Markets Update - 1/22/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

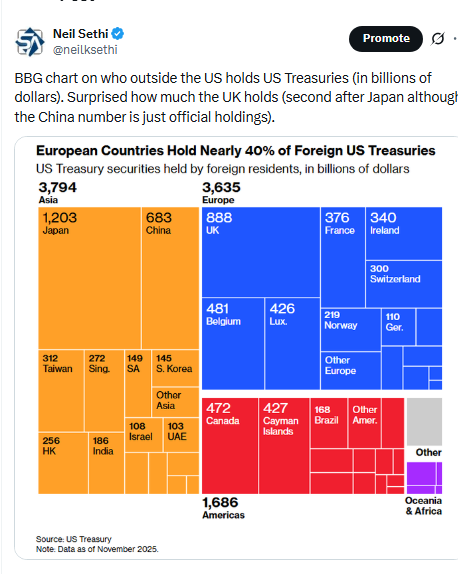

US equity indices opened today’s session higher, continuing on from Wed’s rally as momentum built overnight towards a solution for Pres Trump’s desire for some level of control over Greenland. Following Wed’s announcement that he would no longer impose new tariffs on eight European countries that were set to begin Feb 1st after he and NATO Secretary General Mark Rutte “formed the framework of a future deal with respect to Greenland,” Danish Prime Minister Mette Frederiksen (Greenland is an autonomous territory of Denmark) described Trump’s discussion on Arctic security with Rutte as “good and natural” and said that the country is ready to hold talks with the U.S. on its “Golden Dome” missile defense plan, while also stressing that sovereignty is non-negotiable. Meanwhile German Chancellor Merz urged cooperation with the US as EU leaders met to plan their next steps.

Also boosting sentiment were several positive tech headlines. News that Alibaba Group Holding Ltd. is preparing to list its chipmaking arm added to bullish comments from Nvidia CEO Jensen Huang in Davos, and details emerged that Anthropic PBC’s revenue run rate has more than doubled since last summer, while OpenAI was in talks about a fresh funding round at a marked-up valuation. Names such as Nvidia and Microsoft were up around 1% each in the premarket (and would extend on those gains as would Micron Technology and Meta Platforms, who were up around 2% (more details below)).

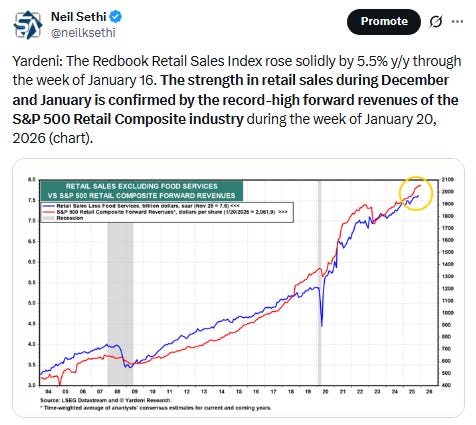

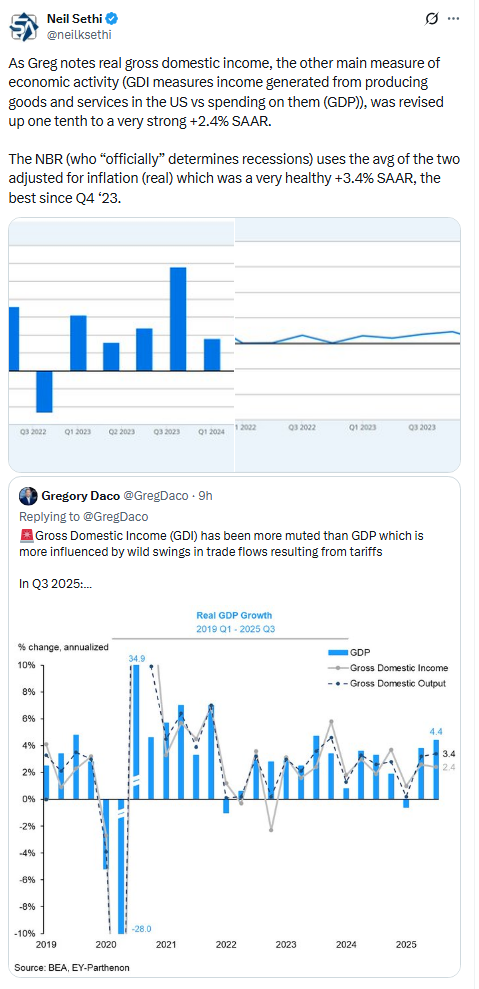

Finally, an already strong 3Q GDP reading was boosted a little further, giving us two of the strongest back-to-back quarters since emerging from the pandemic, fueled by consumer spending, trade, and business investment.

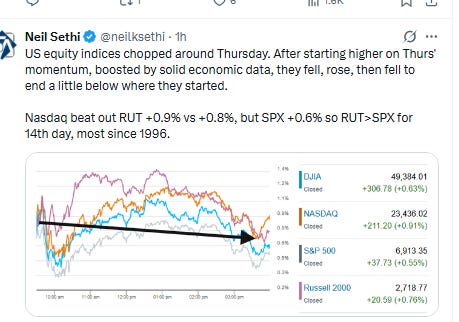

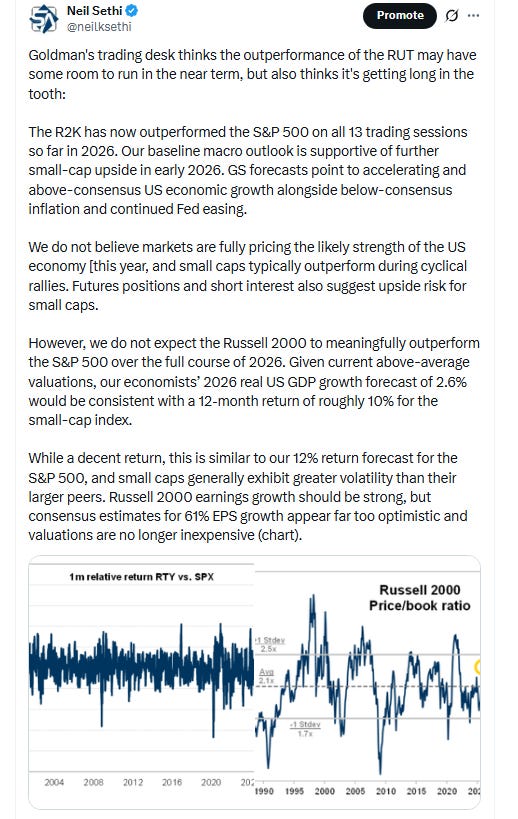

But equity indices weren’t able to extend on their morning gains, instead chopping around Thursday. After starting higher, they fell, rose, then fell again to end a little below where they started. The Nasdaq beat out the small cap Russell 2000 +0.9% vs +0.8%, but that was still better than the S&P 500’s +0.6%, so the streak of Russell 2000 outperformance extended to a 14th session, the most since 1996.

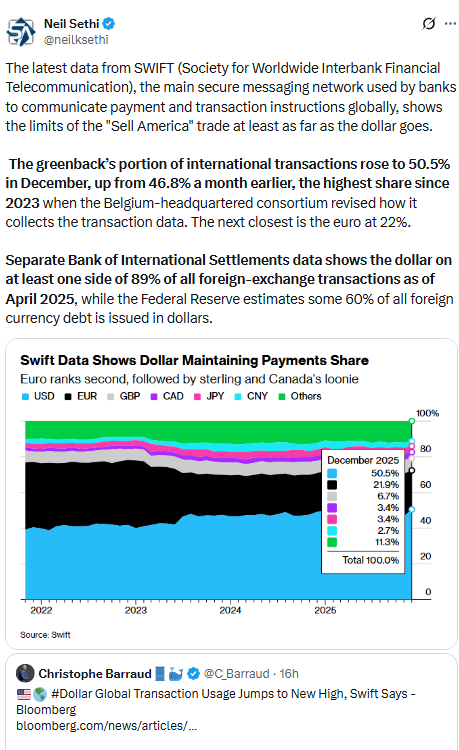

Elsewhere, bond yields were mixed, while the dollar fell to lows for the year. Crude, copper, bitcoin, and natgas were also lower (the latter after touching three-year hghs), while gold continued to surge to new record levels

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite +0.9% (and the top 100 Nasdaq stocks (NDX) +0.8%), the SOXX semiconductor index +0.2%, and the Russell 2000 (RUT) +0.8%.

