Markets Update - 12/16/25

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

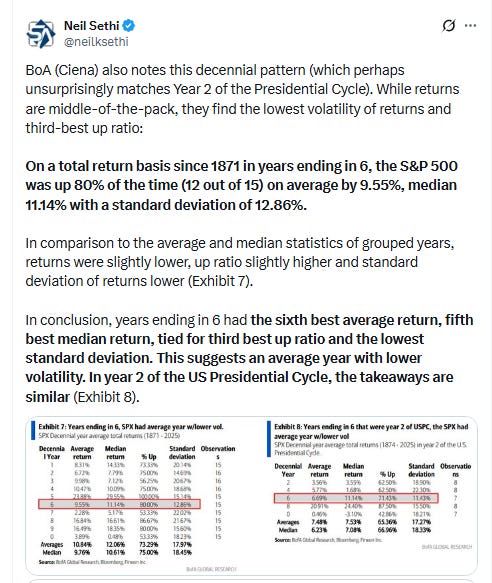

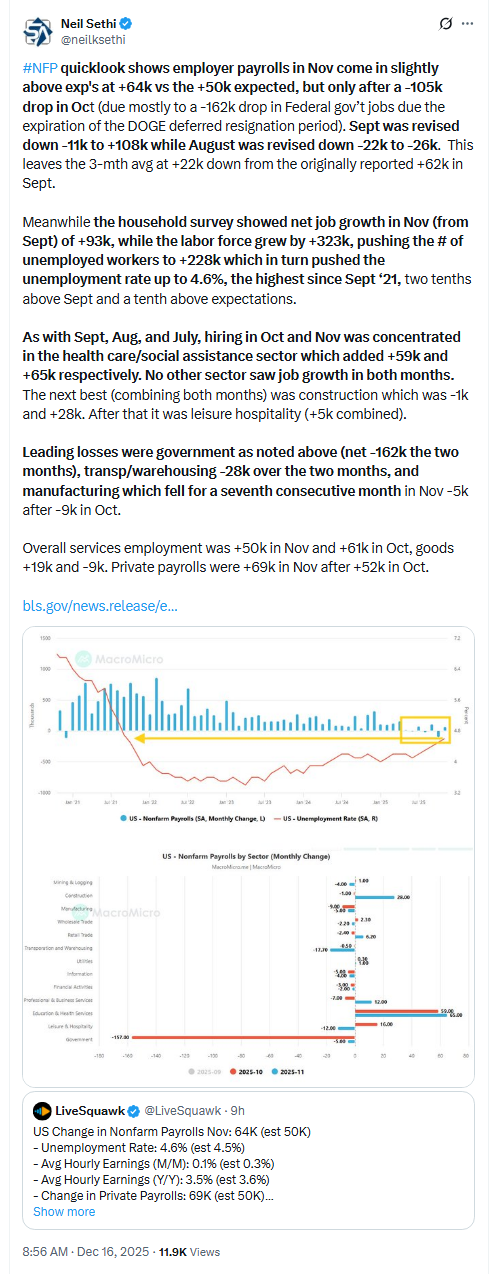

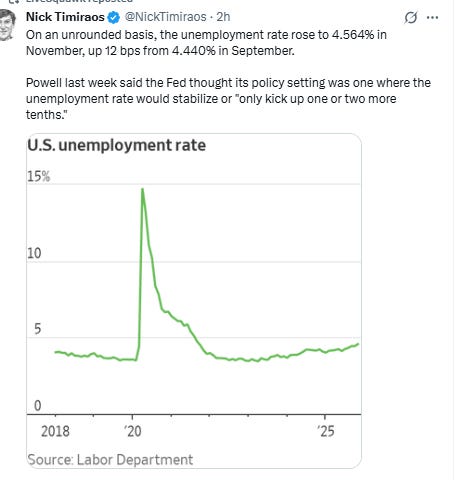

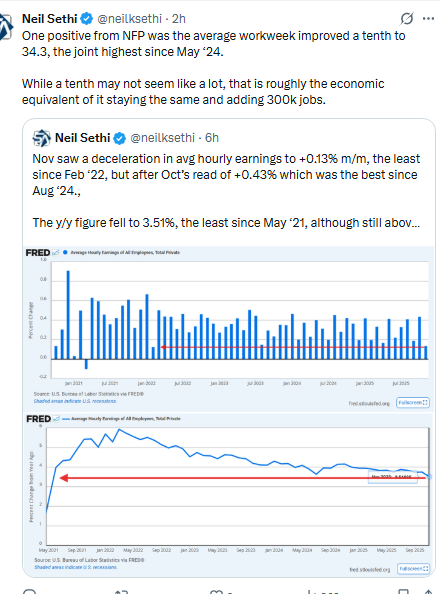

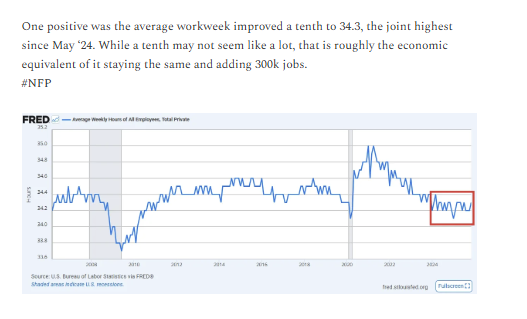

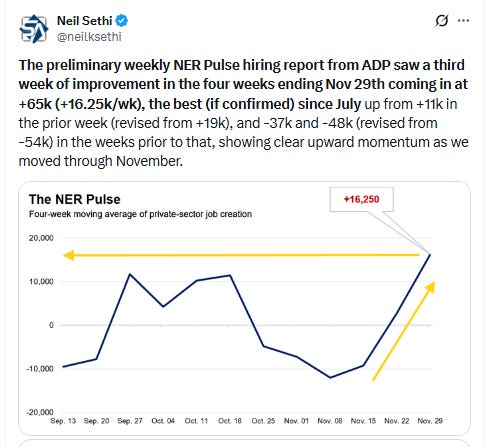

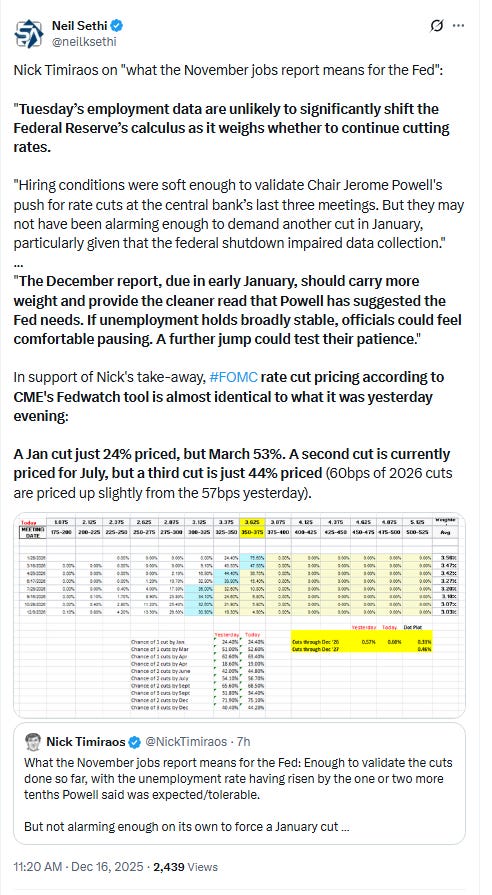

US equity indices opened Friday’s session modestly lower as they digested a flurry of economic data including a two-month employment report that saw a better than expected Nov payrolls but weaker than expected Oct (on a big drop in Federal government jobs), an unemployment rate which rose to the highest since 2021 after another boost to the labor supply, and a retail sales report which showed weak auto sales but very strong control group sales (which feed into GDP). The weekly ADP report also improved to the best since July. Given the mixed picture, the data didn’t though change expectations for Fed rate cuts much with January remaining at just 24% (more details below).

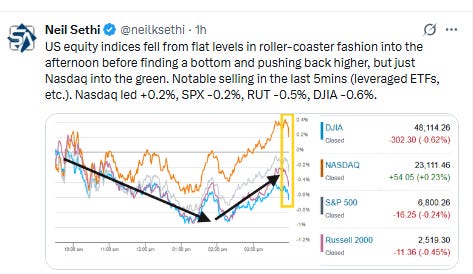

Indices fell from those levels in roller-coaster fashion until the early afternoon where they stabilized and began to move higher, picking up steam in the last 90 minutes before seeing a drop in the last 5 minutes ((leveraged ETFs, etc.). Just Nasdaq though made it into the green +0.2%, SPX was -0.2%, Russell 2000 -0.5%, and DJIA -0.6%.

Elsewhere, bond yields edged lower, as did the dollar. Crude fell to the lowest since Feb ‘21 and natgas, copper and bitcoin were also lower while gold was little changed.

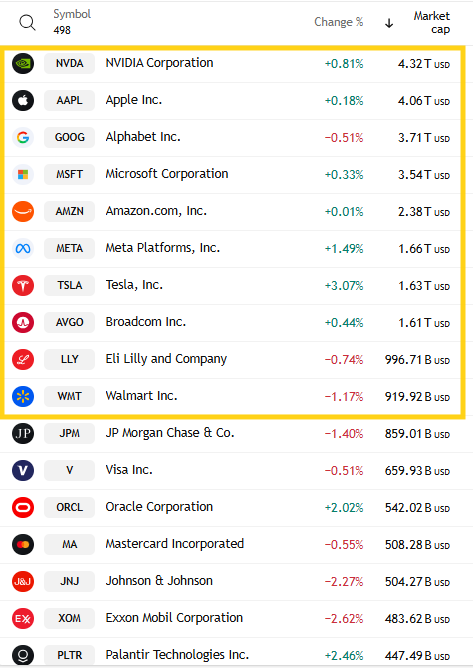

The market-cap weighted S&P 500 (SPX) was -0.2% for a second session, the equal weighted S&P 500 index (SPXEW) though -0.7%, Nasdaq Composite +0.2% (and the top 100 Nasdaq stocks (NDX) +0.3%), the SOXX semiconductor index -0.5%, and the Russell 2000 (RUT) -0.5%.

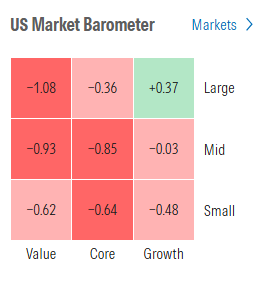

Morningstar style box saw only large growth escaping the red.

Market commentary:

“Investors didn’t get much clarity on the economic outlook from this morning’s flurry of economic data, and while traders are now pricing in two cuts to the Fed funds rate in 2026, that’s not likely enough to light a fire for stocks already expecting as much,” Gina Martin Adams, the chief market strategist of HB Wealth, told MarketWatch via email. Adams noted that job growth remained weak. While that may be enough to justify further rate cutting, other data pointed to economic strength — including real wage growth, core retail sales and expanding PMIs. “Both markets and the Fed will likely need to wait for more clarity to emerge as the calendar turns to the new year,” she said.

