Markets Update - 12/26/25

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts! (includes Wed/Thurs posts also)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

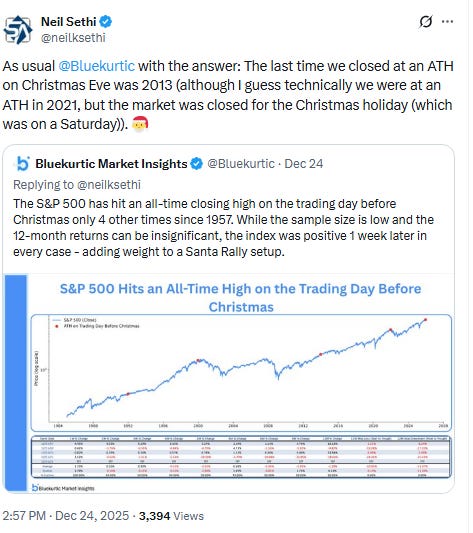

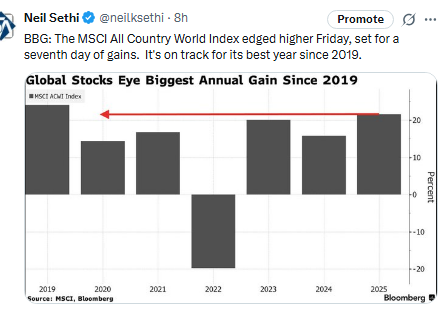

Hope everyone had a nice holiday. US equity indices opened little changed as traders returned from the Christmas holiday and embarked on day two of the “Santa Rally” period that lasts through Jan 5th (last five trading days of December through the first two trading days of January), one of the strongest seasonal periods of the year (averages a +1.3% return, with positive results occurring 78% of the time). That followed a Wednesday half-session which saw a modest gain led by small-caps.

Despite the strong seasonality for the day after Christmas (traditionally one of the best days of the year for the SPX), US equity indices had a holiday hangover with large cap indices trading near unchanged levels all day and finishing slightly to the downside while the Russell 2000 fell in the first hour and was only able to marginally cut those losses, finishing -0.5%. Still it was a good week for equities, with the SPX posting its best weekly return in a month +1.4%.

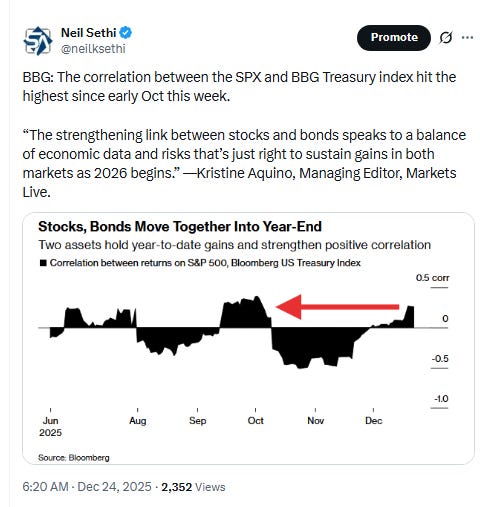

Elsewhere, bond yields edged lower, while the dollar saw a small gain but remained near the least since early Oct. Crude fell, and bitcoin was little changed, but gold (and silver), copper, and natgas all saw solid advances.

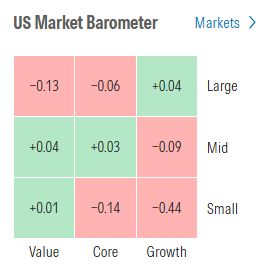

The market-cap weighted S&P 500 (SPX) was unch, the equal weighted S&P 500 index (SPXEW) unch, Nasdaq Composite -0.1% (and the top 100 Nasdaq stocks (NDX) -0.1%), the SOXX semiconductor index +0.1%, and the Russell 2000 (RUT) -0.5%.

Morningstar style box showed the subdued action extending across the box, although small growth saw a bit more selling.

Market commentary:

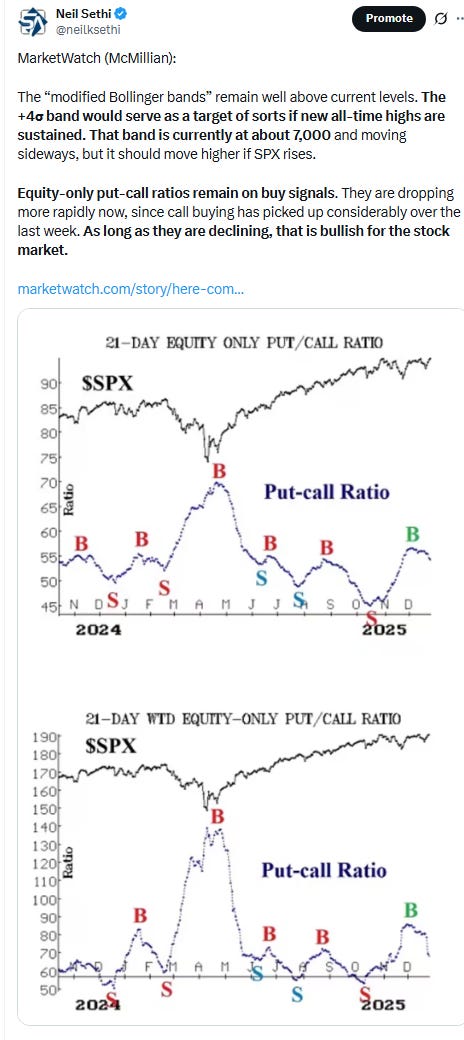

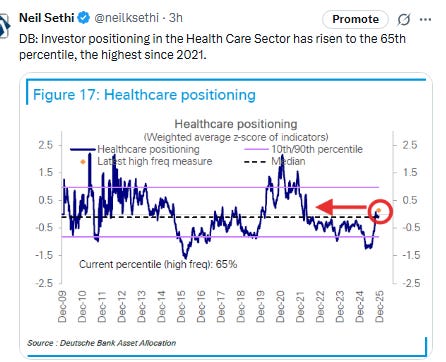

“Momentum heading into year-end suggests a favorable setup for a positive Santa Claus Rally — a historically bullish signal for January and the year ahead,” LPL Financial chief technical strategist Adam Turnquist said. “While overall market breadth remains somewhat narrow for an index near record highs, the trend is moving in the right direction, supported by a rotation toward cyclical sectors. A close above the S&P 500′s December high could pave the way for the next leg higher above the 7,000-point milestone.”

“In the short-term, I believe in Santa Claus,” said Steve Sosnick at Interactive Brokers. “I could easily see a run at 7,000 just because we’re already so close. There’s a reason ‘don’t short a dull tape’ applies.” Sosnick notes there are a lot more people who have incentive to push their holdings to a high year-end close than there are those who have any particular interest in selling before then.

“Recent sessions suggest Santa may still arrive,” wrote Ipek Ozkardeskaya, analyst at Swissquote. After that “reality may bite. Parts of the technology market probably look bubbly, and next year’s earnings season will be less about shiny numbers and more about where revenues actually come from.”

