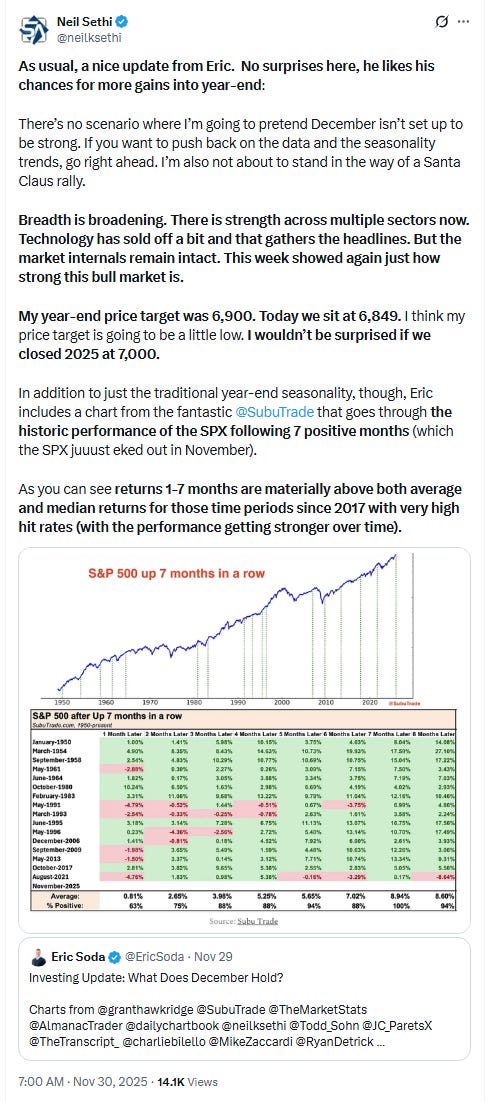

Market commentary:

“The market is still hesitating a bit ahead of the upcoming macro data, and before the Christmas rally people typically expect,” said Andrea Tueni, head of sales trading at Saxo Banque France. “The drop in Bitcoin is weighing on sentiment and so are the comments from the BOJ.”

“With Japanese government bond yields lurching higher in recent days, this has effectively been pressing the brakes on cheap-yen funding many traders have used to leverage their positions,” said Razaqzada. “In other words, we are seeing a bit of a reverse-carry reaction which has rippled across risk assets today, pressuring speculative corners of the market as global investors unwind leveraged bets previously buoyed by rock-bottom Japanese yields.”

“Japanese rates have been normalizing, albeit with a `stop and go’ approach. When it appears to be `go,’ we have bouts like today and the spillover effect becomes clear,” said Greg Faranello, head of U.S. rates trading and strategy at AmeriVet Securities in New York. “In the grand scheme of things, U.S. rates will be driven by the domestic economy and as a function of monetary and fiscal policy,” Faranello wrote in an email. But “a continued rise in Japanese yields would offer the foreign account base alternatives,” which means that investors outside the U.S. would have greater options to place their money somewhere else besides Treasurys.

“There’s some risk aversion creeping into the markets to start the week,” said Kyle Rodda at Capital.com. “At the moment, it looks benign and without a fundamental impetus.”

“I am a bit more constructive on the prospects for a positive December, given the sharp rally [last] week, which has helped market breadth to begin to rebound after a difficult early part of November,” Mark Newton, technical strategist at Fundstrat, wrote last week. “The equity market seems to be growing more comfortable as the chances for a December rate cut have grown.”

