Markets Update - 12/22/25

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

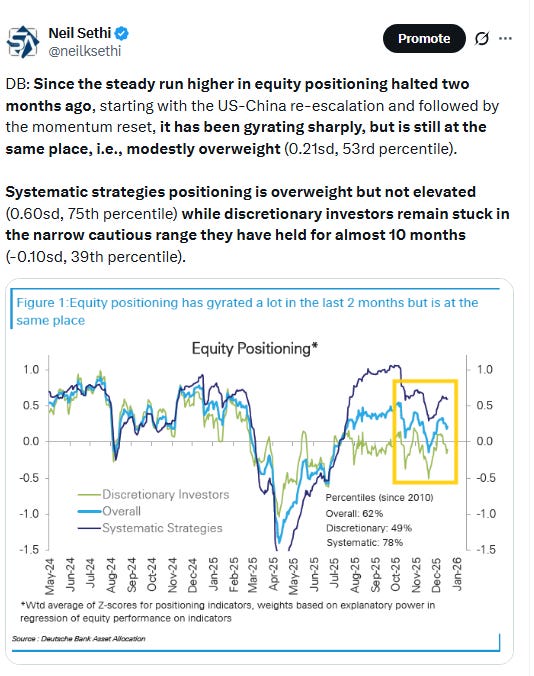

US equity indices opened started the week up around a half percent as they embarked on a holiday-shortened trading week that will see increasingly light volumes as we progress. Tech shares were seeing early buying. Nvidia shares rose nearly 2% in premarket trading after Reuters said the company is looking to begin shipments of its H200 chips to China by mid-February. Meanwhile, Micron Technology and Oracle climbed about 4% and almost 3%, respectively.

The large cap indices traded right around those opening levels straight through the session. The small cap Russell 2000 though climbed all morning before giving back some (but not all) of that, ending the day +1.2%.

Elsewhere, bond yields rose joining a global move higher in yields for a second day, but the dollar fell back along with natgas. Gold (to a record), crude, copper, and bitcoin advanced.

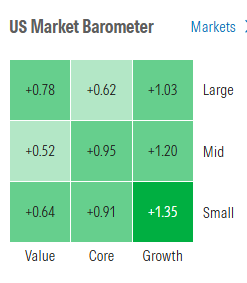

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite +0.5% (and the top 100 Nasdaq stocks (NDX) +0.5%), the SOXX semiconductor index +1.1% (but was flat on the week), and the Russell 2000 (RUT) +1.2%.

Morningstar style box showed a preference for growth shares for a third session but less dramatic Monday.

Market commentary:

“Markets are riding a risk-on liquidity wave into year-end as resilient US growth underpins earnings next year, while a lower Fed fund rate eases financial conditions,” said Desmond Tjiang, chief investment officer for equities and multi-asset investment at BEA Union Investment. “Fears of AI capex and returns also recede on improving compute economics.”

“My view a couple of weeks ago was an end of year grind,” said Justin Bergner, portfolio manager at Gabelli Funds. “And I think that’s become an end of year churn.”

“While 2025 was a volatile year with April’s tariff-driven correction, we don’t think we’re out of the woods when it comes to volatility for 2026,” said Clark Bellin at Bellwether Wealth. While Bellin expects the tech sector to continue its corrective phase, he bets a bottom will be achieved sometime in the next few months. He also sees the Fed refraining from any more rate cuts until there is a new chair mid-year, but says stocks can move higher during this time even without additional rate cuts.

“The trend is our friend, 2026 looks to have a strong start, and a potential Santa Claus rally is back on the table, which would leave us ending the year at new highs,” said Louis Navellier at Navellier & Associates.

Despite bouts of volatility and concerns about the health of the AI trade, tech has led the market to the upside this year, and it will probably be the difference between a positive and negative December for US stocks, according to Chris Larkin at E*Trade from Morgan Stanley. “If a Santa Claus rally does kick in this year, St. Nick’s gift bag will likely need to be full of positive tech sentiment,” he said.

“Can the market hold up if AI enthusiasm and a dovish Fed aren’t helping it?” said Tom Essaye at The Sevens Report. “The answer is yes, but only as long as economic growth stays solid.” Essaye noted that there was a data deluge last week, and the net result was that economic data and inflation remain “Goldilocks enough to help support stocks.”

“Economic data will start to hit the wires tomorrow, but for now, traders are taking their cue from the general sense amongst participants that there’s little standing in the way for a Santa Claus rally to manifest,” said Jose Torres at Interactive Brokers.

“Everything is shaping up for a festive end to the year,” said Mark Hackett at Nationwide. “This week is being driven by technical tailwinds, a bit of stimulus optimism, and self-fulfilling prophecy, all of which are setting up a strong year-end and a solid start to next year.” Hackett noted that the last two weeks of the year are typically the best on the calendar since 1950. The so-called Santa Claus rally, which includes the last five trading days of December and the first two of January, has been positive roughly 80% of the time, by an average of 1.6% since 1928, he added. “When this pattern is heavily discussed, it can become a bit of a self-fulfilling prophecy,” Hackett said. “An important caveat, however, is the consistent theme of the past five years that historical patterns have provided little direction, with last year delivering a negative return.” Yet Hackett said that market action is encouraging, including healthy breadth, shifting leadership, and greater discernment by investors around valuations.

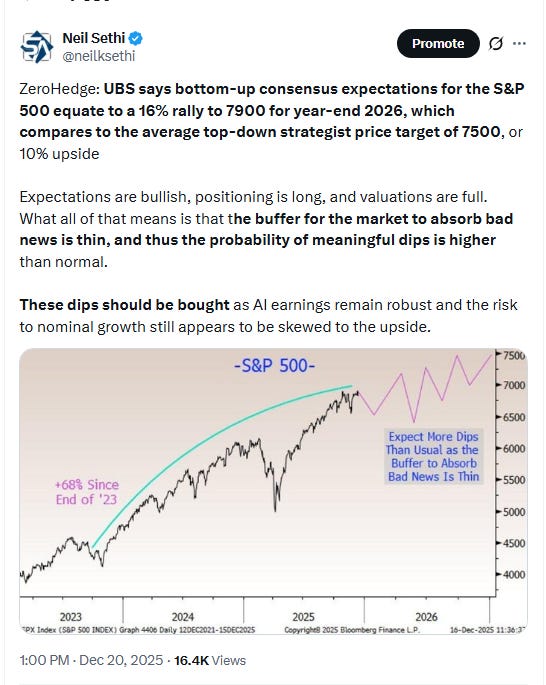

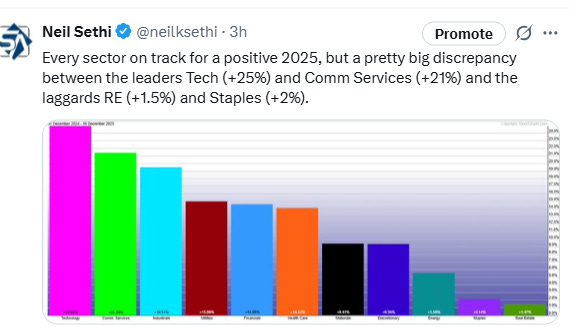

“From a market perspective, there’s not a whole bunch of things that are going to move [the SPX], in my opinion, so everybody is, rightfully so, looking for the Santa Claus rally,” Will McGough, deputy chief investment officer at Prime Capital Financial, said to CNBC. He added that he’s watching to see at what level the markets end at, especially with the S&P 500 nearing the 7,000 level. Currently, the index has jumped about 17% in 2025. That’s after it recorded a gain of more than 24% and more than 23% in 2023 and 2024, respectively.

With the index close to scoring a three-peat of 20% gains, which would be a “pretty rare” move, McGough said that he is “constructively optimistic” on the market for next year but that investors should brace for some volatility.

