Markets Update - 12/3/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

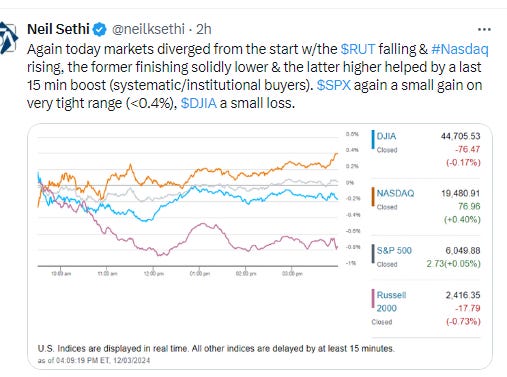

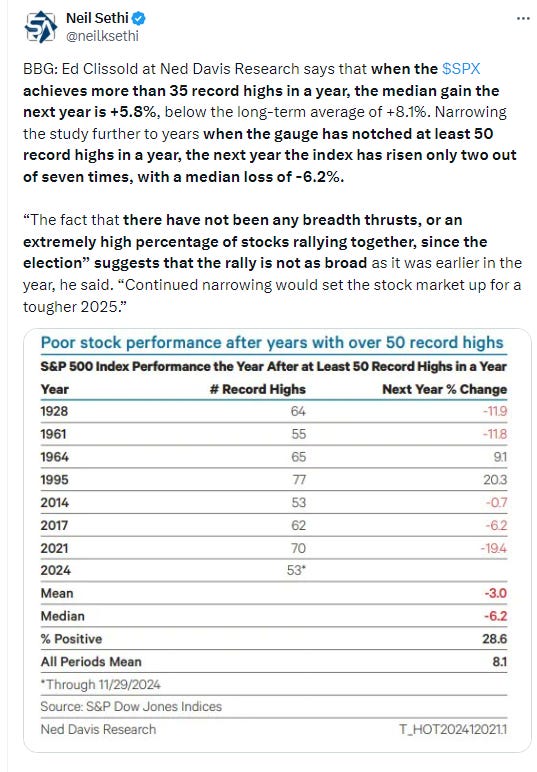

US equity indices Tuesday saw similar action to Monday with the SPX edging and the Nasdaq pushing more strongly to new record highs, again led by the largest, growthiest stocks. Outside of that, again, the gains were much more sparse with small caps and all of the non-megacap growth sectors finishing in the red.

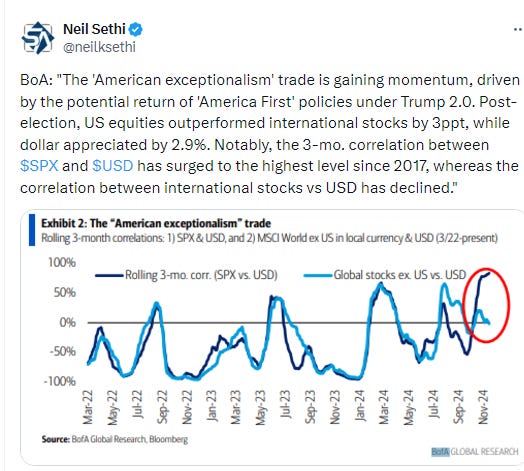

Bond yields were again little changed while the dollar fell back after jumping Monday. Gold and bitcoin were also little changed while copper and oil advanced and nat gas fell back now down -12% the past week.

The market-cap weighted S&P 500 was +0.1%, the equal weighted S&P 500 index (SPXEW) -0.4%, Nasdaq Composite +0.4% (and the top 100 Nasdaq stocks (NDX) +0.2%), the SOX semiconductor index -0.4%, and the Russell 2000 -0.7%.

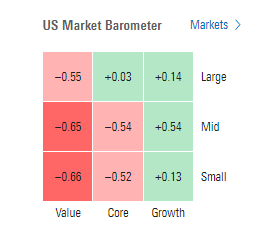

Morningstar style box consistent with large growth in the lead but every style in the green.