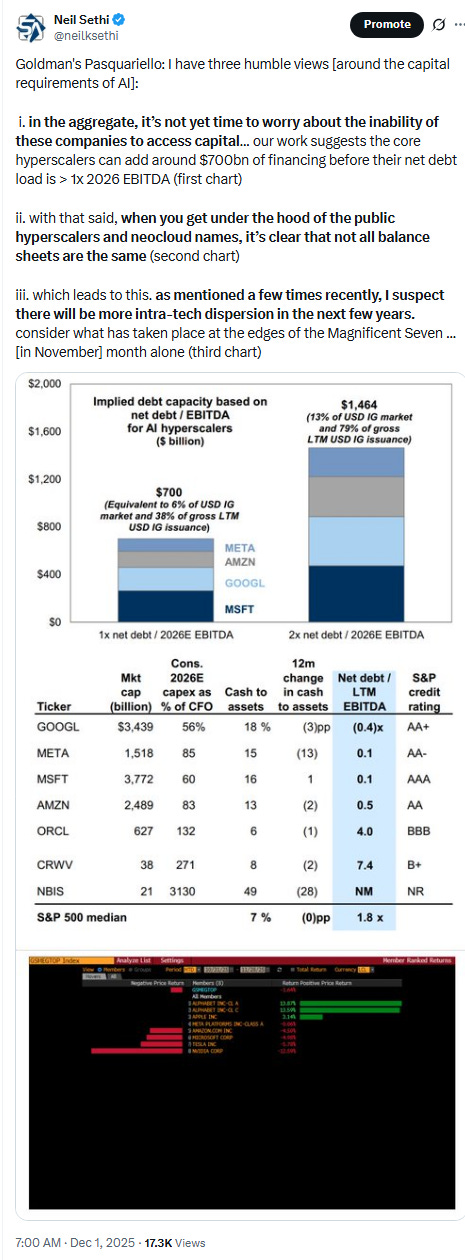

Don’t be worried about the bull market following the tumultuous month as traders question the artificial intelligence trade, according to Ross Mayfield, investment strategist at Baird. “Continued scrutiny on A.I. spending viability and valuations will persist,” Mayfield said. But, it’s “nothing close to fatal for the bull market.” Mayfield added that the bounce off recent lows “has been impressive in numerous ways” and signals the market will finish the year strong.

“We have highlighted that stocks historically performed best when the economy is not in recession and the Fed is cutting interest rates,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “The latest available data suggest that the Fed is more likely to proceed with a 25-basis-point cut.”

She also noted that the current soft patch in the US economy is likely temporary, and global growth should accelerate in 2026.

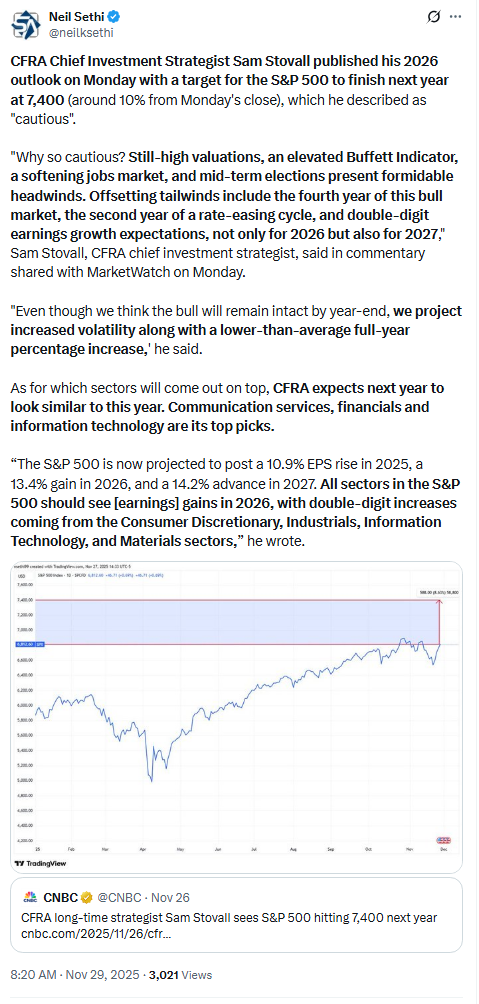

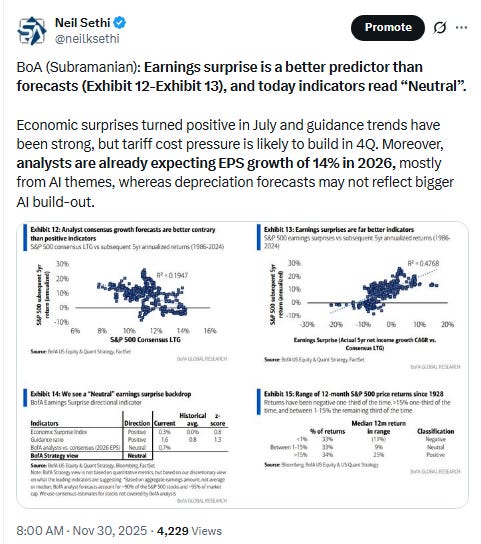

“Robust earnings growth expectations should drive further equity gains,” said Hoffmann-Burchardi. “We also believe that earnings growth is a more important indicator of forward returns, and our earnings growth estimates for major markets in the coming year are in a solid range of 7% and 14%, supporting near-term upside.”