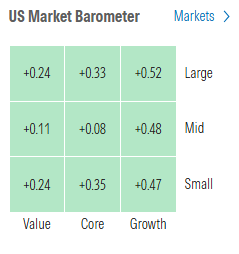

Morningstar style box again all green but gains much less robust.

Market commentary (note almost all were before Trump took tariff threat completely off the table):

“The Greenland crisis appears to be defusing and reversing the recent sell-off, although details are still forthcoming around the ‘framework,’” said Eric Teal, chief investment officer for Comerica Wealth Management. He said that the relief rally sparked significant gains in traditional value sectors such as financials and energy stocks.

“This episode once again highlights how headline-driven the market remains, and how quickly sentiment can flip when geopolitical risk is dialed back,” said Fawad Razaqzada at Forex.com.

“Greenland is likely to stay in the headlines in the near term, and markets remain susceptible to fresh political or geopolitical developments,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “But the latest stock rebound serves as a reminder that favorable fundamentals remain in the driver’s seat.”

Geopolitics only truly affect stock prices when they have direct effects on the factors that truly influence equity valuations, according to Steve Sosnick at Interactive Brokers. “Unless one can draw a straight line between the global event and the revenues, earnings, or cash flows of a particular company or sector – the items that directly affect the value of a company – then geopolitics can be considered ‘background noise’ from a market viewpoint, no matter how newsworthy the events,” he said.

“Despite a very positive market narrative about 2026, geopolitical crisis and US tariffs can fuel volatility spikes at any time,” said Raphael Thuin, head of capital markets strategies at Tikehau Capital in Paris. “The fast-changing AI industry, like last year, also represents both a big upward potential as much as a potential downward risk.”

President Donald Trump saying Wednesday that he “won’t use force” with Greenland removed an extreme volatility risk, according to Julian Emanuel, senior managing director at Evercore ISI. “The phrase ‘No use of force’ removed the ‘left tail outcome’ ... and his Truth Social post that the ‘Framework of a Future Deal’ was being forged with NATO’s Rutte while the 2/1 Tariffs were called off further underpinned risk assets,” he wrote in a Thursday note. Emanuel added that investors are now turning their attention to the next Federal Reserve meeting, the naming of Trump’s nominee for the next Fed chair, the potential aversion of another federal government shutdown and the upcoming earnings releases from key tech companies. A year-end 2026 price target of 7,750 on the S&P 500 remains in focus, he added.

For Alfonso Peccatiello, founder of Palinuro Capital, options beyond big tech are increasingly looking like a winning bet as the outlook for the US economy improves. “I’m focusing back on fundamentals because I think it’s pretty clear that Trump wants to run the economy hot, so the Republicans can sweep the midterms,” he said. “Big tech will be fine with a lot of dispersion this year, so not every name will behave the same way.”

“When you look underneath the market surface and away from the market cap-weighted S&P 500 that’s so dominated by [‘Magnificent Seven’] and these big megacap names at the top of the index, it’s like the market didn’t skip a beat at all,” Eric Parnell, chief market strategist at Great Valley Advisor Group, said in an interview with CNBC. “A lot of times the words that come out of the White House, it’s all kind of part of the grander negotiation and that there’s a certain outcome that’s being driven towards, so any of the noise that takes place in the midst of that process playing out more often than not … they turn out to be buying opportunities,” Parnell added. “The fundamentals underlying the market continue to be strong.”

“It is often said that the stock market is not the economy and vice versa, however, higher corporate profits do drive stock prices and to the extent a sustainable increase in productivity and output allow companies to meaningfully increase profits, we should expect the market to increase as well,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management, in commentary shared with MarketWatch.

“Disposable income is growing strong, driven by compensation growth, and that’s keeping consumption humming,” Sonu Varghese, global macroeconomic strategist at the Carson Group wrote in emailed commentary. Yet with inflation still well above the Federal Reserve’s 2% yearly target, he said, Thursday’s economic data “is likely going to keep the Fed on pause for a few a months, at least until we get a new Fed Chair who will likely push for renewed cuts.”

“US consumers continue to underpin the economy,” said Lale Akoner at eToro. “Resilient spending lowers near-term recession risk and supports corporate revenues, particularly in consumer-facing sectors. However, steady demand also means interest rates are likely to stay higher for longer.”

The latest data should reassure the Fed that the economy remains on a solid footing, despite a cooler labor market, said James McCann at Edward Jones.

“There looks to be little urgency to cut rates at next week’s meeting, and the central bank could stay on hold for longer should growth remain robust into 2026 and inflation continue to run at above target rates,” he added.

This set of new data reinforces the view that the US is experiencing stronger — not hotter — growth, according to Marco Casiraghi at Evercore. “If macro conditions continue to evolve in this favorable manner, we think the Fed will keep rates on hold before delivering a cut in June – when the new Fed chair will take over,” and then cut two more times in the second half of 2026, he said.

“Fundamentals are good and the Fed is likely to cut two or three times this year,” said Scott Helfstein at Global X. “That continues to set up a favorable backdrop even if the calm is occasionally disrupted by geopolitical volatility.”

“US consumers continue to underpin the economy,” said Lale Akoner at eToro. “Resilient spending lowers near-term recession risk and supports corporate revenues, particularly in consumer-facing sectors. However, steady demand also means interest rates are likely to stay higher for longer.”

Recent data support the Fed adopting a cautious approach to policy changes in the near term, according to Oscar Munoz and Gennadiy Goldberg at TD Securities. “There is now a higher burden on the data to justify further easing,” they said.

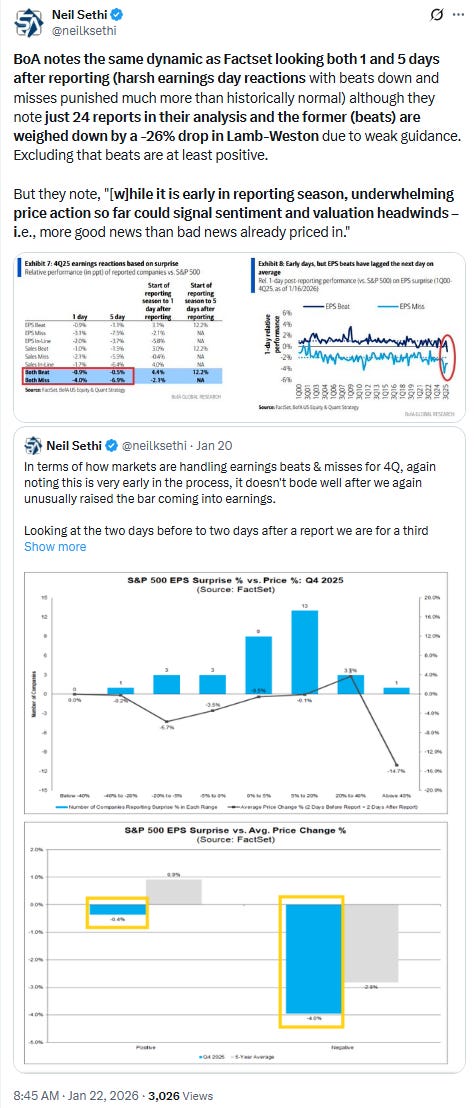

“It’s broad based,” said Keith Lerner, chief investment officer at Truist Advisory Service. With tariffs related to Greenland now off the table, investors can get back to focusing on the U.S. economy and company earnings, which both appear to be chugging along. “Earnings are the north star of this bull market,” Lerner said.

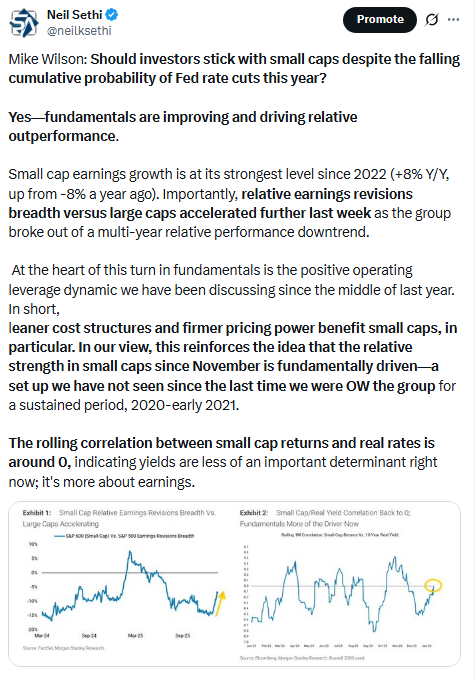

With small-caps are outperforming large-caps yet again, there is a clear shift in leadership underway, noted Jonathan Krinsky at BTIG. “While there will be pullbacks, we want to stick on the side of this new trend which is still in its early days, in our view,” he said.

