Markets Update - 12*2=24

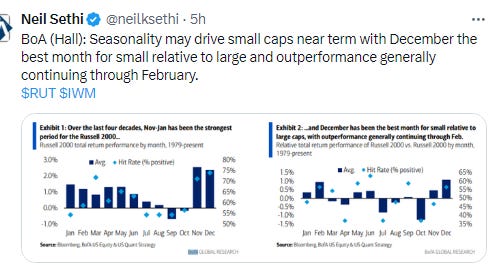

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

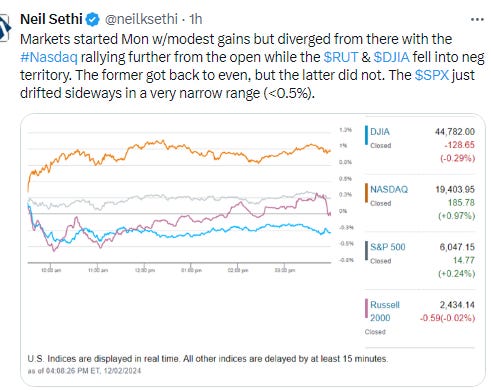

US equity indices looked to build on the best month broadly of the year (SPX since Nov ‘23), which they did as long as you were a growth stock, which pushed the SPX and Nasdaq to new record highs. Outside of that, though, the gains were much more sparse.

Bond yields were little changed but the dollar rebounded strongly from its worst week in 3 months on the back of a crumbling euro after Marine Le Pen pledged to topple Prime Minister Michel Barnier’s government after he failed to meet her demands on a new budget and incoming Pres Trump pushing a dollar first policy with the BRICS group. Gold, copper, and oil were all little changed, while bitcoin and nat gas fell back.

The market-cap weighted S&P 500 was+0.2%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite +1.0% (and the top 100 Nasdaq stocks (NDX) +1.1%), the SOX semiconductor index +2.6%, and the Russell 2000 unch.

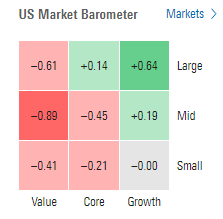

Morningstar style box consistent with large growth in the lead but every style in the green.

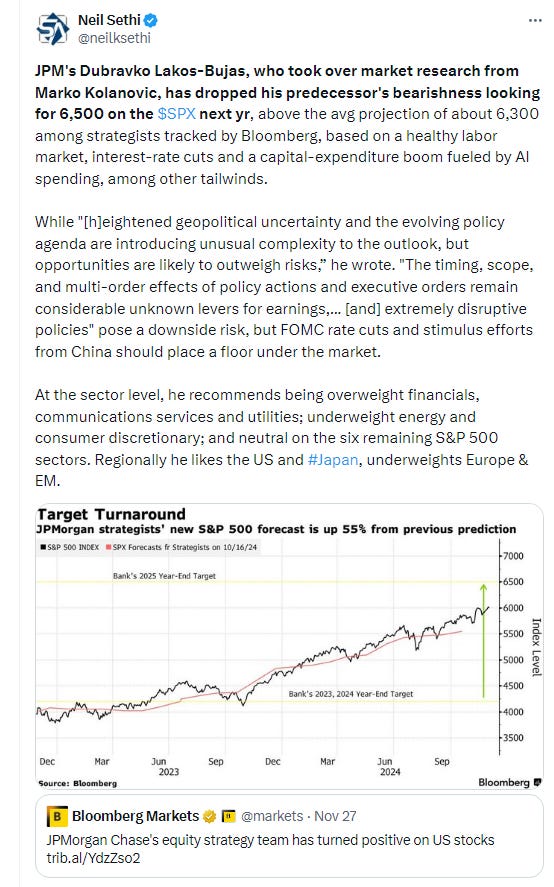

Market commentary:

“One of my top concerns is extreme bullishness, and we are seeing signs of that,” said Eric Diton, president and managing director of the Wealth Alliance. “We know from history that when investors are too bullish, and everyone is in the market, the question is who is buying to drive it higher?”

“Investors seem to be shunning virtually any risk-averse strategy,” Richard Bernstein Advisors wrote in a note to clients this week. “Anyone who thinks we are not in a highly speculative period, if not a bubble, isn’t really paying attention,” said Richard Bernstein, founder and chief investment officer at Richard Bernstein Advisors. “Look at crypto. There is nothing fundamental going on there.”

December is traditionally a good month for stocks, but Jay Hatfield, founder and CEO of InfraCap, only sees the market range-bound into the end of 2024.

“I think we’ll grind higher, but not rocket higher,” he told CNBC, citing 6,200 as a potential year-end estimate for the S&P 500. This is less than 3% above where the benchmark closed on Friday. “I think we’ve priced in the upside from the new, pro-business administration, and now we need to get details — not just tweets — but details of what the policy is.”

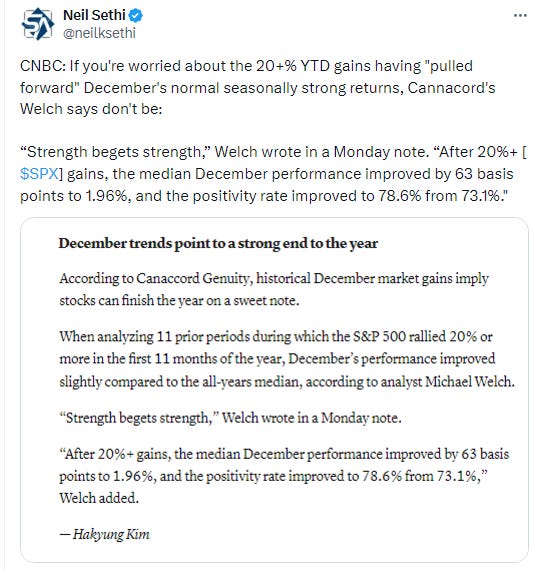

To Sam Stovall at CFRA, after the big November gains, investors still have much to look forward to. Since World War II, he says the S&P 500 returns in December recorded: 1) the second highest average monthly return 2) the greatest frequency of advance and 3) the lowest standard deviation of returns, which during election years has been nearly 40% below the average for the 11 other months of the year.

