Markets Update - 12/30/25

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

NOTE: NO UPDATE TOMORROW BUT WILL HAVE ONE FRIDAY. HAVE A SAFE AND HAPPY NEW YEAR’S CELEBRATION.

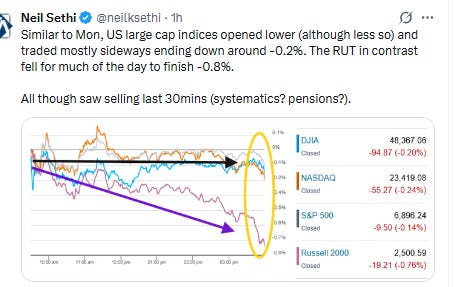

US equity indices opened little changed as they continued to struggle to find their post-Christmas footing. Silver and gold though saw a rebound after Monday’s big selloff although gold ending up returning to flat levels. Similar to Monday, US large cap indices traded mostly sideways from the open ending down around -0.2%, while the RUT fell for much of the day to finish -0.8%, all down for a third session. All also selling in the last 30 minutes which could have been pension fund rebalancing, systematic traders, or likely some combination.

Elsewhere, bond yields were little changed, while the dollar edged higher. Commodities were mixed with silver and copper bouncing back, but gold, crude, natgas, and bitcoin all little changed.

The market-cap weighted S&P 500 (SPX) was -0.2%, the equal weighted S&P 500 index (SPXEW) -0.2%, Nasdaq Composite -0.2% (and the top 100 Nasdaq stocks (NDX) -0.25%), the SOXX semiconductor index -0.1%, and the Russell 2000 (RUT) -0.8%.

Morningstar style box again showed broad losses led by growth and small cap styles (mid-cap value edged out a tiny gain).

Market commentary:

“The overriding theme is that global stock indices have lost momentum into year-end,” wrote Kathleen Brooks, research director at XTB. “There are plenty of reasons for this, including decent returns for 2025, and investors waiting to make big trading decisions until after the Christmas break.”

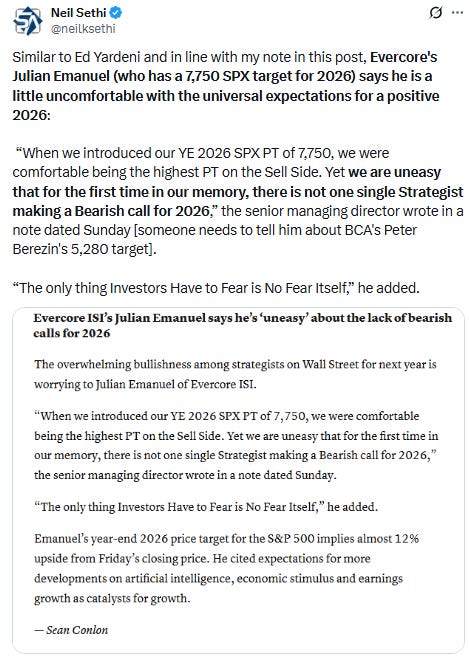

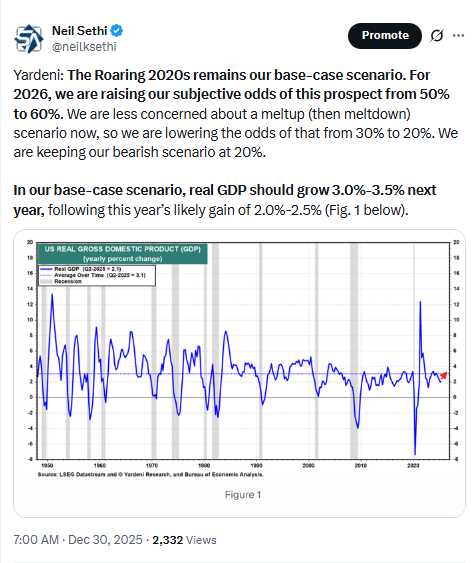

“The 2026 consensus for the S&P 500 is overwhelmingly bullish. Looking at 2018 offers some comparisons on what could send stocks lower. Next year brings mid-term elections, which tend to be negative for US stocks as campaign politics dominate policy advances. The S&P 500 dropped 6.2% in 2018, Trump’s last mid-term election year. And while the Fed is highly unlikely to tighten policy in 2026, any disappointment in rate cut expectations would, all other things equal, weigh on valuations.” Adam Linton, BBG macro strategist.