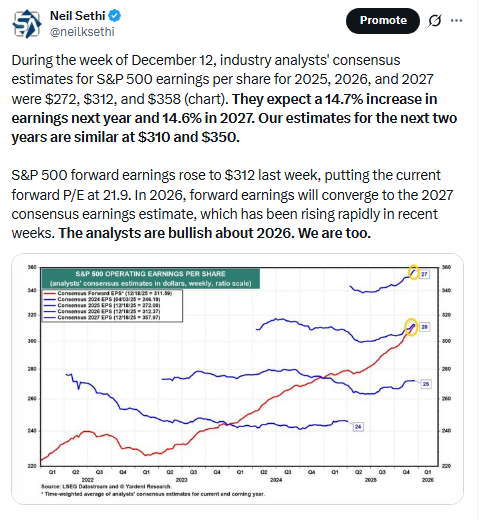

“The market is forecasting like 14% earnings growth for 2026-2027, which is a big number,” the deputy CIO said. “There’s going to be hiccups along the way,” he continued, citing a new Fed chair and the midterm elections as potential catalysts for turbulence.

An S&P 500 valuation metric that adds in consumer sentiment suggests stocks are better positioned for gains next year than a more conventional price-earning multiple measure might indicate, according to veteran investment strategist Jim Paulsen. He says that both price-earnings ratios and consumer confidence are “abnormal,” with today’s S&P 500 price-earnings multiple higher than 94% of the time since 1960, while consumer sentiment is at its first percentile since then. The unusually-high PE multiple might be alarming if it weren’t for the accompanying exceptionally low sentiment, he says, writing that “until the Emotion-Adjusted PE rises to a concerning level, investors may be best served by remaining bullish.”

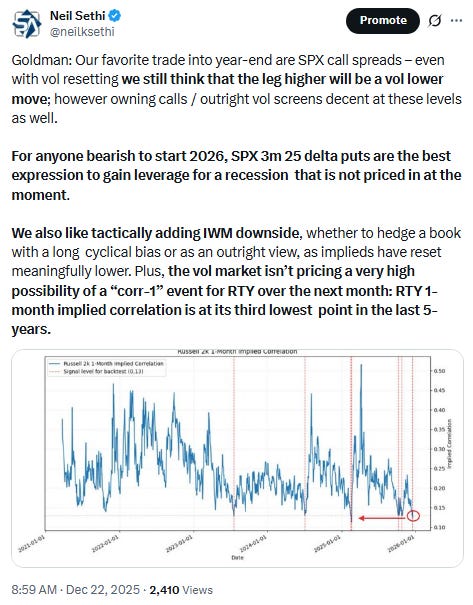

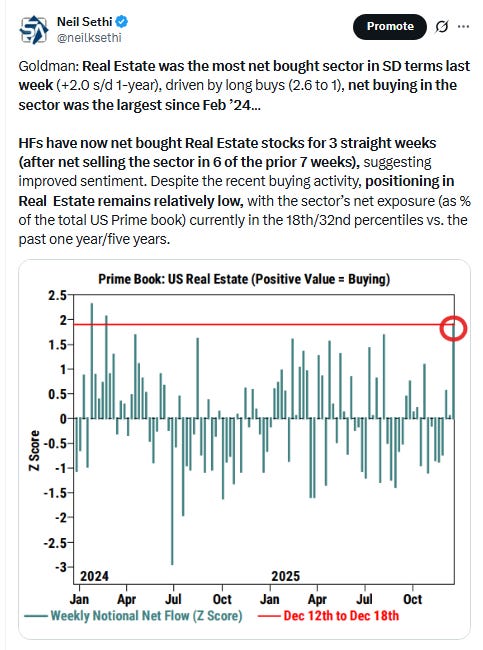

Meantime, Goldman Sachs Group Inc. strategists led by Ben Snider noted the bank’s baseline macro outlook is “supportive for small-cap upside in early 2026.” “We do not believe markets are fully pricing the likely strength of the US economy next year, and small-caps typically outperform during cyclical rallies,” they wrote.

“The incoming economic data is second-tier at best, a fact that further reinforces the notion that rates will stay in an all-too-familiar territory as 2026 quickly approaches,” said Ian Lyngen at BMO Capital Markets.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

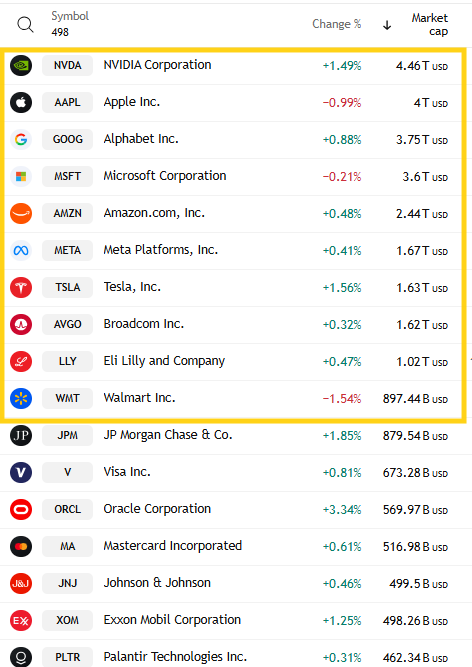

Almost 400 of the S&P 500 rose Monday as the benchmark approached a record. Tesla Inc. and Nvidia Corp. led megacaps higher.

Corporate Highlights from BBG:

Alphabet Inc. has agreed to buy clean energy developer Intersect Power LLC for $4.75 billion in cash, plus existing debt, marking one of the largest deals by the tech giant to dramatically expand its data center footprint for AI.

Nvidia Corp. has told Chinese clients it aims to ship its second-most powerful AI chips to China by mid-February, Reuters reported, citing people familiar with the matter.

Meta Platforms Inc.’s Threads will launch podcast previews, or the ability to upload snippets of shows that play directly in user feeds, as part of a broader effort to encourage podcasters and their fans to spend more time on the social network, according to a person familiar with the plans.

Target Corp., Whole Foods Market and Walmart Inc. will be added as defendants in lawsuits against baby formula maker ByHeart for selling a product potentially contaminated with spores that cause infant botulism.

Netflix Inc. refinanced part of a $59 billion bridge loan with cheaper and longer-term debt, bolstering the financial package underpinning its bid for Warner Bros. Discovery Inc.

Larry Ellison is throwing his personal fortune behind Paramount Skydance Corp.’s bid for Warner Bros. Discovery Inc., raising the stakes in a fiercely contested battle with Netflix Inc.

The US is suspending leases for all five wind farms under construction off the East Coast in the latest blow to a sector that’s been targeted repeatedly by the Trump administration as part of its attack on clean energy.

JPMorgan Chase & Co. is considering offering cryptocurrency trading to its institutional clients, as large banks around the world deepen their involvement in the asset class.

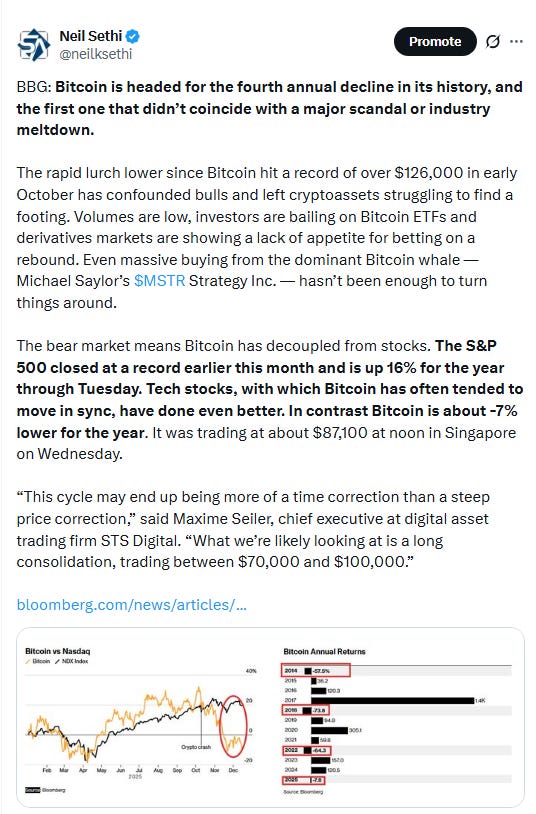

Michael Saylor’s Strategy Inc. bolstered its cash reserve to $2.19 billion and paused purchases of Bitcoin over the past week as the largest digital asset treasury company appears to be settling in for a long crypto winter.

Coinbase Global Inc. announced Monday that it will acquire a derivatives clearinghouse, The Clearing Company, to boost its entry into the growing prediction markets business.

Wells Fargo & Co.’s global-markets business is expanding into options clearing, a capital intensive and operationally arduous corner of finance dominated by Bank of America Corp. and Goldman Sachs Group Inc.

