Markets Update - 12/23/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

NOTE: I’ll most likely skip tomorrow as it’s just a half day with an almost completely empty calendar, and normally not a lot of market activity. If it is more eventful, I’ll put out a note.

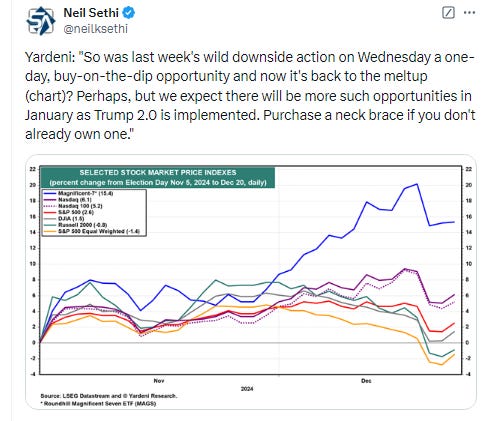

US equities fell at the open but were able to rebound late morning to push higher throughout the afternoon, led by the large cap indices as megacap growth stocks resumed their leadership, particularly semiconductor names. Small caps lagged though finishing with a small loss, likely in part due another push higher in the 10yr yield to a nearly 7-mth high.

Like yields, the dollar gained, which again weighed on commodities. Gold, oil, copper, and nat gas all were little changed (although the last only after hitting another 2yr high intraday) while bitcoin fell to a 1-mth low.

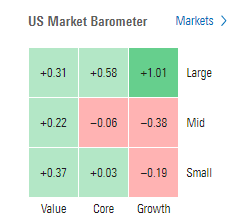

The market-cap weighted S&P 500 was +0.7%, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite +1.0% (and the top 100 Nasdaq stocks (NDX) +1.0%), the SOX semiconductor index +3.1%, and the Russell 2000 -0.2%.

Morningstar style box showed an interesting divergence between the strength in large cap growth and relative weakness in mid & small-cap.

Market commentary:

“There are still hopes that the US stock markets in particular will end 2024 with a positive undertone,” Dana Malas, a strategist at SEB, wrote in a note. “After two explosive weeks of central banking and news, to say the least, it is time for the market to recharge batteries and update forecast models for the world that begins on January 20 with Donald Trump in the White House.”

“Friday’s PCE data was enough to cheer the mood and reignite hopes about the possibility of lower inflation next year, which would allow the Fed to cut rates faster,” said Daniela Hathorn, a senior market analyst at Capital.com. “The avoidance of a US government shutdown over the weekend has also helped ease some of the negative pressure on stocks.”

“Primary uptrends remain intact for equities despite the recent profit-taking,” said Craig Johnson at Piper Sandler. “Given the short-term oversold conditions, we expect a ‘Santa Claus Rally’ to be a strong possibility this year.”

“Last week’s action should mark the end of the recent pullback and allow a ‘Santa Claus Rally’,” said Jonathan Krinsky at BTIG. “We do think a deeper correction early in ’25 is likely, albeit from a new all-time high.”

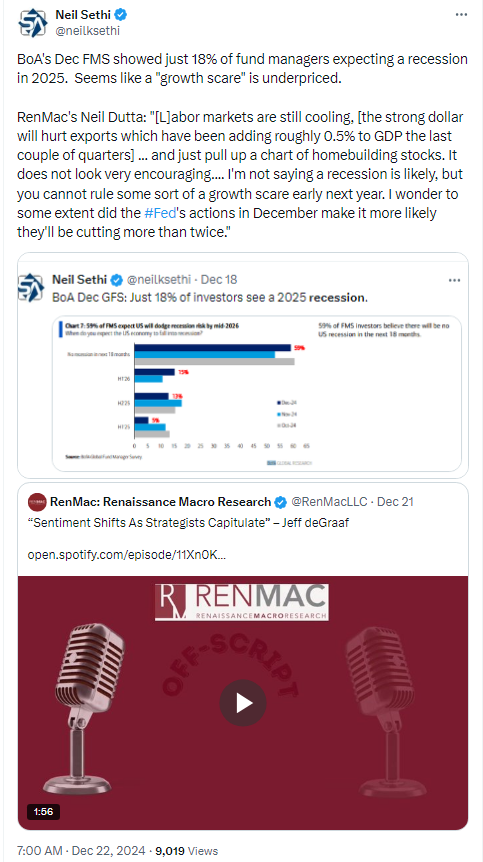

“The economic outlook is deteriorating,” said Neil Dutta at Renaissance Macro Research. “This was true before the Fed’s December confab and remains true. The risk of the Fed flip-flopping is quite high.”