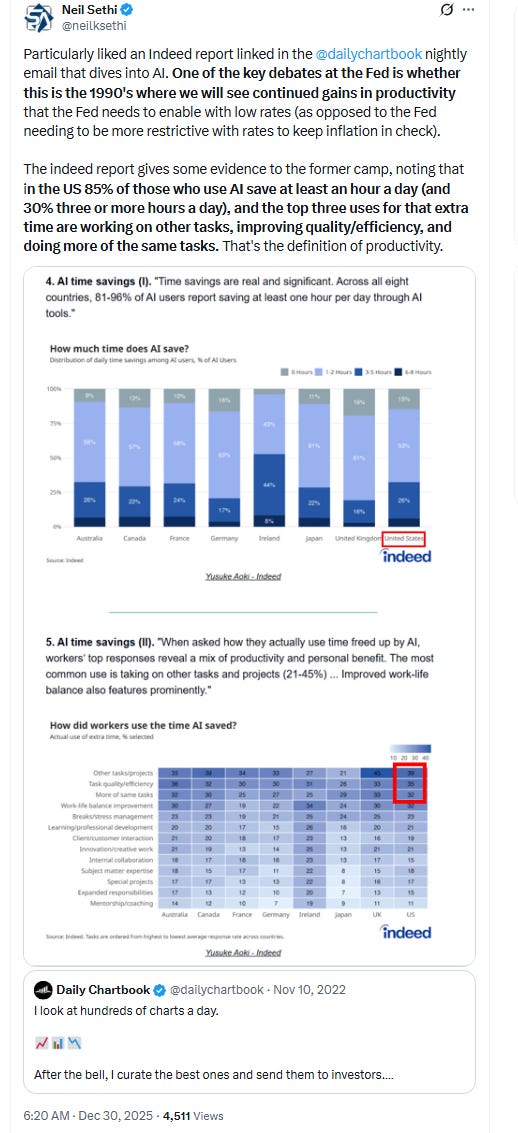

Gains in AI should be poised to continue in the new year, according to Bill Northey of U.S. Bank Asset Management, who cited the fundamentals underlying the technology and data center buildout. “The clear early beneficiaries to this have been more the picks-and-shovels components, where we’re looking at semiconductors and the main primary feed stocks into the buildout,” he said. “We believe that as we move into 2026, it may actually be more the beneficiaries of the application of artificial intelligence who begin to see some of those productivity gains and see corporate earnings acceleration.”

“We do believe that there is some opportunity for broadening that exists in 2026 where we have had some relatively narrow leadership through the course of this year,” he added.

“Traders continue to lean closer toward favoring two cuts next year, instead of the three they priced earlier in December. Despite Fed policymakers’ focus on labor market risks, traders are likely awaiting delayed data to corroborate those concerns.” — Kristine Aquino, Managing Editor, Markets Live.

To keep pushing higher next year, the equity market needs a dovish Fed, Amanda Agati, PNC Asset Management Group’s chief investment officer said on Bloomberg Television on Tuesday. “I joke that the equity market is like a kid in a candy store, braving a sugar high for more policy accommodation, a more dovish Fed — but it doesn’t know what’s good for it,” she said. “The bond market is the adult in the room taking away the last lollipop. It is maybe the first time in observable market history that we’re seeing the market react to the deficit and debt level concern. I think there’s continued upward pressure on long yields, for sure.”

“I think a firing of a Fed chair in the new year is not something that the market is priced for, but to the extent that we stay a little more dovish and don’t start talking about moving in the opposite direction, the market can probably work through the noise,” Agati said.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

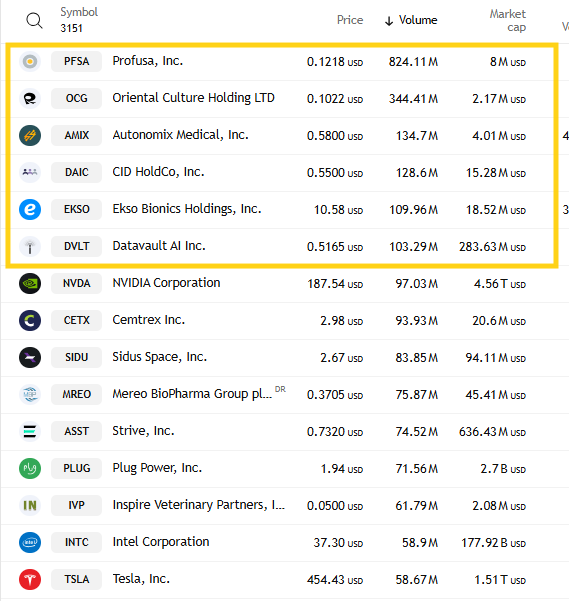

Nvidia posted back-to-back losing sessions, as did fellow AI play Palantir Technologies.

Corporate Highlights from BBG:

Warner Bros. Discovery Inc. plans to once again reject a takeover bid from Paramount Skydance Corp. after the rival media company amended the terms of its offer, according to people familiar with the company’s thinking.

Tesla Inc. took the unusual step of publishing a series of sales estimates indicating the outlook for its vehicle deliveries may be lower than many investors were expecting.

Goldman Sachs Group Inc. is co-leading financing for a Texas project to build private power campuses for artificial intelligence.

Meta Platforms Inc. has agreed to buy Manus, a popular Singapore-based artificial intelligence agent with Chinese roots, in its effort to build a business around its massive AI investment.

Elon Musk’s xAI is planning an expansion of its massive data center complex in Memphis, and has purchased a third building in the area that will bring the company’s artificial intelligence computing capacity to almost 2 gigawatts, the billionaire wrote Tuesday in a post on X.

