Markets Update - 12/24/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

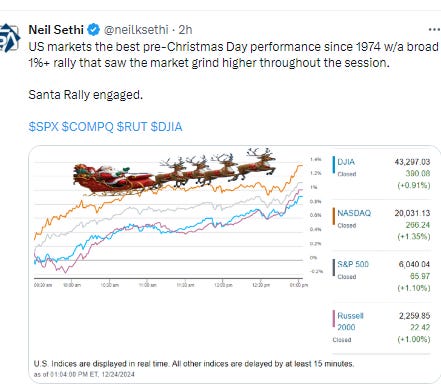

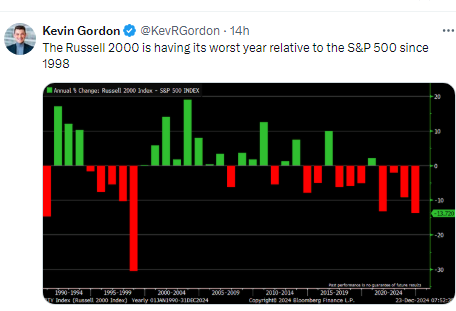

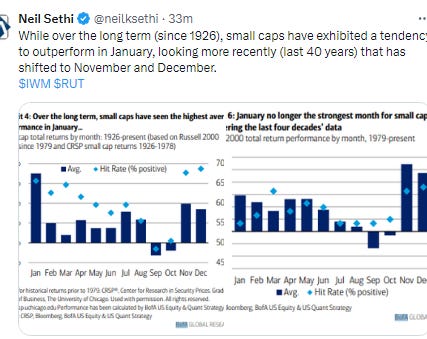

I know I said I wasn’t going to do an update today unless “something notable” happened, and I thought the best pre-Christmas day performance for the S&P 500 since 1974 qualified. US equities steadily moved higher today in a typical holiday fashion although the gains were far from ordinary as noted with the major market indices all moving up around 1% (or more). As with Monday, the advance was led by the megacap growth sectors. Small caps weren’t far behind though, aided by yields falling back a touch after initially pushing higher to start the session.

While yields edged lower, the dollar moved modestly higher, but most commodities were able to advance anyway. Gold, oil, copper, bitcoin and nat gas all were higher (with the last to a near 2yr high).

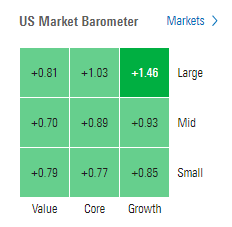

The market-cap weighted S&P 500 was +1.1%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite +1.4% (and the top 100 Nasdaq stocks (NDX) +1.4%), the SOX semiconductor index +1.1%, and the Russell 2000 1.0%.

Morningstar style box showed the broad rally led by large cap growth.

Market commentary:

“The action of the past few weeks shows that the big-cap tech names are still the key leadership group in today’s stock market,” said Matt Maley at Miller Tabak. “These big-tech names are highly overweighted in the portfolios of a huge number of institutional investors. Any buying they do over the next week is likely to be concentrated in these names.”

“Santa Claus rally could still be alive, with strong seasonality into the end of the year,” said London Stockton at Ned Davis Research. Since 1950, the S&P 500 has generated average and median returns of 1.3% during this period, widely outpacing the market’s average seven-day gain of 0.3%, according to Adam Turnquist at LPL Financial. “When investors are on the ‘nice’ list, and Santa delivers a ‘positive’ Santa Claus Rally return, the S&P 500 has generated an average January and forward annual return of 1.4% and 10.4%, respectively,” he said.