In individual stock action, Qualcomm Inc. (QCOM 158.24, +5.35, +3.5%) climbed after prevailing at trial against Arm Holdings Plc’s (ARM 126.87, -5.28, -4.0%) claim that it breached a license for chip technology. Rumble Inc. soared the most on record as Tether will buy a stake in the video-sharing platform. NVIDIA (NVDA 139.67, +4.97, +3.7%) and Broadcom (AVGO 232.35, +12.15, +5.5%) were also top performers from the semiconductor space, contributing to the 3.1% gain in the PHLX Semiconductor Index (SOX). Fellow mega cap Eli Lilly (LLY 796.28, +28.52, +3.7%) was another story stock after the FDA approved Zepbound (tirzepatide) as the first and only prescription medicine for moderate-to-severe obstructive sleep apnea in adults with obesity.

The Nordstrom family is joining forces with a Mexican retailer to take its namesake department store private.

Corporate Highlights from BBG:

MetLife Inc. agreed to buy PineBridge Investments’ assets outside of China from Hong Kong billionaire Richard Li’s Pacific Century Group as part of the US insurer’s push to grow in asset management.

Xerox has agreed to buy printer maker Lexmark International Inc. from a consortium of Asian investors in a deal valued at $1.5 billion.

Hyatt Hotels Corp. is in exclusive talks with Playa Hotels & Resorts NV over strategic options that may include an acquisition of the all-inclusive resort owner.

Aviva Plc agreed to buy Direct Line Insurance Group Plc for roughly £3.7 billion ($4.65 billion) in a deal that would create the UK’s largest motor insurer.

Prosus NV is acquiring online travel agency Despegar.com Corp. for $1.7 billion as the Dutch technology investor seeks to expand its online commerce presence in Latin America.

Honda Motor Co. sketched plans for a drawn-out deal that amounts to a takeover of Nissan Motor Co. in all but name, as Japan’s automakers struggle to keep up in an increasingly competitive global car industry.

Some tickers making moves at mid-day from CNBC.

In US economic data (note the first two came a day early due to Federal workers being given tomorrow off over the weekend, meaning they had to get all of the Tuesday data out today, I’ll be catching up on this tomorrow):

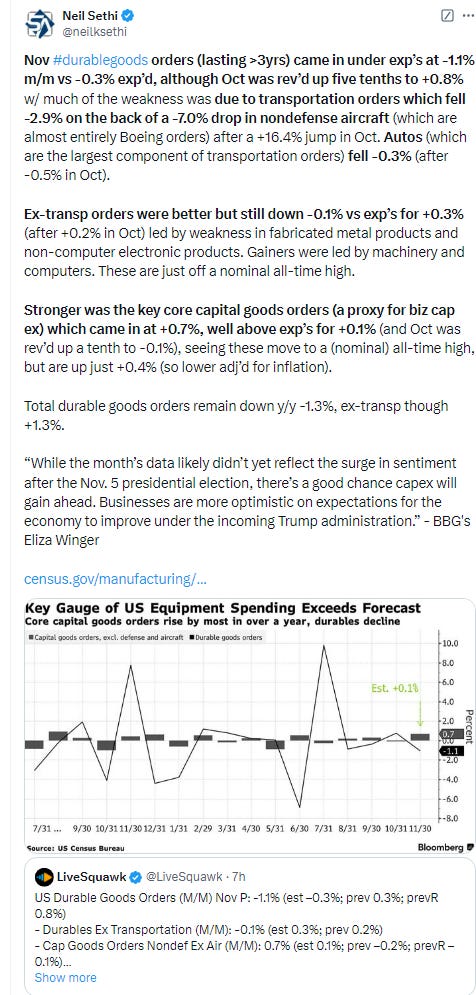

Bookings for all durable goods — items meant to last at least three years — dropped 1.1% in Novmber on fewer orders for commercial aircraft and a decline in defense spending. Excluding transportation equipment, orders decreased 0.1%. Orders placed with US factories for business equipment though rebounded, posting the strongest monthly advance in over a year. The November gain was much stronger than anticipated by economists.