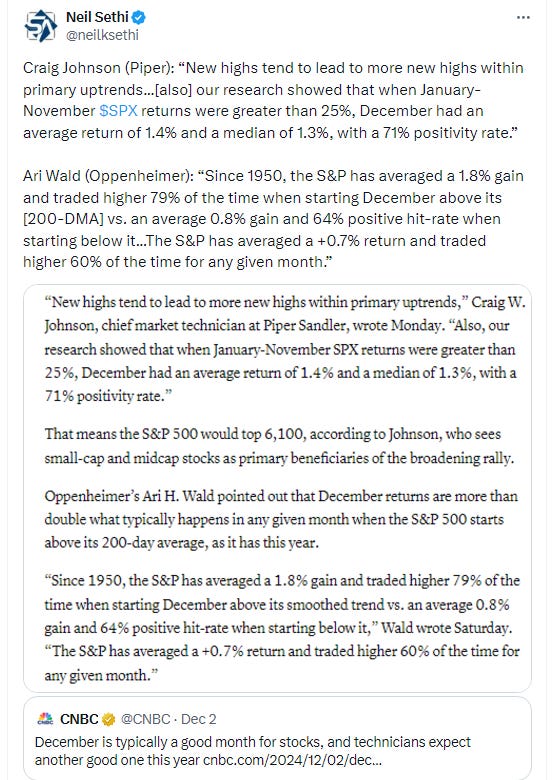

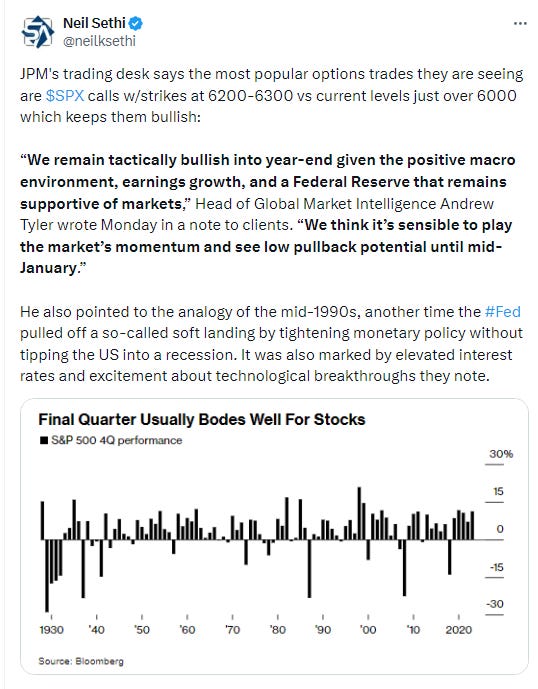

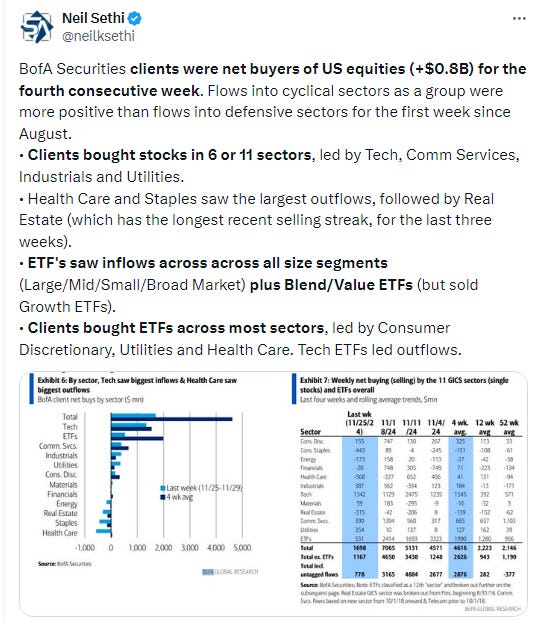

Market commentary:

CFRA’s Sam Stovall wrote Monday that he sees “additional new highs through year-end” as the index approaches the firm’s 6,145 price target.

“While there are likely to be a few more hiccups before the year wraps up, the path of least resistance remains higher,” BTIG’s Jonathan Krinsky wrote Sunday.

“Things are getting extremely crowded on one side of the boat — the bullish side,” said Matt Maley at Miller Tabak + Co. “Valuation levels are a lousy timing tool. However, sentiment and positioning are better tools. So it’s not out of the question that today’s extreme readings on these issues could create a surprising pick up in volatility before year-end.”

“The market still expects the Fed will cut rates,” Mark Haefele, chief investment officer at UBS Global Wealth Management, said on Bloomberg Television. “We will see when the employment data comes through on Friday how brave you have to be. But I think the bias is still there and the market thinks there is still room to do that, given the overall picture.”

“U.S. equities are trending sideways today in front of Friday’s job report, which may provide insight into what the Fed might do following its December 17 and 18 FOMC meeting,” said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management. “On balance, we think there’s much to like about U.S. equities, despite a wall of worry that looms on the horizon.”

“Inflation, interest rates and earnings are supportive of a risk-on bias, and technological advances such as Gen AI continue to expand markets while pushing equities higher,” he added.

“US stocks are likely to continue grinding higher into next year. In our view, the exuberance synonymous with frothy financial markets is far from widespread,” said Solita Marcelli at UBS Global Wealth Management. “While we expect bouts of volatility and corrections in the year ahead, we continue to believe that the S&P 500’s next leg up to our December 2025 target of 6,600 will be fueled by solid economic growth, the Fed’s easing, and AI advancement.”

Within the US equity market, she favors technology, utilities and financials.

“The question for investors isn’t ‘will the Fed cut again.’ but rather ‘will the next cut be in December or January’,” said Lauren Goodwin at New York Life Investments. “Our base case is that the Fed cuts 25 basis points in December, but we have much higher confidence that another cut is coming in December or January as the data evolves.”

A New York University professor known for his expertise on valuations says the “Magnificent Seven” megacaps are a buy during corrections as most of them will keep generating money. “As a value investor, I have never seen cash machines as lucrative as these companies are,” Aswath Damodaran, a finance professor at NYU’s Stern School of Business, said in a Bloomberg Television interview. “And I don’t see the cash machine slowing down.” There will be corrections and “I’d suggest that when that happens you find a way to add at least one, maybe two or three of these companies, because these are so much part of what drives the economy and the market,” he added.

“When the market is up 10% or more with a newly elected President, it has never gone down in the month of December,” said Ken Mahoney, CEO of Mahoney Asset Management. But Mahoney cautioned this doesn’t mean that stocks will soar in December, since November was the best month of the year for the market. During the last trading day of November, the Dow and the S&P reached new intraday and closing highs, leading both indexes to post their best months of 2024. The Dow added 7.5%, while the S&P 500 gained 5.7% last month. “But there’s still enough demand for stocks, because I do think there’s a fair amount of money that’s coming up the sidelines post election,” he added.

In individual stock action, Apple (AAPL 242.65, +3.06, +1.3%) and Meta Platforms (META 613.65, +20.82, +3.5%), which hit fresh 52-week highs, were top performers from the mega cap space, along with Amazon.com (AMZN 213.44, +2.73, +1.3%), NVIDIA (NVDA 140.26, +1.63, +1.2%), and Eli Lilly (LLY 813.33, +13.53, +1.7%).

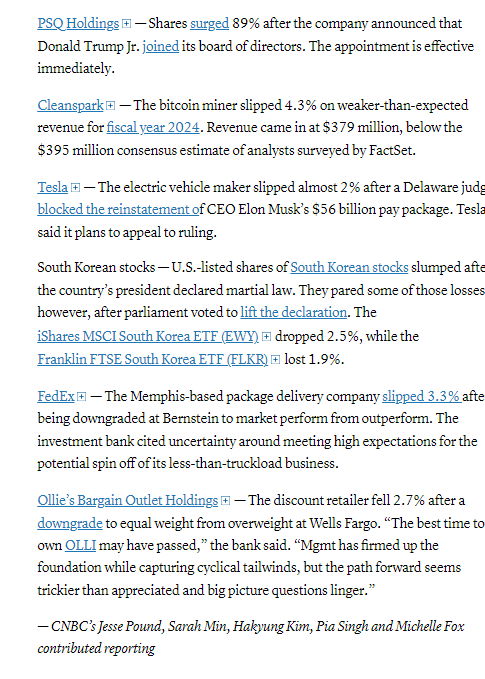

Tesla (TSLA 351.42, -5.67, -1.6%) lagged its mega cap peers, settling lower in response to CEO Elon Musk's pay package getting rejected by a Delaware judge, according to Bloomberg, and after China-produced electric vehicle sales fell 4.3% in November, according to Reuters.