Despite the fact that growth stocks are negative year-to-date, momentum names are doing well, noted Louis Navellier at Navellier & Associates.

“The broadening of returns is a positive development, and the strength of smaller companies is a major vote of confidence in broad economic growth and reflects the expectation of lower interest rates, which is more meaningful for smaller companies,” he concluded.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

Energy shares led gains, hitting all-time highs. Tech stocks like Nvidia and AMD also led the market comeback as investors piled back into their favorite growth stocks after hunkering down earlier in the week.

Bank stocks also rose after the president said in his Davos speech that he would be asking Congress to implement his proposed credit card cap of 10%, an uncertain prospect given lack of support among lawmakers. Citigroup and Capital One each rose roughly 1%.

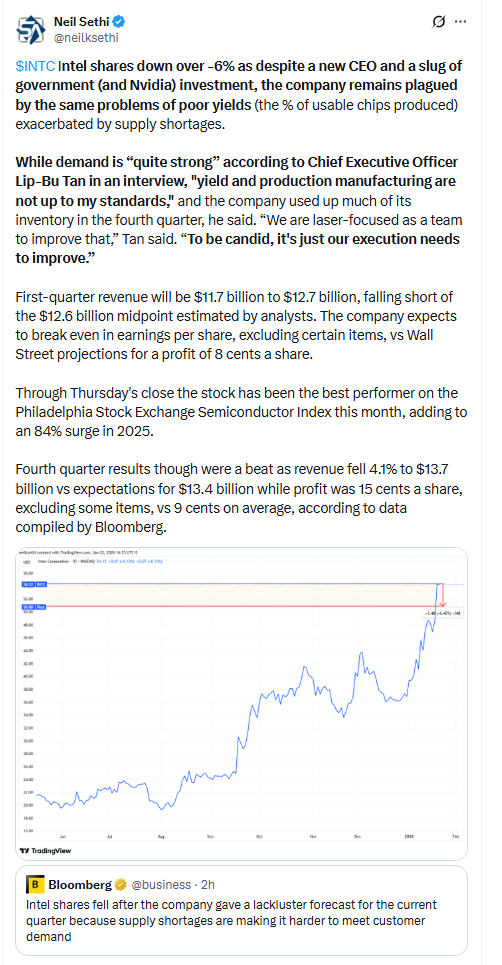

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Tesla Inc. will probably sell its Optimus robots to the public by the end of next year, according to Chief Executive Officer Elon Musk, who’s said the carmaker’s fortunes will be increasingly dependent on humanoid machines.

SpaceX has lined up four banks to lead its initial public offering, according to people familiar with the matter, as Musk’s rocket and satellite firm moves forward with plans for the biggest-ever listing.

Apple Inc. has expanded the job of hardware chief John Ternus to include design work, solidifying his status as a leading contender to eventually succeed Chief Executive Officer Tim Cook.

Alphabet Inc.’s Google is rolling out a new option to personalize search results by tapping user data from the tech giant’s other applications, its latest bid to keep ahead of competition from the likes of OpenAI.

Alibaba Group Holding Ltd. is preparing to list its chipmaking arm, tapping strong investor interest in the small circle of companies aspiring to compete with Nvidia Corp. in the hot AI accelerator business.

Netflix Inc. co-Chief Executive Officer Ted Sarandos is planning to testify in February at a US Senate committee hearing looking into his company’s proposed $82.7 billion purchase of the streaming and studio operations of Warner Bros. Discovery Inc.

Paramount Skydance Corp. again extended its tender offer for Warner Bros. Discovery Inc. shares and said it would ask investors to vote against a proposed sale to Netflix Inc. at a special meeting of Warner Bros. shareholders.

Bank of America Corp. and Citigroup Inc. are exploring options they could offer up as an olive branch to satisfy President Trump’s demand to cap credit card interest rates at 10% for one year.

US airlines are already announcing backup plans for passengers ahead of an expected winter storm this weekend that could be the biggest of the season and cause massive disruptions to air traffic nationwide.

General Motors Co. plans to move production of its next-generation Buick Envision compact SUV, which is currently built in China, to a plant in Kansas in 2028, a sign of the pressure automakers are under to reshore output of vehicles sold in the US.

Procter & Gamble Co.’s executives signaled sales are rebounding in the US and expressed confidence the company will meet its full-year guidance.

General Electric Co.’s full-year outlook underwhelmed investors, a sign of high expectations on the jet-engine maker after a steep rise in the stock last year.

Abbott Laboratories said first-quarter profit will be lower than Wall Street expected after the company was forced to offer discounts on nutrition products to lure price-conscious customers.

Moderna Inc.’s chief executive officer said the company doesn’t plan to invest in new late-stage vaccine trials because of growing opposition to immunizations from US officials.

Waymo will start offering its robotaxi service in Miami to the public Thursday, the first of around a dozen cities where the Alphabet Inc. company plans to launch this year.

Freeport-McMoRan Inc. is making progress on a restart of its sprawling Indonesian copper mine, it said Thursday, after a deadly mudslide shuttered the operation that’s critical to global supply.

Target Corp. is adding two retail veterans to its board as the beleaguered retailer seeks to reverse a sales slump under incoming Chief Executive Officer Michael Fiddelke.

Lululemon Athletica Inc.’s “Get Low” leggings, derided for being see-through, are available for sale again online. Shoppers just have to make sure to read the disclaimers first.

PayPal Holdings Inc. agreed to acquire Cymbio, a platform designed to help merchants sell products across AI chatbots. Terms weren’t disclosed.

General Fusion Inc. has agreed to a merger with a blank-check company in a deal that’s expected to create one of the first publicly traded nuclear fusion technology developers.

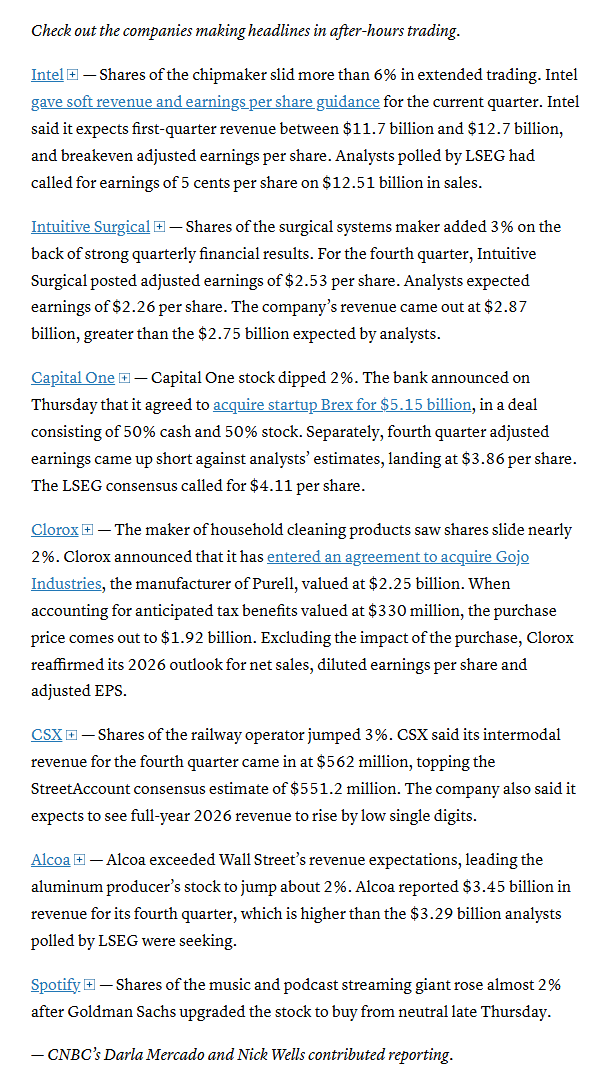

Mid-day movers from CNBC:

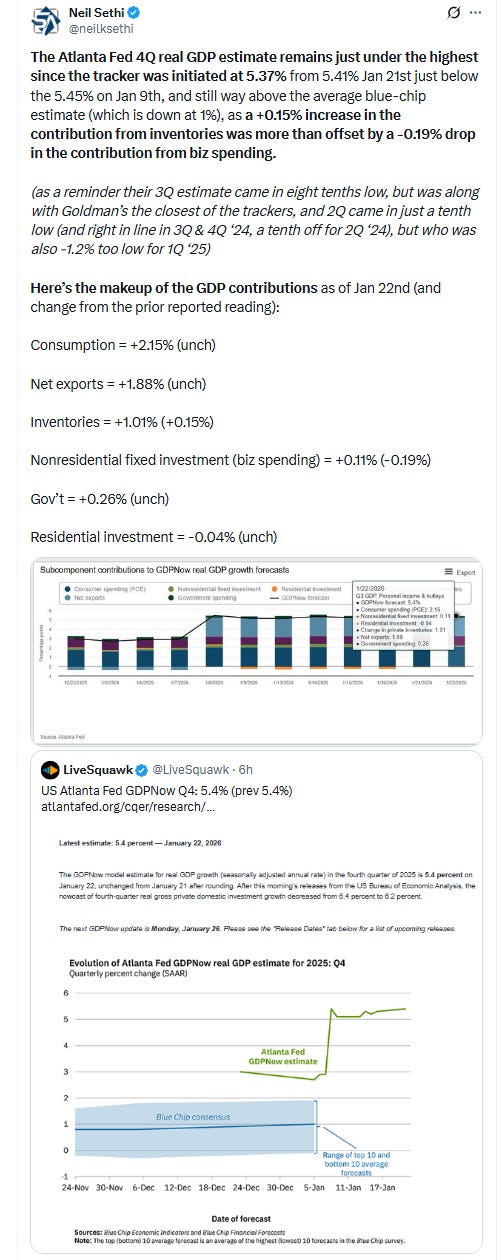

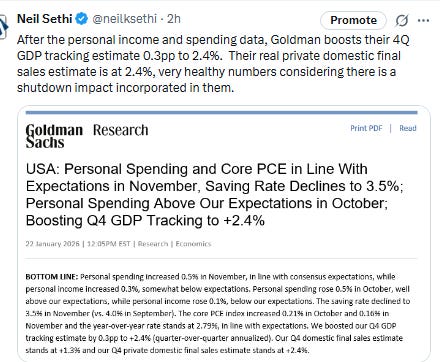

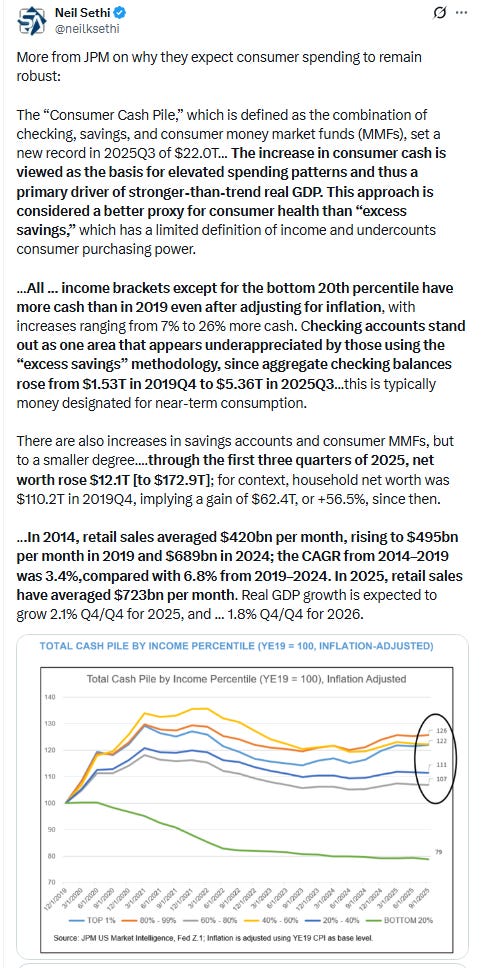

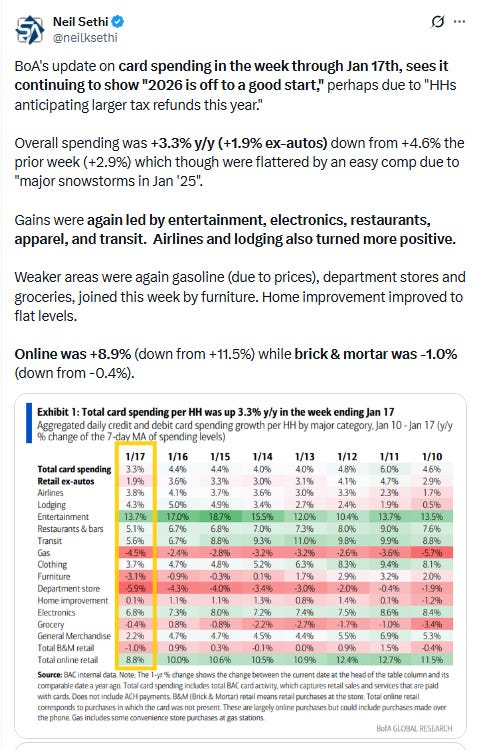

In US economic data:

Substack links:

Jobless Claims - 1/22/26

Initial jobless claims remain near 50-year lows while continuing jobless claims are lower y/y for the second time since Feb ‘23

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

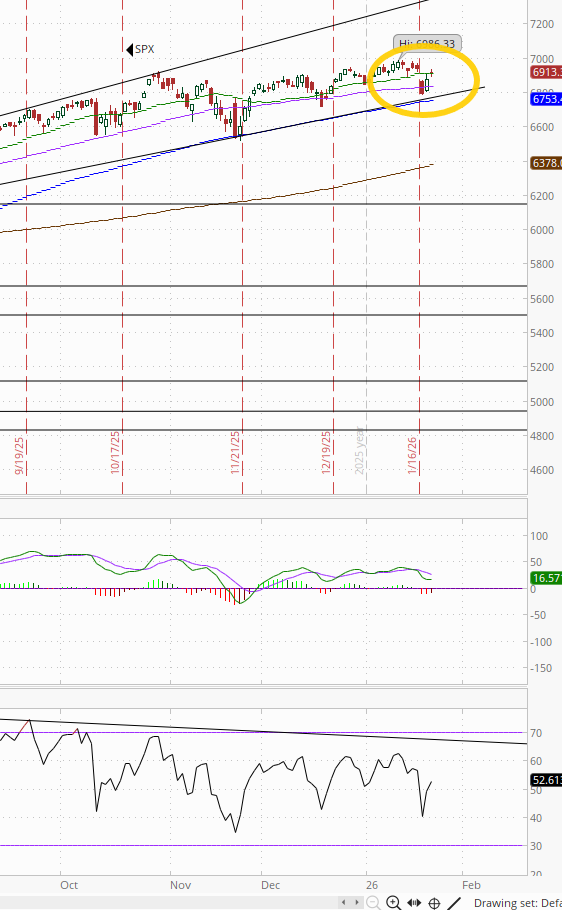

The SPX recovered more of Tuesday’s loss, now just above the 20-DMA. The daily MACD remains in “sell longs” positioning while the RSI bounced from the weakest since Nov but continues to remain in divergence.

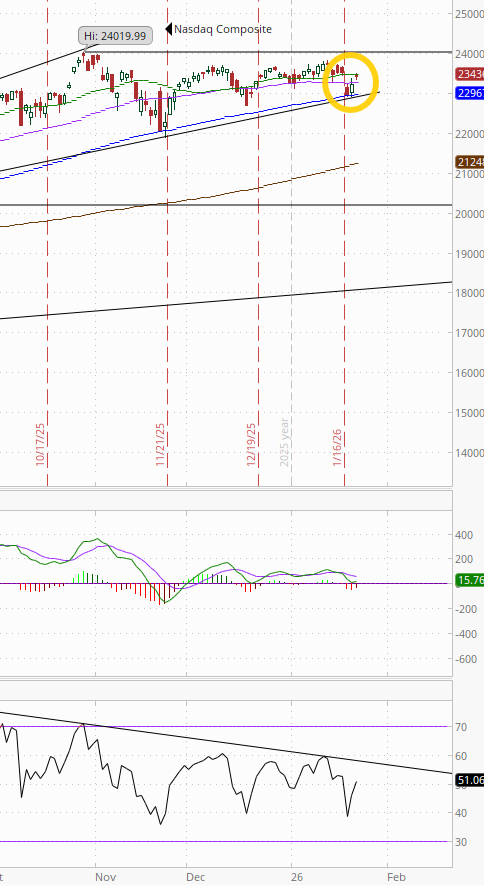

The Nasdaq Composite a similar story.