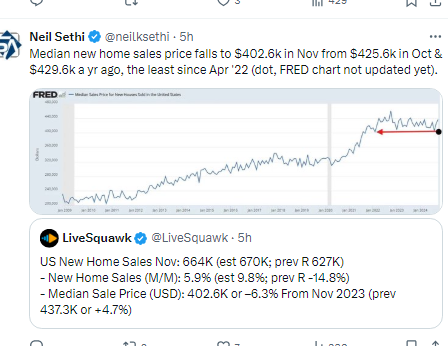

New-home sales in the US rebounded last month as builders and consumers sealed deals that had been delayed by storms in the South, and buyers took advantage of heavy sales incentives. Sales of new single-family homes increased 5.9% last month to a 664,000 annualized rate, according to government data issued Monday. That was in line with the median estimate of economists surveyed by Bloomberg, who expected 669,000. Builders last month played catchup especially in the South, the nation’s biggest homebuilding region, where hurricanes in the fall sank October sales. In November, sales in the South recovered nearly 14%. Meantime, they increased in the Midwest to the fastest pace since 2021. Sales in the Northeast and West declined. Prices fell with the median the lowest since April 2022.

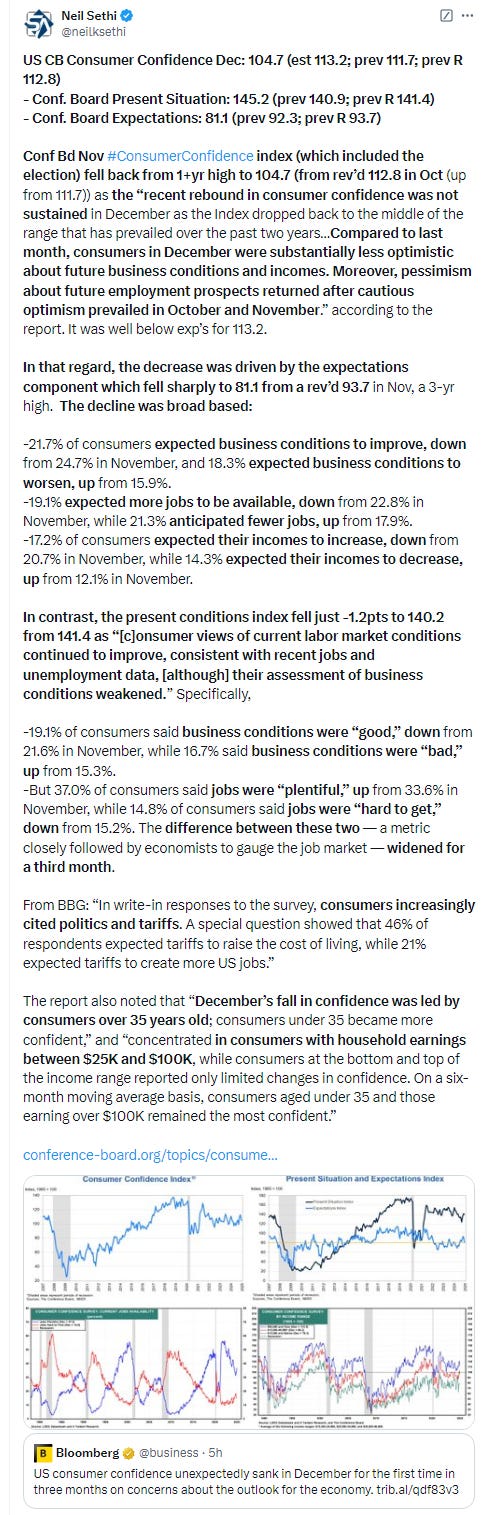

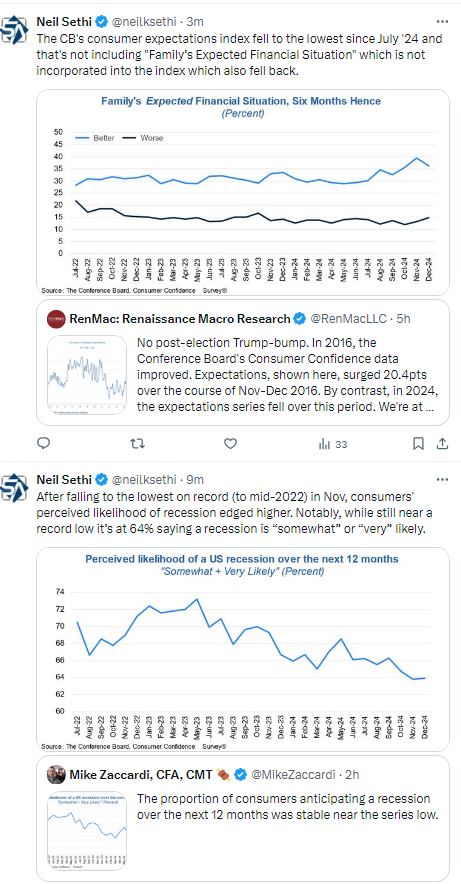

US consumer confidence unexpectedly sank in December for the first time in three months on concerns about the outlook for the economy amid uncertainty around the Trump administration’s policies. The Conference Board’s gauge of confidence decreased to 104.7, led by consumers over 35 years old, data released Monday