Markets Update - 1/21/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

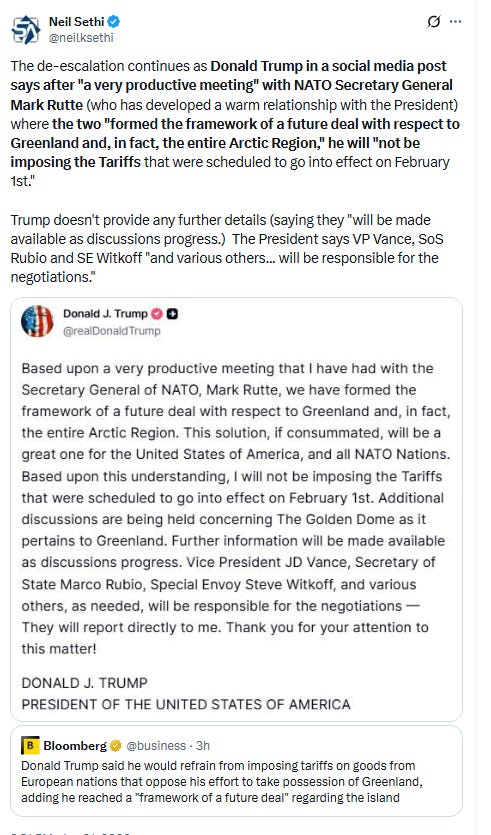

I mentioned last night the possibility that Trump might use his appearance at Davos today to “perhaps walk [the Greenland issue] back a bit?” And he did that to some extent in his morning speech when he told the World Economic Forum he would not use force to acquire Greenland. “We probably won’t get anything unless I decide to use excessive strength and force, where we would be, frankly, unstoppable. But I won’t do that,” Trump said. US equity indices took that positively, climbing into the green, up around 1% for the SPX, 1.5% for the Russell 2000 (RUT).

But those gains deteriorated after noon, and markets were more subdued, up until we got the “real” walkback in a social media post where Trump said due to a "a very productive meeting" with NATO Secretary General Mark Rutte during which the two "formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region," he would "not be imposing the Tariffs that were scheduled to go into effect on February 1st."

Equity markets shot to the highs of the day before settling back some to all finish at least +1.2% (SPX/Nasdaq/DJIA) with the RUT leading again +2% (outperforming the SPX for a 13th straight session, tying a streak from 2008).

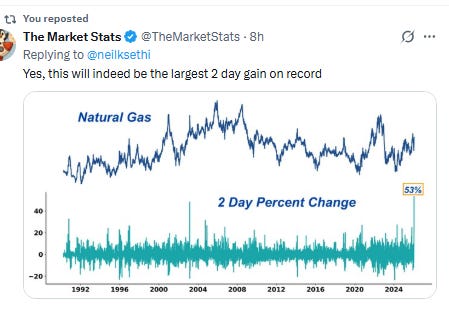

Elsewhere, bond yields fell back, while the dollar stabilized. Crude, gold, bitcoin, and natgas all were higher with the latter seeing the largest two-day gain in its history. Copper edged lower

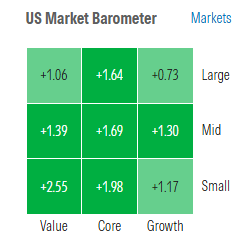

The market-cap weighted S&P 500 (SPX) was +1.2%, the equal weighted S&P 500 index (SPXEW) +1.7%, Nasdaq Composite +1.2% (and the top 100 Nasdaq stocks (NDX) +1.4%), the SOXX semiconductor index +3.2%, and the Russell 2000 (RUT) +2.0%.

Morningstar style box reflects the continued small cap outperformance.

Market commentary (note almost all were before Trump took tariff threat completely off the table):

The tone of Trump’s remarks made in Davos, Switzerland, was “less adversarial than some market participants expected,” said Bill Northey, senior investment director at Minneapolis-based U.S. Bank Asset Management Group. “And as we get a touch of a relief rally today, there may be the sentiment that the worst-case scenario is potentially avoided, which would have been a more confrontational position with our NATO partners.” Moving forward, he said via phone, “this refocuses capital-market participants on the fundamentals — which is the pace of growth, the pace of inflation and the implications for monetary policy. What does that mean for equity markets? We are in the heart of the fourth-quarter-earnings reporting season. Strong fundamentals continue to be the case and set the stage for a healthy environment.”

It wasn’t so much what President Trump said that mattered as what he didn’t say, according to Brian Jacobsen at Annex Wealth Management. “He didn’t reiterate his tariff threat against Europe, He didn’t say the government would use force to get Greenland. He didn’t say he’d cap credit-card rates, instead asking Congress to do it,” Jacobsen added. “It felt like a dialing down of the substance even if the style was still pure Trump.”

“President Trump is so unpredictable and he changes direction so quickly. The stock market no longer assumes that his pronouncements are going to be enforced,” Jed Ellerbroek, portfolio manager at Argent Capital Management, told CNBC. “The battle with Europe over Greenland would have taken the stock market down a lot more than the 2% yesterday if investors actually believed that this was a major geopolitical rift.”

“The markets breathed a sigh of relief during Trump’s speech marathon, where the US President ruled out the use of military to acquire Greenland,” said Fawad Razaqzada at Forex.com. “But does this mean it is risk back on, and markets will kick on from here after the recent falls? Well, time will tell. But caution remains the order of the day.” While military use would have been quite the unthinkable and no one really believed the US would have gone down that road anyway, a trade war with Europe cannot be ruled out just yet, Razaqzada added.