“Today’s data paints a picture of an economy catching its breath,” said Gina Bolvin, president at Bolvin Wealth Management Group. “Job growth is holding on, but cracks are forming. Consumers are still standing, but not sprinting This combination gives the Fed more freedom to pivot without panic — and gives investors a reason to lean into quality, income, and long-term themes rather than short-term noise.” This combination gives the Fed more freedom to pivot without panic — and gives investors a reason to lean into quality, income, and long-term themes rather than short-term noise, Bolvin said.

“We’re entering a market environment where selectivity matters more than ever,” she said.

The Fed is unlikely to put much weight on today’s report given data disruptions, according to Kay Haigh at Goldman Sachs Asset Management.

“The report on December’s employment data, released in early January ahead of the next meeting, will likely be a much more meaningful indicator for the Fed when it comes to deciding the near-term policy trajectory,” Haigh noted.

“With the continued cooling in the labor market, this should have the Fed leaning slightly more dovish as attention turns to 2026. The committee may gain more confidence in that view if this week’s inflation update shows that prices are being held in check. Should that be the case, it could give bulls an early advantage to start the year,” Bret Kenwell, U.S. investment analyst at eToro, said in an email.

“We agree with markets that today’s data flow was a wash,” said a group of Bank of America Corp. economists and strategists in a note. “Every data point, whether hawkish or dovish, had a caveat. On balance, we think the Fed is well positioned to wait for December data before making its policy decision.”

At JPMorgan Chase & Co., Michael Feroli says the November household survey data are more subject to a skeptical reading, but the likely ongoing rise in the unemployment rate remains a cause for mild concern. “We continue to believe these concerns will motivate the Fed to cut rates one more time in January, though that call will be informed by whether the cleaner December jobs report indicates growing labor market slack,” he said.

The jobs reading was at best a mixed review of a labor economy that has neither fallen off a cliff nor regained momentum – a middle ground, but one that’s still quite far from a “not too hot, not too cold” Goldilocks outcome, according to Jim Baird at Plante Moran Financial Advisors.

“Our baseline outlook hasn’t changed and it’s unlikely to have changed for the Federal Reserve,” said Tiffany Wilding at Pacific Investment Management Co. “An economy with resilient growth (despite policy shocks) and a stable labor market will receive fresh stimulus, front-loaded in 1H 2026.”

“Overall, the report contains enough softness to justify prior rate cuts, but it offers little support for significantly deeper easing ahead,” said Kevin O’Neil at Brandywine Global. “With labor market signals sending mixed messages, the next inflation reading may become the primary driver for markets as we enter the new year.”