“The stock market is finally starting to eke out some gains for December after a choppy few weeks, and just in time for the market’s Santa Claus rally, which we expect to take place in its typical format via the last several trading days of the year,” said Paul Stanley at Granite Bay Wealth Management.

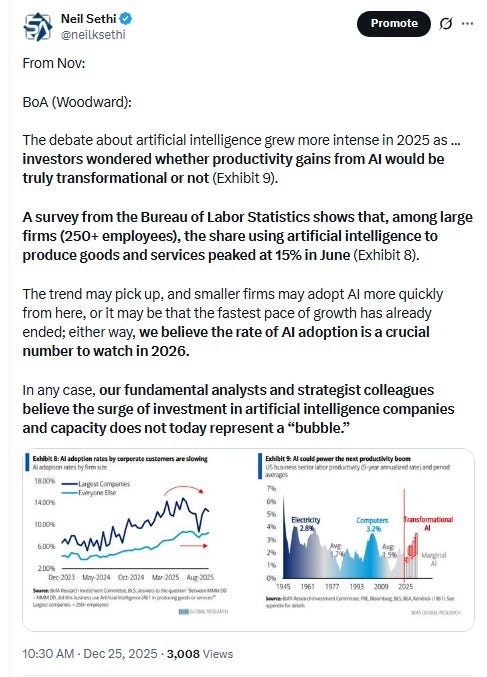

“While overall market breadth remains somewhat narrow for an index near record highs, the trend is moving in the right direction, supported by a rotation toward cyclical sectors,” Adam Turnquist at LPL Financial said. Among the risks to the market, Turnquist cites increased scrutiny over AI — given lofty expectations for earnings and spending. Inflation concerns may also resurface, he noted, reducing prospects for rate cuts, while continued labor market weakness could add to economic uncertainty.

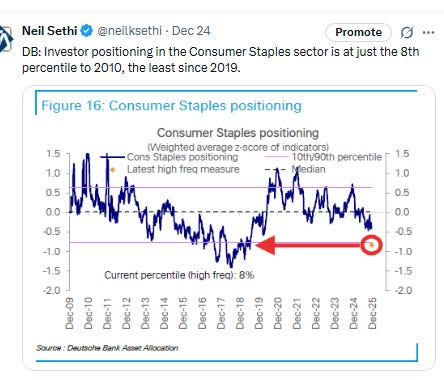

“Markets remain constructive, but selective,” said Craig Johnson at Piper Sandler. “The combination of improving breadth and easing inflation supports the call for a Santa Claus rally. Leadership continues to narrow toward AI, cyclicals, and select defensives.” Seasonal tailwinds may help, but confirmation via breadth and participation is still required, he noted.

“The sentiment or word of the day is ‘melt up,’” said Jay Hatfield, chief executive and founder of Infrastructure Capital Advisors in New York. “In our view, we had a little bit of a pullback post-earnings, and then we had a very, very bullish inflation report last Thursday.” In his view, “inflation will almost certainly go to 2%” by the end of 2026. As soon as that inflation report arrived, “we started this melt-up toward our target of 7,000 for year-end,” he said via phone. “We are having a normal ‘Santa Claus rally’ on the technicals. The fundamentals are that the outlook for inflation is extremely bullish, which means Fed cuts next year, solid economic growth and the AI boom. We have a target for 8,000” on the S&P 500 by the end of 2026, he added, and he expects three quarter-point rate cuts by the Fed — which is more than the consensus expectation for two reductions.

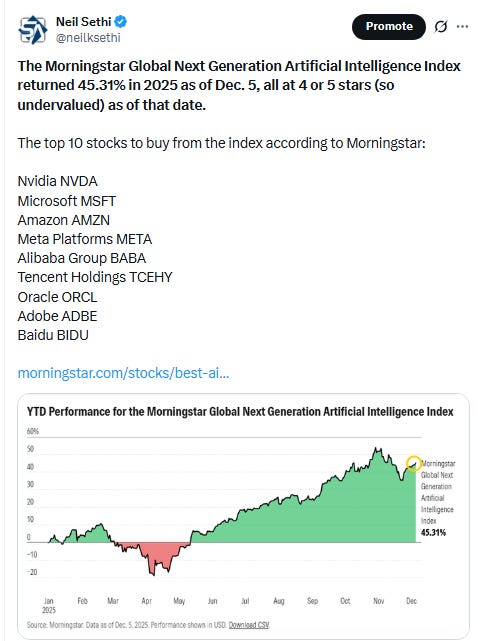

“While I’ve been talking about a broadening out (and rotation to other areas) of this AI-led rally, I also want to reiterate that keeping Magnificent Seven, mega-cap tech and AI exposure is important,” said Tom Essaye at The Sevens Report.

The point here is that while bubble concerns are valid, this AI movement hasn’t yet reached levels that are similar to other “bubble bursts,” he said.

Thomas Martin of Globalt Investments anticipates a “quiet” period through the end of the year due to lower trading volume. However, Martin believes there’s still some bias to the upside — enough for the S&P 500 to reach the 7,000 level. “Could it be up 1% or 2% before the end of the year? Sure, that’s sort of standard,” the senior portfolio manager said to CNBC, noting that the market is already at record levels. “Do I expect an eye-popping kind of rally? No, because I don’t really think we’re going to get any news that’s going to do that.”

“2025 is coming to an end with a few more positives than negatives this year,” wrote Mark Newton, head of technical strategy at Fundstrat. “While the common narrative revolves around an “AI Bubble” and tariff fears, along with volatility possibly surrounding another government shutdown and/or tariffs and inflation, U.S. stocks have largely ignored all of these fears thus far, heading into late 2025.”

“There were AI-related concerns earlier this month, but those seem to have been digested by the market,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management in Tokyo.

“People are taking profits here and there, or buying on lows, but there’s not a lot of information. You’re not getting corporate profit results. You’re not getting a lot of economic data, so it’s probably just more technicals and positioning heading into here,” said Tom Hainlin, national investment strategist at U.S. Bank Asset Management. The strategist highlighted the recent broadening that’s been taking place in the market as a trade in play for the new year, noting that the S&P 500′s rise to fresh records Wednesday wasn’t propelled by the technology sector but rather financials and industrials – two cyclical areas of the U.S. economy. “That just gives more confidence heading into 2026 that it’s not just tech here and everybody behind them. It’s the market benefiting from the tax bill that was signed in July, the rate cuts that came in the fourth quarter of this year,” he continued. “Heading into 2026, those are some tailwinds.”

“We believe investors should position for further advances in equity markets,” Ulrike Hoffmann-Burchardi at UBS Global Wealth Management said this week. “We maintain our attractive rating on US equities. We find compelling opportunities in tech, health care, utilities, as well as financials, which should broaden the foundation for further gains.”

What supports stock prices over the long term are expanding earnings, which essentially require a growing economy, according to Jose Torres at Interactive Brokers. “If the reacceleration continues as we flip the calendar, the market doesn’t need monetary policy accommodation to continue appreciating,” he said. Torres expects “sufficient fuel” from fiscal stimulus, lighter taxation, capital expenditure depreciation incentives, milder regulations, and subdued energy costs to sustain the run, amid amplified top and bottom lines.