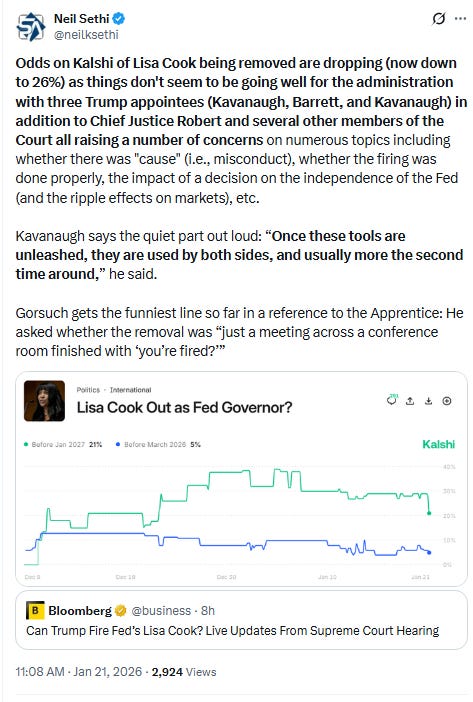

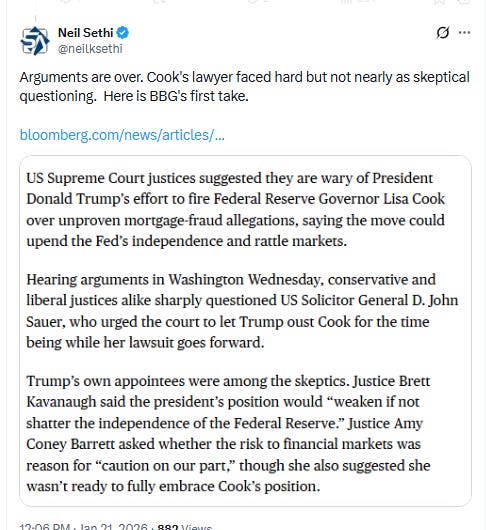

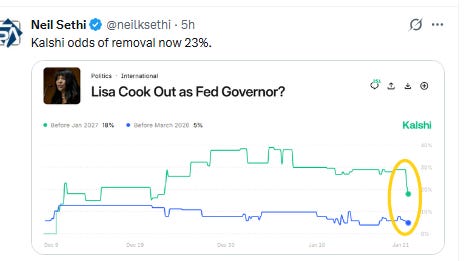

“Sharp turn Wednesday in favor of risk with Trump’s Greenland ‘TACO’ reversal and a Supreme Court hearing on the Trump/Cook case that seemed to go well for the Fed governor and the Fed as an institution – not to mention an easing of the Japanese yield surge,” said Krishna Guha at Evercore. “None of these issues go away, however, and all three will be with us for some time.”

“His speech was focused on economics instead of geopolitics and the president’s foreign policy ambitions. He spent the vast bulk of the speech talking up the U.S. and its economic achievements,” said Kathleen Brooks, research director at XTB. “This is more palatable to traders and it is why stocks are rallying, particularly in the U.S.” However, Trump’s remarks still serve as a reminder not to take what he says “at face value,” as he is still a president who cares about the performance of the stock market “above everything else,” Brooks told MarketWatch in emailed commentary.

“Many investors worry it could rattle equity markets. We are less convinced,” Alastair Pinder at HSBC Holdings Plc, wrote in a Jan. 20 note. The 36 major geopolitical events since 1940 saw US stocks rise 60% of the time in the three months that followed, he said.

“These episodes create chaos in the short term, but they tend to cool over time,” said Kenny Polcari at SlateStone Wealth. “None of this changes the trajectory of the US economy or the expectations for a strong 2026. Volatility is your friend, and weakness should be used to build positions in quality leaders that are getting unnecessarily whacked by the headlines.”

Polcari also cites the fact that we’re in the middle of what is expected to be a strong earnings season.

JPMorgan Asset Management’s Bob Michele said the recent selloff in markets Tuesday was a message to the Trump administration to take action to restore calm as officials did after Liberation Day tariffs rattled investors last year. “Things are a bit chaotic and the markets do feel a bit panicked,” he said. “The market had a fit in April and then they backed off of a lot of things and then calm ensued. We need to hear some of the same kinds of things.”

David Laut, chief investment officer at Kerux Financial, said Tuesday’s selloff shows investors had assumed stocks were desensitized to tariff risks, only to be reminded that markets remain headline-driven. “We remind investors that tariff headlines can cause short-term volatility, but that applies in both directions,” Laut said. “The tariff threats can easily be unwound and reversed, sparking upside market volatility.” The tariff-driven market declines also present opportunities for investors who are looking for an attractive entry point to put new money to work, Laut said. He added that his team favors value stocks in financials, materials and energy sectors, which are all “the better buys right now” given elevated valuations in megacap technology names. Laut also said that the tariff-driven stock market declines present opportunities for investors who are looking for an attractive entry point to put new money to work. He bets value stocks, in sectors like financials, materials and energy, are the better buys right now given elevated valuations in tech stocks.

The tariff threats surrounding Greenland show that the stock market, while resilient, is still headline-sensitive, and there will be plenty of headlines in the coming weeks, whether they are from Washington, earnings, economic data or the Federal Reserve, noted David Laut at Kerux Financial. “We remind investors that tariff headlines can cause short-term volatility, but that applies in both directions,” Laut added. “The tariff threats can easily be unwound and reversed, sparking upside market volatility.”

Despite the market rebound, the rally was kept in check by persistent concerns about Trump’s simultaneous commitment to seeking immediate negotiations on Greenland and his continued threats to impose escalating tariffs on European partners if they refused to cooperate, according to Giuseppe Sette at Reflexivity. The market’s cautious response reflected investors’ recognition that while the elimination of military escalation risk was significant, the underlying trade tensions and “Sell America” narrative remained unresolved, he added.

“This episode may accelerate an emerging structural shift: global investors have shown greater appetite to diversify away from US concentration risks, especially in AI leadership, and renewed geopolitical unpredictability strengthens this incentive,” she said. “Recent dollar softness is consistent with this gradual global portfolio rebalancing.”

“America First is quietly driving diversification away from dollar assets, especially among government entities,” wrote Joyce Chang, chair of global research at JPMorgan in a note. “While we have long argued that the dollar maintains its transactional FX dominance, ‘Sell America’ narratives of diversification away from dollar assets have reemerged quietly but persistently.”

