Markets Update - 12/2/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

US equity indices opened trading in the green after the SPX broke a five-day winning streak Monday as some of the risk off tone lifted even as bond yields edged higher (they would reverse lower). Bitcoin was higher by 2% (it ended nearly +7%, recouping its losses from the prior day). Tech players linked to the AI trade supported the broader market as well, with names like Oracle and Broadcom similarly reversing course from the previous session’s losses. Apple was higher for a second day and AI chip maker Nvidia was up around 1%.

Similar to Monday the indices chopped back and forth to end the day mostly where they started with the exception of the Russell 2000 (RUT) which deteriorated into negative territory. All also saw last hour selling again, particularly the RUT. The SPX was +0.3%, the Nasdaq +0.6%, DJIA +0.4%, RUT -0.2%

Elsewhere, Treasury yields edged lower, as did the dollar, gold, crude, natgas, and copper. Bitcoin though rallied to recover Monday’s losses.

The market-cap weighted S&P 500 (SPX) was +0.3%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite +0.6% (and the top 100 Nasdaq stocks (NDX) +0.8%), the SOXX semiconductor index +1.8%, and the Russell 2000 (RUT) -0.2%.

Morningstar style box was mixed for the first time in seven sessions with a bias towards large cap growth.

Market commentary:

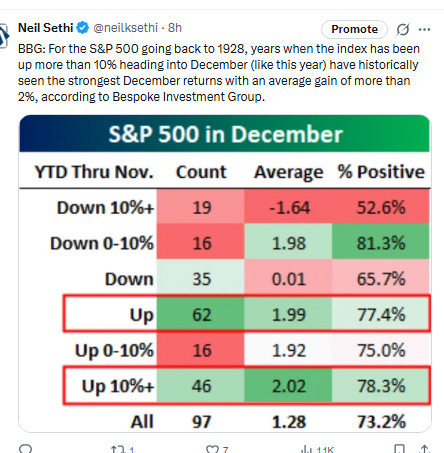

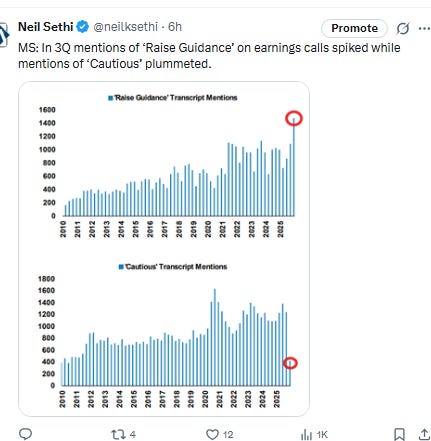

“Bulls still enjoy a strong tailwind from technical and fundamental factors as we approach year-end. On the technical front, December remains a strong seasonal month, fund flows have been steady, risk metrics have improved, the S&P 500 has surged back above the 50-day moving average, breadth has improved, yet sentiment remains historically weak,” said Mark Hackett, chief market strategist at Nationwide. “The bear’s argument relies on concern over the sustainability of the AI buildout and elevated valuations.”

“The stock market is continuing its rebound from the November lows and this rebound coincides with the seasonal strength we usually see in December,” Robert Edwards, chief investment officer at Edwards Asset Management, told MarketWatch in an email. “Since stocks had lackluster performance in November, that raises the odds of a Santa Claus rally in December, since sentiment was reset in November and that reset helps pave the way for the stock market’s next move higher,” he continued. Despite recent risk-off trading, Edwards believes the artificial-intelligence trade is still intact and said there has been no recent news to suggest otherwise.

“Dips continue to present attractive buying opportunities,” wrote Michael Brown, senior research strategist at Pepperstone. “The narrative behind that bull case remains an attractive one, with earnings growth solid, the underlying economy resilient, a calmer tone on trade continuing to prevail, and the monetary backdrop growing looser.”

The stock market still requires a bit more broadening out before expecting an immediate push back to fresh highs, according to Mark Newton at Fundstrat Global Advisors. “I have a constructive view for December, but still believe it is likely to show a ‘back and forth’ type pattern over the next couple of weeks,” he said.

At Piper Sandler, Craig Johnson says more time and technical evidence are needed for a “buy” signal to occur.