“For now, we expect two rate cuts next year, likely in the first half, and, provided unemployment doesn’t spiral, a resilient economy, cooling inflation and easier policy should be supportive for risk assets in the year ahead,” Magdalena Ocampo at Principal Asset Management said this week.

“The Federal Reserve will likely refrain from any more rate cuts until there is a new Fed Chair mid-year,” said Clark Bellin at Bellwether Wealth. “We believe stocks can move higher during this time even without additional rate cuts from here.”

“Investors often view the Magnificent Seven stocks as a single, unified force, assuming they move in lockstep and that the broader market’s success depends on their leadership,” said Brian Levitt at Invesco. “This perception is understandable given their outsized weight in major indexes, but it oversimplifies reality.” In fact, Levitt notes that the narrative doesn’t match the numbers. Most of these megacaps are actually underperforming the S&P 500 this year — with the US equity benchmark up about 18% in the span. “Valuations in tech are high, but some Magnificent Seven names have actually underperformed the S&P 500 this year, which suggests that there is still more room to run and that not all tech stocks are trading at runaway or complacent valuations,” Stanley said.

“Even though equity markets are doing well, even though data points to a bit of a risk-on environment, I do think that, on the margins, that people want to be defensive against inflation and other risks as much as possible,” Geoff Yu, EMEA macro strategist at BNY, told Bloomberg TV. “Hence, gold is doing well.”

Jeremy Siegel, Wharton professor emeritus and WisdomTree chief economist, expects tempered gains for the S&P 500 next year, potentially ranging between 5% and 10%. “Although the S&P 500 might not do as well the last two or three years, an equal-weighted or median stock performance might do better in 2026 than we’ve seen in a long time,” he said on CNBC’s “Squawk on the Street,” adding that smaller companies are trading at valuations he considers “cheap in today’s world.”

“If the current AI-driven bull market for stocks is a ‘bubble,’ then certainly what we’ve seen in precious metals lately qualifies as well,” Bespoke said. “Ironically, many bears that call the AI trade a speculative bubble also recommend increasing exposure to gold and other precious metals.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

Nike was among the day’s winners on Wednesday, advancing 4.6% after Apple CEO Tim Cook disclosed he bought shares in the apparel maker. Micron Technology and Citigroup were other standouts, with shares up 3.8% and 1.8%, respectively, and both hitting fresh highs during the session.

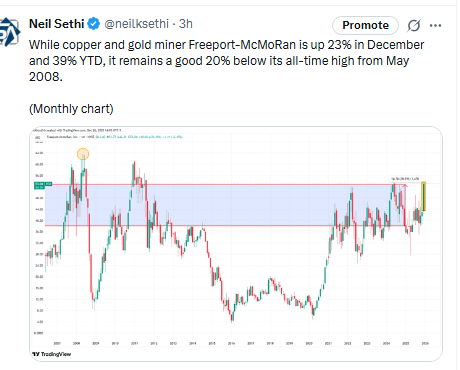

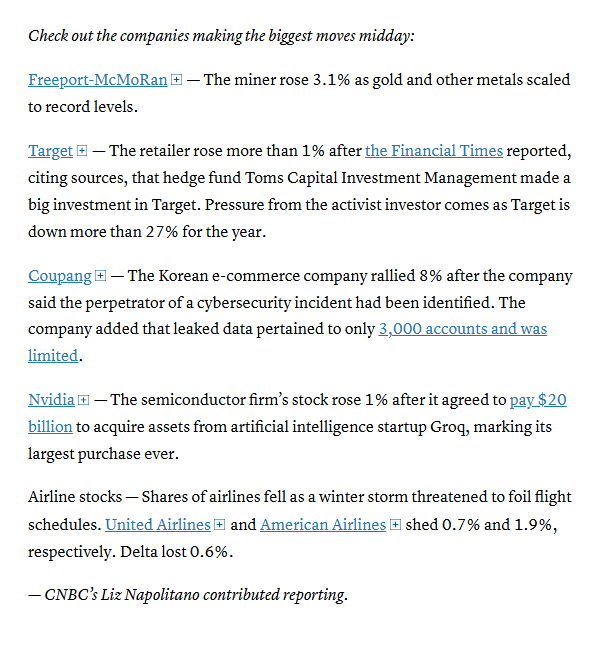

Many megacaps fell Friday, but Nvidia Corp. rose on a licensing deal with artificial-intelligence startup Groq. Freeport-McMoRan Inc. paced gains in materials producers as gold hit a record.

Corporate Highlights from BBG:

From Wed:

Nike Inc. rose after a filing showed that Apple Inc.’s Tim Cook purchased $2.95 million worth of shares on Dec. 22.

Tricolor Holdings founder Daniel Chu collected nearly $30 million in compensation in the year leading up to the subprime auto lender’s collapse amid alleged fraud, according to a lawsuit filed by the trustee overseeing the company’s liquidation.

Sanofi agreed to buy Dynavax Technologies Corp. for about $2.2 billion, as it seeks to expand a vaccines business currently anchored by its flu shot franchise.

BP Plc agreed to sell a majority stake in its Castrol lubricants division to US investment firm Stonepeak Partners, marking a key milestone as the oil and gas major seeks to reduce debt and reset its business.

KKR & Co. and PAG agreed to buy the real estate holdings of beermaker Sapporo Holdings Ltd. in one of Japan’s largest property deals this year.

Honda Motor Co. will buy out LG Energy Solution Ltd.’s facilities and other assets from their joint battery plant in Ohio for about 4.2 trillion won ($2.9 billion) as America’s pullback in electric vehicles continues to ripple across the industry’s supply chain.

Tokyo Electric Power Co. plans to restart the world’s largest nuclear power plant next month, marking the Japanese utility’s return to atomic energy nearly 15 years after the Fukushima disaster.

China’s Jiangxi Copper Co. has agreed to buy copper miner SolGold Plc in a deal that values the company at little over $1 billion.

Chinese home appliance maker Haier Smart Home Co. agreed to sell a 49% stake in its India unit to Bharti Enterprises Ltd. and Warburg Pincus.

From Fri:

Target Corp. rose after the Financial Times reported that an activist investor built up a stake in the big-box retailer, citing people it didn’t identify.

Warner Bros. Discovery Inc. slid after a report from the New York Post that Paramount Skydance could walk away from its $30-per-share cash bid and instead litigate against the company’s board for how it handled the process.

Coupang Inc. rose after the e-commerce company said it identified the former employee who allegedly accessed personal data of 33 million customers and retrieved all devices used in the data leak.

Coinbase Global Inc. Chief Executive Officer Brian Armstrong said that a former customer service agent for the largest US crypto exchange was arrested in India, months after hackers bribed customer service representatives to gain access to customer information.

Tory Bruno, the former chief executive officer and president of United Launch Alliance, will become the president of the new national security group at Blue Origin, the Jeff Bezos-founded space venture that is one of ULA’s biggest suppliers and rivals.

China Vanke Co., which just days ago got a reprieve on a local bond, has gained further breathing room after investors agreed to extend the grace period of another note, helping the embattled developer avert an imminent default once again.

A Dutch nonprofit is seeking €1.4 billion ($1.6 billion) in compensation from Tata Steel’s Netherlands units, alleging that harmful emissions from its operations have caused environmental harm and health damage to nearby residents.