Ultragenyx Pharmaceutical shares rebounded after the shares hit a record low Monday on study failure. Jefferies analysts say the stock could rebound in 2026 ahead of a late-stage data update.

Consumers using Walmart Inc.’s online services experienced outages earlier Tuesday, leaving them unable to access the retailer’s mobile ordering tools.

Pop Mart International Group Ltd. shares tumbled after media reports of waning reseller demand for its Labubu toys dented investor sentiment.

Citigroup Inc. said it expects to post a roughly $1.1 billion after-tax loss on the sale of its remaining business in Russia to Renaissance Capital.

Artificial intelligence drug discovery startup Insilico Medicine Cayman TopCo jumped 25% in its Hong Kong trading debut on Tuesday, capping a year of investor frenzy over China’s biotech and AI boom.

Mid-day movers from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

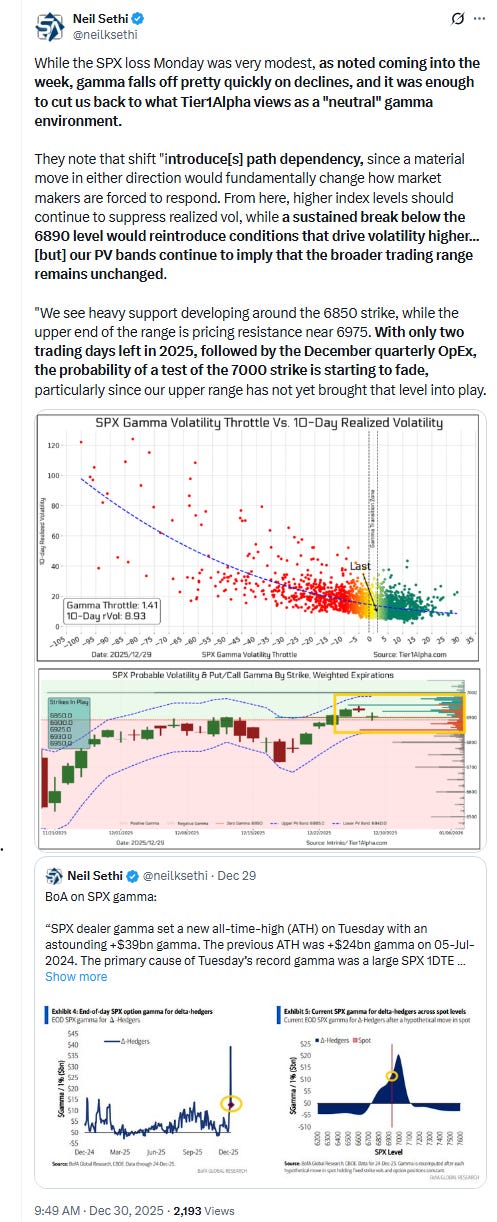

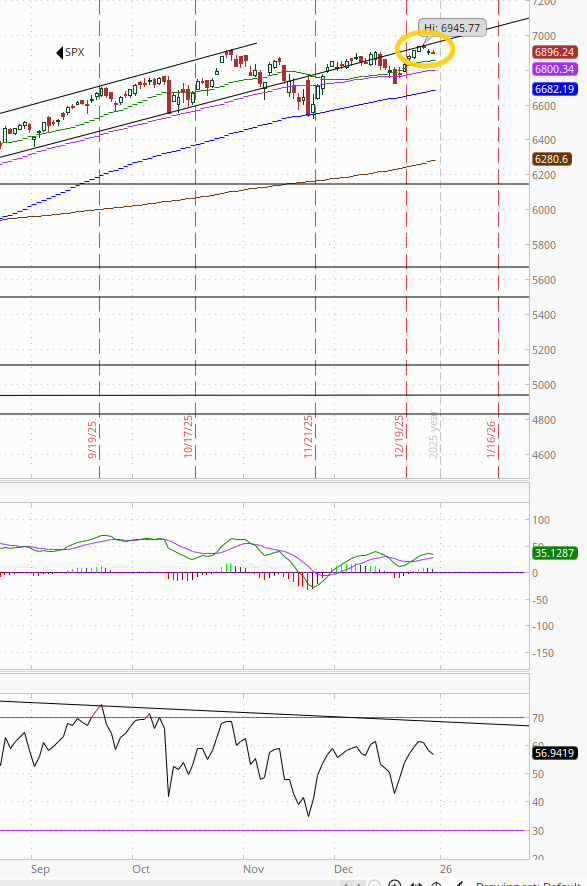

The SPX remains just under the ATH made Wed. As noted Tues the daily MACD has flipped back to “go long” positioning, while the RSI is over 50 but both with negative divergences (lower highs).

The Nasdaq Composite held its 20-DMA just above the 50-DMA.

RUT (Russell 2000) continued its decline to a nearly 2-week low. It also has a mild “sell longs” MACD positioning and falling RSI (now under 50).