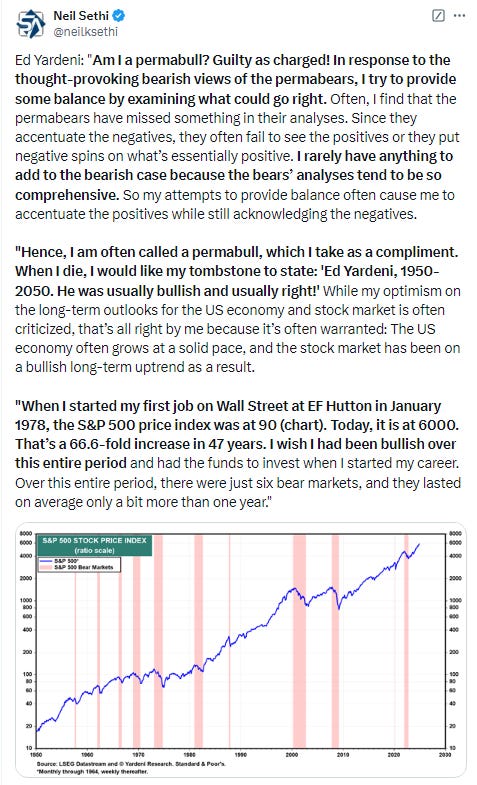

While a positive “Santa Claus Rally” has preceded a 10.4% average annual gain for the S&P 500 since World War II, Sam Stovall at CFRA says a more accurate indicator in his view is the “January Barometer.” That’s a market hypothesis positing that January’s performance predicts the year’s performance. The term was coined by Yale Hirsch, creator of the Stock Trader’s Almanac, in 1972.

Since 1945, when the year started with a gain in January, the S&P 500 rose an average of 18.3% in price during the entire year, Stovall at CFRA said. If the first month saw a decline in price, however, the average full-year return was negative 1.9%.

“The year is ending with a renewed strength in the US market, thanks to an increase in breadth,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “The reality is that US growth has surprised everybody as it’s been very resilient, while unfortunately Europe is closing very downbeat as it still struggles to get some growth.”

“There’s a lot of good to think about, but I think at the same time, you want to be restrained in your enthusiasm here because the market has rallied,” Paul Hickey, Bespoke Investment Group co-founder, said on CNBC’s “Squawk Box.”

Jay Hatfield of Infrastructure Capital Advisors is calling for a bit of a stall in the market over the coming days. He is sticking with his year-end 2024 S&P 500 target of 6,000, which implies only a 0.4% increase for the broad market index from Monday’s close. “We might get a Santa Claus rally, but those aren’t that powerful [of] rallies,” the firm’s CEO told CNBC. “We’re neutral on the market.

Investors should have a more-balanced approach in US stocks over the first quarter, according to Citigroup Inc. strategists led by Scott Chronert, who see a greater opportunity in defensive sectors. They raised health care to overweight, noting valuations are now lower and fundamentals seem close to inflection point. Meantime, they are selective on growth stocks, looking for stronger fundamental trend versus valuation and potential margin improvement. Citi’s strategists are overweight in media, internet and semiconductors, while raising software to market weight.