Indian technology services provider Coforge Ltd. agreed to buy Encora at an enterprise value of $2.35 billion in an all-stock deal, adding artificial intelligence, data and product engineering expertise.

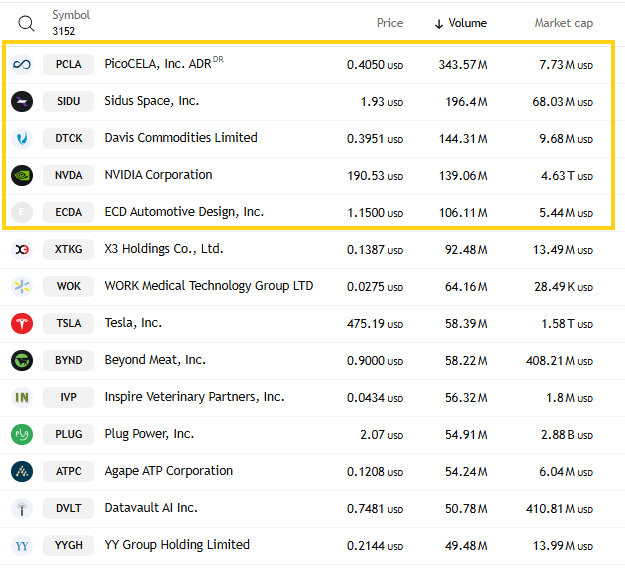

Mid-day movers from CNBC:

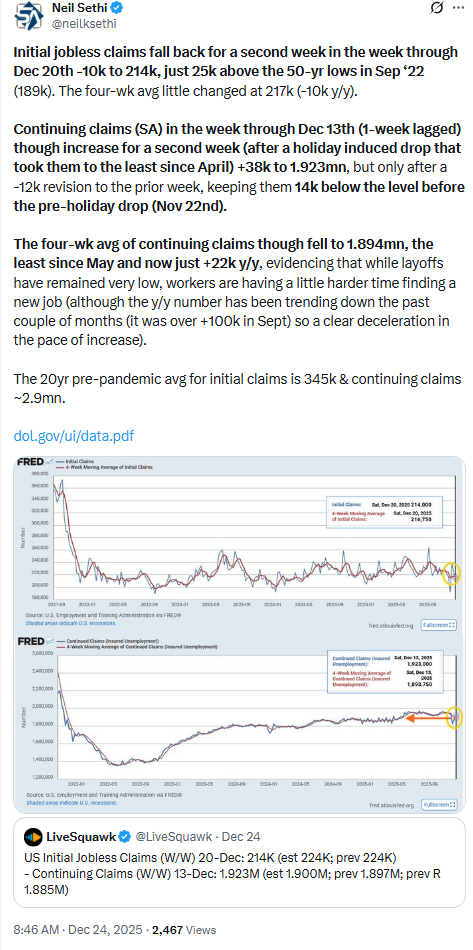

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

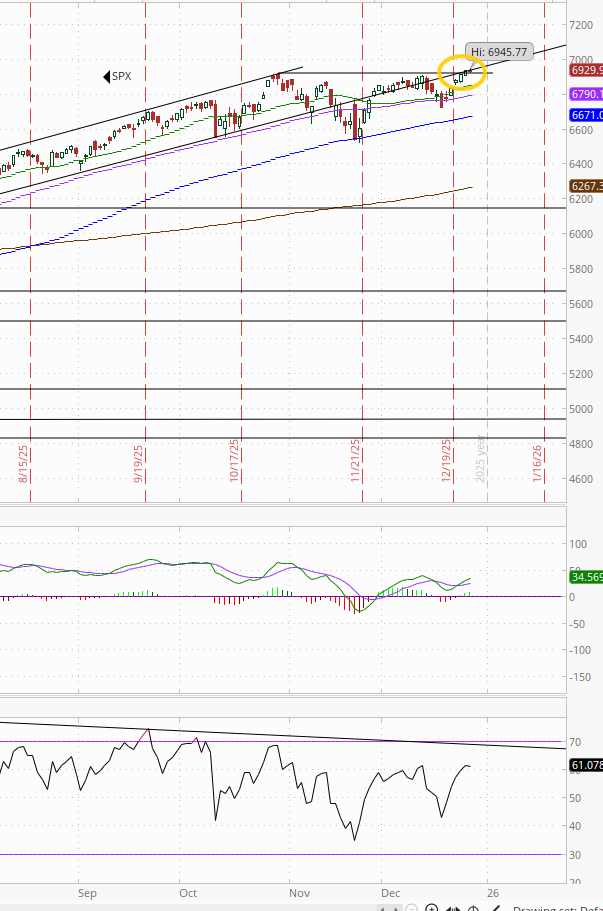

The SPX edged back from the ATH made Wed. As noted Tues the daily MACD has flipped back to “go long” positioning, while the RSI is over 50 but both with negative divergences (lower highs).

The Nasdaq Composite remains below its ATH.

As does the RUT (Russell 2000). The RUT though also has a mild “sell longs” MACD positioning and falling RSI (though remains over 50).

Weekly charts are mixed, but interestingly the RUT is the only one with a “go long” weekly MACD.

