Markets Update - 12/26/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

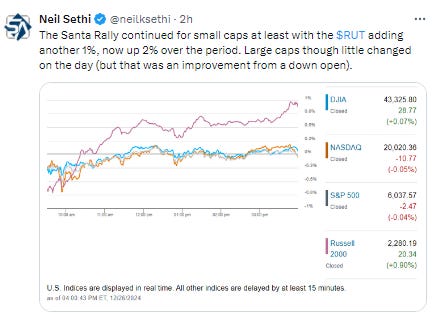

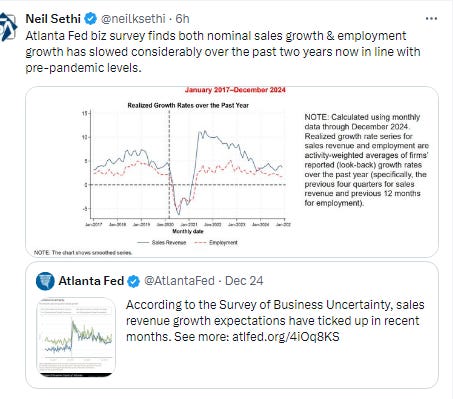

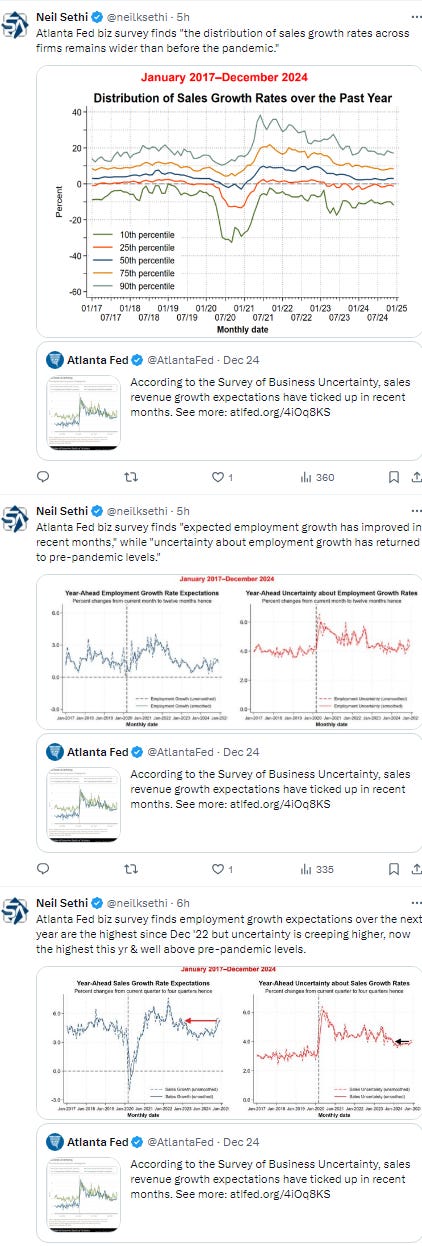

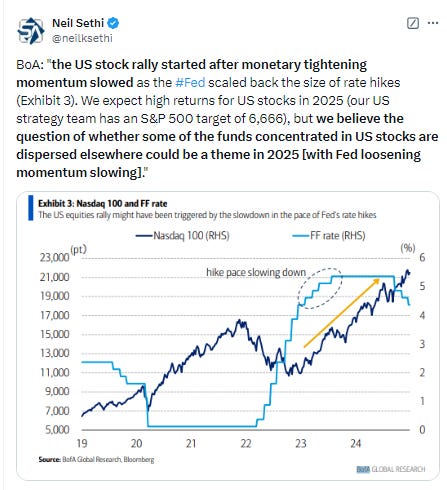

US equities were mixed Thursday. While all the major indices advanced from a negative start, it was the small caps that continued the Santa Rally today adding nearly another 1% to Tuesday’s similar sized move. Large caps though weren’t able to make any upward progress (although they didn’t give back any of Tuesday’s over 1% gains either).

Bond yields started the day higher but fell back after another strong Treasury note auction, the dollar was little changed while commodities were mixed with metals (gold and copper) advancing, but oil, nat gas, and bitcoin all falling back.

The market-cap weighted S&P 500 was unch, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite -0.1% (and the top 100 Nasdaq stocks (NDX) -0.1%), the SOX semiconductor index unch%, and the Russell 2000 +0.9%.