showed. That was well below the median estimate in a Bloomberg survey of economists, and a measure of expectations hit a five-month low. “Compared to last month, consumers in December were substantially less optimistic about future business conditions and incomes.” Dana Peterson, chief economist at the Conference Board, said in a statement. “Moreover, pessimism about future employment prospects returned after cautious optimism prevailed in October and November.”

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX pushed further over its 50-DMA after the “outside day” Friday. The daily MACD & RSI remain weak but rebounding.

The Nasdaq Composite for its part was able to push further over its 20-DMA and bottom of its uptrend channel. Its daily MACD remains fairly negative, but its RSI is more positive.

RUT (Russell 2000) was remains trapped under its 100-DMA. Daily MACD & RSI remain very weak.

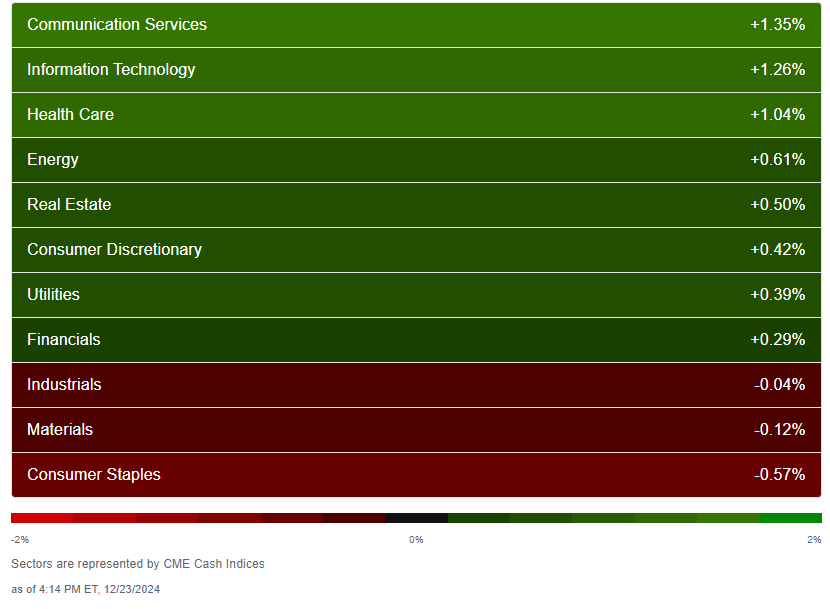

Equity sector breadth from CME Indices eased back from Friday’s very strong day where every sector finished higher & seven >1%. Today seven higher w/three >+1%. Sector mix also returned to megacap growth leading, taking 2 of the top 3 spots (after taking 2 of the bottom 3 Friday).