“The trends in the equity market remain constructive,” said Craig Johnson at Piper Sandler. “We expect a continued broadening into SMID-caps, which should be a rising tide that lifts all boats.”

At Miller Tabak, Matt Maley says that indeed, there are concerns about the level of euphoria in the marketplace as many sentiment indicators are reaching extreme levels. “However, most investors seem to be thinking that this is not something to worry about until next year,” Maley noted. “As you might imagine, this kind of complacency tells us that a further rally into the end of the year is not a lock, but until we see signs that the market is actually starting to roll back over, it’s hard to raise any warning flags right now.”

“As the year winds down, investors should be thankful for the bounty of stock returns seen over the last two years. However, we believe the road ahead could look more challenging than most investors appear willing to recognize at the moment,” said Anthony Saglimbene at Ameriprise. “That said, we also believe the outlook for next year remains favorable despite the known risks, and stocks could grind higher if fundamental conditions stay on track.” A more selective stock approach, a realistic assessment of potential fiscal and monetary policy headwinds or tailwinds, and a well-balanced investment strategy could be the keys to navigating what is very likely to be an eventful 2025, he noted.

into year-end/2025, it’s worth noting that positioning and sentiment are pushing toward extremes, while charts remain overbought against negative divergences in momentum, said Dan Wantrobski at Janney Montgomery Scott.

“The markets are priced to near-perfection, in our opinion, and this still renders them vulnerable to pullbacks as we move toward the first quarter of the new year,” he said. “Our outlook is for a correction within the magnitude of 10% to 15% to strike at some point during the first half of next year.”

“While tech remains near the top of the leader-board on a year-to-date basis, it’s near the bottom over the last one and three months,” Jonathan Krinsky, chief market technician at BTIG, wrote in a note to clients. “Bulls really need to see semis stabilize here to prevent a bigger breakdown into 2025.”

“People’s experience with the stock market in Trump’s last term is skewing their perception of what to expect in this frothy market,” said Alex Atanasiu, portfolio manager at Glenmede Investment Management. “At that time, the market was recovering, and this time valuations are even higher, we have had two strong years and it is risky to assume the market has the same kind of legs.”

Consumer confidence that the stock market is rising is at its highest in decades — but that hasn’t necessarily translated over to the macroeconomy, according to UBS. “The holiday season is in full swing and spirits seem bright, at least among investors,” the firm wrote in a Monday note. “If anything, it’s raising concern about the markets getting frothy, a claim backed up by the latest Conference Board consumer survey showing confidence that stock prices will increase is at a 37-year high. Signs of actual froth are most evident in crypto prices, long positions in S&P 500 futures, and trading volumes in leveraged ETFs.” However, UBS added that while financial markets are frothy, there’s still a lack of exuberance regarding the economy, specifically among consumer and business sentiment indicators. “Sentiment measures are rising, but their current pace of improvement implies that they won’t approach prior peaks until at least 2026. While this isn’t a necessary condition for market frothiness, investor euphoria is hard to achieve and sustain when public sentiment about the economy is not similarly optimistic,” the firm said.

In individual stock action, Shares of Tesla gained about 3.5% following an upgrade to buy from neutral at Roth MKM, with the firm citing CEO Elon Musk’s close relationship with President-elect Donald Trump as a catalyst. Artificial intelligence server maker Super Micro Computer surged nearly 29% after a special committee found “no evidence of misconduct” and that the firm’s financial statements were “materially accurate.” Meanwhile, Amazon added more than 1% amid the start of the holiday shopping season on Cyber Monday.

Corp Highlights from BBG:

Intel Corp. Chief Executive Officer Pat Gelsinger was forced out after the board lost confidence in his plans to turn around the iconic chipmaker, adding to turmoil at one of the pioneers of the technology industry.

Super Micro Computer Inc. said an independent review of its business found no evidence of misconduct but recommended that the server maker appoint new top financial and legal leadership.

MicroStrategy Inc. sold 3.7 million shares over the past week and used the proceeds to buy another $1.5 billion worth of Bitcoin, the fourth consecutive weekly purchase announced by the crypto hedge fund proxy.

Roughly 66,000 Volkswagen AG workers across Germany abandoned their posts on Monday, the first wave of temporary walkouts triggered by a stalemate over how to slash costs at the carmaker’s namesake brand.

Stellantis NV Chief Executive Officer Carlos Tavares’s surprise departure leaves the maker of Jeep SUVs and Peugeot cars without clear leadership at a time of significant upheaval in the industry.

Some tickers making moves at mid-day from CNBC.