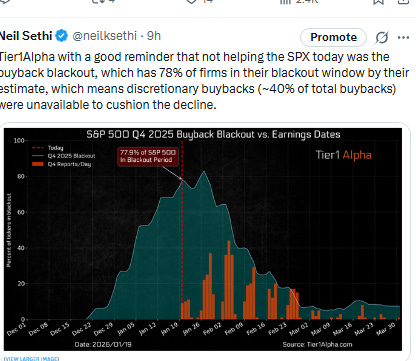

Tuesday served as a reminder that investors remain emotional about geopolitical and tariff headlines, and that record allocations to equities leaves little margin for error, according to Mark Hackett at Nationwide. “Following the strong run to record highs, it is not unusual or unhealthy to see a period of consolidation,” he said. “As skepticism arises, investors are more reactive, and companies are unable to buy back shares due to earnings blackout periods. The weakness has been temporary, however, with the rally continuing shortly after earnings season.”

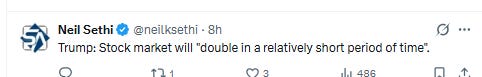

Now, the market will be driven by earnings results. "We are bullish on the stock market," Jay Hatfield, chief executive of Infrastructure Capital Advisors in New York said, adding that he has a target of 8,000 on the S&P 500 by year-end.

Legendary investor Bill Gross, who was once known as the “bond king,” said in his latest investment outlook on Wednesday that he senses the stock market is “in need of a cane to steady its momentum.” He wrote: “Positives abound with fiscal and monetary stimulus leading to earnings expectations that steady prices for now. But I wonder how U.S. markets in particular can thrive in a current environment of political unrest,” which is threatening a “capitalistic model based on competition and survival of the fittest.” Tariffs and government aid “lead possibly to `unfittest’ for some in a distant marketplace,” he said.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

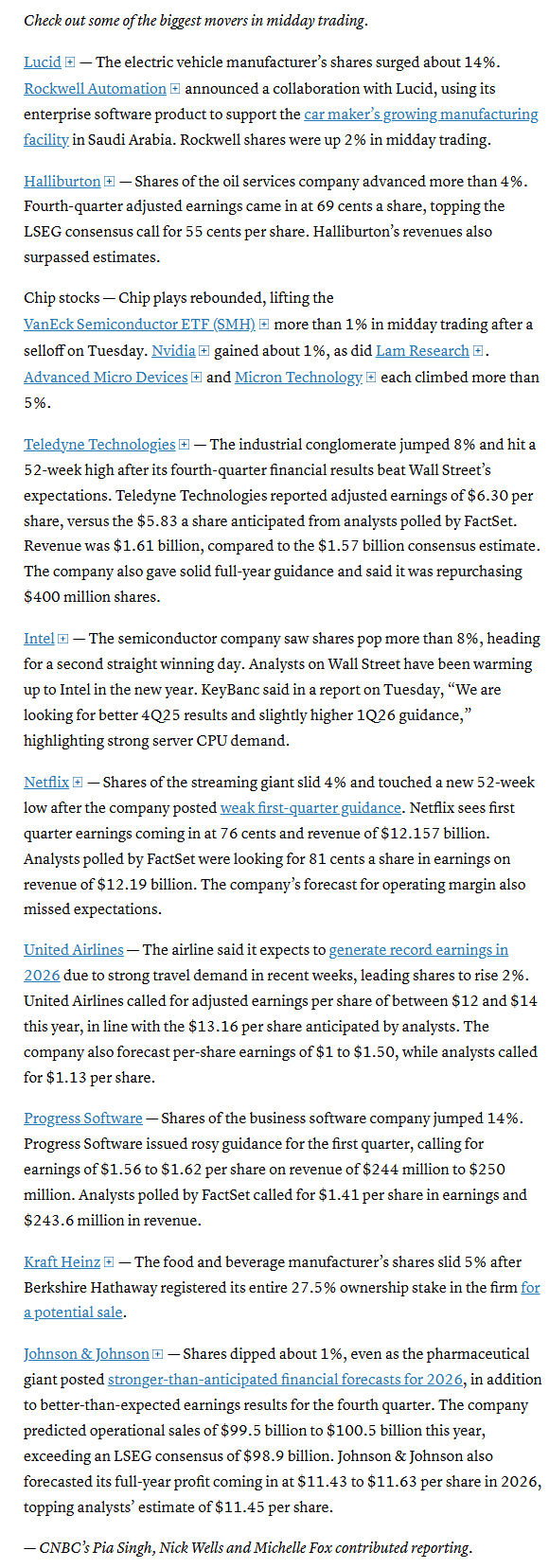

In individual stock action:

Energy shares led gains, hitting all-time highs. Tech stocks like Nvidia and AMD also led the market comeback as investors piled back into their favorite growth stocks after hunkering down earlier in the week.

Bank stocks also rose after the president said in his Davos speech that he would be asking Congress to implement his proposed credit card cap of 10%, an uncertain prospect given lack of support among lawmakers. Citigroup and Capital One each rose roughly 1%.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Netflix Inc. slumped after giving a disappointing forecast for earnings in the months ahead as it spends more on programming and works to close its $82.7 billion deal with Warner Bros. Discovery Inc.

European Union regulators are poised to review competing bids for Warner Bros. Discovery Inc. at the same time — thrusting Netflix Inc. and Paramount Skydance Corp. into a rare head-to-head antitrust battle.

Apple Inc. plans to revamp Siri later this year by turning the digital assistant into the company’s first artificial intelligence chatbot, thrusting the iPhone maker into a generative AI race dominated by OpenAI and Google.

United Airlines Holdings Inc. warned that geopolitical tensions risk disrupting what’s been “a pretty hot start to the year.”

Johnson & Johnson lost a key battle to block experts linking the company’s withdrawn baby powder products to cancer from testifying in court, sending shares lower.

Berkshire Hathaway Inc., the largest investor in Kraft Heinz Co., may soon sell some or all of its stake in the cheese and ketchup maker, just months after the firm announced plans to split into two companies.

UnitedHealth Group Inc. plans to give profits from its Affordable Care Act plans back to customers in 2026 as Congress weighs extending tax credits for those plans, the company’s top executive said in prepared testimony.

As artificial intelligence threatens to upend job markets in countries around the world, Nvidia Corp. Chief Executive Officer Jensen Huang brushed off longer term concerns and made the case that skilled vocational workers are seeing increasing demand now.