At Glenmede, Jason Pride said investors should avoid overly extrapolating the signals from the “exceptionally noisy employment report.”

“All else equal, today’s report likely strengthens the case for further easing on the margin,” he said. “However, after delivering three rate cuts at the end of 2025, it is likely that the Fed will take a few months to digest incoming data before deciding on its next move.”

“The recent employment data didn’t rock the boat too much,” said Ryan Detrick at Carson Group. “We assumed the labor market was weakening some. Still, there’s something for everyone in there, as November jobs were better than expected, which could be a clue the post summer weakness is ending.”

Bottom line, Detrick says: this continues to give the Fed cover for a dovish tilt in 2026.

“There’s data, but not clarity, and this situation is consistent with a Fed pause in January,” said Don Rissmiller at Strategas. “The uptrend in the US unemployment rate is likely to keep the Fed’s bias toward an eventual easing again in 2026. A stalled labor market still needs some support.”

“Our view remains that the Fed is likely to cut interest rates by another 25 basis points in the first quarter of next year, providing a favorable backdrop for risk assets,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “But with volatility likely to pick up as markets assess fresh data, we think investors should revisit some of the foundational principles in constructing a resilient portfolio.”

“Markets better hope this employment report is distorted because it is nothing but bad, bad news for the economy and the outlook in 2026,” said Christopher Rupkey, chief economist at FWDBONDS. “It will be a miracle if we are not headed to a recession next year. The labor market gloom has turned to doom for job seekers and Washington doesn’t have a way yet to fix it.”

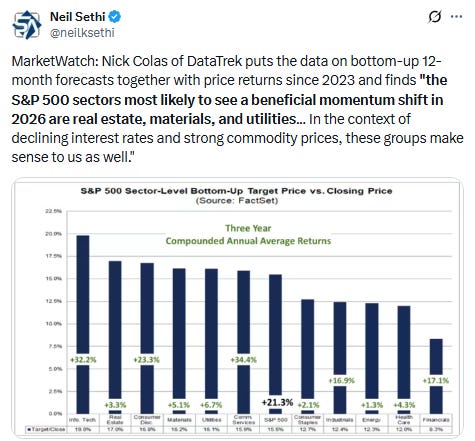

“I think for the next four, five, six months, there is some runway here when you look at the real economy corners of the market,” Chris Verrone, head of technical and macro research at Strategas, said Monday on CNBC’s “Closing Bell.”

“The groups that I think are starting to inflect here have shown us that,” he added. “Where have we seen the new high expansion? Industrials, financials, discretionary, materials. There’s a very real economy feel to this.”

“Higher unemployment might seem dovish for rates,” said David Russell at TradeStation. “However, it resulted from government job cuts and not weakness in the cyclical economy. This data does little to move the needle after three cuts, especially because policymakers know stimulus is coming.”

The theme of consolidation in bonds managed to survive the top-tier data releases, noted Ian Lyngen at BMO Capital Markets. “Not only did the range manage to hold, the price action itself was notably choppy as Treasuries initially rallied, then bear steepened, and eventually firmed with yields slightly lower on the day,” he said. “The phrase ‘this changes nothing’ quickly comes to mind as we consider the forward monetary policy implications.”

The bond market is mostly looking through the jobs report released on Tuesday, as the delayed data within it captures disruption from the government shutdown, according to a Brij Khurana, fixed-income portfolio manager at Wellington Management. Still, “the overall labor market is not terribly strong,” with the rise in the U.S. unemployment rate to 4.6% in November likely weighing on Treasury yields, Khurana told MarketWatch on Friday. That’s higher than where the Federal Reserve’s latest Summary of Economic Projections indicated the unemployment rate could end up next year, which might argue it should be cutting interest rates more, he said.

But investors “quickly dismissed the October data” in Tuesday’s U.S. jobs report, which was “really weak” due to the government shutdown, according to Khurana. “I think we don’t really get a clean read until the data comes in January.” In his view, the market is being too aggressive in pricing interest-rate cuts by the Fed next year, including one in the first half of 2026. That has left short-term Treasurys looking relatively “expensive” while long duration Treasuries appear more attractive, said Khurana. He anticipates the U.S. economy may see “strong growth” during the first half of next year, due in part to tailwinds from the GOP tax law known as the One Big Beautiful Bill Act and continued benefits from spending on artificial intelligence. But he expects economic growth may then slow, with the Fed potentially cutting its policy rate in the second half of 2026. “The market is assuming those cuts are going to be front-loaded, and if anything, I would assume it’s more back-loaded,” Khurana said.

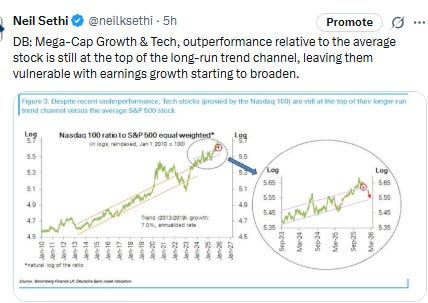

“I’m hearing about people taking money out of the Magnificent Seven trade, and they’re going elsewhere in the market,” said Craig Johnson, chief market technician at Piper Sandler & Co. “They’re not just going to be chasing the Microsofts and Amazons anymore, they’re going to be broadening this trade out.”

“The market is selling off today, and there’s these crosscurrents going on. Everyone’s like, ‘Oh my god, the AI trade, is it done?’” Eric Diton, president and managing director at The Wealth Alliance, said to CNBC. “It’s completely normal for the AI trade and the tech trade to sell off and and take a breather.”

“Are there risks? Of course,” he added. “But is this an unhealthy market? No, we’re actually seeing a broadening of the market.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Losses in key artificial intelligence names weighed on the broader market on Monday. Notably, Broadcom, Oracle and Microsoft ended the session lower as investors continued to take profits from high-flying AI trades and move into other areas of the market, including health care and utilities.

Energy stocks suffered losses along with it. Shares of oil majors Exxon Mobil and Chevron dropped roughly 2% each. Others such as ConocoPhillips and Marathon Petroleum were in the red as well.

Corporate Highlights from BBG:

Pfizer Inc. forecast little to no sales growth next year, a warning sign as the drugmaker works rebuild its pipeline of hit drugs with a series of pricey acquisitions.

Kraft Heinz Co. named a new chief executive officer, with former Kellanova CEO Steve Cahillane set to take over from Carlos Abrams-Rivera on Jan. 1.

Tesla Inc. plans to launch battery-cell production at its plant outside Berlin as soon as 2027, German press agency DPA reported.

Truist Financial Corp. said it would repurchase as much as $10 billion of stock under a new program.

Visa Inc. is opening its US network to stablecoin settlement, expanding crypto-linked products and services enabled by the relaxed regulatory environment under the second Trump administration.