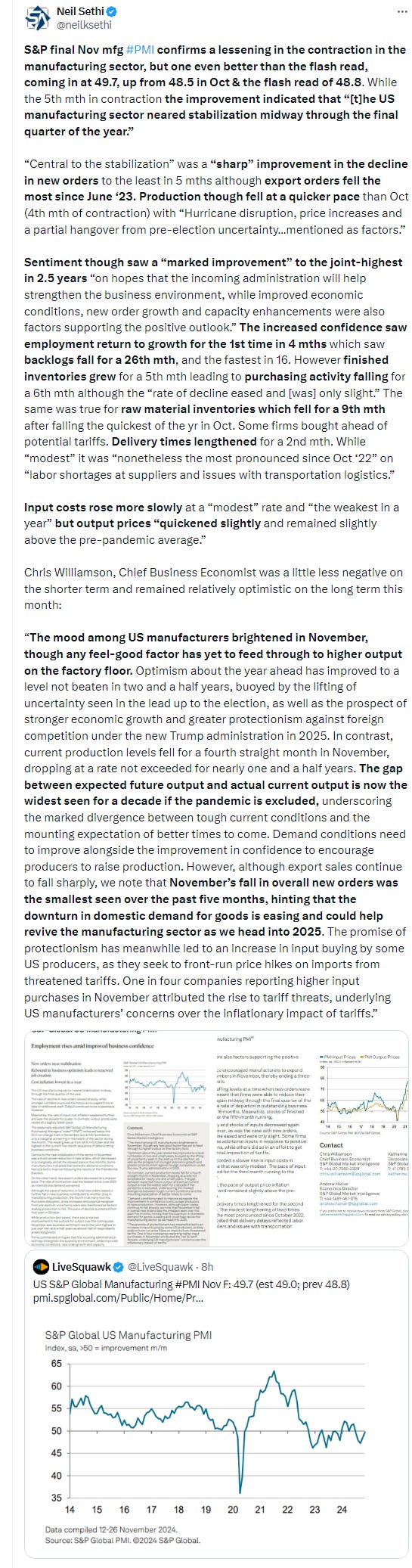

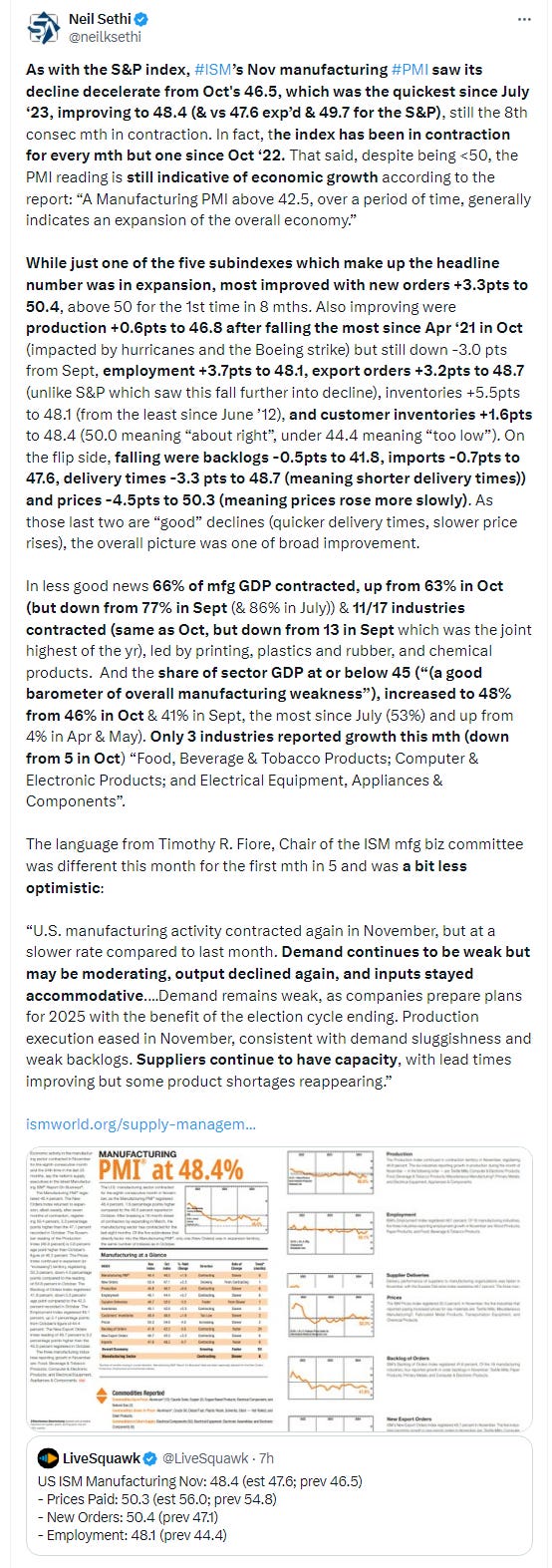

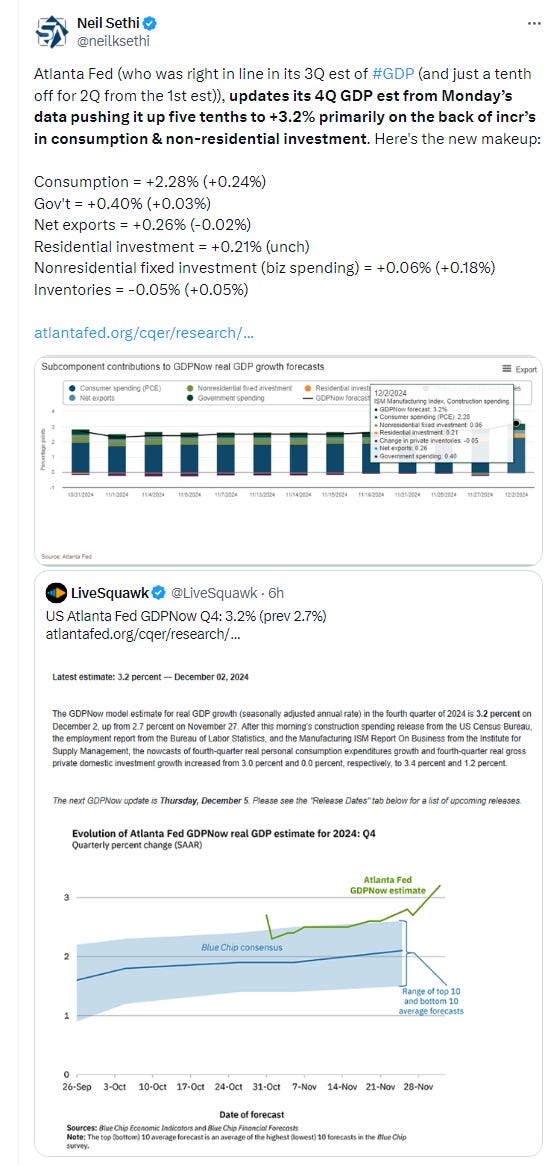

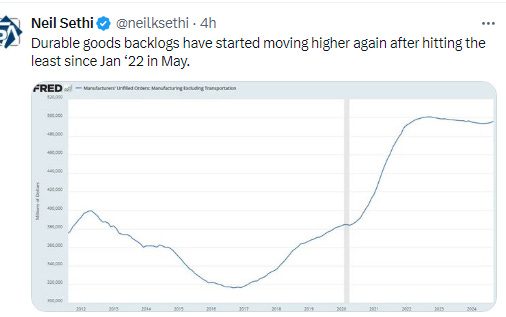

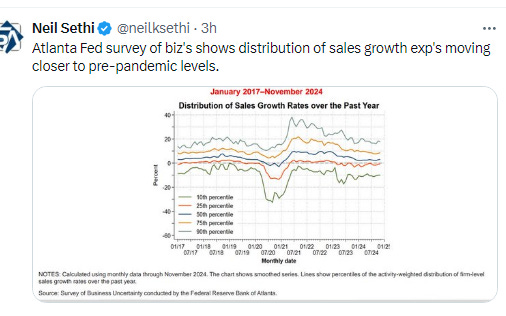

In US economic data we had the final Nov manufacturing PMIs which, while remaining in contraction, came in better than expected with significant slowing in the rate of decline. We also got Oct construction spending which came in better than expected (didn’t get to today, will tomorrow).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX started the week with another ATH (its 54th of the year), up for the 9th session in 10. Its daily MACD & RSI remain tilted positive.

The Nasdaq Composite also was able to get its first ATH in 3 weeks. It daily MACD & RSI are also now tilted positive.

RUT (Russell 2000) little changed for 4th session as it hangs just below its ATH which it touched a week ago for the first time since Nov ‘21. Its daily MACD & RSI remain positive as well.