One of OpenAI’s top executives defended the company’s addition of ads to its popular chatbot ChatGPT as a way to democratize access to artificial intelligence.

Artificial intelligence startup SambaNova Systems Inc. is considering raising up to $500 million after talks to sell to Intel Corp. stalled, according to people familiar with the matter.

Halliburton Co. is ready to quickly restart operations in Venezuela once it obtains US government approval and some sort of payment protections, said Chief Executive Officer Jeff Miller.

Charles Schwab Corp. reported a surge in average daily trading volume in the fourth quarter as retail investors sought to take advantage of the end of a strong year for the stock market.

Ally Financial Inc. reported higher-than-anticipated provisions for credit losses in the fourth quarter to prepare for the potential of soured loans.

Jeff Bezos-backed Blue Origin is building a satellite communication network to deliver connectivity to data centers, governments and businesses, the company said on Wednesday.

TikTok will be able to continue operating its subsidiary in Canada for now, after a previous order for it to wind down its operations in the country was shelved by a judge.

Deutsche Boerse AG agreed to acquire European fund distribution platform Allfunds Group Plc for about €5.3 billion ($6.2 billion) in cash and stock.

Ryanair Holdings Plc’s chief executive officer said his online sparring with Elon Musk this past week has been good for business.

Ubisoft Entertainment SA is canceling game projects, shutting down studios and cutting its guidance as the Assassin’s Creed maker restructures its business into five units.

L’Occitane Groupe, the skincare retailer that was taken private by its billionaire owner Reinold Geiger in 2024, is weighing an initial public offering in the US as soon as this year, people with knowledge of the matter said.

Burberry’s sales advanced over the key holiday period as shoppers snapped up the British brand’s tartan scarves and trench coats, especially in China, bolstering hopes of a luxury rebound.

Renault SA plans to reintegrate its Ampere electric vehicle and software operations as Chief Executive Officer Francois Provost reverses a strategy that sputtered due to lower-than-expected EV demand.

Volvo Car AB, unveiling its first fully electric mid-size SUV, will stick to plans to manufacture the vehicle in Sweden for global shipments, even as the threat of further US tariffs mounts.

Qiagen NV, the European molecular testing firm, is weighing strategic options including a potential sale amid fresh takeover interest, people with knowledge of the matter said.

Sony Group Corp. introduced its latest pair of consumer earbuds, with a clip-on design that resembles recent efforts from Bose Corp., Lenovo Group Ltd.’s Motorola unit and Huawei Technologies Co.

Indian drugmaker Dr Reddy’s Laboratories Ltd. is planning to launch a generic version of Novo Nordisk A/S’s Ozempic in March after the drug’s patent expiry, becoming one of the first firms to capture the gold rush for the therapy in the South Asian country.

Mid-day movers from CNBC:

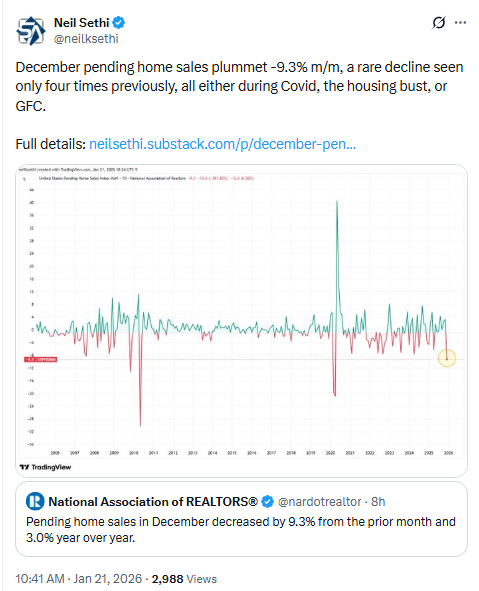

In US economic data:

Substack link:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

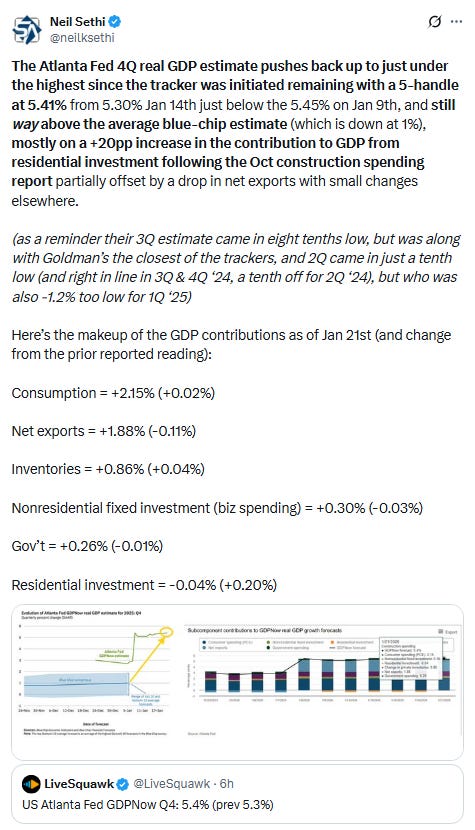

The SPX recovered some of Tuesday’s loss, the worst day in nearly three months, but remains below the 20-DMA. The daily MACD remains in “sell longs” positioning while the bounced from the weakest since Nov.

The Nasdaq Composite a similar story.

RUT (Russell 2000) remains the best chart of the bunch popping back into ATH territory. Its MACD remains with a “go long signal,” but the RSI is in a small negative divergence.