Stock-by-stock $SPX chart from Finviz consistent with Mag-7 all green ex-MSFT (-0.3%), and semi’s very strong. Healthcare and energy were broadly higher, but a lot of weakness in staples and industrials.

Positive volume (the percent of volume traded in stocks that were up for the day) on Monday fell back from Friday. That was understandable on the NYSE which at 57% despite a down day on the NYSE Composite Index was not bad, but Nasdaq was down to 64% from 79% despite a bigger gain in the index. Positive issues (percent of stocks trading higher for the day) remained weaker at 49 & 46% respectively (returning us to the negative breadth in terms of number of stocks participating the 10th session of negative issues breadth in the past 15 weeks on the Nasdaq).

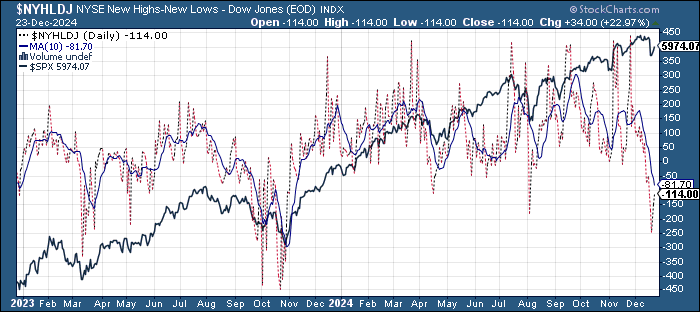

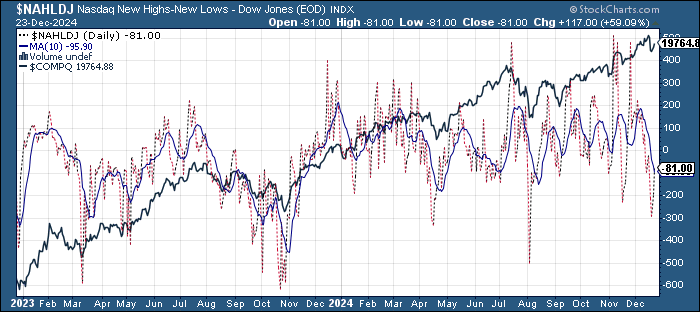

New highs-new lows though improved although both remained solidly negative with the NYSE at -114 from -146 Fri & -245 Thurs (which was the weakest since Aug and 2nd weakest since Oct ‘23), while the Nasdaq moved to -81 from -197 Fri & -297 Thurs (the least since Aug (& 2nd least since April). Both are now back to around the respective 10-DMAs which though are still heading sharply lower (more bearish) w/the NYSE the least since Nov ‘23 (Nasdaq is least since Aug).