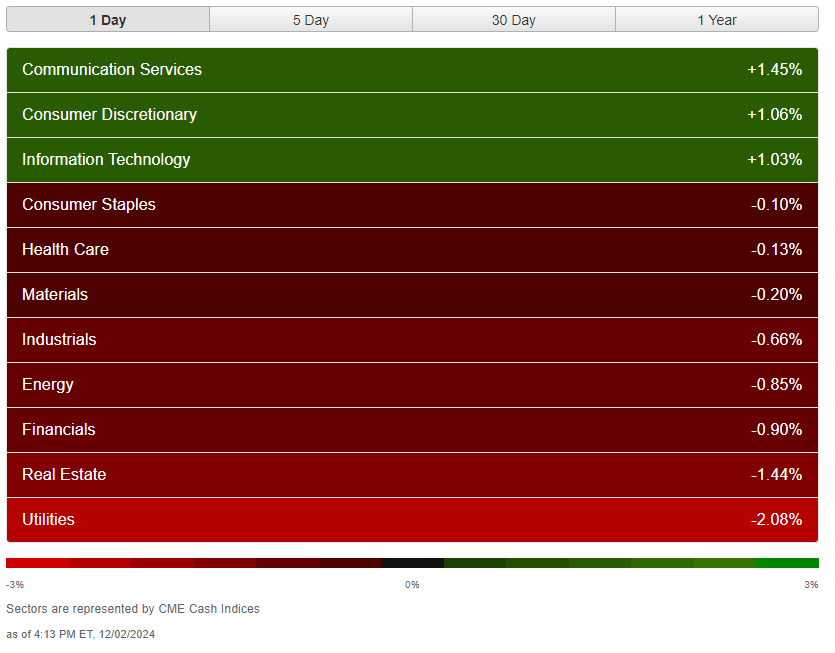

Equity sector breadth from CME Indices was the weakest in over a week w/just 3 green sectors after seeing 8 or 9 in five of the previous six sessions, although all 3 (all megacap growth which also led Friday) were up over 1%. Only 2 sectors were down that much (RE & utilities). It’s been a while but back to an “either/or” day as Helene Meisler calls it.

Stock-by-stock SPX chart from Finviz consistent with the most red we’ve seen in a while outside of the big growers.

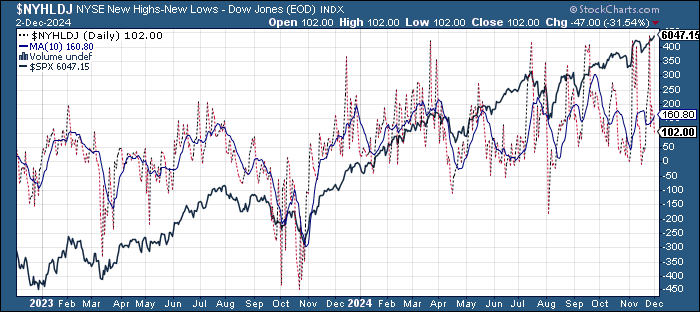

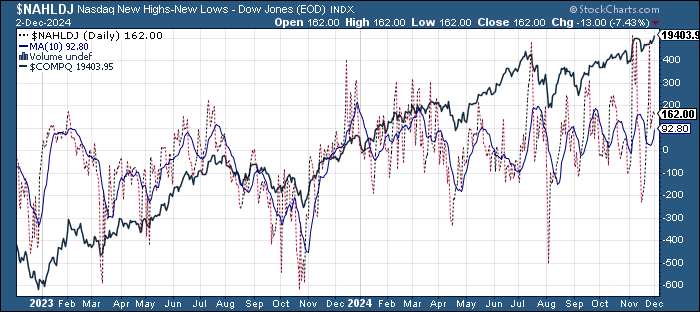

Positive volume was weak Mon for only the 2nd session since Nvidia’s earnings. The NYSE fell to 39%, not terrible but not great even considering the NYSE Composite was down a quarter percent, while the Nasdaq was just 57% despite the index finishing up 1%. That was after the best day since the election. Issues were 42 & 51%. So we again took a break from the clear improvement in breadth post-Nvidia earnings.