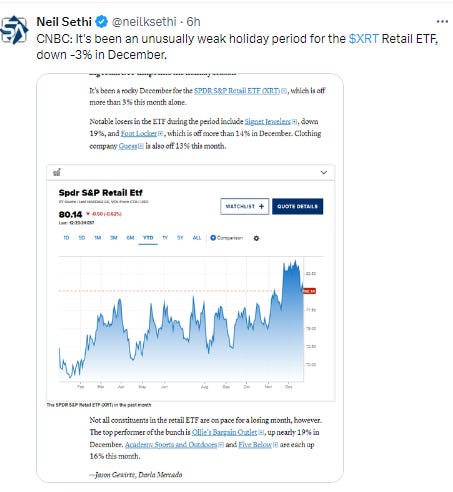

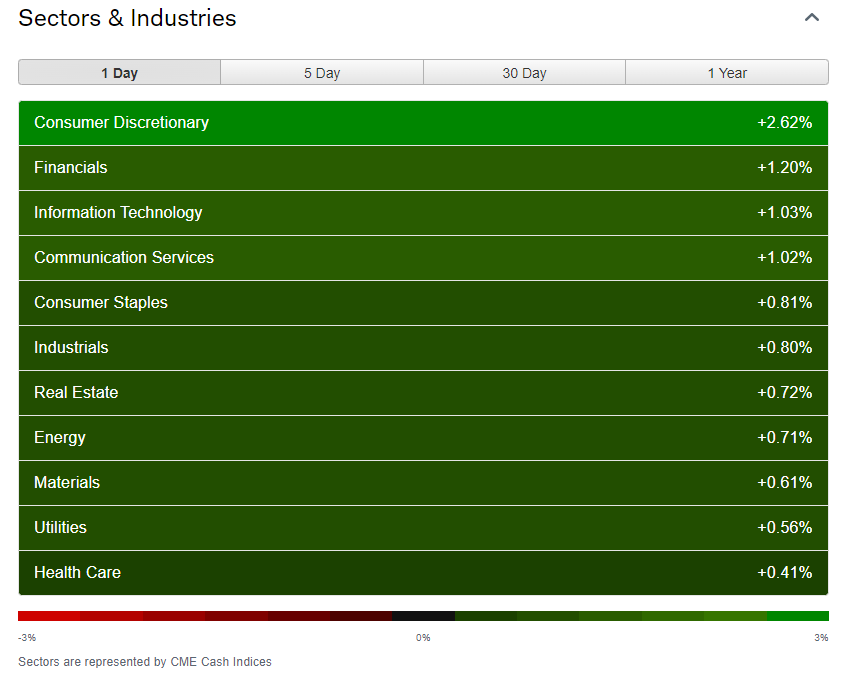

In individual stock action, the consumer discretionary sector logged the biggest gain by a decent margin, jumping 2.6% thanks to Tesla (TSLA 462.28, +31.68, +7.4%) and Amazon.com (AMZN 229.05, +3.99, +1.8%). Apple (AAPL 258.20, +2.93, +1.2%), Microsoft (MSFT 439.33, +4.08, +0.9%), NVIDIA (NVDA 140.22, +0.55, +0.4%), and Broadcom (AVGO 239.68, +7.33, +3.2%) helped propel the information technology sector to a 1.0% gain the latter two boosted by President Joe Biden’s team launching a probe into Chinese-made chip.

American Airlines (AAL 17.35, +0.10, +0.6%) was a story stock after temporarily grounding all flights due to a technical issue. Other airline stocks fared better than American, leading the US Global JETS ETF (JETS) to settle 0.5% higher. American Airlines is not a component in the S&P 500 industrial sector (+0.8%), but its competitors like Delta Air Lines (DAL 62.56, +1.04, +1.7%) and United Airlines (UAL 101.16, +1.68, +1.7%) were some of the top performing components.

Corporate Highlights from BBG:

American Airlines Group Inc. said a technical vendor glitch was the cause of a brief groundstop on all US flights on Christmas Eve, one of the busiest days of the holiday travel season.

Nippon Steel Corp.’s proposed $12.3 billion acquisition of US Steel Corp. moved a step closer to being blocked after a US national security panel deadlocked on its review and left the final decision with President Biden, who has repeatedly indicated his opposition to the deal.

Salesforce Inc. says it’s taking multiple large customers from former partner Veeva Systems Inc. in a mounting rivalry to sell software to the pharmaceutical industry.

A Starbucks Corp. barista strike has shut down about 170 cafes, according to the coffee chain, disrupting service at locations nationwide during the final days of the crucial holiday shopping season.

Arcadium Lithium Plc, a chemicals company, said it obtained all shareholder approvals for a proposed acquisition by Rio Tinto Plc.

Some tickers making moves at mid-day from CNBC.

No US economic data today.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX back over its 20-DMA with just some moderate resistance between it and ATH’s. The daily MACD remains weak but rebounding while the RSI back over 50.

The Nasdaq Composite for its part was able to push further over its 20-DMA and firmly back into its uptrend channel. Its daily MACD still remains weak, but its RSI is back over 60. Now less than a percent from ATH’s.

RUT (Russell 2000) able to get back over its 100-DMA, setting up a potential run to at least test the 2290 breakout level. Daily MACD & RSI remain very weak though.

Equity sector breadth from CME Indices reflected the broad participation with every sector in the green for the 2nd time in 3 sessions & four >1%, led for a 2nd day by the megacap growth sectors, 3 of the top 4 spots. Defensives lagged but every sector up at least +0.4%.