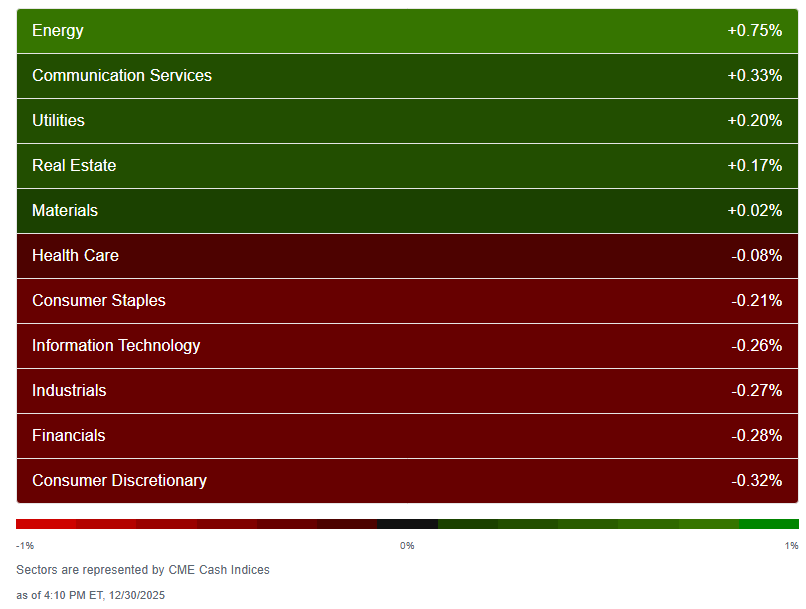

We did improve to 5 of 11 sectors higher according to CME Cash Indices (uses futures prices) up one from Mon/Fri but down from 10 Wed, but again just one sector up over +0.35% (again Energy +0.75% after +0.95% Mon).

And again bond proxies RE, Utilities, and Staples were in the top half, while Cons Discr lagged for a third session (although just -0.3%).

SPX stock-by-stock flag from @finviz_com continued for a third session to display definitely more red than green, again some of it shifting around, but Tues even fewer names moving more than 2% in either direction (more on that below).

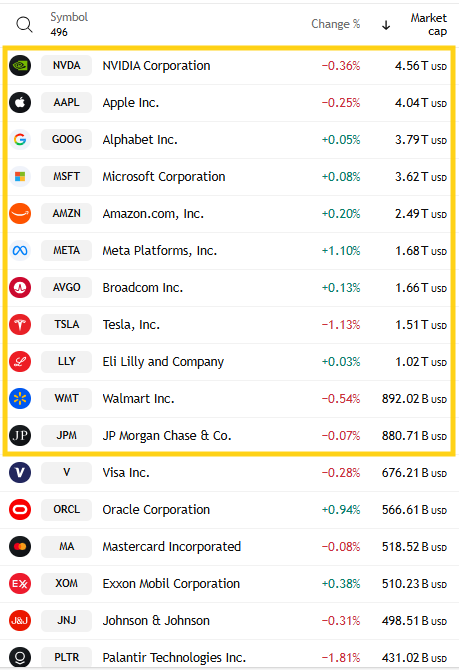

5 of the top 11 by market cap were lower (down from 8 Mon, and 6 Fri), but as with Mon/Fri only three moved more than 1%. To the downside was for a third session TSLA -1.1% after -3.3% and -2.1% Mon and Fri, while to the upside it was META +1.1%. Mag-7 was -0.05% on track for only its second down week in the past 6.

No SPX components were up 3% or more, the first time since I started doing this early summer (after just one Mon/Fri). The top stock on the SPX was AES +2.6%. So obviously no >$100bn in market cap up 3% or more (after only one in the previous three sessions total). The closest was NEM +2.1%.

2 SPX components down -3% or more (down from three Mon, up from one Fri) led by Ares Management -3.5%. No >$100bn in market cap down -3% or more (after seeing just one the prior five sessions). The closest was PLTR -1.8%.