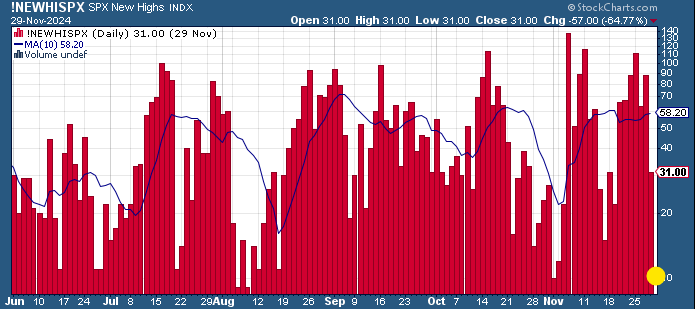

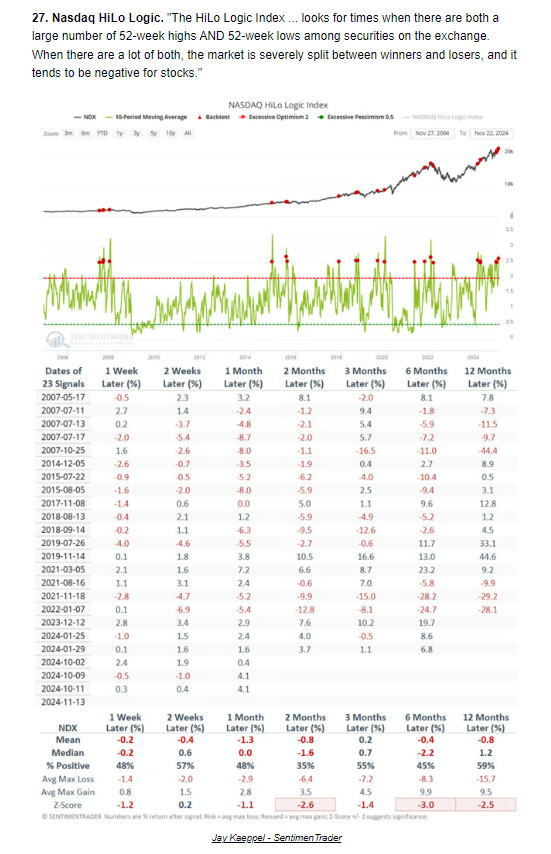

New highs-new lows fell as well w/the NYSE to 101 from 151, weakest since 11/20 while the Nasdaq fell to 148 from 171 (down from 480 a week ago, which was the 2nd best since mid-’21). Both are below the 10-DMAs but they continue to curl up (more bullish) for now.