“Seasonality, solid consumer spending despite grumpy sentiment, and year-end positioning all set the stage for a Santa Claus rally this year, most likely in the back half of the month,” said Mark Hackett at Nationwide.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Broadcom and Super Micro Computer lost more than 4% and 1%, respectively, indicating more profit-taking on some names in the artificial intelligence trade. But Synopsys shares popped after Nvidia announced an investment in the company. Meanwhile, shares of Nvidia — the AI darling who has become a favorite of Wall Street and Main Street — rose more than 1%.

Outside tech, retailers such as Ulta and Walmart advanced as the holiday shopping season kicked into high gear. The State Street SPDR S&P Retail ETF (XRT) bucked the market’s downtrend on Monday, propelling its five-day gain above 6%.

Energy producers joined an advance in oil.

Corporate Highlights from BBG:

Nvidia Corp. invested $2 billion in chip-design software maker Synopsys Inc. as part of a broader engineering and design tie-up, aiming to infuse its AI-computing technology into more industries.

OpenAI is taking an ownership stake in Thrive Holdings, an investment vehicle set up earlier this year by Thrive Capital, adding to a growing list of circular deals involving the ChatGPT maker and its backers.

China’s DeepSeek unveiled two new versions of an experimental artificial-intelligence model it released weeks ago, adding fresh capabilities the startup said would help with combining reasoning and executing certain actions autonomously.

Strategy Inc. said it had created a $1.4 billion reserve to fund future dividend and interest payments, in a bid to temper fears that the Bitcoin accumulator may be forced to sell some of its roughly $56 billion cryptocurrency haul if token prices continue to fall.

First Digital Group is planning to go public by merging with a blank-check company, as crypto firms take advantage of more favorable regulations to list their shares on stock markets.

Eli Lilly & Co. is cutting the price for introductory doses of its weight-loss drug Zepbound again, as competition heats up with rival Novo Nordisk A/S.

Moderna Inc. fell after the Food and Drug Administration said in a memo late last week it would place new restrictions on which vaccines hit the market.

Walt Disney Co.’s Zootopia 2 pulled in $272 million to claim China’s second-biggest opening ever for a foreign film, boosting the US studio in a key market.

Barrick Mining Corp. is exploring an initial public offering of its prized North American gold assets that may be worth over $60 billion as the company grapples with mining setbacks and a management shakeup.

Somnigroup International Inc., the world’s largest bedding company, proposed to buy one of its biggest suppliers, Leggett & Platt Inc., in an all-stock transaction worth about $1.6 billion.

Airbus SE has alerted customers that hundreds of its A320neo family jets will need to be inspected for potential structural defects linked to faulty manufacturing techniques at a supplier.

BHP Group offered around £40 billion ($53 billion) in its now-aborted attempt to acquire Anglo American Plc, according to people with knowledge of the matter.

A massive data breach at South Korea’s largest e-retailer Coupang Inc. caps what is set to be a record year for online leaks in the country, highlighting weaknesses in Seoul’s cyber defenses.

BYD Co.’s sales fell for a third straight month as the world’s largest electric vehicle maker faces intensifying competition from rivals churning out popular models.

China Vanke Co., the distressed builder that surprised markets last week when it proposed an unspecified delay in paying a local bond, has now asked holders to wait a year to be made whole, as it faces mounting liquidity pressure amid waning state support.