Mortgage giant Freddie Mac announced that Kenny M. Smith will be its chief executive officer effective Dec. 17, putting the former Deloitte Consulting LLP vice chairman in a critical position ahead of a long-promised share sale by the Trump administration.

Apollo Global Management Inc. is exploring a potential sale of its aviation company Atlas Air Worldwide Holdings Inc., according to people familiar with the matter.

Mozilla Corp. elevated the head of its Firefox web browser to chief executive officer of the company, which is trying to position itself as an independent, privacy-focused alternative to Big Tech options.

Databricks is raising over $4 billion in a new funding round that values the software firm at $134 billion, another example of how some tech companies are achieving massive scale without going public.

Northwell Health Inc., one of New York state’s largest hospital systems, has signed a deal with a major labor union intended to lower costs and expand access to thousands of doctors for its members in the New York area.

President Donald Trump sued the BBC for at least $10 billion over a misleading edit in a documentary last year that gave the impression he’d made a direct call for violence in a speech leading up to the Jan. 6, 2021, attack on the US Capitol by his supporters.

Gucci owner Kering SA will get $690 million following its sale of a stake in a New York property to French investment fund Ardian as part of the fashion group’s efforts to shrink its debt.

Thames Water has deferred payment of almost £2.5 million ($3.4 million) in bonuses to its senior managers this month bowing to pressure not to reward staff while the company is ranked among the worst-polluting suppliers in the UK.

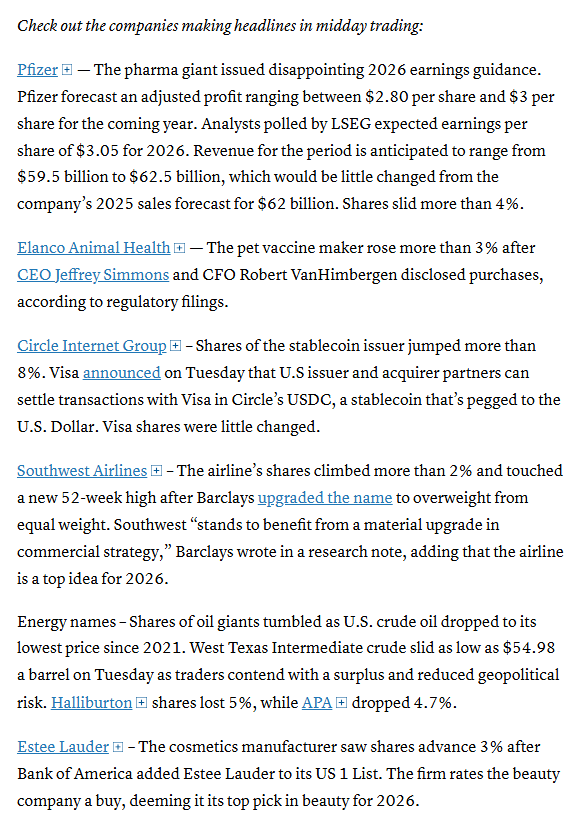

Mid-day movers from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

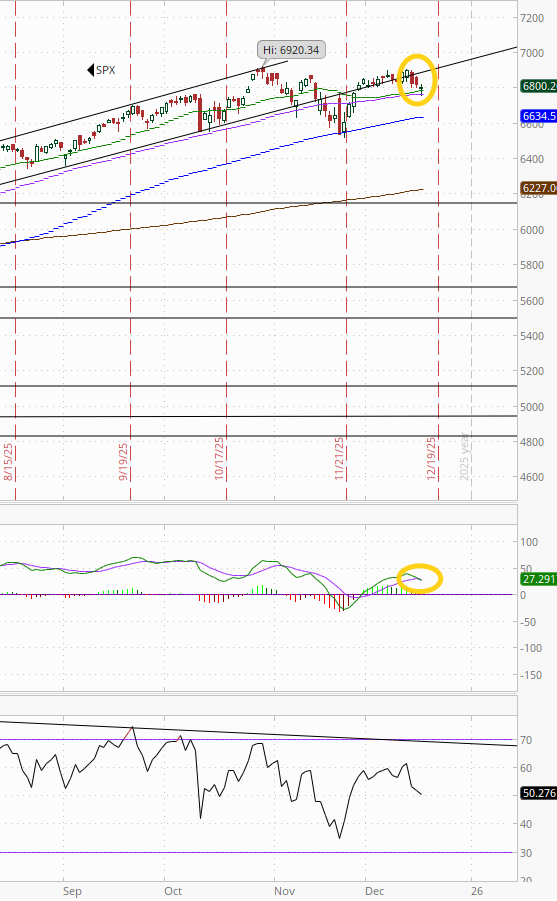

The SPX seems to have lost again its uptrend line from July (which it also broke two weeks ago) and made its way to the 50-DMA which held, still not far from ATHs. But the daily MACD flipped back to “sell longs” positioning, while the RSI is just above 50. Both also continue to have a negative divergence (lower high) and are close to turning more negative.

The Nasdaq Composite a similar story but it fell through its 50-DMA.

RUT (Russell 2000) continues to be the best picture not yet to the 50-DMA and not yet with the daily MACD crossover.

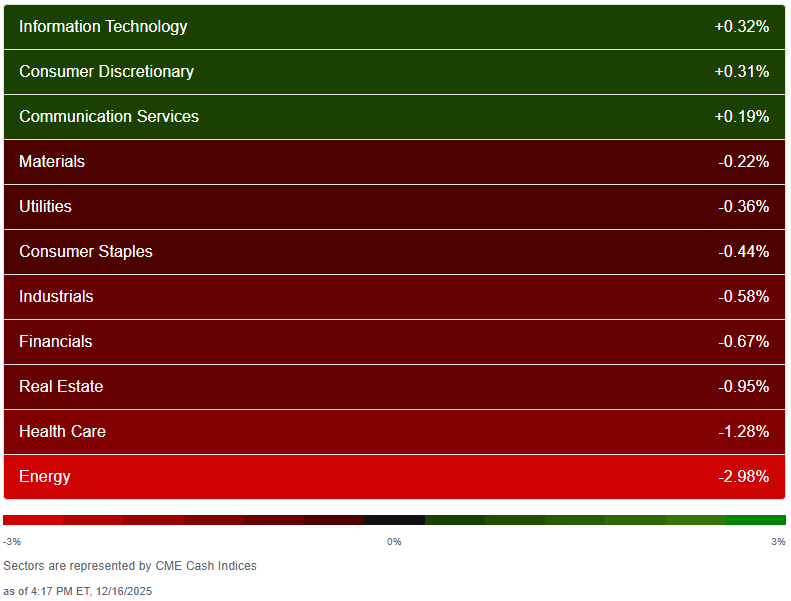

Sector breadth from CME Cash Indices (uses futures prices) in contrast to Mon looked worse than the modestly down day in the SPX with just 3 of 11 sectors higher, down from 7 Mon, 5 Fri, and none up more than +0.32%. The three green sectors were though the three megacap growth sectors though, which supported the cap-weighted SPX.