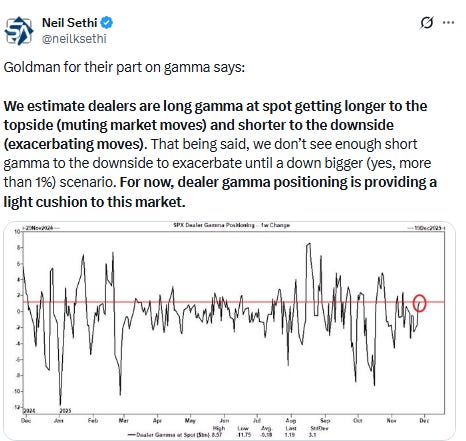

“A combination of resilient tech stocks and fragile undercurrents is pinning the S&P 500 within recent ranges, as investors lean on mega-cap growth while bracing for a likely hawkish Fed cut next week.” —Michael Ball, Macro Strategist, Markets Live

“Markets appear to have moved away from uncertainties surrounding Fed policy and the Dec. 10 FOMC and focusing instead on better-than-expected earnings projections for the fourth quarter and calendar year 2026, in addition to looking beyond the economic soft patch we’re currently experiencing to growth accelerating later next year,” said Doug Beath, global equity strategist at Wells Fargo Investment Institute. “Seasonality also favors stocks in December, particularly after a weak November.”

“December is not a bad month, earning on average 0.59% over the past 20 years,” notes Siebert Financial CIO Mark Malek. “Not exactly the 2.56% expected in November, but certainly better than worst-month September’s—0.65% average loss. In December, the S&P 500 logged a gain in 12 out of the last 20 years…Rather than getting caught up in all that, it would seem like focusing on the Fed and what it does and says next week may be a better predictor of whether we get a positive return for the month, or we end up with a lump of coal.”

“For long-only investors like we are, I’d say in the absence of any major catalyst, it’s very much wait-and-see until the Fed meeting, while keeping an eye on US jobs and inflation data,” said Karen Georges, a fund manager at Ecofi Investissements in Paris.

“Nothing is going to change our view that the Fed eases next week, but it is looking more like a hawkish cut,” said Andrew Brenner at NatAlliance Securities. “We can see at least three dissents next week.”

“If the Fed doesn’t deliver as many cuts, there’s some normalization” in Treasury yields, said Jay Barry, JPMorgan’s head of global rates strategy, at a media briefing. The US economy “bends but doesn’t break,” he added.

It was a quiet trading day with no major headlines weighing on the market, but investors were “largely ignoring” the fact that the U.S. Navy is operating off the coast of Venezuela, targeting boats that are allegedly carrying illegal drugs, said Louis Navellier, chair and chief investment officer of Navellier & Associates. “The U.S. action in Venezuela is expected to be a boon for Venezuela’s domestic oil industry, which has fallen into disrepair, but could boom again with help from U.S. energy companies,” Navellier said in emailed commentary on Tuesday. In the long term, a resurgent Venezuelan energy sector would likely cause crude oil prices to remain soft due to the new supply that could hit the world market, he added.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Apple Inc. led gains in megacaps, but Tesla Inc. fell as Michael Burry called the shares “ridiculously overvalued.” Boeing Co. surged 10% as it expects to generate cash again in 2026.

AI infrastructure play Credo Technology soared 10% and hit an all-time high on the back of better-than-expected earnings.

Corporate Highlights from BBG:

Michael Burry called Tesla Inc. shares “ridiculously overvalued” and said shareholder dilution is set to continue after the proposed $1 trillion pay package for co-founder Elon Musk, according to a Substack post.

Amazon.com Inc.’s cloud unit raced to get the latest version of its artificial intelligence chip to market, renewing efforts to sell hardware capable of rivaling products from Nvidia Corp. and Google.

Cloud-computing provider Vultr is building a 50-megawatt cluster of Advanced Micro Devices Inc. artificial intelligence processors at a data center in Ohio, a move aimed at offering AI infrastructure at a lower cost.

Boeing Co. expects to generate cash again in 2026, a significant reversal in the planemaker’s finances as it prepares to boost monthly production rates of its passenger aircraft.

Warner Bros. Discovery Inc. fielded a second round of bids, including a mostly cash offer from Netflix Inc., in an auction that could wrap up in the coming days or weeks, according to people familiar with the discussions.

Comcast Corp. is looking to merge its NBCUniversal division with Warner Bros. Discovery Inc., according to people familiar with the company’s plans.