Uber Technologies Inc. and Lyft Inc. are each teaming up with Baidu Inc. to trial driverless taxis in the UK, as ride-sharing companies race to deploy autonomous services around the world.

Nelson Peltz’s Trian Fund Management and General Catalyst agreed to buy Janus Henderson Group Plc in a deal that values the asset manager at about $7.4 billion.

A group of private equity firms led by Permira and Warburg Pincus has agreed to acquire Clearwater Analytics Holdings Inc. in a deal valuing the investment and accounting software maker at $8.4 billion including debt.

The US Federal Communications Commission said it would ban most foreign-made drones and and critical components for unmanned aircraft systems going forward, a day ahead of a deadline for adding Chinese drone-maker SZ DJI Technology Co. to the agency’s so-called covered entity list.

Tory Bruno, the chief executive officer of Boeing Co. and Lockheed Martin Corp.’s rocket joint venture United Launch Alliance, has resigned after serving in the position for nearly 12 years.

A Silicon Valley-focused banking startup backed by Palantir Technologies Inc. co-founder Peter Thiel is expected to raise $350 million in a funding round that would more than double its valuation.

Cintas Corp. proposed a renewed takeover bid of UniFirst Corp. worth about $3.96 billion in equity in another attempt to buy out the rival uniform maker.

Wingtech Technology Co. Chairwoman Ruby Yang warned that global chip supplies remain at risk unless the Chinese company’s control over Dutch chipmaker Nexperia BV is restored.

Telecom Italia SpA’s board approved a proposal to convert the company’s savings shares into ordinary stock and to reduce its share capital, a long-delayed change that would simplify its capital structure.

Telefonica SA will book a cost of €2.5 billion ($2.9 billion) to pay for the exit of about 5,500 employees as part of a sweeping cost-reduction plan.

Roche Holding AG Chief Executive Thomas Schinecker said the new US drug deal signed last week could raise prices for some medicines in Switzerland.

Harbour Energy Plc agreed to acquire LLOG Exploration Co. for $3.2 billion, marking the UK company’s entry into the deepwater US Gulf of Mexico.

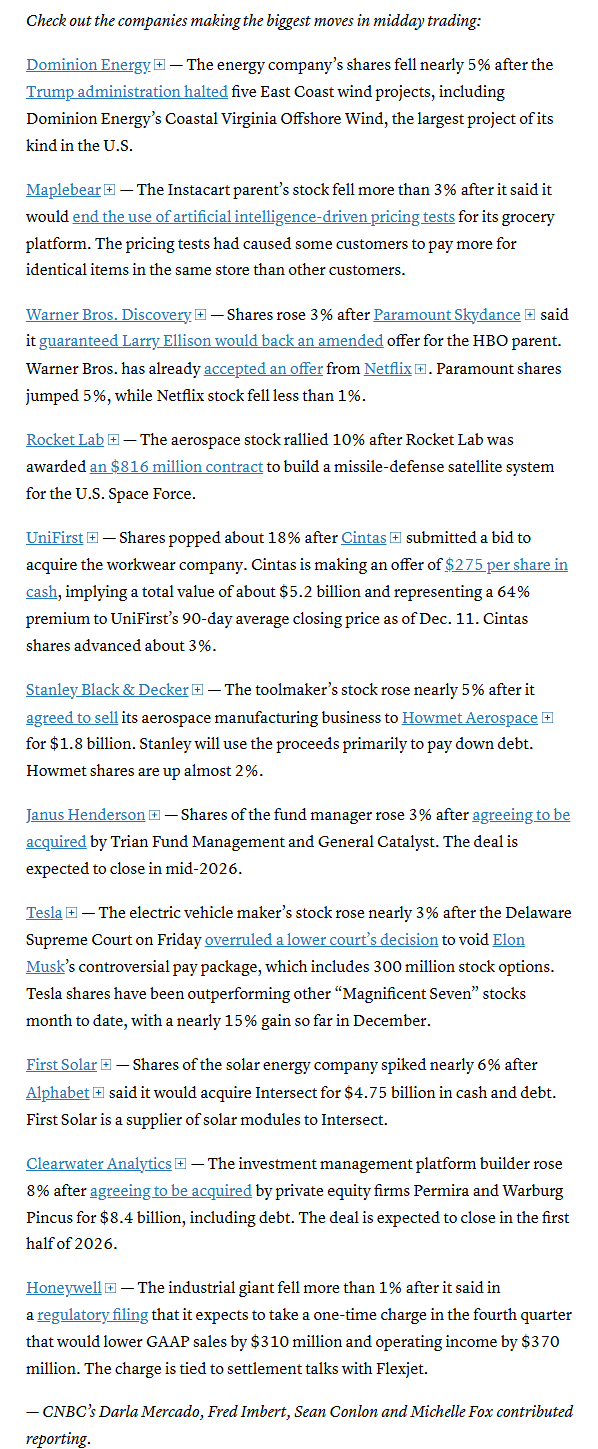

Mid-day movers from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

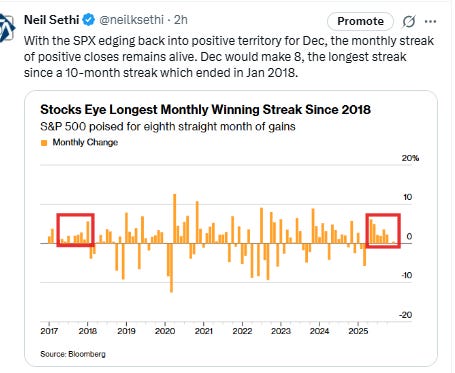

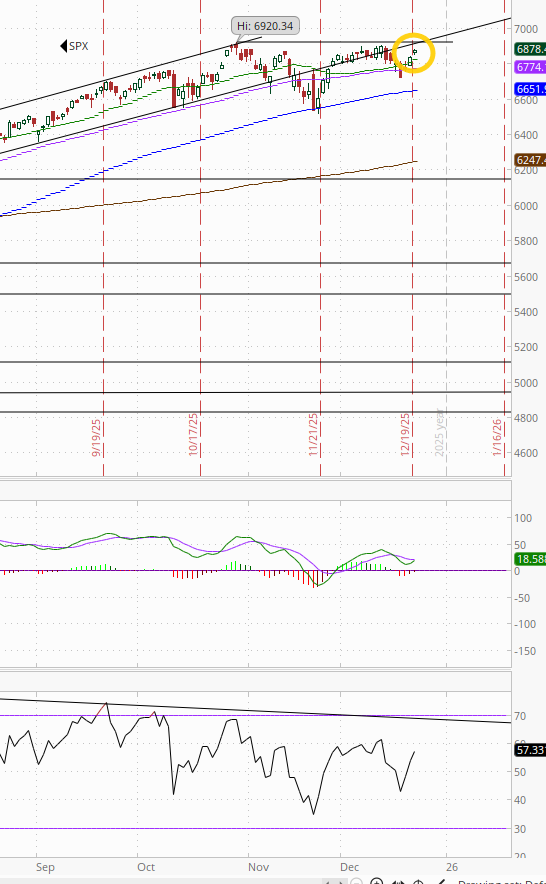

The SPX made further progress back towards its ATH. As noted Tues the daily MACD flipped back to “sell longs” positioning but is close to flipping back more positive, while the RSI is pushing over 50.

The Nasdaq Composite a similar story a little further from its ATH.

RUT (Russell 2000) continues to be the best picture above both its 20 and 50-DMAs and also closing in on its ATH. As noted Thurs we did get a daily MACD crossover to “sell longs” but very mild for now. RSI remains over 50.