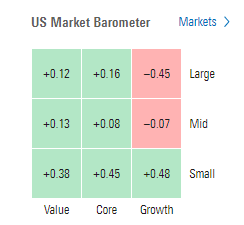

Morningstar style box showed the broad rally led by large cap growth.

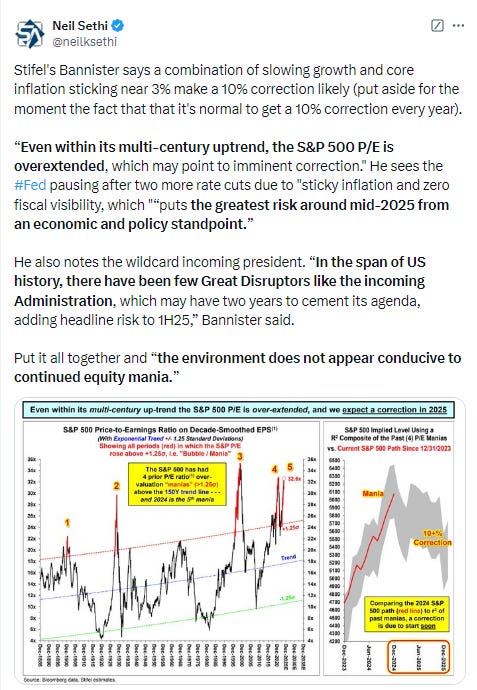

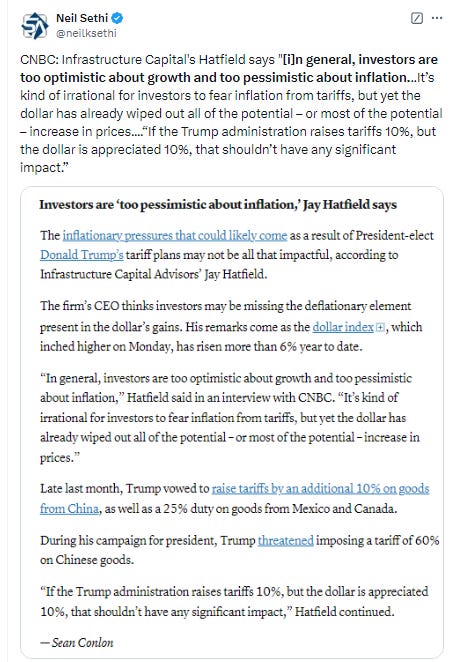

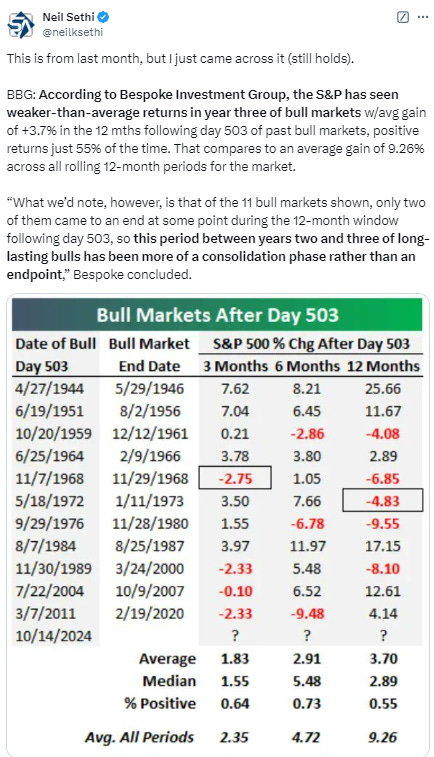

Market commentary:

“The Santa Claus Rally may be alive and well. We’ll see, or it could be tough sledding,” Michael Zinn, UBS Wealth Management’s senior portfolio manager, said on CNBC’s “Squawk Box.” “It’s a sleepy time of year. The institutions aren’t really trading. It’s a little bit more retail driven. So what happens at the end of the year is not necessarily an indicator for how January and February.”