Mid-day movers from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

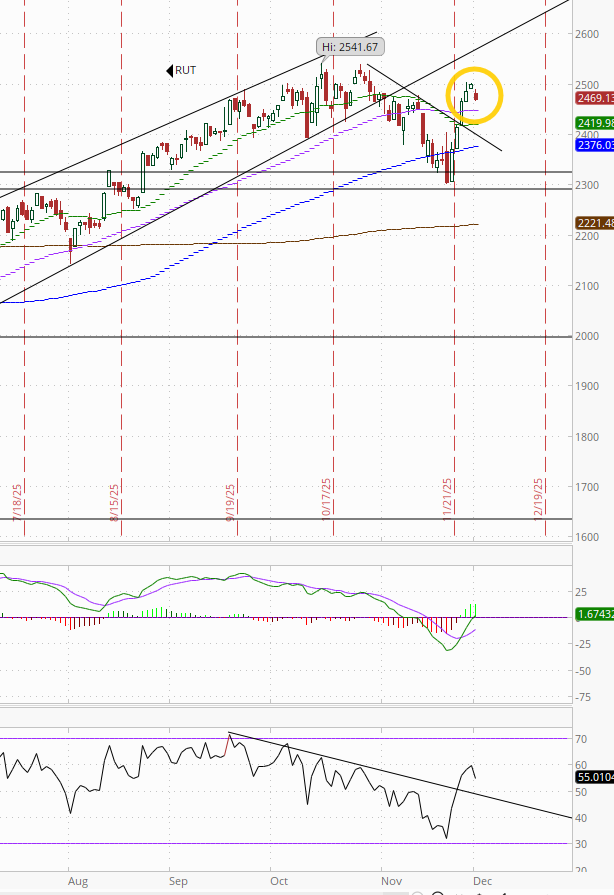

The SPX edged back to just on both its downtrend line from the highs and its uptrend line (which it broke last week) from Aug. As noted Fri, the daily MACD has flipped to “go long” positioning, and the RSI is back above 50.

The Nasdaq Composite a similar story (although remains above its steeper downtrend line and technically its MACD is “cover shorts”).

RUT (Russell 2000) sort of in between the two.

Sector breadth from CME Cash Indices weakened to just three of 11 sectors higher (breaking the streak of at least 8 higher the previous five sessions), and two of those were up less than +0.1% Six though were down more than -0.5% (actually -0.8%) after none the prior few sessions. Only one sector up that much in Energy (+0.9%) which led for a second session.

SPX stock-by-stock flag from @finviz_com consistent with quite a bit more red outside of Energy.

Just three of the top 9 (trillion-dollar club) were higher (after six Fri, five Wed, eight Tues, nine a week ago) led by NVDA +1.7% (AAPL just behind +1.5%). AVGO led decliners giving back -4.2% of last week’s +18.5% gain. With NVDA & AAPL higher it kept the loss in the Mag-7 to just -0.1% after it was up +5.1% last week.

Just 7 SPX components were up 3% or more, actually up from 6 Friday but down from ~24 Wed, 70 Tues, 40 a week ago, led by Synopsys SNPS +4.9% after Nvidia took a $2bn stake. APP was the only >$100bn in market cap up more than 3%, so only one again after 6 Wed, 10 Tues, 18 Mon.

26 SPX components down -3% or more, after none Friday (for the first time since Sept 26th), 10 a week ago, led by Moderna MRNA -7.0% after the FDA says it will tighten vaccine approvals. The >$100bn in market cap down more than 3% were AVGO, HOOD, LMT, RTX, GEV (in order of percentage losses).

NYSE positive volume (percent of total volume that was in advancing stocks) halved to 36.9% not a bad reading though given the -0.72% loss in the index.

Nasdaq positive volume (% of total volume that was in advancing stocks) similarly fell to 37.9%, a worse result given the smaller -0.38% loss in that index.

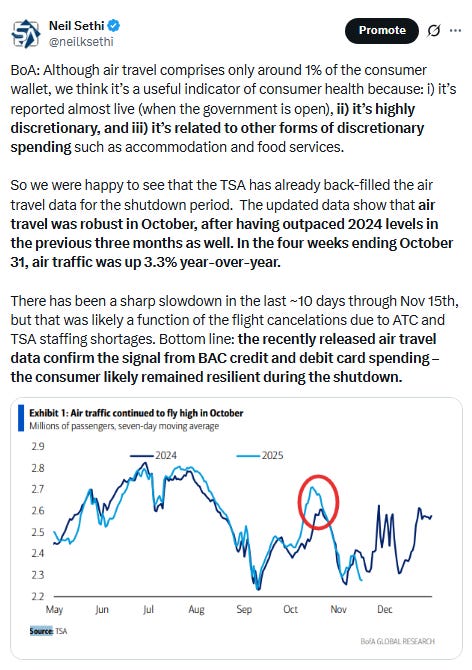

Speculative volumes remained on the low side, at least compared to what we had seen a couple of weeks ago when the top stock by volume saw 1.4bn shares traded and 12 stocks saw over 100mn shares traded. Today that was just 311mn and only 6 with over 100mn shares traded.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks were notably lower at 28% on the Nasdaq while the NYSE was at 35d%.

New 52-wk highs minus new 52-wk lows (red lines) also fell back again to 75 on the NYSE (although still a big improvement from the -115 Nov 20th) and 8 on the Nasdaq (but up from -357 Nov 20th (the least since April)).

