Markets Update - 12/27/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

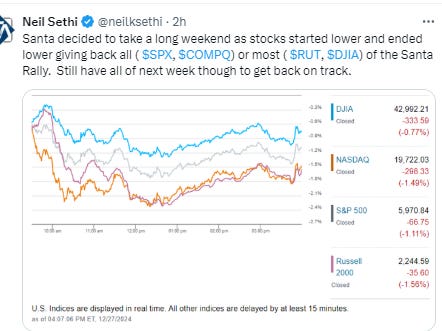

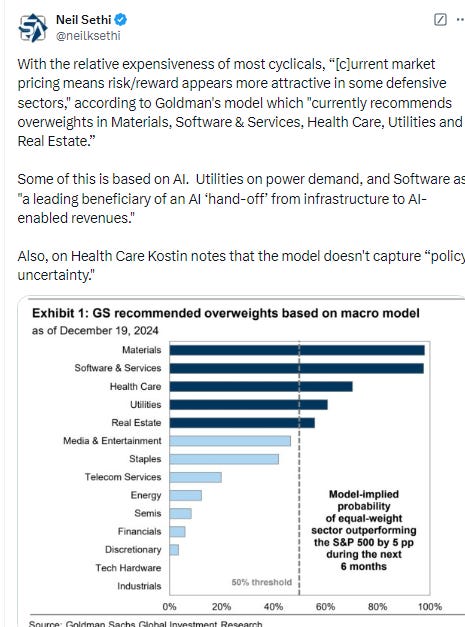

Santa decided to take Friday off as US equities started lower and ended lower, giving back most (for small caps and the Dow) to all (for the S&P 500 and Nasdaq) of their Santa period gains (since Tuesday’s open) on a broad based decline led by growth stocks, but every sector ended in the red today. Still the major indices registered gains for the week with the SPX +0.7% and the Nasdaq +0.8%.

Not helping was another move higher in longer duration bond yields with the 10 & 30yr yields moving to the highest closes since May & April respectively. The dollar was little changed for a 3rd day, while commodities were mixed with crude and nat gas advancing (although the latter only after a contract roll that dropped the price -11%), but gold and bitcoin moving lower. Copper was little changed.

The market-cap weighted S&P 500 was -1.1%, the equal weighted S&P 500 index (SPXEW) -0.7%, Nasdaq Composite -1.5% (and the top 100 Nasdaq stocks (NDX) -1.4%), the SOX semiconductor index -1.0%, and the Russell 2000 -1.6%.

Morningstar style box showed the broad decline led by growth styles.

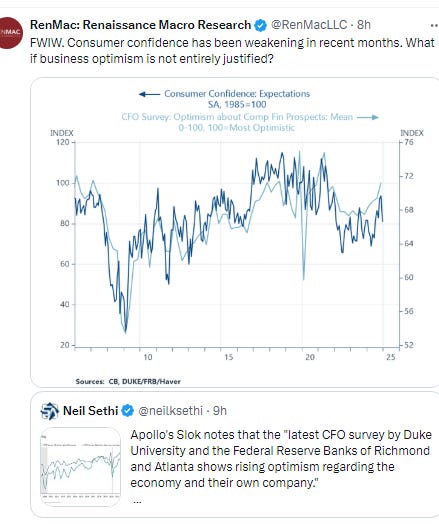

Market commentary:

“The most important move in this year-end is the rise of the US 10-year bond; this shows how much everybody is waiting for Trump’s inauguration and its impact on inflation,” said David Kruk, head of trading at La Financiere de L’Echiquier in Paris. “Other than that, most of the trades are technical ones, short-covering and profit taking but there’s no big trend going on as is typical during this time of the year.”

“The nation is experiencing a collective sigh of relief after navigating through a contentious election cycle and unusual market dynamics to end 2024 with strong year-to-date gains,” said Todd Ahlsten, chief investment officer at Parnassus Investments. “Looking ahead to 2025, the markets are expected to broaden and improve.”

“I think what you’re seeing today is a lack of faith,” Alan Rechtschaffen, UBS Global Wealth senior portfolio, said on CNBC’s “Market Movers.” “I think there’s a lot of noise about tariffs, there’s a lot of concern about productivity.”