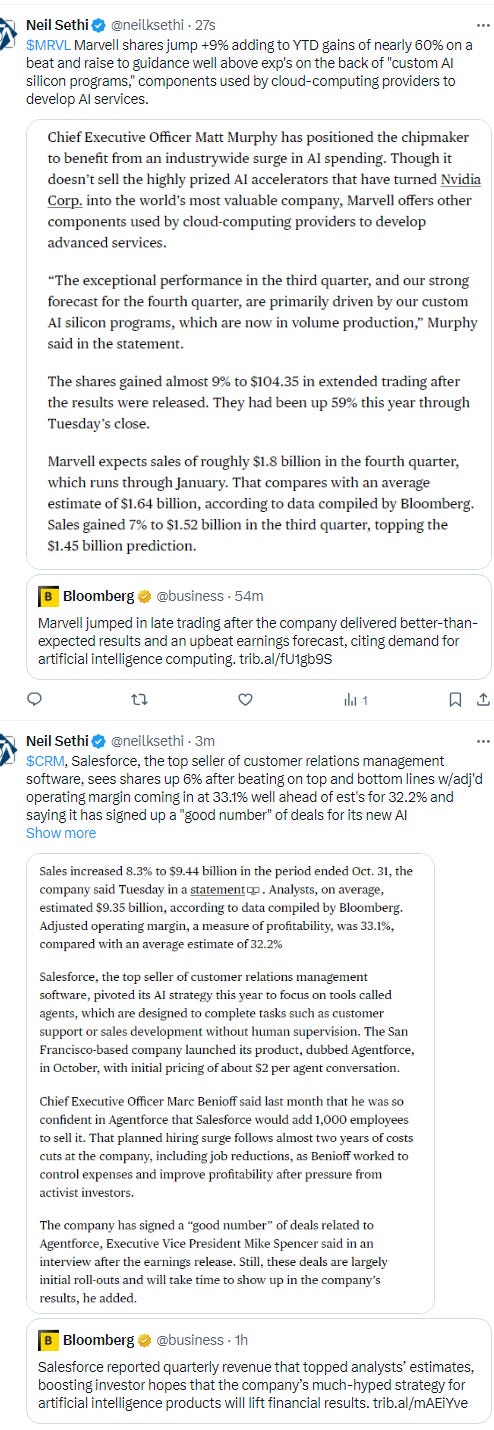

In late hours, Salesforce Inc. climbed as its solid revenue boosted hopes the much-hyped strategy for artificial-intelligence products will lift financial results. Marvell Technology Inc. jumped on a bullish outlook.

Corp Highlights from BBG:

Intel Corp.’s search for a new chief executive officer will focus heavily on outsiders, with the chipmaker considering candidates such as Marvell Technology Inc. head Matt Murphy and former Cadence Design Systems Inc. CEO Lip-Bu Tan, according to people familar with the situation.

AT&T Inc. predicted sustained profit growth over the next three years, including double-digit gains in 2027, a payoff from its investments in mobile-phone and fiber-optic networks.

BlackRock Inc. agreed to buy HPS Investment Partners in an all-stock deal valued at roughly $12 billion, a purchase that will propel the world’s largest asset manager into the highest ranks of private credit.

SpaceX is in talks to sell insider shares in a transaction valuing the rocket and satellite maker at about $350 billion, according to people familiar with the matter.

Bank of Nova Scotia missed earnings estimates on higher-than-expected expenses and taxes.

Honeywell International Inc. and Bombardier Inc. reached a deal on the development of aviation technology and settled a long-running legal dispute.

MARA Holdings Inc. bought the North Texas wind farm in Hansford County from a joint venture between National Grid Plc and the Washington State Investment Board,

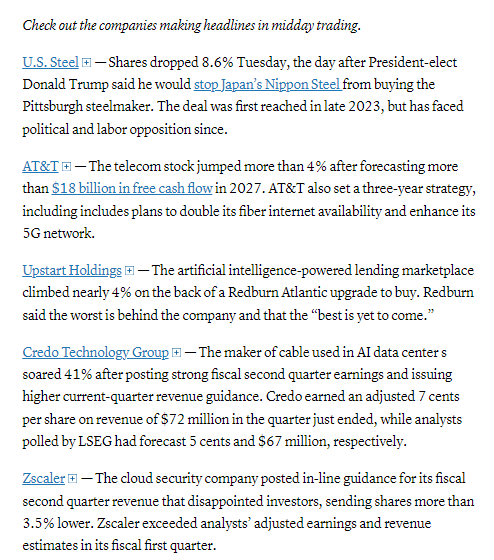

Some tickers making moves at mid-day from CNBC.