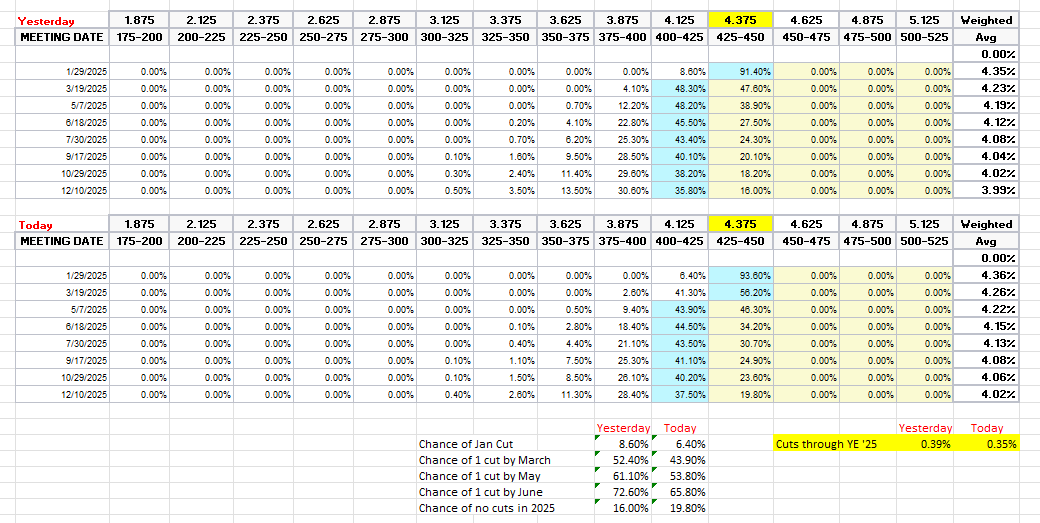

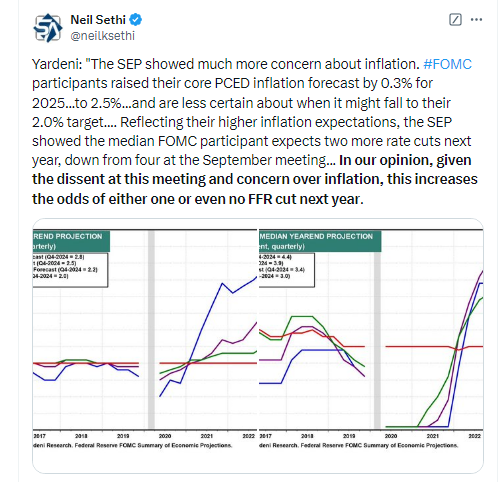

FOMC rate cut probabilities from CME’s #Fedwatch tool moved move hawkish (fewer cuts) on Monday. Overall, 2025 cut expectations decreased -4bps to 35bps so less than a 50/50 chance for two cuts, remaining fewer than the dot plot which has a full two. The one cut is now priced in May (54%). Chance of no cuts up to 20%.

This overall still seems quite aggressive to me, and I continue to expect at least two cuts, but I guess you never know, and we do have that pesky residual seasonality in 1Q inflation (inflation has tended to increase in 1Q the past few years) that may see the first cut pushed off to the summer (although it also means there are more favorable “base effects” in terms of y/y compares which will flatter the y/y numbers if inflation doesn’t spike as it has in the past).