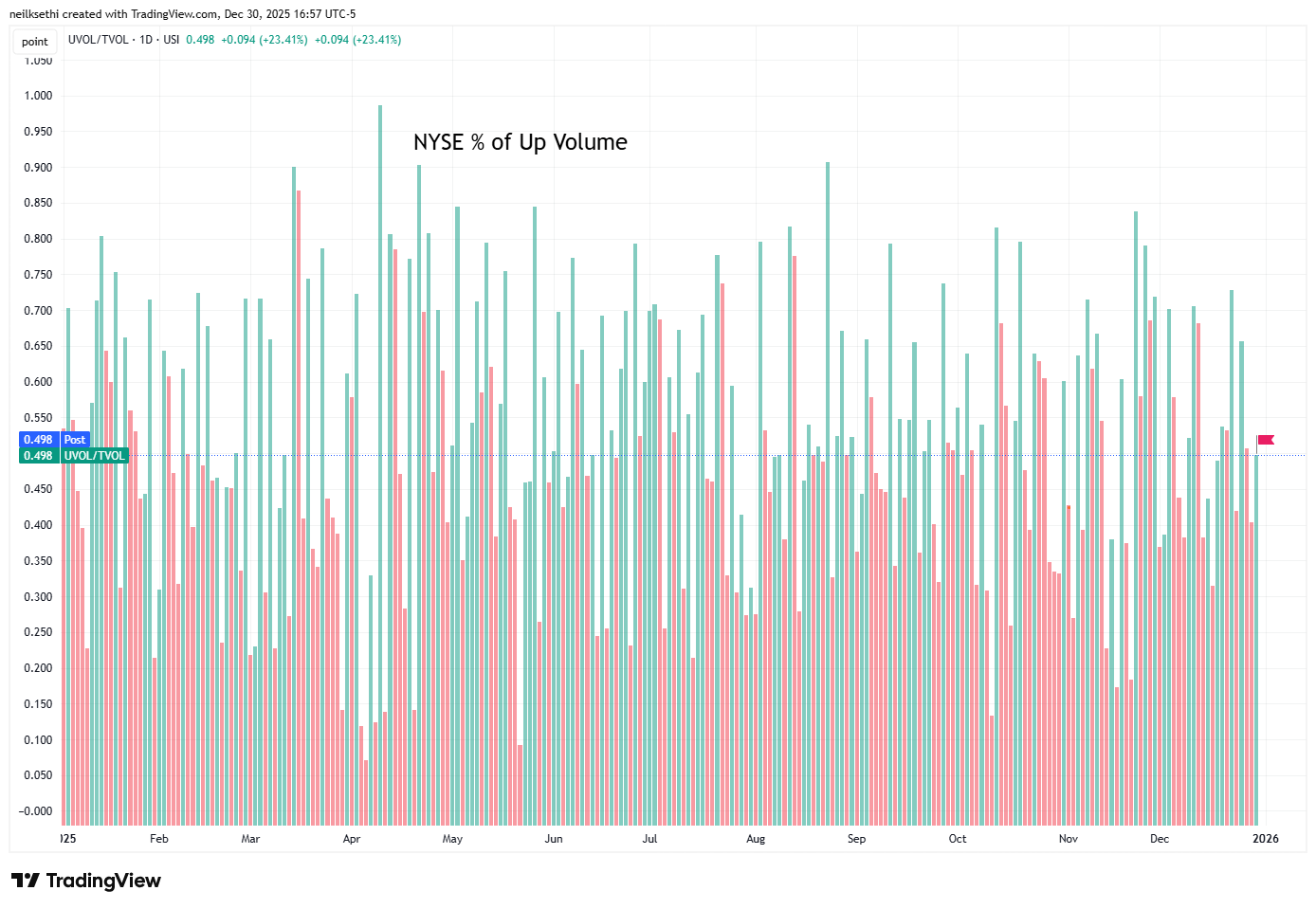

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) improved along with the index coming in at 49.8%, not bad for the -0.08% loss in the index.

Nasdaq positive volume (% of total volume that was in advancing stocks) also improved to 54.3% also not bad for the -0.24% decline in the index.

And as you know if you read regularly, the difference is the higher speculative volumes on the Nasdaq. Those continued to grow for a third session with the top three stocks by volume on the Nasdaq Tuesday collectively trading around 1.3bn shares, the most in a couple of weeks. That’s up from around half that (~700mn) on Friday. That said, only 6 companies had volumes over 100mn shares down from 8 Mon (but up from 5 Fri/Wed).

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks for that reason continued to be much weaker on the Nasdaq at 36.0% while the NYSE was 46.3%.

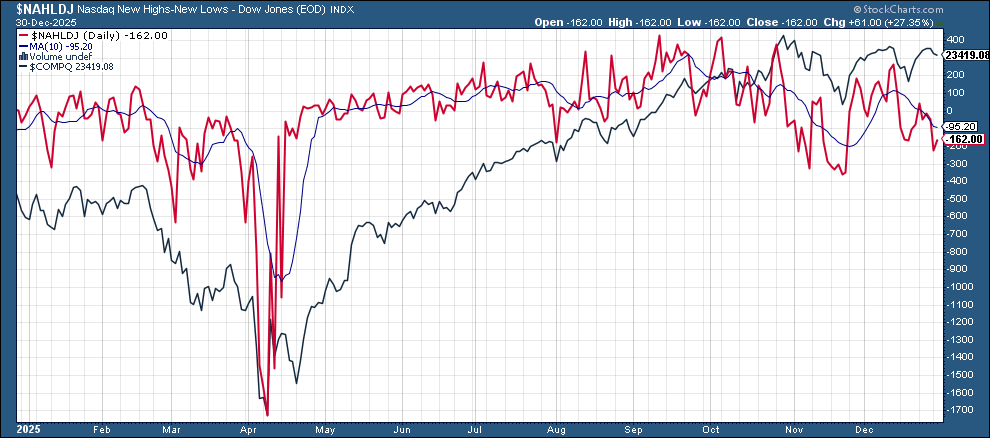

New 52-wk highs minus new 52-wk lows (red lines) improved from the least in a month to 26 from 14 on the NYSE and to -162 to -223 on the Nasdaq.