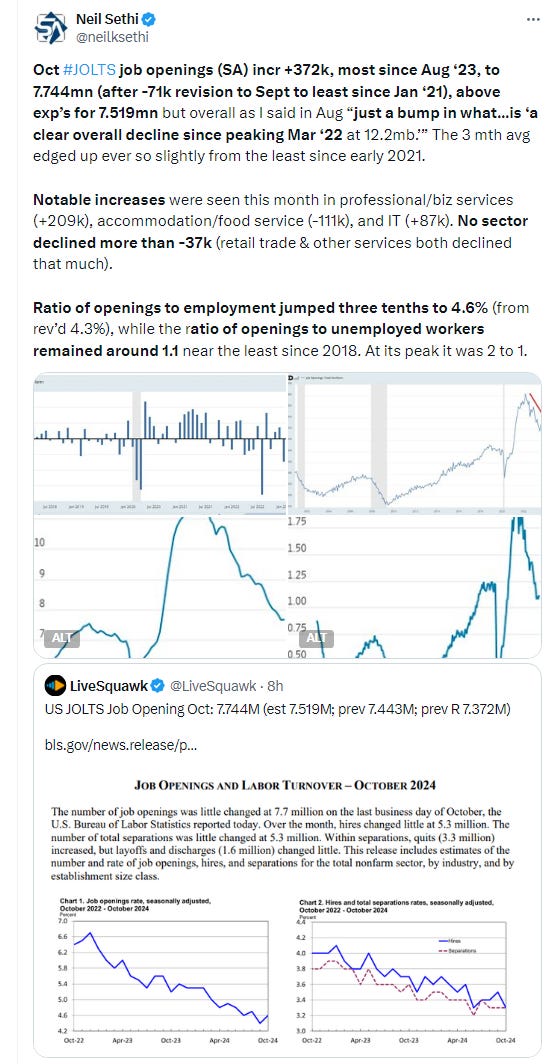

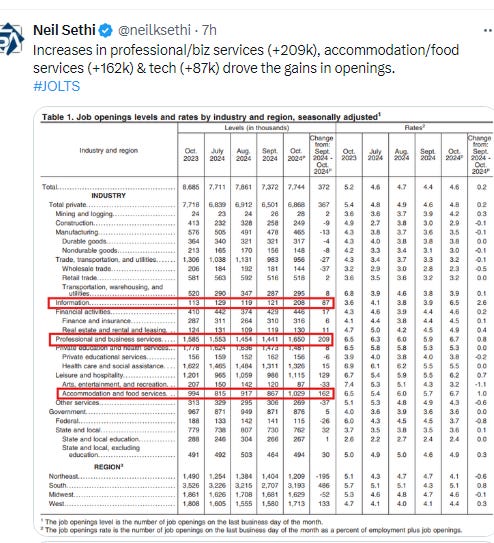

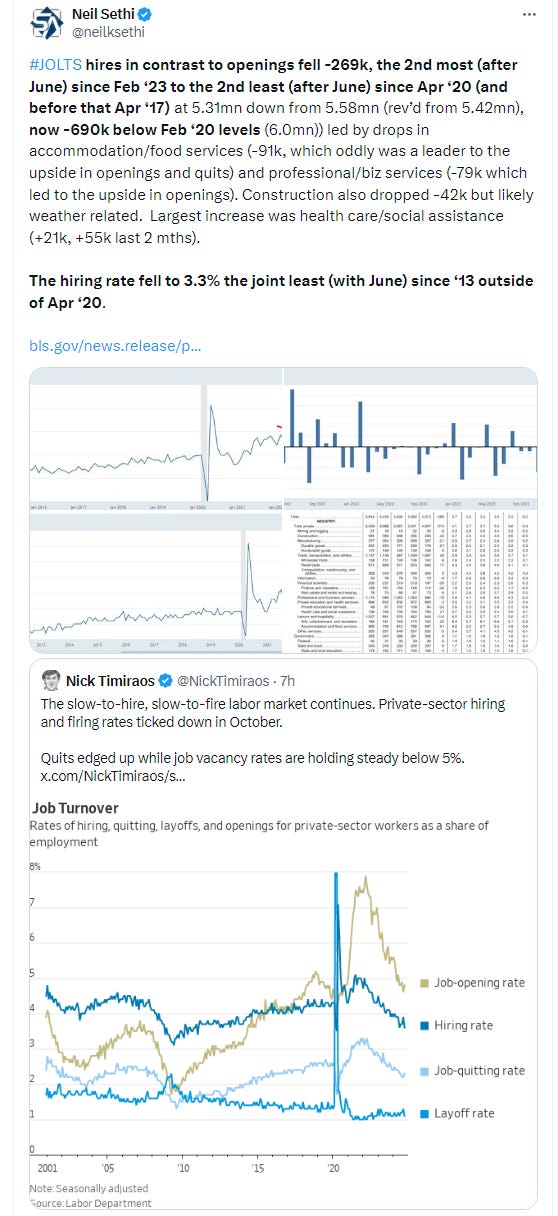

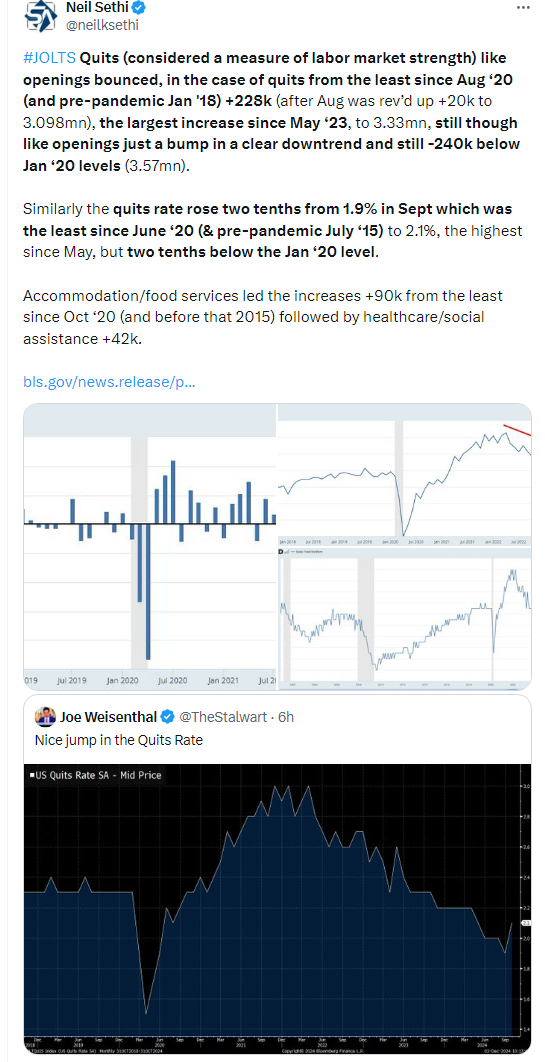

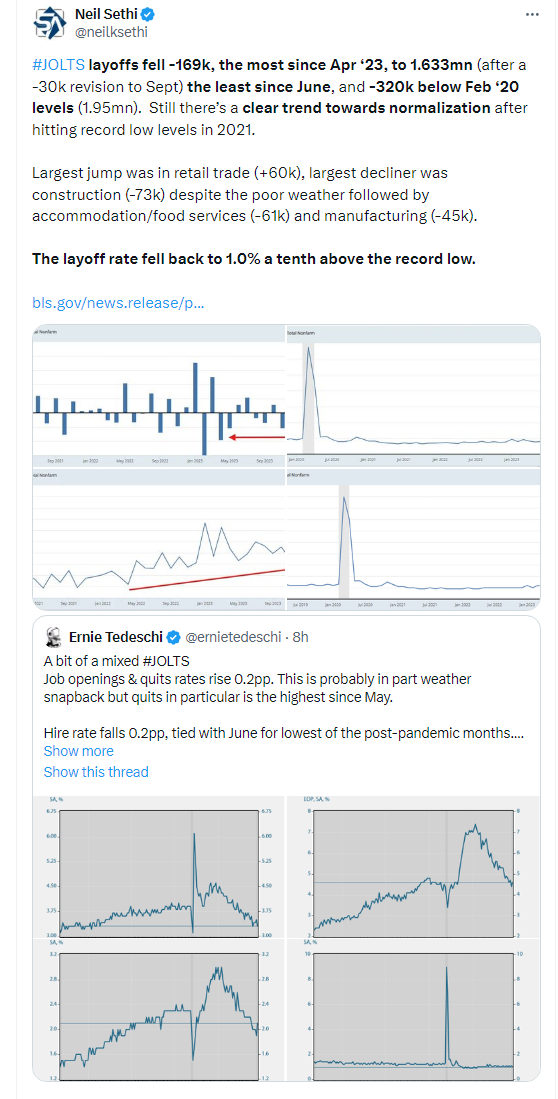

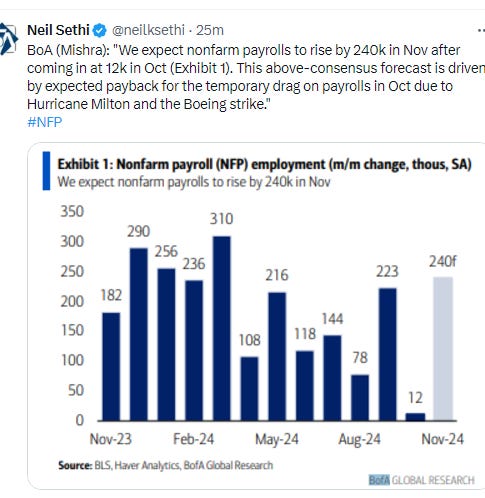

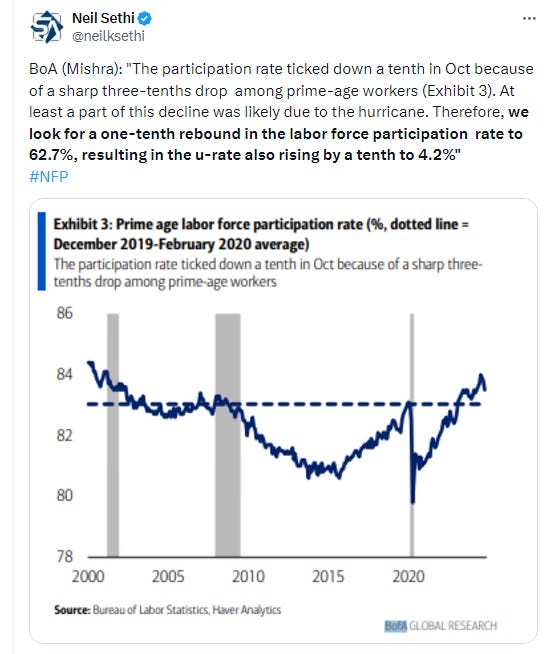

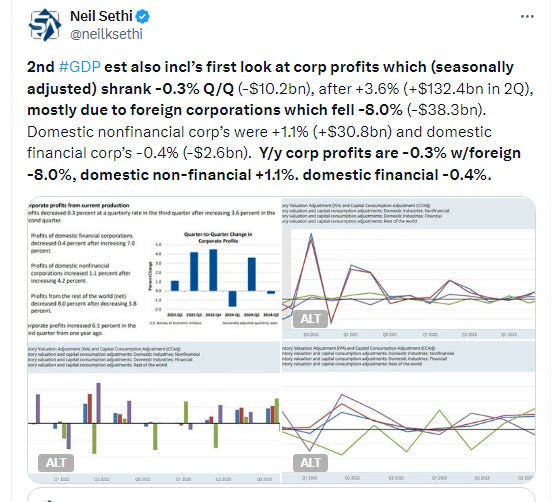

In US economic data we had the JOLTS report which showed the largest