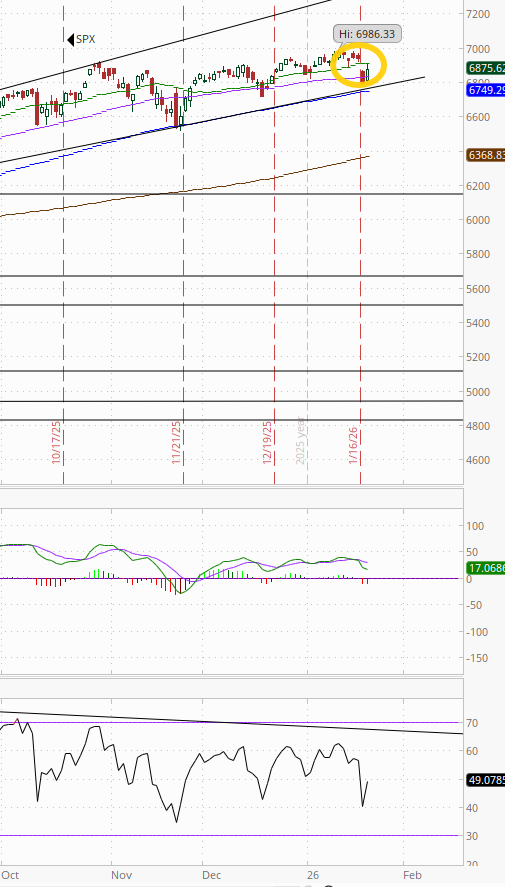

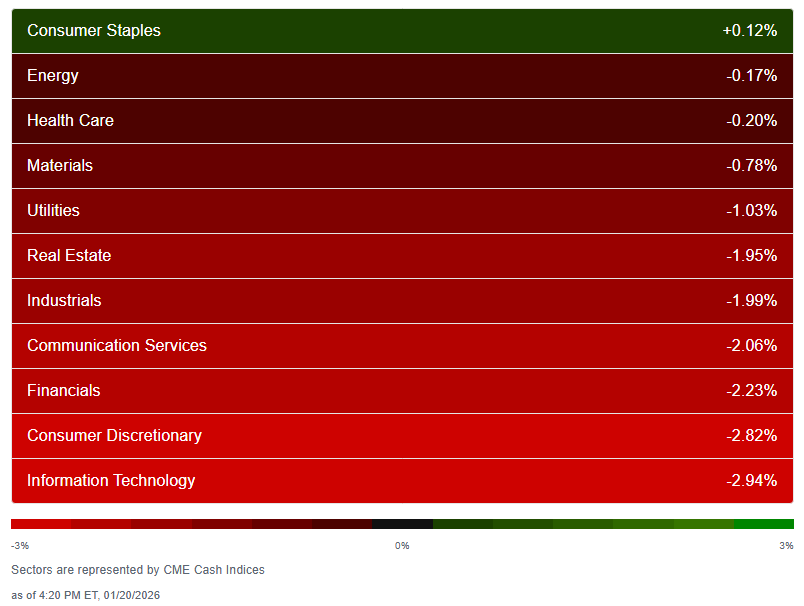

Sector breadth according to CME Cash Indices went from the worst of the year Tuesday (with just one sector higher (only the second time this year we had less than 6 higher)) to the best of the year with all 11 higher Wednesday

The top four continued to be dominated by “the other 493” (a megacap growth sector (Tech, Comm Services, Cons Discr) has only appeared twice in the top four over the past 7 sessions). Today those top four were Energy, Materials, Health Care, and Industrials, all up at least +1.7% (and another three were up 1% or more).

Unlike Tuesday though where the three megacap growth sectors all came in at the bottom of the flag, they were 5-7 today with former highflying Staples finishing at the bottom with Utilities (although note both were still green with Staples the 8th up day in 9).

As you might imagine, again a very different stock-by-stock flag from @finviz_com for Wed going from “red all over the place and just a few pockets of green” to the opposite.

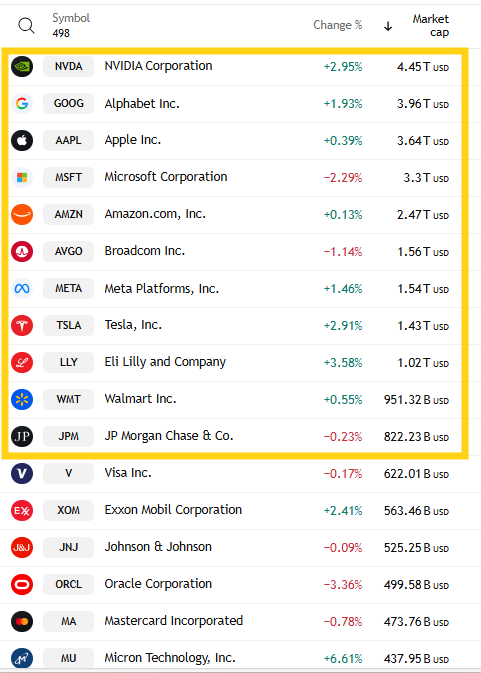

In that regard eight of the largest 11 SPX components was higher (from 1 Tues, 6 Fri, 5 Thurs) led by LLY for a second day +3.6%. Two others (TSLA/NVDA) were up at least +2.9%. MSFT led to the downside -2.3%

Mag-7 +1.1%, nut still down -2.0% for the week after -2.1% the prior week.

~100 SPX components were up 3% or more (after 8 Tues, 13 Fri, 40 Thurs). And 2025 loser turned 2026 winner Moderna MRNA was the leader for a second time this year +15.8%. It’s up a huge 70% so far this year.

13 of those 100 up 3% or more were >$100bn in market cap (after 3 Tues, 4 Fri, 11 Thurs) in INTC (again), AMD, MU, IBKR, VRTX, DE, GILD, AMGN, LLY, UNP, DHR, LOW, ADI (in descending order of percentage gains).

4 SPX components down -3% or more (down from 125 Tues, the most this year, 3 Fri, 12 Thurs) led by Applovin APP -5.8%.

2 of the 4 down -3% or more were >$100bn in market cap (after 24 Tues, 3 Fri/Thurs) in APP and ORCL (in order of percentage losses).