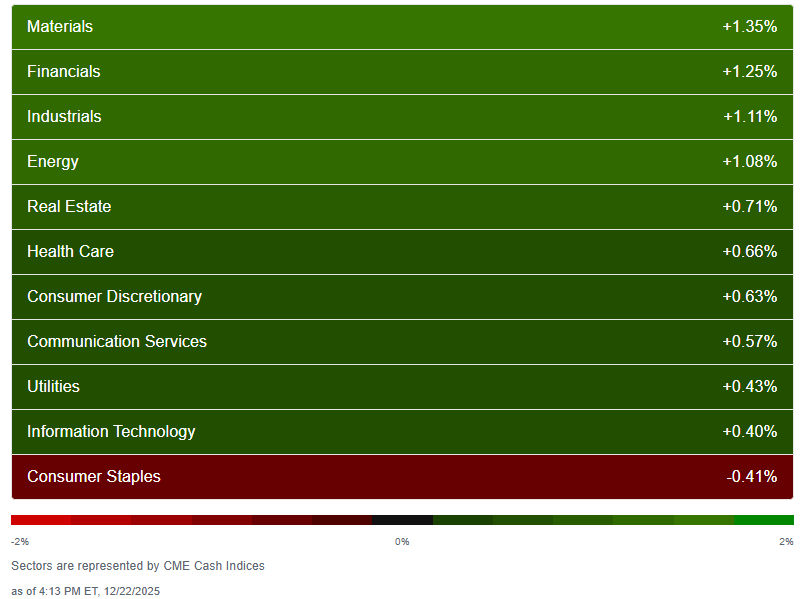

Sector breadth from CME Cash Indices (uses futures prices) continued to improve to 10 of 11 sectors higher, from 7 Fri, 6 Thurs, 4 Wed, 3 Tues.

And for a second day it wasn’t the megacap growth sectors leading (but they did trade together for the fourth day in five finishing with modest gains) but instead classic cyclicals which took the top 4 spots all up over +1%.

Staples the only red sector -0.4% (after -0.5% Fri).

SPX stock-by-stock flag from @finviz_com a very similar look to Fri with the difference the AI related plays (ex-Utilities) eased back a little while Utilities flipped from red to green. Also a lot more green in Financials, RE, and Energy.

Again just 3 of the top 10 by market cap lower (but up from one Thurs,down from nine Wed), led by WMT -1.5%, its fourth down session in the last five. TSLA led to the upside +1.6%, edging out NVDA +1.5% who led Fri. Mag-7 was +0.5% after finishing +1.5% last week.

17 SPX components were up 3% or more, down from 25 Fri, 22 Thurs, but up from 8 Wed, 7 Tues, led by First Solar +6.6%. The >$100bn in market cap up 3% or more were MU (for a third session), MRK, NEM, ORCL (again) (in descending order of percentage gains).

Just 3 SPX components down -3% or more, up from 2 Fri, down from 9 Thurs, 28 Wed. Again though none >$100bn in market cap. The closest was WMT -1.5%.

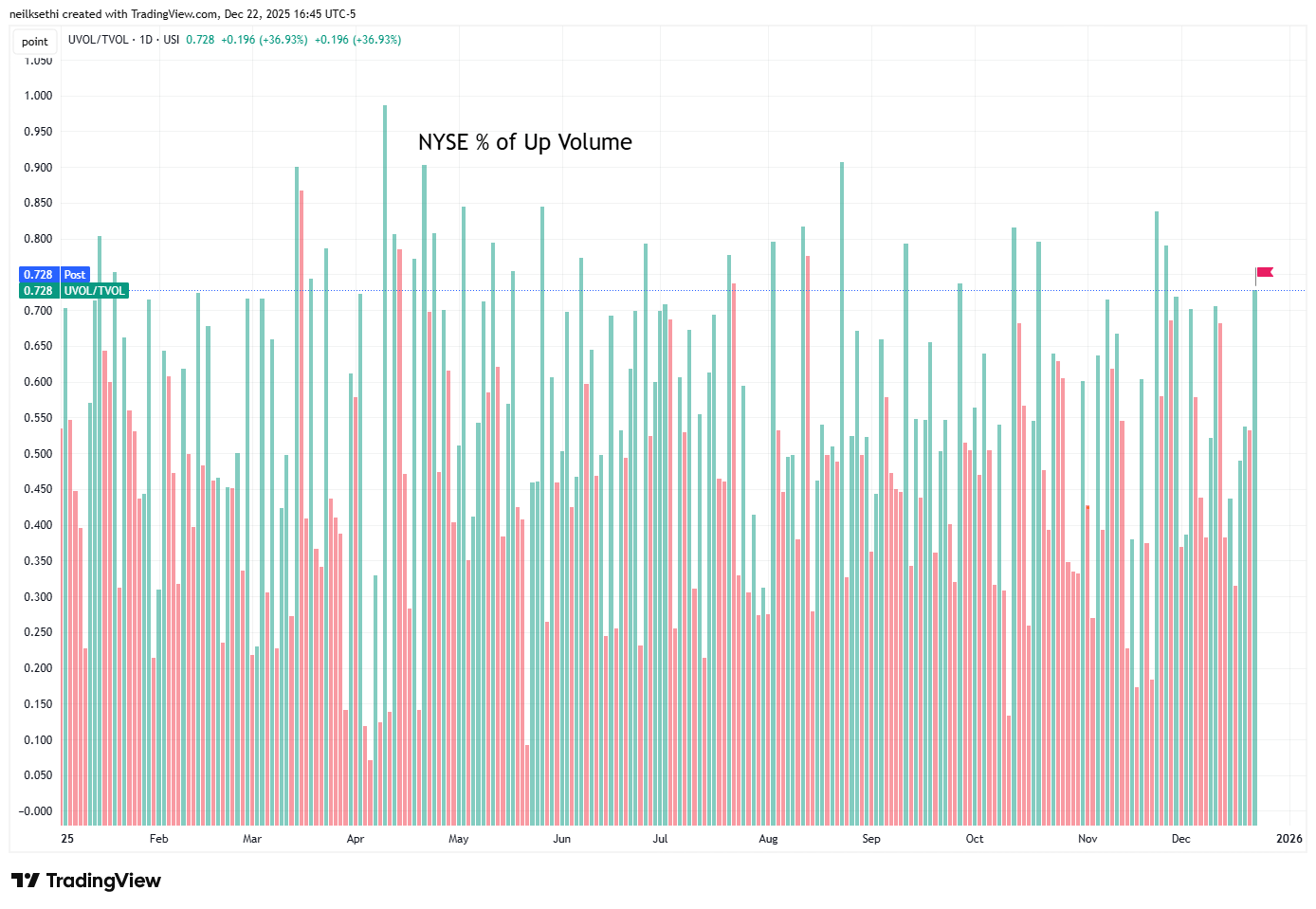

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) a big improvement after a weak reading Fri, going from 53.2% to 72.8%, in line with the index gain of +0.85%. It was the best since Nov 25th (when the index was +1.3%).