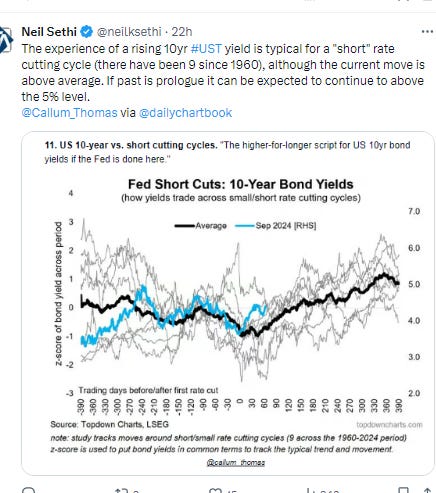

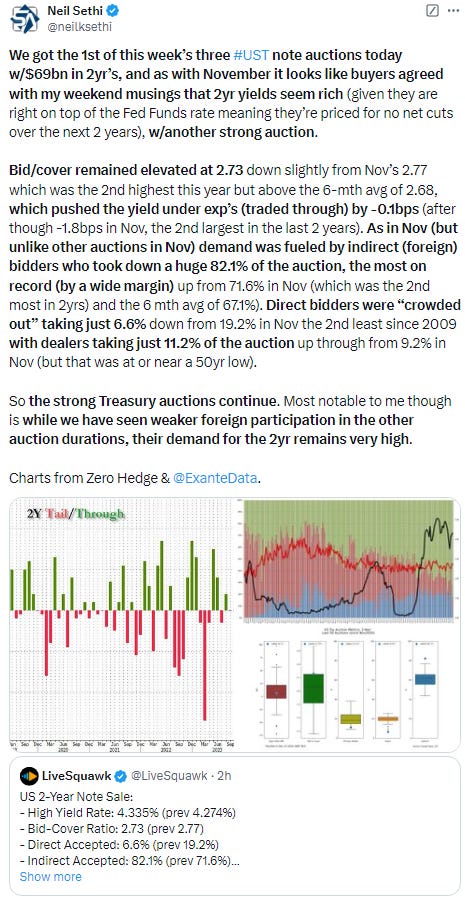

Treasury yields resumed their move upward Monday with the 10yr +7bps to 4.59%, the highest close since May now up +21bps since the Dec FOMC meeting (& +84bps from the Sept FOMC meeting & +47bps from the low three weeks ago when it bounced off what is now a decent uptrend line), still eyeing the 4.7% level. The 2yr yield, more sensitive to Fed policy, edged up +3bps to 4.34% despite a very solid auction.

Dollar ($DXY) moved higher but remained below last week’s highs. Daily MACD and RSI remain positive.

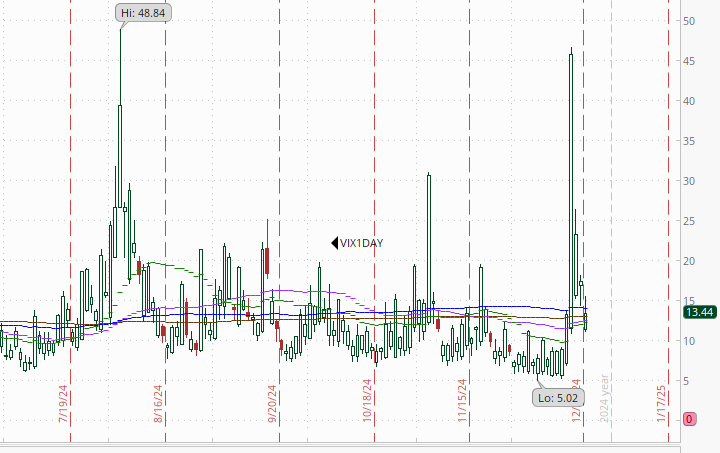

The VIX fell again now down to 16.8 (consistent w/1.09% daily moves over the next 30 days), and the VVIX (VIX of the VIX) fell back further from its highest close since August Thursday but remains just over 100 at 102 (consistent with “elevated” volatility and daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX also fell back after closing last Wed at an ATH (since inception in April ‘23) still relatively elevated at 13.4, looking for a move of 0.85% Tues.

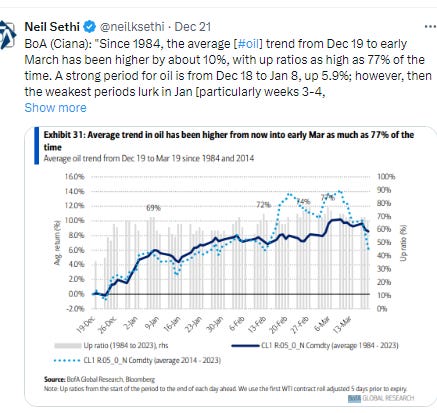

WTI continued to trade in a very narrow range for a 4th day in the middle of its range since mid-Aug. Daily MACD & RSI still tilt positive though. Needs to get over the 100-DMA which seems to have become resistance since August and the $72 level.

Gold edged lower but remained over its 100-DMA & uptrend line from Feb. Its MACD and RSI are negative for now though.

Copper (/HG) unlike gold remains under the support turned resistance in the form of the uptrend line running back to Oct ‘23 although has also not fallen back to the $4 level as I thought might happen. Its RSI and MACD are negative though.

Nat gas (/NG) took a run at $4 before falling back to finish mildly lower. Remains above its breakout levels. Daily MACD and RSI are positive w/the RSI starting to break out of a negative divergence as noted Friday.