Stock-by-stock $SPX chart from Finviz consistent with very little red, and what there was saw very mild losses.

Positive volume (the percent of volume traded in stocks that were up for the day) on Tuesday back to very solid at 81% on the NYSE, while Nasdaq was a little weaker at 79% which is a little disappointing given the over 1% gain in the index. Positive issues (percent of stocks trading higher for the day) remained weaker at 73 & 67% respectively but at least above 50%.

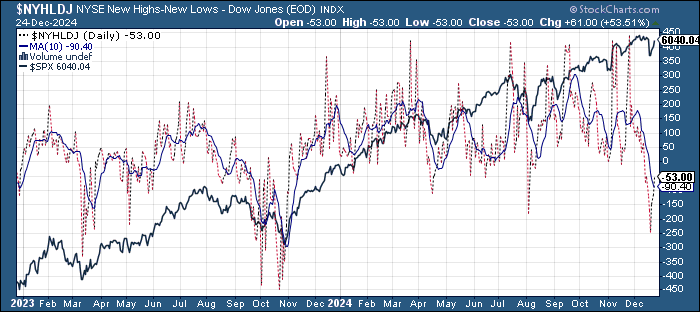

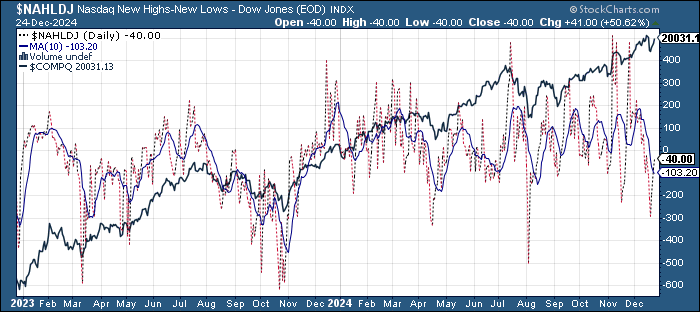

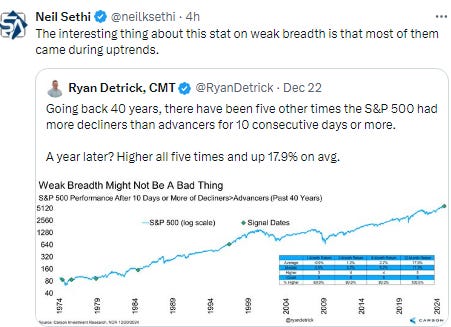

New highs-new lows again improved although both remained negative with the NYSE at -52 from -114 Monday & -245 Thurs (which was the weakest since Aug and 2nd weakest since Oct ‘23), while the Nasdaq moved to -43 from -81 Monday & -297 Thurs (the least since Aug (& 2nd least since April). Both are now back above the respective 10-DMAs which though are still heading lower (more bearish) w/the NYSE the least since Nov ‘23 (Nasdaq is least since Aug).