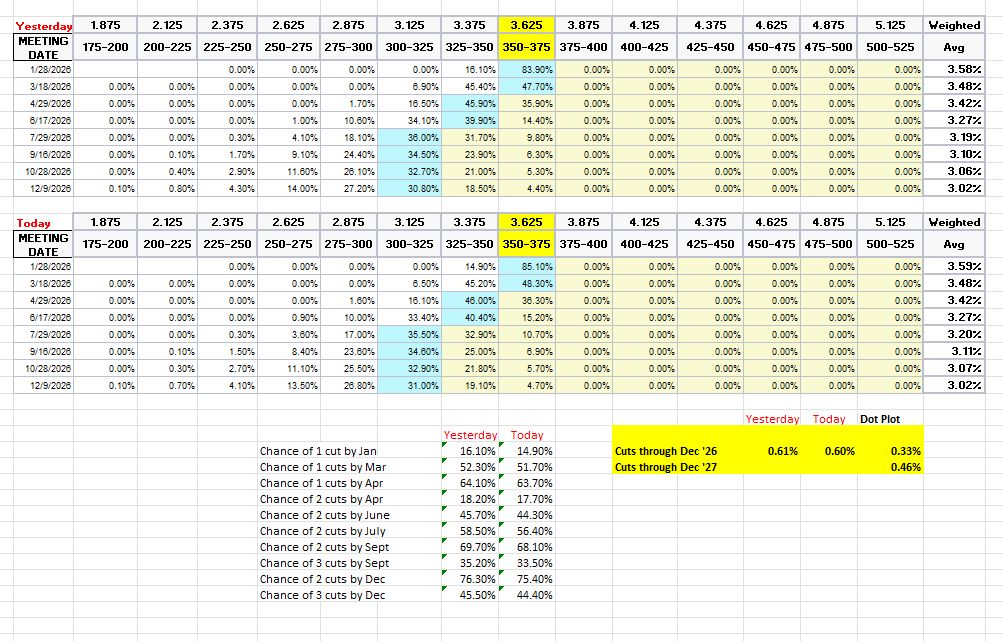

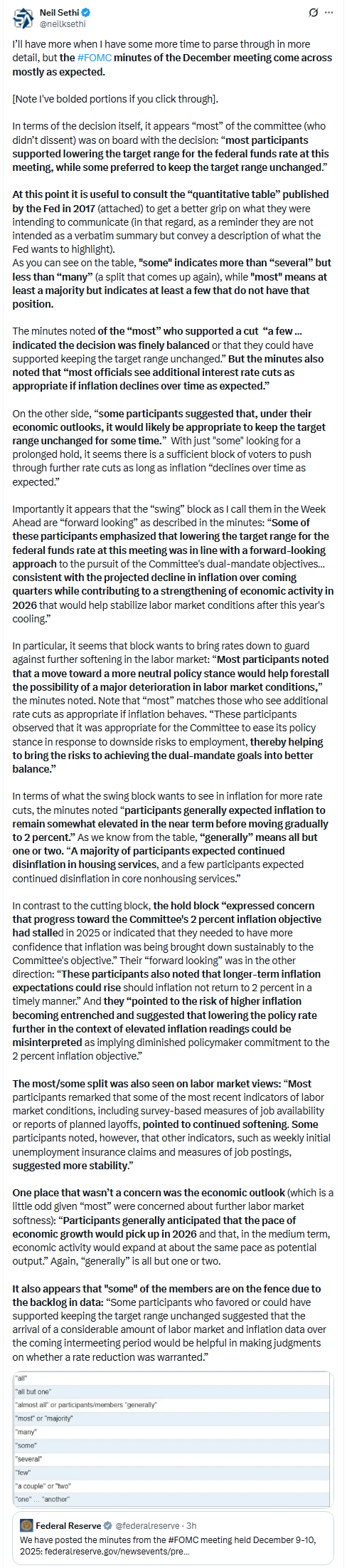

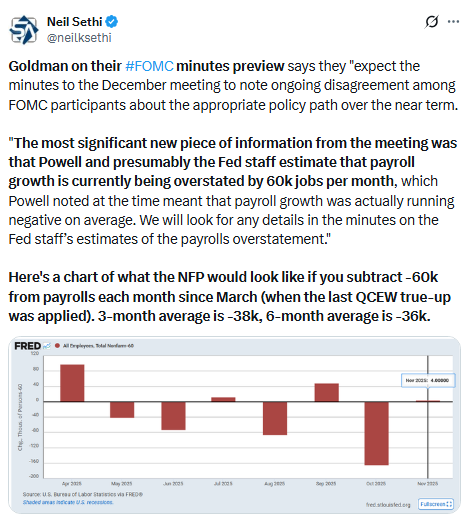

#FOMC minutes didn’t do much to change market rate cut pricing according to the CME’s Fedwatch tool which just eased back a touch. Probability of a cut in Jan remains low at 15% (up slightly from 13% a week ago which was the least since pre-Dec FOMC), with the first cut in March at 52% (from 47%). A second cut is in July at 56%.

Pricing for 2026 overall -1bps from Mon to 60bps, with pricing for two cuts 75% (from 69% a week ago) and three cuts 44% (from 36%), down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has just 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

The 10yr #UST yield edged up +1bps to 4.13%. Still in its range over the past three weeks.