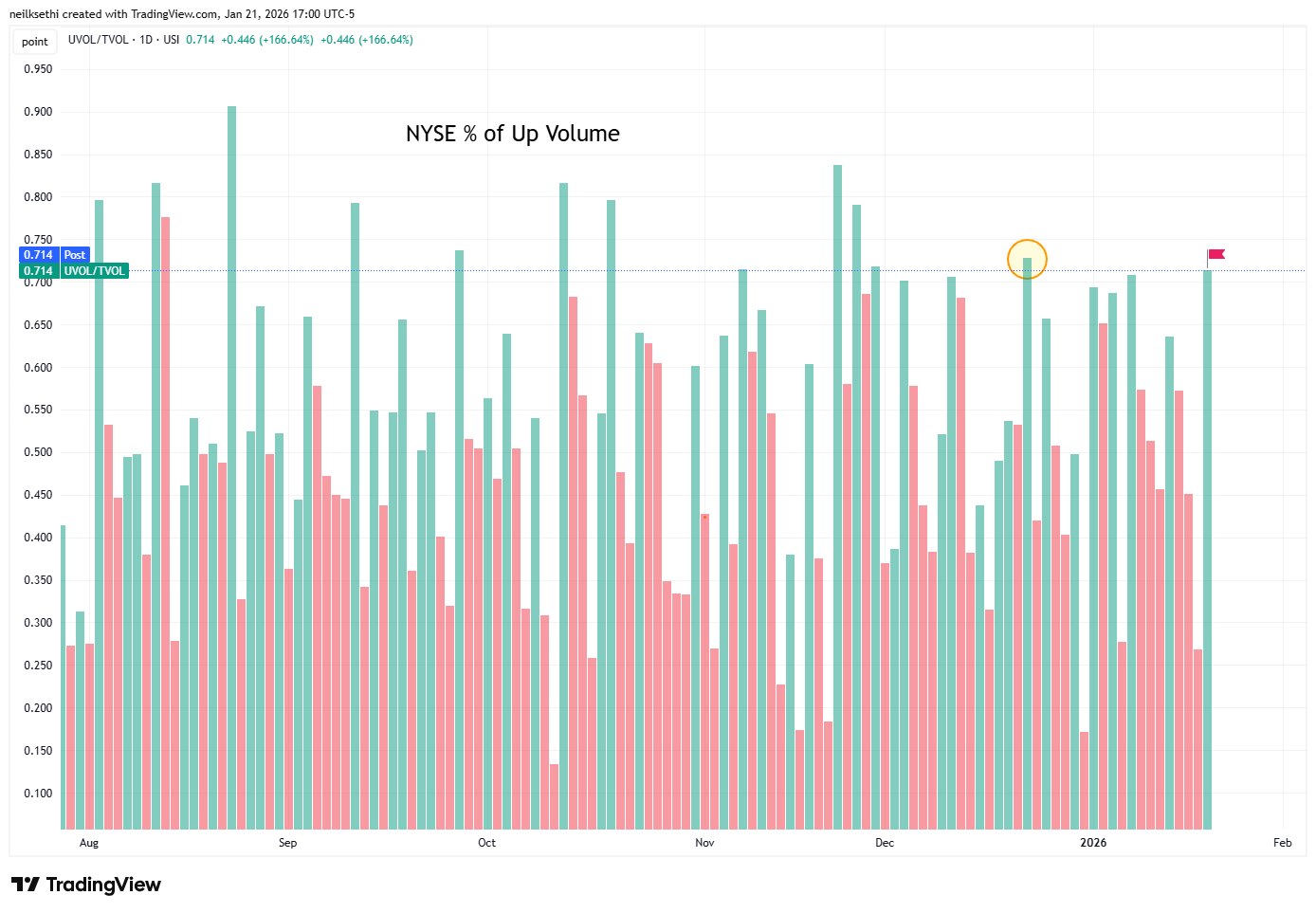

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) was the best since Dec 22nd although it was a little underwhelming at 71.4% given the +1.13% gain in the index.

Dec 22nd it was 72.8% on just a +0.85% gain.

Nasdaq positive volume (% of total volume that was in advancing stocks) similarly improved to 68.3% around what you might expect for the +1.18% gain in the index with the caveat that it’s all over the place due to the speculative volumes.

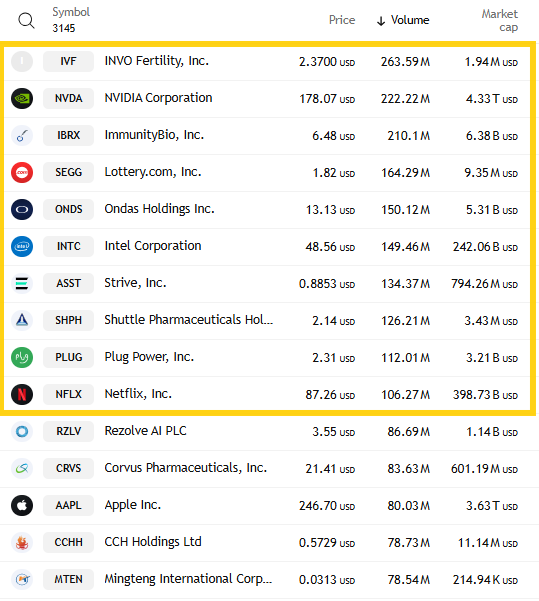

And in that regard speculative volume on the Nasdaq did fall back for a fourth day (from one of the highest days since the summer a week ago). The top three stocks by volume fell back to a little under 600mn shares from 700bn Tues, 1bn Fri, 1.4bn Thurs and a huge 4bn Wed.

There were another four that traded over 100mn shares (down from 7 Tues, 10 Fri, 9 Thurs) so speculative activity continued to move back towards more average levels.

Also, notably, neither of the top two by volume were penny stocks, the first time I’ve seen that in a while.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, did reflect that today with the Nasdaq right on positive volume at 68%, while the NYSE was 77%.