Seven sectors down more than -0.3% with three down around -1% or more (RE, Health Care, Energy) with the latter almost -3% as crude prices fell to the lowest since Feb ‘22.

SPX stock-by-stock flag from @finviz_com consistent with not much green outside of some of the biggest names.

In thar respect 7 of the top 10 were higher, up from 5 Mon, 4 Fri/Thurs, led for a third session by TSLA +3.1% after +3.5% Mon & 2.7% Fri. WMT led decliners -1.2%. Mag-7 was +0.8%.

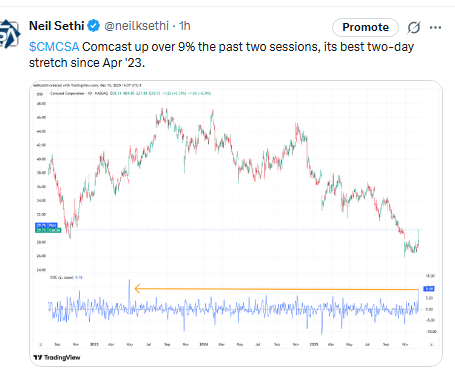

Just 7 SPX components were up 3% or more, down from 14 Mon, 8 Fri, ~40 Thurs, and 100 Wed, led by Comcast CMCSA +5.4% (after +3.6% Mon, its best two-day gain since Apr ‘23). CMCSA (again), HOOD, TSLA (again) were the >$100bn in market cap up 3% or more (in descending order of percentage gains).

23 SPX components down -3% or more, up from 14 Mon but down from ~45 Fri, led by Phillips 66 PSX -6.9%. COP, PFE were though the only >$100bn in market cap down -3% or more (in order of percentage losses).

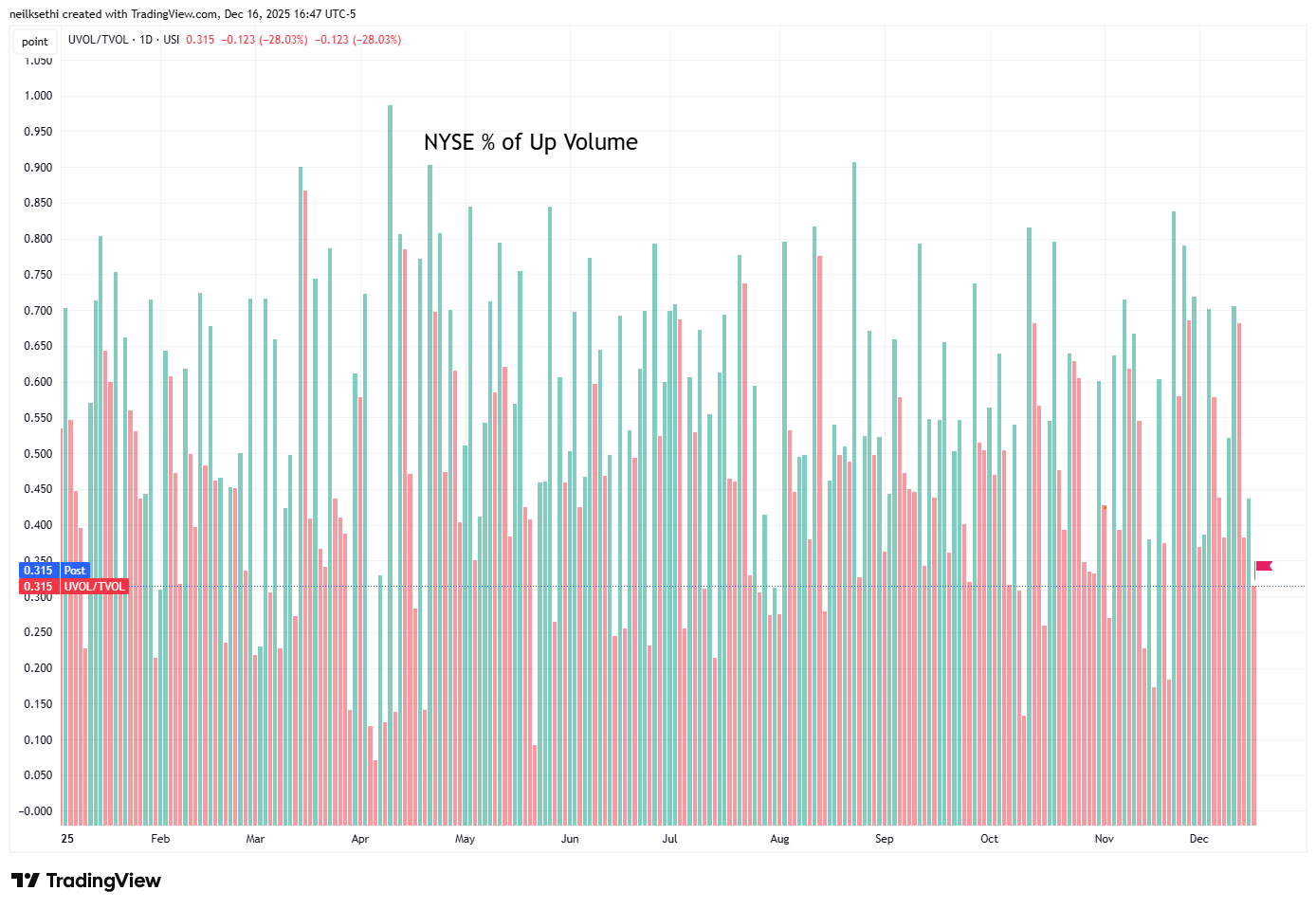

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) deteriorated as would be expected given the -0.85% decline in the index to 31.5%, in line with what you’d expect (after coming in well under what would be expected Mon).