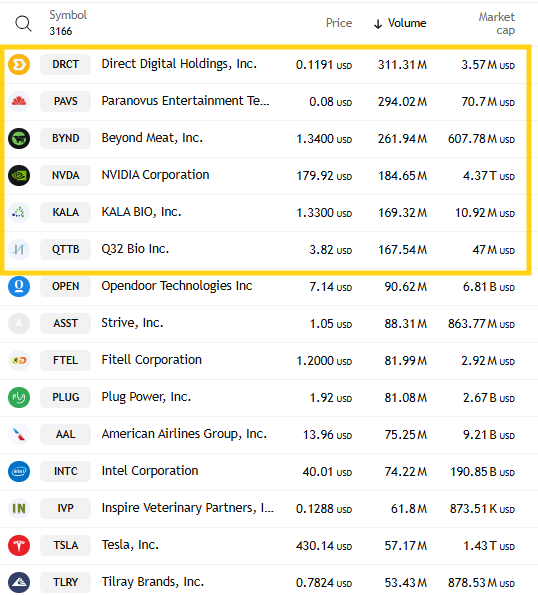

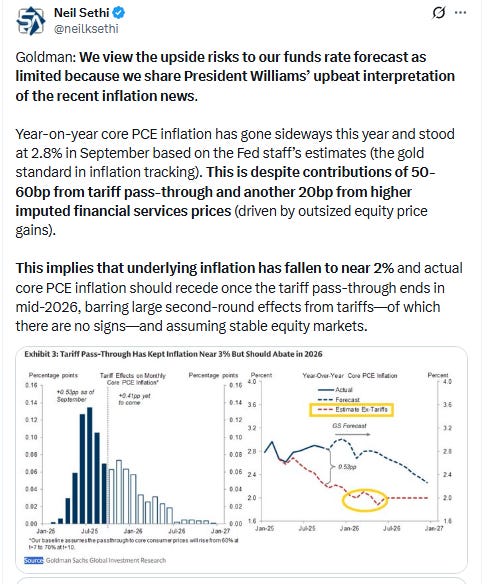

Odds on a Dec #FOMC rate cut edged higher to 88%, the highest since the Oct FOMC, up from 33% two weeks ago, although still down from 100% Oct 16th.

A cut by Jan edged to 91% (also the best since Oct 16th (96%)), but cuts at both the Dec & Jan meetings fell back to 21% barely up from 20% two weeks ago.

And pricing for 2026 eased back another -3bps to 64bps (down from 80bps two weeks ago which was highest we’ve been for 2026 cuts), and total cuts through Dec ‘26 eased to 86bps (down from 103bps pre-Oct FOMC which was the highs of the year (for cuts from December on)).

As a reminder the average dot on the dot plot has ~60bps of total rate cuts through Dec ‘26 from this point, so over a cut off.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is definitely where we were Apr 20th (a little too far) at 102bps). I said the day before July NFP “now it seems like we’re perhaps getting back to too few cuts”. I thought at 76bps heading into the Sept FOMC we were perhaps a bit overdoing it, but continued to expect at least 50bps this year (which we’ve now gotten) but probably not a lot more than that (which has been my call since last December). I said I thought we got back to overdoing it when over 50bps of rate cuts were priced for the rest of the year Oct 16th. I had said “while 50bps is my base case it’s less than 100% I think.” I then said we were pushing a bit to far when we got into the low 40% and under range, but now we’re back up over 80% which I think may be a touch high, but it certainly feels like Powell sent out the doves to talk it back up which means it’s almost certainly more likely than not.

Also remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point)