RUT (Russell 2000) remains the best chart of the bunch pushing further into ATH territory. I’m not sure if that old trendline means anything but the last rally stopped there, so I’m going to leave it for now.

Its MACD remains with a “go long signal,” and the RSI has caught up with price (although now around levels that have seen the index stall out in the past year.

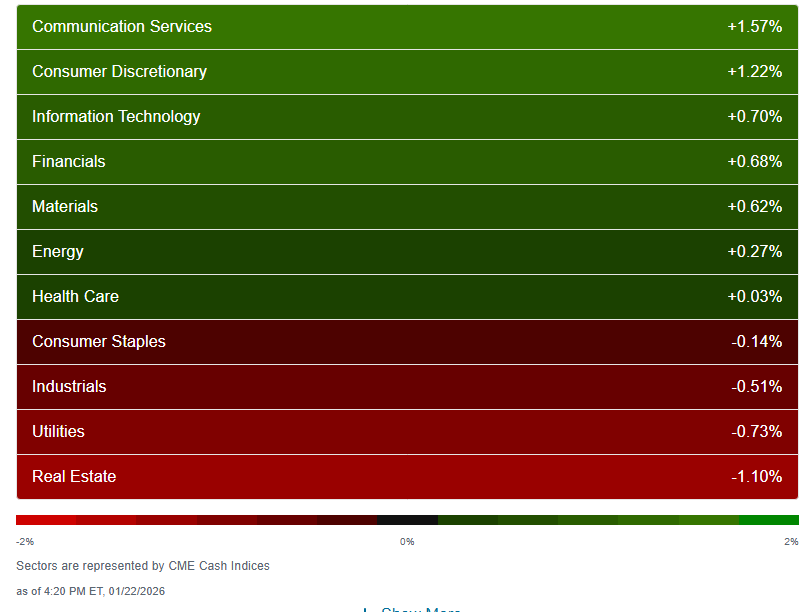

Sector breadth according to CME Cash Indices remained with the better breadth we had seen all year outside of Tues and Jan 7th (the only two days with less than 6 sectors higher) with 7 of 11 sectors in the green (down from all 11 Wed).

But for the first time this year the megacap growth sectors (Comm Services, Cons Discr, Tech) finished in the lead (in fact we had only seen two crack the top four in the previous 7 sessions), all up at least +0.7%. Two sectors were down that much in Utilities and RE.

Still lots of green on the stock-by-stock flag from finviz_com for Thurs but definitely more red as well, particularly on the right side of the flag where those smaller sectors saw larger losses (Utilities, RE, Staples).

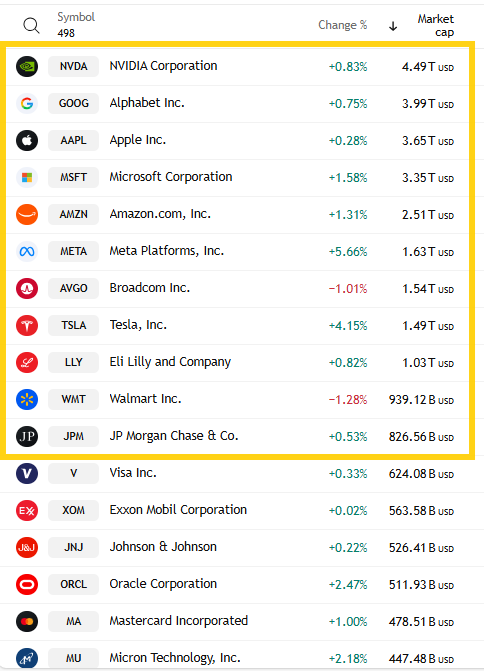

nine of the largest 11 SPX components were higher (from 8 Wed, 1 Tues, 6 Fri) led by META +5.7% who beat out TSLA +4.2%. WMT led to the downside -1.3%.

Mag-7 +2.1%, bringing the index back to even for the week.

~20 SPX components were up 3% or more (after ~100 Wed, 8 Tues, 13 Fri), led by Arista Networks ANET +8.7%. It’s up a huge 70% so far this year.

4 of those 20 up 3% or more were >$100bn in market cap (after 13 Wed, 3 Tues, 4 Fri) in META, CVNA, INTU, TSLA (in descending order of percentage gains).

13 SPX components down -3% or more (up from 4 Wed, down from 125 Tues, the most this year) led by Abbott Labs ABT -10.0%.

4 of the 13 down -3% or more were >$100bn in market cap (after 2 Wed, 24 Tues, 3 Fri/Thurs) in ABT, GE, PLD, LRCX (in order of percentage losses).

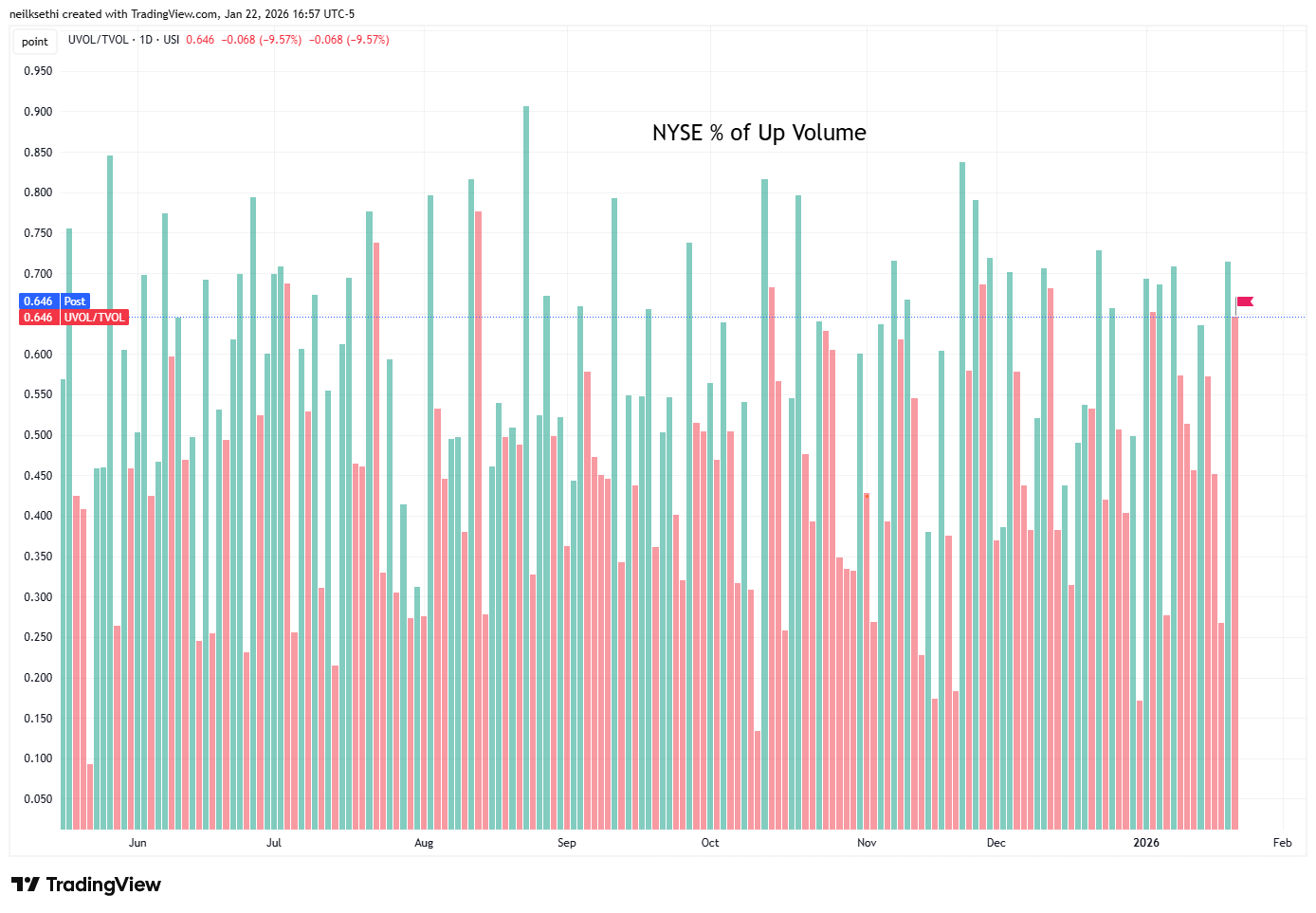

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) fell back to a still very solid 64.6% a better performance for the +0.31% gain in the index than the 71.4% Wed on the +1.13% gain in the index.