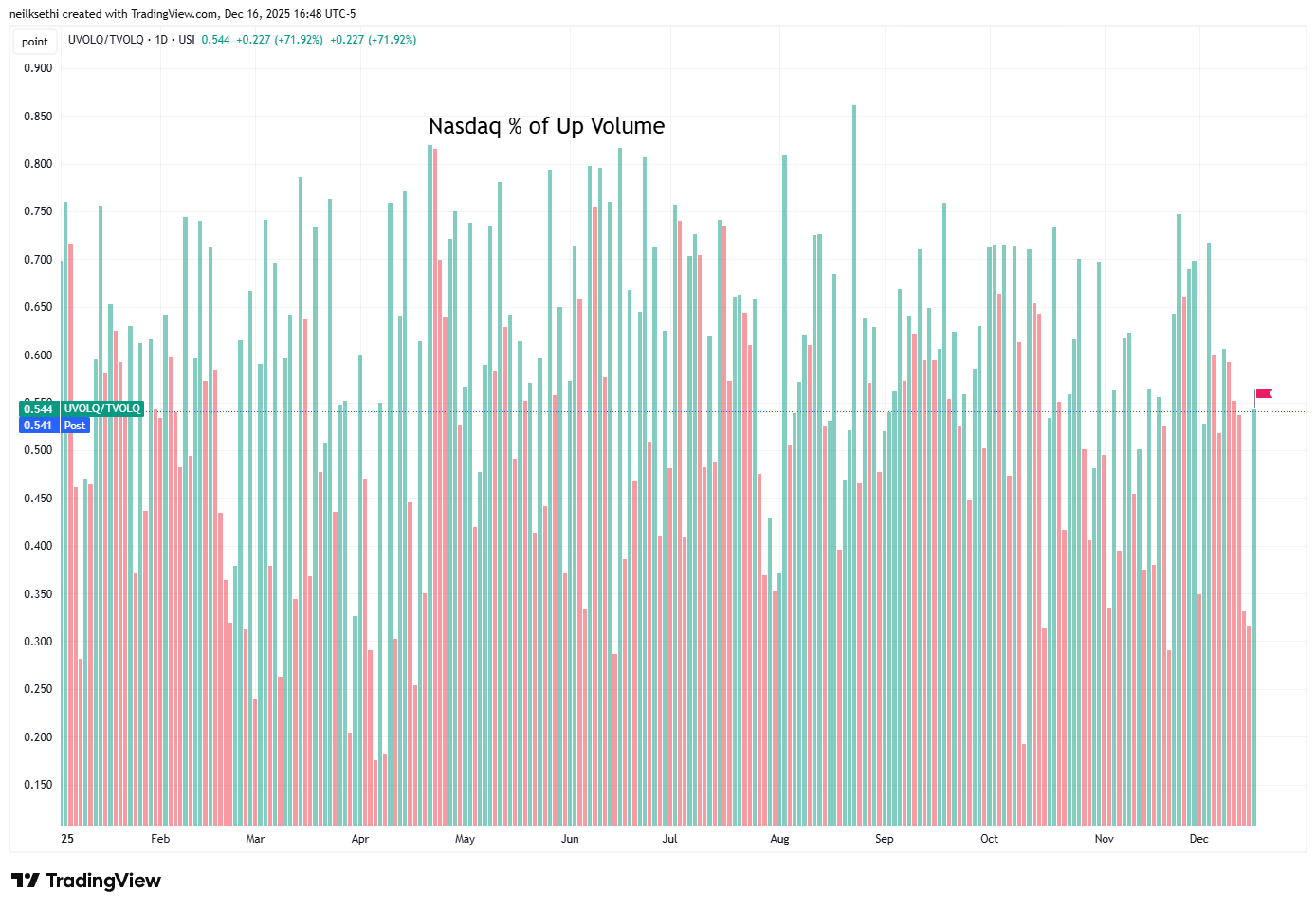

Nasdaq positive volume (% of total volume that was in advancing stocks) up to 54.1% from 38.1% as the index gained +0.23% vs a loss of -0.6% Mon, relatively in line with what would be expected.

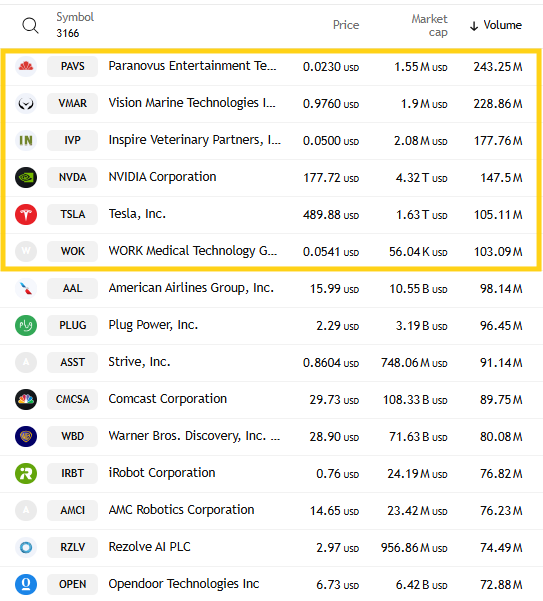

In terms of speculative volume on the Nasdaq, it was more subdued Tues with the the top stock (a return of penny stock PAVS to the top) at 243mn, down from the top stock Mon of 312mn, 510mn Fri, and 769mn Thurs. There were also just 6 companies with over 100mn shares traded down from 8 Mon, 7 Fri, 10 Thurs.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks a little further off despite the muted penny stock action at 43% while the NYSE was 37%.

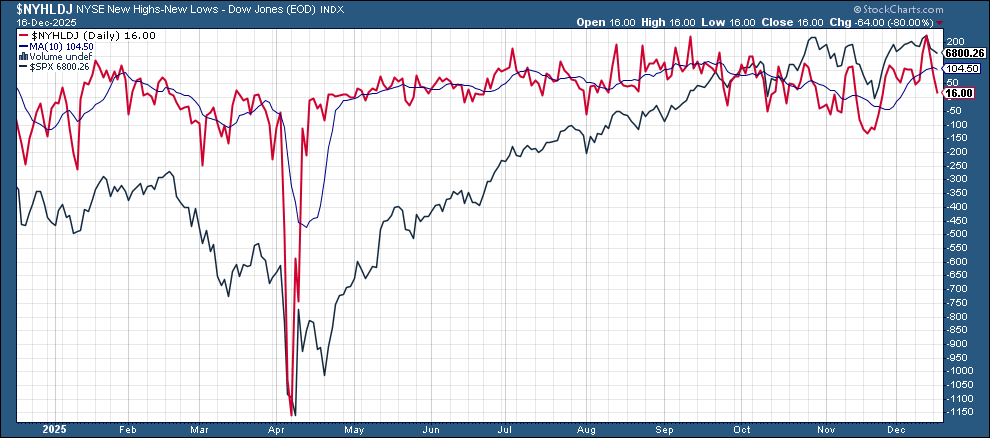

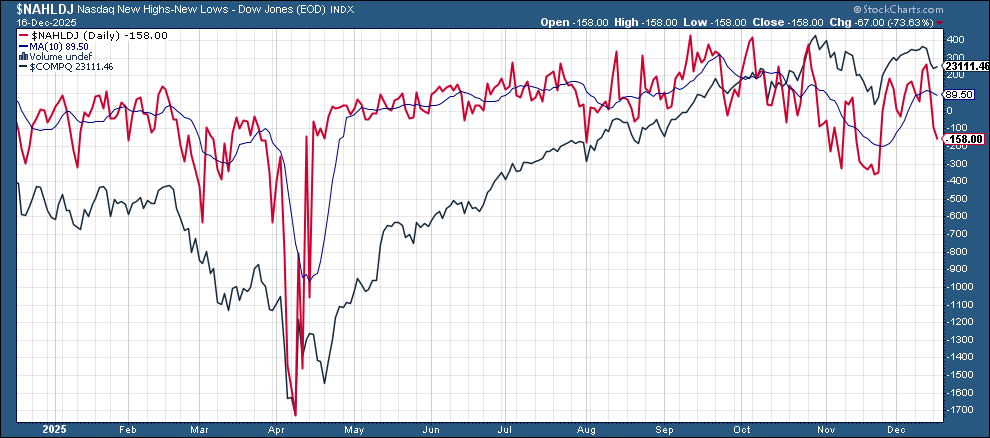

New 52-wk highs minus new 52-wk lows (red lines) though continued to fall back with the NYSE at 16 down from 225 Thurs which was the best since Nov ‘24 and -159 on the Nasdaq from 265 Thurs which was the best since Oct.