jumps in job openings and quits since 2023 although overall remaining on a clear downtrend from the peaks in 2022. Layoffs also fell as did hires.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

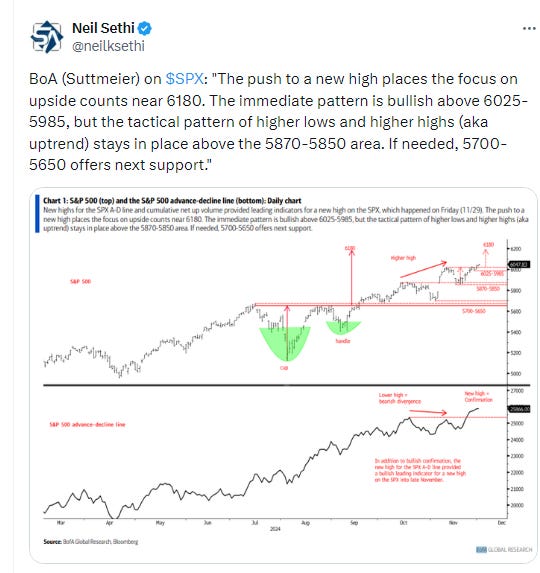

The SPX again another ATH (its 55th of the year), and up for the 10th session in 11, by the slimmest for margins. Its daily MACD & RSI remain tilted positive.