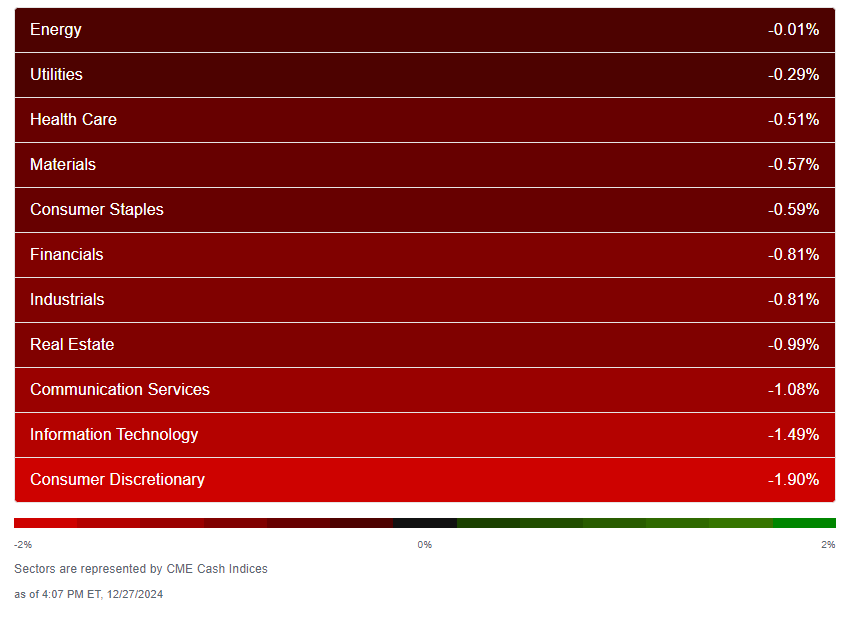

In individual stock action, declines in many mega caps were influential in the overall market performance, leading the heavily-weighted consumer discretionary (-1.9%), information technology (-1.5%), and communication services (-1.1%) sectors to close at the bottom of the pack. NVIDIA (NVDA 137.09, -2.84, -2.0%), Apple (AAPL 255.65, -3.37, -1.3%), Amazon.com (AMZN 223.79, -3.26, -1.4%), and Alphabet (GOOG 194.07, -3.03, -1.5%) were among the standouts in that regard.

Some tickers making moves at mid-day from CNBC.

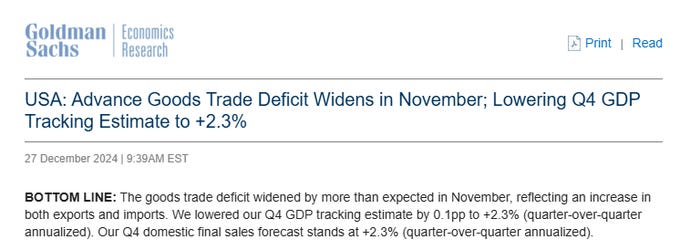

In US economic data we just got preliminary Nov inventories, which came in light, leading to some downgrades to 4Q GDP estimates as did a wider than expected goods trade deficit.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX was able to bounce at its 50-DMA, but that “moderate resistance” as I called it Tuesday has now become a bit more strong. The daily MACD remains weak and the RSI is back under 50.

The Nasdaq Composite for its part just held its 20-DMA and uptrend channel. Its daily MACD still remains weak, but its RSI remains over 50.

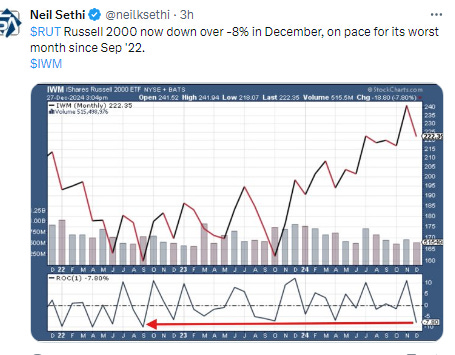

RUT (Russell 2000) which I noted Tuesday was “set up for a potential run to at least test the 2290 breakout level,” fell back to around its 100-DMA. Daily MACD & RSI remain weak.

Equity sector breadth from CME Indices was ugly. Every sector in the red with 9 of 11 down at least a half percent, four down -1% or more. Megacap growth sectors got the worst of it, taking the bottom 3 spots.