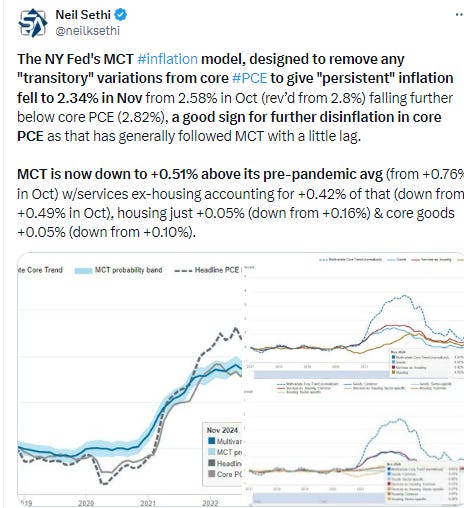

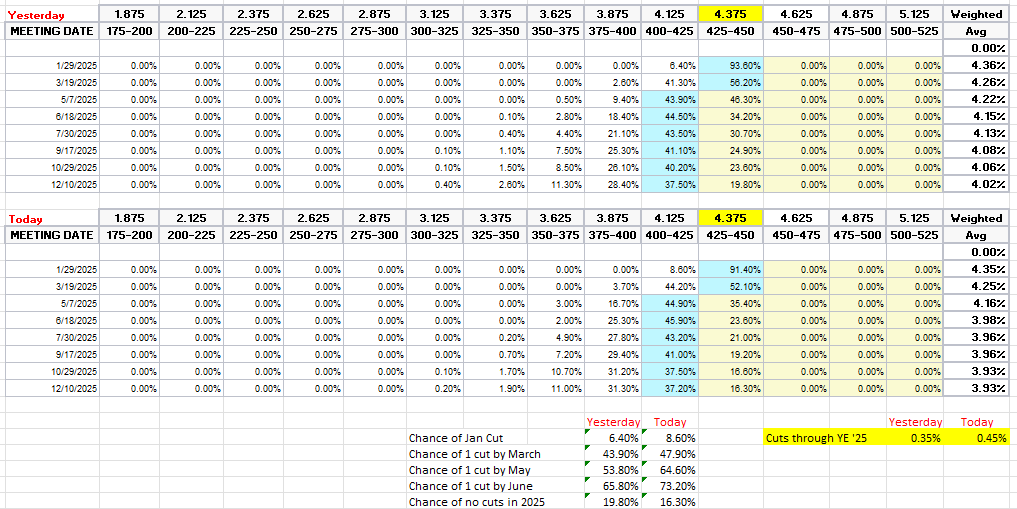

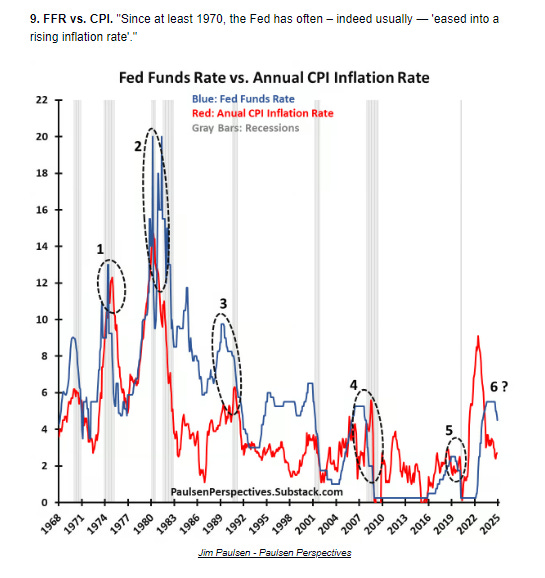

FOMC rate cut probabilities from CME’s #Fedwatch tool moved around a little with chances of cuts through May getting more likely but also seeing chances of a hike after May coming back (which we’ve seen before but then disappeared, not sure the reason for that (hedging?)). Anyway overall 2025 cut expectations remained at 35bps so less than a 50/50 chance for two cuts, remaining fewer than the dot plot which has a full two. The one cut is now priced in May (65%). Chance of no cuts down to 18%.

This overall still seems quite aggressive to me, and I continue to expect at least two cuts, but I guess you never know, and we do have that pesky residual seasonality in 1Q inflation (inflation has tended to increase in 1Q the past few years) that may see the first cut pushed off to the summer (although it also means there are more favorable “base effects” in terms of y/y compares which will flatter the y/y numbers if inflation doesn’t spike as it has in the past).