The Nasdaq Composite again stronger with another ATH. It daily MACD & RSI are also now tilted positive.

RUT (Russell 2000) fell to the lowest in over a week as it again falls away from its ATH which it touched a week ago for the first time since Nov ‘21 but has yet to close over. Its daily MACD & RSI remain positive as well for now.

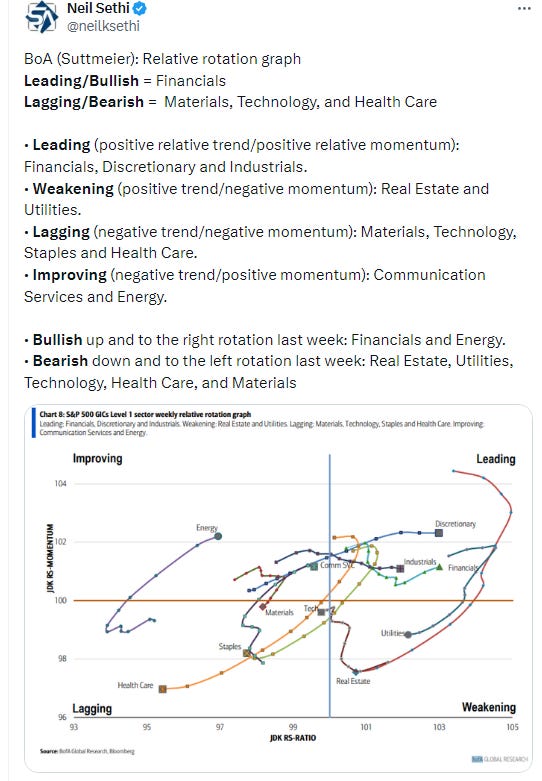

Equity sector breadth from CME Indices weak again w/again just 3 green sectors and again the three megacap growth sectors, but today just one up over 1% (comm services). No sectors were down that much (after 1 Mon), but we continue with the gains being mostly in large growth.

Stock-by-stock SPX chart from Finviz consistent with not much green outside of large/growth companies.

Positive volume improved but not particularly strong. The NYSE was 49%, not terrible considering the NYSE Composite was down -0.14%, while the Nasdaq was just 49% despite the index finishing solidly in the green. Issues were considerably worse at 39 & 36%. So with breadth on the weak side 3 of the last 4 sessions, we seem to have lost our more positive trajectory from the clear improvement in breadth we had been seeing post-Nvidia earnings.

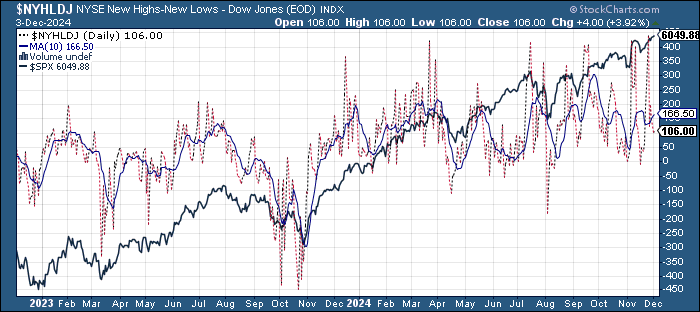

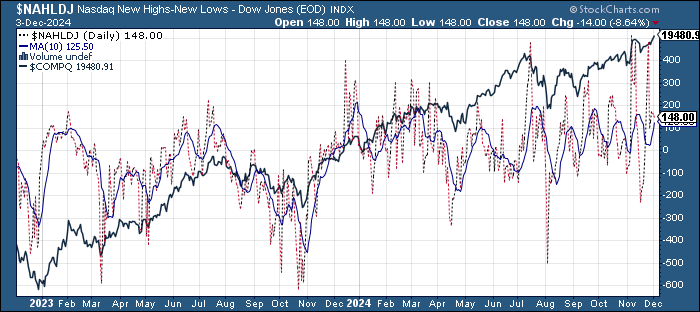

New highs-new lows saw a bit of improvement as well w/the NYSE at 104, just off the weakest since 11/20 while the Nasdaq was 148 (still down from 480 last Monday, which was the 2nd best since mid-’21). Nasdaq is above but NYSE below the respective 10-DMAs but they (the 10-DMAs) continue to curl up for now.

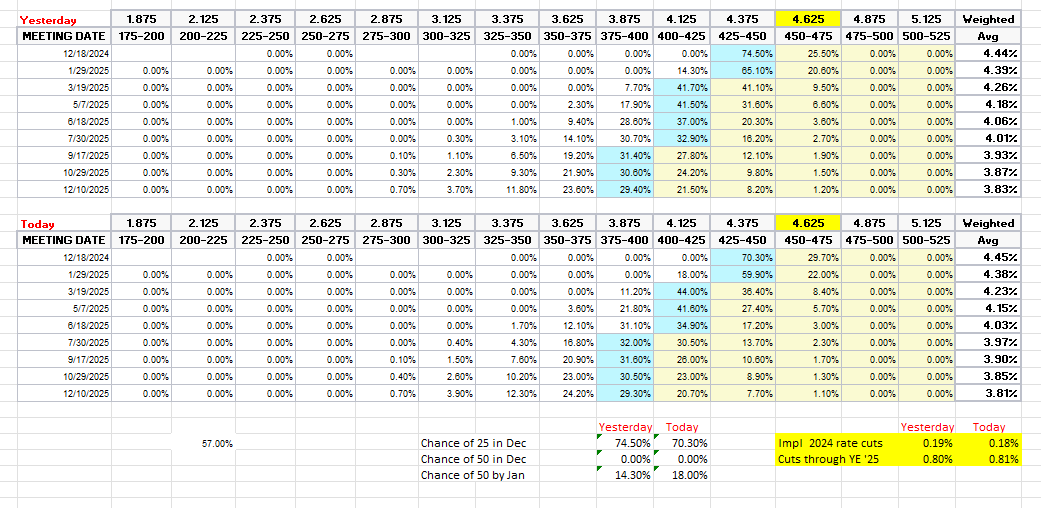

FOMC rate cut probabilities from CME’s #Fedwatch tool edged back a little following the strong JOLTS report and continued “on the fence” Fed speakers with chances for a December cut falling to 70% from 75% Mon (which was the highest since before the July FOMC meeting (when they held rates steady)). Total cuts through YE 2025 though now at 81bps (+1bps), keeping us over 3 cuts in total priced from here.