Stock-by-stock $SPX chart from Finviz consistent with very little green, and what there was not up by much. Need to add some of those quantum computing stocks. Bad day for TSLA -5%.

Positive volume (the percent of volume traded in stocks that were up for the day) broke its streak of solid days at just 22% on the NYSE, under 50% for the 1st time in 5 days, while Nasdaq was a strong 51%, an excellent result given the index was down over -1%, the 5th consecutive day over 50%. Positive issues (percent of stocks trading higher for the day) were not so good though at 18 and 26% (and interestingly according to the tweet below it’s the 1st time NYSE advancers have been under 20% in the last 3 sessions of a year) .

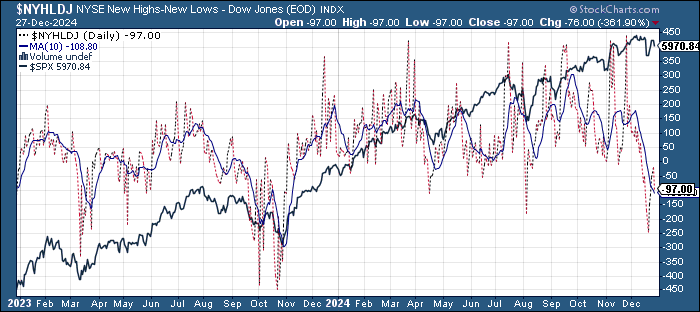

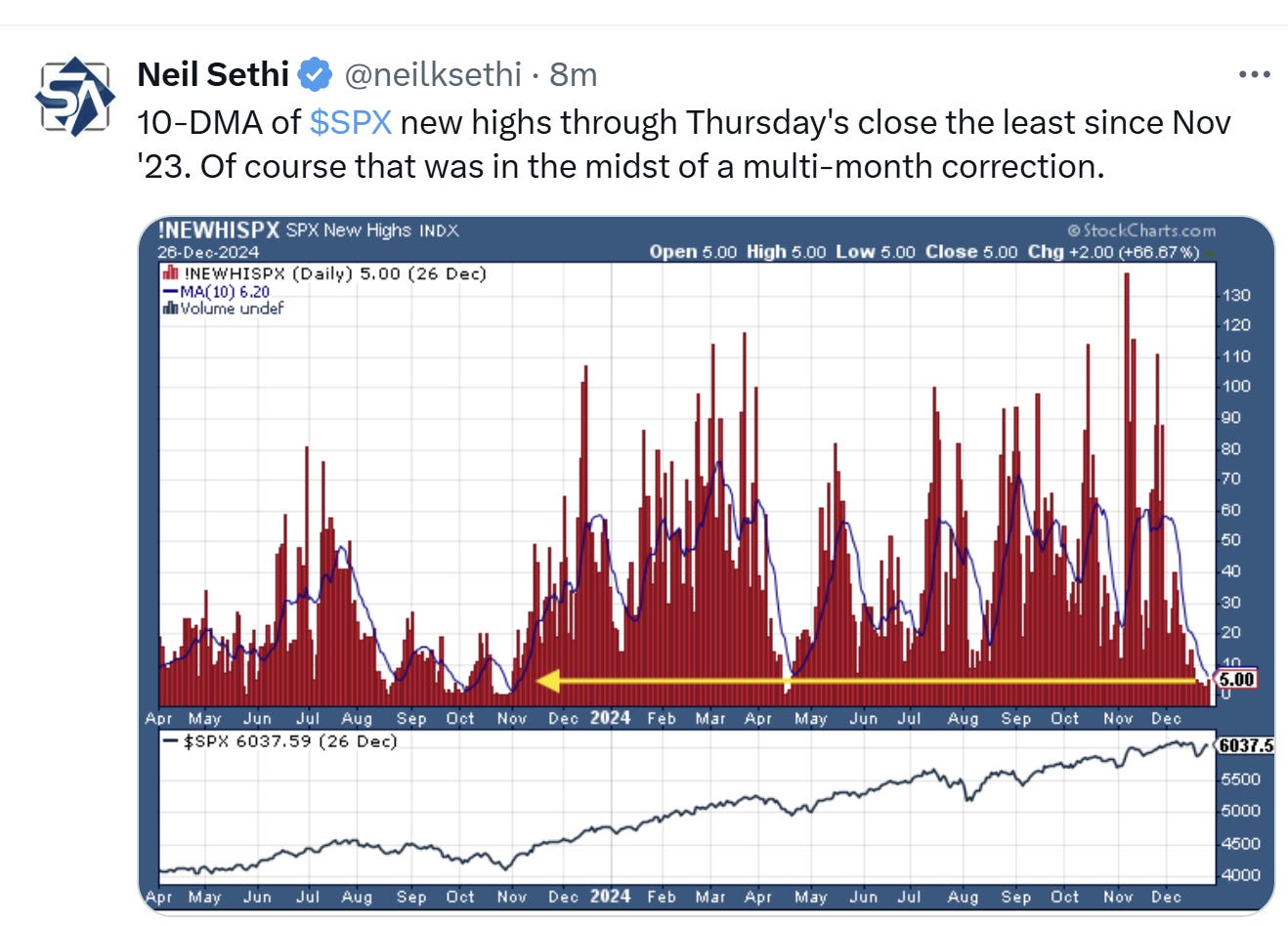

New highs-new lows deteriorated particularly on the NYSE falling to -97 from -21 (but still up from -245 a week ago (which was the weakest since Aug and 2nd weakest since Oct ‘23)), while the Nasdaq fell to +3 from +7 (well above the -297 last Thurs, the least since Aug (& 2nd least since April)). The NYSE fell back to its 10-DMA which continues to head lower (more bearish) the least since Nov ‘23, but Nasdaq remains above, and its 10-DA (the least since Aug) is starting to turn.