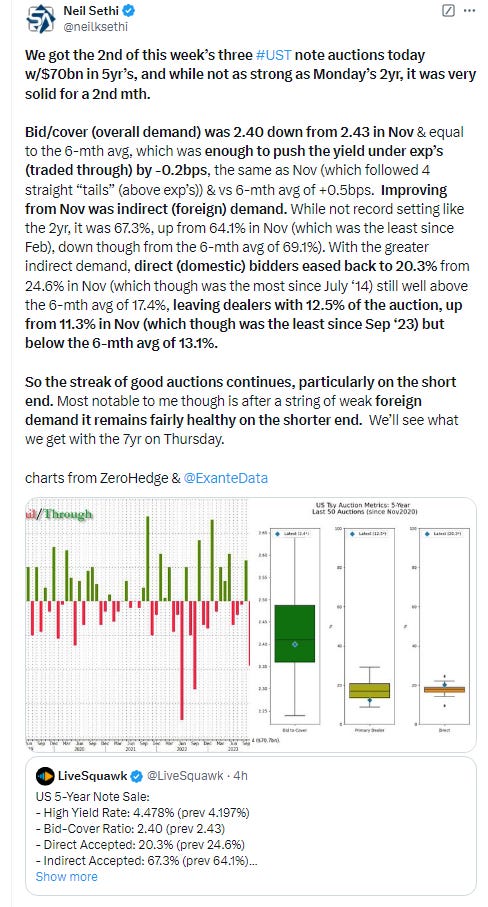

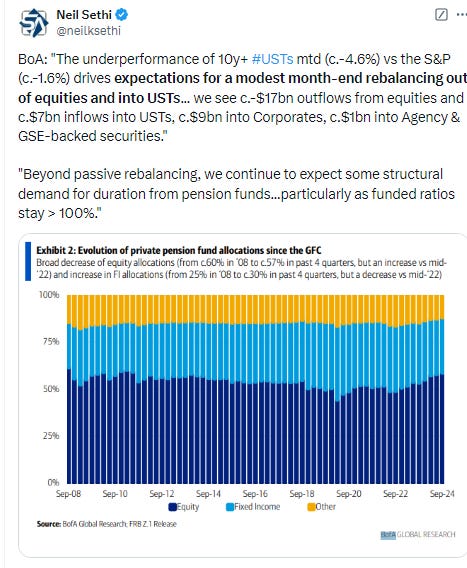

Treasury yields resumed their move upward early in the session before falling back after a strong 5yr Treasury auction with the 10yr -1bps to 4.59%, from the highest close since May still up +20bps since the Dec FOMC meeting (& +83bps from the Sept FOMC meeting & +46bps from the low three weeks ago when it bounced off what is now a decent uptrend line), still eyeing the 4.7% level. The 2yr yield, more sensitive to Fed policy, also -1bps to 4.34%.

Dollar ($DXY) moved higher but remained below last week’s highs. Daily MACD and RSI remain positive.

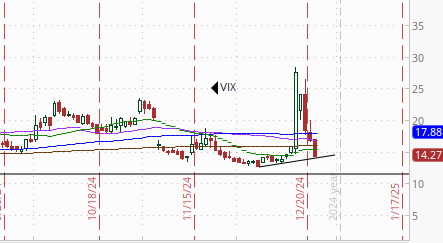

The VIX fell again, now down to 14.3 (consistent w/0.9% daily moves over the next 30 days), under 16 for the 1st time post-FOMC, and the VVIX (VIX of the VIX) fell back further from its highest close since August on Thursday, now back under the 100 “stress level” identified by Nomura’s Charlie McElligott at 91 (consistent with “moderate” volatility and daily moves in the VIX over the next 30 days (normal is 80-100)).

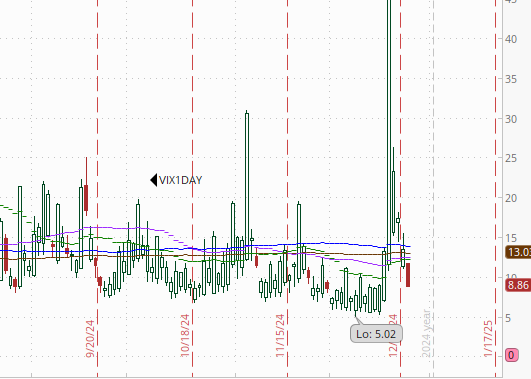

1-Day VIX dropped back sharply after closing last Wed at an ATH (since inception in April ‘23) now down to 8.9, the lowest close since before the Dec FOMC meeting, looking for a move of 0.56% Thurs.