Nasdaq positive volume (% of total volume that was in advancing stocks) similarly edged back to 64.8% from 68.3% again around what you might expect for the +0.91% gain in the index (with the usual caveat that positive volume on the Nasdaq is all over the place due to the speculative volumes).

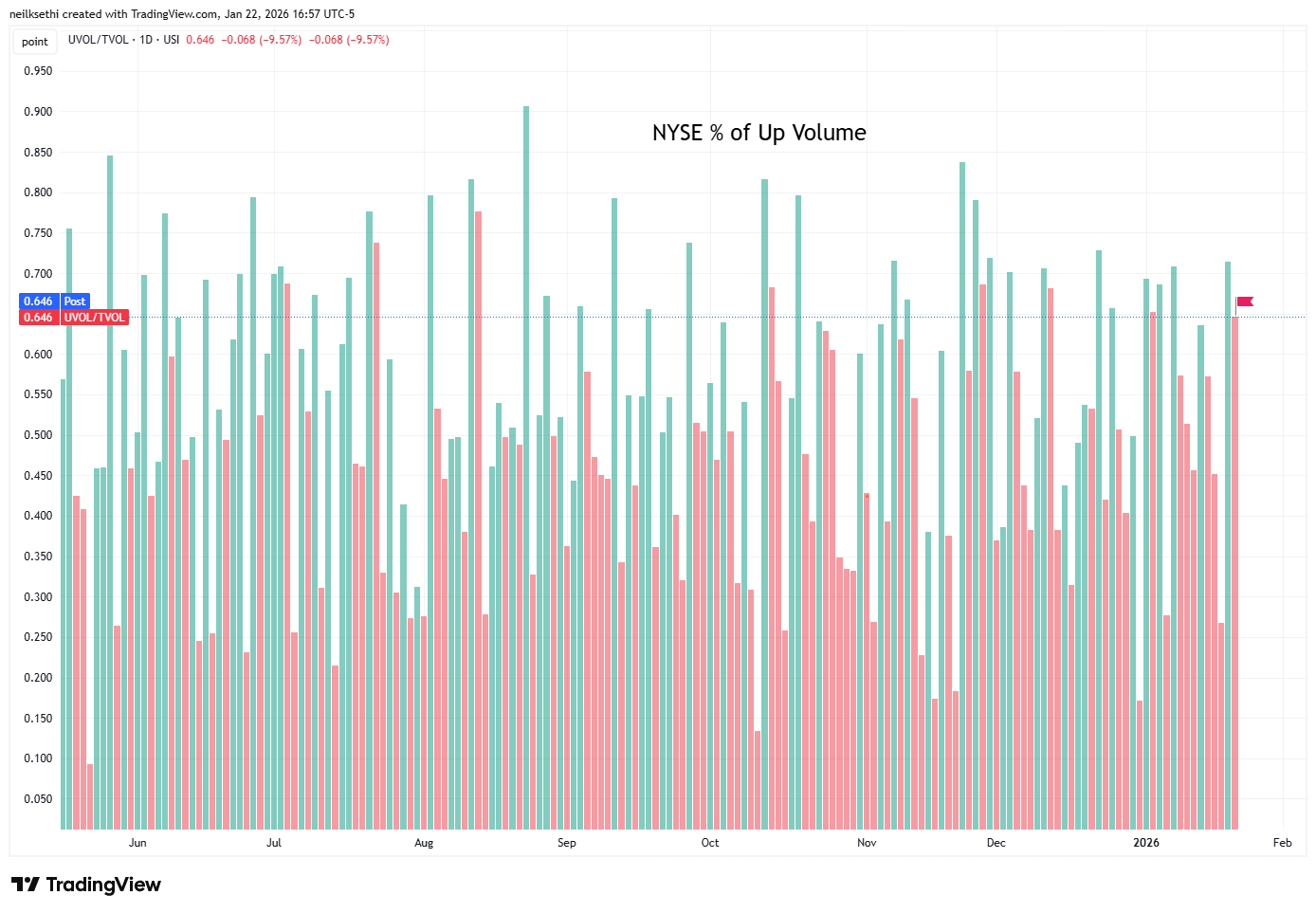

And in regard to those speculative volume on the Nasdaq, they did edge higher after falling back for four sessions from one of the highest days since the summer on Jan 14th. The top three stocks by volume were around 900mn up from 600mn Wed and 700bn Tues, near the 1bn Fri, but well below the huge 4bn Jan 14th.

There were another six that traded over 100mn shares (up from four Wed but down from from 7 Tues, 10 Fri, 9 Thurs) so speculative activity remains a little elevated.

We also got back to the normal situation of smaller caps dominating the top of the list.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, didn’t reflect a lot of speculation today though with the Nasdaq again right on positive volume at 66%, while the NYSE was 61%.

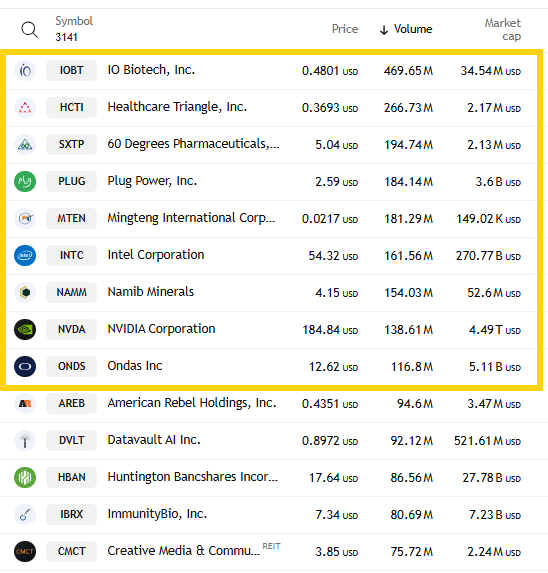

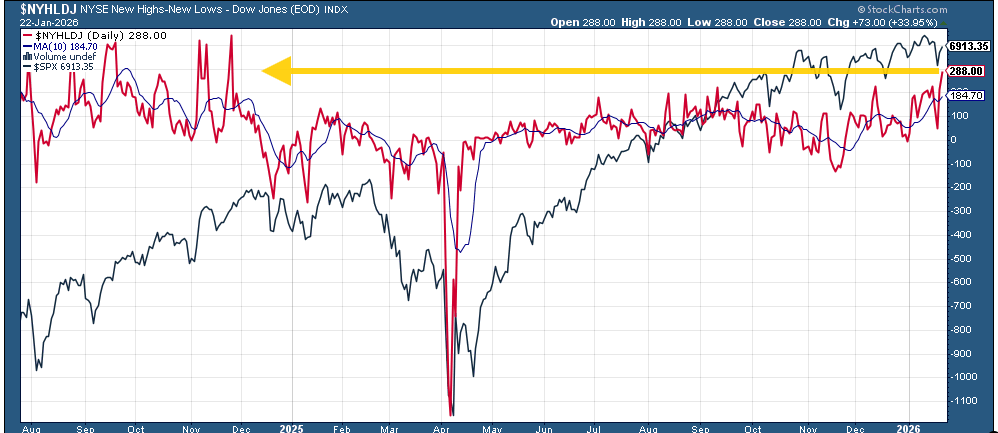

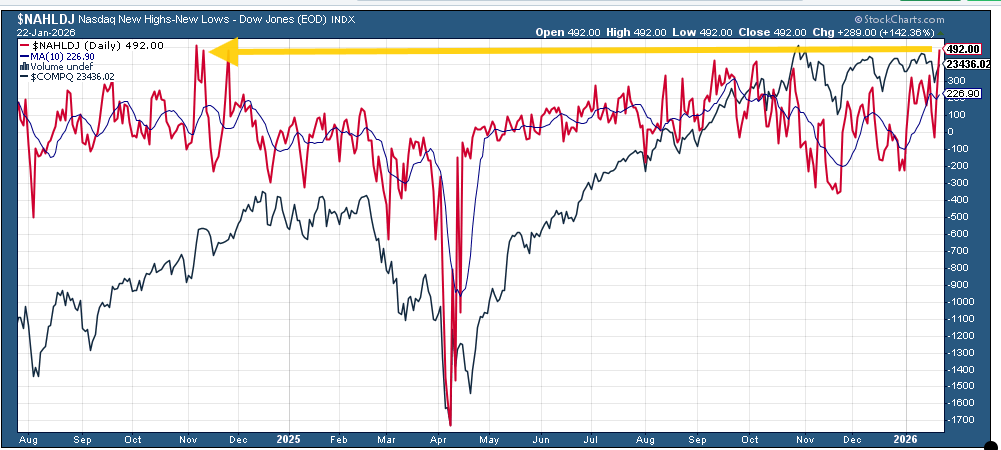

New 52-wk highs minus new 52-wk lows (red lines) though were where the action was jumping to 288 on the NYSE, while the Nasdaq surged to 490, both the best since Nov ‘24.