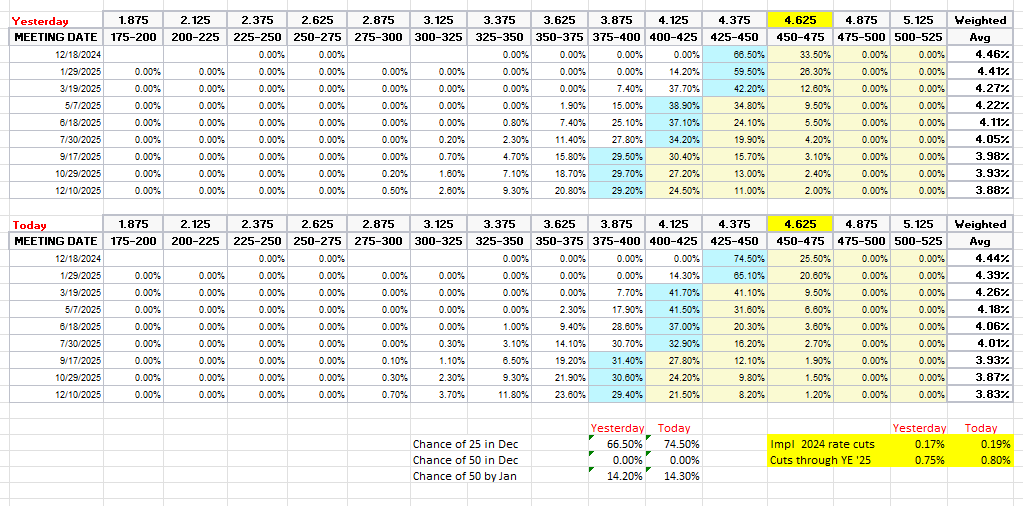

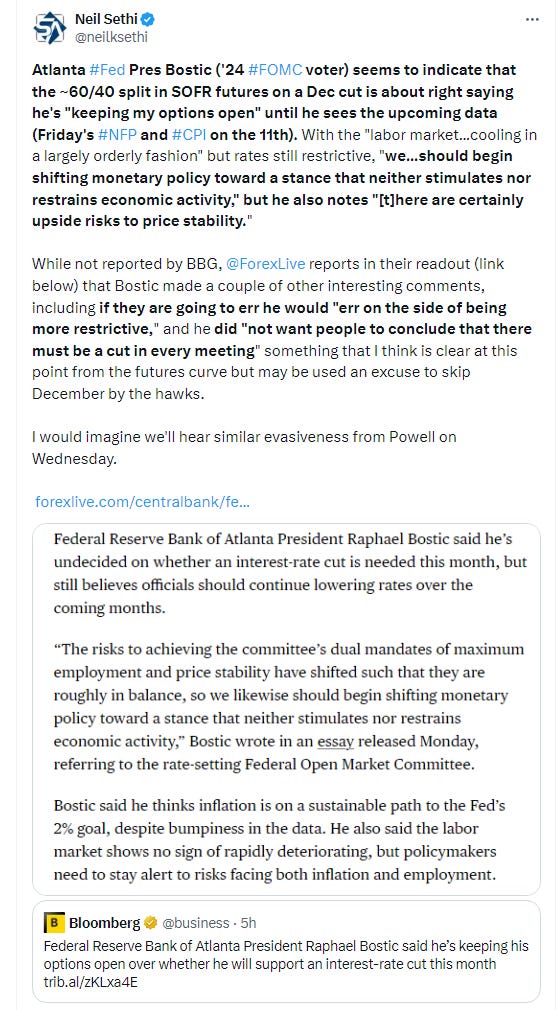

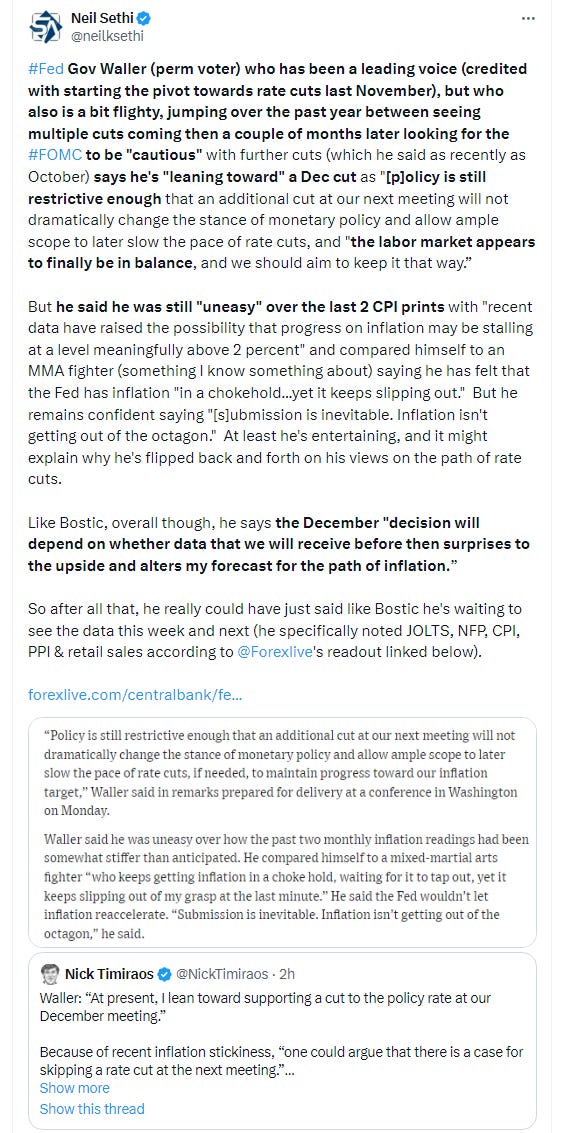

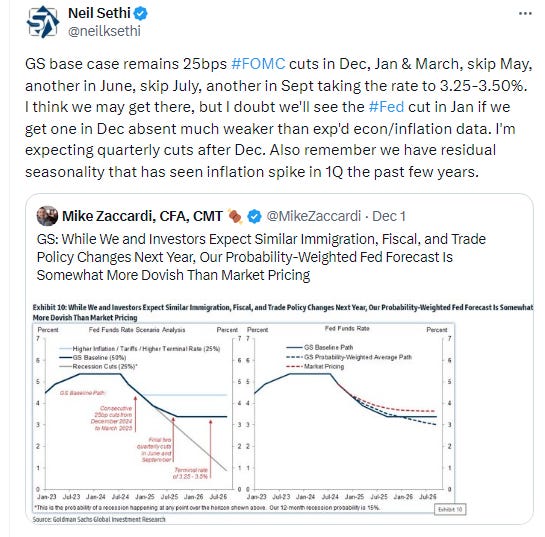

FOMC rate cut probabilities from CME’s Fedwatch tool edged to more cuts despite the better than expected manufacturing PMI’s and “on the fence” Fed speakers with chances for December cut firming to 75% from 67% Friday, the highest since before the July FOMC meeting (when they held rates steady). Total cuts through YE 2025 now at 80bps (+5bps), pushing us over 3 cuts in total priced from here.

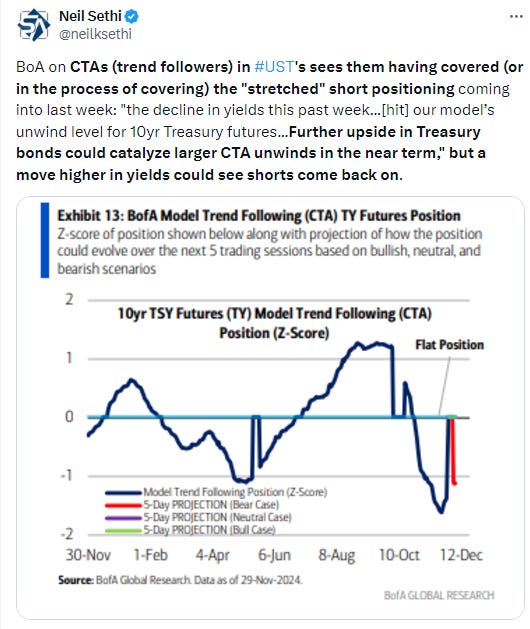

Treasury yields edged higher with the 10yr yield, more sensitive to economic growth and long-term inflation, up +2 basis points to 4.20%, still down -22bps since the election and remaining just under its 200-DMA after bouncing from its 50-DMA, and the 2yr yield, more sensitive to Fed policy, up +1bp to 4.17% down just -5bps since the day after the election (but down -17bps since last Monday).