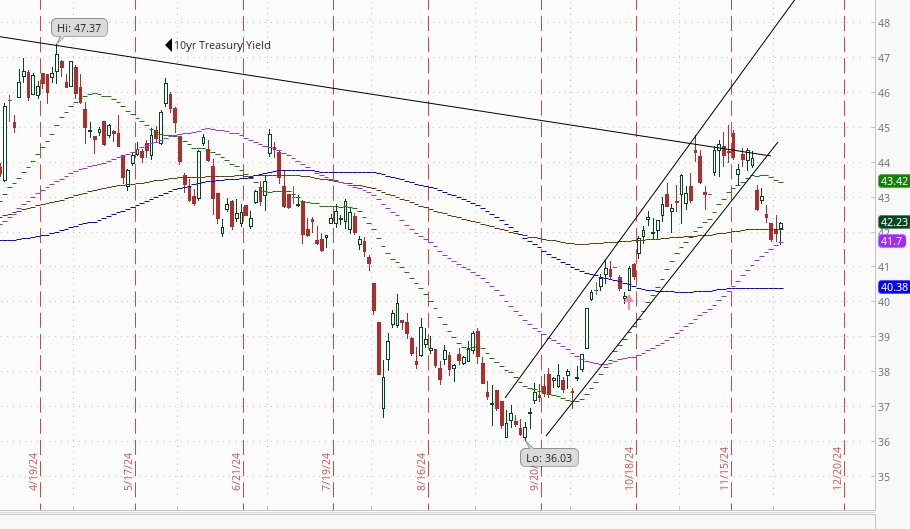

Treasury yields were mixed with the 10yr yield, more sensitive to economic growth and long-term inflation, up +2 basis points to 4.22%, still down -20bps since the election but getting back over its 200-DMA after bouncing from its 50-DMA, and the 2yr yield, more sensitive to Fed policy, down -2bp to 4.17% down -10bps since the day after the election (and -19bps since last Monday).

Dollar ($DXY) edged lower but finished off the lows after bouncing off the 20-DMA, remaining below a congestion zone which runs to the mid-$107 area. As noted last week its daily MACD & RSI have moved to a less supportive positioning though.

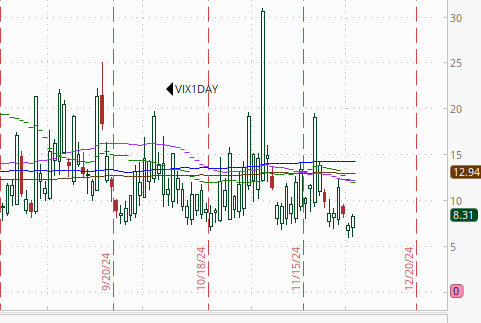

The VIX & VVIX (VIX of the VIX) were little changed, both remaining under uptrend lines running back to early July and remaining at the lowest levels since that time with the former at 13.3 (consistent w/0.84% daily moves over the next 30 days) and the latter 86 (consistent with “moderate” daily moves in the VIX over the next 30 days).

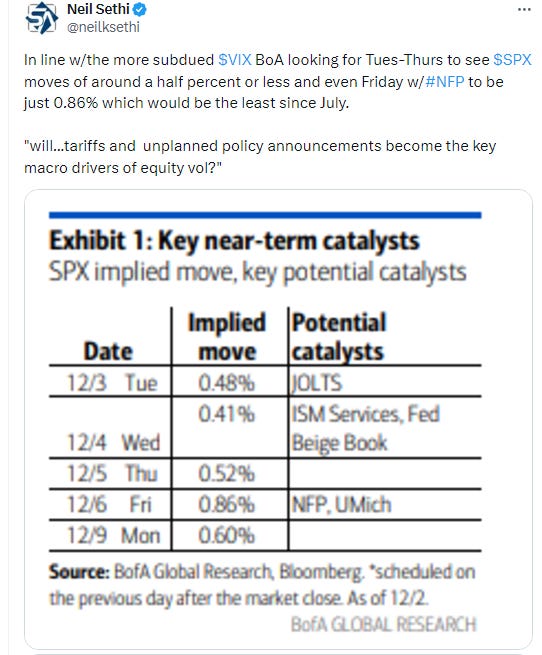

1-Day VIX got a little jump ahead of Powell’s appearance tomorrow after falling under 6 at one point Monday for only the 4th time since inception (Apr '23). Still at 8.3 it is looking for a move of just +0.52% Tuesday, a little above the +0.41% the BoA said was implied by options coming into the week.

WTI up almost 3% today to test the $70 level. For now though just another lower high in the series of them since April. As noted Monday it has “little support to protect from a retest of the key $67 level.” A push above $72 would start to perhaps change the picture.