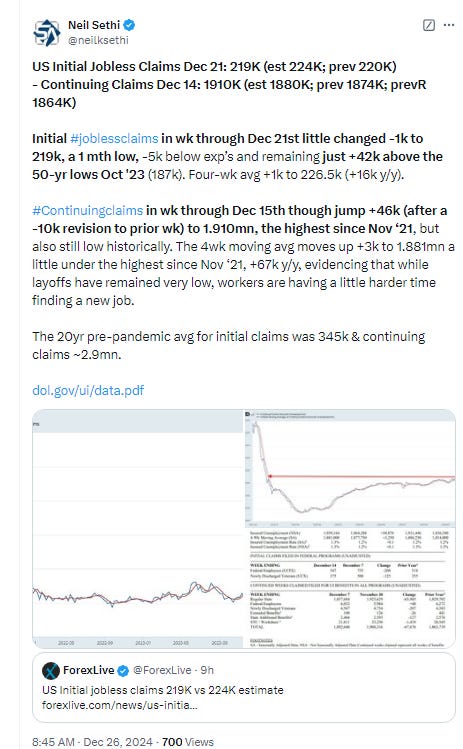

“Employment claims has too much noise to spark a move,” said Andrew Brenner at NatAlliance Securities. “Direction for now in bonds is lower and steeper, but that could change on a dime. As for Fed outlook, they believe they have convinced the markets that the recalibration phase is over. And that the number of rate cuts next year will be minimal.”

“Eco data is a non-event until we move into the new year,” said Kenny Polcari at SlateStone Wealth. “Christmas is behind us, but the New Year is ahead of us. Volumes will remain muted.”

To Jonathan Krinsky at BTIG, the market can continue to make upside progress into year-end, hitting a fresh all-time high for the S&P 500 above 6,100. Looking ahead to January, however, he thinks think volatility will re-emerge. “If the S&P 500 does make new highs, there are going to be massive divergences in breadth and momentum, which is another red flag as we get into January,” he noted.

“The Fed has entered a new phase of monetary policy — the pause phase,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. “The longer it persists, the more likely the markets will have to equally price a rate hike versus a rate cut. Policy uncertainty will make for more volatile financial markets in 2025.”

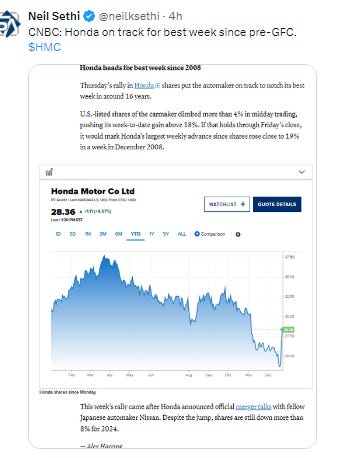

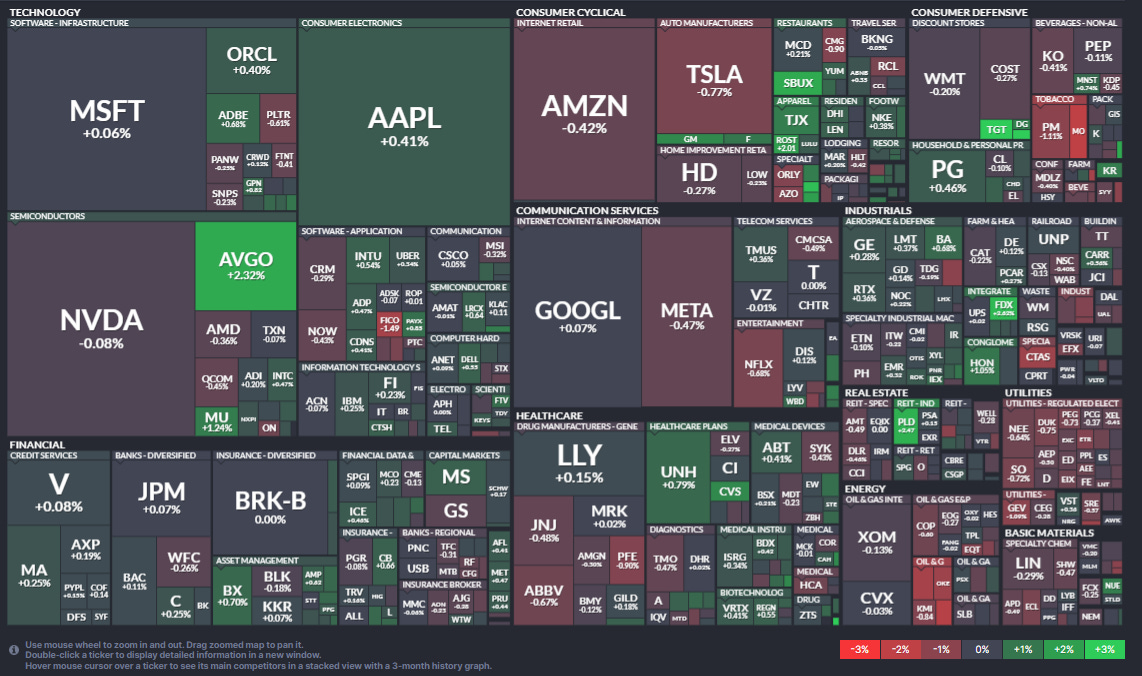

In individual stock action, most megacaps fell, but Apple Inc. outperformed after a bullish note from Wedbush. GameStop Corp. rallied after an X post from Keith Gill, the online persona known as Roaring Kitty.