Strategy Inc.’s new $1.4 billion reserve gives the Bitcoin accumulator flexibility to meet short-term obligations such as its dividend and interest payments during times of market turbulence, according to Chief Executive Officer Phong Le.

Crypto exchange Kraken is acquiring a tokenized assets platform in a vote of confidence for stock trading tied to blockchains.

Cloudflare Inc. climbed after Barclays launched coverage on the infrastructure software company with an overweight rating and a $235 price target.

MongoDB Inc., a database software company, reported stronger-than-expected results. It also raised its full-year forecast.

Six Flags Entertainment Corp. rallied after Truist Securities upgraded the theme park operator’s stock to buy from hold.

Analog chipmaker SiTime Corp., which specializes in chips that keep circuits in sync inside data centers, is in talks to acquire Renesas Electronics Corp.’s timing unit, according to people familiar with the matter.

Carlyle Group Inc. sold a troubled loan it provided to iRobot Corp. less than three years ago as the maker of Roomba vacuum cleaners is trying to stave off a potential bankruptcy filing.

Bank of Nova Scotia topped estimates on better-than-expected results at its capital-markets unit while forecasting faster growth next year in its core Canadian banking division.

Laurentian Bank of Canada is set to become the latest small Canadian bank to exit the market after reaching an agreement to sell itself to Fairstone Bank for C$1.9 billion ($1.4 billion) while hiving off its retail banking unit to focus on commercial lending.

Novo Nordisk A/S is planning a large study of its next-generation obesity shot CagriSema in children, a sign the drugmaker is pressing forward with the compound despite disappointing results in other trials.

BMW AG is pressing the European Union to formally adopt a trade deal with the US that would give the German carmaker respite from ongoing tariff pressure.

TotalEnergies SE has emerged as the leading bidder to buy a stake in Galp Energia SGPS SA’s major oil discovery offshore Namibia, according to people familiar with the matter.

Vale SA and Glencore Plc are considering a joint copper project in Canada as the two companies look to increase their exposure to a metal projected to be in short supply as the world electrifies.

Samsung Electronics Co. unveiled its first so-called trifold smartphone, flaunting its engineering prowess in foldable devices even as the broader category has yet to catch on with mainstream consumers.

Taiwanese prosecutors charged Tokyo Electron Ltd. for failing to prevent staff from allegedly stealing Taiwan Semiconductor Manufacturing Co. trade secrets, escalating a dispute involving two Asian linchpins of a chip industry increasingly vital to national and economic security.

Mid-day movers from CNBC:

Maplebear — The parent company of Instacart fell nearly 4% after Amazon said it’s testing “ultra-fast” delivery of groceries in Seattle and Philadelphia. These deliveries take about 30 minutes or less, said Amazon.

Boeing — The aerospace giant rose 8% after winning a $104.4 million U.S. Navy contract to repair displays in certain aircrafts. On top of that, the company issued positive free cash flow guidance for 2026.

Solaris Energy Infrastructure — The data center energy provider gained more than 3% after Morgan Stanley initiated coverage with an overweight rating. “Generation equipment has been secured through 2028, the business model builds contracted cash flows, and the stock is pricing in only limited growth beyond 2028,” Morgan Stanley wrote.

XPO — The logistics stock fell more than 7% after it said that tonnage for November fell around 5% year on year, with shipments also sliding 2%.

MongoDB — Shares of the developer data platform soared 23% following strong third-quarter results. Adjusted earnings were $1.32 per share on revenue of $628 million, compared to earnings of 80 cents per share on $592 million in revenue expected by analysts polled by LSEG. MongoDB also raised guidance for its full fiscal year.

Strategy — The stock added 4% as bitcoin, Strategy’s treasury asset, rose nearly 6% after plunging Monday. The token briefly fell below $85,000, but has since climbed above $90,000 again.

Janux Therapeutics — The clinical-stage biopharmaceutical company tumbled 47% after early-stage data from its phase one prostate cancer trial trailed expectations.

Signet Jewelers — The Kay Jewelers and Zales Jewelers owner sank 4% on the back of disappointing fourth-quarter guidance. Signet sees revenue between $2.24 billion and $2.37 billion in the holiday quarter, less than the $2.38 billion expected by analysts polled by FactSet. Third-quarter revenue topped expectations and the company raised full-year 2026 guidance.