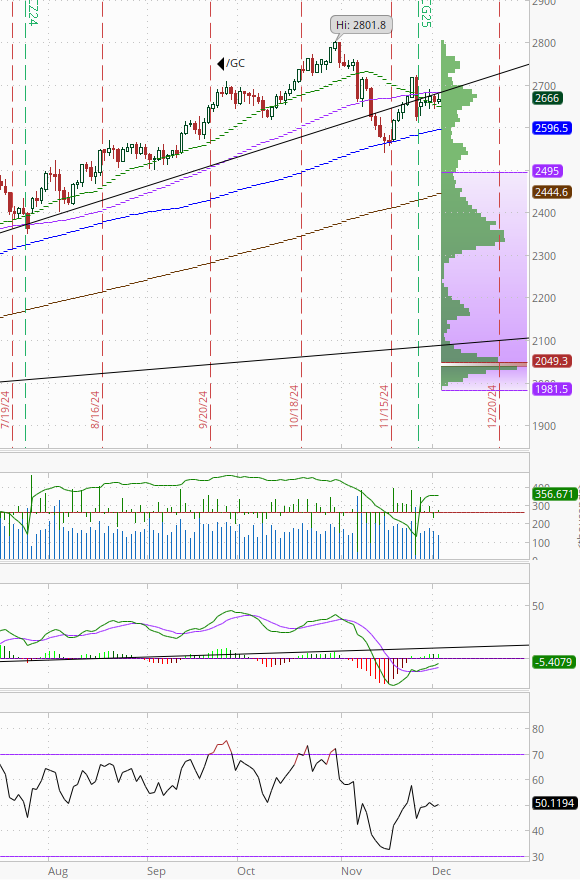

Gold tried again but wasn’t able for a 4th day to get through the resistance of the 50-DMA (w/$2700 level just above). As noted last Tues, “until it gets over that, we have to look lower not higher,” but as noted Friday “the daily MACD & RSI have turned more positive, so perhaps a sign it will push through next week.”

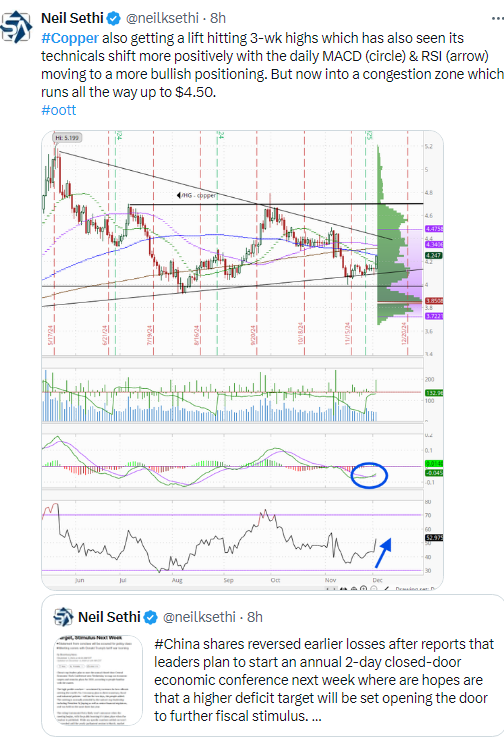

Copper (/HG) saw a strong move higher early in the session on the back of more hopes for China stimulus but pared about half of those gains, still though moving to a 3-week high. The move also saw its daily MACD & RSI turn more positive. As noted Monday, “not much resistance if it wants to take a run at the 50-DMA (purple line),” although it seems to have found some in the 100-DMA (dark blue line). The congestion zone runs through the $4.50 level.

Nat gas (/NG) remained volatile falling another -5% (now down -12% the past week) pushing through the $3.15 level (June highs) to the 20-DMA (green line). We’ll see if that can hold. The daily MACD & RSI are on the verge of turning bearish though.

Bitcoin futures continued to bounce back and forth just under the $100k level, up marginally today. The daily MACD & RSI as noted Monday “have turned more negative again but that has actually been a contrary indicator with Bitcoin for the most part this year. I continue to see it equally likely to break either way from this $90-100k range.”

The Day Ahead

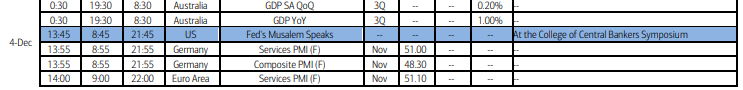

A heavier slate of US economic data tomorrow with Nov ADP and final services PMI’s, Oct factory orders, the Fed Beige Book, and weekly mortgage applications and EIA petroleum inventories.

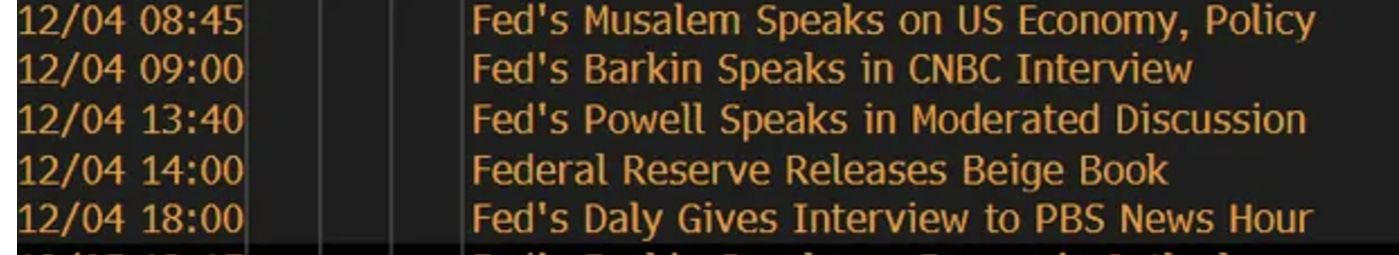

We’ll get a few more Fed speakers tomorrow headlined by Chair Powell in a moderated discussion at the NY Times Dealbook conference. We also get Musalem, Barkin, and Daly (again).

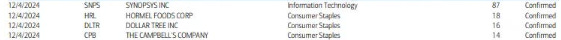

In earnings we’ll get 4 SPX components the largest of which is Synopsys (SNPS) at $87bn market cap, but also Hormel Foods (HRL), Dollar Tree (DLTR), and Campbell’s Company (CPB). (see the full earnings calendar from Seeking Alpha).

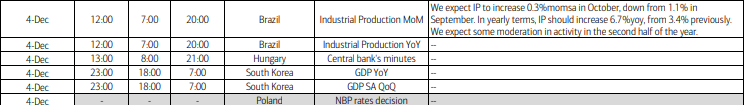

Ex-US the highlight in DM is final services PMIs as well as Australia GDP and Canada productivity. In EM we get GDP from South Korea (who had quite a day if you didn’t hear about it), Brazil industrial production and a policy decision in Poland.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,