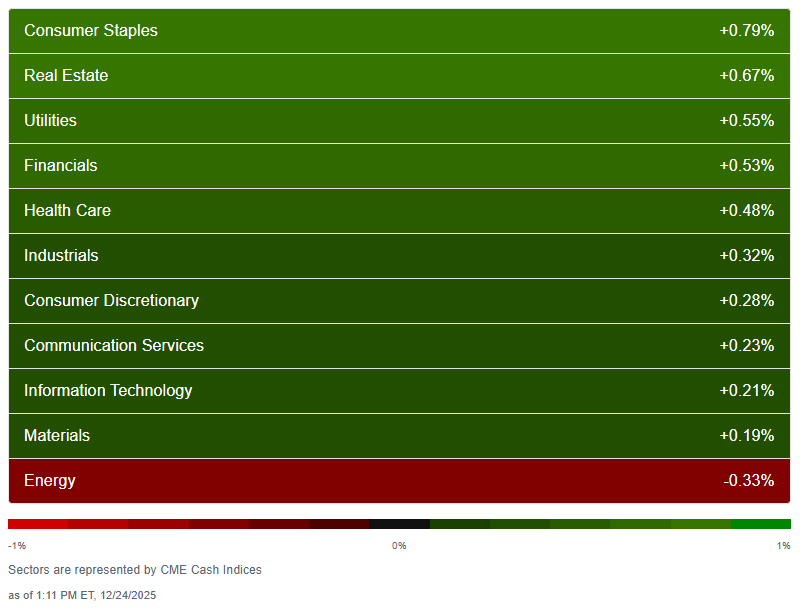

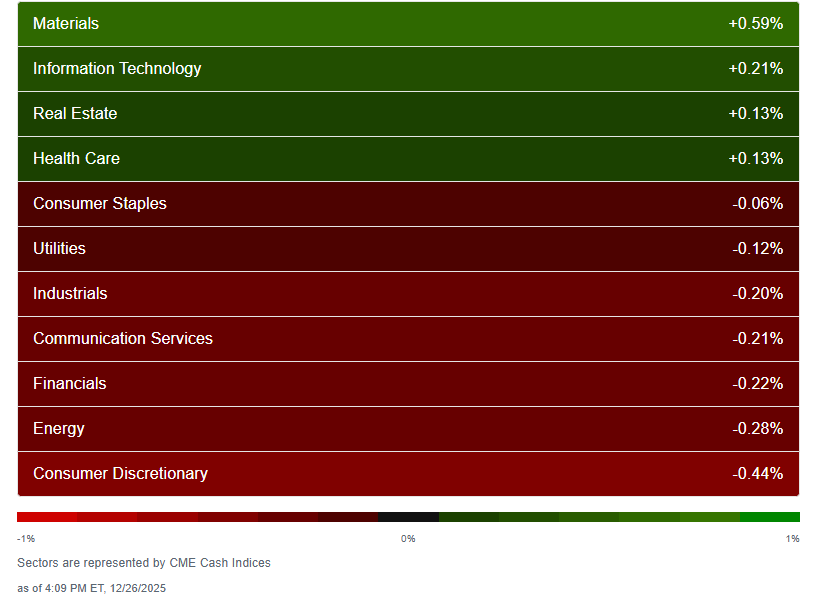

In stark contrast to the Christmas Eve session when 10 of 11 sectors were higher according to CME Cash Indices (uses futures prices) with just Energy lower (but only -0.3%) while five sectors were up more than +0.3% led by Staples +0.8% (which had finished in last place Mon/Tues) followed by RE & Utilities as bond yields fell, Friday just four sectors were higher and only one (Materials +0.6%) was up more than +0.2%. That said, no sector was down more than -0.44% (Cons Discr), so a very subdued day. Energy down again Friday.

Wed:

Fri:

SPX stock-by-stock flag from @finviz_com consistent with definitely more red than green, but not many names moving more than 1% in either direction.

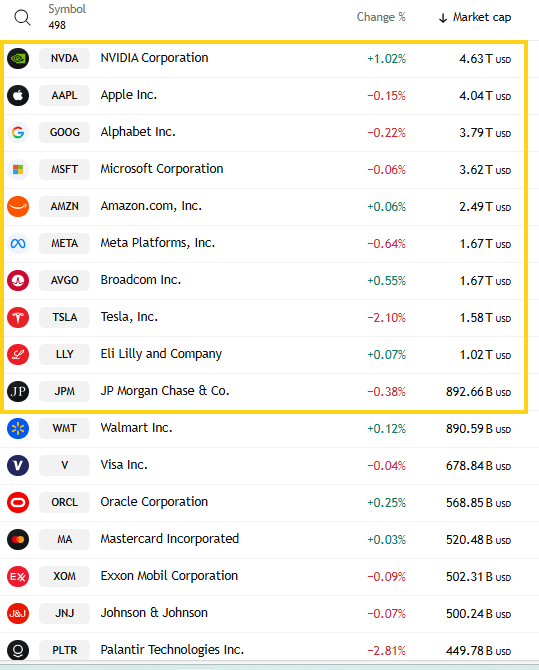

In that regard, 6 of the top 10 by market cap were lower (the most in over a week), but only two moved more than 1%. To the downside was TSLA -2.1%, while to the upside it was NVDA +1%. Mag-7 was -0.3% but finished up for the 4th week in the last 5 +1.3%.

Just one SPX components was up 3% or more, tied for the least since I started doing this early summer (last time Nov 17th), in Target TGT +3.1%. So a second session in three the biggest gainer on the SPX was up +3.1%. And also no >$100bn in market cap up 3% or more (closest was UNH +1.3%).

But we also had just one SPX component down -3% or more (we have had zero a couple of times) in Moderna MRNA -4.7% (also the largest decliner on Tues -7.5%). So for a fourth session no >$100bn in market cap down -3% or more. The closest was PLTR -2.8%.

With the caveat it was a half session, the participation was very good Wed with NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) jumping to 65.7% with just an index gain of +0.35%. Compare that to Friday when it was 53.2% with a +0.53% gain.

On Friday it was more middling coming in at 50.7% although the index gain also fell back to +0.08%. While just above 50% it is still much better than similar small index gains over the past couple of weeks. On Tuesday, for example, it was just 42.0% on an index gain of +0.18%.