United Natural Foods — The grocery distributor moved 9% higher following an earnings beat. United Natural Foods earned an adjusted 56 cents per share in its fiscal first quarter, topping a 40-cent consensus estimate, per FactSet. Revenue fell short but United Natural reaffirmed full-year guidance.

Cloudflare — Barclays initiated coverage of the cybersecurity company with an overweight rating, sending shares 2% higher. The bank’s $235 price target implies about 19% upside from Monday’s close.

Credo Technology — The manufacturer of cables and chips used in AI computers rose 14% following better-than-expected fiscal second-quarter earnings. Credo earned an adjusted 67 cents per share, beating the 49 cents analysts had expected, per LSEG. Credo’s $268 million revenue also topped the forecast $235 million. Credo forecast current-quarter revenue of $335 million to $345 million, while analysts had penciled in $248 million.

Six Flags — The theme park operator added 2% following a Truist upgrade to buy from hold. The bank lauded Six Flags’ experienced new CEO and its commitment to improving the business.

Teradyne — Shares moved 4% higher. Stifel upgraded Teradyne to buy from hold, saying the company’s positioning and growth in AI networking remains under-appreciated

Bausch + Lomb — Morgan Stanley upgraded the eye care company to overweight, citing a strong ophthalmology pipeline. The stock gained 4%.

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX continues to sit on both its downtrend line from the highs and its uptrend line (which it broke last week) from Aug. As noted Fri, the daily MACD has flipped to “go long” positioning, and the RSI is back above 50.

The Nasdaq Composite a similar story (although remains above its steeper downtrend line and technically its MACD is “cover shorts”).

RUT (Russell 2000) sort of in between the two.

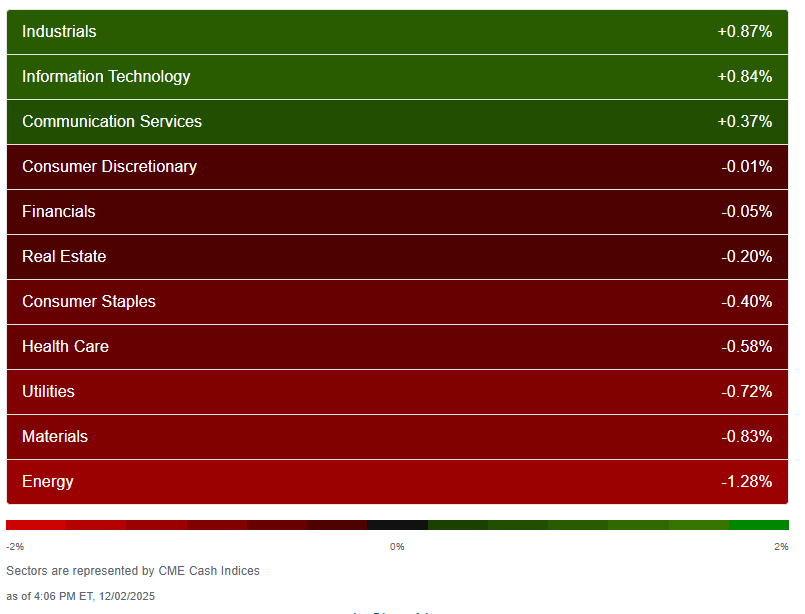

Sector breadth from CME Cash Indices remained weak with again just three of 11 sectors higher (after no less than eight every day last week), but the difference was they saw slightly larger gains and included three of the larger sectors in Industrials, Tech and Comm Services (and Cons Discr was fourth meaning the megacap growth sectors took three of the top four spots), although again none up over 1%.

One sector though down that much in Energy (which led Monday).

SPX stock-by-stock flag from @finviz_com consistent with definitely less red (especially bright red (>3% loss)) outside of Energy which flipped from green to red. Still plenty of red though particularly in Utilities, Health Care, and consumer names.