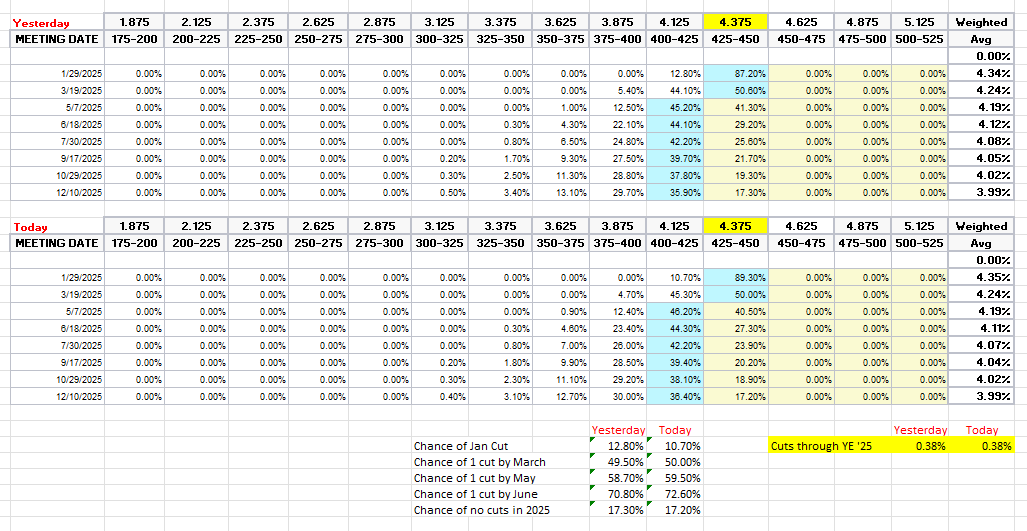

FOMC rate cut probabilities from CME’s #Fedwatch tool were little changed Friday. Overall 2025 cut expectations remained 38bps (around a 50/50 chance for two cuts, fewer than the dot plot which has a full two). The one cut was 50/50 for March. Chance of no cuts at 17%.

Previous note: This overall still seems quite aggressive to me, and I continue to expect at least two cuts, but I guess you never know, and we do have that pesky residual seasonality in 1Q inflation (inflation has tended to increase in 1Q the past few years) that may see the first cut pushed off to the summer (although it also means there are more favorable “base effects” in terms of y/y compares which will flatter the y/y numbers if inflation doesn’t spike as it has in the past).

Treasury yields edged higher at the long end with the 10yr up +4bps at 4.62%, highest close since May, +23bps since the Dec FOMC meeting (& +86bps from the Sept FOMC meeting), as I’ve said the past week “still eyeing the 4.7% level.” The 2yr yield, more sensitive to Fed policy, was unchanged at 4.33%.