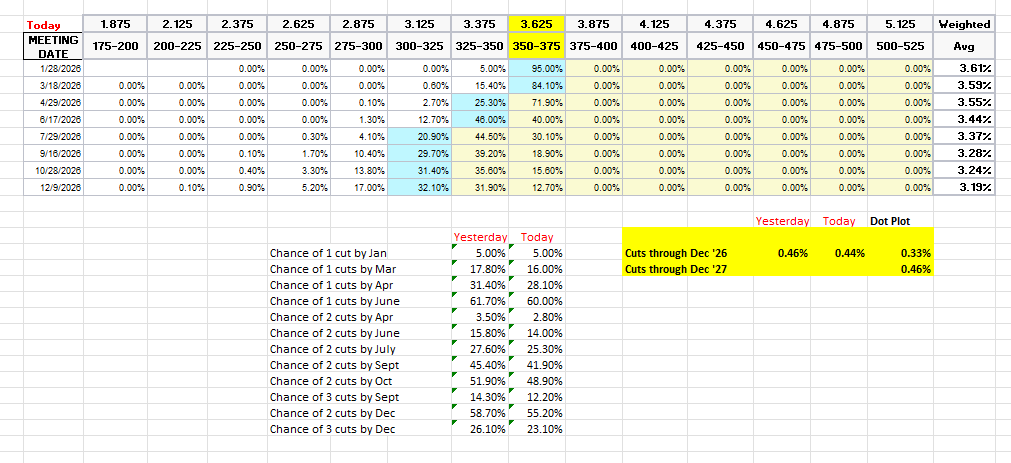

#FOMC 2026 rate cut pricing took another step down (fewer cuts) on the solid economic data falling to the least since pricing for the Dec ‘26 contract was initiated (or at least as far back as the CME Fedwatch tool has been tracking it), and a second cut in 2026 was pushed to December for the first time.

January didn’t move, but off the table unless the Fed chooses to revive it (very unlikely) at 5%. March is 16% (from 51% Jan 6th), April 28% (from 63%), with the first cut in June (60%). As noted the second cut moved to Dec (55%, as compared to a a 55% chance of a July cut on Jan 6th).

Pricing for 2026 edged back -2ps to 44bps (as noted a new low), with pricing for two cuts 55% and three cuts 23% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

The 10yr #UST yield fell back from a second session but found some support at the 200-DMA ending little changed at 4.25%. We’ll see if it breaks through that and returns to its old range or bounces to again test that major downtrend line.

With rate cut bets falling to new lows, the 2yr yield, more sensitive to FOMC rate cut pricing, pushed to the highs of the year at 3.61% remaining over the top of the channel it had been in since the start of 2024 until breaking out last week.

It is -3bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for rate cuts, but now just one or two.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield., but I’m starting to get tempted.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) fell to the lowest close of the year now back under its 20. 50, 100, and 200-DMAs (as well as the downtrend line from Feb).

In addition, the daily MACD has crossed to “sell longs” positioning and the RSI is under 50.

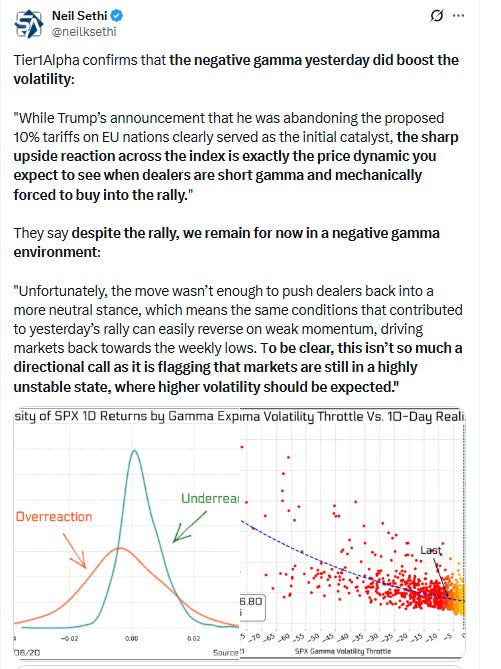

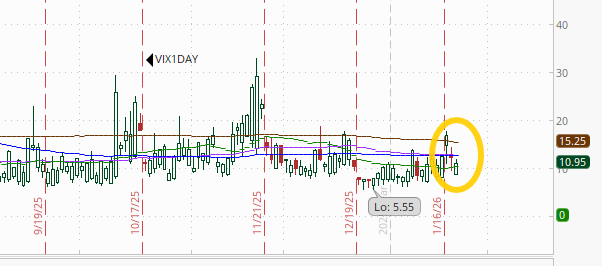

VIX fell back again after Tues moving over 20 for the first time since Nov. It ended Thurs’s session at 15.6. That level is consistent w/~0.96% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also fell back from the highest since Nov now at 96.2.

The current level is consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is the level flagged by Charlie McElligott as one to watch.

The 1-Day VIX like the VIX and VVIX fell back in its case to 11.0. That reading implies a ~0.69% move in the SPX next session.

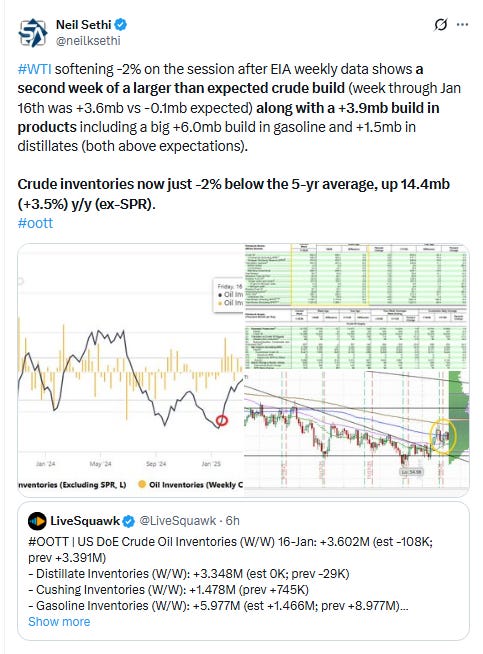

WTI futures gave back Wed’s gains but continued to hold the 50-DMA remaining in the range of the past week. Daily MACD remains in “go long” positioning while the RSI is just above 50.