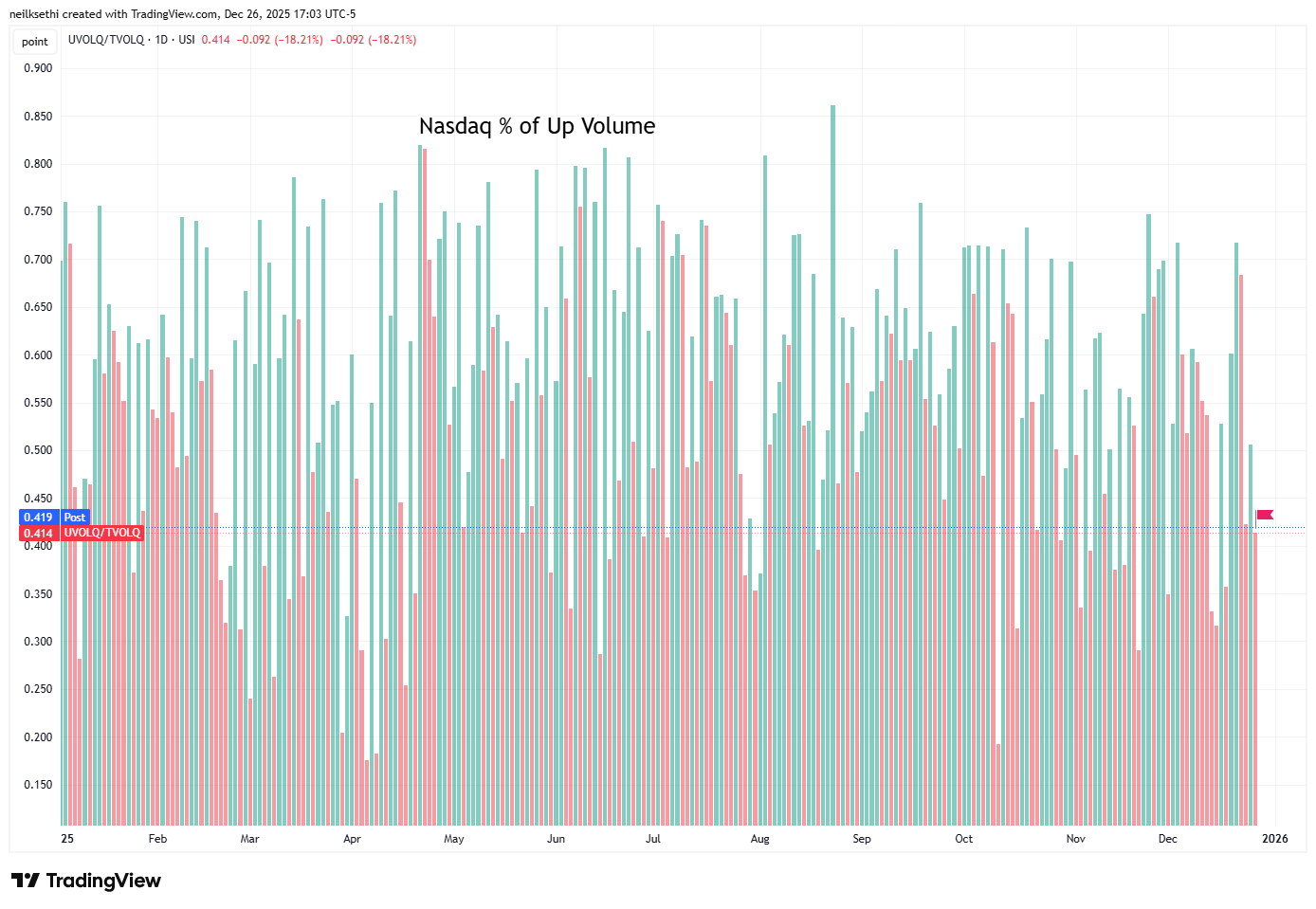

Nasdaq positive volume (% of total volume that was in advancing stocks) was not as strong Wed coming in at 50.6% on the index gain of +0.22%, an improvement though from Tues’s very weak showing.

Friday it fell back through to 41.4% on an -0.09% decline in the index. While better than Tues, not as strong as what we were seeing a couple of weeks ago.

But in part that is due to lower speculative volumes than what we were seeing a couple of weeks ago when the top three collectively were trading over 1bn shares traded regularly (which we did see Tues and a week ago). Friday though they were ~700mn and again just 5 companies with over 100mn shares traded.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks in line on both exchanges with the Nasdaq at 41.5% while the NYSE was 49.3%.

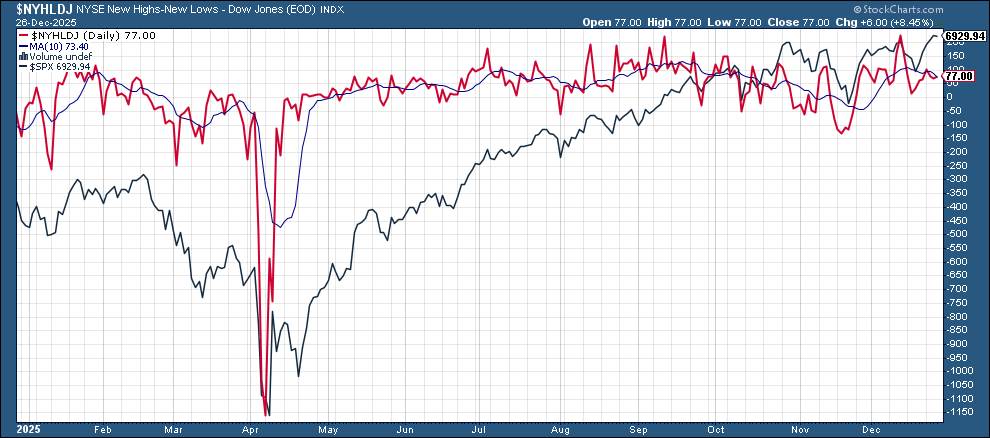

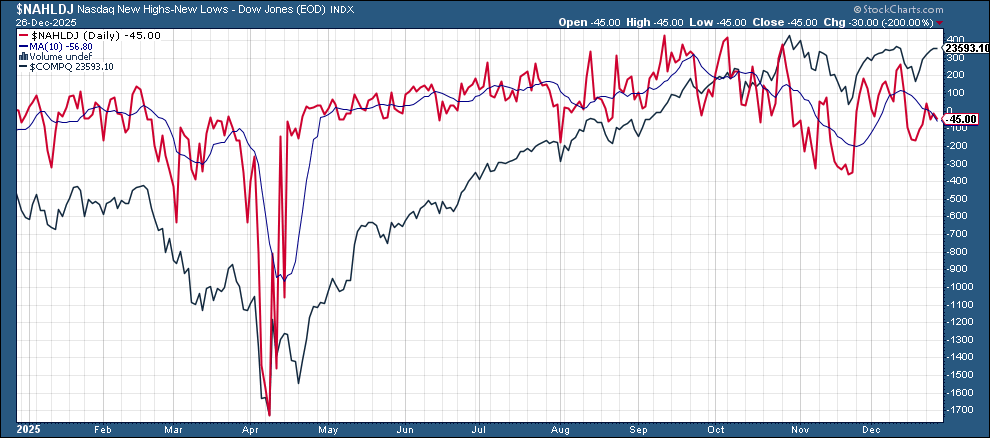

New 52-wk highs minus new 52-wk lows (red lines) back to where they were Tuesday at 77 on the NYSE, and -45 on the Nasdaq, well under recent highs.