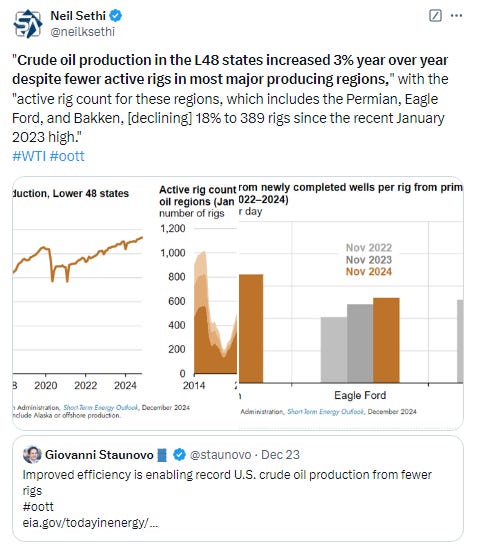

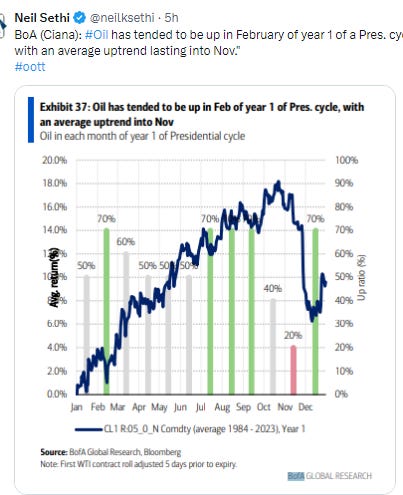

WTI saw its biggest move in a week with a nearly 1% gain but overall remains in the middle of its range since mid-Aug. Daily MACD & RSI still tilt positive. As I’ve said the past 2 weeks, “it needs to get over the 100-DMA which seems to have become resistance since August then the $72.50 level.”

Gold edged higher remaining just over its 100-DMA & uptrend line from Feb. Its MACD and RSI are negative for now though.

Copper (/HG) unlike gold remains under the support turned resistance in the form of the uptrend line running back to Oct ‘23 although has also not fallen back to the $4 level as I thought might happen. Its RSI and MACD are negative but improving.

Nat gas (/NG) up another +6% today with the highest close since early Jan ‘23. Daily MACD and RSI are positive w/the RSI breaking out of a negative divergence as noted Friday.

Bitcoin futures up +5% back to testing the 20-DMA. The daily MACD remains very weak but the RSI is rebounding from the weakest since mid-October.

The Day Ahead

Global markets are closed tomorrow for the Christmas holiday. Many will extend to Thursday (mostly Europe and ex-European colonies (Canada, Australia, etc.)) but we’ll be back at work in the US. Economic data is light with weekly jobless claims and mortgage applications.

No Fed speakers on the calendar, but we do get our final Treasury auction of the week (and year) in $44bn of 7yr notes.

No earnings scheduled.

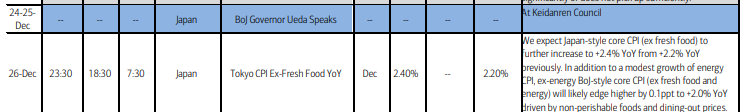

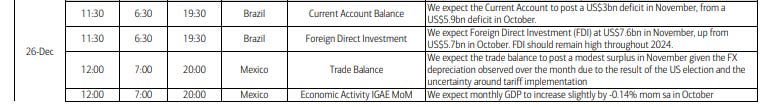

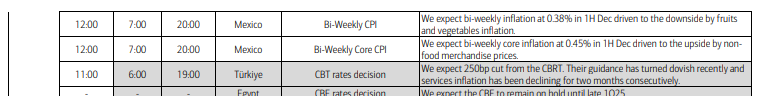

Ex-US we’ll get the BoJ’s Gov Ueda making a Christmas Day speech tomorrow, then we’ll get Japan’s Dec Tokyo CPI Thursday (leading indicator for the whole country CPI). In EM Thursday we’ll get policy decisions from Turkey & Egypt as well as Mexico GDP, trade and half-month CPI data.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,