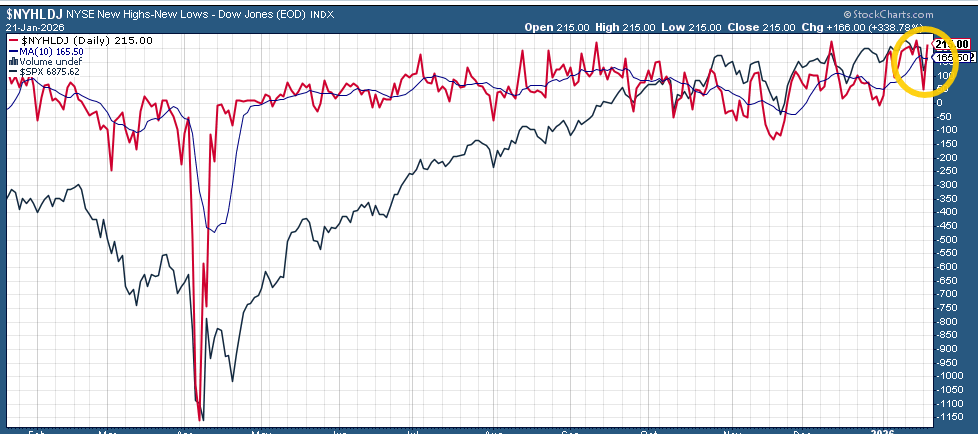

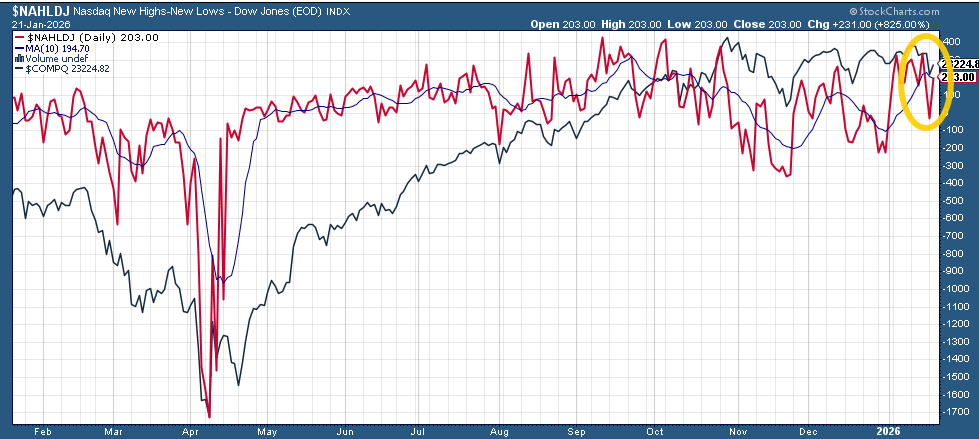

New 52-wk highs minus new 52-wk lows (red lines) though jumped higher to 215 on the NYSE just a little under the 227 Thurs, which was the best since Nov ‘24, while the Nasdaq improved to 201, down from 335, the best since Oct.

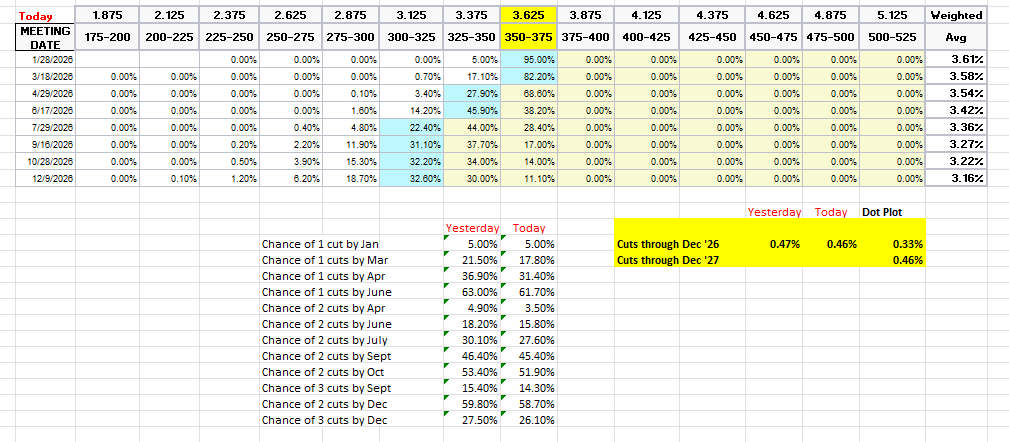

#FOMC rate cut pricing continues to ignore all the drama elsewhere in markets remaining around the least since pricing for the Dec ‘26 contract was initiated (or at least as far back as the CME Fedwatch tool has been tracking it).

January didn’t move, but off the table unless the Fed chooses to revive it (very unlikely) at 5%. March is 18% (from 51% Jan 6th), April 31% (from 63%), with the first cut in June (62%). A second cut remains in Oct (52%, there was a 55% chance of a July cut on Jan 6th).

Pricing for 2026 edged back -1ps to 46bps (remaining under two cuts after having fallen blow for the first time Thurs), with pricing for two cuts 59% and three cuts 26% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

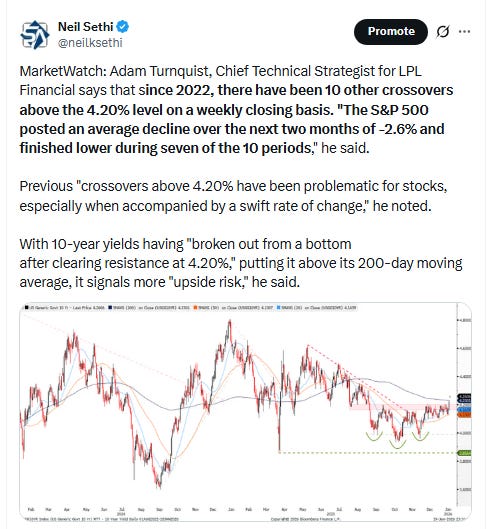

The 10yr #UST yield fell back from the downtrend line from the Jan ‘25 peak -5bps to 4.25%. We’ll see if it can continue to hold which was my initial expectation.

The 2yr yield, more sensitive to FOMC rate cut pricing, edged lower but just -1bps to 3.59% from the highs of the year and for now remaining over the top of the channel it’s been in since the start of 2024, which it had not previously closed over since then.

It is -5bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) stabilized after the biggest drop in a month Tuesday sitting in the middle of a cluster of its 20. 50, 100, and 200-DMAs (as well as the downtrend line from Feb).

The daily MACD remains for now in “go long” positioning with the RSI around 50.

VIX fell back after Tues moving over 20 for the first time since Nov. It ended at 16.9. That level is consistent w/~1.06% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also fell back from the highest since Nov now at 102.6.