Dollar ($DXY) little changed Friday but still managed a slight gain for the week, bringing its streak to 12 of the last 13. It remains just below last week’s near 2-yr highs. Daily MACD and RSI tilt positive.

The VIX moved higher to 15.9 (consistent w/0.99% daily moves over the next 30 days), after falling under 16 for the 1st time post-FOMC on Tuesday, and the VVIX (VIX of the VIX) was up to 98 but remaining under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderate” volatility and daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX jumped to 13.7 Friday, after seeing the lowest close since before the Dec FOMC meeting on Tuesday, looking for a move of 0.86% Monday.

WTI continued to move back and forth Friday gaining back Thursday’s -1% and remaining in the middle of its range since mid-Aug. Daily MACD & RSI still tilt positive. As I’ve said the past 2+ weeks, “it needs to get over the 100-DMA which seems to have become resistance since August, then the $72.50 level.”

Gold gave back Thursday’s gain Friday taking it back to its 100-DMA/uptrend line from Feb, still under resistance of the 20 & 50-DMAs. Its MACD and RSI remain negative for now as noted the past week.

Copper (/HG) little changed Friday after its best day of the week Thursday pushing back over the the support turned resistance in the form of the uptrend line running back to Oct ‘23. Its RSI and MACD are negative but improving.

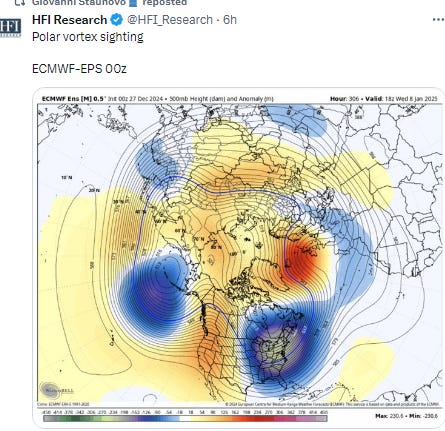

Nat gas (/NG) dropped back Friday but mostly on its roll to the Feb contract which saw it drop -11%. From there it did gain +2.7% on the day despite a smaller than expected storage draw (helped by some potentially colder weather coming). Overall though it’s back under the $3.65 breakout level. Daily MACD and RSI don’t respect the fact it was a roll so those continue to turn less positive.

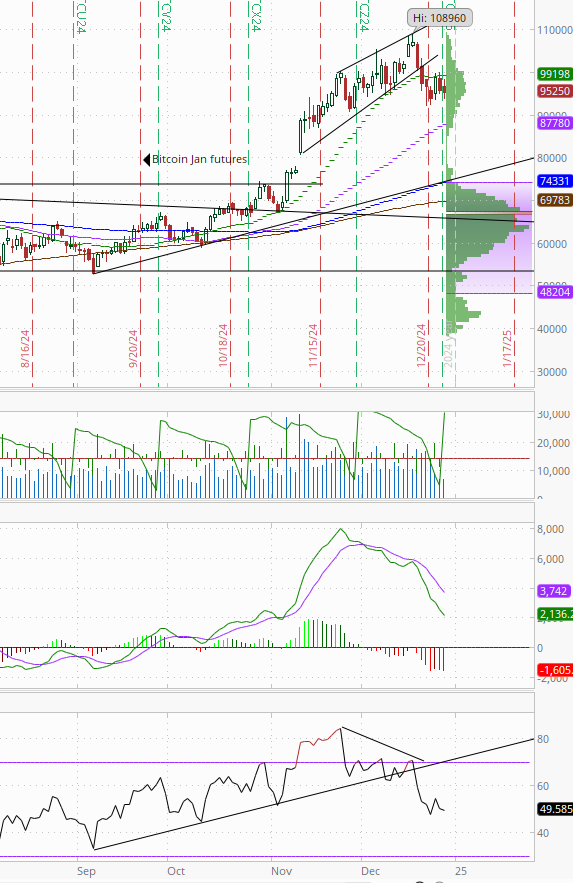

Bitcoin futures edged lower, overall remaining in the trading range of the past week just under its 20-DMA. The daily MACD remains very weak, but the RSI is stabilizing from the weakest since mid-October.

The Day Ahead

Enjoy the weekend! More on Sunday.

ChatGTP made a snowy picture, but where I am (Columbus, OH) it’s going to be 20 degrees above normal. But I liked the picture so I went with it.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,