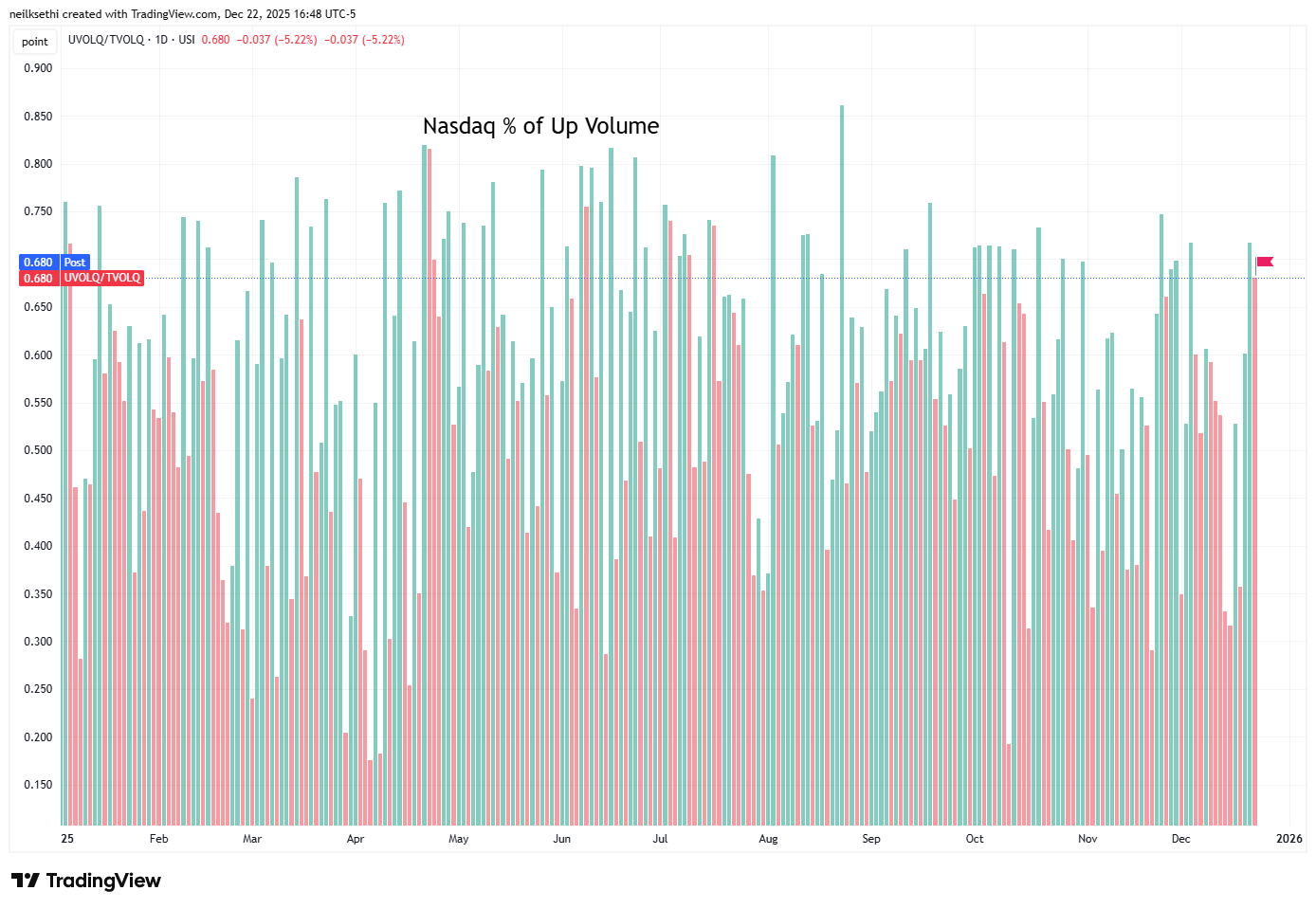

Nasdaq positive volume (% of total volume that was in advancing stocks) in contrast eased back to 68.0% from 69.8% Fri but that was as the index gain fell to +0.52% from +1.31% Fri, so in that context a very solid result.

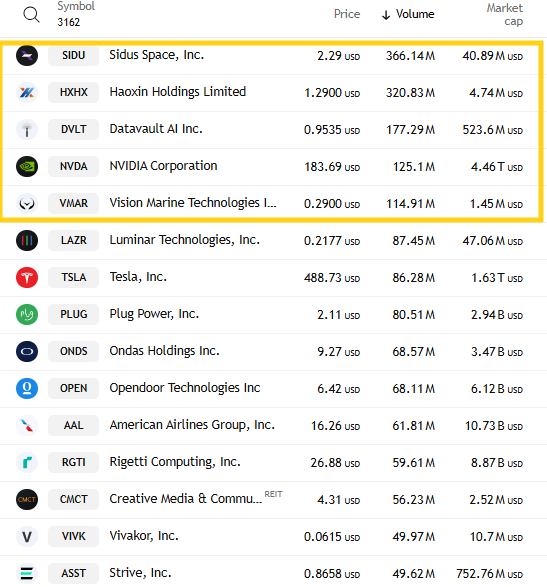

And that was even as speculative volume on the Nasdaq fell back with the top three stocks seeing under 1bn shares traded after 1.5bn Fri, and just 5 companies with over 100mn shares traded down from 17(!) Fri (the most since I’ve started tracking this early summer) but up from 4 Thurs.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks a bit lower on both exchanges with the Nasdaq at 60% while the NYSE was 61%.

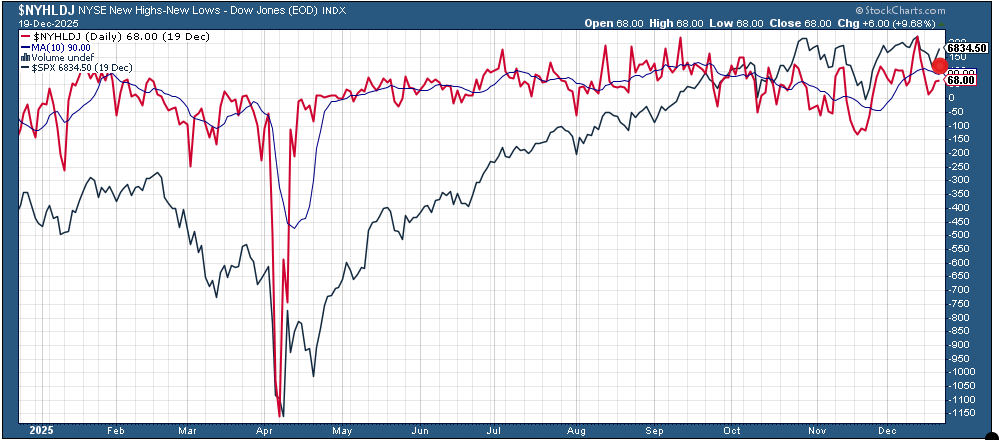

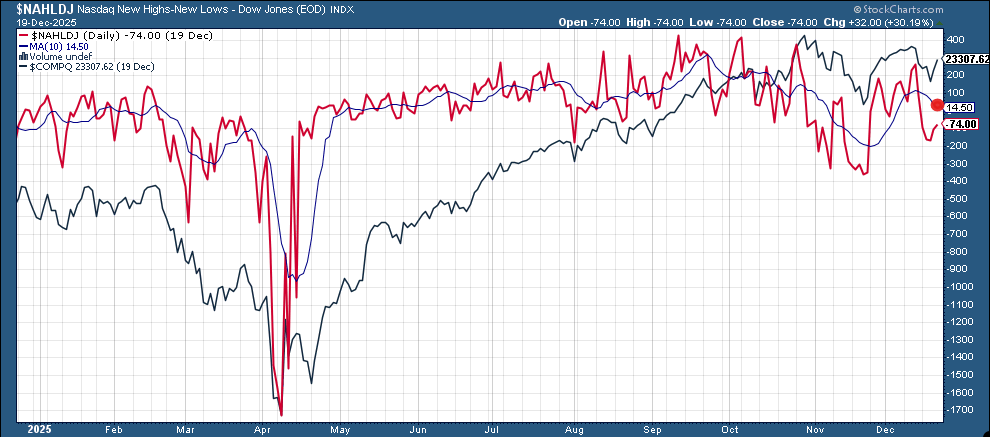

New 52-wk highs minus new 52-wk lows (red lines) continued to improve but remain well below the highs of the month at 104 on the NYSE, down from 225 Dec 11th which was the best since Nov ‘24, and 34 on the Nasdaq, down from 265 Dec 11th which was the best since Oct.

[Charts not updated yet, but put in Friday’s with a dot where Monday’s were].