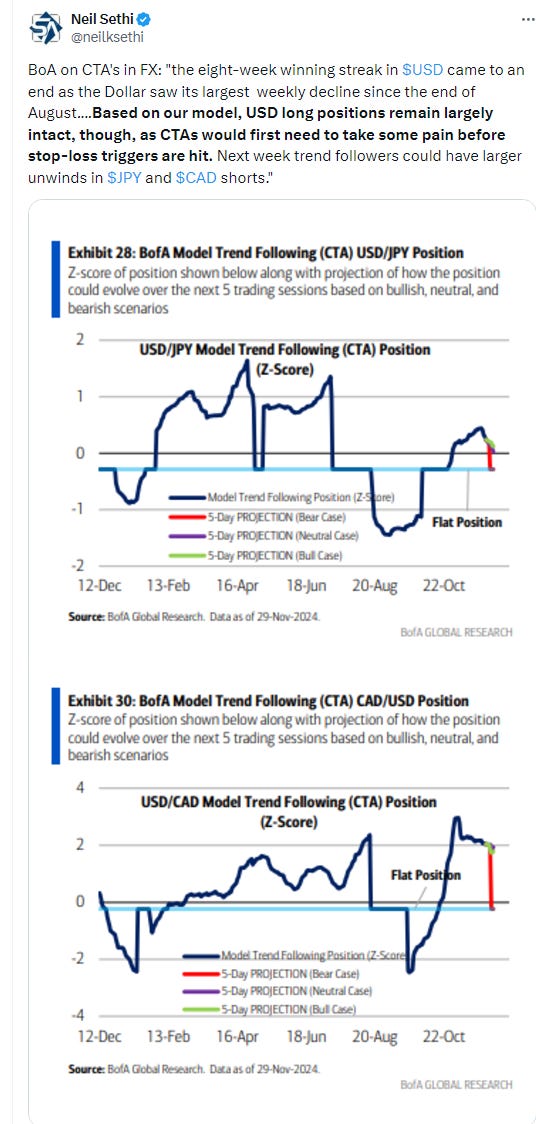

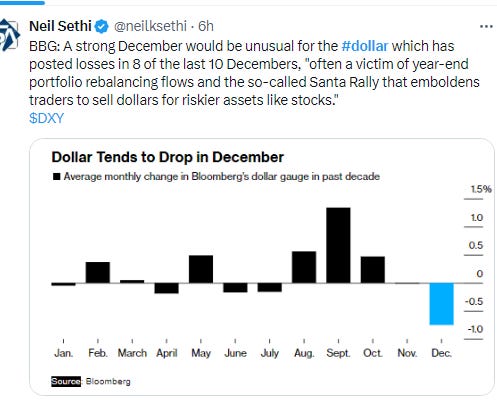

Dollar ($DXY) got a big bounce, after its first down week in 9 last week, off the lower trend line area on the back of euro weakness as France's budget situation remains in a precarious state and also Donald Trump’s comments over the weekend that the BRICS nations shouldn’t create a currency to rival the greenback. It’s now into a congestion zone though. As noted last week its daily MACD & RSI have moved to a less supportive positioning. We’ll see if it can get through that congestion which runs to the mid-$107 area.

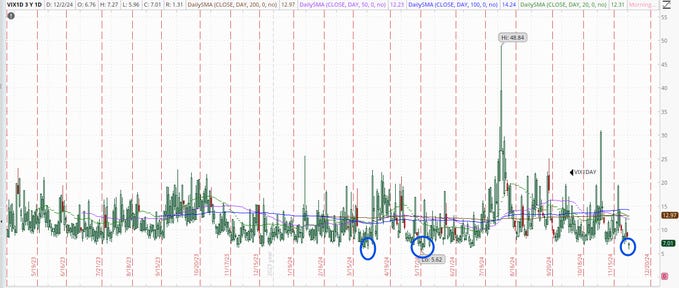

The VIX & VVIX (VIX of the VIX) went different directions today, with the former continuing to push through its uptrend line running back to early July to the lowest close since July 16th at 13.3 (consistent w/0.84% daily moves over the next 30 days) but the latter edging to 87 (consistent with “moderate” daily moves in the VIX over the next 30 days).

1-Day VIX dropped sharply today trading under 6 at one point for only the 4th time since inception (Apr '23). It closed at 7.3 looking for a move of just +0.46% Tuesday.

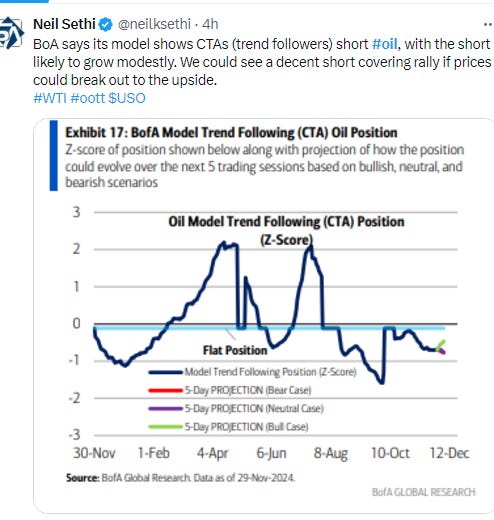

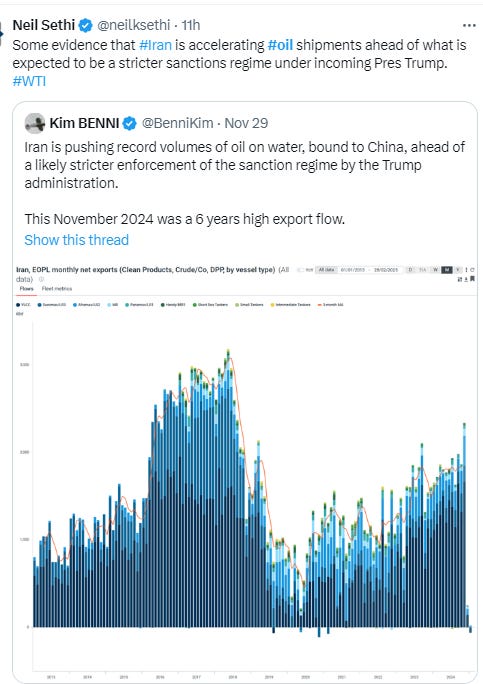

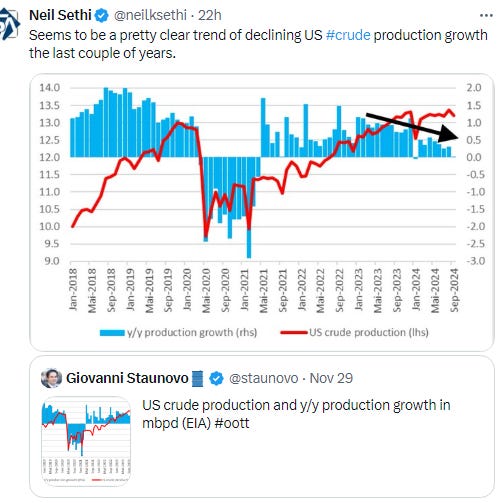

WTI edged lower Fri to its lowest close in 2 weeks. As noted Monday it has “little support to protect from a retest of the key $67 level.”