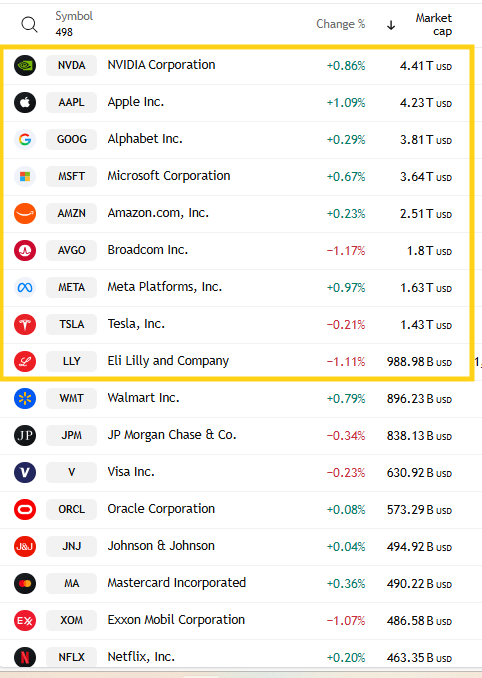

Six of the top 9 (trillion-dollar club (going to leave LLY in for now)) were higher (after just three Mon matching Fri) although only AAPL was up over 1% (+1.1%, after +1.5% Mon). AVGO again led decliners giving back another -1.2% after -4.2% Mon (but only after last week’s +18.5% gain). Mag-7 was +0.5%, now +0.4% so far this week after it was up +5.1% last week.

19 SPX components were up 3% or more, up from 7 Mon, 6 Fri but down from 24 Wed, 70 Tues, led by Boeing BA +10.2% after the CFO said cash flow should be “mid single digits” positive next year. BA, INTC, BKNG, APP, GEV, TXN, AMAT were the >$100bn in market cap up more than 3% (in descending order of percentage gains).

10 SPX components down -3% or more, down from 26 Mon but up from none Fri, led by Block XYZ -7.0% after its presentation at a UBS conference was poorly received. The only >$100bn in market cap SPX component down more than 3% was MCK.