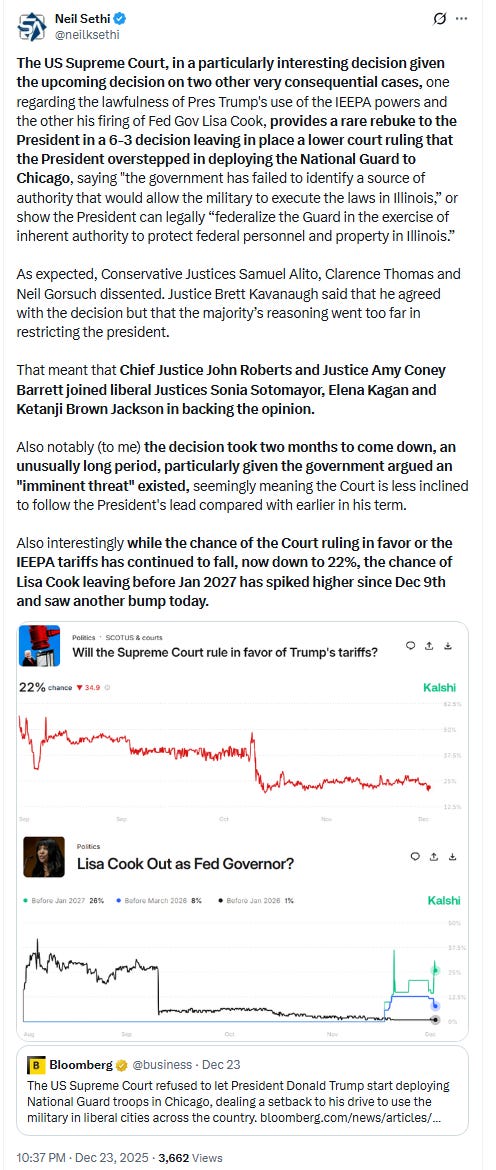

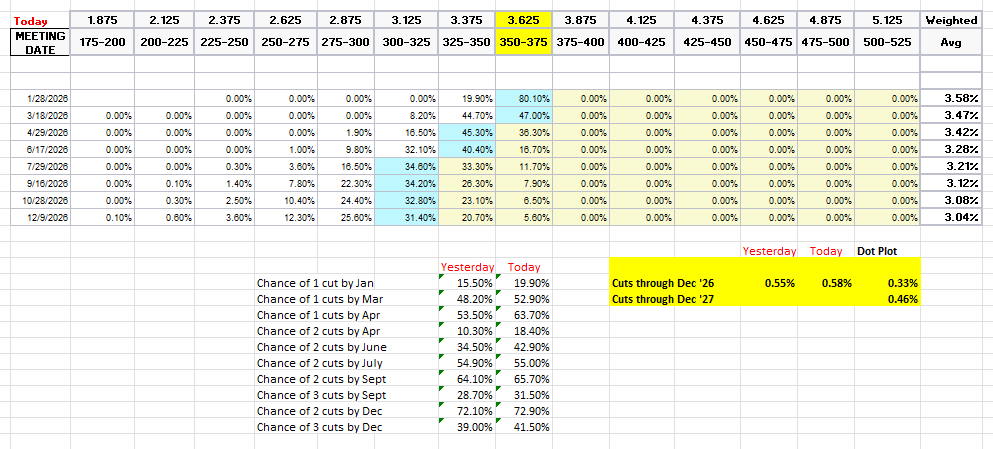

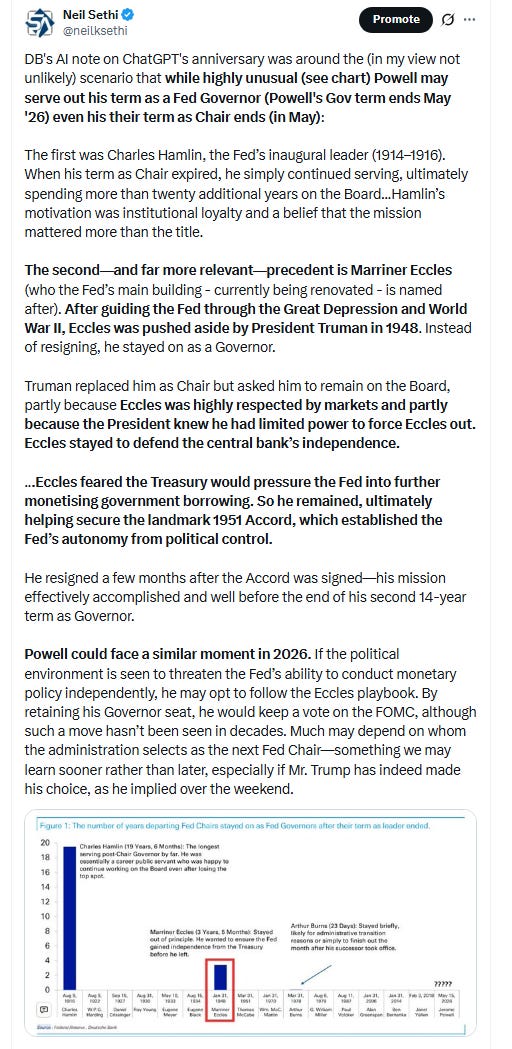

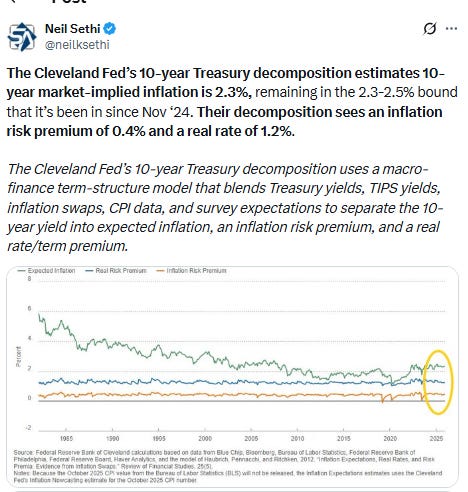

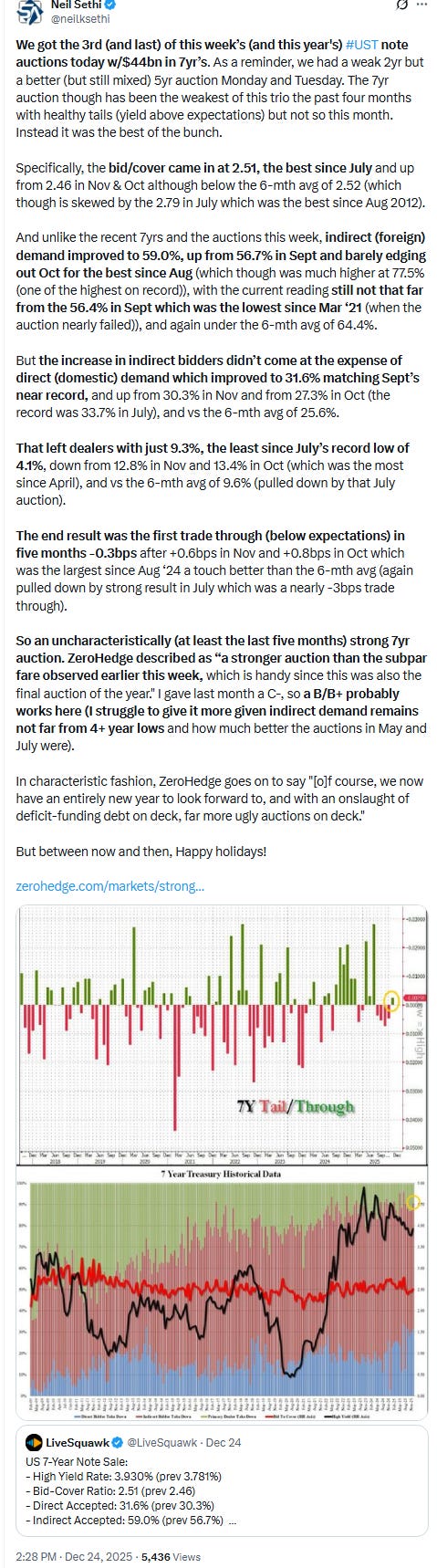

As noted at the top, #FOMC rate cut pricing from the CME’s Fedwatch tool edged higher after falling Tues to the least since before the Dec FOMC. A cut in Jan remains low at 20% (up from 13%), a cut by March 53% (from 47%). A second cut is now back in July at 55%.

Pricing for 2026 overall moved +4bps from Tuesday to 58bps, with pricing for two cuts 73% (from 69%) and three cuts 42% (from 36%) but down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as reminder has just 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

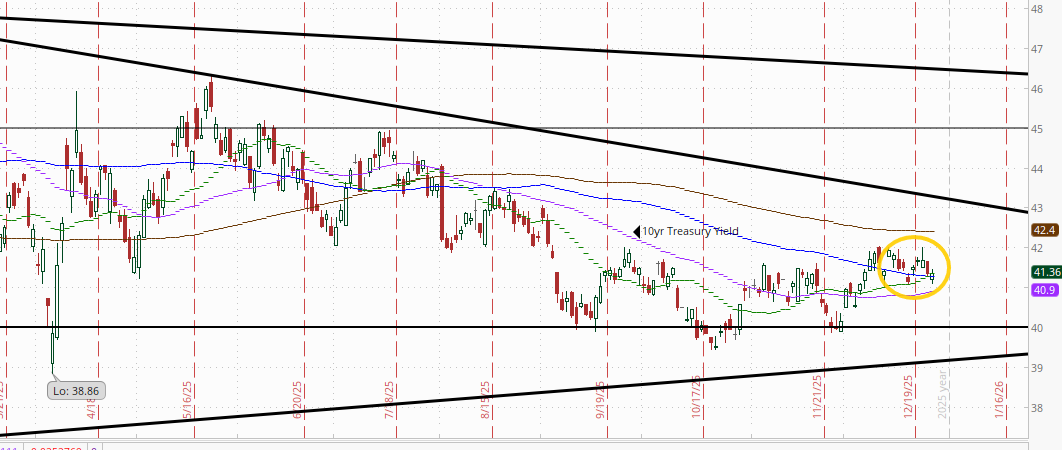

The 10yr #UST yield a little lower than the Tues report now at 4.14%. Still in its range over the past three weeks.