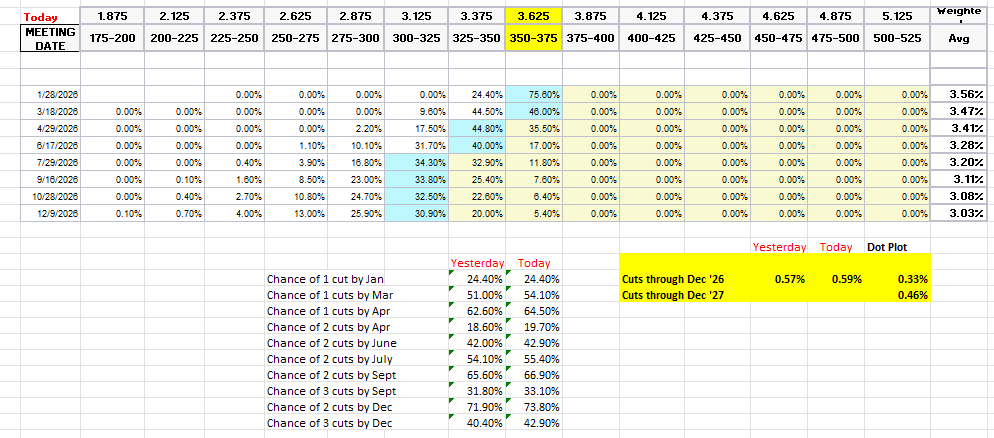

Looking at #FOMC rate cut pricing from the CME’s Fedwatch tool, despite the flurry of economic data this morning, we continued to see very incremental changes for a fourth day. A cut in Jan remained at 24%, a cut by March edged to 54%, and a cut by April to 64%. A second cut remains priced for July at 55%.

Pricing for 2026 did move +2bps to 59bps with pricing for two cuts 74% and three cuts 43%, still down from 68bps two weeks ago (and 80bps four weeks ago which was highest we’d been for 2026 cuts).

The dot plot as reminder has just 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

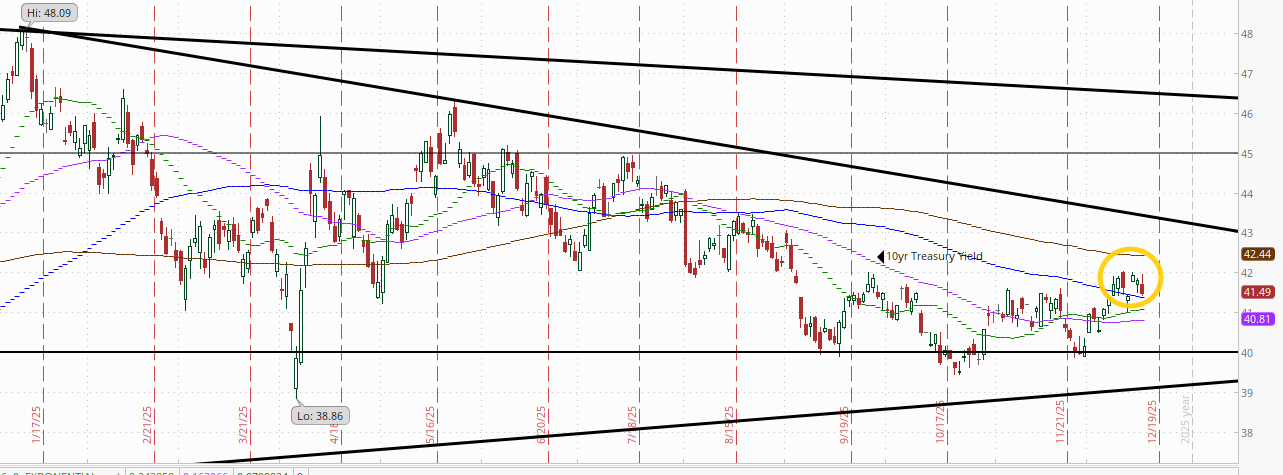

The 10yr #UST yield edged lower for a second day -3bps lower at 4.15%.

The 2yr yield, more sensitive to FOMC rate cut pricing, also fell -2bps to 3.49%, It remains in the channel it’s been in since the start of 2024, but is still just 13bps below the Fed Funds midpoint, so not calling for aggressive rate cuts from here.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher). That said I just don’t know that I want to buy 2-year’s at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) continued its slow deterioration from the Nov highs falling to new 3-month lows. The daily MACD and RSI remain negative with the former in “go short” territory as noted Wed, while the RSI is the weakest since July.

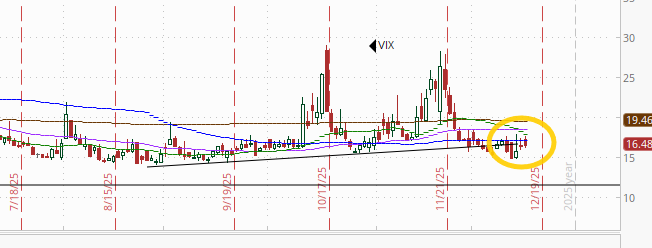

VIX little changed remaining near the lowest since mid-Sept at 16.5. The current level is consistent w/~1.03% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) edged back to 98.4, consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire year)).

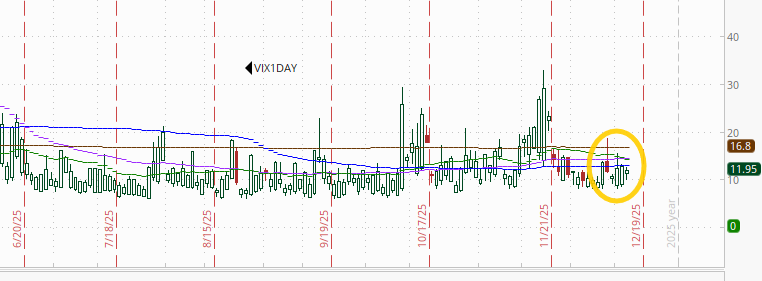

Despite the NFP print behind us and no major economic data Wednesday, 1-Day VIX just edged down by a point to 11.9. The current reading implies a ~0.75% move in the SPX next session.