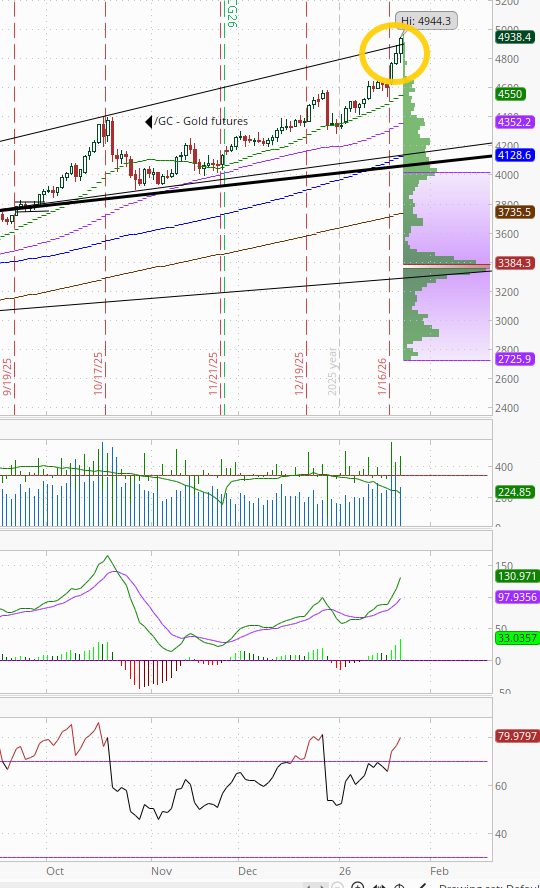

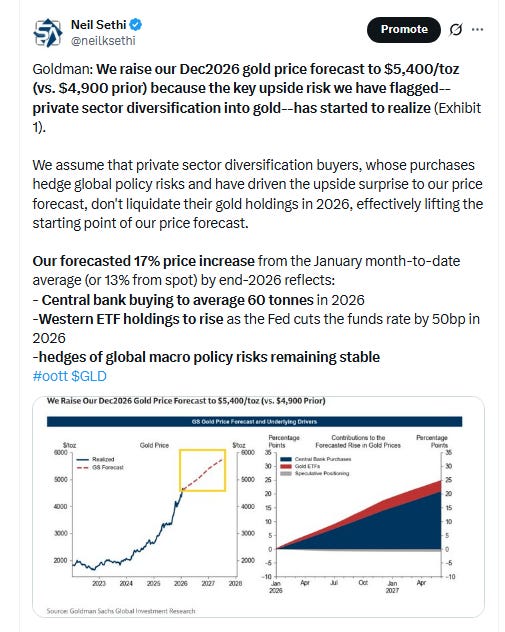

Gold futures (/GC) got a boost from a Goldman Sachs upgrade adding another +2.1% taking their 3-day rally to +7.2% now pressing up against the trendline from April where the October rally petered out. Daily MACD remains in “go long” positioning, but the RSI is now nearly 80.

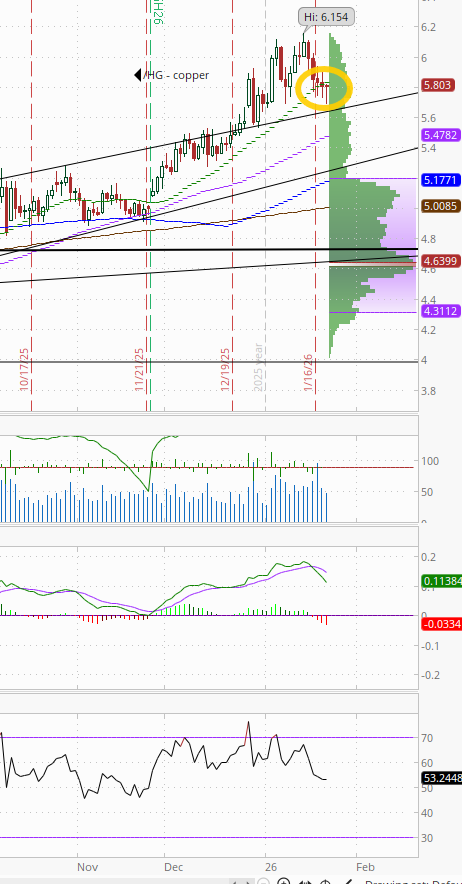

US copper futures (/HG) remain unable to get going losing some ground for a fifth session although still not far from all-time highs. But as noted Friday, “the daily MACD has crossed to ‘sell longs’ positioning while the RSI has fallen to the least since Nov, so we’ll see if a deeper pullback is in the cards.”

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

I asked Wed whether natgas futures (/NG) might “take a stab at the $5.50 highs from 2025,” and they did just that, jumping over +10% after their best two-day gain on record to surpass them to set new 3-year intraday highs before reversing sharply to finish lower on the day. Sounds a lot like a potential “blow off top”. A down day Friday would complete that pattern, and we could see some retracement. A lot depends on weather forecasts can continue to meet the now super-high expectations for ongoing frigid temperatures.

The daily MACD as noted Tues flipped to ‘cover shorts’ positioning, and RSI is above 60..

Bitcoin futures didn’t join growth stocks today, edging lower not able to get back over the $90k level or 50-DMA. Noted Wed “has a good deal of resistance above.”

The daily MACD as noted Tues flipped to “sell longs” positioning, while the RSI fell back under 50.

The Day Ahead

US economic data wraps up Friday with Jan flash PMIs and the final UMich consumer sentiment read,.

No Fed speakers with the blackout, and no US Treasury auctions.

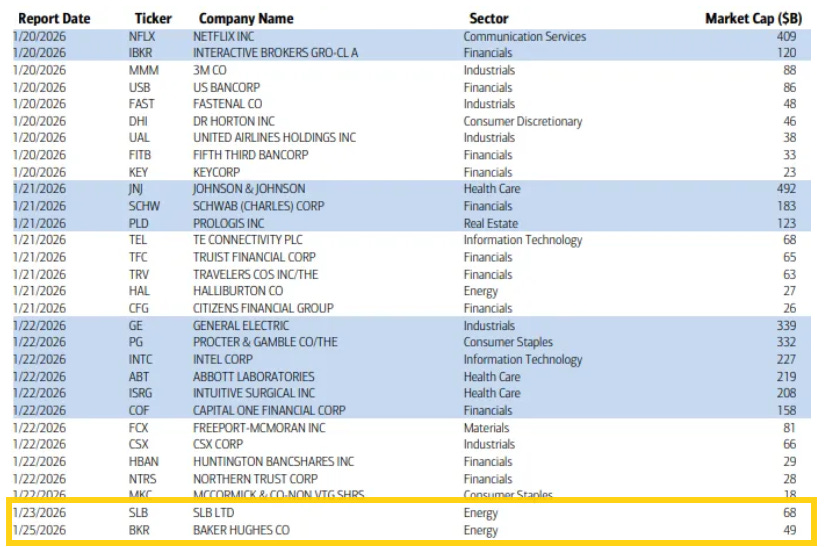

Q4 SPX earnings continues but a lighter day ahead of our heaviest week of the season next week with two SPX reporters, neither of which are over $100bn in market cap in energy exploration firms SLB and BKR (in descending order of market cap).

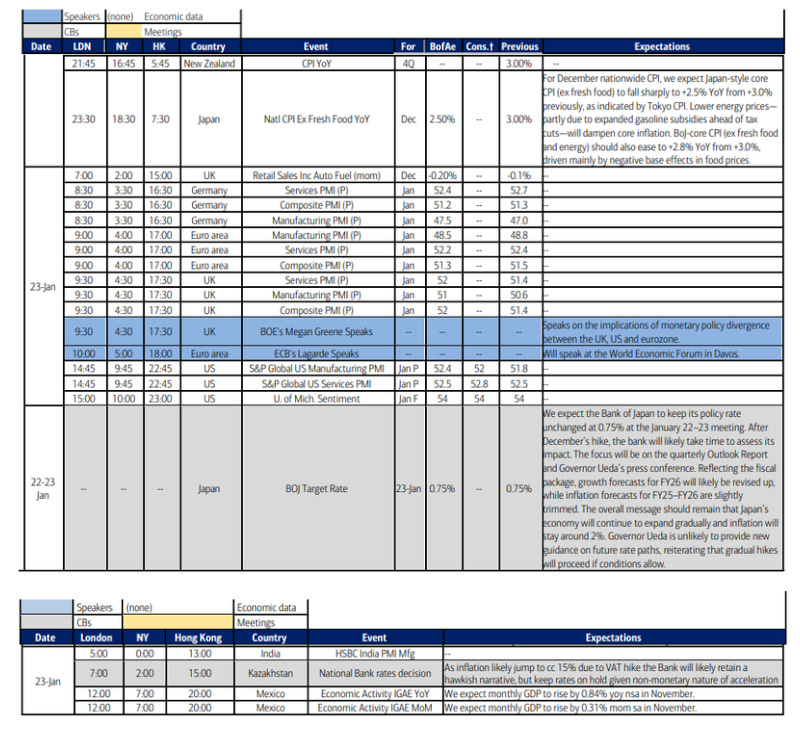

Ex-US highlights include a BoJ decision. While a hold on rates is widely expected, there is some uncertainty about the language that will be used in terms of the speed of future cuts and/or the BoJ reducing its QT in order to try to slow the rapid increase in bond yields and depreciation in the yen. Ahead of that we’ll get Japan Dec national CPI. We’ll also get Fri global Jan flash PMIs, UK GfK consumer confidence and French business confidence, UK Dec retail sales and Canada November retail sales.

From Goldman:

Friday, January 23

09:45 AM S&P Global US manufacturing PMI, January preliminary (consensus 52.0, last 51.8)

S&P Global US services PMI, January preliminary (consensus 52.9, last 52.5)

10:00 AM University of Michigan consumer sentiment, January final (GS 53.5, consensus 54.0, last 54.0)

University of Michigan 5-10-year inflation expectations, January final (GS 3.4%, last 3.4%)

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,