The 2yr yield, more sensitive to FOMC rate cut pricing, a little further below Tuesday’s levels at 3.48%. It remains in the channel it’s been in since the start of 2024, but just 6bps above the least since 2022 and 15bps below the Fed Funds midpoint. Outside of recessions it is normally above by around 50bps on average, so still calling for a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) edged off the lowest close since Oct 3rd on Tuesday but remains in its short-term downtrend from the Nov peak. The daily MACD and RSI remain negative with the former in “go short” territory as noted three weeks ago, while the RSI is below 40.

Weekly chart remains mixed.

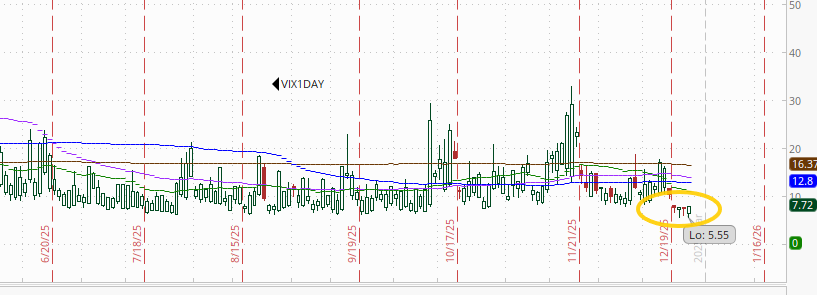

VIX little changed remaining near 52-week lows at 13.6. The current level is consistent w/~0.86% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also little changed at 84.2 a little above the 81.7 from Mon which was the least since July ‘24 (before the carry trade blow-up). The current level remains consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

Like the VIX and VVIX the 1-Day VIX remains near the lows of the year at 7.7. The current reading implies a ~0.49% move in the SPX next session.

#WTI futures predictably fell back from the resistance they have struggled with since the start of Oct (50-DMA and downtrend line from the July highs). Like several previous times the daily MACD crossing to “cover shorts” and the RSI moving over 50 weren’t enough to push it through.

Weekly chart continues to look precarious.

The unstoppable run of gold futures (/GC) continues with another ATH. Daily MACD as noted last week remains in “go long” positioning, but the RSI is now over 80 so starting to get quite extended (but not yet as extended as in Oct)

I asked Tuesday “Do we have a change in trend? US copper futures (/HG) again closed higher but this time just over the old support line from the start of the year that has capped their advance the last couple of months.”

And it does appear that was the case as copper futures have continued that advance shooting up +5% Fri (their best day since the July tariff scare) and closing in on ATHs. As noted four weeks ago the daily MACD is in “go long” positioning, and RSI has shot above above 70 to levels similar to that July spike. Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Weekly chart - All-time weekly closing high.

Natgas futures (/NG) remained volatile getting back Wed’s -4% loss which followed a +10% gain Tues, the largest one-day gain since Oct 30th (when it rolled contract months), on colder weather model updates.

The daily MACD remains in ‘sell longs’ positioning (but close to turning more positive), but the gain shot the RSI back up over 50.

Bitcoin futures remain trapped between the $85k level on the downside and $90k resistance (now for two weeks). The daily MACD remains “go long” positioning, but the RSI is still under 50.

Weekly chart remains uninspiring.

The Week Ahead

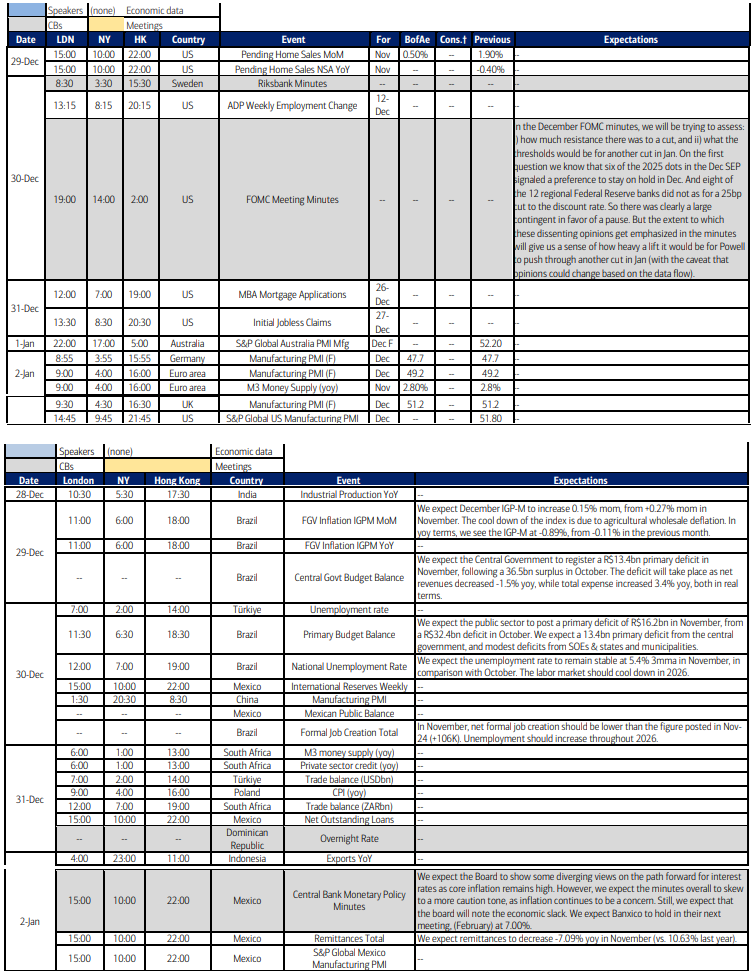

Next week will be another very light week (although we will have an extra half-session as New Year’s Eve is a full trading day (as is Jan 2nd)). New Year’s Day of course is a full global holiday.

In US economic reports we’ll just get Dec manufacturing PMI from S&P Global (Fri, not listed; ISM though will be Jan 5th), Nov pending home sales, Oct repeat home price indices plus weekly jobless claims (Wed due to the holiday), ADP employment change, mortgage applications, and EIA petroleum inventories.

No Fed speakers on the calendar, but there could be media interviews. More importantly, we’ll get the FOMC minutes from the Dec meeting which may shed some more light on where the committee’s collective mind is around the expected path for rates in 2026.

Non-Bill Treasury auctions (>1yr in duration) are done for the year.

As are SPX earnings (done for the year).

Ex-US it looks like the highlight are the final Dec manufacturing PMIs, but I’ll have a more complete update Sunday.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,