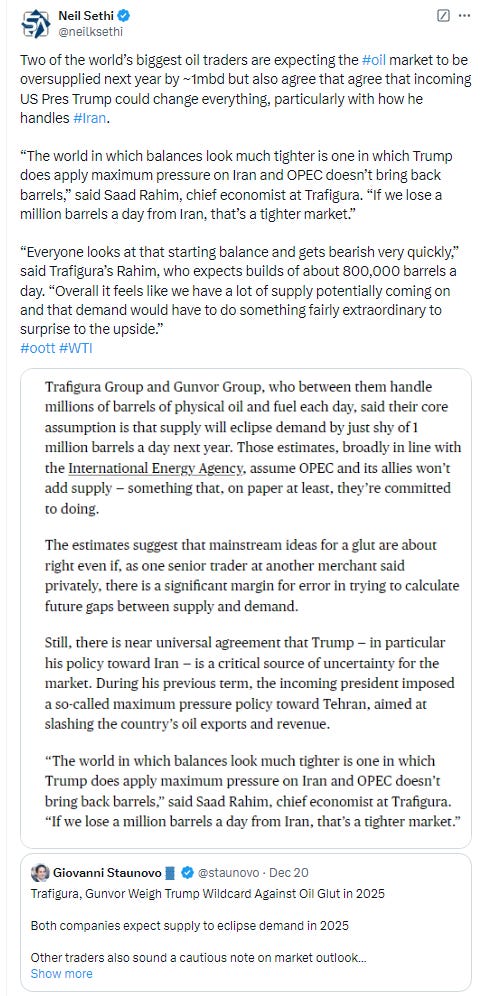

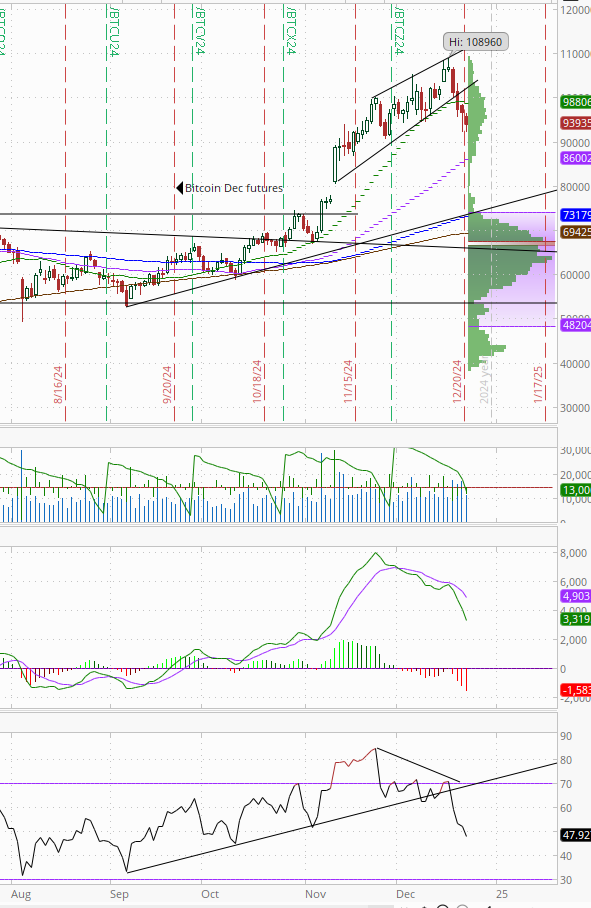

Bitcoin futures resumed their decline after failing at the 20-DMA on Friday. The daily MACD remains very weak and the the RSI is the weakest since mid-October.

The Day Ahead

With the early release of tomorrow’s originally scheduled economic reports today, not a lot going on tomorrow. No US economic reports, no Fed speakers, no earnings. We do get a 5yr Treasury auction, which I assume will be at 11am ET given bond markets close at 2pm. Equity markets in the US close at 1pm.

Ex-US a similar story with the only thing on my calendar the “Christmas speech” from BoJ Gov Ueda that will be watched for clues about a Jan rate hike. Most international markets are either closed or half-day tomorrow as well.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,