Corporate Highlights from BBG:

Alibaba Group Holding Ltd. agreed to merge its South Korean operations with E-Mart Inc.’s e-commerce platform to better compete in the country’s fast-paced online retail sector.

Progressive Corp. was upgraded to outperform from market perform at Raymond James, which wrote the company’s “long-term record of growth and value creation makes it a core holding for large cap growth investors.”

Some tickers making moves at mid-day from CNBC.

In US economic data we saw initial jobless claims remain near 50-yr lows, but continuing claims continued their upward move this year hitting a 3-yr high.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

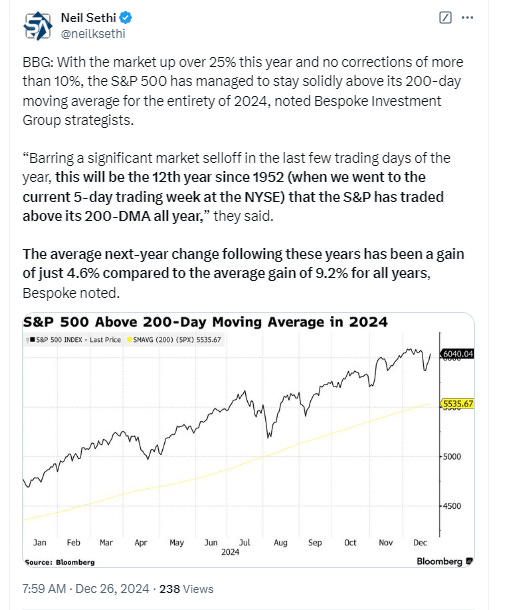

The SPX remained over its 20-DMA but still has that moderate resistance between it and ATH’s. The daily MACD remains weak but rebounding while the RSI back over 50.

The Nasdaq Composite for its part is further over its 20-DMA and firmly back into its uptrend channel. Its daily MACD still remains weak, but its RSI is back over 60. Now less than a percent from ATH’s.

RUT (Russell 2000) per Tuesday’s note it was “set up for a potential run to at least test the 2290 breakout level,” go almost all the way there today. Daily MACD & RSI remain weak but are turning.

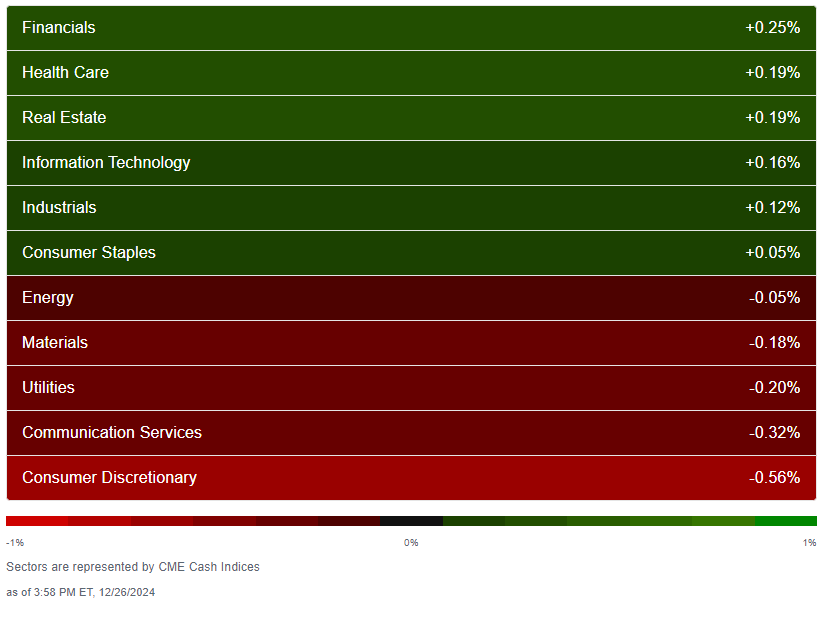

Equity sector breadth from CME Indices a fairly tight range today. After every sector in the green Tues, just six Thurs, and none up over +0.2%. Just two sectors down more than that though, and none worse than -0.6%.