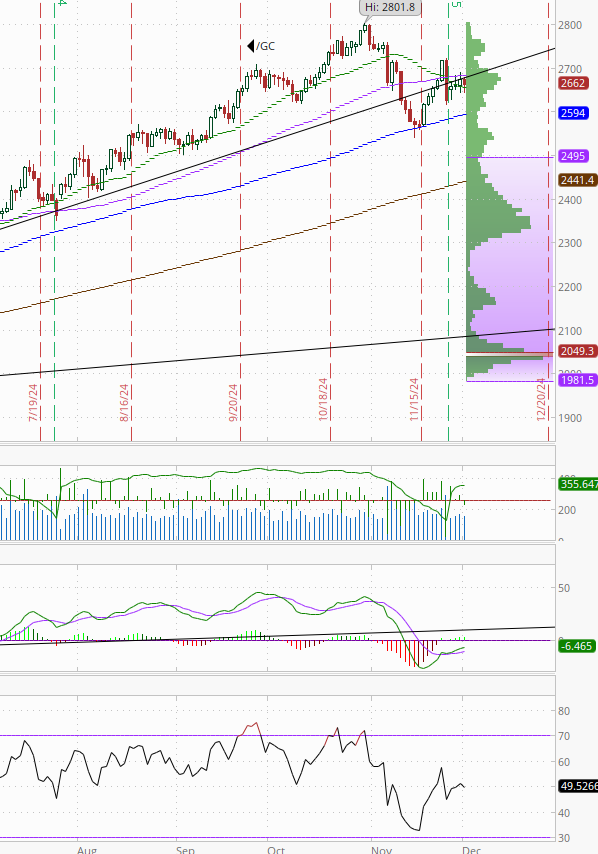

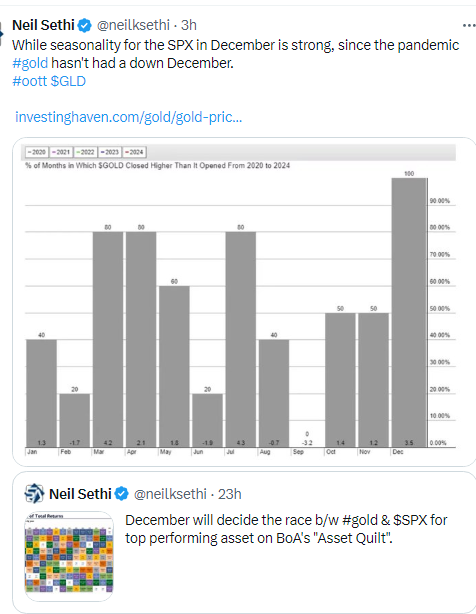

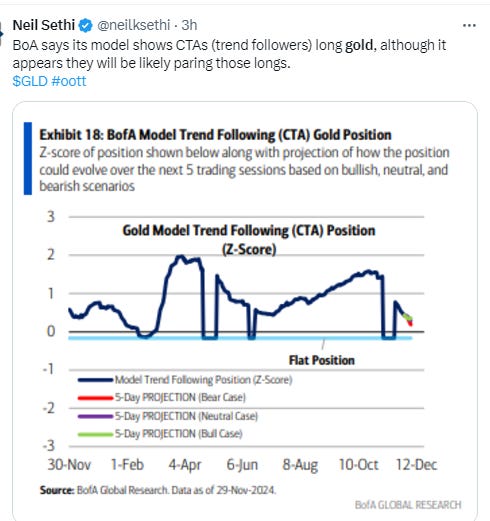

Gold tried again but wasn’t able for a 3rd day to get through the resistance of the 50-DMA (w/$2700 level just above). As noted last Tues, “until it gets over that, we have to look lower not higher,” but as noted Friday “the daily MACD & RSI have turned more positive, so perhaps a sign it will push through next week.”

Copper (/HG) little changed as it continues to sit just above its trendline back to the Oct ‘23 lows. As noted Friday though daily MACD & RSI though are turning more positive. Not much resistance if it wants to take a run at the 50-DMA (purple line).

Nat gas (/NG) remained volatile falling -4.5% after a continued warmer turn in intermediate term forecasts, holding though the $3.15 level (June highs) that I had said Wed might provide some support. The daily MACD & RSI remain positive but the weakest in 2 weeks.

Bitcoin futures continued to bounce back and forth just under the $100k level, down today. The daily MACD & RSI are turning more negative again but that has actually been a contrary indicator with Bitcoin for the most part this year. I continue to see it equally likely to break either way from this $90-100k range.

The Day Ahead

US economic data headlined tomorrow by the Oct JOLTS report (so a month behind the other employment reports we get this week). It’s actually forecast to edge a bit higher in the most watched job openings category. Auto sales will also be released from November.

We’ll get a couple more Fed speakers in Kugler & Goolsbee as we await Powell Wednesday.

Earnings will be headlined by Salesforce (CRM) as the >$100bn market cap reporter but Marvell Technology (MRVL) will also get some attention (see the full earnings calendar from Seeking Alpha).

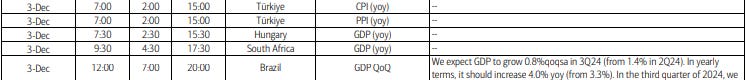

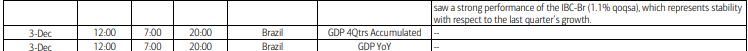

Ex-US not much going on in terms of economic reports from DM countries. In EM we get GDP from Brazil and South Africa, CPI from South Korea & Turkey, and employment from Mexico.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,