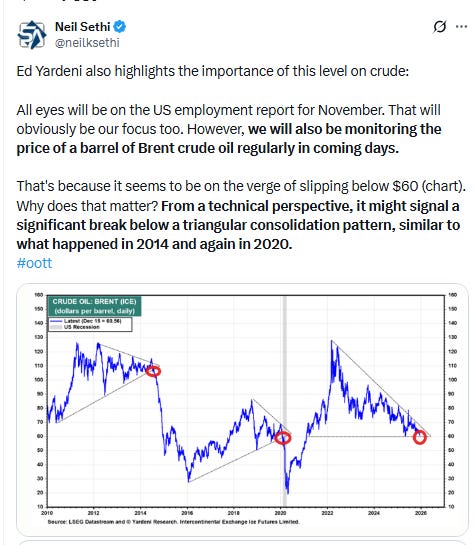

#WTI futures fell for the 6th session in 7 to again the lowest close since Feb ‘21, continuing their downward travel since the Sept ‘23 high, and now testing the key $55 level which is the intra-day lows of the year. The MACD and RSI are negative as well.

Gold futures (/GC) little changed as they remain just under the $4400 level (which is where the Oct rally stalled out). Daily MACD as noted Wed now in “go long” positioning, and the RSI is approaching 70, so not nearly as extended as in Oct.

US copper futures (/HG) continue to trade just under the old support line from the start of the year that has capped their advance the last couple of months. As I said Friday “the good news is that it slopes up so they will keep making incremental progress as long as they follow it.”

As noted two weeks ago the daily MACD has crossed to “go long” positioning, and RSI has pushed to 60 but both are softening. Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) down for sixth session in seven as they continue their pullback after the “blow off top” on Friday, now down -31% from that level. No real support until we get down to the $3.60 area.

As I said at the start of last week, “we’ll see how much of a pullback we get. The RSI has fallen sharply from the highest since Apr ‘22 to the least since Oct [now the least since April],” and as I noted the next day, “you can add to that the daily MACD crossing to ‘sell longs’ positioning.”

Bitcoin futures remained choppy bouncing mildly from the $85k level which they haven’t closed under since April. The daily MACD remains in “cover shorts” positioning (but is softening), but the RSI is around 40.

The Day Ahead

After a firehose of US econ data Tuesday, we get no major releases Wednesday, although we will get the weekly mortgage applications and EIA petroleum inventories.

But we do get Fed speakers with Gov Waller along with regional Fed Presidents Williams and Bostic. Williams and Bostic have both made their positions clear already this week, but we’ll see what Waller says after he said before the December cut that after that cut it would be “meeting-by-meeting” for him.

And duration Treasury auctions resume Wed with a $20bn reopening.

Earnings reports accelerate with three SPX components in MU, GIS, JBL, the former >$100bn in market cap.

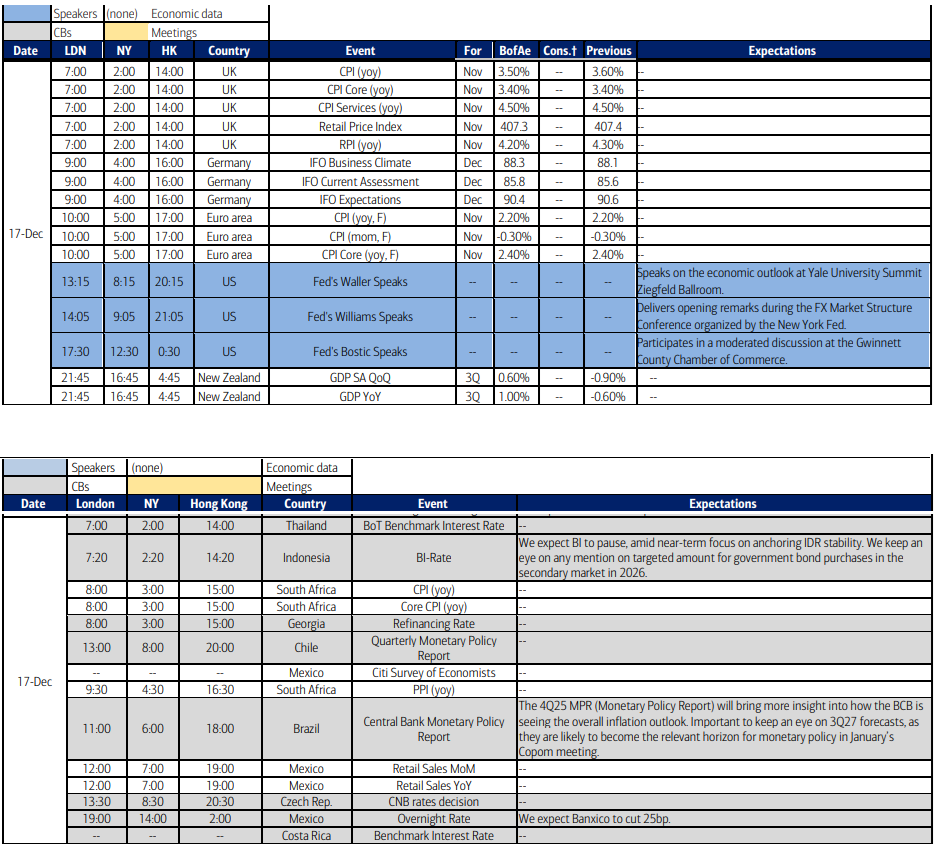

Ex-US DM highlights include Japan trade balance, UK CPI, German Ifo business climate, and EU final Nov CPI.

In EM, highlights are policy decisions in Mexico, Thailand, Indonesia, Czech Republic, and Georgia, S Africa CPI, Monetary Policy Reports in Brazil and Chile and Mexico economist survey and retail sales.

From Goldman:

08:15 AM Fed Governor Waller speaks

Fed Governor Christopher Waller will speak on the economic outlook at Yale University. Q&A and a livestream are expected. On November 17, Waller said, “I worry that restrictive monetary policy is weighing on the economy, especially about how it is affecting lower-and middle-income consumers. A December cut will provide additional insurance against an acceleration in the weakening of the labor market and move policy toward a more neutral setting.”

09:05 AM New York Fed President Williams (FOMC voter) speaks

New York Fed President John Williams will deliver opening remarks during the FX Market Structure Conference organized by the New York Fed. A livestream is expected.

12:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks

Atlanta Fed President Raphael Bostic will participate in a moderated discussion at the Gwinnett County Chamber of Commerce. Q&A is expected. On November 12, Bostic said, “In these circumstances, moving policy near or into accommodative territory risks pumping fresh blood into the inflation beast and threatening to untether the inflation expectations of businesses and consumers.”

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,