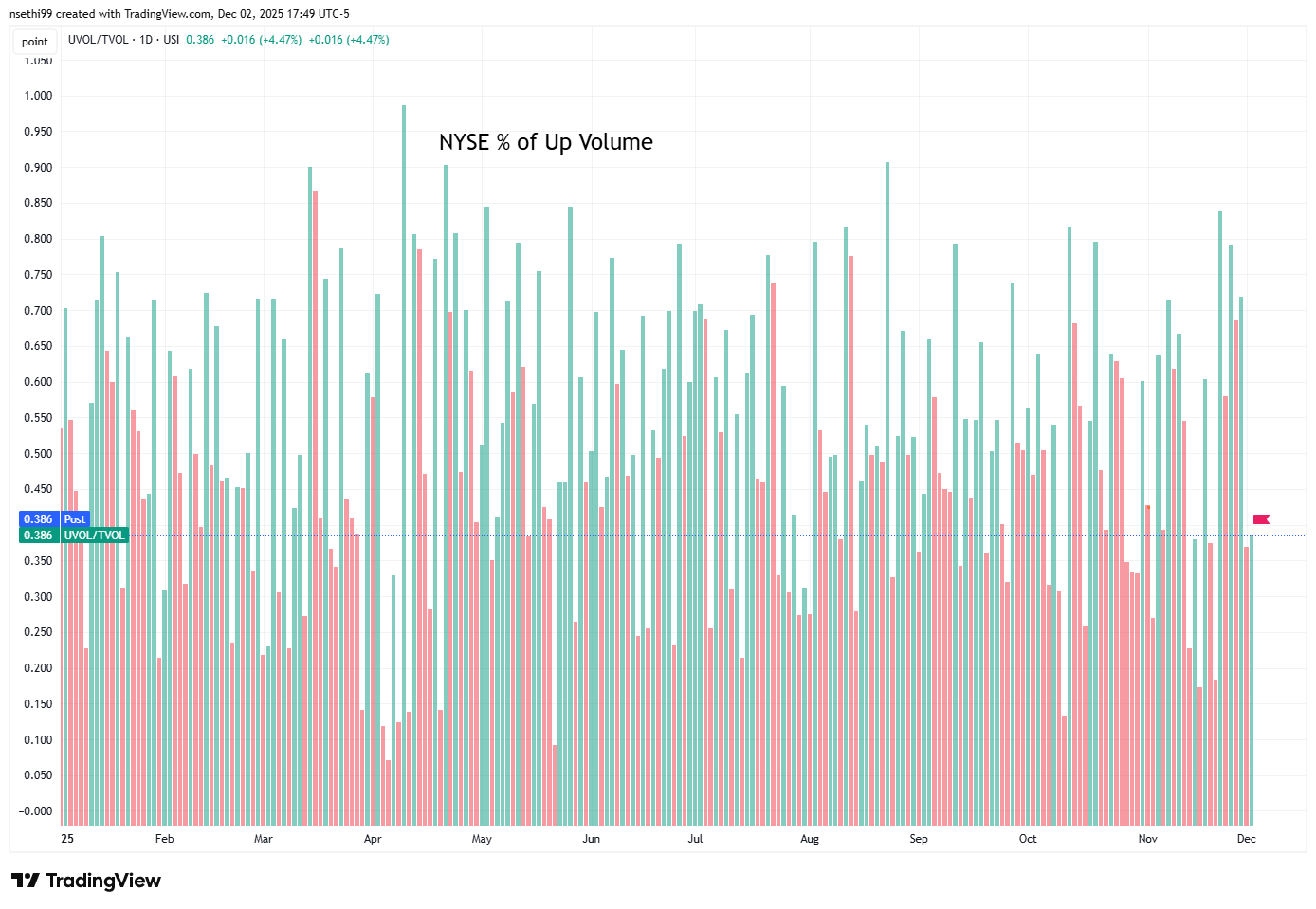

NYSE positive volume (percent of total volume that was in advancing stocks) very weak only improving slightly to 38.6% from 36.9% despite the loss in the index dropping to -0.07% from -0.72%. Hopefully that’s just a one-day thing.

Nasdaq positive volume (% of total volume that was in advancing stocks) also weak (although not as bad as the NYSE) coming in at 52.6%, not great for the +0.59% gain in that index. Compare to Friday when it was 69.8% on a slightly larger +0.65% gain (circle).

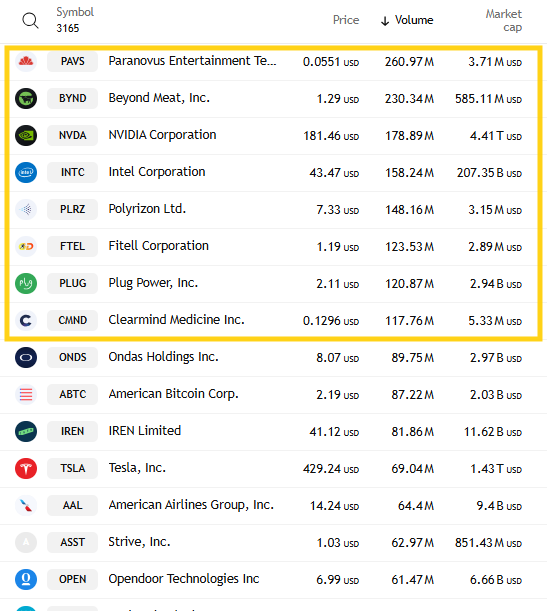

Speculative volumes continued to be more subdued with the top stock by volume seeing just 261mn shares, traded one of the lowest full day numbers we’ve seen in weeks. Eight companies though saw over 100mn shares traded up from just 6 Mon (but down from 12 a couple of weeks ago).

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks were closer today on the Nasdaq at 46% while the NYSE was at 44%.

New 52-wk highs minus new 52-wk lows (red lines) also fell back four a fourth day to 55 on the NYSE (still well above the -115 Nov 20th) and -35 on the Nasdaq (still up from -357 Nov 20th (the least since April)).

[Charts not updated yet]