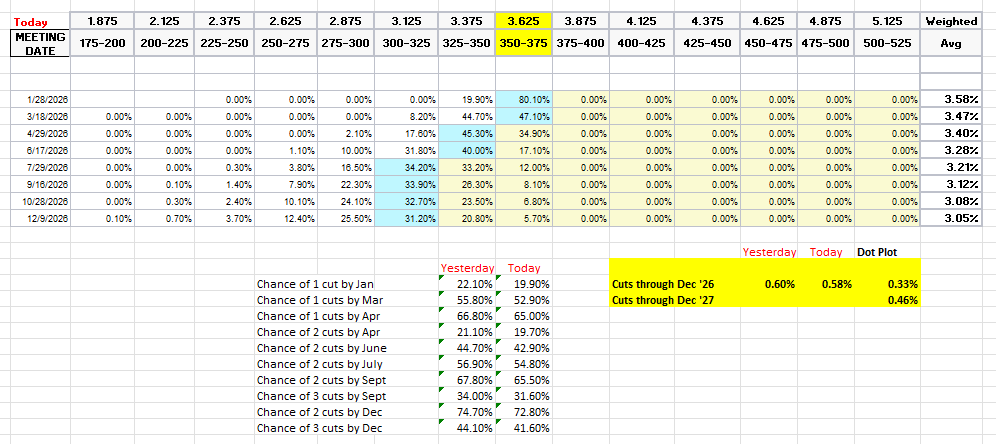

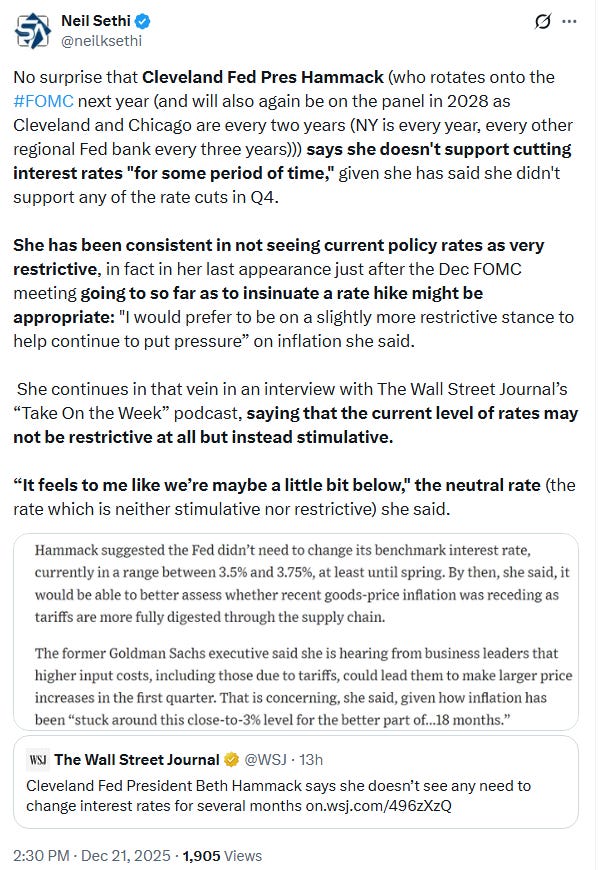

Looking at #FOMC rate cut pricing from the CME’s Fedwatch tool it edged back for a second day after another hawkish speech from Clev Fed Pres Hammack (who rotates onto the FOMC next year). A cut in Jan fell back to 20%, the least since the Dec FOMC, a cut by March to 53%. A second cut remains priced for July at 55%.

Pricing for 2026 overall moved -2bps to 58bps, back where we were a week ago, with pricing for two cuts 73% and three cuts 42% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as reminder has just 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

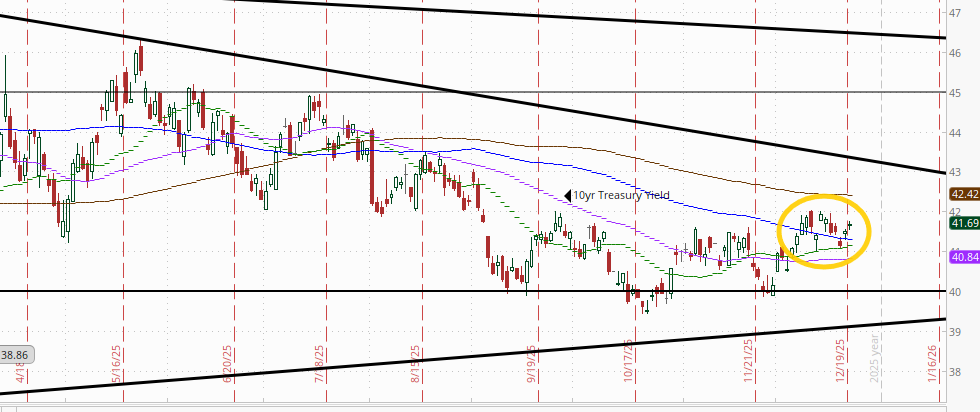

The 10yr #UST yield +5bps to 4.17%, on the back of the global bond selloff led by Japan. Still in its range over the past two weeks.

The 2yr yield, more sensitive to FOMC rate cut pricing, +2bps to 3.51%. It remains in the channel it’s been in since the start of 2024, but is just 9bps above the least since 2022 and remains 11bps below the Fed Funds midpoint. Outside of recessions it is normally above by around 50bps on average, so calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) fell back from its downtrend line from the Nov highs. The daily MACD and RSI remain negative with the former in “go short” territory as noted two weeks ago, while the RSI is below 50.