Stock-by-stock $SPX chart from Finviz consistent with most stocks up or down less than a percent.

Positive volume (the percent of volume traded in stocks that were up for the day) remained solid on Thursday at 67% on the NYSE, the 4th day over 50% (after having been over just once before in December) while Nasdaq was 73%, an excellent result given the index was slightly down, the 4th consecutive day over 60% for that index. Positive issues (percent of stocks trading higher for the day) have also improved although continue to lag a bit at 59 & 67%.

New highs-new lows again improved, although NYSE remains negative at -21 (but that’s up from -245 a week ago (which was the weakest since Aug and 2nd weakest since Oct ‘23), while the Nasdaq moved to +7 (from -297 last Thurs, the least since Aug (& 2nd least since April)). Both are pushing further above the respective 10-DMAs which though are still heading lower (more bearish) w/the NYSE the least since Nov ‘23 (Nasdaq is least since Aug), but the decline is slowing.

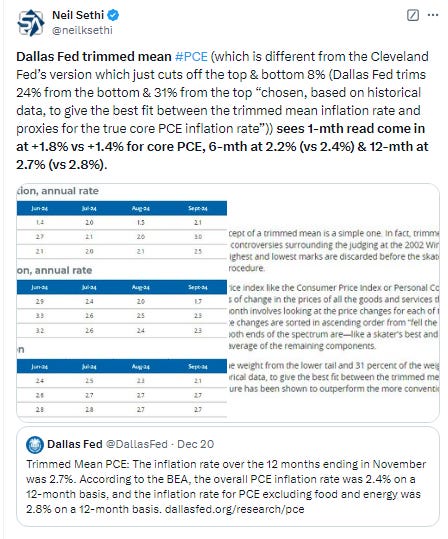

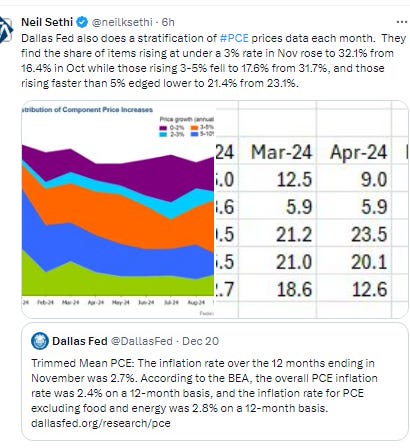

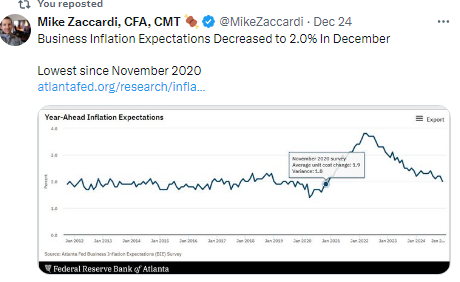

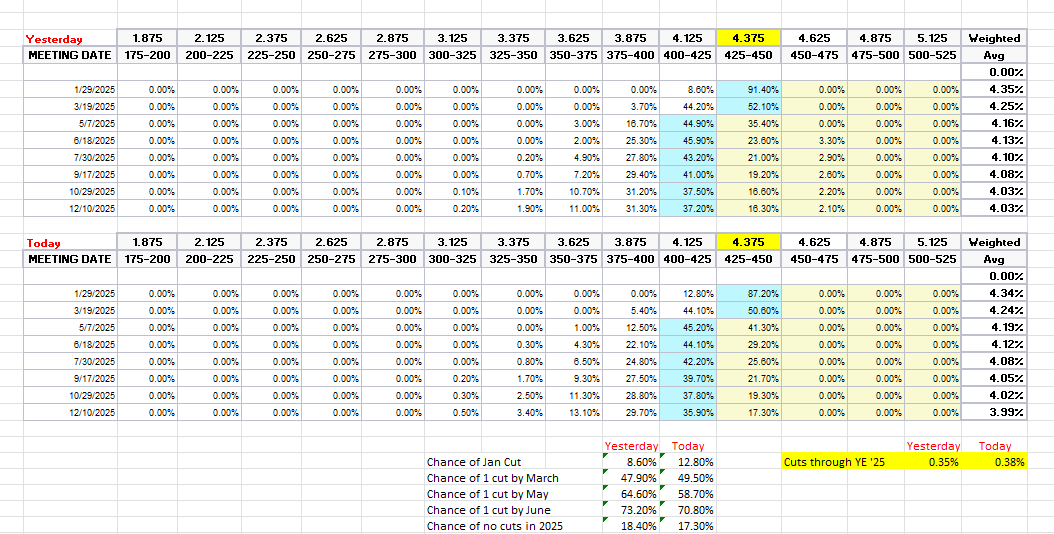

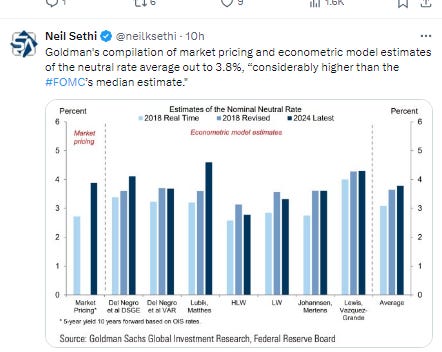

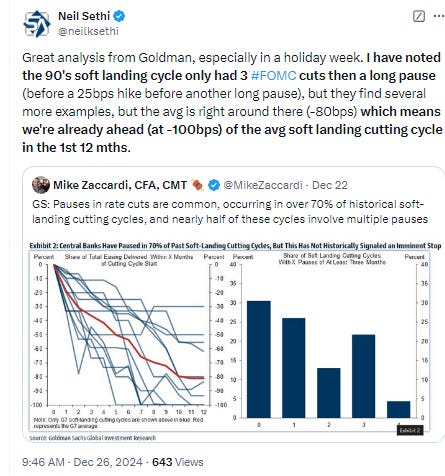

FOMC rate cut probabilities from CME’s #Fedwatch tool a little less hawkish (and we saw those rate hike bets exit as I anticipated). Overall 2025 cut expectations eased to 38bps around a 50/50 chance for two cuts, remaining fewer than the dot plot which has a full two. The one cut is now 50/50 for March. Chance of no cuts down to 17%.

This overall still seems quite aggressive to me, and I continue to expect at least two cuts, but I guess you never know, and we do have that pesky residual seasonality in 1Q inflation (inflation has tended to increase in 1Q the past few years) that may see the first cut pushed off to the summer (although it also means there are more favorable “base effects” in terms of y/y compares which will flatter the y/y numbers if inflation doesn’t spike as it has in the past).