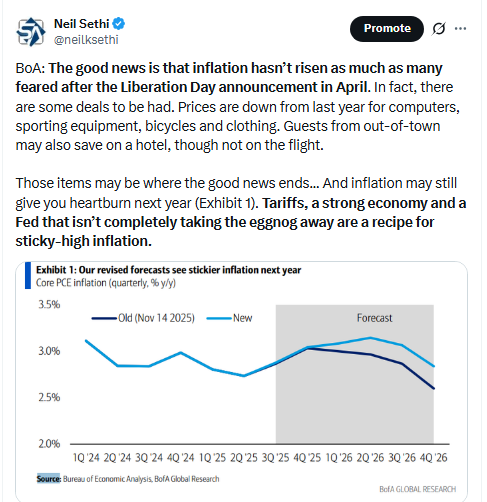

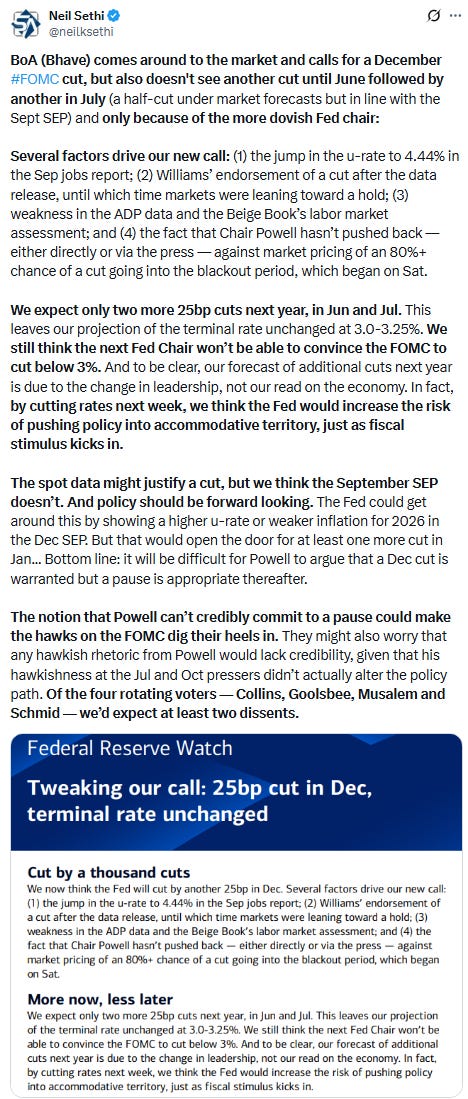

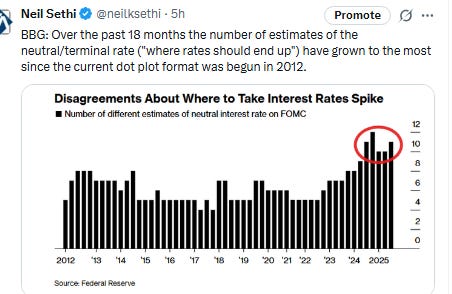

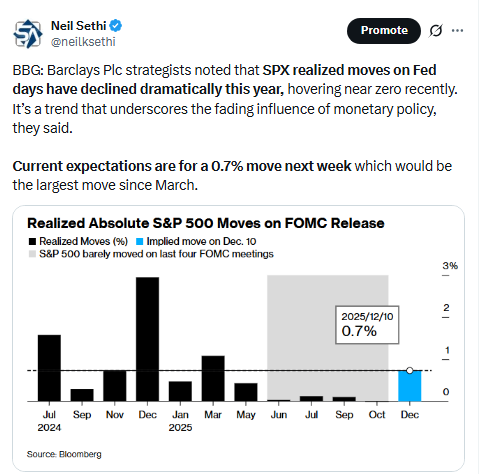

Odds on a Dec #FOMC rate cut edged higher to 89%, the highest since the Oct FOMC, up from 33% two weeks ago, although still down from 100% Oct 16th.

A cut by Jan edged to 92% (also the best since Oct 16th (96%)), and cuts at both the Dec & Jan meetings also edged up to 26% still not much moved from the 20% two weeks ago despite the dramatic increase in Dec pricing.

And pricing for 2026 edged up +1bps to 65bps (down from 80bps two weeks ago which was highest we’ve been for 2026 cuts), and total cuts through Dec ‘26 to 87bps (down from 103bps pre-Oct FOMC which was the highs of the year (for cuts from December on)).

As a reminder the average dot on the dot plot has ~60bps of total rate cuts through Dec ‘26 from this point, so over a cut off.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is definitely where we were Apr 20th (a little too far) at 102bps). I said the day before July NFP “now it seems like we’re perhaps getting back to too few cuts”. I thought at 76bps heading into the Sept FOMC we were perhaps a bit overdoing it, but continued to expect at least 50bps this year (which we’ve now gotten) but probably not a lot more than that (which has been my call since last December). I said I thought we got back to overdoing it when over 50bps of rate cuts were priced for the rest of the year Oct 16th. I had said “while 50bps is my base case it’s less than 100% I think.” I then said we were pushing a bit to far when we got into the low 40% and under range, but now we’re back up over 80% which I think may be a touch high, but it certainly feels like Powell sent out the doves to talk it back up which means it’s almost certainly more likely than not.

Also remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point)

The 10yr #UST yield started higher but fell back to end little changed at 4.09%.

The 2yr yield, more sensitive to FOMC rate cut pricing, was -2bps to 3.51% still just 9bps from the bottom of the range since late August. It is 37bps below the Fed Funds midpoint.