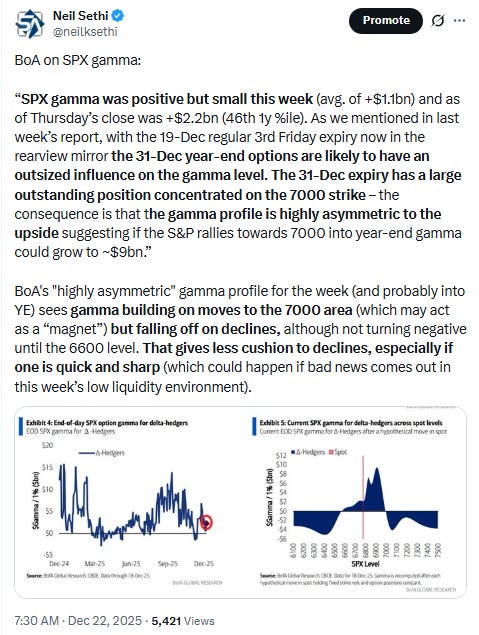

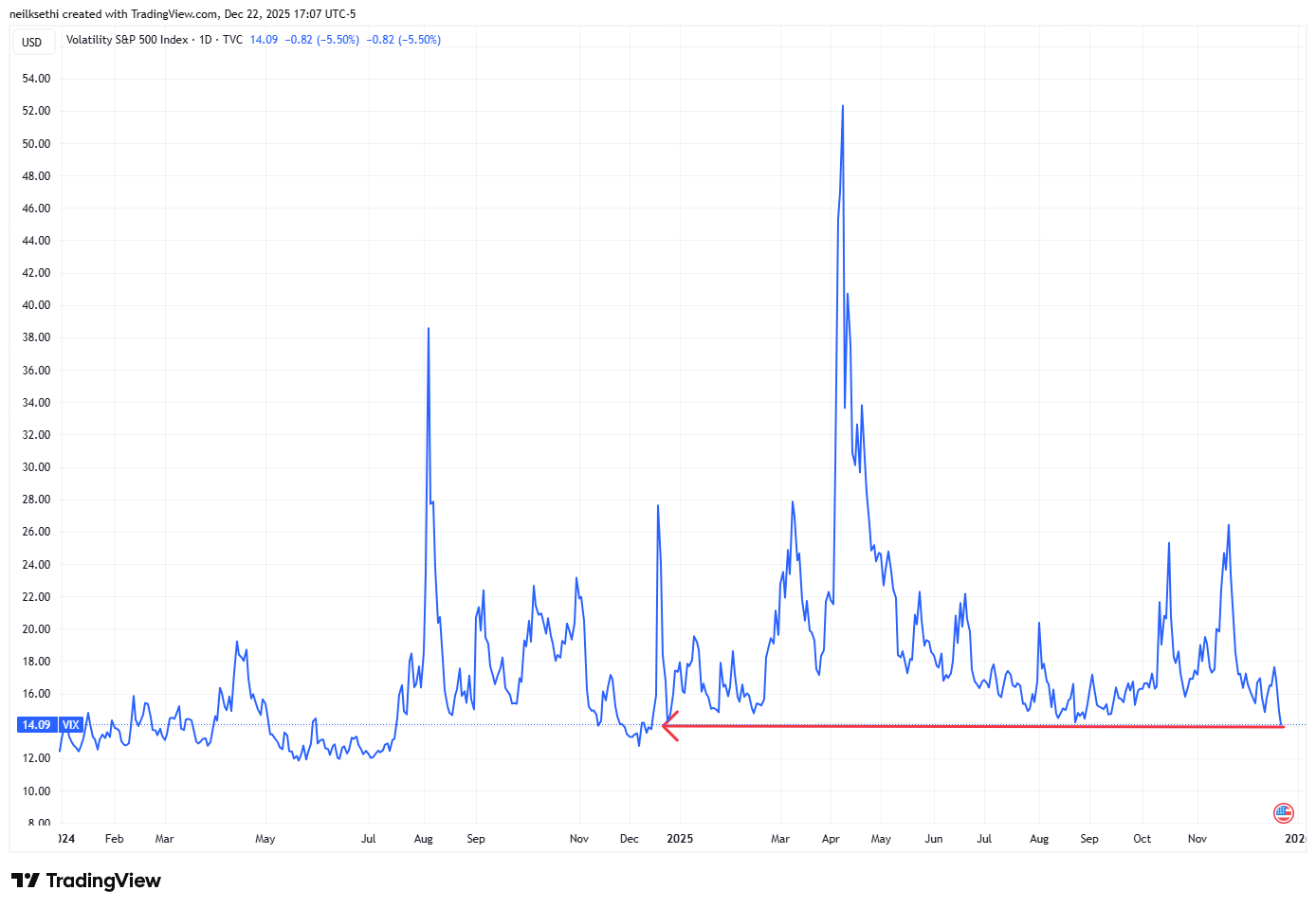

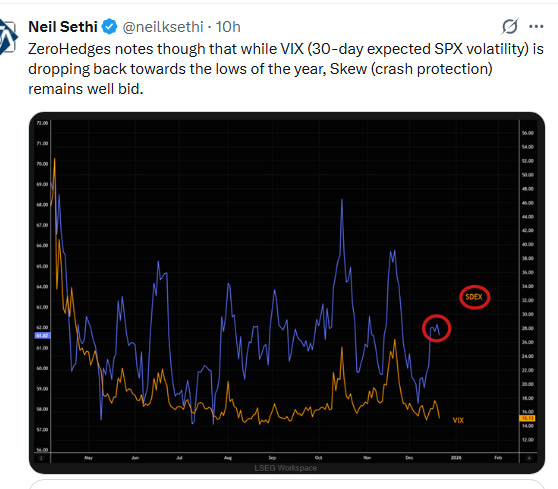

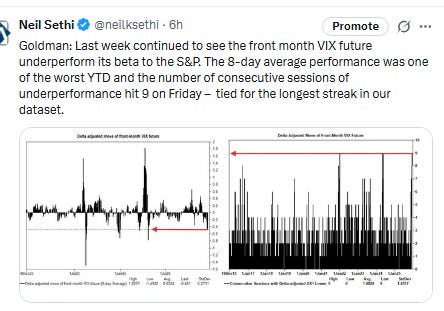

VIX fell back to 14.1, the lowest close since last December. The current level is consistent w/~0.89% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also fell back in its case to 82.0, the least since March and second lowest since July ‘24 (before the carry trade blow-up). That is consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

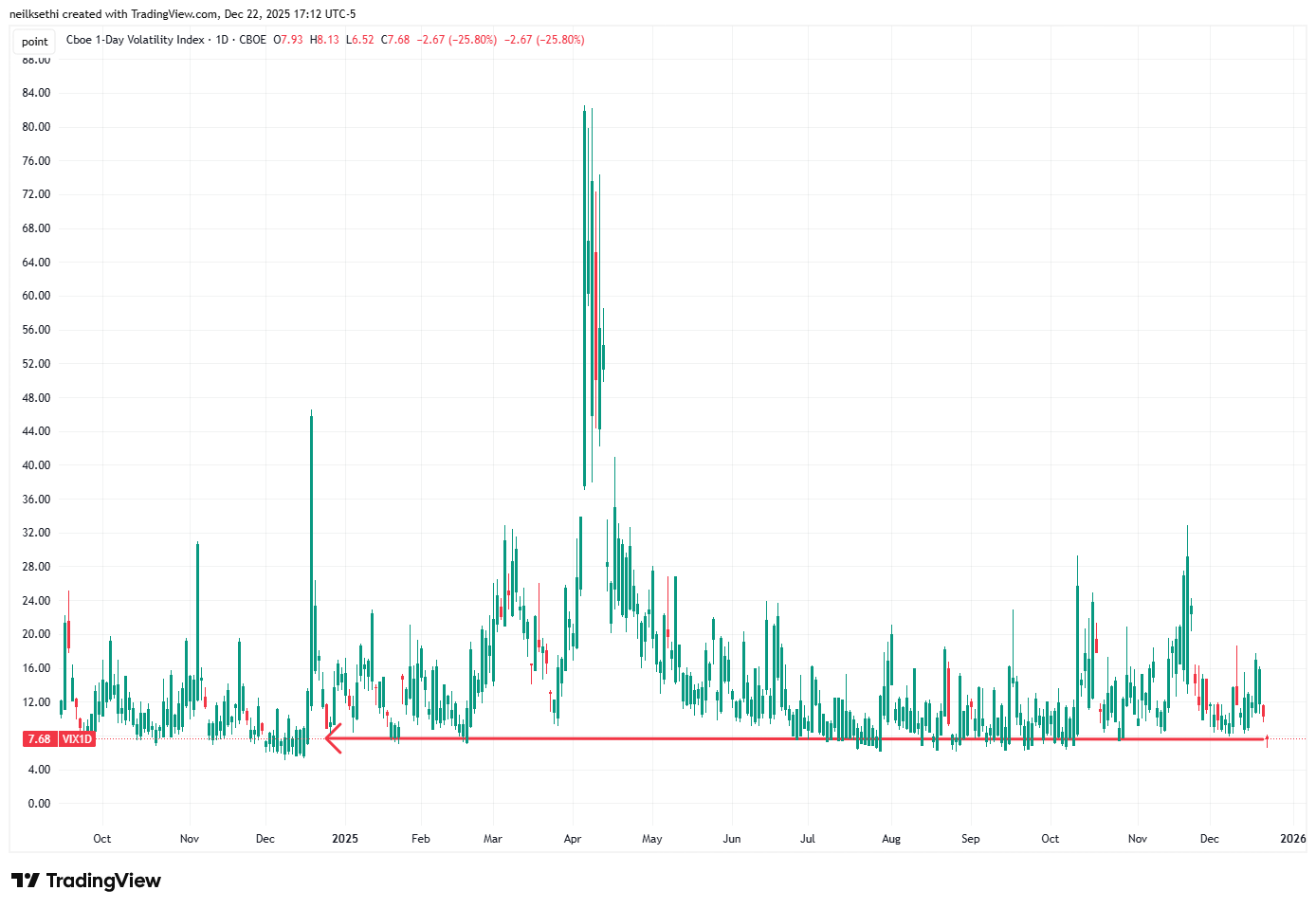

Coming out of the weekend, like the VIX the 1-Day VIX fell to the lowest in a year at 7.7. The current reading implies a ~0.48% move in the SPX next session.

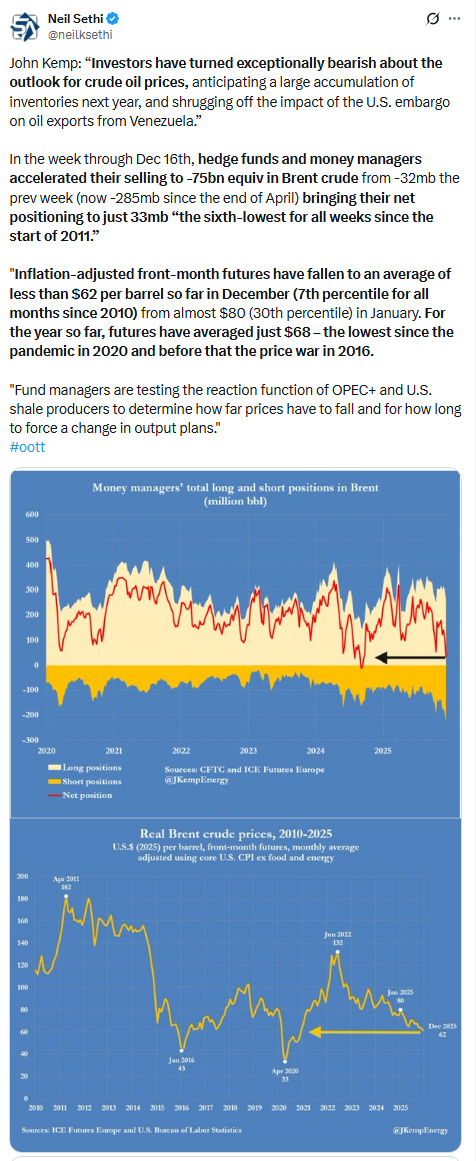

#WTI futures had a solid session rising +2.5% but now just back to the resistance it has struggled with since the start of Oct (50-DMA and downtrend line from the July highs). So as noted last week “for now it remains in its downtrend since the Sept ‘23 high with negative MACD and RSI.” Those latter two are improving though.