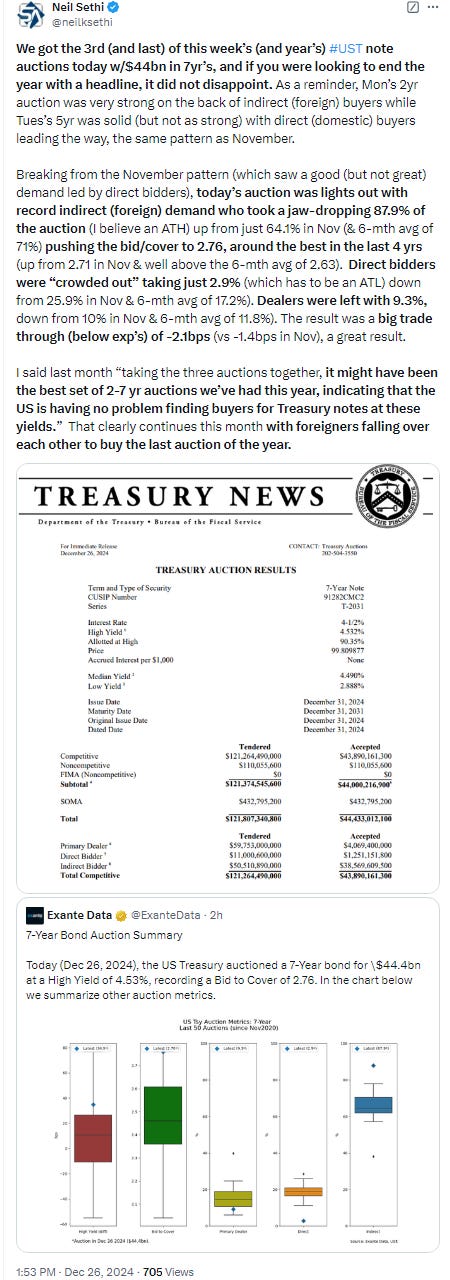

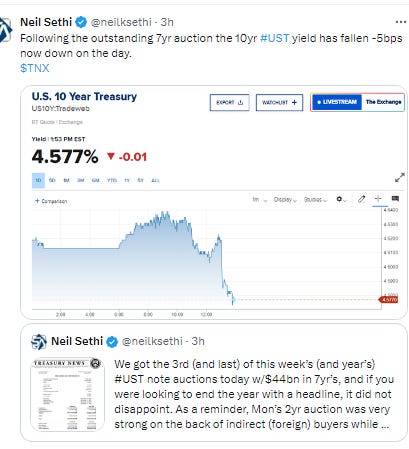

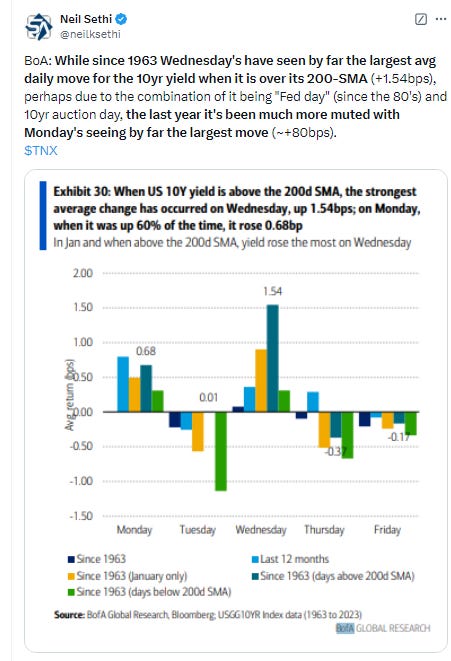

Treasury yields resumed their move upward early in the session before falling back after another strong Treasury auction, this time the 7yr which saw record foreign demand. The 10yr went from 4.64% before the auction (which would have been the highest close since April) to end the day -1bps at 4.58%, still up +19bps since the Dec FOMC meeting (& +82bps from the Sept FOMC meeting), still for now eyeing the 4.7% level. The 2yr yield, more sensitive to Fed policy, also -1bps to 4.33%.

Dollar ($DXY) little changed remaining just below last week’s near 2-yr highs. Daily MACD and RSI remain positive.