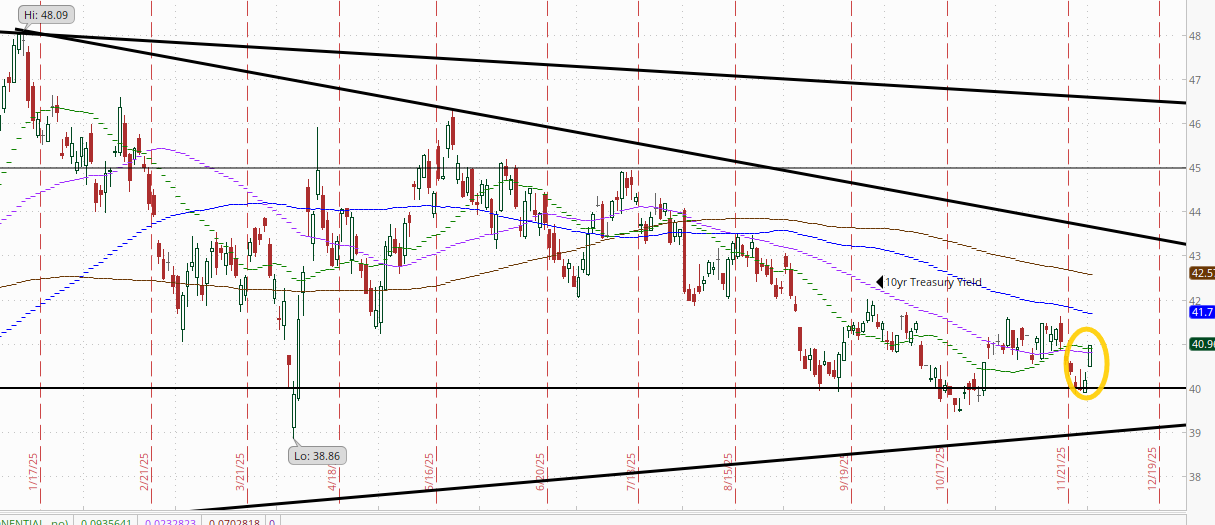

The 10yr #UST yield jumped higher along with global yields as noted above, up +8bps to 4.10% after having closed just below 4% on Thursday.

The 2yr yield, more sensitive to FOMC rate cut pricing, was +3bps to 3.53% now 11bps from the bottom of the range since late August. It is 35bps below the Fed Funds midpoint.

The Effective Fed Funds Rate (red line) though edged up another tenth to 3.89% further above the Fed Funds midpoint and up 6sbps since Sept, evidence of continued growing stresses in funding markets that will likely see the Fed adding assets to its balance sheet soon.

I had said when the 2yr yield it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO said on his weekly podcast he now sees it at 3.3% by year’s end (but sees risk to the downside), but I still took some off Sept 5th at 3.5%. I have been waiting for ~3.90% to add back but it seems now that ship might have also sailed.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) was lower for a fifth session after hitting the highest since May, falling at one point to its 50-DMA. The daily MACD and RSI have softened back to modestly negative.

VIX was up for the first session in six but modestly to 17.2 from the lowest close since October (after the highest since April the week before). The current level is consistent w/~1.08% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) similarly bounced from the lowest close since late Aug, but at 93.8 it remains well below Nomura’s Charlie McElligott’s breakeven “stress level” of 100 (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)) and still hasn’t quite retaken its trendline running back to March that it has never spent this long under.

1-Day VIX like the VIX and VVIX saw a mild increase Monday, in its case to 11.7. That level implies a ~0.74% move in the SPX next session.

#WTI futures caught a bounce but just so far another lower high with all that resistance remaining above. The MACD and RSI improved to more neutral levels though.

Gold futures (/GC) up for a fifth session (+4.8% over that time) as they continue to look to break out of their consolidation since peaking a month ago, now the highest close since the all-time high a month ago. Daily MACD as noted Wed has now flipped to “go long” positioning, and the RSI is above 60

US copper futures (/HG) edged back but only after hitting the highest since the July meltdown. In addition, as noted Wed the daily MACD has crossed to “go long” positioning, and RSI has pushed over 60. Longer term, they remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

As a side note, London copper futures hit all-time highs today.

Natgas futures (/NG) added another +0.7% after jumping over 5% Friday to the highest close since Dec ‘22. The technicals are also starting to firm. As I noted Friday “you can’t ignore this price action.”

Bitcoin futures gave back most of their rally since closing a week ago at the least since April falling -5.2%.

The daily MACD remains in “go short” positioning but still is close to flipping more positive, and the RSI remains over 30. I said Friday “I would assume we’ll retest those lows,” but honestly didn’t think it would come this quickly.

The Day Ahead

US economic data very light Tuesday with just Nov auto sales scheduled.

The Fed is in their speaking blackout (which though does allow for “communications on historical, educational, and informational subjects,” but as noted in the Week Ahead, tonight we’ll still hear from Chair Powell. The Fed calendar lists it as “Brief Remarks and Panel Discussion with Michael Boskin and Condoleezza Rice on George Shultz and his Economic Policy Contributions at the Hoover Institution’s George P. Shultz Memorial Lecture.” Given the Fed regulations, I would be shocked if he goes beyond that. Similarly Gov Bowman speaks Tuesday morning at the 2025 Santander International Banking Conference, in Madrid, Spain. While the topic is “Bank Supervision and Monetary Policy” I would be similarly surprised if she got into the latter.

The wrap-up of Q3 earnings will continue, but just one SPX component reporting tomorrow (per TradingView) in >$100bn in market cap CRWD.

Ex-US DM highlights include EU CPI and unemployment, UK house prices and BRC shop prices.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,