The Effective Fed Funds Rate (red line) remained at 3.89%, up 6bps since Sept, evidence of continued growing stresses in funding markets that will likely see the Fed adding assets to its balance sheet soon.

I had said when the 2yr yield it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO said on his weekly podcast he now sees it at 3.3% by year’s end (but sees risk to the downside), but I still took some off Sept 5th at 3.5%. I have been waiting for ~3.90% to add back but it seems now that ship might have also sailed.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) was lower for the 8th session in 9, but remaining above its 50-DMA. The daily MACD and RSI remain modestly negative.

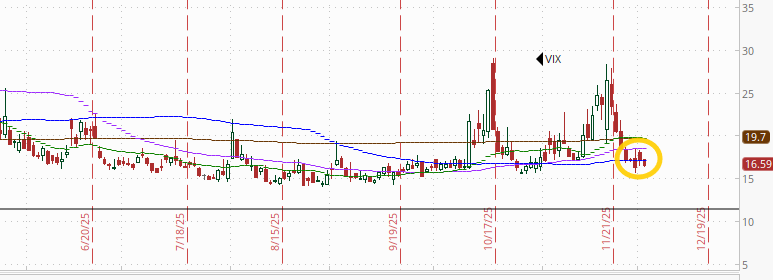

VIX eased for the sixth session in seven but modestly to 16.6 a little above last week’s low. The current level is consistent w/~1.03% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) similarly edged back towards the lowest close since late Aug, and at 91.7 remains well below Nomura’s Charlie McElligott’s breakeven “stress level” of 100 (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)). It also still hasn’t retaken its trendline running back to March that it has never spent this long under since then.

1-Day VIX like the VIX and VVIX saw a mild decrease Tuesday, in its case to 10.5. That level implies a ~0.67% move in the SPX next session.

#WTI futures as expected fell back from the trendline that has capped them since July The MACD and RSI remained at neutral levels.

Gold futures (/GC) edged lower for the first time in six sessions (still +4.2% over that time) as they continue to look to break out of their consolidation just off the highest close since the all-time high a month ago. Daily MACD as noted Wed is now in “go long” positioning, and the RSI is above 60.

US copper futures (/HG) also edged back again after Monday hitting the highest since the July meltdown. As noted Wed the daily MACD has crossed to “go long” positioning, and RSI has pushed over 60. Longer term, they remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) took a breather after a nearly 6% two-day run to the highest close since Dec ‘22. The technicals continue to show a divergence, but as I noted Friday “you can’t ignore the price action.”

Bitcoin futures remained volatile getting back all of Monday’s -5.2% drop and a tiny bit more. In addition, some of the daily technicals are starting to confirm the rally with the daily MACD crossing over to “cover shorts” and the RSI pushing to a 3-week high.

The Day Ahead

US economic data will be heavy Wed with Nov ADP kicking it off, followed by Sept import prices and industrial production, and Nov final services PMIs. We’ll also get weekly mortgage applications and EIA petroleum inventories.

The wrap-up of Q3 earnings will continue, and we’ll get two SPX components reporting tomorrow (per TradingView) in DLTR and >$100bn in market cap CRM.

Ex-US DM highlights include final services PMIs, EU PPI, and Australia GDP.

EM highlights are a rates decision in Poland and services PMIs.

08:15 AM ADP employment change, November (GS -20k, consensus +10k, last +42k)

08:30 AM Import price index, September (consensus +0.1%, last +0.3%)

09:15 AM Industrial production, September (GS flat, consensus +0.1%, last -0.1%)

Manufacturing production, September (GS flat, consensus +0.1%, last +0.1%)

Capacity utilization, September (GS 75.8%, consensus 77.3%, last 75.8%)

We estimate that industrial production was unchanged in September, as declines in auto manufacturing and natural gas production were offset by increases in non-auto manufacturing and electricity, oil and gas production. We estimate capacity utilization was unchanged at 75.8%, following the recent downward adjustment implied by the annual revision to the industrial production index.

09:45 AM S&P Global US services PMI, November final (consensus 55.0, last 55.0)

10:00 AM ISM services index, November (GS 52.5, consensus 52.0, last 52.4)

We estimate that the ISM services index increased 0.1pt to 52.5 in November, reflecting sequential improvement in our non-manufacturing survey tracker (+0.6pt to 53.1).

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,