The VIX little changed at 14.7 (consistent w/0.92% daily moves over the next 30 days), after falling under 16 for the 1st time post-FOMC on Tuesday, and the VVIX (VIX of the VIX) also little changed remaining under the 100 “stress level” identified by Nomura’s Charlie McElligott at 93 (consistent with “moderate” volatility and daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX remained relatively tame at 9.6, just off the lowest close since before the Dec FOMC meeting, looking for a move of 0.6% Fri.

WTI gave back Tuesday’s nearly 1% gain today remaining in the middle of its range since mid-Aug. Daily MACD & RSI still tilt positive. As I’ve said the past 2+ weeks, “it needs to get over the 100-DMA which seems to have become resistance since August then the $72.50 level.”

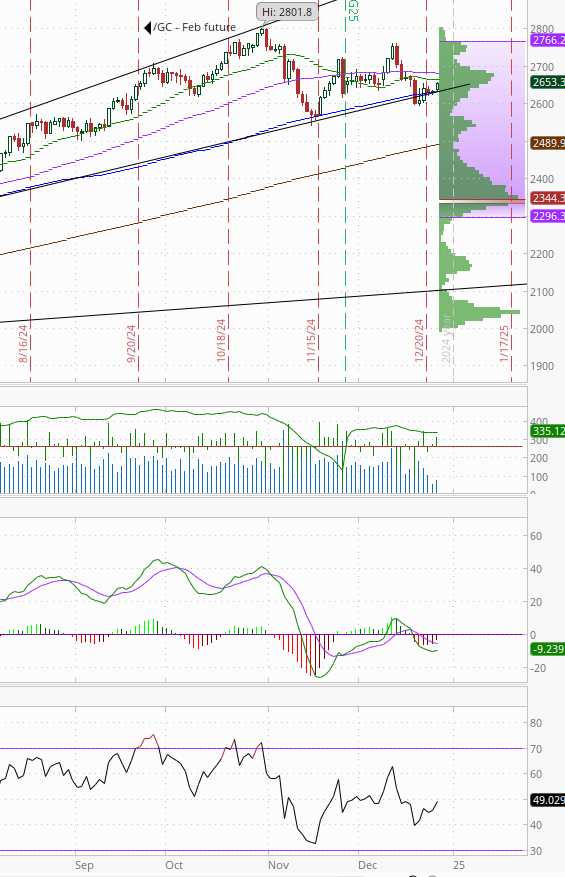

Gold a little bigger gain Thursday but still under resistance of the 20 & 50-DMAs. Its MACD and RSI remain negative for now though.