The current level is consistent with “moderately elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is also a level flagged by Charlie McElligott as one to watch.

The 1-Day VIX like the VIX and VVIX fell back in its case to 12.2. The current reading implies a ~0.76% move in the SPX next session.

WTI futures decided that the de-escalation was a good thing adding +1.9% although still in the range of the past week, remaining just above support of the 50-DMA. We’ll see if that can continue to hold or if they decide to retest the 200-DMA (brown line) again.

Gold futures (/GC) liked the tariff escalation, but they had no problem with the de-escalation either adding another +1.4% after their best day since Apr 2020 Tuesday. They are now up against the trendline from April where the October rally petered out. Daily MACD remains in “go long” positioning, while the RSI is well over 70.

US copper futures (/HG) remain unable to get going losing some ground for a fourth session although still not far from all-time highs. But as noted Friday, “the daily MACD has crossed to ‘sell longs’ positioning while the RSI has fallen to the least since Nov, so we’ll see if a deeper pullback is in the cards.”

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) surged another nearly 30%, after 25% Tuesday, their best two-day gain on record on what I would imagine is a huge amount of short covering once they got moving after the polar vortex was forecast which will drop temperatures sharply through the end of the month. They’re now back over $5 (after having touched $3 Friday). We’ll see if they take a stab at the $5.50 highs from 2025.

The daily MACD as noted Tues flipped to ‘cover shorts’ positioning, and RSI is incredibly almost at 70 from 33 Friday.

Bitcoin futures found a bottom at $87.5k level (which happens to be the “point of control” (most frequent price) over the past year. Still it has a good deal of resistance above.

The daily MACD as noted Tues flipped to “sell longs” positioning, while the RSI fell back under 50.

The Day Ahead

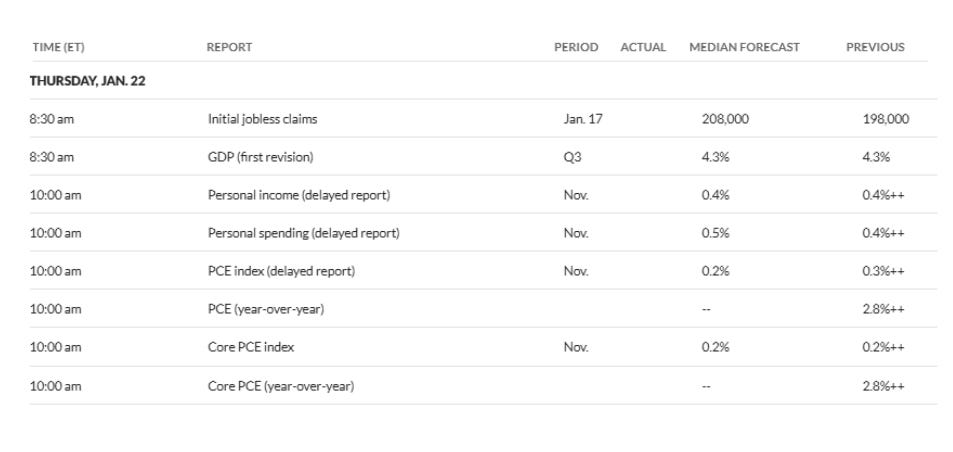

US economic data picks up Thursday with some important, albeit delayed, data in a combined Oc/Nov personal income and spending report which includes PCE prices (the Fed’s preferred inflation indicator) as well as the first revision (and I think only revision in this case) to 3Q GDP in addition to weekly jobless claims and EIA petroleum inventories.

No Fed speakers with the blackout, but we will get a second Treasury auction in the 10yr TIP, an auction that has never been market moving.

Q4 SPX earnings season continues with 11 SPX reporters, six of which are over $100bn in market cap in GE, PG, INTC, ABT, ISRG, COF (in descending order of market cap).

Ex-US highlights include rates decisions by Norges Bank (Norway), Turkey, Malaysia, and Costa Rica, ECB minutes from Dec, UK Dec public finances, Japan Dec exports, Eurozone Jan consumer confidence, South Korea Q4 GDP, Australia Dec employment, New Zealand Q4 CPI, and Mexico bi-weekly CPI.

From Goldman:

Thursday, January 22

08:30 AM GDP, Q3 third release (GS +4.4%, consensus +4.3%, last +4.3%)

Personal consumption, Q3 third release (GS +3.6%, consensus +3.5%, last +3.5%)

We estimate a 0.1pp upward revision to Q3 GDP growth to +4.4% (quarter-over-quarter annualized), reflecting an upward revision to consumer spending (+0.1pp to +3.6%) and stronger exports growth and inventory accumulation.

08:30 AM Personal income, November (GS +0.4%, consensus +0.4%, last +0.4% [September])

Personal income, October (GS +0.3%)

Personal spending, November (GS +0.4%, consensus +0.5%, last +0.4% [September])

Personal spending, October (GS flat)

Core PCE price index, November (GS +0.20%, consensus +0.2%, last +0.20% [September])

Core PCE price index, October (GS +0.16%)

Core PCE price index (YoY), November (GS +2.79%, consensus +2.8%, last +2.83% [September])

Core PCE price index (YoY), October (GS +2.69%)

PCE price index, November (GS +0.19%, consensus 0.2%, last +0.27% [September])

PCE price index, October (GS +0.16%)

PCE price index (YoY), November (GS +2.76%, consensus 2.8%, last +2.79% [September])

PCE price index (YoY), October (GS +2.68%)

We estimate that personal income increased by 0.3% in October and 0.4% in November, and that personal spending was flat in October and increased by 0.4% in November. We estimate that the core PCE price index increased by 0.16% month-over-month in October and by 0.20% in November, corresponding to year-over-year rates of 2.69% and 2.79%, respectively. Additionally, we expect that the headline PCE price index increased by 0.16% month-over-month in October and by 0.19% in November, corresponding to year-over-year rates of 2.68% and 2.76%, respectively.

08:30 AM Initial jobless claims, week ended January 17 (GS 215k, consensus 210k, last 198k)

Continuing jobless claims, week ended January 10 (consensus 1,895k, last 1,884k)

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,

Thanks !