The 2yr yield, more sensitive to FOMC rate cut pricing, though edged lower -1bps to 3.45%, the lowest in two months. It remains in the channel it’s been in since the start of 2024, but just 3bps above the least since 2022 and -18bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) edged further off the lowest close since Oct 3rd hit a week ago now pressing against its short-term downtrend line from the Nov peak. The daily MACD and RSI remain negative with the former in “go short” territory as noted three weeks ago, while the RSI is below 50 but both are improving.

VIX little changed for just off its 52-week lows at 14.3. The current level is consistent w/~0.90% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) edged higher for a fourth session in five to 87.1 after hitting 81.7 last week, which was the least since July ‘24 (before the carry trade blow-up). The current level remains consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

Like the VIX and VVIX the 1-Day VIX edged further off the lows of the year to 10.1. The current reading implies a ~0.65% move in the SPX next session.

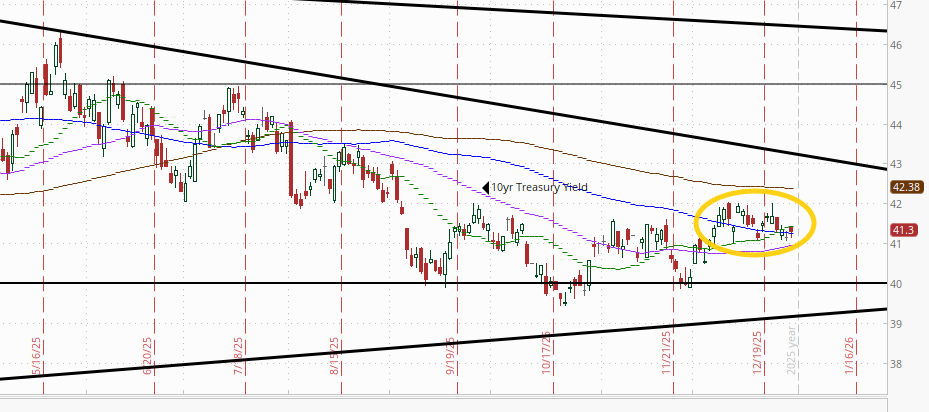

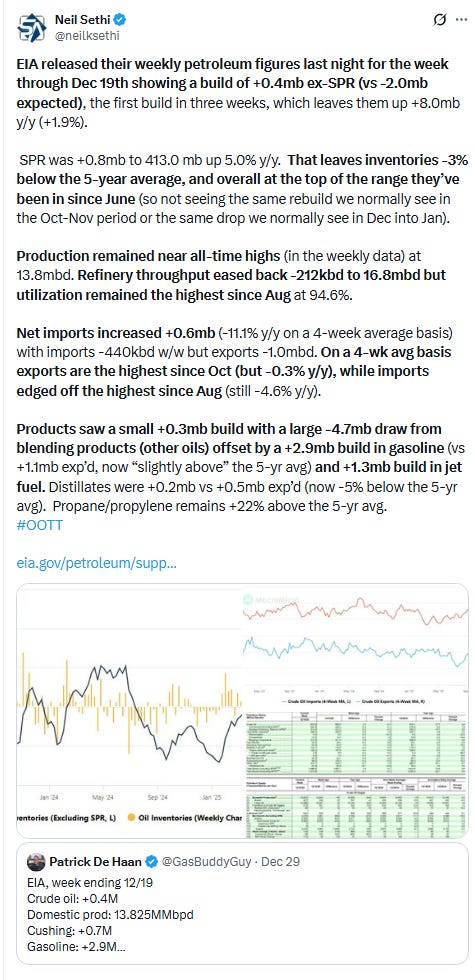

#WTI futures again not able to clear the resistance they have struggled with since the start of Oct (50-DMA and downtrend line from the July highs). As I said Friday, “like several previous times the daily MACD crossing to ‘cover shorts’ and the RSI moving over 50 weren’t enough [so far at least] to push it through.”

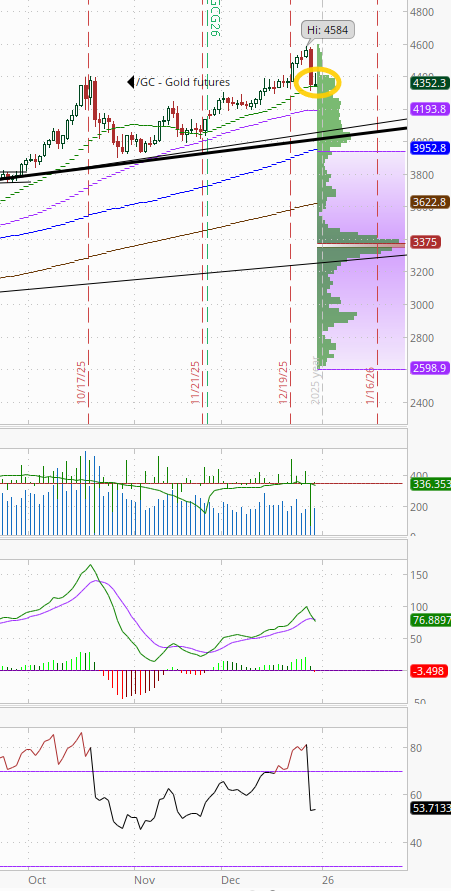

Unlike silver futures (see post below), gold futures (/GC) not able to bounce after their largest pullback since October.