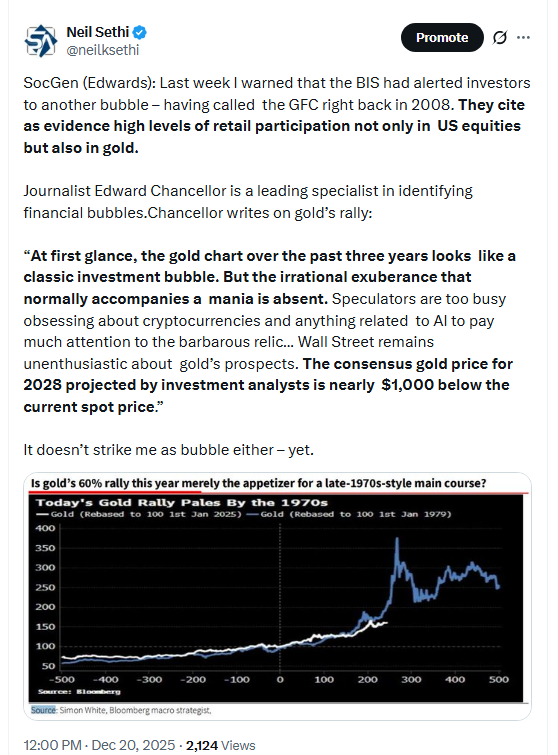

I said Friday “Feels like it’s a matter of time?” and sure enough gold futures (/GC) finally pushed through the $4400 level (and then ran almost another $100) into new ATH territory. Daily MACD as noted last week remains in “go long” positioning, but the RSI is now well over 70 so starting to get extended (but not yet as extended as in Oct).

Stop me if you’ve heard this one before but US copper futures (/HG) closed higher but continue to trade just under the old support line from the start of the year that has capped their advance the last couple of months. As I said two weeks ago “the good news is that it slopes up so they will keep making incremental progress as long as they follow it.”

As noted three weeks ago the daily MACD has crossed to “go long” positioning, and RSI has pushed to 60 but both have softened. Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

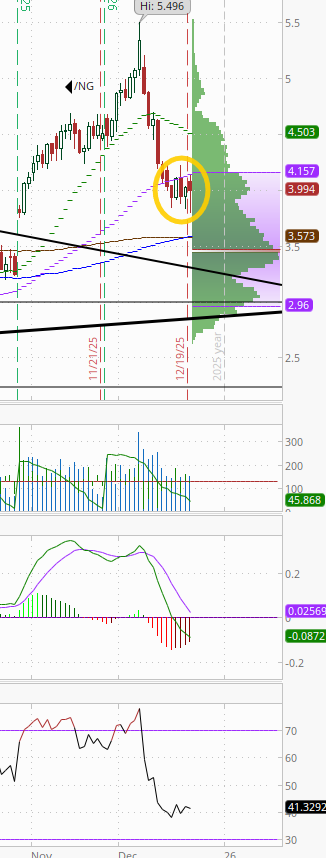

Natgas futures (/NG) lower but modestly so after recovering from much deeper losses. As noted Thurs, they seem to be trying to carve out a bottom here, but it’s an odd place just under the 50-DMA with no round number support.

As I said at the start of last week, “we’ll see how much of a pullback we get. The RSI has fallen sharply from the highest since Apr ‘22 to the least since Oct [now the least since April],” and as I noted the next day, “you can add to that the daily MACD crossing to ‘sell longs’ positioning.” Those all remain for the most part.

Bitcoin futures remain trapped between the $85k level on the downside and $90k resistance. The daily MACD remains “go long” positioning, but the RSI is still under 50.

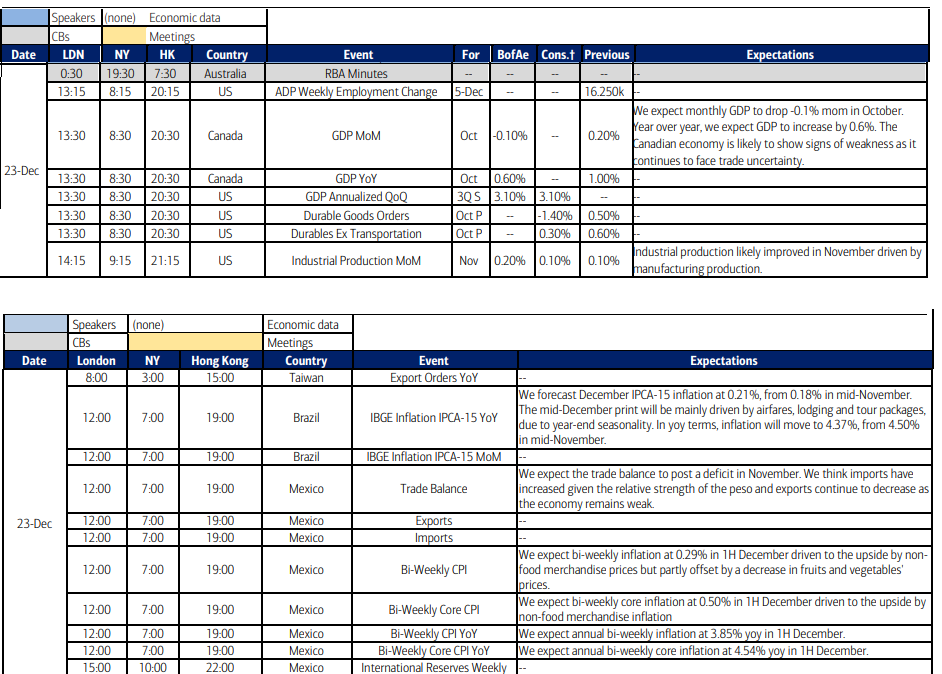

The Day Ahead

Tuesday brings us (by far) our biggest day of US economic data. Probably the headline is a very delayed 3Q GDP report. We’ll also though get more recent data in Oct/Nov industrial production (our broadest look at the manufacturing sector), the weekly ADP report, and Dec Conference Board consumer confidence, plus a delayed Oct read on durable goods orders.

Treasury auctions will continue with 5yr USTs.

Ex-US DM highlights include RBA (Australia) minutes and Canada GDP.

In EM, highlights are Taiwan exports, inflation reads from Brazil and Mexico, plus Mexico trade balance and unemployment.

From Goldman:

08:30 AM GDP, Q3 second release (GS +3.6%, consensus +3.2%, last +3.8%)

Personal consumption, Q3 second release (GS +2.8%, consensus +2.7%, last +2.5%)

Core PCE inflation, Q3 second release (GS +2.86%, consensus +2.9%, last +2.6%)

We estimate that GDP rose 3.6% annualized in the initial reading for Q3, following a +3.8% annualized increase in Q2. Our forecast incorporates a further decline in imports (-5.5%, quarter-over-quarter annualized vs. -29.3% in Q2 and +38.0% in Q1) after frontloading ahead of tariff increases boosted imports earlier in the year. We expect a further acceleration in consumption growth (+2.8% vs. +2.5% in Q2) but another quarter of soft residential investment growth (-3.9% vs. -5.1% in Q2). We estimate that domestic final sales rose 2.4% in Q3, and that the core PCE price index increased 2.86% annualized (or 2.86% year-over-year) in Q3.

08:30 AM Durable goods orders, October preliminary (GS -3.0%, consensus -1.5%, last +0.5%)

Durable goods orders ex-transportation, October preliminary (GS +0.2%, consensus +0.3%, last +0.6%)

Core capital goods orders, October preliminary (GS +0.5%, consensus +0.3%, last +0.9%)

Core capital goods shipments, October preliminary (GS +0.2%, consensus +0.3%, last +0.9%)

We estimate that durable goods orders declined 3% in the preliminary October report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast a 0.2% increase in core capital goods orders and a 0.5% increase in core capital goods shipments—the latter reflecting the sharp increase in orders in the prior month.

09:15 AM Industrial production, November (GS +0.1%, consensus +0.1%, last +0.1% [September])

Industrial production, October (GS +0.1%)

Manufacturing production, November (GS flat, consensus +0.1%, last flat [September])

Manufacturing production, October (GS -0.1%)

Capacity utilization, November (GS 75.9%, consensus 75.9%, last 75.9% [September])

Capacity utilization, October (GS 75.9%)

We estimate industrial production increased by 0.1% in October and 0.1% in November. Our November forecast reflects strong oil and mining production partially offset by weak natural gas and auto production. We estimate capacity utilization remained at 75.9%.

10:00 AM Conference Board consumer confidence, December (GS 91.0, consensus 91.2, last 88.7)

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,