Copper (/HG) also saw its best day of the week pushing back over the the support turned resistance (which should now be support again) in the form of the uptrend line running back to Oct ‘23. Its RSI and MACD are negative but improving.

Nat gas (/NG) saw a big reversal. After touching $4 on the Feb contract at one point, it fell back sharply, giving back all of Tuesday’s 6% gain to the highest close since early Jan ‘23. It was able to hold the $3.65 breakout level though. Daily MACD and RSI are turning less positive so we’ll see if that level holds.

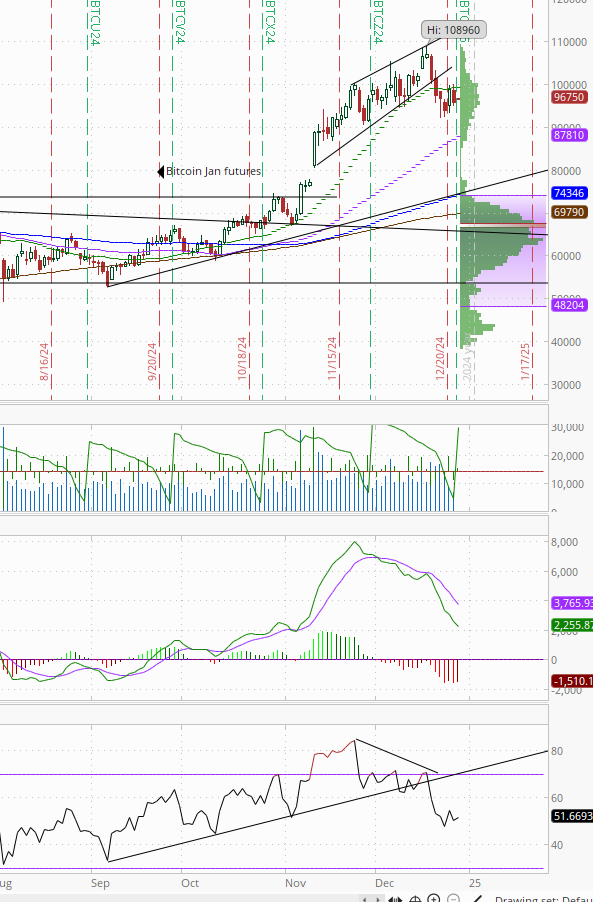

Bitcoin futures fell back from the 20-DMA. The daily MACD remains very weak but the RSI is stabilizing from the weakest since mid-October.

The Day Ahead

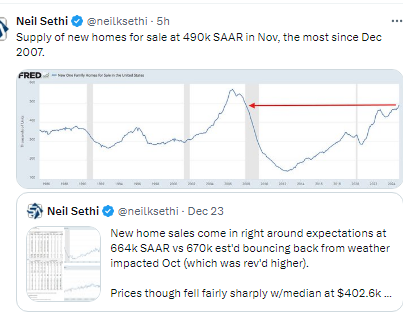

In US economic data we’ll wrap up a light data week with the preliminary goods trade balance and inventories along with the EIA weekly petroleum data.

No Fed speakers on the calendar and no Treasury auctions.

Also no earnings scheduled.

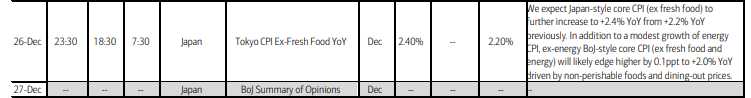

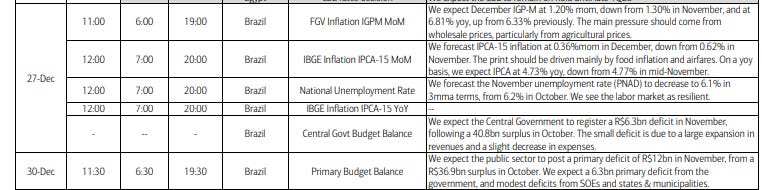

Ex-US overnight we’ll get Dec Japan’s Tokyo CPI (leading indicator for the full country) along with the summary of opinions from the BoJ’s Dec meeting as well as Nov industrial production, retail sales, and unemployment. It looks like we get Nov China industrial profits as well. In EM we’ll get employment and inflation data from Brazil.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,