As noted Mon, “like [the October pullback], the RSI fell from well over to well under 70, and the daily MACD has crossed over to ‘sell longs’ positioning. After that plunge, gold futures drifted lower over the following week or so before resuming the uptrend. We’ll see if we get something similar here.”

Like silver, US copper futures (/HG) were able to recover a chunk of Monday’s losses, gaining back +3.2% as they bounced from the top of that trendline they had been struggling to get over most of 4Q. Similar to gold the RSI went from well over to well under 70, but the daily MACD has not crossed over from “go long” positioning.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) an interesting day following their roll to the February contract Monday which saw them drop to around the lowest since they rolled to the December contract two months ago, a -10% drop. They jumped early in the session and filled that large roll gap, but as soon as they did, they dropped back ending little changed.

The daily MACD remains in ‘sell longs’ positioning, and RSI under 50.

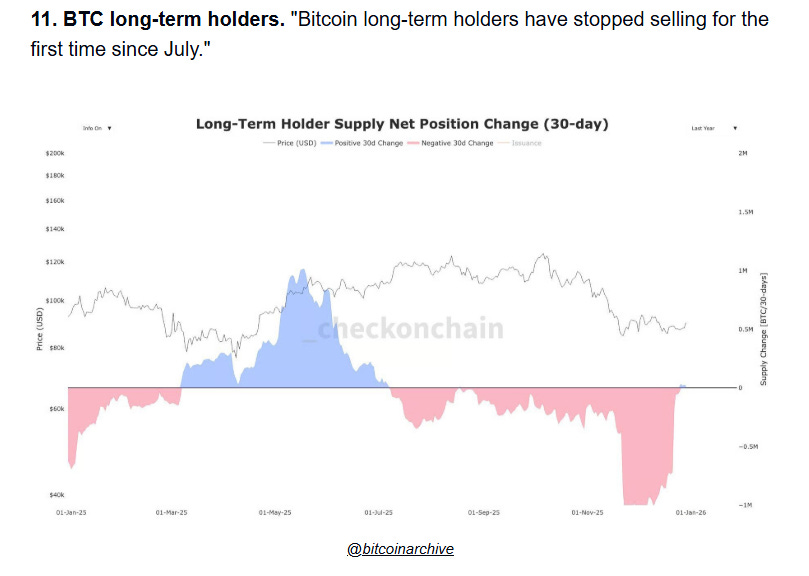

Bitcoin futures again took a stab at breaking out but again fell back remaining trapped between the $85k level on the downside and $90k resistance (now for over two weeks). The daily MACD remains in “cover shorts” positioning, but the RSI is still under 50.

The Day Ahead

US economic data Wednesday brings us weekly jobless claims and mortgage applications, and Friday we’ll get final Dec manufacturing PMI from S&P (ISM is next week).

No Fed speakers on the calendar for Wed, and it would be quite surprising if we got an interview on NYE, and none for Fri either, but Goldman says Philly Fed Pres Paulson (2026 FOMC voter) will be appearing Saturday.

Non-Bill Treasury auctions (>1yr in duration) are done for the year.

As are SPX earnings (done for the year).

Ex-US DM is a very light day with many major markets (including Germany, Switzerland, Italy, and Japan) closed for the full day and many others (including U.K., Spain, France, New Zealand, and Australia) with half-day closures. Japan, Switzerland and New Zealand are also closed Friday. In economic data Friday (some Thursday) we’ll get the final manufacturing PMIs.

In EM, it’s similar, although we will get China PMIs tonight along with S Korea CPI, then Wed we’ll get some other scattered reports including S Korea trade, Poland CPI, and a rate decision from the DR, with the rest of the manufacturing PMIs and Banxico minutes Friday. We’ll have closures in Brazil, S Korea, and Hong Kong Wed, and China Friday.

Wednesday, December 31

08:30 AM Initial jobless claims, week ended December 27 (GS 235k, consensus 215k, last 214k)

Continuing jobless claims, week ended December 20 (consensus 1,917k, last 1,923k)

We estimate that initial jobless claims rebounded 21k to 235k in the week ended December 27, reflecting a potential boost from seasonal distortions introduced by the timing of the Christmas holiday.

Friday, January 2

09:45 AM S&P Global US manufacturing PMI, December final (consensus 51.8, last 51.8)

Saturday, January 3

10:15 AM and 02:30 PM Philadelphia Fed President Paulson (FOMC voter) speaks

Philadelphia Fed President Anna Paulson will take part in two sessions during the Allied Social Science Associations’ Annual Meeting. The morning event will be on “Lifetime Experiences and Implications for Monetary Policy,” and the afternoon event will be on “Global Growth in Transition: Divergence, Policy Choices, and Risks.” Text and audience Q&A are expected.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,